Abstract

This article examines the social and financial performance of an international sample of non-governmental organizations (NGOs) which transformed into microfinance institutions (TMFI). It shows that recent calls for the transformation of NGOs into TMFIs help improve the financial sustainability and the breadth of outreach of microfinance activities. However, this transformation hinders the depth of the services provided by TMFIs. This is especially significant in the case of bank-TMFIs and suggests that although the transformation might increase the financial independence of TMFIs, it might cause a mission drift that both NGOs and policy-makers ought to consider.

Résumé

Le présent document étudie les performances sociales et financières d’un échantillon international d’organisations non gouvernementales (ONG), qui sont devenues des institutions de microfinance (IMF). Il démontre que les demandes récentes de transformation des ONG en IMF permettent d’améliorer la viabilité financière et l’étendue de la portée des activités de microfinance. Pourtant, cette transformation représente un obstacle à l’approfondissement des services apportés par les IMF. Cet aspect est particulièrement significatif dans le cas des IMF bancaires, et donne à penser qu’en dépit du fait que cette transformation pourrait accroître l’indépendance financière des IMF, elle est également susceptible de provoquer la dérive de la mission dont doivent tenir compte les ONG et les responsables politiques.

Zusammenfassung

Dieser Beitrag untersucht beispielhaft die sozialen und finanziellen Leistungen einiger nicht-staatlicher Organisationen in verschiedenen Ländern, die in Mikrofinanzinstitutionen umgewandelt wurden. Es wird dargelegt, dass die jüngsten Forderungen nach der Umwandlung nicht-staatlicher Organisationen in Mikrofinanzinstitutionen die finanzielle Nachhaltigkeit fördern und die Reichweite der Mikrofinanzaktivitäten vergrößern können. Allerdings begrenzt diese Umwandlung das Dienstleistungsspektrum der betroffenen Mikrofinanzinstitutionen. Dies ist insbesondere von Bedeutung für die umgewandelten Mikrofinanzinstitutionen, die zugleich Banken sind, und lässt darauf schließen, dass, obgleich die Umwandlung zu einer erhöhten finanziellen Unabhängigkeit der Mikrofinanzinstitutionen führen kann, unter Umständen jedoch vom ursprünglichen Zweck abgewichen wird. Dies sollte sowohl von den nicht-staatlichen Organisationen als auch von den Entscheidungsträgern berücksichtigt werden.

Resumen

El presente trabajo analiza los resultados sociales y financieros de un grupo internacional de organizaciones no gubernamentales (ONG) que se han transformado en instituciones de microfinanzas (en adelante, IMFT). El trabajo demuestra que los recientes llamamientos para la transformación de las ONG en IMFT ayudan a mejorar la sostenibilidad financiera y la amplitud de alcance de las actividades microfinancieras. No obstante, esta transformación limita la profundidad de los servicios prestados por las IMFT, circunstancia que es especialmente significativa en el caso de las IMFT bancarias y sugiere que, aunque la transformación podría aumentar la independencia financiera de las IMFT, podría también ocasionar un cambio de misión que deberían tener en cuenta tanto las ONG como los políticos.

摘要

本论文研究那些非政府组织 (NGO) 转化成小额信贷机构 (Transformation of Micro-finance institutions,以下缩写为 TMFI) 后在社会和财务业绩方面的一个国际选样。论文表明,最近在 NGO 的 TMFI 转化方面的呼吁,有助于改进小额信贷活动在财政方面的可持续性及其扩展服务面的广度。然而,该转化也阻碍了 TMFI 提供服务的深度。 这在银行与 TMFI 之间关系方面尤其明显,并表明了尽管该转化可能增加 TMFI 的财务独立性,但也可能造成一个 NGO 以及政策制定者双方都应该予以考虑的使命偏离。

ملخص

يفحص هذا البحث الأداء الإجتماعي والمالي لعينة دولية للمنظمات الغيرحكومية(NGOs) التي تحولت إلى مؤسسات التمويل الصغير (من الآن فصاعدا ،TMFI). يبين أن الدعوة الأخيرة إلى تحول المنظمات الغير حكومية(NGOs) إلى مؤسسات التمويل الصغير(TMFIs) يساعد في تحسين الإستدامة المالية وإتساع نطاق أنشطة تمويل المشاريع الصغيرة. مع ذلك، هذا التحول يعوق عمق الخدمات التي تقدمها مؤسسات التمويل الصغير(TMFIs). هذا أمر مهم لا سيما في حالة المصرف- مؤسسات التمويل الصغير(TMFIs)، ويشير إلى أن على الرغم من أن التحول قد يزيد من الاستقلال المالي لمؤسسات التمويل الصغير (TMFIs)، فإنه قد يتسبب في انحراف المهمة التي يجب أن ينظر فيها كلاً من المنظمات الغير حكومية (NGOs) وواضعي السياسات.

Similar content being viewed by others

Avoid common mistakes on your manuscript.

Introduction

“This is not charity. This is business: business with a social objective, which is to help people get out of poverty” Muhammad Yunus—the Grameen Bank, Nobel Peace Prize winner—the Nightly Business Report in 2005.

Microfinance is one of the most “effective and flexible strategies” in the fight against global poverty (Grameen Foundation). It should be and can be implemented on a large scale in order to respond to the urgent needs of the world’s poorest, as it focuses on the moral consequences of financial exclusion (Hudon 2009). Over the past several decades non-governmental organizations (NGOs) have pioneered the initiative of providing financing to the poor to help alleviate their poverty and improve their socio-economic conditions. Those needs are tremendous, and the dependence of NGOs on donor financing hinders the sustainability and continuity of those activities. As such, and given that financial markets have proven to help in promoting economic development and growth by extending financing to those in need, a recent call has been initiated to transform microfinance NGOs into transformed microfinance institutions (TMFI), a legal status that would enable them to tap capital markets and to better provide microfinance services (Fernando 2004; Ledgerwood and White 2006). In this article we examine the viability of this transformation on NGOs’ social and financial sustainability. We further examine the transformation into a bank legal status given that banks have proven to be instrumental in the lending process.

