Abstract

The effectiveness of the Triple Helix model of innovations can be evaluated in bits of information using the TH indicator of synergy based on information theory. However synergy, measured in bits of information can’t be straightforwardly interpreted in economic terms. The present paper is an attempt to establish a connection between synergy and other growth relating economic measure, such as complexity indices. The synergy distribution among 31 Chinese territorial districts is compared with corresponding distribution of complexity. The latter are calculated with three different complexity measures and on different datasets. Synergy and complexity show substantial linear relationship with each other. These complexity measures are further tested with their ability to predict future GDP per capita growth using employment, income, and investment data for 31 territorial districts of China and 19 industries. The results of regression analysis suggests that the accuracy of growth forecast can be substantially improved when exploiting links of different origin in bipartite networks in comparison with export oriented approach.

Similar content being viewed by others

Avoid common mistakes on your manuscript.

1 Introduction

A knowledge-based economy is a fundamentally more complex system than an industrial economy. While an industrial economy can be described with a linear (input–output) model of development, where an action can be expected to produce a predictable reaction, in which innovation remains an external factor to the process of production (OECD 2018) post-industrial economy develops non-linearly due to increased complexity of innovation process (OECD 2015; Kline and Rosenberg, 1986). In post-industrial knowledge-based economy innovations are created through collaboration of formally independent agents engaged into network of relations that form an ecosystem through their interactions (OECD 2015; Bramwell et al. 2012; Wessner and Wolff 2012). Ecosystems are typical organizational format to produce knowledge, goods and values, in the modern economy (MacGregor et al. 2012).

Innovation ecosystems, proliferating in period of post-industrial economy, are supposed to generate innovations. As an example of innovation ecosystem may serve Triple Helix (TH) model of university-industry-government relations (Etzkowitz and Leydesdorff 1995). Innovation capacity of the TH system can be mapped by the synergy of TH actors’ interaction. This synergy can be measured on the base of network of relations among major TH actors (i.e. university, industry and government) with respect to geographic, size, and technological distributions of firms in bits of information using the TH indicator (e.g. Leydesdorff and Zhou 2014), Synergy refers to the coherence in the interactions among the actors which helps to generate additional options and foster innovations. However synergy, formulated mostly as information theoretical measure, can hardly be directly interpreted in terms of innovations and economic growth.

Innovations also add to new economic capabilities, referring to manufacturing goods and products, providing services, forming new organizational structures, etc. Manufacturing capabilities result in new products. So that considering the product range of an economy one can roughly judge on its innovativeness. The more capabilities accumulate countries the more complex is the economy. The notion of”complexity” has been discussed in the literature about “complex adaptive systems” (CAS) (Holland 2002; Miller and Page 2007) and in “complexity economics” (Beinhocker 2006; Antonelli 2011; Wilson and Kirman 2016). Different measures have been proposed to estimate the relative economic complexity in terms of countries-exported products networks, such as Economic Complexity Index (ECI) (Hidalgo and Hausmann 2009), Fitness (Tacchella et al. 2013), Modified Economic Complexity Index (MECI) (Ivanova et al. 2019). Economic complexity measures estimate relative countries’ manufacturing capabilities in the set of countries.

Accordingly an innovation-driven economy can be considered either as driven by mutual arrangements, such as the Triple Helix (TH) of university-industry-government relations, which can be mapped with help of synergy, or estimated on the basis of capabilities which are revealed in the range of manufactured and exported products. One can hypothesize that these two approaches can be interrelated. The first research question of present paper is to explore whether there is a correlation between TH synergy and economic complexity measures. In other words – whether synergy distribution among the set of geographic regions follows that of complexity? Also, economic complexity stands as a holistic measure of manufacturing capabilities. The major advantage of economic complexity is that they can be used to predict long-term future growth (Hidalgo and Hausmann 2009; Ourens 2013). Originally two dimensional complexity measures were based on analyzing country-product export network. However the use of only trade export data seems rather one-sided approach. One could expect that complexity measures prediction power can be increased by using alternative dimensions. Hence the second research question is – if adding additional manufacturing relating dimensions helps to improve the model predictive power with respect to future growth? Also since synergy and complexity capture somewhat different information one can add the third research question – whether the combination of synergy and complexity is able to still further improve growth forecast accuracy?

