Abstract

Using quarterly data for all 379 metropolitan statistic areas (MSAs) in the U.S. from 1980:1 to 2008:2, this paper empirically studies the effect of house prices on local Gross Metropolitan Product (GMP). We compare the effects of predictable and unpredictable house price changes, which we use to capture the collateral and wealth effects of house prices respectively. We further analyze the relationship between the effects and household borrowing constraints, as well as the temporal pattern of the effects. Our analysis provides the following findings. First, house price changes have significant effects on GMP growth, and the effect of predictable changes (the collateral effect) is about three times stronger than the effect of unpredictable changes (the wealth effect). Second, the persistent component of predictable changes has a stronger collateral effect than the novel component. Third, when households are more financially constrained, the collateral effect is stronger, the wealth effect is weaker, and the total effect remains unchanged. Finally, the effects last for eight quarters, and peak on the fourth quarter after house price changes take place.

Similar content being viewed by others

Avoid common mistakes on your manuscript.

Introduction

There seems to be a consensus among economists and policy makers that house prices play an important role in fueling the growth or decline of the economy. For instance, the strong housing market during the crash of the stock market in 2001 might have helped save the US economy from a more serious recession,Footnote 1 and recent cooling of the housing market has triggered a recession since December 2007.Footnote 2 An ostensible channel through which house prices might affect the economy is the wealth effect.Footnote 3 Friedman’s permanent income hypothesis suggests that people would change their desired consumption if house price changes affect their expected life time wealth. Recently, economists propose a collateral effect of house prices: house price increases help relax homeowners’ borrowing constraints and increase their actual consumption since housing wealth is easy to collateralize.Footnote 4

Empirical evidence of the consumption effect of house prices is generally consistent with theories. At the aggregate level, Benjamin et al. (2004), Case et al. (2005), Kishor (2007), Lettau and Ludvigson (2004), among others, find that housing wealth significantly correlates with consumption, and the correlation is stronger than the correlation between consumption and financial wealth. At the household level, Engelhardt (1994), Engelhardt (1996), and Sheiner (1995), among others, find that house price changes may affect homeowners and renters’ saving behavior; and Bostic et al. (2008), Campbell and Cocco (2007), and Haurin and Rosenthal (2006, working paper) find strong correlation between house prices and consumption. Up to now, the only evidence we know of that suggests no effect of house price changes on the economy is Phang (2004).

In this paper we analyze the aggregate effect of house price changes on local economic growth, which is measured with Gross Metropolitan Product (GMP), using a panel data for all the 379 metropolitan statistic areas (MSAs, 2007 definitions) in the U.S. from the first quarter of 1980 through the second quarter of 2008. This paper focuses on the following questions. First, do house price changes have an aggregate effect on per capita GMP growth? Second, do the predictable house price changes, which capture the collateral effect (see e.g. Campbell and Cocco 2007), or the unpredictable changes, which capture the wealth effect, have a stronger effect? Third, out of the predictable house price changes, does the persistent component, which we measure with the simple moving average of lagged changes, or the novel component, have a stronger effect? Fourth, do house price changes, or their components, have a stronger economic effect when homeowners are more financially constrained? Finally, do house price changes have long term effects on GMP, and if so, what is the temporal pattern?

While next section provides a detailed literature review and discusses how this paper fits into the literature, here we summarize the original contributions this paper hopes to make. First, this paper seems the first to focus on the effect of house prices on economic production instead of consumption. While consumption is very important, production is a key variable that formally defines economic expansions and recessions. By focusing on production, this paper compliments the literature that has been focusing on consumption effects of house price changes.

Second, this paper compares the economic effects of different components of house prices at the aggregate level. The analysis uses a two-way and a three-way decomposition of house price changes. In the two-way decomposition, we analyze the economic effect of the predictable and unpredictable house price changes, which we assume capture the collateral and the wealth effect of house prices. The distinctions between the two effects are important for their distinctive policy implications. For instance, if a fall in house prices leads to an economic recession due to the collateral effect instead of the wealth effect, the monetary authority might want to stimulate the economy by relaxing borrowing constraints. However, if the recession is caused by the wealth effect of house prices instead of the collateral effect, which means that households voluntarily reduce consumption because they feel poorer, easing the credit availability may not help stimulate the economy. In the three-way decomposition, we further decompose the predictable house price changes into a persistent component and a novel component, and analyze if they affect economic components differently. We hypothesize that the persistent component has a stronger effect, as households may more likely borrow against sustainable values.

Third, this paper seems the first to control for all unobserved common factors that affect both house prices and the economy, so that estimators are not biased due to omitted variables. This paper achieves this by applying a recent advance in econometrics, the Common Correlated Effects (CCE) estimators in a multifactor error structure model that is developed by Pesaran (2006), on a large panel data set. This new econometric method controlled not only common factors that affect all MSAs to the same extent, which conventional time dummies would completely capture, but also factors that have different effects across MSAs, including regional factors such as spatially correlated house prices.

