Abstract

Many decisions require tradeoffs over time and in the presence of risk. To examine interactions between risk and intertemporal effects we developed a laboratory experiment. In the experiment, subjects choose between payoffs that take place at different points in time. We find that very few subjects are consistently risk averse or risk loving. Instead, we find that subjects are less patient in the presence of risk. We also find that increased risk decreases subjects’ patience levels. However, we do not find evidence that the effect of risk on the intertemporal decision depends on the length of the temporal delay.

Similar content being viewed by others

Avoid common mistakes on your manuscript.

Many questions of interest to policy makers involve decisions with risk and with tradeoffs over time. These questions are frequently evaluated using two classic economic theories of decision making: Von Neumann and Morgenstern’s (1947) expected utility theory of choice under uncertainty, and Samuelson’s (1937) discounted utility theory of intertemporal decision making. Due to the widespread use of these models, a number of researchers have separately studied their predictive power with respect to decision making in the presence of risk and to intertemporal choice. However, examining risk and intertemporal effects individually ignores potential interactions between the two. Although only a few empirical studies have combined intertemporal choice with risk, there is evidence that such interactions may exist.

Empirical analyses of decision making with risk have been hindered by the fact that it is difficult to measure and control risk in naturally occurring situations. Laboratory experiments provide an ideal environment to study individual decision making because the nature and degree of the risk can be observed and manipulated. The experimental literatures on choice with risk and intertemporal choice are relatively well developed. Experiments on choice with risk are quite varied with different experimental procedures, subject pools (e.g., humans versus animals), and types of rewards (e.g., real versus hypothetical payoffs). The results of this research have established a number of empirical regularities including the Allais and Ellsberg paradoxes, preference reversals, and framing effects such as gain/loss asymmetry.Footnote 1 The experimental studies on intertemporal choice are primarily designed to elicit discount rate information and provide insight into the question of whether choices exhibit dynamic consistency. Frederick et al. (2002) provide a comprehensive review of this experimental literature. The experiments vary in terms of the procedure used to elicit discount rates, the types of payoffs (e.g., monetary rewards versus goods), and whether the payoffs are real or hypothetical. One of the main findings from this survey is that intertemporal preferences cannot be characterized by a constant discount rate.

The experimental literature on intertemporal choice with risk, in contrast to the research areas discussed above, is relatively limited.Footnote 2 The majority of the studies that do exist are non-temporally extended experiments that ask subjects to make decisions between options at two different points in time, knowing that the choices are hypothetical and the outcomes will never be realized. For example, Keren and Roelofsma (1995) present subjects with a hypothetical choice between payoffs at two points in time. For one set of subjects the payoffs are certain, and for a second set the payoffs are probabilistic. The authors find that when the choices are in the “imminent future” (on the day of the experiment or 4 weeks later), subjects faced with certain payoffs are more likely to choose the smaller but more immediate payoff. However, as the probability of receiving the payoff decreases, fewer subjects choose the more immediate payoff. When choices are in the “remote future” (26 or 30 weeks from the day of the experiment), subjects are more likely to choose the later payoff and the introduction of risk does not appear to have a significant effect on the subjects’ choices.

Albrecht and Weber (1997) also examine risky intertemporal decision making using hypothetical choices. Subjects first complete a matching task. Each subject is presented with a lottery that will take place in the future at time t. Subjects must then identify the certain amount X to be received at time t which makes them indifferent to the lottery. Next, subjects must identify the certain amount to be received immediately which makes them indifferent to receiving X at time t. The same subjects then complete a choice task where they choose between lotteries at two different points in time. The authors find that in the matching task, discount rates are higher for the short term than the long term both for certainty and risk. Additionally they find that risky outcomes are discounted less than certain outcomes in the matching task. However, in the choice task they do not find any significant difference either for short versus long term or certain versus risky outcomes.

Öncüler (2000) asks subjects to complete a hypothetical matching task between (1) certain options at different points in time, (2) risky options at different points in time, and (3) certain and risky options at the same point in time. She finds that the introduction of risk has less effect on future decisions than on immediate decisions. However, unlike Keren and Roelofsma (1995) and Albrecht and Weber (1997), she also finds that risky options are discounted more heavily than certain ones. Additionally, Öncüler finds that there is an interaction between time and risk which leads to higher discounting of the future than would occur if the two effects of time and risk were independent of each other.

Unlike the other intertemporal experiments discussed above, Chesson and Viscusi (2000) introduce risk in the payment date, rather than in the amount of the payment. Subjects choose between receiving a fixed amount of money at a certain future date t or playing a lottery to determine whether the money will be paid at a date earlier than t or later than t. In addition subjects report a fixed payment amount that makes them indifferent between the certain payment date and the risky payment date. The authors report that discount rates are lower for subjects who are offered payments in 5 or 25 years compared to 1 or 5 years. In addition, there is considerable heterogeneity in discount rates across subgroups of the population, including the unexpected finding that smokers have lower discount rates than non-smokers.

To our knowledge, only one existing study includes real rather than hypothetical decisions and incorporates real time delays. Anderhub et al. (2001) investigate the interaction between risk and time preferences. In their design, subjects are offered a lottery with a 50:50 chance of a high/low payoff compared to a certain immediate payoff. This experiment also includes a risky payoff date. The lottery is paid in one of three possible time periods: immediately, in 4 weeks, or in 8 weeks, with each possible time period occurring with a probability of 1/3. There are two treatments, one in which subjects are endowed with the lottery and express the minimum certain price at which they are willing to sell it and one in which subjects receive an initial cash endowment and express the maximum price at which they are willing to buy the lottery. Subjects’ certainty equivalents for each time period are elicited using the Becker et al. (1964) random price mechanism. Each subject’s payoff depends on his decision as well as the realization of both the time period and lottery uncertainty. Post-dated checks, a common practice in Israel, are used to convey future payments if necessary. Since checks are written the day of the experiment, the lottery is played on the day of the experiment. The authors find that there is a statistically significant correlation between subjects’ degree of risk aversion and discount rate. In particular, subjects with a high degree of risk aversion discount the future more heavily. However, given the experimental design, the authors cannot say anything about the effect that introducing risk or increasing the level of risk has on intertemporal decisions.

