Abstract

We study the immediate and delayed market reaction to U.S. Securities and Exchange Commission (SEC) EDGAR 10-K filings. Unusual trading volumes and stock-price movements are documented during the days around the 10-K filing dates. The abnormal price movements are positively associated with future accounting profitability, indicating that 10-K reports contain useful information about future firm performance. In addition, investors’ reaction to 10-K information seems sluggish, as demonstrated by the stock-price drift during the 12-month period after 10-K filing. We find that investors’ underreaction tends to be stronger for firms with more complex 10-K reports.

Similar content being viewed by others

Avoid common mistakes on your manuscript.

1 Introduction

At the time a company files its 10-K report with the SEC, most likely all key information has already been disclosed to the public. Earnings per share, dividends, sales growth, and other summary measures are often disclosed in earnings releases and conference calls weeks or even months before. As a result, investors often view the filing of 10-K as a formality and largely ignore it. In fact, early empirical research (for example Easton and Zmijewski 1993) finds little evidence of investor response to 10-K and 10-Q reports.

However, as business evolves, new types of transactions emerge that cannot be readily captured by the traditional accounting summary measures. For instance, when companies pay their employees with stock options instead of cash, not expensing such options would likely distort the companies’ earnings. On the other hand, how to expense such options is the subject of a rather heated debate. When facing such difficult issues, the accounting profession often requires firms to significantly expand their disclosure regarding the transaction in footnotes and other parts of the 10-K. This types of additional information in 10-K increases its usefulness to investors. Moreover, the requirement of electronic filing (that is, the implementation of EDGAR by SEC) makes it significantly easier for investors (especially small investors) to access information in 10-K (Griffin 2003; Asthana et al. 2004).

In this paper we examine several issues concerning investors’ response to information in the 10-K. First, because of the potential for investors to underestimate the importance of 10-K information, the market could under-react to such information. Based on a sample of firms that filed 10-K forms electronically with the SEC between January 1, 1995 and December 31, 2005, we show that investors, as a whole, tend to underreact to information contained in the 10-K. Using the three-day abnormal stock return around the filing date (FDR) as a measure of 10-K information, we document that stocks with good news tend to experience price increases relative to their peers during the subsequent 12-month period. In contrast, the prices of stocks with bad news tend to drift downward. The magnitude of such a drift, between the top and bottom quintile of firms ranked based on their three-day price changes, averages around 2.3, 6.0, and 10.6%, respectively, during the 3-, 6-, and 12-month holding periods. Such a drift remains robust after controlling for common risk factors and anomalies.

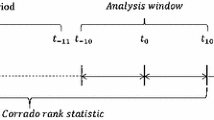

We conduct several tests to determine whether this price drift reflects a distinctive underreaction to 10-K information, or is merely a reflection of the post-earnings-announcement drift (for example, Bernard and Thomas 1989; Abarbanell and Bernard 1992). Using a multivariate regression, we test whether FDR still has significant correlation with post-filing stock returns after controlling for the standardized unexpected earnings (SUE) in earnings releases. The regression result shows that FDR is significant at the 1% level. Livnat and Mendenhall (2006) document that the post-earnings-announcement drift is larger when earnings surprise is defined based on analyst forecasts as opposed to past earnings. We also use this alternative measurement of SUE in the regression test. The result further confirms that FDR is significantly correlated with future stock return. Lastly, to test whether the documented price drift is due to information in the 10-K, we construct a pseudo-FDR which measures the three-day return starting 10 days before 10-K filing (as opposed to FDR which starts on the day 10-K is filed). If the price drift is due to underreaction to 10-K, then the pseudo-FDR should have no (or less) predictive power regarding subsequent returns. The test results show that this pseudo-FDR has no statistically significant predictive power regarding future returns.Footnote 1 Collectively, these results suggest that the price drift we documented is distinct from the post-earnings announcement drift, and it is unique to the filing of the 10-K.

Next we analyze the cross-sectional variation of the stock price drift. Any pattern observed, hopefully, would help explain the cause of it. A key feature of information contained in the 10-K is the large volume and high degree of complexity. Deciphering the footnotes on options, deferred taxes, and pensions requires expertise. These disclosures can be quite challenging to the average investor and might contribute to investors’ underreaction. There are several reasons why a high level of information complexity might correlate with the magnitude of the price drift. First, if investors simply underestimate the importance of 10-K information, then the more information contained in the 10-K, the more likely the price deviates from its intrinsic level. Second, Brav and Heaton (2002) show that when investors are uncertain about information structure, rational leaning can lead to a pattern of underreaction that varies with the level of uncertainty. Lastly, research on cognitive behavior also predicts that investors may underreact to complex information. Hong and Stein (1999) build a model based on the assumption that firm-specific information diffuses gradually across investors. The degree of underreaction by investors depends on the speed of information diffusion, which is affected by the complexity of the information. Barberis et al. (1998) model underreaction as the result of the conservative bias observed when individuals update their beliefs in the face of new evidence. The impact of such conservatism is affected by the magnitude of uncertainty. Hirshleifer (2001) argues that information that is presented in a cognitively costly form is weighed less by investors. All these arguments predict that complexity would have positive correlation with investor underreaction.

