Abstract

We propose the Modified Economic Complexity Index (MECI) as a possible refinement to two relevant complexity measures: the Economic Complexity index (ECI) and the Fitness and Complexity index (FCI). Both ECI and FCI are used for the evaluation of competitive advantages and growth potentials of countries. ECI and FCI assume bipartite country-network data, whereas MECI provides an ecosystem-based design using technology as a third dimension. We test the three complexity measures with respect to Balassa’s Revealed Comparative Advantage index (RCA) and the newly introduced Revealed Effectiveness Advantage index (REA) using empirical data for 41 countries. Regression analysis shows that the predictive power of the three measures with respect to GDP per capita growth improves using the REA index instead of RCA. MECI improves the prediction when compared with ECI and FCI. However, the results for the three measures converge in terms of initial diversity scores and GDP per capita correlation in the case of using the REA index. MECI is based on an eco-system’s approach and can therefore be further developed into simulations.

Similar content being viewed by others

Avoid common mistakes on your manuscript.

1 Introduction

The post-industrial economy, often referred to in the economic literature as a knowledge-based economy or an innovation-driven economy, is a fundamentally more complex system than the industrial one. The increase in complexity is due to the fact that technological progress and the ICT revolution have significantly modified the key development parameters of economic systems: their organizational structure, the composition of production factors, the mechanism of sustainable growth, etc. As follows from traditional analytical models, an industrial economy can be considered as homogeneous and basically oriented toward equilibrium. Such a system can be described with a linear (input–output) model of development, where an action can be expected to produce a predictable reaction, while innovation remains rather an external factor to the process of production (OECD 2018).

In contrast, the post-industrial economy of the twenty-first century is developing non-linearly, both because of feedback loops in the system (Kline and Rosenberg 1986) and because of increased complexity of the innovation process (OECD 2015b), when economic growth starts resting not just on the internal but on the interactive and perpetual innovation activity (OECD 2018). As a result, today’s economies tend to become complex adaptive systems (CAS), whose properties and behavior are described in the interdisciplinary theory of CAS (Axelrod and Cohen 2000; Holland 2002; Miller and Page 2007) and, more recently, in the emerging branch of the CAS theorizing, known as ‘complexity economics’ (Beinhocker 2006; Antonelli 2011; Wilson and Kirman 2016).Footnote 1

According to complexity economics, the non-linear post-industrial economies demonstrate a specific emergent behavior and a basic state of dynamic disequilibrium, typical for CAS or ecosystems (OECD 2009, 2018; Elsner 2015). Ecosystems evolve as decentralized, heterarchical communities of networked agents (Padgett and Powell 2013) that rely on feedback linkages and coordinate their activities through distributed communication nodes (for example, through online platforms). Due to the agile, constantly changing structure of linkages, ecosystems are tailored for continual renewals, in particular, for an interactive model of co-creation of innovations by participants of collaborative networks (Russell and Smorodinskaya 2018).

Since the 2000s, the creation of new goods and values is seldom singularly producer-led or user-driven. Instead, today’s innovations are increasingly co-created interactively through collaboration of legally independent but economically interdependent networked agents that develop in the course of their interactions an ecosystem of relatively sustainable linkages, shared rules, and shared assets (OECD 2015b; cf. Mercan and Göktaş 2011; Bramwell et al. 2012; Wessner and Wolff 2012; Tsujimoto et al. 2017). Multiform ecosystems, emerging at the level of regional clusters and other collaborative networks, shape an innovative industrial landscape of today’s economies or, in other words, a typical organizational format to produce goods and values in the twenty-first century (MacGregor and Carleton 2012; Smorodinskaya et al. 2017).

