Abstract

Considering the three dimensions of sustainability, viz. economic, environmental, and social, the social dimensions of sustainability are getting lesser attention by firms and the same can be evinced from the sustainability ratings of firms, particularly in developing economies. Social sustainability is measured over several dimensions, where Thomson Reuters uses an integrated framework using four major indicators: the shareholders score, the community score, the product responsibility score, and the human rights score to measure and evaluate the social sustainability performances of firms. These four indicators are measured based on a number of company level indicators, as observed from the reported information of firms. We consider for this study, the Environmental, Social, and Governance (ESG) ratings of 10 Indian firms that are constantly evaluated for their social sustainability performances, for the past nine years in the reports of Thomson Reuters. We have formulated a periodic prediction model for the social sustainability performances of firms based on a basic grey prediction model (GM (1, 1)) and a moving probability Markov based error prediction model. It is observed from the results of the case evaluation that Indian firms have to mend or amend their strategies to improving their focus on social sustainability. Although, some of the firms show trivial increasing performance trends for these indicators, many of them follow declining trends. Focusing on the theory of Utilitarianism, we conclude that any improvements in socially responsible activities of firms can result in social good; along with the gain of sustainable competitive advantages for them.

Similar content being viewed by others

Avoid common mistakes on your manuscript.

1 Introduction

Sustainability and performances evaluations remain as attractive research keywords for supply chain practitioners of the decade. Sustainability and the triple bottom line approaches are incorporated into the supply chains of almost all global firms, considering competitive advantages and owing to increasing pressure from stakeholders (Jadhav et al., 2019). Economic, environmental and social dimensions of sustainability are widely discussed across the literature on sustainability and sustainable supply chains (Bappy et al., 2019; Govindan et al., 2020). As we see, sustainability ratings provided by different rating agencies can offer an indication of the performance of firms on various dimensions of sustainability. Although sustainability and the related issues are discussed in literature and practice of supply chains, social dimensions of sustainability are getting lesser attention; particularly, as we discern through the sustainability ratings of firms in developing economies (Drempetic et al., 2019). Environmental, Social and Governance (ESG) scores of global firms released by Thomson Reuters can offer a comprehensive outlook of the sustainability performance of global firms. These ESG scores are measured over 10 major indicators and 400 plus sub-indicators leading to the overall sustainability of firms (Thomson Reuters, 2019). Among which, the social sustainability is measured over four major indicators: the shareholders score, the community score, the product responsibility score, and the human rights score.

One pillar model of sustainability defies the fact that the three dimensions of sustainability are given equal weighting, while consideration for implementation into practice (Boyer et al., 2016). Apart from that, this model gives added priorities to the ecological dimension of sustainability and observes that sustainable development need to conserve eco systems and those resources needed for better economic and social life (Rajesh, 2023a, b). In the one pillar model, aspects such as economic and social become pertinent considering the fact that the ecological advancements and developments desires to be economically viable and socially attuned, too (Gast et al., 2017). Later on, social sustainability has gained prominence with a chief aim to curb the level of poverty in various developing economies. The three pillar model of sustainability, which was developed later, agrees to the fact that human wants shall not be adequately fulfilled by merely giving an ecologically stable and healthy environment, but the socio-cultural needs are also to be considered with priority (Clune & Zehnder, 2018; Rafiaani et al., 2020). Although there are several existing disputes regarding the assumption of equal weightings for the pillars of sustainability, ecological objectives are the one slightest disputed and the economic goals follows it. But, there are several disagreements in defining the major social purposes considering sustainable development (Yadava & Sinha, 2016). Social sustainability is defined in various ways considering social standards, democratic rights, and institutional sustainability. Sustainability approaches seek for the marginal social necessities for development on a long run, i.e. it pursues to recognize the challenges for the operation of the society for a long term (Fischer et al., 2020).

The social dimension of sustainability is assessed in literature using several indicators, where there are a set of three major pointers to evaluate this dimension (Ahmadi et al., 2017). First of which, deals with the gratification of the basic needs and is related to the quality of life. The major sub-indicators of this can include distribution of income, individual income, poverty, unemployment, education and training, conditions of housing, health conditions, and security. Apart from that, it also includes personal gratification with housing, income, work, health, and the environment. The additional sets of core indicators are related to the privilege of social justice in sustainability discourse, in addition to social coherence. The notion of social justice specifies the justice concerning the dissemination of economic goods or it can be defined as providing equal opportunities, considering quality of life and partaking in society. Hence, we observe that the second group of indicators can cover issues related to gender equity and equal opportunities for education. And the third set of major pointers can relate to aspects of social coherence and the same can evaluate social network integration, measures of solidarity, and measures of tolerant attitudes. Social dimension of sustainability is boosted by the introduction of the concepts of Corporate Social Responsibility (CSR). Exact and commonly accepted demarcations for social sustainability and corporate social responsibility are not available in the extant literature on supply chains. Still, there are strong linkages, as seen in literature linking the concepts of sustainability and CSR (Liang & Renneboog, 2017). Many of the available definitions of CSR relates to the ethical behaviors towards environment, society and economy. It is recommended from literature that a firm that considers the aspects of social sustainability need to consider its’ implementation over the entire supply chain (Singh et al., 2023).

We consider the four measures of social sustainability given by Thomson Reuters and formulate a prediction model for the future sustainability performances of firms based on grey prediction models and moving probability state Markov models. As we focus our research in the Indian context, we consider the social sustainability performances of select Indian firms that perform consistently well in the Thomson Reuters’ ESG ratings. Thus, the study considers 10 Indian firms for predicting their future performances in social sustainability. This paper is further arranged as follows. Section 2 details the theoretical background of the study and elaborates the constructs for measuring the social sustainability of firms. Section 3 specifics the methodology for prediction using the combined model of grey theory and moving probability Markov models.Sect. 4 elaborates the case study considering the data of 10 Indian firms, which is followed by the analysis of the results and related discussions in Sect. 5. Section 6 incorporates the conclusions, limitations, and future directions of work that is followed by the implications of the research towards the theory, practice, and policy of social sustainability of firms, which are presented in Sect. 7.

