Abstract

The literature shows that earnings have come to explain less stock price movement over time, suggesting that firm fundamental information has become less important. In this paper, we replace earnings with earnings announcement returns as a measure of firm fundamental news and find that these firm fundamentals have come to explain more price movement over time. In the years after 2003, earnings announcement returns explain roughly 20% of the annual return—almost twice as much as they did before, indicating that fundamental information has become more important, not less, in explaining stock returns. This pattern occurs for other forms of firm fundamental information. Collectively, the returns around earnings announcements, management guidance, analyst forecasts, analyst recommendations, and 8-K filings went from explaining 17% of annual returns on average in the late 1990s to 39% on average in the early 2010s. In exploring possible explanations for the increase in the explanatory power of fundamental information, we find evidence consistent with regulatory changes, such as new 8-K filing requirements and Sarbanes-Oxley, collectively making disclosures more informative.

Similar content being viewed by others

Avoid common mistakes on your manuscript.

1 Introduction

Stock prices can move in response to firm-specific fundamental news, such as earnings announcements and business acquisitions; market-wide information, such as Treasury rates and commodity prices; or nonfundamental factors, such as noise trading and irrational investor behavior. How much of the movement in stock prices is explained by firm fundamental news, as opposed to market news and nonfundamental factors? And how has the amount explained by firm fundamentals changed over time? These questions are important to the accounting and finance literatures, because the accounting profession focuses on firm fundamental variables reflected in the accounting system and standard theory suggests that stock prices should converge toward fundamental values in equilibrium. Yet the accounting literature has lamented the low relevance of summary fundamental variables, such as earnings, to stock prices (Ball and Brown 1968; Lev 1989) and has suggested that the primary role of accounting is perhaps not to provide new information to the capital markets but to play important contracting and confirmatory roles (Ball and Shivakumar 2008; Beyer et al. 2010). In this paper, we try to quantify the importance of firm fundamental information in explaining stock returns and to examine how the relative importance of this information has changed over time.

Starting from Ball and Brown (1968), the literature has focused on earnings to examine the relationship between firm fundamental information and stock returns. Although earnings is, conceptually, a good measure of firm performance, the literature shows that the correlation between returns and earnings has declined in the past 50 years (Collins et al. 1997; Francis and Schipper 1999; Lev and Zarowin 1999). Recent work also shows that one-time and non-operating items have become a larger part of earnings, making earnings a noisier measure of firm performance (Bushman et al. 2016). Confronted with these results, some might conclude that firm fundamental information has become less important in explaining stock returns over time (e.g., Lev 1989; Dichev and Tang 2008). However, a low correlation between earnings and stock returns does not prove that investors ignore firm fundamentals. Maybe earnings just poorly summarizes firm fundamental news.

In this paper, we do not use earnings as a summary measure of firm fundamental news. Rather, in the vein of Ball and Shivakumar (2008), we measure firm fundamental news as the return at the time the news is announced and quantify its explanatory power using the R2s from regressions of annual returns on these announcement day returns.Footnote 1 Conceptually, our measure of firm fundamental news captures firm-specific (and to a lesser degree industry-wide) fundamental information contained in the announcement, including both accounting and non-accounting information, and both current and future period information. Our measure does not capture (1) firm-specific fundamental information that is leaked to investors prior to the disclosure, (2) market-wide fundamental information, and (3) nonfundamental factors affecting stock prices, such as noise trading and idiosyncratic investor irrationality. Intuitively, there are three reasons why announcement-date returns, as opposed to earnings, provide a better summary measure of firm fundamental news. First, announcement returns capture the market’s surprise with less measurement error than earnings changes and analyst forecast errors do. Second, announcement returns contain different types of fundamental news—both quantitative and qualitative financial information, and both current and future fundamental news. Finally, the relationship between annual returns and announcement returns is more homogeneous across firms than the relationship between annual returns and earnings surprises.Footnote 2 Such homogeneity is necessary to accurately measure the explanatory power of firm fundamentals in a linear regression framework.

When we use earnings announcement returns to proxy for firm fundamental news, we find that fundamental information explains a large fraction of annual stock returns. And, contrary to tests that use earnings as a proxy, we find that this fraction has recently become much larger. The power of earnings announcement returns to explain annual returns almost doubled around 2004 and has remained high ever since (other than during the financial crisis). We explore various potential reasons for this large increase and propose that earnings disclosures likely became more informative, because of regulatory changes, such as the Sarbanes-Oxley Act (SOX) and new mandatory 8-K filings related to earnings announcements.

To begin our tests, we replicate the finding in the literature that earnings now explain less stock price movement. When we regress annual returns on earnings changes, we find that adjusted R2s have gradually declined over time. This decline has been dramatic—earnings changes went from explaining 18% of annual returns in 1973 to only about 2% of annual returns in recent years. On its face, this finding suggests two possibilities: either earnings has become a worse summary measure of fundamental news, or fundamental news has become less important to investors. Our results support the first possibility, since we find evidence in later tests that fundamental news has recently become more important, not less.

When we regress annual returns on earnings announcement returns, instead of earnings changes, the adjusted R2s follow a different pattern. Rather than gradually decreasing, they remain flat at between 10% and 15% from 1973 to 2003 and then jump to between 20% and 25% in the years after 2004 (other than during the financial crisis).Footnote 3 This evidence suggests that firm fundamentals, if anything, are more important now than in 1973. It also suggests that earnings announcement disclosures, as a whole, convey a large amount of value-relevant information. After 2003, the four earnings announcements alone explain roughly 20% of the variation in annual returns. Earnings changes, in contrast, explain only 2%. So while returns indicate that earnings announcement disclosures are quite informative (in total), the earnings number itself does not capture much of this information. We explore why the trends are so different for earnings changes versus earnings announcement returns. We find evidence that earnings changes have become noisier and capture less news about future cash flow over time. The variance of earnings changes has increased over time, and earnings changes are now more likely to reverse than in the past. In contrast, after 2003, earnings announcement returns now provide more information about future cash flow news.

The increase in explanatory power is not restricted to earnings announcements. We also find it with management guidance, 8-K filings, and analyst reports. Thus the explanatory power of firm-specific fundamental news appears to be increasing in general. Altogether, earnings announcements, management guidance, analyst reports, and 8-K filings explain 39% of the annual return, on average, in the early 2010s as opposed to 17%, on average, in the late 1990s. We posit that 39% serves as a lower bar for the ability of firm fundamentals to explain stock returns, as we do not include all value relevant information events in our analysis, which is empirically impossible to do.

The observed pattern of fundamental news explaining the annual stock return suggests a regime shift in the early 2000s. In a series of exploratory tests, we examine the following potential reasons for the increase in explanatory power: (1) regulatory changes, including SOX 404 and the SEC’s requirement that firms file 8-Ks for their earnings announcements; (2) an increase in management guidance bundled with the earnings announcement; and (3) a change in sample composition. We find support for the first of these potential reasons, with evidence suggesting that regulatory changes in the early 2000s make disclosures more informative. In particular, SEC release No. 33–8176 in 2003 mandated 8-K filings for earnings announcements, representing a regime shift that fits well with the observed regime shift in the power of earnings announcements in explaining variation in annual stock returns. We demonstrate, in a difference-in-differences analysis, that firms that filed more of these 8-Ks in their earnings announcement windows experienced a much larger increase in explanatory power than other firms. Similarly, for SOX 404, we use another difference-in-differences analysis to demonstrate that firms experienced a greater increase in explanatory power if they were subject to SOX 404’s requirement that managers and auditors attest to the firm’s internal controls. In contrast, we do not find consistent evidence that the sudden increase in explanatory power came from bundled management guidance or changes in the sample of firms. We recognize that we may not have considered other explanations. For example, Regulation FD, which was promulgated in 2000, might have needed a few years to begin preventing information leaks. Thus the regulatory changes we examine might not be the exclusive explanation.

