Abstract

Entrepreneurial performance is almost always confounded with firm performance. In this paper we argue for an instrumental view of the firm by formally showing that entrepreneurs can amplify their expected success rates by designing their careers as temporal portfolios that exploit contagion processes embedded in serial entrepreneurship. The advantages to holding concurrent portfolios that exploit heterogeneity are well known. The same advantages may be achieved in the serial context through contagion. Our model exploits an observation due to William Feller on the near equivalence of the two, statistically speaking. It also leads to empirically plausible implications about the size distribution of firms in the economy and illustrates the relevance of considering firms and entrepreneurs as distinct loci of analysis.

Similar content being viewed by others

Avoid common mistakes on your manuscript.

1 Introduction

Most firms fail, appears to be a consensus among entrepreneurship scholars and practitioners alike, even when they disagree on the actual proportions (Aldrich and Martinez 2001; Cader and Leatherman 2009; Fichman and Levinthal 1991; Hannan and Freeman 1984; Headd 2003; Low and MacMillan 1988; Phillips and Kirchhoff 1989; Stinchcombe 1965). Estimates of firm success rates range from the disputed but optimistic 44% of Kirchhoff (1997) to the widely acknowledged but overly narrowly engendered one in ten of the National Venture Capitalists Association. Admittedly, firm cessation is not necessarily a sign of failure, understood as financial unfeasibility (Amaral et al. 2009; Gimeno et al. 1997; Headd 2003; Storey 1989). For example, using US data for the period 1992–1996, Headd (2003) estimated that approximately one-third of firms were profitable at the time of closure. However, even if only a fraction of closed businesses are considered by their owners unsuccessful at the time of closure, this still leaves a relatively high rate of new firm closure. Under these circumstances, economists such as Arrow (quoted in Sarasvathy 2000) are not easily refuted in their claims about the irrelevancy of business school programs that profess to “teach” entrepreneurship.Footnote 1

Are we trying to isolate a claim that some particular set of individuals with certain characteristics or particular set of institutions create – distinguish the successes and the failures? and this introduces me to what I call the null hypothesis: That there is no such thing.

Such a null hypothesis begs the question as to why any entrepreneur would ever start a firm, to say nothing of the serial entrepreneur who starts several, both before and after successes and failures. To that the economist normally replies either that the entrepreneur is extraordinarily risk loving, or that he or she is prey to overconfidence bias—or both. There is credible empirical evidence that the former explanation based on a supra-normal preference for risk, cannot be justified. Entrepreneurs have been shown to range all over the risk preference spectrum and the distribution may even be skewed toward risk aversion rather than otherwise (Brockhaus 1980; Palich and Bagby 1995; Sarasvathy et al. 1998). Recent meta-analytic studies of the risk preference literature also contradict each other (Miner and Raju 2004; Stewart and Roth 2001).

As for the latter claim, the literature involves confounding constructs. For example, Griffin and Varey (1996) concluded that “In fact, there are probably two distinct overconfidence phenomena in the real world.” The two distinct types of overconfidence they derived from the literature were: (1) Predictive overconfidence—“… the tendency to overestimate the likelihood that one’s favored outcome will occur” and (2) Personal overconfidence—“the overestimation of the validity of one’s judgment” (Griffin and Varey 1996 p. 228). Whereas the former might indeed by a problem for entrepreneurs, the latter is linked to self-efficacy, a construct that has consistently been linked to positive performance (Boyd and Vozikis 1994; Chen et al. 1998; Zhao et al. 2005). Even in the case of predictive overconfidence, it is not clear how entrepreneurs ought to estimate the probability of their success or failure, for the dominant practice of the extensive literature on estimating rates of firm success/failure is to unwittingly or explicitly equate the expected success rate of firms with the expected success rate of entrepreneurs.

This leads us to the central question of this paper: Given what we think we know about firm success and failure, namely, that most firms fail, can we say anything about the possible success or failure of entrepreneurs? In the following pages we argue that irrespective of what we might believe the failure rate of firms to be, we can still rigorously understand important relationships between entrepreneurial success and failure and derive useful prescriptions to improve the success rates of entrepreneurs. We begin our investigation by briefly reviewing three streams of literature—namely, (1) Industrial organization, (2) Population ecology, (3) Labor and micro economics—and a fourth (4) Entrepreneurship, more extensively, to summarize what we know about entrepreneurial success.

We then formally demonstrate the efficacy of serial entrepreneurship by modeling it as a contagion process. The process relates two sample spaces, one involving entrepreneurs (E-space) and the other involving firms (F-space). The probabilities of entrepreneurial success are then expressed in terms of the probabilities of firm success, and bounds for the amplification factor (due to seriality) are derived. While the models are quite elementary and use off-the-shelf results from the theory of Polya Urns and correlated Bernoulli walks, even at this basic level they offer three interesting insights.

The first insight rests on the finding that F-space and E-space are governed by different probabilities, objectives and processes, so that decisions that are apt in one space need not be adequate in the other. More concretely, seemingly unreasonable behavior in the space of firms may be rendered appropriate in the space of entrepreneurs.

The second insight builds upon William Feller’s robust observation that heterogeneity and contagion may both produce the same sort of statistical effects. In financial economics and related literature on risk management, the advantages of heterogeneity are very well known in theories involving portfolio diversification. Feller’s observation, which we demonstrate through an example, suggests that the same advantages may be achieved through the use of a contagion process. Serial entrepreneurship, modeled as a temporal portfolio, attempts to set up such a process. We assess the conditions under which contagion effects embedded in serial entrepreneurship amplify expected success rates for entrepreneurs and measure their impact under different conditions.

The third insight consists in an empirically testable implication for a population of serial entrepreneurs, namely, that the distribution of the proportion of expected number of entrepreneurs who have started i successful firms in a time period T follows the negative binomial. As is well known, the negative binomial distribution is associated with Gibrat’s law, which in turn is central to studies of size distributions of firms in the economy such as Simon (1955), Simon and Bonini (1958), and Ijiri and Simon (1975). As we show through our review of the literature related to Gibrat’s law, even when the evidence on it is elusive, the skewed distribution of firm size across industries remains a strong empirical regularity.

2 What we know about entrepreneurial success/failure

Success rates of firms and entrepreneurs have been studied extensively by a variety of researchers under a number of rubrics such as: firm formation and entry (by scholars in industrial organization); organizational founding and survival (by population ecologists and organizational theorists); and entrepreneurial success and failure (by entrepreneurship researchers). In the spirit of Carter and Ram (2003) who called for multidisciplinary approaches to study this phenomenon, we now examine each of these areas and summarize their findings to show that all of them either confound the spaces of entrepreneurs and firms, or focus exclusively on the space of firms.

2.1 From studies of industrial organization

Following a plea by Mansfield (1962, p. 1023) to encourage econometric studies of the birth, growth, and death of firms, a slew of industrial organization scholars began studying the process of entry with a view to understanding its determinants as well as its impact on market performance. In an excellent review of this stream of research, Geroski (1995) summarizes the results as a series of stylized facts that are generally agreed upon by scholars in the area. For our particular purposes in this paper, the key facts from this body of work are: (a) While entry is common, survival is not. In other words, while large numbers of firms enter most markets in most years, survival of new entrants, especially de novo entrants, is low; and, (b) Most markets are subject to enormous waves or bursts of entry in the early stages of their life cycles.

2.2 From studies of population ecology of organizations

The above two results culled from industrial organization are independently supported (at least partially) by organization theorists who use an evolutionary and/or population ecology perspective (Aldrich and Fiol 1994). Population ecologists have found that success rates of organizations are age dependent. As concisely summarized by Henderson (1999), this literature does not always agree on the exact relationship between the age of a firm and its probability of success or failure. While some stress the liability of newness as a factor of firm failure (e.g. Hannan and Freeman 1984; Stinchcombe 1965), others argue that there is an early window of survival due to the initial stock of assets acquired at founding after which the liability of adolescence takes over and reduces the life expectancy of firms (Bruderl and Schlussler 1990; Fichman and Levinthal 1991). But besides the high probability of infant (or adolescent) mortality, this literature also finds a high probability of failure due to old age when firms tend to become highly inertial and misaligned with their environments (Barron et al. 1994; Baum 1989).

Neither the industrial organization literature, nor the one based on population ecology addresses the success or failure rates of entrepreneurs.

