Abstract

This study uses a longitudinal matched employer–employee database to examine how ex-entrepreneurs’ levels of general and specific human capital influence their likelihood of re-entering entrepreneurship over time, in a different firm, thereby becoming serial entrepreneurs. The results reveal a negative effect of general human capital on the hazard of becoming a serial entrepreneur; the impact of entrepreneurial-specific human capital on the hazard of re-entering entrepreneurship is in general positive. This research provides a dynamic approach to serial entrepreneurship revealing that specific types of human capital play distinct roles on individuals’ entrepreneurial behavior.

Similar content being viewed by others

Avoid common mistakes on your manuscript.

1 Introduction

Entrepreneurship is not confined to new business creation (Cooper and Dunkelberg 1986), nor is it a single-action event (Birley and Westhead 1993). Individuals may become business owners by acquiring or inheriting an existing business. Additionally, entrepreneurs may not limit themselves to one firm, instead choosing to run several of them. This broader perspective emphasizes the heterogeneity of entrepreneurship and highlights the importance of studying both firms and individual entrepreneurs. The need to better understand the behavior of individual entrepreneurs in a variety of settings that extend beyond one-time entrepreneurial experience is highlighted by, among others, MacMillan (1986), Westhead and Wright (1998), Carter and Ram (2003), Westhead et al. (2005) and Stam et al. (2008). Entrepreneurs involved in more than one venture, or habitual entrepreneurs, are gaining the attention of researchers.Footnote 1

The present study concentrates on the subset of habitual entrepreneurs who exit their first business and subsequently start or acquire a second one, thereby becoming serial entrepreneurs. For the purpose of this research, “entrepreneurs” includes all individuals who report themselves as business owners, with full or partial ownership (Parker 2004; Van Stel 2005) and who have started or acquired a business (Westhead and Wright 1998). A growing, but still narrow, stream of work explores the differences in characteristics between novice and serial entrepreneurs (Kalleberg and Leicht 1991; Westhead et al. 2003, 2005). Serial entrepreneurship is said to be important for its potential in fostering the process of wealth creation (Scott and Rosa 1996; Westhead et al. 2005), job generation (Flores-Romero 2006; Westhead et al. 2005) and economic performance (Westhead et al. 2003, 2005; Colombo and Grilli 2005). Several works in the entrepreneurship literature recognize that serial entrepreneurship signals high levels of general and entrepreneurial-specific human capital (e.g., Ucbasaran et al. 2003, 2008; Westhead et al. 2005) and that serial entrepreneurs learn from earlier entrepreneurial experiences, thereby increasing their initial endowment of skills (Stam et al. 2008; Ucbasaran et al. 2008). Therefore, serial entrepreneurs are expected to have better managerial and technical skills; better networks of contacts and access to market-specific information; and, consequently, be better equipped to identify and take advantage of new business opportunities (McGrath and MacMillan 2000; Ucbasaran et al. 2008).

Research on serial entrepreneurship is relevant for advancing the understanding of entrepreneurs’ learning patterns over time, as they go through multiple entrepreneurial experiences. So far, to our knowledge, there are no studies focusing on the effect of general and entrepreneurial-specific human capital on time to re-entry. This paper focuses specifically on the transition between the first and second entrepreneurial experiences. Given the inherently dynamic nature of serial entrepreneurship, we believe this makes a significant contribution to the literature on this subject. In particular, little attention is paid by previous research to the fact that this transition does not necessarily occur immediately upon exiting a first business. Indeed, there may be a prolonged interval between entrepreneurial exit and subsequent re-entry, which is of significance for a better understanding about entrepreneurial dynamics and for the design of public policies targeted to the specific types and needs of ex-entrepreneurs (Westhead et al. 2005).

The absence of a dynamic approach to serial entrepreneurship in the literature is possibly due to the fact that records of entrepreneurs and their businesses are mostly drawn from cross-sectional data, and, therefore, researchers usually look at the businesses currently owned by entrepreneurs. Rosa and Scott (1999) find that most empirical studies only observe one of the ventures of the habitual entrepreneur. The present paper addresses this gap in the literature by using appropriate data to explore different behaviors among former entrepreneurs and ascertain whether their human capital plays a role on the time to re-enter entrepreneurship.

This study uses longitudinal matched employer–employee data covering the period 1986–2003 to study entrepreneurs’ time to re-entry decision following exit from their previous business ownership experience. The analysis focuses primarily on ex-entrepreneurs’ general human capital (years of formal education and employment experience) and specific human capital (previous entrepreneurial, managerial and founding experience), while controlling for the individuals’ demographics, characteristics of their first business, industry and macroeconomic context. Results reveal different impacts of specific and general human capital on the decision to anticipate or delay re-entry into entrepreneurship.

The paper proceeds as follows. The next section discusses the literature on human capital and serial entrepreneurship, defining the research goals and propositions of the present study, and clarifying its contribution. Section 3 presents the data and provides a detailed discussion of relevant issues in data construction associated with entrepreneurial careers and serial entrepreneurship. Section 4 presents the empirical model used, as well as the variables influencing time to serial entrepreneurship. Section 5 displays and discusses the results from model estimates. Section 6 presents some concluding remarks and addresses limitations of the study; suggestions for future research avenues to be pursued are also presented.

2 Theory and hypotheses

The analysis is theoretically grounded in human capital theory. Human capital models propose a positive association between formal and on-the-job training (i.e., education and professional experience) and the performance (i.e., productivity) of individual workers (Mincer 1974; Becker 1975). The human capital perspective can be applied to entrepreneurship since individuals’ formal education and labor market, managerial and entrepreneurial experience have a significant effect on their choice of entering and exiting entrepreneurship, as well as on their performance as entrepreneurs (see Parker 2004, for a review). We investigate how individuals’ human capital impacts on time to re-enter entrepreneurship. In particular, and in line with Brüderl et al. (1992) and Becker (1993), a distiction is made between general and specific forms of human capital. Ucbasaran et al. (2008) distinguish between general and specific forms of human capital in the case of serial entrepreneurship.

For this study, general human capital comprises the formal education and paid-employment experience of the entrepreneur,Footnote 2 which may lead to skills that are useful across different occupations and economic settings. Specific human capital entails prior experiences that are more relevant for an ex-entrepreneur to re-enter entrepreneurship in a subsequent firm. Having had previous experience in entrepreneurship and possessing senior management skills endow individuals with specific knowledge of business dynamics (e.g., knowledge about customers, suppliers, products and services), as well as business opportunities identification and the process of entering and running a firm (Bates 1990; Gimeno et al. 1997; Bosma et al. 2004; Ucbasaran et al. 2008).

Human capital theory poses that those individuals whose human capital is more specific to the venture will be less mobile across organizations (Becker 1975). Accordingly, those whose human capital is more specific to entrepreneurial activities would be less mobile from entrepreneurship and face higher opportunity costs of becoming wage workers. Hence, even if individuals with higher entrepreneurial-specific human capital decide to leave their firms, they will want to continue in the same occupation in the labor market, thereby becoming serial entrepreneurs. In order to disentangle the role played by individuals’ backgrounds and experiences on the time to become a serial entrepreneur, this study focuses on differences among general and specific forms of human capital.

