Abstract

The majority of studies discussed the existence of a trade-off between financial performance and outreach, pointing out those MFIs that look for higher profits lead to lower outreach. Another stream of research discussed the phenomena of mission drift, which see MFIs leave from their social mission, which is to provide micro financial services to break the cycle of poverty by reducing financial exclusion and move away from the traditional microcredit business model by three different ways. The paper contribute to the debate focussing the impact of mission drift phenomena on both financial performance and outreach of MFIs. This paper uses a dataset of 194 microfinance institutions (MFIs), 788 annual ratings from 2001 to 2010, collected by MicroFinanza Rating, an international MFIs’ rating agency, to study and test three hypotheses on the relationship between mission drift, financial performance and outreach of MFIs. Data analysed with mixed effect regressions shows that a trade-off exist between financial performance and outreach. Results show that mission drift positively impacts on financial performance but it reduces outreach. MFIs should be encouraged to clearly define if their main aim is to assure remuneration of shareholders or if they want to contribute to the outreach of poor.

Résumé

La majorité des études ont traité de l’existence d’un compromis entre les résultats financiers et la portée, signalant que les IMF qui recherchent des profits plus élevés en viennent à réduire leur champ d’action. Un autre courant de recherche a examiné les phénomènes de dérive de mission, qui voient les IMF s’écarter de leur mission sociale, qui est d’offrir des services de la microfinance pour briser le cycle de la pauvreté en réduisant l’exclusion financière et de s’éloigner du modèle économique du microcrédit traditionnel de trois façons différentes. Cet article alimente le débat en mettant en évidence l’impact des phénomènes de dérive de mission aussi bien sur les performances financières que sur la portée des IMF. Cet article utilise un ensemble de données de 194 institutions de microfinance (IMF), 788 évaluations annuelles de 2001 à 2010 rassemblées par MicroFinanza Rating, une agence de notation internationale des IMF, pour étudier et tester trois hypothèses sur la relation entre la dérive de mission, les performances financières et la portée des IMF. Les données analysées avec des régressions à effets mixtes montrent qu’un compromis existe bien entre les performances financières et la portée. Les résultats montrent que la dérive de mission a des répercussions bénéfiques sur les performances financières mais qu’elle réduit la portée. Les IMF devraient être encouragées à définir clairement si leur objectif principal est d’assurer la rémunération des actionnaires ou si elles veulent contribuer à offrir des services aux pauvres.

Zusammenfassung

Die Mehrzahl von Studien diskutierte den existierenden Kompromiss zwischen der finanziellen Leistung und dem Outreach und wies darauf hin, dass Mikrofinanzinstitute, die höhere Profite anstreben, weniger Outreach-Arbeit betreiben. Ein weiterer Forschungsstrom diskutierte das Phänomen der Missionsabweichung, wonach Mikrofinanzinstitute von ihrer sozialen Aufgabe abweichen - nämlich Mikrofinanzdienstleistungen anzubieten, um den Teufelskreis der Armut zu durchbrechen, indem die finanzielle Exklusion reduziert wird - und sich vom traditionellen Mikrokredit-Geschäftsmodell auf drei unterschiedliche Weisen entfernen. Die Abhandlung ist ein Beitrag zu dieser Diskussion und konzentriert sich auf die Auswirkungen des Phänomens der Missionsabweichung auf die finanzielle Leistung und die Outreach-Arbeit der Mikrofinanzinstitute. Der Beitrag stützt sich auf einen Datensatz von 194 Mikrofinanzinstituten und 788 Jahreswertungen von 2001 bis 2010 von MicroFinanza Rating, einer internationalen Ratingagentur für Mikrofinanzinstitute, um drei Hypothesen zu der Beziehung zwischen Missionsabweichung, finanzieller Leistung und Outreach-Arbeit von Mikrofinanzinstituten zu untersuchen und zu testen. Die Daten, die mittels des gemischten Regressionsmodells analysiert wurden, zeigen einen Kompromiss zwischen der finanziellen Leistung und dem Outreach. Die Ergebnisse legen dar, dass sich eine Missionsabweichung positiv auf die finanzielle Leistung auswirkt, die Outreach-Arbeit jedoch reduziert. Mikrofinanzinstitute sollten dazu aufgefordert werden, genau festzulegen, ob ihr Hauptziel darin besteht, die Bezahlung ihrer Aktionäre zu gewährleisten oder ob sie zur Outreach-Arbeit für Arme beitragen wollen.