This paper’s main takeaway is as follows. Although earnings, as a summary measure, has become less useful over time, due to increased noise and one-time items (Bushman et al. 2016), firm fundamental information still matters to capital markets. In fact, it has recently become much more important. Before 2003, the four earnings announcements explained between 10% and 15% of the annual return. Now they explain between 20% and 25% of it. And that is when we restrict the analysis to earnings announcement news. When we construct a broad measure of firm fundamental news that includes earnings announcements, management guidance, analyst forecasts and stock recommendations, and 8-K filings, the percentage of annual returns explained by firm fundamental news increases from 17%, on average, in the late 1990s to 39%, on average, in the early 2010s. Based on this result, we believe that researchers should reevaluate the prevailing view in the literature that accounting disclosures do not provide much new information to capital markets. Echoing Kinney et al. (2002), Ball and Shivakumar (2008), and Basu et al. (2013), we also promote the use of earnings announcement returns as a summary measure of earnings news. The near-zero adjusted R2s of earnings-return regressions in recent years indicate that the earnings number is not a good summary measure. Recent papers (e.g., Kishore et al. 2008; Thomas et al. 2020a), use earnings announcement returns as a measure of earnings news.

Our study relates to the work of Beaver et al. (2018, 2019), Hand et al. (2018), and Thomas et al. (2020b), who focus on abnormal return volatility at earnings announcements (i.e., the U-statistic) to study earnings informativeness. While Beaver et al. (2018) and our paper suggest that earnings announcements have become more informative since the 2000s, we study different underlying constructs and document different results. Empirically, the U-statistic captures the information that is immediately impounded into the stock price at the time of the earnings announcement. Any systematic under- or overreaction to earnings news affects the U-statistic, but it should not affect the R2 in our regressions.Footnote 4 Our analysis shows an average mis-reaction of 12% in our sample period, which we correct for in our measure. Another important issue that impacts the U-statistic, but not our approach, is that the finance literature has documented a dramatic decline in idiosyncratic return volatility since 2000 (e.g., Bekaert et al. 2012; Schwert 2011; Bartram et al. 2018). Indeed, Thomas et al. (2020b) show that the decline in idiosyncratic volatility, which is the denominator of the U-statistic, explains the rise in the U-statistic since 2000. To the extent that idiosyncratic volatility does not affect aggregate non-announcement or announcement returns, any change in idiosyncratic volatility should not affect our R2 measure.Footnote 5 Not surprisingly, the time-series patterns of earnings informativeness documented by the U-statistic and R2 approaches are quite different. While we show a regime shift in the R2 around 2004, Beaver et al. (2018) and others document a steady increase in the U-statistic since 2000.Footnote 6 Our R2 approach also has the benefit of quantifying the percentage of annual returns explained by firm fundamental information, which is particularly important as we aim to answer the broad question of how much variation in stock returns can be explained by firm fundamentals, whereas the U-statistic approach only shows whether the measure is significant. Finally, we explore a different perspective—regulatory changes, which complements increasing concurrent disclosures in Beaver et al. (2019) and increasing dissemination of value relevant information in analysts’ forecasts in Hand et al. (2018) to explain the observed time-series patterns.

The rest of the paper is organized as follows: Section 2 discusses related literature, Section 3 discusses the data, Section 4 discusses our research design and main empirical findings, Section 5 explores potential explanations, and Section 6 concludes.

2 Related literature and empirical predictions

2.1 Related literature

Capital markets research in accounting has long focused on the role of earnings in explaining stock returns. The literature, starting from Ball and Brown (1968), shows that stock prices respond to earnings. Since then, a huge literature has developed on the earnings-return relationship (e.g., the earnings response coefficient). The focus on earnings makes intuitive sense, as earnings are a summary performance measure that captures the profit attributable to shareholders. One strand of earnings-return research related to our paper investigates changes in the value-relevance of earnings and other financial metrics over time. This literature generally finds that the value-relevance of earnings has decreased over time, though it finds mixed evidence on changes in the value-relevance of book values.

Collins et al. (1997) explore the power of earnings and book values to explain prices from 1953 to 1993. While they find, as we do, that the value-relevance of earnings has declined, they also find that the value-relevance of book values has increased. They attribute this to the increasing frequency of losses and one-time items. Francis and Schipper (1999) also find that the value-relevance of earnings declined from 1952 to 1994, but the value-relevance of balance sheet information increased. Brown et al. (1999) call the Collins et al. (1997) results into question, demonstrating that per-share scaling and the use of levels, rather than changes drive the increase in balance sheet value-relevance, as measured by R2s. Once they control for scale effects, they find that the value-relevance decreased over time. Furthermore, Lev and Zarowin (1999) demonstrate that, even without this adjustment, balance sheet value-relevance decreased from 1977 to 1996, meaning that the increase found in prior studies was driven by the 1950s, 1960s, and early 1970s. Core et al. (2003) also find declining value-relevance in the late twentieth century. They demonstrate that traditional financial variables explain less equity value variation during the second half of the 1990s than in earlier periods.

More recently, a number of papers examine the time-series pattern of accounting properties. For example, Dichev and Tang (2008) document a continuous and pronounced decline in the contemporaneous correlation between revenues and expenses from 1967 to 2003. Bushman et al. (2016) find that the negative correlation between accruals and cash flows has dramatically declined from about 70% in the 1960s to near zero in more recent years. A key property of accrual accounting is to smooth temporary timing fluctuations in operating cash flows, so a reduction in the negative correlation suggests a reduction in smoothing. Bushman et al. (2016) find that increases in one-time and non-operating items as well as the frequency of loss firm-years explain the majority of the overall decline. These changes in accounting properties are consistent with the decline in the power of earnings to explain stock returns.

Another line of research uses abnormal trading volume and abnormal return volatility (the “U-statistic”) around earnings announcements to measure their information content. Beaver (1968) shows that both volume and return volatility are higher during earnings announcements than during non-earnings announcement periods. Landsman and Maydew (2002) find that their three-day U-statistic increases over time, indicating that earnings announcements have become more informative. Francis et al. (2002) conclude that this increase in information content comes from more concurrent disclosure in earnings announcements, whereas Collins et al. (2009) show that the increase relates to the intensity of the market’s reaction to Street earnings. More relevant to our study, Beaver et al. (2018) show that their three-day cumulative U-statistic experiences a dramatic increase from 2001 onward. Beaver et al. (2019) show that increases in U-statistic are associated with concurrent disclosures—management guidance, analyst forecasts, and disaggregated financial statement line items—being more frequently bundled with earnings announcements over time. Hand et al. (2018) show that analyst forecast data feeds have become richer and deeper over time and that this change in analyst forecasts helps to explain abnormal squared returns and abnormal trading volume around earnings announcements. Thomas et al. (2020b) provide a framework to understand what drives the U-statistic, and they show that the ratio also reflects variation in trading noise, normal information arrival, and investor under- and overreaction. We complement these studies by using a different approach to study the informativeness of earnings announcements and to answer a broader question of how much variation in stock returns can be explained by firm fundamental information.Footnote 7

2.2 Empirical specification and predictions

Conceptually, stock prices could change because of fundamental news that is specific to the firm, fundamental news that is common across firms, or nonfundamental reasons. Nonfundamental reasons include liquidity trading, noise trading, investor irrational behavior, and other factors unrelated to fundamentals. Fundamental news that is common across firms includes market-wide information. Firm-specific fundamental news includes both hard and soft financial information that is specific to a firm’s fundamentals, such as sales, earnings, cash flows, and growth. This firm-level news can relate to both information about the current period and adjustments to expectations about future periods. Since our main empirical specification is to regress annual returns on earnings announcement returns, following Ball and Shivakumar (2008), we essentially examine how much annual stock returns can be explained by firm-specific fundamental news released during earnings announcements. Our specification does not capture firm-specific information leaked to the market prior to the announcement, market-wide information captured in the announcement, or nonfundamental factors.Footnote 8

Given that annual logarithmic returns are just the sum of daily logarithmic returns, our empirical specification has intuitive predictions. If daily returns are i.i.d.,Footnote 9 then the adjusted R2 of the regression is just the fraction of trading days included in the explanatory variables. Therefore, when we regress annual returns on earnings announcement returns, the adjusted R2 should be 4.76% (= 12/252), given that there are 252 trading days on average and four quarterly earnings announcements have 12 trading days. If earnings announcements contain new fundamental information and investors value it, then we can partition trading days into information days and non-information days. We predict that the adjusted R2 of the regression is larger than 4.76% for information days. When we construct pseudo earnings announcements from non-information days, we expect the adjusted R2 to be smaller than 4.76%.

