Abstract

This paper studies the relation between endogenous and exogenous switching costs. A firm can determine the size of endogenous switching costs, but not the size of exogenous switching costs. This paper develops a game theoretical model to investigate whether these two types of switching costs complement or substitute each other in a firm’s strategy. Our analysis uncovers a substituting relationship, i.e., the equilibrium size of endogenous switching costs should be higher in markets with lower exogenous switching costs. In the equilibrium, the endogenous switching costs cause profit losses to competing firms; the amount of profit loss decreases with the size of exogenous switching costs.

Similar content being viewed by others

Avoid common mistakes on your manuscript.

1 Introduction

Switching costs refer to the costs that buyers have to incur when switching suppliers. Klemperer (1995) classifies switching costs into two types: endogenous and exogenous switching costs. Common examples of exogenous switching costs include transaction costs, learning costs, and psychological brand attachment. These switching costs are considered exogenous because the size of these switching costs is not subject to firms’ pricing and promotion decisions. In contrast, endogenous switching costs arise from firms’ marketing decisions; hence, the size of endogenous switching costs is determined by the firms’ actions. The most common example of an endogenous switching cost is the loyalty rewards that firms use to encourage repeat purchases. These loyalty rewards can be offered in the form of customer loyalty programs (e.g., Kim et al. 2001; Lal and Bell 2003; Singh et al. 2008) or in-pack/on-pack coupons to be redeemed when consumers make future purchases (Raju et al. 1994, 1996). These promotional devices artificially create switching costs because the rewards will be forfeited if consumers switch to other suppliers. (In the rest of this paper, we use endogenous switching costs and loyalty rewards interchangeably.) An extensive review of both types of switching costs is provided by Klemperer (1995) and Farrell and Klemperer (2007).

The objective of this paper is to study the relation between endogenous and exogenous switching costs. To consumers, while exogenous switching costs impose a negative penalty for switching to other suppliers, endogenous switching costs offer a positive reward for loyalty. To the firms, offering endogenous switching costs is costly, but exogenous switching costs are costless. In the situations when the exogenous switching cost is smaller, should the competing firms provide more or less loyalty rewards? On the one hand, two types of switching costs can be substitutes in generating customer loyalty. When the exogenous switching cost is smaller, a firm may provide more endogenous switching cost to raise the overall level of switching costs. On the other hand, two types of switching costs could be complements. Consider loyalty rewards as delayed incentives for customer acquisition. When the exogenous switching cost is smaller, the customer retention rate will be lower; moreover, since the market becomes more competitive, the returning customers will be less profitable. As the customer lifetime value becomes smaller, the competing firms may offer less loyalty rewards to attract the new customers.

This paper applies game theoretical analysis to investigate the research question. We develop a two-period symmetric duopoly model where two competing firms decide the size of endogenous switching costs in the form of loyalty rewards according to their exogenous switching costs. Our analysis shows that the equilibrium endogenous switching costs decrease with the size of exogenous switching costs. While both types of switching costs support customer retention in the second period, the endogenous switching costs also help acquire customers in the first period. A key intuition for our result is related to the probability of switching suppliers due to preference change in the second period. When a consumer chooses between two firms in the first period, the consumer incorporates the anticipated loyalty rewards in his or her decision. However, if the consumer changes the relative preference and switches to another firm in the second period, then the consumer will not redeem the loyalty rewards. When such switching probability is higher, firms find it optimal to offer a larger amount of loyalty rewards. Thus, when exogenous switching costs are smaller, since consumers are more likely to switch, the equilibrium endogenous switching costs should be greater. We also find the equilibrium outcome to be a “prisoner’s dilemma,” as both competing firms suffer profit losses from offering increased endogenous switching costs.

This paper is the first to study how endogenous switching costs should depend on exogenous switching cost. The literature on exogenous switching costs has focused on its impact on price competition and market dynamics (e.g., Klemperer 1987a and 1987b; Farrell and Shapiro 1988; Villas-Boas 2004; Shi et al. 2006; see Klemperer 1995 and more recently Farrell and Klemperer 2007 for a review). Research on endogenous switching costs is more diverse due to different forms of loyalty rewards observed in practice. For example, Caminal and Matutes (1990) studies the size of loyalty coupons; Kim et al. (2001) studies the size and type of loyalty rewards; Singh et al. (2008) examines why not all competing firms may offer loyalty rewards; Sjostrom (2002) studies the size of shipping rebates; and Raju et al. (1994, 1996) investigates the profitability of on-pack and in-pack coupons. The common goal of this stream of research is to investigate how such loyalty-inducing mechanisms may create switching costs and affect price competition. To the best of our knowledge, the existing research has studied either endogenous or exogenous switching costs, but none has studied both simultaneously.

This paper is closely related to research on behavior-based pricing discrimination (BBPD) strategies (e.g., Chen 1997; Villas-Boas 1999; Fudenberg and Tirole 2000; Shaffer and Zhang 2000; Pazgal and Soberman 2008, and Shin and Sudhir 2010). In a typical two-period model commonly adopted in the traditional BBPD literature, a firm would charge a lower second-period price for those switching customers who bought from another firm in the first period, but a higher second-period price for returning customers (Chen 1997; Shaffer and Zhang 2000). Such a poaching pricing policy is necessary to help new customers overcome their switching costs. As a variation of the traditional BBPD model, in industries such as telecommunications services, a firm can use long-term contracts to commit consumers to its second-period prices in the first period (Fudenberg and Tirole 2000). Unlike the traditional BBPD model, our model does not allow a firm to charge different second-period prices based on consumers’ purchase behavior in the first period. Instead, each competing firm offers a uniform price for all consumers. However, we allow each firm to offer loyalty rewards for returning customers. Effectively, the loyalty rewards create price discrimination between new and returning customers in the second period. But the price discrimination facilitated by loyalty rewards differs from BBPD not only conceptually, but also in the direction of discrimination. Specifically, the traditional BBPD model posits a lower poaching price for new customers, while in our model, returning customers receive better deals. Moreover, unlike the long-term contracts in BBPD models, in our model, firms cannot commit to future prices in the first period. Finally, while the short-term contracts in BBPD literature do not require the products to be specifiable in the future, our model requires such products to be specifiable. Our model fits in markets where firms cannot or find it too costly to implement BBPD practices. Most consumer packaged goods companies sell their products through retailers. It would be virtually impossible for a brand manufacturer to ask its retailers to charge one price for the brand’s new customers and another price for repeat customers of the brand, or to ask its retailers to implement long-term pricing contracts. However, many packaged goods companies such as Lean Cuisine offer loyalty rewards to encourage repeat purchases. Similarly, service firms like airlines and hotels offer loyalty programs, but their retailers, including travel agencies and other third-party ticketing agencies, do not price discriminate between new customers and repeat customers for a given airline. Even the service firms that sell to consumers directly, such as retail gasoline stations, provide loyalty programs but do not practice BBPD strategies.

