Abstract

This study examines the value of stock recommendations made by columnists in three leading business magazines; Business Week, Forbes, and Fortune during the period 2000–2003. Empirical results suggest that the anomalous returns documented in prior studies on columnists are sample specific and are not representative of columnist recommendations in general. We also investigate whether columnists’ timing, content and style affect the market reaction to recommendations. We find that recommendations that contain references to management or provide merger & acquisition related rumor trigger significantly greater market reactions. Finally, our long-term performance analysis of columnist recommendations suggests that investors following columnists’ advice during the 2000–2003 period would not have consistently earned abnormal returns controlling for market risk, book-to-market, size, and momentum effects.

Similar content being viewed by others

Avoid common mistakes on your manuscript.

1 Introduction

Business magazines remain well and alive amid today’s high-tech and fast serving information intermediaries such as websites and data feeds. Today, business magazines continue to cater to readers interested in keeping up with financial markets and to those who are in the process of making investment decisions. Leading business magazines are still read by millions and advertisement spots in these publications are highly demanded. For the 6-month period ending in June 31st, 2005, Business Week, Forbes and Fortune magazines each reported readership figures in ranges of three to five million readers—exceeding 13 million readers combined (see Table 1).

Despite their reach to wide investor masses, research on columnists’ stock recommendations has been overshadowed by research on financial analysts. The literature often regards financial analysts as investors’ sole source of advice and sets aside other sources as either similar to analysts or minor in follower size. Nevertheless columnists are highly influential in investors’ decision making process and differ from financial analysts in many respects.

This study focuses on business magazine columnists’ recommendations in general. Previous research on this area is concentrated only on a few columns and is limited to the short term market reaction to columnists’ recommendations. Whether the documented findings are similar for columnists in other magazines is an unanswered empirical question. Moreover there is no prior research on what types of stocks columnists recommend, the content of their recommendations and what columnist recommendations’ long-term performance is.

We extend this line of research on several fronts. First we employ an extensive sample encompassing all stock recommendations made by leading business magazines. This gives us more room to generalize our results to the columnist profession. We then move on to columnists’ behavior and explore what type of stocks columnists recommend. Further, we examine how recommendations’ timing, content and style are associated with recommendations’ market reaction. Finally, we examine the long-term performance of columnists’ stock recommendations.

Our results suggest that previous studies’ findings on columnists are not pervasive in the large sample of columnist recommendations we study. Published results on certain columnists are actually limited to those specific columnists and documented findings are not a profession wide phenomenon. These results reaffirm Fama’s (1998) concerns of only anomalous findings being published in the literature.

Further, we find that recommendations that have references to management officials or that contain merger and acquisition news generate significantly greater market reactions. Overall, our results expand the understanding of columnist recommendations’ impact on prices, the long-term value of recommendations to investors and the relation between recommendations’ qualitative characteristics and their market impact.

The remainder of this paper is organized as follows. Section 2 provides an overview of the literature. Section 3 describes the data and explains the methodology. Section 4 presents and discusses the empirical results, and Section 5 concludes.

2 Literature review

Researchers have focused on market reaction to columnists’ stock recommendations for several decades. In fact research on columnist recommendations dates back to Cowles’s (1933) early study. Cowles, in his study, examined Wall Street Journal editor William Peter Hamilton’s recommendations and found them to be inferior to a buy and hold strategy. Since then, numerous studies have investigated the return behavior surrounding columnists’ stock recommendations.

Particularly after Fama et al. (1969) event study on dividend announcements and Fama’s (1970) efficient markets hypothesis there was an increase in research studying stock recommendations. In this period, Lloyd-Davies and Canes (1978) (hereafter, LC) examined the performance of second-hand information published in the Wall Street Journal (Heard on the Street) for the period, 1970–1971. They documented that Wall Street Journal (WSJ) articles affected stock prices on publication day. This implied that columnists could have traded and generated abnormal profits based on the column’s information prior to its publication. More interestingly the columns did not provide any information that was not available to the public, they merely repeated previous news. LC argued that the publication effect on returns suggested that not all publicly available information was fully reflected in prices and WSJ articles helped markets adjust to previously disseminated information. Lloyd-Davies and Canes’ findings, although for a limited sample, provided evidence against strong-form efficient market hypothesis. Later Liu et al. (1990) and Beneish (1991) found confirming results using data from 1982–1985 and 1978–1979, respectively. Palmon et al. (1994) study also showed similar behavior for stocks mentioned in the “Inside Wall Street” column of Business Week magazine for the period 1983–1989. However, different from LC, later studies also documented reversals in prices to pre-publication levels. In most studies, a slow reversal was spotted within the 20–25 day period following recommendations. In addition, Liu et al. and Palmon et al. documented a significant increase in trading volume during the 3 days centered on the publication day of the columns. On the other hand Lee (1986) measured the abnormal returns before and after the publication of the Forbes column written by Heinz H. Biel. He found that recommendations did not allow investors to consistently outperform the market but provided useful information.

The aforementioned studies relied on the information hypothesis to explain recommended stocks’ return behavior surrounding the publication day. The information hypothesis claimed that the column’s publication revealed new information to the public and this yielded an abnormal return on publication day.

A stream of subsequent articles relied on the price pressure hypothesis to explain abnormal returns on the publication day. The price pressure hypothesis asserted that heavy buying pressure by naïve investors drove abnormal returns on publication day.

