Abstract

We examine how changes in dividend policy in 2008 as the financial crisis was unfolding influenced firm risk-adjusted returns in the following years. Our sample consists of NYSE- and NASDAQ-traded firms that paid dividends in 2007. We divide these firms into four groups based on their dividend policy in 2008. We find that firms that decreased or eliminated dividends in 2008 had higher risk-adjusted returns in 2009. The higher risk-adjusted return is consistent with the better corporate governance in 2007. This finding suggests that the firms that quickly reacted to the deteriorating economic conditions by cutting dividends and preserving cash were able to better weather the coming financial crisis.

Similar content being viewed by others

Avoid common mistakes on your manuscript.

1 Introduction

Corporate dividend policy has been the subject of finance and economic research for decades as new factors are considered in determining why firms pay dividends, why they choose to initiate dividends as well as why they choose to reduce/suspend dividends. The recent financial crisis offers a unique situation in terms of examining the dividend behavior of U.S. firms in the face of somewhat dire economic conditions. Generally speaking, a reduction in dividends has been viewed as a negative signal in terms of firm value. However, the financial crisis represented such a significant event not only in the U.S. but globally, that it is of interest to further examine the dividend behavior from the pre-crisis period and on throughout the crisis period.

It is the objective of this research to examine firms that reduced or eliminated their cash dividends at the beginning of the financial crisis and assess subsequent performance. Firms are categorized according to their crisis-related dividend behavior. That is, our data sample considers firms that made no changes at all in their dividend policy; those that reduced their dividends to zero; those that reduced their dividends but not totally; and finally those that actually increased their dividends. Financial returns for these four groups are followed through until the end of 2009. The methodology is designed to assess whether the changes in dividend policy during the crisis period impacted the risk-adjusted returns of the sample firms. The general conclusions show that firms that eliminated or reduced their dividends had significantly higher risk-adjusted returns in 2009, a finding somewhat contrary to traditional theory. The overall conclusion is that it was beneficial for firms to react quickly to the deteriorating economic conditions in 2008 by adjusting their dividend policy to preserve cash.

The paper will continue with a brief literature review followed by a discussion of the data utilized and then the specific empirical methodology. The results will be discussed and followed by the final conclusions and implications.

2 Related literature

The body of research regarding corporate dividend policy is very extensive and we will provide just a brief review of the more important literature. Of course, Miller and Modigliani (1961) offer the classic work in this area where they argued that firm value is unaffected by the choice of distribution methods under certain assumptions. Many others have built upon this early work with studies examining the tax effects on dividends also (see Talmor and Titman 1990; Change and Rhee 1990; Naranjo et al. 1998; Kuo and Lee 2013). Additional dividend research has considered the information content of dividends (see Healy and Palepu 1988; Gonedes 1978; Benartzi et al. 1997; Best and Best 2001). The argument in that body of work is that dividends convey information that investors use in their assessment of the overall risk and future of the firm and hence firm value. Generally speaking, decreases or omissions of dividends are viewed as conveying negative information regarding a firm’s prospects for the future. Another line of research has addressed the agency relationship and how that may influence dividends. One argument is that a higher payout firms have less in retained earnings and are forced to turn to the capital markets when they need additional equity. The scrutiny of the capital market serves to mitigate any agency issues that may have developed if the firm only retained earnings. In other words, this agency effect emphasizes the role of investment bankers and analysts in insuring that management is indeed acting in the best interest of the shareholders. Rozeff (1982) examined this issue by looking at the tradeoff between agency costs and the cost of external financing. His empirical work provides evidence to support the conclusion that investment policy does indeed affect dividend policy. This was expanded and reinforced by Lloyd et al. (1986). Firms with greater investment opportunities exhibit lower dividend payout ratios. Many other studies have considered the agency issues as related to dividend policy (see for example Easterbrook 1984; Jensen et al. 1992; Schooley and Barney 1997; Fenn and Liang 2001; Lee 2011).

Frankfurter and Wood (2002) review the conflicts among the results from earlier work on dividend policies. Their overall conclusion is that explanatory models for dividends are likely to continue to be inconclusive due to the various factors and the difficulty in capturing all the relevant factors. A more recent work by Baker et al. (2002) reexamines the dividend puzzle to see if “all the pieces now fit.” This work offers a review of much of the major research as well as discussion of the reasons for dividends and also offers results of various surveys on dividends. The general conclusion is that the many studies regarding dividends have helped in putting the “puzzle” together, but it is still not complete nor may it ever be complete. Baker et al. (2002) list the main factors from their review of the work; market imperfections, behavioral issues, firm specific characteristics, and management preferences. A more “practical” research work is by Brav et al. (2005) and is based on survey research. They survey a large number of financial executives and conduct actual interviews to gain a better understanding of the elements that determine dividends as well as stock repurchases. Their conclusions are not surprising. First, they conclude that management still hesitates to cut dividends given the perceived adverse reaction on the part of investors. That is, dividends tend to be “sticky” in the sense that firms tend to maintain existing dividend policies for long periods. In addition, many of the respondents in their survey indicated that they would have preferred to not pay dividends but once dividends were initiated they were hesitant to cut them. Another finding is that share repurchases have gained in importance given the relative flexibility of that means of distribution. Jagannathan et al. (2000) point out that financial flexibility is an important consideration when the firms make decision on payout policy. They focus on the choice between cash dividends and repurchases, finding that firms that generate stable cash flows tend to pay cash dividends while firms with unstable and uncertain cash flows tend to distribute through share repurchases. Iyer et al. (2017) confirm that mangers want to maintain a flexible payout policy by using stock repurchases rather than dividend. This flexibility allows the managers to better meet future capital expenditures of the firm. The authors find that capital expenditures are significantly negatively related to repurchases, especially under financial constraints. They do not find any significant relation between capital expenditures and cash dividend payouts. Arslan-Ayaydin et al. (2014) further link the financial flexibility to investment behavior and performance of firms in Asian Countries. They find that firms with more financial flexibility have better performance during the 1997–1998 and 2007–2009 crises.

