Abstract

Allowing for sign-dependence in discounting substantially improves the description of people’s time preferences. The deviations from constant discounting that we observed were more pronounced for losses than for gains. Our data also suggest that the discount function should be flexible enough to allow for increasing impatience. These findings challenge the current practice in modeling intertemporal choice where sign-dependence is largely ignored and only decreasing impatience is allowed. Overall, the sign-dependent model of Loewenstein and Prelec (1992) with the constant sensitivity discount function of Ebert and Prelec (2007) provided the best fit to our data.

Similar content being viewed by others

Avoid common mistakes on your manuscript.

Empirical evidence abounds that people deviate from constant discounting, the traditional model of intertemporal choice. The best-known deviation is the finding that discount rates are not constant, but decrease over time (Frederick et al. 2002; Manzini and Mariotti 2009). Other deviations include the magnitude effect (larger amounts are discounted at a lower rate than small amounts), the gain-loss asymmetry (gains are discounted at a higher rate than losses), and the delay-speedup asymmetry (the willingness to pay to speed up consumption is lower than the willingness to accept a delay in consumption).

There is a close analogy between the deviations from constant discounting and the violations of expected utility observed in decision under risk (Baucells and Heukamp 2011; Epper et al. 2011; Halevy 2008; Prelec and Loewenstein 1991). In spite of this analogy, the approach in modeling these deviations has been different. In prospect theory, the most influential descriptive model of decision under risk, sign-dependence, and loss aversion in particular, plays a central part in explaining deviations from expected utility. On the other hand, sign-dependence has largely been ignored in modeling intertemporal choice in spite of the existence of a considerable literature showing that losses are discounted at a different rate than gains (e.g. Benzion et al. 1989; Loewenstein 1987; Thaler 1981). Most alternatives for constant discounting, like the widely-used quasi-hyperbolic model (Laibson 1997; Phelps and Pollak 1968), have focused on the explanation of decreasing discount rates for which sign-dependence is not required. An exception is Loewenstein and Prelec’s (1992) generalized hyperbolic discounting model in which utility (but not the discount function) is sign-dependent and reflects loss aversion. Loewenstein and Prelec (1992) showed that generalized hyperbolic discounting can account not only for decreasing discount rates, but also for the magnitude effect, the gain-loss asymmetry, and the delay-speedup asymmetry.

In spite of its parsimony, Loewenstein and Prelec’s model has rarely been applied in economic analyses. One reason might be that there exists no method to measure it. The first contribution of this paper is to present a method for measuring generalized hyperbolic discounting and, to the best of our knowledge, to provide its first complete quantification. Abdellaoui et al. (2010) also allowed for sign-dependence of utility, but their method could not measure loss aversion.Footnote 1 Abdellaoui et al. (2013) did measure loss aversion in intertemporal choice, but they have no data on discounting.

We applied our method in two experiments involving 120 subjects in total. The first experiment provided a complete measurement of generalized hyperbolic discounting and explored whether allowing for sign-dependence improved the description of people’s time preferences. The second experiment tested the robustness of some of the findings of the first experiment to changes in the experimental design, in particular the use of real incentives.

We obtained clear evidence of the importance of sign-dependence in modeling intertemporal choice. In agreement with Loewenstein and Prelec’s (1992) assumptions we observed that the shape of utility differed for gains and losses and that our subjects were loss averse. What is more, the description of people’s time preferences improved considerably when we also allowed discounting to be sign-dependent. The discount function differed between gains and losses and the violations from constant discounting were more pronounced for losses than for gains.

Our data, and in particular the second experiment, revealed another shortcoming of the commonly-used discount functions: they allow only for decreasing discount rates. Even though most studies have found decreasing impatience, increasing impatience has also been observed (Chesson and Viscusi 2003; Epper et al. 2011; Loewenstein 1987; Rubinstein 2003; Sayman and Öncüler 2009; Scholten and Read 2006; Takeuchi 2011). In our second experiment 26% of the subjects were increasingly impatient. To model increasing impatience requires more flexible discount functions like the constant sensitivity discounting function of Ebert and Prelec (2007) that can account for both decreasing and increasing impatience and that overall best fitted our data. To draw another parallel with the literature on decision under risk: whereas most subjects are risk averse, some subjects are risk seeking (and for losses most subjects are actually risk seeking) and a desirable feature of theories of decision under risk is that they can capture such preferences as well. Likewise, to be applicable at the individual level discounting models should be able to capture both decreasing and increasing impatience.

1 Background

The objects of choice are temporal prospects (x,t;y) denoting the receipt of outcome x at time point t and of outcome y at time point 0, which denotes the present. We assume that a preference relation ≽ is defined over temporal prospects. Strict preference is denoted by ≻ and indifference by ∼. Outcomes are monetary gains and losses relative to a reference point, which we assume to be 0. Gains are outcomes strictly preferred to 0 and losses are outcomes strictly less preferred than 0.

Generalized hyperbolic discounting holds if preferences over temporal prospects (x,t; y) can be represented by

With U a real-valued utility function and φ a real-valued discount function that satisfies φ(0) = 1.

Loewenstein and Prelec (1992) assumed that the utility function U has similar properties as the utility function of prospect theory (Kahneman and Tversky 1979; Tversky and Kahneman 1992): concave for gains, convex for losses and steeper for losses than for gains to reflect loss aversion. Utility is a ratio scale that equals 0 at the reference point, i.e. U(0) = 0. To explain the gain-loss asymmetry, Loewenstein and Prelec (1992) also imposed that the elasticity of utility is larger for losses than for gains: the utility function “bends over” faster for gains than for losses. To explain the magnitude effect, Loewenstein and Prelec (1992) assumed that the utility function is more elastic for outcomes that are larger in absolute magnitude. Figure 1 illustrates the utility function of generalized hyperbolic discounting.