Our paper contributes to the literature on intertemporal decision making with risk by combining important features from previous experiments with real consequences and a temporal delay. Our design differs from Anderhub et al. (2001) in several important ways. First, there is no uncertainty about the timing of the future payments although we do vary the temporal delay across experimental treatments. Second, subjects do not have the option to choose an immediate payoff, rather they must choose between payoffs at two future dates. Third, subjects do not learn the outcome of the lottery until the payment date, thus, both the payment and the risk resolution are delayed.Footnote 3 Fourth, as discussed in more detail in the next section, we vary whether risk is present in both of the future options. Finally, we vary the level of risk in the lotteries presented to subjects. The resulting experimental design allows us to examine the effect of time on decision making when outcomes are uncertain, and in particular to examine whether there are interactions between risk and intertemporal effects.

We find that many subjects do not appear to have consistent risk preferences; that is, these subjects appear to be risk averse at some times, but risk preferring at other times. Rather, we find that the presence of risk in an intertemporal decision makes subjects less patient in general, regardless of when the risk occurs. We also find that an increased degree of risk decreases subjects’ patience levels. However, we do not find conclusive evidence that the effect of risk on subjects’ patience levels varies significantly with the length of the temporal delay. Our results suggest that there are important interactions between risk and intertemporal effects that need to be accounted for both in empirical and theoretical models of intertemporal decision making in the presence of risk. We believe that further laboratory experiments can play a valuable role in determining more explicitly what those interactions are. The next section of this paper describes our experimental design, Section 2 presents the results of our experiment, and Section 3 provides some conclusions.

1 Experimental design and procedures

Subjects in this experiment are asked to make a choice between two payment options for a set of 25 scenarios. Each scenario asks subjects to choose between Option A, which will be paid 2 weeks from the date of the experiment, and Option B, which will be paid in 2 weeks + n days.Footnote 4 The structure of the two payment options varies across scenarios but the timing (n) does not. The 2-week delay between the date of the experimental session and the first payment date is included to control for the “immediacy effect” described by Keren and Roelofsma (1995).Footnote 5 The immediacy effect occurs if outcomes later in time are perceived as less certain and thus the imminent future receives a disproportionate weight in the evaluation process. It is important to control for this effect as Öncüler (2000) hypothesizes that it may be the source of the discrepancy in existing experimental results on intertemporal decision making with risk. Additionally Coller et al. (2003) note that there may be transactions costs involved with delayed payments that are not present with immediate ones. To ensure that transactions costs are as similar as possible across the two payment options, both future payment days occur at the same time and on the same day of the week. Also, because the subject pool is drawn from students at the College of William and Mary, payment dates do not occur on weekends or holidays and both payment dates occur within the same academic semester.

To provide a baseline for each subject, the first five scenarios ask subjects to choose between certain payment options. The remaining scenarios ask subjects to choose between:

-

○ A certain Option A and a risky Option B;

-

○ A risky Option A and a certain Option B; and

-

○ A risky Option A and a risky Option B.

Risk is modeled using an Ellsberg urn design.Footnote 6 The urn contains a known distribution of colored markers and each color corresponds to a different known payment. Subjects are paid based on the color of the marker they draw from the urn. For example, a 50:50 lottery between $18 and $22 would be represented by an Ellsburg urn containing 100 markers, 50 of which are red and 50 of which are blue. If the subject draws a red marker, she will receive $18 and if the subject draws a blue marker she will receive $22. For each risky option, subjects are told both the composition of the urn, that is the number of markers of each color in the urn, and the payment options associated with each color marker. A complete set of instructions and the scenario options used in one of the experimental treatments is presented in Appendix A.

Option A always has a certain or expected value of $20. All of the Option B lotteries have expected values equivalent to one of the certain values offered in the first five scenarios. Therefore we can compare any decision that includes a risky option to a decision that is identical except that the risky option has been replaced by a certain option. This holds when both options are risky as well. For example, if there is a scenario with an Option A lottery with an expected value of $20 and an Option B lottery with an expected value of $22, there are also scenarios with (1) a certain Option A payment of $20 and a certain Option B payment of $22; (2) a certain Option A payment of $20 and an Option B lottery with an expected value of $22; and (3) an Option A lottery with an expected value of $20 and a certain Option B payment of $22.

Given the time requirements for conducting the experiments, we chose to use three different temporal extensions: 14, 28, and 56 days. For each temporal extension, we conducted six experimental sessions. The session sizes ranged from eight to 13 subjects with a total of 183 subjects participating in these experiments. For the experiments with a 14 day extension, we used two different questionnaires which differ from each other only in the dollar values offered to subjects for Option B. Similarly we had two treatments for the experiments with a 28 day extension that are identical in all respects except for the Option B payment amounts. However, all of the 56 day experiments used the same questionnaire.Footnote 7

Sessions began with the experimenter reading the instructions aloud. Subjects then completed an on-line questionnaire with 25 decision-making scenarios and five demographic questions.Footnote 8 In all sessions the 25 scenarios were listed in the same order on the computer screen. One concern with presenting the 25 scenarios to all subjects in the same order is that the precise order of the choices might bias decision making. To minimize order biases, subjects saw all of the scenarios at once, and they were told that they could make the 25 decisions in any order and change them as much as they wished (see instructions in Appendix A). Anecdotally, we observed many subjects skipping around the questionnaire rather than moving down the list of scenarios as presented. Furthermore, subjects made all 25 decisions without any feedback about the outcomes of the lotteries.Footnote 9

Subjects were paid $5 on the day of their experimental session as a participation fee. In addition, at the end of the experimental session we randomly selected one of the 25 scenarios by drawing a numbered ball from a container containing 25 numbered balls. The lottery was only played for the one scenario selected at random, and subjects were paid based on their decision for that selected scenario.Footnote 10 Thus subjects had to return on one of the two payment days to receive the amount indicated. If the option selected was risky, the risk was resolved on the payment day. To minimize any credibility concerns on the part of subjects in the experiment, we stressed in the instructions that the payments students would receive were “personally guaranteed by Professors Anderson and Stafford of the William and Mary Economics Department,” at least one of whom was present for each session of the experiment. In addition, at the end of the session each student was given a “payment certificate” that was signed by both professors and indicated the amount to be collected (or the lottery that would be conducted) and the date and time for collection for the payment option selected. The initial experimental sessions took 30 to 45 min and each payment session took 5 min.