2.3 From studies of labor and microeconomics

There are at least two stylized facts that emerge from economists’ studies of entrepreneurial performance. First, in considerations of firm performance, a variety of studies from Christensen (1971) to Moskowitz and Vissing-Jorgensen (2002) find that returns to investment in the private (non-corporate) sector are not significantly different than those achieved by publicly traded corporations. Second, in terms of entrepreneur performance, several studies such as Blanchflower and Oswald (1998) and Hamilton (2000) find that the earnings of the self-employed are in many instances lower than those of comparably paid workers. This effect is worse when so-called “star” performers are taken out of the sample of self-employed.

Also, this result has been independently verified by business management scholars such as Gimeno et al. (1997). Taken together, these two facts throw up an interesting challenge to conventional wisdom from finance as to why people choose to become entrepreneurs and invest their net worth in (presumably) high risk ventures, when they do not stand to gain substantial premia over less risky investments in public equity markets. The simple answer, of course, is that non-pecuniary benefits matter. For example, Storey (1989) argues that owners of small firms are guided by different motives compared to owners of large firms. Whilst entrepreneurs in large firms are broadly oriented toward the maximization of profit (including sometimes the maximization of market share or diversification strategies into related markets) the main motivation of small firm owners is mostly to ensure a satisfactory flow of income from their businesses, the maintenance of ownership and the attainment of job satisfaction. Furthermore, individual firms in entrepreneurial portfolios often have an instrumental role, as they are often created, acquired or sold as part of a broader entrepreneurial strategy (Amaral et al. 2009; Birley and Westhead 1994; Headd 2003; Storey 1989). In particular, high growth firms (Acs et al. 2008) seem to fit into this pattern as they tend to become acquired by large firms and are overwhelmingly owned by entrepreneurs who have stakes in at least another business (BERR 2008; Storey 1989).

Furthermore, several of these studies convincingly rule out the selection argument advanced by sociologists—i.e., that less able individuals (or “misfits”) select themselves into self-employment. There is also some evidence that the longer the self-employed remain self-employed the less likely they are to exit entrepreneurship and rejoin the workforce. Considering the selling and the dissolving of a venture as proxies for positive and negative founding experiences, Amaral et al. (2009) confirm the hypothesis that positive founding experiences are more conducive to further re-entry into self-employment than negative founding experiences. Similar results are reported in Ucbasaran et al. (2003, 2006), Westhead et al. (2003, 2005) and Stam et al. (2008) in the domain of habitual entrepreneurship. Furthermore, research shows that entrepreneurs who exited their previous ventures by selling them are more likely to re-enter entrepreneurship. They seem to have not only accumulated more financial and social resources but also gained confidence in their own skills (Amaral et al. 2009; Ucbasaran et al. 2003; Westhead and Wright 1998).

Perhaps the most interesting study of the relationship between the two spaces of firm performance and entrepreneur performance is Holmes and Schmitz (1995) that looks at two types of small business failure—discontinuance through closure and discontinuance through sale—and relates them to the age of the business and tenure of the manager (who may be a founder or a non-founder). The study explicitly seeks to separate the manager from the business (Holmes and Schmitz 1995, p. 1,007). In particular, it theorizes about two qualities associated with firm failure—one that is characteristic of the business opportunity (as distinct from the abilities of the manager) and another that is specific to the match between manager and business. The results of the study can be summarized as follows: Most new businesses are of poor quality; the better ones get sold; and of those that get sold, the ones that survive tend to have high match quality between manager and business. In other words, as the authors aver, “who is managing the business matters” (Holmes and Schmitz 1995, p. 1,037). With regard to differences between non-founders and founder managers, “among businesses of the same age, businesses owned by non-founders of 0–2 years have higher discontinuance rates than businesses owned by their founders (except for the very oldest businesses, those with more than 23 years)” (Holmes and Schmitz 1995, p. 1,032). Arguably, then, founders are more likely to have found better match quality in the businesses that they found.

Even this lone study that explicitly seeks to separate out firm performance from manager/entrepreneur performance does not have any data on founder experience—i.e. the number of startups the founder has been previously involved with—and its effect on performance in the long run. In sum, it is clear that there is a lot of work yet to be done in characterizing and developing a deeper understanding of serial entrepreneurship. In our research program, therefore, we seek to investigate the role of entrepreneurial experience in the performance of firms and entrepreneurs through the study of serial or multiple entrepreneurs—entrepreneurs who start several firms, some successful and others not. But before we turn to that task, we briefly summarize what we do know about the phenomenon and outline the possible impact that serious scholarship in this area could achieve.

2.4 From entrepreneurship research

Entrepreneurship scholars do worry about entrepreneurs as well as firms. All the same, it is in this literature that the greatest confounding between firms and entrepreneurs occurs (Plehn-Dujowich 2009). For example, there is a rather large stream of effort in this literature devoted to the traits and characteristics of entrepreneurs and how they affect firm performance. In a comprehensive review of this stream, Gartner (1988) identified a number of studies starting around the middle of the twentieth century that focused on the personality of the entrepreneur as a predictor of firm success. He argued for the futility of the traits approach since it sought to separate “the dancer from the dance” and in over three decades did not result in any clear understanding of the phenomena concerned with firm creation.

Although the traits approach has since been largely abandoned, recent studies have turned to a more sophisticated understanding of the cognitive biases of entrepreneurs and their ability to garner human and social capital as predictors of firm success. Examples include Baron (2000), Bates (1990), and Busenitz and Barney (1997). Also interesting are studies such as Gimeno et al. (1997) that relate firm survival to factors other than objective measures of firm performance. In particular they find that subjective thresholds of performance based on human capital characteristics of entrepreneurs (such as alternative employment opportunities, psychic income from entrepreneurship, and cost of switching to other occupations) result in firm survival even in the case of so-called “underperforming” firms. All the same the focus on the personality of the entrepreneur as a predictor of firm success is not quite dead, as is evidenced by Brandstaetter (1997), Miner (1997) and more recently Baum et al. (2007).

The primary reason for the paucity of evidence about the success and failure of entrepreneurs as distinct from firms consists in the fact that most data collection efforts track firms and not entrepreneurs. However, a recent trend that emphasizes the phenomenon of serial or habitual entrepreneurs offers a ray of hope. Although several entrepreneurship researchers (MacMillan 1986; McGrath 1996; Scott and Rosa 1996) have urged the necessity to study “habitual” entrepreneurs (i.e., entrepreneurs who enjoy the venture creation process and, once established, tend to hand over their ventures to professional managers and go on to start others), only a handful of empirical studies have so far been conducted and virtually no theoretical development has taken place in this area (Ucbasaran et al. 2006, p. 2). But these studies already show that this is not a phenomenon to be ignored. In fact:

Empirical evidence suggests habitual entrepreneurs are a widespread phenomenon. The proportion of habitual entrepreneurs identified in UK studies ranges from 12% (Cross 1981) to 52% (Ucbasaran 2004). High proportions of habitual entrepreneurs have also been detected in the US (51–63%) (Schollhammer 1991; Ronstadt 1986); Australia (49%) (Taylor 1999); and Norway (34%) (Kolvereid and Bullvag 1993). (Ucbasaran et al. 2006, p. 1).

2.5 About the role of learning

According to Starr and Bygrave (1991) the skills and knowledge required to run a firm have a predominantly experiential nature. As business ownership and the creation of further ventures enhance the accumulation of entrepreneurship-specific human capital (Ucbasaran et al. 2008), the literature on serial entrepreneurship naturally bears on the relation between experience, learning and performance. Habitual entrepreneurs are likely to have accumulated knowledge about customers and suppliers, networks of contacts as well as market-specific information (Ucbasaran et al. 2006; Zhang 2009). Therefore they are expected to be more effective in the substantiation of further findings (Bates 1990; Bosma et al. 2004; Gimeno et al. 1997; Ucbasaran et al. 2003, 2006, 2008; Westhead et al. 2003, 2005). Previous ownership has also been shown to increase survival rates, probably by inducing more calibrated expectations and strengthening the perception of having been successful (Headd 2003). Additionally, experiential learning has been found to exert a positive effect upon the development of different types of skills such as resource-acquisition and organizing (Cope and Watts 2000; van Gelderen et al. 2005; Stam et al. 2008; Wright et al. 1997a, b).

There is also evidence that venture creation is subject to self-reinforcement and strong path dependencies. Embracement of entrepreneurship and the consequent learning by doing have been found to encourage further persistence (Burke et al. 2008; Evans and Leighton 1989; Ucbasaran et al. 2003). In particular, several studies indicate that entrepreneurs who exited their previous ventures by selling them are more likely to re-enter entrepreneurship. They seem to have not only accumulated more financial and social resources, but also gained confidence in their own skills (Amaral et al. 2009; Stam et al. 2008; Ucbasaran et al. 2003).

