Abstract

Tolls have increasingly become a common mechanism to fund road projects in recent decades. Therefore, improving knowledge of demand behavior constitutes a key aspect for stakeholders dealing with the management of toll roads. However, the literature concerning demand elasticity estimates for interurban toll roads is still limited due to their relatively scarce number in the international context. Furthermore, existing research has left some aspects to be investigated, among others, the choice of GDP as the most common socioeconomic variable to explain traffic growth over time. This paper intends to determine the variables that better explain the evolution of light vehicle demand in toll roads throughout the years. To that end, we establish a dynamic panel data methodology aimed at identifying the key socioeconomic variables explaining changes in light vehicle demand over time. The results show that, despite some usefulness, GDP does not constitute the most appropriate explanatory variable, while other parameters such as employment or GDP per capita lead to more stable and consistent results. The methodology is applied to Spanish toll roads for the 1990–2011 period, which constitutes a very interesting case on variations in toll road use, as road demand has experienced a significant decrease since the beginning of the economic crisis in 2008.

Similar content being viewed by others

Avoid common mistakes on your manuscript.

Introduction

Tolls have increasingly become a common mechanism to fund road projects (Matas and Raymond 2003). Improving knowledge of road demand behavior and estimating more accurately traffic forecasts constitute critical aspects for the evaluation of transport policies and for the assessment of future investment needs. Therefore, stakeholders involved in toll road management (governments, private operators, etc.) find it essential to identify the key parameters influencing road demand, as well as to quantify the strength of the relationships between traffic and certain socioeconomic variables. However, the state of knowledge concerning demand behavior for toll roads is still limited, partly because of its scarce number in the international context (Odeck and Brathen 2008; Matas and Raymond 2003).

Most of the previous research studies have been focused on urban areas (Borjesson et al. 2012; Olszewski and Xie 2005) or on particular tolled sections, such as bridges or tunnels (Holguín-Veras et al. 2011; Hirschman et al. 1995). However, research on interurban toll roads is scarcer and leaves some aspects insufficiently studied. Among other issues, GDP is generally the only socioeconomic explanatory variable included in the analysis. Furthermore, the econometric models applied often do not disaggregate toll road traffic into light and heavy vehicle demand, despite it being clear that the use of the two kinds of vehicles differs, based on different behavioral patterns. Finally, the impact of an economic crisis on road demand has hardly been analyzed in the literature.

The aim of this paper is to contribute to a better knowledge of the evolution of light vehicle demand on interurban toll roads by identifying some of the key socioeconomic variables influencing traffic behavior. Through an original methodology, we discuss the suitability and limitations of GDP as a socioeconomic explanatory variable of light vehicle demand on toll roads, and present alternative variables. The main objective is thus to fill the research gap found in the literature regarding the socioeconomic variables that better explain the evolution of light traffic demand over time. Additionally, this paper analyzes the effects of the economic crisis on light traffic for toll roads, and tests the suitability of the explanatory variables chosen.

The paper focuses on the Spanish toll road network, which constitutes an interesting case in the international context. The deterioration of the economic situation in Spain since 2008 has had a great impact on the level of traffic in the toll road network. According to data from the Spanish Ministry of Transportation (Ministerio de Fomento 2013), traffic has undergone a reduction of 28 % as compared with the peak reached in 2007. As a consequence, demand on toll roads has returned to levels of 1998, when the toll road network was 46 % shorter. Revenues of private concessionaires have decreased by 10 % in 2012 as compared with levels in the previous year, which led the government to take critical measures to relieve their financial situation. This research discusses whether the significant reductions in recent years can be considered an anomalous fact when compared to previous trends.

This paper is organized as follows. After the introduction in “Introduction” section, “State of knowledge” section summarizes the state of knowledge regarding road traffic analysis, mainly focusing on interurban toll roads. In the “Methodology” section establishes the methodology of this research, by describing both data series and the panel data specification used to estimate demand elasticities. In the “Modeling Results and Discussion” section presents and discusses the results. Finally, “Conclusions and further research” section sets out the main conclusions and further research.

State of knowledge

Evolution of road demand over time has generally been a matter of interest in transport economics, and numerous studies have been conducted in the last decades to identify the key parameters influencing travel patterns. The responsiveness of road traffic with respect to different factors is measured through the concept of elasticity, by definition the relative change in travel demand induced by a relative change in a certain explanatory variable. Research studies aimed at calculating the demand elasticity on free and tolled roads are briefly summarized in the following subsection.

Previous research for free roads

The literature analyzing travel patterns on free roads is extensive, specifically those studies measuring the influence of fuel prices on road demand. In the 190s, the first research works appeared which measured the impact of substantial gasoline price rises on fuel consumption and travel demand (Matas and Raymond 2003). More recent studies (Goodwin et al. 2004; Graham and Glaister 2004; De Jong and Gunn 2001) found that short-run elasticities with respect to fuel prices commonly range between −0.10 and −0.40, and typically average about −0.30. Nevertheless, demand elasticity can vary depending on different factors, such as magnitude of price changes, level of user´s income, perceived stability of price changes, or quality of alternatives, among others (Litman 2013). The percentage that fuel represents on the total cost of driving is also an aspect to be taken into account when analyzing the influence of fuel costs on travel behavior.

