Abstract

This paper investigates “asymmetries” between non-monetary gains and losses in intertemporal choice. We considered gains and losses of spare/working time with respect to a reference duration defined in a working contract. Specifically, we elicited a behavioral model of intertemporal choice that accounts for a gain/loss-dependent discounting function and a reference-dependent utility. Additionally, we did not impose preference for the present (positive discounting) and allowed for both decreasing and increasing impatience. While our results are standard regarding the discount of money (our baseline treatment), our subjects heavily discounted gains of time. More patience was observed for losses of time and a sizable portion of subjects even exhibited negative discounting, i.e. they preferred to expedite losses of time. Our econometric estimations also reveal a much larger heterogeneity of behavior in terms of both utility and discounting for gains and losses of spare time as compared to money.

Similar content being viewed by others

Avoid common mistakes on your manuscript.

1 Introduction

Most of the behavioral research on intertemporal choice, under Samuelson’s (1937) discounted utility (DU) model and extensions, has been dominated by studies involving intertemporal tradeoffs of monetary outcomes. Yet, the easier transferability of money over time, due to its intrinsic fungibility and the access to credit that decouples money from consumption, may generate specific findings regarding discounting and utility (see Bleichrodt et al. 2016a; Cubitt and Read 2007). Additionally, empirical investigations have focused mainly on monetary gains, leaving the problems of “asymmetries” between gains and losses, initially detected in decision under risk and reasonably expected in intertemporal choice (Shelley 1994), relatively unexplored. The focus on monetary gains in the literature was favoured due to the complications related to the implementation of real incentives to losses.Footnote 1

Several papers have investigated temporal preferences towards other attributes than money, such as chocolate, beer or drugs (Estle et al. 2007; Read and Van Leeuwen 1998; Tsukayama and Duckworth 2010). These studies reveal that the nature of the consequence can impact discounting even though, like money, the goods considered can be received at a given time period and consumed later. More recently, a few research works have explored the idea that the time dedicated to a specific task or activity may be a better proxy for consumption than money (e.g., Meissner and Pfeiffer 2015). Similarly, Augenblick et al. (2015) measured temporal preferences and dynamic inconsistencies for decisions involving the effort dedicated to a specific task. Unlike money, time can neither be stored nor exchanged on a market: an hour of spare (or working) time at a given period has to be enjoyed (or endured) at the same period. The present paper contributes to this research direction.

We report the results of an incentivized experimental elicitation of intertemporal preferences when consequences are gains and losses of time with respect to a given reference point, assuming Loewenstein and Prelec’s (1992) behavioral model. We did not impose constant discounting (see Table 1) or a linear utility function, i.e. we accounted for the subjective value assigned by the subjects to gains and losses of time. Our investigation consisted of a series of situations where subjects faced a choice between temporal prospects involving soon and late gains (losses) of time. The reference point with respect to which gains and losses of time were defined was set up by means of a concrete research assistantship contract that consisted of two working sessions initially planned to last 4 hours each at two different dates (sooner and later). For instance, a temporal prospect that entails gaining (losing) 1 hour now and 1 hour in six months means that the duration of the two sessions will be shortened (extended) by 1 hour each. We managed to have a homogenous sample of subjects with similar time schedule within the time span of the (receipt) delays involved in the experiment. In addition to its reference and sign-dependence (i.e., gain/loss dependence), our elicitation did not impose positive discounting, i.e. subjects were allowed to exhibit preference for the futureFootnote 2 (see Loewenstein and Prelec 1993). We also elicited individual preferences for gains of money, as a benchmark. To our knowledge, this is the first paper that proposes an elicitation of temporal preferences for both gains and losses of time while assuming a general behavioral model of intertemporal choice (Loewenstein and Prelec 1992).

Many everyday life decisions involve saving or losing time, now or in the future. Understanding how people discount future gains and losses of time is therefore economically important. Gains and losses of time are always defined with reference to a specific duration. For example, an employee with a standard working contract of 40 hours per week would consider any decrease (increase) of weekly working time as a gain (loss) of time. Regarding time gains, any company or state policy of working time reduction raises the question of how employees prefer to allocate their spare time. An employee who is offered 5 hours of extra free time due to a reduction of working time can, for example, choose to leave the office one hour earlier every day or instead have a complete afternoon off at the end of the week. The choice of this employee would depend on the way she discounts gains of time and her preference for smoothing such gains over time. The first aspect is captured by the discounting function while the second is captured by the utility function. Regarding time losses, imagine the situation where the same employee is asked to work overtime due to an increase of activity and has to decide between working 42 hours next week or 44 hours four weeks from now; would the employee prefer to lose two hours in the coming week or four hours next month? Similarly, the decision of when to edit the minutes of a meeting is another example of intertemporal choice involving losses of time that most professionals have experienced. The task can be completed right after the meeting when the memory is still “fresh”, or may be postponed and take longer.

Several research works have observed that discounting non-monetary consequences may produce distinctive discount patterns (Augenblick et al. 2015; Bleichrodt et al. 2016a; Prelec and Loewenstein 1997; Read et al. 1999; Winer 1997; Zauberman and Lynch 2005). For instance, while negative discounting (preference for satisfaction later than sooner) is the exception for money, it has been observed for health consequences in a number of experimental investigations (Ganiats et al. 2000; van der Pol and Cairns 2000). Similarly, according to Loewenstein (1987) “the pleasurable deferral of a vacation, the speeding up of a dental appointment, the prolonged storage of a bottle of expensive champagne are all instances of this phenomenon.” Regarding time gains, the behavior of a person attempting to accomplish a time-consuming task as soon as possible and to “save” free time for the future is also considered rational by Adam Smith: “He is enabled gradually to relax, both in the rigour of his parsimony and in the severity of his application; and he feels with double satisfaction this gradual increase of ease and enjoyment, from having felt before the hardship which attended the want of them” [Adam Smith, The Theory of Moral Sentiments, as cited in Loewenstein and Prelec (1991)].

In line with these results, our experiment shows that people do not discount time in the same way they discount money. Overall, at the aggregate level, both the level of impatience and the degree of deviation from constant discounting are higher for gains of time than for gains of money. We also observe a much higher heterogeneity in discounting behavior for time than for money. Furthermore, our main finding is the strong asymmetry in discounting behavior between gains and losses of time: the level of impatience is much higher for gains than for losses of time. More specifically, in contrast to the classical view that people would prefer to experience losses further along in the future, we observe that the majority of our subjects prefers to expedite losses of time, i.e. exhibits negative discounting. On the other hand, a wide majority of the subjects exhibits positive discounting for gains of time, i.e. they prefer to gain time now than in the future.

The present paper proceeds as follows. Section 2 introduces the theoretical background and the parametric specifications used in the paper. Section 3 details the experimental design and the incentive system. Section 4 presents the results obtained in a model-free fashion while Section 5 introduces the results of the econometric analyses. The paper ends with a discussion and concluding remarks.

2 Theoretical background

We consider decision makers who have to choose between temporal prospects that consist of streams of outcomes received at different time periods. For the sake of simplicity, the temporal prospects studied in this experiment involved one or two outcomes. \((x,t;y,T)\) denotes a prospect that offers x at period t and y at period T with \(0\leq t<T\). In order to simplify the notation, a prospect with only one outcome x received at t is referred to as \((x,t)\) instead of \((x,t;0,T)\). For instance, a prospect that offers x now is denoted \((x,0)\).

