Abstract

Using the non-parametric data envelopment approach, the long-run profit efficiency of nine pre-classified merger deals of merging and non-merging U.S. banks is investigated during the period from 1992 to 2003 for a sample of 359 merger deals. The findings show that, in general, large acquirers have and maintain higher efficiency scores than targets and non-merging banks. The results also show that merger deals that match least efficient acquirers with the least efficient targets could improve their profit efficiency 4 years following the merger event, which is different than all other merger deals. Finally, value-maximizing mergers are determined to be mostly large and match banks with clear opportunities to increase their future efficiency rankings.

Similar content being viewed by others

Avoid common mistakes on your manuscript.

1 Introduction

The United States witnessed its fifth wave of banking industry consolidation during the 1990s, according to Moeller et al. (2004). This last consolidation wave was associated with “higher stock valuations, greater use of equity as a form of payment for mergers, and more takeover defenses in place than the merger wave of the 1980s.” These changing merger characteristics were combined with serious wealth losses to acquiring firms’ stockholders. Moeller et al. (2004) indicate that acquiring firms’ stockholders lost as much as 50 times the amount that they lost during the 1980s ($216 billion in the 1990s vs. $4 billion in the 1980s).

The 1990s merger wave was motivated, in part, by regulatory reforms and technology changes. The two primary regulatory influences were the enactment of the 1994 Riegle-Neal Interstate Banking and Branching Efficiency Act and the 1999 Graham-Leach-Bliley Act. Riegle-Neal removed the remaining geographic restrictions on branching. However, it was not fully effective until June 1, 1997 (Cornett et al. 2003). The Graham-Leach-Bliley Act repealed the Glass-Steagall Act of 1933 by allowing commercial banks to engage in other activities such as investment banking. The result of these regulatory changes was a surge in bank merger activity that sharply reduced the number of operating banks but led to an increase in the total number of bank branches. According to Berger and DeYoung (2001), the merger wave of the second half of the 1990s produced the largest number and greatest value of banks acquired during any 5-year period. Wang (2003) indicates that, during the 1990s, the average size of banking organizations increased by more than 35 %. Some of these mergers resulted in the emergence of banks with assets exceeding $50 billion. That the banking industry is getting more concentrated was acknowledged by the chairman of the Federal Reserve Board of Governors, Alan Greenspan,Footnote 1 who stated, “If all the mergers that have been announced are completed, the ten largest banking organizations in the United States will account for about 51 % of all domestic banking assets, almost double their share in 1995. Consolidation has not been a phenomenon involving only large banks. Roughly 45 % of the mergers involved an acquirer and a target each of which had less than one billion dollars in assets.”

The extant literature proposes two main motives for consolidation: value-maximization motives and non-value maximization motives. According to Akhavein and Humphrey (1997), value-maximization motives for mergers include at least three possible motives. The first is increasing cost efficiency through improving economies of scale. Akhavein et al. argue that consultants and managers are motivated more often by cost efficiency improvement than any other motive. This argument is further supported by Rhoades (1997), who showed that the primary reason for the nine mergers in his study was to achieve higher cost efficiencies in the intermediate time horizon. The second value-maximizing motive is profit efficiency improvement, which implicitly includes cost efficiency improvement. The goal in this case is to increase revenues and to decrease costs simultaneously. The third value-maximizing motive for bank mergers is the pursuit of market power in setting prices. In this case, the merger is motivated by achieving higher market share.

Berger et al. (1999) support the increasing market power motive. Their findings show that 50 % of merger and acquisition activities (M&A) were in-market mergers. Akhavein and Humphrey (1997) find that changes in prices after mergers are very small and not statistically significant. According to Akhavein and Humphrey (1997), this result is consistent with the hypothesis that antitrust policy has been successful in preventing mergers that would result in increased market power. However, their findings show significant profit efficiency gains attributable to shifts in output from securities to loans. Wang (2003) argues that antitrust policies were balanced enough to permit efficiency gains to be achieved through mergers and that regulators generally sanction mergers that can concretely achieve such potential. Shaffer (1993) shows that, if the most efficient banks acquired the least efficient banks, efficiency gains should be expected. Berger and Humphrey (1992) find that, for the most part, acquiring banks tend to be more efficient than targets. They argue that the acquirer needs sufficient time to improve the efficiency of the target.

However, the non-value maximization motive is represented by the free cash flow hypothesis (Jensen, 1986). According to Jensen, managers with access to a large surplus of cash tend to engage in value-destroying investments (i.e., adding negative net present value projects to the investment portfolio of the bank) that diminish stockholders’ returns. The free cash flow theory implies that acquirers with surplus cash pay in cash for merger transactions, while acquirers with no surplus cash engage in stock-for-stock deals. If these explanations are accurate, the free cash flow hypothesis can explain both the motive of mergers and the method of payment to be used in merger transactions. Myers and Majluf (1984) proposed the information asymmetry hypothesis to explain the method of payment used in merger deals. According to this hypothesis, if the acquirer is more informed about the real value of the company than the public, the acquirer can use cash if the bank is undervalued and stock if the bank is overvalued. Rhodes et al. (2005) argue that firms whose stocks are overvalued should use stock to buy firms, especially if the entire sector is overvalued.

To understand the motivations behind mergers, researchers have examined the post-merger performance of the acquirers and targets in two ways. The first way is the operating performance approach, which analyzes changes in profit, cost, and other performance measures surrounding a merger. For example, Rhoades (1986, 1990), Spindt and Tarhan (1992), Linder and Crane (1993), Peristiani (1993), and Rose (1987) indicate no performance improvement after a merger. Cornett and Tehranian (1992) and, more recently, Cornett et al. (2003), find an increase in post-merger operating performance, while Berger and Humphrey (1992); Pilloff and Santomero (1997), and Berger (1997) do not. However, operating performance studies have two main weaknesses: (1) they use simple ratios that depend on accounting data, and (2) there are methodological problems with using performance ratios to measure cost and profit efficiencies because ratios do not control for differences in input prices and output mix.

Attributable in part to these weaknesses, the focus of research has switched recently to another, more comprehensive aspect of efficiency: X-efficiency (cost, revenue, and profit efficiencies). Unlike efficiency ratios, the frontier X-efficiency concerns a bank’s use of inputs. Akhavein and Humphrey (1997) argue that there are methodological problems with using performance ratios to measure cost and profit efficiencies because ratios do not control for differences in input prices and output mix. Berger and Humphrey (1992) use the frontier efficiency methodology to show no cost efficiency improvement post-merger. These findings are similar to those of Rhoades (1993); DeYoung (1993), and Akhavein and Humphrey (1997), although Akhavein and Humphrey (1997) find that merged banks experience a statistically significant 16 % improvement in the profit efficiency of large banks before a merger, especially those with the lowest efficiency scores.