Other studies (Su 2011; Hymel et al. 2010) also mention the significance of the rebound effect, that is, the additional mileage driven that results from increased fuel efficiency. The elasticity of road demand with respect to income is also analyzed (Boilard 2010; Goodwin et al. 2004; Hanly et al. 2002) in urban and metropolitan areas. For Spain, González and Marrero (2011) have quantified the induced road traffic in Spanish regions, with a short-run fuel price elasticity of −0.28, but they did not find significant results attributable either to variations in GDP or in GDP per capita.

Previous research for toll roads

As mentioned above, the literature regarding demand evolution for toll roads is still limited. After excluding studies in urban areas and special tolled sections (bridges and tunnels), only a handful of papers can be found, and they are focused on just a very few nations, including Spain, Norway, and the United States.

The implementation of tolls on roads can affect different aspects of travel patterns, as the user may reduce the mileage driven, change the origin/destination of the trip, shift to alternative modes, etc. (Litman 2013). In the long-term, it could even affect the location of residential housing, as well as manufacturing and distribution activities. Nevertheless, toll elasticities can show a wide range of values depending on the different purposes of a trip, income levels, and overall trip costs, as well as the attractiveness of alternative routes (Lake and Ferreira 2002). Therefore, the level of toll elasticity can significantly vary depending on the context, mainly in urban and metropolitan areas. Table 1 includes the most important previous studies analyzing light vehicle demand in toll roads, both in the urban and interurban context, and summarizes their main characteristics and results.

This paper focuses on interurban roads, generally with higher toll elasticities as compared to road traffic in urban contexts, as can be observed in Table 1. These differences may be caused by the higher cost and the greater percentage of long-distance trips in interurban road demand. According to the literature, long-distance trips have empirically shown higher travel demand elasticities than short-distance movements, typically within urban areas. Mattson (2008) concluded that vehicles operating for longer distances are more sensitive to changes in gas prices than those travelling shorter ones. Regarding transit ridership, a study conducted in Australia by Currie and Phung (2008) found that short-run fuel elasticities for journeys over 25 km were four times higher than those routes below 7 km. Furthermore, Odeck and Brathen (2008) calculated toll elasticities for different Norwegian roads, with higher values for rural roads than for urban motorways. Therefore, long-distance trips seem to be more sensitive to changes in generalized transport costs. This varying responsiveness of long and short-distance trips have been linked (Mattson 2008) to the higher amount of costs—fuel, tolls, etc.—associated with the former, with long-distance trips providing greater motivation for changing the route, shifting to alternative modes of transport, or cancelling the trip altogether.

Next, we summarize the main results of interurban toll roads from the literature, sorted by country. In the case of the United States, the most consistent research was developed by Burris and Huang (2011), who analyzed a sample of 12 interurban and metropolitan toll roads throughout the nation during an 11 year period (2000–2010). They establish an approach based on time series ADL models, including population, unemployment rate, gas prices and toll rates as explanatory variables. They found statistically significant results for light vehicle demand elasticities with respect to gas prices (with a mean of −0.06) and toll rates (averaging −0.30). As for the socioeconomic variables in the model, short-run elasticities with respect to population averaged 1.31, while results for unemployment rate were not completely consistent. On the other hand, the study by Wilbur Smith (2008) for the North Texas Tollway Authority focused on the potential impacts that gas prices can have on toll revenues rather than solely on travel demand.

Regarding Norway, Odeck and Brathen (2008) calculated the elasticity of travel demand in 19 Norwegian toll road projects, including cordon toll rings, tolled trunk roads between cities and tolled roads in peripheral regions. Explanatory variables considered in the analysis were generalized transport costs, household income and toll rates. Detailed results were only provided for the last variable, with short-run toll elasticities of motorways around −0.40 and −0.48. Furthermore, Odeck and Kjerkreit (2010) provided further insight into users´ attitudes towards charges for road user by examining 6 different Norwegian toll schemes.

For the case of Spain, the study on the tolled motorway network by Matas and Raymond (2003) can be considered as the most significant. For the 1979–1997 period, they develop a panel data approach, showing an average demand elasticity of around −0.30 with respect to both gasoline prices and to toll rates. National GDP is the socioeconomic variable chosen in the analysis, with a demand elasticity of 0.89. More recently, results for Spain have been updated by Matas et al. (2012). In their new research paper, that included the 1980–2008 period, they obtained toll elasticities—between −0.15 and −0.49—, while short-run elasticities with respect to gasoline prices and GDP were, respectively, −0.39 and 0.75. The authors pointed out that it is often unrealistic to assume a constant elasticity, as it can vary depending on such factors as road capacity constraints. Furthermore, Cantos and Álvarez (2009) analyzed demand behavior in the radial toll roads in Madrid, while Álvarez et al. (2007) calculated the value of time and travel elasticities for both a Spanish toll motorway and its free parallel road. In this case, short-run elasticities concluded a substantial influence of toll prices (−0.54) and GDP (0.83) on road demand, with a lower value for fuel prices (−0.06).

As can be seen, the existing literature on interurban toll roads leaves some aspects to be investigated. First, GDP is generally the only socioeconomic variable included in the analysis for light vehicle demand. In this respect, it is necessary to assess to what extent GDP constitutes a suitable explanatory variable for toll road demand, and to explore other possible alternatives. Furthermore, few researchers (Burris and Huang 2011) have analyzed the impact of an economic crisis on toll road demand. For the case of Spain, no previous studies have addressed this particular question.

