Abstract

Corporate governance and social sustainability are conceptualized in western countries and their practices have developed over the globe. Environmental, Social, and Governance (ESG) scores can measure the sustainability performances of firms and the social measures of sustainability are at present gaining greater importance. Hence to recuperate the level of corporate governance, this study links the same to performance in social sustainability. The study consider about 1820 firms, globally that are listed in the Thomson Reuters’ ESG scores and observe the relations among social sustainability, corporate governance, and overall sustainability performances. Through this research; we empirically deliberate the relationship between social sustainability and corporate governance, which in return can influence the overall ESG score of an organization. Through partial least square (PLS) analysis, positive and significant relations of social sustainability over corporate governance and in turn over the overall sustainability performance of firms were observed. The insights from the study also indicate how efficiently the organizations are dealing with their corporate governance. These empirical findings can provide support to the theories explaining the rationale for the impact of social sustainability on corporate governance.

Highlights

Empirically deliberate the link between social factors, corporate governance, and sustainability.

Conducted study of 1820 firms, globally that are listed in the Thomson Reuters’ ESG scores.

Partial Least Square (PLS) analysis and standard bootstrapping are used to observe the results.

Findings can support the theories explaining the impact of social sustainability on corporate governance.

Managers can understand the binding relations among social sustainability, governance performances and the overall sustainability performances.

Similar content being viewed by others

Explore related subjects

Discover the latest articles, news and stories from top researchers in related subjects.Avoid common mistakes on your manuscript.

1 Introduction

Considering the global scenario, which is going to be distinct by inflation, augmented prices of raw materials, and labor that weakens the financial system and magnifies political instability, sustainability has the potential to aid the balanced development over three dimensions: economic, social and environmental (Ng and Rezaee 2015). Unfortunately, the first dimension i.e., economic only is receiving most attention considering the business world. Corporate governance and its relevance have been rapidly increased. It has witnessed a continuous improvement during the period 1993–2007. In the previous two decades, corporate governance has emerged as the most concentrated topic all over the world and it has also defined the concept of privatization and has also combined a chain of world-wide failures (Stellner et al. 2015; Husted and de Sousa-Filho 2017; Drempetic et al. 2019). The frequent corporate failures have been creating the pressure on the organizations across the globe to effectively and successfully put into good governance practices.

Therefore, nowadays in several countries, researchers have investigated the problems and have shown the considerations over the issue of the corporate governance issues and sustainability development integration (Papoutsi and Sodhi 2020; Sachin and Rajesh 2022). This study investigates the relationship among social factors, corporate governance and sustainability performances. Increasing awareness among the public about the role that corporations can play with various social issues can pressurize companies to understand the greater responsibility of sustainable performances (Lokuwaduge and de Silva, 2020; Lo and Kwan 2017). The increased significance of corporate social responsibility is coupled with an increased demand for information sharing on companies’ performances in sustainability. During the 20th century, corporate governance is becoming an essential en route for mainstream corporate activity. Hence, skills, talent, knowledge, and erudition involved in leading sustainable performance are also becoming an important, considering the management decision-making processes.

Some researches in sustainability have focused on topics related to studies restricted to specific countries, whereas others deal with it using a broader spectrum (Baraibar-Diez and Odriozola 2019). Corporations at present face increasing pressure from different stakeholders to consider social factors, while taking action on sustainability-related issues. If corporations do not succeed to positively react to issues related to sustainability, they may have to suffer a loss of business penalties, legitimacy issues, and other financial losses due to reducing profits and even may fail to exist (Aureli et al. 2020a, b). This raises questions about how corporations can play in the critical social delicacies and how it may persuade to corporate sustainability performance. Corporate governance as such plays a chief role in ensuring the business success of a firm. Researches in the direction of sustainability and corporate governance are often perceived separately, with fewer attention paid to the areas of interaction of both (Hussain et al. 2018). This paper extends and enhances prior literature by examining corporate governance and performance in corporate sustainability, jointly. Also, this research examines the role of corporate governance in corporate sustainability performance and observes the intermediary role of corporate governance on building the relationship between social sustainability and overall sustainability performances based on Environmental, Social, and Governance (ESG) scores.

This study attempts to observe and examine some of the corporate governance practices aiding the sustainability performance of the firms from a secondary dataset of about 1820 firms across the world. Also in this study, the influence of social sustainability on the governance practices of firms is observed. A research in this direction is not conducted till date and the same has motivated the authors to conduct this study. The study is motivated by the fact from the existing literature (Hussain et al. 2018; Crifo et al. 2019) that social sustainability defined by its constructs and the corporate governance practices can significantly improve sustainability performances of firms. We observe whether firms that focus on social sustainability initiatives, can have any positive effects on their corporate governance, which in turn has any positive effects over the overall sustainability performances of firms? Hence, the following research questions are posed. Whether social sustainability practices can improve the corporate governance of firms? Whether good governance practices can improve the sustainability performances of firms? This paper is arranged further as follows. Section 2 elaborates the literature review on social sustainability, corporate governance, and ESG scores in detail. Section 3 elucidates the development of the model connecting social sustainability, corporate governance, and ESG scores, which is followed by the evaluation of the model as in Sect. 4. Section 5 explains the results and the related discussions that is again followed by the conclusions and scope of future works as in Sect. 6.