The rest of this paper is organized as follows. In Section 2, we develop a game theoretical model of switching costs. We analyze the model and discuss the results in Section 3. We conclude with main results and discuss the implications and future research in Section 4.

2 Model setup

Consider a market where two firms, denoted by i = A or B, compete in a two-period game. We follow the standard Hotelling model and assume that these two firms are differentiated by locating at the two ends of a unit interval [0, 1]. The market consists of one unit of consumers uniformly distributed along the unit interval [0, 1]. We let the unit transportation cost be t. In each of the two time periods, each consumer purchases one unit of product from either firm. Without loss of generality, we assume the competing firms incur the same marginal cost c that is equal to zero. We further assume that each consumer is uncertain about his or her future preference defined by the location on the Hotelling line. More specifically, each consumer expects his or her future location to be uniformly distributed along the unit line. The change of preference can be attributed to many factors. For example, a business traveler may not know which route he or she would need to fly next time, and hence which airline would offer preferred flights; a taxi driver may not know the preferred location to refill gasoline next time because of the uncertainties associated with pickup locations and travel routes. The change of preference can also result from the heavy influence of ongoing marketing activities. The independent preference assumption is not uncommon in the literature. Both Caminal and Matutes (1990) and Von Weizsacker (1984) adopt the same independent preference assumption. This assumption has the advantage of ensuring the existence of consumer switching in the equilibrium and smoothing the demand function. In contrast, when consumers maintain the same preferences over time, Kim et al. (2001) shows that switching may not occur, and the demand functions are not always differentiable. Alternative model structures may consist of two types of consumers – one segment with constant preferences and another segment with independent preferences (e.g., Klemperer 1987a), allow consumer preferences to be correlated between two periods (e.g., Shin and Sudhir 2010), or include consumer uncertainty about future consumptions (Singh et al. 2008). Such model structures are often required to explain specific observations, such as asymmetric reward strategies; however, with this complexity, the analysis of endogenous switching costs may no longer be tractable (Singh et al. 2008). Moreover, the additional model complexity is unlikely to alter the qualitative implications of our results.

In the first period, the competing firms simultaneously announce their loyalty rewards (denoted by τ i for firm i) along with their first-period prices (denoted by\( p_1^i \) for firm i). After observing the firms’ decisions, each consumer chooses a firm to maximize total expected values from two periods. All first-period consumers will return to the market in the second period. In the second period, the competing firms set their prices (denoted by \( p_2^i \) for firm i), and then each consumer chooses a firm to maximize the second-period value. When a consumer makes a repeat purchase from the same firm in the second period, the consumer receives the loyalty reward.Footnote 1

In the second period, each firm faces two types of consumers based on their first-period choices: the firm’s current customers and its competitor’s customers. We let τ 0 denote a consumer’s exogenous switching costs. We assume the exogenous switching cost τ 0 is identical across all consumers. As a standard assumption in the literature, we assume the exogenous switching cost τ 0 <t to ensure that some consumers switch between the firms in the second-period equilibrium. This scenario is more common and interesting than the scenario in which the exogenous switching cost is so large that τ 0 >t and all consumers would stay loyal.

3 Model analysis

We now analyze consumers’ purchase decisions and firms’ equilibrium strategies. In our model, both consumers and firms are forward looking and maximize their surpluses or profits from the remaining part of the decision horizon. Given the dynamic nature of the problem, the subgame perfect equilibrium is derived through a backward induction method. The analysis starts with the second period, when a firm’s state is described by the number of customers the firm has in the first period. After analyzing the subgame, we move backwards to the first period and investigate each firm’s first-period prices and loyalty-rewards decisions in a symmetric equilibrium.

3.1 Second-period price competition

In the second period, each firm decides its second-period price to maximize the firm’s second-period profit. Given the prices set by the firms, each consumer chooses a firm based on the consumer’s current preference as well as the consumer’s choice in the first period. For notational convenience, we focus on discussing firm A’s customer acquisition and retention strategy in the second period. The analysis for firm B is essentially the same. We let \( x_1^A \) and \( x_1^B \) denote the number of first-period buyers for firm A and B, respectively, where \( x_1^A + x_1^B = 1 \). These \( x_1^A \) consumers who buy from firm A in the first period need to decide whether to stay with firm A or switch to firm B. They can enjoy loyalty reward τ A if they stay loyal to firm A. By switching to another firm (B), they not only forfeit the rewards but also incur the exogenous switching cost τ 0 .

Recall that we assume independent consumer preferences over two time periods. In other words, firm A’s first-period customers are uniformly distributed along the unit interval in the second period. To determine firm A’s retention rate among the \( x_1^A \) consumers, we identify the marginal consumers located at point \( x_2^A \) who are indifferent between buying from firm A or B.

where v is the consumer’s common reservation price for the competing products and t is the unit transportation cost. From Eq. (1), we can determine firm A’s second-period market share among its \( x_1^A \) past customers.

Equation (2) provides firm A’s retention rate for its first-period customers. The remaining \( x_1^A\left( {{1} - x_2^A} \right) \) customers switch to firm B. Firm A’s retention rate increases with both the endogenous switching cost (τ A ) and exogenous switching cost (τ 0 ). While the endogenous switching cost enhances the value of a repeat purchase, the exogenous switching cost reduces the value of the alternative option (firm B). In Eq. (2), these two types of switching costs are substitutable in generating customer retentions. Clearly, firm A enjoys a competitive advantage in this segment due to the switching costs. The retention rate also increases with the competitor’s price and decreases with the firm’s own price. Finally, the effect of prices and both types of switching costs on the firm’s retention rate decreases with unit transportation cost (t). Thus, when the competing firms are further differentiated, product preferences become more important, and then the switching costs become less important in consumers’ decisions.

Similarly, the \( x_1^B \) consumers who buy from firm B in the first period are uniformly distributed in the unit interval in the second period. Among these consumers, the marginal consumers who are indifferent between staying with firm B or switching to firm A are located at point \( x_2^B \) determined by the following equation:

Equation (3) measures firm A’s new customer acquisitions. Since these consumers buy from firm B in the first period, in switching to firm A, they have to overcome both the exogenous and endogenous switching costs.

Each firm sets its second-period price to maximize its own second-period profit. Specifically,

where \( x_2^A \) and \( x_2^B \) are given by Eqs. (2) and (3), respectively. We use the first-order conditions to solve the above equilibrium second-period prices. (See the Appendix for the derivation.)