Methodology

This section presents the data collected for the analysis of light vehicle demand on Spanish toll roads, as well as the methodology we followed to develop the dynamic panel data approach.

Previous data analysis

In order to estimate the demand equation for light vehicle traffic, we establish a dynamic panel data corresponding to 14 Spanish toll roads observed between 1990 and 2011. The sample includes those toll highways whose traffic data series are sufficiently long for the statistical approach adopted in this paper, which analyzes—as shown later—the evolution of demand elasticity values as the time period becomes longer. Other existing tolled sections in Spain—those toll highways resulting from the second phase of tender offers in the Spanish toll network, whose operation started after 1998—provide traffic data series too short to be usefully considered in the analysis. All the toll highways in the sample have a free parallel conventional road that competes with it. The analysis then focuses on toll roads for which a free alternative of lower quality exists, characteristics of which have kept constant during the period analyzed. Additionally, competing alternative modes have remained almost unchanged for the sample selected. Use of only two toll highways may be influenced by the new high-speed rail services operating between Madrid–Valladolid and Madrid–Barcelona since 2007 and 2008, respectively. The toll roads included in the study, and new high speed services implemented in Spain, do not generally belong to the same travel demand corridor. For the only two cases where toll road demand may have been affected by new rail services, the effect can be considered limited as the implementation of high speed rail may only affect 4–6 observations in a sample with a total of 294 observations. Then, it can be assumed that they do not provide a lot of insight, and their effect on the results is expected to be very limited. Additionally, passenger transport in Spain mainly corresponds to road transport (91.5 % of total passenger-km in 2012), whose percentage is even greater when considering only land transport (94.3 % of total passenger-km in 2012). Therefore we have not taken into account competing modes in the model, given the size of the sample and the length of the period covered (1990–2011) in the analysis.

The dependent variable of the demand equation is the annual average daily traffic volume (AADT) for light vehicles in each toll road. These data have been collected from the statistics of the Spanish Ministry of Transportation (Ministerio de Fomento 2012). Although traffic data from shorter tolled sections were available—approximately, every 20 km-, only the data for the entire length of a toll road has been considered in order to avoid spatial correlation problems in the models, since data from short sections of the same highway are highly dependent on each other. That is, traffic volumes from consecutive road sections are very similar and clearly related to each other.

Three kinds of explanatory variables have been included in the demand equation (see Table 2): demand variables of previous years, socioeconomic variables and generalized cost ones. The demand variable (AADT(−1)) consists of a lag of the traffic volume, a term needed due to the dynamic nature of the panel. For socioeconomic variables, three alternatives have been considered: GDP, employment, and GDP per capita. These data have been collected from the Spanish National Statistics Institute (INE). Other socioeconomic variables, such as population and size of vehicle fleet, have been discarded for two main reasons. Firstly, they are highly correlated with other socioeconomic variables included in the model. And secondly, weaker relations with traffic evolution were observed when compared to other explanatory variables considered, especially after the beginning of the crisis.

As mentioned before, three kinds of explanatory variables are included in the demand equation: previous demand, socioeconomic variables, and generalized cost variables. Specifically, it incorporates a lag of the traffic volume (AADT(−1)), a Socioeconomic variable and two Generalized cost parameters (Toll and Fuel), which results in a total of four categories of independent variables:

According to Table 2, the analysis often considers alternatives within these four categories, mainly in the socioeconomic one. This methodology allows us to calibrate several versions of the model just by taking one variable in each category presented for the demand equation. Therefore, by running all the available combinations of variables, we can establish up to 12 different versions of the model specification we propose. This variability improves the analytical capability of the methodology applied. Further details about both the demand equation and the methodology specification are provided in "Dynamic panel data methodology specification" section. Additionally, a precise definition of each variable included in Table 2 is presented in the Appendix.

Concerning socioeconomic variables, two levels of data have been considered in the analysis: the provincial level and the national level. With the aim of better understanding the influence of local socioeconomic characteristics on light vehicle demand, data have been collected at the provincial level. In Spain, a province is a geographical and political subdivision of a region. Each toll road is assigned the socioeconomic data from the various provinces it crosses, as detailed in the Appendix. Furthermore, data at the national level has also been tested, since the panel analysis comprises different toll roads spread throughout the country. National parameters are expected to constitute a good proxy for socioeconomic data, not for any particular road, but for the panel as a whole. Likewise, national data may be a satisfactory explanatory variable, as a significant part of light vehicle traffic in Spanish toll roads makes long trips, generally less related to local activities. Monetary socioeconomic variables (GDP and GDP per capita) have been deflated by the consumer price index (CPI) to reflect their real value over time.