NGOs have shown their ability to extend microcredit but they need the legal framework to collect deposits so that they won’t have to find a donor to sustain their operations. “If I have to borrow money to lend it, I will be at the mercy of someone else. When I am allowed to take public deposits, I have more options. I may still borrow but as a legal entity, I have a greater ability to borrow” (Yunus 2007). While the provision of microcredit is often administered by NGOs, there is mixed evidence on the success of this transformation into TMFIs in enhancing the mission of microfinance institutions on both the social and financial fronts.

On the one hand, some studies suggest that the increased social outreach through transformation does not come at a zero cost. Woller (2002) argues that the transformation might lead to a possible “mission drift.” On the other hand, there is no compelling evidence that the transformation leads to a mission drift among microfinance institutions (see Christen 2001 for a further discussion). The transformation is shown to improve the financial flexibility of TMFIs and thus enhance the access of the poor to financial services (Fernando 2004). Increased financial flexibility will enable higher profitability (Gibbons and Meehan 1999), which helps attract private capital, a necessary condition to the flourishing of social benefits (Hassan 2002). Given that poverty is measured by the percentage of population having income below the minimum expenditure required for meeting the basic subsistence (Ullah and Routray 2007), TMFIs should thus be able to attract and retain a greater number of borrowers (Fernando 2004). They should have a greater depth of social outreach and thus, be in a position to better service the population in need, namely the poorer clients who are unable to have access to the loans of regular financial institutions (Fernando 2004). The increased depth of social outreach should reflect a lower average loan balance per borrower for these TMFIs.

To test our hypotheses, this article uses a refined econometric method and examines whether the call for transformation has allowed TMFIs to achieve the double goal of increased outreach and financial sustainability of operations. As such, we collect an exhaustive set of data for 68 TMFIs for the period extending from 1994 to 2006. We use to the return on assets (ROA) and the return on equity (ROE) ratios to verify the effect of transformation on the financial performance of TMFIs. We also consider the changes in the number of active borrowers and the average loan balance per borrower to examine the effect of transformation on the social breadth and depth of TMFIs, respectively. Moreover, we test the effect of the legal status of the TMFI, bank versus non-bank, on both the financial and social fronts. In order to increase the statistical significance of our test results, we match our sample of TMFIs with a control sample of 68 NGOs based on size and geographic location.

The contributions of this article are three-folds: First, this article refers to an econometric methodology to examine the effect of transformation on both the financial and social performance of NGOs involved in microfinance activities. Using a large number of TMFIs, it provides a solid framework and contributes to the on-going debate related to the role played by microfinance institutions in different settings. Second, our empirical evidence sheds light on the dilemma faced by TMFIs between financial sustainability and outreach. As expected, we show that the independence of TMFIs helps improve their operating performance, however, enhancement comes at a cost. Although the transformation of NGOs into TMFIs increases the breadth of their social services, i.e., the number of active borrowers; there is a decrease in the depth of microfinance services, i.e., an increase in the average loan balance per borrower. Since financial independence requires that TMFIs increase their interest rate and/or become more selective in the choice of beneficiaries, our findings suggest that TMFIs exhibit a significant drift in their social activities toward more solvent borrowers with better abilities to repay. This is consistent with our further results showing that the transformation into bank-TMFIs permits TMFIs to have a higher operating performance together with a larger breadth of social performance. Since banks tend to be more professional in the choice of services provided, they are likely to focus on larger loan balance per borrower, thus reflecting a lower depth of outreach. Our third contribution is thus on the choice of the legal status that TMFIs should adopt. NGOs and Policy-makers should consider carefully the choice of their legal status, in being a bank or a non-bank related TMFIs, in view of their social mission.

The remainder of this article is organized as follows. Second section presents the institutional framework and discusses the role of NGOs versus banking industry. Third section reviews the literature and presents our testable hypotheses. Fourth section presents our database and research methodology. Fifth section discusses the empirical results, and final section concludes.

Institutional Framework

During the past decades NGOs have grown in size, number and reach. Their interventions have been instrumental in shaping the resolution of many issues facing businesses and governments (Doh and Teegen 2003). The goals of NGOs range from influencing world trade to bringing about relief to poor people.

NGOs’ proximity to the people more specifically the poor, their know-how, and their results-oriented drive, enable them to better reach the impoverished (Jamali 2003). NGOs work with people to find out what their needs are, and who is providing what (Willburn 2009). They are familiar with the huge needs at the bottom of the pyramid (Prahalad 2006), and with the slow adoption process to those needs. As such, they have been innovative and successful in this early stage market (Chesbrough et al. 2006).

In a hypothetical world where there would be no transaction costs and contractual uncertainties, there would be no need for aid agencies; private markets would deal with aid transfers (Easterly 2008). However, transaction costs may exist for various reasons, namely the cost of collecting and channeling funds, cost of collecting information and selecting potential recipients, and the cost of monitoring aid projects, to name a few. Uncertainties arise because parties have different and incomplete perceptions of the others’ preferences and objectives. In the real world, with positive transaction costs and uncertainties, aid agencies provide economies of scale and institutional arrangements that reduce costs and mediate between donors and recipients to reduce conflicts related to divergence of preferences. Thus, the role of aid agencies becomes different than the traditional definition of transferring financial resources to recipients, or supplying recipients with goods and services and know-how. Aid agencies fill the gap that exists between donors and recipients. Within this framework, MFIs among other bilateral and multilateral aid agencies, contribute to this process due to their proximity to the ultimate clients, technical know-how, and access to information.