The answer to these questions would help to link structural and productive aspects of innovation ecosystem and advance the mapping, analysis, and forecasting. Data sources include the data for 31 territorial districts of China and 19 industries for the measurement of three complexity measures—ECI, Fitness, and MECI with respect to bipartite networks of territorial districts and industries in terms of employment, income, and investments, synergy distribution and product export data for 31 provinces.

The findings show a positive Pearson correlation between synergy and complexity. Though generally correlation doesn’t infer causal relationship but synergy and complexity may be considered as interlinked since both rely on innovations in their origin and hence don’t satisfy the property of probabilistic independence (e.g. Russell and Norvig 2002). That means one can relate the TH synergy to economic complexity. The paper encourages theoretical researches which combine information theoretical approaches (e.g. synergy measurement) with complexity studies into a single framework. Also simultaneously accounting for multiple dimensions in bipartite territory-industries network (such as employment, income, and investments) and combining complexity with synergy one can obtain better fit in predicting GDP/capita growth.

The paper is organized as follows. Section 2 presents data sources and the description of the metrics used to evaluate the economic complexity, namely Economic Complexity Index (ECI), Fitness, and Modified Economic Complexity Index (MECI). The results of the calculations are delivered in Sect. 3. In Sect. 4, results are summarized and discussed. Additional information of Chinese provinces Triple Helix synergy and relative complexity values for three complexity measures—ECI, Fitness, MECI – with respect to employment, income, and investment is provided in the Appendix.

2 Data and method

The data for 31 Chinese territorial districts (Beijing, Tianjin, Hebei, Shanxi, Inner Mongolia, Liaoning, Jilin, Heilongjiang, Shanghai, Jiangsu, Zhejiang, Anhui, Fujian, Jiangxi, Shandong, Henan, Hubei, Hunan, Guangdong, Guangxi, Hainan, Chongqing, Sichuan, Guizhou, Yunnan, Xizang(Tibet), Shaanxi, Gansu, Qinghai, Ningxia Hui, Xinjiang Uygur) and 19 industries (Agriculture, forestry, animal husbandry and fishery; Mining; Manufacturing; Electricity, gas and water production and supply; Construction; Transportation, warehousing and postal services; Information transmission computer service and software industry; Wholesale and retail trade; Accommodation and catering industry; Finance; Real estate industry; Leasing and business services; Scientific research, technical services and geological exploration; Water, environmental and public facilities management; Resident services and other services; Education; Health, social security and social welfare; Culture, sports and entertainment; Public administration and social organization) which roughly correspond high level aggregation of NACE Rev. 2 classification,Footnote 1 with respect to employment (number of people employed by industry), income (total earnings of employees by industry), and investments (total investment in fixed assets by industry) for the period 2008–2017 were obtained from the National Bureau of Statistics of China.Footnote 2 The values of TH synergies among geographic, size, and technological distributions of firms, based on 402,604 records on Chinese firms in the Orbis database for the period 2008–2010, for 31 territorial districts of China were retrieved from Leydesdorff and Zhou (2014). Synergies were obtained for all sectors, and separately for high- and medium-tech manufacturing and knowledge-intensive services. The classification of high- and medium-tech manufacturing and knowledge-intensive services is defined according NACE (Rev. 2).Footnote 3 Data for provincial export for 38 industry branches (which partly coincide with NACE Rev 4 two-digit level classificationFootnote 4): Coal mining and washing industry; Ferrous metal mining and dressing industry; Non-ferrous metal mining and dressing industry; Non-metallic mining and dressing industry; Oil and gas extraction industry; Food manufacturing; Agricultural and sideline food processing industry; Beverage manufacturing; Tobacco products industry; Textile industry; Textiles, shoes and hats manufacturing; Leather, fur, feather (velvet) and their products industry; Wood processing and wood, bamboo, rattan, palm and grass products industry; Furniture manufacturing; Paper and Paper Products Industry; Printing and recording media reproduction; Cultural, Educational and Sporting Goods Manufacturing; Petroleum processing, coking and nuclear fuel processing industries; Chemical raw materials and chemical products manufacturing; Pharmaceutical manufacturing; Chemical fiber manufacturing; Rubber products industry; Plastic products industry; Non-metallic mineral products industry; Ferrous metal smelting and rolling processing industry; Non-ferrous metal smelting and rolling processing industry; Metal products industry; General equipment manufacturing; Special equipment manufacturing; Transportation equipment manufacturing; Instrumentation, cultural and office machinery manufacturing; Electrical machinery and equipment manufacturing; Communication equipment, computer and other electronic equipment manufacturing; Crafts and other manufacturing; Waste resources and waste materials recycling and processing industry; Electricity and heat production and supply industry; Gas production and supply industry; Water production and supply industry were taken from Zhonghong Industry Database 3.0.Footnote 5

