Abstract

In this paper, we examine the long-run cointegration relationship between electricity consumption and GDP per capita in Gibraltar over the period 1996–2012. We examine the short-run and long-run and the causality nexus. The results show electricity consumption has a long run association with the output per capita at levels. Moreover, we note a statistically significant coefficient of electricity consumption the short run (0.53) and in the long-run (1.46). Moreover, a unidirectional causality running form electricity consumption to GDP per capita is noted. Hence, electricity consumption causes income growth in the economy and therefore we recommend efficient use of electricity consumption in key productive sectors of the economy as a way forward to spur growth in the small semi-sovereign economy of Gibraltar.

Similar content being viewed by others

Avoid common mistakes on your manuscript.

1 Introduction

1.1 Background

Gibraltar, a member of the European Union, is a very small economy with the population size of around 30,000 people (Abstract of Statistics 2012). The economy is part of the British Overseas Territory located on the southern end of the Iberian Peninsula at the entrance of Mediterranean. Gibraltar has been part of the United Kingdom (UK) since 1713 when Spain handed the territory to Britain as part of the Treaty of Utrecht. However, it has a separate legal jurisdiction from the United Kingdom. Under the Gibraltar constitution of 2006, the country is self-governing in all areas except defense and foreign relations, which is the responsibility of the UK Government. The British Nationality Act 1981 grants Gibraltarians full British citizenship. Gibraltarians elect their own representatives to the territory’s House of Assembly and the British monarch appoints a governor.

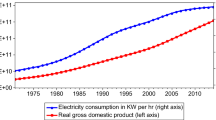

On average, the nominal per capita gross domestic product (GDP) of Gibraltar was about £35,953 (2008–2012). Over the same period, the economy grew on average by 8.1 %. Electricity consumption per capita [in kilo Watt hours (kWh)] also noted an unprecedented growth—the average per capita electricity consumption was 1569 kWh in 1970–1980. In 1981–1990, the per capita electricity consumption increased to 2055 kWh; and this further increased to 3382 kWh in 1991–2000 and 5015 kWh in 2001–2012 periods, respectively.

The production structure of the economy is largely characterized as a pure service economy which rests on four pillars: the financial services, e-gaming, tourism and the port. Each of these sectors contributes nearly 25 % to the GDP. Gibraltar’s economy benefits on the one hand largely from that fact that it has no value added tax, no capital gain tax, no inheritance tax and a corporate tax rate of only 10 %. On the hand, Gibraltar has a high-class jurisdiction within Europe that is internationally cooperative on all fronts, particularly in relation to exchange of information on tax matters. The financial and the e-gaming sectors are strongly regulated. Therefore the OECD lists Gibraltar on its “white list” and it shares the same status as the UK, USA or Germany.

At the crossroads of the north–south and east–west shipping routes, the port offers services ranging from bunkering to dry-docking, chandlery, crew changes, charts, hull cleaning and underwater surveys. The second important sector is tourism which records on average, around 12 million visitors per year. However, these sectors are suffering because of the sluggish economic performance of the EU and the rest of the world since 2008. Moreover, Gibraltar is becoming an attractive destination for hedge funds, insurances and high net worth individuals. Additionally, Gibraltar has licensed 25 international gaming companies and 10 predominantly US and UK games software suppliers. These companies park a lot of intellectual property in Gibraltar because the royalty income on intellectual property is tax-free.

Electricity is at the heart of these sectors. Notably, one of the largest capital and operating expenditures for any e-gaming business are caused by the data centers which consume relatively high depend watts of electricity. In Gibraltar, Gibtelecom, Cube and Sapphire Networks provide the necessary data centers.Footnote 1 Subsequently, the energy consumption of data centers in Gibraltar is far more important than in a bigger country because of its importance relative importance to the development and functioning of key sectors such as transportation, finance, and e-gaming.

In this paper, we examine the role of electricity consumption in determining the GDP per capita in Gibraltar over the period 1996–2012. Notably, most of the studies in the literature are conducted on relatively large and sovereign states. This paper focuses on a small semi-sovereign economy which is growing at unprecedented rates while faced with a number of constraints such as small population size and geography, and striving to maintain sound political and diplomatic ties with the UK and Spain. Moreover, although the literature on electricity (energy) viz. economic growth is exhaustive, to our knowledge, thus far, no attention has been given to the semi-sovereign state of Gibraltar possibly because of: (a) data limitations which have been resolved to some extent with the availability of reliable data provided by the Government of Gibraltar (2014a); (b) and the recent advancement in cointegraton techniques and tools (Pesaran and Pesaran 2009); and (c) lack of interest given that the Gibraltar is a relatively small country. However, we argue given that Gibraltar is a semi-sovereign economy with a peculiar production structure, and the fact that electricity consumption has increased over the last four decades, partly due to the booming energy dependent sectors such as e-gaming and online banking, examining the nexus between electricity consumption and income in Gibraltar is of interest and a modest contribution to the literature.Footnote 2