2.1 General human capital

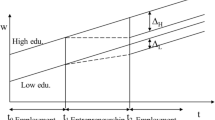

Previous studies provide mixed evidence regarding human capital and the likelihood of becoming an entrepreneur. Some authors argue that better educated individuals are endowed with better skills and abilities, and thus may have a higher probability of choosing entrepreneurship than the less educated (Lucas 1978; Carrasco 1999). Additionally, better educated individuals tend to be better informed, implying that they are more efficient at assessing new entrepreneurial opportunities (Rees and Shah 1986).

In contrast, various authors find negative or non-linear effects on human capital and entrepreneurship (Blanchflower 2004; Minniti and Bygrave 2003; Koellinger et al. 2007). Some studies show—for the case in which human capital is specifically measured through tertiary education—that individuals with higher educational levels have less chance of being entrepreneurs than people holding primary and secondary education (Amaral and Baptista 2007; Livanos 2009).

One common explanation is that higher levels of general human capital can facilitate transitions into wage employment, thus reducing the likelihood of entrepreneurship (Evans and Leighton 1989; De Wit and Van Winden 1989). This view is substantiated by Lazear (2005), who argues that entrepreneurs should be endowed with a human capital that is more varied than formal education (i.e., it should comprehend other knowledge and forms of experience that are more applied and specific to entrepreneurship), while those who are paid employees should be specialists (i.e., with a more specialized educational background).

Literature specific to serial entrepreneurship suggests that individuals with multiple entrepreneurial experiences are, in general, more educated than novice entrepreneurs (Donckels et al. 1987; Kolvereid and Bullvag 1993; Stam et al. 2008).Footnote 3 However, this literature focuses on individuals’ current occupational status instead of on their behavior and transition from an initial to a subsequent entrepreneurial experience. Therefore, the extant literature is not explicit about the role played by education on time to re-enter entrepreneurship.

The study of time to serial entrepreneurship focuses on individuals’ occupational paths after leaving their first entrepreneurial experience. According to Gimeno et al. (1997), those with more education have more personal opportunities available after exiting their current venture. In fact, individuals with entrepreneurial experience and higher education are better equipped to choose an alternative occupation in the labor market rather than directly starting or acquiring another business. In line with the human capital theoretical framework, ex-entrepreneurs with more education have greater occupational mobility and flexibility to opt for a different and eventually more attractive immediate occupation in the labor market. Therefore, we propose that being endowed with higher levels of education will lower the hazard of re-entry into entrepreneurship.

Hypothesis 1

Ex-entrepreneurs with more education are more likely to delay re-entry into entrepreneurship.

The same reasoning applies to individuals’ previous experience in employment, which is usually highly valued by employers (Mincer 1974). Hence, ex-entrepreneurs with high levels of previous employment experience may be more attracted by a new opportunity as wage employees than by the prospect of a new entrepreneurial experience. Hyytinen and Ilmakunnas (2007) find that tenure in paid-employment is insignificant for individual’s aspirations and transitions to serial entrepreneurship; however, its negative effect suggests that prior employment experience hinders the decision to re-enter entrepreneurship. Some of these ex-entrepreneurs may be willing to re-enter entrepreneurship, but—given their high labor mobility—choose to spend some time working for an employer while planning and preparing their resources for engaging on a subsequent entrepreneurial experience. We can then formulate the following hypothesis:

Hypothesis 2

Ex-entrepreneurs with more experience in paid employment are more likely to delay re-entry into entrepreneurship.

2.2 Entrepreneurial-specific human capital

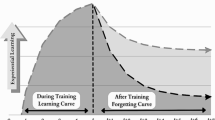

According to Starr and Bygrave (1992), the skills and knowledge relevant to managing and operating a business are experiential by nature. One explanation for the importance of this kind of specific human capital is that it influences how individuals seek information (Cooper et al. 1995) and create or identify entrepreneurial opportunities (Shane 2000, 2003). The positive effect of entrepreneurial experience on entrepreneurial intentions and transitions (Kolvereid and Isaksen 2006) extends to the particular case of serial entrepreneurs (Hyytinen and Ilmakunnas 2007). Serial entrepreneurs, who are endowed with entrepreneurial-specific human capital built from their earlier experiences as business owners, feel better prepared to detect and pursue opportunities (Ucbasaran et al. 2003; Westhead et al. 2005). Therefore, we derive the next hypothesis:

Hypothesis 3

Ex-entrepreneurs with more experience in business ownership are more likely to re-enter entrepreneurship more quickly.

In the same vein, individuals with managerial experience are more likely to have developed the necessary skills to pursue market opportunities and organize new businesses (Bates 1990; Gimeno et al. 1997; Eckhardt and Shane 2003). In general, studies analyzing the differences between serial and novice entrepreneurs with regard to their backgrounds sustain that experience of managing a previous business is important for the management of subsequent ones (Ucbasaran et al. 2006; Westhead et al. 2003) and that it has a positive effect on the probability of re-entering entrepreneurship (Stam et al. 2008). For example, Westhead et al. (2005) find that a larger proportion of serial, rather than novice entrepreneurs, had been self-employed or in a managerial position prior to gaining an equity stake in their current businesses.

Hypothesis 4

Ex-entrepreneurs with managerial experience are more likely to re-enter entrepreneurship more quickly.

While it is widely stated in the literature that individuals’ past entrepreneurial experience is important in shaping their future entrepreneurial careers, studies usually fail to specify the entry mode(s) associated with that experience (Kolvereid and Isaksen 2006). Westhead and Wright (1998) discuss a conceptual framework for categorizing novice and habitual entrepreneurs (owners–managers) that incorporates the possibility of either firm founding or acquisition. This distinction is important because business founders and non-founders may have different behavioral characteristics (Busenitz and Barney 1997). However, the majority of literature in serial entrepreneurship tends to focus their empirical analysis on firm founders rather than firm acquirers (Kolvereid and Bullvag 1993; Birley and Westhead 1993; Westhead and Wright 1998).

One exception, provided by Ucbasaran et al. (2003), examines both habitual starters (i.e., those who have established more than one business) and habitual acquirers (i.e., those who have acquired more than one business). The authors find that individuals experienced in starting a firm are more likely to found a second one. Conversely, Westhead et al. (2005) argue that serial entrepreneurs who have founded a firm are more likely to acquire a subsequent business because they find the start-up process daunting and are less likely to report that they enjoy the early stages of starting a venture. Hence, evidence on entry modes and serial entrepreneurship suggests that founding experience can be considered a significant form of entrepreneurial-specific human capital and that it has a positive impact upon entrepreneurial re-entry, both through the start-up or acquirement of a subsequent firm. However, this is insufficient to predict the impact of founding experience on time to re-enter entrepreneurship. Founding experience may not be, per se, a positive outcome, as it brings not only assets but also liabilities (Starr and Bygrave 1992). Ucbasaran et al. (2003) propose that the extent to which individuals’ would retard or speed up their re-entrance into entrepreneurship is influenced by the success (asset) or failure (liability) associated with their previous entrepreneurial experience.