With regard to economic variables, historical toll rates—expressed in euro/km—were collected from the statistics by the Spanish Ministry of Transportation (Ministerio de Fomento 2012). As for fuel cost, two simplifications have been effected when including this variable in the analysis. First, gasoline and diesel prices—expressed in euro/liter—have been taken together to create a Fuel price variable. To that end, both values are weighted by the proportion of gasoline and diesel light vehicle fleet for each year in the 1990-2011 period in Spain. And second, in order to include the rebound effect and reflect real fuel costs when driving (euro/km), an alternative variable called Fuel cost incorporates values of fuel consumption (liter/km) for light vehicles. For calculating fuel consumption over the 1990–2011 period, we introduce linear improvements in fuel efficiency, from average 1990 values provided by the Ministry of Transportation (MOPU 1990), to current levels, as supplied by the Ministry of Industry (Idae 2011). This way, we include the progression in fuel efficiency experienced during the 1990–2011 period in Spain. Both toll rates and fuel prices/costs have been adjusted for inflation by using the CPI.

As shown in Table 2, the model includes an explanatory variable to indicate the location of the toll road within the country. Although we usually work with the whole sample, separate analyses have been conducted for coastal and interior roads in Spain. Our analysis is intended to identify potential differences in traffic trends depending on the location of the toll road. Traditionally, the economy in coastal regions (Catalonia, Valencia, Andalusia, etc.) has been highly dependent on local activities such as tourism. Road traffic in these regions experiences significant peaks during the summer time and at Easter, and is expected to be greatly influenced by tourist demand. By contrast, toll roads in the inner part of the peninsula generally pass through less developed areas, with low population density, so their traffic is expected to be influenced more by the general status of the economy in the country. Then, it may happen that light traffic along coastal roads is better explained by provincial socioeconomic variables, whereas traffic along interior roads is better explained by national data. This distinction tries to evaluate what explains differences in toll road demand in coastal and interior areas, particularly with respect to both national and provincial socioeconomic data.

At this point, we want to emphasize the analytical capability of our methodology. Given the explanatory variables considered according to Table 2, the panel data allows us to calibrate up to 36 different versions of the model, if we take into account the 3 possibilities regarding the size of the sample. Numerous and quick cross-comparisons of elasticity estimates can be made in order to identify the most suitable explanatory variables of light vehicle demand.

Table 3 provides an overview of the evolution of some of the provincial socioeconomic variables for the toll roads selected before and after the economic recession. It shows the information for three significant years in the sample: the starting point (1990), the peak reached just before the economic crisis (2007), and the ending point (2010) because information for 2011 at this level was not available at the time of the writing of this paper. Figures show the long and strong economic growth experienced in Spain during the 1990–2007 cycle, when national GDP increased by 78.0 %. For the provinces crossed by the toll roads selected, information presents average growth rates of 76.4 % for GDP, 50.2 % for employment and 55.4 % for GDP per capita. This period of prosperity has been followed by a slowdown that entailed a deterioration of the overall economic performance since 2008. National GDP fell by 7.4 % between 2007 and 2011. Provincial socioeconomic data also experienced significant average reductions from 2007 to 2010 for GDP (−5.2 %) as well as for employment (−8.9 %) and GDP per capita (−8.5 %).

Light vehicle demand has experienced trends similar to those of socioeconomic variables. For the selected toll roads, demand rose on average by 146.8 % over the period 1990–2007, which was in line with the economic growth in the country. Since the crisis began, the trend has changed, and traffic levels in 2010 were 9.9 % lower than the peak reached in 2007. These sharp variations observed in the toll road network during the last 20 years make Spain an interesting case to be analyzed, as well as a way to test the robustness of the models.

Dynamic panel data methodology specification

In this section we present a dynamic panel data methodology for studying the behavior of light vehicle demand in toll roads. It allows us to estimate short-term demand elasticities with respect to explanatory variables included in Table 2. All variables are expressed in logarithms. The form proposed for the estimation models is:

With provincial socioeconomic data: t = 1990,…, 2010; i = 1,…, 14

With national socioeconomic data: t = 1990,…, 2011; i = 1,…, 14

Given the dynamic nature of the analysis, the equation includes a lag of the demand variable (AADTt−1). Fuel denotes fuel costs assumed by users, expressed either in euro/liter or euro/km. Toll it denotes the toll rate (euro/km) applied in road i for year t. Finally, Socioec it denotes different socioeconomic data (GDP, Employment and GDP per capita) assigned to road i, either at the provincial or national level. Regarding the rest of the parameters, βk is the short-run elasticity of road demand with respect to explanatory variable k; λ measures possible autocorrelation in traffic data series; ηi denotes unobserved individual effects, that is, constant and specific factors for each tolled road, not accounted for by in the rest of the variables in the model; finally, εit is the residual or idiosyncratic error.

Regarding initial conditions, we assume (Blundell and Bond 1998) that ηi and εit are independently distributed across i and have the familiar error components in which:

In addition, there is the standard assumption concerning the initial conditions of the demand variable, included in (4). According to Blundell and Bond (1998), these conditions imply moment restrictions that are sufficient to identify and estimate ηi in a dynamic panel data for T ≥ 3, as it is in our case.

As pointed out by Graham et al. (2009), the main issue to be addressed in the context of dynamic panel estimation is correlation between the lagged dependent term (AADTi,t−1) and the unobserved cross-section individual effects (ηi). This fact greatly limits the use of the estimators to be applied. The ordinary least squares (OLS) estimator for λ is then inconsistent (Hsiao 1986; Bond 2002) and biased upwards, at least in large samples (Nickell 1981; Blundell et al. 2000). The Within Groups (WG) estimator eliminates this source of inconsistency by transforming the equation to eliminate ηi, but gives an estimate of λ that is biased downwards, especially in short panels (Blundell and Bond 1998; Bond 2002). Therefore, a consistent estimate of λ can be expected to lie between the OLS and WG estimates (Arellano and Bond 1991; Bond et al. 2001).