Habitual entrepreneurs, like individuals who develop other kinds of expertise, are known to develop cognitive frames that facilitate the encoding and selective access of representative information, abstract representation and retrieval of relevant information (Baron 1998; Feltovich et al. 2006; Forbes 1999). Yet entrepreneurial experience, similarly to other kinds of expertise, is also associated with cognitive liabilities (Feltovich et al. 2006; Rerup 2005; Starr and Bygrave 1991). Biases accruing from limited information processing and the tendency to become constrained by acquired routines and networks hinder the entrepreneur from conceiving new insights and attempting novel modes of behavior. Besides these cognitive limitations, the literature acknowledges that in business environments the identification of clear patterns linking behavior with performance may be hindered by the occurrence of unexpected and non-recurring events (Fichman and Levinthal 1991; Woo et al. 1994). In addition, the intricacy of interdependent human action reinforces the concealment of regularities under a veil of randomness. Consistent with this argument, the literature on expertise shows that in domains characterized by complexity and unpredictability, expertise does not systematically translate into superior performance. In these domains the study of expertise is feasible once we go beyond the mere relationship between experience and performance (Ericsson 2006).

2.6 To sum up, what do we know about serial entrepreneurship?

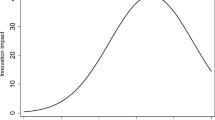

To date, empirical studies involving serial entrepreneurs (cited above) tend to focus either on the differences between novices and multiple entrepreneurs (Birley and Westhead 1993; Westhead et al. 2005) and/or the effects of experience on the magnitude of firm performance, which so far they have either found to be (a) insignificant (Alsos and Kolvereid 1999) or (b) having an inverted U shaped form (Ucbasaran et al. 2009) or (c) significant when previous experience involves VC-backed firm success (Gompers et al. 2007). One reason for the lack of clarity in results could be the fact that failed firms are a way for serial entrepreneurs to learn what works and does not work. In other words, if we consider that learning occurs as much through failed startups as through successful ones, learning through serial entrepreneurial experience may not show up as a higher likelihood for the success of any particular firm started by the serial entrepreneur. It will only show up as a higher probability of success for the entrepreneur measured over his/her entire career. The proper unit of comparison then would not be novices versus habitual entrepreneurs (because the novice even though failing at his or her first firm may nevertheless go on to succeed as an entrepreneur eventually), but habitual entrepreneurs versus entrepreneurs who start only one firm during their entire entrepreneurship career. For the one time entrepreneur, the firm is an end in itself; whereas for the multiple entrepreneur, each firm, whether successful or failed, is an instrument of learning that enables him or her to achieve better performance over time. A recent study of bankruptcies makes the point in a different way:

The typical Chap. 11 debtor is a small corporation whose assets are not specialized and rarely worth enough to pay tax claims. There is no business worth saving and there are no assets to fight over. The focal point is not the business, but the person who runs it. She is a serial entrepreneur, searching for the business that best matches her skills. For the vast majority of cases, then, Chap. 11 is best seen through the lens of labor economics, not corporate finance. (Baird and Morrison 2005, p. 2,310).

Most entrepreneurship researchers, however, do not investigate the role of firms as implements in the entrepreneurs’ toolbox as they explore and pursue their own goals, whether such goals may or may not coincide with “objective” measures of firm performance. Given so many studies that demonstrate the importance of non-pecuniary benefits in entrepreneur performance, and the growing market for entrepreneurship education nationally and internationally, it may be worth studying serial entrepreneurship as a learning process rather than as a game of dice. Furthermore, there is some evidence that at least some new entrants design their firms with early failure in mind, as experiments as it were, to test the waters of potential success in both established and new industries:

To put the point provocatively, we have thought many entrants fail because they start out small, whereas they may start with small commitments when they expect their chances of success to be small. At the same time, small-scale entry commonly provides a real option to invest heavily if early returns are promising. Consistent with this, structural factors long thought to limit entry to an industry now seem more to limit successful entry: if incumbents earn rents, it pays the potential entrant to invest for a “close look” at its chances. (Caves 1998, p. 1,961).

It could be argued that serial entrepreneurship is nothing but a diversified portfolio over time, as opposed to concurrent diversification in a normal portfolio. But a little investigation into the features of the two shows almost immediately that the two are vastly different. First, concurrent portfolio diversification requires considerable up-front investments, while serial entrepreneurship can begin with investments as low as zero. Second, the most that large portfolios can do is reduce risk, given whatever levels of return may be achieved by the individual management teams in each of the firms. Serial entrepreneurship, on the other hand, allows the entrepreneur to cumulate learning over each firm that he or she helps found and run, thereby leading to increased returns as well as reduced risk. Third, if it is argued that small portfolios such as those held by venture capitalists do provide some upside control, even those portfolios would benefit from the cumulated knowledge and experience of serial entrepreneurs. In a sense, these two approaches to managing uncertainty are non-ergodic—i.e., temporal averages are not equivalent to ensemble averages.

In sum, what we do know about serial entrepreneurship suggests that any serious empirical attempt to investigate this phenomenon is likely to generate interesting questions for scholarship as well as important implications for policy, practice, and pedagogy.

3 Entrepreneurs, as distinct from firms: E-space and F-space

We have argued that serial entrepreneurs can succeed even if some (but not all) of their firms fail. This relaxed requirement for success is based on the suspicion that the ‘probability of entrepreneurial success’ can be greater than the ‘probability of firm success’. Of course, underlying sample spaces, measures, and criteria for what counts as success all need to be specified before such suspicions can be either confirmed, rejected or quantified. For example, some commonly used measures of firm success include several dimensions—some objective such as profit, survival, growth, etc., and others subjective, such as owner satisfaction, yet others result from a weighted average of the two.

From a macroeconomic perspective, a relevant measure of entrepreneurial success is given by the rate of job creation (Acs et al. 2008). Empirical evidence shows that small, young and innovative firms operating in industries that have not reached maturity tend to exhibit higher employment growth rates than their larger and older counterparts (Acs and Armington 2006; Almus and Nerlinger 2000; Calvo 2006). Recent work based on new BDS data from the U.S. Bureau of the Census (Kane 2010; Stangler and Litan 2009) attests to the fact that over the last 25 years new firms—whether single or multi-unit—accounted for positive net job creation whereas in the aggregate, all other age groups lost jobs.

The data do not show whether these new jobs were created by new (or first-time) entrepreneurs or by serial or habitual entrepreneurs. However, Ucbasaran et al. (2008) report rates of habitual entrepreneurship in the US ranging between 51 and 64%. Even if we take a conservative estimate of 50% of these new jobs being created by entrepreneurs with prior founding experience, their contribution to net new job creation would be considerable. Additionally, if we assume the probability of failure for the firms they create is the same as or higher than that of firms created by first-time entrepreneurs, given that they start multiple firms, their contribution to job creation will be higher than that of the one-time entrepreneur and even if the probability of success for the firms they create turns out to be higher than those created by first-timers, it is highly likely they do not continue to run these firms as they grow into large corporations. There is considerable evidence from the venture capital industry, for example, that over 50% of founders either leave or retire or are forced out before the firm goes public. Therefore, we can theorize as follows:

-

In F-space, Pr (net new job creation/age 0 firm) >Pr (net new job creation/established firm)

-

In E-space, Pr (net new job creation at the end of given period/serial entrepreneur) >Pr (net new job creation at the end of given period/one-time entrepreneur)

In other words, whereas the quantity of job creation is necessarily subject to decline over time in the F-space, there is no such limitation in the E-space. In the case of the one time entrepreneur (where E-space simply collapses to F-space), either both ventures and jobs are short lived, or to the extent they survive, the fewer net new jobs they add to the economy. With habitual entrepreneurs, the propensity to exit firms (be it through sale, voluntary or involuntary shut downs) and start new firms (thereby adding to net new jobs) enables a much larger contribution to job creation in the economy. Based on the foregoing analysis, we would offer up a strong proposition to future empirical work that the key to new jobs seems to lie at the junction of habitual entrepreneurship and contagion processes—ensuring the ability to exit both failed and successful firms in addition to contributing to the effective creation and survival of subsequent new firms.