In order to disentangle the positive and negative effects of founding experience on the time to become a serial entrepreneur, founding experience is determined by the mode of exit from the first firm. Serial entrepreneurs who exit by selling out their initial venture may have generated sufficient funds to use personal resources for financing the subsequent venture (Westhead and Wright 1998). Moreover, they are likely to have a good reputation with financiers, customers and suppliers, and other stakeholders (Ucbasaran et al. 2003). Therefore, it is proposed that founders who sell out their businesses will evaluate more positively their founding experience and, as a result, will hasten the decision to re-enter entrepreneurship, as opposed to founders who have failed and dissolved their businesses. For the present research, we term this form of entrepreneurial-specific human capital, “positive founding experience,” i.e., founders who have sold their business, vis-à-vis “negative founding experience,” i.e., founders who have dissolved their business. Consequently, we put forward the next hypothesis to be tested:

Hypothesis 5

Ex-entrepreneurs with “positive founding experience” are more likely to re-enter entrepreneurship more quickly.

3 Data description

The present investigation benefits from an extensive data set comprised of individuals’ backgrounds, career paths, and flows between firms and industries, originating from a longitudinal matched employer–employee database, the Quadros de Pessoal.Footnote 4 The database is built from legally mandatory surveys submitted by firms with at least one employee to the Portuguese Ministry of Employment and Social Security and accounts for nearly the entire population of entrepreneurs within the country. Firms and individuals (workers and business owners) are identified and matched through a unique identification number, so they can be followed over time. Yearly data on business owners and paid employees includes: gender, age, hierarchical qualification, tenure, formal education and skill levels.

For each firm, yearly data are available on ownership composition, size (employment), age and industry. The study considers a set of predictors for the choice of entering or re-entering entrepreneurship that, according to the literature, are found to be consistent and important in explaining the entrepreneurial process (see Parker 2004; Shane 2004; Van Praag 2005; Westhead et al. 2005; Ucbasaran et al. 2006, 2008). These variables can be grouped into four dimensions: human capital, demographics, firm and industry characteristics, and macroeconomic context.

The longitudinal and often all-inclusive nature of large surveys, such as the one used in the present study, can be used to answer research questions where interrelated heterogeneous factors concerning firms and individuals require large, unbiased samples with the possibility to simultaneously investigate a variety of factors, thus making the use of such data particularly appropriate for the research issue being studied here.

3.1 Choice of labor market status

Our data set covers the period 1986–2003Footnote 5 and accounts for male and female non-agricultural workers, aged 16 or more, who have exited from a first entrepreneurial experience. We start by categorizing individuals according to their professional status at moments in time: business owner, paid employee or non-employed.Footnote 6

Exit from business ownership experience from a given firm (exit stage) occurs at time t. The decision-making process modeled here occurs after the exit stage, meaning exit from the first experience as an entrepreneur. At time t + n (n ≥ 1), individuals decide whether and when to enter (or not) a subsequent experience as entrepreneur.

3.2 Issues in data construction

The initial data set for the present study is comprised of 176,747 entrepreneurs who are observed to have exited their firms and for whom we have complete information on all the variables under analysis. While 19,074 individuals re-enter entrepreneurship in a subsequent firm, thus becoming serial entrepreneurs, the remaining 157,673 do not. In an attempt to control for potential biases in our analysis, the empirical investigation will focus primarily on a subsample of our initial data set, which is comprised of those ex-entrepreneurs who were 30 or younger when exiting their initial firm.

In fact, it is expected that individuals with more human capital are simultaneously older and have an edge with respect to resource acquisition and opportunity exploitation over younger entrepreneurs. Moreover, for older entrepreneurs, the opportunity cost of time increases with age because of a shorter remaining lifespan (Becker 1965). Therefore, we perform estimates using a sub-sample of ex-entrepreneurs who left their initial business at the age of 30 or younger. The rationale for this methodological step is that, on the one hand, by controlling for the initial conditions, we are giving ex-entrepreneurs sufficient time to become a serial entrepreneur and, simultaneously, reducing potential left censoring issues regarding individuals’ eventual entrepreneurial experiences prior to 1986.Footnote 7 On the other hand, we are disentangling professional experience from age, thus decreasing the prevalence of unobserved heterogeneity in our analysis.

After filtering, the final data set consists of 23,172 observations, including 21,076 cases at risk of re-entering entrepreneurship and 2,096 actual re-entrants. As the present study investigates time to re-enter into entrepreneurship after individuals terminate their first entrepreneurial experience, there are a number of groups excluded from the study. This includes: individuals who have never entered entrepreneurship, individuals who have never left their business and, finally, portfolio entrepreneurs.Footnote 8

Another important issue concerns the modes of entry and exit from entrepreneurship. The mode of entry into entrepreneurship is determined by differentiating between firm founders (or starters) and firm acquirers. If an individual enters a firm for the first time and that same firm is new in the market, (i.e., firm start-up and transition to business ownership happen simultaneously)Footnote 9 it is assumed that entry into entrepreneurship occurs through founding; otherwise, we assume that a pre-existing firm has been acquired by the business owner. The mode of exit is examined in a similar fashion. It is more likely that simultaneous entrepreneurial exit and business dissolution associate with business failure (i.e., a negative performance),Footnote 10 while entrepreneurial exit from a firm that continues operating in the market after such exit is more likely to result from sale of the entrepreneur’s share of the business to a third person and is therefore less likely to result from business failure (Gimeno et al. 1997; Headd 2003). Hence, we build a binary variable distinguishing firm dissolution (i.e., the period when the business owner exit coincides with the firm extinction) from sell-out (i.e., the business owner exits from a firm that continues operating in the market).

The data are limited with regard to the mode of exit, more specifically the absence of information distinguishing mergers from true dissolutions of firms. We estimate a proxy for merger accounting for dissolutions by looking at the extent to which a sizeable part of the workforce of each firm moves to a different one. We reach a similar conclusion to Mata and Portugal (2002) that, within the Portuguese private sector, <1% of the total dissolutions are due to merger. This suggests that the inability to track mergers is unlikely to impact the results significantly.

3.3 Descriptive statistics for all ex-entrepreneurs

Table 1 presents variable definitions and descriptive statistics for all ex-entrepreneurs. In the complete data set 8.5% of the total observations consist of individuals re-entering entrepreneurship, the event of interest. The sample is composed mostly of males (72%). The proportions for each gender are similar for those who re-enter and those who do not. While the average age at exit is 43, individuals who become serial entrepreneurs exit their initial entrepreneurial experience at a younger than average age, at 40.

While firm age averages 13 years, serial entrepreneurs come from younger firms, aged about 11 years. Serial entrepreneurs also come from smaller firms (8.5 employees vs. an overall average of 12.8). On average, 23% of serial entrepreneurs founded their first firm, while this proportion is 20% for non-serial entrepreneurs. About 63% of re-entrants have dissolved their first business, while the overall proportion of dissolutions is only 49%.

3.4 Descriptive statistics for the sub-sample of ex-entrepreneurs aged up to 30

The proportion of individuals re-entering entrepreneurship (about 9%) in the sub-sample of ex-entrepreneurs aged up to 30 is similar to that observed for the whole sample (about 8%). This means that the sub-sample has similar characteristics to the overall sample with regard to the incidence of serial entrepreneurs.

