Abstract

Using a large sample of nations, this paper examines the relation between corruption and the shadow economy, focusing especially on geographic spillovers. The results point to complementarity between corruption and the shadow economy. We find evidence of own contagion across nations in both corruption and shadow economy activity, while cross-contagion mostly points to substitution between own shadow economy (corruption) and neighboring corruption (shadow economy). These findings are fairly robust across different estimation techniques and measures of the shadow economy.

Similar content being viewed by others

Avoid common mistakes on your manuscript.

1 Introduction

Underground or shadow sectors and corruption exist to varying degrees in almost all nations (Schneider and Enste 2000; Tanzi 1982).Footnote 1 This global prevalence has prompted policymakers and researchers to understand their causes and effects (Aidt 2003; Gërxhani 2004; Lambsdorff 2006; Schneider and Enste 2000; Seldadyo and de Haan 2006; Treisman 2000, 2007). Recently, researchers have turned attention to examining the relation between corruption and the shadow sector—i.e., the extent to which the two phenomena coexist. A significant relation between the two illegal activities can have significant implications for public policy.

Figures 1 and 2 (Appendix A) provide details about the global prevalence of corruption and the shadow economy. We see that, although there are some similarities in the spatial prevalence of the two, there are significant differences. What is less clear, however, is how the influence of one type of illegal activity (corruption or shadow economy) spills over across national borders.

It seems plausible to conjecture that corruption and the shadow economy may be related—corrupt nations are likely to have large shadow sectors as one might aid the other (underground operators might have to offer bribes to continue operations—e.g., obtain electricity connections from public sector power companies). However, the underlying formal theoretical arguments (Choi and Thum 2005; Dreher et al. 2009) and the associated empirical evidence are mixed (Buehn and Schneider 2012; Dreher et al. 2009; Dreher and Schneider 2010; Johnson et al. 1997). Specifically, it is argued that the shadow economy and corruption may be substitutes when firms moving to the underground sector reduce rent-seeking opportunities for corrupt officials in the official sector (and thus reduce corruption). On the other hand, corruption and the shadow economy would be complementary when firms operating in the shadow economy would offer bribes to avoid punishment or to secure services from the official sector (Hendriks et al. 1999). Empirically, Buehn and Schneider (2012) and Johnson et al. (1997) find support for the complementarity view, while Dreher et al. (2009) find substitution.Footnote 2 Thus, the extant body of knowledge has been unable to provide definitive insights into the links between corruption and the shadow economy. Yet, pegging a relation can be instructive for policy coordination.

It has been recognized for some time that institutions diffuse across neighboring nations (Bonaglia et al. 2001; Seldadyo et al. 2010; Simmons and Elkins 2004). Contiguous nations, owing to shared histories or learning and from relatively frequent exchanges of populations, tend to mimic institutional setups. Both corruption and the shadow sector are two instances. Economic agents in a nation might “learn” from corrupt neighbors about corrupt practices (Lambsdorff and Teksoz 2004). Alternatively, neighboring countries might share colonial legacies, language or culture and these might shape institutions.

Empirical tests until now are limited primarily to examining the presence of corruption contagion. In terms of related empirical evidence, Goel and Nelson (2007) find support for corruption contagion across U.S. states, while Becker et al. (2009), Majeed and MacDonald (2011) and Márquez et al. (2011) focus on the cross-national spatial dimensions. Herwartz et al. (2011) have examined the regional spatial effects of the shadow economy within Europe, whereas Seldadyo et al. (2010) study the spatial aspects of governance. It is yet not clear, however, whether (i) the shadow economy in a country has contagion effects; and (ii) if corruption (the shadow economy) in a country has spillovers in terms of substitution/complementarity with the neighboring shadow economy (corruption) (we call this cross-contagion).

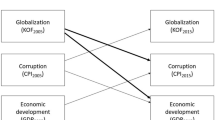

The present research adds to the debate surrounding corruption and the shadow economy by considering their spatial dimensions. Specifically, we uniquely consider the cross-country spatial spillovers involving corruption and the shadow economy, focusing on both own-spillovers (i.e., the shadow economy (corruption) in a country affecting the neighboring shadow economy (corruption)), and cross-spillovers (the shadow economy in a country affecting neighboring corruption and vice versa). Thus, the contribution herein is both to the corruption-shadow economy literature and to the related contagion literature. Can the ambiguity in the corruption-shadow economy relation be attributed to a lack of consideration of spatial dimensions? Findings of regional linkages in the corruption-shadow economy nexus can be instructive in policy formation.

The results show complementarity between corruption and the shadow economy. We find evidence of own contagion in both corruption and the shadow economy, while cross-contagion mostly points to substitution between own shadow economy (corruption) and neighboring corruption (shadow economy). These findings are fairly robust. In the remaining sections of this paper, we discuss the model in Sect. 2. Section 3 describes the data set; the empirical results are reported in Sect. 4; and the final section offers concluding remarks.

2 Model

2.1 Theoretical background

2.1.1 Corruption and the shadow economy

Theoretically, one can envision how corruption and the shadow economy might be intertwined. The prevalence of corruption in an economy would make shadow operations easier to set up—e.g., obtain official permits. The potential cost of operating underground is lower when bribes enable shadow operators to escape or mitigate punishment. Further, since underground operators do not have legal rights, corruption might enable them to bribe corrupt officials into acting as enforcers. On the other hand, a shadow sector can also aid corrupt activity, e.g., when shadow operations enable stashing of corrupt earnings.

The perceived complementarity between corruption and the shadow economy, however, becomes weak when one thinks about the nature of bribes—i.e., their size (petty or grand corruption) and their nature (cash versus non-cash); see Goel et al. (2013). For instance, stashing of petty cash or in-kind corrupt earnings would generally not be possible in the shadow sector, thus undermining the complementarity view. While it has been noted that firms’ opportunities to shift to the underground sector can reduce the rent-seeking pie for corrupt officials, our focus on how the nature and the size of bribes might have the same effect seems new.

