Abstract

There is extensive evidence indicating a negative risk–return relation when a firm’s performance is measured based on accounting measures such as return on asset (ROA) and return on equity (ROE). Previous studies show that the risk-return paradox can be explained by the prospect theory, which predicts that managers’ risk attitudes are different for firms of different performances. However, those studies mostly use earlier data from the COMPUSTAT database, which suffers from a survivorship bias. Failure to account for delisting firms may understate the risk–return relation. We reexamine the mixture of risk-seeking and risk-averse behaviors based on an updated 20-year sample period that is free from the survivorship problem. Interestingly, our results show stronger and robust evidence supporting the prospect theory during the period from 1984 to 2003.

Similar content being viewed by others

Avoid common mistakes on your manuscript.

1 Introduction

Asset pricing theories, such as the Sharpe–Lintner–Black capital asset-pricing model (CAPM) and the Ross’s arbitrage pricing theory (APT), assert a positive relationship between the expected return and some measure(s) of risk. Based on accounting measures, however, Bowman (1980) identifies a negative relationship between risk and average return, which is known as the “risk-return paradox” in the literature. Based on a sample of firms from 85 US industries over a nine-year sample period (1968–1976), Bowman (1980) finds a negative relation between the variance and average of returns on equity (ROE).

Bowman’s findings soon attracted several researchers to investigate why such a paradoxical phenomenon exists. Nickel and Rodríguez (2002) provide an excellent survey on the literature. Among various competing theories, perhaps the most interesting is the prospect-theory-based explanation proposed by Fiegenbaum and Thomas (1988) and Fiegenbaum (1990). They show that the risk-return paradox can be explained based on Kahneman and Tversky’s (1979) prospect theory, which predicts that agents have different risk attitudes towards gains and losses, measured with respect to a certain reference point.

Empirically, Fiegenbaum and Thomas (1988) and Fiegenbaum (1990) document that (1) a negative association exists between risk and return for firms having returns below their industry target levels (or reference points) (2) a positive association exists for firms with returns above the target, and (3) the below target tradeoff is generally steeper than that above the target. Thus, the results explain Bowman’s risk-return paradox because when the regression is applied to all firms, the estimate of the slope term will be dominated by the below-target firms, which have a steeper negative risk–return relation.Footnote 1

A potential problem of the existing studies, however, is that the analyses are mostly conducted using the early data from the COMPUSTAT database, which is subject to the survivorship bias. As is well known, the COMPUSTAT database was greatly expanded to cover over 6,000 companies in 1978. The histories of these companies were back-filled, but no companies were added that failed to survive through 1978. The survivorship issue has been investigated extensively in recent years. Researchers find that failure to account for survivorship bias may induce spurious performance persistence in mutual funds (see Brown et al. 1992; Elton et al. 1996). Shumway (1997) and Shumway and Warther (1999) show that at least part, if not all, of the small-firm effect is due to the failure to incorporate the delisted firms in the CRSP database.

Notably, Davis (1996) finds that the cross-sectional relationships between stock returns and accounting variables such as book-to-market equity are attenuated when non-surviving firms are added into the regressions. Thus, he suggests that the explanatory power of accounting-based variables may be significantly overstated if the empirical analysis does not adjust for the survivorship bias. As Fiegenbaum and Thomas (1988) and Fiegenbaum (1990) cover only the periods of 1960–1979 and 1977–1984, respectively, their empirical results might be subject to the survivorship problem.

In this paper, we reexamine the risk-return paradox based on an updated US sample over the period 1984–2003 to provide more recent evidence on the risk–return relation with data free from the survivorship bias. Except for studying the full sample period, we also examine the risk–return relation in two sub-periods (i.e., 1984–1993 and 1994–2003). Horowitz et al. (2000) point out that sub-period tests serve as robustness checks on the proposed relation between risk and return. Various hypotheses implied by the prospect theory proposed by Fiegenbaum (1990) are reexamined.