2 Background of the Study

We review some of the recent developments in the literature concerned to social sustainability and glimpses of these works are presented here. Govindan et al. (2021) presented a state of the art literature on social sustainability tensions in supply chains and outlined some of the important factors and barriers contributing to the same. Considering frameworks, Sajjad and Shahbaz (2020) presented a conceptual framework incorporating mindfulness and social sustainability, and outlined the role of mindfulness practices to achieving social sustainability for workplaces. Seeing the financial benefits of social sustainability, Schönborn et al., (2019) observed the role of social sustainability in the financial success of firms and identified the dimensions of social sustainability in corporate culture that can act as predictors of financial success.Prior to this, Mani and Gunasekaran (2018) studied how pressures from sustainability culture, government, stakeholders, and customers can influence the adoption of social sustainability practices of firms, with particular focus on developing economies context.

Larimian and Sadeghi (2021) considered urban social sustainability by incorporating dimensions of social interaction, sense of place, social participation, safety, social equity and neighborhood satisfaction, and developed a comprehensive measurement scale to assess urban social sustainability. Considering studies on indicators, Popovic et al. (2018) identified several quantitative indicators of social sustainability in supply chains and classified them into categories of generic, echelon, and specific indicators. It is seen that most of the recent developments in the area of social sustainability are focused on conceptual development, creating frameworks, and analysing drivers and barriers. It is also seen that forecasting social sustainability performances, particularly using small datasets are not attempted in the literature and is the typical focus of this study.

An information integrated approach is needed for addressing the CSR and issues related to social sustainability of firms. And decision-makers call for exact tools that require complete picture of the dimensions of CSR and the potential impacts of its implementation. Social sustainability has been described using several indicators in businesses and is interpreted in a variety of means (Ajmal et al., 2018; Mani et al., 2016a, 2016b; Schönborn et al., 2019). Some of the representative indicators, while operationalizing social sustainability are taken from the extant literature. We observe that these indicators appear prominently in the publically reported information of firms, such as; annual reports, reports on sustainability, data on social responsibility, and citizenship initiatives.The indicators are discussed as follows.

2.1 Labor Equity

This measure is an indicator of the distribution of employee returns inside an organization (Eizenberg & Jabareen, 2017). It is required to benchmark this measure for all workforces of firms. It is measured as the average hourly labor cost to the hourly compensation package offered for the top paid employee by the firm. The more this fraction is, the more is the level of labor equity of the firm.

2.2 Healthcare

This matric measures the role of a firm or a corporation in providing better healthcare for its employees and their families (Maghsoudi et al., 2020). This is measured as the ratio of the healthcare expenses paid by company per employee to the per employee market capitalization. As there can be biases due to different industry types, market capitalization is considered as a better measure than revenue or profit per employee. Wellness expenses per employee or health maintenance can also be used as a measure of healthcare, although it is challenging to observe this data from the publically reported information.

2.3 Safety

Social sustainability measures, as observed from the reported information of firms can also consider the safety of workplace (Ballet et al., 2020). The hours lost due to accidents can be an indicator for the safety of workplace. Still, the ratio of mean days not injured to the total employee working days can be a better indicator of the level of safety of the firm.

2.4 Philanthropy

Most of the firms play vital financial roles in the public and in a society that do not add to its core business functions (Mani et al., 2016a, 2016b). Some of these are, funding various public welfare programs, providing fellowships, etc. A firm’s philanthropic obligation can be evaluated as the ratio of contributions in charity to its market capitalization.

These four indicators, in general can be observed from the publically reported information of the firm, such as; corporate reports or sustainability reports. All of these indicators are positive indicators of social sustainability of the firm; as when these indicators increase, there is an improvement in the overall level of social sustainability performance of the firm. Although these four indicators need not include the entire spectrum of measures for social sustainability, they can cover many of the human and social needs and can act as an opening plug for evaluating the social sustainability of firms or corporations. Considering the ESG evaluations of Thomson Reuters, the four indicators that describe social sustainability are the shareholders score, the community score, the product responsibility score, and the human rights score (Thomson Reuters, 2019). These major indicators are measured using a number of minor indicators contributing to it and these indicators can include all the general traits of social sustainability discussed above, such as; labor equity, healthcare, safety, and philanthropy. The ESG indicators of social sustainability performances of firms taken into consideration for the study and the definitions for the same given by Thomson Reuters in their ESG ratings are elaborated as follows.

2.5 Workforce Score

The Workforce Score, as indicated by Thomson Reuters represents a measure of the effectiveness of a company in achieving and maintaining the levels of job satisfaction, a healthy and safe workplace through sustaining diversity, equity, and equal opportunities, and at the same time providing opportunities for progressing their workforce.

2.6 Human Rights Score

The Human Rights Score indicates the competences of the firm to follow the fundamental human rights. At the same time, it represents the proficiencies of the firm to monitor, evaluate, and improve the effectiveness of retaining the fundamental human rights concords.

2.7 Community Score

The Community Score provided in the ESG ratings of Thomson Reuters indicates the commitment of the firm in developing the communities, which are located in and around the whereabouts of the firm. This also includes the evaluation of the business ethics of the firm, considering their obligations towards public education and public health.

2.8 Product Responsibility Score

The Product Responsibility Score offered by Thomson Reuters can gauge the capacity of a company for producing goods and services within the quality standards. Also, this indicator measures several other practices for producing responsible products, such as; health and safety of customers, integrity, and privacy of data. Hence, these four measures are used for evaluation of performances in social sustainability of firms and the methodology for prediction is elaborated in the coming section.

3 Methodology

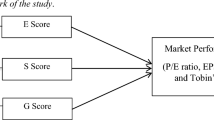

Industrial integrations enhance the need for standard prediction models for firm performances (Xu, 2020). And hence, social sustainability performances are also a matter of concern. We use a grey prediction model, GM (1, 1) and a moving probability state Markov model for prediction and error correction (Deng, 1982, 1989). Grey prediction models are advantageous; as it can successfully handle small data and limited information and are able produce promising results (Hu, 2020; Lin & Liu, 2004; Liu & Lin, 2006; Wu et al., 2020). The moving probability Markov models are used to predict the state that the future error can occur, so as to improve the exactitude of prediction results (Kumar & Jain, 2010). The combined methodology has the stated advantage that it can produce reasonably good prediction results out of the small or limited information available. The methodology for prediction is pictorially displayed in Fig. 1 and is detailed as follows.