The objective of this paper is twofold. The first is to examine post-merger cost, revenue, and profit efficiency dynamics following the merger event. The second is to examine the wealth effects of bank mergers by distinguishing pairwise between efficiency types of mergers. Specifically, each merger transaction is classified according to the efficiency of both acquirers and targets where merging banks are subsampled according to their profit efficiency scores. This idea is motivated by DeLong (2001a, b), who classified banks by geographic and activity diversifications. The argument is that the variables used in DeLong’s papers are proxies of the means of efficiency, but they missed the efficiency itself as a determinant of the combined bank’s future efficiency. While there is voluminous literature concerned with the effect of the pre-merger efficiency scores on post-merger operating performance (e.g., Berger and Humphrey 1992; Shaffer 1993; Rhoades 1997; Rhodes et al. 2005), this work is the first to discuss the pairwise efficiency dynamics of acquiring banks.

2 Literature review

2.1 Bank merger literature

The body of literature on efficiency dynamics following financial institution mergers is enormous. This section reviews a portion of the literature closely related to this paper. Rose (1987) finds that the operating performance of merging banks as measured by return on assets and return on equity does not improve after a merger if compared with non-merging control banks. Rose used a sample of 106 merging banks and the same number of control group banks matched according to size and geographic market. The results show no improvement on either efficiency proxies.

Rhoades (1990) analyzes the performance changes before and after 68 mergers between 1981 and 1987. To compare the performance of merging and non-merging banks, Rhoades selected 322 peer banks matched by size. Rhoades’ analysis is based on average performance during the period from 3 years before the merger to 3 years after. The results show no improvement in either profit or non-interest expenses.

Berger and Humphrey (1992) study 57 U.S. mergers from 1981 to 1989. They use the X-efficiency and technical efficiency scores in addition to return on assets, total revenues to average assets and non-interest expenses to total assets. Their findings show a 5 % X-efficiency improvement relative to the peer group. They also find that some mergers improve efficiency, whereas others worsen it. Berger and Humphrey argue that mergers in which the acquiring firms are more efficient than the targets do not lead to efficiency improvement when compared with other mergers.

Akhavein and Humphrey (1997) applied the profit efficiency concept to the sample of merging banks used by Berger and Humphrey (1992). Their findings indicate a 16 % average increase in acquiring banks’ profit efficiency when compared with control banks. They argue that most of the improvement comes from the output mix changes (from securities to loans). Inconsistent with Berger and Humphrey, Akhavein and Humphrey (1997) indicate that banks with the lowest profit efficiencies before the merger achieved the greatest improvement after the merger. Al-Sharkas et al. (2008) use parametric and non-parametric approaches to estimate frontier efficiency scores before and after a merger using a U.S. banking data set from 1986 to 2000. Consistent with Akhavein et al., the results show that mergers improved cost and profit efficiencies and that both the acquirer and the target have lower efficiency levels relative to their peer after merger.

Cornett et al. (2003) examine whether corporate governance mechanisms reduce the managerial incentive to enter value-destroying bank acquisitions. They look at announcement period abnormal stock returns for diversifying (interstate or activity) acquisitions versus focusing (intrastate or activity) acquisitions. They find that the announcement period excess returns earned by the bidder banks are significant and negative for diversifying bank acquisitions but not for focusing acquisitions. Further, they find that corporate governance mechanisms that reduce the manager–shareholder conflict are not as effective in diversifying acquisitions as they are in focusing acquisitions.

More recently, some studies have subsampled the population of banks engaged in merger activities according to their shared characteristics. Subsampling allows researchers to analyze whether these shared characteristics create or destroy shareholder wealth and whether they affect the performance of the target or acquirer. By examining bank mergers within the context of the focusing versus diversification debate, DeLong (2001a) finds that the market does distinguish among various types of mergers. The degree of diversification, however, is not the sole influence on returns to merger partners. Her analysis reveals that the cumulative abnormal returns (CARs) increase in relative target to bidder size and decrease in pre-merger performance of targets. Further dimensions, such as the type of corporate governance (Brickley and James, 1987; Hubbard and Palia 1997) or agency costs (Cornett et al. 2003), could also influence the return on bank mergers.

DeLong (2001b) shows that long-term performance is enhanced when mergers involve inefficient acquirers, when earnings streams are not diversified, and when payment is not made solely in cash. Upon announcement, the market reacts positively to mergers that are both activity and geography focused. Although the long-term benefits accrue to mergers that focus managerial efficiency and revenue streams as well as reduce over-investment, the market reacts to more tangible aspects of focusing, namely activity and geography. The market seems to understand that focusing is beneficial, yet it does not seem to know what aspects of focusing are worthwhile.

Cornett et al. (2006) find that industry-adjusted operating performance of merged banks increases significantly after a merger. Further classification of banks’ merger deals according to size, activity focus, and geographic diversification shows that large bank mergers produce greater performance gains than small bank mergers, activity focusing mergers produce greater performance gains than activity diversifying mergers, geographically focusing mergers produce greater performance gains than geographically diversifying mergers, and performance gains are larger after the implementation of full nationwide banking in 1997 through the Riegle-Neal Act. Further, they find that the improved performance is the result of both revenue enhancement and cost reduction activities. Additionally, the revenue enhancement opportunities appear to be greatest in mergers that offer the most opportunity for cost-cutting activities (i.e., activity focusing and geographically focusing mergers).

By employing a pair of truncated regressions conditioned on managerial objectives, Gupta and Misra (2007) find that the marginal valuation impact of the relative size of the merger partners, the premium paid for target shares, and inter versus intrastate transactions is asymmetric across deals made by good versus bad managers. In particular, they document that in deals made by good (bad) managers, merger gains increase (decrease) with respect to the relative size of the transaction and to the premium paid for target shares. They also find that within the set of good mergers, interstate transactions have a negative impact on merger gains. Koetter et al. (2007) distinguish between five possible events, including distressed targets and acquirers, non-distressed targets and acquirers, and banks subject to only regulatory intervention in analyzing banks mergers. Their findings show that merging banks share a below average profile with a comparative advantage for acquirers. The finding also indicates that the probability of being acquiring or non-acquiring depends on sheer size and capitalization. Hannan and Pilloff (2009) employ a subsample of publicly traded banking organizations to investigate the role of managerial ownership in explaining the likelihood of acquisition with the consideration of differences in the determinants of acquisition between in-state and out-of-state acquirers (i.e., acquirers were classified according to location and size). Their findings show that less profitable, inefficient firms have a greater chance to be acquired, regardless of the type of acquirer. They finally reported that banks with high capital to asset ratios are less likely to be acquired.

