Companies would rather cut dividends and make sure they have adequate cash than risk running low and trying to borrow at unfavorable terms. Cutting a dividend is better than hanging onto the dividend and bankrupting the company.

John Buckingham, Chief Investment Officer, Al Frank Asset Management (USA Today, 2/29/2008, “2008 on track as record year for dividend cuts.”)

Abstract

Dividend cuts are typically associated with a negative stock price reaction. We contend that the market’s reaction to dividend cuts depends on the reason for the cut and the economic environment. Specifically, we posit that when external financing is constrained, firms that cut dividends and have high growth opportunities are better off than dividend cutters with low growth opportunities. We test this growth opportunities hypothesis by examining stock price reactions to dividend cuts around the 2008 financial crisis. Not surprisingly, we find negative average abnormal returns around the announcement day. However, consistent with our hypothesis, we find that firms with high growth opportunities experience higher abnormal returns. We also find that firms with high growth opportunities are more likely to resume the dividend payment within 5 years of the dividend cut and firms that resume their dividends have significantly higher long-term returns than non-resumers. Taken together, our evidence provides strong support for the growth opportunities hypothesis.

Similar content being viewed by others

Avoid common mistakes on your manuscript.

1 Introduction

Dividend cuts and omissions are generally perceived as bad news and, accordingly, researchers have consistently found that they are associated with negative average abnormal returns (e.g. Aharony and Swary 1980; Below and Johnson 1996; Best and Best 2001; Eades et al. 1985; Ghosh and Woolridge 1988; 1989; Grullon et al. 2002; Van Eaton 1999). While the average market reaction to dividend cut and omission announcements is negative, some studies have focused on situations in which dividend omissions/cuts may be perceived as good news (e.g. Bulan et al. 2007; Ghosh and Woolridge 1989). A prominent explanation that has been offered for the positive market reaction is that firms are cutting dividends so that they can invest the funds in growth opportunities. We refer to this as the growth opportunities hypothesis.

A few studies have investigated the growth opportunities hypothesis using announcements of dividend omissions/cuts. Ghosh and Woolridge (1988) regress cumulative abnormal returns on an indicator for whether managers reported investment needs as the reason for the dividend omission and do not find a significant relation. Similarly, Bulan and Subramanian (2008) regress cumulative abnormal returns on dummy variables for strategic reasons explaining the omissions and also do not find support for the growth opportunities hypothesis. We build on this literature by testing the growth opportunities hypothesis in a setting where access to external capital (the other viable investment-financing alternative for cash-constrained firms) is severely limited—the 2008 financial crisis period. In addition, we use market to book ratios as our proxy for growth opportunities instead of a self-reported measure such as the reason for the dividend omission given by the firm’s manager. Bulan and Subramanian (2008) and Ghosh and Woolridge (1988) report that most firms do not provide a reason for the dividend omissions. Thus, using a proxy for growth opportunities that is available for all firms and focusing on a period with a record number of dividend cuts and when access to external financing was limited, makes this an ideal setting for testing the growth opportunities hypothesis.

During the crisis, banks struggling with hefty default rates and a declining market found themselves in a position where lending between each other, and to clients, froze. Firms that had once enjoyed frequent transactions on deep lines of credit were denied access. With economic peril looming, and no real sign of recovery, companies began cutting dividends faster than they had ever done since the 1930s. USA TODAY reported that companies slashed dividends by $23.4 billion in the fourth quarter of 2008 alone, and by $42 billion in the first quarter of 2009 (USA Today 2009).

We contend that when external financing is constrained, firms with high growth opportunities will have a more positive (or less negative) reaction to dividend cuts than firms with low growth opportunities. Due to poor and/or costly access to debt financing during a financial crisis, investors of firms with high growth opportunities may value substituting dividends for investment in those growth opportunities. Otherwise, firms may compromise the viability of their long-term projects and a competitor could take advantage of those opportunities.