Time periods are expressed in months and range from 0 to 12. We consider time prospects, whose outcomes are expressed in minutes, and money prospects, whose outcomes are expressed in euros. For all prospects, outcomes are deviations from a reference point r that depends on the attribute (money/time). A monetary outcome x is a gain (loss) if \(x>r = 0 \ (x<r = 0)\). For time prospects, an outcome x is expressed as the difference \(x=r-\hat {x}\), where \(r \neq 0\) is the (reference) working time set up by means of a concrete research contract, and \(\hat {x}\) is the actual working time. An outcome x is considered as a gain (loss) of time when \(x>0 \ (x<0)\). A prospect (x, t;y, T) is a gain prospect if \(x,y\ge 0\) and a loss prospect if \(x,y\leq 0\).

Under the Loewenstein and Prelec (1992) behavioral model a prospect (x, t;y, T) is valued as follows

where the discounting function \(\varphi \) satisfies \(\varphi (0)= 1\) and is usually assumed to be strictly decreasing, and u stands for utility with \(u(0)= 0\). Most empirical studies on intertemporal choice have considered a linear utility. However, this could lead to spurious interpretations (Attema 2012) and particularly to an overestimation of the discount rates (Frederick et al. 2002). To avoid this issue, we assume a power utility, i.e., \(u(x)=x^{\alpha }\).Footnote 3 Following most studies on intertemporal choice and recent developments on discounting behavior for non-monetary outcomes we also assume that the utility is stationary (Augenblick et al. 2015; Bleichrodt et al. 2016a; Ioannou and Sadeh 2016). Because preferences are measured for different types of prospects, components u and \(\varphi \) are allowed to differ across attributes (time vs. money) and domains (gains vs. losses). This allows us to take into account, among other things, differences in preference for grouping or smoothing outcomes across attributes and domains.

A long list of empirical findings on temporal discounting reveals systematic discrepancies from exponential discounting, a necessary condition for the normatively praised temporal consistency. For descriptive purposes, the hyperbolic discounting function (Loewenstein and Prelec 1992; see Table 1, row 4) is nowadays commonly used in the literature (e.g., Kirby and Maraković 1995). It allows for a decrease of the per-period rate of time preference over time. The parameter \(\delta \) represents the discount rate, while the parameter \(\gamma \) determines how much the function deviates from constant discounting. Laibson (1997) introduced another specification to account for time-inconsistent preferences: the quasi-hyperbolic function. In Laibson’s (1997) model (Table 1, row 5), individuals discount future rewards at a constant rate (as in the exponential discounting model); however they exhibit a present bias: they overvalue outcomes received at time \(t = 0\) compared to any outcome received at \(t>0\). In the quasi-hyperbolic specification, the second parameter γ measures the present bias, namely the discontinuity of the discounting function at \(t = 0\). The tau-discounting function is an adaptation of the quasi-hyperbolic function, recently proposed by Bleichrodt et al. (2016b), where the parameter \(\tau \) also measures a discontinuity at \(t = 0\) (Table 1, row 6) . Under this specification, the discontinuity is due to a biased perception of time: the future is perceived as being further away in time than it actually is. More precisely, while the present is perceived as present, a time period t is perceived as \(t+\tau \). The advantage of this specification is that the hyperbolicity parameter \(\tau \) can be expressed in units of time (i.e., months in this paper). All the specifications given in Table 1 account for non-constant discounting in terms of decreasing impatience. Besides, Bleichrodt et al. (2009) have demonstrated that it is impossible to generalize hyperbolic and quasi-hyperbolic specifications to account for increasing impatience. However, there is empirical evidence that increasing impatience can be observed in certain circumstances (Bleichrodt et al. 2016a; Sayman and Önçüler 2008; Scholten and Read 2006).

In this paper, we take a descriptive perspective and explore the possibility of increasing impatience for both time and monetary outcomes. To this end, we use the constant-sensitivity discounting function (Ebert and Prelec 2007). The latter specification separates impatience from delay-sensitivity (defined as the impact of time variation on value variation).Footnote 4 The parameter \(\delta \) measures impatience. The delay-sensitivity parameter \(\gamma \) provides information about non-constant discounting patterns: individuals exhibit insensitivity to the temporal dimension when \(\gamma <1\) and over-sensitivity to the temporal dimension when \(\gamma >1\). In the case of positive discounting, insensitivity can be interpreted as decreasing impatience while over-sensitivity can be interpreted as increasing impatience.

The aforementioned discounting specifications are generally used under the assumption of preference for the present. Under this assumption, the discount rate is strictly positive. In this paper, we take a descriptive perspective and allow for negative discounting. Restrictions on the parameters space are consequently relaxed for all the specifications under consideration so that the functions can account for both positive and negative discounting.

3 Experiment

3.1 Procedure

We recruited 101 bachelor and master’s students from HEC Paris. In order to avoid a confounding effect due to a major increase in wealth or to a change in availability, we considered only participants who would still be students a year after the day of the experiment. Therefore, students in the last year of their master’s (who could have expected a change of status during the 12 months following the experiment) were not allowed to participate. We implemented this procedure in order to guarantee that all participants had a similar (school) time schedule in the upcoming year, and thus had similar time constraints. By doing so, we made sure that our subjects had a similar time slack on the temporal horizon considered in the experiment. Such control was not possible for the income of participants, whose personal or family income and possible loans or debts were unknown.

Each experimental session lasted one hour on average and took the form of an individual computer-based interview. At the beginning of the session, subjects watched a 15-minute video explaining the experimental protocol and the functionalities of the software.Footnote 5 Then, they answered two practice questions, one for money and one for time, to test their comprehension of the instructions and make sure they understood the procedure and were familiar with the software. Subjects were told that there was no right or wrong answer, and that the goal of the experiment was to measure and understand their preferences.

3.2 Stimuli and measurement

For a specific attribute (time/money) and a specific domain (gains/losses), each subject was presented with a series of choice lists \(CL_{k}=\{x_{k},y_{k},z_{k},t_{k},T_{k}\}\). A choice list \(CL_{k}\) was defined by two periods, \(t_{k}\), \(T_{k}\), and three outcomes, \(x_{k}\), \(y_{k}\), \(z_{k}\), with \(x_{k}\leq z_{k}<y_{k}\).Footnote 6 Each choice list aimed at determining the outcome \(c=c^{\star }\) that made the subject indifferent between a fixed temporal prospect (x, t;y, T) and a varying temporal prospect (c, t;z, T). Under the behavioral model given by equation (1), assuming preference for the present implies \(c^{\star }\in [x,y]\) (see Table 2). During the pilot, we observed that some subjects did not systematically exhibit a preference for the present for gains and losses of time, whereas none of the subjects exhibited this same behavior for gains of money. In order to take this behavior into account, we allowed c⋆ to be greater than y for choice lists on gains of time and losses of time. Outcome c varied between x and y for gains of money, and between x and \(y+{\Delta }\) for gains and losses of time.Footnote 7 We note that, when \(z = 0\) and \(t = 0\), \(c^{\star }\) is the present value of the prospect \((x,t;y,T)\). Table 2 reports the choice lists that were used. Money outcomes ranged from 0 to 300 euros. Time outcomes ranged from 0 to 240 minutes and were defined with respect to the time devoted to a specific task involved in a research assistantship contract (see Section 3.3 “Gains and losses of time”). Each choice list was completed according to a two-step process. First, a series of binary choices aiming at identifying the indifference value (by bisection) was carried out. A choice list was then pre-filled according to this indifference value. Second, subjects had to check all the choices of the list. Each choice could be validated or modified in the event that the subject decided to change their answer (see Fig. 10 in the Appendix). Once all the choices were validated, the entire list could be confirmed and the subjects could move on to the next list. Subjects were informed that it was no longer possible to change their decisions after a list was confirmed.