The utility function in Loewenstein and Prelec’s (1992) generalized hyperbolic discounting model. Utility is concave for gains, convex for losses, and reflects loss aversion

Loewenstein and Prelec (1992) assumed that the discount function φ is a generalized hyperbola:

The coefficient α determines how much the function departs from constant discounting (Rohde 2010). The limiting case of α equal to zero corresponds to constant discounting: φ(t) = e−βt. This shows that β can be interpreted as a discount factor. Equation (2) can describe decreasing discounting over time, which occurs if α > 0. However, it cannot account for discount rates that increase over time (Bleichrodt et al. 2009). In Loewenstein and Prelec’s (1992) model the discount function is sign-independent. Any difference in discounting between gains and losses is explained through the shape of the utility function.

Empirical evidence on the descriptive validity of generalized hyperbolic discounting is thin on the ground. The model is clearly consistent with many of the violations of constant discounting that have been observed, but hardly any evidence exists whether utility and discounting take the forms hypothesized by generalized hyperbolic discounting and whether people are loss averse when making intertemporal choices. Abdellaoui et al. (2010) found support for Loewenstein and Prelec’s assumptions on utility. They measured utility for gains and losses using a parameter-free method, which imposed no restrictions on utility. They found concave utility for gains and convex utility for losses. The utility for losses was closer to linearity, which is consistent with a larger elasticity of utility for losses than for gains. On the other hand, Abdellaoui et al. (2013), using a parametric method, observed that utility was linear for gains and slightly concave for losses.

Most empirical studies on discounting assumed that intertemporal utility was linear. Abdellaoui et al. (2010) and Attema et al. (2010) measured discounting using methods that require no assumptions about intertemporal utility. Abdellaoui et al. (2010) found that Eq. (2) fitted their data better than most other discount functions that have been proposed as alternatives for constant discounting including the quasi-hyperbolic discount function that is widely used in economic analyses of intertemporal preferences (DellaVigna and Malmendier 2006; DellaVigna 2009; Laibson et al. 2007). They also observed that discounting differed between gains and losses even when the difference in the shape of utility for gains and for losses was taken into account. In other words, their data suggest that the parameters α and β in Eq. (2) are sign-dependent. Attema et al. (2010) found evidence of increasing impatience, which is inconsistent with Eq. (2).

Andersen et al. (2008) and Takeuchi (2011) did not measure intertemporal utility directly, but assumed that it was equal to utility under risk. Takeuchi (2011) obtained evidence of an inverse S-shaped discount function according to which discount rates first increase and then decrease. Such a discount pattern is inconsistent with Eq. (2). Andersen et al. (2008) did not test Eq. (2) but observed that a large majority of their subjects behaved according to constant discounting. A concern about these studies is that the assumed equivalence between utility under risk and intertemporal utility is not self-evident. The dominant view within economics is that utility is specific to the context in which it is measured and that utility under risk and intertemporal utility cannot be taken as identical (see for example Arrow (1951), Luce and Raiffa (1957), and Fishburn (1989)). Abdellaoui et al. (2013) provided empirical evidence suggesting that utility under risk and intertemporal utility do indeed differ. An additional problem of Andersen et al. (2008) and Takeuchi (2011) is that they assumed that people behave according to expected utility. This assumption has been rejected empirically and introduces biases (Wakker 2010). Finally, in Andersen et al. (2008) all outcomes were delayed by at least 1 month which tends to decrease the amount of hyperbolic discounting (Coller and Williams 1999; Laury et al. 2012).

There exists a lot of evidence on loss aversion in decision contexts other than intertemporal choice (e.g. Zank 2010), but it is unknown whether these findings carry over to decision over time. To the best of our knowledge, the only studies that measured loss aversion in intertemporal choice are Tu (2004) and Abdellaoui et al. (2013). Tu (2004), assuming linear utility, found a loss aversion coefficient close to 2, which is comparable to the degree of loss aversion found in other decision contexts (Novemsky and Kahneman 2005). Abdellaoui et al. (2013) allowed for utility curvature. They also found loss aversion, but less than commonly observed in other decision contexts with loss aversion coefficients varying between 1.15 and 1.44.

2 Experiments

We performed two experiments. The first experiment provides a complete measurement of generalized hyperbolic discounting. The second experiment adds validation to the findings of the first experiment by changing some aspects of the experimental design. Both experiments were part of a larger experiment. The remaining data are reported in Abdellaoui et al. (2013).

2.1 First experiment

2.1.1 Subjects

Subjects in the first experiment were 68 students of Erasmus University Rotterdam from various academic backgrounds. Three subjects were removed from the final analyses, because they did not understand the experimental tasks even after repeated explanation. This left 65 subjects in the final analyses.

Subjects received a participation fee of €10. Because the experiment involved losses, we chose not to play out the questions for real. It is difficult to recruit volunteers to take part in an experiment where they may lose money. One could, of course, pay a participation fee as large as the largest loss that could be incurred, but because our experiment involved large amounts such a procedure would be costly and we could not be sure to what extent subjects integrated the fee into each decision problem (Thaler and Johnson 1990). Playing out both gain and loss questions may still be unattractive to subjects unless the prospect of a gain clearly outweighs the prospect of a loss. For the above reasons, we decided to use hypothetical questions.

It is natural to question whether answers to hypothetical questions provide insight into real behavior. There is no consensus in the literature on the impact of using real incentives, but the prevailing view is that for the type of tasks performed in our experiment hypothetical decisions are not treated very differently from financially motivated decisions (for an excellent discussion see Bardsley et al. 2010). Nevertheless, we decided to check this in the second experiment.

