Abstract

This study examines the space-time dynamics of real house prices and macroeconomic fundamentals such as real per capita disposable income and interest rate across 373 metropolitan areas in the US during 1976–2011. The estimation results of the dynamic spatial Durbin model show significant spatial spillover effects indicating that macroeconomic fundamentals of neighboring metropolitan areas play important role in real house price determination. The time varying version of the dynamic model also indicates an increasing spatial correlation in house price and income interactions over the sample period.

Similar content being viewed by others

Avoid common mistakes on your manuscript.

1 Introduction

Investigating the interactions between the housing market and macroeconomic fundamentals in the US economy has been a dominant theme of research in the field. Malpezzi (1999) studies the dynamics of house prices using error correction model on a panel of 133 metropolitan areas in the US during 1979–1996. Holly et al. (2010) examine spatial interactions in the US housing markets and the macroeconmoy. Using the common correlated effects estimator of Pesaran (2006) on 49 states over the period 1975–2003 they show that real house price changes are driven by real per capita disposable income and interest rate. Further, they identify significant spatial interaction effects. In a more recent study, Baltagi and Li (2014) replicate Holly et al. (2010) using a more extended dataset over the period 1975–2011 on a panel of 381 metropolitan areas in the US. They show that house prices are driven by macroeconomic fundamentals such as real per capita disposable income and spatial interaction effects are stronger at metropolitan level than that found at state level.Footnote 1

A fundamental feature of the studies by Holly et al. (2010) and Baltagi and Li (2014) is that they allow spatial interaction effects in the disturbance terms but not spatial interaction effects in the dependent or independent variables in their model. LeSage and Pace (2009), Elhorst (2010) and LeSage and Fischer (2008) argue that a more flexible spatial Durbin model that allows spatial interactions both in the dependent and independent variables provides a better consistent coefficient estimates irrespective of the true underlying data generating process. Elhorst (2012) also states that models that allow spatial dependence in the disturbance terms are less appropriate for empirical research because in such models spatial spillover effects (which are the main focus of empirical spatial econometric studies) are set zero by construction. In addition, Anselin (1998) argues when the focus of interest is to examine the magnitude and existence of spatial interaction effects, allowing spatial dependence in the dependent variables instead of the disturbance terms is more appropriate.

In this study, using recent developments in spatial econometric techniques, we examine the interactions between real house prices and macroeconomic fundamentals across 373 US metropolitan statistical areas (MSAs) over the period 1976–2011. A more flexible dynamic spatial Durbin model (DSDM) is estimated using direct and indirect effects approach of LeSage and Pace (2009).Footnote 2 The estimation results show that changes in real house prices in neighboring MSAs have a positively significant role in house price determination of a particular MSA. We identify significant both direct and indirect impacts of real income on house price determination indicating that real income in nearby areas play an important role in driving house prices. These results are robust to the inclusion of spatial fixed effects. Further, a time varying version of the dynamic model is examined which can capture important changes in the economy both across space and over time. We identify an increasing spatial correlation in house price and income interactions over the sample period.

The article is organized as follows. In Sect. 2 we introduce both non spatial and spatial empirical models. Section 3 discusses the data used in the empirical section. Section 4 presents the results, Sect. 4 concludes.

2 Empirical methodology

In the spirit of Holly et al. (2010) consider an equation of the form:

where \(\Delta p_{it} \) is the change in log real house price index for metropolitan area i during year t, \(p_{it-1} \) is one period lag of real house price index, \(\Delta y_{it} \) is the change in log real per capita disposable income, \(c_{it} \) is the real cost of borrowing defined as \(c_{it} =r_{it} -\Delta n_{it} \) where \(r_{it} \) is the long term real interest rate and \(\Delta n_{it} \) is the growth rate of population and \(v_{it} \) is a white noise process.