We use a simple word-count as a proxy for the complexity level of 10-K information as perceived by investors. We group firms based on word counts and compare the magnitude of the stock-price drift. When regressing the post 12-month stock return on the 10-K filing date return, the coefficient is significant for the high-complexity firms but not for the low-complexity firms. In a pooled regression, the interaction term of filing-date-return and complexity index is also positively significant.

To further differentiate the above hypotheses, we examine how the magnitude of price drift changes over time. If investors underestimate the information content of the 10-K, or if they learn about its information content over time, we would expect the magnitude of the predictable return to diminish over time. On the other hand, if the price drift is due to cognitive bias or risk, then the price drift would persist over time. Our test results suggest, on average, that the magnitude does seem to diminish over time. However, the reduction is not statistically significant.

Making financial reports more comprehensible to ordinary investors has been a priority on the SEC’s agenda.Footnote 2 However, the underlying question of the target audience for financial reports is a difficult one to answer. It is commonly believed that a primary reason for mandatory reporting is to guarantee equal access to information for all investors. Therefore ordinary investors should be a primary target. On the other hand, with the increase in mutual funds, more and more investors entrust their investment decisions to professionals. Thus it has been argued that investors can be better served by providing them with unfiltered facts regarding ever-more-complex firm transactions. The evidence presented in the paper supports making 10-K information more intelligible to the average investor.

2 Literature review

Our study builds on prior research of investor reaction to 10-K information. Early research finds little evidence of investor response around 10-K and 10-Q filing dates (Foster et al. 1983; Stice 1991; Easton and Zmijewski 1993). Recent studies, which are based on samples taken after the adoption of the EDGAR system, find evidence of market reaction to 10-K (and 10-Q) filings. For example, Qi et al. (2000) examine 417 EDGAR 10-K filings over the period 1993 through 1995 and find that the cumulative excess stock returns on EDGAR 10-K filing days are significantly associated with the following year’s earnings change. Using a broader sample, Griffin (2003) finds that the absolute values of excess returns are significantly greater during the 10-K/Q EDGAR filing days than during nonfiling days. We extend this line of research by examining whether such reactions are unbiased.

Several prior studies provide evidence consistent with investors underreacting to public information. Bernard and Thomas (1989) find that investors underreact to information contained in earnings surprises. Givoly and Lakonishok (1980), Stickel (1991), and Gleason and Lee (2003) document a delayed market response to analyst forecast revisions. Womack (1996) shows that the market reaction to analysts’ recommendations is incomplete and sluggish. He finds significant positive (negative) stock returns following new buy (sell) recommendations over the 6 months after the recommendations are issued. In this paper, we investigate whether investors underreact to the information contained in 10-K filings. We add to the literature by showing how information complexity affects investors’ ability to fully incorporate such information into stock price. Hirst and Hopkins (1998) document that analysts fail to access comprehensive income information under certain reporting formats and suggest that “clear reporting” of information increases analysts’ use of it. McEwen and Hunton (1999) document that analysts whose forecasts are less accurate tend to ignore certain information. They speculate that this effect “may be a function of its relevance, complexity, or both.” Plumlee (2003) shows that analysts assimilate less complex information to a greater extent than they do more complex information (about tax-law changes). We study how information complexity affects the end users, that is, investors.

Jiang et al. (2005), Zhang (2006), and Francis et al. (2007) document how information uncertainty affects stock-price drift. The information uncertainty measures used in these studies capture the overall level of uncertainty associated with a firm’s future cash flows. In contrast, our information complexity measure focuses directly on the property of one piece of information, that is, the 10-K report. On a conceptual level, investors’ reaction to a piece of information depends on both the complexity of the information itself and the overall information uncertainty level of the firm. The two measures are related, but the correlation is not clear. One could argue that providing more information can reduce the overall uncertainty about a firm’s cash flows. On the other hand, it is also conceivable that firms provide more complex information simply in reaction to the greater information need due to high uncertainty. To appreciate the difference between these two concepts, note that the information complexity measure usually classifies large firms as having more complex 10-K filings. However, in Zhang (2006), firm size is assumed to be negatively correlated with information uncertainty. We include these information uncertainty measures in a sensitivity test. The result shows that the information complexity measure has significant predictive power for post-10-K stock returns after controlling for information uncertainty.