Finally, this paper seems the first to investigate the temporal pattern of the economic effect of house prices at the aggregate level. While almost all empirical papers in the literature focus on the immediate effect of house prices on the economy, it is highly plausible that house prices have a long term and time varying economic effect. Further, the temporal pattern of the effect has important policy implications. For example, the pattern helps policy makers forecast the future effects of current house price changes.

This paper provides the following novel empirical evidence. First, after controlling for unobserved common factors and spatially correlated house prices, local house price changes significantly relate to local per capita GMP growth. This is consistent with an aggregate effect of house price changes on economic growth. Second, the economic effect of the predictable component of house price changes is about three times stronger than the effect of the unpredictable component, which indicates that the collateral effect is stronger than the wealth effect at the MSA level. Third, the persistent component of predictable house price changes has a stronger effect than the novel component. This is consistent with the notion that households more likely borrow against sustainable house price changes. Fourth, the economic effect of house price changes relates to borrowing constraints. Specifically, when households are more financially constrained (the ratio of home price to income being lower), the collateral effect is stronger but the wealth effect is weaker. Finally, house price changes have long term effects on economic growth, which last for up to eight quarters. Further, the effects peak four quarters after the house price changes take place.

This rest of this paper is organized as follows. “Literature Review” provides a literature review and discusses how this paper fits into the literature. “Data” describes the data. “Empirical Analysis” discusses the empirical analysis and evidence. “Conclusions” concludes.

Literature Review

This section reviews the theoretical and empirical work regarding the economic effect of house prices. While house prices may affect the economy through a variety of channels, most research in the literature focuses on the wealth effect and the collateral effect of house prices on consumption. This section first discusses theoretical insights regarding the wealth effect and the collateral effect, and then empirical evidence.

Theories

Friedman’s permanent income hypothesis seems to provide the first theoretical insight regarding the wealth effect of house prices. The intuition is simple. Since home equity is an important component of homeowners’ wealth, unexpected house price appreciation would increase the expected life time wealth of homeowners. Based on the intuition that individuals would wish to smooth consumption over their life time, the increase in life time wealth would increase their desired consumption. Recently, Morris (2006, working paper) presents a partial equilibrium model to analyze the wealth effect, and predicts that both age and expected mobility affect the wealth effect. His analysis based on data from the Panel Study of Income Dynamics (PSID) supports the predictions.

While the wealth effect of house prices suggested by Friedman’s permanent income hypothesis seems sensible for homeowners, recent theoretical work suggests that house price changes do not necessarily have net aggregate effects on consumption in equilibrium. The intuition is that house price changes might only redistribute wealth between those who “long” housing and those who “short” housing, and thus there is no net wealth effect. Bajari et al. (2005) build a dynamic model of household consumption and investment decisions, and show that there is no aggregate change in welfare due to price increases in the existing housing stock. Using a Yaari-Blanchard OLG model, Buiter (2008) suggests that there is no pure wealth effect on consumption from house price changes if the changes are in fundamental house values. However, changes in the speculative bubble component of house prices have wealth effect. Buiter (2008) also suggests that house price changes can have an aggregate effect if the marginal propensity to consume out of wealth differs between those long housing and those short housing, or homeowners are financially constrained and housing wealth can be collateralized to help relax borrowing constraints. Also using a life-cycle model which incorporates the dual feature of housing as both a consumption good and an investment asset, Li and Yao (2007) find that house price changes have small aggregate effects, and have different effects on homeowners at different stages in the life cycle.

The collateral effect refers to the phenomenon that house price changes may affect the actual consumption instead of the desired consumption. For house price changes not to affect desired consumption, they must be fully expected and not affecting the expected life time wealth. At the same time, households need to be financially constrained so that their actual consumption is lower than their desired consumption. Under these conditions and the assumption that housing wealth can be collateralized, house price increases can help relax homeowners’ financial constraints and thus may increase their actual consumption. In addition to Buiter (2008), other recent theoretical papers that predict the collateral effect of house prices include Aoki et al. (2004) and Lustig and Van Nieuwerburg (2008a, working paper).

Aggregate Level Empirical Evidence

Empirical work has been done at both the household level and the aggregate level. We first discuss major empirical work at the aggregate level. Early work that uses macro level consumption and wealth data, such as Bhatia (1987), often finds strong effects of real estate values on consumption. Recently, there is a fast growing literature that compares the consumption effect of housing and financial wealth. Case et al. (2005) find that housing wealth has a stronger consumption effect than financial wealth, using state level panel data from the U.S. and OECD country panel data. Benjamin et al. (2004) fit the national level time series data of consumption, income, and housing and financial wealth of the U.S. from 1952 to 2002 to a vector autoregression model, and also find a stronger consumption effect of housing wealth. Using a panel data of 16 countries, Slacalek (2006, working paper) finds heterogeneity in the consumption effect of housing wealth across countries. For example, housing wealth seems to have a weaker consumption effect than financial wealth for most countries other than UK and US. Further, an increasing housing wealth effect is found after 1988, which the author believes shows that it has been easier to borrow against housing wealth since 1988. Carroll et al. (2006, working paper) question the validity of cointegration approach, and focus on the speed and the strength of the consumption effect of housing wealth. Using macro data from the U.S. from 1960 to 2004, they find that the immediate consumption out of $1 increase in housing value is 2 cents, while the total consumption can be in the 4–10 cents range. They also find that housing wealth has a stronger consumption effect than financial wealth. Aron and Muellbauer (2006, working paper) focus on disentangling the effect of housing wealth and the effect of common factors that affect both house prices and consumption, particularly the credit liberalization. They estimate a consumption model for the UK and South Africa, and find that housing wealth has a similar effect with financial wealth.