2 Results

2.1 Results for certain scenarios

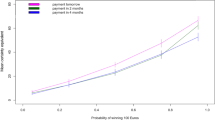

In each session, the first five scenarios presented to subjects were choices between a certain payment of $20 in 2 weeks (Option A) and a certain payment of $X in 2 weeks plus n days (Option B). The results for the certain scenarios help to set a baseline for subjects in terms of their time preferences. Figure 1 shows the percentage of subjects in each treatment that chose the later option, Option B, in the certain scenarios. As expected, the percentage of subjects choosing Option B increases as the value of Option B increases. Also as expected, the percentage of subjects choosing Option B for a given value is generally smaller the longer the temporal delay between the two options. While not all of the differences across temporal extension are statistically significant, a number of them are, as is shown in Table 1.Footnote 11 However, the two 14-day treatments and the two 28-day treatments do not differ significantly from each other in terms of the percentage of subjects choosing Option B for a given value.Footnote 12

Table 2 presents additional data from the certain scenarios that we used to establish a baseline for subjects’ behavior. For each treatment, the table shows the total number of subjects, and the percentage of subjects in each treatment that always chose Option A, always chose Option B, or switched between Options A and B. For those subjects that switched from Option A to Option B the table also shows the average value of Option B that induced the switch and the average daily interest rate associated with that switch. Although the Average Daily Interest Rates (ADIR) for the 14.1 and 14.2 treatments are not statistically different from each other, they are statistically different from the ADIRs for all other treatments.Footnote 13 The ADIRs for the 28.1 and 28.2 treatments are also statistically different from each other, but are not statistically different from the ADIR for the 56 day treatment.

To better understand the factors that affect the decision-making process when there is no risk, we conducted a probit analysis of the decision to choose Option A for those scenarios in which there is no risk. Let \(a_{it}^* \) represent the utility that subject i receives from choosing Option A instead of Option B for scenario t and let \(a_{it} \) represent a binary variable indicating the observed outcome of subject i’s decision for scenario t. That is, if subject i chooses Option A then \(a_{it} = 1\) and \(a_{it}^* >0\). Because each subject makes multiple decisions, we use a random effects probit that allows the error terms to be correlated for an individual subject, but requires that the error terms across subjects are uncorrelated.Footnote 14 Thus the latent variable \(a^{*}_{{it}} = x\prime _{{it}} \beta _{{}} + \upsilon _{i} + \varepsilon _{{it}} \) where \(x_{it} \) denotes the vector of explanatory variables, \(\beta \) is the coefficient vector to be estimated, and \(\upsilon _i \) and \(\varepsilon _{it} \) are independent error terms with \(\upsilon _i \)∼ N(0,\(\sigma _\upsilon ^2 \)) and \(\varepsilon _{it} \)∼ N(0,1). We obtained maximum likelihood estimates for the random effects probit model using the xtprobit command in Stata.Footnote 15

As shown in Table 3, the higher the Average Daily Interest Rate (ADIR), the lower the probability that Option A is selected. However, the effect of the ADIR is not always consistent across the experimental treatments, as shown by the statistically significant coefficient on ADIR*28 Day Extension. The coefficient on ADIR*56 Day Extension is not significant, which might be due in part to the fact that ADIR*56 Day Extension and Option B Value are highly correlated.Footnote 16 Additionally, there is a positive and significant coefficient on the 28 Day Extension variable. Although the positive coefficient on the 56 Day Extension dummy is not significant, the magnitudes of the coefficients on the temporal extension dummies are consistent with our prior expectations that the longer the temporal extension, the less willing participants would be to wait to receive the Option B payment.

Note that the value of the Option B offering, Option B Value, does not significantly affect the probability that Option A is chosen. Additionally, although there are statistically significant differences between the ADIR that induced subjects to switch from Option A to Option B in treatments 14.1 and 14.2, the insignificant coefficient on Option B % of Maximum suggests that subjects’ choices were not influenced by the maximum value that was presented to them. It could be the case that the differences were due to demographic difference in the subject pools, as Science Major has a statistically significant coefficient. Finally, note that ρ which represents the coefficient of correlation between choices from the same individual is significantly different from zero, indicating that it is necessary to allow for correlated error terms across a given subject’s choices.Footnote 17

2.2 Results when risk is introduced

Scenarios 6 through 25 presented subjects with at least one risky payment option. Table 4 summarizes how subjects responded to the introduction of risk into the payment options. First note that in all of the treatments a number of subjects chose Option B for all 25 scenarios. The remaining subjects chose Option A for at least one scenario and Option B for at least one scenario.Footnote 18 For these subjects, we first determined whether their choices were consistent with discounted expected utility theory, that is whether their choices exhibited intertemporal certainty equivalence. For example, consider a subject who chose $24 dollars in 4 weeks over $20 in 2 weeks. If that subject also chose a 50:50 lottery between $22 and $26 (a $24 expected value) in 4 weeks over $20 in 2 weeks, her actions would be consistent with certainty equivalence. Alternatively, if she chose $20 in 2 weeks over a 50:50 lottery between $22 and $26 in 4 weeks, her actions would be inconsistent with certainty equivalence.