In addition to our clear predictions, our R2 approach has additional advantages. One advantage of our regression specification is to transform a nonlinear relationship between stock returns and fundamental news into a linear one. Specifically, as logarithmic annual returns are the sum of logarithmic daily returns, the relationship between logarithmic annual returns and logarithmic earnings announcement returns is linear, as opposed to a potentially nonlinear relationship between stock returns and traditional earnings surprise measures, such as seasonally differenced earnings and analyst forecast errors. Another advantage of our specification is that earnings announcement returns capture not only earnings surprises but also other firm fundamental news, such as expanded disclosure of the income statement and the balance sheet or guidance of next quarter performance, released upon earnings announcements. In that sense, earnings announcement returns are a more comprehensive measure of firm fundamental news than earnings surprises, which is the focus of the prior literature.

3 Data

Returns data, which we use in each of our tests, come from CRSP. Annual earnings and earnings announcement dates are from Compustat and are available starting in 1973. The sample for our main tests consists of 167,893 firm-year observations for publicly-listed US firms (i.e., shrcd = 10 or 11 in CRSP) from 1973 to 2017. Descriptive statistics for this sample are in Panel A of Table 1. Panel B of Table 1 contains correlations of some key variables in the data. The correlation between annual returns and earnings announcement returns is higher than the correlation between annual returns and earnings changes. Both of these correlations are higher than the correlation between earnings changes and the earnings announcement return.

Some of the tests use announcement dates for other types of information. Data on analyst forecasts and recommendations come from I/B/E/S and are available beginning in 1982. Data on management guidance come from I/B/E/S Guidance and are available starting in November 1992. However, our tests using this data start in 1995, since, in early years, less than 10 firms have guidance bundled with the earnings announcement. For our tests using this guidance data, we have 112,307 firm-years from 1995 to 2017.

Data on filing dates for SEC filings, including 8-Ks, come from the S&P Filing Dates dataset, which is available on WRDS. This dataset was last updated in August 2016, and WRDS confirmed that it has no plans to update the dataset in the future. There is sufficient filing data starting in 1994, and the last full year with available data is 2015. Thus all of our tests that use 8-K filing dates run from 1994 to 2015.

4 Main empirical analysis

In our main analysis, we focus on earnings, which may be the most important piece of firm fundamental news. It is certainly the piece that is most central to accounting. We consider two proxies for earnings news. One is earnings changes, a traditional measure of earnings surprises that is widely used in the literature.Footnote 10 The other is earnings announcement returns. We measure the importance of earnings news as the R2 from a regression of annual stock returns on either earnings changes or earnings announcement returns. For each regression, this R2 can be thought of as the fraction of annual stock returns that is explained by earnings or by fundamental information released in the four earnings announcements. We run these regressions on the cross-section of firms each year to see how the R2 has changed over time. In the earnings announcement return regressions, we use both arithmetic returns and logarithmic returns, though we prefer logarithmic returns, since the annual logarithmic return is a linear function of the daily logarithmic returns. As discussed earlier, if the daily returns were i.i.d., then we would expect the R2 to equal the fraction of the year’s trading days that are in the announcement window. The fraction of a year’s days that are earnings announcement days is fixed.

4.1 Changes in the explanatory power of earnings over time

We begin by confirming that earnings changes have become less important in explaining stock returns over time. Each year from 1973 to 2017, we run the following cross-sectional regression.

RET is a firm’s annual return starting three months after the prior fiscal year end.Footnote 11∆E is earnings changes, measured as earnings before extraordinary items in year t minus earnings before extraordinary items in year t-1, scaled by average total assets. Results from each annual cross-sectional regression are in Table 2, Panel A, and the adjusted R2s from these regressions are plotted in Fig. 1. Consistent with the literature, the R2 has decreased steadily from about 18% in 1973 to about 2% in recent years, indicating that earnings changes explain less of the annual return than they used to. Panel B of Table 2 confirms this with a time-series regression of the adjusted R2s on a time trend variable counting the number of years since 1973. This regression estimates that the adjusted R2 decreased by an average of 0.33 percentage points each year from 1973 to 2017. In untabulated tests, we have found that the R2s exhibit the same declining pattern when we measure earnings changes excluding Compustat special items and when we use analyst forecast errors instead of earnings changes.Footnote 12

The relation between annual returns and earnings changes. This figure plots the adjusted R2 from RETi, t = β0 + β1∆Ei, t + ei, t, which is estimated annually. RET is a firm’s annual returns starting three months after the prior fiscal year-end. ∆E is earnings changes, measured as earnings before extraordinary items in year t minus earnings before extraordinary items in year t-1 scaled by average total assets. The sample includes 167,893 firm-year observations for publicly listed U.S. firms (shrcd = 10 or 11) with nonmissing RET, ARET, and ∆E from 1973 to 2017. Each year, ∆E is Winsorized at 1% and 99%. Table 2 contains regression results

4.2 Changes in the explanatory power of earnings announcement returns over time

In this section, we use the earnings announcement return as a summary measure of firm fundamental news revealed during an earnings announcement. We run the following cross-sectional regression each year from 1973 to 2017.

As before, RET is a firm’s annual return starting three months after the prior fiscal year-end. ARET is the earnings announcement return, measured as the sum of three-day [−1, 1] announcement window returns across the four quarterly earnings announcements, where day 0 is the earnings announcement date. Panel A of Table 3 shows the results for this regression each year. We include this specification with arithmetic returns to match the regression in Table 2.

In Panel B, we show regression results for our preferred specification, which uses logarithmic returns, as follows.

The left-hand side is simply the annual logarithmic return. On the right-hand side, log(1 + ARET) is the sum of three-day window logarithmic returns across the four earnings announcements. As logarithmic annual returns equal the sum of logarithmic daily returns, Eq. (3) is a linear regression with a natural interpretation.

Figure 2 plots the adjusted R2s from these regressions. Panel A shows the R2s from the arithmetic return specification, and Panel B shows them from the logarithmic return specification. Unlike the R2s from the yearly change-in-earnings regressions, these R2s do not change significantly between 1973 and 2003. This suggests that, even as the importance of earnings diminishes over the years, the importance of firm fundamental information released during earnings announcements does not. Even more striking, both Panels A and B show that the explanatory power of earnings announcement returns almost doubles in 2004. The increase also appears to be permanent, since it has persisted to the present. In the logarithmic return specification, the R2s are higher every year after 2004 than they were in any year before, other than during the 2008–2009 financial crisis.