We begin our analysis by examining the average stock price reaction of firms that announce dividend cuts during the recession starting November 2007–December 2009. Consistent with previous literature, we find a significant and negative average abnormal return of −3.8% over a 3-day window around the announcement date. However, we find that approximately 40% of our sample experienced positive abnormal returns on the announcement day in contrast with only 24% reported by Ghosh and Wooldridge (1988). We then perform cross-sectional regressions to evaluate the causes for observed variation in market reaction to dividend cuts. Consistent with the growth opportunities hypothesis, we find a positive relation between a growth opportunities proxy (the market-to-book ratio) and 3-day cumulative abnormal returns.Footnote 1 Our results also show that firms with high growth opportunities are more likely to resume the dividend payment within 5 years of the dividend cut and firms that resume their dividends have significantly higher long-term returns than non-resumers. Taken together, this evidence strongly supports our main hypothesis that the stock market reaction to dividend cuts during the 2008 financial crisis should be positively related to firms’ growth opportunities.

The paper is organized as follows: In Sect. 2 we briefly review the extant literature related to dividend changes. Section 3 describes the data gathering process and the sample restrictions. Section 4 describes our methodology and hypotheses. Section 5 reports our event study results. Section 6 contains our multivariate results and we conclude with Sect. 7.

2 Prior literature

While dividend increases (and initiations) are usually associated with positive abnormal returns, dividend cuts (and omissions) are generally perceived as bad news and are therefore associated with negative abnormal returns (e.g. Aharony and Swary 1980; Below and Johnson 1996; Benartzi et al. 1997; Best and Best 2001; Dielman and Oppenheimer 1984; Eades et al. 1985; Ghosh and Wooldridge 1988, 1989; Grullon et al. 2002; Healy and Palepu 1988; Jones et al. 2014; Lacina and Zhang 2008; Pettit 1972; Van Eaton 1999). A significant portion of the dividends literature has focused on the question of whether dividend cuts are badly perceived because they are an indication of poor past performance or poor future performance. Nissim and Ziv (2001) find that dividends do contain information concerning future earnings. They document that dividend changes are positively related to earning changes for the subsequent 2 years. However, Grullon et al. (2005) find that dividend changes are uncorrelated with future earnings changes after controlling for nonlinearities in the earnings process. Moreover, Benartzi et al. (1997) find that dividend increases (decreases) are associated with good (poor) prior performance but that dividends do not appear to signal future performance.

There is limited evidence regarding the circumstances under which dividend cuts may be beneficial to firms. Using a sample of 445 dividend omissions announced between 1962 and 2001, Bulan et al. (2007) find that 35% can be classified as “good” omissions. The performance of these firms increases significantly after the omission and often results in a resumption of the dividend payment within 5 years after the omission. However, the market is not able to differentiate between “good” and “bad” omissions at the time of the announcement. The stock price reaction to “good” omissions is not significantly different from the reaction to “bad” omissions. Moreover, the fraction of “good” omissions is surprisingly high given that over 80% of omissions result in negative abnormal returns. Bulan et al. (2007) also find that “good” omitters have strong fundamentals. Two key determinants of “good” omitters are high profitability and low debt overhang prior to the omission.

Ghosh and Wooldridge (1988, 1989) test whether cumulative abnormal returns are related to an indicator for whether managers reported investment needs as the reason for the dividend omission and do not find a significant relation. Similarly, Bulan and Subramanian (2008) test whether investors react differently to dividend omissions depending on the reason for the omission provided by the firm at the time of the announcement. They find that 66% of the firms in their sample did not provide an explanation for the omission and only 9% of the firms claimed to have omitted a dividend to fund current or future investments. Their results show no evidence of a relationship between cumulative abnormal returns and the reason for the omission. Hence, there is very little evidence supporting the growth opportunities hypothesis.

We contribute to this literature by testing the growth opportunities hypothesis during the 2008 financial crisis—a period in which access to external capital was severely constrained. We also extend the extant literature by using a market-based proxy for growth opportunities (the market to book ratio) rather than self-reported measures, such as reasons for dividend omissions given by managers.