Resumen

La mayoría de los estudios analizaron la existencia de una compensación entre el rendimiento financiero y el alcance, señalando que aquellas instituciones de microfinanzas (MFI, por sus siglas en inglés) que buscan beneficios más elevados llevan a un alcance menor. Otra corriente de investigación analizó el fenómeno de la desviación de su misión, que ve a las MFI abandonar su misión social, que es proporcionar servicios de microfinanzas para romper el ciclo de pobreza mediante la reducción de la exclusión financiera y se alejan del modelo de negocio tradicional de microcréditos de tres formas diferentes. Este documento contribuye al debate centrando el impacto del fenómeno de la desviación de su misión tanto sobre el rendimiento financiero como sobre el alcance de las MFI. El presente documento utiliza un conjunto de datos de 194 instituciones de microfinanzas (MFI), 788 calificaciones anuales desde 2001 a 2010, recopiladas por MicroFinanza Rating, una agencia de calificación internacional de MFI, para estudiar y poner a prueba tres hipótesis sobre la relación entre la desviación de su misión, el rendimiento financiero y el alcance de las MFI. Los datos analizados con regresiones de efecto mixto muestran que existe una compensación entre el rendimiento financiero y el alcance. Los resultados muestran que la desviación de su misión afecta de manera positiva al rendimiento financiero pero reduce el alcance. Debe alentarse a las MFI para que definan con claridad si su principal objetivo es garantizar la remuneración de los accionistas o si desean contribuir a la participación de los pobres.

摘要

主要的研究都集中在讨论财务表现和客户范围之间的平衡上,并指出寻求更高利润的微型金融机构会导致客户范围减小。其他 的研究讨论了使命漂移现象,也就是微型金融机构离开了它们的社会使命——也就是通过减少金融排斥来提供微观的金融服务从而打破贫穷循环——通过三个不同的方式离开了传统的小额信贷业务。 对于集中在使命漂移现象对微型金融机构的财务表现和客户范围的影响的讨论 , 本文对这些讨论起补充作用。 本论文采用194微型金融机构的数据集以及2001到2010年的788个年度评级来研究和检验三个有关微型金融机构使命漂移、金融表现和客户范围和之间的关系的假说。这些评级由一个国际性的微型金融机构评级机构“微型金融机构评级机构”收集,带有混合效应回归的数据分析显示财务表现和客户范围之间存在平衡关系。 研究结果显示,使命漂移对财务表现有积极影响,但能减少客户范围,应鼓励微型金融机构清楚说明他们的主要目标是否是要确保股东的薪酬或要帮助穷人。

ملخص

ناقشت معظم الدراسات وجود مفاضلة بين الأداء المالي والتوعية، تحديد مؤسسات التمويل الصغير(MFI) التي تبحث عن إرتفاع الأرباح الذي يؤدي إلى إنخفاض التوعية. تيار آخر للبحث ناقش ظاهرة إنحراف الرسالة، التي ترى مؤسسة التمويل الصغير (MFI)تترك مهمتهما الإجتماعية، التي هي تقديم الخدمات المالية الصغيرة للخروج من دائرة الفقر من خلال الحد من الإستبعاد المالي والإبتعاد عن نموذج القروض الصغيرة لأعمال تقليدية بثلاثة طرق مختلفة. يساهم البحث للنقاش بالتركيز على تأثير ظواهر إنحراف الرسالة على كل من الأداء المالي والتوعية من مؤسسات التمويل الصغير((MFI. يستخدم هذا البحث مجموعة بيانات من 194 من مؤسسات التمويل الصغير((MFI ، 788 تصنيفات سنوية 2001-2010، التي تم جمعها عن طريق وكالة تصنيف التمويل الصغير (MicroFinanza)، وكالة تصنيف لمؤسسات التمويل الصغير(MFI) الدولية، لدراسة وإختبار ثلاث فرضيات حول العلاقة بين إنحراف الرسالة، والأداء المالي والتوعية من مؤسسات التمويل الصغير(MFI). تحليل البيانات مع تراجع تأثير مختلط يبين أن المفاضلة موجودة من بين الأداء المالي والتوعية. تشير النتائج إلى أن إنحراف الرسالة يؤثر إيجابا على الأداء المالي لكنه يقلل من التوعية. ينبغي تشجيع مؤسسات التمويل الصغير(MFIs) لتحديد بوضوح إذا كان هدفهم الرئيسي هو ضمان مكافأة المساهمين أو إذا كانوا يريدون المساهمة في التوعية للفقراء.

Similar content being viewed by others

Avoid common mistakes on your manuscript.

Introduction

The microfinance industry is made up of an increasing variety of microfinance institutions (MFIs) such as non-governmental organisations, foundations, government bodies, saving banks, banks, credit unions, cooperatives and non-bank financial institutions. Among all the different types of existing MFIs, the last worldwide available data reported that only 2 % had reached financial sustainability (Woller et al. 1999; Paxton et al. 2000; Woller, 2002; Olivares-Polanco 2004; Hermes et al. 2011). It is in this situation that a stream of research has discussed the relation between MFIs’ financial performance and their capacity to help the poor with setting up their own income-generating businesses (i.e. ‘outreach’) (Olivares-Polanco 2004).

No clear evidence has been found with regard to the outreach–financial performance relationship, and the issue is central to the debate around MFIs. Several studies indirectly considered the trade-off, and their findings suggest that a conflict may exist between outreach and sustainability (Pinz and Helmig 2015; Louis et al. 2013; Mersland and Strøm 2010; Olivares-Polanco 2004; Woller 2002; Paxton et al. 2000; Woller et al. 1999) or outreach and efficiency (Hermes et al. 2011). However, the rigour of these analyses has been questioned (Hermes and Lensink 2011; Mersland and Strøm 2010), thus calling for further investigation (Pinz and Helmig 2015; Hermes and Lensink 2011). Other studies found that more financially conscious MFIs are better able to provide credit to the poor, thus contradicting the existence of an outreach–performance trade-off. The ambiguity of these results supports the need for more research.