Furthermore, there has been evidence showing that some of the famous market anomalies, such as the size effect, may be driven by extreme observations. Knez and Ready (1997) show that after trimming only 1% of the most extreme observations, the size effect all but disappears.Footnote 2 It is thus possible that the previous results supporting the prospect theory may also be affected by extreme observations. To examine this possibility and check the robustness of our empirical findings, we apply two additional empirical methodologies to estimate the risk–return relation. First, we employ Knez and Ready’s (1997) least trimmed squares (LTS) technique by trimming a proportion of the influential observations. Second, we trim extreme observations whose risk measures fall outside the range of absolute three standard deviations from the mean.

Since our sample suffers less from the survivorship problem, we can make a few predictions. First, we would expect the risk–return relations to be stronger for both below-and above target-firms in comparison with the early study, if the prospect theory is correct. Second, other things being equal, we expect the loss aversion phenomenon to be stronger in recent years. This is because overall the below-target firms are more vulnerable to the survivorship problem than the above-target firms, one would obtain a flatter negative risk–return relationship for the below-target firms in the presence of survivorship bias. As a result, the loss aversion phenomenon is also weaker in the presence of survivorship bias.

The contribution of this paper is two fold. First, we examine the risk-return paradox in the accounting literature to a recent sample that is free from the survivorship bias. Second, we formally analyze how the presence of survivorship bias could affect the risk–return relations. Indeed, the empirical results show that the risk–return relations are stronger in recent years, thus providing a stronger support for the prospect theory. Our empirical findings indicate that the survivorship bias embedded in the early COMPUSTAT data could have a significant impact on empirical studies using accounting data.

The rest of the paper is organized as follows. Section 2 describes the data, the hypotheses and the empirical methodology. The impact of the presence of survivorship bias on the risk–return relationship is also discussed. Section 3 presents the empirical results, and Sect. 4 concludes the paper.

2 Data and methodology

2.1 Data

We use return on assets (ROA) and its standard deviation as a firm’s return and risk measures, respectively.Footnote 3 We obtain the annual ROA of all firms for the period 1984–2003 from the COMPUSTAT database. Analyses are performed for the entire 20-year period, as well as for two non-overlapping sub-periods 1984–1993 and 1994–2003. Following Fama and French (1997), we classify firms into 48 industries based on the standard industry classification (SIC) codes. In addition, following Fiegenbaum (1990), only industries with more than 20 firms are included. Firms with fewer than five non-missing values during each period are eliminated from our sample. Our final sample has a total of 27,416 firms during the entire 20-year period, grouped into 45 industries with an average of about 608 firms within each industry.Footnote 4

2.2 Hypotheses and research methodology

Kahneman and Tversky (1979) prospect theory suggests that most individuals are risk seeking when their returns are below the reference point, and are risk averse when returns are above the reference point. At the market level, the theory successfully explains why investors tend to sell their “winner” stocks too early, while holding the “losers” for too long, the so called “disposition effect” in the literature (Odean 1998). At the corporate level, Fiegenbaum and Thomas (1988), among others, show that the theory also works well in explaining the managers’ behavior.

A firm is classified into the “above” (“below”) group if its average return over a sample period is higher (lower) than the target level (i.e., the reference point). Kahneman and Tversky (1979) do not explicitly discuss how a reference point is determined. Although Fiegenbaum and Thomas (1988) argue that such mixture of risk attitudes may exist both within and across industries, most studies (including Fiegenbaum 1990) only adopt the industry median as the reference point. To examine if the mixture of risk attitudes exits within industries as well as across industries, we examine the risk–return relation for the above- and below-target firms both at the industry level and at the market level. That is, the target levels in our paper include the industry median returns and the market median returns.

In accordance with the literature, we test the following three hypotheses:

Hypothesis 1

A negative relation between risk and return exists for firms performing below the target level.

Hypothesis 2

A positive relation between risk and return exists for firms performing above the target level.

Hypothesis 3

The relation between risk and return is steeper for firms that underperform the target level than the relation for firms that outperform the target level.

The third hypothesis is known as loss aversion in the literature. The hypotheses are examined at the industry level as well as at the market level. At the industry level, the hypotheses are tested by running regressions separately for firms above and below the industry median returns. Suppose there are m industries. Let Return ij and Risk ij denote the mean and standard deviation of ROA for firm j in industry i over a certain sample period. For firms in the above and below groups of each industry, we perform the following cross-sectional regression:

where i = 1,…, m; j = 1,…, N i . a i is the intercept term for industry i, and b i is the slope coefficient of the risk–return relation for industry i. The estimates of the slope coefficients across all industries are then aggregated to test if the average slope conforms to the hypotheses of interest. Similarly, at the market level, each firm is classified into the above and below groups according to the market median returns, i.e., the median ROA of all firms in the markets. The above regression is then applied to each of the two groups.