2 Literature Review

Corporate governance can be viewed as an emerging concept, while all the organizations over the world are facing the problem of corporate sustainability paradigm. The word paradigm is used in this context as corporate governance is a substitute to traditional models for growth and profit maximization. Sustainability considerations for an organization recognize that social sustainability is important, as this in return will advocate the corporate governance to establish a sustainable organizational environment. An extended literature review in this direction suggests that the concept of corporate governance borrows many elements from the following established concept of stakeholder theory (Ranängen 2017). The contributions of the concept are illustrated. The associated concepts and their relations to sustainability performance are elaborated below.

2.1 Stakeholder Theory

Stakeholder theory of the firm is a relatively newer concept. It has been popularized by Edward Freeman through his book Stakeholder management: framework and philosophy (Freeman 1984). Freeman defined stakeholder as “any group or individual who can influence or can be influenced by the success or failure of organizational objectives.” It says that the stronger is the relations of the firm with the external factors, the easier will be for it to meet its’ corporate business objectives; alternatively, the shoddier the relationships of the firm, the difficult it will be to meet its’ specific objectives (Jahn and Brühl 2018). Relationships with stakeholders can become strong considering trust, respect, and cooperation. Distinct from the concepts of Corporate Social Responsibility (CSR) that is mainly a philosophical concept, stakeholder theory is formerly, and is still typically, a strategic management concept (Frynas and Yamahaki 2016). The ultimate aim of stakeholder theory is to aid corporations to strengthen relationships with several external groups to developing a sustainable competitive advantage.

Corporate governance studies a list of various social sustainability elements from different concepts (Yu and Choi 2016; Jamali and Carroll 2017). Social sustainability enhances the areas of performances that companies should care on, and it also contributes the vision and societal goals, where corporation should focus, namely environmental protection, social justice, equity, and economic development. Corporate social responsibility can contribute to ethical arguments and stakeholder theory can provide business arguments, to adjust the goals of corporations and to really work in the right direction. Corporate accountability can provide firms the rationale and explanation to the need for companies to report back to society, considering their performance in these areas.

2.1.1 Corporate Governance

Corporate governance was first introduced in the year of 1970 in the US. All these years it has been become the most debatable topic around the world. Apparently, discussions on managerial and corporate accountability rose; hence, it is necessary for emerging markets to have a stout framework considering corporate governance rules and regulations. And the same can enable investors to build confidence in the system and several other entrepreneurs with incentives to expanding their businesses (Brogi and Lagasio 2019). During the late 20th century, it has gained huge popularity in the US. After the large-scale implementation of corporate governance, the stock market had undergone huge depreciation and hence in return, it anticipated the corporation’s focus. Adding to this, the growth of corporations and their tools for financing has altered the way they are structured into more multifarious institutions (Theodoulidis et al. 2017). Thus, there is a gap in the ownership or control hassled and a successive number of scandals, related to the maltreatment of power and control, buoyant the issues, where corporations are managed and the needed to standardize their practices.

2.1.2 Sustainability Performance

Theories on sustainability have emphasized the three dimensions of the corporate sustainability, such as environmental, social, and economic. According to this, sustainability can be achieved by the continuous improvement of the value addition process in the organizational process. Hence, it is clear that sustainable performance is the combination of the environmental, social and economic factors. The concept says that the stakeholders are the most important part of the organization (Rajesh et al. 2022). Thus, organizational sustainability can be achieved with the simultaneous advancement in the benefits of the stakeholders. This needs the organization to create value by using the managerial approach, which is sustainability oriented. This can help firms to avoid several malpractices, including Greenwashing (Rajesh 2022).

2.2 ESG Score

ESG Score is largely a score that shows the relations among corporate social and governance advancement of firms. ESG score is used as a measure to evaluate sustainability by Thomson Reuters (Thomson Reuters ESG Scores, 2019). They can provide a model that the ESG scores are designed in a way that it transparently and independently evaluates the organizational performances relative to ESG performance and effectiveness (Muñoz-Torres et al. 2019). This model depicts the following constructs to measure corporate sustainability.

2.2.1 Environmental Score

This indicator of ESG score concentrates on the environmental performance of the organization (Welford and Young 2017). This is because the environmental performance has become one of the major attractions of the stakeholders of the firm (Welford and Gouldson 1993). It can be classified into two parts, such as internal environment and external environment. The organization has to maintain the balance between the internal and external environments through managerial advancements. Internal environment includes the internal stakeholders, such as employee, employee culture, etc.; whereas, the external environment can include the external factors such as shareholders, customers, activists’ group, government regulators etc.