Hernando et al. (2009) indicate that large, cost-inefficient banks are more likely to be acquired by other banks in the same country within the European Union. The likelihood of being a target in a cross-border merger deal is greater for banks quoted in the stock market. Finally, highly concentrated banking industries are less likely to be acquired by other banks in the same country but are more likely to be acquired by banks in other European Union countries.

Pasiouras et al. (2011) evaluated the impact of bank-specific measures, namely size, growth and efficiency of banks, and external influences reflecting industry-level differences in the regulatory and supervisory framework in the European Union. Consistent with Koetter et al. (2007), Hannan and Pilloff (2009), and Hernando et al. (2009), their findings indicate that targets and acquirers were significantly larger, less well capitalized and less cost efficient when compared to non-merging banks, while targets were less profitable with lower growth prospects than acquirers.

Using a sample of 1,071 European bank, Ben Slama et al. (2012) find that the target banks tend to be specialized in market and investments activities while the acquiring banks tend to approach themselves to the universal bank model.

2.2 Regulatory environment of the study period

As mentioned earlier, the 1990s merger wave was motivated, in part, by regulatory reforms and technology changes. The two primary regulatory influences were the enactment of the 1994 Riegle-Neal Interstate Banking and Branching Efficiency Act and the 1999 Graham-Leach-Bliley Act. From the efficiency point of view, it was expected that the passage of these two acts would positively enhance banks efficiency (See Strahan (2003)).

What the Riegle Neal Act did was that it removed restrictions on interstate banking and branching and permitted banks to diversify geographic risk. The passage of this Act was due in part to the increasing number of failing banks during the 1970s and 1980s. In their study of the effects of implementing the Riegle Neal Act, Jayaratne and Strahan (1996) indicate that bank efficiency improved greatly once branching restrictions were lifted. Loan losses and operating costs fell sharply, and the reduction in banks’ costs was largely passed along to bank borrowers in the form of lower loan rates.

The other deregulation which is certain to have impacted our study period is Gramm-Leach-Bliley (GLB) Act of 1999. This Act largely removed some historical barriers that forced a separation between commercial banks, investment banks, and insurance companies in the U.S banking industry. Yuan and Phillips (2008) findings suggests that a significant number of cost scope diseconomies, revenue scope economies, and weak profit scope economies exist in the post-GLB U.S. integrated banking and insurance sectors. Argued by many to be the main drive for the fifth merger wave (see Hawawini and Swary (1990); Berger et al. (1999); Dermine (1999), and Beitel and Schiereck (2001)), the 1990s mass deregulation wave became itself cause for significant regulatory concern as it had adverse effects on competition and led to a rising concentration in markets. That is why, according to Wang (2003), the Antitrust Division of the Justice Department endeavors to eliminate each merger’s anti-competitive effects in the affected markets, mainly by limiting the increase of the Herfindahl–Hirschman Index (HHI). Merger deals that raise the HHI by more than 200 points to over 1,800 are deemed a threat to competition, and unapproved accordingly.

3 Methodology

3.1 The non-parametric data envelopment analysis

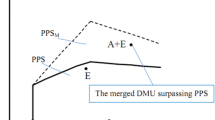

Charnes et al. (1978) coined the term ‘data envelopment analysis’ (DEA). There has since been a multitude of works that have applied and extended the DEA methodology. DEA constructs a frontier based on the sample data rather than using an assumed production function. This non-parametric approach shows how a particular decision making unit (DMU) operates relative to other DMUs by providing a benchmark for the best practice technology based on the DMUs in the sample. Because DEA makes no assumptions about inefficiency distributions, it is subject to data problems and inaccuracies created by accounting rules (Isik, 2000). However, DEA works better than the parametric approach when the sample size is small.

Following Rangan et al. (1988); Berger and Humphrey (1992); Elyasiani and Mehdian (1992); Fare et al. (1994); Grabowski et al. (1993); Leightner and Lovell (1998); Wheelcock and Wilson (1995); Isik and Kabir (2003); Pasiouras (2008); Liang et al. (2008); Chunhachinda and Li (2010), DEA is used in this paper to measure U.S. banks’ efficiency scores. This choice is motivated by the small sample size during some years of the data set. Some other reasons for this choice are: (1) most studies that have used both Stochastic Frontier Approach (SFA) and DEA have found that both approaches preserve the efficiency ranking of the DMUs (see Isik and Kabir, 2002, 2003; and Al-Sharkas et al. (2008). Since the purpose of this paper is to use the efficiency scores to rank merging banks according to their efficiency characteristics, DEA is used rather than SFA; (2) the non-parametric DEA is the better choice when the industry has experienced a series of reforms and/or shocks because we can assume variable returns to scale (which is not an option in SFA); and finally, and most importantly, (3) under DEA, profit efficiency scores can be broken down into more basic components (cost efficiency, revenue efficiency, etc.). Farrell (1957) decomposes the overall cost efficiency (CE) of each DMU into two components: (a) technical efficiency (TE), which shows the ability of a DMU to achieve the maximum output for a given production set; and (b) allocative efficiency (AE), which shows management’s ability to construct an optimal product mix, given their respective prices. Assuming constant returns to scale (CRS), CE is decomposed as follows:

Banker et al. (1984) proposed the variable returns to scale frontier (VRS), in which the frontier changes over time due to technological progress, financial crises, higher industry concentration due to mergers and acquisitions, and financial deregulation (Isik and Kabir 2003). However, Banker et al. further decompose TE into two components: a) pure technical efficiency (PTE), which indicates the proportional reduction in input usage if inputs are not wasted; and b) scale efficiency (SE), which represents the proportional output reduction if the bank achieves CRS. So, Eq. 1 can be re-written as follows:

As shown previously, cost efficiency can be estimated by summing input prices rather than output quantities. Consider n DMUs, where each DMU uses m inputs to produce s outputs. The general form of the cost minimization problem is then:

where p i is a vector of input prices for the jth DMU and x * i is the cost minimization vector of input quantities for the jth DMU, given the input prices and the output levels.