Among the studies that relied on the price pressure hypothesis were Sant and Zaman (1996) and Mathur and Waheed (1995). They studied price reactions to stocks mentioned in Business Week’s “Inside Wall Street” column for the periods; 1976–1988 and 1981–1989, respectively. Barber and Loeffler (1993), Metcalf and Malkiel (1994), and Liang (1999) examined Wall Street Journal’s Dartboard column for a period covering the early 1990s. Pari (1987) and Ferreira and Smith (2003) looked at recommendations brought up in the television program Wall Street Week. These studies, using the price pressure hypothesis explained positive abnormal returns on the publication day and negative returns during the subsequent 20 days.

The literature provides evidence on specific columns in the financial press. Prior results suggest that columnist recommendations have an economically significant impact on firm market value. However, whether these results can be generalized remains unclear. In addition, prior research only studies the implications of recommendations’ final output (e.g., buy or sell) on asset prices. There are no prior studies examining the relation between market reaction and recommendations’ timing, content and style. We aim to fill this gap in the literature by studying a large sample of columnist recommendations, examining the relation between recommendations’ market impact and contextual characteristics and assessing recommendations’ long-term performance.

3 Data and methodology

3.1 Data

We hand collected information on all stock recommendations made in the three leading business magazines; Business Week, Forbes and Fortune during the 4-year period between 2000 and 2003. These magazines were selected on the basis of their wide circulation and readership (see Table 1). For each stock recommendation we recorded columnist’s name, recommended trading position, columnist’s source of information (whether it relied on his research or someone else’s research), whether the recommendation contained a reference to other investors, managers or analysts, whether it had merger and acquisition or product related news, and the date on the cover of the issue. Ambiguous recommendations were excluded.

The final sample, which is the intersection of CRSP (Center for Research in Security Prices) and our recommendation sample, consists of 2,503 buy recommendations.Footnote 1 Dates on the cover of magazines do not indicate magazines’ publication dates. To identify the first day that readers had access to the magazines, we retrieved magazine sale dates for each magazine’s issues from the Standard Rate and Data Service—Consumer Magazine volumes.

We obtained data on return, price, shares outstanding and trading volume from the CRSP’s daily file, quarterly earnings announcement dates from Compustat’s quarterly file and accounting data from Compustat’s annual file. We compiled data on financial analysts’ consensus recommendation rating from the I/B/E/S recommendation file and earnings forecasts from I/B/E/S’s detail file. In addition, we retrieved all upgrades made by financial analysts from the I/B/E/S recommendation file.

We obtained data on the bid-ask spread from the TAQ database and included the Gibbs and Amihud liquidity variables from the database made available by Joel Hasbrouck. Finally, we downloaded Fama and French (1993) and Carhart (1997) factor returns and Fama & French industry classifications from Kenneth French’s website.Footnote 2

3.2 Event study methodology: a review

Event-study analysis has been widely applied to investigate research questions in numerous academic fields including accounting, economics, finance and law (see Binder 1998). The event-study methodology allows researchers to measure the economic impact of an event on firm value and test market efficiency. One of the earliest studies to use the event study methodology was Dolley (1933) who investigated the impact of stock-splits on security prices. Myers and Bakay (1948), Barker (1956) and Ashley (1962) were other early studies that used the event study analysis. The seminal studies by Ball and Brown (1968) and Fama et al. (1969) developed the event study methodology substantially and a variation of their methodology continues to be in use today.

Since event study analysis’s development, a wide range of methodologies has been applied to estimate the economic impact associated with events and corporate developments. These include (1) mean adjusted model, (2) market adjusted model, (3) market and risk adjusted returns model, (4) calendar-time portfolio approach, (5) Ibbotson’s returns across time and securities (RATS) approach, (6) event parameters approach and (7) cross-sectional stochastic dominance approach.

The mean adjusted returns model estimates abnormal returns (e it) as the difference between raw returns (R it) and a firm-specific constant expected return (C i): e it = R it − C i. The market adjusted returns model assumes abnormal returns for all firms to be equal to the market return and estimates abnormal returns as the difference between raw and market returns: e it = R it − R mt. The market and risk adjusted returns model estimates abnormal returns based on expected returns derived from an asset pricing model (e.g., CAPM, three-factor, four-factor model). This method involves a 2-stage estimation whereby first risk sensitivities are estimated and in the second stage these sensitivities are used to compute expected (E[R it]) and abnormal (e it) returns: e it = R it − E[R it]. In the calendar-time portfolio approach a rolling portfolio is formed each period which includes all sample firms remaining in the event period. When CAPM is assumed to be the asset pricing model, constructed portfolio’s excess returns are regressed on excess market returns and the intercept (also known as the Jensen’s alpha) of the regression is used as an estimate of abnormal returns. Ibbotson’s RATS approach developed by Ibbotson (1975) computes abnormal returns as the intercept of the cross-sectional regression that is estimated for each event period. This approach is particularly useful in estimating abnormal returns when there is no historical return data to estimate market model parameters. The event parameters approach developed by Binder (1985) and Schipper and Thompson (1983) relies on the simultaneous estimation of a system of equations which conditions the return generating process on the occurrence of an event. To accomplish this, the market model (or multifactor model) is augmented with a dummy variable that equals one if an event took place and zero otherwise. The event parameter approach possesses the advantage of providing test statistics that potentially reflect the cross-sectional covariance among firms. Finally, the cross-sectional stochastic dominance approach examines the whole distribution of returns of assets and tests whether investors can increase expected utility by investing in an alternative asset. The primary advantage of this approach is that it does not make distributional assumptions and does not require the identification of risk measures. There are three major types of stochastic dominance: first-order, second-order and third-order. The first-order stochastic dominance makes no assumption regarding investors’ risk preference, the second-order assumes that investors are not risk preferring and the third-order assumes decreasing absolute risk aversion. Larsen and Resnick (1999) based on simulations find that the stochastic dominance approach augmented with the bootstrap method performs as well and at times better than traditional event study methodologies.