More generally, in terms of the formal thesis developed in the rest of this paper, however we choose to define firm success, using the same definition over the temporal portfolio of the entrepreneur, we can still define entrepreneurial success as the rate of success of an entrepreneur over a set of firms and during a given period of time. Therefore, we will not embark on a detailed operationalization of each type of firm success used in the literature; nor will we debate the merits and demerits of specific criteria and/or statistical tests; instead we will focus on clarifying the larger perspective and making it more precise for use in future empirical work.

4 Modeling E-space as distinct from F-space

The problem of determining the rates of failure for entrepreneurs from that for firms is complicated with the usual confounding issues that plague cohort analysis over heterogeneous groups (Haunsperger and Saari 1981; Vaupel and Yashin 1985). The focus of this section, however, is the following question: What specific aspects of seriality help reduce the failure rates for entrepreneurs as compared to that for firms?

For serial entrepreneurship to work, three conditions need to be met over the career of each serial entrepreneur:

-

1.

The firm failure rate should be less than 100%.

-

2.

Firm failure should not necessarily imply entrepreneurial failure.

-

3.

A certain minimum number of successes, say, r successes out of n attempts, should suffice to ensure entrepreneurial success.

The first condition ensures that entrepreneurship is feasible. The second and third conditions try to ensure that seriality is feasible. From the second condition, it follows that the threshold r < n.

Serial entrepreneurship is modeled, in the simplest case, as a (possibly correlated) Bernoulli process. Each outcome is either a failure (F), with constant probability q (the unconditioned firm failure rate), or a success (S) with probability p = 1 − q. Two random variables are of central importance:

The fundamental identity connecting the two variables is given by:

For example, if it has been decided that a minimum of three successes are required to qualify an entrepreneur as a success, and the sequence of tosses for a particular entrepreneur is FFSFFSFS, then in this case, N 3 = 8, or equivalently, X 8 = 3.

The above identity ‘explains’ why the entrepreneur is needed in serial entrepreneurship. Suppose n = 10 and the threshold r = 2. Then,

Pr(#(success) in 10 trials <2) = Pr(#(trials) needed for two successes >10).

The left hand side of the above equation is the probability of failure for the serial entrepreneur. To minimize the left hand side probability, the serial entrepreneur can minimize the right hand side expression. One way to do this is to ensure that the trials are not independent, but correlated in such a way that a success in one trial makes a future success more likely. If success is contagious, then high firm failure rates may be ameliorated. What the entrepreneur contributes to serial entrepreneurship is to effect this correlation; a theory of this process may be found in theories of expertise.

To flesh out these ideas, we will first consider the un-correlated case, and then examine the correlated one. The analysis uses mostly off-the-shelf results from the mathematical literature, and we have avoided extensive derivations where possible.

Case 1

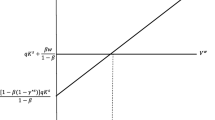

The un-correlated case is a Bernoulli process with independent tosses of a biased coin with probability of success p and probability of failure q; since the firm failure rate is high, q≫p. If a minimum of r successes are required to declare the entrepreneur a success, then:

Or equivalently,

The above probability mass function (p.m.f.) is the well known negative binomial distributionFootnote 2 (Jain and Consul 1971) with parameters r, p. If the entrepreneur is given a maximum of \( m \ge r \) trials, the cumulative probability that he/she achieves r successes in at most m trials is:

The amplification achieved by seriality (and the definition of entrepreneurial success) is the ratio of the probability that entrepreneur achieves r successes in at most m trials to the probability of success in a single trial (determined by firm success rate):

The summation term can be bounded by the fundamental identity and an approximation result due to Bahadur (1960):

where

For example, if \( r = 2,p = 0.1,q = 0.9,m = 6 \) then the amplification factor due to seriality is bounded as:

Thus, seriality in this case will give an amplification somewhere between 34% increase to 82% increase over the firm success rate.

Case 2

If the outcomes are considered independent, one is really assuming that whatever is learnt during a trial is thrown away. A more realistic assumption is to hold that the trial outcomes are non-independent. In this case, the analysis deals with a correlated Bernoulli process where the item of interest is, as before, the distribution function for the event N r = n.

The analysis of Bernoulli trials with the contagious correlation structure is extremely complicated. Almost 80 years after its introduction, the simple Polya urn and its variants are still the subject of increasingly ferocious analytic attacks (Flajolet et al. 2005). We will consider a simpler case that retains some of the intricacies of the general situation, but is much more tractable.

In the simplest case, the correlation is Markovian, that is, the conditional probability that an outcome is a success or a failure in the next trial depends only on the current outcome. This simplification is not entirely unrealistic, given the boundedly rational nature of human beings and the resultant myopia in how history influences new decisions. The simplified process, known as the correlated Bernoulli or Markovian Bernoulli, can be simplified even further by assuming that the transition probabilities and the success (failure) probabilities in a single outcome are constant. Let p, q = 1 – p represent the probabilities of success and failure in any single trial. Then the transition probabilities can be written as (Klotz 1973):

where q > p. In the Markovian Bernoulli model, it is not possible to have ‘success breed success’ without having ‘failure breed failure’. Again, this only makes our argument for amplification of entrepreneurial success rates more conservative. To see this, observe that any increase (decrease) in \( \Pr (O_{i + 1} = S|O_{i} = S) \) also leads to an increase (decrease) in \( \Pr (O_{i + 1} = F|O_{i} = F) \).

For the Markovian Bernoulli process, Viveros et al. (1994) show that,

Assume q 2≫p 2, (that is, assume p 1≫q 1). Since \( f_{{N_{r - 1} }} (n - 1) \le f_{{N_{r - 1} }} (n - 2) \), it follows from the above recurrence that,

and consequently,

Recall, that in the example presented earlier in the independent case (see case 1 above), for r = 2, p = 0.1 and a maximum of m = 6 attempts, the amplification was upper bounded by 1.826, the success rate for the entrepreneur could at best increase by 82% over the firm rate. Here, as \( p_{1} \to 1 \), \( q_{2} \to 1 \) and the amplification \( \to 2 \), that is a 100% increase. Also, the power-law dependence of the amplification factor on the conditional probabilities is of particular interest. It is clear that the analysis is rather simple minded; there is considerable opportunity here for tightening of the bounds, more reasonable Markovian assumptions, etc.

4.1 The deeper implications of seriality

Consider what that multiplicity really offers the entrepreneur. If entrepreneurial success really was just a matter of getting a certain minimum number of successes in a multiplicity of trials, then the entrepreneur is relegated to the task of waiting out failure. In this regard, it is useful to compare the serial entrepreneur’s situation with that of the portfolio manager. The major difference between the two problems is that in portfolio allocation, diversification can be used to ameliorate the risks associated with a fixed level of expected return (Samuelson 1967). In contrast, the use of heterogeneity (diversity) to average out losses from firm failure is not an option for the serial entrepreneur; he/she cannot start n firms concurrently with the idea of exploiting negatively correlated dependencies between the firms. To paraphrase a well known example, it may make sense to buy ‘shares in a coal and in an ice company’ (Samuelson 1967), but it may not be feasible to start coal and ice companies at the same time.

However, seriality offers a different route to beating the odds; the serial entrepreneur manages to effect the benefits of heterogeneity through contagion. It is a remarkable fact that contagion processes can quite often achieve the same qualitative statistical effects as heterogeneity (Feller 1943; Taibleson 1974; Xekalaki 1983). This ‘equivalence’ is unexpected because contagion is intrinsically a serial and cumulative process, just as diversification is quintessentially a concurrent and balancing one. Traditionally, this relationship between heterogeneity and contagion has been considered a confounding factor in statistical estimation, and hence a nuisance effect. But the confounding actually works both ways; if heterogeneity’s effects can produce the appearance of spurious or pseudo-contagion, then contagion can also effect a pseudo-heterogeneity. This explains, intuitively, why contagion is useful for the sequential amelioration of risks. It also explains why there is an entrepreneur required in ‘serial entrepreneurship’; unlike the ‘given’ set of assets in portfolio allocation, contagion has to be learnt, manufactured, designed, discovered, made, constructed, invented and/or fabricated.