The most important property of ecosystems is their adaptability to unpredictable changes and high uncertainties, brought into the global context by digitalization and the proliferation of networks (Kidd 2008; OECD 2018). This advantage of ecosystems is the result of functional interdependences and aggregate effects, arising from collaborative and interactive relationships among their components. In other words, the ecosystem model implies a recursive dynamics between the growing organizational complexity of an economy, on the one hand, and its increasing innovativeness and diversification, on the other (Antonelli 2011; Freeman and Perez 1988; cf. Durkheim 1893). Hence, the organizational adaptability of economic systems to a volatile non-linear environment (resilience) can be considered as a prerequisite for their functional adaptability (robustness), that is, the ability to maintain competitiveness and sustainable growth under the condition of continuous upgrading of technologies and demands in globalized markets (OECD 2015a).

In a world of growing complexity, national economies are no longer subordinate to traditional methods of control, forecasting, and planning. To assess the potential of economic systems for sustainable growth, economists have proposed several indicators for the measurement of their functional complexity such as the Economic Complexity Index (ECI; (Hidalgo and Hausmann 2009), and the Fitness and Complexity index (FCI; Tacchella et al. 2013). ECI relies on linear correlations between the estimated economic parameters; FCI entertains non-linear relations. Against this background, we submit a third indicator: the Modified Economic Complexity Index (MECI) which improves on capturing the interplay between the functional complexity of modern economies and the organizational one. We model the pattern of correlations among estimated economic parameters in a way typical for network interactions among components of complex systems (economic agents and their groups).

If economies are increasingly organized as nonlinear network-based ecosystems, then indicators for assessing their functional complexity should reflexively be constructed as nonlinear and network-based (Ashby 1958). In other words, we try to embed the ecosystem’s approach recursively into the process of construction of the Modified Economic Complexity Index. Under the pressure of technological revolutions, modern economies can be expected to transit gradually to an ecosystem-based design, thus transforming themselves in complex adaptive systems which rely on nonlinear interactions and co-evolution of various local ecosystems as their constituent components. Our focus on measuring economic complexity assumes the ecosystem’s approach as a general point of departure. The advantage of coupling to the ecosystem’s approach is that the iterative self-organization of the estimated parameters follows the mechanisms envisages in economic systems and the approach is scalable from two-dimensional (country–product) to multidimensional networks.

As a conceptual basis for justifying the ecosystem’s approach to measuring complexity, we rely on the CAS theory for the description of the organizational structure and the processes of self-organization of complex systems. Technically, we build on the Method of Reflections (Hidalgo and Hausmann, 2009) and construct its non-linear version. We compare the three indices—ECI, Fitness, and MECI—and show advantages of the modified index with respect to predicting GDP per capita and future growth.

The paper is organized as follows. In Sect. 2, we review merits and limitations of the two existing complexity indicators and provide a detailed methodology for building the Modified Economic Complexity Index. In Sect. 3, we describe the operationalization of the proposed complexity indicator, present data sources, obtained results of calculations, and their limitations. Section 4 contains concluding remarks and provides a perspective on future research. Additional information, comprising the comparative rankings of countries using the three different measures of economic complexity, is provided in the Appendix.

2 Method

One of the key applications of the CAS theory is the estimation of the development prospects of concrete economic systems through measuring their complexity. Porter’s (1990) theory of competitiveness argues that the development prospects of a territory correspond to its competitive advantages. According to this theory, competitive advantages of a territory are associated not so much with the variety of products it can produce and export, but rather with the development potential it can be expected to realize. However, the development potential depends on the existing opportunities for economic growth, the availability of advanced technologies, the achieved level of R&D, the quality of human capital, etc. In this sense, competitive advantages of a territory can be seen as its potentially existing but not yet realized additional development options. Applied to a network-based ecosystem, the number of possible pathways, or additional options of its development is determined by the intensity of and synergy among interactions of its actors and components (Leydesdorff et al. 2018). This implies that the more complex an economy is, the larger the number of additional options which can potentially be realized, and therefore, the better its development prospects. In other words, one can estimate the development prospects of a given economy by means of measuring its complexity as an ecosystem. New options are based on synergy and add to the redundancy in the system.