Despite the success of NGOs in microfinance lending, there is evidence that the microfinance market remains underserved (Helms 2006). There are various reasons which contribute to the weaknesses of microfinance activities: (1) a misunderstanding of the forms of representation and intervention (Jordan and Van Tuijl 2000), (2) a dependence of NGOs on the “political agenda” stated by official funding and donor agencies (Edwards and Hulme 1996), (3) complex requirements for project appraisal, reporting, and evaluation (Salamon and Anheiser 1993; Smillie and Helmich 1993), and (4) a supply gap in the provision of microfinance services (Hodson 1996).

NGOs are also facing increased competition to limited funding, escalating societal needs, hostile environmental forces and serious sustainability concerns. These issues have raised questions as to whether microfinance activities should be provided by NGOs or may be better provided by banks that have access to enormous resources, have managerial efficiency, technical knowhow, and can take on deposits (Osborne and Gaebler 1992). While profit-oriented organizations do not usually have a cash problem, NGOs are chronically under-budgeted (Levine 2002). Indeed, NGO independence from donor financing would only be possible if borrowing and deposit taking were added to their activities, and that would be feasible in countries where MFIs become regulated. According to recent report by Deutsche Bank (2007), if MFIs can be grouped into four pyramid-like categories depending on their degree of commercialization: Tier 1 will include MFIs that are profitable, have the most assets, have the most access to commercial funds, serve the vast majority of borrowers, and are financially sustainable. Less than 3% of MFIs would belong to this category. Tier 2 will consist of MFIs that are transforming into regulated MFIs that have less access to international funding, are young and small. Tier 3 MFIs will suffer from lack of funding and are approaching profitability, and finally Tier 4 are mainly start-up MFIs.

The banking industry has shown its ability to support growth as a major source of external financing for business firms, especially in developing and emerging economies (Levine and Zervos 1998; Barth et al. 2009). Compared to NGOs, there is evidence that banks exert a first order impact on economic development (Levine 1997. Indeed, financial intermediation overcomes problems of moral hazard and adverse selection in accessing external financing and, therefore, helps firms reduce their cost of external financing, which increases their rate of return on capital (Greenwood and Jovanovic 1990; Demirgüç-Kunt and Maksimovic 1996). More specifically, financial institutions play a significant role in supporting small size firms that face higher obstacles in accessing financial sources than large size firms (Berger and Udell 1998; Galindo and Schiantarelli 2003; Beck et al. 2004). This is especially the case with the recent spread of mobile banking, a solution that is gaining popularity among millions of unbanked customers, and where banking services are only available in big cities. Mobile banking has come in handy in many parts of the world with little or no infrastructure development, e.g., in remote and rural areas, making it the perfect solution for MFIs. This increases their reach and decreases their cost and eventually their break-even point. Developing countries like Ghana, Iran, Sudan, and South Africa, Uruguay, Argentina, Brazil, Venezuela, Columbia, Guatemala, and Mexico have introduced this new commerce with great success (MXit 2009).

The international funding support to MFIs may, however, expose them to various risks that include foreign exchange risk exposure and the variability of funding in local currency. As a result, and in light of the global financial meltdown of 2008, research has shown that many MFIs will be having difficulties meeting their lending targets especially those in the early stages of development that is Tiers 3 and 4. However, more successful and profitable MFIs, Tiers 1 and 2, are more likely to benefit from this crisis when investors who need to diversify their investment portfolios will be looking for investment alternatives shielded from international financial markets. Moreover, those MFIs that depend on local and international banks for funding will suffer from the crisis more than those who have built a deposit base, whereas transformed MFIs with large deposits will be better able to weather global recessions (Visconti 2009).

However, emerging markets crisis may have alternate effects on MFIs. On the one hand, international portfolio investors who are highly sensitive to market signals may reduce their investments in times of crisis, which reduces liquidity and affect bank-TMFIs. On the contrary, MFIs may continue to benefit from funding via international development agencies and socially responsible investors who understand the importance of this sector for the local economy (Krauss and Walter 2009).Footnote 1 As such, there might be a need for insurance policies to protect this promising sector.Footnote 2 MFIs clients being the borrowers are faced with the risk of lost cash-flows and income generating abilities from sudden unexpected shocks such as death, illness and disaster.Footnote 3

Consequently, financial development should disproportionately help firms typically dependent on external financing for their growth. This highlights the importance of transforming NGOs into microfinance institutions. It also shows the role that the banking sector could have as a major financing source for TMFIs given their high level of development in financial intermediation.

Review of Literature and Hypotheses

Despite empirical evidence on the effectiveness of NGOs in some fields of service-delivery (Howes and Sattar 1992; Hulme and Mosley 1995), there is a large debate on their role in producing forms of representation and intervention that do not always reduce rural poverty and foster increased participation of poor people (Jordan and Van Tuijl 2000). NGOs, for example, continue to view rural people primarily as agriculturalists, and continue to emphasize agriculturally based exit paths from poverty (De Janvry and Sadoulet 2000). As a consequence, interventions that continue to emphasize support to agriculture have mainly tended to represent and respond to the needs of the middle poor more than those of the chronically poor in order to foster capitalized family farming (Lehmann 1986), who are more viable producers.

Jordan and Van Tuijl (2000) discuss the role of NGOs and the nature of accountability and representation in aid chains. They suggest that in the absence of formal accountabilities within NGO networks, it is most important that all participants act in a way that is “politically responsible”—that is, a way consonant with the democratic principles such organizations espouse in the normative positions they take.

Edwards and Hulme (1995) argue in promoting a “New Policy Agenda,” that bilateral and multilateral donor agencies are keen to finance NGOs on the grounds of their economic efficiency and contribution to “good governance.” They find, however, that much of the case for emphasizing the role of NGOs rests on ideological grounds rather than empirical verification. They also conclude that, though the evidence is inconclusive, there are signs that greater dependence on official funding may compromise NGO performance in key areas, distort accountability, and weaken legitimacy.