In this study, to analyze the short-term behavior surrounding recommendations we use the market and risk-adjusted returns model and to assess the long-term performance of recommendations we use the calendar-time portfolio regression approach which was also used by Jaffe (1974) and Mandelker (1974) and advocated by Mitchell and Stafford (2000).

3.2.1 Short-term return analysis

To measure the short term market reaction to columnists’ recommendations we use the four-factor model (market model augmented with Fama & French and Carhart factors). The four-factor model relies on the linear relationship between returns of individual stocks, market, size, book-to-market and momentum portfolios. For any security i:

where R it is firm i’s return on day t. R mt is the CRSP value weighted index return for day t. SMB is the average return on the three small portfolios (value, neutral and growth) minus the average return on the three big portfolios (value, neutral and growth), HML is the average return on the two value portfolios (small and big) minus the average return on the two growth portfolios (small and big), UMD is the average return on the two high prior return portfolios (small and big) minus the average return on the two low prior return portfolios (small and big).Footnote 3 ε it, is a zero-mean disturbance term. The parameters of Eq. 1 are estimated using a 255 day estimation period (between τ–46 and τ–300 where τ is the event date). The abnormal return for the ith asset on day t is defined as:

where the coefficients \( \hat{\alpha }_{\text{i}} \), \( \hat{\beta }_{\text{i}} \), \( \hat{s}_{\text{i}} \), \( \hat{h}_{\text{i}} \) and \( \hat{u}_{\text{i}} \) are ordinary least squares estimates of \( \alpha_{\text{i}} \), \( \beta_{\text{i}} \), \( s_{\text{i}} \), \( h_{\text{i}} \), and \( u_{\text{i}} \) in Eq. 1. The cumulative average abnormal return for the period between T 1 and T 2 is defined as:

The null hypothesis of \( {\text{CAAR}}_{{T_{ 1} ,\,T_{ 2} }} = 0 \) is tested using the following test statistic:

where \( \hat{\sigma }_{\text{AAR}}^{ 2} = \frac{{\mathop \sum \limits_{{t = T_{ 1} }}^{{T_{ 2} }} ({\text{AAR}}_{t} - \overline{\text{AAR}} )^{2} }}{{T_{ 2} - T_{ 1} - 1}} \) and \( \overline{\text{AAR}} = \frac{{\mathop \sum \limits_{{t = T_{ 1} }}^{{T_{ 2} }} {\text{AAR}}_{\text{t}} }}{{T_{2} - T_{1} - 1}}. \) We also compute the generalized sign z test statistics which is a non-parametric test-statistics. Cowan (1992) based on simulations using daily stock return data finds the generalized sign test to be well specified and superior to the rank test when investigated securities have thin trading, large return variance or the examined event windows are long. To compute the generalized sign test statistics we first measure the ratio of positive abnormal returns during the estimation period (255 days):

where \( S_{\text{jt}} = \left\{ {\begin{array}{*{20}c} {1\quad {\text{if}}\,{\text{AR}}_{\text{jt}} > 0} \\ {0\quad {\text{otherwise}}} \\ \end{array} } \right. \). Then use the positive to negative abnormal return ratio from the estimation period as the expected ratio for the test window. Finally, we calculate the number of positive abnormal returns (w) and measure its divergence from the expectation as \( Z = \frac{{w - n\hat{p}}}{{(n\hat{p}(1 - \hat{p}))^{ 1 / 2} }} \).

3.2.2 Abnormal trading volume analysis

To measure abnormal trading volume behavior we use the market model approach described in Ajinkya and Jain (1989) and Campbell and Wasley (1996).Footnote 4 In this methodology a trading volume metric for each day and security is computed and regressed on CRSP equally weighted index’s trading volume metric. The residuals derived from this estimation are then used as the abnormal trading volume indicator. The trading volume metric is computed as follows:

where n it is the number of shares traded for firm i on day t, S it is the firm’s outstanding number of shares on day t. As suggested by the results in Ajinkaya et al. and Cready and Ramanan (1991), we use the log-transformation of percentage of shares traded. Before taking the log-transformation, we add a small constant of 0.000255 to prevent taking the log of zero, in case there is no trading volume on any firm day (as in Campbell et al.). The market model abnormal trading volume is as follows:

And abnormal trading volume is defined as:

where \( \hat{\gamma }_{\text{i}} \) and \( \hat{\rho }_{\text{i}} \) are ordinary least squares estimates of the trading volume market model parameters. V mt is computed as the sum of the trading volume metric of all securities in the CRSP equally weighted-index: \( V_{\text{mt}} = \frac{1}{N}\sum\limits_{i = 1}^{N} {V_{\text{it}} } \).

3.2.3 Regression analysis

In addition to the univariate analysis, we conduct a regression analysis of publication returns to examine the variation in returns to recommendations’ source, timing and content while controlling for liquidity, information leakage, information asymmetry and size factors.Footnote 5 Using ordinary least squares (OLS) we estimate the following equation:

where the dependent variable CAR(−1, +1) is the three-day cumulative abnormal return centered on the date of recommendation. IWS is an indicator variable that takes a value of one (zero otherwise) for recommendations published in the Inside Wall Street column. Recommendations may be associated with significantly higher returns due to recommended stock’s liquidity. To control for liquidity we include the variable SPREAD which is the trade-weighted relative bid-ask spread computed based on all transactions made during the most recent calendar-month before the recommendation date. In untabulated analysis instead of using SPREAD, we use the sum of the number of shares traded during the most recent fiscal year divided by the average number of shares outstanding, CRSP/Gibbs estimate of effective cost and the Amihud (2002) illiquidity measure. The results remain robust to the choice of liquidity measure. For brevity, we report results based on the use of the SPREAD variable.