The relevant methodology for the measurement was introduced in the end of the 2000s by the American economists Cesar A. Hidalgo and Ricardo Hausmann in the form of the Economic Complexity Index (ECI). These authors proposed to determine economic complexity of individual countries according to the complexity and diversification of their respectively exported goods (Hidalgo and Hausmann 2009).

The point of departure in constructing ECI is the self-organization of CAS, as a process of multiple steps forming cyclic iterative sequences. Building on this sequence, Hidalgo and Hausmann (2009) proposed to measure relative economic complexity of countries through a linear iterative procedure, known as the Method of Reflections (MR). Using this method, one can obtain ECI values which correlate with a country’s GDP per capita. Also ECI is used to predict a country’s future growth. However, in the MR the values of variables used to measure economic competitiveness by means of ECI deviate from the initial diversity value in the course of iterations. Successive iteration terms can hardly be interpreted (Kemp-Benedict 2014).

In the early 2010s, Tacchella et al. (2013), while following the example of the American scholars in constructing ECI, proposed another non-linear technique for measuring complexity, known as the Fitness and Complexity Index (FCI). FCI also assesses a country’s competitiveness in terms of the complexity (diversity) of its export-products basket, but measures complexity of separate product items by comparing countries exporting the same products. Relying on empirical observations, the authors conclude that countries can export national products in accordance with their available capabilities. Consequently, developed countries are able to export across the spectrum of products, while less developed ones can export only a limited number of product items.

Similar to ECI, FCI can be used for assessing the potential for economic growth. The literature on measuring Fitness also presents some results on the time-lag effect in the correlation: in case of the U.S. economy, the Fitness value is correlated to the value of GDP per capita on a time scale of about four years (i.e. it can predict an increase or decrease of GDP four years ahead), while in case of Japan this time lag is five years, and in some of the other developed countries, two years (Vinci and Benzi 2018). The advantage of FCI over ECI is that a high correlation of a country’s economic complexity with initial diversity of its exports can be maintained at each iteration.

Notwithstanding the merits and limitations of both ECI and FCI, we propose the Modified Economic Complexity Index (MECI), constituting a non-linear modification of HH’s (2009) Method of Reflections. Since incorporating the technological dimension into the index, on the base of ecosystem’s approach, improves the forecasting capabilities of the index (Ivanova et al. 2018). However, we here reduce the network dimensionality to country-product one in order to make a clear comparison between ecosystem’s and non-ecosystem’s based approaches.

Our method is based on the Method of Reflections developed by Hidalgo and Hausmann (2009), and defined by the following iterative sequences:

where

Matrix Mc,p is normalized using Balassa’s (1965) Relative Comparative Advantage (RCA) index so that:

where Xc, p stands for a Country (c)–Product (p) Exports matrix. ECI is defined as a limit of iterations of the vector \(\vec{k}\):

according the formula:

The Method of Reflections can be extended to the technological domain (Ivanova et al. 2018), incorporating the tripartite network of countries, technologies, and products. Non-linear generalization of the MR can then be defined by the following set of equations:

The set of Eq. (7) can be considered as a discrete version of generalized Lotka–Volterra equations, widely used in biology to describe the evolution of ecosystems. Though there may be some differences in self-organization between biological and economic ecosystems—the latter are driven by the generation and adaptation of new knowledge (Beinhocker 2006)—applications of Lotka–Volterra equations are relevant for our purposes, since all classes of complex adaptive systems, be they natural or social, are assumed (in CAS) to have the same logic of increasing structural complexity (Al-Suwailem 2011).

Incorporating the technology dimension to the index provides a slightly higher correlation of GDP per capita with growth than ECI or FCI (Ivanova et al. 2018). However, this increase in explanatory power may be due to the extension of the network dimensions from countries and products to country-technology-product combinations. Let us first compare the three complexity indicators excluding the technology dimension in the case of MECI. The set of equations (7) can then be written analogously to Equation 1, as follows:

In essence, Eq. (8) represents a non-linear generalization of Eq. (1). So, we define MECI, as calculated according to Eq. (8), in the same way as we defined ECI in Eq. (6).