2.3 Sources of survivorship bias and their impact

Survivorship bias occurs when the researcher fails to consider firms that do not exist over the entire sample period. There are two potential sources of the bias. First, the researcher requires that all firms exist over the entire sample period; those fail to meet this requirement are dropped from the sample. Second, the original database fails to include some firms, especially the non-surviving firms. The occurrence of the first source of bias is most common, and can be avoided by properly incorporating all firms that ever existed in the database. The second source of the bias, however, is detrimental because it is “exogenous,” i.e., non-surviving firms are discarded along the database compilation process, and it is likely beyond the researcher’s ability to correct for the bias.

The survivorship bias in the COMPUSTAT database belongs to the second category. Kothari, Shanken and Sloan (hereafter KSS 1995) point out that there are two aspects of the selection procedures that impart the survivorship bias in the COMPUSTAT data. First, although the COMPUSTAT database was greatly expanded to cover over 6,000 companies in 1978, and the histories of these companies were back-filled; no companies were added that failed to survive through 1978. Second, KSS (1995) show that even in recent years the COMPUSTAT’s procedures in selecting firms still favor surviving firms.Footnote 5

The survivorship bias is easily confused with the delisting bias. The survivorship bias is broader in terms of the sources of missing observations. Firms whose financial statements are missing are oftentimes those in distress, which may later be deleted from the sample because of merger or delisting. The exclusion of a firm, however, does not necessarily imply that the firm would be delisted; it may also be attributed to the firm’s failure to meet the requirement of the database selection criteria.

The survivorship bias is sometimes referred to as the ex post selection bias (e.g., McElreath and Wiggins 1984). The survivorship bias is a form of ex post selection bias because some (mostly non-surviving) firms are excluded ex post along the database compilation process, but the information concerning non-surviving firms would not have been known a priori. There are yet other forms of ex post selection bias. A second type of ex post selection bias occurs when a new company enters a database with a full history; a bias is introduced because some of the data backfilled are not available on the file at an earlier time (Banz and Breen 1986). This introduces a potential bias when using the database for analysis. For example, suppose a firm that met the COMPUSTAT selection criteria in 1975 was included with its history being traced back to 1973. Researchers who get access to the data would have treated the firm as available starting from 1973, but in fact investors who accessed the database in 1973 would not have information on the firm.

This type of ex post selection bias is similar to the look-ahead bias in nature.Footnote 6 To avoid this type of bias, some researchers (e.g., Fama and French 1997) require additional historical data before a firm is included into the sample.Footnote 7 Such a requirement, however, does not really eliminate the delisting bias, which is the major source of the survivorship bias.

The survivorship issue has been investigated extensively in recent years. Researchers find that failure to account for survivorship bias may induce spurious performance persistence in mutual funds (see Brown et al. 1992; Elton et al. 1996). Shumway (1997) and Shumway and Warther (1999) show that at least part, if not all, of the small-firm effect is due to the failure to incorporate the delisted returns in the CRSP database.

How would the presence of survivorship bias affect the risk–return relationship? Presumably, non-surviving firms are mostly those that perform poorly. They are characterized with high risks and low returns. Suppose the risk–return relation conforms to the prospect theory, implying that firms performing under the target level have a negative risk–return relation. Since stocks of higher (distress) risk are more likely to be discarded, other things being equal, one can expect a negative, but flatter, risk–return relationship in the presence of survivorship bias.

In addition, although both above and below target firms are affected by the survivorship bias, the below-target firms are more susceptible to the bias. Thus, it can be expected that the loss aversion phenomenon will be weaker in the presence of survivorship bias. In other words, we would expect recent observations to exhibit a stronger loss-aversion phenomenon.