The relation between annual returns and earnings announcement returns. Panel A: Annual adjusted R2 from RETi, t = β0 + β1ARETi, t + ei, t. Panel B: Annual adjusted R2 from log(1 + RETi, t) = β0 + β1 log(1 + ARETi, t) + ei, t. Panel A plots the annual adjusted R2 from RETi, t = β0 + β1ARETi, t + ei, t, whereas Panel B plots the annual adjusted R2 from log(1 + RETi, t) = β0 + β1 log(1 + ARETi, t) + ei, t. RET is a firm’s annual returns starting three months after the prior fiscal year-end. ARET is earnings announcement returns, measured as the sum of three-day [−1,1] returns across four quarterly earnings announcements, where day 0 is the earnings announcement date. In the logarithmic specification (Panel B), log(1 + ARET) is the sum of logarithmic returns across the four quarterly announcement windows. The sample includes 167,893 firm-year observations for publicly listed U.S. firms (shrcd = 10 or 11) with nonmissing RET, ARET, and ∆E from 1973 to 2017. Table 3 contains regression results

We believe that the short-lived drop in R2 during the financial-crisis years should receive less weight when assessing whether the increase in R2 is permanent. The financial crisis was an uncommon event where market conditions were very different from normal. The explanatory power of earnings announcements could be lower during the crisis, because of larger shifts in investor sentiment and risk premium and because of larger transitory items contained in earnings. However, these conditions would disappear once the crisis ended. In Fig. 2, we see that the high post-2003 R2 prevails both before and after the crisis.

Ball and Shivakumar (2008) also notice an R2 increase in 2004, but their data only runs up to 2006, so it is unclear whether they are witnessing a temporary or permanent change. Figure 2 shows that the change appears to be permanent.

It is also useful to examine the coefficient estimate on logarithmic announcement returns over time. If there is no under- or overreaction to earnings news, the coefficient should be equal to 1. As a measure of the degree of mispricing, we take the absolute value of the difference between the β1 estimates in Panel B of Tables 1 and 3. We find that the average degree of mispricing is 12%.

In Panel C of Table 3, we regress the adjusted R2s from Panels A and B on Time, a trend variable that counts the number of years since the beginning of the sample. For both the arithmetic return and logarithmic return specifications, we find that the R2’s increase significantly over time. In a separate regression, we add an indicator, POST2003, that turns on for all years after 2003. This indicator has a significant positive coefficient in both specifications, estimating an increase in R2s of about 8% after 2003. The coefficient on Time becomes insignificant or marginally negative, indicating there is no general increasing trend other than a regime shift caused by some events in the early 2000s.Footnote 13

To confirm that our earnings announcement return results are not driven by a change in the cross-correlation of daily returns within a year, we re-perform our main analysis, in an untabulated test, with pseudo earnings announcement days that are either 35 days before the earnings announcement or 35 days after (exactly five weeks in either direction to ensure the same weekday). Each year from 1973 to 2017, we perform the following regression.

RET is a firm’s annual returns starting three months after the prior fiscal year-end. ARET_PSEUDO is pseudo earnings announcement returns, measured as the sum of three-day [−1,1] returns across four pseudo quarterly earnings announcements, where day 0 is the earnings announcement date plus or minus 35 days. In this untabulated test, we find that the average adjusted R2s are 2.4% and 2.6% for the two pseudo events of +35 and − 35 days, respectively. Consistent with our prediction, average adjusted R2s are smaller than 4.76% (=12/252), as there is no new information released during these two pseudo windows. It makes sense for the adjusted R2s to be smaller than—rather than equal to—4.76% because the earnings announcements already explain more than their fair share of the annual return. Crucially, in the regressions with pseudo earnings announcements, we do not observe any dramatic increase in the adjusted R2s in 2004, indicating that the results with real earnings announcements are unlikely to be driven by changes in the cross-correlation of daily returns. We have also run a time-series regression of the R2’s from the pseudo regressions on Time, and we found no clear trend over time, indicating that the main earnings announcement return results are not driven by a change in the cross-correlation of daily returns.

4.3 Why is there a different trend for earnings changes versus earnings announcement returns?

We conduct two tests to illuminate why the relation between earnings and returns has been weakening, even though earnings announcements now contain more information. The first test is to decompose the R2 into variance and covariance terms, as follows.

where, as above, RET is the annual return, ΔE is the change in earnings and ARET is the earnings announcement return. Then we examine the time-series pattern of these variance and covariance terms by regressing them on Time, measured as the number of years since 1973.

The results are shown in Table 4. Panel A shows the results when we decompose the R2 values obtained from regressions of RET on ΔE. Both COV(RET, ΔE) and VAR(RET) are relatively stable over time in the sample period, whereas VAR(ΔE) increases significantly over time. The increase in VAR(ΔE) leads to the decline in R2 for the regressions of RET on ΔE. Panel B shows the results when we decompose the R2 values obtained from regressions of RET on ARET. COV(RET, ARET) is strongly increasing over time. This explains the increase in R2 over time, since the increase in VAR(ARET) acts to depress the R2. Overall, these results suggest that the declining relationship between returns and earnings changes is due to the increasing variance of earnings changes, whereas the increasing informativeness of earnings announcement returns is due to the increasing covariance between annual returns and earnings announcement returns.

Next, we turn to our second test that examines the annual return’s changing relationship with earnings changes versus earnings announcement returns. For this test, we examine how much information on future cash flow news and discount rate news is captured in ΔE and ARET and how this information content changes over time. As proxies for future cash flow news, we use analysts’ revisions around the earnings announcement of the next-quarter earnings forecast (REV(FQ1)),Footnote 14 and we use the actual future change in earnings from year t to year t + 1 (ΔE). As a proxy for future discount rate news, we use the actual future change in stock volatility from year t to year t + 1 (ΔRVOL).Footnote 15

These three proxies appear on the left-hand side of the following three regressions, which we run cross-sectionally each year, as follows.

where X is either the current change in earnings (ΔE) or the earnings announcement return (ARET).Footnote 16 The results from these regressions are reported in Table 5. For the results in Panel A, X is earnings changes (ΔE). For the results in Panels B and C, X is the earnings announcement return (ARET).

In Panel A, we find that the correlation between current changes in earnings (ΔE) and analyst forecast revisions for future earnings (REV(FQ1)) has become less positive over time, suggesting that earnings changes have become less informative about changes in future cash flows. When we regress the R2 values from the REV(FQ1) regressions on a time trend variable (untabulated), we find that the coefficient on the time trend is −0.00195 (t = −5.26). In the results for the regressions with the future change in earnings (ΔE) on the left-hand-side, we find that the coefficient on the current change in earnings has become more negative over time, suggesting that earnings have become more transitory over time and that earnings changes now exhibit a larger reversal. Finally, the results for the ΔRVOL regressions suggest that earnings changes are slightly negatively correlated with future changes in volatility and that the negative correlation does not change much over time.

For Panels B and C, the right-hand-side variable in the regressions becomes the earnings announcement return (ARET). These panels show that earnings announcement returns capture more news about future cash flows after 2003 than before but not more news about risk. Panel B shows the coefficients on ARET and the adjusted R2s each year for each of the three regressions. Panel C shows the results when we regress the adjusted R2s from Panel B on Time, a time-trend variable that counts the years from the beginning of the sample, and POST2003, an indicator that turns on for all years after 2003. In Panel C, the coefficient on POST2003 is positive and relatively significant for forecast revisions (REV(FQ1)) and future changes in earnings (ΔE), suggesting that earnings announcement returns got better after 2003 at providing information about future cash flows. On the other hand, the coefficient on POST2003 is insignificant for the future change in volatility (ΔRVOL), suggesting that earnings announcement returns got no better after 2003 at providing news about future discount rates.