3 Information content of the 10-K

Our sample is constructed based on all the 123,449 electronic 10-K (including 10-K405, 10-KSB, 10-KSB405) filings from January 1, 1995 to December 31, 2005.Footnote 3 We use a database provided by Xignite Inc. and a dataset from Compustat to merge the 10-K filings with the 2007 CRSP and Compustat database. This yields 65,664 firm-year observations. We further eliminate 4,646 observations on securities other than common stocks as well as 1,146 observations where 10-K filings occur more than 120 days after fiscal year end. Since our base dataset also includes 10-K fillings by small business (SB), it raises the issue of whether any market underreaction we document is due mostly to stocks with very low liquidity. To control for the impact of low-liquidity stocks we also exclude firm-year observations with a market cap less than $200 million or stock price less than $1 (that is, the penny stocks). The final sample consists of 24,269 firm-year observations. Details of this sample selection procedure are outlined in Table 1.

To gauge the information content of 10-K, we test whether there is discernable investor reaction to EDGAR 10-K filings. Panel A of Fig. 1 depicts the average daily trading volume (number of shares traded scaled by the number of shares outstanding) over the 21 trading days centering around the 10-K filing dates. As the graph shows, the trading volumes during a 4-day period (starting from the filing date) are abnormally high. We also report the average absolute stock returns over the same periods in Panel B. This return volatility test confirms our findings from the volume test, that is, stock volatility also increases during the same time after 10-K filing. The stock return volatility does not seem to revert back to the pre-filing level even 10 days after the filing dates.

For comparison purposes, we also report the daily volume and volatility for the 21 trading days around the annual earnings announcement dates. Panel A of Fig. 2 shows that trading volumes are considerably higher during day 0 and day 1. In particular, the trading volume on day 1 is more than twice as large as the average volume on other days. Stock return volatility also exhibits a similar pattern (Panel B). Note that, contrary to the case with 10-K filings, market reaction to earnings announcements appears to be prompt and short-lived. By the third day after earnings releases both the volume and the return volatility are almost indistinguishable from the pre-announcement levels. This difference confirms the intuition that 10-K reports are perceived to be more complex and take a longer time for investors to digest.

While abnormal trading volume and return volatility may indicate market reaction to new information, they could also simply reflect an increase in noise trading. To differentiate these alternatives, we test whether such stock movement around 10-K filing dates actually reflects changes in a firm’s fundamentals. For firm i in year t, we measure the filing date return (FDR) as the cumulative, size-adjusted returns over a three-day window starting with the filing date:

where RET i,t,τ is the return on stock i on date τ relative to the firm’s year t 10-K filing day.Footnote 4 DECRET i,t,τ is the day τ average return of all firms in the corresponding size group. Table 2 provides the distribution of FDR and the number of observations each year. The number of firms in our sample increases from 1,652 in 1996 to 2,702 in 2005. The distribution of FDR is not very stable over time. The largest cross-sectional standard deviation of FDR is 9.19% in year 2000, almost three times as large as the value in year 2005, which is 3.32%.Footnote 5

To see whether stock movements around 10-K filings dates reflect changes in firm fundamentals, we examine the correlation between FDR and firms’ future earnings. If 10-K filings contain useful information about future performance and if investors react to such information, we would expect FDR to be positively associated with future profitability. More specifically, we estimate the following model:

where ROA i,t is the return on assets in year t, measured as earnings before extraordinary items scaled by the average total assets; ATO i,t is the asset turnover, measured as sales scaled by the average total assets; ACC i,t is the difference between earnings from continuing operations (COMPUSTAT #123) and cash flow from continuing operations (COMPUSTAT #308–#124) scaled by average total assets; SIZE i,t is the logarithm of market cap at the end of the fiscal year; and BM i,t is the book value of equity divided by the market value of equity as of the fiscal year end.

Table 3 contains the regression results of several variations of model (2). We report the White t-statistics adjusted for within cluster (year) correlation. Univariate regression suggests that FDR is significantly correlated with future profitability (ROA). Column III shows that FDR has significant predictive power over future ROA after controlling for current year ROA, asset turnover, firm size, and book-to-market ratio. As shown in Sloan (1996), the accrual component of earnings is less persistent than the cash portion, hence ACC may also has predictive power for future earnings. Given that many firms choose to release their cash flow information in 10-K filings, we test whether FDR and ACC have different information regarding future firm performance. The last column of Table 3 shows that ACC does have a significant negative correlation with future ROA. However, the coefficient on FDR stays virtually unchanged. The filing date return is still positively and significantly associated with future ROA even in the presence of ACC.

4 Investor underreaction to 10-K information

The key summary measures of the 10-K are often released to the market at the earnings announcement date. As a result, some investors view the filing of the 10-K as a formality and largely ignore it. Early empirical research (for example Easton and Zmijewski 1993) finds little evidence of investor response to 10-K and 10-Q reports. This suggests the possibility that investors, as a group, might underreact to 10-K information.

4.1 Investor underreaction

We split our sample of 24,269 firm-years into good news and bad news groups based on the sign of FDR. For each group, we calculate the future stock returns starting from the beginning of the month after the three-day FDR window. On average there is a lag of about 17 days between the end of the FDR window and the beginning of the return accumulation periods.