For each subject, we randomly assigned the order of the 3 treatments: gains of money, gains of time and losses of time.Footnote 8 However, in order to reduce the cognitive effort, we maintained the same order of the choice lists (given in Table 2) within each treatment. Subjects started with one-outcome prospects, which are easier to understand, before moving on to more complex prospects (e.g., Abdellaoui and Kemel 2013b).

We used a timeline to visually represent the outcomes and the time when the outcomes would be received. Figure 1 illustrates the choice question “Would you prefer to receive 300€ six months from now or to receive 150€ now and 100€ six months from now?” The two alternatives were placed on different sides of the timeline. Gains were represented using a green plus sign, while losses were represented using a red minus sign.

3.3 Gains and losses of time

For money, positive outcomes are defined as gains while negative outcomes are defined as losses. For time consequences, an exogenous reference point has to be set up experimentally. The valuation of time is also highly context-dependent: wasting one hour doing nothing on a beach does not have the same meaning as wasting one hour being stuck in a traffic jam. It was therefore important to standardize the definition of gains and losses of time before eliciting their respective utilities.

A concrete research assistantship contract was considered in order to create a reference point, in the form of a reference duration, against which subjects could evaluate gains and losses of time. In the present study, prospects involved time outcomes received at two different time periods t and T. Therefore, a reference point had to be set up for each of these periods.Footnote 9 Each subject was asked to imagine that a professor had offered her the possibility of receiving a given salary in exchange for several hours of research assistantship. The research assistantship contract required the subject to attend 2 working sessions: the first at t and the second at T. Each session was initially planned to last 4 hours. This reference duration defined the reference point. Gains (losses) of time received at t were defined as the possibility to shorten (extend) the duration of a session scheduled at t. We do not make any assumption about the way the subjects enjoy the time gained: it could be dedicated to leisure, homework or any other activity. Similarly, we also do not make any assumption about the way subjects spend the gains of money.

During the presentation of the experiment to the subjects, gains and losses of time were illustrated as in Fig. 2, which corresponds to the question “Would you prefer to gain 2 hours now or to gain 3 hours in six months?” In this question, subjects were asked to consider that the two 4-hour research assistantship sessions were to be scheduled now and six months from now, and that they had the possibility of gaining time by shortening the duration of one of the sessions. If the subject chose to gain 2 hours now, then they would gain time (spend less time) now but would have to work the reference time of 4 hours six months from now (gain nothing). If the subject chose to gain 3 hours in six months, then they would gain time in six months (spend less time) but would have to work the reference time of 4 hours now (gain nothing).

Let us take another example that involves losses of time (see Fig. 9 in the Appendix). Here, the question is: “Would you prefer to lose 1 hour now and 1 hour six months from now or to lose 3 hours six months from now?” This question assumes that the research assistantship sessions are scheduled now and six months from now. Therefore, losing 1 hour now and 1 hour six months from now means that the duration of the two sessions would be increased by one hour, while losing 3 hours six months from now means that only the duration of the second session (scheduled six months from now) would be increased by 3 hours (leading to a total session duration of 7 hours), the duration of the first session remaining unchanged.

In order to avoid time-versus-money tradeoffs, it was made clear to the subjects that the salary was fixed and independent of the duration of the two sessions. In particular, the payment would not be reduced (increased) in the event that one or both of the sessions were shortened (extended). A similar procedure was implemented by Augenblick et al. (2015) who offered a large fixed monetary payment, received after completion of the tasks, and independent of the number of hours spent working on the task. In order to ensure the strict monotonicity of utility of time, our subjects were also told that the work consisted in editing a bibliography and that it was not pedagogical. It was therefore in their best interest to enjoy reductions in working time and to avoid increases in working time. The research assistantship contract aimed at providing a standardized definition of time gains and losses, and could be used for the implementation of real incentives.

3.4 Implementation of real incentives

The implementation of real incentives raised a few practical problems that had to be circumvented. To detect utility curvature, we used relatively important consequences both for money and time. Additionally, the prior provision of a reference point for time consequences led us to offer a salary of 400€ for a two time 4-hour assistantship contract. The salary offered aimed at ensuring that the subjects would agree to participate in an experiment with sizable gains and losses of time. Moreover, the reference point for time consequences imposed severe constraints on the timing of the experiment as we wanted to be sure that subjects would be available for the research assistantship for each time period used in the experiment (2, 3, 6, 9 or 12 months after the day of the experiment). Therefore, we carefully selected a two-week time frame in which none of the time periods projected coincided with holidays or exams.

To test whether the presence of real incentives had an effect on individual behavior, we randomly separated the subjects into two sub-samples: a real incentive group and a hypothetical choices group. At the beginning of the session, each subject in the real incentive group was informed that, immediately after the interview, a random draw would decide whether they were selected to have one choice question for money or one choice question for time played out for real. Real incentives applied to gains of money as well as to gains and losses of time. We ran a series of t-tests on the indifference values obtained with and without real incentives (see Table B.5 in Online Appendix B). We found that the presence of incentives did not impact the subjects’ decisions. We will now describe the procedure implemented for each group.

3.4.1 Subjects in the real incentive group

In this group, subjects received a flat payment of 20€ for their participation in the experiment. Before they were recruited, subjects were informed that the experiment would last around one hour. Moreover, they were told that, at the end of their individual interview, they would have to draw a ball from a transparent urn to determine whether they would be selected to play out one choice for real. The subject had a probability of 5 percent of being selected.Footnote 10 Then, we determined the category from which the question would be randomly chosen: gains of money, gains of time or losses of time (Online Appendix A).

In the event that the subject was selected to have a question about gains of money played out for real, we would randomly select one question that they had answered in the section on gains of money. The monetary amount and the time when the subject would receive the money were defined by the subject’s answer to this question. In the case that a payment was to be made at a future date, the subject received a document signed by a school representative certifying that they would receive the amount of money at the time specified according to the previously described procedure.

In the event that the subject was selected to have a question about gains (losses) of time played out for real, we would randomly choose one question they had answered in the gains (losses) of time section of the questionnaire and implement it for real. The subject was given an official document certifying that a payment of 400€ would be made after the subject had completed the second working session. Before the beginning of the experiment, subjects from this group were invited to sign an informed consent form in which they acknowledged that they agreed to the working contract if they were selected for real gains or losses of time. None of the subjects refused to sign the release. This may be because the fixed amount of money largely covered the possible losses of time.

3.4.2 Subjects in the hypothetical choices group

In this group, subjects received a flat payment of 25€ for their participation in the experiment. At the beginning of the interview, subjects were told that they would have to make hypothetical choices about gains of money, gains of time and losses of time. We used the same research assistantship contract scenario as the one used with the real incentive group. Here, subjects were asked to imagine that a professor had offered them a research assistantship contract (identical to the one offered to participants in the real incentives group) and that they had the option of gaining (or losing) time. Time gains referred to the hypothetical possibility of shortening one or two of the working sessions. Time losses referred to the hypothetical obligation of extending one or two of the working sessions without extra payment. Subjects were invited to read and sign an informed consent form detailing the experimental scenario and experimental procedure.