2.2.2 Social Score

Social indicators and the score define the responsiveness of the organization toward the society. It includes the social welfare activities of the organization that not only promotes the social relationships of the organizations, but also improves the employee loyalty within the organization (Cucari et al. 2018). Hence, companies have to be more concentrated towards the enhancement of product responsibility, community development, human rights and related issues, diversity and opportunity for all, quality of employment, health and safety, and training and development of employees.

2.2.3 Governance Score

Governance within the organization is a system i.e. generally is referred as the corporate governance. It is a system that enables the organization to optimize the performance of the business (Lokuwaduge and Heenetigala 2017). It is characterized by the procedures and structures that are used to organize the business undertakings to deal with growth of the organization. It creates the relationship between the firm performance and the organizational sustainability performance. The system of corporate governance reveals the necessity of the competitive management compensation to attract the opportunities and the scope of organizational growth (Garcia et al. 2017).

A brief of the indicators of social sustainability, corporate governance and the sustainability performances, as defined by ESG scores are elaborated above. Further to this, a detailed analysis of the recent literature on social sustainability, corporate governance and sustainability performances was conducted and the particulars are included in Table 1. It is observed from the literature review that several authors concluded significant impact of corporate governance practices over sustainability performances and corporate social responsibility initiatives (Hussain et al. 2018; Crifo et al. 2019). While, some of the recent works confirmed the role of corporate governance practices over economic sustainability performances of firms (Alsayegh et al. 2020). Some of the authors also focused on studying the challenges and barriers to implement corporate social responsibility to promote sustainable business practices (Ikram et al. 2020). Also we observe that many authors focused on studying the role of board structure in corporate governance and corporate social responsibility initiatives (Adnan et al. 2018; Ong and Djajadikerta 2018). Hence, we observe that none of the studies were focused on looking over the effect of social sustainability on corporate governance or studying the effect of corporate governance practices on sustainability performances of firms. This indeed is a gap in literature and we are motivated to address this gap through an empirical analysis.

3 Model Development

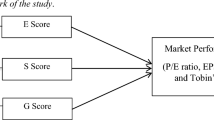

3.1 Corporate Governance and ESG Combined Scores

ESG combined score is observed as an overall company score obtained from the reported information of the firm across the environmental, social and corporate governance pillars (ESG Score) considering an ESG controversies overlay. We have considered the 10 major factors or indicators based on ESG score that has been developed by Thomson Reuters (Thomson Reuters ESG Scores, 2019). It considers over 400 company-level measures and indicators of ESG, which includes a subset of 178 most comparable and relevant fields. This assessment is to aid an effective overall company evaluation process. We used the secondary data collected from the Thomson Reuters. These indicators are represented as major indicators and are based on different company-level measures stated by the rating providers (Escrig-Olmedo et al. 2019). The choices of these indicators are made based on comparability, data availability and industry relevance. These are then classified into 10 categories and are used as weighted measures to estimate the three main pillars of ESG performances. From the review of recent literature in this area, we observe that Maali et al. (2021) pointed that corporate social responsibility can mediate the relationships among corporate governance and sustainability performances. Also, we observe from the works of Mahmood et al. (2018) that corporate governance can have significant impacts over sustainability performances of firms. Based on the above concepts of ESG and the literature support, the following hypotheses are formulated.

H1

Social sustainability has a positive and significant impact on the corporate governance.

H2

Corporate governance has a positive and significant impact on the sustainability performance of an organization.

3.2 Social Sustainability & Corporate Governance

The ESG combined score is a score that brings together both the ESG score defined by Thomson Reuters and the ESG controversies (Kaiser 2020). This allows evaluating the organizational commitment to the performance based on the publicly collected ratings over 10 major indicators. Here, we attempt to identify the relations between the social sustainability performances and the ESG scores and in return to understand the importance of the social sustainability factors on the corporate governance for company’s sustainability performances. We observe the constructs of social sustainability and posit the following hypothesis.

H3(a)

Workforce score is a significant construct of social sustainability.

H3(b)

Human rights score is a significant construct of social sustainability.

H3(c)

Community score is a significant construct of social sustainability.

H3(d)

Product responsibility score is a significant construct of social sustainability.

Thomson Reuters have evaluated the ESG controversies, which depicts that the organization is either evolved in any kind of the scandals or not (Thomson Reuters ESG Scores, 2019). This is because the controversial activities may have impacts on the ESG score of the organization and hence it will enable us to depict the relation of the social indicators towards the corporate governance.

H4(a)

Shareholder score is a significant construct of corporate governance.

H4(b)

Management score is a significant construct of corporate governance.

H4(c)

Corporate strategy score is a significant construct of corporate governance.

The following model has been constructed as in Fig. 1, based on the above information. The model and the hypotheses were then evaluated empirically.