To control for information leakage we include the cumulative abnormal return during the 9-day period ending 2 days before the recommendation, CAR (−10, −2). The market reaction on publication day may be associated with the amount of information that was leaked before the recommendation was made public.

To control for information asymmetry we include the standard deviation of analysts’ earnings forecasts, FOR_STD and the ratio of R & D expenditure and sales for the most recent fiscal year assuming a reporting lag of three-months, RND_INTENSITY.Footnote 6,Footnote 7 Finally, we control for size using the natural logarithm of the recommended firm’s market value, SIZE.

To examine the relation between recommendations’ contextual characteristics and their market reactions we include several indicator variables. DIRECT is an indicator variable that takes a value of one for recommendations that rely on the columnist’s own analysis rather than other sources’ (e.g., analysts, money managers) analysis. REF_ANLYST, REF_INV, and REF_MGMT are indicator variables that take a value of one for recommendations that make references to analysts, investors, and management, respectively. MERGER_NEWS and PRODUCT_NEWS are indicator variables that take a value of one for recommendations that contain merger & acquisition rumor and product news, respectively. CNFDG is an indicator variable that takes a value of one for recommendations that follow an earnings announcement, analysts forecast, recommendation or other columnist’s recommendations within a seven-day period. Finally, we include Fama and French 49 industry fixed-effects, IND, to control for industry effects.

3.2.4 Long term performance analysis

To measure the long term abnormal performance of stock recommendations we first construct a rolling value-weighted daily portfolio that takes positions in shares of recommended firms. A recommended stock enters the portfolio 1 day after the magazine’s publication date and remains in the portfolio for 1 year. The portfolio’s value-weighted daily return is computed as

where R m,d is the day d return on security m, n p,d is the number of firms in the portfolio and \( {\text{mv}}_{m,d - 1} \) is the market value of firm m on day d − 1. The daily portfolio returns are compounded to monthly returns, Rpt, as follows:

where n d is the number of trading days in the month t and R pd is the raw return for the portfolio on day d. Then, using OLS, we regress this portfolio’s monthly excess returns on excess market returns, size, book-to-market and momentum factor returns.Footnote 8

where R pt is the value-weighted monthly return for month t, R ft is the Ibbotson One Month Treasury Bill Rate. The market and factor returns are as defined in Eq. 1. In this regression, the intercept (also known as the Jensen’s alpha) is an estimate of the average monthly abnormal return accumulated by holding the portfolio during the estimation period.

4 Empirical results

4.1 Short-term return behavior

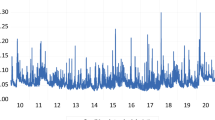

The short-term return analysis reveals that share prices of firms recommended by columnists increase prior to and on publication day. The running cumulative average return for columnist recommendations, illustrated in Fig. 1, begins increasing 3–4 days prior to publication day and rises sharply on publication day. The cumulative average abnormal return for the 3 day period centered on the publication day is 1.41% (Table 2, Panel A) which is statistically significant at the one-percent significance level.

Abnormal return behavior during the 30 day period centered on recommendation-publication-day. The x-axis indicates the number of days relative to recommendation’s publication date. The y-axis represents the average abnormal return cumulated starting 15 days before the recommendation’s publication date up to the corresponding day on the x-axis. Abnormal returns are computed using the 4-factor model with the CRSP value-weighted index as the market index. Six separate running cumulative average abnormal return series are illustrated for: (1) the Inside Wall Street (IWS) column, (2) Business Week excluding IWS, (3) Forbes, (4) Fortune, (5) all columnists (BW, Forbes and Fortune), and (6) financial analysts’ upgrades

However, the increase in prices prior to and on publication day of columnist recommendations is temporary. Part of the cumulative return accumulated up to publication day is reversed within the 20-day period following columnist recommendations. In comparison to the 1.41% market reaction on publication the cumulative average abnormal return for the (+2, +20) is −1.60% which is statistically significant at the 1% significance level.

Analyst upgrades are also associated with a strong market reaction leading up to announcement date which however is not followed by a price reversal. The cumulative average abnormal return for the 3-day period centered on analyst upgrades’ publication day is 3.02% (Table 2, Panel B). The 3.02% market reaction is statistically significant based on both parametric and non-parametric tests. In contrast to columnist recommendations, analyst upgrades do not exhibit a price reversal during the post-event period. The cumulative average abnormal return for analysts’ upgrades for the (+2, +20) event window is −0.02% and the median CAR is 0.29%. In untabulated analysis, we find the mean difference between the cumulative average abnormal return (+2, +20) of analysts’ and columnists’ recommendations to be statistically significant.

The return behavior following analyst and columnist recommendations is substantially different. We observe no price reversal for analyst upgrades whereas a strong price reversal follows columnists’ stock recommendations. The price reversal we document for columnist recommendations is consistent with the price pressure hypothesis whereby no new information is released to the markets but prices temporarily increase because of buying pressure imposed by investors. On the other hand, financial analysts’ upgrades appear to reveal more information which the markets incorporate into prices without a subsequent short-term price reversal.

The return behavior we document for columnists is substantially weaker in magnitude than findings of prior studies that examine particular columns in business magazines. For instance, Palmon et al. (1994), Mathur and Waheed (1995), and Sant and Zaman (1996) find that the cumulative average abnormal return for publication ranges between 2.44% and 3.25% whereas we document a 1.41% market reaction on publication.

A potential explanation for the difference between our findings and prior studies’ results is the sample we use. Prior studies focus on particular columns whereas we study a large sample of columnist recommendations from several leading business magazines. The most widely examined business magazine column in the prior literature is the Inside Wall Street (IWS) column of Business Week magazine. In search of an explanation for differences between our finding and prior findings we split our sample into four sub-samples: IWS, Business Week (excluding IWS), Forbes and Fortune.