2.4 Robustness checks

To examine the robustness of our empirical results, we apply two techniques that exclude extreme observations from the cross-sectional regression. We first use the least trimmed squares (LTS) procedure suggested by Knez and Ready (1997). In the context of the cross-sectional determinants of stock returns, Knez and Ready (1997) find that when only 1% of the extreme observations are trimmed, the relation between firms size and returns changes drastically from significantly negative to significantly positive. Thus, they suggest that the size effect may have been induced by extreme observations in the sample.

The LTS procedure trims a proportion of influential observations and then fits the remaining observations using the ordinary least squares (OLS) method. The trimmed observations, or the outliers, are not necessarily “contaminates” that are to be discarded or deleted to obtain more precise inference. Instead, the LTS regressions are used to provide a diagnostic check for evaluating the sensitivity of inferences conducted using OLS. Formally, the LTS coefficients are defined as:

where \( \varepsilon_{[1]}^{2} \le \varepsilon_{[2]}^{2} \le \cdots \le \varepsilon_{[q]}^{2} \) are the squared residuals listed in order of increasing magnitude, \( \hat{\lambda } \) is a parameter vector of length p, and q ≤ N is the size of the remaining sample after trimming a certain proportion of the extreme observations. That is, the LTS estimator fits q of the observations and ignores the rest. Following Knez and Ready (1997), the number q is chosen as the following:

where α denotes the trimmed proportion. In our study, we use 5% as the trimming proportion. The LTS is applied to a cross-sectional regression of firms at the industry level and at the market level. This gives a series of robust slope coefficients, i.e., \( \hat{\lambda }_{i} ,\; i = 1, \ldots ,m \). Inferences are made based on the average of the coefficients across industries.

An additional robustness check is done by trimming firms whose risk measures (standard deviation of ROA) fall outside the range of absolute three standard deviations from the mean. At the industry level, the standard deviation is the cross-sectional standard deviation of Risk ij within each industry. The trimming procedure is applied separately to the above- and the below-target firm groups. If the distribution of risk does not deviate too much from normality, this amounts to drop less than 1% of firms from the sample. The same steps are repeated for the market-level analysis. Unlike the LTS method that trims a fixed proportion of observations, this method trims different proportions of observations as the samples vary.

3 Empirical results

3.1 Industry-level analysis

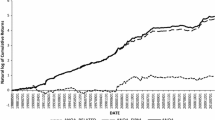

As a quick visualized example of the general patterns of the relation between risk and return among most industries, Fig. 1 through Fig. 3 show the risk–return relation for firms above and below the industry median returns during 1984–2003 for the trading industry.Footnote 8 Figure 1 shows the risk–return relation by the OLS regression, Fig. 2 shows the relation by the LTS estimation and Fig. 3 shows the results by trimming extreme values whose risk measures are more than absolute three standard deviations from the mean, respectively. As can be seen clearly from the figures, the risk–return relation has a positive (negative) slope for the above-target (below-target) firms, and the results are consistent regardless of the empirical methodologies employed. The slope of the negative risk–return relation also seems steeper.

Table 1 presents the empirical results for all sample firms at the industry level. For the entire 20-year sample period, Panel A of Table 1 indicates that the slope coefficients, b i ’s, for the below-target firms have a mean of −1.985 and a median of −1.867 across the 45 industries. In particular, without exceptions, the slope coefficients are all negative and significant at the 5% level. For firms above the industry median, the slope coefficients have a mean of 1.172, and a median of 0.237, suggesting that the distribution of the slopes for the above-target firms are less consistent across industries. Among the 45 industries, only 2 industries have negative slopes, whereas 26 industries have significantly positive slopes. The results based on the 20-year sample period strongly support Hypotheses 1 and 2 that the risk–return relations are different for firms with difference performances.

The prediction of Hypothesis 3 is also supported as the average slopes for the below-target firms are larger than those for the above-target firms in magnitude. The evidence is stronger if one focuses on the statistics of medians. The absolute value of the median slope, 1.867, for the below-target firms is more than seven times than that of the above-target firms, which is 0.237.