4 Model Evaluation

This study used Smart PLS 3.0 to evaluate the measurement model as well as structural model. The PLS is acclaimed as an important technique to producing a linear equation to describe the differences in values of one or many properties, considering those differences in the values of other properties. PLSs is used like Multiple Regression (MR), because they produce same result for the same problem (Cramer 1993). The details of evaluation are as follows.

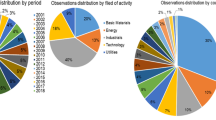

4.1 Background of data

This study verified the relations among the constructs and the latent variables. This is in response to determine the relationship between the social sustainability performance and corporate governance. Here, the initial data includes the ESG scores of firms over 10 major themes (Thomson Reuters ESG Scores, 2019). It considers the secondary data collected from Thomson Reuters of 2578 companies through Bloomberg Terminal. This includes the major indicators that are used to obtain ESG scores and these are used to build the initial measurement model. The evaluation is then based on the periodical performances of the firms on various domains of ESG over a period of 10 years (2009–2018). But many of the companies from Asia-Pacific regions have joined the analysis after 2012. Thus, to reduce the bias from the analysis, we have included the responses within the time period of 5 years from 2014 to 2018. Firms having any missing values have been excluded. Finally, we have sorted 1,820 firms out of 2,578 firms. We have converted these scores in likert scales varying from 1 to 7 and the average scores for the indicators during this period is noted. Also, the validity and the reliability of the data have been checked.

4.2 Measurement model evaluation

Due to the formative nature of the latent variables, we have studied the factor loadings. The factor loadings for all the factors have been recorded better (Thompson 2004) values (> 0.7) excluding only one factor i.e. shareholder score which has been recorded lesser value (0.52). The Cronbach’s alpha (Santos 1999) shows the acceptable value for the latent variables. The discriminant validity measures of latent variables lie well within the acceptable level, as it is seen that the diagonal values are higher. The outer and inner Variance Inflation of Factors (VIF) has been evaluated and has been found to be in the acceptable level (Craney and Surles 2002) for the corresponding model. The path coefficients of the model have also been studied, showing that the latent variable, corporate governance has significant effect on the ESG score. The complete analysis on the measures of validity and reliability and the results of PLS analysis of the model are indicated in Tables 2, 3, 4, 5, 6 and 7.

4.2.1 Reliability

The reliability for the measurement of the model has been evaluated using the measures of composite reliability and Cronbach’s Alpha. Here, the model is checked against a suggested threshold (0.6) and that of satisfactory threshold (0.7), considering the values for composite reliability and the value of Cronbach’s alpha. Hence, as per the results of analysis, the model has found to be appropriate. The rho-A value i.e. called as Spearmen’s correlation coefficient has a value within the acceptable limit.

4.2.2 Percentage Variance explained

The percentage of variance explained by one factor should not exceed the satisfactory limits of 50% (> 50%) and was observed to be the true for the model (Doksum et al. 1994). The value of R2 and adjusted R2 has been found to be in limit (> 0.5) that shows that the constructed measurement model is appropriate to proceed with.

4.2.3 Discriminant Validity

It refers to the degree for which the latent variables can separate from each other. It’s formulated, when the correlations amid the constructs are lower than the Average Variance Extracted (AVE). We observe whether discriminant validity (Zaiţ and Bertea 2011) is established as in our study. For this, we observe that the value of diagonal elements is higher than that of the other elements. This states that the discriminant validity measures of the model are in the acceptable threshold.

4.2.4 Common Method Bias

The data for the latent variables has been collected from same source; still the common bias method test (Jakobsen and Jensen 2015) has been conducted for the verification of the variance shared among the constructs. Here, the result has agreed to an acceptable level (< 50%). Following tables are included to show the result of PLSs.

-

The path coefficients in PLS analysis (see Table 2).

-

The measures of construct reliability and validity (see Table 3).

-

Discriminant validity measures (see Table 4).

-

VIF measures (see Table 5).

-

The path coefficients, t-statistics, and the p-values indicating the significance of the relations as observed on bootstrapping (see Tables 6 and 7).

4.3 Structural model evaluation

The structural model for this study has been developed from the above measurement model. Then, the initial model of constructs and the latent variables have been tested based on their connections to ESG performances. It has been found that the p-values are less than 0.05 and the t-statistics has been found to be greater than 1.96. We have standardized the model and analyzed the relations among the latent variables. The factor loadings were calculated and are found to be within the acceptable level. All of the values in the bootstrapping model have also been found to be significant with p-values constantly low and close to zero and with high values of t-statistics (lowest value of 19.894), which are statistically significant.

Depending on the sustainability score on the firms, we have found that the path coefficients raging in between the values of 0.832 and 0.367. From the above path analysis, it has been clear that social sustainability has a significant impact on corporate governance, which in turn has a positive and significant impact on the sustainability performance of the firm. It has also been found that social sustainability practices of a firm have a positive and significant impact on the corporate governance performances of the firm. We have conducted a basic bootstrapping considering a bias corrected and accelerated confidence interval determination method. It is seen that a basic bootstrapping is fast and accurate to determine the results including those path coefficients, indirect effects, total effects, outer loadings, and outer weights. We have also observed the t-statistics and all relations were observed to be statistically significant. The observed results on PLS bootstrapping are shown in Figs. 2 and 3.