Figure 3 presents the cumulative returns for the two groups. Over the next 12 months, good news firms on average earn a size-adjusted return of about 3.43%. In contrast, the average size-adjusted return for the bad news group is about −1.57%. And the difference of stock returns between the two groups is significant at less than 0.1% level.

Cumulative abnormal returns for 12 months after 10-K filings. This figure plots the cumulative size-adjusted returns over the 12-months following 10-K filings. Firms with positive size-adjusted returns over the 3 days filing windows [0, 2] are classified as the good news firms, while others are placed into the bad news group. The good (bad) news group has 12,071 (12,138) firm-year observations

To test whether this price drift after 10-K filings is affected by the magnitude of FDR, we perform the following portfolio analysis. Each year we split our sample into five groups based on FDR and track the average stock return over the next year.Footnote 6 More specifically:

-

1.

We calculate FDR using Eq. 1 for all firm-year observations.

-

2.

For each year we form five portfolios based on FDR using the quintile breakpoints from the prior year FDR distributions.Footnote 7

-

3.

We track the average stock returns for each of the five portfolios for the 12-month period starting from the beginning of the month after the three-day filing window.Footnote 8

We plot the size-adjusted abnormal returns for the five groups in Fig. 4. The graph clearly shows an increasing pattern in abnormal stock returns for 3-, 6-, and 12-month holding periods as we move from the lowest FDR quintile to the highest one.

Average size-adjusted abnormal returns. Each year firms are sorted by their FDRs and placed into five groups based on the prior year’s FDR distribution. Group 1 contains observations with the lowest FDRs and group 5 contains the observations with the highest FDRs. Stock return accumulation starts from the month after the 3-day filing window

Panel A of Table 4 lists the average size-adjusted as well as raw returns for firms in each quintile. The drift in the size-adjusted returns of the extreme bad-news quintile equals −0.82, −3.20, and −6.38% over the subsequent 3, 6, and 12 months, respectively. The size-adjusted abnormal returns for the top quintile accrue to 1.49, 2.76, and 4.25% over the same period.

4.2 Controlling for additional risk measures

To see how firms in each group may differ in risk characteristics, we calculate beta, size, book to market, as well as stock return momentum for each group of firms. Market risk (beta) is calculated with monthly stock returns over the 36 months before the starting date of future return accumulation. We require firms to have at least 18 months stock return data to obtain a reliable beta estimate. Market capitalizations and book-to-market ratios are calculated as of the fiscal year end. SIZE is defined as the logarithm of market capitalization. We also construct a variable MOM, which equals the 6-month stock return ending on the month when companies file their 10-K reports to capture the momentum effect (Jegadeesh and Titman 1993).

Panel B of Table 4 presents firm characteristics for each of the five groups. The average FDR for the lowest quintile group (P1) is −6.82%, which increases monotonically to 6.86% for the highest group (P5). Compared with firms in P1, firms in P5 have lower beta, larger market capitalization, and higher book-to-market ratios. MOM almost monotonically increases with FDR as we move from the lowest FDR decile to the highest.

To control for possible risk variation in the return analysis, we conduct a set of cross-sectional regressions by including beta, size, book-to-market, as well as MOM (Fama and French 1992, 1993). These models are estimated using a pooled, cross-sectional time-series regression and report the t-statistics based on White standard errors that are robust to within cluster correlation (Petersen 2006). The results are presented in Table 5. Panel A shows the correlation matrix of the variables. The Pearson correlation between FDR and future 12-month returns is 0.065, and the Spearman correlation is about 0.077. Both correlations are significant at less than 0.1% level. The positive correlation between FDR and future stock returns is consistent with our underreaction hypothesis.

Regression results are presented in Panel B. FDR is positively correlated with future stock returns, even after control for a variety of firm characteristics. The coefficients on FDR are uniformly positive and almost always significant at less than 1% level when we use 6- and 12-month stock returns as the dependent variables. Although FDR is also positively associated with future three-month stock returns, such association is insignificant after controlling for various risk factors. Consistent with the findings of Fama and French (1992, 1993), the coefficients on beta are close to 0 and not significant. The coefficients on SIZE are always negative. The significant positive coefficients on BM are consistent with the findings of the value-glamour literature that value stocks outperform glamour stocks.

We use the buy-and-hold method to measure the abnormal stock returns for two reasons. (1) As shown in Barber and Lyon (1997), buy-and-hold is favored over cumulative abnormal return (CAR) on a conceptual ground. (2) BHAR facilitates the cross-sectional analysis of how abnormal return varies with complexity. However, as pointed out by Mitchell and Stafford (2000), BHAR may exaggerate the short-term abnormal return due to compounding. To address this issue, we conduct a calendar time analysis. Specifically, each month we place firms into five portfolios based on their most recent FDR. We then calculate the value-weighted returns for the five portfolios (P1, P2,…, P5) over time. The hedge returns are the difference between the returns of the two extreme portfolios (P5 − P1). We test the significance of the alphas using both Fama and French (1993) three-factor and Carhart (1997) four-factor model.Footnote 9 The results are reported in Panels C and D of Table 5. The monthly alphas remain significant with a magnitude around 0.41% and 0.64%.Footnote 10

4.3 Information in the 10-K versus earnings release

Given the close link between 10-K information and earnings, a logical question would be whether the documented price drift is a reflection of the post-earnings announcement drift (Bernard and Thomas 1989; Abarbanell and Bernard 1992). We conducted a series of tests to see if the price drift represents a distinctive investor underreaction to 10-K information.