Mutual information in three (or more) dimensions, derived from Shannon’s (1948) formulas of information theory (e.g., McGill, 1954; Abramson, 1963: 131 ff.), is no longer Shannon-type information since it can also be negative (Krippendorff 2009; Yeung 2008: 59f.). It can be shown that this mutual information can be consistently considered as a measure of redundancy or reduction of the uncertainty that prevails at the systems level (Ivanova and Leydesdorff 2014). The mutual information in three dimensions in formula format is:

where: \(H_{i} = - \mathop \sum \limits_{i} p_{i} log_{2} p_{i} ;\) \(H_{ij} = \mathop \sum \limits_{i} \mathop \sum \limits_{j} log_{2} p_{ij}\) (and accordingly for other combinations of variables); \(H_{ijk} = \mathop \sum \limits_{i} \mathop \sum \limits_{j} \mathop \sum \limits_{k} log_{2} p_{ijk}\). The probabilities are defined as: \(p_{i} = {\raise0.7ex\hbox{${n_{i} }$} \!\mathord{\left/ {\vphantom {{n_{i} } N}}\right.\kern-\nulldelimiterspace} \!\lower0.7ex\hbox{$N$}}\) (here i stands for x,y,z, the same for j,k; \(i \ne j \ne k\)).

Corresponding variables – x, y, z – are operationalizes as geographical, technological, and organizational dimensions in terms of postal firm addresses (as an indicator of regional or other geographic provenance), OECD classification of firms according to the NACE (Rev. 2), and the numbers of firm employees.

The relative economic complexity index (ECI) of a country in the group of countries can be evaluated as in the MR of Hidalgo and Hausmann (2009):

where:

and \(k_{c,n}\) is defined through iterative sequence:

Here:

Matrix \(M_{c,p}\) is defined with help of Balassa’s (1965) Relative Comparative Advantage index (RCA):

where \(X_{c,p}\) stands for a Country (\(c\))–Product (\(p\)) Exports matrix (measured in monetary units). Then:

The other metric for economic complexity can serve the Fitness index (\(F_{c}^{\left( n \right)}\)) elaborated by Tacchella et al. (2013):

\(Q_{p}^{\left( n \right)}\) is the Product Complexity Index estimating complexity of separate product items by comparing countries exporting the same products.

The intermediate values are computed and normalized at each step of the iteration:

With the initial conditions set as: \(\tilde{F}_{c}^{\left( 0 \right)} = 1\) and \(\tilde{Q}_{p}^{\left( 0 \right)} = 1\) (denominators in the system of Eq. (9) are the average values for each country and product).

Still another metric of economic complexity is the Modified Economic Complexity index (MECI), based on eco-system approach (Ivanova, Smorodinskaya, and Leydesdorff 2019), which modifies the set of Eq. (4) as following:

In the next section we calculate the three complexity measures using Chinese data. Instead of country-product network we use binary network of 31 Chinese territorial districts and 19 industries, measured in employment (the number of employees by industry), income (summary earnings of employees by industry), or investment (summary investment in fixed capital by industry). Employment, income, and investment indicate the magnitude of respective industry in specific province in corresponding sphere.