Similarly, researchers have been called to investigate the relationship between financial performance and the pursuit of MFIs’ mission: the ‘mission drift’ phenomenon. MFIs’ mission is traditionally identified as providing credit to the poor who have no access to commercial banks in order to break the cycle of poverty and reduce their financial exclusion. The academic literature suggests that many kinds of mission drift exist. Among these, the most observed can be identified as pertaining to one of the following three phenomena. First, MFIs move to wealthier clients searching for higher financial performance, reducing their microfinance services to the poor and increasing the average loan (Cull et al. 2007). Second, MFIs tend to reduce the needs of conveyances, shifting from group to individual lending methodology (Ghatak and Guinnane 1999; Armendariz de Aghion and Morduch 2005; Cull et al. 2007). Third, MFIs shift from offering services to the poor in rural areas to addressing the urban poor, who reside in more cost-effective markets (Mersland and Strøm 2010).

We contribute to the debate by exploring the impact of the mission drift phenomenon on both financial performance and MFIs’ outreach. Using a large longitudinal dataset collected through MicroFinanza Rating (we analysed 788 annual ratings of MFIs), an international and well-known MFIs rating agency, we attempted to deepen the understanding of the impact of mission drift on outreach and financial performance. This paper provides a theoretical framework regarding the relation between mission drift and outreach and mission drift and financial performance; then, it describes the empirical study we conducted, discusses the results and finally concludes.

Theoretical Framework

Being financially sustainable and achieving outreach are two different objectives that MFIs are expected to reach. Although empirical studies point out that they seem to alternate (see e.g. Woller et al. 1999; Paxton et al. 2000; Woller 2002; Olivares-Polanco 2004; Hermes et al. 2011), in an ideal situation, financial performance and outreach should be pursued simultaneously (Pinz and Helmig 2015).

In the last 20 years, the debate on the relation between financial performance and outreach in MFIs has focused on two positions: the poverty lending approach and the financial system approach (Robinson 2001). The former asserts that aiming for financial performance hinders MFIs’ capability to reduce poverty; therefore, MFIs should concentrate their efforts on helping the poor by providing credit at subsidised rates (Morduch 1999; Hermes and Lensink 2007). On the contrary, the latter approach stresses that good financial performance is a requirement for microfinance programmes, as they need to be able to cover the costs of lending money while minimising their operational costs (Dichter and Harper 2007). The debate between the two approaches has not been solved, although the most recent microfinance paradigm seems to favour the financial systems approach (Hermes and Lensink 2007). Among others, Hermes and Lensink (2011) reported that the main argument in support of paying more attention to MFIs’ financial performance is that outreach, considered in the long-term, cannot be achieved if MFIs are not financially sustainable.

Earlier research largely addressed the relation between financial performance and the number (breadth of outreach) and socioeconomic level (depth of outreach) of the clients that MFIs serve. The literature provides mixed evidence, especially regarding the depth of outreach. Among others, Cull et al., (2007) examined financial performance and outreach in a large comparative study based on a dataset of 124 MFIs in 49 countries. The authors investigated whether their financial performance was better if it was associated with a lower depth of outreach to the poor. They found that MFIs that mainly used the individual lending methodology performed better financially, but at the same time, the proportion of poor borrowers and female borrowers in their loan portfolios was lower than MFIs that mainly used group lending methodology. Quayes (2012) found the opposite to be true: he investigated the interaction between financial performance and outreach in a sample of 702 MFIs in 83 countries. He asserted that financial performance has a positive impact on the depth of outreach of an MFI, and simultaneously, that the depth of outreach increases the probability of achieving financial sustainability. His study gives evidence of a positive complementary relationship between financial performance and depth of outreach. In particular, he proposed an endogenous model to capture any evidence of a complementary relationship between depth of outreach and financial self-sufficiency and found that a number of variables, including the fraction of women borrowers, have a statistically significant positive impact on the depth of outreach. The analysis also showed that a financially self-sufficient MFI has better outreach than an MFI that is not self-sufficient. More recently, Louis et al., (2013) investigated the association between outreach and financial performance using a comprehensive dataset of 650 MFIs. They found a positive relationship between outreach and financial sustainability.

Mission Drift and Outreach

Even if advocates of microfinance argue that access to financing services can help reduce poverty (Littlefield et al. 2003; Deloach and Lamanna, 2011; (Imai et al. 2012), a growing number of studies have raised concerns about the efficacy of microfinance in poverty reduction. MFIs have been subject to criticism, with claims that they cannot reach the poorest of the poor but only the less poor (Scully 2004). Other critics of microfinance raise the issue of the risk associated with the loans (Hermes and Lensink 2011). First, the extreme poor may decide not to participate in microfinance programmes because they fear that taking out a loan is too risky and that it is not worth investing for the future. Second, there may be a problem of exclusion of the poorest by other group members because they consider it too risky to accept the core poor into their group (Hulme and Mosley 1996; Marr 2004). Third, the staff members of MFIs may exclude the poorest, since lending to them is rated as extremely risky (Hulme and Mosley 1996). Fourth, in some cases, MFIs are organised in a way that tends to exclude the core poor, for example, they may define the ability to save as a necessary requirement to access a loan (Kirkpatrick and Maimbo 2002; Mosley 2001).