When limiting the analysis to entrepreneurs who have left their firms between the ages of 16 and 30 years old, inclusive, we find similar characteristics to those of the overall sample in terms of gender, top management experience and sector composition, as shown in Table 2. As this group focuses on younger entrepreneurs, variables accounting for firm age, number of years in paid-employment, non-employment and business ownership are, in general, lower.

Education, the proportion of founders (versus acquirers) and firm size are greater for younger ex-entrepreneurs. The subsample composed of younger ex-entrepreneurs leave their first firms with, on average, 8.5 years of education, compared with 7 years for all individuals. Among ex-entrepreneurs who left their preceding business before turning 31 years, exit occurs at an average age of 25 for those individuals not re-entering and 26 for those re-entering. While firm dissolution is more frequent among younger entrepreneurs than for the overall sample (55 vs. 49%), both display a higher rate of dissolutions among serial than non-serial entrepreneurs. Apart from the variable accounting for number of years in business ownership (which is slightly higher for serial entrepreneurs), differences between re-entrants and non-re-entrants are, in general, similar or proportional to those observed in the overall sample (see Table 1).

4 Empirical model and variables

4.1 Dependent variable

The primary dependent variable is the time from exiting one entrepreneurial experience to the start of the next entrepreneurial experience. A spell starts when an individual exits entrepreneurship, and the duration of that spell corresponds to the time elapsed until the moment the individual re-enters entrepreneurship. Single-spell duration data are obtained by flow sampling: the beginning of a spell out of entrepreneurship is observed for all individuals in the sample—there is no left censoring. While for a group of individuals we observe the periods until transition back to entrepreneurship—completed spells—for another group of individuals there is right censoring as they remain out of entrepreneurship longer than is observable in the data.

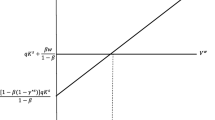

A piecewise-constant exponential hazard rate model (Jenkins 2005; Van Den Berg 2001) is used to examine how human capital variables influence time to re-entry into entrepreneurship. In the present framework, the regressors are assumed to be time-invariant. In the hazard model, T is a continuous random variable denoting the number of years an individual remains between two entrepreneurial experiences. The hazard function gives the instantaneous probability of re-entering entrepreneurship at t + n (n ≥ 1), given that the individual has exited an experience in entrepreneurship (t = 0) and stayed in paid-employment or non-employment occupational status until t,

where the probability density function of T is f(t), F(t) is its cumulative distribution function, and S(t) denotes the survival function.

Rather than specifying the shape of the hazard function a priori, it is fitted from the data using a piecewise constant proportional hazard function (PCH). The PCH departs from the proportional hazards model given by\( \theta (t,X_{t} ) = \theta_{0} (t)\exp (\beta X_{t} ). \) In the particular case of the PCH, we have,

where the time axis is partitioned into K intervals denoted by \( \tau_{1} ,\tau_{2} \ldots ,\tau_{K - 1}. \) The baseline hazard rate\( \left( {\bar{\theta}_{\text{k}} } \right) \) is constant within each of the K intervals, but can change between them. As the year is the time unit, in specifying the baseline hazard function, four interval specific intercept terms are defined in the overall hazard, with binary variables distinguishing one initial interval of 1-year length, two subsequent intervals of 3 years and one final interval of 10 years duration.Footnote 11

4.2 Independent variables

As discussed in Sect. 2.1, general human capital is empirically approached using education and paid-employment experience as independent variables. Education is measured using the years of education reported by individuals in the Quadros de Pessoal questionnaire. Similarly, paid-employee experience is measured by the number of years in the occupation of paid-employee, observed in our longitudinal data.Footnote 12

Entrepreneurial-specific human capital entails three dimensions: experience in entrepreneurship, managerial attainment and founding experience. Entrepreneurial experience is measured by the number of years as business owner. Previous managerial attainment and firm founding experience (vis-à-vis firm acquirement) are captured using binary variables.

The time spent in non-employment, measured in years, is included as a variable associated with individual human capital. Some literature suggests that individuals who experience unemployment prior to entering self-employment suffered a deterioration of their human capital and therefore should have relatively lower survival rates (Evans and Leighton 1989; Carrasco 1999; Georgellis et al. 2007). However, there is, to the authors’ knowledge, no literature distinguishing the general and entrepreneurial-specific human capital attributes of non-employment, or its impact upon serial entrepreneurship. Moreover, as the data do not allow observing the reasons explaining individuals’ non-employment, this variable is used as a control with no further assumptions about the expected effect.

4.3 Control variables

4.3.1 Entrepreneurs’ demographics

There is a fairly small amount of theoretical and empirical work predicting the effects of personal characteristics on the decision to become a serial entrepreneur. Moreover, the more abundant literature on the occupational choice of becoming an entrepreneur finds somewhat ambiguous results with regard to some variables, thus making difficult any attempt to bridge the literatures on occupational choice and serial entrepreneurship.

One such example is age. The literature suggests several effects associated with age on the decision to become an entrepreneur. Some authors find that the transition into self-employment is positively correlated with age (for example, Van Praag and Van Ophem 1995). The reason for this is that older people have had more time to build better networks and to identify valuable opportunities (Calvo and Wellisz 1980), and are more likely to have accumulated capital that can be used to establish a business (Blanchflower and Oswald 1998). Another research stream suggests that self-employment is concentrated among young individuals because older people are more risk averse (Miller 1984) and because older individuals are inclined to embark upon the more demanding work required by self-employment (Rees and Shah 1986). The literature is, nonetheless, consistent in showing that serial founders start their first business at a younger age than other novice founders (Birley and Westhead 1993; Kolvereid and Bullvag 1993; Westhead and Wright 1998).

In general, women have a lower likelihood of becoming an entrepreneur than males (Wagner 2005). Studies of serial entrepreneurship find very few women becoming engaged in a second entrepreneurial experience (Kolvereid and Bullvag 1993; Westhead and Wright 1998; Westhead et al. 2005). It is therefore expected that being female impacts negatively on the hazard of becoming a serial entrepreneur.

4.3.2 Organizational and industry characteristics of the first business owned

Firm age is frequently included in empirical analyses as an indicator of the firm life cycle (Mitchell 1994; Holmes and Schmitz 1996). Westhead et al. (2005) find that serial entrepreneurs’ firms are significantly younger than novice entrepreneurs’ firms. Hence, logarithm of firm age at the moment of exit is included in our empirical analysis.

Firm size is used as a predictor for serial entrepreneurship (Westhead and Wright 1998; Westhead et al. 2005); therefore, this analysis includes the firm size log, as measured by number of workers in the firm. The logarithm of number of partners (owners) in the firm is included as a control for size of entrepreneurial team, since some studies regard each member of the founding team as having human capital that must be taken into account (Helfat and Peteraf 2003).

The mode of exit (i.e., whether the business was dissolved or sold as the entrepreneur exited) is deemed to be associated with the decision to re-enter entrepreneurship. The analysis also distinguishes between entrepreneurs that started a business from those who acquired one, following Ucbasaran et al. (2003) and Stam et al. (2008).

In our estimates, industry is controlled for as specific business environments may impact differently upon firms’ profitability and performance. Moreover, different industries may be associated with different business opportunities (Shane 2003), and it may influence individuals’ decision to re-enter, or not, entrepreneurship (Westhead and Wright 1998). Dummy variables are employed to distinguish among Primary sector, Manufacturing, Energy and construction, Services, and Community, social and personal services.