3 Sample selection

The data for our study is obtained from the center for research in securities prices (CRSP) and Compustat databases. Using the CRSP monthly event file, we first obtain an initial sample that comprises all the dividend announcements associated with a payout cut during the financial crisis period (November 2007-December 2009). To be included in the final sample, each dividend cut should satisfy the following criteria (as per Grullon et al. 2005):

-

1

The firm’s data are available in both CRSP and Compustat databases.

-

2

The firm is not a financial institution (SIC codes 6000-6999) or a utility company (SIC codes 4900-4999).

-

3

The firm pays a quarterly cash dividend (Distribution code 1232) in the current and previous quarter.

-

4

Other distribution events (e.g., stock splits, stock dividends, and mergers) are not declared between the declaration date of the previous dividend and 4 days after the declaration of the current dividend.

-

5

There are no ex-distribution dates between the ex-distribution dates of the previous and current dividends.

-

6

For each firm, dividend cut announcements are made more than 150 trading days apart.

Our final sample includes 145 dividend cuts during the 2008 financial crisis period. We have included a detailed description of our sample selection process in Table 1.

4 Methodology and hypotheses

Following Bouwman et al. (2009), we examine the market reaction to dividend cuts by studying the short-run stock performance in a univariate setting and in a multivariate framework in which we control for other factors that may affect the stock performance. We also investigate the long-run performance to provide complementary evidence. Section 4.1 discusses our announcement return measure: cumulative abnormal returns (CARs). Section 4.2 describes the determinants of announcement returns. Section 4.3 presents our long-run performance measure: holding period abnormal returns (HPARs).

4.1 Announcement returns

Following Hull (2013) we calculate the abnormal returns using the Fama and French three factor model including the Carhart momentum factor.Footnote 2 The regression factors are obtained from Kenneth French’s website. The coefficients on regression factors are estimated in the following equation.

where \(R_{i}\) is the return on firm \(i\), \(R_{f}\) is the risk free rate (one-month T-bill rate), \(RM_{t}\) is the CRSP market return, \(SMB\) is the average return of a portfolio of small cap stocks minus the return of a portfolio of high cap stocks, \(HML\) is the average return of a portfolio of firms with high book-equity to market-equity minus a similar portfolio of low book-equity to market-equity, and \(UMD\) is the average return of a portfolio of winner stocks minus the return of a portfolio of loser stocks.

In our study, the four-factor coefficients (\(\delta_{i}\)) are calculated within a 100-trading day estimation window, starting from day -150 though day -50 of the announcement (day 0). Utilizing the coefficients obtained from the estimation window (\(\delta_{i}^{*}\)) and the factors from an event window around a dividend announcement, we construct the CARs by applying the equation as follows,

In our analysis, we calculate and report the CARs in 6 different event windows ([0], [−1,0], [0,1], [−1,1], [−9,9], and [−21,21]).

4.2 Determinants of announcement returns

To test our main hypothesis we model cumulative abnormal returns as a function of firm-specific growth opportunities, other firm characteristics, and a series of control variables.

The dependent variable (CAR it ) is previously defined in Sect. 4.1 and the independent variables, and their predicted signs, are as follows:

Growth opportunities Our main hypothesis is that the stock market reaction to dividend cuts during the 2008 financial crisis should be positively related to the firm’s growth opportunities. We refer to this as the growth opportunities hypothesis. Firms with high growth opportunities should react more positively (or less negatively) to the announcement of a dividend cut as they can use the extra cash to invest in those growth opportunities. We use the market-to-book ratio (MTB) to proxy for the growth opportunities of a firm (Barclay and Smith 1995; Gaver and Gaver 1993; Smith and Watts 1992). MTB is calculated as the ratio of the market value to book value of equity. We expect a positive relation between MTB and CAR.