In a related study, Choi and Thum (2005) posit that complementarity between official and unofficial sectors of the economy can exist when the presence of the shadow sector induces corrupt officials in the official sector to reduce their bribe demands, thus expanding the formal sector. Dreher et al. (2009) have also argued that going underground enables firms to avoid bribery. In this sense, the shadow economy can have an overall beneficial effect. On the other hand, Johnson et al. (1997) and others have argued that shifting production to the unofficial sector lowers tax revenue and affects the provision of public goods. This diminished provision of public goods negatively impacts productivity, implying that the expansion of the shadow sector is harmful. While not disagreeing with these arguments, we add a third dimension to the linkage between corruption and the shadow economy by arguing that when firms move to the underground sector, they expose themselves to the risk of punishment and detection. Unlike the previously mentioned studies, we argue that not all law enforcement officials are honest and the underground firms would be at greater risk of exploitation by corrupt officials. In this sense, growth in the shadow sector would be accompanied by growth in corruption and these linkages could be both internal and external (cross-contagion). Overall, the theory does not provide a definite relation between the shadow economy and corruption (see Buehn and Schneider 2012).

2.1.2 Spatial diffusion of the shadow economy and corruption

Corruption contagion

Spatial dimensions incorporate externalities that common histories, culture or trade might confer on contiguous nations (Anselin 1988; Herwartz et al. 2011). National borders might have been drawn by colonial powers and might not form independent economic units. Further, insights about the mechanisms of offering bribes in one nation might be instructive to potential lawbreakers in other nations and such information flows faster in geographically closer nations (Seldadyo et al. 2010). Additionally, contiguous nations might over time imitate the institutional setups of their successful neighbors (Simmons and Elkins 2004). Thinking about petty versus grand corruption, petty corruption exchanges are likely to be confined within national borders—e.g., bribing a local police officer. Yet another possible diffusion difference might occur when one considers the distinction between economic and political corruption. Economic corruption might diffuse across nations through trade, while political corruption might be more nation-centric and its diffusion is likely to occur slowly.

Shadow economy contagion

Underground businesses deal with other firms, who themselves might not also be operating underground. These business operators often trade with firms in neighboring nations—thus spreading shadow economy contagion. The outsourcing of production and business services has bolstered international trade—both in the official and unofficial sectors.

Government officials are not generally directly involved in unofficial trade, unless underground operators are seeking favors from corrupt officials. The absence of direct involvement by government officials in shadow economy deals makes such transactions relatively less reliant on the specifics of government structure (rules) of any one nation, and thereby more prone to geographic spillovers. An example might be shadow operators making lower cost goods by not adhering to official environmental standards and then exporting the output. Here too, there might be learning from neighbors about ways to “dodge the system” to operate underground.

Reflecting some more on the possible spatial differences between corruption and the shadow economy, it is conceivable that the two might diffuse differently. For instance, corrupt relations involve two parties—a corrupt government official and a bribe payer.Footnote 3 Spatial externalities in corruption would exist when one of the parties is either located in a different country (e.g., an exporter paying a bribe to a foreign official) or the agents in one nation are learning to be corrupt from their corrupt neighbors (see Lambsdorff and Teksoz 2004). However, because regulations and bureaucratic hierarchies are mostly nation-specific, dealing with foreign (potentially corrupt) officials is not on the same footing as dealing with domestic corrupt officials. Thus, other than the demonstration effect, cross-border spillovers of corruption might be limited, especially to grand corruption.

Corruption-shadow economy cross-contagion: from shadow to corruption

The consideration of cross-contagion, wherein a nation’s corruption (the shadow economy) affects the neighboring shadow economy (corruption) is unique to this paper. Broadly speaking, these cross-spillovers arise from international trade.

As a start, similar arguments regarding substitution-complementarity between corruption and the shadow economy internally can also apply to cross-contagion. First, cross-border transactions, especially involving underground operators, are likely to spur corruption in the customs department (in both nations). This can engender cross-contagion—greater shadow operations in country A can spur corruption in country B, especially when the exporters of products produced in the shadow sector seek to sell them in the neighboring official sector through bribery. Second, products produced in the shadow sector might not meet labor guidelines or environmental standards and exporters of such products would then bribe officials in the importing country to have their products certified. Third, as argued in the previous section, higher taxes induce firms to operate underground (Johnson et al. 1997), by setting up shadow operations in a neighboring country. This would spur corrupt activity in the home country when the profits of the shadow operations are sent back to the home country and bribes are paid to disguise such transfers. Finally, remittances by foreign workers employed in the shadow sector might be accompanied by bribes in their home country to have them flow through official channels. The relation between the shadow economy and foreign corruption does not, however, necessarily have to be positive. For instance, greater movement of firms to the underground sector might reduce rent-seeking opportunities—when, for example, corrupt license issuers in the official sector are not solicited by underground operators (Dreher et al. 2009).

Corruption-shadow economy cross-contagion: from corruption to shadow

More corruption increases the size of the shadow economy when bribes facilitate setting up underground operations; conversely, more corruption can reduce the shadow economy when corruption is seen as an additional cost of operating underground. In a spatial context, higher corruption in one country might force some firms in the official sector to set up shadow operations in neighboring nations to lower the costs of doing business. Further, corrupt military leaders might find it easier to solicit procurement bribes from neighboring shadow defense suppliers. Democratically elected leaders, answerable to their voters, might find it politically expedient to solicit bribes for favors from foreign shadow producers. Additionally, corrupt officials might find ready buyers of privileged information (e.g., government patents, government procurement plans) among neighboring underground operators. Finally, corrupt officials might find neighboring nations ‘safer’ for stashing corrupt earnings and setting up underground production facilities in neighboring nations might be an expedient way to do that.