Taken together, the results in Table 5 suggest that earnings announcement returns became more informative about future changes in cash flows after 2003, whereas earnings changes have become more transitory and are now less informative about future changes in cash flows. These results are well in line with our key finding that the relation between annual returns and ΔE is worsening over time but the relation between annual returns and ARET is improving.

4.4 The total explanatory power of firm fundamental information

In this section, we estimate the amount of stock return variation that is explained by all disclosures of firm fundamental information. We examine the information that is released in earnings announcements, management guidance, analyst forecasts and recommendations, and 8-K filings. Arguably, there are many other sources of firm fundamental information released to the market, so our estimates in this section serve as a lower bar regarding the importance of firm fundamental information in explaining stock returns. We perform the following cross-sectional regression each year from 1994 to 2015.

RET is a firm’s calendar annual return. Log(1 + ARET_all) is the sum of announcement day logarithmic returns on information event days, which include days in the three-day earnings announcement window as well as days with management guidance, analyst forecasts, analyst recommendations, and 8-K filings. The sample period is limited to between 1994 and 2015 because of our 8-K filings data, which comes from the S&P Filing Dates dataset on WRDS. This dataset was last updated in August 2016, and WRDS has no plans to update.

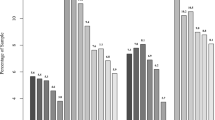

In Fig. 3, we plot the R2s from the annual regressions and the average fraction of days in the firm-year that contain information events as well as the difference between the R2 and this benchmark. This difference is the amount in excess of what the R2 would be if daily returns were i.i.d., so it estimates the proportion of annual returns that these fundamental disclosures explain. Figure 3 shows that the R2 for all firm fundamental information increased from an average of 17% in the late 1990s to an average of 39% in the early 2010s. There was an increase from around 25% right before 2004 to around 35% in the years between 2004 and the start of the financial crisis. The difference between the R2 and the benchmark, which is captured by the dotted purple line, indicates that between 20 and 30% of the annual return is explained by news that comes out on these event days, starting in 2004 (excluding the financial crisis). We view this percentage as a lower bound, since it excludes any firm fundamental information that is leaked privately or that is publicly disclosed in some other form not considered here. Overall, an impressive portion of variation in stock returns is explained by firm fundamental information, highlighting the importance of this information in capital markets.

Regressions of annual returns on returns during all information days. The solid blue line reports the adjusted R2 from the following regression, which is estimated each year. RET is a firm’s calendar annual return. Log(1 + ARET_all) is the sum of announcement day logarithmic returns on days that contain an information event, which includes the earnings announcement window (day −1 to day +1) and days with management guidance, analyst forecasts, analyst recommendations, and 8-K filings. The dashed red line plots ratio_info_days, the average fraction of information event days in a year. The dotted purple line plots the difference between the solid blue line and the dashed red line and represents the proportion of annual returns explained by the fundamental information disclosed on event days. The sample has 120,439 firm-years for publicly listed U.S. firms (shrcd = 10 or 11) from 1994 to 2015 with nonmissing data. The S&P filing data are from wrds.wharton.upenn.edu, but were last updated in August 2016. (WRDS confirmed that it has no plans to update the dataset.)

5 Potential reasons for the increased importance of fundamental information

To explain an increasing trend in the U-statistic, Beaver et al. (2019), Hand et al. (2018), and Thomas et al. (2020b) consider a number of factors including increasing concurrent disclosures around earnings announcements, increasing dissemination of value relevant information in analysts’ forecasts, and trading noise. While these factors are certainly possible explanations, we focus on potential explanations for the regime shift in explanatory power that we observe in the early 2000s, as opposed to the increasing trend in the U-statistic.Footnote 17

We explore a number of potential explanations for the higher R2s in the post-2003 period. One possibility is that information released during earnings announcements becomes more informative because of regulatory changes in the early 2000s. Other possibilities include concurrent management guidance and changes in the sample composition.

5.1 Regulatory changes

There was a tsunami of accounting scandals at the beginning of the millennium. The list includes Adelphia, AOL, Bristol-Myers Squibb, Computer Associates, Dynegy, Enron, HealthSouth, Qwest, Rite Aid, Sunbeam, Tyco, Waste Management, WorldCom, and Xerox, with Enron and WorldCom being the most familiar, due to the scope and audacity of their deficient reporting. In response, the United States introduced the most substantial change in the regulation of public financial reporting in 75 years, under the Sarbanes-Oxley Act of 2002, and created the Public Company Accounting Oversight Board (PCAOB) with almost unfettered powers to adopt and enforce rules governing the audit industry and to discipline audit firms and employees. These regulatory changes aimed to improve the quality of financial disclosure and the information environment in the capital markets. We posit that these regulatory changes made disclosures more informative and thus increased the explanatory power of earnings announcement returns.

5.1.1 8-Ks become required for earnings announcements (SEC release no. 33–8176)

The observed regime shift around 2003 coincides with the newly required 8-K filings related to earnings announcements. Specifically, Section 409 of Sarbanes-Oxley mandates the public disclosure, in plain English and on a rapid and current basis, of all material changes to a firm’s financial conditions or operations. In response, the SEC promulgated SEC release No. 33–8176 in 2003, requiring firms to furnish a Form 8-K within five business days of any public disclosure related to fiscal period results of operations. This new rule introduced a regime shift in Form 8-K filings related to earnings announcements. Prior to 2003, firms typically announced their earnings in press releases without filing a Form 8-K. Post 2003, firms have to file a Form 8-K related to their earnings announcements. Lerman and Livnat (2010) show that nearly 65% of earnings-related 8-Ks (Item 2.02, “Results of Operations”) are filed within one business day of the disclosure of this information to the public, indicating the timeliness of 8-K filings. Lerman and Livnat (2010) also find that the new SEC 8-K guidance increased the information content of periodic reports, as reflected in both trading volume and return volatility around these reports. In Fig. 4, Panel A, we plot the average, each year, of the number of 8-Ks filed during a firm’s four earnings announcement windows. The average number of 8-Ks filed during a firm’s earnings announcement windows over the year goes from less than one 8-K before the rule change to more than three 8-Ks after.

Analysis of 8-Ks filed during earnings announcement windows. Panel A: Average number of 8-Ks during earnings announcement windows per year. Panel B: The effect of concurrent 8-K filings on the variation of annual returns explained by earnings announcement returns. Panel A reports the average, each year, of the number of 8-Ks filed during a firm’s four earnings announcement windows (day t-1 to t + 1, where t is the day of the earnings announcement). Panel B reports the adjusted R2 from the regression of the annual return on earnings announcement returns each year for three samples: all observations, a subsample of observations with concurrent 8-K filings no more than 25% of the time (one out of four quarters), and a subsample of observations with concurrent 8-K filings at least 75% of the time (three out of four quarters). The S&P filing data are from wrds.wharton.upenn.edu but were last updated in August 2016. (WRDS confirmed that it has no plans to update the dataset.) Our sample for this figure contains 100,777 firm-years from 1994 to 2015

8-K filings provide a centralized information system that facilitates investors’ locating and disseminating information. In addition, SEC filings may discipline firm disclosure. As a result, the mandate of 8-K filings for earnings announcements could increase the market’s reaction to earnings information. Furthermore, the 8-Ks could induce the firms to include more information than was previously included in the earnings press releases.