Another body of research has considered dividend changes and the reaction and reasons for such changes. Lie (2005) examines a large number of dividend decreases and omissions for the time frame 1980 to 1998. He relates the dividend changes to changes in earnings. His conclusions are that earnings generally suffer at the announcement time but then tend to recover in subsequent periods. He does find a negative stock price effect consistent with the view that the market overreacts to any negative inferences. Jensen et al. (2010) look at firms that had dividend reductions from 1967 to 2006. Their methodology considers both the standard stock return reaction to the announcement and then also a consideration of financial characteristics. As shown in much of the earlier research, there is a negative market reaction to a reduction in dividends but this is followed by a recovery in earnings after the dividend reduction period. When looking at other characteristics, they find that the earnings recovery is due to the reduction in certain other costs such as capital investments, R&D as well as the level of employment. Lacina and Zhang (2008) investigate dividend initiations of high-tech firms and non-high-tech firms. They find that the market performance of high-tech firms after dividend initiations is better than that of non-high-tech firms. They also argue that higher liquidity of assets held by high-tech firms strengthens investor confidence and hence leads to better market reaction on the dividend initiations.

Another study by Chay and Suh (2009) empirically studies the dividend behavior of over 5000 firms from Australia, Canada, France, Germany, Japan, the UK and the U.S. Their research determines that cash flow uncertainty is a major driver of dividend policy while controlling for other relevant factors. This is consistent with the idea that uncertainty resulting from a financial crisis can indeed affect dividend policy and in a very short time frame.

More directly related to our research are works related to the financial crisis and dividends. Campello et al. (2010), using survey methodology, focus on some broader aspects of financial change during a crisis. They study how financial constraints impacted firms in terms of employment levels, capital investment, marketing and technology spending. Their survey covers 1050 CFOs in 39 countries. The results show that the above items all faced reductions in funding levels. The survey results further indicate that firms were burning cash quickly which led to dividend cuts that were greater than anticipated. Floyd et al. (2015) examine dividend paying behavior for both financial as well as industrial firms. Citing earlier evidence that dividends for industrial firms have been in something of a long run decline, they find that the reluctance to reduce dividends remains quite high (see Fatemi and Bildik 2012). In a somewhat related paper by Fuller and Goldstein (2011), dividends are found to have greater importance in declining markets. They consider the period from 1970 to 2007 and examine the stock returns for a sample of dividend paying firms as well as those not paying dividends. While their results do capture the 37-year effect, it stops short of the period of the 2008 financial crisis which is the focus of our current research. Che et al. (2018) document the effect of dividend cuts during 2008 financial crisis. They confirm a negative market reaction to dividend cuts and find that this market reaction is related to the firm’s growth opportunities. Higher abnormal returns on dividend cut are found for firms with better growth opportunities.

Of direct relevance to our research is a work by Abreu and Gulamhussen (2013) on the dividend payout behavior of 462 bank holding companies in the U.S. Their findings are not surprising. Overall macroeconomic conditions do influence dividend behavior. Further, firm specific characteristics play a major role with, as expected, stronger institutions paying greater dividends. Abreu and Gulamhussen feel that their results offer continuing support for the signaling effect of dividends. In another interesting study for firms on the London Stock Exchange, Bozos et al. (2011) consider signaling effects of dividend announcements, comparing reactions between periods of economic stability and economic turmoil. They confirm the continuing information importance of dividends but do find that dividend changes and their impact are related to overall economic stability. Another study by Pathan et al. (2014) considered a large sample of dividend increase announcements by US firms for the period 1989–2012. Their general conclusions are that firms that are financially constrained actually displayed higher post increase performance relative to unconstrained firms. In explaining this finding, they suggest that there is a timing effect to dividend increase announcements made in anticipation of a seasoned equity offering. They cite this as evidence of a signaling effect for those firms. They further find that dividend-increasing firms that are also financially constrained exhibited weaker returns during the financial crisis.

Hauser (2013) asks whether corporate dividend policy changed during the recent U.S. financial crisis. Hauser used 2006 as a base year to insure that management had not yet gained knowledge of the impending problems with our financial system. Using data from Compustat and the period 2006–2009, Hauser utilized logistic regression. In summary, he found a decline in the likelihood of dividends being paid for 2008 and 2009 ceteris paribus. Not surprising is his finding that dividend cuts increased during his sample period as firms preserved cash during the time of greater uncertainty. One other paper by Lee et al. (2013) considers dividend payout as well as stock repurchases during the financial crisis. Their results, like many others, are not terribly surprising. Overall, firms must exhibit a sound financial condition if they are to increase dividends in a crisis period. Further, such firms tended to continue also with stock repurchase programs. This suggests that they were not diverting funds from a repurchase plan simply to continue paying dividends. Bliss et al. (2013) examine financial policies and any adjustments made during the recent financial crisis. Specifically, they focus on credit availability and find that those firms with more leverage, greater growth and less liquidity displayed reductions in dividends. Simply stated, they find that firms paid out less but used the funds to support growth and investment.