4.3.3 Macroeconomic context

As individuals’ decisions to enter and exit entrepreneurship may be influenced by the unemployment level (Carree et al. 2007; Audretsch et al. 2005), a control variable for unemployment is also included, thus accounting for the macroeconomic environment. This variable was constructed by calculating the unemployment rate variations relative to the homologous last quarters in 1986–2003 using official data gathered by INE–Statistics Portugal.

5 Results

This section presents the results from estimating the impact of general and specific human capital on individuals’ hazard rate of re-entering entrepreneurship, thus becoming serial entrepreneurs. Figure 1 shows the baseline hazards for individuals aged up to 30 (dashed line) and for all individuals (thick line).

The baseline hazards for re-entering entrepreneurship have negative duration dependence. Furthermore, individuals aged up to 30 have a slightly higher baseline when compared with all individuals, but the pattern remains the same. For both groups, the hazard of re-entering entrepreneurship is much higher during the first years following exit from a previous entrepreneurial experience. This negative relationship between time and the hazard of re-entry into entrepreneurship is also shown in Table 3, where in estimates I–II the time dummy controlling for re-entry between the 2nd and 4th years (t2) is about 2.2 times smaller than the hazard for the first year (t1); re-entry in the 5th to 7th years (t3) is about 2.6 times smaller than in the 1st year, and, finally, re-entry between the 8th and 17th years (t4) is three times smaller than in the first year.

As noted in Sect. 3.2, the empirical analysis focuses primarily on Table 3, which includes only entrepreneurs who have left their initial firm prior to turning 31.Footnote 13 Estimates I and II in Table 3 differ in that while I includes individual, firm, industry and macro characteristics, II adds interaction terms between start-up experience and the mode of exit from the first firm (sell-out versus dissolution) in order to test the effect of a “positive entrepreneurial experience” (the interaction: “start up” × “sell-out” representing founders who have sold their business) on the hazard of re-entering entrepreneurship.

The estimates show that, as proposed in Hypothesis 1 (H1), ex-entrepreneurs who are better educated will postpone their decision to re-enter entrepreneurship. In effect, education is negatively associated with the hazard of re-entering entrepreneurship. A negative impact on the hazard means that education has lower conditional re-entry rates (Exp(β) = 0.98), and therefore, highly educated individuals experience longer periods in-between two entrepreneurial events. Hence, the first hypothesis is confirmed.

The argument, put forward in Hypothesis 2 (H2), that ex-entrepreneurs with more experience in paid-employment are more likely to delay re-entry into entrepreneurship is not confirmed because coefficients, although negative, are insignificant. One possible interpretation of this result is that entrepreneurs who left their business at up to 30 years old have not had sufficient time to build a significant stock of experience in the labor market.

The argument proposed in Hypothesis 3 (H3) that ex-entrepreneurs with more experience in business ownership will re-enter entrepreneurship more quickly is confirmed. Individuals with 1 additional year of experience in entrepreneurship are about 4% more likely to re-enter entrepreneurship (Exp(β) = 1.041).

Hypothesis 4 (H4) claims that ex-entrepreneurs with managerial attainment will re-enter entrepreneurship more quickly. Results provide empirical support for a strong negative impact of managerial attainment on time to re-enter entrepreneurship. Individuals with managerial experience are about 36% more likely to re-enter entrepreneurship (Exp(β) = 1.355). Therefore, the fourth hypothesis is confirmed.

Finally, Hypothesis 5 (H5) proposes that ex-entrepreneurs with “positive founding experience” are likely to re-enter entrepreneurship more quickly. As detailed in Sect. 2.2 (when discussing Hypothesis 5), the mode of exit is used to proxy for the positive or negative aspects of founding experience on serial entrepreneurship. Firm founding can lead to a negative outcome if there is firm closure/dissolution. Consequently, this particular type of founding experience can be seen as a liability rather than an asset. Interactions between founding experience and modes of exit show that individuals who have founded their own firm and, later on, dissolve it are more likely to delay their re-entry. Conversely, those who found their firm and then exit through sell-out are more likely to re-enter entrepreneurship sooner. This result suggests that a positive founding experience (i.e., the individual sells his firm as an exit strategy) contributes to speed up the decision to become a serial entrepreneur. On the contrary, starting a firm that later on is closed/dissolved has a negative effect on the hazard of re-entering (i.e., there may be a “scarring” effect, or a stigma of failure). Therefore, the results confirm Hypothesis 5, by showing those individuals who have had a “positive founding experience” (start-up and subsequent sell-out) are nearly 17% (Exp(β) = 1.171) more likely to re-enter entrepreneurship than individuals with a “negative founding experience” (start-up and subsequent dissolution).

A set of controls is included in the estimates. Variables controlling for entrepreneurs’ demographics show that, in general, males and older individuals tend to re-enter more quickly than females and the younger. The age effect is, however, insignificant, which is expected since the study focuses on a sample of individuals of similar age (younger than 31 years old at the time of exit).

The logarithm of firm age has a significant negative effect on the hazard of re-entering entrepreneurship, meaning that individuals who have left older firms will have a lower hazard of re-entering entrepreneurship. Individuals who leave larger firms are more likely to quickly re-enter entrepreneurship. One possible explanation is that, by leaving a large firm, the probability of being endowed with more human, financial and physical resources is greater. All estimations consistently show that entrepreneurial team size negatively impacts the hazard of re-entering entrepreneurship, so an individual leaving a firm with no partners will be more likely to rapidly become a serial entrepreneur. One possible explanation for this result is that these individuals do not feel they need to search for the complementary skills provided by entrepreneurial partners.

Exit with firm dissolution—instead of sell-out or transfer—has a positive coefficient, which means it decreases the time to re-enter entrepreneurship. However, when looking exclusively at ex-entrepreneurs who started their first business, firm dissolution has a negative effect on the hazard (Table 3, Estimate II) of re-entry. This finding is consistent with Stam et al. (2008).

When controlling for the macroeconomic context it is found that, in a context of high unemployment, individuals are more likely to postpone their decision to re-enter entrepreneurship. There is, to our knowledge, no study concentrating on unemployment dynamics and serial entrepreneurship. Nevertheless, this finding is consistent with the “prosperity pull” rather than the “unemployment push” hypothesis of entrepreneurial entry (Evans and Leighton 1990; Blanchflower and Oswald 1991; Abell et al. 1995; Carrasco 1999). This suggests serial entrepreneurs are influenced by the more optimistic expectations or more numerous business opportunities that occur during economic booms.

Even though our analysis is focused on a sub-sample composed of ex-entrepreneurs aged up to 30 years old, we include supplementary estimations for all ex-entrepreneurs in Appendix Table 5. Results for all ex-entrepreneurs do not differ significantly from the ones obtained for ex-entrepreneurs aged up to 30 years old regarding the impact of education and “positive start-up experience,” thereby confirming H1 and H5.

While paid-employment experience has a negative but insignificant impact on the hazard of re-entry into entrepreneurship in estimations for the sub-sample including only individuals younger than 31, this negative effect is significant for the whole sample; it is, however, of small magnitude: a 1-year increase in paid-employment experience leads to a reduction of about 2% in the hazard of re-entering entrepreneurship. Therefore, H2 is confirmed when looking at all ex-entrepreneurs.