4 Results: Raw data analysis

Before proceeding to the econometric analysis of the collected data, the present section describes several patterns of the observed discounting behavior using descriptive statistics. We start by focusing on choice lists that involve sooner/smaller vs. larger/later tradeoffs. This analysis reveals clear differences between gains and losses of time, and highlights a high level of heterogeneity in the sample. We then focus on discounting, and show that subjects display larger deviations from constant discounting for time than for money.

4.1 Present values

We first consider the choice lists \(CL_{2}\), \(CL_{3}\), \(CL_{4}\), CL5 listed in Table 2. For these lists, the outcome \(c^{\star }\) that makes the decision maker indifferent between the two prospects (c⋆,0) and \((y,T)\) is called the present value of (y, T). We consider the normalized present value \(c^{\star }/y\). In the absence of a pronounced curvature of u (in equation (1)), as shown in the next sections, this normalized present value approximates the value of the discounting function \(\varphi \) at T, i.e. \(c^{\star }/y\simeq \varphi (T)\).

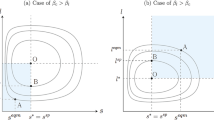

Figure 3 shows the empirical distributions of the normalized present values for gains of money, gains of time and losses of time, and for \(T = 3\), 6, 9 and 12 months. As expected, for both gains of time and gains of money, the average and the median present values decrease when T increases; on average, people are more likely to accept a smaller present gain when the delayed outcome is postponed further in the future. The means and medians of present values look similar for gains of money and gains of time; however, there is much larger heterogeneity in behavior for time. For instance, the first quartiles (Q1) are much lower for time than for money suggesting that a sizable portion of the subjects discounts time more than money.

If we compare gains and losses of time, we observe that the means of the normalized present values are systematically higher \((p\!{\kern -.5pt}<\!0.001)\) for losses than for gains (see Table B.2 in Online Appendix B). This suggests that, on average, people discount more gains of time than losses of time. As for gains, losses of time also generate a wide diversity of behavior. In particular, we observe that a majority of the subjects exhibit negative discounting behavior for losses of time (normalized present value greater than one). These subjects are ready to pay a (time) premium to expedite losses.

4.2 Deviations from constant discounting

Several choice lists were designed in order to check the assumption of constant discounting in a model-free fashion. Concretely, choice lists \(CL_{2}\), \(CL_{7}\), \(CL_{8}\), and \(CL_{9}\) involve a time interval of 3 months between t and T and different delays t (0, 3, 6 and 9 months, respectively), and should therefore have identical indifference values under constant discounting. As an illustration, Fig. 4 compares the cumulative distribution of normalized indifference values for \(CL_{2}\) (t = 0, \(T = 3\)) and CL9 (t = 9, \(T = 12\)). Contrary to the constant discounting assumption, we observe systematic differences between the normalized indifference values of \(CL_{2}\) and \(CL_{9}\) for gains of money, gains of time and losses of time. For gains of money, we observe that normalized indifference values are systematically higher when both alternatives are postponed. For gains and losses of time, a similar pattern is observed but only for values lower than 1 (positive discounting). For normalized values greater than 1 (negative discounting), we observe the opposite: the values are lower when both alternatives are postponed. This suggests that both positive and negative discounters are less sensitive to delays when both alternatives are postponed in the future. We also observe that the differences between normalized indifference values of \(CL_{2}\) and \(CL_{9}\) are much smaller for money than for time, indicating a greater deviation from constant discounting for time than for money.

We ran a series of paired t-tests to compare the normalized indifference values of \(CL_{2}\) and \(CL_{k}\), with \(k = 7,\) 8 and 9 (see Table B.3 in Online Appendix B). The null hypothesis (i.e., constant discounting) stipulates that normalized indifference values between \(CL_{2}\) and \(CL_{k}\) should be equal. For gains of money, we observe that the values are significantly different \((p<0.05)\) only between \(CL_{2}\) (t = 0) and \(CL_{9}\) (t = 9). For gains of time, we also find that normalized indifference values are significantly different \((p<0.05)\) only between \(CL_{2}\) and \(CL_{9}\). For losses of time, no significant differences are detected. In order to take into account the asymmetry observed in Fig. 4 for gains of time and losses of time, we ran a series of paired t-tests on positive discounters and negative discounters separately (see Table 3). We classify as a positive (negative) discounter a subject that exhibits a positive (negative) discounting behavior for a majority of the choice lists \(CL_{1}\) to \(CL_{9}\).Footnote 11 Differences are detected in both groups. For both gains and losses of time, positive (negative) discounters exhibit less preference for the present (future) when both alternatives are postponed. This result is confirmed by a series of Wilcoxon tests. Regarding size effects, the magnitude of the differences is greater for time than for money, indicating that individuals display more deviations from constant discounting for time than for monetary outcomes.

5 Results: Econometric analysis

This section presents the econometric model that was used to estimate the components of the DU model for gains and losses of time, as well as for gains of money. We then present and comment on the estimated distributions of parameters over our subject sample. The last subsection recovers individual estimates from these distributions. This allows us to illustrate the heterogeneity of behavior by looking at several individual patterns; more interestingly, it allows us to measure correlations of individual parameters between time and money.

5.1 Estimation method

For each domain and attribute, choice lists \(CL_{k}=\{x_{k},y_{k},z_{k},t_{k},T_{k}\}\) allowed us to determine, for each subject i, a sufficiently small interval [\(c_{i,k}^{-}\) - \(c_{i,k}^{+}\)] containing the outcome \(c_{i,k}^{\star }\) that makes the subject indifferent between \((c_{i,k}^{\star },t_{k},z_{k},T_{k})\) and \((x_{k},t_{k},y_{k},T_{k})\). According to the behavioral model given by equation (1), the theoretical indifference value \(\hat {c}_{i,k}\) for subject i with utility \(u_{i}\) and discounting function \(\varphi _{i}\) follows

We assume that \(c_{i,k}^{\star }=\hat {c}_{i,k}+\epsilon _{i,k}\) with \(\epsilon _{i,k}\sim N(0,\sigma _{i})\). A similar error specification is used by Bruhin et al. (2010) for the estimations of risk preferences from certainty equivalents. Choice lists aimed at providing values \(c_{i,k}^{-}\) and \(c_{i,k}^{+}\) such that \(c_{i,k}^{-}<c_{i,k}^{\star }<c_{i,k}^{+}\). Therefore, the likelihood associated with a choice list is the probability of observing that the indifference value lies between \(c_{i,k}^{-}\) and \(c_{i,k}^{+}\):

where F is the cumulative function of a normal distribution. This specification allows us to account for the precision of the choice list (\(c_{i,k}^{+}-c_{i,k}^{-}\)) in the estimation, and was used by Beauchamp et al. (2012), and by Kemel and Travers (2016).