Equation (4) shows that a firm’s second-period price increases with the unit transportation cost, the firm’s endogenous switching cost, and the firm’s first-period market share. The effect of the exogenous switching cost depends on the firm’s first-period market share. First, in this period, loyalty rewards become additional costs in serving repeat customers. Such impact of the loyalty rewards on the second-period price increases with the firm’s market share. Second, due to the exogenous switching cost τ 0 , a firm wants to price high to exploit the captive consumers but price low to attract competitor’s customers. Overall, the exogenous switching cost increases a firm’s second-period price if and only if the firm has more than half of the market share in the first period. Substitute the second-period prices into the market share equations, and we have:

Equation (5) shows that the retention probability increases with both firms’ loyalty rewards as well as with the exogenous switching costs. For firm A’s first-period customers, loyalty reward τ A serves as the endogenous switching cost and increases customer retention. Surprisingly, firm A’s retention rate also increases with firm B’s loyalty reward τ B . This is because the loyalty reward τ B is costly to firm B; by increasing firm B’s second-period price, the loyalty reward τ B increases firm A’s retention rate. Finally, the retention rate increases with the exogenous switching cost τ 0 . Since switching is the opposite of retention, as indicated by Eq. (6), the switching probability is lower when firms’ loyalty rewards are higher and/or the exogenous switching costs are greater.

Substitute Eqs. (4), (5) and (6) into a firm’s profit function, and we can obtain the equilibrium second-period profit.

The above equation indicates that a firm’s second-period profit decreases with its endogenous switching costs. Although a firm increases its retention rate through the loyalty rewards, its profit margin decreases significantly due to the reward costs. However, in the equilibrium, the firm’s second-period profit increases with its first-period market share. Thus, in a market with switching costs as modeled in this paper, a firm offers the loyalty rewards to acquire customers through delayed incentives. We summarize these results in the following proposition.

Proposition 1:

-

1.1.

A firm’s second-period equilibrium price and customer retention rate increases with the endogenous switching cost.

-

1.2.

A firm’s second-period retention rate increases with the exogenous switching cost; the second-period equilibrium price increases (decreases) with the exogenous switching cost if the firm’s first-period market share is greater (smaller) than 0.5.

We now move backwards to the first period to study the endogenous switching costs.

3.2 First-period price competition

In the first period, a consumer chooses a firm to maximize the expected (discounted) value from two periods. A consumer not only considers the first-period price and transportation costs, but also the expected second-period price and transportation costs. To compute the expected value in the second period, a consumer needs to anticipate the probability of remaining with the same firm and receiving loyalty rewards, as well as the probability of switching to another firm and incurring the exogenous switching cost. The equilibrium market share \( x_1^A \) and \( x_1^B \) are determined by the location of marginal consumers satisfying the following equation:

where \( x_2^A \) and \( x_2^B \) are given by (5) and (6), respectively, \( p_2^A \) and \( p_2^B \) are given by (4), and parameter δ is the consumer’s discount factor. Note that both \( x_2^A \) and \( x_2^B \) are functions of \( x_1^A \) and are computed from the subgame equilibrium outcomes. On the left side of Eq. (8), the marginal consumer chooses to purchase from firm A in the first period. In the second period, with probability \( x_2^A \) this consumer will be located at point \( {\mathrm{x}} \in \left( {0,x_2^A} \right) \), will make a repeat purchase from firm A, and will incur transportation cost xt; with probability \( \left( {{1} - x_2^A} \right) \) this consumer will be located at a point \( {\mathrm{x}} \in \left( {x_2^A,\;{1}} \right) \), will switch to firm B, and will incur transportation cost (1 - x)t. Similarly, the right side of Eq. (8) calculates the total expected value if the marginal consumer located at \( x_1^A \) chooses to purchase from firm B in the first period.

Each firm sets the first-period price and loyalty rewards to maximize its total expected profits from two periods.

where \( x_1^i \) is determined by (8), second-period profit \( \pi_2^i\left( {x_1^A} \right) \) is given by (7), and i = A, B. We use the first-order conditions to solve the equilibrium endogenous switching cost and first-period price in (9). Given our interest in the symmetric equilibrium, we apply the symmetry (\( x_1^{{A^* }} = x_1^{{B^* }} = {{1} \left/ {2} \right.},\tau_A^* = \tau_B^* \)) to the first-order conditions. A challenge with directly applying the first-order approach is the complexity of Eq. (8). Since \( x_2^A \), \( x_2^B \), \( p_2^A \), and \( p_2^B \) are all functions of \( x_1^A \), deriving the first-period market share and calculating the first-order derivatives is rather complex. Instead of obtaining the explicit expression for \( x_1^A \), we use the implicit function method to obtain the first-order derivatives, \( \partial x_1^i/\partial p_1^i \) and \( \partial x_1^i/\partial {\tau_i} \). To ensure the validity of this approach, following implicit function theory (Chiang 1984), we prove in the Appendix that Eq. (8) defines an implicit function \( x_{1}^{i}=h(p_{1}^{A},p_{1}^{B},{{\tau }_{A}},{{\tau }_{B}}) \), which is continuous and has continuous partial derivatives \( \partial x_1^i/\partial p_1^i \) and \( \partial x_1^i/\partial {\tau_i} \). We then substitute the first-order derivatives \( \partial x_1^i/\partial p_1^i \) and \( \partial x_1^i/\partial {\tau_i} \) into the first-order conditions for the problem defined in Eq. (9), and solve the equilibrium strategies in the first period. We keep in the Appendix the detailed derivations and the proof that the Hessian matrix is negative definite to ensure the optimality of solutions.

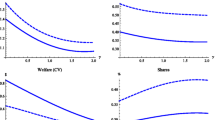

Equation (10) shows that the first-period equilibrium price decreases with exogenous switching cost but increases with consumer’s discount rate. First, Eq. (10) shows that, since 3 >δ 2, the first-period equilibrium price decreases with the exogenous switching cost τ 0. A higher exogenous switching cost implies a higher retention rate, and hence greater customer lifetime value. Competing firms would charge lower first-period prices in order to acquire these customers. Second, Eq. (10) shows that the first-period price increases with the consumer’s discount rate (δ). This is because with a larger value of δ, a forward-looking consumer values future payoff more, and therefore the firm will offer more rewards. A larger loyalty reward would increase the first-period price by increasing the firms’ expected costs of serving their customers. Finally, Eq. (10) shows that the first-period equilibrium price can exceed t, which is the equilibrium price in a static model without any switching costs. As firms offer loyalty rewards, the cost of serving customers and hence the prices increases. Note that the loyalty reward increases with t and δ as indicated by (11). Thus, when t and δ are sufficiently large, the equilibrium loyalty reward is big enough that the first-period price can exceed t.