The first constraint places a restriction on the input side, requiring the use of inputs in a linear combination at the efficient frontier to be less than or equal to the use of the inputs by the ith bank. The second constraint shows that the observed outputs of DMUj must be less than or equal to a linear combination of outputs, x * i , of the DMUs forming the efficient frontier. The third constraint assures the feasibility of the solution. The fourth constraint imposes the VRS assumption. The only way to derive a more cost efficient DMU is by getting it closer to the efficient frontier. This can be achieved by using input equal to X * rather than X 1, holding the output fixed (the bold horizontal arrow shows this choice). Finally, the cost efficiency of the each DMU can be obtained as follows:

where the cost efficiency value will be equal to one for the DMUs that lie on the efficient frontier. The cost efficiency scores take values in the range (0,1). The allocative efficiency can be obtained using Eq. 1 as follows:

3.2 Estimation of revenue efficiency

Using the same considerations as in the previous section, the revenue efficiency (RE) scores can be obtained for each DMU. The revenue maximization problem maximizes the vector of output quantities, y *, in the first step. Then, the revenue-maximizing problem is calculated as follows:

where q r is a vector of output prices for the jth DMU, and \( y_{r}^{*} \) is the maximization vector of output quantities of the DMUs forming the efficient frontier. The first constraint indicates that the use of the inputs in a linear combination of efficient DMUs must be less than or equal to the use of inputs of the jth DMU. The second constraint shows that the observed outputs of the jth DMU must be less than or equal to the linear combination of the DMUs forming the efficient frontier. The last two constraints are well defined in the previous section. After solving the above problem, RE is obtained as follows:

where \( \sum\nolimits_{r = 1}^{S} {q_{r} y_{r} } \) is the observed/actual revenue of the DMU, and \( \sum\nolimits_{r = 1}^{S} {q_{r} y^{*} } \) is the virtual efficiency profit that could be achieved if the DMU were situated on the efficient frontier. The value of the profit efficiency scores will always fall in the range (0,1).

3.3 Estimation of profit efficiency

Summing the cost and revenue efficiencies generates the profit efficiency (PE) concept, which seeks to minimize costs and maximize revenue simultaneously. Unlike cost and revenue efficiencies, PE is obtained by allowing inputs and outputs to vary. The profit maximization problem can be described as follows:

where the first constraint indicates that the use of the inputs in a linear combination of efficient DMUs must be less than or equal to the use of inputs of the jth DMU. The second constraint shows that the observed outputs of the jth DMU must be less than or equal to the linear combination of the DMUs forming the efficient frontier. However, the two constraints in this problem are solved simultaneously. The third constraint is imposed to assure that the revenue maximization and cost minimization are both achieved. This constraint requires that the inputs of the jth DMU must be greater than or equal to the output of the DMUs on the efficient frontier, and it indicates that the output of the jth DMU must be less than or equal to the outputs of the DMUs on the efficient frontier. This constraint is important because it is possible to maximize profit efficiency by minimizing costs only. In this case, profit maximization will be equivalent to cost minimization. The same argument is valid for the revenue efficiency. Finally, the profit efficiency can be obtained using the following equation:

where \( \sum\nolimits_{r = 1}^{s} {q_{r} y_{r} } - \sum\nolimits_{i = 1}^{m} {p_{i} x_{i} } \) represents the observed profitability of DMU i . This value could be negative for DMUs with losses. \( \sum\nolimits_{r = 1}^{s} {q_{r} y_{r}^{*} } - \sum\nolimits_{i = 1}^{m} {p_{i} x_{i}^{*} } \), on the other hand, represents the virtual profitability that could be achieved if the DMU is located on the efficient frontier. Accordingly, the profit efficiency values must lie in the range (−α, 1).

4 Data, sample characteristics, and variable definitions

4.1 Data and sample characteristics

A sample of successful domestic public mergers occurring during the period 1992–2003 is examined. The sample of cash, mixed, and stock-for-stock mergers comes from the Securities Data Company’s (SDC) U.S. Merger and Acquisition database. We select a sample of mergers and acquisitions with announcement dates between 1992 and 2003 and eliminate those with effective dates outside this period. All mergers in the sample were completed by December 2003. Only mergers where acquiring firms attain 100 % of the shares of the target firm to enable the acquirer to re-allocate resources more efficiently are considered, i.e., the target is de-listed after merger and is no longer a decision making unit. Further, we require that: (1) the acquirer and the target have SIC codes 6021 (banks, commercial: national), 6022 (banks, commercial: state), 6035 (banks, savings: federal), or 6036 (banks, savings: not federally chartered); (2) the transaction is completed; and (3) the acquirer and the target are both public firms with data available in the Center for Research in Security Prices database (CRSP) for at least 1 year prior to the merger announcement date. The resulting sample includes some banks that engaged in multiple acquisitions during the sample period. We required that accounting and stock market data for both firms be available from the Compustat database and from CRSP. Also, the firms had to be in existence for at least 1 year prior to the merger announcement. This requirement is important for us to be able to classify mergers according to their efficiency scores achieved 1 year before the merger. The data extracted from CRSP consists of market capitalizations of the acquirers and targets in addition to other variables used to obtain the efficiency scores. The market capitalization of a firm is the product of the total number of shares outstanding and the closing price per share as measured at the end of the year prior to the stock-for-stock merger announcement. The relative size is then measured as the ratio of the market capitalization of the acquirer to the market capitalization of the target bank.

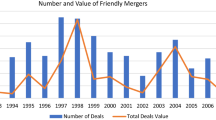

The final sample consists of 359 mergers. Table 1 shows the distribution of mergers over the study period. As Table 1 shows, most of the merger deals were accomplished by using the stock-for-stock method of acquisition, especially during the 1992–1997 period. Using a combination of stocks and cash has become more favorable since that time. Cash-only financing, however, is relatively rare. In fact, there were no cash deals in the last 2 years of the sample. The method of using a cash and stock combination, on the other hand, increased substantially in 2002 and 2003. In general, 65 % of merger deals were stock-for-stock, 17.5 % used cash only, and 17.5 % used a combination of cash and stock, with stock accounting for a greater percentage of the total transaction value.

4.2 Bank efficiency variables

DEA needs a set of inputs and outputs in order to measure efficiency, and therefore, relative productivity. There are two main approaches to measure efficiency: the production approach and the intermediation approach (see Sealy and Lindley 1977). In the production approach, outputs are measured as number of bills or processed transactions, and inputs are measured as capital or labor force, but not as interest expense. In contrast, the intermediation approach assumes that banks are considered brokers who transform financial resources into profits. This approach is more commonly used in the study of banking efficiency, and so the intermediation approach is adopted in this study. Accordingly, commercial banks are modeled as multi-product firms, producing two outputs and employing three inputs. All variables are measured in millions of U.S. dollars except prices, which are measured as ratios.