These probabilities define the likelihood of the observations collected in the choice lists characterized by \(u_{i}\) and \(\phi _{i}\). The components of model (1) are estimated using parametric specifications. For the utility, a power specification is used: \(u(x)=x^{\alpha }\). Several specifications are considered for the discounting function, all of them defined by a discount rate \(\delta \) and a parameter \(\gamma \) that measures deviation from constant discounting.Footnote 12 Therefore, for a given attribute a (money/time) and domain d (gains/losses), the preferences of a given individual i are characterized by a vector of parameters \(\theta _{i,a,d}=\{\alpha _{i,a,d},\delta _{i,a,d},\gamma _{i,a,d},\sigma _{i,a,d}\}\). In order to account for heteroscedasticity across individuals and decision contexts, the variance of errors, \(\sigma _{i,a,d}^{2}\) is specific to each individual, attribute and domain. This flexible error structure also allows us to separate heterogeneity of preference parameters from heterogeneity of errors.

Parameters are estimated by maximum likelihood, using the structural equation given by equation (2). We estimated the structural equation using mixed-models techniques. This allows us to account for heterogeneity in preferences (and parameters). We considered lognormal distributions for the non-negative parameters (α, \(\gamma \), \(\sigma \)) and a normal distribution for the discount rate \((\delta )\) in order to allow for negative discounting. The details of the estimation procedure are given in Online Appendix C.

5.2 Parameter distributions and individual-level analyses

In the next section, we report the estimated distributions of the utility parameter (α) and the discounting parameters (δ and \(\gamma \)). For each component of the model (α, \(\delta \), γ), we compare the estimated distribution characteristics (mean and standard deviation) measured for money gains, and for time losses to those measured for time gains. To this aim, we coded variables in the econometric model so that money-gain parameters and time-loss parameters would be defined by their difference from the time-gain parameters (see Online Appendix C).

Several discounting specifications were tested: exponential, constant-sensitivity, hyperbolic, quasi-hyperbolic and tau-discounting (see Table 1). They all give similar patterns. We focus on constant-sensitivity as it is the only specification that allows for both insensitivity and over-sensitivity to the temporal dimension.

Moreover, we further investigate the heterogeneity of intertemporal preferences by looking at individual parameters under the constant-sensitivity specification. Individual-level parameters are derived from mixed estimations using Bayes’ rule (see Train 2009 for a presentation of the method and von Gaudecker et al. 2011 for an application).

5.2.1 Utility

Figure 5 displays, for each treatment, the estimated distributions of the utility parameter (power). The median of the utility parameter for gains of time is close to 1 (0.987). This is also the case for the utility of gains of money \((0.986)\), as previously observed by Miao and Zhong (2012). There is little heterogeneity in attitude towards gains of money. On the contrary, there is a higher level of heterogeneity in attitude towards gains of time as seen by the larger standard deviation of the log-normal distribution (0.2 vs. 0.01, p < 0.001). Across domains, the median of the utility parameter for losses of time is significantly higher \((p<0.001)\) than the median utility parameter for gains of time, to the extent that a slight convexity is observed for losses of time \((1.086)\). Besides, the level of heterogeneity in utility parameters is lower for losses of time than for gains of time (0.09 vs. 0.2, p < 0.001).

At an individual level, the utility of time in the gains domain is convex for half (49) of the subjects. In contrast, the utility function for gains of money exhibits a slight concavity for all but one subject. This suggests that subjects prefer to smooth monetary gains over the future. For time, however, half of the subjects have a preference for grouping gains.Footnote 13 Preference for smoothing is even stronger for losses of time where all but 7 subjects exhibit a convex utility function.

Overall, intertemporal utility functions for time and for money are not correlated \((r = 0.005, p = 0.96)\). We speculate that this may be due to intrinsic differences in the nature of the utility of time and the utility of money. This may also be due to the fact that there is a high heterogeneity in utility of time, whereas utility of money is less heterogenous across subjects. For time, utility of gains and utility of losses are correlated \((r = 0.22, p = 0.024)\): the higher the preference for grouping time gains, the higher the preference for smoothing time losses.

5.2.2 Discounting

The estimated distributions of the discounting parameters (assuming the constant-sensitivity specification) are presented in Fig. 6. We report that the median discount rate is higher for gains of time than for gains of money (0.525 vs. 0.342, p < 0.001). This suggests that the median subject exhibits more impatience towards gains of time than towards gains of money. Comparing gains and losses of time, we observe that the subjects discount more gains of time than losses of time, as suggested by a higher median discount rate (0.525 vs. 0.092, p < 0.001).

Regarding delay-sensitivity, the median parameter is lower for gains of time than for gains of money (0.704 vs. 0.877, p < 0.001), indicating that the median subject exhibits more (delay) insensitivity for time than for money. A similar level of delay-sensitivity parameter is observed for losses and for gains of time (0.626 vs. 0.704, p = 0.11). Deviations from constant discounting are consequently more likely for gains and losses of time than for gains of money. This result is consistent with the recent findings by Augenblick et al. (2015) who observed more decreasing impatience for effort (i.e. losses) than for gains of money.

Our mixed-model estimation approach also allows us to capture heterogeneity in behavior. There is a significant degree of heterogeneity on the two parameters of the discounting function. In order to illustrate this diversity, we display discounting behavior for the median as well as for the first and third quartiles (see Fig. 7). The discrepancy between the dashed lines gives an indication of the discounting behavior of half of the sample. More heterogeneity in discounting behavior is observed for gains of time than for gains of money. This is due to a greater standard deviation of the log-normal distribution, in both discount rates (0.71 vs. 0.27, p < 0.001) and delay-sensitivity parameters (0.56 vs. 0.21, p < 0.001), as illustrated in panels a and b of Fig. 6.

Across domains, the level of heterogeneity for both discount rates and delay-sensitivity parameters is similar for gains and losses of time. As displayed in panel c of Fig. 7, we observe that a significant portion of the subjects display negative discounting behavior for losses of time; in other words, they have a preference for losing time as soon as possible.

Table C.1 (in Online Appendix C) reports the detailed results of the distributions of the utility (α) and discounting parameters (δ and \(\gamma \)) estimated with the exponential and constant-sensitivity discounting specifications. Estimations obtained with other discounting specifications and some graphical illustrations are also available in the Online Appendix. Overall, the results are consistent across discounting specifications.

5.2.3 Individual-level analyses of discounting behavior

In this section, we further study the heterogeneity of preferences in the sample by analyzing individual discounting patterns (see Figures C.4 and C.5 in Online Appendix C). We also use the example of four individual subjects to illustrate the heterogeneity of preferences in the sample (see Fig. 8).

A sizable minority of subjects (20) exhibits negative discounting for gains of time, i.e. preference for the future, whereas no subject does so for gains of money (see panel a of Table 4). Discounting of gains of time and discounting of gains of money are nonetheless correlated (r = 0.47, p < 0.01), suggesting that a common cognitive mechanism drives time discounting for both attributes.

Negative discounting is more common for losses of time than for gains of time, with more than half (55) of the subject pool exhibiting this type of behavior (e.g., subject 17 in Fig. 8b). More generally, discount rate parameters are larger for gains than for losses of time (for 80 subjects, including subjects 23 and 17), and are correlated across domains (r = 0.67, p < 0.01): the higher the propensity to prefer soon (late) time gains, the higher the propensity to prefer late (soon) time losses. Specifically, 19 of the 20 subjects who exhibit negative discounting for time gains do so for time losses (see panel b of Table 4); subject 16 is one of them (see Fig. 8c). For these subjects, a strong difference of discounting behavior is observed between attributes, but discounting functions for time are similar across domains. They prefer to postpone gains of time in order to keep free time in the future, and also prefer to get rid of losses of time as soon as possible. Another group of 36 subjects shows a strong gain/loss asymmetry: they exhibit negative discounting for losses of time but positive discounting for gains of time and money (e.g. subject 17). In other words, they prefer to gain time now rather than in the future and, at the same time, to lose time now rather than in the future.

