Abstract

Earlier work characterized pricing with switching costs as a dilemma between a short-term “harvesting” incentive to increase prices versus a long-term “investing” incentive to decrease prices. This paper shows that small switching costs may reduce firm profits and provide short-term incentives to lower rather than raise prices. We provide a simple expression which characterizes the impact of the introduction of switching costs on prices and profits for a general model. We then explore the impact of switching costs in a variety of specific examples which are special cases of our model. We emphasize the importance of a short term “compensating” effect on switching costs. When consumers switch in equilibrium, firms offset the costs of consumers that are switching into the firm. If switching costs are low, this compensating effect of switching costs causes even myopic firms to decrease prices. The incentive to decrease prices is even stronger for forward looking firms.

Similar content being viewed by others

Avoid common mistakes on your manuscript.

1 Introduction

Switching costs (SC) are a common feature in markets where consumers make repeated purchases over time. Starting from Klemperer (1987), the economic analysis of SC compared a short term incentive to “harvest” loyal customers with a long term incentive to attract new customers (“invest”) for future harvesting. This is echoed in the recent handbook chapter by Farrell and Klemperer (2007) who conclude that the majority of theoretic models imply that the short term effect dominates and SC should relax competition and increase prices.

This paper highlights an additional short term effect of SC beyond the harvest-invest dichotomy that actually decreases prices. If most of the firms’ marginal customers pay the switching cost, an increase in the SC acts like a tax. The firm has to decrease prices below the competitive level in order to compensate the customers that are switching from other goods. This downward pressure on prices applies even if the firm is completely myopic and has no incentive to invest and increase its market share for future harvesting.

The compensating effect of SC is the mirror image of the harvesting effect. Whereas harvesting reflects the ability to charge more to loyal customers—who are less likely to switch due to SC—compensating reflects the short-term value of non-loyal customers who can be induced to switch products. The compensating effect is distinct from the long-term investing effect because it reflects the short term value of marginal customers to today’s revenue while the investing effect reflects the long term value of a loyal customer tomorrow who will be willing to pay more for the firm’s good in order to avoid any switching costs.

Whether an increase in SC generates a short term incentive for the firm to increase or decrease prices depends on the balance between the compensating and harvesting effects. This, in turn, depends on the ratio between the firms’ marginal customers that would have to pay the SC and those that do not. Our results show that in many situations when SC are low, the compensating effect by itself explains why SC decrease resulting prices and profits, even if firms are completely myopic.Footnote 1 In particular, attributing the decrease in prices only to long run investing behavior by the firms in such settings, as is suggested by the harvest-invest approach, is unwarranted.

While intuitive, common modeling assumptions obscure the compensating effect. First, much of the earlier work (e.g., Farrell and Shapiro 1988; Beggs and Klemperer 1992) assumed that SC are so large that, at least in equilibrium, all of the firms’ marginal customers are non-switchers. This eliminated the compensating effect by construction. Our results, in contrast, focus on the case that SC are low. A second alternative assumption is price-discrimination based on consumer loyalty (e.g., Chen 1997; Dubé et al. 2009; Cabral 2012). While the qualitative result under price discrimination is similar to ours—SC create a short term incentive to decrease prices—the economic forces leading to it are different. In particular, firms can compete fiercely for customers that are not loyal to them without affecting the profits from their loyal customers. This changes the short term game considerably from the non price-discrimination case and replaces the compensating effect. In particular, the optimal prices under price discrimination are independent of the relative size of each loyalty group, which is not the case without price discrimination. Finally, a common assumption is that all firms in the market are symmetric and there is no outside good (e.g, Klemperer 1987; Rhodes 2014).Footnote 2 Proposition 3.1 shows that in such settings, if consumers are myopic and SC are low, the short term effects (harvesting and compensating) cancel and prices and profits decrease due only to the investing effect. Our results show that this result is knife-edge, and for example, can be reversed by the introduction of an outside good.Footnote 3

The model presented in this paper—small switching costs in competition between asymmetric firms that do not price discriminate—is applicable to understand the dynamics of many consumer markets which have been studied empirically (e.g., orange juice, yogurt, ketchup – all considered in the empirical literature cited below).Footnote 4 This paper is the first to formalize the short term harvestingandcompensating incentives as well as the long term investing incentive of SC using an infinite-horizon framework. While it is possible to see the compensating effect even in a static game, the dynamic setting is required to determine the firms’ steady state market shares and the resulting balance between harvesting and compensating in equilibrium (Klemperer 1987). This holds even if firms are myopic. In addition, a static analysis cancels the important investing effect for forward looking firms.

To determine the conditions under which switching costs are likely to increase or decrease prices, we examine a series of special cases of our model. Under surprisingly modest conditions the compensating effect dominates short-term incentives and causes even a myopic firm—seeking to maximize only present-period profits—to react to an increase in SC by lowering prices, in contrast to common intuition.Footnote 5 The more familiar role of the investing incentive is also clear, as firms become more patient, holding all else equal, they are more likely to decrease prices as a result of the introduction of switching costs. Combining both short and long term incentives, Propositions 3.1 through 3.5 provide precise characterizations of common settings in which the overall effect of SC is a decrease in prices.

To see why the compensating effect is likely to dominate harvesting, consider an environment without switching costs. With many firms in this market, consumers switch frequently, so a firm’s marginal consumer is unlikely to be a repeat purchaser. If a low SC is introduced to the market, demand from the “non-loyal” consumers drops while demand from loyal consumers increases. Critically, the firm’s prices and profits are still driven by the demand from marginal consumers who in many cases are primarily non-loyal. Thus, compensating dominates: the short term effect of an increase in SC is to reduce prices and profits. Note that this logic holds even if firms are myopic (i.e., there is no incentive to invest). If firms are forward looking, the investment effect provides additional incentive to lower prices.

An important implication of our analysis is that price changes may not reflect the welfare effects of SC. An increase in SC will generally reduce consumer welfare—consumers are either forced to pay an extra SC or to stay with a good they would rather switch away from. However, an increase in SC may either decrease or increase prices and profits. We find that, in competitive markets with small SC, an increase in SC is likely to decrease consumer welfare, prices and profits.

Our analysis adds to a long literature on SC.Footnote 6Farrell and Klemperer (2007) provide a detailed and current review of the economic analysis of SC, outlining the “harvesting” and “investing” conclusions described above. In addition to the papers mentioned above, the working paper version of Viard (2007) provides an alternative two period model of SC, but the results rely on price competition. Our analysis shows that all the effects occur even if only one firm changes its price in response to the SC while the other firms’ prices are fixed, as well and in a more general dynamic setting.

Our work, which does not rely on strong functional form assumptions, complements recent work which investigates switching costs without price discrimination in more stylized models. Recently, Biglaiser et al. (2013) have pointed out that when SC are heterogeneous, they may result in lower firm profits. This result, however, relies on the existence of “shoppers” who face relatively low (or non-existent) SC, while in our analysis lower profits are obtained even if all consumers face the same SC. We consider heterogeneous SC in Appendix B. Garcia (2011) uses a continuous time framework and a particular functional form for consumer utility and also finds that prices are decreasing in the magnitude of SC. In a commentary, Shin et al. (2009) analyze two-period model of a symmetric Hotelling competition and also find that a small SC would decrease prices. Rhodes (2014) extends the analysis to an infinite horizon setting and finds a closed form solution that confirms the result in Shin et al. (2009). Somaini and Einav (2013) extend a Hotelling-style model with switching costs to more than two firms and use their model to analyze the price and welfare effects of mergers in markets with SC. Pearcy (2014) extends the analysis for symmetric firms with large SC and forward looking customers.

Several empirical studies have emphasized that switching costs play an important role in a variety of industries, and have found estimates of switching costs that are consistent with our assumptions of non-zero but non-infinite SC.Footnote 7Shy (2002) uses a homogeneous goods model to approximate SC. In the Israeli mobile phone industry, he finds SC are roughly equal to the cost of a new phone. In the Finnish demand-deposit banking industry, he finds SC are approximately 10 percent of deposits. Shcherbakov (2010) estimates SC in the paid TV industry to be $149 for cable subscribers and $238 for satellite subscribers using market level data. These costs are non-trivial, but are less than the price of a year of satellite or cable television service. Keane (1997) employs a series of models with increasingly flexible forms of unobserved heterogeneity to estimate SC in consumer preferences for ketchup. While SC remain significant after controlling for unobserved heterogeneity, he finds that they are quantitatively small—equivalent to roughly 5 cents. Dubé et al. (2010), use consumer-level data and find that the median consumer exhibits SC in retail margarine and orange juice industries on the order of 12 % and 21 % of product prices respectively. Their results, like Keane’s, are robust to highly flexible controls for unobserved heterogeneity and auto-correlation in taste shocks. Ellickson and Pavlidis (2014) separately estimate SC associated with parent brand and sub-brand in Yogurt. They find that both SC are significant and that a reduction in the SC increases prices. In all these cases, consumers have a reasonable probability of switching, which indicates that the compensating effect may be important. Based on our numerical simulations, the level of SC found in these studies are well within the range we might expect to cause price declines relative to the no SC case. While the above studies take a structural approach, an alternative methodology examines plausibly exogenous changes in switching costs to ascertain their effect. Viard (2007) uses a difference-in-difference estimation on the impact of number portability in the 800-number service market. Viard argues SC would be very high without number portability, since firms use their 800-number in marketing campaigns. He finds that the introduction of number portability (a substantial reduction in SC) caused prices to fall. Park (2011) considers the impact of number portability in the retail cellular phone market. Park finds evidence that the introduction of number portability reduced prices for high-volume consumers—who presumably had high SC—but not for low-volume consumers who would be likely to have low SC.