3.1 The Grey Model of the First Order and with One Variable (GM (1, 1)) Model

Let us assume that the initial sequence of data representing the performance in social sustainability of the firm for the period \(1\le i\le n\), be.

Thus, \({Z}^{(0)}\) represents the periodical indicator of the social sustainability performance. Say for example; \({z}^{\left(0\right)}\left(2\right)\) indicates the zero order performance indicators of social sustainability for the second period taken into consideration.

Let us consider the following sequence of data;

Referring to the previous example, we can consider that \(\mathrm{z}\left(2\right)\) indicates the periodical indicator for the second time period.

3.1.1 Data Transformation (Strengthening or Weakening Operators)

Due to the occurrence of some shock waves, the observed data may show too slow or too fast developmental tendencies and the same not represent the true developmental tendencies of the system (Liu & Lin, 2006). As such, the data cannot be used for statistical analysis, making predictions, or drawing conclusions out of it. Hence, strengthening or weakening of the data is needed and we employ either of these operators successively to remove the interference of shock waves. These operators can level the data for prediction and the accuracy of predictions can be enhanced.

Let us assume \(\tau\) as a sequence operator, performed on the periodic data sequence, \(Z\) such that,

Consider the sequence \(Z\) as a monotonically increasing sequence, then \(\tau\) can represent weakening operator if,

Consider for an example, if \(z\left(2\right)\tau \ge z\left(2\right)\) for the second period and the same hold true for all periods; then \(\tau\) can be a weakening operator of the data. Similarly, \(\tau\) can represent a strengthening operator of the monotonically increasing data sequence \(Z\), if the following condition satisfies;

Consider for an example, if \(z\left(2\right)\tau \le z\left(2\right)\) for the second period and the same hold true for all periods; then \(\tau\) can be a strengthening operator of the data. Considering the case of monotonically decreasing sequences, the reverse of Eqs. (4) and (5) holds true. For monotonically increasing sequences, the data will expand on application of a weakening operator and the data will shrink on application of a strengthening operator (Liu & Lin, 2006).Hence, for the response time sequences representing social sustainability, we use a weakening operator of second order to expand the data. The operator \({\tau }^{2}\) is applied as follows;

Where.

and

where

The sequence \(\widetilde{Z}\) can be used to represent the sequence after second order weakening operation (\({Z}^{(0)}{\tau }^{2})\), i.e.,

For example, we can say \({\widetilde{z}}^{(0)}\left(2\right)\) represents the value of indicator sequence for the second period, after applying the second order weakening operator.

3.1.2 Data Transformation (First Accumulating Generator Operator)

We obtain the first accumulating generator operators (1-AGO) of the sequence \(\widetilde{Z}\) as follows;

where

Thus, \({\widetilde{z}}^{(1)}\left(k\right)\) represents the cumulative sum up to \(k\). For example, we can say that \({\widetilde{z}}^{(1)}\left(2\right)\) represents the value of indicator sequence for the second period, after application of the weakening operator of second order and the first accumulating generator operator, subsequently.

3.1.3 Data Transformation (Mean Generator Operator)

We obtain the mean generator sequences \({\dot{Z}}^{(1)}\) using the neighborhood values of \({\widetilde{Z}}^{(1)}\) and the same are displayed as follows;

where

Consider as an example; \({\dot{z}}^{(1)}\left(2\right)\) represents the value in the periodical indicator sequence, after the weakening operator of second order, the accumulating generator operator, and the mean generator operator are applied.

3.1.4 Simulate the Performance Sequences

We use the GM (1, 1) prediction model and the sequences are simulated using the matrices \(\upgamma\) and \(B\) as follows;

Here, we assume,

The prediction parameters \(a,b\) are observed using the method of least squares, represented as;

where \(\widehat{a}\) represents the column vector of prediction parameters obtained as follows;

The following expression results after expansion of the terms;

The time response sequences are built based on GM (1, 1) model, after obtaining the parameters \(a,b\) and is shown as follows;

and

Based on the Eqs. (20) and (21), we simulate the sequences of social sustainability performances, which are represented as follows;

Say for example, we can say that \({\widehat{z}}^{\left(0\right)}\left(2\right)\) indicates the simulated sequences for the second period.

3.1.5 Prediction Error Estimates

We calculate the error estimates to observe the accuracy of the prediction results. The prediction results, as obtained for the performances in social sustainability of 10 firms considered in the study were subject to satisfy a level one or level two predictions, based on five indicative error measures (Rajesh & Rajendran, 2019). The sequences of errors are observed as;

where

and the relative errors of the sequences are as follows;

where

with the mean relative errors of the sequences are indicated as follows;

and the filtering errors of the sequences are shown as follows;

We observe the error measures to lie in their permissible levels for a compatible level one or level two prediction results.

3.2 Grey Moving Probability Markov Model

Let us assume \(\left\{{Y}_{n}:n\in T\right\}\) as a stochastic process; hence, for any integer \(n\in T\) and for any states,\({s}_{0}, {s}_{1},\dots , {s}_{n}\in I\), then \(\left\{{Y}_{n}:n\in T\right\}\) is referred to as a Markov chain, supposing that the following condition is satisfied;

Equation (29) reveals that the future state at time \(t=n+1\) is merely dependent on the present state,\(t=n\); and therefore, the future state is independent of all past states considering time \(t\le n-1\). Let us consider the following equation;

which holds true for any random state \(n\in T\) and \(i,j\in I\), then \({P}_{ij}\left(n\right)\) can be referred to as the moving probability of the Markov chain (Kumar & Jain, 2010). Let’s assume, if the moving probability of the Markov chain \({P}_{ij}\left(n\right)\) shows no relation to \(n\), and then \(\left\{{Y}_{n}:n\in T\right\}\) can be said as a homogenous Markov chain. We represent the moving probability matrix, considering a system state of a homogenous Markov chain as follows;