The discussion above shows that numerous channels exist through which the shadow economy can affect neighboring corruption and vice versa. Our spatial analysis will systematically determine whether they matter in fostering corruption and the shadow economy.

Hypotheses

To test the previous arguments formally, we posit three hypotheses:

- H1::

-

There is complementarity between corruption and the shadow economy

- H2::

-

There exists spatial contagion between own corruption (shadow economy) and neighboring corruption (shadow economy)

- H3::

-

There exists spatial cross-contagion between own corruption (shadow economy) and neighboring shadow economy (corruption)

2.2 Empirical setup

To test the above hypotheses, borrowing from the extant literature, we estimate alternate equations explaining the determinants of the shadow economy and corruption. While the body of relevant literature is rather vast (for literature reviews see Gërxhani 2004; Lambsdorff 2006; Schneider and Enste 2000; Treisman 2000, 2007), research examining the linkages between the two is more limited (Buehn and Schneider 2012; Dreher et al. 2009; Dreher and Schneider 2010; Johnson et al. 1997). Whereas intuitively a relation between the shadow economy and corruption is plausible, the empirical evidence is mixed. To contribute to the debate, we ask, does a country’s geographic location affect the prevalence of corruption/shadow sector and, if so, what is the nature of the relation?

2.2.1 Estimated equation

The basic empirical model draws on Dreher and Schneider (2010), and adds spatial dynamics.Footnote 4 Formally, we estimate the following equation for a cross-section of countries:

where i indexes a country; X i and Y i represent either corruption or the size of the shadow economy; the variable Z i is a vector of control variables (see details below); and ε i is the error term. The dependent variables in different models include (see Table 5): (i) a cross-country index of corruption from ICRG; and (ii) three different measures of the shadow economy—(a) from Schneider et al. (2010), called shadow economy; (b) from Alm and Embaye (2013), dubbed shadow economy (AE); and (c) from Elgin and Öztunali (2012), called shadow economy (EO).

Following the broader literature on the determinants of corruption/shadow economy and Dreher and Schneider (2010), the vector Z i of explanatory variables in Eq. (1) includes price controls, democracy, fiscal burden, rule of law, and logGDP per capita when corruption is the dependent variable; and government effectiveness, minimum wage regulations, credit market regulations, and logGDP per capita when shadow economy is the dependent variable.

These variables broadly proxy for macroeconomic conditions and institutions that likely impact corruption and the shadow economy. The rationales for including them are well documented in the literature. For instance, less regulation and better institutions would reduce corruption as rent-seeking abilities of bureaucrats are undermined (see Seldadyo and de Haan 2006; Treisman 2000). Greater economic prosperity increases the costs of illegal activity, and this result is quite robust in empirical studies of corruption (Gundlach and Paldam 2009). In the literature, GDP is considered an indicator of the shadow economy (Dell’Anno et al. 2007; Herwartz et al. 2011). The protestant religion has also been found to reduce corruption (Lambsdorff 2006). More stringent regulations, labor market bottlenecks and high taxes in the formal sector induce some firms to go underground (Gërxhani 2004; Herwartz et al. 2011; Schneider and Enste 2000).

Turning to how we model contagion, the spatial lag variables WY j and WX j capture externalities associated with corruption and the shadow economy from neighboring country j. Each neighbor is weighted using the predetermined weight matrix W, which is a 106×106 (106 is the number of countries in this study) matrix defining “neighborliness.” To ensure identification, the weight matrix must be exogenous (Anselin and Bera 1998) and we therefore define neighborliness using geographic distance. Specifically, \(w_{ij}=\frac{1}{d_{ij}}\) where w ij is the ijth element in the weight matrix W, and d is the geographic distance from country i to country j.Footnote 5 This distance function assigns heavier weight to countries that are geographically closer.

The error term may also follow a spatial autoregressive process of the following form:

where λ is a scalar (<1); W is the weight matrix in Eq. (1); and ξ i is the i.i.d. error term.

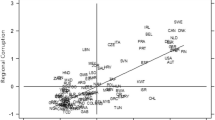

2.2.2 Testing for the presence of spatial dependence

To test Hypotheses 2 and 3, this study incorporates recent developments in spatial econometrics (Anselin et al. 2004; LeSage and Pace 2009). To test for the existence of spatial dependence, we use two widely used measures of spatial autocorrelation: (1) Moran’s I statistic (Kelejian and Prucha 2001; Moran 1954); and (2) Geary’s C statistic (Geary 1954). The tests agree that the shadow economy and corruption exhibit spatial dependence (see Appendix B).

2.2.3 Estimation procedures

The inclusion of the spatial lagged dependent variable (and the other spatial lag(s)), however, induces an endogeneity problem because the spatial lag and the dependent variable are determined simultaneously, thus using OLS leads to inconsistent estimates. In order to obtain consistent estimates in the presence of spatial dynamics, a number of estimation techniques have been employed, including instrumental variables (IV) (Kelejian et al. 2006; Kelejian and Prucha 1998), maximum likelihood estimation (MLE), and general method of moments (GMM) (Conley 1999). However, given the presence of multiple endogenous variables, MLE is not feasible, and in the presence of unknown forms of heteroscedasticity, traditional IV may not be the most efficient estimator. Conversely, efficient GMM estimation makes use of orthogonality conditions to produce consistent and efficient estimates in the presence of unknown forms of heteroscedasticity.Footnote 6 In order to circumvent endogeneity problems associated with the spatial lags, we follow the advice of Kelejian and Robinson (1993) by instrumenting the spatial lags using spatial lags of the exogenous regressors along with their higher powers. To ensure “good” instruments—i.e., correlated with the endogenous variables and orthogonal to the errors—we employ three identification tests: (1) an overidentification test using Hansen’s J statistic; (2) an underidentification test using the Kleibergen-Paap (2006) rk LM statistic; and (3) a weak identification test using the Kleibergen-Paap (2006) rk Wald statistic.Footnote 7