4.2 Modeling contagion—the polya urn example

The canonical example of a contagious process is the Polya urn. The urn has red and green marbles; at instant t = 0, their numbers are r and g, respectively. A draw consists of a random (uniform) selection of a marble from the urn. The drawn marble is replaced along with c marbles of the same color and d marbles of the other color. In the most well studied case, the one we focus on here, d is set to zero (so like breeds like). Let the random variable R t = 1 if on the tth draw a red marble is drawn; else set \( R_{t} = 0 \) (thus, \( R_{t} \)is the indicator for the event \( E \equiv \)‘the draw results in a red marble’). It is easy to show via induction (or symmetry arguments) that,

In other words, the probability of drawing a red marble at any given trial does not change over time despite the addition of new marbles. So too, is the conditional probability of drawing a red marble at the nth drawing given that a red marble was drawn at instant t − 1, that is:

It will be immediately noticed that for all \( t \ge 1 \) and c > 0:

4.3 Applying the Polya urn model to successes and failures of firms and entrepreneurs

Although there appears to be no widely accepted definition of contagionFootnote 3 we suggest the following based on the above example. A process \( \{ E(0),E(1), \ldots ,E(t), \ldots \} \) to be considered contagious is that (a) it is a birth-and-death process, and (b) the conditional probabilities satisfy the inequality:

That is:

Thus, if ‘success’ is identified with the occurrence of E(t), then the above set of inequalities is one possible formalization of the idea that success breeds success. What happens in the event of failure is not specified; for example, failure could breed failure (as in the basic Polya model), or it could breed success (learning from failure) or do nothing at all.

Note that a mere change in the conditional probability of one event given anotherFootnote 4 event does not indicate contagion. Also, a change in the probability of an event with respect to time is neither required nor does it imply contagion; indeed, in the Polya urn the unconditioned probabilities are independent of the trial index (time), as are the conditioned probabilities. Finally, the inequality requirements are by themselves only necessary but not sufficient. This is because of the relationship between heterogeneity and contagion mentioned earlier. A stratified sampling procedure (mixture models) can have statistical characteristics that are indistinguishable from those of contagion processes. It is helpful to consider a small demonstration of this equivalence (Feller 1968, section V.2).

4.4 Note on mixture models and contagion processes

One of Feller’s classic examples (Feller 1968, Section V.2) illustrates how events may be conditionally but not causally dependent. Consider two urns U 1 and U 2, with initial proportions of r i red and g i green marbles, respectively. Select urn U 1 with probability p and U 2 with probability 1 − p; once an urn is selected, marbles are drawn with replacement. As before, let R t = 1 if on the tth draw a red marble is drawn; else set R t = 0. The relevant probabilities are given by:

It can then be seen that for all \( t \ge 1 \), \( \Pr (R_{t} = 1|R_{t - 1} = 1) > \Pr (R_{t} ) \), and that the other contagion inequalities are satisfied as well. The events R t = 1 and R t−1 = 1 are causally independent of each other. Yet, \( \Pr (R_{t} = 1|R_{t - 1} = 1) > \Pr (R_{t} ) \)suggests otherwise.

Thus, heterogeneity (here in the form of two urns with different compositions, that is, different statistical moments) appears to indicate that an event at t – 1 has created an after-effect; in actual fact, it is merely an artifact of the sampling procedure. In the definition for contagion, the requirement that there be an underlying birth–death process that is responsible for the inequalities tries to ensure that there is a physical basis for contagion besides a purely formal one.

5 Implications for what we can expect to see in a population of serial entrepreneurs

We turn our attention however to a somewhat different consequence of contagion, one that should be eminently amenable to empirical testing. If it is assumed that success breeds success, then it can be shown that the distribution of the number of entrepreneurs n i who have started i successful firms (assuming contagion) is that of a negative binomial. This is a result not of the distribution of successes of a single entrepreneur, but that of a group of entrepreneurs. Our derivation closely follows that of Irwin (1941), who was attempting to demonstrate that effects due to heterogeneity in accident data could have been caused just as well by contagious after-effects. See also comments on the contagious Poisson in Coleman (1964, Chap. 10).

Consider a sample of N entrepreneurs, and let \( P(t,i)dt \)denote the probability that an entrepreneur who has started i successful firms by time t will create an additional successful firm in time dt. If n i (t) is the expected number of entrepreneurs who’ve started i successful firms at time t, then the dynamics is specified by the birth–death system:

It is assumed that the relative probabilities of an additional success for entrepreneurs who have had i successes does not change with time. That is, the transition probabilities are the product of two independent components:

P(i)dt is the probability of an entrepreneur producing an additional success in time dt given that he/she has already had i successes. Consider the simplest contagious case:

where α, β are non-negative constants such that P(i) is well defined. If β = 0, then there is no contagion; the entrepreneur who has started six successful firms and one who has had zero successes both have the same chance of creating an additional successful firm. But if β > 0, then success breeds success and hence, the conditional probability of start-up failure progressively reduces with increasing numbers of previous successes.

Under these assumptions, it can be shown (Irwin 1941) that the proportion of expected number of entrepreneurs who’ve started i successful firms in a time period T is given by:

The above expression is easily seen to be the negative binomial distribution with parameters r = (α/β) and \( p = \text{e}^{ - \beta T} \) (the value of T may be set to 1 for a per unit interval analysis). Therefore the distribution of the number of entrepreneurs n i who have started i successful firms is completely specified once the constants α, β have been specified.

5.1 Connections of above implications to extant evidence

The fact that our analysis leads us to the negative binomial distribution as the connecting link between E-space and F-space is cause for comfort and confidence in the validity of our approach. The negative binomial is the classic contagion distribution, going all the way back to the origins of the subject (Greenwood and Yule 1920). It is one of the simplest possible distributions that can be associated with Gibrat’s law which forms the basis for other contagious growth distributions such as Zipf’s, Pareto’s, Geometric, etc. The importance of Gibrat’s law in economic phenomena such as the size distribution of firms has been amply evidenced by Simon (1955), Ijiri and Simon (1975) and Sutton (1997).

The law of proportional effect or Gibrat’s law provides a theoretical justification for a strong empirical regularity, namely, the skewed distribution of firm size across industries, countries and history. According to the law, the expected growth rate of a firm is independent of its current size (Sutton 1997). Whereas early studies found support for the law or at least, failed to categorically reject it (Storey 1989), further tests provided evidence that not only firm growth but also survival were affected by firm size (Sutton 1997; Wagner 1992). While research based on sub samples of established and relatively large firms (those who have reached their minimum efficient scale) tend to confirm the law, tests based on cross-sectional data of younger and relatively small firms tend to reject it (Almus and Nerlinger 2000; Bertinelli et al. 2006; Calvo 2006; Mata 1994; Oliveira and Fortunato 2006; Petrunia 2008; Reid 1995; Rodriguez et al. 2003; Storey 1989; Weiss 1998; Yang and Huang 2005).

Overall, the empirical evidence on Gibrat’s law is mixed. The law has been argued to limit its validity to large firms and mature—typically less innovative—industries. In the long run, once the forces of market selection have had enough time to operate, studies tend to confirm the convergence of the rates of growth (Lotti et al. 2009). Despite numerous disconfirmations, there are salient studies that still fail to reject Gibrat’s law (Audretsch et al. 2004; Botazzi et al. 2007; Contini and Revelli 1989; Lotti et al. 2009; Rodriguez et al. 2003; Wagner 1992; Yang and Huang 2005). We argue that the thrust of academic efforts allocated to the assessment of the Gibrat’s Law attests to its theoretical significance. Furthermore, the wealth of results from these studies overwhelmingly confirms the skewness in the size distribution of firms implied by our analysis.

Needless to say, the negative binomial distribution does not rule out the possibility that the real underlying phenomenon might be heterogeneity in the entrepreneurial population. There is also no reason why both phenomena cannot exist concurrently. But heterogeneity cannot explain why seriality is a useful strategy for entrepreneurs. In particular, both learning effects and positive path dependencies are viable sources of contagion in serial entrepreneurship. An intelligent serial entrepreneur, we posit, can learn both from their failures and successes; in fact, in explicating the theory of effectuation based on studies of entrepreneurial expertise, Sarasvathy (2001 p. 259) has argued that.

…effectuation posits a plurality of “failed” firms for any one or more “successful” firms that actually get created by any given entrepreneur. The normative aspects of effectuation, if any, for the creation of successful firms would have to do with the “management” of failures, rather than with their avoidance.

Similarly, successes too provide useful lessons for the serial entrepreneur. Furthermore, successes also enable and sustain certain positive path dependencies such as persistent social networks, increased financial and reputational resources, and access to useful corridors for future opportunities.