Clearly, the more recent literature offers some insights into the dividend policy reaction to the U.S. financial crisis. Given the breadth and depth of the financial crisis, a better understanding of firm reactions is of importance in guiding corporate dividend policy. A summary view of the literature is that firms did indeed respond to the crisis through preservation of cash, reduction in capital investment, R&D, etc. Our research is designed to consider further the reaction for a broad set of firms that may have eliminated dividends, reduced dividends or actually increased dividends.

3 Data

Our sample consists of all companies trading on the NYSE and NASDAQ. To avoid biases associated with highly regulated financial companies, we exclude all companies with SIC code 6000-6999 (Finance). We use information on dividends and daily returns from CRSP, the risk-free rate and factor loadings from the Fama–French database, and fundamental data from Compustat. Institutional holding data comes from Thomson Reuters.

First, we provide basic information on dividends and stock repurchases for NYSE- and NASDAQ-traded companies from 2000 to 2015 (Table 1). The number of firms included varies from year to year. For NYSE firms, the number ranges from 1567 in 2009 to 1945 in 2000. For NASDAQ firms, the number ranges from 2221 in 2012 to 4442 in 2000. The ratio of cash dividend paying stocks traded on the NYSE was increasing until the year 2007 when it reached 62.7% of firms in our sample (i.e. 1070 firms). Starting in 2008, the ratio of dividend payers was declining. It reached the bottom of 56.77% (902 firms) in 2010 and then started to increase again recovering to 61.26% in 2012 (998 firms). For NASDAQ-traded firms, the ratio of dividend payers reached its high of 16.7% in 2008 (i.e. 424 firms), then declined to 16.0% (389 firms) in 2009 and started to increase again in 2010. The year 2009 was also the year of the lowest rate of stock repurchases for both NYSE and NASDAQ-traded stocks.

4 Grouping the firms based on their dividend policy

To examine the consequences of changes in dividend policy, we identify all firms that paid cash dividends in 2007. Our sample contains 861 dividend-paying firms on NYSE and 350 on NASDAQ (Table 2).Footnote 1 These are our sample firms and we use 2007 as the benchmark year. We use this year because the financial crisis is generally thought to have begun at the end of 2007 and it was well underway in 2008. Also, the National Bureau of Economic Research (NBER) defines the beginning of the crisis as December of 2007. So, it is unlikely firms would have had sufficient time to react to deteriorating economic conditions via dividend policy changes in 2007. In other words, we view 2007 as a “clean” year in terms of normal dividend policies.

We divide these sample firms into four groups based on their dividend policy in 2008 (Table 2). We use the dividend payout information (DIVAMT, RCRDDT, DISTCD) in the CRSP monthly stock file. Dividend policy change is proxied by changes in the total amount of dividends and frequency of dividends. Group 0 consists of firms that decreased both the amount and frequency of dividends to zero in 2008. This group represents 8.48% of the sample firms for NYSE and 8.86% for NASDAQ. Group 1 includes firms that decreased either the amount or frequency of dividends, from 2007 to 2008 (16.03% of the sample firms on NYSE and 15.71% on NASDAQ). Group 2 contains firms that made no change to their dividends (19.28% of the sample firms on NYSE and 18.57% on NASDAQ). Group 3 includes firms that increased either the amount or frequency of their dividends. This is the largest group, representing 56.21% of the sample firms on NYSE and 56.86% on NASDAQ. This is not surprising because this group represents the most typical dividend policy when firms increase their dividends over the years. To address possible distribution by stock repurchases in our sample, Table 3 reports firms in our sample that reported stock repurchases from 2007 to 2009. Only very small proportion of these firms repurchased during our study period. In fact, only 9 out of 861 NYSE firms and 10 out of 350 NASDAQ firms in our sample repurchased shares between 2007 and 2009. Therefore, we can assume that repurchases were not an important way of distribution to shareholders in our sample.

Basic characteristics of different groups are shown in Table 4. As can be seen, the group of firms that stopped paying dividends in 2008 (group 0) had on average the lowest profitability, the highest book-to-market ratios and high level of debt. These firms were also the smallest firms. Such firms were clearly encountering more difficulty related to profitability, debt, etc. and had the need to preserve cash. On the other hand, the group of firms that increased dividends in 2008 (group 3) had the highest profitability, lowest leverage, lowest book-to-market ratios and the highest market value. Average daily returns for individual groups in 2009 are also shown in Table 4. The highest daily returns were for group 0 on NYSE and group 1 on NASDAQ.

We follow all four groups until 2009 and examine whether dividend policy in the crucial year of 2008 influenced their risk-adjusted returns. Note here that the groups were created based on their dividend policy in 2008 and no further adjustments to the groups were made. That is, the assigned group number remains the same regardless of subsequent dividend changes. Changes in dividend policy in the 2009 year did not result in reclassification.