In what follows, we extract the actual data available from the Abstract of Statistics (Government of Gibraltar 2014b) over the period 1996–2012. The method used in the analysis is the auto-regressive distributed lag (ARDL) procedure (Pesaran et al. 2001; Pesaran and Pesaran 2009), and the Toda and Yamamoto (1995) causality procedures, respectively. In summary, the results show that electricity consumption has a long run association with the output per capita at levels with a statistically significant coefficient of electricity consumption in the short run (0.53) and the long-run (1.46); and a unidirectional causality running form electricity consumption to GDP per capita duly supporting electricity-led growth hypothesis. The reminder of the paper is set out as follows. In the next section (Sect. 2), we provide a brief literature survey of studies pertaining to electricity/energy viz. economic growth. In Sect. 3, we discuss the methods, followed by the results in Sect. 4. In Sect. 5 we conclude.

2 Literature survey

In many instances, energy and electricity are interchangeably used in the literature. Subsequently, we summarize studies on electricity and energy consumption viz. economic growth. In surveying the literature on energy-growth nexus, Payne (2010) proposed that energy-growth causality can be categorized into four streams: (1) the growth hypothesis which asserts a unidirectional causality from electricity (energy) consumption to economic growth; (2) the conservation hypothesis in the presence of a unidirectional causality from economic growth to electricity (energy) consumption; (3) the neutrality hypothesis which indicates the absence of any causal relationship between electricity consumption and economic growth; and (4) the feedback hypothesis which emphasizes a bidirectional causation between energy consumption and growth.

Early studies that looked at the income and electricity/energy nexus dates back to Kraft and Kraft (1978) who used the Granger causality test to provide evidence of causality running from income to energy in the US. Studies that further support the conservation hypothesis are: Abosedra and Baghestani (1989) for the US, Yu and Choi (1985), Ghosh (2002) for India, Soytas and Sari (2003) for South Korea, Erol and Yu (1987) for West Germany, Masih and Masih (1996) for Indonesia, Soytas and Sari (2003) for Korea and Italy, Oh and Lee (2004a) for Korea, Narayan and Smyth (2005) for Australia, Wolde-Rufael (2006) for six African countries (Cameroon, Ghana, Nigeria, Senegal, Zambia, Zimbabwe), Yoo (2006) for Indonesia and Thailand, Lee (2006) for France, Italy and Japan, Yoo and Kim (2006) for Indonesia, Huang et al. (2008) for middle income groups (lower and upper middle income groups) and high income group countries, and Odhiambo (2009) for Congo (DRC), and Kumar et al. (2014a) for Albania, Bulgaria, Hungary and Romania.

Evidence supporting unidirectional causality from energy/electricity consumption to income (growth hypothesis) are: Stern (1993, 2000) for the US, Erol and Yu (1987) for Japan, Yu and Choi (1985) for Philippines, Masih and Masih (1996) for India and Indonesia, Glasure and Lee (1998) for Singapore, Soytas and Sari (2003) for Turkey, France, Germany and Japan, Shiu and Lam (2004) for China, Wolde-Rufael (2004, 2006) for Shanghai, China, and Benin, Congo (DRC) and Tunisia, respectively, Altinay and Karagol (2005) for Turkey, Lee (2005) for eighteen developing countries, Yuan et al. (2007) for China, Odhiambo (2009) for Tanzania, Odhiambo (2010) and Kumar and Kumar (2013a) for South Africa and Kenya. Moreover, Bowden and Payne (2009) use the US annual data from 1949 to 2006 using aggregate and sectoral primary energy consumption measures within a multivariate framework and the Toda-Yamamoto (Toda and Yamamoto 1995) procedure. They find that industrial primary energy consumption Granger-cause real GDP. Akinlo (2009) and Abosedra et al. (2009) finds a unidirectional causality from electricity consumption to real GDP for Nigeria and Lebanon, respectively; Yoo and Kwak (2010) find a unidirectional short-run causality from electricity to real GDP for Argentina, Brazil, Chile, Columbia, and Ecuador. Moreover, Bowden and Payne (2010) using the USA as a reference country, explore the causality between renewable and non-renewable energy consumption at sectoral level and find a unidirectional causality from residential renewable energy consumption and non-renewable energy consumption to real GDP, respectively, and Payne (2011a) finds a unidirectional causation from biomass energy consumption to real GDP.