As NGOs become more involved in large-scale service provision, however, and rely more on funding from official donor agencies, the dangers of bureaucratization are very real (Korten 1990; Hellinger et al. 1988; Friedmann 1992). The acceptance of increasing amounts of donor funds, which usually comes with complex (and often conflicting) requirements for project appraisal, reporting, evaluation and accounting, exposes NGOs to problems (Salamon and Anheiser 1993; Smillie and Helmich 1993). When donors finance service delivery they expect contracted outputs to be achieved and may withdraw if targets are not met (Voorhies 1993; Perera 1996; Hodson 1996).

As such, some proponents of microfinance argue that the existence of dependent NGOs, that require financial support from donors and governments in order to function, will be hindered anytime public support diminishes. For microfinance to flourish, a consensus is needed about how much and what kind of support should come from private versus publicly subsidized capital, and where it is most appropriately allocated in the market (Callaghan et al. 2007). Therefore, it is crucial that NGOs establish procedures to ensure operational and financial self-sufficiency (Hassan 2002).

However, due to their dependence, NGOs face a trade-off between effective services leading to poverty reduction and their financial self-sufficiency. On the one hand, Fernando (2004) discusses the transformation of NGOs into TMFIs. He shows that the transformation allows newly created TMFIs to increase their equity capital, their leverage, and their access to both commercial and semi-commercial funds. He also indicates that the newly created TMFIs tend to have lower reliance on grants and subsidies, larger scope of services, and more importantly, they serve more clients and poorer households. Fernando (2004) concludes that the transformation can thus improve poor households’ access to financial services. Moreover, Van Beurden and Gossling (2008) find that social and financial responsibilities are not contradictory and can in fact coexist in financial institutions. They argue that there is a positive correlation between Corporate Social Responsibilities and Corporate Financial Responsibilities.

On the other hand, Gibbons and Meehan (1999) argue that a financially sustainable TMFI will be able to increase borrowing in private-capital markets, adding to its ability to loan money, but the balance between social and financial performance is difficult to attain. Since TMFIs will be tempted to increase profits by raising interest rates, fees, or both, this method shuts out those least able to repay and increases default rates. Most MFIs argue that they should charge high interest rates in order to be able to service the small loans in rural areas of clients that have no credit history. Their administrative costs are very high they could amount to two-thirds of interest paid by clients. Lewis (2008) indicates that worldwide the annual percentage rate averages between 28 and 31% for most MFIs.Footnote 4 In addition, Tucker and Miles (2004) argue that TMFIs may seek their sustainability and profitability by making larger loans to better-off clients in order to gain economies of scale that would both minimize expenses per loan and increase the probability of repayment. Hence, Tucker and Miles (2004) expect the concerns related to TMFIs financial sustainability to make the goal of poverty alleviation unreachable (Otero 1999), and to leave the poor with limited access to capital. Financial sustainability is, therefore, a serious concern for a TMFI looking to increase its borrowing capacities in private-capital markets.

Building on prior research, we expect the transformation into a TMFI to improve financial performance, whereas the effect on social sustainability remains inconclusive. Thus, we make a non-directional hypothesis for the social performance of TMFIs. Hence:

Hypothesis 1a:

The transformation of NGOs into TMFIs will increase financial performance.

Hypothesis 1b:

The transformation of NGOs into TMFIs will moderate social performance, i.e., outreach.

The transformation of an NGO in a TMFI raises, however, the question on the choice of the legal status of the TMFI. NGOs have the choice between transforming into a bank or a non-bank financial institution, and this should differentially affect the association between TMFIs and changes in both social and financial performance. Prior research shows that banks are usually more experienced in allocating credits to various market participants than non-bank financial institutions (Beck and Demirguc-Kunt 2006). Banks also have a better access to financing sources, and are likely to provide more professional services to wider number of beneficiaries (Barth et al. 2009). To the contrary, banks are usually concerned with return objectives, and thus more likely to focus on larger, thus more profitable, loan balances per borrower, which reflects a lower depth of outreach.

Moreover, Holdren (1991) find that a bank that is a high lender is a high performance bank. He asserts that the key to profitable banking is the ability to lend and to hold losses down. He further concludes that high performance banks are able to decrease losses as loan volume increased.

In line with our first hypotheses, we expect the transformation into a bank-TMFI to have a greater positive effect on financial performance than non-bank-TMFIs. The effects of the choice of the legal status of TMFIs on social sustainability remain, however, mixed, and we make the following hypotheses:

Hypothesis 2a:

Bank-TMFIs have a higher effect on financial performance than non-bank-TMFIs.

Hypothesis 2b:

Bank-TMFIs have a higher number of borrowers than non-bank-TMFIs.

Hypothesis 2c:

Bank-TMFIs have a higher average loan balance per borrower than non-bank-TMFIs.

Data and Methodology

The analysis is based on data collected from the Microfinance Information Exchange website (www.themix.org). All 973 registered institutions with the Mix Market from various regions have been reviewed, and a list of 80 potential institutions was extracted. However, and in order to be able to perform trend analysis, enough data around the transformation date had to be available (at least over the 3-year period: t −1 to t +1). Therefore, of this list 12 institutions had to be dropped and 68 TMFIs were kept that were found to have transformed their status from NGOs to non-bank-TMFIs or banks. Those institutions were selected and data were collected for 44 different variables, resulting in a sample containing institutions from five different regions, namely: Eastern Europe (21 TMFIs), Eurasia (13 TMFIs), South-East Asia (15 TMFIs), Africa (11 TMFIs), and Latin America (8 TMFIs). The years of data collection varied from one TMFI to another depending on the availability of information, with the broadest range spreading between 1994 and 2006. In addition, a control sample of 68 NGOs has been selected, in a manner to mimic the geographical and time distribution of data variables of the TMFI sample. Finally, the data refer to nine variables which give clear insight on both the financial and social sustainability of TMFIs, and which were available for both the studied and the control samples.