4.2.1 Firm characteristics

Profitability (ROA) Bulan (2010) finds that CAR around dividend cut announcements are more negative for firms with less visible signs of poor performance and that the stock price reaction is proportional to the element of surprise. Dividend cuts announced by highly profitable firms have an element of surprise. We argue that the unexpected nature of the dividend cut in this case, should have a negative effect in the firm’s abnormal returns. Therefore, we include return on assets (ROA) as a profitability measure and expect a negative relation between ROA and CAR.

Liquidity (current ratio) We also include a liquidity measure (current ratio) as an independent variable. The expected relation between liquidity and dividend cut-induced abnormal stock returns is ambiguous. On one hand, highly liquid firms are likely not cutting dividends because they are in financial distress but rather because they are financing investment opportunities.Footnote 3 This line of reasoning suggests a positive relation between current ratio and CAR. On the other hand, proactive dividend cutting behavior (Bulan 2010) by illiquid firms should be considered positive news by investors—suggesting a negative liquidity-CAR relation. Similarly, the relation between current ratio and CAR should be negative if dividend cuts announced by firms with high liquidity have a significant element of surprise.

We also include in our model three other independent variables that are firm characteristics expected to explain variation in CARs. First, we include the debt ratio (calculated as the ratio of total debt to total assets) because we expect that highly levered dividend cutters are more likely experience a negative stock reaction as investors will view the dividend cut as an indicator that the firm has exhausted other sources of capital. Therefore, we expect a negative relation between debt ratio and CAR. Second, we include a measure of operating cash flows (OCF ratio) because we expect that investors will react more positively (or less negatively) to cutters with strong cash flows who are clearly not cutting dividends to finance operations and are more likely seeking funds for other investment opportunities. We define OCF ratio as the ratio of operating cash flows to lagged total assets and expect a positive relation between OCF ratio and CAR. Third, we include the accruals ratio in our model to proxy for potential earnings management problems. Consistent with Ayers et al. (2006), the accruals ratio is calculated as the difference between IBEI (Income before Extraordinary Items) and OCF, scaled by total assets at year t-1. Firms with a higher accruals ratio have more discretion over their revenue and cost accounts. We contend that companies with a lower accruals ratio should have a more positive reaction to dividend cuts as they are less likely to have a cash problem. Accordingly, we expect a negative relation between the accruals ratio and CAR.

4.2.2 Control variables

Following Below and Johnson (1996) we include four control variables in Eq. (1). PRCTYLD is the positive or negative percentage change in dividend yield and it measures the relative information content of the announcement. Beta is the market beta for the pre-event estimation period. RESVAR is the residual variance for the pre-event estimation period and it measures the variability of earnings patterns. Logsize is the natural logarithm of firm size, where firm size is measured as the total number of shares outstanding times the average price per share over the period t-10 to t-6 relative to the announcement day (t = 0).

4.3 Long-run stock performance

Our measure of long-run stock performance is holding period abnormal returns (HPAR). Following Bulan et al. (2007), we calculate holding period returns (HPR) as:

Then we compute HPAR using the following equation,

where \(R_{benchmark}\) is the return to the corresponding CRSP value-weighted index. We start the holding period from the first day following the announcement and calculate the 1-year, 2-year, and 3-year HPR and HPAR.

5 Event study results

First, we report the results of the event study of the dividend cuts announced during the financial crisis period (Table 2). On average, firms have a significantly negative reaction of −1.3% on the day of the announcement and a −3.8% during the 3-day window surrounding the announcement. However, approximately 40% of sample firms experience a positive abnormal return around the announcement.

In Table 3 we present the summary statistics of the 145 firms that announced dividend cuts during the financial crisis. The median firm has a market value that is 1.3 times its book value. The median profitability, measured as ROA, is 1%. The median liquidity, measured as the current ratio, is 2.0. This implies that the median firm has current assets that double its current liabilities. The median firm has 53% of its assets financed with debt and an accrual ratio of −6.8%. Furthermore, the median percentage change in the dividend yield is −1%, the median beta is 1.02, the median RESVAR is 0.001, and the median Logsize is 13.22.