While most firms file Form 8-Ks related to earnings announcements in a timely fashion, we explore variations in the timeliness of 8-K filings to assess the impact of concurrent 8-K filings on the adjusted R2 in our regressions. As firms have five business days to file a Form 8-K once they announce their earnings, some firms will file their 8-Ks outside of the [−1,1] three-day earnings announcement window. Whether the firm files the 8-K in the three-day window could affect the information content in the earnings announcement return. This could be because the 8-Ks have new information that could not be reasonably anticipated based on the earnings announcement press release. In this case, releasing the 8-Ks at the time of the earnings announcements will increase the total amount of information coming out during the announcements, as opposed to other times during the year, and this will increase the R2 in a regression of annual returns on earnings announcement returns.Footnote 18

We first construct two subsamples based on how many 8-Ks are filed within the three-day earnings announcement window: one subsample of observations with concurrent 8-K filings no more than 25% of the time (i.e., one out of four quarters) and another of observations with concurrent 8-K filings at least 75% of the time (i.e., three out of four quarters). Figure 4, Panel B, plots the adjusted R2s of Eq. (3) for these two subsamples as well as the full sample. We find that, except for the 2008–2009 financial crisis, the adjusted R2 is higher every single year for the more concurrent 8-K subsample than for the full sample but is lower every single year for the less concurrent 8-K subsample than for the full sample. Indeed, the adjusted R2 is around 14% for most years in the post-2003 period for the less concurrent 8-K subsample, a number comparable to the average adjusted R2 in the pre-2003 period for the full sample. On the other hand, the adjusted R2 is substantially higher in the post-2003 period for the more concurrent 8-K subsample, driving the regime shift in the adjusted R2 around 2003 for the full sample.

We formally test the effect of concurrent 8-K filings in a difference-in-differences test, where we compare the change in the R2s around the rule change between firms that tend to file their 8-Ks in the earnings announcement window versus firms that do not. Because we have no way to determine treatment versus control firms before the rule change, we use their 8-K filing behavior in the post period to determine treated status. Specifically, we include a firm in the treatment group if, during the post period, it has a yearly average of at least three earnings announcement windows that contain 8-Ks. We take this average from 2004 to 2006, excluding later years so that our sample of treatment and control firms is not whittled away by later changes in behavior. For the control group, we include a firm if, during the post period, its yearly average of earnings announcement windows with 8-Ks is no greater than one. We drop all remaining firms that are not in the treatment or control groups. We compare treatment firms with control firms in the pre (2000–2002) and post (2004–2006) periods. We exclude 2003, since the rule requiring 8-Ks for earnings announcements took effect partway through that year. Each year, we regress annual returns on earnings announcement returns separately for the treatment and control groups. From these regressions, we obtain R2s for each group over the pre and post periods.

We report results in Table 6. Panel A shows the regression results each year for both the treatment and the control groups. Panel B shows the difference-in-differences, where we treat each R2 value in Panel A as an observation. In this analysis, we regress the R2 values from Panel A on indicators for TREAT, POST, and the interaction between the two. TREAT is an indicator that turns on for the treatment group (i.e., the firms with many concurrent 8-Ks), and POST is an indicator that turns on for the years after 2003.

In Panel B, the positive coefficient on POST shows that the R2 for the control firms increased by 6.5 percentage-points (t = 3.79) in the post period. The positive coefficient on TREAT*POST shows that the treatment firms saw an additional increase of 5.5 percentage-points (t = 2.27) over and above the control firms, for a total increase of 11.9 percentage-points in the post period.

Given that the firms with more concurrent 8-Ks have an increase in R2s that is almost double the increase for firms with fewer concurrent 8-Ks, it appears that the increase in R2s could be driven by the introduction of mandatory 8-K filings for announcements of earnings.Footnote 19 However, given that there is still an increase among the firms with fewer concurrent 8-Ks, this rule change might not be the only driver of the increase. It might be helped along by other factors, including other regulations that began during the period. However, it could also be that the firms with fewer concurrent 8-Ks are still receiving a boost in R2s from the concurrent 8-Ks they do have.

5.1.2 Sox 404

While concurrent 8-K filings are a likely driver of the increase in the R2, the new 8-K requirement is not an isolated event but rather part of an improving regulatory and monitoring environment that made disclosures more informative. Therefore we investigate whether other regulatory changes contributed to the increase in the R2. In particular, we examine SOX 404, which targets firms with public floats above $75 million, and construct a difference-in-differences test. SOX 404 is one of the largest changes brought about by SOX (Prentice 2007; Singer and You 2011), and its implementation was costly (Iliev 2010; Alexander et al. 2013). It requires every company to include a report from its managers on the company’s internal controls over financial reporting. Within the report, managers have to assess, and auditors must attest to, the effectiveness of the company’s internal controls. In testimony concerning the impact of the Sarbanes-Oxley Act, SEC Chairman William Donaldson said: “The requirements of Section 404 may have the greatest long-term potential to improve financial reporting by public companies by helping to identify potential weaknesses and deficiencies in internal controls.” The chairman of the PCAOB concurred that the internal controls were important, saying, “It is clear to us that the internal control assessment and audit process has the potential to significantly improve the quality and reliability of financial reporting.” The academic literature has also found evidence that Sarbanes-Oxley tends to increase the quality and reliability of financial reporting, making fundamental news more informative (e.g., Ashbaugh-Skaife et al. 2008; Schroeder and Shepardson 2015; Singer and You 2011).

Because implementation was expected to be costly, firms are only required to comply with SOX 404 if they are classified as accelerated filers. In general, a firm becomes an accelerated filer in the first fiscal year when its public float exceeds $75 million on the last day of its second quarter. We use this rule to conduct a difference-in-differences to explore whether SOX 404 relates to the increase in the explanatory power of earnings announcement returns. We begin by performing the same yearly cross-sectional regressions of logarithmic annual returns on logarithmic earnings announcement returns as we did in Section 4.2, but now we conduct regressions separately for firms with market values above the $75 million threshold and firms with market values below it.Footnote 20

Panel A of Table 7 shows the results from these regressions. From examining this panel, both groups of firms experience an increase in R2s around 2004, but the firms above the threshold appear to have a larger increase. Furthermore, the increase for firms below the threshold does not appear to be as permanent, since the adjusted R2s for 2013 through 2016 are similar to pre-2004 levels.

We formally test this in a regression. Treating each R2 value in Panel A as an observation, we run the following difference-in-differences.

POST2003 is an indicator that turns on for all years after 2003, when SOX 404 was implemented, and D is an indicator that turns on for the group of firms with market values above the threshold. In Panel B of Table 7, the results show that b3 is significantly positive. This provides evidence that SOX 404 is partially responsible for the increase in R2 in the post-2003 period.Footnote 21 The coefficient b2 is also significantly positive, so the firms below the threshold also see an increase, suggesting that other factors also play a role here.

To provide further evidence in support of SOX 404 causing part of the change, Panels C and D of Table 7 narrow the bandwidth around the $75 million threshold, limiting the sample to firms with market capitalizations greater than $20 million and less than $300 million. For these panels, we also limit the sample to three years before and three years after SOX 404 went into effect. For this restricted sample, Panel C reports yearly regressions of annual returns on earnings announcement returns for firms above and below the threshold. Panel D treats each R2 in Panel C as an observation and runs the difference-in-differences analysis.Footnote 22 The results are very similar to the difference-in-differences analysis for the full sample, in Panel B.

In sum, we examine two regulatory changes related to earnings announcements: SEC release No. 33–8176, which requires firms to file 8-Ks related to earnings announcements, and SOX 404, which emphasizes the role of internal controls. While each test has limitations, the results from both point in the same direction and are consistent with the view that regulatory changes in the early 2000s helped firm fundamental disclosures explain a greater proportion of the annual return.

5.2 Concurrent management guidance

To explain an increasing trend in the U-statistic, Beaver et al. (2019) propose that it came from more concurrent management guidance around earnings announcements. Indeed, Rogers and Van Buskirk (2013) show that the bundling of management guidance in earnings announcements increased significantly from 5% in 1999 to 30% by 2007. The increase in the frequency of concurrent management guidance at the earnings announcement is a credible potential explanation for the increase in R2 that we observe in Table 3.