In order to verify our hypotheses (1a and 1b) on the effects of the transformation on both financial and social sustainability, we examine the long-term changes in the studied variables around the transformation date. Within this framework, we first analyze the changes in MFIs size and activities, their operating costs. We then focus on changes in our proxies for financial (ROA and ROE) and social (number of active borrowers, average loan balance per borrower) performance.

To verify our second hypothesis on the differential role played by bank- versus non-bank-TMFIs, we run Ordinary Least Squares regressions for the changes in financial and social performance over a 2-year and a 5-year period around the transformation year, and show the differential effects of TMFIs characteristics on both financial and social performance. Our OLS regressions are as follows:

where, ∆Perf is the change in financial and social performance variables over a 2- and 5-year period (ROA, ROE, number of active borrowers, and the average loan balance per borrower).

Bank dummy is equal to one if the NGO was transformed into a bank-TMFI, zero otherwise. The study of the effect of transformation on the performance of TMFIs considers the role played by several control variables such as the changes in the size of the TMFI (total asset), its financial flexibility (Debt-to-Equity ratio), and its operating costs (cost per borrower) at the time of the transformation. All variables were uniformly calculated across various institutions, and all figures are adjusted figures by the changes in the control sample over the same period.

Further variables control for the effect of cultural differences (a region dummy), the legal status of the transformation (bank- or non-bank-related-TMFI) and the legal status of TMFIs, and the changes in regulation and other social and demographic conditions using a year dummy.

Regionally we expect institutions operating in the same region to be affected by similar factors relating to culture, regulation, demography, social conditions, etc.

Empirical Results

Descriptive Statistics

Table 1 presents the distribution of the studied sample of TMFIs by type, region, and year of transformation. It should be noted that most of these transformations occurred between 2000 and 2004 (79.4%), with the largest fraction being located in the Eastern Europe region (30.9%), followed by South-East Asia (inc. India) (22%), Eurasia (19.1%), Africa (16.2%), and then Latin America (11.8%). Table 1 also shows that upon transformation most NGOs opt for the non-bank legal status (80.9%), which might suggests that non-bank-TMFIs offer more advantages than bank-TMFIs.

Table 2 presents the mean, median, and standard deviation of the studied variables for both the studied sample and the control sample of comparable NGOs during the transformation year. Descriptive statistics indicate a highly positively skewed distribution of the size- and activity-related variables of TMFIs. The studied sample of TMFIs exhibits an average size of $15.6M (a median value of $4.13M), which is significantly higher than the average size of non-TMFIs (p = 5%). There is, however, no significant difference between results in median values using Z-test. TMFIs also have a total equity capital of $3.2M on average, and they exhibit a heavy reliance on leverage, as indicated by an average debt to equity ratio of 362.3% (a median value of 115.4%). Both variables are significantly higher than those for NGOs (at the 5 and 10% level, respectively). TMFIs which transform their legal entities are larger have more equity capital, and have a greater debt to equity ratio. This suggests that to transform, NGOs need to have a minimum size, but may also suggest that the transformation might be driven by the need to improve the financial structure of the NGO.

TMFIs have operating expenses amounting to an average of 42.61% of the loan portfolio, which is significantly lower than the expenses paid by NGOs (equal to 10% on average). On the contrary, TMFIs have an average cost per borrower of $383, which is higher than the cost calculated for NGOs (p = 5%). This suggests that there are non-operating costs which might offset the costs related to loans, thus increasing the average cost per borrower.

Interestingly, both financial and social performance indicators are not significantly different between TMFIs and NGOs. TMFIs have an average ROA of −0.33% and an average ROE of 3.61% (1.27 and 4.23% on median values, respectively). Moreover, TMFIs have an average of 13,581 active borrowers per TMFI and have an average loan balance per borrower reaching $1,166, which is significantly higher than the operating expenses per loan portfolio. Interestingly, the loan balance per borrower per TMFI is significantly higher than the $300 average loan balance that United States Agency for International Development (USAID) usually uses as a proxy indicator to determine whether microfinance institutions’ clients are among the poorest, which suggests that TMFIs clients are larger thus suggesting a drift from the objective of increased depth of outreach (Dunford 2002). As a result, the transformation might be driven by other reasons than the financial and social performance, which is consistent with Drake and Rhyne (2002), and Campion and White (2001) who argue that the move to privately held institutions is motivated by the goal of accessing commercial capital and leveraging equity.

Long-Term Operating Performance and Outreach

Table 3 presents the trend analysis of changes in (1) the size and activities, (2) operating expenses, (3) operating performance, and (4) social outreach of the TMFIs. Panel A exhibits the results of the trend analysis over the period t −5 to t +2 year around the transformation date. Panel B includes a comparative analysis of the average figures over the period t −5 to t −1, t −2 to t −1, and t +1 to t +2 years around the transformation date. All figures are adjusted by the ones of our selected control sample.

This table indicates that TMFIs have a larger asset base, and the difference significantly increases following the transformation, confirming our expectation that transformation has a significant effect on the size of the TMFI. The increase in the size of the asset base of TMFIs is due to both higher and significantly increasing equity and debt financing sources, as confirmed by Fernando (2004).

TMFIs have lower operating expenses and the difference increases after the transformation, which might result from TMFIs gradually benefiting from the synergies of the transformation, which is consistent with Hypothesis 1a. Moreover, the cost per borrower starts decreasing following the transformation, and ends up being not significantly different between TMFIs and NGOs 3 years following the transformation date. This suggests that TMFIs experience lower and significantly decreasing costs per borrower upon transformation enabling them to achieve economies of scale and scope. This is consistent with Rosengard et al. (2000) who finds that one of the objectives behind NGO transformation is to achieve sustainability via a combination of factors namely the growth in the scale and scope of operations.