We assume that the elements of the moving probability matrix are satisfying the following conditions; \({p}_{ij}\ge 0, i,j\in I\); and \({\sum }_{j\in I}{p}_{ij}=1,\) for all \(i\in I\). This implies that the row sum of elements of \(P\) is always 1. Hence, the \({n}^{th}\) step moving probability of the Markov chain is indicated as follows;

Considering the same, \({P}^{(n)}=\left[{p}_{ij}^{(n)}\right]\) is referred to as the \({n}^{th}\) step moving probability matrix, which fulfills the ensuing properties; \({{p}_{ij}}^{(n)}\ge 0, i, j\in I\); \({\sum }_{j\in I}{{p}_{ij}}^{(n)}=1,\) for all \(i\in I\); and \({P}^{(n)}={P}^{n}\).Let’s reassume that the moving probability matrix of a Markov chain encompasses of grey values, and then the Markov chain can be referred to as a grey Markov chain (Wang & Meng, 2008). We can take on the initial state distribution of a finite grey Markov chain as,

and let’s also assume that the moving probability matrix of the same be represented as,

And then, the distribution of the next state system can be represented as,

Also, we can represent the second state system distribution as,

If we continue like this up to the \({n}^{th}\) state, we can characterize the system distribution as,

Hence, we are able to predict the next state distribution or any future state distributions of the system by knowing the initial distribution and the moving probability matrix.

3.3 Grey State Markov Model

Let’s assume \(Z=(z\left(1\right), z\left(2\right), \dots , z\left(n\right))\) is representing the raw data series and \(\widehat{Z}=(\widehat{z}\left(1\right), \widehat{z}\left(2\right), \dots , \widehat{z}\left(n\right))\) is indicating the simulated data series built using the GM (1, 1) model. Also, we assume that the sequence \(\widehat{Z}\) is representing the trend prevalent in the original sequence \(Z\). We divide it into \(n\) states in consideration that \(Z\) is an instable stochastic sequence and this satisfies the condition of a Markov chain.

and

We define the state moving probability for the sample data having size \({M}_{ij}(m)\), indicating the development of the system state from \({\otimes }_{i}\) to \({\otimes }_{j}\) through \(m\) steps. And we assume that the size of the sample data remaining at state \({\otimes }_{i}\) is \({M}_{i}\); hence the state moving probability is indicated as follows;

We often regard this as a one-step moving probability matrix indicated by \(P\) and we take on that the item to be forecasted is at the \({\otimes }_{k}\) state. We further check whether the \({k}^{th}\) row of \(P\) is satisfying the following condition;

If the condition is satisfied, the system can be assumed to develop from state \({\otimes }_{k}\) to \({\otimes }_{l}\). We further check whether two or more probability values in the \({k}^{th}\) row of the matrix \(P\) are equal or nearly so. If the above condition satisfies, we can observe the \({n}^{th}\) step moving probability matrices indicated as,\({P}^{(2)}\),\({P}^{(3)}\), and \({P}^{(n)}\). Markov chains and related models find several applications, as seen in literature (Ardia et al., 2018; Fei et al., 2017). We implement a case evaluation to exemplify the methodology elaborated for prediction and the details of the same are discussed in the next section.

4 Case Evaluation

We consider for this study, the integrated ESG ratings of 10 Indian firms that are consistently rated for their social sustainability indicators for the past nine years (Thomson Reuters, 2019). The reason for selecting 9 years as the time period of the study is that continuous ratings are available for the firms for the past nine years and also nine years data can be successfully incorporated in a small data prediction model like GM (1, 1), which is used in this study to provide accurate results. For the study, we separate the indicators of social sustainability from the ESG ratings and we consider the developmental tendencies of the 10 firms for a period of 9 years. We construct five different values for the social sustainability measures by assigning diverse importance weightings to the values of the 4 indicators used in the study: the shareholders score, the community score, the product responsibility score, and the human rights score. The weighting schemes vary from assigning equal weightings towards assigning highest priority weightings to each indicator, separately constituting five distinct values for the measure of social sustainability for a particular year. This is done to identify, if any potential biases are there in the calculation of social sustainability scores. The assumed weightings for the four factors (in the order) for the five different instances are as follows; ((0.25, 0.25, 0.25, and 0.25), (0.55, 0.15, 0.15, and 0.15), (0.15, 0.55, 0.15, and 0.15), (0.15, 0.15, 0.55, and 0.15), and (0.15, 0.15, 0.15, and 0.55). The firms considered for analysis of their social sustainability performances, the reference codes for them, their business sector classifications, and the Thomson Reuters economic sector classifications are shown in Table 1. The step-wise implementation of the methodology for prediction is elaborated below.

4.1 Step 1

The initial five sequences representing the social sustainability indicators of the firm code REDY.NS is shown in Table 2. Similarly, the social sustainability indicator sequences for all other firms are constructed. The first and second order weakening operators are employed and the sequences corresponding to the same are constructed as per Eqs. (1)–(10). The sequences corresponding to the same for the firm code REDY.NS is shown in Table 2. Similarly, the weakening operator sequences for all other firms are calculated.

4.2 Step 2

The first aggregate generator operator sequences and the mean generator operator sequences are constructed as per Eqs. (11)–(14). These sequences for the firm code REDY.NS is as shown in Table 3. Similarly, for all other nine firms the sequences are constructed.

4.3 Step 3

The matrices for estimating the prediction parameters are built as per Eqs. (15)–(19) for the five sequences, separately. These matrices for the firm code REDY.NS is as shown in Table 4. Similarly, the tabulations are made for other firms, as well.

4.4 Step 4

The simulated accumulating generator sequences and the actual simulated sequences are built, as per Eqs. (20)–(22). Predictions are made for the year 2019 and 2020, based on the data available till 2018. The simulated value of social sustainability performances for the year 2018, as well as the predicted value of social sustainability performances for year 2019 and 2020 for the firm code REDY.NS is shown in Table 5. Likewise for other firms, the sequences are built.