Another perspective to study the consumption effect of housing wealth is to quantify the effect of different components of housing wealth. Lettau and Ludvigson (2004) distinguish trend from cycle in asset values use aggregate wealth, income and consumption in the U.S. from 1952 to 2002, and show that permanent changes in wealth correlate with consumption, but transitory changes do not. They also find that conventional research tends to overestimate the total effect of asset values on consumption by not considering the cointegration of income, wealth, and consumption. Using a similar empirical framework, Kishor (2007) compares the effects of housing wealth and financial wealth, and finds a stronger effect from the housing wealth, which is due to the fact that a larger portion of the housing wealth is permanent.

Note that the above papers do not try to distinguish the wealth effect from the collateral effect at the aggregate level. Lustig and Van Nieuwerburg (2008a, working paper) seem to be the first to substantiate the collateral effect of house prices on consumption at the aggregate level. They construct consumption and income data from 1952 to 2002 for 23 U.S. MSAs, and find consumption is more sensitive to income in times and regions where housing collateral is scarce. Their results are consistent with the hypothesis that homeowners are financially constrained and housing wealth is important collateral. While they do provide evidence for the collateral effect of housing wealth, they do not quantify or compare the wealth effect and the collateral effect at the aggregate level.

While all above papers substantiate the consumption effect of house price changes, Phang (2004) finds no evidence that house price increases have either wealth or collateral effects on consumption using macro data from Singapore. Her model allows households to respond differently to an increase versus a decrease in housing wealth, and finds that both house price increases and decreases appear to reduce aggregate consumption. Phang (2004) conjectures that liquidity constraints of homeowners seem to be the main reason why house price increases in Singapore do not increase consumption: households are either unable or unwilling to withdraw housing equity to finance consumption. She further conjectures that households may view housing as a risky asset with uncertain value, leading them to regard gains as temporary and losses as permanent.

Household Level Empirical Evidence

Household level research in the literature has analyzed the effects of house price appreciation on the saving and consumption behavior of homeowners and renters. We first discuss selected papers that analyze the effect of house prices on savings, and more complete reviews of the literature of saving can be found in these papers. Engelhardt (1994) uses probit analysis and regressions on Canadian data to show that higher house prices discourage saving among renters for down payments for their first homes. Sheiner (1995) uses the U.S. PSID 1984 data to find a positive effect of house prices on the net worth of young renters, which indicates that young renters save more, possibly for down payments for their future homes, when house prices increase. Engelhardt (1996) use the 1984 and 1986 PSID data and find homeowners save more when house prices fall, possibly to offset home equity loss to maintain down payments on future homes in case they need to move. These findings are important for they suggest that house price changes may affect households who long and short housing differently.

We now discuss some important pieces analyzing the effect of house prices on consumption at the household level. Campbell and Cocco (2007) analyze the effects of predictable and unpredictable house price movements, which are assumed to capture the collateral effect and the wealth effect respectively, at the national and local level on the consumption of homeowners and renters, using pseudo-panel data from the UK Family Expenditure Survey over the period 1988 to 2000. They find that while both national and local house price changes affect consumption, the effect is lowest and insignificant for young renters, and highest for old owners. They also find that the national average of predictable house price changes, but not the local deviations, affects consumption. Further, both the national average and local deviations of the unpredictable house price changes affect consumption. The results seem to indicate that the collateral effect is observed only at the national level, while the wealth effect is observed at both the national and the local levels.

Bostic et al. (2008) match homeowners in BLS Consumer Expenditure Survey data and Fed Survey of Consumer Finance data using income, and find that home values and equities affect consumption more significantly than financial wealth. They further find that deviations from trend as well as volatility reduce the effect. They find no evidence for the effect of borrowing constraints on the consumption effect of house prices. Haurin and Rosenthal (2006, working paper) examine the effects of house prices on the debt and expenditures of homeowners, using data from Fed Survey of Consumer Finance and the National Longitudinal Survey of Youth. They find that house price appreciations increase homeowners’ debt and expenditures, and the effects increase with age and income, but low for homeowners at age 65 and older. The two above papers focus on the total effect of house prices on consumption, not the distinctions between the wealth effect and the collateral effect.