The next section presents the model and the abstract result. Section 3, derives the SC comparative statics when SC are small for various demand specifications. Finally, we augment the analysis with numerical simulations that confirm the effect for empirically relevant parametrizations. Section 4 summarizes our results and briefly discusses implications for policies aimed at reducing SC. All proofs are provided in Appendix A.

2 A switching–costs model

2.1 The basic model

Time is discrete and infinite, indexed by t∈{0,1,2,…}. There are J goods, each produced by a different firm. We allow for “inside” and “outside” firms. The only difference between the two is that while all inside firms j announce each period a price p t,j , the outside firms’ price is assumed to be exogenous to the analysis. The vector of period t prices is \(p_{t}=\left (p_{t1},...,p_{tJ}\right ) \in R^{J}\).

The demand model generalizes the commonly used Logit and Hotelling models. Assumption 2.1 provides the formal description. There is a unit mass of consumers, all of which have the same preferences over products and money up to preference shocks and switching costs. To capture demand heterogeneity, each period each consumer receives an i.i.d. (over consumers, goods and time) preference shock. Consumers purchase each period the good that maximizes their utility net of price. As usual, integrating out these shocks provides a demand function for each good that depends on the distribution of the shocks. Since the shocks are i.i.d. a consumer that bought good j in period t may prefer another good in period t+1. This is the source of switching in the model.

Each consumer belongs to a specific loyalty group. A consumer can only be loyal to one good at a time and becomes immediately loyal to the last good purchased. Consumers in loyalty group j (i.e., who purchased j last period) derive γ≥0 more utility from j than an otherwise identical consumer who is in some other loyalty group (i.e., did not purchase j last period).Footnote 8 Thus, γ is the switching-cost value. For the consumer, the cost of a good is higher by γ if the consumer has to “switch-into” that good. If γ=0, then there are no SC and preference is unaffected by loyalty.

The unit mass of consumers is thus separated to J segments of size s t j defined by loyalty to good j. The vector of market shares, s t =(s t1,…s t J ), identifies the state of the market. We restrict attention to Markov pricing strategies by the firms (i.e., firm strategies depend only on s t ).

The key primitive for the analysis will be the induced demand function for good j at period t within each loyalty group k, denoted D t,j,k. That is, D t,j,k is the share of consumers that bought good j in period t out of the set of consumers that bought good k in period t−1. We drop the period indication from the notation unless more than a single period is referenced.

The following summarizes the demand assumptions:

Assumption 2.1

Of the customers loyal to good k at the start of the period, the share that choose good j depends only on the current prices p and the SC parameter γ. This share is given by the demand function \(D^{j,k}\left (p,\gamma \right )\) which satisfies the following:

-

(1)

When switching costs are not present, γ=0, the share of of consumers purchasing good j is the same for all loyalty groups of previous purchasers. That is, for all price vectors p,

$$D^{j,k_{1}}\left(p,0\right) = D^{j,k_{2}}\left(p,0\right) $$This ensures that consumers preferences are only affected by previous purchases only through the switching cost. It also rules out any other sources of consumer preference heterogeneity that would be correlated with previous purchasing decisions.Footnote 9

-

(2)

Demand is smooth in prices, decreasing in own price and increasing in rival prices:

$$\frac{\partial D^{j,k}\left(p,\gamma\right)}{\partial p_{j}} \le 0 \le \frac{\partial D^{j,k}\left(p,\gamma\right)}{\partial p_{i \neq j} } $$ -

(3)

An increase in the SC increases (decreases) demand for a good from it’s loyal (switching) customers:

$$\frac{\partial D^{j,j}\left(p,\gamma\right)}{\partial \gamma} \ge 0 \ge \frac{\partial D^{j,k \neq j}\left(p,\gamma\right)}{\partial \gamma } $$Note that because D j,j represents the share of consumers repurchasing, this inequality is intuitive whether the direct effect of γ is to increase the benefit of the re-purchasing j (habit formation) or to decrease the utility of having to switch to another product (switching cost).

The two demand specifications that are most common to studies of SC are “logit with SC” (e.g., Dubé et al. 2009; Pearcy 2014) and “Hotelling with SC” (e.g., Rhodes 2014). Both satisfy all of our assumptions. Section 3 considers the logit model in detail. Appendix C provides similar qualitative results this for the Salop (1979) circular city model that generalizes the Hotelling (1929) model.

Assumption 2.1 reflects three economic assumptions. First, it implies that consumers are myopic: demand does not depend on any future expectations on prices. We make this assumption for tractability reasons, as introducing forward looking consumers make demand dependent on consumer’s price expectations, which would need to be determined in equilibrium. Second, we assume that demand changes smoothly in prices and switching costs. This rules out out Bertrand-trap pricing behavior. Finally we assume that other sources of consumer heterogeneity aside from switching costs are idiosyncratic over time. This allows us to compute shares for each group without explicitly tracking the distribution of tastes within a group into account, as they do not depend on previous purchases. In a more general model with time persistent consumer heterogeneity, consumers with a persistent preference for a good would be over-represented in that good’s loyalty group even when switching costs were very small. It is natural to expect that consumers that choose product j do so in part because of some persistent preference to product j’s characteristics. We consider this extension in Appendix B. To the extent that time-persistent sources of consumer heterogeneity decrease the competitiveness of the market, it strengthens the harvesting effect of SC and weakens both the compensating and investing effects.

We now turn to the firms’ pricing game. Total demand for a firm is the aggregate of group specific demands,

The state variable for this model is the vector of market shares. The law of motion is simple: Firm j’s total demand in period t is also the measure of consumers that will be loyal to firm j at the start of the next period:Footnote 10

Each firm maximizes profits over an infinite horizon given a common discount factor, β. We assume that the firms have identical marginal costs normalized to zero.Footnote 11 The present discounted value of firm j’s future profits given the pricing strategies p are

Subject to the law of motion specified in Eq. 2.2. The following assumption on the equilibrium outcome without SC is technical and shared by virtually all relevant demand models. It ensures that the comparative static of introducing SC is well-defined.

Assumption 2.2

If there are no SC (γ=0), the period profit function, p j D(p,s), is quasi-concave in p j and strictly positive for all firms. The game when γ=β=0 has a unique equilibrium.

If β>0, the firms play a dynamic game. When SC are absent (γ=0), the game is a standard repeated game and the folk theorem applies.Footnote 12 Adding SC does not alter the possibility of collusion. The multiplicity of equilibria makes it difficult to analyze the impact of SC. We focus only on the “competitive” Markov Perfect Equilibrium. When SC are zero, there is no future value to gaining market share, and the most competitive equilibrium is simply to price to maximize stage game profits in every period. Assumption 2.2 ensures that this “competitive” equilibrium is unique. Under this scenario, the firms name the same prices in each period regardless of last period market share, and it is clear that this equilibrium strategy will converge to a steady state. We analyze the effect of SC by perturbing this competitive equilibrium to characterize the change in steady state prices, profits, and share with due to the addition of SC.

2.2 Two fundamental equations

This section establishes the economic forces that determine the comparative static effects of small SC on profits and prices.

By the Principle of Optimality, the firm’s problem around the steady state can be represented as the solution to the following Bellman equation for firm j, where V j(⋅) is a stationary function of the current state s and \(D\left (\cdot \right ) \) is the vector of the resulting demand for all firms.

We wish to characterize the behavior of the firm in a steady state and derive comparative statics with respect to the introduction of SC. The definition of a steady state is standard—all firms optimally set prices and consumer purchasing behavior is such that the states (i.e., the firms’ market shares) are constant over time. Note that while shares are constant, many consumers may be switching goods between periods.

We first consider the impact of an introduction in switching costs on firm values. The effect relies on partial effects of prices, shares and the SC themselves on demand at the steady state without SC. These are all well defined via Assumption 2.2. While these are abstract at this point, they are all well known for any demand specification. The proof is provided in the Appendix A.