The outputs include (1) net loans; and (2) other earning assets, which consist of loans to special sectors, interbank loans, and investment securities (Treasuries and other securities). All output prices are estimated as proxies. These are calculated as follows: (1) the price of loans is defined as total interest income to net loans; and (2) the price of other operating income is defined as other operating income to other earning assets weighted by the proportion of other earning assets over the total of other earning assets plus off balance sheet items.

Inputs include (1) personnel expenses; (2) book value of premises and fixed assets; and (3) loanable funds, which is defined as the sum of demand and time deposits and non-deposit funds as of the end of the respective year. Also inputs prices are estimated as proxies. The price of labor is calculated as personnel expenses over total assets. The price of capital is calculated as non-interest expense over total assets. Finally, the price of funds is calculated as total interest expense over loanable funds.

Table 2 shows the summary statistics for the total input and output variables of targets, acquirers, and control banks. Panel A of Table 2 shows the absolute dollar value of input and output variables. To make the comparison easier, we divided each of the variable values in 2003 by its respective value in 1992. The results are shown in Panel B of Table 2. The results indicate that loans by acquirers had increased by 1,300 % when compared with 1992. This huge growth was complimented by an 800 % growth in deposits. Loans by targets, on the other hand, had increased by 317 %. This growth was complimented by a 228 % increase in targets’ deposits. Loans by control banks increased by 252 % combined with a 221 % increase in their deposits. This result is interesting because it clarifies that acquirers usually depend more on equity in running their businesses. The same result is indicated for the other earning assets where acquirers had increased their investment by 900 %, while targets and control banks had increases in this category of only 255 and 501 %, respectively. This result is also interesting because it shows that some banks (acquirers and control banks) were able to take advantage of the Graham-Leach-Bliley Act of 1997, which allowed banks to engage in investment banking activities.

Looking at the cost side (inputs side), acquirers had increased their personnel expenses by 900 % when compared with 1992, which is tremendously higher than the growth rates of personnel expenses of targets and control banks (220 % increases for each). Acquirers also had increased their fixed assets by 450 %, which is considerably higher than targets and control banks, which increased by 190 and 220 %, respectively. This result looks consistent with Akhavein and Humphrey (1997) and Rhoades (1997), who argue that consultants and managers are motivated more often by cost efficiency improvement than by any other motive.

Table 3 shows the summary statistics of input and output prices. In addition, an interest margin variable (interest on loans minus interest on deposits) is added to get a better grasp of each group’s profitability from traditional banking activities. Starting with the price of loans, non-merging banks typically charged higher interest than acquirers and targets. This result appears for all years except 1992, 1993, and 1999. Ranked second, targets charged higher interest on loans than acquirers. This can be explained by the higher risk premium that smaller banks charge relative to larger banks. According to DeYoung et al. (2004), small banks’ access to “soft information” about their clients makes them more accurate in determining customers’ creditworthiness, especially in smaller communities where direct communication is more feasible. On the other hand, they argue that large banks have better access to “hard information” and have a comparative advantage gained by the use of new technology in their operations. This advantage of capital intensity in banking operations allows large banks to gain more economies of scale in their operations while sacrificing accuracy in evaluating customers’ creditworthiness. The price of labor is calculated as personnel expenses over total assets. The price of capital is calculated as non-interest expense over total assets. The price of funds is calculated as total interest expense over loanable funds. The price of loans is determined as total interest income over net loans. The price of other operating income is defined as the ratio of other operating income to other earning assets. The interest margin is the difference between the interest paid on loans and the interest paid on deposits.

On the other hand, interest paid on deposits is higher in non-merging banks than in either acquirers or targets for the period from 1999 to 2003. For earlier years, we find no clear difference between groups. To have a more complete idea of the profits generated from traditional banking activities, an interest margin variable is added to the summary statistics variables (Column 6 of Table 3). It looks clear that targets were achieving the highest interest margin. One explanation for this could be that the small banks tend to depend more on lending activities relative to other banks. Actually, the passage of the Graham-Leach-Bliley Act in 1997 may have facilitated this result by enticing banks with sufficient resources to invest more in capital markets, while small banks remained focused on traditional banking activities. This result is supported by the return on other earning assets (investment). Consistent with the previous discussion, acquirers have the highest return on investment. Ranked second, control banks appear to be balanced in their investment and banking policies. Except for 1992, targets are ranked last in return on investment. It appears that acquirers have a comparative advantage in non-traditional banking activities over targets, but targets have a comparative advantage in traditional banking activities over acquirers. The comparison of personnel expenses to total assets (price of labor) indicates that targets achieved the lowest labor price, except in 1992 and 2003. In these years, acquirers achieved the lowest price. In contrast, control banks maintained a smooth, stable trend for the whole period. This result supports the cost minimization motive of mergers, where acquirers choose targets that have lower operating costs.

5 Empirical findings on efficiency scores

This section discusses the summary statistics of cost, revenue, and profit efficiency scores for acquirers, targets, and control banks for the period from 1992 to 2003. These results were obtained from the DEA linear programming problems solved for each bank. The results are derived from efficient frontiers constructed separately for each year. Table 4 shows the number of banks included in constructing the annual frontiers. Unlike much of the previous literature (see Berger and Humphrey 1992; Rhoades 1997; Akhavein and Humphrey (1997), the largest possible sample of non-merging banks is included. This sampling is argued to be crucially important because the market distinguishes the efficiency characteristics relative to the whole industry, even before the merger is announced. In other words, acquirers and targets cannot be matched with one another in one frontier because the market had not yet recognized them as a merging pair. Accordingly, the more banks that can be included in determining the efficient frontier, the more reliable the efficiency scores will be. Efficiency analysis is fully discussed in the following three sections. In the first section, the efficiency characteristics of merging and non-merging banks for the entire study period are examined. The efficiency changes following the merger event are discussed in detail in the second section using the time trend of the efficiency scores considering the year of merger as the base year. Finally, the last section discusses the efficiency changes of the nine merger combinations for which the profit efficiency scores will be deducted for each efficiency pair for the 4 years following the merger event.