3 Data

The data consist of a cross-section of 106 countries averaged over the period 1999 to 2008 (although we extend the series somewhat in Table 3). The main variables of interest include: three measures of the shadow economy and one measure of corruption. We use the ICRG corruption index to capture cross-national corruption. This index is based on expert ratings of corruption in a country (see www.prsgroup.com for details).Footnote 8

Regarding measures of the shadow economy, we employ three different measures. Schneider and associates have long provided estimates of the shadow economy (as a percentage of GDP). The series we use is based on the MIMIC method (see Herwartz et al. 2011 and Schneider et al. 2010; also Frey and Weck-Hanneman 1984; Giles 1999; and Schneider 2007). The span of the shadow economy data constrains the time period of our study.

In addition, we incorporate two other measures of the shadow economy from Elgin and Öztunali (2012) (EO) and Alm and Embaye (2013) (AE). Elgin and Öztunali (2012) provide a recent measure based on a two-sector (official and shadow) dynamic general equilibrium model. The authors solve this model for the steady state and calibrate the model’s key parameters to match observables in the data. They then use the model to back out the unobservable size of the shadow economy. Alternatively, Alm and Embaye (2013) constructed estimates for the shadow economy using the currency demand approach and dynamic panel estimation methods. Given that underground operations are secretive and inherently hard to measure, using alternate measures of the shadow economy provides a useful robustness check.

In our sample, the average size of the shadow economy is 32.2 % of GDP (based on the Schneider et al. 2010 measure of the shadow economy), but varies significantly across countries (Table 5). For instance, the smallest shadow economy is only 8.5 % of GDP (Switzerland) and the largest is 66.1 % (Bolivia), again based on Schneider et al. (2010). Similarly, the average corruption level is 3.5 with a low of zero (Finland) and high of 5.6 (Zimbabwe), on a zero to six scale. The simple pairwise correlation between corruption and shadow economy is 0.626; between corruption and shadow economy (EO) is 0.608; and between corruption and shadow economy (AE) is 0.706. The correlation between shadow economy and shadow economy (EO) is 0.990; between shadow economy and shadow economy (AE) is 0.703; and between shadow economy (EO) and shadow economy (AE) is 0.678. The other variables are from “standard” sources used in the literature (see Appendix A).

4 Results

4.1 Effect of corruption on the shadow economy

Table 1 provides estimates of Eq. (1) with the shadow economy (from Schneider et al. 2010) as the dependent variable (Y) and corruption as an explanatory variable (X). Column 1 includes the results for the baseline regression using standard OLS. The coefficient on corruption is positive, but statistically insignificant. Thus, in the OLS model, statistical support for complementarity is weak (Hypothesis 1).

Regarding the control variables for explaining the prevalence of the shadow economy, the coefficient on logGDP per capita is negative and significant, suggesting that higher levels of income lead to a shrinking shadow economy. Greater economic prosperity makes operating in the shadow economy less attractive (by increasing the opportunity cost of breaking the law), and more prosperous nations are also likely to have stronger checks and balances against illegal activities. Furthermore, fewer (lax) regulations in the credit market lead to a larger shadow economy, given by the negative and significant coefficient. Minimum wage regulations result in a larger shadow economy, as firms move underground. Finally, more effective government leads to a smaller shadow economy, as shown by the negative and statistically significant coefficient. These results are generally consistent with intuition and are in line with the findings of Dreher and Schneider (2010).

It is plausible, however, that corruption is endogenous (i.e., corruption is affected by the shadow economy); therefore we instrument corruption with fiscal burden, price controls, rule of law and democracy and estimate Eq. (1) using two-step efficient GMM (see Dreher and Schneider 2010). These variables have been identified by others as affecting corruption (Lambsdorff 2006; Seldadyo and de Haan 2006). These results in column 2 are generally consistent with the results using OLS.

In light of our earlier discussion of possible spatial dependence with respect to both the shadow economy and corruption, along with tests of spatial autocorrelation confirming evidence of spatial dependence (Appendix B), the last two columns in Table 1 include spatial lags of shadow economy (column 3) and both shadow economy and corruption (column 4).

Interestingly, the coefficient on corruption is now positive and significant, suggesting that more corruption is associated with a larger shadow economy. In other words, we find that corruption is complementary to the shadow economy, supporting Hypothesis 1. On average, an increase in the index of corruption by one point increases the size of the shadow economy (% of GDP) by approximately five percentage points. These findings suggest that greater corruption increases the incentives for businesses to go underground.

The coefficient for the spatial lag on the shadow economy in column 3 is positive and significant, indicating that a larger shadow economy in one country encourages larger shadow economies in neighboring countries (Hypothesis 2). Specifically, a one percentage point increase in the size of country j’s shadow economy, on average, increases country i’s shadow economy by approximately 0.48 percentage points. This finding is consistent with the notion that underground operators in one nation are more likely to deal/trade with underground operators in neighboring nations (because of lower costs or lower expected punishment).

To ascertain the effects of neighboring corruption on the shadow economy (cross-contagion), column 4 includes a spatial lag of corruption. The coefficient on this variable, although positive, is statistically insignificant. In other words, we are unable to find support for cross-contagion. The ineffectiveness of neighboring corruption might arise because foreign corrupt activities are relatively less likely to involve domestic shadow operators bribing foreign officials.

The control variables in columns 3 and 4 have effects similar to the baseline regression, except that government effectiveness is now insignificant—conceivably due to the spatial lag terms capturing possible yardstick competition associated with government effectiveness. The diagnostic tests show that the instruments are both valid and relevant.