H3 and H4 are not confirmed for the sample including all individuals. The effect of the number of years in business ownership (H3) becomes negative and insignificant, which may be explained by the fact that this sample includes older individuals who are closer to retirement and eventually not up to the challenge of re-entering entrepreneurship.Footnote 14 Top management experience (H4) has a significant but negative impact on the hazard of re-entry into entrepreneurship for the overall sample. One possible explanation is that although there is a high percentage of ex-entrepreneurs who are also top managers (nearly 80% of the sample), management experience among younger and less experienced individuals is shorter and may be less valued by hiring firms than for older and more experienced individuals. Therefore, these older people would benefit from their top management experience in the job market, having better perspectives of finding attractive paid employment. This would raise the opportunity cost of entrepreneurship, thereby delaying the decision to engage on a subsequent entrepreneurial experience.

As the impacts of business ownership experience and managerial attainment on the hazard of re-entering entrepreneurship become negative in the sample including all ex-entrepreneurs, particular attention should be paid to initial conditions when studying serial entrepreneurship, principally those related with individuals’ age.

The major findings for the group of interest—ex-entrepreneurs aged up to 30—show the distinct effects of general human capital, measured as formal education and paid-employment experience, as well as entrepreneurial specific human capital, as measured by years in entrepreneurship, managerial attainment and “positive founding experience.” While variables fitting the general human capital category have a negative impact upon the hazard of re-entering entrepreneurship, variables associated with specific human capital have a positive impact.

As a robustness check to our empirical approach, additional continuous-time models are estimated using a piecewise constant exponential model with interval-specific intercept terms to capture the hazard for each year (in a total of 17 years). The use of this alternative baseline does not impact significantly or change our findings. Furthermore, an unbalanced panel data set-up is used in order to apply a complementary log–log discrete specification for both ex-entrepreneurs aged up to 30 years and all ex-entrepreneurs (see Appendix Table 5). Results from the discrete approach are consistent with those of the continuous approach.

6 Concluding remarks

The present paper uses a longitudinal matched employer–employee database to examine serial entrepreneurship, more specifically the determinants of the time in-between entrepreneurial events. In particular, the study focuses on how individuals’ general and specific human capital influences their decision to re-enter entrepreneurship in a different (new or acquired) business, thereby becoming serial entrepreneurs.

Results from model estimation using ex-entrepreneurs aged up to 30 years old highlight important differences between general and entrepreneurial-specific human capital on the time necessary to become a serial entrepreneur. The empirical analysis reveals negative effects of general human capital upon the hazard of becoming a serial entrepreneur and a clearly overall positive impact of entrepreneurial-specific human capital on time to re-entering entrepreneurship. While higher levels of education and employment experience are likely to delay ex-entrepreneurs’ decision to re-enter, more years of previous entrepreneurial experience, previous managerial attainment and having had a “positive founding experience” are likely to speed up individuals’ return to entrepreneurship. Results suggest that even though the success (asset) or failure (liability) of individuals’ previous entrepreneurial experience may play a role on re-entry, the speed with which individuals’ re-enter entrepreneurship is fundamentally related to their general and specific human capital.

These findings are consistent with human capital theory since individuals whose human capital is more specific to entrepreneurship are less likely to delay re-entering entrepreneurship. Another explanation is that ex-entrepreneurs endowed with higher entrepreneurial-specific human capital may also face higher opportunity costs of choosing a different occupation and are consequently more likely to accelerate the decision to re-enter entrepreneurship.

A concurrent view to the opportunity costs approach is the one of entrepreneurial-opportunity identification and pursuit. Our results are consistent with Ucbasaran et al. (2008) who find that, while general human capital variables have lower "explanatory" power with regard to opportunity identification and pursuit, several aspects of entrepreneurship-specific human capital are significantly associated with both a higher probability of identifying more opportunities and pursuing more opportunities.

From the evidence, some crucial implications emerge. First, this study contributes to the literature on serial entrepreneurship since, more than simply analyzing serial entrepreneurship as a static phenomenon, it focuses on time to re-enter as the main variable of interest. By monitoring the skills and experience of each type of entrepreneur, and the ‘flows’ across occupations over time, the research presented here reveals an enriched process of occupational choice for serial entrepreneurs, providing better contextual and empirical evidence. As both the theoretical approach and empirical results suggest, further studies on serial entrepreneurship should account for the fact that different forms of human capital impact how individuals learn from their first business ownership differently, affecting their propensity to delay or hasten entry in a subsequent entrepreneurial event.

There are some limitations that need to be acknowledged and addressed. The first limitation concerns the fact that this study looks at human capital and other variables’ effects on time to re-enter entrepreneurship, measuring such variables at the time of exiting the first entrepreneurial experience. Hence, it does not address individuals’ occupational choices and experiences in between exit and re-entry. Further research on serial entrepreneurship can benefit from studying the dynamics of choosing different alternative occupations upon exiting entrepreneurship. For example, competing risks models with time-variant variables can be applied to investigate in more detail the occupational path of ex-entrepreneurs.

This study is also limited by the fact that it focuses on transitions from entrepreneurship in one firm to entrepreneurship in a subsequent firm. Since serial entrepreneurship may entail multiple transitions (i.e., individuals may exit and re-enter more than once), future research can extend the present analysis by using mixed proportional hazard models and its multivariate extensions to account for this aspect.

Since time to entrepreneurial re-entry is not just associated with human capital factors, but also with a stigma of failure, there is a need to replicate this research using data from different countries, institutional settings and periods. Complementarily to time-to-event data modeling accounting for the time lag between entrepreneurial events, panel data estimation techniques can be used to assess sequences of different occupations and decisions of serial entrepreneurs through time, therefore shedding new light on the entrepreneurial process.

Notes

Habitual entrepreneurs are defined as individuals who have established, inherited and/or purchased more than one business, as opposed to novice entrepreneurs, who have established, inherited and/or purchased only one business. Habitual entrepreneurs include individuals who, after owning one venture in a specific moment, start, acquire or inherit another business in a subsequent moment, i.e., serial entrepreneurs, and individuals who own several businesses simultaneously, i.e., portfolio entrepreneurs (Birley and Westhead 1993; Westhead and Wright 1998).

Previous spells of non-employment are controlled for in our empirical analysis; however, for the context of this investigation, it is expected that ex-entrepreneurs derive no direct utility from having had a non-employment experience and that it has no significant impact on the decision of re-entering entrepreneurship.

An exception is the study by Westhead et al. (2005), which found no statistically significant differences between novice and serial entrepreneur types with regard to their educational level.

The data set registers a gap in the years 1990 and 2001, for which there is no information available on employees. We control for this fact in the estimation procedure.

“Non-employed” people are classified as those who are disengaged from any firm (i.e., exit the database), either because they are inactive, unemployed, employed in private non-agriculture firms or because they exited the private job market. The non-employed also include people who have not yet entered the job market (i.e., became engaged with a firm for the first time) at a certain moment, but will do so at a subsequent time.