Better estimates can be calculated with a generalized method of moments (GMM) approach, proposed by Arellano and Bond (1991). Within this technique, Eq. (2) is differenced to eliminate the individual effects:

In this expression, we find that Δ(AADTi,t−1) is correlated with Δεit, since AADTi,t−1 and εit−1 are clearly correlated. Therefore, the condition of moment restrictions expressed in (4) cannot be fulfilled. To solve this problem, Arellano and Bond (1991) adopted the so-called difference GMM estimator (GMM-DIFF), which includes an instrumental variables (IV) approach. The GMM-DIFF estimator assumes that values of the dependent variable lagged two periods or more (AADTi,t−s, for s ≥ 2) are valid instruments for the lagged dependent variable in the differenced equation, Δ(AADTi,t). That is, assuming a set of instrumental variables which are correlated with Δ(AADTi,t−1) but orthogonal to the differenced residuals Δεit, we can establish a set of moment conditions that would be satisfied by the true values of the parameters to be calculated (Graham et al. 2009). Then, the moment conditions are defined as:

In this respect, if we assume an absence of serial correlation, in the differenced Eq. (5) we find that, for t = 3, AADTi,1 will be correlated with Δ(AADTi2) but orthogonal to Δεi3, so that it can be used as an instrumental variable. Equally, for t = 4 Δ(AADTi3) can be instrumented by AADTi1 and AADTi2, and so on. Then, it can be easily noted that an extra valid instrument is available with each additional time period. Nevertheless, due to some problems that can arise when too many instruments are considered (Roodman 2009), we have opted for using only the first lag available in each time period. Furthermore, according to Judson and Owen (1999), limiting the number of instruments does not materially reduce the performance of this technique.

The GMM-DIFF approach generates consistent and efficient estimates of the parameters (Rey et al. 2011), among other attractive properties noted in the literature (Graham et al. 2009). However, it suffers from very low precision in particular situations with finite samples (Kiviet 1995), mainly for highly autoregressive panel series. As pointed out by Blundell and Bond (1998), the instrumental variables estimator performs poorly as the value of λ increases towards unity, particularly at values around and above 0.8. In these cases, lagged levels AADTi,t−s become weak instruments in the differenced Eq. (5), which can result in serious problems of bias.

To overcome the weak instrument problem for persistent series, Arellano and Bover (1995) and Blundell and Bond (1998) suggested a system GMM estimator (GMM-SYS). This approach establishes a system of equations in both first differences and levels, where the instruments used in the levels equations are lagged first differences of the series. It allows yielding (T−2) additional moments:

Exploiting these additional moment conditions can produce some advantages in cases where the autoregressive parameter is only weakly instrumented. Among other issues, the GMM-SYS approach can reduce the finite sample bias of results, improves the precision and constitutes a more efficient estimator (Arellano and Bover 1995). However, despite being smaller, the finite sample bias of the GMM-SYS estimator is generally upwards, in the direction of OLS levels (Blundell and Bond 1998). Finally, it must be noted that the most suitable technique in each case can change depending on the size of the panel (Judson and Owen 1999).

The most widely used tests to check the validity of hypotheses assumed in GMM estimators are the m1 and m2 tests, as well as the Sargan test (González and Marrero 2011). The m1 and m2 tests, proposed by Arellano and Bond (1991), detect first and second-order serial correlation problems in Δεit, respectively. Both tests are generally used to check that no serial correlation is observed in the estimated residuals εit, by meeting certain requirements (see “Robustness of results” section). Basically, there should be evidence of negative first-order correlation and no evidence of second-order correlation in Δεit (González and Marrero 2011). Not fulfilling the needed requirements in m1 and m2 tests can reveal inconsistency of estimates (Garín-Muñoz 2006) or the possibility of improving the instruments chosen (Rey et al. 2011).

Additionally, the Sargan test checks the validity of the instruments used in the model. It is asymptotically distributed as a Chi square under the null of instrument validity, and detects possible correlation between the instruments and differenced residuals Δεit. It is a test of over-identifying restrictions, so that not rejecting the null is consistent with valid instruments. However, as noted by Böckerman et al. (2009), the Sargan test can have extremely low power when using too many instruments in the GMM model, so that results from the test should be interpreted with care (Graham et al. 2009). In order to limit this problem, we have adopted the alternative procedure proposed by Roodman (2009) consisting of using only the first lag instead of all available lags for instruments in the demand equation.

Further details about validity tests used in this paper are displayed in “Robustness of results” section analyzing robustness of results.

Modeling results and discussion

This section summarizes the main findings from the analysis of light vehicle demand evolution over time applied to Spanish toll roads. First, general aspects of the panel data approach adopted in this paper are shown in “General aspects” subsection. Next, “Analysis of explanatory variables influencing light vehicle demand” section presents the main results of travel demand elasticities and discusses the suitability of explanatory variables considered in the specification model. “Summary of results” section displays a summary of the results previously estimated. Finally, the robustness of results is discussed in “Robustness of results” section.