Studies that support the feedback hypothesis includes: Erol and Yu (1987) for Japan and Italy, Hwang and Gum (1992) for Taiwan, Masih and Masih (1996) for Pakistan, Glasure and Lee (1998) for South Korea and Singapore, Hondroyiannis et al. (2002) for Greece, Soytas and Sari (2003) for Argentina, Ghali and El-Sakka (2004) for Canada, Oh and Lee (2004b) for Korea, Wolde-Rufael (2006) for Egypt, Gabon, and Morocco, Lee (2006) for the US, Yoo (2005, 2006) for Korea, Malaysia and Singapore, Mahadevan and Asafu-Adjaye (2007) for energy exporting developed countries; and between commercial and residential primary energy consumption and real GDP, respectively, for the US (Bowden and Payne 2009). Moreover, Tang (2008) finds no evidence of cointegration between electricity consumption and economic growth in Malaysia however concludes a bi-directional causation between the two. Yoo and Kwak (2010), Ouédraogo (2010), Shahbaz et al. (2011) find bidirectional causality between electricity consumption and economic growth for Venezuela, Burkina Faso, and Portugal, respectively.

On the other hand, some studies find no evidence of causality between energy and income thereby supporting the neutrality hypothesis. These studies include: Akarca and Long (1980), Yu and Hwang (1984), Yu and Choi (1985), Erol and Yu (1987) for the case of the US, Masih and Masih (1996) for Malaysia, Singapore and Philippines, Glasure and Lee (1998) for South Korea (based on the standard Granger causality), Soytas and Sari (2003) for nine countries including the US, Asafu-Adjaye (2000) for Indonesia and India, Altinay and Karagol (2004) for Turkey, Wolde-Rufael (2005) for eleven African countries (including Kenya and South Africa), Lee (2006) for the UK, Germany and Sweden, Soytas and Sari (2006) for China, Wolde-Rufael (2006) for Algeria, Congo Republic, Kenya, South Africa, and Sudan, and Huang et al. (2008) for low income group countries, and Yoo and Kwak (2010) for Peru. More recent studies showing the absence of causality in the US at disaggregated and sectoral levels include: Payne and Taylor (2010) who find absence of causality between nuclear energy consumption and real GDP growth, Bowden and Payne (2010) who find the no causality between commercial and industrial renewable energy consumption and real GDP, and Payne (2011b) who find absence of causality between coal consumption and real GDP.

Notably, the disagreements in the direction of causality as well seen in the literature are mainly due to country-specific structural factors; the sample size; the differences in the methods and approaches used; and the definition and the level of disaggregation of energy in examining the electricity-growth nexus.Footnote 3

3 Methods

3.1 Framework

We use the Cobb–Douglas type production function and define the GDP per capita equation as:

where y = real GDP per capita; and ELEC = electricity consumption per capita in kWh; and α is share or elasticity coefficient of electricity consumption.

Hence taking the logarithm of (1), we obtain the basic equation for estimation as:

where π, is a constant. Equation (2) is then used to estimate long-run relationship once a cointegration is identified.

3.2 Data

We use the annual data from 1996 to 2012. The data used in the analysis are extracted from the report: Abstract of Statistics published for 2002 and 2012 by the Statistics Office of the Government of Gibraltar (Government of Gibraltar 2014a, 2014b). It was noted that data on GDP are in given nominal terms, and hence need to be adjusted for inflation to convert the data into real terms. The data for GDP per capita in nominal terms (in pounds) is available for the period 1996–2012. The GDP per capita is then adjusted with the respective year retail index to obtain the values in real terms. The report publishes data on electricity consumption in millions of kWh and population for the period 1970–2012, respectively. Therefore, we compute the electricity per capita (in KWH) by dividing electricity consumption in KWH by the respective period population (ELEC). Given that the per capita GDP data is from 1996 to 2012, we restrict the sample to this period only.Footnote 4 Notably, this reduces the sample size to 18. However, as discussed in Sect. 3.3, examining the cointegration of small sample size is also possible using the Microfit 5.01 software which provides the critical bounds and the F- and W- statistics to reach a reliable conclusion. All variables are transformed into log form before proceeding to estimation. The descriptive statistics and correlation matrix are provided in Table 1, which shows that all variables are positively correlated.