Further empirical results show that TMFIs have higher and significantly increasing ROA and ROE reflecting the fact that decreasing costs overweigh the significant increases in assets and equities shown earlier, thus positively affecting financial performance. This fact was also shown by Campion and White (2001), who found that the transformation is usually initiated by those institutions that are able to achieve cost recovery in their operations, attain significant social outreach. Enlarging their activities reduces their operating expenses as percentages of their loan portfolios and their costs per borrower, and thus positively affects TMFI financial performance. Schoombee (1998) finds that in South Africa, the success of commercial banks in microfinance rests on their ability to both limit their costs, and charge full-cost lending rates.

From a social perspective, empirical evidence shows that TMFIs have a larger number of borrowers and the number increases significantly following the transformation, which indicates an increasing breadth of social outreach (Ledgerwood and White 2006). There is, however, a higher average loan balance per borrower, which reflects a decreasing depth in social outreach. This is consistent with Woller (2002) who presents confirming evidence that a mission drift occurs after transformation, and confirmed by Campion and White (2001) who refute conclusions by Christen (2001) that there is no significant evidence of mission drift. More specifically, in Northern Bangladesh, Hasan (2003) finds that microfinance reaches the upper level of the poor and thus does not address the needs of the poorest.

Consequently, the improvement in financial performance is complemented by a partial enhancement of social outreach. This is consistent with our non-directional Hypothesis 1b, where TMFIs are accessible to a larger number of active borrowers, i.e., a higher breadth, but a have a higher average loan balance per borrower, i.e., a lower depth.

Further Investigations

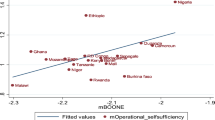

Table 4 examines the second hypothesis on the differential effect of bank versus non-bank-TMFIs. Although our sample size is limited, we have run an Ordinary Least Squares regressions of the changes in both financial and social performance indicators over a 2-year and 5-year period following the transformation, and the results should be carefully considered.Footnote 5 Moreover, due to the skeweness of the total asset, empirical investigations consider the logarithm of the total asset as a proxy for the size of studied microfinance institutions.

In line with Hypothesis 2a, both TMFIs’ operating performance variable ∆ROA and ∆ROE are positively related to the bank dummy (at the 5 and 10% level, respectively) suggesting that the transformation into a bank legal status helps TMFIs generate higher operating performance.Footnote 6

Moreover, Table 4 indicates that the adjusted change in ROA is negatively related to the change in the TMFI size (p = 5%), and the debt to equity ratio (p = 1%). This suggests that TMFIs with a larger change in their size and those that borrow more following their transformation are less likely to benefit from the transformation. As expected, the lower the cost per borrower the higher the ROA (p = 5%). These results are consistent for both 2 years and 5 years following the transformation.

Except for the size effect, the regression run for the adjusted change in ROE shows consistent results with the changes in the ROA regression for both the 2- and 5-year periods following the transformation.

On the social front, both TMFIs’ social outreach variables, the change in the breadth of outreach and the change in the number of active borrowers, are positively related to the bank dummy (at the 10% level). This suggests that the transformation into bank legal status helps TMFIs increase its breadth of social outreach, however, at the expense of a lower depth, which is consistent with Hypotheses 2b and 2c.

In terms of control variables, both the change in the breadth of outreach and the change in the number of active borrowers are positively related to the debt to equity ratio (at the 1 and 10% level for the 2- and 5-year period, respectively, following the transformation). This suggests that the transformation offers more opportunities to increase the social outreach of TMFIs through improving the management of their sources of funding, and providing them with better access to commercial capital, as confirmed by previous evidence from Fernando (2004), Campion and White (2001), and Rosengard et al. (2000).

In addition, the depth of social outreach as measured by the adjusted change in the average loan balance per borrower seems to be negatively related to the cost per borrower (p = 10%) for 2 and 5 years following the transformation. TMFIs might benefit from an increased ability to target the lower end of the population once economies of scale and scope set into operations.

Geographically, the changes in financial performance is higher in Africa (p = 1%) over 2- and 5-years following the transformation. This suggests that the transformation offers TMFIs further abilities to sustain financially, especially in needed areas. Also, there is a significantly higher breadth of social outreach, a larger number of active borrowers, (at the 5 and 10% level 2 and 5 years following the transformation, respectively), and a larger depth of social outreach (a lower average of loan balance per borrower) in African geographical region following the transformation. Hence the transformation of African MFIs seems to be vital to formalize microfinance in Africa as advanced by Otero (2003).

Conclusion

Does transformation help in aligning social and financial responsibility for microfinance institutions? There is a recent debate on the need of NGOs to transform into TMFIs. We examine this issue by selecting a sample of TMFIs and test results for evidence of improved social and financial performance. Our results show that the transformation helps TMFIs reach a wider client base, increases their financial sustainability by enabling cost economies of scale and scope, and improves their capital structure by means of a larger dependence on leverage financing.

However, we also show that the improved financial performance of TMFIs comes at a cost of decreased depth of social outreach. Further evidence suggests that there is a greater advantage for an NGO to transform into a bank legal status than a non-bank-TMFI on the financial level, however, at the expense of decreasing depth of social outreach. More results show that on a regional front, it seems that for the African continent, transformation is essential for sustainable microfinance services.

This study contributes to previous research in confirming that transformation from NGOs to TMFIs helps improve the social breadth and financial sustainability of TMFIs. It also confirms evidence found by some researchers that transformation leads to a “mission drift” by decreasing the social depth of TMFIs.

We also show that there is a clear advantage for NGOs to affect a transformation into a bank legal status that provides significant positive results in financial sustainability and the breadth of social outreach, i.e., the number of active borrowers; however, a negative effect on the depth of outreach, i.e., the average loan balance per borrower. This suggests that while commercial banks might be more efficient in allocating credit in economies, they are more selective and may thus be counter-productive from a social standing. As such, our results confirm that the Hudon’s (2009) “right to credit” is an important element in the development of microfinance activities. They, however, raise important questions on whether the change in capital structure increases the riskiness of TMFIs. Policy-makers should thus implement rules and regulations which might better guide NGOs in their transformation process into TMFIs.