General aspects

This paper develops an original approach in order to analyze travel demand evolution over time and identify the key explanatory variables influencing road traffic. This research is based on estimating short-run demand elasticities with a panel data specification. Nevertheless, we include some new aspects in the analysis:

-

Stability of results is checked by gradually calibrating new runnings of the model with a longer time period considered in the analysis. Thus, the traditional static approach that presents elasticity results for a specific period is replaced by a dynamic approach, including the evolution of demand elasticities over time, when the time period is gradually extended. In this respect, those variables with poor stability and significant variations in their demand elasticities over time can be considered as unsuitable to explain the evolution of travel demand in the long term.

-

As mentioned in “Methodology” section, the methodology includes a great variety of explanatory variables with regard to socioeconomic data, hypotheses about fuel costs, location of the toll road, etc. This variation enables us to run many different versions of the model and hence to make a direct and deeper comparison of available alternatives within the panel data specification. This analysis facilitates the identification of the variables that explain road demand evolution in a better way.

-

Very few studies (Burris and Huang 2011) have included the period of economic crisis in the analysis of toll road demand. Studying such an interesting case as the Spanish tolled network allows testing the robustness of the results when the economic outlook changes dramatically.

The great diversity of versions within the model presented in the methodology makes it impractical to show the results for each and every one of the calibrations available. Instead, our research focuses on the behavior of some variables, especially the socioeconomic ones, due to their great explanatory potential for road demand. Furthermore, different figures below summarize the evolution of short-run demand elasticities as described above, in order to make the presentation of the analysis both more appealing and more easily grasped. The following subsection presents and discusses the most interesting results from all the runnings of the model considered in the analysis.

Analysis of explanatory variables influencing light vehicle demand

This subsection summarizes the estimates of elasticities of light vehicle demand by using the panel data methods described before (OLS, WG and GMM), when taking into account all the variables considered according to Table 2. Results are sorted by socioeconomic variable (GDP, Employment and GDP per capita) as they may constitute the key explanatory variable of demand behavior.

Table 4 includes detailed results for the most common estimates of toll road demand in the literature, considering applicable local (i.e., according to province) GDP, toll rates, and fuel prices (€/l) as explanatory variables for the 1990–2010 period. According to Arellano and Bond (1991) and Bond et al. (2001), the λ estimates for OLS-pool (0.975) and WG (0.311) are biased upwards and downwards, respectively. Regarding the GMM-DIFF estimator, the elasticity result (0.436) comfortably falls between that of OLS and WG, and is significantly different from zero. However, the λ estimate for the GMM-SYS estimator (0.917) is very close to that from the OLS-pool, which suggests some kind of bias in the results. It has been a circumstance frequently met along the analysis, so in the end we have chosen the GMM-DIFF approach for the analysis. Some reasons support this choice. In this particular case, problems regarding persistence of series are not found with GMM-DIFF estimators, as λ estimates for all the runnings of the model developed below range from 0.310 to 0.596, clearly lower than 0.8. Furthermore, our case constitutes a long panel, with at least T = 21. Finally, choosing a GMM-DIFF approach rather than a GMM-SYS method limits some problems arising when robustness tests are applied (see “Robustness of results” section).

For the particular case shown in Table 4, as well as for the results presented below, detailed comments addressing the robustness of the estimates are displayed in “Robustness of results” section.

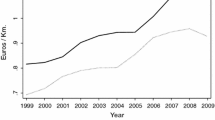

Previous studies often conclude their research at this point. We now introduce some variability in the analysis by calibrating new runnings of the model specification with time periods progressively extended over time. An illustrative example of how the results are displayed can be seen in Fig. 1. It shows elasticity results from models including GDP by province, toll rates and either fuel prices (Fig. 1a) or fuel costs (Fig. 1b) as explanatory variables. Furthermore, each subfigure reveals how short-run demand elasticities vary when the time period being considered changes over time. The y-axis measures demand elasticities. The x-axis indicates the last year considered in the time period, taking 1990 as the starting point, so it allows for analysis of the evolution of travel elasticities when an additional year is included in the model. Therefore, subfigures show how elasticity results change when the time period gradually varies from 1990–2000 to 1990–2010. It can be easily seen that results shown in Table 4 are displayed in Fig. 1a (fuel prices) in the right-hand side, specifically for x = 2010. As can be noted, all the elasticities have the expected sign: positive for GDP, and negative for both Toll and Fuel prices.

We want to draw attention to the great analytical capability of Fig. 1. As can be seen, it enables a quick and simultaneous comparison of the results for 22 different runnings of the model (11 runnings per subfigure). This approach is useful to analyse elasticity evolutions over time, observe trends and identify key explanatory variables.

In analyzing the results from Fig. 1, some questions arise. As for the influence of fuel—both prices and costs—on light vehicle demand, it can be noted that traffic elasticities experience limited variation when including improvements in fuel efficiency. Demand elasticities with respect to fuel prices (see Fig. 1a) and fuel costs (Fig. 1b) present values of the same order of magnitude in most of cases. Particularly before including year 2005 in the analysis, fuel elasticities in Fig. 1a lie between −0.10 and −0.20, while values in Fig. 1b are often near zero and not statistically significant. These findings are in line with the results concluded by Burris and Huang (2011) and Álvarez et al. (2007). It is also important to note that the other explanatory variables in the model (GDP, toll) present only comparatively small changes and clearly exhibit the same trend in both subfigures. Since fuel costs (€/km) provide a more realistic approach of fuel influence on travel demand than simply considering fuel prices (€/l), and given the limited influence in the rest of the estimation results, this is the option adopted from this point onwards.

