Abstract

Equity crowdfunding can provide significant resources to new ventures. However, it is not clear how crowd investors decide which ventures to invest in. Building on prior work on professional investors as well as theories in behavioral decision-making, we examine the weight non-professional crowd investors place on criteria related to a start-up’s management, business, and financials. Our conceptual discussion raises the possibility that crowd investors often lack the experience and training to assess complex and sometimes technical investment information, potentially leading them to place larger weight on factors that appear easy to evaluate and less weight on factors that are more difficult to evaluate. Studying over 200 campaigns on the platform Crowdcube, we find that fundraising success is most strongly related to attributes of the product or service, followed by selected aspects of the team, in particular, founders’ motivation and commitment. However, financial metrics disclosed in campaign descriptions do not predict funding success. We discuss implications for investors and entrepreneurs, as well as platform organizers and policy makers.

Similar content being viewed by others

Avoid common mistakes on your manuscript.

1 Introduction

This study explores the decision criteria used by a newly emerging class of investors: the “crowd” of non-professional individuals who can invest in entrepreneurial ventures through equity crowdfunding platforms (Ahlers et al. 2015; Mohammadi and Shafi 2018; Vismara 2018).Footnote 1 We consider three sets of criteria: (i) attributes of the venture’s management team, (ii) characteristics of the product or service and the market, and (iii) the venture’s financial potential. These criteria are sourced from surveying a large body of research in finance and entrepreneurship that has examined how professional investors decide which ventures to invest in (Tyebjee and Bruno 1984; Zacharakis and Shepherd 2001; Mason and Stark 2004).

Studying crowdfunding investors is important because prior findings on professional investors may not generalize to the crowd for at least two reasons. First, whereas professional investors tend to have access to significant organizational resources as well as personal knowledge and experience when making investment decisions, crowd investors may lack the resources and experience to perform extensive due diligence on young firms that are often characterized by high uncertainty and information asymmetries. Second, crowd investors tend to invest relatively small amounts of money and also receive a relatively small stake of a company in return (Ahlers et al. 2015). As such, even if crowd investors could potentially employ the more sophisticated decision-making approaches used by professional investors, the associated (fixed) costs are unlikely to be justified given the relatively low stakes. Instead, crowd investors may prefer simpler heuristics that allow for fast decision-making at relatively low cost.

To examine crowd investment decisions empirically, we analyze 207 equity crowdfunding campaigns started on Crowdcube, the largest equity crowdfunding platform in the UK. For each project, we acquired from an independent rating agency standardized ratings of three broad sets of criteria: (i) management quality (capturing the experience, skills, and commitment of the start-up team), (ii) attributes of the product, market potential, and competition, and (iii) financial metrics (capturing profitability, cash flow, and the potential rate of returns). While these ratings were likely unobserved by crowd investors, they provide us with unique measures to compare a comprehensive set of attributes across campaigns and to examine the weight given to different aspects of crowdfunding proposals by investors. We also assess whether the perceived risk of investing in a given venture influences the relative weight given to these criteria.

Our study contributes to two mainstreams of literature. We contribute to the literature on investor decision-making (Zacharakis and Meyer 1998; Zacharakis and Shepherd 2001) by studying an increasingly important type of investor—the crowd. In fact, our knowledge in terms of both investment criteria and decision-making processes is limited about this group of investors compared with those of the more professional investors such as angels and VCs. Unlike professional investors, crowd investors supposedly lack organizational resources, relevant industry and financial expertise, and venture investing experience to perform extensive due diligence. Additionally, non-professional investors typically take smaller stakes in new ventures and therefore have limited incentives to engage in time-consuming and complex processing of multi-dimensional information required for evaluating a venture. For these reasons, the current research in crowdfunding benefits from attempts to study not only the relevant criteria used by non-professional investors but also the underlying decision processes that investors use to integrate and process information. We employ the evaluability theory in behavioral decision-making (Hsee and Zhang 2010) that offers the bounded rationality assumption that decision-makers select decision strategies that balance decision accuracy with the costs such as cognitive effort and time required to arrive at those decisions. In doing so, we show that the crowd places little weight on financial metrics and appears to place more weight on characteristics of the product and service than on the founding team. Additionally, we offer new insights into the moderating effect of perceived risk of investing in a venture: as the percentage of equity offered in the campaign increases, crowd investors seem to value information on financials more.

We also contribute to a growing literature on the drivers of crowdfunding success (Mollick 2014) and, in particular, equity crowdfunding (Ahlers et al. 2015; Vismara 2016; Vulkan et al. 2016). Much of the emerging work in equity crowdfunding investigates whether and how the crowd responds to certain information on campaign quality or to signals such as awards and the presence of prominent investors (Ahlers et al. 2015; Ralcheva and Roosenboom 2016), early investors as endorsements (Kim and Viswanathan 2014), or early funding collected from private networks (Lukkarinen et al. 2016). Using a novel set of measures, our study adds to this body of work by assessing the relationship between funding success and a broad range of campaign characteristics related to the quality of the management team, attributes of the venture’s product/service and target market, and financial metrics. While some of our results (such as the relationship between the quality of human capital and success) support prior findings in this literature (Ahlers et al. 2015; Piva and Rossi-Lamastra 2018), we use finer-grained data that extend previously considered set of criteria. For example, the measures used by Ahlers et al. (2015) do not take into account that ventures might have different financial performance (as presented in the financial statements) that, if processed by investors diligently, can presumably help investors assess the equity crowdfunding ventures better. Additionally, while the signaling theory employed by Ahlers et al. (2015) views the availability of financial forecasts or disclosures of risk as a proxy for increased information and uncertainty reduction, we adopt behavioral theories of decision-making as our theoretical lens to better understand when financials influence crowd investors’ judgments. The premise in the signaling theory is how investors use signals of quality to resolve information asymmetries inherent in purchasing equity in a venture; however, the theory assumes away (i) the cognitive limitations of signal receivers (bounded rationality assumption on investors) in their evaluations or (ii) their varying levels of incentives to engage with and interpret such information (Connelly et al. 2011). Therefore, we hope our research inspires further attention to the limitations of investors in processing signals or other information correlated with venture quality.

2 Literature review

Equity crowdfunding

To identify attractive investment opportunities, the crowd seems to value factors that signal the underlying quality of the venture. Ahlers et al. (2015) report that successful equity crowdfunding campaigns benefit from better human capital (as proxied by the number of board members in the management team and the share of board members holding an MBA degree). Similarly, Piva and Rossi-Lamastra (2018) find that entrepreneurs’ business education and their experience are correlated with campaign success. Receipt of grants, early funding from private networks, and backing by professional investors such as business angels and venture capitalists increase the chances of successful funding (Lukkarinen et al. 2016; Ralcheva and Roosenboom 2016; Kleinert et al. 2018).

A second series of studies highlight the heterogeneous nature of crowd investors, their underlying logics, and the unfolding dynamics during fundraising (resulting from interacting with prior investors and entrepreneurs’ posted updates during campaign). Several studies suggest how information cascades can form among crowd investors that leads to herding (Vulkan et al. 2016; Hornuf and Schwienbacher 2018; Vismara 2018), which is prevalent in other types of crowdfunding markets (Colombo et al. 2015). For instance, Vismara (2018) reports that a larger number of initial early investors increase the number of subsequent investors, the total funding amount, and thus the probability of a successful campaign. Investors with a public profile make the offer more appealing to early investors, who in turn attract subsequent investors. Relatedly, entrepreneurs can post updates about their new developments, such as funding events, business developments, and cooperation projects to increase the chances of funding success (Block et al. 2018).