Equation (1) ignores spatial interaction in house prices across metropolitan areas. However, house prices in nearby metropolitan areas may spatially interact each other. Holly et al. (2010), for example, argue that high prices in metropolitan area could lead people to commute from nearby areas. Particularly, labor mobility across metropolitan areas in the United Stets is very common. In order to account for possible spatial interaction effects in the dynamics of house prices and macroeconomic fundamentals, we consider a DSDM of the form:

where \(\rho \) is a spatial autoregressive coefficient, \(W_{ij} \) is a spatial weight matrix that connects MSA i and j, \(\gamma \) is a coefficient that that measures the effects of neighboring MSAs growth rate in real per capita disposable income on changes in house prices in a particular MSA, \(\mu _{it} \) is a white noise process and the remaining variables are as defined in Eq. 1. Note that in the empirical section, the spatial lags of all the independent variables are considered.

3 Data

The data on real house price index (log transformed), real per capita disposable income (log transformed), real cost of borrowing, and population (log transformed) cover the period 1976 to 2011 across 373 MSAs. The U.S Office of Management and Budget (OMB) defines metropolitan areas based on a core area containing a large population nucleus, together with adjacent communities having a high degree of economic and social interaction with that core. The source of data is Baltagi and Li (2014) which is available online at: http://qed.econ.queensu.ca/jae/datasets/baltagi005/.

Table 1 reports the descriptive statistics of changes in real per capita income \((\Delta y_{it} )\), changes in real house prices \((\Delta p_{it} )\), population growth rate \((\Delta n_{it} )\), and real cost of borrowing \((c_{it} )\) across 373 MSAs in the US during 1976–2011. Whereas the average growth rate of log real per capita income has been about 1 %, the average growth rate of log real house price has been about 0.047 % over the sample period. Figure 1 also plots the mean growth rate of real house price (blue dashed line) and average growth rate of real personal disposable income (solid red line) across 373 MSA over the period 1976–2011 where it can be seen that real house prices and real income tend to show similar growth patterns over the sample period.

4 Results

The estimation results of Eq. 1 (non-spatial model) are reported in Table 2. Column (1) contains the estimation results without fixed effects and time trend while Column (2) reports the estimation results with fixed effects as well as time trend. As shown in the table, previous house prices and real income have a positively significant effect on current real house price growth rates. Real cost of borrowing, on the other hand, has a statistically significant negative impact on real house prices.

The estimation results of the DSDM are reported in Table 3. In the estimation of the DSDM, we use 10 nearest neighbor spatial weight matrix. Column (1) contains the estimation results without fixed effects as well as time trend whereas Column (2) contains the estimation results with fixed effects as well as time trend. The spatial dynamic model results indicate that the spatially lagged dependent variable has a statistically significant positive coefficient estimate indicating that observed house prices in nearby MSAs are important variables in house price determination.

Both the direct and indirect effects of changes in real per capita disposable income are positively significant. The indirect effect of real income also indicates the importance of neighbors’ real income in driving house prices. One period lagged real house prices in neighboring MSAs also takes a significant positive coefficient estimate. The main results do not change with the inclusion of a time trend and metropolitan area specific fixed effects.

An alternative way of modelling spatial dependence is through common factor models as in Pesaran (2006). Common factor models are advantageous in that they do not require a priori assumption on the nature of spatial dependence. Such models, however, allow dependence in the error terms but not dependence in the dependent and/or independent variables.

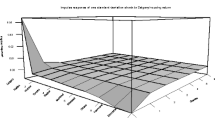

Time varying DSDM

We estimate a time varying version of the DSDM implied by Eq. 2. We apply 5 years rolling window using 10 nearest neighbor weight matrix. The parameter estimates of the coefficient for the spatially lagged dependent variable (\(\rho )\) is shown in Fig. 2 with 95 % upper and lower confidence intervals. The spatial correlation coefficient has been increasing over the sample period. This might reflect the increasing housing market correlations and co-movements over time and across cities in the US. Particularly, the correlation coefficient shows a significant increase after the 2000s and steadily rising thereafter. The recursive analysis of house prices across MSAs and over time can be used as an alternative measure of house price integration and correlation across different areas over the sample period.