Figure 2 includes results for short-run demand elasticities when considering GDP as the socioeconomic variable in the model, either at the provincial or national level. It therefore enables quick and visual comparison of model estimations when taking provincial or national socioeconomic data. Both cases show very similar results. Regarding demand elasticities with respect to GDP, three distinct periods emerge. Until 2004, demand elasticity moves around 0.8–1.0, which is in line with previous studies for toll roads in Spain (Matas et al. 2012; Matas and Raymond 2003). These results corresponded to the peak in the economic growth experienced by Spain during the 1990s and early 2000s. Next, a decline in GDP estimates is observed when gradually including the 2004–2009 period. Elasticities tend to decrease, from almost 1.0 in 2004 to values near 0.4 after incorporating 2009. These years corresponded to a slowdown in the long and deep period of economic growth in Spain. That decrease makes clear that, once a certain level of economic development is reached, further increments in growth consecutively cause smaller increases in road traffic. Finally, GDP elasticities rise again after the beginning of the economic crisis, with values around 0.6.

Figure 2 evidences that demand elasticity with respect to GDP experiences great variability over time. The results support that, as pointed out by Matas et al. (2012), it is often unrealistic to assume a constant elasticity over time for certain explanatory variables. GDP elasticities move from 0.45 to 0.96 when considering provincial data, and range from 0.40 to 0.98 when choosing GDP data at the national level. This significant variability in demand elasticities lessens its usefulness in explaining traffic behavior in the long term and to make traffic forecasts, since the relationship between both variables shows little stability over time. This makes evident that GDP does not represent the most suitable explanatory socioeconomic variable to be considered for light vehicle demand on toll roads.

Figure 2 also demonstrates that light vehicle behavior during the crisis on Spanish toll roads cannot be considered an anomaly, despite sharp reductions suffered since 2007. GDP elasticities in recent years move within the usual range of values of previous years and, therefore, nothing can be concluded in this respect. Furthermore, we want to point out that Fig. 2a and b present quite similar results. We could initially expect better results for data displayed according to province, as there is a stronger relationship with local specific factors for each road. Nevertheless, GDP data at the national level have also been shown to be a good proxy for the whole tolled network. Furthermore, this good performance of national GDP as explanatory variable can be attributed to the high share of long-distance trips in the tolled high capacity network, less influenced by local effects.

Now we are going to focus on demand elasticities with respect to toll rates and fuel costs. Toll elasticities show a quite stable trend, with values moving from −0.20 to −0.41, which is consistent with previous research (Matas et al. 2012; Burris and Huang 2011; Odeck and Brathen 2008). This behavior is likely caused by the fact that real toll rates in the sample remain constant, as toll rates in Spain are usually adjusted through inflation. It is also noted that toll elasticities tend to increase over time, especially when the most recent years (2008–2011) are added and, consequently, the price-sensitivity of users seems to have considerably risen since the beginning of the economic crisis. Nevertheless, this result needs to be reinforced through a model specification explicitly taking account of temporal variation of elasticities, as shown below. Regarding fuel elasticities, greater variations are observed. Estimates move from 0.0 to −0.31, not being far from zero in most of the versions of the model, as in Burris and Huang (2011). Thus, toll elasticities are generally above fuel ones. This result suggests that user´s perception of the burden of tolls seems to be higher than that for fuel costs.

In this respect, a comprehensive analysis of potential differences in users´ attitudes towards tolls and fuel costs has scarcely been addressed in the literature. Only some remarks from previous studies have been found. Matas and Raymond (2003) wondered about reasons why users may react differently to changes in a discrete and fixed cost, such as tolls, and changes in per-km costs, such as fuel prices. They gave as estimates similar values of demand elasticities for both components of generalized transport cost, but noted that toll elasticities can vary greatly depending on the quality of the free alternative road.

Burris and Huang (2011), however, found that the magnitude of the elasticity estimates with respect to toll rate was generally larger than that for gas price. They explained that “this makes sense as increases in the toll price can only be avoided by no longer taking the toll route, while increases in the price of fuel may be mitigated by driving more fuel efficient vehicles or by switching routes”. Similarly, toll elasticities (−0.54) calculated by Álvarez et al. (2007) regarding light vehicle demand were significantly higher than that for fuel costs (−0.06). Despite being far from conclusive, our results seem to be in line with previous studies concerning demand responsiveness to tolls and fuel costs.

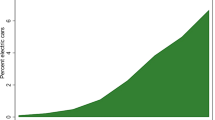

Figure 3 includes elasticity estimates when considering Employment as the key socioeconomic variable in the model, either at the provincial (Fig. 3a) or the national level (Fig. 3b). Unlike GDP, results for Employment show great stability when gradually varying the time period. Demand elasticities move from 0.54 to 0.72 with provincial data, and from 0.49 to 0.78 when taking national data. Again, demand elasticities when including the crisis are of the same order of magnitude as that of previous years, so traffic reductions in Spanish toll roads cannot be considered anomalous.