Finally, some studies question the assumption that the “crowd” is a homogeneous community by pinpointing distinguishing characteristics that segregate the crowd. Mohammadi and Shafi (2018) show that female crowd investors behave more risk-averse than male ones when choosing which equity crowdfunding ventures to support. Guenther et al. (2018) compare retail from accredited investors and find no statistically significant difference in their sensitivity to geographical distance when investing in their home country.Footnote 2

Professional investors’ investment criteria

Numerous studies have examined the decision-making criteria of professional venture investors (Tyebjee and Bruno 1984; MacMillan et al. 1986; Fried and Hisrich 1994; Shepherd 1999). To the extent that these investors are primarily motivated by financial gains, they choose investments based on their perceived risk and the expected rate of returns (Tyebjee and Bruno 1984; Shepherd and Zacharakis 1999). In this context, return is most often evaluated in terms of profitability (Robinson and Pearce 1984; Roure and Keeley 1990) and risk in terms of the probability of venture survival (Gorman and Sahlman 1989). As such, decision-makers gather and evaluate information on a wide range of evaluation criteria that are likely to shape the risk-return profile of investment opportunities (Shepherd and Zacharakis 1999; Riding et al. 2007; Franke et al. 2008; Maxwell et al. 2011; Petty and Gruber 2011). Broadly speaking, these criteria fall into three major categories: (1) the start-up team; (2) the business itself; and (3) financial metrics:

-

1. Team characteristics (the “jockey”). The human capital characteristics of the start-up team play a key role in professional investors’ evaluation of proposals (Mason and Harrison 1996; Feeney et al. 1999; Mason and Stark 2004).Footnote 3 For example, Mason and Stark (2004), in a comparative analysis of different investors, highlight investors’ criteria related to the experience and track record of the entrepreneur, their personal qualities (e.g., commitment, enthusiasm), and the range of skills/functions of the management team. VC investors place great value on teams’ experience in the focal industry or in running new ventures (Franke et al. 2008) as well as on technical and managerial skills (Tyebjee and Bruno 1984; Dixon 1991). The quality of the start-up team is also important to business angels (Landström 1998; Sudek 2006). Experience and skills likely matter because they enable founding teams to make better decisions regarding which opportunities to pursue and how to build a new venture, while also enabling them to develop the capabilities required for implementation. Several empirical studies highlight the correlation between founding team characteristics and the likelihood of a venture’s business success (Beckman et al. 2007; Colombo and Grilli 2010). Gruber et al. (2008) suggest that experienced start-up teams will consider a larger number of market opportunities than teams without experience, which in turn allows them to be more successful. In addition to experience and skills, entrepreneurial success also hinges on founders’ commitment to the new venture. Consistent with this notion, MacMillan et al. (1986). identify the capability for sustained intense effort as a key criterion considered by VCs (Carter and Van Auken 1992) (for BAs, see Sudek 2006).

-

2. Business (the “horse”). A second set of criteria relates to features of the new venture and the entrepreneurial opportunity itself. VCs look for innovative products or services that satisfy important customer needs. To provide the potential for profit, the venture’s products should be unique and offer proprietary protection against future competition (Landström 1998). Drawing on the strategic management literature, Shepherd (1999) shows that aspects of competition, such as the level of rivalry and lead time advantages, also influence VCs’ assessment of the probability of ventures’ survival. Finally, market potential refers to the potential size and growth of the target market; investors prefer large and growing markets that provide greater revenue potential (Tyebjee and Bruno 1984). Product and market attributes are important not only to venture capitalists but also to business angels (Mason and Harrison 1996; Landström 1998; Mason and Stark 2004; Riding et al. 2007; Clark 2008).

-

3. Financial metrics and indicators. Professional investors look for investments with high potential returns and low levels of risk (MacMillan et al. 1986; Gompers and Lerner 2001). These characteristics are often captured in financial metrics. As Fried and Hisrich (1994, p. 43) note: “VCs analyze pro forma financial projections prepared by the entrepreneur to assess a project’s potential for earnings growth, as well as gain information about management’s understanding of their proposal and their realism toward its future. The financial projections provide a basis for comparison with the market value of other companies, to give the VC an estimate as to the potential value that can be received when it exits the investment.” More specifically, investors “like to see the business will have a good cash flow …or will get a product on the road” to become potentially profitable (Sweeting 1991, p. 613; emphasis ours). BAs also consider financial metrics to be important (Feeney et al. 1999; Mason and Stark 2004; Clark 2008) including revenue potential, return on investment, and exit routes (Sudek 2006). Although prior work tends to highlight the role of financial forecasts, financial statements that reflect past performance may be important indicators of future potential as well. Either way, financial metrics may be best understood as a reflection of other venture characteristics (including team and business) rather than as a stand-alone attribute: “It appears, quite logically, that without the correct management team and a reasonable idea, good financials are generally meaningless because they will never be achieved.” (Muzyka et al. 1996, p. 274).

3 Theory and hypothesis development

Although professional investors pay attention to all three sets of criteria, not all criteria receive the same attention. Harrison and Mason (2002) and Fiet (1995) find that BAs emphasize the qualities of the entrepreneurial team more than characteristics of the product or service. Similarly, a consistent finding across studies on VC decision-making is the high importance placed on the characteristics of the management team, such as the quality and experience of the entrepreneur, and industry expertise in the team (Shepherd and Zacharakis 1999).Footnote 4 At the same time, Petty and Gruber (2011) find that a lack of experience seems to matter less than expected. This result may reflect that VCs do not have to simply accept the existing management team but often play an active role in shaping and replacing management after making an investment (Wasserman 2003; Conti and Graham 2016; Ewens and Marx 2016). The most recent evidence on relative weights comes from Gompers et al. (2016), who ask VCs about the importance of different criteria. The management team was mentioned most frequently as an important factor (by 95% of VC firms), followed by business model (83%), product (74%), and market (68%).

Unlike professional investors, crowd investors supposedly lack organizational resources, relevant industry and financial expertise, and venture investing experience to perform extensive due diligence (Ahlers et al. 2015). Additionally, non-professional investors typically take smaller stakes in new ventures and therefore have limited incentives to engage in time-consuming and complex processing of multi-dimensional information required for evaluating a venture. For these reasons, the current research in crowdfunding benefits from attempts to study both the relevant criteria used by non-professional investors and their relative importance. To address this research gap, we leverage evaluability heuristic (proposed in behavioral theories of decision-making) to hypothesize that crowds place little weight on financial metrics but appear to place more weight on characteristics of the product and the founding team.