Fitting this Paper to the Literature

This paper hopes to make the following contributions to the literature. First, we focus on production instead of consumption. While consumption is certainly important, it is not a complete statistic for the economy. We believe that the relation between house prices and production is important, yet it is largely ignored in the literature.

Second, we try to more effectively control for all common factors that affect both house prices and economic production, including spatially correlated house prices, using the panel data econometric technique recently developed by Pesaran (2006). Most household level and aggregate analyses in the literature ignore unobserved common factors. While Aron and Muellbauer (2006, working paper) try to control for the common factors, they rely on proxies for known factors. Therefore, it is unclear if they have controlled for all common factors, including unobserved and unknown ones. Campbell and Cocco (2007) include time dummies in regressions, which, however, only control for common factors that affect all households to the same extent.

Finally, we analyze the long horizon effect of house price changes on production. Almost all the papers discussed above focus on immediate economic effects of house prices. While the immediate effect of house prices is important, the total effect, as Carroll, Otsuka, and Slacalek (2006, working paper) point out,Footnote 5 can significantly differ from the immediate effect. Further, it is not only the magnitude, but also the timing of the effect, that is important to economists and policy makers.

In addition to the novel contributions discussed above, this paper also differs from existing aggregate level analyses as this paper tries to disentangle the wealth effect and the collateral effect of house prices at the aggregate level. The distinctions between the two effects are important due to their distinctive policy implications. We further analyze the economic effects of the persistent and the novel components of the predictable house price changes.

This paper also significantly differs from the household level research in the literature. The household level analyses focus on homeowners with Campbell and Cocco (2007) being the exception, which, however, find insignificant consumption effects on renters. While these papers make important contributions regarding “micro” economic behaviors, they do not directly answer the question if house prices have aggregate effect on the economy. This paper, on the contrary, aims to directly answer this question.

Data

Variables

Our analysis focuses on six quarterly time series for each of the 379 MSAs (the U.S. Census Bureau 2007 definitions) in the U.S. from 1980:1 to 2008:2.Footnote 6 They are per capita GMP, the Office of Federal Housing Enterprise Oversight (OFHEO) house price index, the median household income, population, the unemployment rate, and the total construction permits for single family houses. In addition, we also use the time series of the median single family home price and the median household income to construct the housing collateral ratio (see Lustig and Van Nieuwerburg 2008a, working paper), which measures borrowing constraints as well as the housing wealth as a portion of total wealth.Footnote 7 Note that not all MSAs have all the six variables or have them from 1980:1, so the panel data set is essentially unbalanced. Our analyses are based on available observations.

Median household income, population, the unemployment rate, and single family house permits are important MSA level control variables in our regression analysis, as they help mitigate the reverse causation from GMP to house prices. It is plausible to assume that GMP affects house prices by affecting either the demand or the supply of housing. Specifically, first, GMP changes might affect household income and trigger migrations and population changes, both of which would affect the aggregate demand for housing.Footnote 8 Second, GMP changes may also affect local industrial structure and frictions in the labor market, and thus cause migrations of labor force, which further affect both the demand and supply for housing. We use the unemployment rate to capture this effect of GMP. Third, housing constructions help contribute to GMP, and also affect housing supply and thus eventually house prices. We use the current and lagged single family house permits to proxy for the construction of single family houses.Footnote 9 Overall, by controlling for all these variables in our regression, the coefficient of house prices in our regression analysis more likely captures the effect of the exogenous component (with respect to GMP) of house prices, which is orthogonal to house prices caused by changes in the demand or supply for housing due to GMP changes.

The panel data at the MSA level have important advantages. In additional to widely understood benefits of panel data (e.g. allowing for the control of individual heterogeneity and having more power due to a large number of observations), the large cross section in our panel of MSAs allows us to use the novel approach by Pesaran (2006) to control for unobserved macro economic variables and spatial effects of house prices. An example of the unobserved variables is the financial liberation that facilitates borrowing against home equity in recent years, which may relate to both economic production and house price changes. While the liberation seems difficult to measure or control in pure time series analysis, it can be effectively controlled at the MSA level using panel data. Another advantage of our data is that, the MSAs in our sample are homogenous in the sense that they are subject to the similar if not identical monetary policy, political environment, legal context, tax codes, and financial market conditions. As a result, MSA-level data seem superior to international data such as those used by Case et al. (2005), because the economic effects of house prices may differ with a different economic, legal and tax environment, as pointed by Slacalek (2006, working paper), and such an environment is difficult to control in international data.Footnote 10 Finally, the sample period in this paper is long enough to covers both economic expansions and recessions so the data do not seem biased.

It is worth noting that the MSAs are not independent samples. Not only macro factors might affect the housing market and the economy of all MSAs to different extents, house price changes may have spatial effects: house price changes in a MSA likely affect the economy in other MSAs. While the empirical analysis in this paper uses a multifactor error structure model (Pesaran 2006) to mitigate possible biases due to unobserved macro factors and the spatial effect of house prices, readers should be cautious that our results should be interpreted as the local effect of house prices on an open economy.