When MFIs incur mission drift, they move away from their original mission, with clear repercussions for their outreach. They change their business model and lose sight of their mission to offer small amounts of credit to the poor, increasing the average loan and addressing the needs of the less poor. As a consequence, when the average loan increases, MFIs’ effectiveness in poverty reduction via microcredit decreases. In addition, the ability of the poor to return the loan decreases; therefore, poor people waive all claims to their loans.

Another consideration about mission drift is that usually, a larger loan is oriented towards more structured and developed activities that are further away from the real possibilities of the poor and from the kind of self-entrepreneurship activities in which they engage (Hudon and Traca 2011). The most common self-entrepreneurial activities, generated by microcredit, are indeed related to the rural world and agriculture, followed by small commercial retail activities. So, it is understandable that for these types of businesses that are typical of developing countries, large amounts of money are not required (Deininger and Liu 2013). These considerations bring us to the first hypothesis in the present study.

Hypothesis 1 (H1)

Mission drift decreases MFIs’ outreach.

Mission Drift and Financial Performance

Among the first studies that pointed out the risk of mission drift in MFIs, Woller et al., (1999) sustained that mission drift occurs when an MFI decides to distance itself from poor customers, moving away from the traditional social mission of MFIs. Starting from this preliminary work, Paxton et al., (2000) and Woller (2002) argued that offering microcredit to the poor and being financially sustainable are alternating aims in MFIs, and that a negative relation exists between transaction costs and loan size. The hypothesis one was largely sustained by further studies that posited that lending to poor borrowers can be very costly because pursuing the traditional social mission of MFIs increases the transaction costs of those institutions, which conflicts with financial performance (Hermes et al. 2011). Referring to transactional costs, Prior and Argandoña (2009) attributed the high costs of microcredit to a financial distribution network that is not capillary and cost-effective. Yet, the criticism of microfinance is that the more an MFI attempts to reach the traditional social mission of microcredit—providing the poor access to financial services—the higher its transaction costs and the lower its financial performance. In light of this consideration, several authors have argued that microfinance programmes definitively cannot reach the poorest of the poor (Scully 2004); further, the poorest are deliberately excluded from microfinance programmes because the related transaction costs are financially unsustainable (Hulme and Mosley 1996; Mosley 2001; Kirkpatrick and Maimbo 2002).

Other authors have proposed the opposite hypothesis. (Littlefield et al. 2003) asserted that MFIs that serve the very poor perform better than others in terms of efficiency (measured by cost per borrower). Fernando’s (2004) study analysed 39 MFIs and found that without shifting from their mission, the MFIs improved their financial performance.

The transactional costs that are connected to lending to the poor are what led us to believe that mission drift (i.e. not providing small loans to the poorest in favour of providing higher loans to the less poor with lower transactional costs) has a positive influence on MFIs’ financial sustainability. From these studies, we offer the following second hypothesis.

Hypothesis 2 (H2)

Mission drift increases MFIs’ financial performance.

Data and Methodology

Sample

We surveyed a total of 194 MFIs to test our hypotheses. The MFIs were included in the institutions that MicroFinanza Rating analysed between 2001 and 2010. MicroFinanza Rating is the leading rating agency specialised in MFIs; it produces independent ratings to promote a responsible flow of investment towards MFIs. Inclusion of MFIs in the MicroFinanza Rating dataset is based on investors’ interest; thus, the sample is skewed towards institutions that are concerned about financial performance and profitability.

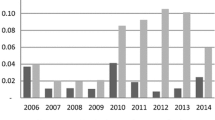

Our full sample consisted of 788 observations (annual ratings). Table 1 describes the dataset in terms of number of observations per year, areas of activities of MFIs, loan types and the legal status of the considered MFIs. As can be seen from table, there are only 13 observations for 2001 and 29 for 2002. The number of observations increases from 29 in 2002 to 130 in 2006. In the sample, there is an equal distribution between inclusion of MFIs that operate in rural areas (25.6 %) and those operating in urban areas (25.6 %). Referring to the lending style, Cull et al., (2007) distinguished between individual lending, which applies to MFIs that use standard bilateral contracts between a lender and a single borrower, and solidarity group lending, in which loans are made individually. In this study, the lending methodologies based on geographical area of activity do not offer particular insights—they are distributed uniformly and equitably in the sample. With reference to the lending methodology, the sample shows that the main type of loan realised is for individuals (31.2 %), while loans aimed at groups of individuals comprise 18.7 %. The data also show that individual loan growth reached 91.2 % in the 2010. The main type of organisation involved in lending is non-governmental organisations (NGOs) (39.1 %); these are followed by non-bank financial organisations (28.8 %); cooperative organisations (26.0 %); and commercial MFIs (6.1 %).