First we examine the predictive power of FDR regarding future returns after controlling for the post-earnings announcement drift and Sloan’s (1996) accrual anomaly. Specifically, we estimated for the following model:

where RET is the cumulative stock return for the 12 months after the company files its annual reports. Following Bernard and Thomas (1989), we define SUE as:

where E q is the earnings before extraordinary item (Compustat Quarterly #8) for quarter q, c q is the mean, and σ q is the standard deviation of the seasonally differenced earnings over the past eight quarters. For each year, we use only the fourth quarter SUE in the regression models.

Table 6 reports the results. In panel A, the first column provides the baseline model regressing future 12-month abnormal returns on FDR and other risk factors. Column II augments the baseline model with SUE. Consistent with prior literature, we find SUE to be positively associated with future stock returns, but the coefficient is only marginally significant. We would like to point out that the results might understate the strength of the post-earnings announcement drifts. As Rangan and Sloan (1998) point out, the post-earnings announcement drift is weaker for the fourth quarter than the other three quarters. After control for SUE, FDR is still significantly associated with future 12-month stock returns. The magnitude of the coefficient is slightly lower than the baseline model, which indicates, as we would expect, that there is some interaction between our FDR and the SUE signal.

Column III examines the predictive power of FDR over future returns after control for the accrual anomaly as well. Consistent with Sloan (1996), ACC has significant predictive power over future returns. The coefficient on FDR is almost unchanged after we control for ACC, and the t-statistic increases slightly. In column IV, both SUE and ACC are included in the regression, and the coefficient on FDR remains significant.

In Column V, we replace SUE with an alternative measure of earnings surprise, SUE’. Livnat and Mendenhall (2006) show that the post-earnings surprise is significantly larger when earnings surprise is measured based on analyst forecast. We define SUE’ as the difference between the actual EPS and analyst consensus forecast as of the month before earnings announcement, scaled by stock prices. The last column reports the results. The coefficient on FDR stands out as the most significant one among all the variables, which confirms that the FDR effect is not a replica of the anomalies found in the prior literature.Footnote 11

To further test whether the price drift is due to information contained in the 10-K we calculate a pseudo-FDR, which is also a three-day abnormal return measure. However, unlike FDR, which starts on the date 10-K report is filed, the pseudo-FDR is calculated as the three-day size-adjusted return starting 10 days before the 10-K filing. If such a measure also predicts future stock return, similar to the way FDR does, then the price drift is likely due to factors other than the 10-K filing (such as the momentum effect). The result is presented in panel B of Table 6. Whether on a standalone basis or together with FDR, the pseudo-FDR measure does not have significant predictive power for future stock returns. The coefficient, as well as the t-statistics on FDR, does not change much when the pseudo-FDR is included. Collectively, this evidence indicates that the price-drift we documented is related to 10-K filing.

5 Information complexity and investor underreaction

Next we conduct tests to understand the cause of this stock-price drift. As we know, information contained in 10-K is generally more difficult to understand. Deciphering footnotes on deferred tax, pensions, and derivative transactions requires expertise. Theoretical works suggest that the degree of investor underreaction may depend on the complexity of the information. For instance, Hong and Stein (1999) build a model based on the assumption that firm-specific information diffuses gradually across investors, and investors cannot extract information from prices using the rational-expectation rules. In their model the degree of underreaction depends on the speed of information diffusion. The complexity and comprehensiveness of the information contained in 10-K may affect the speed of such information diffusion.

We conduct a cross-sectional regression test to examine how complexity of 10-K reports relates to the extent of investor underreaction. Since lengthier reports are more likely to contain details on subjects such as option pricing and since investors generally perceive lengthier 10-Ks as being more difficult to decipher, we use a simple word count as a measure of 10-K complexity. More specifically, each year we count the words in the 10-K report after excluding all tables (NWORD). We split our samples into high and low complexity groups annually based on the median NWORD. We then run the return model for high and low complexity groups separately. Specifically, each year a firm is placed in the low (high) complexity group if its 10-K report contains less (more) words than the annual median. The following model is used to test whether the difference in the degree of underreaction between the two groups is statistically significant:

where COMPLEX i,t is a dummy variable which equals 1 if the number of words in the 10-K filing is greater than the median NWORD of year t and 0 otherwise. Year and industry dummies are also included in the regression.Footnote 12

Table 7 reports the test results. For the low complexity group we find very little, if any, underreaction to 10-K information. The coefficient on FDR, 0.208, suggests that for every 1% immediate reaction (during the three-day filing window) there is only about 0.21% delayed market reaction. The t-statistics of 1.22 indicates that such underreaction is not statistically significant. By contrast, we find underreaction to be both economically and statistically significant for the high complexity group. The coefficient of 0.782 indicates that for each 1% of immediate market response, there is about 0.782% in delayed market response. This implies that only 56% of the market reaction takes place around 10-K filing. A sizable proportion of 10-K information is gradually incorporated into the stock price over the subsequent 12 months. The difference in underreaction between the low and high complexity groups is statistically significant at less than the 1% level.