Data Sources

Quarterly series of annualized GMP for MSAs are estimated by Moody’s economy.com using a two step procedure.Footnote 11 The GMP might be measured with errors since MSA productivity might differ from national average productivity. However, the errors do not seem to weaken our results. It is well known that measurement errors in dependant variables, which is our case, cause no bias unless the errors correlate with explanatory variables. It seems plausible that, holding constant everything else, MSAs with productivity higher than national average productivity may have higher average household income, which in turn may be associated with higher house prices. Therefore, the measurement error, which equals estimated GMP minus true GMP, may be negatively correlated house prices. In regressions of estimated GMP on house prices, this might bias the estimator of house price coefficients downward. In the regression results that next section will discuss, house price coefficient estimators are significantly positive; therefore, if the estimators are downward biased, the true coefficients would be even more significant. In this sense, the results can be even stronger than they appear.

The sources for other variables are as follows. The Office of Federal Housing Enterprise Oversight (OFHEO) provides transaction-based quarterly home price indices. The OFEHO house price indices are estimated with the repeat sale regression using actual transaction prices. The indexes control for time invariant attributes of houses that enter into the sample at least twice, and thus appear to be superior to median or mean sale prices. Moody’s economy.com estimates quarterly population series using census data and IRS records of migration flows among MSAs. It also compiles unemployment rates using Bureau of Labor Statistics (BLS) data, estimates median single family home prices, median household income, and compiles total single family housing permits using Bureau of Census data.

Data Cleaning and Summary

We process the data by first dividing GMP with population to obtain per capita GMP. Second, we use CPI to adjust for inflation and obtain real terms (in 1980 dollars) for per capita GMP, the house price index, the median single family home price, and the median household income. Finally, we calculate the first order differences of log values of all six key variables. We choose to work on log differences instead of the original variables or their logs (level) because all OFHEO house price indices are set to be 100 in 1995:1, and thus house price levels are not comparable across MSAs.

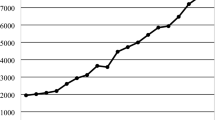

Figure 1 plots the quarterly time series of the 25%, 50%, and 75% percentiles of the annualized per capita GMP (in 1980 dollars) across the 379 MSAs in the U.S. from 1980:1 to 2008:2. Figure 2 plots the time series of the 25%, 50%, and 75% percentiles of the gross appreciation rates (first order differences of log price index levels) of OFHEO house price indexes over the same period. The figures seem to show strong cross-sectional correlations in the two, and thus highlight the importance of controlling for common macro factors and spatial effects of house prices.

Table 1 summarizes the six time series across MSAs. The correlation between house prices and GMP is significantly positive, which is consistent with a positive effect of house prices on economic growth. However, both GMP and house prices significantly relate to the MSA control variables. Therefore, it is important to control for these variables in measuring the impact of house price changes on GMP growth rates.

Decomposing House Price Changes

We decompose the house price changes (log first order differences) so that we can analyze the effects of their different components. We first identify the predictable component, denoted by hp.e i,t , and the unpredictable component, denoted by hp.ue i,t , of the house price change hp i,t . We follow Campbell and Cocco (2007) and use twice lagged log differences of per capita GMP, the OFHEO house price index, population, and median household income as instrumental variables.Footnote 12 We regress house price changes on an intercept term and the instrumental variables for each MSA separately, and call the fitted values the predictable components and the residuals the unpredictable components.

We also conduct a three-way decomposition of house price changes. Here we further decompose the predictable component into two parts. The first part is the moving average of house price changes in four past quarters. We call this part the persistent component, denoted by hp.e.p i,t . The difference between the predictable component and the persistent component is the novel component, denoted by hp.e.n i,t and \( hp.e.{n_{i,t}} = hp.{e_{i,t}} - hp.e.{p_{i,t}} \).

Table 2 summarizes the different components of house price changes. A few things are worth noting. First, panel A shows that the predictable component dominates the unpredictable component in terms of economical magnitude. This is not surprising for the unpredictable components are regression residuals and sum to 0. Second, panel A shows that the persistent component is more economically significant than the novel component, which shows strong persistence of house price changes. Third, panel B indicates that the persistent and the novel components are negatively correlated, which appears to substantiate short term reversal in house price changes.

Empirical Analysis

Baseline Model

Our baseline model is a contemporaneous regression of changes in per capita GMP on changes in house price indexes or their components. The regression controls for not only MSA fixed effects, but also changes in median household income, population, the unemployment rate, and the current and lagged permits for single family houses. More precisely, we estimate:

where for MSA i, α i is a MSA fixed effect; gmp i,t and hp i,t are respectively the log difference of GMP and the log difference of the house price index from quarter t to t + 1; x i,t is a vector of MSA level control variables including log differences of population, median household income, the unemployment rate, and the current and lagged permits for single family houses; and u i,t is the error term.