4.2 Effect of the shadow economy on corruption

Table 2 provides the estimates of Eq. (1) with corruption as the dependent variable (Y) in Eq. (1) and the shadow economy as an explanatory variable (X). Researchers examining the causes of corruption have a relatively larger body of work that they can draw upon (compared to the shadow economy) (Aidt 2003; Lambsdorff 2006; Seldadyo and de Haan 2006; Treisman 2000).Footnote 9 Given its very nature, corruption can be affected by numerous factors (see Seldadyo and de Haan 2006). Our choice of the set of determinants is dictated by selecting the key variables from the literature (Dreher and Schneider 2010; Lambsdorff 2006; Seldadyo and de Haan 2006).

Column 1 provides the baseline OLS estimates for Eq. (1). Here, the coefficient on the shadow economy is positive but insignificant. So we fail to find complementarity between corruption and the shadow economy in the corruption equation. This could happen when shadow operators are successful at evading detection or when some government services are also available from private vendors in a mixed oligopoly where private and public sector firms compete.

With respect to the control variables, both logGDP per capita and democracy are negative and insignificant, whereas fiscal burden and price controls are positive and significant; rule of law is negative and significant. In other words, more corruption is present in countries that are less economically free (Goel and Nelson 2005); have tighter price regulations; and have an ineffective rule of law.

The second column gives estimates of Eq. (1) using two-step efficient GMM and instrumenting the shadow economy with credit market regulations, minimum wage regulations, and government effectiveness to account for endogeneity issues. The estimated coefficients are similar to those in column 1, except that the coefficient on shadow economy is now negative, albeit insignificant.Footnote 10 Again, the shadow to corruption linkage fails to find statistical support. The coefficient on economic prosperity is negative and marginally significant.

The last three columns in Table 2 include spatial dynamics. The coefficient on the spatial lag of corruption is positive and statistically significant in two of the three models (Becker et al. 2009). Thus, we find support for corruption contagion (Hypothesis 2).

Column 4 includes spatial lags of corruption and of the shadow economy. For all specifications controlling for simultaneous effects, the diagnostic tests agree that the instruments are relevant and valid. Here, the coefficient on the spatial lag on corruption becomes significant, suggesting complementarity between corruption in one country and corruption of neighboring countries. That is, a one point increase in the corruption index for country j increases country i’s level of corruption by 0.48 points (on average). The coefficient on the spatial lag of the shadow economy is significant and negative—larger neighboring shadow sectors reduce corruption in own country as bribe-seeking opportunities are diminished (Dreher et al. 2009).

To summarize, the results show complementarity between corruption and the shadow economy in the shadow economy determinants equation. We also find support for own-contagion (Hypothesis 2), as well as for cross-contagion (Hypothesis 3).

4.3 Robustness checks

We perform robustness checks to test the validity of our findings, including using alternate measures of the shadow economy, different estimation techniques and additional influences.Footnote 11

4.3.1 Using alternate measures of the shadow economy

The shadow economy is by its very nature unobservable in official statistics and thus difficult to measure. As a robustness check, the previous specifications are replicated using two different measures of the shadow economy developed recently by Elgin and Öztunali (2012) and Alm and Embaye (2013). Elgin and Öztunali (2012) use a two-sector dynamic general equilibrium model, whereas Alm and Embaye (2013) use the currency demand method. The EO shadow measure is more closely correlated with the Schneider et al. (2010) measure than the AE measure.

Columns 1 and 2 of Table 3 show results when shadow economy (AE) and shadow economy (EO), respectively, are the dependent variables. Alternatively, columns 3 and 4 provide results when corruption is the dependent variable and shadow economy (AE) and shadow economy (EO) are the main regressors, respectively. Again, we find complementarity between corruption and shadow economy in the shadow economy determinants regressions (with a positive and statistically insignificant sign on shadow economy in that equation). In both cases there are significant own- and cross-contagion effects. Overall, the results remain robust to different measures of the shadow economy.

4.3.2 Using alternate estimation techniques

As a further robustness check, we employed different estimation techniques, including three-stage least squares (3SLS) and panel regressions and re-estimated the models in column 3 of Tables 1 and 2. When estimating cross-section regressions, significant variation is masked by using average data; we therefore use annual observations by country and estimated a panel regression. These results are in columns 2 and 4 in Table 4 (with a sample of 67 countries over 2000–2006).

Corruption and the shadow economy are complements in the shadow determinants equation, but substitutes in the corruption-determinants equation. The substitution between corruption and the shadow economy in the corruption equation has been identified earlier in the literature (Dreher et al. 2009). The two spatial lags remain significant and supportive of earlier predictions—i.e., significant own contagion and negative and significant cross-contagion.Footnote 12

Further, in light of a possible simultaneity bias caused by corruption and shadow economy being simultaneously determined in Eq. (1), we employ a system of simultaneous equations using 3SLS. The results are Table 4 (columns 1, 3); the main findings remain robust.

4.3.3 Using additional explanatory variables

Following the larger literature (Lambsdorff 2006), the last column in Table 2, considers some additional determinants of corruption. Social structure and religion can significantly dictate propensities to be corrupt. In particular, we include the percentage of the population belonging to the Protestant religion and ethnolinguistic fractionalization. The Protestant work ethic is argued to be “clean” and greater fractionalization of the populace might suggest that people are unable effectively to use bribes to enforce contracts (Lambsdorff 2006). The coefficients on both ethnolinguistic fractionalization and Protestant are negative and insignificant (see Becker et al. 2009; Lambsdorff 2006; Treisman 2000). The coefficient on the spatial lag on corruption remains positive and significant, and that on cross-contagion is negative and significant.

4.3.4 Impact of outliers

We also checked for the sensitivity of our results to the presence of outliers by dropping countries with the largest and smallest shadow economies (Bolivia and Switzerland) and the highest and lowest level of corruption (Zimbabwe and Finland). The results remained robust.