Hence, this can be interpreted that when the investment on corporate governance increases, the ESG scores and hence the sustainability performances increases. This also clarifies that there is a simultaneous effect of the social sustainability and the corporate governance on the ESG scores. Hence, we can say that corporate governance can play an intermediary role between social sustainability and total sustainability performances, as well as having a direct role also influencing the ESG score of firms.

5 Results and discussion

Measuring and evaluating the sustainability performance of firms has become gradually more important, considering the present business scenario containing globalization and vertical integrations. As we can observe from the recent past that the issues of sustainability are gaining greater importance amongst the minds of various shareholders and stakeholders (Alda 2019). This scenario enhances the need of a standard measuring scheme to assess the sustainability performances of firms. Considering various rating schemes for sustainable performances, the assessment scheme of Thomson Reuters is a widely acceptable scheme of evaluation. We have conducted an empirical study to find out the effect of the social sustainability on corporate governance, which can then influence the sustainability performances defined by the ESG scores of the firm.

Initially, we have considered the secondary data of 2,578 companies, but later reduced to 1,820 companies, considering missing values and the same is observed for a period of 5 years from 2014 to 2018. The averages of the scores were used in the empirical study. We have built a measurement model along with a structural model and have formulated nine hypotheses for testing. We use a PLS analysis and a standard bootstrapping to test the hypothesis and to find statistical evidences for the study. Here, we use Smart PLS 3.0 to evaluate and analyse the data on ESG performances observed from 1,820 companies.

5.1 Major findings

We have constructed the measurement model and checked for reliability and validity of the data. Then the measurement model has been observed for the measures for composite reliability, rho-A values, average variance extracted and the factor loadings. Along with this, we have checked for the measures of discriminant validity, VIF, path coefficients and R square measures to be in the acceptable limits. We followed the Thomson Reuters ESG model evaluation scheme for measuring the environmental, social, and governance performances, which is constructed based on 10 major indicators. In this model, the management score, shareholder score and the CSR strategy score are the independent constructs that are influencing the governance performances of firms.

And we also observe that the social sustainability performance of the firm can significantly impact the corporate governance performance, which in turn influences the overall ESG performances of firms. To validate the findings, we have done a basic bootstrapping and noticed that the results appear to be significant considering t statistics and p values. Thus, we observe that any changes in the corporate governance performances can bring substantial changes in the sustainability performances of firms through improved ESG scores. The same has been observed for social sustainability, as any improvements in social sustainability can bring notable differences in the governance performances of firms and also, it is reflected in the sustainability performances of firms.

5.2 Discussion of findings

Although the constructs are standardised in the evaluation of ESG by Refinitiv, by Thomson Reuters, we check for the role of these constructs in defining the latent variables constituting social sustainability, corporate governance, and sustainability performances. We found all the constructs are significant constructs of the corresponding latent variables. We also observe that the management score and the corporate social responsibility strategy score are important constructs of corporate governance scores, as seen from the outer loadings. This indicates that these two constructs can be vital in determining the corporate governance scores and the corporate governance performances of firms. Similarly, we observe that the human rights score and the workforce score are important constructs of social sustainability performances of firms, considering the outer loadings. This indicates that safeguarding human rights and having focus on the philanthropy of the workforce can significantly improve the social sustainability performance scores, which in turn improves the overall sustainability performance scores of firms.

5.3 Implications to theory

We study the impact of social sustainability performances on corporate governance and towards the total sustainability performances of firms. The various social sustainability constructs such as; workforce, human rights, community and finally the product responsibility performance measures of firms were considered for the study and their relationship to corporate governance has been studied through the light of stakeholder theory. The observations and findings are very useful for the manager to take some effective decisions related to social sustainability performances, corporate governance, as well as sustainability performances of firms. Hence, managers of the firm can keep a regular eye on the ESG score of the organization, which can necessitate them towards understanding the conditions to improve or adjust their governance performances, as per the demands of the stakeholders, shareholders, or customers.

Corporate governance has also been a great major driver of the corporate growth. It also depends on many indicators such as; management, shareholder and CSR strategy scores, as we observe from the constructs on Thomson Reuters ESG. The findings suggest that managers have to take decisions for their organization in the direction of social sustainability initiatives, in order to compete in the market and to have profitability. Alternatively, if the organization is not performing well considering all the competitors, then their governance performances need to be monitored. Also, if the shareholder creates the pressure, the organization has to take some serious measures that will assist the organization to improving their overall ESG performances. If not, poor governance performance can create instability and uncertainty within the organization.