5 Conclusion

This study examines the interactions between the housing market and macroeconomic fundamentals across 373 US metropolitan areas during 1976–2011. We begin with estimating a non-spatial model of house prices and real income. The estimation results indicate that previous house prices and real income have a positively significant effect on current real house price growth rates. Real cost of borrowing has a statistically significant negative impact on real house prices.

In the dynamic spatial model, we use direct and indirect effects approach of LeSage and Pace (2009) and decompose the impacts of changes in macroeconomic fundamentals on house prices into direct and indirect effects. We find significant spatial interaction effects of real house prices and real income. A time varying version of the dynamic spatial model indicates an increasing correlation of house price growth rates across metropolitan areas over the sample period considered. The main results do not change with the inclusion of a time trend and area fixed effects.

Notes

LeSage and Pace (2009) stress that a more valid parameter interpretation of spatial econometric models involves decomposing impacts into direct and indirect effects using partial derivatives approach because standard point estimates approach may lead to erroneous conclusion. Recently, dynamic spatial econometric models received much attention in the literature, see, for instance, Elhorst (2014), Halleck Vega and Elhorst (2014), and Debarsy et al. (2012).

References

Anselin, L.: Spatial Econometrics: Methods and Models. Kluwer Academic Publishers, Boston (1988)

Apergis, N., Payne, J.: Convergence in U.S. house prices by state: evidence from the club convergence and clustering procedure. Lett. Spatial Resour. Sci. 5, 103–111 (2012)

Baltagi, B., Li, J.: Further evidence on the spatio-temporal model of house prices in the United States. J. Appl. Econ. 19, 515–522 (2014)

Debarsy, N., Ertur, C., LeSage, J.: Interpreting dynamic space-time panel data models. Stat. Methodol. 1–2, 158–171 (2012)

Elhort, J.P.: Spatial Econometrics: From Cross-Sectional Data to Spatial Panels. Springer, Briefs in Regional Science (2014)

Elhorst, P.: Dynamic spatial panels: models, methods and inferences. J. Geogr. Syst. 14, 5–28 (2012)

Elhorst, P.: Applied spatial econometrics: raising the bar. Spatial Econ. Anal. 5, 9–28 (2010)

Halleck Vega, S., Elhorst, J.P.: Modeling regional labor market dynamics in space and time. Pap. Reg. Sci. 93(4), 819–841 (2014)

Holly, S., Pesaran, M.H., Yamagata, T.: A spatio-temporal model of house prices in the USA. J. Econ. 158, 160–173 (2010)

Kryvobokov, M., Mercier, A., Bonnafous, A., Bouf, D.: Simulating housing prices with UrbanSim: predictive capacity and sensitivity analysis. Lett. Spatial Resour. Sci. 6, 31–41 (2013)

LeSage, J., Fischer, M.: Spatial growth regressions: model specification, estimation and interpretation. Spatial Econ. Anal. Taylor Francis J. 3, 275–304 (2008)

LeSage, J., Pace, R.K.: Introduction to Spatial Econometrics. CRC Press Taylor & Francis Group, Boca Raton, FL (2009)

Malpezzi, S.: A simple error correction model of house prices. J. Hous. Econ. 8, 27–63 (1999)

Pesaran, M.H.: Estimation and inference in large heterogeneous panels with a multifactor error structure. Econometrica 74, 967–1012 (2006)

Author information

Authors and Affiliations

Corresponding author

Rights and permissions

About this article

Cite this article

Abate, G.D. Spatio-temporal dynamics of house prices in the USA. Lett Spat Resour Sci 10, 141–147 (2017). https://doi.org/10.1007/s12076-016-0177-3

Received:

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s12076-016-0177-3