Lemma 2.1

The derivative of firm j’s steady-state value with respect to SC is given by

where p ∗ represents the vector of steady state prices for the equilibrium when γ=0.

Lemma 2.1 identifies the two forces determining the qualitative effect of SC on firm profits. Simply put, SC are good for the firm if they increase demand for the firm, and bad if they decrease it. There are two channels for SC to affect demand. First, holding prices fixed, SC increases demand by loyals and decreases demand by non-loyals. The second, indirect effect is the competition effect—if SC cause rivals to reduce prices, this will affect demand as well. As we will show below, in markets with no significantly dominant firm,Footnote 13 both effects will be negative with small SC, leading to the conclusion that SC hurt competitive firms.

As all policy functions and state transitions are smooth, the first order condition for V j with respect to p j is

\(D_{p_{j}}^{j}\) is the derivative of the firm’s demand w.r.t. it’s price and \(\nabla _{p_{j}}\) is the gradient of the change in demand for all firms resulting from the firm’s price change. The first order condition has no closed form solution in general, and is difficult to characterize due to the effect of changes in switching costs on firms implicitly defined continuation values. To make progress, we will focus on the effect of small SC—in particular, the effect of an increase in SC from zero. This case makes it possible to characterize the continuation value term. To simplify the notation, we let \(D^{j,i}_{\gamma }\) denote the change in firm j’s demand among loyals to good i due to the change in SC, holding all else fixed, and let \(D^{j}_{\gamma }\) denote the total change for firm j aggregating over all loyalty markets:

For any specific demand function, \(D^{j}_{\gamma }\) can be derived directly at γ=0, as we show for the demand specifications considered in the following section.

The equilibrium price effect of the introduction of SC relies on the first order effect of SC on each firm’s price, as well as the interaction effect between the firm’s prices. Our strategy for the general analysis is to focus instead on sufficient conditions for which the price effect can be signed (either negative or positive).Footnote 14 For this, it is sufficient to consider SC effect on each firm’s first-order condition (2.5), which we refer to as \(F^{j}_{\gamma }\). The next lemma identifies the formal price effect of the introduction of small switching costs. As before, the effect is characterized by equilibrium outcomes from the no switching cost steady state. While these are abstract at this point, they can be derived for any given demand specification. Thus, Lemma 2.2 can be applied directly in many cases, as is done in the remaining sections.

Lemma 2.2

The derivative of firm j’s steady state price with respect to SC at γ=0 has the same sign as \(F^{j}_{\gamma }\) , given by:

Where all χ jk ≥0 and p ∗ represent the vector of steady state prices for the equilibrium when γ=0. Moreover, long run incentives—i.e., \( {\sum }_{k \in J} \left (D^{j,k}_{\gamma } \cdot D^{k}_{p_{j}} \right ) \) —are always negative.

Equation 2.6 is obtained by manipulating the full derivative of F j with respect to γ at γ=0, holding p j fixed.

The first two terms of \(F^{j}_{\gamma =0}\) are simple derivatives reflecting the static incentives of switching costs. \(D^{j}_{\gamma }\) is the direct effect of SC on demand holding prices fixed through greater consumer inertia. It is a mixture of the “harvesting” effect for loyal consumers \((D^{j,j}_{\gamma } >0)\) and the “compensating” effect for switching consumers \((D^{j,k\neq j}_{\gamma } < 0)\). If harvesting dominates, the firm’s optimal response is to raise prices. However, if most marginal consumers are switchers, SC will depress demand for the firm’s good and the firm will have a short term incentive to decrease prices to compensate. The second term, \(p^{*}_{j}\cdot D^{j}_{p_{j} \gamma }\), is a second order effect capturing the change in price sensitivity. Prices increase (resp. decrease) if consumers are less (resp. more) price sensitive with higher SC.Footnote 15

The third term captures the investing effect. When SC increase, j’s next period demand increases for customers that bought j’s good today and decreases for all other customers. The total future profit effect is \(p^{*}_{j} \cdot {\sum }_{k} D^{j,k}_{\gamma }\). Multiplying by the price sensitivity obtains the first order investing effect on the optimal price. As expected, the proposition confirms the results obtained in previous related literature – long term (investing) considerations related to SC always decrease prices.

Finally, each element in the last term accounts for j’s price reaction to any of it’s rivals’ price reaction to the SC. The rival price reaction \(\frac {dp}{d\gamma }\) includes both short and long term considerations and in general could be positive or negative. The firm’s price reaction to the rival’s reaction \(\left (\chi _{j,k}\right )\) is evaluated at the no-SC equilibrium and so is positive by strategic complementarity. Therefore, if we find that \(F^{j}_{\gamma }\) has the same sign for all firms given χ j k =0, then this is also the sign for the true value of χ j k ≥0.

Lemmas 2.1 and 2.2 identify the two fundamental equations that determine the effect of small switching costs on prices and profits. These equations show that the effect can be determined by the steady state price and shares without SC and the partial derivatives of demand at no SC: \(D^{j}_{\gamma }\), \(D^{k}_{p_{j}}\), \(D^{j}_{p_{j} \gamma }\), and \(D^{j,k}_{\gamma }\). By continuity, the signs of \(F^{j}_{\gamma =0}\) and \(V^{j}_{\gamma =0}\) determine the effect of a small SC on firm profits and prices.

The next section applies these general results to analyze the economic forces that determine the effects of SC on prices and profits.

3 Determining the effect of small switching costs

The previous section provided general results that do not depend on the specific demand structure. To identify the specific determinants for the effect of SC, some structure must be imposed. This section applies the abstract analysis to a quasi-linear discrete choice random utility demand system, and also makes use of its special case, the logit demand model, which is widely used in theoretical and empirical work.Footnote 16 We find that under the logit model, a firms’ short run price incentive to raise or lower prices is closely related to its share relative to the Herfindahl index. We also consider the implications of firm symmetry, which is commonly used for tractability in theoretical analysis. Finally, we introduce an outside good into the model. This in turn enables us to analyze the effect of switching costs on a monopolist. One point that comes out of the analysis is that the important intuitions are gleaned from the firm’s first-order reaction to the change in SC—the first three terms of Eq. 2.6—rather than any reaction to the rival’s first-order reaction—the last term of Eq. 2.6.

The logit demand system is a special case of a discrete-choice random utility model. In a random utility model, consumers have heterogeneous utilities and purchase one unit of the product that maximizes their utility. In our setting, the utility of person i, for purchasing good j when she purchased k last period (and hence is ‘loyal’ to k) in time t is,

Where 𝜖 i j k t is the iid preference shock that induces preference heterogeneity among consumers. We will assume that utility is quasi-linear in price and SC, that is,

Proposition 3.1 in Section 3.2 will be provided for the general quasi-linear utility case. However, the logit demand system, which is defined by assuming that 𝜖 i j k t follows the type-1 extreme value distribution, allows for stronger results. Logit demand has been popular in recent empirical and theoretical investigations of SC—e.g. Dube et al. (2009) and Pearcy (2014). As is well known, the logit demand model is especially convenient because it gives rise to a a closed form expression for group-level demand:

which makes it possible to derive precise results. It will be useful to recall the Herfindahl index when γ=0 as a measure of industry concentration, defined as:

The next lemma identifies the main quantities used in the general Lemmas 2.1 and 2.2 for logit demand:

Lemma 3.1

With logit demand, at γ=0:

Where all χ jk ≥0.

Again, χ j k incorporates all the effects resulting from any change in a firm k’s price on j’s incentives, which, by strategic complementarity, is weakly positive. As alluded to in Section 2.2, the demand specification replaces the general terms in Lemmas 2.1 and 2.2 with the steady state prices and shares without SC. The next subsections identify the various economic considerations that determine the effect of SC: long vs short-term firm reaction, symmetric vs. asymmetric firms and the existence and strength of an outside good.

3.1 Myopic firms

The first term of Eq. 3.5 identifies the determinants of a myopic firm’s reaction to a change in the SC. This reaction is based on the effect the SC has on the marginal consumers’ willingness-to-pay (WTP) for the firm’s product. Every marginal consumer for firm j is choosing between product j and some other product \(j^{\prime }\) (which may be an outside good). If more marginal consumers making this choice start the period loyal to firm j, then SC shift demand up for firm j for this segment, and allow the firm to increase prices. If more marginal consumers start the period loyal to the firm’s rivals, SC shift demand down for firm j and the firm would decrease prices.

Equation 3.5 shows that in the logit model, the correct way to aggregate the myopic effect for a firm over all of it’s rivals is to compare the firm’s market share against the Herfindahl index. Moreover, as the long term consideration is always to decrease price (Lemma 2.2), the following is obtained:

Corollary 3.1

In the logit model:

-

(1)

IIf a firm’s share is lower than the Herfindahl, its reaction to an increase in SC is to decrease price.