If a subject’s preferred option was always the same for scenarios with the same expected Option A and Option B values, we classified that subject’s choices as consistently exhibiting intertemporal certainty equivalence. The number of subjects in each treatment whose choices alternated between Options A and B and who exhibited behavior that was consistent with intertemporal certainty equivalence is shown in Table 4.Footnote 19 Note that for most of the treatments, relatively few subjects’ behavior was consistent with intertemporal certainty equivalence. This result is not necessarily surprising, as subjects with either a preference or aversion to risk would be likely to change their payment choice when risk is introduced.

For those subjects whose behavior was not consistent with certainty equivalence, we next examined their decisions to determine whether we could identify a particular taste for risk. First, we analyzed how each subject’s choices changed when risk was introduced into Option A alone. If a subject switched her choice from A to B when risk was introduced into Option A compared to her choice for the analogous certain scenario, we classified that change as an aversion to risk. Alternatively, if a subject switched her choice from B to A when risk was introduced into Option A, we classified that change as a preference for risk. Similarly, we analyzed how each subject’s choices changed when risk was introduced into Option B alone, classifying all changes as either an aversion to or preference for risk. Finally, we determined whether a subject’s changes exhibited only risk aversion, exhibited only risk preference, or exhibited both. The number of subjects that fall into each of these three categories is presented in Table 3. The last category in this table, “Other,” includes subjects who do not exhibit complete certainty equivalence, but only make changes in their choices when risk is introduced into both options. While each treatment has some subjects that appear to prefer risk and some subjects that appear averse to risk, in all treatments a significant number of subjects appear to be risk averse at some times, but risk preferring at other times. This suggests that in an intertemporal context, risk preferences alone may not be sufficient to explain an individual’s choice.

To better understand how the introduction of risk affects subject’s choices, we conducted a random effects probit regression of the choice of Option A using the full data set. As shown in Table 5, we added a number of variables to the regression we conducted for the certain scenarios to capture different aspects of the risky options presented to subjects. The results for Average Daily Interest Rate (ADIR), ADIR*28 Day Extension, and ADIR*56 Day Extension are consistent with the results we obtained in the regression conducted on certain scenarios alone. Also note that the results for 28 Day Extension and 56 Day Extension are consistent with the results in Table 3 except that in this regression, both of the coefficients are significant. Thus the longer the temporal extension, the less likely participants are to choose Option B.

Now consider the results for Risk in Option A. The coefficient is positive and significant indicating that the presence of risk in the early option (Option A) makes subjects more likely to pick it. Note that the coefficient on Risk in Option B is also positive and significant suggesting that a risky later option (Option B) also makes subjects more likely to pick the early option (Option A). Finally, the coefficient on Both Options Risky is also positive and significant. Thus, introducing risk in either option makes subjects more likely to choose the early option. More specifically, risk appears to make subjects less patient regardless of which option is risky. This is consistent with Elster and Lowenstein’s (1992) hypothesis that individuals may have a more difficult time assessing the utility of a future risky event than a future certain event, so that the anticipated utility of delayed consumption is lower for risky options than for certain options. Our results are also consistent with Öncüler’s (2000) results using hypothetical gambles, but are the opposite of Keren and Roelofsma (1995) and Albrecht and Weber’s (1997) finding that risky options are discounted less than certain outcomes.

To capture the level of risk, we included Option A Standard Deviation and Option B Standard Deviation in the regression. When an option is not risky, the standard deviation of the option is zero. If the option is risky, the variable measures the standard deviation of the lottery. For example, a 50:50 lottery between $18 and $22 has a standard deviation of 2.8 while a 75:25 lottery between $16 and $32 has a standard deviation of 9.8.Footnote 20 The higher the standard deviation, the greater the risk presented in the lottery. The coefficients on both Option A Standard Deviation and Option B Standard Deviation are positive and significant. These results show that higher levels of risk are associated with a higher probability of choosing the earlier option, regardless of whether the risk occurs in the earlier or later option. In this regression, the only demographic variable that has a significant coefficient is Smoker. The positive sign on this coefficient is consistent with many theories about the causes of smoking but is the opposite of what Chesson and Viscusi (2000) find.

To determine whether there are significant interactions between risk and the length of the temporal delay, we amended the random effects probit to include such interactions. As shown in Table 6, we interacted the Risk in Option A, Risk in Option B, and Both Options Risky variables with the 28 Day Extension and 56 Day Extension variables. While none of the coefficients on these interactions are significant, the qualitative results for all the other variables are essentially the same as those reported in Table 5. Thus, while the probability of choosing Option A is significantly related to the presence of risk, there is no conclusive evidence that the effect of risk on an individual’s decision depends on the time between the two payment options.

2.3 Robustness checks

We conducted two additional treatments to check the robustness of our results to the experimental design. First, to test the robustness of our results to the length of the front-end delay (FED), we ran a set of experiments that were identical to the 14.2 experiments except for the timing of the two payment options: Option A was paid on the day following the experiment, rather than 2 weeks after the experiment, and Option B was paid 15 days after the experiment, rather than 28 days. Rather than having a front-end delay of 2 weeks, in the Short FED treatment, there was only a delay of one day. Note that both options still require the student to come back on a day different from the day of the experiment and the two options are paid on the same day of the week so that the transactions costs should be equal for both of the two options. To determine whether the shortened FED had any effect on the subjects’ choices, we compared the choices for each scenario in the Short FED treatment to the choices in the 14.2 treatment using a two-tail Fisher Exact Probability test. As shown in Table 7, there are no statistically significant differences in the probability of choosing Option A at the 95% confidence level.Footnote 21 Additionally, when we included the observations from the Short FED treatment in a random effects probit regression identical to that reported in Table 5 with the addition of a Short FED indicator variable, the coefficient on Short FED was not significant.