Complexity measures ECI, Fitness, and MECI were further tested as predictors of future growth with help of OLS linear regression growth model for ten year period 2010–2019 according the formula:

where: \(A\), \(B\), \(C_{i}\) – constants, \({\text{GDP}}\) – gross domestic product, \(V_{i}\) – additional variables (complexity indices – either MECI, ECI, and Fitness – taken with respect to one or all three different data—i.e. employment, income, and investment). The sum may include zero, one or three terms. Zero sum corresponds to null model where \(LN({GDP percapita}\left( {t + \Delta t} \right)\) depends only on \({{GDP}}\left( t \right)\). Here t refers to 2010 and t + Δt to 2020.

Complexity was originally estimated with respect to bipartite network connecting countries and exported products, in the assumption that countries are able to make products for which they have available capabilities. But using only exported products doesn’t account for product domestic consumption and services which also adds to economic growth. Here complexity measures were used to evaluate not countries but different regions of one country – China. Bipartite networks are China provinces – industries, where industries are characterized with respect to employment, income and investment. One can expect that extending product space dimensionality may increase model prediction accuracy. The effect of employment, income and investment on production and growth seem obvious, though it also depends on the market situation.

3 Results

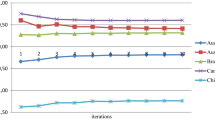

Figures 1, 2 and 3 present ECI, Fitness, and MECI longitudinal chart for six Chinese territorial districts (provinces) Beijing, Guangdong, Liaoning, Shaanxi, Gansu, Qinghai during the period 2010–2019, calculated according income data. The sample serves for illustrative purposes and represents high medium and low developed regions. Figure 4 displays GRP per capita by provinces (Yuan) for 2010–2019. Beijing's economy (164,212) is one of the most developed and prosperous in China (in brackets is the volume of GRP per capita in Yuan for 2019). It is becoming more and more famous as a center for innovative entrepreneurship and successful venture business. There are six high-end economic zones around Beijing which serve the base for local economic growth.

Guangdong (93,456) also appears among the main economic provinces of China appear. Guangdong in terms of GDP surpasses all other provinces and is the most economically developed province, where the special economic zones of Shenzhen, Shantou, Zhuhai are located.

Liaoning (57,236) and Shaanxi (66,545) are in the middle of the list. The most important industries in Hunan are metallurgy, energy, electronics production. Liaoning province specializes in the development of light industry, vegetable growing and cattle breeding. Shaanxi province is focused on light and food industries, mechanical engineering, electronics and other areas.

Gansu (32,936) and Qinghai (48,782) are among the poorest Chinese provinces. Gansu's economy is mostly based on mining and the extraction of minerals and Qinghai specialization is iron and steel production and oil and gas mining.

When ECI and MECI provide similar territorial districts’ ranking, Fitness index is inverse proportional to the previous two measures. One can mention that complexity measures follow provinces stratification in accordance with GRP.

While ECI/MECI and ECI/Fitness strongly correlate during the observed period, the MECI/Fitness correlation is less accentuated (Fig. 5) which may indicate that they capture different kinds of information.

Correlation numerical values between complexity indices (obtained for employment, income, and investment data) and regional TH synergy for all, high- and medium- tech, and knowledge intensive sectors are given in Tables 1, 2 and 3.

For employment based data both ECI and MECI positively correlate with TH synergy for high- and medium- tech. sectors, Synergy/Fitness correlation is low in comparison with synergy/ECI and synergy/MECI correlation.

Data for synergy correlation with income and investment based complexity measures provide roughly the similar results (Tables 2, 3) but correlation for income based data is less accentuated. This may indicate that regional innovation system actors’ relations have less effect on income. Correlation with KIS based synergy for all three complexity measures in all cases is missing. This may be attributed to either non-linear synergy/complexity KIS coupling or policy issues. According European Commission undertaken policy measures for promoting KIS innovation activity are ineffective since they are concentrated mostly on manufacturing technologies and miss organizational innovations.Footnote 6 That is one should search for additional variables, other than employment, income and investment, for supporting KIS innovation activity.

Observed correlation points to statistical linear relationship of synergy and complexity, where change in the values of one these quantities accompany a systematic change in the values of the other. The correlation is calculated for 2010 and the value can change over time. This is due to different nature of these two measures. While synergy refers to “coherence” of interactions among major TH actors and generation of additional options (Leydesdorff 2021) complexity reflects “manufacturing capabilities”, which can be considered as a result of additional options realization. And there is no rigid link between these things.