4.5 Step 5

The error measures are constructed for the GM (1, 1) model as per Eqs. (23)–(28). Based on the basic error measure, as shown in Eqs. (23) and (24), we construct different error states. Here, for the 10 firms, we carefully observe the errors and construct error intervals by considering 6 different error states. The error states for the firm code REDY.NS is indicated in Table 6. Similarly, the tabulations are made for other firms, as well. The range of error values is also shown in Table 6.

4.6 Step 6

The sum of moving probabilities for transition from one state to another is tabulated for all the five constructed sequences of social sustainability performances, based on the computed errors. These four sequences can represent the one step moving probability values, the two step moving probability values, the three step moving probability values, and the four step moving probability values. The basis for calculating the moving probabilities is as shown in Eqs. (29)–(41). These four sequences for the firm code REDY.NS is as presented in Table 7. Likewise for other firms, the sequences are constructed. Hence, the moving probabilities are calculated for 10 firms, 5 instances, and 6 states with 4 set of moving probabilities, i.e., we observe 200 (10 × 5 × 4) moving probability values. Say for instance, the one step moving probability represents the probability of moving from one state of error to another state, considering a one-step movement. Similarly, the two step moving probability indicates the probability of moving from one state of error to another state, considering a two-step movement. Likewise, the three step and four step moving probabilities are calculated.

4.7 Step 7

The sum total of the probabilities for 5 instances, and 6 states with 4 set of moving probabilities are calculated and the final values of the same for all the 10 firms taken into consideration are shown in Table 8. The moving probabilities considering the four set (one step, two step, three step, and four step) of values in contemplation and the sum total of the moving probabilities for the firm REDY.NS is pictorially displayed in Fig. 2.This is for clarity of understanding and for visualization purposes. Similarly, the moving probabilities and the cumulative moving probabilities can be represented for other firms, as well.

4.8 Step 8

The sum of total probabilities and the error states for the predicted year 2019 and 2020 are calculated and are shown in Table 9. The cumulative sum of state moving probabilities for all the 10 firms for the 6 states are graphically displayed in Fig. 3.

4.9 Step 9

The modified predicted sequences, based on the combined model of GM (1, 1) and the moving probability state Markov model based error correction model is as represented in Table 10.

5 Results and Discussion

Integrated performance evaluation for social sustainability is receiving increased attention in recent times, as this can be reflected in the increase in number of research articles that discusses on the same (Dempsey et al., 2011; Vallance et al., 2011). Many research works can be seen discussing the theme of social sustainability with a conceptual basis (Hervani et al., 2017; Wang et al., 2018). Also, we can see that some of the works are based on empirical evidences, while others have discussed on the modeling aspects of social sustainability (Mani et al., 2020; Sroufe & Gopalakrishna-Remani, 2019). We formulate a periodic performance prediction model for social sustainability that considers four measurement aspects of social sustainability. These four indicators include the workforce score, the human rights score, the community score, and the product responsibility score. We have formulated a periodic prediction model for the social sustainability performance indicators of firms, based on the basic grey prediction model (GM (1, 1)) and the moving probability Markov model based error state prediction model. The combined model is capable of handling small data and provides useful and reliable prediction results.

The case evaluation has been conducted for 10 Indian firms and the results of prediction are analyzed. We observe the following from the trends of prediction; four (GLSM.NS, SAIL.NS, SUN.NS, and MRTI.NS) of the considered firms show increasing trends for social sustainability performances for the year 2019, while six (REDY.NS, BHEL.NS, ITC.NS, LART.NS, MAHM.NS, and TISC.NS) among them show decreasing trends for social sustainability performances. This shows that major Indian firms need to consider revisiting their strategies to support more social sustainability initiatives. These declaiming trends for firms are alarming and social sustainability should be considered with high priorities to upsurge its performances through proactive measures. Considering the trends for the year 2020, we observe some similar patterns, but more firms are showing better performances on social sustainability, when compared to 2019.The Indian firms that are considered for analysis and prediction and are showing increasing trends for social sustainability performances for the year 2020 are GLSM.NS, BHEL.NS, TISC.NS, SAIL.NS, and SUN.NS; while the firms REDY.NS, ITC.NS, LART.NS, MAHM.NS, MRTI.NS show declining performances on social sustainability performances for the year 2020, as per the results observed from the proposed prediction model. We have done a validation of the results considering the best fit distribution for the data representing each of the 10 firms. This is done using the ©XLSTAT software and the best distribution considering the fit of data are observed. The distribution fit, the p values, and the parameters for the best fit distribution are calculated and are represented in Table 11.

In order to validate the findings of study and for the generalizability of the results, we analyse the data of 39 Indian firms listed in the Thompson Reuters ESG evaluation and are continuously rated for a period of 10 years from 2009 to 2018. We observe that some of the firms show too fast or too slow developmental tendencies considering a past data trend. Hence to avoid this trend, we restrict our analysis for a period from 2014 to 2018 and observe for predicting the social sustainability performances of these firms for 2019. We have assigned equal weighting (0.25) for the four indicators of social sustainability performance namely; shareholders score, the community score, the product responsibility score, and the human rights score for calculating the overall score for social sustainability performances. This is to reduce the bias and to obtain the social sustainability score with equal consideration to all of the four indicators. We observe from the results of implementation of the grey prediction model to the 39 firms that the social sustainability indicators of Indian firms need significant improvements. Among these firms, 16 out of the 39 show declining trends for social sustainability performances and 19 of them show slight improvements.

Only four firms (VDN.NS, GOCP.NS, DIVI.NS, and PIRA.NS) show significant improvements in the social sustainability performance scores for the predicted year 2019. The detailed results of prediction considering the 39 firms, their industrial sector classifications are shown in Table 13 and are attached in the “Appendix”. Hence, the analysis substantiates the results of our study that the Indian firms need significant focus on their social sustainability and indicators and this also throw insights into the policy implications of the study. As we consider the data corresponding to a five year window and the Markov based error corrections were not applied, some small discrepancies in the prediction results has been observed for the prior firms. The firms REDY.NS, BHEL.NS, GLSM.NS, LART.NS, TISC.NS, and SUN.NS show slight improvements in their social sustainability performances, where the firms ITC.NS, MAHM.NS, MRTI.NS, and SAIL.NS show declining performances for their social sustainability performances.