5.1 Cost efficiency results and dynamics

In this section, cost efficiency results are discussed. Table 5 shows the average cost efficiency scores of acquirers, targets, and non-merging banks. Acquirers maintained the highest cost efficiency until 1998, when the entire sector experienced a substantial decrease in cost efficiency. The comparison between 1992 and 2003 indicates that acquirers achieved 58 and 31 % efficiency scores, respectively. However, targets and non-merging banks appear similar in terms of cost efficiency and time trends. However, the minimum efficiency scores were always reported within non-merging banks.

Table 6 presents the cost efficiency dynamics of acquiring banks and their peers. The results show that small merging banks lost about 7.7 % of their cost efficiency during the 4 years following the merger event compared with an average efficiency gain of 10.0 % for their peers. Small merging banks maintained higher cost efficiencies over their peers for the entire period but in decreasing margins. However, large merging banks experienced insignificant losses during the 4 years following the merger event compared with a significant efficiency gain of 6.4 % for their peers. Again, large acquirers maintained higher efficiencies than their peers.

5.2 Revenue efficiency results and dynamics

Revenue efficiency indicates a bank’s efficiency in maximizing its output level, holding prices fixed. Revenue efficiency results are presented in Table 7. The results show that acquirers lost 11 % (.56–.45) of their revenue efficiency between 1992 and 2003. Similar results are reported for non-merging banks, which lost 18 % (.42–.60), and for targets, which lost 32 % (.61–.29) during the same period. However, Table 7 shows that acquirers have persistently higher efficiency scores than others. As previously noted, this revenue efficiency advantage may be the result of higher returns on other earning assets (investments) rather than higher interest charges on loans. Furthermore, Table 7 shows an interesting result regarding the acquirers’ management style. While targets and non-merging banks maintained a smooth decreasing efficiency trend over time, acquirers were more active in enhancing their product mix and waste rates. This result may indicate that acquiring banks utilize more active management techniques.

Table 8 presents the revenue efficiency dynamics of the merging and peer banks. The results show that small acquiring banks experienced a statistically significant loss of 7.6 % by the fourth year versus an 8.8 % significant gain for their peers. The results further show that acquirers lost their superiority after the second year to their peers, who experienced a 12.9 % higher efficiency by the fourth year. Large acquirers also experienced a 2.5 % insignificant loss versus a 3.7 % significant gain for their peers, but they continued to exceed the efficiency of their peers by more than 5.4 %. These results supports this argument that acquirers exercise market power in setting prices.

5.3 Profit efficiency results and dynamics

As previously noted, profit efficiency is the most demanding efficiency measure because it seeks to minimize costs and maximize revenues simultaneously by allowing inputs and outputs to vary throughout the optimization process. The results for this section are presented in Table 9. The results show that acquirers lost 4 % (.41–.37) of their profit efficiency during the study period. Targets and non-merging banks suffered efficiency reductions of 18 % (.41–.23) and 16 % (.49–.33), respectively. The results indicate that profit maximization is almost equivalent to revenue efficiency maximization. Acquirers maximize the output level of a given input level with little cost minimization enhancement. In general, the results show that efficiency measures decrease over time. However, acquirers maintained the highest average cost, revenue, and profit efficiencies. This trend may account for the latest merger wave that, according to Floegel et al. (2005),Footnote 2 started in late 1997. Using efficiency scores to explain merger waves could be a subject for future research.

Table 10 presents the profit efficiency changes for acquirers for the 4 years following the merger. The results show that small banks experienced gradual statistically significant losses following the merger, losing around 11.7 % in 4 years. On the one hand, however, control banks of the same size experienced a statistically significant average gain of 11.6 % during the same period. On the other hand, large banks experienced a 2.1 % statistically insignificant efficiency loss during the 4 years following the merger compared with a 7.5 % statistically significant efficiency improvement for control banks. Furthermore, merging and non-merging banks’ performance was compared for each year starting from the merger year. The results are reported in columns 1 and 6 and show that small merging banks continued to outperform other banks of the same size with decreasing margins during the first 2 years but then underperformed their peer banks by a statistically significant 13.5 % during the fourth year. This result indicates that small merging banks lost their profit efficiency comparative advantage following the mergers. The results are different for large banks, which had insignificant efficiency losses and maintained greater profit efficiency than their peers. However, the profit efficiency difference between large merging and non-merging banks decreased from 14.9 % in the merger year to 5.3 % during the fourth year following the merger event.

5.4 Classifying merger deals

In this section, targets and acquirers are classified according to their profit efficiency measures. Profit efficiency is chosen to separately classify acquirers and targets into three groups because profit efficiency is the most conservative and demanding efficiency measure. The three groups are high-efficiency banks, medium-efficiency banks, and low-efficiency banks. The sample consists of the following nine merger classifications (acquirer/target): low efficiency/low efficiency (LELE); low efficiency/medium efficiency (LEME); low efficiency/high efficiency (LEHE); medium efficiency/low efficiency (MELE); medium efficiency/medium efficiency (MEME); medium efficiency/high efficiency (MEHE); high efficiency/low efficiency (HELE); high efficiency/medium efficiency (HEME); and high efficiency/high efficiency (HEHE). To reach these classifications, one standard deviation around the annual mean was allowed to achieve the average bank’s efficiency range/bounds. Any bank with an efficiency score higher than the upper bound is considered a high efficiency bank. Any bank with an efficiency score less than the lower bound is considered a low efficiency bank. The classifications are performed one period before a merger to reflect the latest efficiency signal perceived by the market. Akhavein and Humphrey (1997) indicate that the average profit efficiency scores of U.S. banks range from 25 to 65 %, although cost and revenue efficiencies are significantly higher. The sample of acquirers and targets are matched when the merger is announced. Based on this classification scheme, the final sample consists of nine merger combinations. One problem in the efficiency literature is that the efficient frontier is generated using only samples of merging and/or peer banks (see Berger and Humphrey 1992; DeYoung 1993; Rhoades 1997). However, this sampling method may cause results to vary from one study to another. The attempt in this paper is to rectify this problem by using the entire universe of U.S. commercial banks. Following Healy et al. (1992), the non-merging (control) bank sample is matched with the merging bank sample 1 year after the merger. According to Healy, this matching will ensure a fair future comparison with the control group. Efficiency scores are compared before and after the merger. Table 11 shows the subsample classification along with the number of mergers for each classification and the method of payment used in merger deals. The table shows that when mergers involve acquirers and targets from the same level of efficiency, mergers are most often paid using cash. In the sample, of 64 mergers paid fully in cash, 56 involved acquirers and targets with the same efficiency classification. In percentages, HEHE, MEME, and LELE mergers were 32, 31, and 36 %, respectively, financed using cash. These are the highest percentage cash deals in the table. This result supports the information asymmetry hypothesis, which argues that bidders engage in stock-for-stock deals rather than cash deals when they recognize that their equity stocks are overvalued. However, this result shows that parties with the same performance level can fairly evaluate each other, but other merger parties working at different efficiency levels are less able to observe the real value of the bidder’s equity value.