Despite insights into the criteria used by venture investors, we know relatively less about the underlying decision processes that investors use to integrate and process information. Implicit in much of the prior work is a “rational” decision model, where investors take full advantage of the available information to maximize decision accuracy. This perspective is challenged by research in other domains, which shows that decision-makers often face limitations in their cognitive capacity for processing information, leading to bounded rationality (Simon 1955; Busenitz and Barney 1997; Maxwell et al. 2011). Given the richness of information, the multi-dimensional nature of investment opportunities, and the large number of options that compete for funding, bounded rationality is also likely to apply in the context of investment decisions (Zacharakis and Meyer 1998). As such, investors may have to economize on their decision process using various simplifying strategies and heuristics. One illustrative approach to reduce information processing cost is called elimination by aspects. This strategy involves flagging and rejecting a choice option with a fatal flaw to limit the number of proposals for subsequent due diligence and further attention. Maxwell et al. (2011) suggest that this approach provides a useful approximation for BAs’ decision-making.

We argue that evaluability heuristic is particularly relevant in our context to investigate the relative importance of different criteria used by crowds. This heuristic states that decision-makers reduce processing costs by placing greater weight on criteria that are easy to evaluate and paying less attention to criteria that are difficult and, thus, more costly to evaluate (Hsee and Zhang 2010). Evaluability theory also specifies conditions under which evaluability is particularly high or low. In particular, an attribute is difficult to evaluate if the decision-maker does not know its distribution across choice options (e.g., its effective range, its neutral reference point) and consequently does not know how “good” or “bad” a particular value of this attribute is. Conversely, an attribute is easy to evaluate if the decision-maker knows its distribution. As such, evaluability not only is a feature of the attribute itself but also depends on the prior knowledge and experience of the decision-maker.

Since our primary interest is in the weight investors may place on different types of criteria, the evaluability heuristic provides useful predictions. Crowd investors may likely have some difficulty to evaluate all three criteria—team characteristics, business characteristics, and financials. However, they may find some of these criteria easier to evaluate than others. In particular, even the crowd may feel comfortable evaluating certain aspects of teams and their human capital. For example, higher levels of education, degrees from prominent schools, and prior entrepreneurial experience are easy to evaluate (as positive) even by inexperienced investors. Crowd investors may also find it relatively easy to form opinions about the desirability of products and services, especially those targeted at a general consumer audience. In contrast, the crowd may find it more difficult to evaluate financial information such as projections of costs and revenues or potential returns for individual investors. Unlike professional investors, most crowdfunding investors see limited deal flow and lack comparative data to evaluate and compare such financial criteria. Similarly, non-professional investors likely lack the technical training to interpret financial terminology or to aggregate and process financial data. Consistent with this claim, survey evidence points to generally low levels of financial literacy in the population (for a review, see Lusardi and Mitchell 2014; and for evidence in the UK, see Disney and Gathergood 2012). Considering aforementioned assumption on limited expertise of the crowd or their limited incentive in assessing complex financials, we expect:

Hypothesis 1. When making funding decisions, crowd investors pay greater attention to criteria related to the quality of the team and the business than to financial information.

We suggest that increasing the financial stakes encourages crowd to focus more attention on attributes that are harder to evaluate. In particular, the larger size of equity offering increases the risk of investment and elicits more incentive from investors; therefore, they allocate more attention to process the investment opportunity given the potential high risks that might ensure higher returns from owning a larger share of the venture.

Those ventures that tend to raise money by selling higher proportions of equity to investors appear risky to investors because investors might perceive higher adverse selection risks faced with owners possessing more knowledge about the underlying quality of the venture. Increased percentage of equity offered to investors is associated with a decrease in the number of investors and the likelihood of success (Ahlers et al. 2015; Vismara 2018). Entrepreneurs who are confident of their venture prospects are likely to retain as much equity as possible to refrain from diluting their future wealth. By retaining high ownership of their ventures, entrepreneurs can show their commitment to prospective investors and signal the quality of the venture.

More investors may be required to contribute to fund the campaigns with higher equity offered (for a given pre-money valuation). This is specially the case if individual investors in the crowd would be reluctant to increase the size of their contributions. For a given level of contribution, each individual investor faces higher marginal (adverse selection) risks when choosing ventures with more equity offerings, and thus, they are more prone to losing their investment from inadequate due diligence. Having said that, we expect the increased risk associated with more equity offering to encourage more effort in screening the focal venture.

Investors may also need to contribute more to fund the campaign when the equity offered is higher (for a given pre-money valuation). Investors typically have greater incentive to evaluate investment opportunities when they expect higher returns from doing so. Holmstrom and Tirole(1997, p. 686) argue that the effort in assessing the focal investment opportunity is endogenous and related to the amount of capital that the intermediary has to put up (“skin in the game”). Case in point, whereas venture capitalists tend to hold large stakes in the projects they finance to justify their intensive due diligence and their involvement following their investments (e.g., by taking board seats), banks engage in relatively less screening and monitoring and, thus, can highly leverage their capital. Therefore, increasing the stakes in the outcome encourages diligent behavior and generates greater incentive to carefully study the information that otherwise would have been relevant but difficult to process. To the extent that the equity offering increases crowds’ intensity of due diligence since the risks from misjudgments are accentuated, we expect the crowd to spend time digesting more complex information such as financials. Thus, we propose the following hypothesis:

Hypothesis 2: When making funding decisions, crowd investors pay greater attention to financial information as the offered equity increases.

4 Data and methods

We examine crowdfunding campaigns on the platform Crowdcube. This platform opened in 2011 in the UK and is now the world’s largest equity crowdfunding platform with cumulative investments of more than £130 million, 352 successful campaigns, and nearly a quarter of a million registered investors as of January 2016.Footnote 5 We examine a sample of 207 campaigns that include all campaigns posted on Crowdcube in the period from 7 September 2015 to 12 August 2016. Although this sample excludes some of the earlier campaigns, campaigns started after September 6 received ratings from an independent agency, which serve as key measures for our empirical analysis (see below).

Crowdcube operates in an “all-or-nothing” manner, which means that investors are only committed to providing their pledged funds if the campaign achieves its funding goal. Business pitches on Crowdcube are typically live for about 30 days. If fully funded, firms have the choice to keep the campaign open and allow it to overfund or close it at the target amount. If unsuccessful, the campaign is closed and investors’ pledges are returned. There is no fee for listing the venture on Crowdcube. A success fee of 7% is only charged on the amount ventures successfully raised (also, a completion fee, which is on average 0.75–1.25% of all funds raised, is applied).Footnote 6 Investors pay no additional fees. Entrepreneurs pitch their ideas with a fixed funding goal and a set amount of shares; however, Crowdcube allows for small adjustments after the pitch is launched so that founders can adapt to the investors’ needs (in our analysis, we take the data at the time of launch). The shares could include voting and preemption rights (A shares) or no rights (B shares). Share issues typically qualify for tax relief schemes (e.g., Enterprise Investment Scheme [EIS] or Seed Enterprise Investment Scheme [SEIS]).Footnote 7 Out of the 207 campaigns in our sample, 111 (54%) campaigns were successful in reaching their targets and 46% failed to achieve their funding goal.

Our empirical analysis builds on two data sources. First, we scraped Crowdcube to obtain information on the campaigns, including their funding goals and funding success. Second, we obtained from an independent agency standardized ratings of key characteristics of the campaigns. Details on these ratings are provided below. Note that while we can rely on these ratings to measure key attributes consistently across campaigns, these ratings are from an independent source and were not published on the Crowdcube website. Although investors who were aware of the ratings could have accessed them through the agency’s website, it is likely that most investors made their investment decisions based on the primary campaign information available on Crowdcube.