6 Conclusions and Scope of Future Works

We have offered in this study, an integrated prediction model using grey theory and moving probability state Markov models for evaluating and predicting the performances in social sustainability of firms. We have used the data and information related to social sustainability performances of 10 Indian firms from 2010 to 2018 and the predictions for their social sustainability performances were made for the year 2019 and 2020.The evaluations were made based on 4 major indicators of social sustainability performances and social sustainability performance sequences are constructed for 5 instances, by changing the weighting scheme of these indicators. The first one, among the sequences was constructed assuming an equal weighting scheme for these indicators; whereas, four of the other sequences are constructed by assuming highest weightings to individual indicators, separately for each instance; while assuming equal weightings for the other indicators.

It is observed from the results of the combined prediction model that Indian firms have to mend or amend their strategies to focus more on their social sustainability performances. Although some of the firms show slight increasing performances for the indicators, most of them follow declining trends. Hence, this research can provide directions for firms towards setting a benchmark for their social sustainability performances and to improve the lagging indicators to achieving and sustaining this benchmark level. There are some confines of this study, as well. The performance indicators taken in this research are the indicators taken into consideration by Thomson Reuters for evaluating the social sustainability performances of firms. Several other rating agencies, such as; the Global Reporting Initiatives, IChemE, or the Wuppertal Sustainability Indicators, and Sustainalytics may provide different indicators to assess the social sustainability performances of firms.

Although a comparative study using the data from Sustainalytics is shown in the study, a detailed relative study considering other indicators into prediction model can provide more insights and can be considered as a direction of future work. Also, we have considered only 10 Indian firms that are consistently rated for their social sustainability for the past 10 years by Thomson Reuters. More firms can be included into study by reducing the time span for consideration. Even though, 29 more firms were later incorporated and considered for the generalizability of the results, additional data can be incorporated to further validate the results. This can provide more insights in the direction of a comparative study on social sustainability performances and can be regarded as another direction of prospect works. As we see that the research consider 10 Indian firms for analysis, followed by the addition of 29 firms, the results are not generic and can be assumed that similar results may be expected for other firms, as well. A detailed study in this direction can provide more discernment on it.

As discussed prior, we analyze the results of the study, considering the alternative data of ESG risk ratings of Sustainalytics, a different ESG score benefactor. The ESG risk ratings provided by Sustainalytics can capture the exposure to ESG risk of a firm, the industry specific risks of a firm, and it also reports how firms manage these ESG risks. The risk ratings on ESG provided by Sustainalytics can provide an overall ESG risk score for investors to understand how much of the ESG risk of a company remain unmanaged. As being a negative indicator, we see that the more of the risk is unmanaged, and then higher is the ESG risk rating score. The score is calculated across 138 pre-defined sub-industry classifications and are based on 20 material ESG issues. Controversies are assessed and accommodated in the ESG, resulting in the decrease in the management score and a subsequent increase in the ESG risk score. The predicted social sustainability performances using the proposed model are compared with the ESG risk ratings and risk classifications of firms provided by Sustainalytics. This is shown in Table 12. We observe the measures of Spearman’s rank correlation (− 0.042) with coefficient of determination (0.002) for the social sustainability predicted performance values and the ESG risk ratings of the company provided by Sustainalytics. A Pearson coefficient of correlation (− 0.125) was also calculated to verify the results, where the coefficient of determination (0.016) is also intended.

Even though a weak negative correlation is only observed, the negative correlation is indicating that the social sustainability indicators of ESG are performing well, then there is less probability that the firms are included under a high risk category by the ESG rating scheme. Although, the measures and indicators of ESG ratings by Thomson Reuters and the ESG risk ratings by Sustainalytics may vary, we can interpret our results in the light of the risk classifications provided by Sustainalytics. We observe that majority of the firms (6 out of 10) considered for the study are classified under the severe or high risk category by the ESG ratings of Sustainalytics. Also, we observe that considerable number of firms (3 out of 10) fall in the medium risk category. Not surprisingly, only one firm, MAHM.NS is classified in the low risk category based on the ESG risk ratings of Sustainalytics.This supports our findings that Indian firms need to improve their social sustainability performances, as well as the overall ESG performances. This can aid firms to gaining sustainable competitive advantages for future, as well as it can make the firm to be appealing to customers, stakeholders, and other shareholders.

7 Implications of the Study

This research offers several implications to the theory of social sustainability and practice of information and data predictions for social sustainability performances of firms. The main advantage is that practitioners can predict the position of their firm on social sustainability in future; so that they can take proper corrective actions for improvement of their performances. The theoretical, practical, and policy implications of the research are discussed below.

7.1 Implications to Theory

We center on the theory of Utilitarianism to elucidate the theoretical underpinnings of the study. Utilitarianism is an ethical theory focusing on normative ethics and the theory states that any action or activity can be considered morally right, if that action or activity produces the most good (Van Staveren, 2007; Warke, 2000). Extending the theory towards social sustainability, we can say that the actions or activities creating more social goodness in the society can be considered as socially sustainable. Since, social sustainability and its building constructs are highly correlated with the ethical dimensions of sustainability; we can infer that the actions taken by the firm can be considered right, if it creates and promotes happiness of society and the same can be considered wrong, vice-versa. Utilitarianism can be considered different, in comparison with other ethical theories, as it is silent on the motive of the action performer. According to Utilitarianism, it is possible for a firm to do a right action, even though the motive of the action may not be exactly right. Applying this towards the concept and practice of social sustainability, we can comment that the focus on social sustainability need to be improved for firms; no matter whether it is arising due to demands from customers or stakeholders for a sustainable product, or due to increasing pressures from competitors, while competitors are focusing more on socially responsible activities and gaining good market share. Thus, we can conclude that increasing socially responsible activities of the firm can cause more social good, along with the gain of several sustainable competitive advantages for firms.