To further control for the correlation between the complexity measure (NWORD) and firm size, we add an interaction term FDR * SIZE to regression (4). The result is reported in the last column of Table 7. The coefficient on FDR * COMPLEX remains positive and significant, while the coefficient on FDR * SIZE is negative and insignificant.

We also examine how the magnitude of the stock-price drift changes over time. If the price drift is due to investor underestimation of information in the 10-K or a lack of understanding about the true underlying structure, then we may see a reduction in mis-pricing due to investors’ learning over time.Footnote 13 On the other hand, if the price-drift is due to some unknown risk or cognitive bias, then the magnitude of hedge return may persist over time. The magnitude of hedge return over the years is plotted in Fig. 5. A simple OLS regression shows the estimated coefficient on year being negative, indicating a very gradual reduction in price drift over time. However, for the sample years, the coefficient is not statistically significant.

Hedge returns to FDR strategy over time. This figure shows the size-adjusted hedge returns from buying firms in the top FDR quintile and shorting firms in the lowest FDR quintile for the 10 years between 1996 and 2005. FDR is calculated as the size-adjusted returns for the 3 days starting from the filing dates. Each year firms are sorted based on their FDRs and placed into five groups according to the prior year’s FDR distribution. Future stock return accumulation starts from the month after the 3-day filing window

6 Supplementary tests

Li (2006) measures the risk sentiment in 10-K and shows that such a measure predicts future stock returns. We test the correlation between FDR and Li’s risk measure.Footnote 14 As shown in panel A of Table 8, the correlation is not significant. Nonetheless we include Li’s risk sentiment measure in a multivariable regression and report the result in panel B. Consistent with Li (2006), we also find that the sentiment measure has significant correlation with future stock return. More important, the results show that FDR remains highly significant after controlling for the changes of risk sentiment.

In Table 9, we report test results with information uncertainty measures used in Jiang et al. (2005), Zhang (2006), and Francis et al. (2007). These information uncertainty measures include firm size, firm age, idiosyncratic return volatility, and standardized information uncertainty measure (SIU). SIU is calculated based on Dechow and Dichev (2002) with revenue and PPE (see Francis et al. 2007, for details).Footnote 15 Panel A reports descriptive statistics of the above variables. The correlation matrix appears in Panel B. Larger firms, as well as firms with a longer history, tend to have more complex 10-K reports. Panel C contains the regression result. The effect of size and firm age, although having the predicted sign, is usually insignificant. The interaction term of FDR and COMPLEX remains highly significant under all the different model specifications, indicating that the effect of information complexity is different from the information uncertainty effect found in Jiang et al. (2005), Zhang (2006), and Francis et al. (2007).Footnote 16

We also conduct several other tests (untabulated). First, for some small firms, earnings announcement and 10-K filings occur on the same day. To exclude the possibility that our result is driven by this set of firms, whose FDR may capture the same information as earnings, we exclude all firm-year observations where companies file their annual report within two trading days after earnings announcements. The abnormal returns the FDR strategy generates over the 12-month period actually increase slightly from 10.62% in Table 4 to 10.89%. Second, we split our sample into value firms and growth firms based on the median book-to-market ratio. The results show that FDR works for both groups, and that the effect of FDR is stronger for firms with lower book-to-market ratios (that is, growth firms). Third, to further control for the possibility that extreme FDR portfolios are disproportionately affected by smaller firms, we deflate the three-day abnormal returns with the square root of the mean squared error from the regression of daily stock returns on the market returns for the 30 days before filing dates (that is, the sigma). The FDR remains significant in all the robustness tests. Forth, Garfinkel and Sokobin (2006) show that investor opinion divergence, as a measure of risk, increases the sensitivity of the post-earnings announcement drift to earnings surprises. We include analyst forecast dispersion in our test, and the result shows that FDR remains significant.

7 Summary and conclusions

In this paper we examine the information content of 10-K filings and how investors react to this information in the post-EDGAR era. Stock return volatility and trading volume increase during the few days after companies file their 10-K reports. Using three-day returns starting from filing dates as a proxy for the information in the 10-K, we show that such information has predictive power over future accounting profitability, which indicates that EDGAR 10-K filings contain useful information about firms’ future performance.