Synergy provides additional options that can eventually transform into new capabilities but realization of these capabilities can be envisaged only over time. The time laps between options emergence and their realization depend on many circumstances, such as the state of economy, economy growth rate, market opportunities, etc. Existing capabilities, in turn, imply the presence of certain synergy as otherwise they wouldn’t be available.

As a further step the model is tested with respect to future growth (Eq. (11)), Results are summarized in Tables 4, 5, 6 and 7. Regression was first calculated with complexity measures evaluated with respect to separate datasets.

Table 4 presents 10 year (2010–2019) OLS growth models with ECI, Fitness, MECI (on the base of employment data).

The best prediction is provided with MECI index which explains up to 50% of the variation. ECI demonstrates close result and Fitness is in last place. Employment affects production and growth. According Okun’s law (Okun 1970) there is a relationship between unemployment and GDP. There is also inverse relationship between GDP per capita growth (decline) and increase (decrease) in employment (Maitah et al. 2015).

The results for income data are even better since income is closely linked with GRP (Table 5). Income is a proxy of labor productivity which is a key driver of economic growth and international competitiveness (OECD 2021). This time ECI takes the first place and is followed by Fitness and MECI.

The situation with investment data is less encouraging (Table 6). One is able to explain only about 30% of the variation. Though investments are known to lead to productivity improvements and also have a distinct role as a determinant of economic growth (Arrow and Kurz 1970; Mankiw et al. 1992) total investments amount is not so decisive for economic growth, since everything depends on their rational use. Both employment and income are more closely linked to growth.

The different results obtained for separate datasets suggest that these complexity measures capture different kinds of information. One can try to combine these dimensions in an attempt to better predictive power. Considering the summary effect of the three data sets in accordance with Eq. (11), where the sum in the right hand part is taken over the sum of complexity measures relating to employment, income, and investment, one can get substantially better results (Table 7). Especially impressive is the ECI case which now explains up to 70% of the variations. Fitness and MECI also improve the model and correspondingly explain 55% and 50%. The last column in the Table 7 refers to the null model (i.e. which has only 2010 GRP as a predictor). Accounting only GRP as a single variable one can explain only about 17% of the variation. Adding synergy increases this value by one and a half times up to 26% (penultimate column).

Since synergy and complexity capture somewhat different kinds of information one can expect that combining them in a single model can further improve the prediction accuracy. This proves to be true for ECI and Fitness measures (Table 8), though MECI measure demonstrates some weaker result. This may be due to the fact that both synergy and MECI were constructed on similar conceptual base utilizing eco-system approach.

Obtained results suggest that simultaneous use of different data sets helps to provide better model growth prediction potential as opposed to one utilizing only product export data. Table 9 displays the results for OLS growth model based on export data for 38 industries.

The comparison of Tables 7 and 9 shows that even without accounting for synergy, employment, income, and investment data based model demonstrates substantially better predictive ability than export based model, since it takes into consideration in region consumption and non-manufacturing and non-exporting assets (e.g. leasing, research, resident services etc.).

4 Conclusion

It is often important to numerically evaluate the effectiveness of innovation system. In case of Triple Helix model of university-industry-government relations this effectiveness can be measured with help of TH indicator built on information theoretical approach. This approach utilizes geographic, size, and technological distributions of firms in the network of relations among TH actors. The effectiveness of innovation system, defined as synergy of interactions among the three dimensions, can be expressed in terms of bits of information. However this abstract information theoretical measure can hardly be appreciated in terms of conventional economic measures.