7.2 Implications to Practice

The research offers several implications to information practitioners and managers. Managers are suggested to utilize the combined prediction model, as proposed in this study to evaluating and predicting the social sustainability performances of their firm. This allows them to apprehend the current status of the firm considering social sustainability and the development directions, where the firm needs to work on to achieving the targeted levels for social sustainability performances. Also, the prediction results can be helpful to understand the competitors’ position in social sustainability, considering future trends; and managers can plan their actions accordingly in this direction. This also helps in benchmarking the performances of the firm in social sustainability; so as it can help them to achieve or maintain the desired level of performances. Also, the model is advantages for managers, as they can process any quantitative and qualitative information or data measured in any ordinal, interval, or ratio scales. Hence, the total social sustainability performances can be calculated based on the proposed methodology by including more parameters, clubbing both the qualitative and the quantitative information, to obtaining satisfactory results.

7.3 Implications to Policy

From a business perspective, social sustainability is considered as a least quantifiable part in the sustainability evaluations using a triple bottom-line approach. Although, measuring social sustainability is a difficult task, identification of the same is an easy job. The policies for social sustainability performance improvements for firms can focus on several thrust areas. Significant among them are the human rights, fair labour practices, living conditions, health, safety, wellness, equity, work-life balance, diversity, empowerment, engagement in communities, volunteerism, philanthropy, etc. Social impacts of businesses can include all entities affecting the company-stakeholder relations, including how well suppliers are being managed and paid? And how much a product can influence and affect the lives of people? Companies need to understand the risks of social sustainability, where poor social sustainability performances can lead to damaging product quality and brand image. At the same time, customers and stakeholders are more informed and engaged that they prefer those companies who are transparent in their social sustainability norms. Finally, social sustainability is achievable and attainable. For this, companies need to partner with Non-Government Organisations (NGOs) or any social sustainability organisations to become more transparent, more ethical in their operations and processes, and for understanding the human cost of businesses.

Availability of Data and Materials

Data will be made available on request.

References

Ahmadi, H. B., Kusi-Sarpong, S., & Rezaei, J. (2017). Assessing the social sustainability of supply chains using Best Worst Method. Resources, Conservation and Recycling, 126, 99–106.

Ajmal, M. M., Khan, M., Hussain, M., & Helo, P. (2018). Conceptualizing and incorporating social sustainability in the business world. International Journal of Sustainable Development & World Ecology, 25(4), 327–339.

Ardia, D., Bluteau, K., Boudt, K., & Catania, L. (2018). Forecasting risk with Markov-switching GARCH models: A large-scale performance study. International Journal of Forecasting, 34(4), 733–747.

Ballet, J., Bazin, D., & Mahieu, F. R. (2020). A policy framework for social sustainability: Social cohesion, equity and safety. Sustainable Development. https://doi.org/10.1002/sd.2092

Bappy, M. M., Ali, S. M., Kabir, G., & Paul, S. K. (2019). Supply chain sustainability assessment with Dempster–Shafer evidence theory: Implications in cleaner production. Journal of Cleaner Production, 237, 117771.

Boyer, R. H., Peterson, N. D., Arora, P., & Caldwell, K. (2016). Five approaches to social sustainability and an integrated way forward. Sustainability, 8(9), 878.

Clune, W. H., & Zehnder, A. J. (2018). The three pillars of sustainability framework: Approaches for laws and governance. Journal of Environmental Protection, 9(3), 211–240.

Dempsey, N., Bramley, G., Power, S., & Brown, C. (2011). The social dimension of sustainable development: Defining urban social sustainability. Sustainable Development, 19(5), 289–300.

Deng, J. (1982). Control problems of grey systems. Systems & Control Letters, 1(5), 288–294.

Deng, J. (1989). Introduction to grey system theory. The Journal of Grey System, 1(1), 1–24.

Drempetic, S., Klein, C., & Zwergel, B. (2019). The influence of firm size on the ESG score: Corporate sustainability ratings under review. Journal of Business Ethics. https://doi.org/10.1007/s10551-019-04164-1

Eizenberg, E., & Jabareen, Y. (2017). Social sustainability: A new conceptual framework. Sustainability, 9(1), 68.

Fei, F., Fuertes, A. M., & Kalotychou, E. (2017). Dependence in credit default swap and equity markets: Dynamic copula with Markov-switching. International Journal of Forecasting, 33(3), 662–678.

Fischer, D., Brettel, M., & Mauer, R. (2020). The three dimensions of sustainability: A delicate balancing act for entrepreneurs made more complex by stakeholder expectations. Journal of Business Ethics, 163(1), 87–106.

Gast, J., Gundolf, K., & Cesinger, B. (2017). Doing business in a green way: A systematic review of the ecological sustainability entrepreneurship literature and future research directions. Journal of Cleaner Production, 147, 44–56.

Govindan, K., Rajeev, A., Padhi, S. S., & Pati, R. K. (2020). Supply chain sustainability and performance of firms: A meta-analysis of the literature. Transportation Research Part e: Logistics and Transportation Review, 137, 101923.

Govindan, K., Shaw, M., & Majumdar, A. (2021). Social sustainability tensions in multi-tier supply chain: A systematic literature review towards conceptual framework development. Journal of Cleaner Production, 279, 123075.

Hervani, A. A., Sarkis, J., & Helms, M. M. (2017). Environmental goods valuations for social sustainability: A conceptual framework. Technological Forecasting and Social Change, 125, 137–153.

Hu, Y. C. (2020). Constructing grey prediction models using grey relational analysis and neural networks for magnesium material demand forecasting. Applied Soft Computing, 93, 106398.

Jadhav, A., Orr, S., & Malik, M. (2019). The role of supply chain orientation in achieving supply chain sustainability. International Journal of Production Economics, 217, 112–125.

Kumar, U., & Jain, V. K. (2010). Time series models (Grey-Markov, Grey Model with rolling mechanism and singular spectrum analysis) to forecast energy consumption in India. Energy, 35(4), 1709–1716.

Larimian, T., & Sadeghi, A. (2021). Measuring urban social sustainability: Scale development and validation. Environment and Planning B: Urban Analytics and City Science, 48(4), 621–637.