We adopt two approaches to examine this potential explanation. The first is to partition the 1995–2017 sample into two subsamples—firms with or without concurrent management guidance—and examine whether the regime shift in R2 is robust for firms without concurrent management guidance. We classify a firm-year observation into the subsample with concurrent management guidance as long as it has management guidance during at least one of its four earnings announcement windows. Then we perform the regressions of logarithmic annual returns on the sum of logarithmic earnings announcement returns by year separately for these two subsamples. Panel A of Table 8 reports the adjusted R2 for each subsample as well as the percentage of firms with concurrent management guidance by year. The percentage of firms with concurrent management guidance increases from 16% in 2000 to 59% in 2012.Footnote 23 Eyeballing the results suggests that the adjusted R2 increases for both subsamples in 2004 but increases more for the subsample with management guidance. In Panel B, we explicitly test the time-series trend of the adjusted R2. Model (1) shows that the subsample of firms without any concurrent guidance still experiences a regime shift in the adjusted R2 around 2004, as reflected in the significant coefficient on POST2003 (b2 = 0.049, t = 2.68). The subsample of firms with concurrent management guidance has higher adjusted R2 and a larger regime shift around 2004, as reflected in significant coefficients on DMG and POST2003*DMG. In Model (2), we further add Time and its interaction with DMG to the regression. We find that firms with concurrent management guidance exhibit an increasing pattern in the adjusted R2 over time, whereas firms without concurrent management guidance still show a regime shift around 2004.

The second approach is to add the percentage of firms with concurrent management guidance, PCT_MG, as an additional explanatory variable to the time-series regression in Panel C of Table 3. PCT_MG is set to be zero prior to 1995.Footnote 24 Panel C of Table 8 reports the results, where Model (1) is copied from Table 3 for the sake of comparison. Model (2) shows that the coefficient on POST2003 is virtually unchanged after we add PCT_MG to the regression and that the coefficient on PCT_MG is essentially zero, suggesting that the frequency of concurrent management guidance does not explain the regime shift in the adjusted R2 around 2004.

Overall, the results on management guidance are mixed. Our main results in Table 3 are robust to firms without concurrent management guidance. Firms with concurrent management guidance do have higher adjusted R2, and the increasing R2 for these firms over time is consistent with the increasing U-statistic observed by Beaver et al. (2019). However, concurrent management guidance does not seem to explain the regime shift in R2 around 2004.Footnote 25

5.3 Changes in sample composition

We next consider whether changes in sample composition explain our results. Srivastava (2014) examines whether shifts in the real economy and specifically the growth in prominence of firms with high intangible intensity explain the bulk of the temporal changes in earnings properties. He finds that such sample composition changes are significantly responsible for the decrease in the relevance of earnings and the matching between revenues and expenses documented respectively by Collins et al. (1997) and Dichev and Tang (2008). We examine this hypothesis by repeating the regressions of annual returns on earnings changes and the earnings announcement return each year but running them separately for different cohorts of firms. All of the firms are divided into four listing cohorts in the following steps. The first year in which a firm’s data are available in Compustat is referred to as the “listing year.” All of the firms with a listing year in 2000 or later are classified as “2000s.” The remaining firms listed in a common decade are referred to as a wave of newly listed firms in the 1970s, 1980s, and 1990s.

The adjusted R2s from these regressions are shown in Table 9, which tells us two things. First of all, changes in sample composition do not drive the gradual decline in the explanatory power of earnings. The decline occurs for each cohort. Secondly, changes in sample composition also do not cause the post-2003 increase in the explanatory power of earnings announcement returns, since firms from the 1970s, 1980s, and 1990s cohorts all experience the increase. Overall, we do not find evidence that a change in sample composition explains our results.

5.4 Firm size, growth, profitability, and industry effects

Although Section 5.3 shows that changes in sample composition do not explain our results, there could still be systematic differences in listed firms over time. In this section, we carry out a battery of additional tests to explore whether our results vary with firm characteristics, such as firm size, growth, profitability, and industry effects.

We first consider the effect of firm size by partitioning our sample into three size terciles each year and running Eq. (3) for each resulting tercile each year. Finally, we take the adjusted R2 from Eq. (3) as the dependent variable and regress it on Time and POST2003. Panel A of Table 10 shows that the coefficients on POST2003 are significantly positive, whereas the coefficients on Time are indistinguishable from zero across all three size terciles, suggesting a regime shift in the adjusted R2, regardless of firm size. Then we perform similar analyses on growth and profitability, where growth is the market-to-book ratio and profitability is earnings scaled by book value of equity. The results in Panels B and C of Table 10 again show a regime shift, with significant coefficients on POST2003 and insignificant coefficients on Time. Finally, we conduct empirical analyses for each one-digit SIC code industry. Panel D of Table 10 shows that the coefficients on Time are uniformly insignificant, whereas the coefficients on POST2003 are significantly positive for most industries.

Overall, Table 10 illustrates the robustness of our results across firm size, growth, profitability, and industry effects. Partitions based on these dimensions all suggest a regime shift in the informativeness of earnings announcements around 2003.

6 Conclusion

We demonstrate that firm fundamental information still matters significantly to capital markets. Even though earnings have come to explain less of the annual return over time, we find that firm fundamental information still explains a significant amount of it when we proxy for the information with earnings announcement returns. Indeed, the explanatory power of earnings announcement returns almost doubled around 2004; they now explain around 20% of the annual return. So even though earnings are becoming less important, firm fundamental information is becoming more so. This pattern occurs for other forms of firm fundamental information. Collectively, the returns around earnings announcements, management guidance, analyst forecasts, analyst recommendations, and 8-K filings went from explaining 17% of annual returns on average in the late 1990s to 39% on average in the early 2010s.

Regarding the explanation for the post-2003 regime shift in the explanatory power of earnings announcement information, we find evidence consistent with the view that regulatory changes in the early 2000s are at least partly responsible. SEC release No. 33–8176 and SOX 404 both appear to increase the explanatory power of earnings announcement disclosures. Because of SEC release No. 33–8176, firms now file 8-Ks for their earnings announcements, and most of them file the 8-Ks in the earnings announcement window. These 8-Ks appear to increase the explanatory power of earnings announcement returns, perhaps because they disclose new information or ease investors’ processing of the information. SOX 404 requires firms to assess and attest to internal controls over financial reporting, and this might improve the explanatory power by making financial disclosures more reliable. Thus, for at least two of the many regulatory changes introduced around the time of the regime shift, we have found evidence that they contributed to the increase in the ability of earnings announcement returns to explain annual returns. Other regulations that we have not considered might have also contributed—in particular, Regulation FD might have started reducing information leaks with delayed effect in 2004, a few years after its promulgation in 2000.

One implication of our results is that the earnings announcement return is a much better summary measure of new information than unexpected earnings is. As standard-setters have shifted away from the traditional income statement approach, which aims to generate high-quality earnings by closely matching revenues with expenses, to the balance sheet model, which emphasizes asset and liability fair values, earnings has become less value relevant. To overcome this loss in value relevance, firms are increasingly emphasizing their own non-GAAP measures and guidance in earnings announcements (e.g., Lev 2018). Our results suggest that the firms’ efforts have succeeded, since earnings announcement returns lost none of their power to explain annual returns even as earnings lost its power to do so. In fact, starting in 2004, earnings announcement returns have increased their explanatory power, indicating that firms are transmitting and investors are processing information better than ever before.