The sub-sample analysis reveals that the Inside Wall Street column drives our full sample results. The return behavior surrounding IWS recommendations is substantially different from other sub-sample results. We find that the publication cumulative average abnormal return for IWS recommendations is 4.61% (Table 2, Panel C) which is more than three times greater than the average market reaction for the full-sample. Table 2, Panels D–F report that the market reaction to recommendations published in Business Week’s other columns, Forbes and Fortune magazines are 0.3%, 0.55%, and 0.65%, respectively. Although average market reactions to non-IWS recommendations are also statistically significant they are considerably weaker than the reaction to IWS recommendations. In untabulated analysis we test and find the difference in market reactions between IWS and Business Week, Forbes and Fortune to be statistically significant.

As in the full-sample results, IWS recommendations are also followed by a price reversal. The cumulative average abnormal return for the post-publication event window (+2, +20) is −3.45% which is statistically significant. Interestingly a similar negative return behavior follows Business Week’s columns other than IWS. However we do not find a statistically significant price reversal for Forbes and Fortune magazines’ recommendations.

Further, the trading volume reaction to IWS recommendations is strongest within our entire sample including analyst upgrades. Figure 2 illustrates the trading volume reaction for recommendations published in the IWS column, Business Week, Forbes and Fortune magazines and financial analysts’ upgrades. The mean abnormal relative volume for IWS recommendations on publication day is approximately 160% whereas analyst upgrades’ mean abnormal relative volume is 90%. Most strikingly, the mean trading volume reaction to IWS recommendations is ~20 times greater than the mean volume reaction to recommendations published in Business week, Forbes and Fortune.

Trading volume reaction to recommendations. The x-axis indicates the number of days relative to recommendation-publication-day. Abnormal relative volume is calculated each day for: (1) the Inside Wall Street (IWS) column, (2) Business Week excluding IWS, (3) Forbes, (4) Fortune, (5) all columnists (BW, Forbes and Fortune), and (6) financial analysts’ upgrades

In addition to the striking abnormal return and trading volume behavior associated with recommendations published in the Inside Wall Street column we identify a long history of scandals linked to the IWS column dating back to 1988. Table 3 provides a sample of news reports related to the Inside Wall Street column. The incidences linked to the IWS column show investors’ strong ambition to obtain access to IWS columns prior to publication and act on the recommendations therein. Investors’ effort to act based on IWS recommendations partly explains the abnormal return and trading volume behavior we observe in Figs. 1 and 2; Table 2.

However, the underlying reason why IWS attracts strong investor interest while other columns receive little interest from investors remains unclear. In search of an explanation as to why IWS recommendations are associated with a different return and trading volume behavior we examine whether differences in recommended firms’ financial characteristics or recommendations’ content, style, and timing play a role.

The empirical analysis of recommended firms’ financial characteristics—reported in Table 4—reveals that firms recommended in the Inside Wall Street column are smaller than firms recommended in other columns. Table 4, Panel A reports that the average firm recommended by IWS has a market value of $9.6 billion, whereas the average firm recommended by Business Week’s other columns, Forbes and Fortune columns have market values of $29, $24.1 and $33.8 billion, respectively. Investors receive information about large firms through various channels (e.g., analysts, media) whereas the number of sources for investors to acquire information on small firms is limited. The scarcity of information for small firms may put forward columnist recommendations for small firms and play a role in the strikingly different return behavior that IWS recommendations are associated with. On the other hand, firms recommended in IWS are similar to firms recommended in other columns in terms of turnover, leverage, current, price-to-book, price-to-earnings and price-to-cash-flow ratios.

Another difference between IWS and other sources may be the way recommendations are written in the IWS column. To examine potential differences in recommendations we explore the content and style of IWS recommendations in comparison to other columnist recommendations. In this analysis we examine various aspects of recommendations’ style and content. For each columnist (or magazine) we compute the ratio of recommendations that:

-

are direct (implying that the author relies directly and solely on his analysis),

-

have references to financial analysts,

-

have references to investors,

-

have references to management officials,

-

contain merger and acquisition related rumors,

-

contain information about new product releases.

We find a substantial difference between IWS and non-IWS recommendations in terms of content and style. First of all, none of IWS recommendations are direct recommendations. Columnists publishing in IWS appear to avoid relying solely on their own analysis. They prefer supporting their recommendations with references to investors, analysts and management more often than other columnists. Table 4, Panel B reports that 58.8% of all IWS recommendations make references to financial analysts whereas Business Week’s other columns, Forbes and Fortune columnists refer to analysts in the range of 6.3%–42.86%. Similarly, IWS columnists in 44.1% and 6.9% of their recommendations make references to investors and management. Both percentages are highest among a large sample of columnists. Finally, Table 4, Panel B reports that IWS columnists in 27.2% and 25.2% of their recommendations supplement their recommendations with merger & acquisition rumors and product news. Again both of these ratios are the highest in our sample. The contextual differences between IWS and non-IWS recommendations highlight the story that columnists transmit as a potentially important factor influencing markets’ response to recommendations.

In addition to recommendations’ content and style, we examine recommendations timing with respect to confounding announcements. We define an announcement as confounding, if it occurs 7 days prior to the columnist’s recommendation. As potential confounding announcements, we consider other columnists recommendations, earnings announcements, analysts’ earning forecasts and analysts’ recommendation revisions.

Table 4, Panel C reports the percentage of recommendations with confounding announcements. The results indicate that IWS recommendations coincide with smaller number of confounding announcements. With the exception of earnings announcements, IWS recommendations rarely fall close to other columnists’ recommendations, analysts’ earnings forecasts and recommendations. Further, the average firm recommended by IWS has the lowest analyst following.