We also find that investors’ response to 10-K filings tends to be sluggish and that the stock price continues to drift. The magnitude of the drift is significant both statistically and economically, even after controlling for common risk factors and other accounting anomalies. We use word counts as a proxy for the information complexity of 10-K filings and find that investor underreaction tends to be stronger for a group of firms with more complex 10-K reports. Firm-years with less complex 10-K filings show little, if any, market underreaction. Overall, our results indicate that the complexity of accounting information does affect the extent to which investors can incorporate that information into price. This lends support to making 10-K information more intelligible to the average investor.

Notes

We thank the referee for suggesting the last test.

See, for example, SEC Rule 421(b), 421(d), and Release Nos. 33-7497, 34-39593, IC-23011.

Mandatory electronic filing was fully phased in at the end of 1995. SB stands for small business, which, according to the SEC, refers mainly to entities with revenue less than $25 million. There is no difference in substance between form 10-K and 10-K405, except where the Rule 405 box on the facing page of the Form 10-K is checked. Checking the box indicates that no disclosure of delinquent ownership reports is required. This classification was discontinued in 2002 after the SEC determined that the use of this designation by companies was inconsistent and unreliable.

To the extent that any other significant public disclosure event also takes place during the 3-day window, our measure of 10-K information content will be noisy.

The high variation in FDR works against finding significant underreaction because, to avoid hindsight bias, we use the FDR distribution in the prior year to form portfolios.

We use a five-group partition, as opposed to the usual 10-group partition, to ensure that firms in the top and bottom groups are comparable to firms in the other groups. The hedge portfolio return is larger and more significant with a 10-group portfolio construction.

This is done to avoid hindsight bias. Using the current year distribution to form portfolios gives similar results.

We report value-weighted portfolio return to reduce the impact of small firms. The hedge returns are larger and more significant with equal-weighted portfolio return calculation.

Chordia and Shivakumar (2006) argue that price momentum is subsumed by a measure of investor underreaction to earnings news. Hence, it is not clear whether the momentum variable represents a risk factor or a measure of underreaction to other news. Therefore, we report this separately from the results using the Fama and French three-factor model.

In conducting the calendar time portfolio analysis, we also vary the length of the holding period from 1 to 12 months. The hedge returns are generally positive, and the statistical significance does not show a monotonic increase as the holding period lengthens. This further indicates that the significant long run BHAR is not simply due to compounding.

We also measure earnings surprise based on three-day abnormal stock return around earnings announcement (see, for example, Brandt et al. 2007). Making the measure of earnings news consistent with FDR reduces the concern that the different predictive power of FDR and SUE is due to the difference in the way news is measured. The result shows that FDR is still positive and highly significant.

To further examine how much of the predictive power of COMPLEX is due to industry differences, we calculate industry-neutral information complexity measure which takes a value of 1 if the length of a firm’s 10-K exceeds the median of all 10-K reports in the same industry during the same year. Using this measure in regression (4), the coefficient on FDR * COMPLEX remains highly significant.

Brav and Heaton (2002) show that when investors are uncertain about information structure, rational leaning can lead to a pattern of underreaction that varies with the level of uncertainty.

We thank Feng Li for providing us with the risk measure.

We use the 2-digit SIC industry classification. At least 10 firms in each industry are used to estimate the Dechow and Dechiv (2002) model. We also require at least four years of historical data to estimate the standard deviation of residuals.

We also redefined the information uncertainty measures into dummy variables similar to the way COMPLEX is defined. The significance of the information uncertainty variables gets weaker. FDR * COMPLEX remains highly significant.

References

Abarbanell, J., & Bernard, V. (1992). Test of analysts’ overreaction/underreaction to earnings information as an explanation for anomalous stock price behavior. Journal of Finance, 47(3), 1181–1207.

Asthana, S., Balsam, S., & Sankaraguruswamy, S. (2004). Differential response of small versus large investors to 10-K filings on EDGAR. Accounting Review, 79, 571–589.

Barber, B., & Lyon, J. D. (1997). Detecting long-run abnormal returns: The empirical power and specification of test statistics. Journal of Financial Economics, 43, 341–372.

Barberis, N., Shleifer, A., & Vishny, R. (1998). A model of investor sentiment. Journal of Financial Economics, 49, 307–343.

Bernard, V., & Thomas, J. (1989). Post-earnings announcement drift: Delayed price response or risk premium. Journal of Accounting Research, 27, 1–36.

Brandt, M., Kishore, R., Santa-Clara, P., & Venkatachalam, M. (2007). Earnings announcements are full of surprises. Working paper, Duke University.

Brav, A., & Heaton, J. (2002). Competing theories of financial anomalies. Review of Financial Studies, 15, 575–606.

Carhart, M. (1997). On persistence in mutual fund performance. Journal of Finance, 52, 57–82.

Chordia, T., & Shivakumar, L. (2006). Earnings and price momentum. Journal of Financial Economics, 80, 627–656.