Out of the 145 dividend cut announcements in our event study sample, 57 have a positive impact on stock prices on the day of the announcement and 88 have a negative impact. In Table 4, we compare the summary statistics of the firms that have a positive reaction to those of the firms that react negatively. In Panel A, we divide the sample using the abnormal returns on day 0 and in Panel B we divide the sample using cumulative abnormal returns for the 3-day window surrounding the announcement. Panel A shows that the mean (median) reaction of the firms that internalized the dividend cut announcement as positive news was 3.6% (2.1%). Firms that reacted negatively, on the other hand, experience mean (median) abnormal returns of −4.4% (−2.7%). The difference in mean (and median) is statistically significant at the 1% level. Surprisingly, none of the firm characteristics are significantly different between the two groups. This implies that firms that reacted positively to the dividend cut announcement are not significantly different from those that had a negative reaction. In Panel B, we obtain similar results using CAR (−1, +1). The mean (median) CAR for the 56 firms that have a positive reaction is 5.5% (3.6%). The mean (median) CAR for the 89 firms that have a negative reaction is −9.6% (−6.9%). The difference in mean (and median) is statistically significant at the 1% level. Similarly to what we observed in Panel A, none of the firm characteristics are statistically different between the two groups.

6 Multivariate results

In this section we present the results of Eq. (1) which models cumulative abnormal returns of dividend cutters as a function of growth opportunities and several control variables. In Table 5, we present the estimation results using the 3-day window CAR as the dependent variable. We find strong support for the growth opportunities hypothesis. The coefficient on the market-to-book ratio, our proxy for growth opportunities, is positive and significant in all specifications. This result is consistent with our hypothesis that firms with high growth opportunities should react more positively (or less negatively) to the announcement of a dividend cut as they can use the extra cash to invest in those growth opportunities.Footnote 4

In addition, we find that our profitability measure (ROA) is negatively and significantly related to the CAR in model (1) and model (2). This finding is also consistent with our hypothesis. Dividend cuts are more unexpected for firms with high profitability and therefore should have a stronger negative impact on stock returns.

Also consistent with our expectations, the current ratio) is positive and significant at the 10% level when controlling for the Below and Johnson (1996) variables [models (2)]. This result indicates that highly liquid firms announcing dividend cuts are considered good cutters. Our results show that none of the other firm characteristics we included in Eq. (1) and the Below and Johnson (1996) control variables are statistically significant.

In Table 6 we run the same model specifications using the abnormal returns on the day of the announcement [AR(0)] as the dependent variable. The results are very similar to those obtained in Table 5 and support our main hypothesis—the higher the growth opportunities, the more positive (or less negative) the investors’ reaction to dividend cuts. The coefficients on the profitability and liquidity (current) ratios are significant in the most complete specification.

If our hypothesis (that firms with high growth opportunities are better off cutting dividends during difficult financial times) is valid, then we should expect the cut to be temporary. Firms need financial flexibility when there are external financing constraints to be able to invest in their growth opportunities. Once these growth opportunities materialize, firms should be able to re-establish their dividends at their normal levels. Based on this premise, our next step is to test whether dividend cutters with high growth opportunities are more likely to resume dividend payments in the 5 years following the announcement of the dividend cut. We use a logistic regression where the dependent variable takes the value of 1 if the firm resumes the dividend within 5 years and the value of zero, otherwise. Table 7 shows strong evidence supporting our hypothesis—the higher the growth opportunities, the more likely the firm is to resume dividends within 5 years. We also find that in the first model, firms with higher leverage are less likely to resume dividends. However, this result is no longer significant once other control variables are included in the regression.