5.5 Profit efficiency changes of merger combinations

The main objective of this paper is to investigate the profit efficiency dynamics of each of the nine merger combinations. The argument expressed in this paper is that higher profit efficiency is related to higher future cash flows. Hence, any merger deal followed by profit efficiency gains is expected to generate greater cash flows that, in turn, are impounded into the stock price. Accordingly, this paper presents the profit efficiency dynamics of the nine efficiency merger combinations. Table 12 presents the profit efficiency scores of the nine merger combinations up to 4 years following the merger event. The results show that most acquirers experienced efficiency losses after a merger, except for three merger combinations: (1) LELE mergers experienced statistically significant efficiency improvements of 5.5 and 4 % during the second and third years, respectively, following the merger; however, the efficiency gains were not significant for the first and fourth year after the merger; (2) LEME mergers experienced persistent positive efficiency improvements over time, but they only experienced statistically significant improvement after the second year; (3) MEHE mergers experienced insignificant efficiency improvement for the entire period, and these mergers account for 15.6 % of the entire sample.

Based on these results, the abovementioned merger combinations are expected to experience positive or at least higher merger returns upon the merger announcement. However, all other merger combinations experienced efficiency losses over time. The two merger combinations with the most extreme efficiency loss were (1) HEHE mergers, which suffered a 32.6 % loss in profit efficiency by the fourth year following the merger, and (2) HELE mergers, which suffered a 47 % loss in profit efficiency by the fourth year following the merger. These two extremes account for 14.7 % of the total sample. Other merger combinations experienced approximately a 2 % efficiency loss by the fourth year. MELE and MEME mergers combined account for 55.5 % of merger deals, and these subsamples experienced 2 and 3 % efficiency losses, respectively, by the fourth year.

6 Conclusions

By applying the non-parametric data envelopment approach, cost, revenue, and profit efficiency scores of merging and non-merging U.S. banks during the period from 1992 to 2003 are estimated. On average, acquirers have 1.65 and 2 % cost efficiency advantages over targets and non-merging banks, respectively.

Furthermore, the post-merger efficiency dynamics for the 4 years following the merger event are investigated. Acquirers experienced statistically insignificant efficiency losses following the merger. On the one hand, however, large acquirers maintained superior efficiency relative to their peers. On the other hand, after a merger, small merging banks experienced statistically significant efficiency losses relative to their peers. Small merging acquirers ranked lower than their peers in efficiency by the fourth year following the merger.

Finally, the profit efficiency dynamics of nine pre-classified merger combinations for 4 years following the merger event are examined. The results show that mergers matching the least efficient acquirers with least efficient targets experienced significant 3 % efficiency gains 4 years following the merger event. At the other extreme, mergers matching highly efficient acquirers with highly efficient targets experienced a significant 47 % loss 4 years following the merger event. In summary, the results suggest that value-maximizing mergers are mostly large and match banks with clear chances of increasing their future efficiency rankings.

Notes

Remarks by Chairman Alan Greenspan, Federal Reserve Board of Governors, at the American Bankers Association Annual Convention, New York, NY, October 5, 2004.

Floegel et al. (2005) studied mergers that took place between 1993 and 2002. Their results show that the early mergers’ (1992–1998) bidders had 1.556 % average abnormal returns; however, the late stage of the merger wave showed −1.1079 % average abnormal returns.

References

Akhavein J, Humphrey D (1997) The effects of megamergers on efficiency and prices: evidence from a bank profit function. Rev Ind Organ 12

Al-Sharkas A, Hassan M, Lawrence S (2008) The impact of mergers and acquisitions on the efficiency of the U.S. banking industry: further evidence. J Bus Finance Acc 35:50–70

Banker RD, Charnes A, Cooper WW (1984) Some models for estimating technical and scale inefficiencies in data envelopment analysis. Manage Sci 30:1078–1092

Beitel P, Schiereck D (2001) Value creation at the ongoing consolidation of the European banking market. Working Paper no. 05/01, September. Institute for Mergers and Acquisitions (IMA), University of Witten, Herdecke

Ben Slama M, Saidane D, Fedhila H (2012) How to identify targets in the M&A banking operations? Case of cross-border strategies in Europe by line of activity. Rev Quant Finance Acc 38:209–240

Berger A (1997) The efficiency effects of bank mergers and acquisitions: a preliminary look at the 1990 s data. In: Amihud Y, Miller G (eds) Mergers of Financial Institutions. Business One-Irwin, Homewood

Berger A, DeYoung R (2001) The effects of geographic expansion on bank efficiency. J Financ Serv Res 19:163–184

Berger A, Humphrey D (1992) Megamergers in banking and the use of cost efficiency as an antitrust defense. Antitrust Bull 37:541–600

Berger A, Demsetz R, Strahan P (1999) The consolidation of the financial services industry: causes, consequences, and implications for the future. J Bank Finance 23:135–194

Brickley J, James C (1987) The takeover market, corporate board composition, and ownership structure: the case of banking. J Law Econ 30:161–180

Charnes A, Cooper WW, Rhodes E (1978) Measuring the efficiency of decision-making units. Eur J Oper Res 2:429–444

Chunhachinda P, Li L (2010) Efficiency of Thai Commercial Banks: Pre- vs. Post-1997 Financial Crisis. Rev Pac Basin Financ Mark Policies 13:417–447

Cornett M, Tehranian H (1992) Changes in corporate performance associated with bank acquisitions. J Financ Econ 31:211–234

Cornett M, Hovakimian G, Palia D, Tehranian H (2003) The impact of the manager-shareholder conflict on acquiring bank returns. J Bank Finance 27:103–131

Cornett M, McNutt J, Tehranian H (2006) Performance changes around bank mergers: revenue enhancements versus cost reductions. J Money Credit Bank 38:1013–1050

DeLong GL (2001a) Stockholder gains from focusing versus diversifying bank acquisitions. J Financ Econ 59:221–252

DeLong GL (2001b) Focusing versus diversifying bank mergers: analysis of market reaction and long-term performance. Working paper, New York University, New York

Dermine J (1999) The economics of bank mergers in the European union, a Review of the Public Policy Issues. Working Paper no. 99-35