Equation (11) shows that the equilibrium loyalty rewards increase with unit transportation cost t and discount factor δ, but decrease with the exogenous switching cost (τ 0). The positive relation with unit transportation cost t is not difficult to understand, because when two firms are further differentiated, any incentives – including lower prices and higher rewards – become less effective in attracting consumers. As a result, the prices are higher and the endogenous switching costs are lower. However, the negative relation between the endogenous switching costs and exogenous switching costs is not straightforward. Further examination of the analysis reveals the key intuition that the firms would offer more loyalty rewards when consumers are less likely to redeem them. As indicated by Eq. (5), the retention rate, and hence the anticipated chance to redeem the reward, increases with the size of the exogenous switching cost. Since the firms have to commit to the loyalty rewards in the first period, the loyalty rewards and the first-period prices are two alternative instruments used to acquire new customers. Either a reduction in first-period price or an increase in future loyalty rewards can boost customer acquisition. While the price reduction leads to an immediate loss of profit margin, the cost of loyalty rewards is delayed to the second period. When consumers are less likely to redeem the rewards due to smaller exogenous switching costs, it is better off for the firms to offer more loyalty rewards because the loyalty rewards become a more efficient customer acquisition tool. Footnote 2

We summarize the main equilibrium results discussed above in the following proposition.

Proposition 2:

-

2.1.

The first-period equilibrium price increases with unit transportation cost t and discount factor δ but decreases with the exogenous switching cost τ 0.

-

2.2.

The equilibrium endogenous switching cost increases with unit transportation cost t and discount factor δ but decreases with the exogenous switching costs τ 0.

3.3 Discussion: equilibrium results

In this section, we further discuss the properties of our equilibrium results in three directions. First, we study the competitive effect of endogenous switching costs by comparing our results with the model without endogenous switching costs. Specifically, we examine how the presence of endogenous switching costs could affect equilibrium prices and profits. Second, we compare our paper with Caminal and Matutes (1990) and discuss the new insights from our model and analysis. Finally, we discuss the differences between models with endogenous switching costs and traditional BBPT models.

3.3.1 Competitive effects of endogenous switching costs

To examine the effects of endogenous switching costs on market competition, we first derive the equilibrium results for the benchmark case where neither firm has the option of offering loyalty rewards, i.e., we impose the constraints τ A = τ B = 0 in the analysis (see the Appendix for details of the derivation). We denote this case by “o”. Note that we cannot derive the equilibrium prices for the benchmark case directly from Eq. (10) because the equilibrium prices in Eq. (10) are optimal only when both firms offer the equilibrium rewards given by Eq. (11).

Effect of switching costs on equilibrium prices and price dynamics over two periods

In the benchmark case, the equilibrium price for the first period \( p_1^{io} = t - 2{\tau_0}\left( {t - \delta {\tau_0}} \right)/\left( {3t} \right) < t \) and for the second period \( p_2^{io} = t \). Since the equilibrium price without any switching costs is equal to t in both periods, the presence of exogenous switching costs decreases the first-period price but does not change the second-period price; as a result, the equilibrium price increases from period one to period two. The firms charge a lower price in the first period to acquire customers, hoping to exploit their switching costs in the second period. Interestingly, once we include the endogenous switching cost, the first-period equilibrium price increases to \( p_1^{{i^* }} \) as given by Eq. (10). The price increase is caused by two factors: 1) the increased costs incurred to serve customers due to the costs of loyalty rewards, and 2) the reduced price sensitivity due to consumers being forward looking. When the discount factor δ is sufficiently large, the first-period price is greater than the second-period price (\( p_2^{{i^* }} = t + \frac{{\delta t - {\tau_0}}}{3} \)), exhibiting a downward price dynamic. Therefore, the endogenous switching costs can dramatically alter the price dynamics. (See the Appendix for the proof for the above results.)

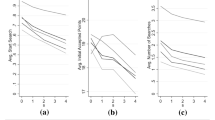

Effect of switching costs on customer retention rates and social welfare

In the absence of any switching costs, the markets would be equally shared by two competing firms in both periods. In our model, with independent brand preferences over time, both the retention rate and the switching rate are 50 %. Once we consider the exogenous switching costs in the benchmark model, the retention rate increases to \( x_2^{Ao} = 0.5 + {\tau_0}/\left( {2t} \right) \) and the switching rate decreases to \( x_2^{Bo} = 0.5 - {\tau_0}/\left( {2t} \right) \). Thus, the exogenous switching costs increase the retention rate by τ 0/(2t) and decrease the switching rate by the same amount. If we incorporate the endogenous switching cost, the equilibrium retention rate becomes \( x_2^{{A^* }} = 0.5 + \left( {2\delta t + {\tau_0}} \right)/\left( {6t} \right) \), and the switching rate becomes \( x_2^{{B^* }} = 0.5 - \left( {2\delta t + {\tau_0}} \right)/\left( {6t} \right) \). Thus, the endogenous switching cost further increases the retention rate by \( \left( {\delta t - {\tau_0}} \right)/\left( {{3}t} \right) \), which is proportional to the endogenous switching cost \( \tau_i^* \). Note that the marginal increase of the retention rate due to the endogenous switching cost is greater when the exogenous switching cost (τ 0) is smaller. This can be explained by the result that when the exogenous switching cost is lower, the equilibrium loyalty rewards offered by the firms are higher. Within our model framework, since consumers’ brand preferences are independent over two periods, a higher retention rate means that a larger percentage of consumers use less preferred brands in the second period, leading to a loss of consumer welfare.

Effect of switching costs on equilibrium profits

In a model without any switching costs, each firm earns an equilibrium profit of t/2 in each time period. With exogenous switching costs as in the benchmark model, both firms set lower prices in the first period to compete for customers. As a result, each firm’s first-period profit decreases to \( \pi_1^{io} = t/2 - {\tau_0}\left( {t - \delta {\tau_0}} \right)/\left( {3t} \right) \), the second-period profit remains the same at \( \pi_2^{io} = t/2{ } \), and each firm’s total profit decreases by\( {\tau_0}\left( {t - \delta {\tau_0}} \right)/\left( {3t} \right) \). Once we incorporate the endogenous switching costs in our model, the competing firms increase their prices but have to incur the cost of loyalty rewards. As a result, the first-period profit increases to \( \pi_1^{{i^* }} = t/2 - {\tau_o}/3 + {\delta^2}\left( {2\delta t + {\tau_0}} \right)/9 \), but the second-period profit decreases to \( \pi_2^{{i^* }} = t/2 - \left( {\delta t - {\tau_0}} \right)\left( {2\delta t + {\tau_0}} \right)/\left( {3t} \right) \). Overall, the competing firms’ total profits decrease with the adoption of endogenous switching costs, representing a prisoner’s dilemma. (See the Appendix for the derivation and proof.) The amount of additional profit loss increases with the size of the discount factor and endogenous switching cost. In our model, the market is always fully covered, and each firm shares half of the market in the equilibrium. As firms offer more loyalty rewards to attract customers, the profit margin goes down, and the equilibrium profit decreases for each firm. Thus, the exogenous switching costs hurt profits because the firms lower their prices to aggressively compete for customers, from whom they expect to reap loyalty benefits in the future. In contrast, the endogenous switching costs hurt profits due to the cost of the loyalty rewards. When the redemption rate for loyalty rewards is low, the firms use the rewards excessively to compete for new customers, leading to the “prisoner’s dilemma” in the equilibrium.