Dechow, P., & Dichev, I. (2002). The quality of accounting and earnings: The role of accrual estimation errors. The Accounting Review, 77, 35–59.

Easton, P., & Zmijewski, M. (1993). SEC form 10K/10Q reports and annual reports to shareholders: Reporting lags and squared market model prediction errors. Journal of Accounting Research, 31, 113–129.

Fama, E., & French, K. (1992). The cross-section of expected stock returns. Journal of Finance, 47, 427–465.

Fama, E., & French, K. (1993). Common risk factors in the returns on stocks and bonds. Journal of Financial Economics, 33, 3–56.

Foster, T., Jenkins, D., & Vickrey, D. (1983). Additional evidence on the incremental information content of the 10-K. Journal of Business Finance and Accounting, 10(1), 57–66.

Francis, J., LaFond, R., Olsson, P., & Schipper, K. (2007). Information uncertainty and post-earnings-announcement-drift. Journal of Business Finance and Accounting, 34, 403–433.

Garfinkel, J., & Sokobin, J. (2006). Volume, opinion divergence, and returns: A study of post-earnings announcement drift. Journal of Accounting Research, 44, 85–112.

Givoly, D., & Lakonishok, J. (1980). Financial analysts’ forecast of earnings: The value to investors. Journal of Banking and Finance, 4, 221–233.

Gleason, C., & Lee, C. (2003). Analyst forecast revisions and market price discovery. The Accounting Review, 78, 193–225.

Griffin, P. (2003). Got information? Investor response to form 10-K and form 10-Q EDGAR filings. Review of Accounting Studies, 8, 433–466.

Hirshleifer, D. (2001). Investor psychology and asset pricing. Journal of Finance, 56, 1533–1598.

Hirst, E., & Hopkins, P. (1998). Comprehensive income reporting and analysts’ valuation judgments. Journal of Accounting Research, 36(Supplement), 47–75.

Hong, H., & Stein, J. (1999). A unified theory of underreaction, momentum trading and overreaction in asset markets. Journal of Finance, 54, 2143–2184.

Jegadeesh, N., & Titman, S. (1993). Returns to buying winners and selling losers: Implications for stock market efficiency. Journal of Finance, 48, 65–91.

Jiang, G., Lee, C., & Zhang, Y. (2005). Information uncertainty and expected returns. Review of Accounting Studies, 10, 185–221.

Li, F. (2006). Do stock market investors understand the risk sentiment of corporate annual reports? Working paper, University of Michigan.

Livnat, J., & Mendenhall, R. (2006). Comparing the post-earnings-announcement drift for surprises calculated from analyst and time-series forecasts. Journal of Accounting Research, 44, 177–205.

Mitchell, M., & Stafford, E. (2000). Managerial decisions and long-term stock price performance. Journal of Business, 73, 287–329.

McEwen, R., & Hunton, J. (1999). Is analyst forecast accuracy associated with accounting information use? Accounting Horizons, 13(1), 83–96.

Petersen, M. (2006) Estimating standard errors in finance panel data sets: Comparing approaches. Northwestern University Working Paper.

Plumlee, M. (2003). The effect of information complexity on analysts’ use of that information. The Accounting Review, 78, 275–296.

Qi, D., Wu, W., & Haw, I. (2000). The incremental information content of SEC 10-K reports filed under the EDGAR system. Journal of Accounting Auditing and Finance, 15, 25–46.

Rangan, S., & Sloan, R. (1998). Implications of the integral approach to quarterly reporting for the post-earnings announcement drift. The Accounting Review, 73, 353–371.

Sloan, R. (1996). Do stock prices fully reflect information in accruals and cash flows about future earnings? The Accounting Review, 71, 289–315.

Stice, E. (1991). The market reaction to 10-K and 10-Q filings and to subsequent the Wall Street Journal earnings announcements. The Accounting Review, 66, 23–41.

Stickel, S. (1991). Common stock returns surrounding earnings forecast revisions: More puzzling evidence. The Accounting Review, 66(April), 402–416.

Womack, K. (1996). Do brokerage analysts’ recommendations have investment value? Journal of Finance, 51(March), 137–167.

Zhang, F. (2006). Information uncertainty and stock returns. Journal of Finance, 61, 105–137.

Acknowledgments

This paper has benefited greatly from comments and suggestions of an anonymous referee, Patricia Dechow, Shai Levi, and Katherine Schipper (editor). The editorial assistance of Joseph Cadora and the financial support of the Center for Financial Reporting and Management at University of California are gratefully acknowledged.

Author information

Authors and Affiliations

Corresponding author

Rights and permissions

About this article

Cite this article

You, H., Zhang, Xj. Financial reporting complexity and investor underreaction to 10-K information. Rev Account Stud 14, 559–586 (2009). https://doi.org/10.1007/s11142-008-9083-2

Published:

Issue Date:

DOI: https://doi.org/10.1007/s11142-008-9083-2