We present both Ordinary Least Square (OLS) estimators and Common Correlated Effects (CCE) estimators for parameters. We report OLS estimators so that they can be compared with results in the literature. OLS estimators correspond to the assumption that the error term is orthogonal to all explanatory variables, which, however, appears to be unrealistic. First, changes in macro variables, such as the interest rate, may affect house prices in all MSAs. The error term captures the macro variables, and thus correlates with house prices. Further, house prices can be correlated across MSAs and also have spatial effects: GMP in a MSA can be affected by not only local house price changes but also house price changes in other MSAs. Therefore, the error term captures house price changes in other MSAs, and thus would correlate with local house price changes. Note that, while a time dummy (time fixed effect) might help mitigate the bias caused by common macro variables that affect all MSAs to the same extent, it is unable to mitigate the bias due to the spatial effects of house prices or macro factors that affect MSAs differently.

The CCE estimators, on the other hand, are based on a multifactor error structure, which controls for unobserved common factors that affect per capita GMP, as well as spatial effects of house price changes. More precisely, the multifactor error structure is the following:

Where f t is a vector of unobserved common factors, which includes variables that are the same across all MSAs in a given time period but vary across time, such as interest rates, the stock market performance, etc. Note that the coefficients of the common factors can differ across MSAs and can be 0, which allows the common factors to affect some but not all MSAs. Therefore, house price changes in each MSA can be treated as a common factor, for they have spatial effects on some other MSAs. ε i,t is a idiosyncratic error, which is assumed to be distributed independently of x i,t and f t and across MSAs.

Table 3 reports both the OLS and the CCE estimators for three regressions. Changes in per capita GMP is regressed on the total house price changes (log differences of the house price index) in regression I, the predictable and unpredictable components in regression II, and the persistent and the novel component of predictable components, and unpredictable components in regression III. The CCE estimators are constructed using regressions augmented with cross-sectional averages of all dependent and independent variables. Pesaran (2006) proves that the cross-sectional averages of all dependant and independent variables span the same space of and thus control for the unobserved common factors.

In regression I, both the OLS and the CCE estimators for the coefficient of the total house price changes are positive and significant, which is consistent with the effect of house price changes on economic growth. Note that the CCE estimator is about one third of the OLS estimator, which seems always the case in all the following tables. This can be due to two reasons. First, the national average of house price changes is controlled in the CCE estimation, and thus the CCE estimator measures the effect of local house price changes. Second, the CCE estimation controls for all unobserved common factors that affect both GMP and house prices, and thus mitigates possible biases caused by these factors, which also helps explain the difference between the OLS and the CCE estimators.

In regression II, both the predictable and the unpredictable components of house price changes are positive and significant. Following Campbell and Cocco (2007), we interpret the coefficient of the predictable component as a measurement of the collateral effect of house prices, and the coefficient of the unpredictable component as a measurement of the wealth effect of house prices. Therefore, the CCE estimators indicate that, at the MSA level, the collateral effect of local house price changes is about three times stronger than the wealth effect, which contrasts with the insignificant collateral effect of local house prices found by Campbell and Cocco (2007).

Regression III analyzes the effects of the persistent component and the novel component of the predictable house price changes. The results show that the coefficient of the persistent component is about 50% greater. This is consistent with the hypothesis that households more likely borrow against more sustainable house prices.

Borrowing Constraints and Long Term Effect of House Prices

We now focus on variation of the economic effect of house prices across time and MSAs. First, we test if the economic effect of house prices relates to the borrowing constraints of homeowners. Lustig and Van Nieuwerburg (2008a, working paper) substantiate the importance of the housing wealth as borrowing collateral, and show that consumption is more sensitive to income in time and MSAs with more binding borrowing constraints. We follow them and use the housing collateral ratio as a measurement of borrowing constraints. The housing collateral ratio in MSA i at time period t, denoted by CR i,t , equals the ratio of the median single family home price to the median household income.

We hypothesize that the collateral effect is weaker when households are less constrained. The hypothesis is based on the intuition that more constrained homeowners more likely borrow against their home equity. On the other hand, we hypothesize that the wealth effect is stronger when households are less constrained. Note that the housing collateral ratio measures not only borrowing constraints, but also the portion of housing wealth in total wealth. The higher is the housing collateral ratio, the greater is the ratio of housing wealth to human wealth (since human wealth is the present value of future income and future income correlate with present income), and the greater is the portion of housing wealth in total wealth. The same appreciation rate of house prices would increase the total wealth more if the housing wealth is a greater portion of total wealth. As a result, the wealth effect of the house price increase would be greater.

Empirically, we add interactions between house prices (or their components) and the housing collateral ratio to regressions I, II, and III. A positive coefficient of an interaction term indicates a stronger effect of house prices when households are less constrained or when the housing wealth is a larger portion of total wealth. The results are reported in Table 4. Note that all regressions include MSA dummies, and in our estimation, the dummies are eliminated by subtracting within MSA means from each variable before regressions. Therefore, the regressions capture the effect of the temporal instead of the cross sectional variation of the housing collateral ratio.