Table 2 shows the number of observations considered in the sample per country. In our sample, MFIs from Ecuador are the most representative (111 observations), followed by Honduras (62). The MFIs included tend to be larger than the standard MFI, with a mean of 116 employees and 11,520 active borrowers. The largest MFIs account for more than 75 % of all customers in the microfinance industry (Honohan 2004); thus, we rely on a high level of representativeness for the industry.

All of the variables used in the analysis were collected and verified by independent analysts of MicroFinanza Rating, who conducted the periodical ratings of the MFIs. The independence of the analysts ensures that the data are highly reliable. Each rating involves variables on basic financial performance, the amount and quality of the managed assets and the customers’ basic demographic information.

As previously mentioned, the central aim of this paper is to test the relationship between MFIs’ mission drift, financial performance and outreach, which emerged as a trade-off between financial versus outreach performance. In line with earlier studies (Olivares-Polanco 2004; Cull et al. 2007; Hermes and Lensink 2007), we used the percentage of women customers that comprised the MFIs’ overall outreach. The Social Performance Task Force (SPTF) (2009) reported that women’s outreach is considered an important indicator in social performance measurement.

Linear Mixed Model Analysis

In longitudinal data, correlations are typically observed between dependent measurements. To handle this type of data, regular statistical analyses (such as OLS regression) do not apply because they assume the independence of measurements; further, specific techniques must be adopted to analyse repeated measures (Omar et al. 1999). Moreover, regular repeated measures of analysis of variance typically cannot cope with missing data, and they only take into account cases with complete data that might not be representative of the full dataset. These techniques estimate group effects and provide no insight into how single cases develop over time. For these reasons, mixed effects regressions have become increasingly popular for analysing longitudinal data. Mixed model analysis includes random regression effects that account for the influence of cases on repeated measurements, enabling the analysis of single cases’ development over time. In addition, in this type of regression analysis, cases with incomplete data can be included.

Using mixed effects regressions, we tested several models to examine which variables should be included to explain the data (Laird and Ware 1982). To assess whether a predictor that was added to the model increased the explained variance, we used Akaike’s information criterion (AIC) (Akaike 1973). The AIC determines the maximum likelihood of a possible model, adjusted for the number of parameters that are estimated. As an additional criterion, we considered the Bayesian information criterion (BIC) (Burnham and Anderson 2002), as this fit measure is insensitive to sampling size, unlike the AIC. The model with the lowest AIC and BIC represents the best model. Moreover, for the tested models, we performed the log likelihood ratio test, comparing the difference in log likelihood between the model with and the model without the added predictor. We performed the Hausman test to choose between fixed and random effects, and the results suggested that we should use fixed effects. Finally, we report the significance of the p-values of the coefficients in the model and the adjusted explained variance of the model. Exploratory inspection of our data revealed that MFI mainly varied at the beginning level of outreach (i.e. the intercept) and less in the growth rate of outreach; therefore, we decided to apply a fixed slope and to only estimate a random intercept.

Control Variables, Outreach and Financial Performance Over Time

First, we tested models with control variables that emerged in earlier studies as predictors of overall outreach and financial performance. In the analysis, we included the year, area of activities, loan types, types of MFIs and the number of employees in the workforce as predictors of the MFIs’ level of outreach and financial performance.

Due to the multidimensional nature of poverty (Armendariz de Aghion and Morduch 2005), outreach has traditionally been treated as a multidimensional variable (Navajas et al. 2000; Schreiner 2002). Although there are more dimensions than depth and breadth of outreach, this research will focus mainly on these two factors. Depth of outreach is the weight of a client in the social welfare function, and it is generally measured by the percentage of women borrowers (Hermes et al. 2011). Breadth of outreach is the number of people using MFIs’ services during a given period, and it is generally measured by the number of borrowers per employee (Copestake 2007; Bhatt and Tang 2001).

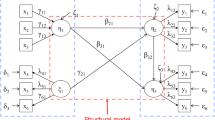

The MFIs’ financial performance was evaluated using two very well-known indicators: return on equity (ROE) and return on assets (ROA) (Mersland and Strøm 2010). We considered four control models, one for each of the following dependent variables: depth of outreach (OUT_DEPTH), breadth of outreach (OUT_BREADTH), ROA and ROE. Models 1A, 1B, 1C and 1D are based on the following formula, which includes the control variables:

In this formula, β 0 denotes the sample intercept. RURAL and URBAN are two dummy variables that refer to MFIs’ activities in rural or urban areas. We included two variables because in the sample, there were MFIs that were active in both contexts. The same situation led us to introduce two dummy variables related to the type of lending, including INDIVIDUAL and GROUP, as two independent dummy variables. In order to control for different types of MFIs having different revenue functions, we added a vector of dummies for type. MFITYPE is a set vector that includes four dummy variables related to types of organisations. To control for the social and financial effects of the type of organisation (Chahine and Tannir 2010), we included dummy variables for commercial, NGO, non-bank financial institutions and cooperative MFIs. STAFF allowed us to consider the size of the MFI. Since MicroFinanza Rating evaluated some MFIs multiple times per year, we considered the rating that referred to the MFI’s overall performance in a given year. The variable DEPENDENTi,t refers to the outcome variable that we used to analyse the MFI (i) in a given year (t). The four variables we considered included OUT_DEPTH, which measured the depth of outreach (percentage of women customers); OUT_BREADTH, which was the breadth of outreach (number of borrowers per employee); ROA; and ROE.