5 Differences in risk-adjusted returns among groups

We ask a question whether the changes in dividend policy in the crucial year of 2008 influenced the market performance of the firms in a following year. Therefore, we sort firms into groups based on changes in dividend policy that they had made in 2008 and examine their risk-adjusted returns in 2009. We believe that firms that quickly reacted to the upcoming financial crisis by preserving cash were able to compensate, at least to some extent, for the lack of internal and external financing sources during this crisis. For dividend-paying firms, of course, the elimination of cash dividends represents an important cash source. Therefore, we expect that firms that adjusted their dividends downward in 2008 had higher risk-adjusted returns in 2009Footnote 2. To estimate the risk-adjusted returns, we use the four-factor model

where \(r_{i,t}\) is the daily return on the asset i in 2009, \(r_{f,t}\) is the risk-free rate, \(r_{m,t}\) is the market return, and SMBt, HMLt and UMDt are the Fama–French factors representing the returns corresponding to size, book-to-market and momentum portfolios.

The average risk-adjusted returns for each group in 2009 are shown in Table 5. We test the stocks trading on NYSE and NASDAQ separately and show the results in panels A and B. The portfolio of firms that decreased their dividends or stopped paying dividends in 2008, i.e. groups 0 and 1, have positive and significant alphas in 2009 for both NYSE and NASDAQ-traded stocks. In addition, the firms that decreased dividends (group 1) have positive and significant alphas for both NYSE and NASDAQ while the firms that stopped paying dividends entirely (group 0) have alpha significant at the 10% level only for NYSE. These results suggest that reducing dividends at the beginning of financial crises was a beneficial decision that resulted in higher risk-adjusted returns in 2009.

We further test whether alphas among groups are significantly different using modified GRS test (detail is provided in the “Appendix”). The modified GRS test follows the method of Gibbons et al. (1989), and Follmann (1996) to test the difference between alphas under one universe. We find a positive and significant difference in four-factor alphas between the groups that reduced or stopped paying dividends (group 0 and 1) and groups that did not make changes to their dividend policy (group 2) or increased their dividends (group 3). This applies to both NYSE and NASDAQ exchanges (Table 6). These results support our previous findings and the notion that the firms who reduced the dividend during the 2008 crisis had significantly stronger recovery.

5.1 Robustness check with matched benchmarks

To address concerns that these differences in mid/long-run performance are due to other factors than changes in dividend policy, we use the propensity score matching to find a benchmark for each dividend payer. We match each dividend-payer with a nonpayer based on similar fundamental information. Specifically, we use the industry, size, leverage, turnover, book-to-market ratio (BM), profit margin, and return on assets (ROA) as matching criteria in 2009.

To ensure that a non-dividend payer mimics the fundamental characteristics of the dividend-payer, we first run a logistic model,

Then, using the predicted value of logit regression as a score, we match each dividend-payer with the closest nonpayer within the same industry.

Table 7 reports the returns/alphas of each group and its benchmark. Our variables of interest are variables Difference in returns and Difference in alphas. Difference in returns is the excess return of each dividend-policy group over the excess return of its matched benchmark. Difference in alphas is the difference in alphas of each group and their matched benchmarks. Consistent with our previous results, the groups 0 and 1, i.e. groups that stopped paying dividends or reduced dividends, have higher excess returns and alphas than their non-payer counterparts. Groups 2 and 3, i.e. groups that continued with their dividend policy or increased dividends, had on the other hand, significantly lower returns than their non-dividend matches.

To demonstrate that the benchmark firms are indeed similar to the sample firms we check the balance of the control variables. We report differences in control variables between the sample and benchmark firms in Table 8, panel A. The differences in all control variables are not significant at 5% level confirming that the benchmark firms are generally similar to sample firms and the matching is efficient. The only exception is the difference in size between the sample and benchmark firms on NYSE. This is because dividend payers tend to be larger and more mature companies within the industry.

Table 8, panel B reports differences in daily returns in 2007 to demonstrate that benchmark and sample firms had similar returns before the changes in dividend policy. The differences in returns are not significant for any group confirming successful matching procedure.

5.2 The effect of dividend omissions

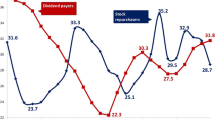

We argue that decreasing dividends at the beginning of 2008 financial crisis was a correct decision that enabled the firms to preserve much needed cash and work through the financial crisis period. Consistent with this premise, we find that firms that stopped paying dividends or those that decreased dividends were rewarded by higher risk-adjusted returns in 2009. Empirical research documents that decreases in dividends are usually associated with significantly lower returns surrounding the announcement day (see for example Dhillon and Johnson 1994; Michaely et al. 1995; Che et al. 2018). Therefore, higher risk-adjusted returns in a year following decrease in dividends may not be due to benefits of improved cash flows during the crisis but rather to a depressed stock price resulting from the change in dividend policy. In other words, our findings may not be specific to the severe financial crisis of 2008. Instead they may be driven by the dividend omissions and consequent recovery effect in long-run performance. To address this concern, we expand the time period and examine the effect of changes in dividend policy on risk-adjusted returns from 1999 to 2015. We use the same methodology and identify dividend-paying firms in year t − 2. In year t − 1, we sort these firms into groups based on changes in their dividend policy. We follow these groups and evaluate their performance in year t. The results are plotted in Fig. 1 (NYSE) and Fig. 2 (NASDAQ). As can be seen from these figures, the large increase in risk-adjusted returns for groups 0 and 1 is present only during the 2008 financial crisis, implying that higher risk-adjusted returns for firms that decreased their dividends are not driven by effects associated with dividend-omission. See Figs. 1 and 2, which cover the time period from 2001 to 2015.