In summary, the univariate analysis reveals a market reaction to columnist recommendations which is both statistically and economically significant. However, we find that the magnitude of the market reaction to columnist recommendations is not uniform across various columns within our full-sample. The sub-sample analysis reveals that IWS recommendations which received the greatest prior academic interest drive our full-sample results. When we exclude IWS recommendations we find that the market reaction to columnist recommendations is muted in magnitude but remains statistically significant. This suggests that prior evidence on particular columnist recommendations cannot be generalized to all columnist recommendations and that the average columnist recommendation has a relatively small impact on prices compared to analysts.

4.2 Regression analysis of publication returns

The regression analysis confirms that recommendations published in the Inside Wall Street column trigger significantly greater publication returns than other columns. Table 5 model I reports the estimation results of the regression of publication returns on the IWS indicator variable and liquidity, information asymmetry, size and industry control factors.Footnote 9 In model I the IWS coefficient, estimated to be 0.024 (significant at the 1% level), indicates that recommendations published in IWS yield an average market reaction that is 2.4% higher than non-IWS recommendations. This is consistent with the univariate results and suggests that the market reaction to IWS recommendations is different from other columnist recommendations. In model I, the SPREAD coefficient is positive and SIZE is negative, consistent with small and illiquid firms being associated with stronger market reactions on publication of recommendations. However we do not find a significant relation between information asymmetry (FOR_STD and RND) and publication returns. This may be because the SIZE variable subsumes most of the information asymmetry effect. Finally, the OLS results do not suggest that information leakage significantly affects publication returns of recommendations.

In model II, we include four indicator variables (DIRECT, REF_ANLYST, REF_INV, and REF_MGMT) to capture recommendations’ qualitative aspects. With the exception of REF_MGMT, none of the estimated coefficients are statistically significant. The REF_MGMT coefficient is estimated to be 0.03 which indicates that recommendations that refer to communications with management officials trigger a market reaction that is on average 3% higher than recommendations that do not contain references to management. Finally, the IWS coefficient in model II, 0.022, is both statistically and economically significant. The significantly positive IWS coefficient is consistent with IWS recommendations being associated with a stronger average market reaction controlling also for recommendation content and style.

Estimation results of model III, which additionally include MERGER_NEWS and PRODUCT_NEWS, show that recommendations containing merger & acquisition rumor are associated with a stronger market reaction whereas the presence of product news does not appear to significantly influence market reaction. Table 5, Model III reports MERGER_NEWS’s estimated coefficient to be 0.021 which is statistically significant and suggests that recommendation containing M & A rumor generate 2.1% higher abnormal returns than other recommendations. However, the PRODUCT_NEWS is estimated to have an insignificant coefficient consistent with markets not reacting differently to recommendations containing product news. Finally, the IWS coefficient in model III is estimated to be 0.019 which is statistically significant.

In model IV we examine whether recommendations timing matters by including the indicator variable, CNFDG, which takes a value of one for recommendations that follow an earnings announcement, analysts forecast, recommendation or other columnist recommendation within a 7-day period. We find weak evidence in support of columnist recommendations close to other confounding events having a lower market reaction. However, the IWS coefficient remains robust to the inclusion of CNFDG.

The regression analysis suggests that IWS recommendations, controlling for liquidity, information asymmetry, size, and recommendations’ contextual, stylistic and timing characteristics, trigger an average market reaction that is between 1.9% and 2.4% higher than other columns’ recommendations. The difference between IWS and non-IWS recommendations is both economically and statistically significant. These results are consistent with IWS recommendations being distinct from other columnists’ recommendations. Hence, prior studies’ results on particular columns are not descriptive of the return behavior surrounding columnist recommendations in general. Finally, we find evidence in support of recommendations with references to management officials or merger & acquisition rumors having 3.1% and 2.1% higher average market reactions.

4.3 Long-term performance analysis of columnist recommendations

The calendar-time portfolio regression results show that a long-term investor (with a 1-year holding period) following columnist recommendations during the years 2000–2003 would not have achieved abnormal returns after controlling for market risk, book-to-market, size and momentum effects. Table 6, Panel A reveals that investors acting based on columnist recommendations published in Business Week, Forbes and Fortune magazines with a 1-day trading delay would have incurred a monthly average loss of 0.31%. Similarly, long-term investors following analyst upgrades with a 1-day trading delay would have incurred a monthly average loss of 0.15%. Finally, portfolios formed according to recommendations in any of the sub-samples, IWS, Business Week excluding IWS, Forbes or Fortune do not provide significantly positive abnormal returns.

The long-term performance results are insensitive to trading delay. Even a long-term investors acting on the day of columnist recommendations would not have achieved abnormal returns controlling for beta, size, book-to-market and momentum factor sensitivities. Results reported in Table 6, Panel B are based on the assumption that investors are able to capture publication day returns of recommendations. According to Table 6, Panel B, the monthly average abnormal return associated with investing in columnist recommendations is −0.29% The sub-sample analysis shows that IWS, Business Week excluding IWS, Forbes and Fortune recommendations accrue a monthly average abnormal return of 0.02%, 0.21%, 0.01% and −0.5%. However, investors able to invest in analyst upgrades on announcement day would have achieved a monthly average abnormal return of 1.2% based on recommendations made during 2000–2003.

Finally, we test for differences in long-term abnormal returns of direct and indirect stock recommendations. Direct recommendations represent stocks endorsed explicitly by columnists based on their own opinion or analysis. On the other hand, indirect recommendations generally represent endorsement by the columnists to the recommendations of others (e.g., analysts).