The paper argues that different approaches to mapping innovation system capacity can be related to each other. The Chinese case-study demonstrates that TH synergy can be linked to complexity measures. Geographic synergy variations linearly relate to geographic complexity variations. Since complexity measures possess explicit economic meaning and can be used to predict future economic growth the same should hold for TH synergy. Complexity is defined with respect to manufacturing and capabilities which are often linked to the endowments of a nation. These endowments are those that cannot be exported or easily acquired from another nation, and usually refer to infrastructures, geography and climate, demographics, laws, instruction, etc. Synergy in turn is defined with respect to innovation system effectiveness and technological change. However, endowments are relatively stable over time. Long-run economic growth is based on technological progress as an additional factor. Technological change is not naturally given, but the result of intentional actions for research and development (Solow 1956; Swan 1956; Romer 1986). Consequently, technological knowledge is largely responsible for technological change and the improvements in manufacturing capabilities. This may explain complexity-synergy relation. In Chinese case study this relation is linear. More research with respect to other countries’ cases is needed to validate the obtained results. Using Chinese data is due to the fact that China is both one of world largest and at the same time rapidly growing economy. That is having a large set of manufacturing capabilities it also possesses wide opportunities for their implementation. Accordingly synergy/complexity correlation can be expected as most prominent in comparison with less dynamically developing economies. However this is a topic of further studies.

Complexity measure originally was based on evaluation of country-product bipartite network where the links between countries and products are expressed in monetary units. Lately it was as well extended to country-patent network with the links measured in number of patents. The paper argues that while analyzing bipartite networks, including geographic and manufacturing dimensions, one should exploit the links of different manufacturing relating origins which can be considered as important methodological decision. Accounting for the summary effect of different origin links can help to substantially improve the model predictive power. Additionally adding synergy still further improves the prediction accuracy. In other words growth is not only a function of available capabilities but also conditioned by network of relations among innovation system actors. This is an important feature which should be considered when developing informed sustainable growth policies.

Notes

https://ec.europa.eu/sfc/sites/sfc2014/files/2007/nace_rev_2.pdf. Accessed 25 January 2021.

http://data.stats.gov.cn/easyquery.htm?cn=E0103. Accessed 25 January 2021.

Eurostat/OECD (2009, 2011); cf. Laafia (2002, p. 7) and Leydesdorff et al. (2006, p. 186).

https://unstats.un.org/unsd/publication/SeriesM/SeriesM_34rev4E.pdf. Accessed 25 January 2021.

http://mcin.macrochina.com.cn Accessed 25 January 2021.

References

Abramson, N.: Information Theory and Coding. McGraw-Hill, New York, etc. (1963)

Antonelli, C. (ed.): Handbook on the Economic Complexity of Technological Change. Edward Elgar Publishing, Cheltenham (2011)

Arrow, K.J., Kurz, M.: Public Investment, the Rate of Return, and Optimal Fiscal Policy. The Johns Hopkins Press, Baltimore (1970)

Balassa, B.: Trade liberalization and “revealed” comparative advantage. Manch School 33(2), 99–123 (1965)

Beinhocker, E.D.: The Origin of Wealth: Evolution, Complexity and the Radical Remaking of Economics. Harvard Business School Press, Boston, MA (2006)

Bramwell, A., Hepburn, N., & Wolfe, D. A. Growing Innovation Ecosystems: University-Industry Knowledge Transfer and Regional Economic Development in Canada. Final Report to the Social Sciences and Humanities Research Council of Canada. Toronto (2012).

Etzkowitz, H., Leydesdorff, L.: The triple helix–-university-industry-government relations: a laboratory for knowledge based economic development. EASST Rev 14(1), 14–19 (1995)

Holland, J.H.: Complex adaptive systems and spontaneous emergence. In: Curzio, A.Q., Fortis, M. (eds.) Complexity and Industrial Clusters, pp. 25–34. Contributions to Economics Physica-Verlag, Heidelberg (2002)

Hidalgo, C.A., Hausmann, R.: The building blocks of economic complexity. Proc. Natl. Acad. Sci. U.S.A. 106(26), 10570–10575 (2009)

Ivanova, I., Leydesdorff, L.: Mutual redundancies in inter-human communication systems: steps towards a calculus of processing meaning. JASSIST 65(2), 386–399 (2014)

Ivanova, I., Smorodinskaya, N., Leydesdorff, L.: On measuring Complexity in a post-industrial economy: The ecosystem’s approach. Qual. Quant. 54(1), 197–212 (2019)

Krippendorff, K.: Information of interactions in complex systems. Int. J. Gen Syst 38(6), 669–680 (2009)