2.1.2 Procedures and stimuli

The experiment was computer-run and administered in small group sessions of at most 4 subjects per session. Subjects were seated in cubicles and could not communicate with each other. An experimenter was present to answer any questions. The entire experiment lasted 30 min on average.

Table 1 shows the experimental questions. The experiment consisted of 12 gain questions to measure utility and discounting for gains, 12 loss questions to measure utility and discounting for losses, and 3 mixed questions to measure loss aversion.

In the gain and loss questions we elicited the amount now, the present equivalent, that subjects considered equivalent to the temporal prospect under consideration. In the mixed questions we asked for the loss L* in 1 year that made subjects indifferent between receiving nothing and the temporal prospect (L*, 1 year; G*), i.e. gain G* now and loss L* in 1 year. The gains that subjects faced in the mixed questions were selected from their responses to the gain questions. We explain below how we could measure the generalized hyperbolic discounting model from the answers to the gain, loss, and mixed questions.

The experiment started with 6 training questions. Subjects then moved on to the gain questions, followed by the loss questions, and finally the mixed questions. We used a fixed order between the different parts, because we learnt from pilot sessions that varying the order tended to confuse subjects. Within the gain, loss, and mixed questions we did randomize the order of the questions.

We used substantial money amounts (up to €500) to be able to detect utility curvature. For small money amounts, utility is typically close to linear (Wakker and Deneffe 1996).

All indifferences were elicited through a choice-based bisection procedure. Previous research has found that this leads to fewer inconsistencies than asking subjects directly for their indifference values (Bostic et al. 1990). Table 2 presents an example of the bisection procedure for one of the discount questions. In the first choice the stimuli were always such that the two choice alternatives had equal undiscounted value. By changing the outcome received now we subsequently zoomed in on subjects’ indifference values. The elicitation process terminated after 5 rounds for the gain and loss questions and after 6 rounds for the mixed questions. The stored present equivalent was the midpoint between the lowest outcome now that was preferred to the temporal prospect and the highest outcome now for which the temporal prospect was preferred. In Table 2 this was (437 + 406)/2 = 421.

Figure 2 shows the presentation of the choices. The figure displays the fourth choice of Table 2. We varied across choices what was Option A and what was Option B: in Fig. 2 the present equivalent was Option B but there were also questions in which it was Option A. Subjects could express their choices by clicking on their preferred option. At the end of each choice-based elicitation we repeated the first choice to control for response error. If a subject reversed his choice, the choice-based elicitation for that question was recommenced. We also repeated the third choice of 16 questions to obtain further insight into the reliability of the data. In the third choice the subjects were generally close to indifference and we could expect a considerable proportion of choice reversals if preferences were unstable.

2.1.3 Analysis

We assumed that the utility function U in Eq. (1) was equal to

According to Eq. (3) the utility function U is composed of a basic utility function u, which captures the decision maker’s attitude to final outcomes and a loss aversion coefficient λ, which captures the decision maker’s attitude to gain and loss. A similar decomposition was proposed for decision under risk by Köbberling and Wakker (2005), Köszegi and Rabin (2006), and Sugden (2003).

Several definitions of loss aversion co-exist. We used the definition of Köbberling and Wakker (2005), that loss aversion corresponds with the kink of utility at the reference point. Then the loss aversion coefficient is equal to \( \frac{{\mathrm{U}}_{\uparrow}^{\prime }(0)}{{\mathrm{U}}_{\downarrow}^{\prime }(0)} \) where U ′↑ (0) stands for the left derivative of utility at the reference point and U ′↓ (0) for the right derivative of utility at the reference point.Footnote 2

We assumed that the basic utility function belonged to the exponential family, i.e. \( \mathrm{u}\left(\mathrm{x}\right)=\frac{1-{\mathrm{e}}^{-\mu \mathrm{x}}}{\mu}\kern0.5em \mathrm{if}\ \mathrm{x}\ge 0 \) and \( \mathrm{u}\left(\mathrm{x}\right)=\frac{{\mathrm{e}}^{\nu \mathrm{x}}-1}{\nu}\kern0.5em \mathrm{if}\ \mathrm{x}<0 \). Utility for gains is concave [convex] if μ > 0 [μ < 0] and utility for losses is concave [convex] if ν < 0 [ν > 0].

The exponential utility function is widely used and generally fits empirical data well. It has the additional advantage over the popular power family that the derivatives of the basic utility functions are 1 at 0 and, consequently, that Köbberling and Wakker’s (2005) loss aversion coefficient is defined. For the power family this coefficient is defined only if utility curvature is the same for gains and for losses. To accommodate the gain-loss asymmetry, Loewenstein and Prelec (1992) required different utility curvature for gains and losses, which rules out the power family. Moreover, the exponential family can account for the magnitude effect, because the elasticity of utility increases for outcomes that are larger in absolute magnitude provided that μ and ν are positive. Under the power family this elasticity is constant for all outcomes.

We now explain how we measured the generalized hyperbolic discounting model. In the gain questions we observed indifferences PE ~ (x, t; y), where PE denotes the elicited present equivalent. Applying Eqs. (1), (3), and (4) these indifferences yield:

Under generalized hyperbolic discounting φ(t) = (1 + α)− β/α and Eq. (4) is an equation in three unknowns, μ, α, and β. From the loss questions we obtain in a similar fashion

yielding one extra parameter (ν) to estimate. Finally, the indifference 0 ~ (L*, 1 year; G*), observed in the mixed questions, entails:

providing information on λ. Equations (4)–(6) were estimated using nonlinear mixed-effects regression. Each individual parameter (μ, ν, λ, α, and β) was estimated as the sum of a fixed effect, common to all subjects, and a random effect that is specific to each individual. The random effect is included to capture heterogeneity in preferences. To model error in the gain and loss questions, we assumed a Fechnerian model in which subjects make mistakes in evaluating the present value. For mixed prospects, the error applies to the difference between the predicted loss and the elicited loss. We estimated the model assuming both homoskedastic and heteroskedastic errors. To test for heteroskedasticity we assumed that the error was proportional to the absolute magnitude of the outcome that was elicited (the present equivalent in the gain and loss questions and the delayed loss in the mixed questions). Homoskedastic errors provided the better fit and, hence, the results reported below are based on homoskedastic error terms.