6 Cross-sectional tests on returns

6.1 The effect of dividend policy change

To further support our finding, we conduct cross-sectional tests on risk-adjusted returns. We regress risk-adjusted return (alpha or average excess return) on firm characteristics and a group variable (Group):

The Alpha is the four-factor model alpha generated from 2009 daily returns [Eq. (1)]. We also use average excess return as another dependent variable. The control variables are firm characteristics in 2009; Group is the group number. We do not further expand the set of our control variables because of concern of losing more observations. Missing values in Compustat may introduce bias leading our sample towards larger firms and value firms and significantly reducing observations, especially in Group 0.

Panel A of Table 9 reports results from the full sample including NYSE observations and NASDAQ observations. All of the Group coefficients (γ) are negative and significant (at 1% level), indicating that alphas and excess returns are significantly higher for groups with lower group numbers, i.e. the groups that decreased or stopped paying dividends in 2008. Panel B reports similar results for NYSE firms. For NASDAQ firms, the effect of change in dividend policy is similar but weaker (panel C) with all γ coefficients negative but only three significant at 5% level and one not significant. In general, we confirm the previous results that dividend policy change in 2007 does affect the risk-adjusted returns after the crisis.

6.2 Survivorship bias

Some firms in our sample may have been acquired by other firms, gone bankrupt and delisted during our time period. Therefore, our results may suffer from survivorship bias. To address this problem, we add back missing observations and conduct the Heckman correction to the tests. First, we collect information on delisted firms and add them back into our sample prior to the date they delisted in 2009. Second, we identify those firms that are present in our 2007 sample but disappear in the 2009 sample. We calculate the inverse Mills ratio (IMR) for each observation and add IMR as an independent variable using following equations:

Control variables include the size, leverage, turnover, BM, margin and ROA. IMR is the inverse Mills ratio, which is estimated from Eqs. (4) and (5). \(\upphi\left( \cdot \right)\) denotes the normal density function and \(\Phi \left( \cdot \right)\) denotes the normal cumulative distribution function. Table 10 shows the results of the Heckman correction test. The Group coefficients (\(\gamma\)) remain negative and significant confirming that our results reported in Table 10 hold. Moreover, the effect of a change in dividend policy for NASDAQ firms is stronger after Heckman correction.

7 The managerial effort

The literature well documents the impact of corporate governance and managerial effort on firm value and performance (see for example Gompers et al. 2003; Bhagat and Bolton 2008; Bebchuk et al. 2009; Lee and Lee 2009; Leung and Horwitz 2010; Chen and Chen 2018). The general finding is that better corporate governance is associated with higher firm value and better performance. In this study, we argue that the strong recovery of groups 0 and 1 is a result of managements’ fast reaction to the financial crisis. Managers, who were able to identify the coming crisis and reduce their dividends, mitigated the effect of liquidity constrains on the firm during the financial crisis. Therefore, we believe that managerial effort played a significant role in firms recovering through correctly reducing dividends during the crisis.

7.1 The cross-sectional tests and managerial effort

To test this hypothesis, we add institutional holdings as a primary variable that proxies for managerial effort and investigate the relationship between managerial effort in 2007 and the group effect on return in 2009. A large body of literature focuses on institutional investors’ effort to improve corporate governance (see for example Shleifer and Vishny 1986; Bertrand and Mullainathan 2001; Velury et al. 2003). In general, institutional investors are viewed as watchdogs that push managers to make right choices. Therefore, a higher level of institutional ownership is associated with better managerial effort. That is, institutional investors bring a level of oversight and monitoring that may influence better management. We are not necessarily interested in the overall effect of the managerial effort on returns but rather in the effect of managerial effort concerning the change in dividend policy. Our argument is that decisions that led to preserving cash, such as the decision to decrease dividends, were crucial decisions at the beginning of the financial crisis and that companies benefitted from these decisions in 2009. Therefore, we test the effect of the managerial effort through a model,

where IH is the institutional holding in 2007. Control variables include size, leverage, turnover, BM, Margin and ROA. The dependent variables are risk-adjusted returns in 2009.

We expect better managerial decisions concerning the dividend policy to be reflected in a negative and significant coefficient on the interaction term \(\left( {Group_{i} IH_{i}^{2007} } \right)\). Consistent with our expectations, the interaction coefficients are negative and significant at 5% level for the full sample (panel A of Table 11). After the interaction term is added into the model, the Group coefficient loses its significance and becomes positive. This finding implies that the effect of dividend policy change on future recovery is indeed associated with managerial effort during the crisis. We find similar results for NYSE firms (Table 11, panel B). The results for NASDAQ firms are weaker (panel C), probably due to smaller sample size.