Analogously, one can calculate the Fitness (F(n)c) index, using the following iterative sequences:

where Q(n)p is the Product Complexity Index which measures complexity of separate product items by comparing countries exporting the same products (Tacchella et al. 2013).

At each step of the iteration, the intermediate values are first computed and then normalized as follows:

where the initial conditions are: \(\tilde{F}_{c}^{\left( 0 \right)} = 1\) and \(\tilde{Q}_{p}^{\left( 0 \right)} = 1\); and denominators in the system of Eq. (10) correspond to the average values for each country and product.

The difference between the complexity indicators is that ECI assumes a linear relationship between initial diversity and ubiquity scores in iterative sequence, Fitness relies on inversely proportional non-linear dependence which may explain the skewness in the country-export matrix (i.e. that developed countries export the full range of product while less developed ones only some products). MECI relies on the eco-system’s approach. Using MECI, one is able to exploit algorithms (such as Lotka–Volterra equations) used for describing biological eco-systems.

The indices are calculated using the Relative Comparative Advantage (RCA) index for the binarization, as defined in Eq. (4). However, RCA determines the relative significance of different products in a country’s exports portfolio. Low values of RCA may not account for additional complexity to the country’s economy when compared with high RCA values countries (Ourens 2013). To overcome this limitation, we replace RCA with the Relative Effectiveness Advantage (REA) index which defines relative efficiency of specific export items as value of the total exports per capita:

where Nc is the population of the country c.

Indices REA and RCA are connected in the following way:

where gc = ∑pXc,p/Nc can be considered as the country’s effectiveness (i.e. amount of export pec capita), and g = ∑c,pXc,p/∑cNc as an average effectiveness in the group of countries under consideration.

3 Results

Our calculations of the family of three complexity indicators—MECI, ECI, and Fitness—were performed for a sample of 41 countries, which include 29 of the 35 OECD affiliated economies, three BRICS countries (Brazil, China, and Russia), and nine smaller economies (not OECD member states): Croatia, Egypt, Georgia, Lithuania, Malaysia, Morocco, Moldova, Romania, and Ukraine (see Table 5 in the Appendix). The export products dataFootnote 2 was retrieved from https://comtrade.un.org. Data for countries’ population and GDP per capita, as well as for the GDP per capita growth were harvested from https://data.worldbank.org.

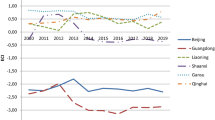

According to our findings, MECI can support the initial diversity distribution, as shown in Fig. 1. We used the first five countries (alphabetically) for illustrative purposes in order to not overload the graph (the data shown is for the year 2015). In this respect MECI matches the Fitness index.

Table 1 shows the Pearson correlations among the values of ECI, Fitness, MECI, the initial diversity scores (designated as kc0), nominal GDP per capita, and the logarithm of nominal GDP per capita in current US$ (for 2004), in the lower triangle. The upper triangle provides rank-order correlations (Spearman’s rho). The three complexity measures were first normalized according RCA (lower triangle) and REA (upper triangle) indices (the values for REA index are italicized). One can notice a significant correlation between MECI-diversity and Fitness-diversity. Meanwhile, ECI correlates better with GDP per capita and ln (GDP per capita). The rank-order correlation between MECI and FCI is above .99. The two measures measure the same in this case.

However, the picture changes upon applying the REA index (Table 2). In this case, the three indices correlate with each other, with MECI and FCI correlating more strongly. ECI additionally correlates with the diversity, while MECI and the Fitness index highly correlate with ln (GDP per capita), exceeding ECI in this respect.

In the Appendix the countries are rank-ordered on the three indices; Table 2 presents the results of Spearman’s rank-order correlation between the values of MECI, ECI, and Fitness.

We tested ECI, Fitness, and MECI using an OLS linear-regression growth model for a 10-year time period, by regressing the rate of growth on the initial level of a country’s income and complexity:

Growth is defined as GDP per capita growth (% for the period); CI (complexity index) denotes the complexity indices MECI, ECI, and Fitness index in the subsequent analyses, respectively.