3.3 ARDL approach

To examine the cointegration relationship and hence the existence of long-run association between the variables, we use the autoregressive distributed lag (ARDL) procedure developed by Pesaran et al. (2001). There are a number of advantages of using ARDL procedure. First, it is relatively simple and recommended for small sample size (Pesaran et al. 2001; Ghatak and Siddiki 2001; Narayan 2005; Wolde-Rufael 2006). Second, in this approach, it is not required to test for unit roots and it is also possible to investigate cointegration irrespective of the order of integration. In other words, the variables can be integrated of at most order one, i.e. either I (0), I (1) or a combination of the two. Nevertheless, the ARDL procedure is not designed to accommodate I (2) variables and therefore appropriate unit root tests need to be provided to clarify the order of integration. Moreover, conducting the unit-root tests also helps in performing a robust causality assessment particularly when using the approach proposed by Toda and Yamamoto (1995). For the purpose of unit root tests, we use the augmented Dickey–Fuller (ADF), Phillips–Perron (PP) and Kwiatkowski–Phillips–Schmidt–Shin (KPSS) (Kwiatkowski et al. 1992) tests to examine the time series properties of the variables and compute the unit root statistics. We examine the presence of unit root with intercept, and intercept and trend. The critical values for ADF, PP and KPSS are based on Mackinnon (1996), Kwiatkowski et al. (1992), respectively. The optimal is automatically lag determined by the Eviews 8 based on the the Akaike information criterion (AIC) for ADF, and bandwidth for PP and KPSS tests, respectively. The null hypothesis for ADF and Phillips-Perron tests is that the given series has a unit root (non-stationary), and for KPSS, the hypothesis is that the given series is stationary. We denote 1 and 5 % level of significance for stationary series by A, and B, respectively. The unit root results (Tables 2, 3, 4) indicate that all variables are I (0)—stationary in their difference within the 1 and 5 % levels of statistical significance.

We also examine the structural break in series using the Zivot and Andrews (1992), Perron (1997) unit root test of unknown single structural break in series (Tables 5). We note that although including the break periods does not influence the long-run and short-run results, and also the break period is not statistically significant in the results), it does affect the statistical significance of the cointegration between level variables. Due to small sample size, we note that including the break periods fails to successfully execute the cointegration analysis and hence the critical bounds and the F- and W-statistics cannot be obtained.Footnote 5 Nevertheless, we report the structural break periods in series. However, we do not include the break periods in examining the cointegration due to small sample size which affects successful execution of the cointergation statistics, and also noting that the break periods are not statistically significant. Moreover, we also note that are possibility of structural breaks earlier than 1996 which is not captured by the data due to the aforesaid limitations and hence using the break periods is not sensible at this point. Hence, based on the conventional unit root tests, we note that the maximum order of integration is one.

Next, since we do not have any prior information regarding the direction of the long-run relationship between the level variables y and ELEC, we construct the following ARDL equations:

To examine the cointegration relationship, the basic steps are as follows: First, Eq. (3) is estimated by ordinary least square techniques, separately. Second, the existence of a long-run relationship is traced by imposing a restriction on all estimated coefficients of lagged level variables equating to zero, in each equation. Therefore, the null hypothesis of no cointegration (H null : β i1 = β i2 = 0) is examined against the alternative hypothesis of existence of long-run cointegration \((H_{ALT} :\beta_{i1} \ne 0;\beta_{i2} \ne 0)\). If the computed F-statistics falls above the upper critical bound, (F − stat > I (1) critical ), then the null hypothesis of no conintegration is rejected. Alternatively, if the test statistics falls below the lower bounds (F − stat < I (0) critical ), then the null hypothesis is accepted. In case when the F-statistics falls within the upper and lower bounds, (I (0) critical < F −stat < I (1) critical ) the outcome is inconclusive. Previously, to examine the cointegration based on the computed bounds F-statistics, the critical bounds from Narayan (2005), which is specifically designed for small sample size (30 ≤ n ≤ 80) is recommended. However, in case where n < 30, one may resort to other procedures proposed by Cheung and Lai (1995), Sephton (1995) and applied in Tang and Abosedra (2014). Moreover, the updated version of Microfit software (Mfit 5.01) by Pesaran and Pesaran (2009), the successor of Microfit 4.1 (Pesaran and Pesaran 1999) also enables one to compute the critical F- and W-statistics at the corresponding 90 and 95 % bounds by stochastic simulations using 20,000 replications with the given sample size. Accordingly, we use Microfit 5.01 to compute the bounds and examine the critical F- and W-statistics against the respective computed bounds to make the conclusion. The results are provided in Table 6. In what follows, we note a long-run cointegration of all the level variables at least at the 10 % level of statistical significance. This indicates the presence of long-run association of level variables between GDP per capita and electricity consumption per capita.