Finally, it’s all about the CSR strategy of the organization that allows the organization to build the impression on the sustainability side, which will increase the customer retention and many more. Hence, the stakeholder theory can help to widen the prospective of the organization towards sustainability in all of the above aspects. ESG score is the overall performances outcome of the organization in all the three dimensions of economic, social, and governance measures. This research provides an insight to improving the social sustainability performances, thus aiding to improve the governance side performances and apparently improving the total sustainability performances.

5.4 Implications to practice

Seeing from the results of the study, we assume that social sustainability performances can significantly contribute towards corporate governance and overall sustainability performances of firms. Focus on the workforce, communities, human rights, and socially responsible developments can help firms to improve their governance standards and can help in achieving sustainable developments through societal transitions. As social sustainability being far less discussed among the three pillars of sustainability, the importance of a firm to be socially sustainable is projected in the study. This research can bring insights into the role of social sustainability in forming good governance practices and thereby improving sustainability performances. Improvement in the welfare of the workers and employees, providing appropriate health facilities, education, training and welfare of the employees, reducing child labour, managing the working hours of employees, developing the communities through innovative programs, can increase the philanthropy and outreach of the firm among employees and communities. Hence, managers are advised to provide more focus on various aspects of improving social sustainability, along with focus on environmental sustainability to improve the overall sustainability performances of firms.

6 Conclusions and future scope

Corporate governance and the related concepts hinge on overall transparency, integrity and accountability of management and are also dependent largely on the board of directors. The significance of corporate governance lies in its expected contribution to business prosperity and it can majorly be defined by various factors including social sustainability performances. In the present age of globalization and global competition, good quality corporate governance can help as a great tool for corporate bodies to understand the steps/ policies/ acts that can improve their present level of governance. As such, corporate governance can act as a medium to explain how corporate excellence can be achieved; as we see the same with respect to ESG scores too. Governance is not merely about confidence in financial statements of firms; it describes all about the confidence in company, in general to achieving sustainable competitive advantages.

Hence, good governance can focus more on the sustainability aspects of development. It is about projecting how the company and its’ business model, strategies, objectives, as well as risks, performances and rewards are governed, which will in turn result in better ESG performances. Also, the results of the study supports several existing literature in this area, particularly, Maali et al. (2021), who pointed that corporate social responsibility can mediate the relationships among corporate governance and sustainability performances. The present study also conclude that social sustainability practices can result in good governance practices, which can in turn improve the overall sustainability performances of firms. Also, the findings of the study aligns with the existing recent literature of Mahmood et al. (2018), who points that corporate governance can have significant impacts over sustainability performances of firms. Hence, the findings of the study line up with the findings of several recent studies on social sustainability, corporate governance, and sustainability performances.

The study opens future scope to measure the indicators that are identified as social sustainability factors. An exhaustive analysis can be conducted to extend the study by including all of the social sustainability factors or indicators of performances. Apart from that, the study also offers scope of future works in the direction of connecting the corporate governance performances or the sustainability performances of firms to their financial and economic performances. Also, we observe that shareholder scores and the CSR strategy scores can act as significant constructs for the governance performances of firms. Hence, by exploring the stakeholder theory, firms must be in a better position to answer several queries related to corporate sustainability. This is another direction for qualitative and empirical research in this area. Thomson Reuters has compiled the ESG scores mainly based on the firms’ publically available data on sustainability performances and the reported data. A region-wise clustering of the data can be done and the apparent differences in the same can be observed. This is also a direction for future exploration in this area.

Data Availability

Data will be made available on request.

References

Aboud A, Diab A (2018) The impact of social, environmental and corporate governance disclosures on firm value: Evidence from Egypt. J Acc Emerg Economies 8(4):442–458

Adel C, Hussain MM, Mohamed EK, Basuony MA (2019) Is corporate governance relevant to the quality of corporate social responsibility disclosure in large European companies? Int J Acc Inform Manage 27(2):301–332

Adnan SM, Hay D, van Staden CJ (2018) The influence of culture and corporate governance on corporate social responsibility disclosure: A cross country analysis. J Clean Prod 198:820–832

Alda M (2019) Corporate sustainability and institutional shareholders: The pressure of social responsible pension funds on environmental firm practices. Bus Strategy Environ 28(6):1060–1071

Alsayegh MF, Rahman A, Homayoun S (2020) Corporate economic, environmental, and social sustainability performance transformation through ESG disclosure. Sustainability 12(9):3910

Aureli S, Del Baldo M, Lombardi R, Nappo F (2020a) Nonfinancial reporting regulation and challenges in sustainability disclosure and corporate governance practices. Bus Strategy Environ 29(6):2392–2403

Aureli S, Gigli S, Medei R, Supino E (2020b) The value relevance of environmental, social, and governance disclosure: Evidence from Dow Jones Sustainability World Index listed companies. Corp Soc Responsib Environ Manag 27(1):43–52