Table 3 presents the results of the regressions for the three indicators (t-values are provided in parentheses) based on the RCA and REA indices (the values for REA index are italicized), the fifth column provides the null model. The three indices show approximately similar results in terms of the R2 value of the OLS ten-year linear regression growth model, albeit that MECI performs slightly better. The Fitness index (with respect to R2 value) is improved when moving from the RCA index to the REA index.

In the OLS regression results the three complexity indicators all have a negative relationship with growth, except the ECI-REA result. However the Pearson correlation between complexity indices, GDP per capita, and ln(GDP/capita) and Growth is negative (Table 4). This to some extent explains the negative signs of the corresponding regression coefficients. Note that our theoretical argument is that complexity induces innovation and the (sustainable) growth potential. Very high rates of growth are often based on low initial values.

4 Discussion and conclusions

The results show that the use of REA instead of the RCA improves the difference among the complexity measurement and introduce refinements in assessing complexity with respect to diversity, the GDP per capita correlation, and the prediction of future growth. In terms of the prediction of growth, MECI provides a slightly better correlation than the other two indicators. The country ranking of competitiveness (see the Appendix) is very similar (ρ > .99) for MECI and Fitness though they use different algorithms.

We attribute the slightly higher correlation results provided by MECI, when compared to ECI and Fitness, to the effects of incorporating the interactive relationships within ecosystems. As noted above, in the course of their interactions, agents (components) reflexively adapt to one another behavior, relying on feedback mechanisms, which generate a stream of correlations in their behavior and, therefore, in the structure of an ecosystem (Schneider 2012). Furthermore, MECI takes into account the process of self-organization of ecosystems, implying that a decentralized global order arises from below, as a result of local interactions of many autonomous players (Al-Suwailem 2011). In this way, MECI contributes to the ecosystem based complexity approach by entertaining iterative sequences approximated by generalized L–V equations in which the two dimensions—countries and products—interact and reach a dynamical equilibrium.

The proposed ecosystem’s approach to measuring economic complexity stems from the holistic and complex nature of the post-industrial economy, obtained under the pressure of ongoing transformations from linear economic systems into non-linear ones. Relying on the CAS theory, this approach highlights the key role of interactions among the various components of an economy in increasing its level of complexity, and thus, in achieving adaptability to rapid and unpredictable changes. Particularly, our approach focuses on the non-linear and interactive nature of such relationships and on their potentially resulting synergy effects. The complexity and the aggregated power of economy-wide ecosystems derives from interactive cooperation of numerous local ecosystems (e.g., innovation clusters).

Considering the non-linear way of increasing the organizational complexity, our revised indicator MECI measures the functional complexity of modern economies on a similar basis, i.e. through building on non-linear interactions between all estimated economic parameters. Such measurement implies that as compared to ECI, MECI can be relatively better in terms of revealing a horizontal cohesion of an economy (or vice versa, the scales of its fragmentation), and hence, in depicting an economy’s state of post-industrial transition.

In practical terms, this suggests that a more complex (diversified) industrial structure and a higher potential for sustainable growth can be expected in those territories which have developed a better networking context such as in metropolitan areas (Florida 2002). Indeed, the modern competitiveness theory, as evolved from Porter’s Diamond model, underscores the importance of creating and supporting a collaborative economic environment to induce the innovation process (Porter et al. 2008), which encourages countries to continually eliminate any emerging barriers that may hamper a smooth self-organization of new business networks and triple-helix partnerships.

MECI also implies that in order to improve the development prospects and positions in globalized markets, countries (especially catching-up economies) can follow the directions in exports diversification, as revealed and prompted by their ECI indicators, upon elaborating more complex policy measures aimed at the ecosystem-oriented reconstruction of their industrial landscapes. This reconstruction is a key idea of the new industrial policies, addressed by a growing number of developed and developing economies after the global recession of 2007–2009 (Warwick and Nolan 2014).