Because a central goal of our paper is to explore the impact of sign-dependence on intertemporal choice, we also estimated a sign-dependent version of Eqs. (4)–(6) in which the discount function parameters α and β were allowed to be different for gains and losses. To compare the fit of Eq. (2) with other functions that have been proposed in the literature and to explore whether allowing for increasing impatience improves the description of people’s time preferences, we estimated Eqs. (4) and (5) under different specifications of the discount function, which are summarized in Table 3. The only functions that account for both decreasing and increasing impatience are the constant sensitivity and constant absolute discounting functions. The other functions can only account for decreasing impatience. Goodness of fit was assessed using Akaike’s Information Criterion (AIC), which takes account of the difference in degrees of freedom between the various functions.Footnote 3 Significance of difference in goodness of fit was assessed using likelihood ratio tests for nested models and Vuong tests for non-nested models. Test statistics are in the Appendix.

To test for robustness, we also estimated Eqs. (4)–(6) using a Gaussian mixture model estimated through maximum likelihood (Bruhin et al. 2010). In this model we distinguished two classes of people and estimated the probability that a subject belongs to a particular class. It is possible that a substantial fraction of the subjects actually behaved according to constant discounting even when at the aggregate level violations of constant discounting were observed. The mixture model can accommodate this possibility and estimates the proportions of subjects belonging to each class.

2.1.4 Results

Consistency was good. In 90.3% of the cases, the replication led to the same choice. This rate of consistency compares favorably with reversal rates of up to 33.3% that are commonly observed (Rieskamp et al. 2006; Stott 2006), particularly because the choices that were repeated were those in which subjects were close to indifference.

2.1.5 Aggregate results

Table 4 shows the results from the mixed-effects estimation. In contrast with Loewenstein and Prelec’s hypothesis of S-shaped utility, utility was linear for gains (z-test, p-value = 0.63) and slightly concave for losses (z-test, p-value = 0.01). The lower exponential coefficient for losses is consistent with Loewenstein and Prelec’s (1992) assumption that utility is more elastic for losses than for gains. The estimated loss aversion coefficient was 1.31, which differed from 1 the case of no loss aversion (z-test, p-value < 0.001), but was lower than what is usually observed in other decision contexts.

Subjects deviated from constant discounting. This is reflected by the parameter α, which measures the deviation from constant discounting, and which differed from 0 (z-test, p-value < 0.01) the value corresponding to constant discounting.

2.1.6 Individual results

Figure 3 shows the individual estimates for utility. Panel a plots the estimated exponential coefficients for gains and losses. Panel b shows the distribution of the individual estimates. For gains most individuals had close to linear utility. For losses, the distribution was more skewed to the left indicating that a majority of subjects had concave utility for losses. Panel a also shows that there was a fair correlation between curvature for gains and curvature for losses (as measured by the estimated exponential coefficient). The Pearson correlation was equal to 0.43 and differed significantly from 0 (p-value < 0.001). In decision under risk many applied studies have assumed reflection, i.e. equal curvature of the utility for losses and the utility for gains. Our data provide some support for reflection in intertemporal choice.

The individual utility parameters in the first experiment. Panel a shows the exponential coefficients for gains and losses when subjects are ordered by the size of the coefficient for gains. Panel b shows the distribution of the individual coefficients. Panel c shows the individual loss aversion coefficients and Panel d their distribution

Panels c and d show the estimated loss aversion coefficients and their distribution. All subjects were loss averse (loss aversion coefficient > 1). Loss aversion was moderate with most loss aversion coefficients between 1.20 and 1.40 and the largest loss aversion coefficient equal to 1.77.

Figure 4 shows the results for discounting. Panels a and b show that for most subjects discounting was modest: the discount rate β was less than 20% and there were only a few outliers. Panels c and d show that most subjects deviated from constant discounting. For most subjects α was between 0.30 and 0.50, different from 0, the case of constant discounting. There were only seven subjects for whom α was between 0 and 0.10.

The individual generalized hyperbolic discounting parameters in the first experiment. Panel a shows the individual β parameters Panel b shows their distribution. Panels c and d show the individual α parameters (indicating deviations from constant discounting) and their distribution. Most values of α were clearly different from 0, the case of constant discounting

2.1.7 Sign-dependent discounting

The model fit improved significantly when we allowed α and β to differ for gains and losses (LR test statistic = 259.1, p-value < 0.001). Table 5 summarizes the results from the mixed-effects estimation and Fig. 5 shows the individual estimates of α and β and their distributions. The estimate of β was slightly lower for losses than for gains. Figure 5 shows that there was a close relationship between the discounting parameters β for gains and losses. The Pearson correlation was 0.70 and differed from zero (p-value < 0.001).

The individual discounting parameters for gains and losses in the first experiment. Panel a shows that the β coefficients were closely correlated for gains and losses and Panel b shows that their distributions were similar. Panel c shows that the α coefficients were uncorrelated and that they were higher for losses than for gains. Panel d shows that the distributions of the α coefficients differed between gains and losses and that the distribution for losses was to the right of the distribution for gains

The parameter α differed substantially between gains and losses. For gains, subjects deviated considerably less from constant discounting than for losses. Even for gains, however, most subjects had a value of α between 0.15 and 0.40, indicating that only a small fraction of subjects (between 10% and 20%) behaved according to constant discounting. Eq. (2) fitted significantly better than constant discounting (LR test, p-value < 0.001). Figure 5 suggests that the deviations from constant discounting that we observed at the aggregate level were not caused by a small number of outliers.