Baraibar-Diez E, Odriozola D, M (2019) CSR Committees and Their Effect on ESG Performance in UK, France, Germany, and Spain. Sustainability 11(18):5077

Brogi M, Lagasio V (2019) Environmental, social, and governance and company profitability: Are financial intermediaries different? Corp Soc Responsib Environ Manag 26(3):576–587

Cancela BL, Neves MED, Rodrigues LL, Dias ACG (2020) The influence of corporate governance on corporate sustainability: new evidence using panel data in the Iberian macroeconomic environment. Int J Acc Inform Manage 28(4):785–806

Correa-Garcia JA, Garcia-Benau MA, Garcia-Meca E (2020) Corporate governance and its implications for sustainability reporting quality in Latin American business groups. J Clean Prod 260:121142

Cramer RD (1993) Partial least squares (PLS): its strengths and limitations. Perspect Drug Discovery Des 1(2):269–278

Craney TA, Surles JG (2002) Model-dependent variance inflation factor cutoff values. Qual Eng 14(3):391–403

Crifo P, Escrig-Olmedo E, Mottis N (2019) Corporate governance as a key driver of corporate sustainability in France: The role of board members and investor relations. J Bus Ethics 159(4):1127–1146

Cucari N, De Falco E, Orlando B (2018) Diversity of board of directors and environmental social governance: Evidence from Italian listed companies. Corp Soc Responsib Environ Manag 25(3):250–266

de Silva Lokuwaduge CS, de Silva K (2020) Emerging Corporate Disclosure of Environmental Social and Governance (ESG) Risks: An Australian Study. Australasian Acc Bus Finance J 14(2):35–50

Doksum K, Blyth S, Bradlow E, Meng XL, Zhao H (1994) Correlation curves as local measures of variance explained by regression. J Am Stat Assoc 89(426):571–582

Drempetic S, Klein C, Zwergel B (2019) The influence of firm size on the ESG score: Corporate sustainability ratings under review. J Bus Ethics. https://doi.org/10.1007/s10551-019-04164-1

Escrig-Olmedo E, Fernández-Izquierdo M, Ferrero-Ferrero I, Rivera-Lirio JM, Muñoz-Torres MJ (2019) Rating the raters: Evaluating how ESG rating agencies integrate sustainability principles. Sustainability 11(3):915

Freeman RE (1984) Stakeholder management: framework and philosophy. Pitman, Mansfield, MA

Frynas JG, Yamahaki C (2016) Corporate social responsibility: Review and roadmap of theoretical perspectives. Bus Ethics: Eur Rev 25(3):258–285

Garcia AS, Mendes-Da-Silva W, Orsato RJ (2017) Sensitive industries produce better ESG performance: Evidence from emerging markets. J Clean Prod 150:135–147

Giannarakis G, Andronikidis A, Sariannidis N (2020) Determinants of environmental disclosure: investigating new and conventional corporate governance characteristics. Ann Oper Res 294(1):87–105

Hussain N, Rigoni U, Orij RP (2018) Corporate governance and sustainability performance: Analysis of triple bottom line performance. J Bus Ethics 149(2):411–432

Husted BW, de Sousa-Filho JM (2017) The impact of sustainability governance, country stakeholder orientation, and country risk on environmental, social, and governance performance. J Clean Prod 155:93–102

Ikram M, Zhang Q, Sroufe R, Ferasso M (2020) The social dimensions of corporate sustainability: an integrative framework including COVID-19 insights. Sustainability 12(20):8747

Jakobsen M, Jensen R (2015) Common method bias in public management studies. Int Public Manage J 18(1):3–30

Jahn J, Brühl R (2018) How Friedman’s view on individual freedom relates to stakeholder theory and social contract theory. J Bus Ethics 153(1):41–52

Jamali D, Carroll A (2017) Capturing advances in CSR: Developed versus developing country perspectives. Bus Ethics: Eur Rev 26(4):321–325

Kaiser L (2020) ESG integration: value, growth and momentum. J Asset Manage 21(1):32–51

Karaman AS, Kilic M, Uyar A (2020) Green logistics performance and sustainability reporting practices of the logistics sector: The moderating effect of corporate governance. J Clean Prod 258:120718

Lo KY, Kwan CL (2017) The effect of environmental, social, governance and sustainability initiatives on stock value–Examining market response to initiatives undertaken by listed companies. Corp Soc Responsib Environ Manag 24(6):606–619

Lokuwaduge CSDS, Heenetigala K (2017) Integrating environmental, social and governance (ESG) disclosure for a sustainable development: An Australian study. Bus Strategy Environ 26(4):438–450

Maali K, Rakia R, Khaireddine M (2021) How corporate social responsibility mediates the relationship between corporate governance and sustainability performance in UK: a multiple mediator analysis. Soc Bus Rev 16(2):201–217

Mahmood Z, Kouser R, Ali W, Ahmad Z, Salman T (2018) Does corporate governance affect sustainability disclosure? A mixed methods study. Sustainability 10(1):207