All of the tested models were run on the 194 MFIs using all 788 observations. The final dataset has 16 missing values (8 in STAFF, 2 in OSS and 6 in LLR). We addressed this problem using linear mixed models in the analysis, and due to the low number of missing values in the total number of observations, they had a limited impact on the correlations.

Control Variables, Mission Drift and Outreach Over Time

To examine whether mission drift affected outreach, we included additional variables in the analysis. Models 2A, 2B, 2C and 2D were based on the following formula:

In this model, the dependent variables were OUT_DEPTH (Model 2A), OUT_BREADTH (Model 2B), ROA (Model 2C) and ROE (Model 2D). In the formula, OSS indicates operational self-sufficiency, which is typical of MFIs’ performance and measures the relationship between an MFI’s operating income and its total costs (operating expenses, loan provision and financial costs). The LLR indicates the loan loss reserves, and it is included in the control to measure the differences in the risk-taking strategies that MFIs use (Fries and Taci, 2005).

Following Mersland and Strøm (2010), we measured mission drift with average loan balance (ALB) per borrower/gross national income per capita (in US dollars), which is an indicator of mission drift. In this sense, the higher the ALB, the less the MFI is close to the traditional business model of an MFI. Thus, an increase in the ALB could be considered as a proxy of mission drift in MFI. We normalised the ALB per borrower using gross national income per capita to correct the effect of different levels of income in a nation with the mean size of the loan.

Results

Since we entered several variables into the analysis that showed relatively high inter-correlations, collinearity among the variables could threaten our results. Table 3 shows that there are inter-correlations with p-values <0.05 %. Therefore, since Shieh and Fouladi (2003) demonstrated that collinearity does not affect the estimation coefficients of linear mixed models, it is unlikely that inter-correlations among the variables biased our analysis and estimates.

Table 4 illustrates the estimated coefficients of our mixed effects regression models on outreach.

Model 1A illustrates to what extent the control variables contribute to the depth of outreach of MFIs, and Model 1B, to the breadth of outreach. The results for the regression weights (β 0–β 8) are provided with the variance of the intercept. Table 4 shows that two of the regression weights were significant: the commercial nature (MFITYPE–COMMERCIAL) and the size (STAFF) of the MFI. Model A shows that commercial MFIs reach lower levels of outreach; on the other hand, large MFIs are more likely to reach higher levels of outreach.

Models 2A and 2B tested whether the control variables (β 0–β 8) and the MFIs’ operational activities (β 9–β 10) and mission drift (β 11) affected outreach over time. Therefore, the OSS, the LLR and the ALB were entered into the formula. The results show that the LLR is not a significant contributor to the equation, but the OSS and ALB are. The models also show that the nature of commercial MFIs and the size of the MFIs still remain relevant for outreach. On the contrary, the more the MFI has a low average loan balance, the more it will reach higher levels of outreach. The AIC and the BIC of Models 1B and 2B are considerably lower than they are in Models 1A and 2A. This indicates an improvement of goodness of the models. This consideration is also supported by the significant reduction of log likelihood and the increase in the adjusted R 2.

To study whether mission drift affects financial performance, we ran models with ROA and ROE as dependent variables. Table 5 shows the results of the analysis on mission drift and financial performance.

Models 1C, 2C, 1D and 2D tested whether the control variables (β 0–β 8) and the operational activities (β 9–β 10) and mission drift (β 11) of the MFIs affected financial performance over time. Therefore, the OSS, the LLR and the ALB were entered into the formula. The results show that the OSS and ALB are significant contributors to the equation. Further, mission drift seems to have a positive effect on financial performance. Models 2C and 2D show an improvement in the goodness of estimation, as seen in the reduction in AIC and BIC. This consideration is also supported by the significant reduction of log likelihood and the increase of the adjusted R2.

Discussion

This study contributes to the literature by exploring the effect of mission drift on both outreach and financial performance through the statistical analysis of 788 longitudinal observations. Thus, it fulfils a gap in the literature, where broad quantitative studies and clear evidence of the relationship between mission drift, outreach and performance do not exist. Hence, the present study contributes to a better understanding of how MFIs can balance their ability to serve the poor and their need to reach positive financial performance.

Comparing the results on outreach and financial performance, we found that when MFIs undergo mission drift, they face a trade-off between the two dimensions, which implies that they cannot pursue both objectives simultaneously. In contrast, our results demonstrated that the capability to enhance operational self-sufficiency allows MFIs to improve both their outreach and financial performance. This result is particularly interesting to contribute to the debate around MFIs, as it highlights that the problem of the confirmed trade-off between outreach and financial performance cannot be solved through a re-orientation of the organisational mission—whether closer to or further from the original aim of microcredit activity. Rather, managers of MFIs should concentrate on designing more efficient operational processes. By so doing, they would avoid the outreach–financial performance trade-off, as the effects of operational efficiency on the two dimensions follow the same direction.