4.3.5 Developed versus developing country subsamples

Developed and developing nations can have structural differences not captured by the variables in our setup. To address this (see Dreher and Schneider 2010), we checked for differences between high and low income countries using World Bank (2013) classifications. We were unable to find statistically significant differences. It could be the case that spatial considerations do not enable “clean” demarcation of developed and developing nations, thus resulting in insignificant differences. Overall, the analysis suggests that spatial considerations matter in explaining the prevalence of the shadow economy and corruption.

5 Concluding remarks

Using a large sample of nations, this paper examines the substitution/complementarity between corruption and the shadow economy, paying special attention to geographic spillovers. Specifically, we examine whether there is own contagion in corruption and the shadow economy and whether there is cross-contagion.

The results show that the shadow economy and corruption are complements when estimating the determinants of the shadow economy (Hypothesis 1); however, the relation is not robust in the corruption-determinants equation. This relation is sensitive to whether cross-sectional or panel analysis is used. We find evidence to support own contagion in both the shadow economy and corruption (Hypothesis 2—see Becker et al. 2009). Further, cross-contagion exists in corruption to the shadow economy and vice versa (Hypothesis 3). In other words, the shadow economy (corruption) in a country is negatively affected by neighboring corruption (shadow economy). These findings hold across alternate measures of the shadow economy.

The results regarding corruption contagion are mixed in the literature. Both Becker et al. (2009) and Márquez et al. (2011) use Transparency International’s corruption perceptions index, and while Becker et al. (2009) find presence of corruption contagion, Márquez et al. (2011), fail to find corruption contagion. Neither study, however, focuses on the shadow economy. In another angle, whereas Dreher and Schneider (2010) have shown that the corruption-shadow nexus is sensitive to national income levels, we find no differences across developed and developing nations when spatial effects are included. The results (at least with regard to the shadow economy) support the notion that governance might diffuse across nations (Seldadyo et al. 2010). The effects of other determinants for corruption and the shadow economy are in general agreement with the literature.

To quantify the impact of contagion from the shadow economy, Table 7 in Appendix C illustrates the extent of shadow economy spillovers from neighboring countries on the size of the U.S. shadow economy (using Table 1, column 3). The largest spillovers on the U.S. shadow economy originate in Canada’s underground sector. A one percentage point increase in the size of the Canadian shadow economy would result in a 0.12 percentage point increase in the U.S. shadow economy, and many neighboring countries exert spillovers on the U.S. shadow economy.Footnote 13

From a policy perspective, regional coordination of policies to combat the shadow economy is recommended. It seems that as the underground sector (corruption) grows, the neighboring nations also see an increase in underground operations (corruption). We find evidence of complementarity between own shadow economy and own corruption, but substitution in cross-contagion. Thus, these illegal activities diffuse differently internally and externally. Policies strengthening governance and promoting economic freedom are supported for controlling corruption and the shadow economy. Given that illegal activities are hard to observe and measure, policymakers examining recommendations for controlling the shadow economy/corruption should keep an eye on alternate measures and new estimation methods.

Notes

Corruption is defined as the abuse of public office for private gain, while the shadow economy encompasses economic activity that is not included in official GDP and is unregistered in the official sector.

In an interesting angle, Dreher and Schneider (2010) argue that the substitution-complementarity relations between corruption and the shadow economy might be different across rich and poor nations.

More generally, both parties could represent multiple players.

Several previous studies have also employed geographic distance (Becker et al. 2009; and Ertur and Koch 2007). The haversine distance formula is used to calculate the great-circle distance between capital cities using data provided by Mayer and Zignago (2011). In constructing the weight matrix, the maximum distance band is selected to ensure that all countries possess at least one neighbor, to avoid rows containing all zeros. In order to facilitate interpretation and make the results comparable (e.g., the Shadow economy (AE) contains only 95 of the 106 countries), we chose to row-standardize each weight matrix (i.e., each element in a row is divided by the row sum).

In order to make efficient GMM feasible, a two-step procedure is used. The first step estimates the covariance matrix under the assumption of i.i.d errors, and the second step uses this estimate for computing the optimal weighting matrix (Baum et al. 2007).

Underidentification tests the relevance of the instruments with a rejection of the null indicating that the model is identified; weak identification tests if the instruments are only weakly correlated with the endogenous variables; and overidentification tests the validity of the instruments wherein a rejection of the null casts doubt on the validity of the instruments (see Baum et al. 2007 and citations therein for more information). To check if the instruments are correlated with the endogenous variables, we also report the first-stage F-statistics. Further, to check the validity of the subset of instruments relating to the spatial lags of the exogenous regressors, we report the C statistic (difference-in-Hansen). A rejection of the C statistic casts doubt on the validity of the spatial lag instruments.

Again, these results are largely consistent with the findings of Dreher and Schneider (2010). However, the diagnostic tests indicate some potential problems with the instrument set. Although the Hansen J test is insignificant, indicating valid instruments, both the first-stage F-statistic and the two Kleibergen and Paap (2006) tests suggest that the instruments are rather poor. As noted above, given the multi-faceted nature of corrupt activities, finding reliable instruments remains a challenge for corruption research.

Furthermore, ignoring spatial dependence of the errors could cause biased estimates of the standard errors; we therefore corrected for spatial error dependence of the form in Eq. (2) and the results remained robust. These results are available by request from the authors.

However, the statistical support for cross-contagion in the shadow equation is weak (Table 4, column 1).

Herwartz et al. (2011: 243) state that, “Depending on the region, different transactions can dominate in the shadow activities”.

References

Aidt, T. S. (2003). Economic analysis of corruption: a survey. Economic Journal, 113, F632–F652.