Panel B and Panel C of Table 1 report the regression results for the two sub-periods, respectively. The purpose is to examine whether the results from the full 20-year period are sample-period dependent. The results for the first sub-period, 1984–1993, provide similar evidence that strongly supports the three hypotheses implied by the prospect theory. Note that there are only 41 industries for the first sub-period because we require each industry having at least 20 firms. The results for the second period, 1994–2003, also mostly support our hypotheses. The only exception is the mean slope for the above-target firms, 2.107, which is larger in magnitude than the mean slope for the below firms, −1.664. This violates the prediction of Hypothesis 3. However, the results based on the median still support Hypothesis 3. As the distribution for the cross-industry slopes is skewed, the result based on the median is likely to be more credible.

Overall, our results provide stronger support for the prospect theory than Fiegenbaum’s study (1990) in which the ratio of median value for the below-target firms to that of the above-target firms is only about 3. Our empirical results also indicate a more pronounced negative risk–return relation for the below-target firms. In Fiegenbaum’s sample period, only 59 out of 85 coefficients for the below-target firms are significantly negative. Our results show that the relation holds for almost every industry.

3.2 Market-level analysis

This section examines the risk–return relation for the above- and below-target firms at the market level. Table 2 shows the results. For the below-target firms, the average slope coefficients for the sample periods 1984–2003, 1984–1993, and 1994–2003 are −3.008, −2.824 and −2.293, respectively, which supports Hypothesis 1. For the above-target firms, the coefficients are 3.640, 2.832 and 3.227, respectively, which supports Hypothesis 2. However, the absolute values of the slopes for the below-target firms are smaller than those for the above-target firms. Thus, the results fail to support Hypothesis 3. The results from Tables 1 and 2 indicate that firms behave in a risk-seeking manner when their performance falls below the “average”, where the average can be either the industry median or the market median. However, firms exhibit loss aversion behaviors only within industries, not across industries, suggesting it is the industry median, instead of the market median that is chosen as the reference point upon which a manager’s decision is based.

3.3 Robustness checks

To examine the extent to which the empirical results are affected by firms with extreme performances, we apply the LTS as a robustness check. Tables 3 and 4 report the empirical results at the industry and the market levels, respectively. Table 3 shows that the negative risk–return relation for the below-target firms remains unchanged after trimming 5% of the extreme observations.Footnote 9

The positive risk–return relation for above-target firms becomes somewhat weaker. For example, for the full period, the mean (median) slope reduces from 1.172 (0.237) in Table 1 to 0.516 (0.127) in Table 3. The number of significantly positive slopes also decreases from 26 in Table 1 to 18 in Table 3. It is also worthwhile to note that after the 5% extreme observations are excluded, the above-target slope becomes significantly negative for 9 out of the 45 industries, compared to only 2 out of the 45 industries by the OLS regressions. The results indicate that the extreme-good performers are partially responsible for the positive risk–return relation for the above-target firms.

Table 4 presents the results at the market level. The empirical results are similar to the results in Table 2. The only difference is the result for the full period (1984–2003), which conforms more to the prediction of the prospect theory. Specifically, Table 4 indicates that over the full period, the slope is −2.806 for the below-market group, and 1.766 for the above-target group, a result that is consistent with the loss-aversion hypothesis.

Tables 5 and 6 present the results by trimming observations whose risk measures fall outside the range of absolute three standard deviations from the mean. For the full period and the two sub-periods, the proportion of observations being trimmed is very small, where the outliers account for less than 1% of the original samples. Overall, the results in Tables 5 and 6 are similar to those in Tables 3 and 4, which indicates that that our empirical results are robust after extreme observations are excluded.

3.4 Evidence from the early sample: 1950–1983

To examine the extent to which early studies are subject to the survivorship bias, we repeat the analysis on an early sample, which is from 1950 to 1983. We obtain the annual ROA of all firms for this sample period from the COMPUSTAT database, and classify firms into 48 industries. Based on the same selection criteria as in Sect. 2.1, the final sample contains 14,426 firms for the entire 34-year period, which are grouped into 45 industries with an average of about 320 firms within each industry. Roughly, the sample size is only half of the recent sample (1984–2003).