DeYoung R (1993) Determinants of cost efficiencies in bank mergers. Economic and Policy Analysis Working paper 93–1. Office of the Comptroller of the Currency, Washington

DeYoung R, Hunter W, Udell GF (2004) The past, present, and probable future for community banks. J Financ Serv Res 25:85–133

Elyasiani E, Mehdian S (1992) Productive efficiency performance of minority and nonminority-owned banks: a nonparametric approach. J Bank Finance 16:933–948

Fare R, Grosskopf S, Norris M, Zhang Z (1994) Productivity growth, technical progress, and efficiency change in industrialized countries. Am Econ Rev 84:66–83

Farrell M (1957) The measurement of productive efficiency. J R Stat Soc (Series A) 120(3):253–281

Floegel V, Gebken T, Johanning L (2005) The dynamics within merger waves: evidence from industry merger waves. SSRN Working paper No. 669525, European Business School, Oestrich-Winkel

Grabowski R, Rangan N, Rezvanian R (1993) Organizational forms in banking: an empirical investigation of cost efficiency. J Bank Finance 17:531–538

Gupta A, Misra L (2007) Deal size, bid premium, and gains in bank mergers: the impact of managerial motivations. Financ Rev 42:373–400

Hannan T, Pilloff S (2009) Acquisition targets and motives in the banking industry. J Money Credit Bank 41:1167–1187

Hawawini G, Swary I (1990) Mergers and acquisitions in the U.S. banking industry. Evidence from the Capital Markets. Elsevier Science, Amsterdam

Healy P, Palepu K, Ruback R (1992) Does corporate performance improve after mergers? J Financ Econ 31:135–175

Hernando I, Nieto MJ, Wall L (2009) Determinants of domestic and cross-border bank acquisitions in the European Union. J Bank Finance 33:1022–1032

Hubbard R, Palia D (1997) Executive pay and performance: evidence from the U.S. banking industry. J Financ Econ 39:105–130

Isik I (2000) Efficiency and performance in international financial institutions. A dissertation. Department of Economics and Finance

Isik I, Kabir M (2002) Technical, scale and allocative efficiencies of Turkish banking industry. J Bank Finance 26:719–766

Isik I, Kabir M (2003) Financial deregulation and total factor productivity change: an empirical study of Turkish commercial banks. J Bank Finance 27:1455–1485

Jayaratne J, Strahan P (1996) The finance-growth nexus: evidence from bank branch deregulation. Q J Econ 111:639–670

Jensen M (1986) Agency costs of free cash flow, corporate finance and takeovers. Am Econ Rev 76(2):323–329

Koetter M, Bos J, Heid F, Kolari J, Kool C, Porath D (2007) Accounting for distress in bank mergers. J Bank Finance 31:3200–3217

Leightner J, Lovell C (1998) The impact of finance liberalization on the performance of Thai banks. J Econ Bus 50(2):115–131

Liang CJ, Yao ML, Hwang DY, Wu WH (2008) The impact of non-performing loans on bank’s operating efficiency for Taiwan banking Industry. Rev Pac Basin Financ Mark Policies 11:287–304

Linder J, Crane D (1993) Bank mergers: integration and profitability. J Financ Serv Res 7:35–55

Moeller S, Schlingemann F, Stulz R (2004) Firm size and gains from acquisition. J Financ Econ 73:201–228

Myers S, Majluf N (1984) Corporate financing and investment decisions when firms have information that investors do not have. J Financ Econ 13:187–221

Pasiouras F (2008) International evidence on the impact of regulations and supervision on banks’ technical efficiency: an application of two-stage data envelopment analysis. Rev Quant Finance Acc 30:187–223

Pasiouras F, Tanna S, Gaganis C (2011) What drives acquisitions in the EU banking industry? The role of bank regulation and supervision framework, bank specific and market specific factors. Financ Mark Inst Instrum 20:29–77

Peristiani S (1993) The effect of mergers on bank performance. In: Studies on excess capacity in the financial sector. Federal Reserve Bank of New York, pp 90–120

Pilloff S, Santomero A (1997)The value effect of bank mergers and acquisitions. Working paper, Wharton Financial institutions Center, University of Pennsylvania

Rangan N, Grabowski R, Aly H, Pasurka C (1988) The technical efficiency of U.S. banks. Econ Lett 28:169–175

Rhoades S (1986) The operating performance of acquired firms in banking before and after acquisition. Staff Studies 149. Board of Governors of the Federal Reserve System, Washington

Rhoades S (1990) Billion dollar bank acquisitions: a note on the performance effects. Board of Governors of the Federal Reserve System

Rhoades S (1993) Efficiency effects of horizontal (in-market) bank mergers. J Bank Finance 17:411–422

Rhoades S (1997) The efficiency effects of bank mergers: an overview of case studies of nine mergers. J Bank Finance 22:273–291

Rhodes KM, Robinson D, Viswanathan S (2005) Valuation wave and merger activity: the empirical evidence. J Financ Econ 77:561–603

Rose P (1987) Improving regulatory policy for mergers: an assessment of bank merger motivations and performance effects. Issues in Bank Regulation, pp 32–39

Sealy C, Lindley J (1977) Inputs, outputs and a theory of production and cost at depository financial institutions. J Finance 32:1251–1266

Shaffer S (1993) Can megamergers improve bank efficiency? J Bank Finance 17:423–436

Spindt P, Tarhan V (1992) Are there synergies in bank mergers? Working paper, Tulane University, New Orleans

Strahan P (2003) The real effects of U.S. Banking deregulation. The Federal Reserve Bank of St. Louis Review (July/August), pp 111–128

Wang J (2003) Merger-related cost savings in the production of bank services. Federal Reserve Bank of Boston, Working Paper 03-08

Wheelcock DC, Wilson PW (1995) Explaining bank failures: deposit insurance, regulation, and efficiency. Rev Econ Stat 77:689–700

Yuan Y, Phillips R (2008) Financial integration and scope efficiency in U.S. Financial Services Post Gramm-Leach-Bliley. Working Paper

Author information

Authors and Affiliations

Corresponding author

Rights and permissions

About this article

Cite this article

Al-Khasawneh, J.A. Pairwise X-efficiency combinations of merging banks: analysis of the fifth merger wave. Rev Quant Finan Acc 41, 1–28 (2013). https://doi.org/10.1007/s11156-012-0298-8

Published:

Issue Date:

DOI: https://doi.org/10.1007/s11156-012-0298-8