Alesina, A., Devleeschauwer, A., Easterly, W., Kurlat, S., & Wacziarg, R. (2003). Fractionalization. Journal of Economic Growth, 8, 155–194.

Alm, J., & Embaye, A. (2013). Using dynamic panel methods to estimate shadow economies around the world, 1984–2006. Public Finance Review, 41, 510–543.

Anselin, L. (1988). Spatial econometrics, methods and models. Boston: Kluwer Academic.

Anselin, L., & Bera, A. K. (1998). Spatial dependence in linear regression models with an introduction to spatial econometrics. In A. Ullah & D. E. A. Giles (Eds.), Handbook of applied economic statistics (pp. 237–290). New York: Marcel Dekker.

Anselin, L., Florax, R., & Rey, S. J. (Eds.) (2004). Advances in spatial econometrics: methodology, tools and applications. Berlin: Springer.

Baum, C. F., Schaffer, M. E., & Stillman, S. (2007). Enhanced routines for instrumental variables/GMM estimation and testing. The Stata Journal, 7, 465–506. http://ideas.repec.org/a/tsj/stataj/v7y2007i4p465-506.html.

Becker, S. O., Egger, P. H., & Seidel, T. (2009). Common political culture: evidence on regional corruption contagion. European Journal of Political Economy, 25, 300–310.

Bonaglia, F., De Macedo, J. B., & Bussolo, M. (2001). How globalization improves governance. OECD Development Centre working paper #181, 2001.

Buehn, A., & Schneider, F. (2012). Corruption and the shadow economy: like oil and vinegar, like water and fire? International Tax and Public Finance, 19, 172–194.

Choi, J. P., & Thum, M. (2005). Corruption and the shadow economy. International Economic Review, 46, 817–836.

Conley, T. (1999). GMM estimation with cross sectional dependence. Journal of Econometrics, 92, 1–45.

Dell’Anno, R., Gómez-Antonio, M., & Alañon-Pardo, A. (2007). The shadow economy in three Mediterranean countries: France, Spain and Greece. A MIMIC approach. Empirical Economics, 33, 51–84.

Dreher, A., & Schneider, F. (2010). Corruption and the shadow economy: an empirical analysis. Public Choice, 144, 215–238.

Dreher, A., Kotsogiannis, C., & McCorriston, S. (2009). How do institutions affect corruption and the shadow economy? International Tax and Public Finance, 16, 773–796.

Elgin, C., & Öztunali, O. (2012). Shadow economies around the world: model based estimates. Boğaziçi University Department of Economics Working Paper.

Ertur, C., & Koch, W. (2007). Growth, technological interdependence and spatial externalities: theory and evidence. Journal of Applied Econometrics, 22, 1033–1062.

Frey, B. S., & Weck-Hanneman, H. (1984). The hidden economy as an ‘unobserved’ variable. European Economic Review, 26, 33–53.

Friedman, E., Johnson, S., Kaufmann, D., & Zodio-Lobatón, P. (2000). Dodging the grabbing hand: the determinants of unofficial activity in 69 countries. Journal of Public Economics, 76, 459–493.

Geary, R. C. (1954). The contiguity ratio and statistical mapping. Incorporated Statistician, 5, 115–145.

Gërxhani, K. (2004). The informal sector in developed and less developed countries: a literature survey. Public Choice, 120, 267–300.

Giles, D. (1999). Measuring the hidden economy: implications for econometric modeling. Economic Journal, 109, F370–F380.

Goel, R. K., & Nelson, M. A. (2005). Economic freedom versus political freedom: cross-country influences on corruption. Australian Economic Papers, 44, 121–133.

Goel, R. K., & Nelson, M. A. (2007). Are corrupt acts contagious? Evidence from the United States. Journal of Policy Modeling, 29, 839–850.

Goel, R. K., Budak, J., & Rajh, E. (2013). Bureaucratic monopoly and the nature and timing of bribes: evidence from Croatian data. Comparative Economic Studies, 55, 43–58.

Gundlach, E., & Paldam, M. (2009). The transition of corruption: from poverty to honesty. Economics Letters, 103, 146–148.

Gwartney, J., & Lawson, R. (2009). Economic freedom of the world: 2009 annual report. Vancouver, BC: The Fraser Institute. Data. retrieved from www.freetheworld.com.

Hendriks, J., Muthoo, A., & Keen, M. (1999). Corruption, extortion and evasion. Journal of Public Economics, 74, 395–430.

Heritage Foundation (2006) Index of economic freedom. www.heritage.org.

Herwartz, H., Schneider, F., & Tafenau, E. (2011). Regional patterns of the shadow economy: modelling issues and evidence from the European Union”. In F. Schneider (Ed.), Handbook on the shadow economy, Cheltenham: Edward Elgar.

International Country Risk Guide (ICRG) (2012), The PRS Group. http://www.prsgroup.com/icrg.aspx.

Johnson, S., Kaufmann, D., & Shleifer, A. (1997). The unofficial economy in transition. Brookings Papers on Economic Activity, 2, 159–239.

Kaufmann, K., Kraay, A., & Mastruzzi, M. (2010). The Worldwide Governance Indicators: a summary of methodology, data and analytical issues. World Bank Policy Research Working Paper No. 5430. http://papers.ssrn.com/sol3/papers.cfm?abstract_id=1682130.

Kelejian, H., & Prucha, I. (1998). A generalized spatial two-stage least squares procedure for estimating a spatial autoregressive model with autoregressive disturbances. Journal of Real Estate Finance and Economics, 17, 99–121.

Kelejian, H., & Prucha, I. (2001). On the asymptotic distribution of the Moran I test with applications. Journal of Econometrics, 104, 219–257.

Kelejian, H., & Robinson, D. (1993). A suggested method of estimation for spatial interdependent models with autocorrelated errors, and an application to a country expenditure model. Papers in Regional Science, 72, 297–312.