5 Variables

Dependent variables

We capture two key outcomes associated with fundraising, consistent with the literature interested in equity crowdfunding (Vismara 2016; Piva and Rossi-Lamastra 2018; Ahlers et al. 2015). First, success measures whether the target amount for the campaign is reached or not. Because Crowdcube follows an all-or-nothing model, the binary outcome of success represents the case in which the campaign has attracted sufficient amount of funds. Second, amount raised (in log British pounds) is the amount of funds pledged by the crowd towards the goal of the campaign (regardless of whether or not the campaign was ultimately successful). This amount is transferred to the company in case of successful campaign; otherwise, this amount represents the total amount the investors would have invested. We explore alternative outcome measures in robustness checks.

Independent variables

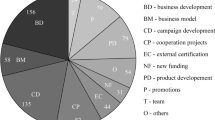

Crowdcube campaigns include three main sections providing detailed information on the management team, the business idea, and financials (see Fig. 1 for an illustration). We take advantage of standardized ratings of these characteristics as provided by the independent agency Crowdrating. For each Crowdcube campaign started after April 2015, the agency uses an algorithmic engine to analyze and rate campaign descriptions. More specifically, the rating methodology assesses each campaign description against 81 criteria covering the three broad categories “management,” “product,” and “investment” (financials). For each category, the Crowdrating score range from 0 to 100%, with 100% reflecting that the campaign achieved the maximum number of possible points. Crowdrating publishes ratings for the three primary categories, as well as three sub-ratings for each category. Examples of two campaign scorings are provided in Fig. 2.

More specifically, the management rating is based on the description of the management team and averages three sub-ratings: team members’ experience, skills, and commitment. The average management rating is 70.5, with a standard deviation of 14.7.

Business rating is the average of three sub-ratings: market potential, product characteristics, and competition. The average business rating is 60.2, with a standard deviation of 12.0.

Financials rating is the average of three sub-ratings: profitability, cash flow, and return of the firm. These ratings are based on a “financial snapshot” published on the campaign website. When a campaign does not provide sufficient financial information (N = 28), Crowdrating does not compute this score. The average financials rating is 57.6, with a standard deviation of 10.6. To be able to use the full sample in regressions even when the financials rating is missing, we assign the respective campaigns a score of zero but include a dummy variable that denotes the observation is missing (see Aghion et al. 2013). This dummy variable is always insignificant in our regressions (not reported in tables to preserve space).

As expected, the correlations between sub-ratings for each category are positive and significant and higher than the correlations between sub-ratings across categories (Appendix Table 6). Our analysis will focus on the three primary ratings but will also use sub-ratings to provide additional insights.

Control variables

Consistent with prior research (Guenther et al. 2018; Vismara 2018), we control for several factors that might influence the crowdfunding outcomes. Equity offered is the percentage of firm equity offered in the campaign (computed as the target fundraising goal divided by the post-money valuation of the firm). It has been argued that equity offered is linked to adverse selection risk in that entrepreneurs who are confident in the potential of their business are likely to retain more equity, as offering more equity to new investors would dilute their future wealth (Ahlers et al. 2015; Mohammadi and Shafi 2018). In contrast, entrepreneurs who are less confident are likely to sell a higher proportion of equity to new investors. Thus, higher equity retention could signal to prospective investors a lower likelihood of adverse selection, increasing the likelihood of funding success. We control for the target amount (target goal, in log British pounds) because previous research has documented that campaigns aiming to raise larger target amounts are less likely to be successful (at least on reward-based platforms with all-or-nothing models, e.g., Mollick 2014). Tax relief (0/1) represents whether the investors can benefit from tax reliefs of the Seed Enterprise Investment Scheme (SEIS) or the Enterprise Investment Scheme (EIS). Both of these tax incentive schemes in the UK are designed to help small companies raise funding by offering tax breaks on new shares in companies. This dummy variable takes the value of 1 if a project qualifies for tax relief, otherwise zero. Prior CF success (0/1) represents whether the firm has successfully crowdfunded before on the Crowdcube platform. We control for age and the firm’s primary industry. High-Tech (0/1) is a dummy variable that takes on the value of 1 for firms classified in Technology, Internet, IT & Telecommunications industries. This variable takes on the value of zero for firms in Art & Design, Business Services, Consumer Products, Education, Environmental & Ethical, Film, TV & Theatre, Food & Drink, Health & Fitness, Leisure & Tourism, Manufacturing, Media & Creative Services, Retail, Sport & Leisure, and others. Additionally, we control for firm location using a dummy variable indicating whether a firm headquarter is in London (firms are required to be incorporated prior to fundraising on Crowdcube). To control for potential platform dynamics, we include a dummy Year 2015 for campaigns starting in 2015 (vs. 2016).

6 Results

Table 1 shows the descriptive statistics for the full sample and separately for successful and unsuccessful campaigns. The mean management rating and the mean business rating are significantly higher for successful campaigns (p < 0.05 and p < 0.01); however, there is no significant difference between failed and successful campaigns in terms of financials rating. The correlations between the ratings and success (0/1) show a similar pattern (Table 2).Footnote 8

Table 3 reports probit regressions of funding success, including point estimates as well as marginal effects (holding all other variables at the mean). Model (1) shows a positive and significant coefficient for management rating (p < 0.05); in terms of economic magnitude, a one-standard deviation increase in management rating is associated with 26.5% higher likelihood of funding success. While this result is consistent with the notion that higher ratings increase funding success, our cross-sectional data do not allow us to establish causality; all results should be considered correlational in nature.

Model (2) includes the sub-ratings of experience, skills, and commitment. Among these, commitment is significantly correlated with success. A one-SD higher commitment rating is associated with a 27.7% higher probability of success. We find no significant coefficients for the experience and skill ratings. However, given the high correlation between skill and experience ratings (Table 6), this result may also partly reflect multi-collinearity. When tested jointly, skill and experience are not significant in model (2) (χ2(2) = 2.64, p value = 0.26). Additionally, when we estimate models with each sub-rating individually, only the coefficient of commitment is significant. The joint significance Wald test of all three sub-ratings yields χ2(3) = 7.22 (p = 0.06).

Model (3) shows that business rating is highly significant (p < 0.01); a one-SD higher score is associated with a 40% higher probability of funding success. Model (4) includes the three sub-ratings market, product, and competition. While none of these coefficients are significant in this model, when entered individually, the sub-ratings of market, product, and competition are significant at the 5%, 10%, and 5% levels, respectively. A joint test of these sub-ratings is significant at the 5% level (χ2(3) = 8.98).

Model (5) includes the financials rating. Consistent with the lack of mean differences (Table 1), we find no significant coefficient. Model (6) includes the sub-ratings profitability, cash flow, and return. None of the ratings is significant, and a joint test does not reach conventional significance levels (χ2(3) = 2.94, p = 0.40). Including each sub-rating separately in the regressions also shows no significant coefficients.

Finally, model (7) includes all three primary ratings. The joint Wald test is highly significant (χ2(3) = 11.73 (p < 0.01)), but only the business rating is individually significant.