3.3.2 Distinctions from Caminal and Matutes (1990)

Our paper analyzes a model very similar to that in Caminal and Matutes (1990). Like Caminal and Matutes (1990), we derive the endogenous switching costs in a two-period model. In addition to modeling horizontal product differentiation through transportation cost as in Caminal and Matutes (1990), in this paper, we also incorporate the exogenous switching costs. In the analysis, we replicate the positive relation between the endogenous switching cost and unit transportation cost as demonstrated by Caminal and Matutes (1990). More importantly, we extend the literature by showing that endogenous switching costs decrease with exogenous switching costs. This new result is not trivial because exogenous switching costs and product differentiation affect market competition very differently.

Endogenous switching costs decrease with exogenous switching costs but increase with transportation cost. Although both product differentiation (as measured by transportation cost) and switching costs mitigate price competition, conceptually these two factors affect consumers very differently. A consumer incurs transportation costs in each purchase of a firm’s product because these costs represent the discrepancy between the consumer’s ideal preference and the firm’s product positioning. In contrast, a consumer incurs exogenous switching costs if and only if the consumer changes suppliers. Exogenous switching costs do not apply to loyal customers who make repeat purchases from the same brands, and thus these costs act only as deterrents for brand switching. Because of these conceptual differences, exogenous switching costs and transportation costs play different roles in determining the size of endogenous switching costs. First, these two factors affect retention rates and reward redemption rates differently. Specifically, a larger exogenous switching cost means a higher retention rate, but a larger transportation cost means a lower retention rate. As the expected cost of loyalty rewards increases with retention, and hence the redemption rate, the competing firms offer smaller loyalty rewards. Second, when the transportation cost is high, consumers place higher weights on their brand preference and lower weights on prices and rewards in their consumer decisions. Since consumers are not responsive to the loyalty rewards, in the equilibrium, the endogenous switching cost is smaller.

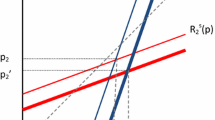

3.3.3 Loyalty rewards versus BBPD

Our model assumes that each firm charges the same second-period price for all consumers. Each firm also commits to a loyalty reward for returning customers in the second period. Effectively, in the second period, returning customers pay less than new customers by the amount of \( \tau_i^* = \frac{2}{3}\left( {\delta t - {\tau_0}} \right) \) given by Eq. (11). In contrast, a BBPD model (e.g., Chen 1997) assumes that each firm charges different second-period prices for new and returning customers. We analyze a BBPD model with our demand structure in the Appendix and find that in the second period a returning customer pays \( t + \frac{1}{3}{\tau_0} \), while each new customer pays \( t - \frac{1}{3}{\tau_0} \). Thus, the price for new customers is lower by the amount of \( \frac{2}{3}{\tau_o} \). Intuitively, under BBPD, the firm should charge a lower price for new customers to help overcome these consumers’ switching costs τ o, and charge a higher price for returning customers to exploit their switching costs. Clearly, the results from our model are opposite to the results under BBPD: while in our model the firm commits to a discount for returning customers, the BBPD model leads to a discount for new customers. Moreover, while the amount of reward received by each returning customer decreases with switching costs, the price difference under BBPD increases with switching costs. Finally, our analysis shows that the first-period price under BBPD is \( p_1^{{i^* }} = t - \frac{2}{3}{\tau_0} \), which indicates a lower price (than t) for customer acquisition in the first period. This price is always lower than the first-period price \( p_1^{{i^* }} = t + \frac{{4{\delta^3}}}{9}t - \frac{2}{9}\left( {3 - {\delta^2}} \right){\tau_0} \) given by Eq. (10) in our model. Thus, while a BBPD strategy intensifies price competition in the first period, the loyalty rewards could mitigate the price competition in the first period.

4 Conclusion

This paper studies the relation between endogenous and exogenous switching costs in a symmetric duopoly model. We find that endogenous switching costs decrease with exogenous switching costs. Higher exogenous switching costs lead to greater customer retention rates, and hence greater redemption rates for loyalty rewards. For a given size of loyalty reward, when the redemption rate is high, the firm’s cost of offering the loyalty rewards will be high, thus making loyalty rewards a costly promotional tool for customer acquisition. Consequently, in the equilibrium, competing firms will provide smaller endogenous switching costs. Our analysis also shows that, while exogenous switching costs decrease the first-period price, endogenous switching costs increase the first-period price. Both types of switching costs increase customer retention rates and reduce the extent of brand switching. Finally, our equilibrium results represent a prisoner’s dilemma, as firms lose more profits when both firms offer higher endogenous switching costs.

Our paper provides theoretical predictions for the relation between endogenous and exogenous switching costs. This result seems consistent with casual observations in certain industries. For example, exogenous switching costs are considerably low in the airline and retail gasoline industries, and these industries typically offer very generous loyalty programs. Future research should more systematically examine the empirical relation between endogenous and exogenous switching costs. One industry worth attention is the packaged goods industry, which frequently uses in-pack and on-pack coupons to encourage repeat purchases (Blattberg and Neslin 1990; Raju et al. 1994). One could measure the brand differentiation and exogenous switching costs in different categories within this industry and study their relation with coupon sizes.

Future research may further extend the domains of switching costs. In this paper, we limit endogenous switching costs to loyalty rewards. There are many other types of switching costs, which are often considered as exogenous, can be treated as endogenous decisions. For example, in wireless communication industry, consumers may have to change phone numbers when switching between service operators. Such switching cost is often considered as exogenous, but becomes endogenous when regulators impose number portability to reduce consumer switching costs (Shi et al. 2006). For another example, switching costs may arise from product compatibility. When competing products are not compatible, consumers have to forego their investment in previous purchases when switching to another supplier. In some markets, competing firms can manage the extent of compatibility through product design (Marinoso 2001). Future research can examine the relationship between the optimal level of compatibility and the size of switching costs. Switching costs may also arise from a customized benefit that a supplier can offer based on preference information collected from previous purchases (Pazgal and Soberman 2008). When a consumer switches to a new supplier, a new learning process is required before the new supplier can start offering customized benefits. Such switching costs could be mitigated through information sharing among the suppliers (Bouckaert and Degryse 2004). Future research may examine how the size of exogenous switching costs may affect a firm’s incentive to invest in such information-based value-creating capabilities. Finally, future research may also extend the domains of exogenous switching costs. For instance, Villas-Boas (2004) shows that exogenous switching cost may arise when consumers learn about the products they purchase. Our paper can be extended to study how the size of loyalty rewards may depend on the distribution of product valuations.