This study focuses on time to serial entrepreneurship rather than differences between novice and serial entrepreneurs. However, by choosing to use 30 years old as the cutoff point, it is assumed with a high degree of certainty that individuals are leaving their first entrepreneurial experience, thereby being novice entrepreneurs. According to the descriptive statistics, on average, individuals re-enter entrepreneurship at 40 years old. Therefore, the specific choice of 30 years old as the cutoff point allows for individuals aged 30 or less to be at risk of re-entering entrepreneurship for a reasonably long period of 10 years on average.

As previously noted, portfolio entrepreneurs are those who remain as business owners in one firm while simultaneously starting or acquiring other firms. Although portfolio entrepreneurship plays a vital role in the economy, this study focuses solely on serial entrepreneurs. This is a methodological choice as this study focuses on individuals who exit one business to engage (or not) in a second one and the time (number of years) mediating those two events, which does not fit the portfolio definition.

Foundation and transition into business ownership are considered simultaneous if the year of firm foundation equals the year the individual becomes a business owner or if there is a difference of 1 year between occurrences, in order to account for possible asymmetries in data collection.

In fact, as shown in Tables 1 and 2, descriptive statistics reveal that a vast majority of start-ups were dissolved rather than sold out. The data do not provide information on the specific reasons leading to firm closure. According to the correlations table (Appendix Table 4), firm dissolution is highly correlated with unemployment rate, suggesting that, to a large extent, real failures are captured. Nevertheless, it is possible that a business failure may also be understood as failure to equal or exceed a performance threshold required by the entrepreneur to keep the business running, while not necessarily indicating failure to be economically viable. It is therefore possible that a business deemed to be failing by an entrepreneur will be acquired by another entrepreneur with a lower performance threshold (see Gimeno et al. 1997).

Percentiles distribution is used in order to fit a better baseline hazard in order to put 25% of the data in each step (Cleeves et al. 2002).

Since information on individuals’ date of hiring for each firm is included in the data, it is possible to track individuals’ experience prior to 1986.

Nevertheless, in Appendix Table 5 we provide similar estimations, but considering all observations within our data set. These results will be focused on further ahead in this section.

The average age for all ex-entrepreneurs is of 43.32 years (with a high standard deviation of 12.57), while the figure for ex-entrepreneurs aged up to 30 is of 24.75 years. Moreover, as shown in the Correlations Table (Appendix Table 4), age is strongly correlated with business ownership experience.

References

Abell, P., Khalaf, H., & Smeaton, D. (1995). An exploration of entry to and exit from self-employment. LSE/CEP Discussion Paper No. 224, London.

Amaral, A. M., & Baptista, R. (2007). Transitions from paid-employment into entrepreneurship: An empirical study for Portugal. In M. J. Dowling & J. Schmude (Eds.), Entrepreneurship in Europe: New perspectives. Cheltenham, UK: Edward Elgar.

Audretsch, D. B., Carree, M. A., Van Stel, A. J., & Thurik, A. R. (2005). Does self-employment reduce unemployment? Discussion Paper on Entrepreneurship, Growth and Public Policy, #0705, Max Planck Institute of Economics, Jena.

Bates, T. (1990). Entrepreneur human capital inputs and small business longevity. Review of Economics and Statistics, 72(4), 551–559.

Becker, G. S. (1965). A theory of the allocation of time. The Economic Journal, 75(299), 493–517.

Becker, G. S. (1975). Human capital. New York: NBER.

Becker, G. S. (1993). Nobel lecture: The economic way of looking at behavior. Journal of Political Economy, 101(3), 385–409.

Birley, S., & Westhead, P. (1993). A comparison of new businesses established by ‘novice’ and ‘habitual’ founders in Great Britain. International Small Business Journal, 12(1), 38–60.

Blanchflower, D. G. (2004). Self-employment: More may not be better. NBER Working Paper, No. 10286.

Blanchflower, D. G, & Oswald, A. J. (1991). Self-employment and Mrs. Thatcher’s enterprise. CEP Discussion Paper, 30, Centre for Economic Performance, London School of Economics.

Blanchflower, D. G., & Oswald, A. (1998). What makes an entrepreneur? Journal of Labor Economics, 16(1), 26–60.

Bosma, N., Van Praag, M., Thurik, R., & De Wit, G. (2004). The value of human and social capital investments for the business performance of startups. Small Business Economics, 23(4), 227–236.

Brüderl, J., Preisendorfer, P., & Zeigler, R. (1992). Survival chances of newly founded business organizations. American Sociological Review, 57(2), 227–242.

Busenitz, L. W., & Barney, J. B. (1997). Differences between entrepreneurs and managers in large organizations: Biases and heuristics in strategic decision-making. Journal of Business Venturing, 12(1), 9–30.

Cabral, L., & Mata, J. (2003). On the evolution of the firm size distribution: Facts and theory. American Economic Review, 93(4), 1075–1090.

Calvo, G. A., & Wellisz, S. (1980). Technology, entrepreneurs, and firm size. Quarterly Journal of Economics, 95(4), 663–677.

Carrasco, R. (1999). Transitions to and from self-employment in Spain: An empirical analysis. Oxford Bulletin of Economics and Statistics, 61(3), 315–341.

Carree, M. A., Van Stel, A. J., Thurik, A. R., & Wennekers, S. (2007). The relation between economic development and business ownership revisited. Tinbergen Institute Discussion Papers, 07-022/3.

Carter, S., & Ram, M. (2003). Reassessing portfolio entrepreneurship: Towards a multi-disciplinary approach. Small Business Economics, 21(4), 371–380.

Cleeves, M., Gould, W., & Gutierrez, R. (2002). An introduction to survival analyses using Stata. College Station, TX: Stata Press.

Colombo, M. G., & Grilli, L. (2005). Founders’ human capital and the growth of new technology-based firms: A competence-based view. Research Policy, 34(6), 795–816.

Cooper, A. C., & Dunkelberg, W. C. (1986). Entrepreneurship and paths to business ownership. Strategic Management Journal, 7(1), 53–68.

Cooper, A. C., Folta, T. B., & Woo, C. (1995). Entrepreneurial information search. Journal of Business Venturing, 10(2), 107–120.

De Wit, G., & Van Winden, F. A. (1989). An empirical analysis of self-employment in The Netherlands. Small Business Economics, 1(3), 263–272.

Donckels, R., Dupont, B., & Michel, P. (1987). Multiple business starters. Who? Why? What? Journal of Small Business and Entrepreneurship, 5(1), 48–63.

Eckhardt, J., & Shane, S. (2003). Opportunities and entrepreneurship. Journal of Management, 29(3), 333–349.

Evans, D. S., & Leighton, L. S. (1989). Some empirical aspects of entrepreneurship. American Economic Review, 79(3), 519–535.

Evans, D. S., & Leighton, L. S. (1990). Small business formation by unemployed and employed workers. Small Business Economics, 2(4), 319–330.

Flores-Romero, M. (2006). An empirical investigation into the job generation capacity of serial entrepreneurs. In A. Zacharis, S. Alvarez, P. Davidsson, et al. (Eds.), Frontiers of entrepreneurship research. Wellesley, MA: Babson College.

Georgellis, Y., Sessions, J., & Tsitsianis, N. (2007). Pecuniary and non-pecuniary aspects of self-employment survival. Quarterly Review of Economics and Finance, 47(1), 94–112.