The fact that entrepreneurs are not passive subjects of event streams, but instead impress their will on them, strongly suggests that serial entrepreneurship is best modeled as a result of contagion processes rather than say, by mixture models. These questions, the robustness of the models outlined here, the intriguing connections with Polya urns, the insights that are to be found in accident theory, reliability theory and the statistical analysis of heterogeneous groups are all items that await systematic and sustained study.

6 Summary and possibilities for future work

In this paper we set out to investigate if we can say anything more about entrepreneurial success and failure than the oft-repeated, well-accepted, and pragmatically bankrupt bromide, “Most firms fail”. A careful exploration of the empirical work to date on this issue revealed the existence of two distinct probability spaces—the space of firms (F-space) and the space of entrepreneurs (E-space)—and the fact that the two were often confounded in the designs of the studies. This confounding ended up clouding the results of the studies and made interpretations of the results either irrelevant or unusable.

Delving deeper into the two spaces and the relationship between the two led us to the following three key findings:

-

1.

Probabilities defined over E-space may assume different values than probabilities defined over F-space. Accordingly, decision making in E-space is not necessarily identical with decision making in F-space.

-

2.

Serial entrepreneurship can be modeled as a temporal portfolio with contagion effects, leading to the argument that the seriality provides a viable strategy for the entrepreneur to improve his or her own expectations of success, over any given success rate for firms.

-

3.

A population of serial entrepreneurs would very much look like the economy we actually observe empirically—i.e. size distributions of firms in such an economy would conform to Gibrat’s law.

In sum, our analysis leads us to challenge the received wisdom that firm successes and failures determine the successes and failures of entrepreneurs. In fact, we contend that entrepreneurs can use firms as instruments to increase the probabilities of their own success. This contention has larger implications for entrepreneurial learning that have to be investigated and developed through future work. In fact, in the interests of an uncluttered exposition of a new conceptualization of entrepreneurial success and failure, we have altogether ignored the treatment of specific learning effects and or path dependencies. But clearly this has to form a vital area of inquiry into the phenomenon of serial entrepreneurship and in the further development of our model of it as a temporal portfolio of firms.

This approach suggests a way for entrepreneurship scholars to pick up the gauntlet that Arrow threw down (quoted at the beginning of this paper). Perhaps the surest way to falsify his null hypothesis—that there is no particular set of individual or institutional characteristics that separate the failures and successes—is to accept it. This is not a paradox. We only need to understand that the null hypothesis does not exclude the possibility that all entrepreneurial individuals and institutions can succeed by exploiting contagion processes embedded in serial entrepreneurship, irrespective of the null hypothesis being true for firms.

Notes

Quoted in Sarasvathy (2000, p.14).

We abuse notation slightly in that we do not explicitly indicate the dependence of the p.m.f on the firm success probability. Also, there are a great many different equivalent formulae for the negative binomial; for a survey of the mess, see (Ross and Preece 1985). The above formulation may be found in (Feller 1968, section VI.8).

Typically, processes such as the Yule process, Polya urn processes, epidemic processes, etc. are pointed to, or specific distributions such as the Pareto, power law, negative binomial, Zipf’s law, etc. are held up as exemplars (Feller 1943; Greenwood and Udny 1920; Xekalaki 1983). The study of contagion originated in the classic analysis of industrial accidents by Greenwood and Yule (1920). Not only has much of the work on contagion remained confined to this literature, but contagion has usually been studied in the context of counting processes. While it is natural to think of contagion as an increase in the number of something or the other, it is also limiting in that it forces a frequentist flavor onto events that may be best described otherwise (for example, belief contagion). Growth is not to be confused with contagion. In the Polya urn, the number of marbles of either color is a non-decreasing function of time, but what makes the process contagious is the conditional increase in numbers.

The events, \( E(0),E(1), \ldots \) etc. are considered as the same event occurring at different time instants.

References

Acs, Z., & Armington, C. (2006). Entrepreneurship, geography and American economic growth. Cambridge: Cambridge University Press.

Acs, Z., Parsons, W., & Tracy, S. (2008). High impact firms: gazelles revisited. small business research summary, No. 328. Office of advocacy, U. S. small business administration. http://www.sba.gov/advo/research/rs328tot.pdf. Accessed 19 March 2010.

Aldrich, H. E., & Fiol, C. M. (1994). Fools rush in? The institutional context of industry creation. Academy of Management Review, 19, 645–670.

Aldrich, H. E., & Martinez, M. A. (2001). Many are called, but few are chosen: An evolutionary perspective for the study of entrepreneurship. Entrepreneurship Theory and Practice, 25, 41–57.

Almus, M., & Nerlinger, E. A. (2000). Testing ‚Gibrat’s Law’ for young firms–empirical results for west Germany. Small Business Economics, 15, 1–12.

Alsos, G. A., & Kolvereid, L. (1999). The business gestation process of novice, serial, and parallel business founders. Entrepreneurship Theory and Practice, 22(4), 101–114.

Amaral, M., Baptista, R., & Lima, F. (2009). Serial entrepreneurship: impact of human capital on time to re-entry. Small Business Economics, doi: 10.1007/s11187-009-9232-4.

Audretsch, D. B., Klomp, L., Santarelli, E., & Vivarelli, M. (2004). Gibrat’s Law: Are services different? Review of Industrial Organization, 24(3), 301–324.

Bahadur, R. R. (1960). Stochastic comparisons of tests. Annals of Mathematical Statistics, 31, 276–295.

Baird, D. G., & Morrison, E. R. (2005). Serial entrepreneurs and small business bankruptcies. Columbia Law Review, 105, 2310–2368.

Baron, R. A. (1998). Cognitive mechanisms in entrepreneurship, why and when entrepreneurs think differently than other people. Journal of Business Venturing, 13, 275–294.

Baron, R. A. (2000). Psychological perspectives on entrepreneurship: Cognitive and social factors in entrepreneurs’ success. Current Directions in Psychological Science, 9, 15–18.

Barron, D. N., West, E., & Hannan, M. T. (1994). A time to grow and a time to die: Growth and mortality of credit unions in New York City, 1914–1990. American Journal of Sociology, 100, 381–421.

Bates, T. (1990). Entrepreneur human capital inputs and small business longevity. The Review of Economics and Statistics, 72, 551–559.

Baum, J. A. C. (1989). Liabilities of newness, adolescence, and obsolescence: Exploring age dependence in the dissolution of organizational relationships and organizations. Proceedings of the Administrative Science Association of Canada, 1095, 1–10.

Baum, J. R., Frese, M., & Baron, R. (2007). The psychology of entrepreneurship. Mahwah: Lawrence Erlbaum.

BERR. (2008). High growth firms in the UK: Lessons from an analysis of comparative UK performance. BERR Economics paper No. 3, Nov 2008. http://www.berr.gov.uk/files/file49042.pdf. Accessed 19 March 2010.

Bertinelli, L., Cardi, O., Pamukcu, T., & Strobl, E. (2006). The evolution of the distribution of plant size: evidence from Luxemburg. Small Business Economics, 27, 301–311.

Birley, S., & Westhead, P. (1993). A comparison of new businesses established by “novice” and habitual” founders in Great Britain. International Small Business Journal, 12, 38–60.

Birley, S., & Westhead, P. (1994). A taxonomy of business start-up reasons and their impact on firm growth and size. Journal of Business Venturing, 9(1), 7–31.

Blanchflower, D. G., & Oswald, A. J. (1998). What makes an entrepreneur? Journal of Labor Economics, 16, 26–60.

Bosma, N., Van Praag, M., Thurik, T. & Wit, G. (2004). The value of human and social capital investments for the business performance of startups. Small Business Economics, 23, 227–236.

Botazzi, G., Cefis, E., Dosi, G., & Secchi, A. (2007). Invariances and diversities in the patterns of industrial evolution: Some evidence from Italian manufacturing industries. Small Business Economics, 29, 137–159.

Boyd, N. G., & Vozikis, G. S. (1994). The influence of self-efficacy on the development of entrepreneurial intentions and actions. Entrepreneurship Theory and Practice, 18, 63–77.

Brandstaetter, H. (1997). Becoming an entrepreneur: A question of personality structure? Journal of Economic Psychology, 18, 157–177.

Brockhaus, R. H., Sr. (1980). Risk taking propensity of entrepreneurs. Academy of Management Journal, 23, 509–520.

Bruderl, J., & Schlussler, R. (1990). Organizational mortality: The liabilities of newness and adolescence. Administrative Science Quarterly, 35, 530–547.