Columnists’ choice of relying solely on analyst recommendations as opposed to their own research suggests the use of a different source of information. Indirect recommendations can be interpreted as more reliant on the efforts of analysts rather than columnists. Analysts and columnists differ in many aspects, and this has the potential to influence the abnormal returns that follow indirect and direct recommendations asymmetrically. Columnists are employed by business magazines, whereas analysts work for investment firms and brokerage houses. This gives columnists more room for independence which is documented by Barber et al. (2007) to be associated with higher performance. Columnists’ greater independence provides them an environment in which they can make unbiased recommendations. Further, columnists and analysts have different incentives. Hong and Kubik (2003) discuss analysts’ career concerns and find that analysts reap higher rewards when they make more optimistic recommendations. The absence of such conflicting incentives for columnists may permit them to make less biased and superior recommendations. On the other hand, the performance of columnists is evaluated less frequently. This can reduce columnists’ incentives for in-depth research and analysis. Finally, columnists’ access to supportive resources (e.g., data, information, research) is often more limited.

Panel A of Table 7 reports summary statistics of directly and indirectly recommended firms’ size, previous-year-return, turnover ratio and average short-term returns preceding recommendations. The results suggest that columnists’ direct recommendations are mainly composed of larger stocks with lower preceding returns and turnover ratios. Further, stocks that are recommended directly have lower abnormal returns in the period preceding the recommendation. The higher average abnormal return that precedes indirect recommendations is consistent with greater information leakage taking place prior to indirect recommendations. Indirect recommendations are more likely to involve prior dissemination to the public. Hence, positive prior returns may be due to the release of information in the pre-recommendation period. Panel B of Table 7 reports that the market risk and size factor sensitivity of direct recommendations are significantly lower than those of indirect recommendations. These results combined, suggest that columnists—when making direct recommendations—avoid stocks that are risky, small and that have recently increased in value.

Separate portfolios constructed according to indirect and direct recommendations do not significantly outperform the market controlling for market risk, size, book-to-market and momentum effects. Table 8, Panel A reports the percentage monthly abnormal returns of portfolios formed with a 1-day trading delay. The results suggest that neither indirect nor direct recommendations have significant long-term value to investors. These results are robust to forming portfolios without any trading delay. Table 8, Panel B reports estimation results for portfolios constructed without a trading delay. As in Panel A neither portfolio is associated with significant abnormal returns. These results suggest that both direct and indirect recommendations fail to outperform the market controlling for market risk, size, book-to-market and momentum effects.

5 Conclusion

This paper investigates the abnormal return and trading volume behavior surrounding columnists’ stock recommendations. For a subset of our sample, limited to recommendations published in the Inside Wall Street (IWS) column, we document results similar to prior studies’ findings. However the return behavior associated with IWS is not pervasive within our full sample which includes columnists’ recommendations from several leading business magazines. These results indicate that prior studies’ findings are not representative of the columnist community in general.

Further, our regression analysis of publication returns suggests that recommendations that make references to management officials, or contain merger and acquisition news trigger a larger market reaction. Consistent with the prior literature, we find that recommendations targeting illiquid and small firms coincide with a stronger market reaction.

Finally, we find that long-term investors following recommendations published in Business Week, Forbes and Fortune magazines during the period 2000–2003 would not have been able to consistently earn abnormal returns controlling for market risk, size, book-to-market and momentum effects.

The short- and long- term return behavior surrounding columnist recommendations can also be examined using alternative methodologies. We relied on the use of a particular set of methods that make strict assumptions about investors’ risk preferences, risk identification, and reference market portfolio. Future research relaxing these assumptions through the use of stochastic dominance approach or alternative methodologies can provide further insights about the market reaction to recommendations and the long-term value of columnists’ advice.

Notes

In addition to buy recommendations there were 129 sell recommendations in our sample. Due to the limited number of sell recommendations we excluded them from our analysis.

We thank Kenneth French and Joel Hasbrouck for making their data available.

Fama and French (1993) construct the six portfolios used in the calculation of SMB and HML factor returns at the end of each June using the intersections of two portfolios (small and big) formed on size (market equity) and three portfolios (value, neutral and growth) formed on the ratio of book equity to market equity (BE/ME). The size breakpoint for year t is the median NYSE market equity at the end of June of year t. BE/ME for June of year t is the book equity for the last fiscal year end in t − 1 divided by ME for December of t − 1. The BE/ME breakpoints are the 30th and 70th NYSE percentiles.

We are indebted to the referee for making us numerous suggestions regarding the regression model.

When R&D expenditure is missing we replace it with zero.

Another potential factor that can be used to control for information asymmetry is the number of analyst following. However, this variable is highly correlated with firm size. In untabulated analysis we exclude firm size from the regression model, control for analyst following and find similar results.

Excess return is raw monthly return minus the one-month Treasury Bill rate (monthly).

We checked for multicolinearity by examining variance inflation factors and found no evidence in support of the presence of serious multicolinearity in any of the models. The mean & maximum variance inflation factors were 1.07 & 1.19 (model I), 1.65 & 3.55 (model II), 1.61 & 3.59 (model III) and 1.58 & 3.59 (model IV).