-

(2)

IA firm’s short term (myopic) reaction to an increase in SC is to increase price if and only if the firm’s share is higher than the Herfindahl index.

3.2 Symmetric vs. asymmetric firms

A common starting point for analysis of SC is the case that all firms are identical and there is no outside good. (see e.g. Rhodes (2014) and Pearcy (2014) for two recent examples). Introducing a small SC does not change the symmetry in the steady state. Building on the intuition from the previous subsection, the share of each firm’s marginal consumers for which demand shifts down exactly equals the share of those for which demand shifts up. In addition, any decreased price sensitivity by loyal customers is matched by an equal increase in price sensitivity by potential switchers. For logit demand, the implication is that short term considerations have no effect on the firm’s reaction. Formally, the first term in Eq. 3.5 cancels: s j −H=0.

This intuition does not depend on the specific features of the logit demand and can be extended to any quasi-linear random utility model (i.e. for any distribution of 𝜖 i j k t in Eq. 3.1 when Eq. 3.2 holds).Footnote 17

While the short term considerations cancel in the symmetric quasi-linear setting, long term incentives decrease prices. This would be exacerbated by strategic price reaction—each firm would decrease prices a bit more. As each firm sells the same amount, just for a lower price, firm profits decrease. Therefore, in symmetric markets SC will decrease both prices and profits.

Proposition 3.1

In a random utility model with quasi-linear utility, if firms are symmetric (δ j =δ), then:

-

(1)

If firms are myopic \(\left (\beta =0\right )\) , small SC have no effect on prices and profits.

-

(2)

If firms are forward looking \(\left (\beta >0\right )\) , prices and profits decrease from a small SC for all firms.

Proposition 3.1 confirms that a small SC will change the steady state for the worse (from the firms’ perspective) in a symmetric market as long as firms are forward looking.Footnote 18

It may be of interest to consider the effect of a small SC on a symmetric industry that starts out of steady state. That is, all firms are equal without SC, but some firms are endowed with a larger market share than others. Equation 3.5 can then be used to determine the price effect of SC on each firm until the steady state is reached. Initially, firms with a higher than average share would set a higher price while firms with a lower share would set a lower price. Eventually, the market would reach the steady state and all prices will be equal.

A related question is whether the price (and thus profit) effects in the symmetric situation are affected by the number of firms in the market.Footnote 19 As the number of firms increases, the likelihood that a firm’s marginal consumer in this period would also be marginal in the next period decreases. This decreases the returns to investing in loyal consumers. However, the increase in products may also affect consumer price sensitivity in equilibrium. If consumers are more price sensitive, the return on investment increases. In the logit model, the increase in the number of firms decreases price sensitivity and therefore the two effects agree. This allows us to sign the overall effect:

Proposition 3.2

In a symmetric logit demand model with SC, if firms are forward looking \(\left (\beta >0\right )\) , the effect of SC on prices strictly decreases in absolute terms when a firm is added to the market. The result applies to all quasi-linear random utility models in which equilibrium price sensitivity ( \(D^{j}_{p_{j}}\) ) weakly decreases in absolute terms when a firm is added to the market.

Proposition 3.2 implies that as the number of firms increases in the market, the effect of an increase in SC is less pronounced.

Finally, the fully symmetric case has a knife-edge quality since the short-term effect is exactly zero. Our model allows us to easily consider alternatives once a demand structure is specified. Consider markets in which there is one leader and the other firms are symmetric. In this case, if the market leader is worse off or reduces prices from a small SC then all firms have the same qualitative effect. As competition is in strategic complements, a sufficient condition for all the firms to decrease (or increase) prices is that all firms would decrease (or increase) prices holding their rival price fixed. Moreover, as the goods are substitutes, profits for each firm increase in rival prices. Thus, a sufficient condition for low SC to depress prices and profits is that this outcome is obtained for the leader, holding rival prices fixed.

Proposition 3.3

Suppose that in the logit demand model, J≥2, firm 1 has share \(s_{1} > \frac {1}{J}\) and all other firms have equal shares \(s_{j>1} = \frac {1-s_{1}}{J-1}\) . A sufficient condition for all prices to decrease with SC is,

Proposition 3.3 identifies both the short term and total effects of a small SC with one market leading firm. The market leader can “harvest” from SC as most of its marginal consumers would avoid the switching cost by choosing it again. The exact opposite is true for all other firms, who must compensate their marginal consumer. However, if the market leader is forward looking, the investment effect drives even the market leader to reduce prices as long as it’s leadership isn’t too strong. Note that the upper bound in Proposition 3.3 decreases with J and is always at least \(\frac {\beta }{1+\beta }\).Footnote 20 Thus, if firms are sufficiently patient (β→1) if a market leader’s share is less than half, prices will decrease. Moreover, in a duopoly (J=2), a market leader reduces prices whenever its share absent SC is less than .75.

3.3 The role of an outside good

The firm’s reactions for an increase in SC remain qualitatively the same when the market is not fully covered or an outside good exists (i.e., when not all consumers purchase from some firm, so firm shares need not sum to 1). Because the price reaction for each firm is determined by considering demand at zero SC, for the purpose of the analysis, the outside good is simply like another rival with the simplification that it’s price is not set strategically.Footnote 21

The primary difference between an outside option and a regular “inside” firm is that the outside option’s price is not set strategically. Our analysis highlights the fact that this has no first order effect. Thus, understanding the SC effects for a single firm facing an outside good is qualitatively the same as understanding the SC effects for a firm in a fully covered duopoly.Footnote 22

In a market with symmetric firms and an outside good, the short-term effect of an increase in SC therefore depends only on the strength of the firms in the industry relative to the outside option. If the share of customers choosing the outside good is smaller than the share of each firm, then all the firms in the industry will see an increase in demand following an increase in SC, holding prices fixed. Because each firm has more loyal customers than the outside option does, there are more marginal consumers that SC sways to stay with the firm over switching to the outside option than there are marginal consumers that choose to stay with the outside good over switching to the firm. Thus, if the outside option is weaker than any of the firms, the short term effect of an increase in SC is higher prices and higher profits. If the outside option is stronger, the short term effect is reversed, following the exact same line of reasoning. The long term effect, however, still decreases prices and potentially profits, as in the case without an outside good.

Proposition 3.4

In the logit model, if all firms are symmetric, δ 1 =δ 2 =⋯=δ J−1 , and an outside good has a share s J , then:

-

(1)

Prices and profits increase with a small SC if firms are myopic \(\left (\beta =0\right )\) and \(s_{J} < \frac {1}{J}\).

-

(2)

Prices decrease from a small SC whenever \(s_{J} > \frac {1}{J}\) or β≥0.077

We note that the introduction of a small outside good reversed the result obtained for myopic and symmetric firms, reinforcing the intuition that the symmetric analysis relies in part on a knife-edge relationship.

The above analysis assumes SC apply symmetrically to inside and outside goods. An alternative variation to consider is when SC do not affect consumers switching out of the outside good J. This is ‘good news’ for all the inside firms, and ‘bad news’ for the outside firm. In particular, for all j<J, \(D^{j}_{\gamma }\) increases by exactly s J ⋅s j compared to our baseline case. However, the investing effect is weaker now, as firms do not have as large a dynamic incentive to entice consumers away from the outside good \((D^{j,J}_{\gamma } = 0)\). Formally, all the components of Eq. 2.6 that deal with the outside good become zero. Both of these effects increase prices and profits. Therefore, with symmetric firms, higher SC may in this setting be profitable for the firms.

3.4 Single firm and an outside good

An important underlying theme of the analysis is that the rivals’ price reaction is only of second order when understanding the effects of a small SC. However, analyzing multiple firms complicates the analysis and obtaining clear results requires stronger demand assumptions.

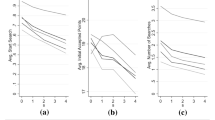

Figure 1 strengthens this intuition and the relevance of small SC analysis. The figure presents the logit model steady-state profits, shares, prices and consumer surplusFootnote 23

for two settings – a duopoly and a monopoly. In each case, the inside firms’ quality is δ j =1 and there is also an outside good (j=0).Footnote 24 We set the income effect at α=−1, firms’ discount factor at β=.95, and the outside good quality δ 0 at cost (δ 0=0).

Overall effect of switching costs in the MPE with the monopoly outcomes for reference. Each panel presents a different measure — prices, profits and shares. The thick solid line is the symmetric MPE (δ 1=δ 2=1, δ 0=0). The thick dashed line is the value under a monopoly for the same parameters (\(\delta _{2}=-\infty \)). In all cases, β=0.95, α=−1 and marginal cost is zero

The similarities between the effects of SC for a duopoly and monopoly is striking. The distance between the monopoly and duopoly price and profits (the dashed and solid lines) remain steady for all values of the SC parameter (from γ=0 to γ=2).Footnote 25

This section leverages this insight and analyzes a monopolist’s reaction to switching costs in the absence of strategic interaction. This allows us to derive strong results and shows that the effect of switching costs may lead to price declines even when price competition is not present (i.e. a single firm with an outside good).