Figure C.5 (in Online Appendix C) plots the individual parameters measuring the curvature of the constant-sensitivity discounting function, i.e. delay-sensitivity. As seen in the previous section, there is more heterogeneity for gains of time than for gains of money. For both attributes, about 80 subjects have a delay-sensitivity parameter lower than 1 and therefore exhibit (delay) insensitivity (see Table 5). This is the case for subjects 17 and 44 (Fig. 8). However, deviations from constant discounting are more pronounced for gains of time than for gains of money. For values lower than 1, the parameters are larger for money than for time; the pattern is reversed for values larger than 1. Therefore, both (delay) insensitivity and (delay) over-sensitivity behaviors are more pronounced for gains of time than for gains of money. Focusing on time, the majority of the subjects (62) exhibit insensitivity (in terms of the parameter \(\gamma \)) for both gains and losses. The share of subjects exhibiting insensitivity is similar in both domains. Among these subjects, the mean value of the delay-sensitivity parameter is lower for losses \((0.56)\) than for gains \((0.62)\) suggesting that, for subjects exhibiting insensitivity, the pattern is more pronounced for losses than for gains. Finally, we note that the correlation between domains (gains/losses) is significant (r = 0.29, p < 0.01), but smaller than the correlations between discount rate parameters. However, there is no correlation between delay-sensitivity parameters across attributes (r = 0.19, p = 0.06). As for the utility functions, delay-sensitivity parameters seem to be more likely to vary with decision contexts (domain and attribute) than discount rate parameters.

We also observe that a significant number of subjects (21) exhibit over-sensitivity (increasing impatience) for gains of money. Approximately the same number of subjects (20) exhibit over-sensitivity for gains of time and a greater number of subjects (25) do so for losses of time. While the portion of subjects who exhibit over-sensitivity for gains and losses of time is similar, there is an asymmetry in the discounting behaviors of these subjects between gains and losses. Indeed, the majority of the subjects who exhibit over-sensitivity for gains of time have a positive discount rate for gains of time. On the other hand, the majority of the subjects (20/27) who exhibit over-sensitivity for losses of time also exhibit negative discounting behavior for losses of time.

5.3 Reference point integration

As discussed earlier, gains and losses of time are always defined with reference to a specific duration. In this project, we set up an exogenous reference point in the form of a concrete research assistantship contract against which subjects could evaluate gains and losses of time. We have so far assumed that the subjects integrated the reference point and considered an increase (respectively a decrease) in the duration of a research assistantship session as a loss (respectively a gain) of time. However, one could speculate that subjects did not integrate the reference point and framed the choice situations only in terms of losses of time. In this section, we test this assumption by comparing the estimations of two models with and without reference point integration.

In Model 1, we consider that subjects estimated gains and losses with respect to the exogenous reference point and we allow for the parameters to differ between gains and losses of time. In Model 2, we consider that the subjects did not integrate the exogenous reference point but instead used their current situation as a reference point (i.e., they considered everything as a loss of time). In this case a gain of 1 hour would be considered as a loss of 3 hours (4 hours of baseline task minus 1 hour) whereas a loss of 1 hour would be considered as a loss of 5 hours (4 hours of baseline task plus 1 hour).

A comparison of the two models’ Akaike (AIC) and Bayesian (BIC) information criteria shows that, for all the discounting functions considered in the paper (see table C.3 in Online Appendix C), Model 1 fits the data better than Model 2. This suggests that the participants integrated the reference point and considered gains and losses differently.

6 Discussion

Behavioral research has extensively used monetary consequences to study intertemporal preferences. Although time is also a scarce and valuable resource, very few studies have analyzed temporal preferences when consequences are measured in units of time. To our knowledge no experimental elicitation of discounted utility has been carried out for both gains and losses of time. We hope the present paper contributes to filling this gap. The main challenge in the present research project was to set up decision making situations where gains and losses of time were clearly defined, and where gaining (losing) more time resulted in more (less) utility / felicity for the decision maker. This was done by means of a concrete research assistantship contract that allowed us to define a reference point for gains and losses, and a homogeneous sample of subjects with very similar time schedule during the time span of the (receipt) delays involved in the experiment. We also separately elicited temporal preferences for monetary gains, and used them as a baseline treatment. No tradeoffs between monetary and time gains were involved in the present investigation. In terms of both utility and discounting, our subjects exhibited across-domain (gains/losses) differences. This suggests that the subjects treated positive and negative deviations from the reference points as gains and losses. Additionally, the observed differences between gains of money and gains of time confirm that subjects did not use monetary equivalents in their intertemporal tradeoffs of time consequences.

6.1 Utility

Although utility is close to linear for both monetary and time gains at the aggregate level, we observed an asymmetry between money and time in terms of the spread of the estimated distributions of utility powers. Actually, the very little heterogeneity exhibited by subjects in terms of utility curvature for money was accompanied by a high variance of the distribution of powers for gains and losses of time. This result suggests that, while the marginal utility of money over time is relatively uniform among subjects, the marginal utility of time seems to vary significantly across subjects. This said, the powers for time exhibited less spread for losses than for gains, with a tendency of utility to be convex for time losses. While most subjects in the sample exhibited a preference for smoothing losses of time, half of the sample displayed a preference for grouping gains of time. Additionally, while the utility of time is correlated across domains (gains vs. losses), the utility of money is not correlated with the utility of time. The latter result shows that subjects did not systematically convert time consequences as their corresponding monetary values. In contrast to the old saying that “time is money,” we observe that the scales of subjective values of these two attributes are not related. This difference is expected to generate differences in terms of discounting between time and money.

In this project, we have elicited a sign-dependent discounted utility model for two attributes. One assumption of this model is that the utility is stationary (Koopmans 1960); in other words, it depends only on the magnitude and not on the receipt time of the outcome. This is a common assumption in the intertemporal choice literature that has been recently used in studies on discounting behavior of both monetary and non-monetary outcomes (Augenblick et al. 2015; Bleichrodt et al. 2016a; Ioannou and Sadeh 2016). For more information on the effect of non-stationarity of utility on discounting behavior see Gerber and Rohde (2015).

6.2 Discounting gains

Overall, under constant-sensitivity discounting, our subjects discount more gains of time than gains of money. Furthermore, our estimations show that they depart from constant discounting, and consequently violate time consistency, for both money and time. Specifically, a majority of subjects exhibit insensitivity to delays (γ < 1), and this phenomenon is more pronounced for time than for money. We also observed more diversity in terms of constant-sensitivity discounting for time outcomes (both in terms of discount rate and delay-sensitivity parameters). Moreover, we find evidence that the discount parameter under constant sensitivity is significantly correlated for gains of time and gains of money. Time and money differ in various ways: time is less fungible than money, it cannot be stored, nor saved, nor exchanged. It is therefore surprising that, despite these major differences, impatience (measured by the parameter \(\delta \)) towards gains of time and towards gains of money are highly correlated. This result confirms previous studies that have found a positive correlation between temporal discounting of money and consumer goods (Tsukayama and Duckworth 2010), and suggests that a general notion of impatience exists beyond attribute differences. In contrast, no significant correlation was found for the parameter measuring deviation from constant discounting. In other words, subjects departed from temporal consistency in radically different ways for different attributes.