Table 4 uses the (log) amount raised as an alternative measure of funding success. These models are estimated using OLS with robust standard errors and follow a similar organization as the models reported in Table 3. Model (1) shows that a one-SD higher management rating is associated with an e0.021×14.7 − 1 = 36% higher amount of funding. Model (2) includes the sub-ratings and shows significant coefficients for both experience rating and commitment rating. This pattern holds when we include the three sub-ratings separately.

Model (3) shows that business rating has a positive and significant coefficient (p < 0.01); a one-SD higher score is associated with a 45% higher amount raised. The sub-ratings shown in model (4) suggest that one-SD higher market rating and competition rating are associated with an increase in the amount raised by 18.55% and 15.22%, respectively. When sub-ratings are inserted separately in the regression models, each is significant. Models (5) and (6) include the financials rating and the related sub-ratings. Consistent with the results from Table 3, none of the coefficients are significant. The joint Wald test of significance of the sub-ratings in model (6) is not significant (F(3) = 0.66, p = 0.57). When included individually, none of the sub-ratings is significant. Finally, in model (7), we include all the ratings. The coefficients of management rating and business rating remain significant, while the financials rating has no significant coefficient. The joint Wald test gives F(3) = 5.25 (p < 0.01).

Overall, the significant coefficients for management rating as well as business rating, but not for financials rating, lend support for hypothesis 1. Moreover, the more detailed analyses on sub-dimensions suggest that team commitment is consistently associated with funding success.

Table 5 offers the results testing H2. We mean-center the ratings to reduce multi-collinearity and include their interactions with equity offered in regression models. The interaction term between equity offered and financials rating is only significant in models (3) and (6). Based on model (3), when equity offered is at the mean (mean plus one SD), the average marginal effects associated with financials rating are 0.2 (p = 0.489) and 1.06 (p = 0.025), respectively; holding all other variables at mean, when equity offered is at the mean, a one-SD increase of financials rating is associated with an increase of about 5% in the success likelihood; when equity offered is set at one SD above the mean, this number is 26.71%. These results provide support for H2.Footnote 9

7 Supplementary analyses and robustness checks

While our analyses thus far have treated the different criteria—team, business, and financials—as independent, it is possible that investors consider them jointly. For example, investors might place greater confidence in financial metrics if they also believe that the management team is very good. Similarly, investors may pay less attention to product and market attributes if the management team is very good—after all, a good team may be able to succeed even with an average idea (see quotes in Section 2). To examine these possibilities, we mean-center the ratings to reduce multi-collinearity and include their interactions in regression models (Table 7). Models (1) and (4) show a negative interaction between management rating and business rating, suggesting that these two aspects may be partial substitutes—if a campaign has a high score on one of these aspects, the other aspect appears to have a smaller influence on funding decisions. Similarly, models (3) and (6) show a negative interaction between business and financials rating. We find no interaction between management rating and financial rating. Although these results are only exploratory, they suggest that future work could usefully theorize and empirically test more complex decision-making models that allow for substitution (or complementarity) between different criteria in investor decision-making (see also Franke et al. 2008).

We performed several robustness checks. First, we use as alternative outcome measures the number of investors (for unsuccessful campaigns, the number of individuals who made a pledge) and the percentage of funding raised. The results (Tables 8 and 9) are qualitatively the same as our featured analyses.

Second, we utilize key financial metrics taken directly from the crowdfunding campaigns to explore their relationship with financials rating and with funding success. More specifically, we include the following measures: operating profit as % of sales in year of the campaign; closing cash as % of sales in year of campaign; forecasted growth in sales (year after campaign vs. year of campaign); forecasted growth in operating profit (year after campaign vs. year of campaign); and forecasted growth in operating profit as % of sales over 3 years. These measures are set to missing for campaigns that fail to provide detailed financials. Models (1) to (4) in Table 12 show that the original financial metrics have significant relationships with the ratings used in the main analysis. More importantly, however, using these metrics instead of the ratings in the regressions of fundraising success again shows no significant coefficients (models (5) and (6)).

Third, our main analysis follows prior work (e.g., Aghion et al. 2013) by replacing missing financial ratings with 0 (and including a dummy variable denoting missing data). As an alternative approach, we drop these observations (Table 13, models (1) and (2)) but again find no significant coefficients for the financials rating.

Fourth, to find additional proxies for the quality of the management team, we collect data on all the members of management team from UK Companies House database. We create three variables: (i) total work experience, a variable that captures the total sum of years that current directors of the venture have work experience; (ii) total tenure with venture, a variable that captures how long all current directors have been involved with the venture; and (iii) diverse occupations, a variable that captures the diversity of roles taken by the management team. Results presented in Table 10 further show that these proxies correlate with both management rating and the related sub-ratings as well as the crowdfunding campaign outcomes. Overall, these results reinforce the external validity of the ratings used in this study in addition to providing support for H1.

Fifth, to find additional proxies for the business, we collect two additional set of variables. First, patent data is obtained from Espacenet (European Patent Office). Patent counts the number of granted patents assigned to the venture. Second, IBISWorld offers several industry-level categorical variables related to barriers to entry, competition, and market share concentration. Table 11 presents the regressions that correlate these variables to business ratings and the sub-ratings and the crowdfunding outcomes. The omitted variable is “low” category whenever applicable. These results again support the validity of business ratings and suggest the relevance of these additional proxies for the campaign success.

Sixth, to address potential differences between industries, we include a more detailed set of 17 industry dummy variables in models (3)–(8) of Table 13. Our results are robust (although some observations drop out when industry dummies predict success perfectly).

Seventh, we explore whether the results are robust in the sample that excludes companies with prior success in crowdfunding. We do so because success breeds success: the set of companies with track record of success finds it easier to attract capital (as our results in this study confirm). Therefore, crowd investors’ perceptions about the likelihood of succeeding again can influence their decision-making processes and the information they seek in evaluating companies. We obtain similar results to those reported in Table 3 in the sample that excludes companies with prior success in crowdfunding (Tables 14 and 15).

Finally, one may be concerned that results for the three ratings differ due to different means and standard deviations of the scores. To address this concern, panel B in Table 13 uses standardized ratings (mean = 0, SD = 1). The results are robust, again showing the strongest coefficients for the product rating, followed by the team rating. We find no significant coefficients for the financials rating. To alleviate concerns over the fact that the ratings are calculated as the equally weighted average of related sub-ratings, we also use factor analysis to find the principal component factors associated with sub-ratings. We find three main factors and obtain similar results to those reported in Table 3.

8 Conclusion and discussion

Crowdfunding plays an increasingly important role for innovation and entrepreneurship (Belleflamme et al. 2014; Mollick and Nanda 2016; Sorenson et al. 2016), especially as a complement to other sources of seed and early-stage funding to new firms (Colombo and Shafi 2016). While reward-based crowdfunding platforms, such as Kickstarter, have received most of the attention in academic research, equity crowdfunding is quickly becoming an important source of funding as well. Indeed, the percentage of equity-based crowdfunding as a proportion of the total UK seed and venture stage equity investment has grown rapidly from just 0.3 in 2011 to 9.6% in 2014 and 15.6% in 2015 (Zhang et al. 2016, p. 10). As regulators clarify the policy frameworks, equity crowdfunding is also likely to accelerate in the USA and other regions (Wilson and Testoni 2014). These developments highlight the need for research on the functioning of equity crowdfunding markets and of the decision processes that non-professional investors use when choosing which projects to support (Vulkan et al. 2016; Mohammadi and Shafi 2018; Vismara 2018).