Gimeno, J., Folta, T. B., Cooper, A. C., & Woo, C. Y. (1997). Survival of the fittest? Entrepreneurial human capital and the persistence of underperforming firms. Administrative Science Quarterly, 42(4), 750–783.

Headd, B. (2003). Redefining business success: Distinguishing between closure and failure. Small Business Economics, 21(1), 51–61.

Helfat, C. E., & Peteraf, M. A. (2003). The dynamic resource-based view: Capability life-cycles. Strategic Management Journal, 24(10), 997–1010.

Holmes, T. J., & Schmitz, J. A. (1996). Managerial tenure, business age, and small business turnover. Journal of Labor Economics, 14(1), 79–99.

Hyytinen, A., & Ilmakunnas, P. (2007). What distinguishes a serial entrepreneur? Industrial and Corporate Change, 16(5), 793–821.

Jenkins, S. (2005). Survival analysis. Unpublished Manuscript. Colchester, UK: Institute for Social and Economic Research, University of Essex. Downloadable from http://www.iser.essex.ac.uk/teaching/degree/stephenj/ec968/pdfs/ec968lnotesv6.pdf.

Kalleberg, A. L., & Leicht, K. T. (1991). Gender and organizational performance: Determinants of small business survival and success. Academy of Management Journal, 34(1), 136–161.

Koellinger, P., Minniti, M., & Schade, C. (2007). I think I can, I think I can: Overconfidence and entrepreneurial behavior. Journal of Economic Psychology, 28, 502–527.

Kolvereid, L., & Bullvag, E. (1993). Novices versus experienced business founders: An exploratory investigation. In S. Birley, I. C. MacMillan, & S. Subramony (Eds.), Entrepreneurship research: Global perspectives (pp. 275–285). Amsterdam: Elsevier.

Kolvereid, L., & Isaksen, E. (2006). New business start-up and subsequent entry into self-employment. Journal of Business Venturing, 21(6), 866–885.

Lazear, E. (2005). Entrepreneurship. Journal of Labor Economics, 23(4), 649–680.

Livanos, L. (2009). What determines self-employment? A comparative study. Applied Economics Letters, 16(3), 227–232.

Lucas, R. E. (1978). On the size distribution of business firms. Bell Journal of Economics, 9(2), 508–523.

MacMillan, I. A. (1986). To really learn about entrepreneurship, let’s study habitual entrepreneurs. Journal of Business Venturing, 1(3), 241–243.

Mata, J., & Portugal, P. (2002). The survival of new domestic and foreign-owned firms. Strategic Management Journal, 23(4), 323–343.

McGrath, R. G., & Macmillan, I. (2000). The entrepreneurial mindset. Boston, MA: Harvard Business School Press.

Miller, R. (1984). Job matching and occupational choice. Journal of Political Economy, 92(6), 1086–1120.

Mincer, J. (1974). Schooling, experience and earnings. New York: Columbia University Press.

Minniti, M., & Bygrave, W. D. (2003). Global Entrepreneurship Monitor: 2003 Executive Report. Wellesley, MA: Babson College.

Mitchell, W. (1994). The dynamics of evolving markets: The effects of business sales and age on dissolutions and divestitures. Administrative Science Quarterly, 39(4), 575–602.

Parker, S. (2004). The economics of self-employment and entrepreneurship. Cambridge: Cambridge University Press.

Rees, H., & Shah, A. (1986). An empirical analysis of self-employment in the U.K. Journal of Applied Econometrics, 1(1), 95–108.

Rosa, P., & Scott, M. (1999). The prevalence of multiple owners and directors in the SME sector: Implications for our understanding of sart-up and growth. Entrepreneurship & Regional Development, 11(1), 21–37.

Scott, M., & Rosa, P. (1996). Has firm level analysis reached its limits? Time for rethink. International Small Business Journal, 14(4), 81–89.

Shane, S. (2000). Prior knowledge and the discovery of entrepreneurial opportunities. Organization Science, 11(4), 448–469.

Shane, S. (2003). A general theory of entrepreneurship. Northampton, MA: Edward Elgar Publishing.

Shane, S. (2004). A general theory of entrepreneurship: The individual-opportunity nexus. Cheltenham: Edward Elgar.

Stam, E., Audretsch, D. B., & Meijaard, J. (2008). Renascent entrepreneurship. Journal of Evolutionary Economics, 18(4), 493–507.

Starr, J. A., & Bygrave, W. D. (1992). The second time around: The outcomes, assets, and liabilities of prior start-up experience. In S. Birley & I. MacMillan (Eds.), International perspectives on entrepreneurship research (pp. 340–363). Amsterdam: North Holland.

Ucbasaran, D., Westhead, P., & Wright, M. (2006). Habitual entrepreneurs. Cheltenham: Edward Elgar.

Ucbasaran, D., Wright, M., & Westhead, P. (2003). A longitudinal study of habitual entrepreneurs: Starters and acquirers. Entrepreneurship & Regional Development, 15(3), 207–228.

Ucbasaran, D., Wright, M., & Westhead, P. (2008). Opportunity identification and pursuit does an entrepreneur’s human capital matter? Small Business Economics, 30(2), 153–173.

Van Den Berg, G. J. (2001). Duration models: Specification, identification, and multiple durations. In J. J. Heckman & E. Leamer (Eds.), Handbook of econometrics (Vol. V). Amsterdam: North Holland.

Van Praag, C. M. (2005). Successful entrepreneurship: Confronting economic theory with empirical evidence. London: Edward Elgar.

Van Praag, C. M., & Van Ophem, H. (1995). Determinants of willingness and opportunity to start as an entrepreneur. Kyklos, 48(4), 513–540.

Van Stel, A. J. (2005). COMPENDIA: Harmonizing business ownership data across countries and over time. International Entrepreneurship and Management Journal, 1(1), 105–123.

Varejão, J., & Portugal, P. (2007). Employment dynamics and the structure of labor adjustment costs. Journal of Labor Economics, 25(1), 137–165.

Wagner, J. (2005). Nascent and infant entrepreneurs in Germany. Evidence from the Regional Entrepreneurship Monitor (REM). Labor and Demography 0504010, Economics Working Paper Archive EconWPA.

Westhead, P., Ucbasaran, D., & Wright, M. (2003). Differences between private firms owned by novice, serial and portfolio entrepreneurs: Implications for policy-makers and practitioners. Regional Studies, 37(2), 187–200.

Westhead, P., Ucbasaran, D., Wright, M., & Binks, M. (2005). Novice, serial and portfolio entrepreneur behavior and contributions. Small Business Economics, 25(2), 109.

Westhead, P., & Wright, M. (1998). Novice, portfolio, and serial founders: Are they different? Journal of Business Venturing, 13(3), 173–204.

Author information

Authors and Affiliations

Corresponding author

Appendix

Appendix

Rights and permissions

About this article

Cite this article

Amaral, A.M., Baptista, R. & Lima, F. Serial entrepreneurship: impact of human capital on time to re-entry. Small Bus Econ 37, 1–21 (2011). https://doi.org/10.1007/s11187-009-9232-4

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s11187-009-9232-4

Keywords

- Serial entrepreneurship

- General and specific human capital

- Longitudinal data

- Piecewise constant proportional hazard