Changes in dividend policy may also be related to changes in institutional ownership as institutional investors adjust their portfolio according to their cash flow needs. Therefore, we report the average institutional holdings for each group in 2007, 2008 and 2009 (Table 12, panels A and B). For the NYSE firms, the institutional holding levels are highest for group 0, i.e. the group of firms that stopped paying dividends and lowest for group 3, i.e. the group that increased their dividends. For NASDAQ firms, the levels of institutional holdings are just opposite with the lowest institutional holdings for the group of firms that stopped paying dividends (group 0) and the highest for the groups that continued or increased their dividends (groups 2 and 3). We find that institutional ownership in groups 0 and 1, i.e. the groups omitting or reducing dividends, decreased during the financial crises. Specifically, the institutional ownership decreased from 86 to 70% for group 0 and from 79 to 71% for group 1 on NYSE. The decrease in institutional ownership for groups that did not decrease dividends, i.e. the groups 2 and 3 decreased as well but not so substantially (from 79 to 71% for group 2 and from 73 to 69% for group 3).

Table 12, panels C and D reports alphas for each group in 2007, 2008 and 2009. In 2007 and 2008, the alphas are lower for firms reducing dividends, but they are not significant. During the financial crises the stock prices of the vast majority of firms were dropping. We cannot make any meaningful conclusions about the effect of dividend changes within this short time interval. We address this concern in Sect. 5.2 by examining the effect of changes in dividend policy on risk-adjusted returns from 1999 to 2015 (Figs. 1, 2). We find strong evidence that our findings are not driven by other events accompanying omission of dividends and are specific only to the financial crises.

As a second proxy for quality of corporate governance we use the entrenchment index proposed by Bebchuk et al. (2009). This index is composed of six corporate provisions that were shown to have influence on firm valuation. Four of these provisions affect shareholder voting power (staggered boards, limits to shareholder amendments of bylaws, supermajority requirements for mergers and supermajority requirements for charter amendments). The remaining two provisions are provisions that affect likelihoods of hostile takeovers, i.e. poison pills and golden parachutes. The corporate governance data are from the MSCI database.

We follow loosely the method of Masulis et al. (2007) and identify the firms with a “dictatorship” governance. We define the “dictatorship” firms as firms with the entrenchment index equal or higher than 4. In general, these firms are firms with weak protection for shareholders and/or strong hostile antitakeover provisions. Therefore, managers of these firms face lower pressure from the market for corporate control and are likely to have worse or less effective management. We run a regression:

where Dictatorship is a dummy variable equal to one if the firm is categorized as a dictatorship firm, zero otherwise. Control variables are size, leverage, turnover, BM, Margin and ROA.

Our expectation is that better managerial decisions will be reflected in a significant and positive coefficient on the interaction term \(\left( {Group_{i} Dictatorship_{i}^{2007} } \right)\). The results are shown in Table 13. Consistently with our expectations, the interaction coefficient is positive and significant for the NYSE sample. The results for NASDAQ are not significant, likely due to a small sample size.

Overall our results indicate that managers that face more pressure from institutional investors or the market for corporate control were more likely to make better decisions about their dividend policy during the financial crises.

7.2 Persistence of institutional holdings

The managerial effort may have affected returns in 2009 through two channels. First, management that reduced dividends at the beginning of crisis preserved cash that benefited the firm during and after crisis. Second, the management that was effective in 2007 kept the position and remained effective in 2009. Because institutional holdings (a proxy for managerial effort) may not change dramatically year to year, the better returns in 2009 may not be due to fast managerial reaction to the upcoming crisis but rather to good corporate governance in 2009.

To address this concern, we use a two-stage regression to exclude the effect of institutional holdings in 2009. The first stage regression is:

The residuals of the first regression are then used in the second stage to exclude the effect of corporate governance in 2009:

The results are reported in Table 14. The coefficients on interaction term (\(Group_{i} IH_{i}^{2007}\)) (except one for NASDAQ) remain negative and significant (at 10% level). These results confirm our argument that fast managerial reaction regarding dividends during crisis contributed to better market performance during recovery period.

7.3 The performance over matched benchmarks

We use institutional holdings as a proxy for managerial effort but other factors may also affect returns, dividend policy and institutional holdings at the same time. To address a possible endogeneity issue, we exclude the effect of these factors by matching each firm in our sample with a similar firm that did not pay dividends in 2007 and therefore is not included in our sample (a benchmark firm). The benchmark firm should react to similar factors as the matched firm. To find a benchmark firm, we estimate a logit regression using firm’s characteristics in 2009.

With the predicted value of logit regression, we match each of our sample firms with the closest nonpayer within the same industry. Then we exclude the effect of potential other factors by calculating the excess risk-adjusted returns,

The coefficients on interaction term \(\left( {Group_{i} IH_{i}^{2007} } \right)\) are still negative and significant for full sample and NYSE (panels A and B of Table 15). For NASDAQ firms the results are weaker with coefficients being negative but not significant. In general, these results support the argument that a change in dividend policy during crisis positively affected future performance because of managerial efforts at that time. The effect of such dividend change is concentrated mainly in the NYSE sample.