Notes

Committing to a loyalty reward assumes that a firm can specify the products being purchased in each period. When a firm sells multiple products, the firm may need to devise a complex incentive system that provides a unique reward for each bundle of products purchased.

This paper focuses on the situations where δ is sufficiently large that reward τ i in Eq. (11) is positive. A very small δ implies that consumers are myopic and their current decisions ignore expected payoff in the second period. In such a case, firms’ commitments to future rewards will not affect consumer decisions in the first period. Consequently, it is optimal for the firms to charge repeat customers higher prices in the second period (i.e., a negative τ i ) to exploit switching costs. Given the focus of this paper on the use of loyalty rewards as a form of endogenous switching costs, it is necessary that consumers anticipate these future rewards and incorporate the future payoffs into their current decisions; in other words, δ should be sufficiently large.

References

Blattberg, R. C., & Neslin, S. A. (1990). Sales promotion: concepts, methods, and strategies. Prentice Hall.

Bouckaert, J., & Degryse, H. (2004). Softening competition by inducing switching in credit markets. Journal of Industrial Economics, LII(1), 27–52.

Caminal, R., & Matutes, C. (1990). Endogenous switching costs in a duopoly model. International Journal of Industrial Organization, 8, 353–373.

Chen, Y. (1997). Paying customers to switch. Journal of Economics and Management Strategy, 6, 877–897.

Chiang, A. (1984). Fundamental methods of mathematical economics, 3rd Edition. McGraw-Hill Inc.

Farrell, J., & Klemperer, P. (2007). Coordination and lock-in: Competition with switching costs and network effects. In M. Armstrong & R. H. Porter (Eds.), Handbook of industrial organization, Vol. 3 (pp. 1967–2072). North Holland: Elsevier.

Farrell, J., & Shapiro, C. (1988). Dynamic competition with switching costs. The RAND Journal of Economics, 19(1), 123–137.

Fudenberg, D., & Tirole, J. (2000). Customer poaching and brand switching. The RAND Journal of Economics, 31(4), 634–657.

Kim, B., Shi, M., & Srinivasan, K. (2001). Reward programs and tacit collusion. Marketing Science, Spring.

Klemperer, P. (1987a). The competitiveness of markets with switching costs. The RAND Journal of Economics, 18, 138–150.

Klemperer, P. (1987b). Markets with consumer switching costs. Quarterly Journal of Economics, 102, 375–394.

Klemperer, P. (1995). Competition when consumers have switching costs: An overview with applications to industrial organization, macroeconomics, and international trade. Review of Economics Studies, 62, 515–539.

Lal, R., & Bell, D. E. (2003). The impact of frequent shopper programs in grocery retailing. Quantitave Marketing and Economics, 1(2), 179–202.

Marinoso, B. G. (2001). Technological incompatibility, endogenous switching costs and lock-in. The Journal of Industrial Economics, 49, 281–298.

Pazgal, A., & Soberman, D. A. (2008). Behavior-based discrimination: Is it a winning play and if so when? Marketing Science, 27(6), 977–994.

Raju, J. S., Dhar, S. K., & Morrison, D. G. (1994). The effect of package coupons on brand choice. Marketing Science, 13(2), 145–164.

Raju, J. S., Dhar, S. K., & Morrison, D. G. (1996). The effect of package coupons on brand choice: an epilogue on profits. Marketing Science, 15(2), 192–203.

Shaffer, G., & Zhang, Z. J. (2000). Pay to switch or pay to stay: preference-based price discrimination in markets with switching costs. Journal of Economics and Management Strategy, 9(3), 397–424.

Shi, M., Chiang, J., & Rhee, B. (2006). Price competition with reduced consumer switching costs: the case of wireless number portability in cellular phone industry. Management Science, 52(1), 27–38.

Shin, J., & Sudhir, K. (2010). A customer management dilemma: When is it profitable to reward one’s own customers. Marketing Science, February.

Singh, S., Jain, D., & Krishnan, T. (2008). Customer loyalty programs: Are they profitable. Management Science, 54(6), 1205–1211.

Sjostrom, W. (2002). Liner shipping: Modeling competition and collusion. In Costas Th. Grammenos (Ed.), Handbook of maritime economics and business (pp. 307–326). London: Lloyds of London Press.

Villas-Boas, M. (1999). Dynamic competition with customer recognition. The RAND Journal of Economics, 30(4), 604–631.

Villas-Boas, M. (2004). Consumer learning, brand loyalty, and competition. Marketing Science, 23(1), 134–145.

Weizsacker, V. (1984). The costs of substitution. Econometrica, 52(5), 1085–1116.

Author information

Authors and Affiliations

Corresponding author

Additional information

The author thanks the editor, two anonymous reviewers, and seminar participants at MIT, Syracuse University, Wharton, and Marketing Science Conference for helpful suggestions on this paper. Financial support from Social Sciences and Humanities Research Council of Canada is gratefully acknowledged.

Appendices

Appendix

1.1 Second-period price competition

The firms’ second-period pricing problems are defined as follows:

where market shares are given below

Substitute (A1) and (A2) into the optimization problem, we take the first order conditions and solve the second-period prices.

Substitute the prices (A3) into the market share Eqs. (A1) and (A2), we have

Substitute (A3), (A4), and (A5) into firms’ profit functions, we obtain the equilibrium second-period profit.

Proof of Proposition 1:

-

(1).

First, from (A3), we see that a firm’s second-period price \( p_2^i \) increases with its own endogenous switching cost τ i , but is independent of competing firm’s endogenous switching cost. Second, from (A4), we see that a firm’s second-period customer retention rate (\( x_2^A \) for firm A) increases with its own (τ A ) as well as competitor’s endogenous switching cost (τ B ).

-

(2).