Notes

Ball and Shivakumar (2008) examine the R2s from regressions of annual returns on earnings announcement returns and find the abnormal R2 to be between 5% and 9%. They do notice higher values in the last three years of their data, 2004 to 2006, although their limited sample period restricts their ability to draw definitive conclusions. We show that the increase in 2004–2006 is not a temporary shift, but a permanent one. We estimate that earnings announcements contribute about 20% of the year’s price-relevant information after 2004, if we exclude the crisis years of 2008 and 2009. This is substantially higher than the headline estimate of Ball and Shivakumar (2008). We go further and estimate the collective explanatory power of earnings announcements, management guidance, analyst forecasts, analyst recommendations, and 8-K filings, which explain almost 40% of the annual return in recent years. We also explore a number of potential explanations for the recent increase in explanatory and suggest that regulatory changes, such as SOX and new 8-K filing requirements, make disclosed fundamental information more informative.

In an untabulated test, we have verified this by running time-series regressions by firm and examining how much the coefficients vary across firms in the regressions of annual returns on earnings changes or earnings announcement returns. They vary much more for earnings changes than for announcement returns. For the changes in earnings coefficients, the standard deviation is about three times the mean, and the value at the third quartile is about nine times the value at the first quartile. In contrast, for the earnings announcement return coefficients, the standard deviation is about equal to the mean, and the value at the third quartile is only about 3.5 times the value at the first quartile.

These numbers come from our preferred specification, which uses logarithmic returns. We also report results for arithmetic returns.

Kishore et al. (2008) find a stronger post earnings announcement drift when surprise is measured as earnings announcement returns (EAR) than when it is measured by standardized unexpected earnings (SUE). In addition, the EAR and SUE strategies are largely independent. To the extent that subsequent returns are correlated with announcement returns, investor underreaction to EAR and SUE is fully picked up by our R2 approach.

The U-statistic is related to time-series volatility of daily returns, which differs from the cross-sectional variation in annual returns that underlies our R2 measure. Take noise trading (or liquidity trading) as an example. More noise trading exaggerates daily price movements and thus increases the volatility of daily returns, but the impact of noise trading on returns reverses over time and does not affect annual returns. Therefore a reduction in noise trading from year to year will increase the U-statistic but may not affect our R2. Empirically, time-series volatility of daily returns and cross-sectional variance in annual returns exhibit different patterns. Ignoring the periods of the bursting of the Internet bubble and financial crisis, Bartram et al. (2018) show that time-series volatility of daily returns declines over time, whereas our untabulated analysis finds that cross-sectional variance in annual returns is largely flat over time (if anything it increases).

Bird et al. (2017) use the increasing explanatory power of earnings announcement returns as a motivation for their paper, which studies the benefits of accounting regulations. They use firms’ own pre-adoption mentions of accounting standards as a measure of treatment intensity and find that accounting standards increase absolute earnings announcement returns. Consistent with standards reducing discretionary disclosure, they show that this increase is explained by the increasing informativeness of negative earnings news.

We expect earnings announcements to capture more firm-specific information as opposed to market-wide or industry-wide information. Market-wide information tends to be captured by the intercept of our regression and thus does not affect the R2, whereas industry-wide information still affects the R2.

Independent identically distributed (i.i.d.) returns imply either that investors do not value firm fundamental information or that the disclosures do not provide any new information. As a result, returns during earnings announcements resemble those during non-announcement periods.

The literature also uses analyst forecast errors, measured as actual earnings minus the analyst forecast. We stick to earnings changes to preserve our long sample period. However, in untabulated tests, we have found that analyst forecast errors exhibit the same patterns that we find for earnings changes.

We measure annual returns starting three months after the prior fiscal year-end so that they do not include the prior year’s earnings announcements but include the current year’s four earnings announcements.

For this untabulated test, we measure analyst forecast errors as the IBES actual earnings minus the consensus (median) analyst forecast at the beginning of the year (where the beginning of the year means the forecast during the third month of the current fiscal year, which is around the time when the previous-year’s annual report comes out), scaled by average total assets per share from the beginning of the year to the end of the year.

Beaver et al. (2018, 2019) find that the U-statistic increases steadily starting in 2001, rather than in 2004. We find that the R2 had no significant increase in 2001. In an untabulated test, we repeat the regression in Panel C of Table 3 but add an indicator that turns on for the years between 2001 and 2003 (inclusive). The coefficient on this indicator is negative and insignificant.

Specifically, REV(FQ1) is the sum of analyst forecast revisions of next-quarter earnings around the earnings announcements during the firm’s fiscal year. For every firm-quarter, we examine the analyst forecast revision of next-quarter’s earnings from before the current quarter’s earnings announcement to after, scaled by the stock price in the month of the current quarter’s earnings announcement (as recorded by IBES). Then we sum up these revisions over the four quarters in the firm’s fiscal year.

Specifically, ΔRVOL is the standard deviation of daily returns in year t + 1 minus the standard deviation of daily returns in year t.

The regressions with REV(FQ1) on the left-hand-side start in 1984, because that is when we first have a large sample of analyst forecasts from IBES. The regressions with ΔE on the right-hand side end in 2017, because we do not yet have 2019 annual earnings data.

While these explanations are not mutually exclusive, another reason for us to examine regulatory changes is that they have not been examined before, implying greater contribution to the literature.

Even for the 8-Ks’ new information that could have been anticipated from the earnings announcement press releases, any underreaction by investors would make it so that moving the 8-Ks into the earnings announcement windows would increase the R2 in the regression. While the R2 does pick up post-earnings-announcement drift, it only picks up the average (systematic underreaction), so any variation in the underreaction across firms (firm-specific under-reaction) will go to the residual and reduce the R2. We could expect there to be variation in the underreaction to the extent that investors pay different amounts of attention to different firms (Hirshleifer et al. 2009). Moving the 8-Ks into the earnings announcement windows essentially moves such variation to earnings announcement returns and thus increases the correlation between annual returns and earnings announcement returns.

This increase is overcoming the negative impact on earnings informativeness of another 8-K rule, from the same period, which increased the frequency of 8-K disclosures. McMullin et al. (2019) find that the more timely 8-K disclosures from this other rule undermined the information content of earnings announcements.

Consistent with the rule that determines accelerated filer status, we measure market values as of the end of the firm’s second fiscal quarter. We use market values instead of public floats because floats are not available in a machine-readable database.

SOX 404 may have increased the credibility of financial statements and the earnings number itself may remain a poor summary measure for the news provided by financial statements. Earnings could remain a poor summary measure of news because the same magnitude of a change in earnings can have different implications for the future in different contexts. Also, we have shown that earnings have become too noisy to capture the informativeness of firm fundamentals. Chen et al. (2013) find evidence that the information content of earnings increased after the introduction of SOX 404, suggesting that SOX 404 has worked to reduce the noise. However, the impact seems negligible in the face of the overall downward trend we show in Fig. 1.

In untabulated analysis, we further narrow the bandwidth around the $75 million threshold by limiting the sample to firms with market capitalizations greater than $35 million and less than $150 million. We find that the coefficient on D*POST2003 becomes stronger (b3 = 0.065) but statistical significance becomes a little weaker (t = 1.73) because of the smaller sample.

Our percentages of concurrent management guidance are higher than those reported by Rogers and Van Buskirk (2013) and Beaver et al. (2019), because they separately examine each earnings announcement, whereas we examine firm-years and count a firm-year as having concurrent guidance if at least one of its earnings announcements does.

The percentage of firms with bundled guidance is about zero prior to 1995. In both 1993 and 1994, the first two years we have manager guidance data, less than 10 firms are included in the group with bundled management guidance.

Ball and Shivakumar (2008) also examined this with their limited sample period and determined that management forecasts could not explain the increase in the last three years of their sample.

References

Alexander, C.R., S.W. Bauguess, G. Bernile, Y.A. Lee, and J. Marietta-Westberg. 2013. Economic effects of SOX section 404 compliance: A corporate insider perspective. Journal of Accounting and Economics 56 (2–3): 267–290.