After confirming the existence of a long-run relationship between level variables, we examine the maximum lag-length needed for the ARDL regression estimation of the short-run and long-run estimation. We note that the maximum lag-length is 1 (Table 7) which also supports the fact that the sample size is relatively small.

3.4 The Toda–Yamamoto approach to Granger non-causality test

Next, we examine the direction of causality using the Granger causality test proposed by Toda and Yamamoto (1995) (T-Y approach). The test has the advantage that the presence of non-causality can be examined irrespective of whether the variables are I (0), I (1) or I (2), not cointegrated or cointegrated of an arbitrary order. In order to carry out the Granger non-causality test, the model is presented in the following VAR system:

where the series are defined in (4)–(5). The null hypothesis of no-causality is rejected when the p values falls within the (conventional) 1–10 % of level of significance. Hence, in (4), Granger causality from ELEC to y implies δ 1i ≠ 0∀i; and in (5) y Granger causes ELEC if θ 1i ≠ 0∀i. The unit root results (Tables 2, 3, 4) show the maximum order of integration is 1 (d max = 1), and the optimal lag length chosen is 1 (k = 1). Hence, the maximum lags that can be used to carry out the non-causality tests is 2 (d max + k ≤ 2). This implies that when examining the causality, appropriate lag used should not exceed 2. Moreover, for small sample size such as in our case, it is recommended to use a shorter lag relative to a longer one to obtain more meaningful results. For our purpose, we use the maximum lag of 1. In conducting the causality tests, it is important to examine the properties of inverse roots of the AR (auto-regressive) characteristics polynomial diagram. In order to obtain a robust causality result based on the Chi square and p values, the inverse roots should lie within the positive and negative unity. In case when the inverse roots lie outside the positive–negative unit boundary, this need to be corrected by including appropriate lags and/or trend variable as instruments (exogenous variable) in the VAR equation before proceeding with the causality assessment. We ensure the AR inverse roots are within the positive–negative unit boundary before proceeding to the causality assessment.

4 Results

4.1 Diagnostic tests

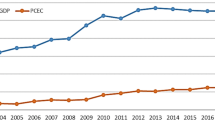

Before presenting the ARDL long-run and short-run results, we present the lag-estimated results (Table 8) which precedes the long-run and short-run results together with the diagnostic tests. These diagnostic tests include: Lagrange multiplier test of residual serial correlation \((\chi_{sc}^{2} )\); Ramsey’s RESET test using the square of the fitted values for correct functional form \((\chi_{ff}^{2} )\); normality test based on the test of skewness and kurtosis of residuals \((\chi_{n}^{2} )\); and heteroscedasticity test based on the regression of squared residuals on squared fitted values \((\chi_{hc}^{2} )\). In what follows (Table 8), we find that the diagnostic test rejects the acceptance of the null hypothesis of the presence of biasness of serial correlation [χ 2 sc (1) = 0.0458: F(1, 12) = 0.0324], functional form [χ 2 ff (1) = 4.7877: F(1, 12) = 4.7045], normality [χ 2 n (2) = 0.5940] and heteroscedasticity [χ 2 hc (1) = 0.0009: F(1, 15) = 0.0008], at least at 5 % level of statistical significance. The CUSUM and CUSUM of squares (CUSUMQ) figures are examined to determine the stability of the parameters of the model (Fig. 1a, b) and as noted, the plots show indicate that parameters are stable in the model.

4.2 Short-run and long-run

In the short-run (Table 9, Panel b), we note that electricity consumption (per capita) is statistically significant. This indicates that a 1 % increase in energy will result in 0.53 % increase in per capita income in the short-run. Furthermore, the coefficient of the error-correction term is −0.75 and significant at 1 % level of statistical significance. This implies a relatively speedy convergence to the long-run equilibrium, i.e., about 75 % of the disequilibrium from the previous year’s shocks in the model adjusts back to the long-run equilibrium in the current year.

In regards to the long-run results (Table 9, Panel a), we note that the coefficients of electricity consumption is positive and statistically significant at 1 % level. Hence, a 1 % increase in energy consumption is increases the per capita income by 1.46 %, in the long-run.

4.3 Granger causality

The results of the causality tests are presented in Table 10. A unidirectional causation running from electricity consumption to GDP is noted. This indicates that electricity consumption Granger causes GDP duly supporting the electricity-led growth hypothesis.