Notes

McGuire and Conroy (1998) find that microfinance appears to have suffered most from the 1997–1998 Asian financial liquidity crisis where it was linked into the formal financial system and caught up in local financial crisis.

Since the transformation process exposes transformed-MFIs to new risks, it is expected that they change their system of guarantees using asset-based versus cash-flow based collateral. Indeed, we have run some interviews with managers at some transformed-MFIs, and we have noticed that there is a shift from group to individual lending, which results into greater exposure to credit risk especially for large-sized loans.

The concept of microinsurance, which New York-based American International Group Inc. pioneered 10 years ago in Uganda, is now attracting major insurers and reinsurers, and is a promising business for most of these companies due to the potentially high demand in this unserved market. So far 75 million working poor have obtained loans and greater economic security with the help of “microinsurance.”

Some extreme cases have been noted namely Banco Compartamos, the largest MFI in Mexico that went public in 2007, and was charging its borrowers a 100% APR. They argue that they have to charge high rates to be able to generate profits, to be able to attract private investment capital which would lead to eventually greater outreach to service more poor clients and more sustainability of operations. However, many are asking whether microfinance should be about profit generation or poverty alleviation and whether it could be both (Lewis 2008).

While OLS regression might be questionable, consistency of a non-parametric regression requires the following conditions: The bandwith parameter needs to tend to zero while the product of the bandwith parameter and the sample size needs to tend to infinity (Ullah and Pagan 1999; Hardle 1994). Given our relatively small sample, the latter condition will be violated yielding inconsistent estimates. Further, the relatively large number of variables used as independent variables in our regressions introduces a bias that relates exponentially (is of the order of magnitude) to the number of independent variables. This latter problem is referred to as the curse of the dimensionality problem, and we thank a referee for this comment.

Further empirical tests show no multicollinearty issues within the database. The Variance Inflation Factors (VIFs) were calculated for all studied variables, and they are all below 1.8. This suggests that our data does not suffer from serious multicollinearity concerns (O'Brien 2007).

References

Barth, J., Lin, C., Lin, P., & Song, F. (2009). Corruption in bank lending to firms: Cross country micro evidence on the beneficial role of competition and information sharing. Journal of Financial Economics, 31, 361–388.

Beck, T., & Demirguc-Kunt, A. (2006). Small and medium-size enterprises: Access to finance as a growth constraint. Journal of Banking & Finance, 30, 2931–2943.

Beck, T., Demirguc-Kunt, A., Laeven, L., & Levine, R. (2004). Finance firm size and growth. World Bank policy research working papers, 3485.

Berger, A., & Udell, G. (1998). The economics of small business finance: the roles of private equity and debt markets in the financial growth cycle. Finance and economics discussion series 1998-15. Board of Governors of the Federal Reserve System, US.

Callaghan, I., Gonzalez, H., Maurice, D., & Novak, C. (2007). Microfinance—on the road to capital markets. Journal of Applied Corporate Finance, 19(1), 115–123.

Campion, A., & White, V. (2001). Institutional metamorphosis: Transformation of microfinance NGOs into regulated financial institutions. Working paper #4. Microfinance Network.

Chesbrough, H., Ahern, S., Finn, M., & Guerraz, S. (2006). Business models for technology in the developing world: The role of non-governmental organizations. California Management Review, 48, 46–61.

Christen, R. P. (2001). Commercialization and mission drift. Working paper. Washington: CGAP.

De Janvry, A., & Sadoulet, E. (2000). Rural poverty in Latin America: Determinants and exit paths. Food Policy, 25, 389–409.

Demirgüç-Kunt, A., & Maksimovic, V. (1996). Stock market development and financing choices of firms. World Bank Economic Review, 10(2), 341–369.

Deutsche Bank Research. (2007). Microfinance: An emerging investment opportunity. http://www.dbresearch.com/PROD/DBR_INTERNET_DE-PROD/PROD0000000000219174.PDF.

Doh, J., & Teegen, H. (2003). Globalization and NGOs: Transforming business, government and society. Westport: Praeger.

Drake, D., & Rhyne, E. (2002). The commercialisation of microfinance. Balancing business and development. Bloomfield, CT: Kumarian Press Inc.

Dunford, C. (2002). What’s wrong with loan size? Davis: Freedom from Hunger Publication.

Easterly, W. (2008). Reinventing foreign aid. Boston: MIT press.

Edwards, M., & Hulme, D. (1995). Non-governmental organizations: Accountability and performance. Beyond the magic bullet. London: Earthscan.

Edwards, M., & Hulme, D. (1996). Too close for comfort? The impact of official aid on NGOs. World Development, 24(6), 961–974.

Fernando, N. A. (2004). Micro success story, transformation of nongovernmental organizations into regulated financial institutions. Bank, A. D. (Ed.). Manila: Asian Development Bank.

Friedmann, J. (1992). Empowerment: The politics of alternative development. Oxford: Basil Blackwell.

Galindo, A., & Schiantarelli, F. (2003). Credit constraints and investments in Latin America. Washington: Inter-American Development Bank.

Gibbons, D. S., & Meehan, J. W. (1999). The microcredit summit’s challenge: Working toward institutional financial self-sufficiency while maintaining a commitment to serving the poorest families. Journal of Microfinance, 1(1), 131–191.

Greenwood, J., & Jovanovic, B. (1990). Financial development, growth and the distribution of income. Journal of Political Economy, 98(5), 1–28.

Hardle, W. (1994). Applied nonparametric methods. In R. F. Engle & D. McFadden (Eds.), Handbook of econometrics (1st ed., Vol. 4, pp. 2295–2339). Elsevier.

Hasan, M. R. (2003). Implications of financial innovations for the poorest of the poor in the rural area: Experience from Northern Bangladesh. Journal of Microfinance, 5(2), 101–137.

Hassan, M. K. (2002). The microfinance revolution and the Grameen bank experience in Bangladesh. Financial Markets. Institutions & Instruments, 11(3), 205–265.