8 Conclusions

Overall, the objective of this research is to examine the effect of dividend behavior during the period of recent U.S. financial crisis. Given the critical decline in economic activity, many firms felt the need to preserve cash and took action to insure sufficient cash levels to survive the crisis. We examine firms that made no changes in dividends, those that eliminated dividends totally, those that reduced but did not totally eliminate dividends and then finally those that actually increased dividends. Overall, we find that firms that were able to quickly react to deteriorating economic conditions in 2008 by adjusting their dividend policy had higher risk-adjusted returns in the subsequent year. Reducing dividends is usually seen as a “bad” signal by the market and followed by negative market reaction. Under exceptionally adverse market conditions, however, a reduction in dividends may signal the ability of managers to quickly react to the changing market conditions and the firms may be rewarded by the market in a long run. Hence, earlier works on the signaling hypothesis may have had some element of time specificity. That is, the results may be driven by financial crises for instance. Clearly, the U.S. financial crisis has been the most significant since the Great Depression with many of the belief that corporate decision-making may have been permanently altered. The dividend payout decision is but one area in which the resulting changes are of interest. That is, despite any negative connotations, many firms felt they had to reduce or eliminate their cash dividends. We further looked at a longer time period to provide more evidence of firm reaction. More research will be needed of course to trace the longer run implication of many of the corporate policy changes that may have occurred since 2008.

Notes

This sample is smaller than the overall number of dividend paying firms in Table 1. It is because some firms were lost due to missing values in Compustat and merging CRSP and Compustat databases.

We pick 2009 as evaluating period because the dividend cut should show immediate effect on the performance. In an unreported result, we extend the evaluating period to 2009–2015. The main results hold and these results are available upon request.

References

Abreu JF, Gulamhussen MA (2013) Dividend payouts: evidence from U.S bank holding companies in the context of the financial crisis. J Corp Finance 22:54–65

Arslan-Ayaydin Ö, Florackis C, Ozkan A (2014) Financial flexibility, corporate investment and performance: evidence from financial crises. Rev Quant Finance Account 42:211–250

Baker HK, Powell GE, Veit ET (2002) Revisiting the dividend puzzle: do all of the pieces now fit? Rev Financ Econ 11:241–261

Bebchuk LA, Cohen A, Ferrell A (2009) What matters in corporate governance? Rev Financ Stud 22:783–827

Benartzi S, Michaely R, Thaler R (1997) Do changes in dividends signal the future or the past? J Finance 52:1007–1034

Bertrand M, Mullainathan S (2001) Are CEOs rewarded for luck? The ones without principals are. Q J Econ 116:901–932

Best RJ, Best RW (2001) Prior information and the market reaction to dividend changes. Rev Quant Finance Account 17:361–376

Bhagat S, Bolton B (2008) Corporate governance and firm performance. J Corp Finance 14:257–273

Bliss BA, Cheng Y, Denis DJ (2013) Corporate payout, cash retention, and the supply of credit: evidence from the 2008–09 credit crisis. J Financ Econ 115:521–540

Bozos K, Nikopoulos K, Ramgandhi G (2011) Dividend signaling under economic adversity: evidence from the London Stock Exchange. Int Rev Financ Anal 20:364–374

Brav A, Graham JR, Harvey CR, Michalely R (2005) Payout policy in the 21st century. J Financ Econ 77:483–527

Campello M, Graham J, Harvey C (2010) The real effects of financial constraints: evidence from a financial crisis. J Financ Econ 97:470–487

Change R, Rhee S (1990) The impact of personal taxes on corporate dividend policy and capital structure decisions. Financ Manag 19:21–31

Chay J, Suh J (2009) Payout policy and cash-flow uncertainty. J Financ Econ 93:88–107

Che X, Liebenberg AP, Liebenberg IA, Morris BC (2018) The effect of growth opportunities on the market reaction to dividend cuts: evidence from the 2008 financial crisis. Rev Quant Finance Account. https://doi.org/10.1007/s11156-017-0663-8

Chen CL, Chen CY (2018) Do weak internal controls affect institutional ownership decisions? Rev Pac Basin Financ Markets Policies 21:1–37

Dhillon US, Johnson H (1994) The effect of dividend changes on stock and bond prices. J Finance 49:281–289

Easterbrook FH (1984) Two agency-cost explanations of dividends. Am Econ Rev 74:650–659

Fatemi A, Bildik R (2012) Yes, dividends are disappearing: worldwide evidence. J Bank Finance 36:662–677

Fenn GW, Liang N (2001) Corporate payout policy and managerial stock incentives. J Financ Econ 60:45–72

Floyd E, Li N, Skinner DJ (2015) Payout policy through the financial crisis: the growth of repurchases and the resilience of dividends. J Financ Econ 118:299–316

Follmann D (1996) A simple multivariate test for one-sided alternatives. J Am Stat Assoc 91:854–861

Frankfurter GM, Wood BG (2002) Dividend policy theories and their empirical tests. Int Rev Financ Anal 11:111–138

Fuller KP, Goldstein MA (2011) Do dividends matter more in declining markets? J Corp Finance 17:457–473

Gibbons MR, Ross SA, Shanken J (1989) A test of the efficiency of a given portfolio. Econom J Econ Soc 57:1121–1152

Gompers P, Ishii J, Metrick A (2003) Corporate governance and equity prices. Q J Econ 118:107–156

Gonedes N (1978) Corporate signaling, external accounting and capital market equilibrium: evidence of dividends, income and extraordinary items. J Account Res 16:26–79

Hauser R (2013) Did dividend policy change during the financial crisis? Manag Finance 39:584–606