We maintain the assumption that demand can be derived from a quasi-linear random utility model. Since there is only one firm and an outside good the period utility for consumer i from purchasing the firm’s good can be described as,Footnote 26

Consumer heterogeneity is captured by 𝜖 i , which is distributed i.i.d. across consumers and time, according to some predefined distribution function Φ. The firm’s demand is then,Footnote 27

In addition, the following assumption requires that at zero switching costs, the short term effect of SC for the firm considering only loyal consumers is to increase price. The requirement is only for the loyal consumers and captures the substance of SC – an increase in demand by loyal consumers. Therefore, it is a very weak and natural assumption. To the best of our knowledge, it holds in all models of SC:Footnote 28

Assumption 3.1

For a monopolist facing an outside good, at γ=0, \(D^{1,1}_{\gamma }+p_{1}\cdot D^{1,1}_{\gamma p_{1}}\geq 0\).

The effect of introducing SC on a firm’s value and steady state prices is summarized in the following proposition. Recall that p 1 and s 1 are the firm’s price and market share in the steady state without SC. All subscripts denote partial derivatives taken using prices and shares at the steady state without SC. Footnote 29

Proposition 3.5

For a monopolist facing an outside good:

Thus:

-

(1)

A small SC increases profits for a monopolist iff the monopolist share of the market is at least .5.

-

(2)

For any discount factor a small SC causes a monopolist to decrease its price if its share is lower than .5.

-

(3)

For any discount factor a small SC causes a monopolist to increase its price if in the equilibrium without SC: \(2s_{1} \cdot p_{1}D_{p_{1}\gamma }^{1,1} > D^{1,1}_{\gamma } + p_{1}D_{p_{1}\gamma }^{1,1}\).

Comparing Propositions 3.5 and 3.1 illustrates the connection between the single-firm and multiple-firm analysis. For small switching costs, the impact of SC is closely tied to the firm’s market share relative to its rivals. In the single-firm case, the rival’s share is simply all the remaining share.

The first part shows that switching costs are beneficial to firms who dominate the no-SC market, essentially high quality firms. This is because higher SC increases inertia, which helps large firms but hinders small firms.

Part 2 establishes that firms with low market shares will respond to SC by decreasing prices. The sign of the first element of \(F^{1}_{\gamma }\) depends, as in part 1, only on whether the firm’s share is larger than half. The second, investing element is negative, but it’s magnitude depends on the discount factor.

The importance of the compensating effect is illustrated when firms are myopic (i.e., β=0). In this case, the investing effect necessarily disappears, since it is motivated by the possibility of future profits. However, the introduction of SC will still cause a decline in steady state prices if the firm’s share without SC is less than half. This highlights the importance of the compensating effect as an independent countervailing force to the well-known harvesting effect.

We stress that the price decrease is not caused by any competitor’s actions. It is simply because the marginal consumer is likely switching and thus should be compensated.

Equation 3.8 also shows that the SC makes a more patient firm price lower. This is the investment effect. Raising β affects only the investing incentive of SC, which drives prices unambiguously downward. Combining these two points implies that if a firm is patient, it will never raise prices upon the introduction of switching costs if its market share is less than one half. On the other hand, if a fully patient firm (β≈1) would increase prices, so would a less patient firm.

The intuition for these results is straightforward. If a good has a low value, it will be purchased in any given period by a minority of customers, even absent SC. As the preference to purchase the good is not persistent over time, most consumers that purchase in any given period would not have bought it in the previous period. The introduction of a small SC does not change this “demographic”. In every period, most of the firm’s buyers are switchers. As a result, SC act like a tax on the marginal consumer and profits and prices are reduced. If the monopolist’s initial value proposition to consumers is high, most of the monopolist’s consumers are loyal. An increase in SC makes these loyal customers more likely to buy due to the extra utility from making a repeat purchase. The effect of SC for the monopoly now mimics a subsidy rather than a tax and the monopolist’s profits increase.

Applying the analysis to the logit demand used in the previous section:

Proposition 3.6

For a single firm facing logit demand, the introduction of a small SC changes profits by

The firm’s price increases iff \(s_{1} \ge \frac {1+2\beta }{2+2\beta }\).

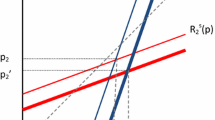

Proposition 3.6 makes explicit the abstract intuitions of the general analysis in this section – SC are valuable for a strong firm. Figure 2 illustrates the proposition’s implications. The figure plots the derivative of the steady-state price with respect to SC at zero SC for a myopic (β=0) and forward-looking firm (β=0.95) while varying the product quality, δ 1−δ 0. The horizontal axis identifies the quality difference between the firm’s good and the outside good, using the optimal firm shares with zero SC.Footnote 30 The myopic curve illustrates the balance between the harvesting and compensating effects. The former dominating when the firm share is high and the latter when it is low.

Derivative of steady-state prices with respect to γ at γ=0 for the single firm logit demand model with α=−1 and myopic consumers. The x-axis is the firm’s market share without switching costs (s 0).The change in market share in the top panel is a reflection only of changing δ 1−δ 0.The myopic curve assumes β=0 and displays the interaction between the consumer-flow effect and the harvesting effect when there is no investing effect. The patient curve is the same model with β=0.95; the difference between the two is the effect of the dynamic marginal value of loyal market share – the investing effect

For a myopic firm, the impact of SC on prices turns from positive to negative when the firm has a 0.5 share – precisely when the compensating and harvesting incentives are perfectly offset. The difference between the curves illustrates the investing effect. As an optimal market share of 0.7 without SC is extreme within the logit demand model,Footnote 31 the model predicts that prices are likely to decrease in response to small SC whenever the firm is as patient as is typically assumed (i.e. β∈(0.9,1)).

The effect of SC on prices is U-shaped with respect to quality (or share). For low quality firms, an increase in quality increases demand elasticity. This increases the magnitude of both the compensating and investing effects. If quality continues to increase, the firm’s product is chosen by a larger share of the consumers and eventually demand becomes inelastic – most consumers are infra-marginal. At this point the firm’s short term incentive is to harvest. Moreover, as the mass of marginal consumers is very small, the investing effect is weak. This is the state of affairs that most resembles a model of switching costs where consumers become fully ‘locked-in’ and are unwilling to switch to other products (e.g., Beggs and Klemperer 1992).

Figure 3 illustrates this relationship between SC, the likelihood of repeat purchase (sometimes referred to as the churn rate) and prices. Panel A of the figure shows that for high SC, the proportion of repeat purchasers increases as loyal consumers are “locked in”. As SC rise, fewer customers switch and demand for each product becomes inelastic. This sorting tends to encourage an increase in price as harvesting comes to dominate compensating: It becomes very hard to attract new customers with discounts, while loyal customers are less likely to leave due to prices increases. When SC are not very high, the dynamic effect encourages investing in shares through lower prices, partially offsetting the growing impact of the harvesting effect. As the market becomes more segmented, the incentive to “harvest” grows while the incentive to attract non-loyal customers (i.e., invest in share) diminishes. Eventually, firms begin to raise prices when facing high SC. As panel B shows, the monopolist’s steady-state price increases with an increase in SC only if the SC effectively segmented the market based on customer loyalty. Steady-state prices and shares behave very similarly to the monopoly case, but competition shifts prices and profits down. This suggests that the effect of SC on market outcomes depends primarily on the existence of an alternative product with similar SC regardless of whether that alternative product adjusts prices strategically. Overall, the message of this figure is that the marginal effects of SC identified in the single-firm analysis carry to multi-firm analysis.

Panel A shows the market segmentation as a function of switching costs. The proportion of consumers in each period who make repeat purchases is plotted for the different values of switching costs. As switching costs grow, consumers sort themselves by loyalty group and demand for the product becomes inelastic, with customers likely to buy the good they are loyal to. Panel B shows the relation between market segmentation and the effect of switching costs on prices. The difference in steady-state prices as switching costs increase is plotted as a function of the share of consumers who make repeat purchases in the steady state. Both plots compare the effect for the low-quality monopoly (δ 1=1, solid line) and high-quality monopoly (δ 1=3, dashed line). Note that the curves nearly merge when a repeat purchase is very likely. While in both cases the firm’s steady state price increases with SC only when a repeat purchase is almost guaranteed, the strong monopolist requires a larger share of repeat purchases. Parametrizations for this plot are α=−1, δ 0=0, β=0.95

Lastly, Fig. 4 illustrates the effect of market power by comparing a ‘moderate’ monopoly (the full line, δ 1=1) with a ‘powerful’ monopoly (the dotted line, δ 1=3). As in the previous figures, the outside good’s value is equal to the cost (δ 0=c=0).Footnote 32 The figure shows that effect of moderate SC on steady-state profits is consistent with the analytic results for low SC. The strong firm’s profits increase while the weaker firm’s profits decrease. As SC increase, the effect on profits seems to level off. As long as the dominating static effect is the compensation effect (i.e. the “normal” monopolist), the firm’s profits are highest without SC. This example also illustrates that the strong firm gains from the introduction of SC even though it’s optimal reaction is to charge lower prices.