As explained in the section describing the experimental protocol, our elicitation of temporal preferences allowed for negative discounting. In fact, after a pilot study, we realized that imposing preference for the present in elicitations could result in many artificial “corner estimates” (i.e., zero discounting).Footnote 14 Our individual estimates show that, in contrast to monetary gains where no subject exhibited a preference for the future, 20 out of 101 subjects exhibited negative discounting for time gains.

6.3 Discounting gains vs. losses

Recent experimental investigations focusing on money discounting showed that allowing the discount to depend on the domain (gains/losses) improves the description of time preferences (Abdellaoui et al. 2013a; Scholten and Read 2010). The present paper shows that this result also holds (in a more pronounced fashion) for intertemporal tradeoffs of gains and losses of time. Specifically, our investigation reveals clear asymmetries between gains and losses of time. We show that, in addition to a significant across-domain correlation, subjects discount gains of time in a more pronounced way than losses of time.

Few experimental studies have documented negative discounting for non-monetary attributes, e.g., electric shocks (Yates and Watts 1975) and health (Hardisty and Weber 2009), and more recently for small financial losses (Hardisty, Appelt, and Weber, 2013). In fact, a notably large body of evidence regarding discounting elicitation has assumed positive discounting from the outset. However, the idea of negative discounting is not new. For instance, Fetter (1915) already suggested that “time preference is not always preference for present goods as compared with future goods [but that instead] we sometimes, indeed very frequently, prefer to have certain things in the future.” The present investigation shows that negative discounting is particularly important for time losses. Specifically, we observe that this pattern was fairly more pronounced for losses (55 out of 101 subjects) than for gains (20 out of 101 subjects). While the common wisdom stipulates that the future would offer more slack in terms of time (Zauberman and Lynch 2005), we observe that sophisticated people (as in our sample) prefer losing time in the present rather than in the future. This may also be interpreted as a tendency to avoid procrastination.

The asymmetry of discounting behaviors for gains and losses of time suggests that intertemporal decisions involving time can be manipulated by framing consequences as gains or losses. For instance, consider a seminar that consists of a 2-hour session and a 3-hour session. The majority of our subjects would prefer to start with the 2-hour session if the situation was framed as the possibility to save 1 hour from two 3-hour sessions; while the same subjects would prefer to start with the 3-hour session, if the situation was framed as the necessity to spend an extra hour on one of the two 2-hour sessions. It is of course hard to extrapolate these findings to ranges of time consequences much larger than the ones used in the experiment (up to 4 hours). However, the range of time consequences studied in this paper is compatible with a large diversity of planning decisions faced in everyday life by students, employees, businessmen and academic fellows.

Many studies have observed a tendency of subjects to deviate from constant discounting for monetary gains (Frederick et al. 2002; Manzini and Mariotti 2009). Under generalized hyperbolic discounting, Abdellaoui et al. (2013a) report experimental findings showing that subjects deviated more from constant discounting for monetary losses than for monetary gains. Under hyperbolic discounting specification, we observe the same pattern between gains and losses of time along with a significant correlation between delay-sensitivity parameters for gains vs. losses of time. Deviations from constant discounting are consequently more likely for gains and losses of time than for gains of money.

7 Conclusion

The present paper conveys three main messages. The first message is that postulating that money could represent a proxy for consumption in intertemporal choice is at best a source of many confounds for preference elicitation. Focusing on money when investigating time preferences may generate an artificial “well-behavedness” of individual behavior due to the easier transferability of money over time. Our analyses reveal less “well-behavedness” for time than for money as choices with gains and losses of time reveal a much larger heterogeneity (including negative discounting behavior) than choices with monetary outcomes. The second message is that eliciting temporal preferences while systematically assuming positive discounting prevents us from observing that people can exhibit preference for the future. It is not illegitimate, nor irrational, that people prefer to immediately get rid of a relatively small loss of time or money as observed by Loewenstein and Prelec (1991). Additionally, preferring a gain of time in the future to the same gain of time in the present could reflect an aversion to the uncertainty regarding future slack of time. The last message is that there is a strong asymmetry between discounting of gains and losses of time. While people prefer to lose time in the present rather than in the future, they also prefer to gain time in the present rather than in the future.

Notes

Many researchers invoke the difficulty of recruiting volunteers to participate in an experiment in which they may lose money. Furthermore, the payment of a participation fee that covers the largest loss is only feasible when small amounts of money are involved.

Impatience, resulting from a strictly decreasing discounting function, implies preference for the present.

This specification fits our data better than the exponential one (Section B.3 in Online Appendix B).

In order to avoid any confusion between the attribute time and the delay before receipt of the outcome, we will call delay-sensitivity the parameter \(\gamma \) of the constant-sensitivity discounting function instead of time-sensitivity (Ebert and Prelec 2007).

The video is available upon request.

We used the absolute values of the outcomes in the presentation of the choice lists.

Δ was fixed at 60 minutes for both questions on gains of time and losses of time.

The experiment included a fourth treatment: losses of money. Because of the difficulties to implement real losses of money, questions in this treatment were hypothetical. In this study, we focus on incentivized choices and do not report the treatment with hypothetical losses of money.

Due to the temporal nature of outcomes and the fact that subjects were interviewed successively during a period of 2 weeks, we could not select the eligible subjects at the end of the experiment.

We excluded choice lists \(CL_{10}\) to \(CL_{15}\) as they are designed to measure the utility parameter.

Exponential (constant) discounting can always be retrieved from the specifications considered, when \(\gamma \) is fixed to a given value. For instance, the constant-sensitivity discounting function is equivalent to the exponential discounting function when \(\gamma = 1\).

To illustrate this, an individual with a concave utility function for gains of time might prefer to gain 1 hour twice at two different periods of time than to gain 2 hours at one point of time. On the other hand, an individual with a convex utility function for gains of time may prefer to group the 2 hours in one gain at a single point of time.

As an illustration, the present value \(c^{*}\) of the temporal prospect that offered a gain of time of 120 minutes six months from now (120,6) was greater than 120 for 20 subjects in our sample: these individuals did not exhibit preference for the present. By imposing preference for the present \((c\leq 120\) in this example), we would obtain “corner estimates” for these individuals as they would never switch and always prefer the option (120,6) rather than any option \((c,0)\).

References

Abdellaoui, M., Bleichrodt, H., l’Haridon, O. (2013a). Sign-dependence in intertemporal choice. Journal of Risk and Uncertainty, 47(3), 225–253.

Abdellaoui, M., & Kemel, E. (2013b). Eliciting prospect theory when consequences are measured in time units: “Time is not money”. Management Science, 60(7), 1844–1859.

Attema, A.E. (2012). Developments in time preference and their implications for medical decision making. Journal of the Operational Research Society, 63(10), 1388–1399.

Augenblick, N., Niederle, M., Sprenger, C. (2015). Working over time: Dynamic inconsistency in real effort tasks. Quarterly Journal of Economics, 130(3), 1067–1115.

Beauchamp, J.P., Benjamin, D.J., Chabris, C.F., Laibson, D.I. (2012). How malleable are risk preferences and loss aversion. Technical report, Harvard University Mimeo.

Bleichrodt, H., Rohde, K.I.M., Wakker, P.P. (2009). Non-hyperbolic time inconsistency. Games and Economic Behavior, 66(1), 27–38.