Burke, A. E., FitzRoy, F. R. & Nolan, M. A. (2008). What makes a die-hard entrepreneur? Beyond the ‘employee or entrepreneur’ dichotomy. Small Business Economics, 31(2), 93–115.

Busenitz, L., & Barney, J. B. (1997). Differences between entrepreneurs and managers in large organizations: Biases and heuristics in strategic decision-making. Journal of Business Venturing, 12, 9–30.

Cader, H. A., & Leatherman, J. C. (2009). Small business survival and sample selection bias. Small Business Economics, 21, 2–17.

Calvo, J. L. (2006). Testing Gibrat’s Law for small, young and innovating firms. Small Business Economics, 26, 117–123.

Carter, S., & Ram, M. (2003). Reassessing portfolio entrepreneurship: Towards a multi-disciplinary approach. Small Business Economics, 21(4), 371–380.

Caves, R. E. (1998). Industrial organization and new findings on the turnover and mobility of firms. Journal of Economic Literature, 36, 1947–1982.

Chen, C. C., Greene, P. G., & Crick, A. (1998). Does entrepreneurial self-efficacy distinguish entrepreneurs from managers? Journal of Business Venturing, 13, 295–316.

Christensen, L. R. (1971). Entrepreneurial income: How does it measure up? American Economic Review, 61, 575–585.

Coleman, J. S. (1964). Introduction to mathematical sociology. London: The Free Press of Glencoe, Collier-Macmillan Ltd.

Contini, B., & Revelli, R. (1989). The relationship between firms growth and labor demand. Small Business Economics, 1, 309–314.

Cope, J., & Watts, G. (2000). ‘Learning by doing. an exploration of experience, critical incidents and reflection in entrepreneurial learning’. International Journal of Entrepreneurial Behaviour and Research, 6, 104–124.

Cross, M. (1981). New firm formation and regional development. London: Gower.

Ericsson, K. A. (2006). Introduction to Cambridge handbook of expertise and expert performance: Its development, organization and content. In K. A. Ericsson, N. Charness, P. J. Feltovich, & R. R. Hoffman (Eds.), The Cambridge handbook of expertise and expert performance (pp. 3–19). Cambridge: Cambridge University Press.

Evans, D. S., & Leighton, L. S. (1989). Some empirical aspects of entrepreneurship. American Economic Review, 79, 519–535.

Feller, W. (1943). On a general class of contagious distributions. Annals of Mathematical Statistics, 14, 389–400.

Feller, W. (1968). An introduction to probability theory and its applications, Vol. 1 (3rd ed.). New York: Wiley Eastern.

Feltovich, P. J., Prietula, M. J., & Ericsson, K. A. (2006). Studies of expertise from psychological perspectives. In K. A. Ericsson, N. Charness, P. J. Feltovich, & R. R. Hoffman (Eds.), The Cambridge handbook of expertise and expert performance (pp. 41–67). Cambridge: Cambridge University Press.

Fichman, M., & Levinthal, D. A. (1991). Honeymoons and the liability of adolescence: A new perspective on duration dependence in social and organizational relationships. Academy of Management Review, 16, 442–468.

Flajolet, P., Gabarró, J., & Pekari, H. (2005). Analytic urns. Annals of Probability, 33, 1200–1233.

Forbes, D. P. (1999). Cognitive approaches to new venture creation. International Journal of Management Reviews, 1, 415–439.

Gartner, W. B. (1988). Who is an entrepreneur is the wrong question. American Journal of Small Business, 12(4), 11–32.

Geroski, P. A. (1995). What do we know about entry? International Journal of Industrial Organization, 13, 421–440.

Gimeno, J., Folta, T. B., Cooper, A. C., & Woo, C. Y. (1997). Survival of the fittest? Entrepreneurial human capital and the persistence of underperforming firms. Administrative Science Quarterly, 42, 750–783.

Gompers, P., Kovner, A., Lerner, J., & Scharfstein, D. (2007). Performance persistence in entrepreneurship. Journal of Financial Economics, 62, 731–764.

Greenwood, M., & Yule, G. U. (1920). An inquiry into the nature of frequency distributions representative of multiple happenings with particular reference to the occurrence of multiple attacks of disease or of repeated accidents. Journal of the Royal Statistical Society, 83, 255–279.

Griffin, D. W., & Varey, C. A. (1996). Towards a consensus on overconfidence. Organizational Behavior and Human Decision Processes, 65, 227–231.

Hamilton, B. H. (2000). Does entrepreneurship pay? An empirical analysis of the returns to self-employment. Journal of Political Economy, 108, 604–631.

Hannan, M. T., & Freeman, J. (1984). Structural inertia and organizational change. American Sociological Review, 49, 149–164.

Haunsperger, D. B., & Saari, D. G. (1981). The lack of consistency for statistical decision procedures. The American Statistician, 45, 252–255.

Headd, B. (2003). Redefining business success: Distinguishing between closure and failure. Small Business Economics, 21(1), 51–61.

Henderson, A. D. (1999). Firm strategy and age dependence: A contingent view of the liability of newness, adolescence, and obsolescence. Administrative Science Quarterly, 44, 281–314.

Holmes, T. J., & Schmitz, J. A., Jr. (1995). On the turnover of business firms and business managers. Journal of Political Economy, 103, 1005–1038.

Ijiri, Y., & Simon, H. A. (1975). Some distributions associated with Bose-Einstein statistics. Proceedings of the National Academy of Sciences of the United States of America, 72, 1654–1657.

Irwin, J. O. (1941). Discussion on chambers and Yule’s paper. Supplement to the Journal of the Royal Statistical Society, 7, 101–107.

Jain, G. C., & Consul, P. C. (1971). Generalized negative binomial distribution. SIAM Journal on Applied Mathematics, 21, 501–513.

Kane, T. (2010). The importance of startups in job creation and job destruction. Kauffman Foundation Research Series: Firm Formation and Economic Growth.

Kirchhoff, B. A. (1997). Entrepreneurship economics. In W. Bygrave (Ed.), The portable MBA in entrepreneurship (2nd ed., pp. 444–474). New York: Wiley.

Klotz, J. (1973). Statistical inference in Bernoulli trails with dependence. The Annals of Statistics, 1, 373–379.

Kolvereid, L., & Bullvag, E. (1993). Novices versus experienced business founders: An exploratory investigation. In S. Birley, I. C. MacMillan, & S. Subramony (Eds.), Entrepreneurship research: Global perspectives (pp. 275–285). Amsterdam: Elsevier Science.

Lotti, F., Santarelli, E., & Vivarelli, M. (2009). Defending Gibrat’s law as a long-run regularity. Small Business Economics, 32, 31–44.

Low, M. B., & MacMillan, I. C. (1988). Entrepreneurship: Past research and future challenges. Journal of Management, 14, 139–161.

MacMillan, I. C. (1986). To really learn about entrepreneurship, let’s study habitual entrepreneurs. Journal of Business Venturing, 1, 241–243.

Mansfield, E. (1962). Entry and market contestability: An international comparison. Oxford: Blackwell.

Mata, J. (1994). Firm growth during infancy. Small Business Economics, 6, 27–39.

McGrath, R. G. (1996). Options and the entrepreneur: Towards a strategic theory of entrepreneurial wealth creation. Academy of Management Proceedings, Entrepreneurship division, 101–105.

Miner, J. B. (1997). The expanded horizon for achieving entrepreneurial success. Organizational Dynamics, 25, 54–67.

Miner, J. B., & Raju, N. S. (2004). Risk propensity differences between managers and entrepreneurs and between low- and high-growth entrepreneurs: A reply in a more conservative vein. Journal of Applied Psychology, 89, 3–13.

Moskowitz, T. J., & Vissing-Jorgensen, A. (2002). The returns to entrepreneurial investment: A private equity premium puzzle? American Economic Review, 92, 745–778.

Oliveira, B., & Fortunato, A. (2006). Firm growth and liquidity constraints: A dynamic analysis. Small Business Economics, 27, 139–156.

Palich, L. E., & Bagby, D. R. (1995). Using cognitive theory to explain entrepreneurial risk-taking: Challenging conventional wisdom. Journal of Business Venturing, 10, 425–439.

Petrunia, R. (2008). Does Gibrat’s Law hold? evidence from Canadian retail and manufacturing firms. Small Business Economics, 30, 201–214.

Phillips, B., & Kirchhoff, B. A. (1989). Formation, growth and survival; Small firm dynamics in the U.S. economy. Small Business Economics, 1, 65–74.