First, from (A4), we see that a firm’s second-period customer retention rate (\( x_2^A \) for firm A) increases with exogenous switching cost (τ 0). Second, from (A3), we see that a firm’s second-period price \( p_2^i \) increases with its exogenous switching cost τ 0 if the firm’s first-period market share \( x_1^i \) is greater than 0.5. When a firm (say, firm A) sets the second-period price, the firm balances between the need to acquire new customers (in segment \( x_1^B \)) with a low price in order to overcome these consumer’s switching costs τ 0, and the need for a high price to exploit existing customers (in segment \( x_1^A \)). The equilibrium price (for firm A) increases with exogenous switching cost (τ 0) if and only if the need to exploit the existing customers has a larger weight (when \( x_1^A \) is larger than \( x_1^B \)). Q.E.D.

First-period competition

To determine the first-period market shares, we identify the marginal consumers who are indifferent between buying from A and B.

where \( x_2^A \) and \( x_2^B \) are given by (A4) and (A5) respectively, and \( p_2^A \) and \( p_2^B \) are given by (A3). (A7) can be simplified to the following equation:

Each firm sets the first-period price and rewards to maximize its total expected profits from two periods. The problem is defined as follows:

where \( x_1^i \) is determined by (A8), 2nd-period profit \( \pi_2^i\left( {x_1^A} \right) \) is given by (A6), i = A, B. Note that we assume a firm does not discount future profit. To solve the equilibrium endogenous switching cost and first-period price, we take the first order conditions:

From (A6), we have

To solve the equilibrium first-period prices and endogenous switching costs with Eqs. (A9.1), (A9.2), (A10.1), and (A10.2), we need to obtain \( \frac{{\partial x_1^i}}{{\partial p_1^i}} \) and \( \frac{{\partial x_1^i}}{{\partial {\tau_i}}} \). A common and direct approach is to solve \( x_1^A \) from Eq. (A8), H = 0, and then obtain these derivatives. However, in Eq. (A8), \( x_2^A \), \( x_2^B \), \( p_2^A \), and \( p_2^B \) are all functions of \( x_1^A \) given by (A3), (A4), and (A5). Since Eq. (A8) involves nonlinear functions of \( x_1^A \), the direct approach, which solve \( x_1^i \) from (A8) before obtaining first-period equilibrium is quite cumbersome. Instead, it is easier to obtain partial derivatives \( \frac{{\partial x_1^i}}{{\partial p_1^i}} \) and \( \frac{{\partial x_1^i}}{{\partial {\tau_i}}} \) from Eq. (A8). To ensure that such an approach is valid, one needs to show that the partial derivatives \( \frac{{\partial x_1^i}}{{\partial p_1^i}} \) and \( \frac{{\partial x_1^i}}{{\partial {\tau_i}}} \) from (A8) are continuous. We prove this property with implicit function theory (Chiang 1984).

Proof with implicit function theory

According to implicit function theory (Chiang 1984, page 204), to ensure that (A8) defines an implicit function \( {x_\downarrow }{1^\uparrow }i = h\left( {{p_\downarrow }{1^\uparrow }A,{p_\downarrow }{1^\uparrow }B,{\tau_\downarrow }A,{\tau_\downarrow }B} \right) \) that is continuous and has continuous partial derivatives \( \frac{{\partial x_1^i}}{{\partial p_1^i}} \) and \( \frac{{\partial x_1^i}}{{\partial {\tau_i}}} \), it is sufficient to show that (a) H has continuous partial derivatives \( \frac{{\partial H}}{{\partial x_1^i}} \), \( \frac{{\partial H}}{{\partial p_1^i}} \), and \( \frac{{\partial H}}{{\partial {\tau_i}}} \), and (b) derivatives \( \frac{{\partial H}}{{\partial x_1^i}} \) can be non-zero at some points. Since H is a quadratic function of first-period shares (\( x_1^i \)), first-period prices (\( p_1^i \)), and endogenous switching costs τ i , condition (a) is clearly satisfied. To demonstrate that condition (b) is also satisfied, we examine \( \frac{{\partial H}}{{\partial x_1^A}} \).

We use (A3), (A4), and (A5) to obtain partial derivatives and substitute into above equation. After further simplification, we obtain

Thus, both conditions (a) and (b) for implicit function theory are always satisfied. Q.E.D.

Take first-order derivative on Eq. (A8) with respect to\( p_1^A \),

From Eqs. (A3), (A4), and (A5), we take first-order derivative with respect to \( p_1^A \).

Substitute (A12.1) ~ (A12.4) into (A11), we simply the expression and have

From the above equation, we can solve

Similarly, we take first-order derivative on Eq. (A8) with respect to τ A ,

Again, from Eqs. (A3), (A4), and (A5), we take first-order derivative with respect to τ A ,

Substitute (A16.1) ~ (A16.4) into Eq. (A15), we simplify the expression and have

From the above equation, we can solve

Substitute (A10.1), (A10.2), (A14), and (A18) into (A9.1) ~ (A9.2), we then apply the symmetry and have

Substitute (A19) and (A20) into (A3), (A4), and (A5), we obtain 2nd period equilibrium results.

Proof for Proposition 2

-

2.1.

From (A19), it is clear that first-period equilibrium price \( p_1^{{i^* }} \) increases with the unit transportation cost (t) but decreases with the exogenous switching cost (τ 0).

-

2.2.

From (A20), it is clear that the equilibrium endogenous switching cost (\( \tau_i^* \)) increases with unit transportation cost (t) but decreases with the exogenous switching costs (τ 0). Q.E.D.

2.1 Validate second-order conditions

Here we validate that (A19) and (A20), which are solutions to the first-order conditions (A9.1) and (A9.2), indeed maximize respective firms’ profits. A sufficient condition is negative-definite Hessian, which requires three conditions: \( \frac{{{\partial^2}{\pi^i}}}{{\partial p_1^{{i^2}}}} < 0 \), \( \frac{{{\partial^2}{\pi^i}}}{{\partial \tau_i^2}} < 0 \), and \( \frac{{{\partial^2}{\pi^i}}}{{\partial p_1^{{i^2}}}}\frac{{{\partial^2}{\pi^i}}}{{\partial \tau_i^2}} > {\left( {\frac{{{\partial^2}{\pi^i}}}{{\partial p_1^i\partial {\tau_i}}}} \right)^2} \). Next we verify each of these three conditions. For notational convenience, we analyze firm A only. From (A9.1) and (A9.2), we have

From (A13), we can obtain following second-order derivatives,

From (A17),

Finally, from (A10.1), we take second-order derivatives, and apply symmetry,

Substitute (A14), (A26.1), and (A27.1) into (A25.1), upon simplification, we have

From (A14), we know that \( \frac{{\partial x_1^A}}{{\partial p_1^A}} < 0 \)always holds. To see if the first part of expression is always positive, we substitute equilibrium solutions and derive following condition:

which is equivalent to \( 36{t^2} + 16{\delta^3}{t^2} + 8{\delta^2}t{\tau_0} > 3{\tau_0}^2 + 2{\delta^2}{t^2} - \delta {\tau_0}t \). This condition always holds because t >τ0 and δ ≤1. Thus, \( \frac{{{\partial^2}{\pi^i}}}{{\partial p_1^{{i^2}}}} < 0. \)