5 Conclusion

Before we proceed to summarize the results, some caveats are in order. We highlight the fact that the sample size is small (1996–2012) which is due to that fact that data on GDP was only available for these periods, and therefore the sample had to be reduced. We chose not to use any extrapolation techniques to backward construct the data on GDP although this can be an option (Kumar and Stauvermann 2014) to overcome the sample size limitations.Footnote 6 Moreover, the presence of structural breaks in the series can equally distort the results. However, the sample size used is relatively small (n = 17) and therefore incorporating the break periods (which we have computed using the Perron (1997), Zivot and Andrews (1992) will give an unclear picture since the odds of identifying break periods in the series prior to 1996 is equally likely. For instances, some notable events that may have plausibly influenced the economic activities and therefore can be examined in future research subject to data availability include inter alia: (1) in 1984, the Royal Forces contributed around 60 % to the GDP compared to around 6 % in 2008; (2) in 1993, which was the year in which Gibraltar celebrated its first National Day with strong commitments to end the colonial status through self-determination; (3) the year 1996 was the period of General Election where the Gibraltar Social Democrats won and pledged to establish a politically secure British Gibraltar with a modern Constitution; and (4) the 1997 period signifies period of continued efforts to uphold fundamental human right of self determination and resolving differences with Spain. The effects of these periods can be better reflected with a relatively large sample size. Nevertheless, we examined the break periods in our sample and noted that they were statistically not significant, did not influence the long-run results, and in fact resulted in failure to successfully execute the cointegration bounds statistics. Examining all these scenarios, we refrained from including the structural break periods in our model. Therefore, we admit that the results presented need to be taken with some caution. However, we contend that even with a larger sample size, electricity consumption will continue to have a momentous effect on the economic growth of the Gibraltarian economy given the huge market of service industry that includes e-gaming, finance, and tourism.

Against these limitations, the results presented indicate that electricity consumption has momentous long-run and short associations with GDP per capita and that electricity consumption duly causes income which subsequently supports the electricity (energy)-led growth hypotheses for the small and semi-sovereign state of Gibraltar. Our results therefore supports the fact that the presence of huge industries such as e-gaming is one of the primary consumers of electricity and hence an important driver of growth (because of its relatively huge demand for electricity via the data centers). It is therefore recommended that the government prioritize the provision of a safe and stable electricity supply, because the success of the e-gaming industry and also online banking sector depends strongly on internet connections and a secure supply of electricity. With respect to information and telecommunication technology, Gibtelecom strives to offer a 100 % broadband coverage. Although the supply of electricity may not be a concern at least for some years from now, it is noted that frequent “freak events” and power outages due to old generators and excess load generators can cause serious economic damage particularly in the online gambling/betting sector.Footnote 7 Moreover, the considering the semi-sovereign structure of the state, the government can jointly partner with British government to ensure sustainable and green energy production and consumption.

Notes

Koomey (2011) estimates that between 1and 2 % of the world wide electricity in 2010 were used for data centers and that the electricity consumption of data centers world-wide increased by 56 % from 2005 to 2010.

We also thank the reviewers for pointing this out in the second round of the review comments.

In most cases, the results from using either energy consumption or electricity consumption data are qualitatively similar.

It is also worth noting that GDP that data older than 1996 could be distorted by the military activities of the Royal Forces.

Although the sample data for electricity consumption is from 1970 to 2012, the per capita income data is from 1996 to 2012 and hence the analysis is restricted to the latter. Additionally, it also should be taken into account that in 1984 the Royal Forces contributed 60 % to the GDP and the contribution was less than 6 % in 2008.

The danger of using approximated data is that it could result in unreliable conclusions. The authors are thankful to the anonymous reviewers for highlighting this and insisting that only actual available data be used in the analysis in the first round of review.

For more information, readers are requested to see http://www.bbc.com/news/uk-27098178 and http://www.gbc.gi/news/3556/power-station-tender-process-near-end,-as-cm-orders-%27telecoms-review%27).

References

Abosedra S, Baghestani H (1989) New evidence on the causal relationship between United States energy consumption and gross national product. J Energy Dev 14:285–292

Abosedra S, Dah A, Ghosh S (2009) Electricity consumption and economic growth, the case of Lebanon. Appl Energy 86(4):429–432

Akarca AT, Long TV (1980) On the relationship between energy and GNP: a reexamination. J Energy Dev 5:326–331

Akinlo AE (2009) Electricity consumption and economic growth in Nigeria: evidence from cointegration and co-feature analysis. J Policy Model 31(5):681–693

Altinay G, Karagol E (2004) Structural break, unit root, and the causality between energy consumption and GDP in Turkey. Energy Econ 26:985–994

Altinay G, Karagol E (2005) Electricity consumption and economic growth: evidence from Turkey. Energy Econ 27(6):849–856