We complement the nascent literature on equity crowdfunding by studying the decision criteria used by non-professional crowdfunding investors on the currently largest equity crowdfunding platform, Crowdcube. In doing so, we leverage a core insight in behavioral decision-making that argues that decision-makers do not necessarily seek to maximize decision accuracy but balance accuracy with the goal to limit the costs of accessing and processing information. We find that crowdfunding investors pay little attention to financial information contained in campaigns, consistent with the idea that they find financial information difficult to evaluate. However, when financial stakes in the form of equity offered in the campaign are high, crowd investors incur the costs of assessing complex financial information. Characteristics of the management team are significantly related to funding success, although experience and skills appear to matter less than motivational aspects such as founders’ commitment to the project. Characteristics of the business are the strongest predictors of success, possibly reflecting that these characteristics are most salient and easy to evaluate for non-professional investors.

We acknowledge important limitations, some of which point to additional opportunities for future research. First, although equity crowdfunding is growing fast and we use data from the largest equity crowdfunding platform in the UK, our sample is relatively small. Future work using larger samples could explore in more detail differences in the predictors of success—and investors’ decision-making—between campaigns in different industries or in different countries. Longitudinal data would also be useful in studying changes in the predictors of funding success over time. Relatedly, our data come from a single platform. This research design allows us to avoid confounding heterogeneity in platform characteristics such as different levels of competition for funding, differences in screening mechanisms exacerbating selection biases related to the project quality (unobservable to the econometrician), or differences in how information is presented. However, future research is needed to examine whether our results generalize to other platforms and how investor decision-making is impacted by platform characteristics.

Third, although we consider three broad categories of investment criteria that have received considerable support in prior literature (i.e., team, business, and financials), there may be other criteria that also influence crowd investors’ decisions. As such, our study does not seek to identify all relevant decision criteria but should be seen as an effort to examine the role of some particularly salient criteria through the lens of a behavioral decision-making framework.

Fourth, our focus is on characteristics of the new ventures; the data do not allow us to explore whether investment decisions also depend on characteristics of the potential investors (Rider 2012), such as their education (Dimov et al. 2007) or prior investment experience (Shepherd et al. 2003). Similarly, although equity investors in crowdfunding tend to be primarily motivated by financial returns rather than non-financial goals (Cholakova and Clarysse 2015), it would be interesting to study whether the weight placed on team characteristics, business plan, and financial aspects differs depending on heterogeneity in investors’ risk preferences (Paravisini et al. 2016), goals, and motives (Cholakova and Clarysse 2015). Finally, we do not have data on the size of contributions pledged by each investor. This variable seems to offer a good proxy for investors’ skin-in-the-game, allowing future researchers to assess whether investors with larger stakes exert more effort to screen projects.

Fifth, to alleviate concerns that our findings might depend on the methodology rating agency uses to provide scores, we follow two steps. First, we investigate the validity of scores provided by the rating agency by assessing their correlations with objective measures such as those generated from cash flow statements (Tables 10, 11 and 12). Second, we have included these objective measures in regressions predicting funding outcomes and obtain similar results. That said, future research could benefit from exploring a different methodology: coding similar criteria by experts such as venture capitalists or business angels and comparing these expert-based scores with crowdfunding outcomes. For example, Mollick and Nanda (2015) ask national experts’ opinions about crowdfunded theoretical projects focusing on several criteria including novelty, relevance, quality, feasibility, and reach. At the same time, they ask experts whether they would fund crowdfunded theoretical projects. We suggest such approaches are better suited for shedding light on the extent to which equity crowdfunders behave more or less like professional investors.

Finally, we draw on a theoretical framework in which decision-makers respond to information about different aspects of crowdfunding campaigns, but the data limit our ability to draw causal inferences and to provide insights into the mechanisms underlying our results. Future work could employ experimental designs to rule out unobserved heterogeneity and potential endogeneity relating to omitted variables across investors and campaigns such as the initial momentum generated by investment from entrepreneurs’ friends and families, pinpoint particular decision-making heuristics investors use, and tie different decision strategies more explicitly to the accuracy of the resulting decisions.

Notwithstanding the need for future research, our results may have important implications for entrepreneurs and crowd investors, platform organizers, and policy makers. Our results may be of interest to entrepreneurs seeking funding by highlighting which criteria are most strongly related to fundraising success, potentially allowing them to better judge their projects’ prospects and to create more successful campaigns. More fundamentally, entrepreneurs may benefit from our framework, which highlights that investors may not process all information but may use a number of heuristics that reduce decision-making costs while preserving satisfactory levels of decision accuracy. Potential investors may similarly benefit from a behavioral perspective. While our framework suggests potential avenues to reduce the costs of decision-making, it also points towards potential trade-offs in terms of lower decision quality. Although we cannot say whether ignoring financial information leads to worse investment decisions, this may well be the case, and investors should consider whether they might be able to process at least some potentially useful financial information without incurring prohibitive costs. The latter point also highlights opportunities for platform providers, who may be able to design mechanisms that allow investors to make better decisions. In particular, to the extent that limited attention to financial indicators reflects investors’ difficulties in evaluating such information, platforms may help by providing distributional information or otherwise putting campaign attributes “in context.” One such approach might be to show different investment options side-by-side rather than in isolation (Hsee and Zhang 2010). Platforms might also include professional investors’ evaluations of financials to educate the crowd and provide a comparative benchmark.

Finally, understanding the crowd’s decision-making may also be important for policy makers. Governments promote crowdfunding as a promising source of funding, especially for women and minorities (Kitchens and Torrence 2012), and the UK government makes some funding to small businesses through crowdfunding platforms (Zhang et al. 2016). However, it is debated whether and how the government should actively encourage non-professional investors to make highly risky early-stage investments (Wilson and Testoni 2014). If crowd investors ignore important information and sacrifice decision accuracy when making decisions, crowdfunding may be an inefficient and socially sub-optimal mechanism to allocate capital to competing opportunities. Moreover, crowdfunding may put individual investors at risk of losing considerable shares of their savings. Although our study does not speak to the quality of crowd investors’ decisions, it does suggest that policy _________________________________________________________________________________________________________________________________________ makers and regulators should consider explicitly how the crowd makes decisions, what errors are likely to be made, and what mechanisms can help improve the efficiency of crowdfunding capital markets for the benefit of entrepreneurs, investors, and society at large.

Notes

Ahlers et al. (2015) define equity crowdfunding as a form of financing in which entrepreneurs make an open call to sell a specified amount of equity in a company on the Internet, hoping to attract a large group of investors. The open call and investments take place on an online platform (such as, e.g., Crowdcube) that provides the means for the transactions (the legal groundwork, pre-selection, the ability to process financial transactions, etc.).

Table 1 in Maxwell et al. (2011) gives an excellent overview of relevant studies in the angel realm on the relevance of team criteria.