The Pearson correlation between α for gains and α for losses was low (0.07) and did not differ from zero (p-value = 0.56). This is surprising as one would expect that subjects who are more likely to deviate from constant discounting for gains are also more likely to deviate from constant discounting for losses. Perhaps it reflects that the estimation of α was relatively unstable.Footnote 4

2.1.8 Mixture model estimations

Table 6 shows the results of the mixture model estimation. About three quarters of our subjects (Type II in the table) had linear utility for gains, concave utility for losses, and rather modest discounting and loss aversion parameters. The remaining 25% (Type I in the Table) had concave utility both for gains and losses, and high discounting and loss aversion parameters. Both types deviated significantly from constant discounting, as witnessed by the estimated values of α, but the deviation was much more pronounced for the Type I subjects. One interpretation of these results is that the Type II subjects represent the more rational subjects, who deviate less from constant discounting, have reasonable discount rates, and only modest loss aversion. Type I subjects are more prone to irrationalities.

The mixture model estimation confirmed that there were few constant discounters in our sample. It also suggests that the degree of deviation from constant discounting and loss aversion were positively correlated. This is intuitively reasonable. Both a high value of α and a high value of λ imply deviations from what is often considered rational behavior in the sense that they give rise to preference reversals.

2.1.9 Other discount functions

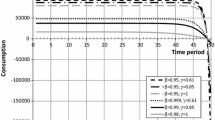

Table 7 shows the results for the different specifications of the discount function. The final rows show the importance of allowing for sign-dependence in discounting: it improved the fit of all functions.

Constant sensitivity fitted the data best. The difference in fit was significant for all other models except quasi-hyperbolic discounting and fixed-cost discounting. This suggests that the additional flexibility that the constant sensitivity function offers to model increasing impatience was valuable. Constant sensitivity reflects increasing impatience when b > 1. This happened, however, for only one subject. Constant sensitivity fitted better than constant absolute discounting, the other discount function that permits increasing impatience. Our estimates of quasi-hyperbolic discounting agree with those of Paserman (2008) for high-skilled workers, a group of subjects who resemble our university students.

Constant discounting was among the worst fitting models. Table 7 shows that mistakenly assuming constant discounting led to overestimations of the curvature of utility. Otherwise, the data on utility were consistent across the models: utility was linear for gains, slightly concave for losses, and loss aversion was moderate.

2.2 Second experiment

The aim of the second experiment was to check whether the conclusions from the first experiment remained valid when several changes were made in the experimental design. The main change was the use of real incentives. Because there are problems with letting subjects face real losses, the second experiment only involved gain questions and we could not check the impact of sign-dependence. We could, however, check whether the results for gains were similar to those of the first experiment. The other changes are explained below.

Subjects in the second experiment were 52 undergraduate students in management at Paris Descartes University. Two subjects were removed from the final analyses. The Paris experiment lasted for 45 min on average. Subjects were paid a participation fee of €10. In addition, each subject had a one in twenty chance to be selected to play out one of his choices for real. Subjects were informed that a random draw from an urn containing 20 balls (with one winning ball) would determine whether they could actually play out one of the questions for real. Three subjects drew a winning ball. This random incentive procedure has been commonly employed in experimental economics and evidence suggests that it generates the same responses as a procedure in which subjects are paid for certain (Bardsley et al. 2010).Footnote 5

If a subject was selected to play out one of his choices for real and he had chosen the immediate option for the selected choice question, the money was paid out immediately. If he had chosen the delayed option, the subject was asked to leave a permanent address (typically his parents’ address) and a sure email address. Subjects were told that they would be contacted 15 days before the payment was due.

2.2.1 Stimuli

The data of the second experiment were collected using personal interview sessions. By using personal interviews we hoped to improve the quality of the data. The elicitation process was similar to the first experiment except that the process continued until the difference between successive stimulus values was less than €2. We did not repeat the first choice as we learnt from the first experiment that choice reversals were very rare in the repeated choice.

We asked 25 questions in total (see Table 8). To better distinguish between the discounting models we increased the number of discounting questions from 5 to 20. Figure 6 shows the presentation of the questions. Again, subjects were asked to click on their preferred option and the program then zoomed in on their indifference value through a bisection process. To test for consistency, we repeated the third rounds of 3 randomly selected gain questions and of 8 randomly selected discounting questions.

2.2.2 Results

Consistency was high and even better than in the first experiment: in 97.3% of the choices the same choice was made. This higher consistency could be due to the use of real incentives, which has been found to reduce errors (Camerer and Hogarth 1999), but also to the use of personal interviews, which also increase data quality.

2.2.3 Aggregate results

Table 9 shows that the results of the mixed-effect estimation were similar to the results for gains in the first experiment (see Table 5), except for the discounting parameter β, which was much higher in the second experiment (z-test, p-value < 0.001). Utility was slightly convex, but the difference from linearity was only marginal (z-test, p-value = 0.09). The value of α differed marginally between the two experiments (z-test, p-value = 0.08). As in the first experiment, α differed from 0, the case of constant discounting (z-test, p-value < 0.001). Consistent with our findings on α, the likelihood ratio test also indicated that Eq. (2) fitted subjects’ preferences significantly better than constant discounting (LR test, p-value < 0.001).

2.2.4 Individual results

Figure 7 shows the individual data on utility. Most subjects had a slightly negative exponent, corresponding with slightly convex utility. However, the observed coefficients were close to zero, the case of linear utility.