5 Further perspectives

Since MECI entertains non-linear interactions among all estimated parameters, this new measure can be adjusted to any additional scales, while such an elaboration is hardly possible for ECI and FCI. MECI can also be used for estimating complexity, and hence, to comparing competitive advantages not just among national or regional economies, but also at the level of other types of economic systems such as companies, local clusters, and transnational macro-regions. For this same reason, the MECI methodology can be easily integrated into a range of other economic indicators dealing with estimation of innovativeness and growth potential. For example, the methodology of building the Global Competitiveness Index of the World Economic Forum has not yet considered non-linear interactions between an economy’s components (https://www.weforum.org/reports/the-global-competitiveness-report-2017-2018). Incorporating this index into the framework of MECI allows for this extension.

For all these reasons, we suggest that the proposed MECI indicator may provide helpful methodological insights to countries’ looking for a better adaptation to the radical uncertainties in today’s globalized world. Clearly, a deeper economic investigation should be pursued in the future to understand how this indicator can be improved for modelling interactions both inside and between components of the economy-wide ecosystems.

We can add that of the two dimensions of the ecosystem’s approach, particularly, the nonlinear and the interactive nature of relations within ecosystems, we have so far formalized only the first one of the two: the nonlinear interactions. The second dimension, which may be concerned with achieving synergistic effects for innovation-driven growth, remains a subject of future research. In particular, this dimension leverages the unique role of triple-helix patterns of collaboration among ecosystems components: both in local and in economy-wide ecosystems such a pattern can provide synergies for a continuous and self-reinforcing innovation process, which provides economies with endogenous sources for sustained growth (Petersen et al. 2016; Russell and Smorodinskaya 2018).

In this paper, we relied on a discrete version of generalized Lotka–Volterra (LV) equations. LV equations are tailored for analyzing complexity in biological ecosystems and provide the possibility of entertaining models of systems dynamics and self-organization. In future research we will need to consider additionally the factor of knowledge flows as a key driver for enhancing complexity in modern economies. To this end, it looks promising to match the proposed MECI with the recently empirically formalized principle of relatedness (Hidalgo et al. 2018), which aims to identify the unique paths that lead to diversification and complexity through facilitating knowledge flows among industries and regions.Footnote 3

Notes

Complexity economics, as a contemporary alternative to traditional economics, has largely emanated from research projects of the Santa Fe Institute (USA) studying complex adaptive systems. In parallel, it has been also developed by a broad community of evolutionary economists that view economic systems first of all as complex evolving systems, highlighting that they obtain their dynamic sustainability when developing (e.g. Dosi 2014).

The data is provided in the format of the Standard International Trade Classification (SITC) revision 3 at the 2-digit level.

Considering that skills, technologies, and knowledge are spatially concentrated, the principle of relatedness assumes that a territory enters or exits a new economic activity as a function of the number of related activities already present in that location (Hidalgo et al. 2018).

References

Al-Suwailem, S.: Behavioural complexity. J. Econ. Surv. 25(3), 481–506 (2011)

Antonelli, C. (ed.): Handbook on the Economic Complexity of Technological Change. Edward Elgar Publishing, Cheltenham (2011)

Ashby, W.R.: Requisite variety and its implications for the control of complex systems. Cybernetica 1(2), 1–17 (1958)

Axelrod, R., Cohen, M.D.: Harnessing Complexity: Organizational Implications of a Scientific Frontier. Basic Books, New York (2000)

Balassa, B.: Trade liberalization and “revealed” comparative advantage. The Manchester School 33(2), 99–123 (1965). https://doi.org/10.1111/j.1467-9957.1965.tb00050.x

Beinhocker, E.D.: The Origin of Wealth: Evolution, Complexity and the Radical Remaking of Economics. Harvard Business School Press, Boston (2006)

Bramwell, A., Hepburn, N., Wolfe, D.A.: Growing innovation ecosystems: university-industry knowledge transfer and regional economic development in Canada. In: Final Report to the Social Sciences and Humanities Research Council of Canada. Toronto (2012)