Table 7 shows the results for this early period. Panel A of Table 7 reports the results with the industry median as the reference point. The results confirm our conjecture. First, the negative risk–return relation for the below-target firms is weaker than that of the recent sample. The mean (median) slope for the below-target firms is −1.251 (−1.026), in comparison with the value of −1.985 (−1.867) in Table 1. Second, the risk–return relation is also weaker for above-target firms. For above-target firms, the mean (median) slope is 1.172 (0.237), also smaller than the value of 0.333 (0.133) in Table 1. However, there loss-aversion phenomenon is only slightly weaker with the early sample. Based on the estimate of median, the slope of below-target firms is 7.71 (=1.026/0.133) times of that of above-target firms, whereas the ratio for the recent sample is 7.88 (=1.867/0.237).

Panel B of Table 7 reports the results with the market level as the reference point. Again, the slope estimates are smaller in magnitude in comparison with the numbers in Table 2. Surprisingly, however, the slope for the above-target firms for 1950–1983, which is 0.509, is much smaller than that of the recent sample, which is 3.640. The results support the loss aversion hypothesis with the market level as the reference point for the early sample, but not for the recent sample. Thus, the results indicate that there is some structural change in the risk–return relation.

So far, the results indicate that overall the risk–return associations are weaker for the early sample. We are not clear, however, if the weaker relations are caused by the survivorship bias. It could be due to structural changes. To make a further comparison, we discard the last five-year observations from this early sample, and repeat the analysis for a shorter sample from 1950 to 1978. The reason we discard the last five-observations (from 1979 to 1983) is because they are “cleaner” in that they are less affected by the survivorship bias (1978 is the year when the COMPUSTAT greatly expanded the sample). By comparing the results for the remaining sample (1950–1978) with the results for 1950–1983, we can learn more about the extent of the impact of the survivorship bias. The results are reported in Table 8. Indeed, the results indicate that the estimates are mostly smaller in magnitudes.

By restricting our sample to periods before 1978, which is the year when COMPUSTAT greatly expanded its database, we find an even weaker negative risk–return relationship for the below-target group (with a value of −1.031), as presented in Table 8. Another interesting finding is that the loss aversion phenomenon is indeed weaker. The ratio of below-target-firm slope to above-target-firm slope is 5.75 (=0.955/0.166), thus confirming our conjecture that the presence of survivorship bias weakens the risk–return relation. Also, Panel B of Table 8 indicates that not only for the industry level, the loss aversion hypothesis is also supported when the market median serves as the reference point, which somehow suggests that the manager’s decision on choosing the reference point may be different over time.Footnote 10

4 Conclusion

During the past two decades, the risk-return paradox has been examined extensively, and various empirical studies have provided evidence supporting the prospect theory, which asserts that the negative risk–return relation is driven by the mixture of risk attitudes for firms of different performances. As the samples used in previous studies suffer from a potential survivorship problem, we use an updated US data that is free from the survival bias to reexamine the risk–return relation.

Interestingly, with the 20-year updated sample, we document stronger and robust evidence supporting the prospect theory. We conclude that (1) firms that underperform their industry median show a strong negative risk–return relation (2) firms that outperform the industry median exhibit a positive, yet weaker, risk–return relation, and (3) at the industry level, the negative risk–return relation for the below–target firms is much stronger, in magnitude, than the positive risk–return relation for the above-target firms, which confirms the loss aversion hypothesis.

Notes

Furthermore, Horowitz et al. (2000) argue that the size effect is sample-period dependent. They find that the size effect disappears in the more recent data period (after 1980).

Our measures of risk and return are consistent with Sinha (1994). Fiegenbaum (1990) uses the average ROA and the variance of ROA as the return and risk measure, respectively. Sinha (1994) instead uses the standard deviation of ROA as it has the same unit of measurement as the sample mean, and is less affected by the skewness of the distribution of ROA.

By the selection criteria, there are 41 and 44 industries in the sub-periods of 1983–1993 and 1994–2003, respectively.

In contrast, the CRSP database does not suffer from the survivorship bias in that there is no exclusion of non-surviving firms (Davis 2001). The CRSP database, however, suffers from a special form of delisting bias in that the delisting returns, i.e., the returns on the last month for which the stock of a to-be-delisted firm is still traded, are missing.

The look-ahead bias is due to a dating problem where data reported for a particular point in time, say at the yearend, are not actually available to investors until sometime later in the next year (Banz and Breen 1986).

Fama and French (1997) indicate that a two-year additional data is required because the COMPUSTAT rarely includes more than 2 years of historical data when it adds firms.