Steady-state outcomes for a monopolist with respect to switching costs in the logit model. The dashed line represents the high-quality monopoly (δ 1=3). The full line represents the low-quality monopoly (δ 1=1). The switching-costs value (γ) varies on the x-axis from zero to two. The other parameters are: δ 0=0,α=−1,β=0.95

4 Conclusion

SC are an important part of many markets. In this paper we have shown that if firms cannot price discriminate between loyal and non-loyal consumers, firm behavior is shaped by three forces: (1) harvesting surplus from loyal customers who must pay SC to purchase other goods, (2) compensating non-loyal consumers to convince them to switch, and (3) investing in share in order to increase the number of loyal consumers in future periods. The first two effects are due to present-day incentives while the final one is due to the incentive to generate future profits. The impact of SC has frequently been described as pitting a short term incentive to raise prices against a long term incentive to maintain a high share (i.e., harvesting versus investing). However, we have shown that in many cases the compensating effect is substantial. Indeed, it may overwhelm the harvesting effect such that the overall short term incentives are to decrease prices, without even considering the investment incentive.

Of the three forces related to SC, only one–harvesting—is anti-competitive. SC are anti-competitive if the market is segmented so that harvesting dominates firms’ short term incentives. Segmentation can arise from very high SC or because of reasons that are independent of SC such as substantial quality differences between firms (considered explicitly in the current model), network externalities or persistent consumer preferences. In either case, such frictions increase the fraction of consumers that are, to a varying extent, “locked-in” to their previous purchases.

While analytic results can only be obtained for small SC, the economic intuitions persisted in numerical experiments for large SC that cause 80 percent of consumers to be repeat purchasers. The empirical evidence cited at the introduction suggests that this is the relevant range for SC in many markets. Hence the compensating effect we highlight, which is masked by assumptions such as price-discrimination or infinite SC, is likely have a significant impact in a number of retail industries.

An important conclusion for policy and empirical work is that changes in prices or shares as a result of SC may not be a valid proxy for changes in welfare or profits. Even if consumers pay lower prices with SC, they suffer welfare loses directly due to paying the switching cost and indirectly because they may consume a lower-utility product to avoid paying the switching cost. The examples show that the introduction of SC may cause declines in prices, profits and consumer welfare. In other words, one should not assume that a program to reduce SC is a failure simply because it does not cause price declines.

Notes

Klemperer (1987) considers several alternative two-period models. Of these, the closest to ours is when consumer preferences are uncorrelated between the two periods. In this setting he focuses on symmetric firms and finds that the short term (second period) effect is zero and the first period (investing) effect decreases prices and profits. Our analysis generalizes this result and confirms Klemperer’s conjecture (in the conclusion there) that in asymmetric markets a firms’ reaction depends on its market share.

Pearcy (2014) shows that allowing for consumers to be forward looking can also reverse the qualitative effect of SC on symmetric markets.

Aside from small SC, the main assumption in our analysis is that the consumers’ purchasing decision is myopic. With the exception of Pearcy (2014), this assumption is common to the previous studies mentioned above, and relaxing it is an important avenue for future research.

Roughly this result requires that the firm has less than average market share.

In this paper, we consider so-called “transactional” switching costs, which are most commonly addressed in the literature. In this framework, a cost must be paid each time consumers switch products. Nilssen (1992) contrasts this type of switching costs with “learning” switching costs, where customers may costlessly switch between products they have already learned how to use.

Klemperer (1995) argues that SC are likely to play an important role in many areas of economics, including industrial organization and international trade.

Equivalently, one could normalize utility without loss of generality such a consumer in loyalty group j derives γ less utility from all goods except j.

In particular, this rules out network effects.

It is also possible to analyze alternative laws of motion that might allow for the introduction of new consumers, or experimentation by consumers who might try a new good, but remain loyal to their earlier purchase with some positive probability. Both of these extensions have the effect of reducing firms’ investment incentive, but do not change the qualitative results of our model.

This normalization is for convenience and the model can be easily generalized to accommodate firm-specific marginal costs.

Moreover, there is no reason to believe that restricting ourselves to stationary strategies will ensure a unique equilibrium as firms may detect defections from market shares.

The propositions below formalize dominance using bounds on market shares and HHI.

The exact price effect is derived for a monopolist in Section 3.4.

Note that consumers in group x are less price sensitive if \(D_{p\gamma }^{x}\geq 0\).

Similar results for the Salop demand system are provided in Appendix C.

For other demand structures, the interaction between SC and price sensitivity may not cancel when firms are symmetric. For example, switchers may become more price sensitive while the price sensitivity of loyals may not change—e.g., add a term \(-\gamma _{p} p_{jt} \mathbf {1}\left [ j\neq k\right ]\) to \(\bar {u}\) in Eq. 3.2.

While the proof relies on the quasi-linearity of utility, Appendix C provides a similar result for linear models.

We thank a referee for suggesting this.

It can be shown that with n symmetric market leaders, the same upper bound applies as \(J \to \infty \)

We focus on the case in which the SC also applies when switching to/from the outside good. Our base case is reasonable for many industries. For example, switching across cable TV, satellite, IP-TV and outside “broadcast” television requires learning the channel layout, acquiring and installing the necessary equipment, and ordering or canceling the relevant services even when switching to or from broadcast. We briefly discuss the alternative where switching to the outside good does not incur SC at the end of this section.

This is illustrated and discussed further using the numerical example in Fig. 1.

Consumer surplus is calculated using compensating variation (CV). In the single firm model this is:

$$CV=-\frac{1}{\alpha}\left( \log\left( e^{\delta_{0}}+e^{\delta_{1} +\alpha\cdot p-\gamma}\right) -\delta_{0}\right). $$For high switching-cost values, this method is actually a generous calculation as it assumes that all consumers can stay with the outside good “for free.” The main alternative, expenditure variation, (EV) would actually be negative for higher SC as loyal consumers are paying a very high price to keep themselves from switching.

Other symmetric specifications do not add qualitative insight. Specifically, in a symmetric duopoly, no firm can dominate the market regardless of δ. Thus, increasing δ 1 and δ 2 provides no additional insight and is not presented

We use value function iteration to approximate symmetric MPEs. The Mathematica software code is available from the authors. Our simulation used a 361 point grid for the state (share) space and process stops when the change in the value over all states is smaller than a threshold, which was set at 10−6. We verify that the optimal policy is unique by verifying that the best response function is quasi-concave and use the optimal pricing strategy to “play out” the equilibrium strategies starting at various states until a steady state is obtained. A unique steady state was obtained for all parameter values that we consider. For higher SC values, we do not expect a steady state exists as firms profit from ’invest then harvest’ cycles that take advantage of consumer myopia. Indeed, our equilibrium for high SC (roughly γ>2.7) did not converge to a steady state.

For expositional simplicity, we subtract 𝜖 in this section rather than add it as in Eq. 3.1. This is without loss of generality.

To see this note that consumers purchase the firm’s product if it offers the higher utility, that is the loyal consumer’s purchase if δ−α⋅p−𝜖 i >−γ and non-loyal consumers purchase if δ−α⋅p−γ−𝜖 i >0. Integrating these expressions over 𝜖 i leads to the demand equation.

Under the quasi-linear model, the assumption is equivalent to log concavity in Φ, i.e., \(({\Phi }^{\prime })^{2}\ge {\Phi } \cdot {\Phi }^{\prime \prime }\).

An older version of the paper derived the exact value for \(\frac {dp_{1}}{d\gamma }\):

$$ \frac{dp_{1}}{d\gamma=0} =-\frac{F^{1}_{\gamma}}{2D^{1}_{p_{1}} +p_{1} \cdot D^{1}_{p_{1} p_{1}} } $$However, this does not provide any additional insights; the proof is available from the authors. Note that the denominator must be negative by the standard second order condition.

We use steady-state non-SC market shares as a convenient proxy for the underlying firm quality

In a logit setting this requires a quality difference of five, which is over three standard deviations above the mean in the idiosyncratic term. In other words, if the firm would sell at the outside good price, it would have a share of over 0.95.