Bleichrodt, H., Gao, Y., Rohde, K.I.M. (2016a). A measurement of decreasing impatience for health and money. Journal of Risk and Uncertainty, 52(3), 213–231.

Bleichrodt, H., Potter van Loon, R.J.D., Prelec, D., Wakker, P.P. (2016b). Beta-Delta or Tau-Delta? A Reformulation of Quasi-hyperbolic Discounting. Unpublished Manuscript.

Bruhin, A., Fehr-Duda, H., Epper, T. (2010). Risk and rationality: uncovering heterogeneity in probability distortion. Econometrica, 78(4), 1375–1412.

Cubitt, R.P., & Read, D. (2007). Can intertemporal choice experiments elicit time preferences for consumption? Experimental Economics, 10(4), 369–389.

Ebert, J.E.J., & Prelec, D. (2007). The fragility of time: Time-insensitivity and valuation of the near and far future. Management Science, 53(9), 1423–1438.

Estle, S.J., Green, L., Myerson, J., Holt, D.D. (2007). Discounting of monetary and directly consumable rewards. Psychological Science, 18(1), 58–63.

Fetter, F.A. (1915). Economic principles volume 1. New York: The Century Co.

Frederick, S., Loewenstein, G., O’Donoghue, T. (2002). Time discounting and time preference: A critical review. Journal of Economic Literature, 40(2), 351–401.

Ganiats, T.G., Carson, R.T., Hamm, R.M., Cantor, S.B., Sumner, W., Spann, S.J., Hagen, M.D., Miller, C. (2000). Population-based time preferences for future health outcomes. Medical Decision Making, 20(3), 263–270.

Gerber, A., & Rohde, K.I.M. (2015). Eliciting discount functions when baseline consumption changes over time. Journal of Economic Behavior & Organization, 116, 56–64.

Hardisty, D.J., & Weber, E.U. (2009). Discounting future green: money versus the environment. Journal of Experimental Psychology: General, 138(3), 329–340.

Hardisty, D.J., Appelt, K.C., Weber, E.U. (2013). Good or bad, we want it now: Fixed-cost present bias for gains and losses explains magnitude asymmetries in intertemporal choice. Journal of Behavioral Decision Making, 26(4), 348–361.

Ioannou, C.A., & Sadeh, J. (2016). Time preferences and risk aversion: tests on domain differences. Journal of Risk and Uncertainty, 53(1), 29–54.

Kemel, E., & Travers, M. (2016). Comparing attitudes toward time and toward money in experience-based decisions. Theory and Decision, 80(1), 71–100.

Kirby, K.N., & Maraković, N.N. (1995). Modeling myopic decisions: evidence for hyperbolic delay-discounting within subjects and amounts. Organizational Behavior and Human Decision Processes, 64(1), 22–30.

Koopmans, T.C. (1960). Stationary ordinal utility and impatience. Econometrica, 28, 287–309.

Laibson, D. (1997). Golden eggs and hyperbolic discounting. The Quarterly Journal of Economics, 112(2), 443–477.

Loewenstein, G. (1987). Anticipation and the valuation of delayed consumption. Economic Journal, 97(387), 666–684.

Loewenstein, G., & Prelec, D. (1991). Negative time preference. The American Economic Review, 81(2), 347–352.

Loewenstein, G., & Prelec, D. (1992). Anomalies in intertemporal choice: Evidence and an interpretation. The Quarterly Journal of Economics, 107(2), 573–597.

Loewenstein, G.F., & Prelec, D. (1993). Preferences for sequences of outcomes. Psychological Review, 100(1), 91.

Manzini, P., & Mariotti, M. (2009). Choice over time. In Anand, P., Pattanaik, P., Puppe, C. (Eds.), Oxford handbook of rational and social choice, chapter 10. Oxford University Press.

Meissner, T., & Pfeiffer, P. (2015). I want to know it now: Measuring preferences over the temporal resolution of consumption uncertainty. Unpublished Manuscript. Available at SSRN: https://ssrn.com/abstract=2654668.

Miao, B., & Zhong, S. (2012). Separating risk preference and time preference. Unpublished Manuscript. Available at SSRN: https://ssrn.com/abstract=2096944.

Prelec, D., & Loewenstein, G. (1997). Beyond time discounting. Marketing Letters, 8(1), 97–108.

Read, D., & Van Leeuwen, B. (1998). Predicting hunger: the effects of appetite and delay on choice. Organizational Behavior and Human Decision Processes, 76(2), 189–205.

Read, D., Loewenstein, G., Kalyanaraman, S. (1999). Mixing virtue and vice: combining the immediacy effect and the diversification heuristic. Journal of Behavioral Decision Making, 12(4), 257.

Samuelson, P.A. (1937). A note on measurement of utility. The Review of Economic Studies, 4(2), 155–161.

Sayman, S., & Önçüler, A. (2008). An investigation of time inconsistency. Management Science, 55(3), 470–482.

Scholten, M., & Read, D. (2006). Discounting by intervals: A generalized model of intertemporal choice. Management Science, 52(9), 1424–1436.

Scholten, M., & Read, D. (2010). The psychology of intertemporal tradeoffs. Psychological Review, 117(3), 925–944.

Shelley, M.K. (1994). Gain/loss asymmetry in risky intertemporal choice. Organizational Behavior and Human Decision Processes, 59(1), 124–159.

Train, K.E. (2009). Discrete choice methods with simulation. Cambridge: Cambridge University Press.

Tsukayama, E., & Duckworth, A.L. (2010). Domain-specific temporal discounting and temptation. Judgment and Decision Making, 5(2), 72.

van der Pol, M.M., & Cairns, J.A. (2000). Negative and zero time preference for health. Health Economics, 9(2), 171–175.

von Gaudecker, H.-M., van Soest, A., Wengström, E. (2011). Heterogeneity in risky choice behavior in a broad population. The American Economic Review, 101 (2), 664–694.

Winer, R.S. (1997). Discounting and its impact on durables buying decisions. Marketing Letters, 8(1), 109–118.

Yates, J.F., & Watts, R.A. (1975). Preferences for deferred losses. Organizational Behavior and Human Performance, 13(2), 294–306.

Zauberman, G., & Lynch, Jr. J.G. (2005). Resource slack and propensity to discount delayed investments of time versus money. Journal of Experimental Psychology: General, 134(1), 23–37.

Acknowledgment

We are grateful to the Editor and an anonymous referee, as well as the participants of FUR (2016), INFORMS annual meeting (2015) and SPUDM (2015) for helpful comments. We also thank the Investissements d’Avenir (ANR-11-IDEX-0003/Labex Ecodec/ANR-11-LABX-0047) for supporting our research.

Author information

Authors and Affiliations

Corresponding author

Electronic supplementary material

Below is the link to the electronic supplementary material.

Rights and permissions

About this article

Cite this article

Abdellaoui, M., Gutierrez, C. & Kemel, E. Temporal discounting of gains and losses of time: An experimental investigation. J Risk Uncertain 57, 1–28 (2018). https://doi.org/10.1007/s11166-018-9287-1

Published:

Issue Date:

DOI: https://doi.org/10.1007/s11166-018-9287-1

Keywords

- Heterogenous intertemporal preferences

- Discounted utility

- Gain-loss asymmetry

- Negative discounting

- Reference point

- Dynamic consistency