Figure 8 shows the individual discounting parameters β and α. A comparison between Figs. 5 and 8 reveals that the distributions of β were clearly different between the two experiments (Kolmogorov-Smirnov test, p-value < 0.001). The distributions of the α coefficients did not differ between the two experiments (Kolmogorov-Smirnov test, p-value = 0.27). Between 20% and 40% of the subjects did not deviate much from constant discounting, as witnessed by the relatively low values of α. This proportion was comparable to the results for α+ in the first experiment.

2.2.5 Mixture model estimations

Table 10 shows the results of the mixture model estimation. Both types had convex utility and the main difference between the two types was in the discounting parameter β. The majority group (approximately two thirds of the sample) had a high discounting parameter. The α parameters were comparable for the two types. They differed from 0 indicating that both types deviated from constant discounting.

A comparison between the mixture model estimations between the two experiments reveals that the deviations from constant discounting were similar for Type II subjects in the Rotterdam experiment and both types of subjects in the Paris experiment. The β parameters differed, however (z-test, p-values < 0.01) and even though the discounting behavior of the Type I subjects in the Paris experiment resembled that of the Type II subjects in the Rotterdam experiment, their discounting parameter β was higher.

2.2.6 Other discount models

Table 11 shows the results of the estimation of the other discount functions, displayed in Table 3. Two-parameter discount functions (generalized hyperbolic, quasi-hyperbolic, fixed-cost, and constant sensitivity discounting) fitted the data better than one-parameter discount functions (constant discounting, proportional discounting, power discounting, and constant absolute discounting) even after adjusting for the number of degrees of freedom. This pattern was also present in the sign-dependent version of the first experiment but in the second experiment all differences were significant.

Generalized hyperbolic and constant sensitivity provided the best fit to the data. Both fitted significantly better than all other models except fixed-cost discounting. There was more increasing impatience in the second experiment: for 13 subjects (26%) the parameter b capturing it in the constant sensitivity model exceeded 1. Again, constant sensitivity was much better able to capture increasing impatience than constant absolute discounting.

3 Discussion

The main message of this article is that good descriptive models of intertemporal choice require sign-dependence. Moreover, we also found that they should be flexible enough to accommodate increasing impatience. These findings challenge the current practice in modeling discounting. The most popular discounting models used today, in particular quasi-hyperbolic discounting, ignore sign-dependence and do not allow for increasing impatience.

Our data were consistent with Loewenstein and Prelec’s (1992) assumptions that the shape of utility differs between gains and losses, that utility is more elastic for losses than for gains, and that people are loss averse. We also observed three deviations from their model. First, utility was not S-shaped but approximately linear for gains and concave for losses. This in turn implies that our data were not consistent with the assumption Loewenstein and Prelec imposed to explain the magnitude effect, that utility is more elastic for outcomes that are larger in absolute magnitude. However, the range of outcomes that we used may have been too small to detect the magnitude effect. Second, discounting was overall better described by the constant sensitivity discount function proposed by Ebert and Prelec (2007) than by Loewenstein and Prelec’s generalized hyperbola (Eq. 2). In the first experiment constant sensitivity fitted better, in the second experiment they fitted equally well. Third, to fully explain the difference in discounting between gains and losses, the discount function had to be sign-dependent. Allowing for sign-dependence of the discount function led to a significant improvement in the description of our subjects’ time preferences.

Deviations from constant discounting were more pronounced for losses than for gains, as witnessed by the higher estimates of the parameter α in Eq. (2). There exists some evidence that preferences for losses are more complex than preferences for gains (de Lara Resende and Wu 2010; Dickhaut et al. 2003) and this additional complexity may have led to more deviations from constant discounting.

Most empirical studies on time preference assumed linear utility. Our data suggest that at the aggregate level this assumption approximately holds for gains and is unlikely to cause biases. At the individual level there is considerable heterogeneity and some subjects deviated strongly from linear utility. For losses, we found utility curvature both at the aggregate and at the individual level. This and the moderate loss aversion that we observed suggest that in intertemporal decision problems involving both gains and losses, such as investment projects, assuming linear utility and ignoring loss aversion may introduce distortions.

The observed linearity of the utility for gains was not due to subjects simply adding the amounts in the different temporal prospects and then choosing the prospect with the highest total value. We checked whether our data were consistent with this hypothesis, but we could reject it. Moreover, our findings of linear utility for gains are consistent with those of Abdellaoui et al. (2010) who explicitly controlled for the heuristic of simply adding money amounts.

Our conclusions were similar in the first experiment, using hypothetical choices, and in the second experiment, using real incentives. The only differences that we observed were the estimate of the discounting parameter β and the number of subjects who were increasingly impatient, which were both higher in the experiment with real payoffs. Perhaps subjects considered future real payoffs uncertain and this may have increased their discounting parameter. Anderson and Stafford (2009) also observed that uncertain future rewards tend to increase discount rates. Halevy (2008) and Epper and Fehr-Duda (2012) provided arguments why uncertainty increases discount rates. On the other hand, Eckel et al. (2010) found no relationship between the degree of trust subjects have in actually receiving a future payment and their attitudes towards impatience. None of our subjects expressed doubt about receiving payment in the personal interviews. Finally, even when subjects applied higher discount rates to account for the uncertainty of future rewards, this does not affect our main conclusion that models of intertemporal choice should be able to capture both sign-dependence and increasing impatience.

4 Conclusion

The development of alternative models to explain intertemporal choice behavior has proved to be a fruitful area of research and many new models have been proposed over the past decade. Most of these models focus on the explanation of decreasing impatience and ignore the other deviations from constant discounting that have been observed empirically. We concluded that allowing for sign-dependence in intertemporal choice substantially improved the description of people’s time preferences. Moreover, the discount function should be flexible enough to allow for increasing impatience. The reference-dependent model of Loewenstein and Prelec (1992) with the constant sensitivity discount function of Ebert and Prelec (2007) provided the best fit to our data. As we have shown, this model is tractable and can easily be measured, and therefore it offers a promising account of the way people deal with the future.