We have experimented with alternative specifications and found the results to be robust and indicative of the key insights. The upper bound of \(\bar {\gamma }=2\) reflects the upper bound for the steady state to exist. Analysis available from the authors shows that the true upper bound is slightly above \(\bar {\gamma }=2\) and decreases with δ. Reducing δ (i.e. making the market more competitive) allows increasing \(\bar {\gamma }\)

Here, because all price-setting firms are symmetric and the game is in strategic complements, can drop the strategic interaction term because we know it will only re-enforce the incentives of the leading terms.

The numerator for the derivative of the RHS wrt s J is

$$\begin{array}{@{}rcl@{}} \left(1-6s_{J}\right)\left(1+3{s_{J}^{2}}\right)-6s_{J}\left(s_{J}-3{s_{J}^{2}}\right) &=&1-6s_{J}+3{s_{J}^{2}}-18{s_{J}^{3}}-6{s_{J}^{2}}+18{s_{J}^{3}}\\ &=&1-6s_{J}-3{s_{J}^{2}}. \end{array} $$This quadratic expression is positive at s J =0 and negative at \(s_{J}=\frac {1}{3}\) (the upper bound). So need to take the maximizing point,

$$s_{J}=\frac{-6\pm\sqrt{36+12}}{6}=-1+\frac{4\sqrt{3}}{6}=-1+\frac{2}{\sqrt{3}}\;. $$By first-order effect we mean that the analysis does not consider the firm’s reaction to it’s rival price change.

A similar analysis can be applied to other models of linear demand, but the qualitative results are the same. In particular, both Rhodes (2014) and Shin et al. (2009) consider a Hotelling model. The Salop model was chosen to highlight the additional endogenous asymmetry caused by SC when there are more than two firms in the market.

References

Beggs, A., & Klemperer, P. (1992). Multi-period competition with switching costs. Econometrica, 60(3), 651–666.

Biglaiser, G., Cremer, J., Dobos, G. (2013). The value of switching costs. Journal of Economic Theory, 148(3), 935–952.

Cabral, L.M.B. (2012). Small switching costs lead to lower prices. New York: New York University.

Chen, Y. (1997). Paying customers to switch. Journal of Economics & Management Strategy, 6(4), 877–897.

Dube, J.-P., Hitsch, G.J., Rossi, P.E. (2009). Do switching costs make markets less competitive. Journal of Marketing Research, 46(5), 435–45.

Dubé, J.-P., Hitsch, G.J., Rossi, P.E. (2010). State dependence and alternative explanations for consumer inertia. RAND Journal of Economics, 41(3), 417–445.

Ellickson, B.E., & Pavlidis, P. (2014). Switching costs and market power under umbrella branding. Rochester, New York: Simon School of Business.

Farrell, J., & Shapiro, C. (1988). Dynamic competition with switching costs. The RAND Journal of Economics, 19(1), 123–137.

Farrell, J., & Klemperer, P. (2007). Coordination and Lock-In: Competition with Switching Costs and Network Effects In Armstrong, M., & Porter, R. (Eds.), Handbook of industrial organization (Vol. 3, pp. 1967–2072): Elsevier. chapter 31.

Garcia, A. (2011). Dynamic price competition, switching costs, and network effects. Charlottesville: University of Virginia.

Hotelling, H. (1929). Stability in competition. Economic Journal, 41–57.

Keane, M.P. (1997). Modeling heterogeneity and state dependence in consumer choice behavior. Journal of Business & Economic Statistics, 15(3), 310–327.

Klemperer, P. (1987). The competitiveness of markets with switching costs. The RAND Journal of Economics, 18(1), 138–150.

Klemperer, P. (1995). Competition when consumers have switching costs: an overview with applications to industrial organization, macroeconomics, and international trade. The Review of Economic Studies, 62(4), 515–539.

Nilssen, T. (1992). Two kinds of consumer switching costs. The RAND Journal of Economics, 23(4), 579–589.

Park, M. (2011). The economic impact of wireless number portability. Journal of Industrial Economics, 59(4), 714–745.

Pearcy, J. (2014). Bargains Followed by Bargains: When Switching Costs Make Markets More Competitive. Bozeman, Montana: Montana State University.

Rhodes, A. (2014). Re-examining the effects of switching costs. Economic Theory, 57(1), 161–194.

Salop, S.C. (1979). Monopolistic competition with outside goods. The Bell Journal of Economics, 10(1), 141–156.

Shcherbakov, O. (2010). Measuring consumer switching costs in the television industry: Yale University.

Shin, J., Sudhir, K., Cabral, L.M.B., Dube, J.-P., Hitsch, G.J., Rossi, P.E. (2009). Commentaries and rejoinder to do switching costs make markets less competitive. Journal of Marketing Research, 46(4), 446–552.

Shy, O. (2002). A quick-and-easy method for estimating switching costs. International Journal of Industrial Organization, 20(1), 71–87.

Somaini, P., & Einav, L. (2013). A Model of market power in customer markets. Journal of Industrial Economics, 61(4), 938–986.

Viard, V.B. (2007). Do switching costs make markets more or less competitive? The case of 800-number portability. The RAND Journal of Economics, 38(1), 146–163.

Author information

Authors and Affiliations

Corresponding author

Additional information

A previous version of this paper circulated under the title ”Do Firms Compensate Switching Consumers?”. We are very grateful to Sridhar Moorthy and two anonymous referees for many valuable suggestions. We also thank Mark Armstrong, Jonathan Eaton, Sarit Markovich, Marco Ottaviani, Rob Porter, Tim Richards, Mark Roberts, Bill Rogerson, Mark Satterthwaite, Yossi Speigel and participants in the 2009 SED meetings and 2010 IIOC for their comments and suggestions. Any remaining errors are entirely our own. Financial support from the General Motors Research Center for Strategy in Management at Kellogg School of Management is gratefully acknowledged.

Appendices

Appendix A Proofs

1.1 A.1. Proof of Lemma 2.1

The derivative of firm j’s steady-state value with respect to SC is given by

where p ∗ represents the vector of steady state prices for the equilibrium when γ=0.

Proof

For \(\frac {dV^{j}}{d\gamma }\): by construction, in any steady state equilibrium

Apply the envelope theorem \(\left (\frac {dV^{j}}{dp_{j}}=0 \right )\) to get

Using

Which simplifies to the desired result. □

1.2 A.2. Proof of Lemma 2.2

The derivative of firm j’s steady state price with respect to SC at γ=0 has the same sign as \(F^{j}_{\gamma }\), given by Eq. 2.6 (repeated here):

Where all χ j k ≥0 and p ∗ represent the vector of steady state prices for the equilibrium when γ=0. Moreover, long run incentives—i.e., \( {\sum }_{k \in J} \left (D^{j,k}_{\gamma } \cdot D^{k}_{p_{j}} \right ) \)—are always negative.

Proof

For \(F_{\gamma }^{j}\): first, derive \(\frac {dV}{d\nabla _{p_{j}}}\) by applying the envelope theorem to \(V\left (s\right )=pD^{1}+\beta V\left (s\right )\) :

Where d D is the gradient of the change in demand for all firms that resulted from the change in the started shares ∇. Next, take the total derivative with respect to λ,

At γ=0 , \(\frac {dV^{j}}{dD}=\frac {dD}{d\nabla }=0\) so the second dynamic term is zero. As we are holding price fixed, at γ=0,

Therefore

It remains to simplify the product multiplication. \(\frac {dD^{j}}{d\nabla _{p_{j}}}\) is a vector with elements \(D_{s_{i}}^{j}\). By construction

At γ=0, \(D_{s_{i}}^{j,i}=0\) and so

This identifies the elements of \(\frac {dD^{j}}{d\nabla _{p_{j}}}\). Taking the derivative w.r.t. γ on the vector \(\frac {dD^{j}}{d\nabla _{p_{j}}}\) yields elements of the form

Now perform the product multiplication:

Placing in \(F_{\gamma }^{j}\) above obtains the desired result:

To see that long run incentives are always negative, observe that \(D^{j,k}_{\gamma }\) is positive iff k=j, while \(D^{k}_{p_{j}}\) is negative iff k=j. □

1.3 A.3. Proof of Lemma 3.1

With logit demand, at γ=0:

Where all χ j k ≥0.

Proof

From Lemma 2.2 we know that,

So we can simply uses the structure of logit demand to determine each element in this equation to arrive at the second expression in the lemma. Note that the first expression of the lemma is shown in step 5 below.

-

(1)

Determine \(\frac {dD^{i}}{dp_{j}}\):

-

For i=j, the element is,

$$\frac{\partial D^{j}}{\partial p_{j}}=-\alpha D^{j}\left(1-D^{j}\right)=-\alpha s_{j}\left(1-s_{j}\right). $$ -

For i≠j, the element is,

$$\frac{\partial D^{i}}{\partial p_{j}}=\alpha D^{j}D^{i}=\alpha s_{j}s_{i}. $$ -

Observe that the irrelevant alternatives (IIA) assumption for how shares compensate is maintained,

$$\frac{\partial D^{i}}{\partial p_{j}}=\frac{\partial D^{j}}{\partial p_{j}}\cdot\left(-\frac{s_{i}}{1-s_{j}}\right). $$

-

-

(2)

Determine \(D_{\gamma }^{j,i}\) :

-

For i=j, \(D_{\gamma }^{j,j}=s_{j}\left (1-s_{j}\right )\);

-

For i≠j, \(D_{\gamma }^{j,i}=-s_{j}s_{i}\).