To test the robustness of our results to the absolute level of our payment options, we ran a set of experiments that were identical to the 14.1 experiments except that all of the payoffs were increased by a factor of three. In particular, the timing of the payment options in this High Payoff treatment was identical to the timing of the payment options in the 14.1 treatment. We also compared the choices for each scenario in the High Payoff treatment to the choices in the 14.1 treatment using a two-tail Fisher Exact Probability test. There was only one scenario where there was a statistically significant difference in the probability of choosing Option A at the 95% confidence level.Footnote 22 Next we included the observations from the High Payoff treatment in a random effects probit regression identical to that reported in Table 5 with the addition of a High Payoff indicator variable. The coefficient on High Payoff is positive and almost significant at the 90% confidence level (the p-value is 0.105). This suggests that subjects in the High Payoff treatment may be less willing to wait than subjects in the other treatments. While there are some minor differences in the results when the High Payoff treatment was included in the analysis (the coefficients on Option B Value and ADIR*56 Day Extension both become significant while the coefficients on Option A Standard Deviation and 56 Day Extension are no longer significant), our primary result—that introducing risk into either option makes individuals less patient—does not change (Table 8).

3 Summary and Conclusions

We developed a laboratory experiment to investigate risky intertemporal decision making. In our design, subjects choose between payment options that take place at different points in time. Some payment options are certain, while other payment options involve lotteries. To examine the relationship between risk and temporal delay in individual decision making, we vary the timing of the two options, the presence and degree of risk, and the scale of payoffs. Two key features of these experiments are that they incorporate real time lags and they involve real payoffs.

We find that very few subjects exhibit intertemporal certainty equivalence, that is always make the same choice for a pair of expected values regardless of the presence of risk. Additionally, very few subjects are consistently risk averse or risk loving. Rather we find that the presence of risk in an intertemporal decision makes subjects less patient, that is, more willing to take the earlier payment option regardless of whether the risk occurs in the early or the latter payoff. These results are consistent with Öncüler’s (2000) results using hypothetical gambles, but are inconsistent with Keren and Roelofsma (1995) and Albrecht and Weber’s (1997) finding that risky options are discounted less than certain outcomes. We also find that an increased degree of risk decreases subjects’ patience levels. However, we do not find evidence that the effect of risk on the intertemporal decision depends on the length of the temporal delay. Finally, our findings are generally robust to changes in the “front-end delay” in the experiment as well as changes in the absolute level of payments. However, we do find evidence of an absolute magnitude effect. When small amounts are involved, subjects were more willing to wait than when large amounts are involved.

These results suggest that there are important interactions between risk and intertemporal effects. These interactions need to be accounted for both in empirical and theoretical models, particularly because many important policy questions involve tradeoffs over time and in the presence of risk. Because the nature and degree of the risk can be easily observed and manipulated in the laboratory, we believe that further experiments can play a valuable role in increasing our understanding of these interactions.

Notes

Holt and Davis (1993) provide a summary of experimental studies of individual decision making with risk.

A few experimental studies have examined dynamic (as opposed to intertemporal) decision making under uncertainty (see, for example, Cubitt et al. (2003)). These experiments focus on sequential decisions, rather than decisions that include a time delay.

In addition to preferences regarding the timing of payments, subjects might also have preferences regarding when the uncertainty is resolved. Chew and Ho (1994) report evidence that subjects prefer to delay resolution in hypothetical survey questions about tax refunds and payments. Alternatively, Wu (1999) presents a theoretical model that separately captures the disutility of delayed consumption and the disutility of delayed uncertainty resolution. Our experimental design does not allow us to make this distinction since the resolution of risk is delayed in all cases. We chose this design because, as Wu notes, “delayed resolution is the norm for many important decisions (p. 161).”

Actual payment dates (e.g., October 21) were used in the experiment rather than delays (e.g., 2 weeks). Read et al. (2005) present evidence that discount rates are lower when dates, rather than delays, are used to describe future payments.

This aspect of the experimental design follows the design used by Coller et al. (2003).

For the 14 and 28 day designs we used two different sets of payoff structures because we wanted to make sure that our results were robust to different payment choices. For example, in the 14.1 treatment subjects were never given a choice between $20 and $21 or between $20 and $25. In the 14.2 treatment, subjects were offered these choices (but not others). As discussed in the results section, we did not find any statistically significant differences between the 14.1 and 14.2 treatments and between the 28.1 and 28.2 treatments, so we chose to not conduct a second 56 day treatment.

We used an on-line survey instrument developed by Charles Holt to collect the data. Subjects were tracked by an identification number that was linked to the subject’s computer location but not to the subject’s identity. See http://veconlab.econ.virginia.edu/guide.php for a discussion of the on-line instrument.

Goeree et al. (2002) discuss how a series of decisions made by a subject can be analyzed as multiple one-shot games when subjects are presented with all of the decisions at once and do not receive feedback about the outcomes of their decisions.

Randomly selecting one of the scenarios to “play” is a common practice and has been shown by Camerer (1989) and Starmer and Sugden (1991) to provide approximately the same results as when subjects only make one decision. Thus it allows the experimenter to collect additional data at no increased cost and to minimize wealth effects. Furthermore, it minimizes any possible order effects since subjects only receive feedback about the outcome of one decision.

Statistical significance was evaluated using two-tail Fisher Exact Probability test.

More specifically, for a given value of the Option B payment, there are no statistically significant differences in the frequency with which Option B is chosen between the 14.1 and 14.2 treatments and the 28.1 and 28.2 treatments according to a two-tail Fisher Exact Probability test at the 95% confidence level.

According to a t-test with a 90% confidence level.

We use a random effects model rather than a fixed effects model because several of the variables of interest do not vary for a given subject (e.g., the length of the temporal delay) and fixed effects models cannot include such variables. Additionally, we would not be able to include any observations from subjects that always choose the same option because the fixed effect would perfectly predict the outcome for those subjects.