Liang, H., & Renneboog, L. (2017). On the foundations of corporate social responsibility. The Journal of Finance, 72(2), 853–910.

Lin, Y., & Liu, S. (October, 2004). A historical introduction to grey systems theory. In 2004 IEEE international conference on systems, man and cybernetics (IEEE Cat. No. 04CH37583) (Vol. 3, pp. 2403–2408). IEEE.

Liu, S., & Lin, Y. (2006). Grey information: Theory and practical applications. London: Springer.

Maghsoudi, T., Cascón-Pereira, R., & Beatriz Hernández Lara, A. (2020). The role of collaborative healthcare in improving social sustainability: A conceptual framework. Sustainability, 12(8), 3195.

Mani, V., Agarwal, R., Gunasekaran, A., Papadopoulos, T., Dubey, R., & Childe, S. J. (2016a). Social sustainability in the supply chain: Construct development and measurement validation. Ecological Indicators, 71, 270–279.

Mani, V., & Gunasekaran, A. (2018). Four forces of supply chain social sustainability adoption in emerging economies. International Journal of Production Economics, 199, 150–161.

Mani, V., Gunasekaran, A., Papadopoulos, T., Hazen, B., & Dubey, R. (2016b). Supply chain social sustainability for developing nations: Evidence from India. Resources, Conservation and Recycling, 111, 42–52.

Mani, V., Jabbour, C. J. C., & Mani, K. T. (2020). Supply chain social sustainability in small and medium manufacturing enterprises and firms’ performance: Empirical evidence from an emerging Asian economy. International Journal of Production Economics, 227, 107656.

Popovic, T., Barbosa-Póvoa, A., Kraslawski, A., & Carvalho, A. (2018). Quantitative indicators for social sustainability assessment of supply chains. Journal of Cleaner Production, 180, 748–768.

Rafiaani, P., Dikopoulou, Z., Van Dael, M., Kuppens, T., Azadi, H., Lebailly, P., & Van Passel, S. (2020). Identifying social indicators for sustainability assessment of CCU technologies: A modified multi-criteria decision making. Social Indicators Research, 147(1), 15–44.

Rajesh, R., & Rajendran, C. (2019). Grey-and rough-set-based seasonal disaster predictions: An analysis of flood data in India. Natural Hazards, 97(1), 395–435.

Rajesh, R. (2023a). Predicting environmental sustainability performances of firms using trigonometric grey prediction model. Environmental Development, 45, 100830.

Rajesh, R. (2023b). An introduction to grey causal modelling (GCM): applications to manufacturing, supply chains, resilience, and sustainability. Artificial Intelligence Review. https://doi.org/10.1007/s10462-022-10314-1

Sajjad, A., & Shahbaz, W. (2020). Mindfulness and social sustainability: An integrative review. Social Indicators Research, 150(1), 73–94.

Schönborn, G., Berlin, C., Pinzone, M., Hanisch, C., Georgoulias, K., & Lanz, M. (2019). Why social sustainability counts: The impact of corporate social sustainability culture on financial success. Sustainable Production and Consumption, 17, 1–10.

Singh, G., Rajesh, R., Daultani, Y., & Misra, S. C. (2023). Resilience and sustainability enhancements in food supply chains using Digital Twin technology: A grey causal modelling (GCM) approach. Computers & Industrial Engineering, 179, 109172.

Sroufe, R., & Gopalakrishna-Remani, V. (2019). Management, social sustainability, reputation, and financial performance relationships: An empirical examination of US firms. Organization & Environment, 32(3), 331–362.

Thomson Reuters ESG Scores. (February, 2019). https://www.refinitiv.com/content/dam/marketing/en_us/documents/methodology/esg-scores-methodology.pdf

Vallance, S., Perkins, H. C., & Dixon, J. E. (2011). What is social sustainability? A Clarification of Concepts. Geoforum, 42(3), 342–348.

Van Staveren, I. (2007). Beyond utilitarianism and deontology: Ethics in economics. Review of Political Economy, 19(1), 21–35.

Wang, X. P., & Meng, M. (July, 2008). Forecasting electricity demand using Grey-Markov model. In 2008 International conference on machine learning and cybernetics (Vol. 3, pp. 1244–1248). IEEE.

Wang, H., Zhang, X., & Lu, W. (2018). Improving social sustainability in construction: Conceptual framework based on social network analysis. Journal of Management in Engineering, 34(6), 05018012.

Warke, T. (2000). Classical utilitarianism and the methodology of determinate choice, in economics and in ethics. Journal of Economic Methodology, 7(3), 373–394.

Wu, L. Z., Li, S. H., Huang, R. Q., & Xu, Q. (2020). A new grey prediction model and its application to predicting landslide displacement. Applied Soft Computing, 95, 106543.

Xu, L. D. (2020). Industrial information integration—An emerging subject in industrialization and informatization process. Journal of Industrial Information Integration, 17, 100128.

Yadava, R. N., & Sinha, B. (2016). Scoring sustainability reports using GRI 2011 guidelines for assessing environmental, economic, and social dimensions of leading public and private Indian companies. Journal of Business Ethics, 138(3), 549–558.

Funding

No funding has been received for this research.

Author information

Authors and Affiliations

Corresponding author

Ethics declarations

Competing interests

No potential conflicts of interests are reported in this research.

Ethics Approval and Consent to Participate

The paper has not been submitted or considered for submission elsewhere.

Consent for Publication

The author transfer the copyrights to the journal and the publisher, if accepted for publication.

Additional information

Publisher's Note

Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

Appendix

Rights and permissions

Springer Nature or its licensor (e.g. a society or other partner) holds exclusive rights to this article under a publishing agreement with the author(s) or other rightsholder(s); author self-archiving of the accepted manuscript version of this article is solely governed by the terms of such publishing agreement and applicable law.

About this article

Cite this article

Rajesh, R. Grey Markov Models for Predicting the Social Sustainability Performances of Firms. Soc Indic Res 168, 297–351 (2023). https://doi.org/10.1007/s11205-023-03132-7

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s11205-023-03132-7