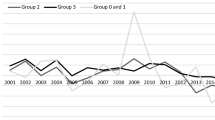

Bulan et al. (2007) find that a significant number of dividend omissions are considered good news and that dividends are resumed within 5 years of the announcement date. However, the market is not able to distinguish between good and bad omissions at the time of the announcement. Our evidence indicates that firms with high growth opportunities are more likely to resume dividends in 5 years which indicates that dividend cutters with high growth opportunities are good cutters. In Table 8, we test whether the market is able to differentiate between good versus bad cutters at the time of the announcement. We divide the sample into two groups, resumers and non-resumers and test whether the difference in the 3-day CAR and AR (0) is statistically significant. We also test for the difference in long-term stock returns between these two groups, using 1-year, 2-year, and 3-year holding period returns (HPR) and holding period abnormal returns (HPAR). The results indicate that resumers (good cutters) experience significant higher HPR and HPAR than non-resumers (bad cutters) in the 3 years following the dividend cut. However, at the time of the announcement, the investors’ reaction to good cutters is not statistically different from the reaction to bad cutters. This finding is consistent with the evidence presented in Bulan et al. (2007).

In summary, investors are not able to discriminate, ex-ante, between firms that will be able to resume their dividends and those who will not. However, we find evidence supporting the notion that high growth opportunities are a significant predictor of a good dividend cutter.

7 Conclusion

Using a sample of 145 dividend cuts announced during the recession starting November 2007–December 2009, we find a significant and negative average abnormal return around the announcement day. However, approximately 40% of our sample experienced positive abnormal returns on the announcement day. Consistent with our hypothesis, we find that firms with high growth opportunities experience higher abnormal returns. Moreover, firms with high growth opportunities are more likely to resume dividends within 5 years of the dividend cut and firms that resume their dividends have significantly higher long-term returns than non-resumers. These results support the hypothesis that firms with high growth opportunities can benefit from a dividend cut during a financial crisis.

The evidence presented in our study has several practical implications. First, given that during periods of financial turmoil firms with high growth opportunities react more positively to the announcement of a dividend cut, it is worth holding on to them as opposed to eliminating them from your portfolio. Second, during a financial crisis a significant number of firms cut their dividends. If an investor is looking to have dividend-paying stocks in her portfolio, firms with high growth opportunities are a good choice as they are more likely to resume those dividends within 5 years. In addition, firms that resume their dividends have significantly higher stock returns in the years following the dividend cut. Thus, once again, it is worth holding on to this kind of stock after a dividend cut, not only because the investor is more likely to receive dividend payments again in a few years but also significant capital gains. Finally, given that the market does not seem to clearly distinguish good cutters from bad cutters at the time of the announcement, it may be a good opportunity to buy more of these high-growth opportunities stocks and take advantage of the market’s overreaction. Of course, this analysis would have to be combined with thorough research of the firm’s fundamentals, but screening for firms with high growth opportunities is a good starting point.

Notes

We also repeat this analysis using day zero abnormal returns.

Given that the three factor model includes the HML factor and our main explanatory variable is growth opportunities measured as the market-to-book ratio, we also calculate abnormal returns using a standard CAPM model. Our main results and conclusions remain the same. The results are available upon request. We thank an anonymous referee for this suggestion.

This argument cannot be applied to firms with high profitability because profits do not necessarily translate into cash. A firm may be highly profitable and have no cash to pay a dividend.

A potential alternative interpretation for our finding is that during the crisis most firms experienced stock price declines and firms with relatively higher market-to-book ratios saw their stock prices drop to a lesser extent than other firms. In this context, the market-to-book ratio reflects overall financial condition rather than growth opportunities. We test this conjecture by including as control variables, and as interactions with MTB, the following variables: ROA, current ratio, logsize, mean bid-ask spread, and an indicator for investment grade bond rating. We also include 2-digit SIC code fixed effects. We do not find evidence in support of this alternative explanation as the positive relation between MTB and CARs still holds after controlling for these additional variables. We thank an anonymous referee for suggesting that we examine this alternative explanation.