Dosi, G.: Innovation, evolution, and economics: where we are and where we should go. In: Fagerberg, J., et al. (eds.) Innovation Studies: Evolution and Future Challenges. Oxford Scholarship Online, Oxford (2014). https://doi.org/10.1093/acprof:oso/9780199686346.003.0005

Durkheim, É.: De la division du travail social: étude sur l’organisation des sociétés supérieures: Ancienne librairie Germer Baillière et Cie. Félix Alcan, Paris (1893)

Elsner, W.: Policy implications of economic complexity: towards a systemic, longrun, strong, adaptive, and interactive policy conception. In: 27th Annual Conference of the European Association for Evolutionary Political Economy. Genoa, Italy, 17–19 September 2015

Florida, R.: Bohemia and economic geography. J. Econ. Geogr. 2(1), 55–71 (2002)

Freeman, C., Perez, C.: Structural crises of adjustment: business cycles and investment behavior. In: Dosi, G., Freeman, C., Nelson, R., Silverberg, G., Soete, L. (eds.) Technical change and economic theory. Pinter Publishers, London (1988)

Hidalgo, C.A., Hausmann, R.: The building blocks of economic complexity. Proc. Natl. Acad. Sci. U.S.A. 106(26), 10570–10575 (2009)

Hidalgo, C.A., Balland, P.-A., Boschma, R., Deldago, M., Feldman, M., Frenken, K., Glaeser, E., He, C., Kogler, D.F., Morrison, A., Neffke, F., Rigby, D., Stern, S., Zheng, S., Zhu, S.: The principle of relatedness. In: Morales, A.J., et al. (eds.) Unifying Themes in Complex Systems IX, pp. 451–457. Springer Nature, Cham (2018)

Holland, J.H.: Complex adaptive systems and spontaneous emergence. In: Curzio, A.Q., Fortis, M. (eds.) Complexity and Industrial Clusters, pp. 25–34. Contributions to Economics Physica-Verlag, Heidelberg (2002). https://doi.org/10.1007/978-3-642-50007-7_3

Ivanova, I., Strand, Ø., Leydesdorff, L.: An eco-systems approach to constructing economic complexity measures: endogenization of the technological dimension using Lotka–Volterra equations. Adv. Complex Syst. 25(1), 1850023 (2018). https://doi.org/10.1142/S0219525918500236

Kemp-Benedict, E.: An interpretation and critique of the method of reflections. http://mpra.ub.uni-muenchen.de/60705/ (2014). Accessed 7 Feb 2019

Kidd, P.T.: Agile holonic network organizations. In: Putnik, G.D., Cruz-Cunha, M.M. (eds.) Encyclopedia of Networked and Virtual Organizations, pp. 35–42. IGI Global, Hershey (2008)

Kline, S., Rosenberg, N.: An overview of innovation. In: Landau, R., Rosenberg, N. (eds.) The Positive Sum Strategy: Harnessing Technology for Economic Growth, pp. 275–306. National Academy Press, Washington (1986)

Leydesdorff, L., Johnson, M., Ivanova, I.: Toward a calculus of redundancy: signification, codification, and anticipation in cultural evolution. J. Assoc. Inf. Sci. Technol. 69(10), 1181–1192 (2018). https://doi.org/10.1002/asi.24052

MacGregor, S.P., Carleton, T. (eds.): Innovation, Technology, and Knowledge Management: Vol. 19. Sustaining Innovation: Collaboration Models for a Complex World. Springer, New York (2012)

Mercan, B., Göktaş, D.: Components of innovation ecosystems: a cross-country study. International Research Journal of Finance and Economics 76, 102–112 (2011)

Miller, J.H., Page, S.E.: Complex Adaptive Systems: An Introduction to Computational Models of Social Life. Princeton University Press, Princeton (2007)

OECD: Applications of Complexity Science for Public Policy: New Tools for Finding Unanticipated Consequences and Unrealized Opportunities. OECD Publishing, Paris (2009)