Notes

Moreover, their econometric analysis did not allow for a complete comparison between the descriptive performance of Loewenstein and Prelec’s generalized hyperbolic discount function and that of other discount functions that have been proposed as alternatives to constant discounting.

Akaike’s information criterion (AIC) is defined as −2 logL + 2 k where k is the number of parameters to be estimated. A better fit (higher likelihood) thus corresponds with a smaller value of the AIC.

Drazen Prelec (personal communication) has experienced similar problems in estimating α.

Baltussen et al. (2012) showed that different responses may occur in more complex tasks than those of this paper.

References

Abdellaoui, M., Attema, A. E., & Bleichrodt, H. (2010). Intertemporal tradeoffs for gains and losses: an experimental measurement of discounted utility. Economic Journal, 120, 845–866.

Abdellaoui, M., Bleichrodt, H., l’Haridon, O., & Paraschiv, C. (2013). Is there one unifying concept of utility? an experimental comparison of utility under risk and utility over time. Management Science, 59, 2153–2169.

Abdellaoui, M., Bleichrodt, H., & Paraschiv, C. (2007). Measuring loss aversion under prospect theory: a parameter-free approach. Management Science, 53, 1659–1674.

Andersen, S., Harrison, G. W., Lau, M. I., & Rutström, E. E. (2008). Eliciting risk and time preferences. Econometrica, 76, 583–618.

Anderson, L. R., & Stafford, S. L. (2009). Individual decision-making experiments with risk and intertemporal choice. Journal of Risk and Uncertainty, 38, 51–72.

Arrow, K. J. (1951). Alternative approaches to the theory of choice in risk-taking situations. Econometrica, 19, 404–437.

Attema, A. E., Bleichrodt, H., Rohde, K. I. M., & Wakker, P. P. (2010). Time-tradeoff sequences for analyzing discounting and time inconsistency. Management Science, 56, 2015–2030.

Baltussen, G., Post, G. T., Van den Assem, M. J., & Wakker, P. P. (2012). Random incentive systems in a dynamic choice experiment. Experimental Economics, 15, 418–443.

Bardsley, N., Cubitt, R., Loomes, G., Moffatt, P., Starmer, C., & Sugden, R. (2010). Experimental economics: Rethinking the rules. Princeton: Princeton University Press.

Baucells, M., & Heukamp, F. (2011). Probability and time tradeoff. Management Science, 58, 831–842.

Benhabib, J., Bisin, A., & Schotter, A. (2010). Present-bias, quasi-hyperbolic discounting, and fixed costs. Games and Economic Behavior, 69, 205–223.

Benzion, U., Rapoport, A., & Yagil, J. (1989). Discount rates inferred from decisions: an experimental study. Management Science, 35, 270–284.

Bleichrodt, H., Rohde, K. I. M., & Wakker, P. P. (2009). Non-hyperbolic time inconsistency. Games and Economic Behavior, 66, 27–38.

Bostic, R., Herrnstein, R. J., & Luce, R. D. (1990). The effect on the preference reversal of using choice indifferences. Journal of Economic Behavior and Organization, 13, 193–212.

Bruhin, A., Fehr-Duda, H., & Epper, T. (2010). Risk and rationality: uncovering heterogeneity in probability distortion. Econometrica, 78, 1372–1412.

Camerer, C. F., & Hogarth, R. M. (1999). The effects of financial incentives in experiments: a review and capital-labor-production framework. Journal of Risk and Uncertainty, 19, 7–42.

Chesson, H. W., & Viscusi, W. K. (2003). Commonalities in time and ambiguity aversion for long-term risks. Theory and Decision, 54, 57–71.

Coller, M., & Williams, M. (1999). Eliciting individual discount rates. Experimental Economics, 2, 107–127.

de Lara Resende, J. G., & Wu, G. (2010). Competence effects for choices involving gains and losses. Journal of Risk and Uncertainty, 40, 109–132.

DellaVigna, S. (2009). Psychology and economics: evidence from the field. Journal of Economic Literature, 47, 315–372.

DellaVigna, S., & Malmendier, U. (2006). Paying not to go to the gym. American Economic Review, 96, 694–719.

Dickhaut, J., McCabe, K., Nagode, J. C., Rustichini, A., Smith, K., & Pardo, J. V. (2003). The impact of the certainty context on the process of choice. Proceedings of the National Academy of Sciences of the United States of America, 100, 3536–3541.

Ebert, J. E. J., & Prelec, D. (2007). The fragility of time: time-insensitivity and valuation of the near and far future. Management Science, 53, 1423–1438.

Eckel, C., Grossman, P., Johnson, C., De Oliveira, A., Rojas, C., Wilson, R. (2010). (Im) patience among adolescents: A methodological note. Available at SSRN: http://ssrn.com/abstract=1883745 or doi:10.2139/ssrn.1883745.

Epper, T. & Fehr-Duda, H. (2012). The missing link: Unifying risk taking and time discounting. University of Zurich Department of Economics Working Paper.

Epper, T., Fehr-Duda, H., & Bruhin, A. (2011). Viewing the future through a warped lens: why uncertainty generates hyperbolic discounting. Journal of Risk and Uncertainty, 43, 169–203.

Fishburn, P. C. (1989). Retrospective on the utility theory of von Neumann and Morgenstern. Journal of Risk and Uncertainty, 2, 127–158.

Frederick, S., Loewenstein, G. F., & O’Donoghue, T. (2002). Time discounting and time preference: a critical review. Journal of Economic Literature, 40, 351–401.

Halevy, Y. (2008). Strotz meets Allais: diminishing impatience and the certainty effect. American Economic Review, 98, 1145–1162.