Kelejian, H., Prucha, I., & Yuzefovich, Y. (2006). Estimation problems in models with spatial weighting matrices which have blocks of equal elements. Journal of Regional Science, 46, 507–515.

Kleibergen, F., & Paap, R. (2006). Generalized reduced rank tests using the singular value decomposition. Journal of Econometrics, 133, 97–126.

La Porta, R., Lopez-de-Silanes, F., Shleifer, A., & Vishny, R. (1999). The quality of government. Journal of Law, Economics, & Organization, 15, 222–279.

Lambsdorff, J. G. (2006). Causes and consequences of corruption: what do we know from a cross-section of countries? In S. Rose-Ackerman (Ed.), International handbook on the economics of corruption (pp. 3–51). Cheltenham: Edward Elgar.

Lambsdorff, J. G., & Teksoz, U. (2004). Corrupt relational contracting. In J. Lambsdorff, M. Taube, & M. Schramm (Eds.), Corruption and the new institutional economics (pp. 138–151). London: Routledge.

LeSage, J. P., & Pace, R. K. (2009). Introduction to spatial econometrics. Boca Raton: CRC.

Majeed, M. T., & MacDonald, R. (2011). Corruption and financial intermediation in a panel of regions: cross-border effects of corruption. University of Glasgow, Economics Working Paper # 2011-18.

Márquez, M. A., Salinas-Jiménez, J., & del Mar Salinas-Jiménez, M. (2011). Exploring differences in corruption: the role of neighboring countries. Journal of Economic Policy Reform, 14, 11–19.

Marshall, M. G., & Jaggers, K. (2012). Polity IV Project: regime authority characteristics and transitions 1800–2011. http://www.systemicpeace.org/polity/polity4.htm.

Mayer, T., & Zignago, S. (2011). Notes on CEPII’s distances measures (GeoDist). CEPII Working Paper # 2011-25. http://www.cepii.fr/%5C/anglaisgraph/bdd/distances.htm.

Moran, P. A. P. (1954). Notes on continuous stochastic phenomena. Biometrika, 37, 17–23.

Rose-Ackerman, S. (1999). Corruption and government. Cambridge: Cambridge University Press.

Schneider, F. (2007). Shadow economies and corruption all over the world: new estimates for 145 countries. Economics: The Open-Access, Open-Assessment E-Journal, 1, 2007–2009.

Schneider, F., & Enste, D. (2000). Shadow economies: size, causes, and consequences. Journal of Economic Literature, 38, 77–114.

Schneider, F., Buehn, A., & Montenegro, C. E. (2010). Shadow economies all over the world: new estimates for 162 countries from 1999 to 2007. Policy Research Working Paper No. 5356, The World Bank.

Seldadyo, H., & de Haan, J. (2006). The determinants of corruption: a literature survey and new evidence. In European Public Choice Society meetings.

Seldadyo, H., Elhorst, J. P., & de Haan, J. (2010). Geography and governance: does space matter? Papers in Regional Science, 89, 625–640.

Shleifer, A., & Vishny, R. W. (1993). Corruption. The Quarterly Journal of Economics, 108, 599–617.

Simmons, B. A., & Elkins, Z. (2004). The globalization of liberalization: policy diffusion in the international political economy. American Political Science Review, 98, 171–189.

Stock, J., & Yogo, M. (2005). Testing for weak instruments in linear IV regression. In D. W. K. Andrews & J. H. Stock (Eds.), Identification and inference for econometric models: essays in honor of Thomas Rothenberg (pp. 80–108). Cambridge: Cambridge University Press.

Tanzi, V. (1982). The underground economy in the United States and abroad. Lexington: Lexington Books.

Treisman, D. (2000). The causes of corruption: a cross-national study. Journal of Public Economics, 76, 399–457.

Treisman, D. (2007). What have we learned about the causes of corruption from ten years of cross-national empirical research? Annual Review of Political Science, 10, 211–244.

World Bank (2013). World Development Indicators, The World Bank, http://data.worldbank.org/data-catalog/world-development-indicators.

Acknowledgements

We thank Dr. William Shughart, two referees, Michael Brün and Mike Nelson for comments.

Author information

Authors and Affiliations

Corresponding author

Appendices

Appendix A

Appendix B: Pre-estimation tests

Prior to estimating Eq. (1), we conduct two tests of spatial dependence with respect to corruption and the shadow economy. The two tests are: (1) the Moran I (Moran 1954) test (2) Geary’s C (Geary 1954) test. The two tests differ in that the Moran I is a test of global spatial dependence, whereas the Geary C test is more sensitive to local spatial dependence. Positive values of Moran’s I statistic indicate positive spatial autocorrelation, negative values indicate negative spatial autocorrelation and a value of zero indicates random spatial correlation. A value of one for Geary’s C test indicates random spatial autocorrelation, zero indicates positive spatial autocorrelation, and a value of two indicates negative spatial autocorrelation. Both test statistics are converted to z-scores and the null hypothesis of spatial independence is tested against the alternative of spatial dependence.

The results for the two tests are in Table 6. Notice for both corruption and the three measures of the shadow economy, the tests overwhelmingly reject the null of spatial independence suggesting significant spatial dependence with respect to both corruption and the size of the shadow economy. These results support the model setup given by Eq. (1) augmented with two spatial lags to capture this spatial dependence.

Appendix C: Spatial spillovers of neighboring shadow activities on U.S. shadow economy

A one percentage point increase in the size of the shadow economy of U.S. neighboring country increases the U.S. shadow economy by (Table 7).

Rights and permissions

About this article

Cite this article

Goel, R.K., Saunoris, J.W. Global corruption and the shadow economy: spatial aspects. Public Choice 161, 119–139 (2014). https://doi.org/10.1007/s11127-013-0135-1

Received:

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s11127-013-0135-1