OECD: Final NAEC Synthesis: New Approaches to Economic Challenges. OECD Publishing, Paris (2015a)

OECD: System Innovation: Synthesis Report. OECD Publishing, Paris (2015b)

OECD: Elements for a new growth narrative. In: Draft report. SG/NAEC. https://www.oecd.org/naec/SG_NAEC(2018)1_Elements%20for%20a%20new%20growth%20narrative.pdf (2018). Accessed 7 Feb 2019

Ourens, G.: Can the method of reflections help predict future growth? http://sites.uclouvain.be/econ/DP/IRES/2013008.pdf (2013). Accessed 7 Feb 2019

Padgett, J., Powell, W.W.: The problem of emergence. In: Padgett, J., Powell, W.W. (eds.) The Emergence of Organizations and Markets. Princeton University Press, Princeton (2013)

Petersen, A.M., Rotolo, D., & Leydesdorff, L.: A triple helix model of medical innovation: Supply, demand, and technological capabilities in terms of medical subject headings. Res. Policy 45(3), 666–681 (2016)

Porter, M.E.: The Competitive Advantage of Nations. Free Press, New York (1990)

Porter, M.E., Delgado, M., Ketels, C.H.M., Stern, S.: Moving to a new global competitiveness index. In: Schwab, K., Porter, M.E. (eds.) The Global Competitiveness Report 2008–2009, pp. 43–63. World Economic Forum, Geneva (2008)

Russell, M.G., Smorodinskaya, N.V.: Leveraging complexity for ecosystemic innovation. Technol. Forecast. Soc. Change 136, 114–131 (2018)

Schneider, V.: Governance and complexity. In: Levi-Faur, D. (ed.) The Oxford Handbook of Governance, pp. 129–142. Oxford University Press, Oxford (2012)

Smorodinskaya, N.V., Russell, M.G., Katukov, D.D., Still, K.: Innovation ecosystems vs. innovation systems in terms of collaboration and co-creation of value. In: Proceedings of the 50th Hawaii International Conference on System Sciences (2017)

Tacchella, A., Cristelli, M., Caldarelli, G., Gabrielli, A., Pietronero, L.: Economic complexity: conceptual grounding of a new metrics for global competitiveness. J. Econ. Dyn. Control 37(8), 1683–1691 (2013)

Tsujimoto, M., Kajikawa, Y., Tomita, J., Matsumoto, Y.: A review of the ecosystem concept—towards coherent ecosystem design. Technol. Forecast. Soc. Change 136, 49–58 (2017). https://doi.org/10.1016/j.techfore.2017.06.032

Vinci, G.V., Benzi, R.: Economic complexity: correlations between gross domestic product and fitness. Entropy 20, 766 (2018). https://doi.org/10.3390/e20100766

Warwick, K., Nolan, A.: Evaluation of industrial policy: methodological issues and policy lessons. In: OECD Science, Technology and Industry Policy Papers No. 16 (2014)

Wessner C.W., Wolff A.W. (eds): Rising to the challenge: U.S. innovation policy for the global economy. In: National Research Council. National Academies Press (US), Washington, DC (2012)

Wilson, D., Kirman, A.P. (eds.): Complexity and Evolution: Toward a New Synthesis for Economics. MIT Press, Cambridge (2016)

Aknowledgements

Inga Ivanova acknowledges support of the Basic Research Program at the National Research University Higher School of Economics (NRU HSE) and a subsidy granted by the Russian Academic Excellence Project ‘5-100’.

Author information

Authors and Affiliations

Corresponding author

Additional information

Publisher's Note

Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

Appendix

Appendix

Rights and permissions

About this article

Cite this article

Ivanova, I., Smorodinskaya, N. & Leydesdorff, L. On measuring complexity in a post-industrial economy: the ecosystem’s approach. Qual Quant 54, 197–212 (2020). https://doi.org/10.1007/s11135-019-00844-2

Published:

Issue Date:

DOI: https://doi.org/10.1007/s11135-019-00844-2