Regression I shows that the effect of the total house price changes does not relate to the housing collateral ratio. However, this seems to be caused by two offsetting effects. Regression II indicates that the collateral effect, which is captured by the predictable house price changes, is significantly weaker when borrowing constraints are looser: the coefficient of the interaction term is negative. At the same time, the wealth effect, which is captured by the unpredictable house price changes, is significantly stronger when high housing collateral ratios are higher. Regression III further indicates that both the persistent and the novel components of predictable house price changes have weaker effects when borrowing constraints are looser. Overall, Table 4 finds strong evidence that the effects of house price changes relate to the housing collateral ratio.

We then analyze the long term effect and the temporal pattern of house price changes on economic growth. We estimate the following conventional long horizon predictability regressions (see, e.g. Lustig and Van Nieuwerburg 2008b) of the per capita GMP growth rate in the kth future quarter on current house price changes. We still include the same control variables in Tables 3 to 4, but add the current per capital GMP growth rate as an additional control for possible autocorrelation in economic growth.

Table 5 reports the CCE estimators for up to eight future quarters. House price changes and their components are no longer significant into the further future. Panel A shows that the effect of the total house price changes lasts for 2 years into the future, and peaks in the fourth quarter into the future. Panels B and C show similar patterns. Panel B also indicates that while the collateral effect is stronger than the wealth effect, the wealth effect seems to last one quarter longer than the collateral effect. Further, the collateral effect also seems to vary more dramatically over time than the wealth effect. Overall, Table 5 provide strong evidence that house price changes have long term effects on economic growth, and the effects very over time.

Conclusions

House price changes can have both the wealth effect and the collateral effect on the economy. The wealth effect and the collateral effect respectively refer to changes in desired consumption and changes in actual consumption due to house price changes. While both effects predict causation from house price changes to economic growth, they affect the economy through different channels and have distinctive policy implications. For instance, if an economic recession is caused by the wealth effect instead of the collateral effect of decreasing house prices, which means that households reduce their desired consumption because they feel poorer not because they are more financially constrained, easing the credit availability may not help stimulate the economy.

This paper empirically compares the wealth effect and the collateral effect of house price changes on economic growth at the aggregate level, investigating if the effects relate to household borrowing constraints, and analyzing the temporal patterns of the effects. A large panel data set that covers all 379 metropolitan statistic areas (MSAs) in the U.S. from 1980:1 to 2008:2 allows us to control for unobserved common factors and spatial effects of house prices to mitigate possible biases due to omitted variables.

We have the following major findings. First, house price changes have significant effects on GMP growth, and the collateral effect is about three times stronger than the wealth effect. Second, persistent components of predictable house price changes have a stronger effect than the novel component. This indicates that households more likely borrow against sustainable house price changes. Third, when the housing collateral ratio—the ratio of home price to household income—is lower, the collateral effect is stronger, and the wealth effect is weaker. This appears to suggest that more financially constrained households more likely borrow against home equity. Finally, the economic effects of house price changes last for eight quarters, and peaks in the fourth quarter after the changes take place. This temporal pattern highlights the importance of the timing and long term effects of economic policies that try to influence the economy through house price changes.

Notes

On September 26th, 2005 Alan Greenspan in a speech to the American Bankers Association re-iterated the important role of house prices in the current economy and suggested that housing may have fueled consumption over the past few years.

See Determination of the December 2007 Peak in Economic Activity, National Bureau of Economic Research.

The definitions of the wealth effect and the collateral effect will be discussed in the literature review section.

The common joke from 2000 through 2005 was that the American home was akin to an ATM machine.

Carroll et al. (2006, working paper) highlight the important of the speed at which the economy adjusts to housing shocks. However, while they distinguish immediate consumption effect from total effect of housing shocks, they do not analyze the temporal pattern of the effect.

Data providers, both economy.com and OFHEO, recalculate historical values of the series whenever the MSA definitions change. As a result, the time series of the variables are consistent geographically.

We use the median single family home price instead of the OFHEO house price index to construct the housing collateral ratio for the OFHEO indexes are all normalized and not denominated with $.

See Clayton et al. (2009) for details regarding the positive relation between house permits and constructions.

While the use on MSA-level data has advantages over international data, it is worth noting that there still could be significant variation in the tax code, political environment, etc. across the municipalities within an MSA.

The first step estimates the “weighted” productivity for each NAICS Supersector industry (e.g., Manufacturing, Education & Health Services, etc) in the MSA by multiplying the U.S. level productivity for this industry with the ratio of industry employment to total employment in the MSA (data from BLS). The second step estimates the GMP with the product of the sum of “weighted” productivity with the total MSA employment. This procedure essentially sums up the estimated products of all NAICS Supersector industries in the MSA.