The xtprobit command uses a Gauss–Hermite quadrature procedure to evaluate the log-likelihood function. (See Butler and Moffitt (1982) for a discussion of this model.) For all of the regressions reported, we estimated the model using 100 quadrature points and used the quadchk command in Stata to confirm that the quadrature was stable.

The correlation coefficient between the two variables is 0.92.

More specifically, \(\rho = \frac{{\sigma _\upsilon ^2 }}{{\sigma _\upsilon ^2 + 1}}\) where \(\sigma _\upsilon ^2 \) is the subject-specific variance.

No subjects chose Option A for all 25 scenarios.

Subjects that always choose Option B also exhibit behavior that is consistent with certainty equivalence. However, there are alternative explanations for their behavior such as a low discount rate.

For the 75:25 lottery, we calculated the standard deviation for the following set of values {$16, $16, $16, $32}.

However, for one scenario the difference was statistically significant at the 90% confidence level.

For the scenario in question, Option A was a 75:25 lottery between $48 and $96 for the High Payoff treatment and between $16 and $32 for the 14.2 treatment. Option B was a 50:50 lottery between $60 and $72 for the High Payoff treatment and between $20 and $24 for the 14.2 treatment. Nine out of 32 subjects chose Option A in the High Payoff treatment while only two out of 35 subjects chose Option A in the 14.1 treatment.

References

Albrecht, M., & Weber, M. (1997). An empirical study on intertemporal decision making under risk. Management Science, 43(6), 813–826.

Anderhub, V., Güth, W., Gneezy, U., & Sonsino, D. (2001). On the interaction of risk and time preferences: An experimental study. German Economic Review, 2(3), 239–253.

Becker, G., DeGroot, M., & Marschak, J. (1964). Measuring utility by a single-response sequential method. Behavioral Science, 9(3), 226–232.

Butler, J. S., & Moffitt, R. (1982). A computationally efficient quadrature procedure for the one-factor multinomial probit model. Econometrica, 50(3), 761–764.

Camerer, C. (1989). An experimental test of several generalized utility theories. Journal of Risk and Uncertainty, 2(1), 61–104.

Chesson, H., & Viscusi, W. K. (2000). The heterogeneity of time-risk tradeoffs. Journal of Behavioral Decision Making, 13(2), 251–258.

Chew, S. H., & Ho, J. L. (1994). Hope: An empirical study of attitude toward the timing of uncertainty resolution. Journal of Risk and Uncertainty, 8(3), 256–288.

Coller, M., Harrison G. & Rutström, E. (2003). Are discount rates constant? Reconciling Theory and Observation. Working Paper, December 2003.

Cubitt, R. P., Starmer, C., & Sugden, R. (2003). Dynamic decisions under uncertainty: Some recent evidence from economics and psychology. In I. Brocas, & J. Carrillo (Eds.), The psychology of economic decisions, Volume 2: Reasons and choice (pp. 81–110). Oxford, England: Oxford University Press.

Elster, J., & Lowenstein, G. (1992). Utility from memory and anticipation. In G. Lowenstein, & J. Elster (Eds.), Choice over time (pp. 213–234). New York, NY: Sage.

Ford, J. L., & Ghose, S. (1995). Ellsberg urns, ambiguity, measures of uncertainty and non-additivity: Some experimental evidence. Applied Economics Letters, 5, 147–151.

Frederick, S., Loewenstein, G., & O’Donoghue, T. (2002). Time discounting and time preference: A critical review. Journal of Economic Literature, 40(2), 351–401.

Goeree, J., Holt, C., & Laury, S. (2002). Private costs and public benefits: unraveling the effects of altruism and noisy behavior. Journal of Public Economics, 83(2), 255–276.

Holt, C., & Davis, D. (1993). Experimental economics. Princeton, NJ: Princeton University Press.

Keren, G., & Roelofsma, P. (1995). Immediacy and certainty in intertemporal choice. Organizational Behavior and Human Decision Processes, 63(3), 287–297.

Öncüler, A. (2000). “Intertemporal choice under uncertainty: A behavioral perspective”. INSEAD Working Paper, 2000/37/TM.

Read, D., Frederick, S., Orsel, B., & Rahman, J. (2005). Four score and seven years from now: The date/delay effect in temporal discounting. Management Science, 51(9), 1326–1335.

Samuelson, P. (1937). A note on measurement of utility. Review of Economic Studies, 4(2), 155–161.

Smith, V. (1969). Measuring non-monetary utilities in uncertain choices: The Ellsberg urn. Quarterly Journal of Economics, 83(2), 324–329.

Starmer, C., & Sugden, R. (1991). Does the random lottery incentive system elicit true preferences: An experimental investigation. American Economic Review, 81(4), 971–978.

Von Neumann, J., & Morgenstern, O. (1947). Theory of games and economic behavior. Princeton, NJ: Princeton University Press.

Wu, G. (1999). Anxiety and decision making with delayed resolution of uncertainty. Theory and Decision, 46(2), 159–199.

Author information

Authors and Affiliations

Corresponding author

Additional information

Financial support from the National Science Foundation (SES-0344732) is gratefully acknowledged.

Appendix A: Sample instructions

Appendix A: Sample instructions

This is an experiment in the economics of decision making. At the end of the session today, you will each receive $5 in cash for showing up. In addition, you will earn more money based on your decisions. Specifically, you will be making choices between two options, such as those represented as “Option A” and “Option B” in Scenario 1 below.

-

1.

Scenario 1. Please choose between the following options:

-

○ Option A: on October 21 receive $20

-

○ Option B: on November 4 receive $22

Notice that you will choose to receive your additional earnings for the decision making phase of this experiment on one of two possible payment days. Option A is always payable on October 21 and Option B is always payable on November 4. The payment sessions are always during the same time period and on the same day of the week as the session you are currently attending. The payment session will require only 15 min of your time.