Asafu-Adjaye J (2000) The relationship between energy consumption, energy prices and economic growth: time series evidence from Asian developing countries. Energy Econ 22:615–625

Bowden N, Payne JE (2009) The causal relationship between US energy consumption and real output: a disaggregated analysis. J Policy Model 31:180–188

Bowden N, Payne JE (2010) Sectoral analysis of the causal relationship between renewable and non-renewable energy consumption and real output in the US. Energy Sources Part B 5:400–408

Cheung YW, Lai KS (1995) Practitioners corner: lag order and critical values of a modified Dickey-Fuller test. Oxf Bull Econ Stat 57:411–419

Erol U, Yu ESH (1987) On the causal relationship between energy and income for industrialized countries. J Energy Dev 13:113–122

Ghali KH, El-Sakka MIT (2004) Energy use and output growth in Canada: a multivariate cointegration analysis. Energy Econ 26:225–238

Ghatak S, Siddiki J (2001) The use of ARDL approach in estimating virtual exchange rates in India. J Appl Stat 28:573–583

Ghosh S (2002) Electricity consumption and economic growth in India. Energy Policy 30(2):125–129

Glasure YU, Lee A-R (1998) Cointegration, error-correction, and the relationship between GDP and energy: the case of South Korea and Singapore. Resour Energy Econ 20:17–25

Government of Gibraltar (2014a) Abstract of Statistics 2012. H.M. Government of Gibraltar. https://www.gibraltar.gov.gi/images/stories/PDF/statistics/2013/Abstract_of_Statistics_2012.pdf. Accessed 1 August 2014

Government of Gibraltar (2014b) Abstract of Statistics 2002. H.M. Government of Gibraltar. https://www.gibraltar.gov.gi/images/stories/PDF/statistics/2002/Abstract_of_Statistics_2002.pdf. Accessed 1 August 2014

Hondroyiannis G, Lolos S, Papapetrou E (2002) Energy consumption and economic growth: assessing the evidence from Greece. Energy Econ 24:319–336

Huang B-N, Hwang MJ, Yang CW (2008) Causal relationship between energy consumption and GDP growth revisited: a dynamic panel data approach. Ecol Econ 67:41–54

Hwang DBK, Gum B (1992) The causal relationship between energy and GNP: the case of Taiwan. J Energy Dev 16:219–226

Koomey J (2011) Growth in data center electricity use 2005 to 2010, Oakland, CA: Analytics Press. http://www.analyticspress.com/datacenters.html. Accessed 10 November 2014

Kraft J, Kraft A (1978) On the relationship between energy and GNP. J Energy Dev 3:401–403

Kumar RR, Kumar R (2013) Effects of energy consumption on per worker output: a study of Kenya and South Africa. Energy Policy 62:1167–1193

Kumar RR, Stauvermann PJ (2014) Exploring the effects if remittances on lithuanian economic growth. Eng Econ 25(3):250–260

Kumar RR, Stauvermann PJ, Patel A, Kumar RD (2014) Exploring the effects of energy consumption on output per worker: a study of Albania, Bulgaria, Hungary and Romania. Energy Policy 69:575–585

Kwiatkowski D, Phillips PCB, Schmidt P, Shin Y (1992) Testing the null hypothesis of stationarity against the alternative of a unit root. J Econom 54:159–178

Lee CC (2005) Energy consumption and GDP in developing countries: a cointegrated panel analysis. Energy Econ 27:415–427

Lee CC (2006) The causality relationship between energy consumption and GDP in G-11 countries revisited. Energy Policy 34:1086–1093

Mackinnon JG (1996) Numerical distribution functions for unit root and cointegration tests. J Appl Econom 11:601–618

Mahadevan R, Asafu-Adjaye J (2007) Energy consumption, economic growth and prices: a reassessment using panel VECM for developed and developing countries. Energy Policy 35:2481–2490

Masih A, Masih R (1996) Energy consumption, real income and temporal causality: results from a multi-country study based on cointegration and error-correction modeling techniques. Energy Econ 18:165–183

Narayan PK (2005) The saving and investment nexus for China: evidence from cointegration tests. Appl Econ 37:1979–1990

Narayan PK, Smyth R (2005) Electricity consumption, employment and real income in Australia: evidence from multivariate granger causality tests. Energy Policy 33:1109–1116

Odhiambo NM (2009) Energy consumption and economic growth nexus in Tanzania: an ARDL bounds testing approach. Energy Policy 37:617–622

Odhiambo NM (2010) Energy consumption, prices and economic growth in three SSA countries: a comparative study. Energy Policy 38:2463–2469