Leydesdorff, L.: The evolutionary dynamics of discursive knowledge: Communication-theoretical perspectives on an empirical philosophy of science. In: Glänzel, W., Schubert, A. (eds.) Qualitative and Quantitative Analysis of Scientific and Scholarly Communication. Springer Nature, Cham, Switzerland (2021)

Leydesdorff, L., Zhou, P.: Measuring the knowledge-based economy of China in terms of synergy among technological, organizational, and geographical attributes of firms. Scientometrics 98(2), 1703–1719 (2014)

MacGregor, S.P., Carleton, T. (eds.): Innovation, Technology, and Knowledge Management: Vol. 19. Sustaining Innovation: Collaboration Models for a Complex World. Springer, New York, NY (2012)

Maitah, M., Toth, D., Kuzmenko, E.: The Effect of GDP per capita on employment growth in Germany. Rev. Eur. Stud. 7(11), 240–251 (2015)

Mankiw, N.G., Romer, D., Weil, D.N.: A contribution to the empirics of economic growth. Quart. J. Econ. 107, 407–437 (1992)

McGill, W.J.: Multivariate information transmission. Psychometrika 19(2), 97–116 (1954)

Miller, J.H., Page, S.E.: Complex Adaptive Systems: An Introduction to Computational Models of Social Life. Princeton University Press, Princeton, NJ (2007)

Okun, A.M.: The Political Economy of Prosperity. Brookings Institution, Washington, D.C. (1970)

OECD. System Innovation: Synthesis Report. OECD Publishing, Paris (2015).

OECD. Elements for a new growth narrative. Draft report. SG/NAEC (2018)1. https://www.oecd.org/naec/SG_NAEC(2018)1_Elements%20for%20a%20new%20growth%20narrative.pdf (2018). Accessed January 25, 2021

OECD. GDP per capita and productivity growth. https://www.oecd-ilibrary.org/employment/data/oecd-productivity-statistics/gdp-per-capita-and-productivity-growth_data-00685-en (2021). Accessed January 25, 2021

Ourens, G., Can the Method of Reflections help predict future growth? http://sites.uclouvain.be/econ/DP/IRES/2013008.pdf (2013). Accessed January 25, 2021

Romer, P.: Increasing Returns and Long-Run Growth. J. Political Econ. 94(5), 1002–1037 (1986)

Russell, S., Norvig, P.: Artificial Intelligence: A Modern Approach. Prentice Hall, Englewood Cliffs, NJ (2002)

Shannon, C.E.: A Mathematical Theory of Communication. Bell Syst. Tech. J., 27, 379–423 and 623–656 (1948).

Solow, R.M.: A contribution to the theory of economic growth. Quart. J. Econ. 70(1), 65–94 (1956)

Swan, T.W.: Economic growth and capital accumulation. Econ. Record. 32(2), 334–361 (1956)

Tacchella, A., Cristelli, M., Caldarelli, G., Gabrielli, A., Pietronero, L.: Economic complexity: conceptual grounding of a new metrics for global competitiveness. J. Econ. Dyn. Control 37(8), 1683–1691 (2013)

Wessner C.W. & Wolff A.W. (eds.). Rising to the Challenge. U.S. Innovation Policy for the Global Economy. National Research Council. National Academies Press, Washington (DC) (2012).

Wilson, D., Kirman, A.P. (eds.): Complexity and Evolution—Toward a New Synthesis for Economics. MIT Press, Cambridge, MA (2016)

Yeung, R.W.: Information Theory and Network Coding. Springer, New York, NY (2008)

Acknowledgment

The author is grateful to Loet Leydesdorff for his valuable comments on a previous version of the manuscript and Kevin Dong for help in data collection. Inga Ivanova acknowledges support of the Basic Research Program at the National Research University Higher School of Economics (NRU HSE) and a subsidy granted by the Russian Academic Excellence Project ‘5-100’.

Author information

Authors and Affiliations

Corresponding author

Additional information

Publisher's Note

Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

Appendix

Appendix

Rights and permissions

About this article

Cite this article

Ivanova, I. The relation between complexity and synergy in the case of China: different ways of predicting GDP growth in a complex and adaptive system. Qual Quant 56, 195–215 (2022). https://doi.org/10.1007/s11135-021-01118-6

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s11135-021-01118-6