A popular saying is that VCs would rather invest “in a grade A team with a grade B idea than in a grade B team with a grade A idea.” Arthur Rock, a legendary venture capitalist, once said, “Nearly every mistake I’ve made has been in picking the wrong people, not the wrong idea” (Bygrave and Timmons 1992, p. 6).

Equity crowdfunding platforms now account for about one-fifth of all early-stage investment deals and 35% of the number of seed stage deals in the UK (http://about.beauhurst.com/report-the-deal-q3-15) with Crowdcube being the market leader with a market share of 52% (http://www.crowdfundinsider.com/2015/08/72395-crowdsurfer-data-released-crowdcube-leads-uks-investment-crowdfunding-market/).

For more information, see https://www.gov.uk/guidance/venture-capital-schemes-apply-for-the-enterprise-investment-schemehttps://www.gov.uk/guidance/venture-capital-schemes-apply-for-the-enterprise-investment-scheme and https://www.gov.uk/guidance/venture-capital-schemes-apply-to-use-the-seed-enterprise-investment-schemehttps://www.gov.uk/guidance/venture-capital-schemes-apply-to-use-the-seed-enterprise-investment-scheme

Thanks to one of the reviewer’s suggestions, we investigate the possibility of a mediation effect for the target goal in the relationship between management rating and raised amount. We do so because better teams set higher goals (a correlation of 0.516 between management rating and target goal), and this could provide an alternative explanation for why better teams raise more money. We perform causal mediation analysis using the command “PARAMED” in Stata; the total direct effect is 0.048 (p < 0.01), the controlled direct effect is 0.021 (p < 0.01), and the natural direct effect is 0.027 (p < 0.01). The results (available upon request) confirm the presence of the mediation effect.

Given that we imputed zero for observations with missing financials and a dummy denoting this missing observations, we include an interaction term between the dummy and equity offered. We do not report the dummy or the interaction term, which are always insignificant.

References

Aghion, P., Van Reenen, J., Zingales, L. (2013). Innovation and institutional ownership. The American Economic Review, 103, 277–304.

Ahlers, G.K.C., Cumming, D., Guenther, C., Schweizer, D. (2015). Signaling in equity crowdfunding. Entrepreneurship Theory and Practice, 39, 955–980.

Beckman, C.M., Burton, M.D., O’Reilly, C. (2007). Early teams: the impact of team demography on VC financing and going public. Journal of Business Venturing, 22, 147– 173.

Belleflamme, P., Lambert, T., Schwienbacher, A. (2014). Crowdfunding: tapping the right crowd. Journal of Business Venturing, 29, 585–609.

Block, J., Hornuf, L., Moritz, A. (2018). Which updates during an equity crowdfunding campaign increase crowd participation? Small Business Economics, 50, 3–27.

Busenitz, L.W., & Barney, J.B. (1997). Differences between entrepreneurs and managers in large organizations: biases and heuristics in strategic decision-making. Journal of Business Venturing, 12, 9–30.

Bygrave, W.D., & Timmons, J.A. (1992). Venture capital at the crossroads. Boston Mass.: Harvard Business School Press. https://books.google.ch/books/about/Venture_Capital_at_the_Crossroads.html?id=J1yUXKd3hA4C&redir_esc=y.

Carter, R.B., & Van Auken, H.E. (1992). Effect of professional background on venture capital proposal evaluation. Journal of Small Business Strategy, 3, 45–55.

Cholakova, M., & Clarysse, B. (2015). Does the possibility to make equity investments in crowdfunding projects crowd out reward-based investments? Entrepreneurship Theory and Practice, 39, 145–172.

Clark, C. (2008). The impact of entrepreneurs’ oral ‘pitch’ presentation skills on business angels’ initial screening investment decisions. Venture Capital, 10, 257–279.

Colombo, M., & Grilli, L. (2010). On growth drivers of high-tech start-ups: exploring the role of founders’ human capital and venture capital. Journal of Business Venturing, 25, 610–626.

Colombo, M., & Shafi, K. (2016). Does reward-based crowdfunding help firms obtain venture capital and angel finance? Available at SSRN 2785538.

Colombo, M., Franzoni, C., Rossi-Lamastra, C. (2015). Internal social capital and the attraction of early contributions in crowdfunding. Entrepreneurship Theory and Practice, 39, 75–100.

Connelly, B.L., Certo, S.T., Ireland, R.D., Reutzel, C.R. (2011). Signaling theory: a review and assessment. Journal of Management, 37, 39–67.

Conti, A., & Graham, S.J.H. (2016). Prominent investor influence on startup CEO replacement and performance. Available at SSRN 2738835.

Cumming, D., Meoli, M., Vismara, S. (2019). Investors’ choices between cash and voting rights: evidence from dual-class equity crowdfunding. Research Policy, 48(8). https://www.sciencedirect.com/science/article/abs/pii/S0048733319300228.

Dimov, D., Shepherd, D.A., Sutcliffe, K.M. (2007). Requisite expertise, firm reputation, and status in venture capital investment allocation decisions. Journal of Business Venturing, 22, 481–502.

Disney, R., & Gathergood, J. (2012). Financial literacy and consumer credit use. University of Nottingham, Centre for Finance, Credit and Macroeconomics (CFCM).

Dixon, R. (1991). Venture capitalists and the appraisal of investments. Omega, 19, 333–344.

Ewens, M., & Marx, M. (2016). Founder replacement and startup performance. Available at SSRN 2717124.

Feeney, L., Haines, G.H., Riding, A.L. (1999). Private investors’ investment criteria: insights from qualitative data. Venture Capital: An International Journal of Entrepreneurial Finance, 1, 121–145.

Fiet, J.O. (1995). Risk avoidance strategies in venture capital markets. Journal of Management Studies, 32, 551–574.

Franke, N., Gruber, M., Harhoff, D., Henkel, J. (2008). Venture capitalists’ evaluations of start-up teams: trade-offs, knock-out criteria, and the impact of VC experience. Entrepreneurship Theory and Practice, 32, 459–483.

Fried, V.H., & Hisrich, R.D. (1994). Toward a model of venture capital-investment decision-making. Financial Management, 23, 28–37.

Gompers, P., & Lerner, J. (2001). The venture capital revolution. Journal of Economic Perspectives, 15, 145–168.

Gompers, P., Gornall, W., Kaplan, S.N., Strebulaev, I.A. (2016). How do venture capitalists make decisions? National Bureau of Economic Research Working Paper Series No. 22587.

Gorman, M., & Sahlman, W.A. (1989). What do venture capitalists do. Journal of Business Venturing, 4, 231–248.

Guenther, C., Johan, S., Schweizer, D. (2018). Is the crowd sensitive to distance?—how investment decisions differ by investor type. Small Business Economics, 50, 289–305.

Gruber, M., MacMillan, I.C., Thompson, J.D. (2008). Look before you leap: Market opportunity identification in emerging technology firms. Management Science, 54(9), 1652–1665.

Harrison, R.T., & Mason, C. (2002). Backing the horse or the jockey? Agency costs, information and the evaluation of risk by business angels. In Bygrave, W D, Brush, C, Davidsson, P, Fiet, J, Greene, P, Harrison, R T, Lerner, M, Meyer, G (Eds.) Frontiers of Entrepreneurship Research 2002: Proceedings of the Twenty-Second Annual Entrepreneurship Research Conference. Massachusetts: Babson College.