References

Aharony J, Swary I (1980) Quarterly dividend and earnings announcements and stockholders’ return: an empirical analysis. J Financ 35(1):1–12

Ayers B, Jiang J, Yeung PE (2006) Discretionary accruals and earnings management: an analysis of pseudo earnings targets. Account Rev 81(3):617–652

Barclay MJ, Smith CW (1995) The priority structure of corporate liabilities. J Financ 50(3):899–916

Below SD, Johnson KH (1996) An analysis of shareholder reaction to dividend announcements in bull and bear markets. J Financ Strateg Decis 9(3):15–26

Benartzi S, Michaely R, Thaler R (1997) Do changes in dividends signal the future or past? J Financ 52(3):1007–1034

Best RJ, Best RW (2001) Prior information and the market reaction to dividend changes. Rev Quant Financ Account 17(4):361–376

Bouwman CHS, Fuller K, Nain AS (2009) Market valuation and acquisition quality: empirical evidence. Rev Financ Stud 22(2):633–679

Bulan L (2010) To cut or not to cut a dividend. Available at SSRN: https://ssrn.com/abstract=1712019

Bulan L, Subramanian N (2008) A closer look at dividend omissions: payout policy, investment and financial flexibility. Available at SSRN: https://ssrn.com/abstract=1335854

Bulan L, Subramanian N, Tanlu L (2007) When are dividend omissions good news? Available at SSRN: https://ssrn.com/abstract=997427

Dielman TE, Oppenheimer HR (1984) An examination of investor behavior during periods of large dividend changes. J Financ Quant Anal 19(2):197–216

Eades KM, Hess PJ, Kim EH (1985) Market rationality and dividend announcements. J Financ Econ 14(4):581–604

Gaver JJ, Gaver KM (1993) Additional evidence on the association between the investment opportunity set and corporate financing, dividend and compensation policies. J Account Econ 16(1–3):125–160

Ghosh C, Woolridge JR (1988) An analysis of shareholder reaction to dividend cuts and omissions. J Financ Res 11(4):281–294

Ghosh C, Woolridge JR (1989) Stock-market reaction to growth-induced dividend cuts: are investors myopic? Manag Decis Econ 10(1):25–35

Grullon G, Michaely R, Swaminathan B (2002) Are dividend changes a sign of firm maturity. J Bus 75(3):387–424

Grullon G, Michaely R, Benartzi S, Thaler R (2005) Dividend changes do not signal changes in future profitability. J Bus 78(5):1659–1682

Healy P, Palepu K (1988) Earnings information conveyed by dividend initiations and omissions. J Financ Econ 21(2):149–176

Hull TJ (2013) Does the timing of dividend reductions signal value? Empirical evidence. J Corp Financ 22:193–208

Jones JS, Gu J, Liu P (2014) Do dividend initiations signal a reduction in risk? Evidence from the option market. Rev Quant Financ Account 42(1):143–158

Lacina M, Zhang Z (2008) Dividend initiations by high-tech firms. Rev Pac Basin Financ Mark Polic 11(2):201–226

Nissim D, Ziv A (2001) Dividend changes and future profitability. J Financ 56(6):2111–2133

Pettit RR (1972) Dividend announcements, security performance, and capital market efficiency. J Financ 27(5):993–1007

Smith CW, Watts RL (1992) The investment opportunity set and corporate financing, dividends, and compensation policies. J Financ Econ 32(3):262–292

USA Today (2008) 2008 on track as record year for dividend cuts. USA Today. http://usatoday30.usatoday.com/money/perfi/stocks/2008-02-28-dividends_N.htm. Accessed 8 November 2016

USA Today (2009) Companies cut dividends in ‘09 at a level not seen since 1930s. USA Today. http://usatoday30.usatoday.com/money/markets/2009-12-23-dividends-down_N.htm. Accessed 8 November 2016

Van Eaton RD (1999) Stock price adjustment to the information in dividend changes. Rev Quant Financ Account 12(2):113–133

Author information

Authors and Affiliations

Corresponding author

Rights and permissions

About this article

Cite this article

Che, X., Liebenberg, A.P., Liebenberg, I.A. et al. The effect of growth opportunities on the market reaction to dividend cuts: evidence from the 2008 financial crisis. Rev Quant Finan Acc 51, 1–17 (2018). https://doi.org/10.1007/s11156-017-0663-8

Published:

Issue Date:

DOI: https://doi.org/10.1007/s11156-017-0663-8