Including the unemployment rate as an additional instrumental variable does not change the results in “Empirical Analysis”, but significantly reduces the sample size in the analysis.

References

Aoki, K., Proudman, J., & Vlieghe, G. (2004). House prices, consumption, and monetary policy: a financial accelerator approach. Journal of Financial Intermediation, 13, 414–435.

Aron, J., & Muellbauer, J. (2006). Housing wealth, credit conditions and consumption. University of Oxford working paper.

Bajari, P., Benkard, L., & Krainer, J. (2005). House prices and consumer welfare. Journal of Urban Economics, 58, 474–487.

Benjamin, J. D., Chinloy, P., & Jud, G. D. (2004). Real estate versus financial wealth in consumption. Journal of Real Estate Finance and Economics, 29, 341–354.

Bhatia, K. B. (1987). Real estate assets and consumer spending. Quarterly Journal of Economics, 102, 437–444.

Bostic, R., Gabriel, S., & Painter, G. (2008). Housing wealth, financial wealth, and consumption: New evidence from micro data. University of Southern California Working Paper.

Buiter, W. H. (2008). Housing Wealth Isn't Wealth, London School of Economics and Political Science working paper.

Campbell, J. Y., & Cocco, J. F. (2007). How do house prices affect consumption? Evidence from micro data. Journal of Monetary Economics, 54(3), 591–621.

Carroll, C. D., Otsuka, M., & Slacalek, J. (2006). How large is the housing wealth effect? A new approach. NBER Working Paper No. W12746.

Case, K. E., Quigley, J. M., & Shiller, R. J. (2005). Comparing wealth effects: the stock market versus the housing market. Advances in Macroeconomics, 5(1), 1–34.

Clayton, J., Miller, N., & Peng, L. (2009). Price-volume correlation in the housing market: causality and co-movements. Journal of Real Estate Finance and Economics, forthcoming. doi:10.1007/s11146-008-9128-0

Engelhardt, G. V. (1994). House prices and the decision to save for down payments. Journal of Urban Economics, 36, 209–237.

Engelhardt, G. V. (1996). House prices and home owner saving behavior. Regional Science and Urban Economics, 26, 313–336.

Gabriel, S. A., Mattey, J. P., & Wascher, W. L. (1999). House price differentials and dynamics: evidence from the Los Angeles and San Francisco Metropolitan areas, Economic Review Federal Reserve Bank of San Francisco, pp. 3–22.

Haurin, D., & Rosenthal, S. S. (2006). House price appreciation, savings, and consumer expenditures. Ohio State University working paper.

Kishor, N. K. (2007). Does consumption respond more to housing wealth than to financial market wealth? If so, why? Journal of Real Estate Finance and Economics, 35(4), 427–448.

Lettau, M., & Ludvigson, S. (2004). Understanding trend and cycle in asset values: reevaluating the wealth effect on consumption. American Economic Review, 94, 276–299.

Li, W., & Yao, R. (2007). The life-cycle effects of house price changes. Journal of Money, Credit and banking, 39(6), 1375–1409.

Lustig, H., & Van Nieuwerburg, S. (2008a). How much does household collateral constrain regional risk sharing? University of Chicago Working Paper.

Lustig, H., & Van Nieuwerburg, S. (2008b). Housing collateral, consumption Insurance and risk premia: an empirical perspective. Journal of Finance, 60(3), 1167–1219.

Morris, E. D. (2006). Examining the wealth effect from home price appreciation. University of Michigan working paper.

Ortalo-Magné, F., & Rady, S. (2004). Housing transactions and macroeconomic fluctuations: a case study of England and Wales. Journal of Housing Economics, 13, 287–303.

Pesaran, M. H. (2006). Estimation and inference in large heterogeneous panels with multifactor error structure. Econometrica, 74, 967–1012.

Phang, S.-Y. (2004). House prices and aggregate consumption: do they move together? Evidence from Singapore. Journal of Housing Economics, 13, 101–119.

Sheiner, L. (1995). Housing prices and the savings of renters. Journal of Urban Economics, 38, 94–125.

Slacalek, J. (2006). What drives personal consumption? The role of housing and financial wealth. German Institute for Economic Research Working Paper.

Acknowledgements

We thank the editor C. F. Sirmans and two anonymous referees for very constructive comments. We also thank Shaun Bond, Grace Wong, and other participants of 2006 AREUEA annual and mid-year conferences for insightful comments. All errors are ours.

Author information

Authors and Affiliations

Corresponding author

Rights and permissions

About this article

Cite this article

Miller, N., Peng, L. & Sklarz, M. House Prices and Economic Growth. J Real Estate Finan Econ 42, 522–541 (2011). https://doi.org/10.1007/s11146-009-9197-8

Published:

Issue Date:

DOI: https://doi.org/10.1007/s11146-009-9197-8

Keywords

- Economic growth

- House prices

- Wealth effect

- Collateral effect

- Common correlated effects estimators

- Long horizon predictability