By the definition in Fama and French (1997), the trading industry includes firms with the SIC codes of 6200–6299, 6700, 6710–6725, 6740–6779, 6790–6795, and 6798–6799.

Results are similar when a 1% trimming proportion is used. The results are available upon request from the authors.

We also repeat the analysis by requiring additional 2-year observations before a firm is included into the sample to avoid the form of ex post selection bias discussed in Sect. 2.3. The results are qualitatively similar. We do not show them to save space, but they are available upon request.

References

Banz RW, Breen WJ (1986) Sample-dependent results using accounting and market. J Finance 41:779–793 data: Some evidence

Bowman EH (1980) A risk/return paradox for strategic management. Sloan Manag Rev 21:17–31

Brown SJ, Goetzmann W, Ibbotson R, Ross S (1992) Survivorship bias in performance studies. Rev Financ Stud 5:553–580. doi:10.1093/rfs/5.4.553

Davis JL (1996) The cross-section of returns and survivorship bias: evidence from delisted stocks. Q Rev Econ Finance 36:365–375. doi:10.1016/S1062-9769(96)90021-6

Davis JL (2001) Explaining stock returns: a literature survey, working paper, Dimenational Fund Advisors

Elton EJ, Gruber MJ, Blake CR (1996) The persistence of risk-adjusted mutual fund performance. J Bus 69:133–157. doi:10.1086/209685

Fama EF, French KR (1997) Industry costs of equity. J Financ Econ 43:153–193. doi:10.1016/S0304-405X(96)00896-3

Fiegenbaum A (1990) Prospect theory and the risk–return association: an empirical examination in 85 industries. J Econ Behav Organ 14:187–203. doi:10.1016/0167-2681(90)90074-N

Fiegenbaum A, Thomas H (1988) Attitudes toward risk and the risk-return paradox: prospect theory explanations. Acad Manag J 31:85–106. doi:10.2307/256499

Horowitz JL, Loughran T, Savin NE (2000) Three analyses of the firm size premium. J Empir Finance 7:143–153. doi:10.1016/S0927-5398(00)00008-6

Jegers M (1991) Prospect theory and the risk–return relation: some Belgian evidence. Acad Manag J 34:215–225. doi:10.2307/256309

Kahneman D, Tversky A (1979) Prospect theory: an analysis of decision under risk. Econometrica 47:263–291. doi:10.2307/1914185

Knez PJ, Ready MJ (1997) On the robustness of size and book-to-market in cross-sectional regressions. J Finance 52:1355–1382. doi:10.2307/2329439

Kothari SP, Shanken J, Sloan RG (1995) Another look at the cross-section of expected returns. J Finance 50:185–224. doi:10.2307/2329243

McElreath RB Jr, Wiggins CD (1984) Using the COMPUSTAT tapes in financial research: problems and solutions. Financ Anal J 40:71–76. doi:10.2469/faj.v40.n1.71

Nickel MN, Rodríguez MC (2002) A review of research on the negative accounting relationship between risk and return: Bowman’s paradox. Omega 30:1–18. doi:10.1016/S0305-0483(01)00055-X

Odean T (1998) Are investors reluctant to realize their losses? J Finance 53:1775–1798. doi:10.1111/0022-1082.00072

Shumway T (1997) The delisting bias in CRSP data. J Finance 52:327–340. doi:10.2307/2329566

Shumway T, Warther VA (1999) The delisting bias in CRSP’s Nasdaq data and its implications for interpretation of the size effect. J Finance 54:2361–2379. doi:10.1111/0022-1082.00192

Sinha T (1994) Prospect theory and the risk return association: another look. J Econ Behav Organ 24:225–231. doi:10.1016/0167-2681(94)90029-9

Acknowledgments

P.-H. Chou gratefully acknowledges financial support from National Science Council of Taiwan (Grant no: NSC 92-2416-H-008-023).

Author information

Authors and Affiliations

Corresponding author

Rights and permissions

About this article

Cite this article

Chou, PH., Chou, R.K. & Ko, KC. Prospect theory and the risk-return paradox: some recent evidence. Rev Quant Finan Acc 33, 193–208 (2009). https://doi.org/10.1007/s11156-009-0109-z

Received:

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s11156-009-0109-z