Substitute (A26.3) and (A27.3) into (A25.2), upon simplification, we have

Upon further simplification, we have

Since t >τ0 and t >τ *i , it is clear that \( \frac{{{\partial^2}{\pi^i}}}{{\partial \tau_i^2}} < 0. \)

Finally, substitute (A18), (A26.2), and (A27.2) into (A25.3), upon simplification, we have

Upon further simplification, we have

To verify the third second-order condition \( \frac{{{\partial^2}{\pi^i}}}{{\partial p_1^{{i^2}}}}\frac{{{\partial^2}{\pi^i}}}{{\partial \tau_i^2}} > {\left( {\frac{{{\partial^2}{\pi^i}}}{{\partial p_1^i\partial {\tau_i}}}} \right)^2} \), we substitute simplified expressions given above. After further simplification, we reduce the condition to

To prove that the above expression is positive, we show that, first, after substituting equilibrium outcomes, the first line of expression is always positive.

Second, after substituting equilibrium outcomes, the second line of expression is also positive as

Thus, the second-order conditions are satisfied: \( \frac{{{\partial^2}{\pi^i}}}{{\partial p_1^{{i^2}}}} < 0,\;\frac{{{\partial^2}{\pi^i}}}{{\partial \tau_i^2}} < 0 \), and

Net effect of reward on second-period equilibrium profit

A firm’s second-period equilibrium profit given by (A6) depends on the firm’s endogenous switching cost in two ways. First, the second-period profit (\( {\pi_\downarrow }{2^\uparrow }i \)) can decrease with τi because, given all others the same, the profit is lower when the cost of reward is higher. Second, the second-period profit (\( {\pi_2^i }\)) can increase with τi because, given all others the same, profit increase with the first-period market share (\( x_1^i \)), which is higher when the firm offers more reward. To examine the net effects, we take first-order derivative on \( \pi_2^i \) given by (A6) and evaluate it at symmetric outcome (\( x_1^{{i^* }} = {{1} \left/ {2} \right.} \)).

Substitute \( \frac{{\partial x_1^i}}{{\partial {\tau_i}}} \) with Eq. (A18), and further simplify the results with equilibrium reward (A20), we have

Since M <1/(2t) and t >τ 0 , clearly the net effect \( \frac{{\partial \pi_2^i\left( {{\tau_i},x_1^i} \right)}}{{\partial {\tau_i}}} < 0 \). Thus, the negative effect of reward cost overweighs the positive effect from a higher market share.

Case 1 for comparison: no endogenous switching costs

As the benchmark case, we derive equilibrium outcomes without endogenous switching costs by imposing τ A = τ B = 0 in the first order conditions. We denote this case by “o”.

4.1 Equilibrium properties

Since δτ 0 <t, from (A28) it is clear that \( p_1^{io} < t = p_2^{io} \). Since the equilibrium price with any switching costs is equal to t, exogenous switching costs decrease first-period price.

Now compare (A28) with (A19), we have

if and only if \( \left( {{2}\delta {\mathrm{t}} + {3}{\tau_{\mathrm{o}}}} \right)\left( {\delta {\mathrm{t}} - {\tau_{\mathrm{o}}}} \right) > 0 \), which is always satisfied because δt - τo >0 as assumed. Thus, endogenous switching costs increase first-period price.

Now compare the equilibrium prices in two periods, (A19) and (A21)

if and only if \( {\delta^{2}}\left( {\delta {\mathrm{t}} - {\tau_{\mathrm{o}}}} \right) > {3}\left( {\delta {\mathrm{t}} + {\tau_{\mathrm{o}}}} \right)\left( {{1} - {\delta^{2}}} \right) \), which will be satisfied with δ is sufficiently close to 1.

We now compute and compare the equilibrium profits,

which can be simplified to \( \delta \left( {{2}\delta t + {3}{\tau_{\mathrm{o}}}} \right)\left( {\delta {\mathrm{t}} - {\tau_{\mathrm{o}}}} \right) < {3}\left( {{2}\delta {\mathrm{t}} + {\tau_{\mathrm{o}}}} \right)\left( {\delta {\mathrm{t}} - {\tau_{\mathrm{o}}}} \right) \). Clearly, this condition is always satisfied. Thus, equilibrium profit decreases with endogenous switching costs; the larger the loyalty rewards, the greater the loss.

Case 2 for comparison: traditional BBPD

Consider a traditional BBPD model like Chen (1997). In the second period, each firm sets two prices, one for new customers (denoted by \( p_{2,n}^i \) for firm i), another for returning customers (denoted by \( p_{2,r}^i \) for firm A).

5.1 Second-period price competition

The firms’ second-period pricing problems are defined as follows:

where market shares are given below

Substitute (A33) and (A34) into the optimization problem, we take the first order conditions and solve the second-period prices.

Equation (35) shows that, first, endogenous switching cost is perfectly covered in second-period price for returning customers. Thus, under traditional BBPD, endogenous switching cost becomes a meaningless device. Second, the net price for returning customers (\( p_{2,r}^i - {\tau_i} = t + {\tau_0}/3 \)) is always higher than the price for new customers (\( p_{2,n}^i = t - {\tau_0}/3 \)). The difference between two prices (2τ 0 /3) increases with the size of exogenous switching cost. Substitute the prices (A35) and (A36) into the market share Eqs. (A33) and (A34), we have

We can then obtain the equilibrium second-period profit.

5.2 First-period competition

To determine the first-period market shares, we identify the marginal consumers who are indifferent from buying from A and B.

where \( x_2^A \) and \( x_2^B \) are given by (A37) and (A38) respectively, and second-period prices are given by (A35) and (A36). After simplification, from (A40) we have

Equation (A41) is very different from the model without price discrimination. This simplified outcome is essentially due to two observations discussed briefly after (A39).

Each firm sets the first-period price to maximize its total expected profits from two periods. Since τi is a meaningless device, we no long include it as a decision variable.

where \( x_1^i \) is determined by (A41), 2nd-period profit \( \pi_2^i\left( {x_1^A} \right) \) is given by (A39), i = A, B. To solve the equilibrium first-period price, we take the first order conditions:

Submitting (A41) and (A39), we have

Total equilibrium profits:

Rights and permissions

About this article

Cite this article

Shi, M. A theoretical analysis of endogenous and exogenous switching costs. Quant Mark Econ 11, 205–230 (2013). https://doi.org/10.1007/s11129-012-9129-4

Received:

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s11129-012-9129-4