In some cases, such as Scenario 2 below, you will be choosing between lotteries and the money prizes will be determined by drawing colored balls from a container. For example, in Scenario 2 below, if you choose Option A, you will return on October 21 and you will have a 50 in 100 chance of earning $18 and a 50 in 100 chance of earning $22. Specifically, we will draw one ball from a container with 50 Gold balls and 50 Purple balls. Similarly, if you choose Option B you will return on November 4 and will have a 50 in 100 chance of earning $20 and a 50 in 100 chance of earning $24.

-

-

2.

Scenario 2. Please choose between the following options:

-

○ Option A: on October 21 receive $18 if a Gold ball is drawn (50 out of 100) OR receive $22 if a Purple ball is drawn (50 out of 100)

-

○ Option B: on November 4 receive $20 if a Red ball is drawn (50 out of 100) OR receive $24 if a Navy ball is drawn (50 out of 100)

Even though you will make 25 decisions, only one of these will end up being used. The selection of the scenario for which you will be paid will be determined at the end of the experiment today by drawing a numbered bingo ball from a container. The container has 25 balls numbered 1 through 25, so no decision is any more likely to be used than any other. You will not know before making your decisions which scenario will be selected, so please think about each one carefully. At the completion of the session today, we will present you with your $5 show up fee and a payment certificate that you must bring with you to your payment session. If you are unable to return on your payment day, you may send someone in your place. However, it is essential that you (or the person you send in your place) bring the certificate to your payment session.

-

1.1 Summary

-

Step 1:

Making Decisions: On the computer screen in front of you, you will see a list with 25 scenarios and five follow up questions. Make your choice by clicking on the buttons on the left, option A or option B, for each of the 30 questions. You may make these choices in any order and change them as much as you wish until you press the “Submit” button at the bottom of the screen.

-

Step 2:

The Relevant Scenario: Once everyone has submitted answers to all 30 questions, one of the 25 scenarios will be selected at random by drawing a numbered ball from a container, and the Option that you chose for that particular scenario will be recorded on a payment certificate. Please think about each decision carefully, since each of the 25 scenarios is equally likely to end up being the one that is used to determine payoffs. Notice that the five follow-up questions at the end are not relevant for your earnings.

-

Step 3:

Determining the Payoff: If you chose Option A for the scenario selected for payment, you will report to Morton 305 on October 21 with your payment certificate. If you chose Option B for the scenario selected, you will report to Morton 305 on November 4 with your payment certificate. If your payment involves a lottery, we will conduct the lottery on the day you return by drawing colored balls from a container. The scenario chosen today (in Step 2) will inform you whether or not your payoff involves a lottery and, if so, the colors and proportions of balls in the container and the payoff associated with each color. You will be paid in cash on your payment day. Each payment certificate has been personally guaranteed by both Professor Anderson and Professor Stafford of the William and Mary Economics Department.

Are there any questions?

1.2 Sample Questionnaire

Welcome statement: Please answer all 30 questions, then wait quietly at your desk until everyone has finished.

-

1.

(Scenario 1) Scenario 1. Please choose between the following options:

-

○ Option A: on November 19 receive $20

-

○ Option B: on December 3 receive $22

-

-

2.

(Scenario 2) Scenario 2. Please choose between the following options:

-

○ Option A: on November 19 receive $20

-

○ Option B: on December 3 receive $24

-

-

3.

(Scenario 3) Scenario 3. Please choose between the following options:

-

○ on November 19 receive $20

-

○ Option B: on December 3 receive $26

-

-

4.

(Scenario 4) Scenario 4. Please choose between the following options:

-

○ Option A: on November 19 receive $20

-

○ Option B: on December 3 receive $28

-

-

5.

(Scenario 5) Scenario 5. Please choose between the following options:

-

○ Option A: on November 19 receive $20

-

○ Option B: on December 3 receive $30

-

-

6.

(Scenario 6) Scenario 6. Please choose between the following options:

-

○ Option A: on November 19 receive $20

-

○ Option B: on December 3 receive $20 if a Red ball is drawn (50 out of 100) OR receive $24 if a Navy ball is drawn (50 out of 100)

-

-

7.

(Scenario 7) Scenario 7. Please choose between the following options:

-

○ Option A: on November 19 receive $20

-

○ Option B: on December 3 receive $16 if a Pink ball is drawn (50 out of 100) OR receive $28 if a Yellow ball is drawn (50 out of 100)

-

-

8.

(Scenario 8) Scenario 8. Please choose between the following options:

-

○ Option A: on November 19 receive $20

-

○ Option B: on December 3 receive $22 if a Purple ball is drawn (50 out of 100) OR receive $26 if a Black ball is drawn (50 out of 100)

-

-

9.

(Scenario 9) Scenario 9. Please choose between the following options:

-

○ Option A: on November 19 receive $20

-

○ Option B: on December 3 receive $24 if a Navy ball is drawn (50 out of 100) OR receive $28 if a Yellow ball is drawn (50 out of 100)

-

-

10.

(Scenario 10) Scenario 10. Please choose between the following options:

-

○ Option A: on November 19 receive $20

-

○ Option B: on December 3 receive $20 if a Red ball is drawn (75 out of 100) OR receive $28 if a Yellow ball is drawn (25 out of 100)

-

-

11.

(Scenario 11) Scenario 11. Please choose between the following options:

-

○ Option A: on November 19 receive $20

-

○ Option B: on December 3 receive $20 if a Red ball is drawn (75 out of 100) OR receive $36 if a White ball is drawn (25 out of 100)

-

-

12.

(Scenario 12) Scenario 12. Please choose between the following options:

-

○ Option A: on November 19 receive $20]

-

○ Option B: on December 3 receive $16 if a Pink ball is drawn (25 out of 100) OR receive $20 if a Red ball is drawn (25 out of 100) OR receive $26 if a Black ball is drawn (50 out of 100)

-

-

13.

(Scenario 13) Scenario 13. Please choose between the following options:

-

○ Option A: on November 19 receive $20

-

○ Option B: on December 3 receive $16 if a Pink ball is drawn (50 out of 100) OR receive $28 if a Yellow ball is drawn (25 out of 100) OR receive $36 if a White ball is drawn (25 out of 100)

-

-

14.