-

-

(3)

Determine the products,

$$D_{\gamma}^{j,j}\cdot\frac{\partial D^{j}}{\partial p_{j}}=-\alpha {s_{j}^{2}}\left(1-s_{j}\right)^{2}; $$$$D_{\gamma}^{j,i}\cdot\frac{\partial D^{i}}{\partial p_{j}}=-\alpha {s_{j}^{2}}{s_{i}^{2}}. $$ -

(4)

The sum,

$$\begin{array}{@{}rcl@{}} \beta\cdot p_{j}\cdot\left(\sum\limits_{i\in J}D_{\gamma}^{j,i}\frac{\partial D^{i}}{\partial p_{j}}\right) && =-\beta\alpha p_{j}{s_{j}^{2}}\left(\left(1-s_{j}\right)^{2}+\sum\limits_{i\neq j}{s_{i}^{2}}\right)\\ && =-\beta\alpha p_{j}{s_{j}^{2}}\left(1-2s_{j}+H\right). \end{array} $$Now use the standard first order condition at γ=0,

$$\alpha p_{j}s_{j}\left(1-s_{j}\right)=s_{j}. $$So \(\alpha p_{j}=\frac {1}{1-s_{j}}\) and the sum is,

$$ \beta\cdot p_{j}\cdot\left(\sum\limits_{i\in J}D_{\gamma}^{j,i}\frac{\partial D^{i}}{\partial p_{j}}\right)=-\beta\frac{{s_{j}^{2}}}{1-s_{j}}\left(1-2s_{j}+H\right). $$(A.1) -

(5)

Determine \(D_{\gamma }^{j}\),

$$\begin{array}{@{}rcl@{}} D_{\gamma}^{j} && =\sum\limits_{i}s_{i}D_{\gamma}^{j,i}\\ && =s_{j}s_{j}\left(1-s_{j}\right)-\sum\limits_{i\neq j}s_{i}s_{i}s_{j}\\ && ={s_{j}^{2}}-s_{j}{s_{j}^{2}}-s_{j}\sum\limits_{i\neq j}{s_{i}^{2}}\\ && ={s_{j}^{2}}-s_{j}\cdot\sum\limits_{i\in J}{s_{i}^{2}}\\ && =s_{j}\left(s_{j}-H\right). \end{array} $$This is the first statement in the lemma, but it still remains to derive the price effect.

-

(6)

Determine \(D_{p_{j}\gamma }^{j}\),

$$\begin{array}{@{}rcl@{}} D_{\gamma p_{j}}^{j,j} && =D_{p_{j}}^{j,j}\left(1-D^{j,j}\right)-D^{j,j}D_{p_{j}}^{j,j}\\ && =D_{p_{j}}^{j,j}\left(1-2D^{j,j}\right)\\ && =-\alpha s_{j}\left(1-s_{j}\right)\left(1-2s_{j}\right) \end{array} $$$$\begin{array}{@{}rcl@{}} D_{\gamma p_{j}}^{j,i\neq j} && =-D_{p_{j}}^{j,i}D^{i,i}-D^{j,i}D_{p_{j}}^{i,i}\\ && =\alpha D^{j,i}\left(1-D^{j,i}\right)D^{i,i}-\alpha D^{j,i}D^{j,i}D^{i,i}\\ && =\alpha\left[s_{j}\left(1-s_{j}\right)s_{i}-s_{j}s_{s}s_{i}\right]\\ && =\alpha s_{j}s_{i}\left(1-2s_{j}\right) \end{array} $$$$\begin{array}{@{}rcl@{}} D_{\gamma p_{j}}^{j} && =\sum\limits_{i}s_{i}D_{\gamma p_{j}}^{j,i}\\ && =-\alpha {s_{j}^{2}}\left(1-s_{j}\right)\left(1-2s_{j}\right)+\sum\limits_{i\neq j}\alpha s_{j}{s_{i}^{2}}\left(1-2s_{j}\right)\\ && =\alpha s_{j}\left(1-2s_{j}\right)\cdot\left(\sum\limits_{i\neq j}{s_{i}^{2}}-s_{j}+{s_{j}^{2}}\right)\\ && =\alpha s_{j}\left(1-2s_{j}\right)\left(H-s_{j}\right). \end{array} $$Using \(\alpha \cdot p_{j}=\frac {1}{1-s_{j}}\) (again, from the first order condition at γ=0):

$$p_{j}D_{\gamma p_{j}}^{j}=\frac{s_{j}}{1-s_{j}}\left(1-2s_{j}\right)\left(H-s_{j}\right). $$ -

(7)

Combine these to determine the price effect:

$$\begin{array}{@{}rcl@{}} F_{\gamma}^{j} &=&D_{\gamma}^{j}+p_{j}D_{\gamma p_{j}}^{j}+\beta\cdot p_{j}\cdot\left(\sum\limits_{i\in J}D_{\gamma}^{j,i}\frac{\partial D^{i}}{\partial p_{j}}\right)+\sum\limits_{k\neq j}\left(\frac{dp^{\ast}_{k}}{d\gamma} \chi_{jk}\right)\\ &=&s_{j}\left(s_{j}-H\right)+\frac{s_{j}}{1-s_{j}}\left(1-2s_{j}\right)\left(H-s_{j}\right)-\beta\frac{{s_{j}^{2}}}{1-s_{j}}\left(1-2s_{j}+H\right)\\ &&+\sum\limits_{k\neq j}\left(\frac{dp^{\ast}_{k}}{d\gamma} \chi_{jk}\right)\\ &=&\frac{s_{j}}{1-s_{j}}\left[\left(s_{j}-H\right)\left(1-s_{j}\right)+\left(H-s_{j}\right)\left(1-2s_{j} \right)-\beta s_{j}\left(1-2s_{j}+H\right)\right]\\ &&+\sum\limits_{k\neq j}\left(\frac{dp^{\ast}_{k}}{d\gamma} \chi_{jk}\right)\\ &=&\frac{s_{j}}{1-s_{j}}\left[\left(H-s_{j}\right)\left(1-2s_{j}-1+s_{j}\right)-\beta\left(1-2s_{j}+H\right)\right]\\ &&+\sum\limits_{k\neq j}\left(\frac{dp^{\ast}_{k}}{d\gamma} \chi_{jk}\right)\\ &=&\frac{{s_{j}^{2}}}{1-s_{j}}\left[-\left(H-s_{j}\right)-\beta\left(1-2s_{j}+H\right) \right] +\sum\limits_{k\neq j}\left(\frac{dp^{\ast}_{k}}{d\gamma} \chi_{jk}\right). \end{array} $$Which is the second statement in the lemma.

□

1.4 A.4. Proof of Proposition 3.1

In a random utility model with quasi-linear utility, if firms are symmetric (δ j =δ), then:

-

(1)

If firms are myopic \(\left (\beta =0\right )\), small SC have no effect on prices and profits.

-

(2)

If firms are forward looking \(\left (\beta >0\right )\), prices and profits decrease from a small SC for all firms.

Proof

With quasi-linear utility and J symmetric firms, consumers that are loyal to firm 1 purchase the firm’s product if

As all ε j are iid, this share can be described by a CDF on the first order statistic of the ε j distribution and the rival’s prices:

Where K is a (linear) function of all the firms’ rival prices. Letting ϕ denote the PDF for Φ:

Note that as \(D_{p_{1}}^{1,1}<0\) and α>0 it must be that \(\phi \left (K-\alpha p_{1}\right )>0\).

Consumers that are loyal to firm k≠1, would purchase if

Because utility is quasi-linear and the shocks are independent, this share can be described by a CDF on the first order statistic of the ε distribution, the rivals’ prices and a function \(\tau \left (\gamma \right )\) that depends only on γ:

Let \(\tau _{0}\equiv \tau ^{\prime }\left (0\right )\). The partials are:

We now prove that, at γ=0, if demand is quasi-linear, and the market is symmetric and fully covered (no outside good), then \(\tau _{0}=\frac {1}{J-1}\) and \(D_{\gamma p_{1}}^{1}=0\).

By construction, at γ=0,

By symmetry, if there’s no outside good, \(D_{\gamma }^{1}=0\), since steady state shares of all firms must remain \(\frac {1}{J}\) with and without switching costs. As \(\phi \left (K-\alpha p_{1}\right )\neq 0\), this requires that,

which proves both results.