Hellinger, D., Hellinger, S., & O’Regan, F. (1988). Aid for just development. Boulder: Lynn Riener.

Helms, B. (2006). Access for all: Building inclusive financial systems. Washington: CGAP.

Hodson, R. (1996). An elephant loose in the jungle? The World Bank experience of funding NGOs in Sri Lanka. In D. Hulme, & M. Edwards (Eds.), Too close for comfort? NGOs, states and donors. London: Macmillan; New York: St. Martins Press (1997).

Holdren, D. (1991). Community banks and the importance of lending. Review of Business, 12(4), 3–12.

Howes, M., & Sattar, M. G. (1992). Bigger and better? Scaling-up strategies pursued by BRAC 1972–1991. In M. Edwards & D. Hulme (Eds.), Making a difference: NGOs and development in a changing world. London: Earthscan.

Hudon, M. (2009). Should access to credit be a right? Journal of Business Ethics, 84, 17–28.

Hulme, D., & Mosley, P. (1995). Finance against poverty (Vols. 1, 2). London: Routledge.

Jamali, D. (2003). NGOs in development: Opportunities and challenges. Labor and Management in Development Journal, 4(2), 2–18.

Jordan, L., & Van Tuijl, P. (2000). Political responsibility in transnational NGO advocacy. World Development, 28(12), 2051–2065.

Korten, D. (1990). Getting to the 21st century: Voluntary action and the global agenda. West Hartford: Kumarian Press.

Krauss, N., & Walter, I. (2009). Can microfinance reduce portfolio volatility? Economic Development and Cultural Change, Chicago, 58(1), 85.

Ledgerwood, J., & White, V. (2006). Transforming microfinance institutions. Washington: The World Bank and The MicroFinance Network.

Lehmann, A. D. (1986). Two paths of agrarian capitalism, or a critique of Chayanovian Marxism. Comparative Studies in Society and History, 28(4), 601–627.

Levine, R. (1997). Financial development and economic growth: Views and agenda. Journal of Economic Literature, 35(2), 688–726.

Levine, A. (2002). Convergence or convenience? International conservation NGOs and development assistance in Tanzania. World Development, 30(6), 1043–1055.

Levine, R., & Zervos, S. (1998). Stock markets, banks, and economic growth. American Economic Review, 88(3), 537–558.

Lewis, J. (2008). Microloan sharks. Stanford Social Innovation Review, 6(3), 54.

McGuire, P. B., & Conroy, J. D. (1998). Effects on microfinance of the 1997–1998 Asian financial crisis. In Second annual seminar on new development finance, Frankfurt.

Mxit. (2009). Mobile banking the answer for Africa’s unbanked. PR newswire Europe including UK disclose. New York.

O’Brien, R. (2007). A caution regarding rules of thumb for variance inflation factors. Quality & Quantity, 41, 673–690.

Osborne, D., & Gaebler, T. (1992). Reinventing government. Reading: Addison-Wesley Publication Company.

Otero, M. (1999). Bringing development back, into microfinance. Journal of Microfinance, 1(1), 8–19.

Otero, M. (2003). Financing MFI growth in Africa through commercial capital. Africap Microfinance Fund.

Perera, J. (1996). Unequal dialogue with donors: The Sarvodaya experience. In D. Hulme, & M. Edwards (Eds.), Too close for comfort? NGOs, states and donors. London: Macmillan; New York: St. Martins Press.

Prahalad, C. K. (2006). The fortune at the bottom of the pyramid. Warton Publishing.

Rosengard, J. K., Rai, A., Dondo, A., & Oketch, H. (2000). Microfinance development in Kenya: K-rep’s transition from NGO to diversified holding company and commercial bank. Development discussion paper no. 762, Harvard Institute for International Development, Harvard University.

Salamon, L., & Anheiser, H. (1993). The third route: Subsidiary third-party government and the provisions of social services in the United States and Germany. Paris: OECD.

Schoombee, A. (1998). Commercial banking services for micro-entrepreneurs in South Africa. South African Journal of Economics, 66(3), 164–175.

Smillie, I., & Helmich, H. (1993). Non-governmental organizations and governments: Stakeholders for development. Paris: OECD.

Tucker, M., & Miles, G. (2004). Financial performance of microfinance institutions: A comparison to performance of regional commercial banks by geographic regions. Journal of Microfinance, 6, 41–56.

Ullah, A., & Pagan, S. (1999). Nonparametric econometrics. Cambridge: Cambridge University Press.

Ullah, A., & Routray, J. K. (2007). Rural poverty alleviation through NGO interventions in Bangladesh: How far is the achievement? International Journal of Social Economics, 34(4), 237–253.

Van Beurden, P., & Gossling, T. (2008). The worth of values—a literature review on the relation between corporate social and financial performance. Journal of Business Ethics, 82, 407–424.

Visconti, R. M. (2009). Are microfinance institutions in developing countries a safe harbour against the contagion of global recession? International Finance Review, 10, 389–438.

Voorhies, S. J. (1993). Working with government using world bank funds: Learnings from the Uganda orphans and health rehabilitation program. World Vision Staff working paper no. 16. Monrovia: World Vision.

Willburn, K. (2009). A model for partnering with not-for-profit to develop socially responsible businesses in a global environment. Journal of Business Ethics, 85, 111–120.

Woller, G. (2002). The promise and peril of microfinance commercialization. Small Enterprise Development, 13, 12–21.

Yunus (2007). Interview by Marc Colvin, ABC news.

Author information

Authors and Affiliations

Corresponding author

Rights and permissions

About this article

Cite this article

Chahine, S., Tannir, L. On the Social and Financial Effects of the Transformation of Microfinance NGOs. Voluntas 21, 440–461 (2010). https://doi.org/10.1007/s11266-010-9136-6

Published:

Issue Date:

DOI: https://doi.org/10.1007/s11266-010-9136-6