(Scenario 14) Scenario 14. Please choose between the following options:

-

○ Option A: on November 19 receive $18 if a Gold ball is drawn (50 out of 100) OR receive $22 if a Purple ball is drawn (50 out of 100)

-

○ Option B: on December 3 receive $22

-

-

15.

(Scenario 15) Scenario 15. Please choose between the following options:

-

○ Option A: on November 19 receive $18 if a Gold ball is drawn (50 out of 100) OR receive $22 if a Purple ball is drawn (50 out of 100)

-

○ Option B: on December 3 receive $24

-

-

16.

(Scenario 16) Scenario 16. Please choose between the following options:

-

○ Option A: on November 19 receive $18 if a Gold ball is drawn (50 out of 100) OR receive $22 if a Purple ball is drawn (50 out of 100)

-

○ Option B: on December 3 receive $26

-

-

17.

(Scenario 17) Scenario 17. Please choose between the following options:

-

○ Option A: on November 19 receive $16 if a Pink ball is drawn (75 out of 100) OR receive $32 if an Orange ball is drawn (25 out of 100)

-

○ Option B: on December 3 receive $24

-

-

18.

(Scenario 18) Scenario 18. Please choose between the following options:

-

○ Option A: on November 19 receive $12 if a Clear ball is drawn (50 out of 100) OR receive $24 if a Navy ball is drawn (25 out of 100) OR receive $32 if an Orange ball is drawn (25 out of 100)

-

○ Option B: on December 3 receive $24

-

-

19.

(Scenario 19) Scenario 19. Please choose between the following options:

-

○ Option A: on November 19 receive $12 if a Clear ball is drawn (25 out of 100) OR receive $20 if a Red ball is drawn (25 out of 100) OR receive $24 if a Navy ball is drawn (50 out of 100)

-

○ Option B: on December 3 receive $22

-

-

20.

(Scenario 20) Scenario 20. Please choose between the following options:

-

○ Option A: on November 19 receive $18 if a Gold ball is drawn (50 out of 100) OR receive $22 if a Purple ball is drawn (50 out of 100)

-

○ Option B: on December 3 receive $20 if a Red ball is drawn (50 out of 100) OR receive $24 if a Navy ball is drawn (50 out of 100)

-

-

21.

(Scenario 21) Scenario 21. Please choose between the following options:

-

○ Option A: on November 19 receive $18 if a Gold ball is drawn (50 out of 100) OR receive $22 if a Purple ball is drawn (50 out of 100)

-

○ Option B: on December 3 receive $22 if a Purple ball is drawn (50 out of 100) OR receive $26 if a Black ball is drawn (50 out of 100)

-

-

22.

(Scenario 22) Scenario 22. Please choose between the following options:

-

○ Option A: on November 19 receive $18 if a Gold ball is drawn (50 out of 100) OR receive $22 if a Purple ball is drawn (50 out of 100)

-

○ Option B: on December 3 receive $20 if a Red ball is drawn (75 out of 100) OR receive $36 if a White ball is drawn (25 out of 100)

-

-

23.

(Scenario 23) Scenario 23. Please choose between the following options:

-

○ Option A: on November 19 receive $16 if a Pink ball is drawn (75 out of 100) OR receive $32 if an Orange ball is drawn (25 out of 100)

-

○ Option B: on December 3 receive $20 if a Red ball is drawn (50 out of 100) OR receive $24 if a Navy ball is drawn (50 out of 100)

-

-

24.

(Scenario 24) Scenario 24. Please choose between the following options:

-

○ Option A: on November 19 receive $12 if a Clear ball is drawn (25 out of 100) OR receive $20 if a Red ball is drawn (25 out of 100) OR receive $24 if a Navy ball is drawn (50 out of 100)

-

○ Option B: on December 3 receive $16 if a Pink ball is drawn (25 out of 100) OR receive $20 if a Red ball is drawn (25 out of 100) OR receive $26 if a Black ball is drawn (50 out of 100)

-

-

25.

(Scenario 25) Scenario 25. Please choose between the following options:

-

○ Option A: on November 19 receive $12 if a Clear ball is drawn (50 out of 100) OR receive $24 if a Navy ball is drawn (25 out of 100) OR receive $32 if an Orange ball is drawn (25 out of 100)

-

○ Option B: on December 3 receive $16 if a Pink ball is drawn (50 out of 100) OR receive $28 if a Yellow ball is drawn (25 out of 100) OR receive $36 if a White ball is drawn (25 out of 100)

-

-

26.

(Follow-up Question 1) Follow-up Question 1: Are you

-

○ Male

-

○ Female

-

-

27.

(Follow-up Question 2) Follow-up Question 2: Have you smoked a cigarette in the past week?

-

○ Yes

-

○ No

-

-

28.

(Follow-up Question 3) Follow-up Question 3: Do you currently have a credit card?

-

○ Yes

-

○ No

-

-

29.

(Follow-up Question 4) Follow-up Question 4: Are you financing any of your college education through loans?

-

○ Yes

-

○ No

-

-

30.

(Follow-up Question 5) Follow-up Question 5: What area does your major (or intended major) fall under?

-

○ Business or Economics

-

○ Humanities (e.g. English, Philosophy, Modern Languages, Religion, Art, Classics, etc.)

-

○ Social Science (e.g. Anthropology, Government, Public Policy, Sociology, Psychology, etc.)

-

○ Science (e.g. Biology, Chemistry, Physics, Geology, etc.)

-

Rights and permissions

About this article

Cite this article

Anderson, L.R., Stafford, S.L. Individual decision-making experiments with risk and intertemporal choice. J Risk Uncertain 38, 51–72 (2009). https://doi.org/10.1007/s11166-008-9059-4

Published:

Issue Date:

DOI: https://doi.org/10.1007/s11166-008-9059-4