Holmstrom, B., & Tirole, J. (1997). Financial intermediation, loanable funds, and the real sector. The Quarterly Journal of Economics, 112(3), 663–691.

Hornuf, L., & Schwienbacher, A. (2018). Market mechanisms and funding dynamics in equity crowdfunding. Journal of Corporate Finance, 50, 556–574.

Hsee, C.K., & Zhang, J.A. (2010). General evaluability theory. Perspectives on Psychological Science, 5, 343–355.

Kim, K., & Viswanathan, S. (2014). The experts in the crowd: the role of reputable investors in a crowdfunding market. Available at SSRN 2258243.

Kitchens, R., & Torrence, P.D. (2012). The JOBS Act-crowdfunding and beyond. Economic Development Journal, 11, 42.

Kleinert, S., Volkmann, C., Grünhagen, M. (2018). Third-party signals in equity crowdfunding: the role of prior financing. Small Business Economics, 1–25.

Landström, H. (1998). Informal investors as entrepreneurs: decision-making criteria used by informal investors in their assessment of new investment proposals. Technovation, 18, 321–333.

Lukkarinen, A., Teich, J.E., Wallenius, H., Wallenius, J. (2016). Success drivers of online equity crowdfunding campaigns. Decision Support Systems, 87, 26–38.

Lusardi, A., & Mitchell, O.S. (2014). The economic importance of financial literacy: theory and evidence. Journal of Economic Literature, 52, 5–44.

MacMillan, I.C., Siegel, R., Narasimha, P.N.S. (1986). Criteria used by venture capitalists to evaluate new venture proposals. Journal of Business Venturing, 1, 119–128.

Mason, C., & Harrison, R. (1996). Why “business angels” say no: a case study of opportunities rejected by an informal investor syndicate. International Small Business Journal, 14, 35–51.

Mason, C., & Stark, M. (2004). What do investors look for in a business plan? A comparison of the investment criteria of bankers, venture capitalists and business angels. International Small Business Journal, 22, 227–248.

Maxwell, A.L., Jeffrey, S.A., Levesque, M. (2011). Business angel early stage decision making. Journal of Business Venturing, 26, 212–225.

Mohammadi, A., & Shafi, K. (2018). Gender differences in the contribution patterns of equity-crowdfunding investors. Small Business Economics, 50(2), 275–287.

Mollick, E.R. (2014). The dynamics of crowdfunding: an exploratory study. Journal of Business Venturing, 29, 1–16.

Mollick, E., & Nanda, R. (2015). Wisdom or madness? Comparing crowds with expert evaluation in funding the arts. Management Science, 62(6), 1533–1553.

Mollick, E.R., & Nanda, R. (2016). Wisdom or madness? Comparing crowds with expert evaluation in funding the arts. Management Science, 62, 1533–1553.

Muzyka, D., Birley, S., Leleux, B. (1996). Trade-offs in the investment decisions of European venture capitalists. Journal of Business Venturing, 11, 273–287.

Paravisini, D., Rappoport, V., Ravina, E. (2016). Risk aversion and wealth: evidence from person-to-person lending portfolios. Management Science, 63, 279–297.

Petty, J.S., & Gruber, M. (2011). “In pursuit of the real deal” A longitudinal study of VC decision making. Journal of Business Venturing, 26, 172–188.

Piva, E., & Rossi-Lamastra, C. (2018). Human capital signals and entrepreneurs’ success in equity crowdfunding. Small Business Economics, 51, 667–686.

Ralcheva, A., & Roosenboom, P. (2016). On the road to success in equity crowdfunding. Available at SSRN 2727742.

Rider, C.I. (2012). How employees’ prior affiliations constrain organizational network change: a study of US venture capital and private equity. Administrative Science Quarterly, 57, 453–483.

Riding, A.L., Madill, J.J., Haines, G.H. (2007). Investment decision making by business angels. Handbook of Research on Venture Capital, 1, 332.

Robinson, R.B., & Pearce, J.A. (1984). Research thrusts in small firm strategic-planning. Academy of Management Review, 9, 128–137.

Roure, J.B., & Keeley, R.H. (1990). Predictors of success in new technology based ventures. Journal of Business Venturing, 5, 201–220.

Shepherd, D.A. (1999). Venture capitalists’ assessment of new venture survival. Management Science, 45, 621–632.

Shepherd, D.A., & Zacharakis, A. (1999). Conjoint analysis: a new methodological approach for researching the decision policies of venture capitalists. Venture Capital: An International Journal of Entrepreneurial Finance, 1, 197–217.

Shepherd, D.A., Zacharakis, A., Baron, R.A. (2003). VCs’ decision processes: evidence suggesting more experience may not always be better. Journal of Business Venturing, 18, 381–401.

Signori, A., & Vismara, S. (2018). Does success bring success? The post-offering lives of equity-crowdfunded firms. Journal of Corporate Finance, 50, 575–591. https://www.sciencedirect.com/science/article/pii/S0929119916302309.

Simon, H.A. (1955). A behavioral model of rational choice. The Quarterly Journal of Economics, 69, 99–118.

Sorenson, O., Assenova, V., Li, G.-C., Boada, J., Fleming, L. (2016). Expand innovation finance via crowdfunding. Science, 354, 1526–1528.

Sudek, R. (2006). Angel investment criteria. Journal of Small Business Strategy, 17, 89.

Sweeting, R.C. (1991). UK venture capital funds and the funding of new technology-based businesses - process and relationships. Journal of Management Studies, 28, 601–622.

Tyebjee, T.T., & Bruno, A.V. (1984). A model of venture capitalist investment activity. Management Science, 30, 1051–1066.

Vismara, S. (2016). Equity retention and social network theory in equity crowdfunding. Small Business Economics, 46, 579–590.

Vismara, S. (2018). Information cascades among investors in equity crowdfunding. Entrepreneurship Theory and Practice, 42, 467–497.

Vulkan, N., Åstebro, T., Sierra, M.F. (2016). Equity crowdfunding: a new phenomena. Journal of Business Venturing Insights, 5, 37–49.

Wasserman, N. (2003). Founder-CEO succession and the paradox of entrepreneurial success. Organization Science, 14, 149–172.

Wilson, K.E., & Testoni, M. (2014). Improving the role of equity crowdfunding in Europe’s capital markets. Available at SSRN 2502280.

Zacharakis, A., & Meyer, G.D. (1998). A lack of insight: do venture capitalists really understand their own decision process? Journal of Business Venturing, 13, 57–76.

Zacharakis, A., & Shepherd, D.A. (2001). The nature of information and overconfidence on venture capitalists’ decision making. Journal of Business Venturing, 16, 311–332.

Zhang, B., Baeck, P., Ziegler, T., Bone, J., Garvey, K. (2016). Pushing boundaries: the 2015 UK alternative finance industry report. University of Cambridge and Nesta.

Author information

Authors and Affiliations

Corresponding author

Additional information

Publisher’s note

Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

Appendix

Appendix

Rights and permissions

About this article

Cite this article

Shafi, K. Investors’ evaluation criteria in equity crowdfunding. Small Bus Econ 56, 3–37 (2021). https://doi.org/10.1007/s11187-019-00227-9

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s11187-019-00227-9