Oh W, Lee K (2004a) Energy consumption and economic growth in Korea: testing the causality relation. J Policy Model 26:973–981

Oh W, Lee K (2004b) Causal relationship between energy consumption and GDP revisited: the case of Korea 1970–1999. Energy Econ 26:51–59

Ouédraogo IM (2010) Electricity consumption and economic growth in Burkina Faso: a cointegration analysis. Energy Econ 32(3):524–531

Payne JE (2010) A survey of the electricity consumption-growth literature. Appl Energy 87:723–731

Payne JE (2011a) On biomass energy consumption and real output in the US. Energy Sources Part B 6:47–52

Payne JE (2011b) US disaggregate fossil fuel consumption and real GDP: an empirical note. Energy Sources Part B 6:63–68

Payne JE, Taylor JP (2010) Nuclear energy consumption and economic growth in the US: an empirical note. Energy Sources Part B 5:301–307

Perron P (1997) Further evidence on breaking trend functions in macroeconomic variables. J Econom 80:355–385

Pesaran B, Pesaran HM (1999) Microfit 4.1 interactive econometric analysis. Oxford University Press, Oxford

Pesaran B, Pesaran HM (2009) Time series econometrics using Microfit 5.01. Oxford University Press, Oxford

Pesaran MH, Shin Y, Smith RJ (2001) Bounds testing approaches to the analysis of level relationships. J Appl Econom 16:289–326

Sephton PS (1995) Response surface estimates of the KPSS stationary test. Econ Lett 47(3–4):255–261

Shahbaz M, Tang CF, Shabbir MS (2011) Electricity consumption and economic growth nexus in Portugal using cointegration and causality approaches. Energy Policy 39:3529–3536

Shiu A, Lam P-L (2004) Electricity consumption and economic growth in China. Energy Policy 31(1):47–54

Soytas U, Sari R (2003) Energy consumption and GDP: causality relationship in G-7 countries and emerging markets. Energy Econ 25:33–37

Soytas U, Sari R (2006) Can China contribute more to the fight against global warming? J Policy Model 28:837–846

Stern DI (1993) Energy and economic growth in the USA, a multivariate approach. Energy Econ 15:137–150

Stern DI (2000) A multivariate cointegration analysis of the role of energy in the US economy. Energy Econ 22:267–283

Tang CF (2008) A re-examination of the relationship between electricity consumption and economic growth in Malaysia. Energy Policy 36(8):3077–3085

Tang CF, Abosedra S (2014) Small sample evidence on the tourism-led growth hypothesis in Lebanon. Curr Issues Tour 17(3):234–246

Toda HY, Yamamoto T (1995) Statistical inferences in vector autoregression with possibly integrated processes. J Econom 66:225–250

Wolde-Rufael Y (2004) Disaggregated energy consumption and GDP, the experience of Shangai 1952–1999. Energy Econ 26:69–75

Wolde-Rufael Y (2006) Electricity consumption and economic growth: a time series experience for 17 African countries. Energy Policy 34:1106–1114

Oxford Bulletin of Business and Economics 57(3): 411–418

Yoo S-H (2005) Electricity consumption and economic growth: evidence from Korea. Energy Policy 33(12):1627–1632

Yoo S-H (2006) The causal relationship between electricity consumption and economic growth in the ASEAN countries. Energy Policy 34(18):3573–3582

Yoo S-H, Kim Y (2006) Electricity generation and economic growth in Indonesia. Energy 31(14):2890–2899

Yoo S-H, Kwak S-Y (2010) Electricity consumption and economic growth in seven South American countries. Energy Policy 38(1):181–188

Yu ESH, Choi JY (1985) The causal relationship between energy and GNP: an international comparison. J Energy Dev 10:249–272

Yu ESH, Hwang BK (1984) The relationship between energy and GNP: further results. Energy Econ 6:186–190

Yuan J, Zhao C, Yu S, Hu Z (2007) Electricity consumption and economic growth in China: cointegration and co-feature analysis. Energy Econ 29(6):1179–1191

Zivot E, Andrews DWK (1992) Further evidence on the great crash, the oil-price shock, and the unit-root hypothesis. J Bus Econ Stat 10:251–270

Author information

Authors and Affiliations

Corresponding author

Rights and permissions

About this article

Cite this article

Kumar, R.R., Stauvermann, P.J. & Patel, A. Nexus between electricity consumption and economic growth: a study of Gibraltar. Econ Change Restruct 48, 119–135 (2015). https://doi.org/10.1007/s10644-014-9156-0

Received:

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s10644-014-9156-0