Other interesting observations can be drawn from the effects determined by the size of the organisation and its orientation towards commercial goals. In particular, our study suggests that if MFIs want to generate a positive impact in terms of poverty reduction, they should build a medium–large organisation and manage their operations in a highly efficient way. Conversely, MFIs that are more oriented towards commercial goals tend to reduce their capability to help the poor exit poverty. However, we found that size and commercial orientation had a neutral effect on financial performance; therefore, they did not help manage the trade-off between outreach and performance.

Conclusions

Using a cross-national sample of 194 MFIs and a total of 788 observations, our study contributes to the understanding of the relationships between mission drift, outreach and financial performance. More specifically, we found strong evidence that when MFIs depart from their original mission, their financial performance tends to improve and their outreach abates. Hence, mission drift amplifies the outreach–financial performance trade-off, forcing MFIs to choose just one objective. However, the results offer an interesting insight into how MFIs could target this trade-off, as our findings demonstrate that equilibrium would be facilitated via efficient management of the lending process. Our findings, then, move the focus from mission drift to self-sufficient operations, suggesting that MFIs would not become more sustainable from deviation from the original mission, reducing their effectiveness in poverty alleviation. Rather, MFIs could simultaneously guarantee greater outreach and positive financial performance by improving their internal operations.

Our study offers interesting insights to both practitioners and scholars. To the managers of MFIs, our findings suggest that when the mission deviates from its original definition, the outreach–financial performance trade-off should be actively managed rather than endured. Accordingly, managers should consider the balance between the capability to serve the poor and the objective in terms of financial performance into the process of revising and redefining their business model.

Our results are also useful to rating agencies, as they confirm that the ALB per borrower/gross national income per capita (in US dollars) (outreach breadth) is a proxy of the strategic aim that the single MFI is pursuing in terms of outreach and financial sustainability. Researchers already recognise the importance of this indicator regarding mission drift, but rating agencies overlook it. A low ALB indicates that the MFI is striving to improve its outreach, whereas a high ALB denotes a stronger orientation towards financial performance. The same considerations would be helpful to investors and donors in order to better evaluate where to invest their money. For instance, investors would probably prefer to choose MFIs with a high ALB, since they would likely be more profit oriented; conversely, donors may prefer a low ALB, assuming that they would pay more attention to MFIs’ social aim. As well, and even more interesting, is the possibility of using OSS as a proxy of the capability of MFIs to pursue outreach and financial performance simultaneously.

Eventually, poverty alleviation programmes that rely on MFIs will find our results useful in defining the criteria for the involvement of such institutions. In this sense, OSS and ALD are important factors to consider during the selection phase in order to guarantee the involved institution’s alignment to the social objective of the programme.

Moving to academic implications, our study has made relevant contributions to the literature on the subject, since it has confirmed the role of mission drift in the trade-off between outreach and financial performance, which scholars should take into consideration when approaching research on MFIs. Moreover, the methodology used to run the research is innovative in studies regarding MFIs and the trade-off between sustainability and outreach.

Future research should investigate the impact of mission drift on MFIs’ operations to better understand how MFIs can reach equilibrium between the search for financial sustainability and the objective of poverty alleviation. Our study, as well as most of the previous literature focuses on exploring whether a trade-off exists, but we do not yet know how the industry should address it. Studies on the role of the normative institutional framework would be welcome to foster knowledge about the mechanisms that support a socially and economically sustainable financial sector for the poor.

References

Akaike, H. (1973). Information theory and an extension of the maximum likelihood principle. In B. Petrov & F. Caski (Eds.), Proceedings of the second international symposium on information theory. Budapest: Akademiai Kiado.

Armendariz de Aghion, B., & Morduch, L. (2005). The economics of microfinance. Cambridge: MIT Press.

Bhatt, N., & Tang, S. Y. (2001). Delivering microfinance in developing countries: Controversies and policy perspective. Policy Studies Journal, 29(2), 319–333.

Burnham, K. P., & Anderson, D. R. (2002). Model selection and multi-model inference: a practical information-theoretic approach. New York: Springer.

Chahine, S., & Tannir, L. (2010). On the social and financial effects of the transformation of microfinance NGOs. Voluntas, 21, 440–461.

Copestake, J. (2007). Mainstreaming microfinance: Social performance management or mission drift? World Development, 35(10), 1721–1738.

Cull, R., Demirgüç-Kunt, A., & Morduch, J. (2007). Financial performance and outreach: A global analysis of lending microbanks. The Economic Journal, 117(1), 107–133.

Deininger, K., & Liu, Y. (2013). Economic and social impacts of an innovative self-help group model in India. World Development, 43, 149–163.

DeLoach, S. B., & Lamanna, E. (2011). Measuring the impact of microfinance on child health outcomes in Indonesia. World Development, 39(10), 1808–1819.

Dichter, T. W., & Harper, M. (2007). What’s wrong with microfinance. In T. W. Dichter & M. Harper (Eds.), What’s wrong with microfinance. Essex: Practical Action Publishing.

Fernando, N. A. (2004). Micro success story, transformation of nongovernmental organizations into regulated financial institutions. Manila: Asian Development Bank.