Healy P, Palepu K (1988) Earnings information conveyed by dividend initiations and omissions. J Financ Econ 21:149–175

Iyer SR, Feng H, Rao RP (2017) Payout flexibility and capital expenditure. Rev Quant Finance Account 49:633–659

Jagannathan M, Stephens CP, Weisbach MS (2000) Financial flexibility and the choice between dividends and stock repurchases. J Financ Econ 57:355–384

Jensen GR, Solberg DP, Zorn TS (1992) Simultaneous determination of insider ownership, debt, and dividend policies. J Financ Quant Anal 27:247–263

Jensen GR, Lundstrum LL, Miller RE (2010) What do dividend reductions signal? J Corp Finance 16:736–747

Kuo NT, Lee CF (2013) Effects of dividend tax and signaling on firm valuation: evidence from taxable stock dividend announcements. Pac Basin Finance J 25:157–180

Lacina M, Zhang Z (2008) Dividend initiations by high-tech firms. Rev Pac Basin Financ Mark Policies 11:201–226

Lee WJ (2011) Managerial entrenchment and the value of dividends. Rev Quant Finance Account 36:297–322

Lee KW, Lee CF (2009) Cash holdings, corporate governance structure and firm valuation. Rev Pac Basin Financ Mark Policies 12:475–508

Lee CH, Lusk EJ, Halperin M (2013) The recent US financial crisis: its impact on dividend payout strategy and a test of the silver-lining hypothesis. J Mod Account Audit 9:662–677

Leung S, Horwitz B (2010) Corporate governance and firm value during a financial crisis. Rev Quant Finance Account 34:459–481

Lie E (2005) Operating performance following dividend decreases and omissions. J Corp Finance 12:27–53

Lloyd WP, Jahera JS Jr, Goldstein SJ (1986) The relation between returns, ownership structure, and market value. J Financ Res 9:171–177

Masulis RW, Wang C, Xie F (2007) Corporate governance and acquirer returns. J Finance 62:1851–1889

Michaely R, Thaler R, Womack K (1995) Price reactions to dividend initiations and omissions: overreaction or drift? J Finance 50:573–608

Miller MH, Modigliani F (1961) Dividend policy, growth, and the valuation of shares. J Bus 34:411–433

Morrison D (2005) Multivariate statistical methods. Thomson, Sydney

Naranjo A, Nimalendran N, Ryngaert M (1998) Stock returns, dividend yields and taxes. J Finance 53:2029–2037

Pathan S, Faff RW, Fernandez C, Masters N (2014) Financial constraints and dividend policy. Aust J Manag 41:484–507

Rozeff M (1982) Growth, beta and agency costs as determinants of dividend payout ratios. J Financ Res 5:249–259

Schooley DK, Barney LD (1997) Using dividend policy and managerial ownership to reduce agency costs. J Financ Res 17:363–373

Shleifer A, Vishny R (1986) Large shareholders and corporate control. J Polit Econ 94:461–488

Talmor E, Titman S (1990) Taxes and dividend policy. Financ Manag 19:32–35

Velury U, Reisch JT, O’reilly DM (2003) Institutional ownership and the selection of industry specialist auditors. Rev Quant Finance Account 21:35–48

Author information

Authors and Affiliations

Corresponding author

Appendix: Modified GRS test

Appendix: Modified GRS test

Gibbons et al. (1989) provide their GRS test on abnormal returns. The null hypothesis of GRS test is all αs equal to zero. In our work, we want to compare abnormal returns between groups. Therefore, we make a modification to GRS test. Following Morrison (2005), we have

\(R^{{\prime }} \hat{\alpha }\) and \(R^{\prime }\Sigma R\) are independent. \(\left( {T - 2} \right)R^{\prime }\Sigma R\) follows Wishart distribution. Then apply GRS’s conclusion,

N is the number of restriction, which is 1 in our tests. K is the number of factors, which is 4 since we use four-factor model. \(\hat{\theta } = \hat{\mu }_{f}^{\prime } {\hat{\varOmega }}^{ - 1} \hat{\mu }_{f}\), where \(\hat{\mu }_{f}\) is the sample mean of factor loadings and \({\hat{\varOmega }}\) is the max-likelihood estimation of covariance matrix of factor loadings.

We are interested whether alpha of one group is significantly larger than alpha of another group.

Null is rejected when \(F \, < F_{2a, N, T - N - K}\) and \(\alpha_{i} - \alpha_{j} > 0\) (Follmann 1996) (Table 16).

We test the effect of management on the return effect of dividend policy changes controlling the persistence effect of institutional holding. We use institutional holding as a measure of managers’ effort in 2007. A two-stage regression is used to exclude the effect of institutional holding in 2009. Alphas and excess returns in 2009 are dependent variables in first stage regressions

Residual from first stage is the dependent variable in second stage.

The interested variable is Group and its interaction term with institutional holding. Results of the second stage regression are reported in Table 14.

Rights and permissions

About this article

Cite this article

Hilliard, J., Jahera, J.S. & Zhang, H. The US financial crisis and corporate dividend reactions: for better or for worse?. Rev Quant Finan Acc 53, 1165–1193 (2019). https://doi.org/10.1007/s11156-018-0778-6

Published:

Issue Date:

DOI: https://doi.org/10.1007/s11156-018-0778-6