References

Ajinkya BB, Jain PC (1989) The behavior of daily stock market trading volume. J Account Econ 11:331–359. doi:10.1016/0165-4101(89)90018-9

Ashley JW (1962) Stock prices and changes in earnings and dividends: some empirical results. J Polit Econ 70:82–85. doi:10.1086/258592

Ball R, Brown P (1968) An empirical evaluation of accounting income numbers. J Account Res 6:159–178. doi:10.2307/2490232

Barber BM, Loeffler D (1993) The “Dartboard” column: second-hand information and price pressure. J Financ Quant Anal 28:273–284. doi:10.2307/2331290

Barber BM, Lehavy R, Trueman B (2007) Comparing the stock recommendation performance of investment banks and independent research firms. J Financ Econ 85:490–517. doi:10.1016/j.jfineco.2005.09.004

Barker AC (1956) Effective stock splits. Harv Bus Rev 34:101–106

Beneish MD (1991) Stock prices and the dissemination of analysts’ recommendation. J Bus 64:393–416. doi:10.1086/296543

Binder JJ (1985) Measuring the effects of regulation with stock price data. Rand J Econ 16:167–183. doi:10.2307/2555408

Binder JJ (1998) The event study methodology since 1969. Rev Quant Finance Account 11:111–137. doi:10.1023/A:1008295500105

Campbell C, Wasley CE (1996) Measuring abnormal daily trading volume for samples of NYSE/ASE and NASDAQ securities using parametric and nonparametric test statistics. Rev Quant Finance Account 6:309–326. doi:10.1007/BF00245187

Carhart M (1997) On persistence in mutual fund performance. J Finance 52:57–82. doi:10.2307/2329556

Cowan AR (1992) Nonparametric event study tests. Rev Quant Finance Account 2:343–358. doi:10.1007/BF00939016

Cowles A (1933) Can stock market forecasters forecast. Econometrica 1:309–324. doi:10.2307/1907042

Cready WM, Ramanan R (1991) The power of tests employing log-transformed trading volume in detecting abnormal trading. J Account Econ 14:203–215. doi:10.1016/0165-4101(91)90005-9

Dolley J (1933) Characteristics and procedure of common stock split-ups. Harv Bus Rev 11:316–326

Fama EF (1970) Efficient capital markets: a review of theory and empirical work. J Finance 25:383–417. doi:10.2307/2325486

Fama E (1998) Market efficiency, long-term returns, and behavioral finance. J Financ Econ 49:283–306. doi:10.1016/S0304-405X(98)00026-9

Fama E, French K (1993) Common risk factors in the returns on stocks and bonds. J Financ Econ 33:5–56. doi:10.1016/0304-405X(93)90023-5

Fama E, Fisher L, Jensen MC, Roll R (1969) The adjustment of stock prices to new information. Int Econ Rev 10:1–21. doi:10.2307/2525569

Ferreira EJ, Smith SD (2003) “Wall Street Week”: information or entertainment? Financ Anal J 59:45–53. doi:10.2469/faj.v59.n1.2502

Hong H, Kubik JD (2003) Analyzing the analysts: career concerns and biased earnings forecasts. J Finance 58:313–351. doi:10.1111/1540-6261.00526

Ibbotson RG (1975) Price performance of common stock new issues. J Financ Econ 2:235–272. doi:10.1016/0304-405X(75)90015-X

Jaffe J (1974) Special information and insider trading. J Bus 47:411–428. doi:10.1086/295655

Larsen GA, Resnick BG (1999) A performance comparison between cross-sectional stochastic dominance and traditional event study methodologies. Rev Quant Finance Account 12:103–112. doi:10.1023/A:1008376819903

Lee JC (1986) Information content of financial columns. J Econ Bus 38:27–39. doi:10.1016/0148-6195(86)90014-7

Liang B (1999) Price pressure: evidence from the “Dartboard” column. J Bus 72:119–134. doi:10.1086/209604

Liu P, Smith SD, Syed AA (1990) Stock price reactions to The Wall Street Journal’s securities recommendations. J Financ Quant Anal 25:399–410

Lloyd-Davies P, Canes M (1978) Stock prices and the publication of second-hand information. J Bus 51:43–56. doi:10.1086/295983

Mandelker G (1974) Risk and return: the case of merging firms. J Financ Econ 1:303–335. doi:10.1016/0304-405X(74)90012-9

Mathur I, Waheed A (1995) Stock price reactions to securities recommended in Business Week’s “Inside Wall Street”. Financ Rev 30:583–604. doi:10.1111/j.1540-6288.1995.tb00847.x

Metcalf GE, Malkiel BG (1994) The Wall Street Journal contests: the experts, the darts, and the efficient market hypothesis. Appl Financ Econ 4:371–374

Mitchell M, Stafford E (2000) Managerial decisions and long-term stock price performance. J Bus 73:287–320. doi:10.1086/209645

Myers J, Bakay A (1948) Influence of stock split-ups on market prices. Harv Bus Rev 26:251–265

Palmon O, Sun H, Tang AP (1994) The impact of publication of analysts’ recommendations on returns and trading volume. Financ Rev 29:395–417. doi:10.1111/j.1540-6288.1994.tb00403.x

Pari RA (1987) Wall Street Week recommendations: yes or no. J Portfol Manage 14:74–76

Sant R, Zaman MA (1996) Market reaction to Business Week ‘Inside Wall Street’ Column: a self-fulfilling prophecy. J Bank Finance 20:617–643. doi:10.1016/0378-4266(95)00025-9

Schipper K, Thompson R (1983) The Impact of merger-related regulations on the shareholders of acquiring firms. J Account Res 21:184–221. doi:10.2307/2490943

Author information

Authors and Affiliations

Corresponding author

Additional information

We are indebted to two anonymous referees, workshop participants at Rutgers University and the 14th Annual Conference on PBFEAM for helpful comments and discussions. We would also like to thank the Whitcomb Center for Research in Financial Services for providing research support through use of the WRDS system.

Rights and permissions

About this article

Cite this article

Palmon, D., Sudit, E.F. & Yezegel, A. The value of columnists’ stock recommendations: an event study approach. Rev Quant Finan Acc 33, 209–232 (2009). https://doi.org/10.1007/s11156-009-0114-2

Received:

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s11156-009-0114-2