Harvey, C. M. (1986). Value functions for infinite period planning. Management Science, 32, 1123–1139.

Herrnstein, R. J. (1981). Self-control as response strength. In C. M. Bradshaw, E. Szabadi, & C. F. Lowe (Eds.), Quantification of steady-state operant behavior. Amsterdam: Elsevier/North Holland.

Kahneman, D., & Tversky, A. (1979). Prospect theory: an analysis of decision under risk. Econometrica, 47, 263–291.

Köbberling, V., & Wakker, P. P. (2005). An index of loss aversion. Journal of Economic Theory, 122, 119–131.

Köszegi, B., & Rabin, M. (2006). A model of reference-dependent preferences. Quarterly Journal of Economics, 121, 1133–1166.

Laibson, D. (1997). Golden eggs and hyperbolic discounting. Quarterly Journal of Economics, 112, 443–477.

Laibson, D., Repetto, A., Tobacman, J. (2007). Estimating discount functions with consumption choices over the lifecycle. Working Paper.

Laury, S. K., McInnes, M. M., & Swarthout, J. T. (2012). Avoiding the curves: direct elicitation of time preferences. Journal of Risk and Uncertainty, 44, 181–217.

Loewenstein, G. F. (1987). Anticipation and the valuation of delayed consumption. Economic Journal, 97, 666–684.

Loewenstein, G. F., & Prelec, D. (1992). Anomalies in intertemporal choice: evidence and an interpretation. Quarterly Journal of Economics, 107, 573–597.

Luce, R. D., & Raiffa, H. (1957). Games and decisions. New York: Wiley.

Manzini, P., & Mariotti, M. (2009). Choice over time. In P. Anand, P. K. Pattanaik, & C. Puppe (Eds.), The handbook of rational & social choice (pp. 239–270). Oxford: Oxford University Press.

Novemsky, N., & Kahneman, D. (2005). The boundaries of loss aversion. Journal of Marketing Research, 42, 119–128.

Paserman, M. D. (2008). Job search and hyperbolic discounting: structural estimation and policy evaluation. Economic Journal, 118, 1418–1452.

Phelps, E. S., & Pollak, R. A. (1968). On second-best national savings and game-equilibrium growth. Review of Economic Studies, 35, 185–199.

Prelec, D., & Loewenstein, G. F. (1991). Decision making over time and under uncertainty: a common approach. Management Science, 37, 770–786.

Rieskamp, J., Busemeyer, J. R., & Mellers, B. A. (2006). Extending the bounds of rationality: evidence and theories of preferential choice. Journal of Economic Literature, 44, 631–661.

Rohde, K. I. M. (2010). The hyperbolic factor: a measure of time inconsistency. Journal of Risk and Uncertainty, 41, 125–140.

Rubinstein, A. (2003). Economics and psychology? The case of hyperbolic discounting. International Economic Review, 44, 1207–1216.

Samuelson, P. A. (1938). A note on the pure theory of consumer’s behaviour. Economica, 5(61–71), 353–354.

Sayman, S., & Öncüler, A. (2009). An investigation of time-inconsistency. Management Science, 55, 470–482.

Scholten, M., & Read, D. (2006). Discounting by intervals: a generalized model of intertemporal choice. Management Science, 52, 1424–1436.

Stott, H. P. (2006). Cumulative prospect theory’s functional menagerie. Journal of Risk and Uncertainty, 32, 101–130.

Sugden, R. (2003). Reference-dependent subjective expected utility. Journal of Economic Theory, 111, 172–191.

Takeuchi, K. (2011). Non-parametric test of time consistency: present bias and future bias. Games and Economic Behavior, 71, 456–478.

Thaler, R. H. (1981). Some empirical evidence on dynamic inconsistency. Economics Letters, 8, 201–207.

Thaler, R. H., & Johnson, E. J. (1990). Gambling with the house money and trying to break even: the effects of prior outcomes on risky choice. Management Science, 36, 643–660.

Tu, Q. (2004). Reference points and loss aversion in intertemporal choice. doi:10.2139/ssrn.644142.

Tversky, A., & Kahneman, D. (1992). Advances in prospect theory: cumulative representation of uncertainty. Journal of Risk and Uncertainty, 5, 297–323.

Wakker, P. P. (2010). Prospect theory: For risk and ambiguity. Cambridge: Cambridge University Press.

Wakker, P. P., & Deneffe, D. (1996). Eliciting von Neumann-Morgenstern utilities when probabilities are distorted or unknown. Management Science, 42, 1131–1150.

Zank, H. (2010). On probabilities and loss aversion. Theory and Decision, 68, 243–261.

Acknowledgments

Thomas Epper, Peter P. Wakker, the editor W. Kip Viscusi, and an anonymous referee gave helpful comments. Arthur E. Attema and Corina Paraschiv helped to collect the data. Christina Stoddard suggested many linguistic improvements. Han Bleichrodt’s research was supported by a grant from the Netherlands Organization for Scientific Research (NWO).

Author information

Authors and Affiliations

Corresponding author

Appendix. Comparison of goodness of fit of the different discount functions

Appendix. Comparison of goodness of fit of the different discount functions

The following three tables show the values of the test statistics of the likelihood ratio tests (in light grey) and the Vuong tests for comparing the goodness of fit of the various discount functions. A positive value indicates that the model mentioned in the column fits better than the model mentioned in the row. A negative value means that the row model fits better than the column model. The p-values are stated in parentheses.

Rights and permissions

About this article

Cite this article

Abdellaoui, M., Bleichrodt, H. & l’Haridon, O. Sign-dependence in intertemporal choice. J Risk Uncertain 47, 225–253 (2013). https://doi.org/10.1007/s11166-013-9181-9

Published:

Issue Date:

DOI: https://doi.org/10.1007/s11166-013-9181-9