Fries, S., & Taci, A. (2005). Cost efficiency of banks in transition: Evidence from 289 banks in 15 post-communist countries. Journal of Banking & Finance, 29(1), 55–81.

Ghatak, M., & Guinnane, T. W. (1999). The economics of lending with joint liability: Theory and practice. Journal of Development Economics, 60, 195–228.

Hermes, N., & Lensink, R. (2007). The empirics of microfinance: What do we know? The Economic Journal, 117(517), 1–10.

Hermes, N., & Lensink, R. (2011). Microfinance: its impact, outreach, and sustainability. World Development, 39(6), 875–881.

Hermes, N., Lensink, R., & Meesters, A. (2011). Outreach and efficiency of microfinance institutions. World Development, 39(6), 938–948.

Honohan, P. (2004). Financial sector policy and the poor: Selected findings and issues (Vol. 43). Washington, DC: World Bank Publications.

Hudon, M., & Traca, D. (2011). On the efficiency effects of subsidies in microfinance: An empirical inquiry. World Development, 39(6), 966–973.

Hulme, D., & Mosley, P. (1996). Finance against poverty. London: Routledge.

Imai, K. S., Gaiha, R., Thapa, G., & Annim, S. K. (2012). Microfinance and poverty—A macro perspective. World Development, 40(8), 1675–1689.

Kirkpatrick, C., & Maimbo, M. (2002). The implications of the evolving microfinance agenda for regulatory and supervisory policy. Development Policy Review, 20(3), 293–304.

Laird, N. M., & Ware, J. H. (1982). Random-effects models for longitudinal data. Biometrics, 38, 963–974.

Littlefield, E., Morduch, J., & Hashemi, S. (2003). Is microfinance an effective strategy to reach the Millennium Development Goals?. Focus Note 24. Washington, DC: CGAP.

Louis, P., Seret, A., & Baesens, B. (2013). Financial efficiency and social impact of microfinance institutions using self-organizing maps. World Development, 46, 197–210.

Marr, A. (2004). A challenge to the orthodoxy concerning microfinance and poverty reduction. Journal of Microfinance, 5(2), 1–35.

Mersland, R., & Strøm, R. Ø. (2010). Microfinance mission drift? World Development, 38(1), 28–36.

Morduch, J. (1999). The microfinance promise. Journal of Economic Literature, 37(4), 1569–1614.

Mosley, P. (2001). Microfinance and poverty in Bolivia. Journal of Development Studies, 37(4), 101–132.

Navajas, S., Schreiner, M., Meyer, R. L., & Gonzalez-Vega, C. (2000). Microcredit and the poorest of the poor: Theory and evidence from Bolivia. World Development, 28(2), 333–346.

Olivares-Polanco, F. (2004). Commercializing microfinance and deepening outreach? Empirical evidence from Latin America, Journal of Microfinance, 7, 47–69.

Omar, R. Z., Wright, E. M., Turner, R. M., & Thompson, S. G. (1999). Analysing repeated measurements data: A practical comparison of methods. Statistics in Medicine, 18(13), 1587–1603.

Paxton, J., Graham, D., & Thraen, C. (2000). ‘Modeling group loan repayment behavior: New insights from Burkina Faso. Economic Development and Cultural Change, 48(3), 639–655.

Pinz, A., & Helmig, B. (2015). Success factors of microfinance institutions: State of the art and research agenda. Voluntas, 26(2), 488–509.

Prior, F., & Argandoña, A. (2009). ‘Credit accessibility and corporate social responsibility in financial institutions: The case of microfinance. Business Ethics: A European Review, 18(4), 349–363.

Quayes, S. (2012). Depth of outreach and financial sustainability of microfinance institutions. Applied Economics, 44(26), 3421–3433.

Robinson, M. (2001). The microfinance revolution: Sustainable banking for the poor. Washington, DC: The World Bank.

Schreiner, M. (2002). Aspects of outreach: A framework for discussion of the social benefits of microfinance. Journal of International Development, 14(5), 591–603.

Scully, N. (2004). Microcredit: No panacea for poor women. Washington, DC: Global Development Research Centre.

Shieh, Y. Y., & Fouladi, R. T. (2003). The effect of multicollinearity on multilevel modeling parameter estimates and standard errors. Educational and Psychological Measurement, 63(6), 951–985.

Social Performance Task Force (2009). Social Performance Standards Report, www.sptf.info.

Woller, G. (2002). The promise and peril of microfinance commercialization. Small Enterprise Journal, 13(4), 12–21.

Woller, G. M., Dunford, C., & Woodworth, W. (1999). Where to microfinance? International Journal of Economic Development, 1(1), 29–64.

Author information

Authors and Affiliations

Corresponding author

Ethics declarations

Conflict of interest

The authors declare that they have no conflict of interest.

Rights and permissions

About this article

Cite this article

Pedrini, M., Ferri, L.M. Doing Well by Returning to the Origin. Mission Drift, Outreach and Financial Performance of Microfinance Institutions. Voluntas 27, 2576–2594 (2016). https://doi.org/10.1007/s11266-016-9707-2

Published:

Issue Date:

DOI: https://doi.org/10.1007/s11266-016-9707-2