Manning B, Braam G, Reimsbach D (2019) Corporate governance and sustainable business conduct—E ffects of board monitoring effectiveness and stakeholder engagement on corporate sustainability performance and disclosure choices. Corp Soc Responsib Environ Manag 26(2):351–366

Muñoz-Torres MJ, Fernández‐Izquierdo M, Rivera‐Lirio JM, Escrig‐Olmedo E (2019) Can environmental, social, and governance rating agencies favor business models that promote a more sustainable development? Corp Soc Responsib Environ Manag 26(2):439–452

Naciti V (2019) Corporate governance and board of directors: The effect of a board composition on firm sustainability performance. J Clean Prod 237:117727

Ng AC, Rezaee Z (2015) Business sustainability performance and cost of equity capital. J Corp Finance 34:128–149

Ong T, Djajadikerta HG (2018) Corporate governance and sustainability reporting in the Australian resources industry: An empirical analysis. Social Responsib J 16(1):1–14

Papoutsi A, Sodhi MS (2020) Does disclosure in sustainability reports indicate actual sustainability performance?.Journal of Cleaner Production, 121049

Rajesh, R. (2022). An Introduction to Grey Influence Analysis (GINA): Applications to Causal Modelling in Marketing and Supply Chain Research. Expert Systems with Applications, 118816.

Rajesh R, Rajeev A, Rajendran C (2022) Corporate social performances of firms in select developed economies: A comparative study. Socio-Economic Plann Sci 81:101194

Ranängen H (2017) Stakeholder management theory meets CSR practice in Swedish mining. Mineral Econ 30(1):15–29

Rudyanto A, Siregar SV (2018) The effect of stakeholder pressure and corporate governance on the sustainability report quality. Int J Ethics Syst 34(2):233–249

Sachin N, Rajesh R (2022) An empirical study of supply chain sustainability with financial performances of Indian firms. Environ Dev Sustain 24(5):6577–6601

Santos JRA (1999) Cronbach’s alpha: A tool for assessing the reliability of scales. J Ext 37(2):1–5

Shahab Y, Ye C (2018) Corporate social responsibility disclosure and corporate governance: empirical insights on neo-institutional framework from China. Int J Disclosure Gov 15(2):87–103

Stellner C, Klein C, Zwergel B (2015) Corporate social responsibility and Eurozone corporate bonds: The moderating role of country sustainability. J Banking Finance 59:538–549

Theodoulidis B, Diaz D, Crotto F, Rancati E (2017) Exploring corporate social responsibility and financial performance through stakeholder theory in the tourism industries. Tour Manag 62:173–188

Thompson B (2004) Exploratory and confirmatory factor analysis: Understanding concepts and applications. American Psychological Association, Washington, DC, US

Thomson Reuters ESG, Scores (2019) https://www.refinitiv.com/content/dam/marketing/en_us/documents/methodology/esg-scores-methodology.pdf

Tseng ML, Tan PA, Jeng SY, Lin CWR, Negash YT, Darsono SN A. C (2019) Sustainable investment: Interrelated among corporate governance, economic performance and market risks using investor preference approach. Sustainability 11(7):2108

Welford R, Young W (2017) An Environmental Performance Measurement Framework for Business. In Sustainable Measures (pp. 98–116). Eds. Martin Bennett, Peter James, Leon Klinkers, Routledge. London, UK

Welford R, Gouldson A (1993) Environmental Management & Business strategy. Pitman Publishing Limited, London, UK

Yu Y, Choi Y (2016) Stakeholder pressure and CSR adoption: The mediating role of organizational culture for Chinese companies. Social Sci J 53(2):226–234

Zaiţ A, Bertea PSPE (2011) Methods for testing discriminant validity. Manage Mark J 9(2):217–224

Acknowledgements

The authors sincerely thank the Editor in Chief, Prof. Carmen De Maio and the 4 unknown reviewers for their insightful comments to improving the quality of the manuscript to a greater extent.

Funding

No funding has been received for this research.

Author information

Authors and Affiliations

Corresponding author

Ethics declarations

Ethics approval and consent to participate

The paper has not been submitted or considered for submission elsewhere.

Consent for publication

The author transfer the copyrights to the journal and the publisher, if accepted for publication.

Competing interests

No potential conflicts of interests are reported in this research.

Additional information

Publisher’s Note

Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

Rights and permissions

Springer Nature or its licensor holds exclusive rights to this article under a publishing agreement with the author(s) or other rightsholder(s); author self-archiving of the accepted manuscript version of this article is solely governed by the terms of such publishing agreement and applicable law.

About this article

Cite this article

CHANDRAKANT, R., RAJESH, R. Social sustainability, corporate governance, and sustainability performances: an empirical study of the effects. J Ambient Intell Human Comput 14, 9131–9143 (2023). https://doi.org/10.1007/s12652-022-04417-4

Received:

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s12652-022-04417-4