Plehn-Dujowich, J. (2009). A theory of serial entrepreneurship. Small Business Economics, doi:10.1007/s11187-008-9171-5.

Reid, G. C. (1995). Early life-cycle behaviour of micro-firms in Scotland. Small Business Economics, 7, 89–95.

Rerup, C. (2005). Learning from past experience: Footnotes on mindfulness and habitual entrepreneurship. Scandinavian Journal of Management, 21, 451–472.

Rodriguez, A. C., Molina, M. A., Perez, A. L. G., & Hernandez, U. M. (2003). Size, age and activity sector on the growth of the small and medium firm size. Small Business Economics, 21, 289–307.

Ronstadt, R. (1986). Exit, stage left: Why entrepreneurs end their entrepreneurial careers before retirement. Journal of Business Venturing, 1(3), 323–338.

Ross, G. & D. Preece. (1985). The negative binomial distribution. Statistician, 34, 323–335.

Samuelson, P. A. (1967). General proof that diversification pays. Journal of Financial and Quantitative Analysis, 2, 1–13.

Sarasvathy, S. D. (2000). Seminar on research perspectives in entrepreneurship (1997). Journal of Business Venturing, 15, 1–57.

Sarasvathy, S. D. (2001). Causation and effectuation: Toward a theoretical shift from economic inevitability to entrepreneurial contingency. The Academy of Management Review, 26, 243–263.

Sarasvathy, S. D., Simon, H., & Lave, L. B. (1998). Perceiving and managing business risks: Differences between entrepreneurs and bankers. Journal of Economic Behavior and Organization, 33(2), 207–226.

Schollhammer, H. (1991). Incidence and determinants of multiple entrepreneurship. In N. C. Churchill, W. D. Bygrave, J. G. Covin, D. L. Sexton, D. P. Slevin, K. H. Vesper, & W. E. Wetzel Jr. (Eds.), Frontiers of entrepreneurship research (pp. 11–24). Wellesley: Babson College.

Scott, M., & Rosa, P. (1996). Opinion: Has firm level analysis reached its limits? Time for rethink. International Small Business Journal, 14, 81–89.

Simon, H. A. (1955). On a class of skew distribution functions. Biometrika, 42, 425–440.

Simon, H. A., & Bonini, C. P. (1958). The size distribution of business firms. American Economic Review, 58, 607–617.

Stam, E., Audretsch, D. B., & Meijaard, J. (2008). Renascent entrepreneurship. Journal of Evolutionary Economics, 18(4), 493–507.

Stangler, D. & Litan, R. E. (2009). Where will the jobs come from? Ewing Marion Kauffman Foundation. http://www.kauffman.org/uploadedFiles/where_will_the_jobs_come_from.pdf. Accessed 23 July 2010.

Starr, J., & Bygrave, W. (1991). The assets and liabilities of prior start-up experience: An exploratory study of multiple venture entrepreneurs. In N. C. Churchill, W. D. Bygrave, J. G. Covin, D. L. Sexton, D. P. Slevin, K. H. Vesper, & W. E. Wetzel Jr. (Eds.), Frontiers of entrepreneurship research (pp. 213–227). Wellesley: Babson College.

Stewart, W. H., & Roth, P. L. (2001). Risk propensity differences between entrepreneurs and managers: A meta-analysis review. Journal of Applied Psychology, 86, 145–153.

Stinchcombe, A. L. (1965). Social structure and organizations. In J. G. March (Ed.), Handbook of organizations (pp. 142–193). Rand McNally: Chicago.

Storey, D. (1989). Firm performance and size: Explanations from the small firm sectors. Small Business Economics, 1, 175–180.

Sutton, J. (1997). Gibrat’s legacy. Journal of Economic Literature, 35, 40–59.

Taibleson, M. H. (1974). Distinguishing between contagion, heterogeneity and randomness in stochastic models. American Sociological Review, 39, 877–880.

Taylor, R. (1999). The small firm as a temporal coalition. Entrepreneurship and Regional Development, 11, 1–19.

Ucbasaran, D., Wright, M., & Westhead, P. (2003). A longitudinal study of habitual entrepreneurs: Starters and acquirers. Entrepreneurship and Regional Development, 15(3), 207–228.

Ucbasaran, D. (2004). Business ownership experience, entrepreneurial behavior and performance: Novice, serial and portfolio entrepreneurs. Unpublished doctoral thesis, Nottingham University Business School.

Ucbasaran, D., Westhead, P., Wright, M., & Binks, M. (2006). Habitual entrepreneurs. Cheltenham: Edward Elgar.

Ucbasaran, D., Wright, M., & Westhead, P. (2008). Opportunity identification and pursuit does an entrepreneur’s human capital matter? Small Business Economics, 30(2), 153–173.

Ucbasaran, D., Westhead, P., Wright, M. & Binks, M. (2009). The nature of entrepreneurial experience, business failure and comparative optimism. Journal of Business Venturing, doi: 10.1016/j.jbusvent.2009.04.001.

Van Gelderen, M., Van der Sluis, L., & Jansen, P. (2005a). Learning opportunities and learning behaviors of small business starters: Relations with goal achievement, skill development and satisfaction. Small Business Economics, 25, 97–108.

Van Gelderen, M., Van der Sluis, L., & Jansen, P. (2005b). Learning opportunities and learning behaviors of small business starters: Relations with goal achievement, skill development and satisfaction. Small Business Economics, 25, 97–108.

Vaupel, J. W., & Yashin, A. I. (1985). Heterogeneity’s ruses: some surprising effects of selection on population dynamics. The American Statistician, 39, 176–185.

Viveros, R., Balasubramanian, K., & Balakrishnan, N. (1994). Binomial and negative binomial analogues under correlated Bernoulli trials. The American Statistician, 48, 243–247.

Wagner, J. (1992). Firm size, firm growth, and persistence of chance: Testing GIBRAT’s Law with establishment data from Lower Saxony, 1978–1989. Small Business Economics, 4, 125–131.

Weiss, C. R. (1998). Size, growth and survival in the upper Austrian farm sector. Small Business Economics, 10, 305–312.

Westhead, P., & Wright, M. (1998). Novice, serial and portfolio founders: Are they different? Journal of Business Venturing, 13, 173–204.

Westhead, P., Ucbasaran, D., Wright, M., & Martin, F. (2003). Habitual entrepreneurs in Scotland: Characteristics, search processes, learning and performance. Glasgow: Scottish Enterprise.

Westhead, P., Ucbasaran, D., Wright, M., & Binks, M. (2005). Novice, serial and portfolio entrepreneur behaviour and contributions. Small Business Economics, 25, 109–132.

Woo, C. Y., Daellenbach, C, & Nicholls-Nixon, C. (1994). Theory building in the presence of randomness: the case of venture creation and performance. Journal of Management Studies, 31(4), 507–524.

Wright, M., Robbie, K., & Ennew, C. (1997a). Serial entrepreneurs. British Journal of Management, 8(3), 251–268.

Wright, M., Robbie, K., & Ennew, C. (1997b). Venture capitalists and serial entrepreneurs. Journal of Business Venturing, 12(3), 227–249.

Xekalaki, E. (1983). The univariate generalized Waring distribution in relation to accident theory: proneness, spells or contagion? Biometrics, 39, 887–895.

Yang, C., & Huang, C. (2005). R&D, size and firm growth in Taiwan’s electronics industry. Small Business Economics, 25, 477–487.

Zhang, J. (2009). The advantage of experienced start-up founders in venture capital acquisition: evidence from serial entrepreneurs. Small Business Economics, doi:10.1007/s11187-009-9216-4.

Zhao, H., Seibert, S. E., & Hills, G. E. (2005). The mediating role of self-efficacy in the development of entrepreneurial intentions. Journal of Applied Psychology, 90, 1265–1272.

Acknowledgments

We would like to thank Professor James G. March for taking the time to give us detailed comments on feedback on an earlier version of this paper and the Darden School Foundation and Batten Institute for funding.

Author information

Authors and Affiliations

Corresponding author

Rights and permissions

About this article

Cite this article

Sarasvathy, S.D., Menon, A.R. & Kuechle, G. Failing firms and successful entrepreneurs: serial entrepreneurship as a temporal portfolio. Small Bus Econ 40, 417–434 (2013). https://doi.org/10.1007/s11187-011-9412-x

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s11187-011-9412-x

Keywords

- Serial entrepreneurship

- Firm performance

- Industrial organization

- Population ecology

- Labor economics

- Financial economics