Stability of elasticity results, even when incorporating the crisis, demonstrates that Employment constitutes a suitable explanatory variable for light vehicle demand. This contrasts with results shown for GDP elasticities, where there is greater variability over time. There seems to be some reasons behind that. While GDP is made up of the aggregation of different and heterogeneous sectors of the economy, Employment could be a better proxy for income and mobility. This variable does not refer to all the potential users of a toll road—that is, the whole population—but only to those who are employed, generally with higher income and greater mobility potential.

Results for toll and fuel elasticities are similar to those concluded for Fig. 2. Toll elasticities present a fairly level trend over time, slightly increasing when we include the period of the economic crisis. Elasticities with respect to fuel costs, moving between −0.17 and −0.38, show higher values when compared with Fig. 2. Although the relative position of toll and fuel curves can change over time, both elasticities now show similar values.

Figure 4 includes short-run elasticity results when GDP per capita is the socioeconomic variable in the model. It constitutes the most solid alternative, as all demand elasticities—socioeconomic, tolls and fuel costs—present very constant results over time. GDP per capita turns out to be a very stable socioeconomic variable. Elasticities run from 0.77 to 0.98 with data displayed according to provinces, and from 0.94 to 1.18 with national data. Despite some extra volatility experienced when including the economic crisis, the relation of GDP per capita to toll road demand can be considered highly satisfactory.

Elasticities with respect to toll rates and fuel costs also show significant stability. Trends of toll elasticities are very constant and values move around −0.20, while those for fuel elasticities are lower and lie between 0.0 and −0.15. These results support the notion that the average user´s perception of tolls seems to be higher than that for fuel costs.

Analysis of temporal variation in travel demand elasticities

Figures 1, 2, 3 and 4 show the evolution of demand elasticities over time for the toll roads selected. This visual display of information can be complemented with a statistical analysis explicitly considering temporal variation in the results. In order to do this, a dummy variable is included in (8) to test whether, as expected from figures previously shown, statistically significant changes over time can be observed for certain demand elasticities, such as GDP.

Through the δ2005–2011 dummy variable, the model measures potential structural changes in demand elasticities for 2005–2011 when compared to the previous period (1990–2004). It allows us to test whether demand elasticities in Spain were significantly different between periods of prosperity (1990–2004), and economic slowdown and recession (2005–2011). Although a separate analysis for the period of economic crisis (2008 forward) would be desirable, it has not been possible due to the paucity of data, as only information up to 2011 is available. Just analysing the 2008–2011 period would result in a panel specification with T = 4. According to Bond et al. (2001), the GMM estimator has been found to have poor finite sample properties in terms of bias and imprecision, so its use is not sufficiently reliable when T gets smaller. In these cases, the scarcity of instruments may lead the GMM estimator to be subject to a large downward bias (Blundell and Bond 1998), which suggests the need for caution concerning the time length in the panel.

The dummy variable δ2005–2011 is applied to both socioeconomic and generalized cost variables (fuel, toll), with the aim of measuring potential changes in users´ responsiveness to costs when changes in the economic environment occur. Results are summarized in Table 5, sorted by the socioeconomic variable chosen (GDP, Employment, GDP per capita) included in the model.

From the results above, some interesting conclusions can be obtained, in line with Figs. 2, 3 and 4. Despite being limited, a structural change is observed for GDP elasticities from 2005 onwards. After the long period of prosperity in the Spanish economy, the GDP elasticity has experienced a statistically significant decrease of 8.0 %. By contrast, elasticities with regard to other socioeconomic variables (Employment, GDP per capita) cannot be concluded to have structurally changed in the last years, since the parameter (Socioec. × δ 2005–2011) is not statistically significant for them. This fact support the notion noted below that GDP does not represent the most suitable explanatory socioeconomic variable to explain light traffic evolution due to its variability. Other explanatory variables have displayed a better performance in the sense of showing a stable relationship with light vehicle demand evolution over time.

Regarding generalized costs of transport, toll elasticities present similar results in all cases, around—0.25, which is in line with previous studies of interurban toll roads. Despite noticeable increases observed in the most recent years (see Figs. 1, 3) for which data is available, toll elasticities have not statistically changed during the economic slowdown and recession, as the (Toll × δ2005–2011) parameter shows. Results for fuel costs are less conclusive. In this case, elasticities present greater variability and are often not statistically different from zero. Neither is the analysis of potential structural changes over time conclusive, likely due to the volatility of fuel elasticities. As a result of this analysis, we cannot firmly conclude that, for the case of Spanish toll roads, users´ responsiveness in the last few years has varied significantly when compared to the earlier period of economic growth.

Analysis of variation in travel demand elasticities depending on the location of the toll road

As previously mentioned, light vehicle demand in coastal and interior toll roads has also been individually analyzed. Results (see Fig. 5) are quite similar to those previously calculated for the whole sample. The most relevant point has to do with different behaviors often observed to be specific to each kind of road. As expected, models for coastal roads better fit with the socioeconomic data for each province, given the greater stability of estimates observed in Fig. 1a when compared to Fig. 1b. By contrast, interior roads (Fig. 2a and b) perform slightly better when considering national data. Figure 5 shows that GDP per capita elasticities in coastal roads lie between 1.21 and 1.52 when considering data at the level of the individual province, but a larger range of values (from 0.36 to 1.05) is observed with national data. As for interior roads, despite showing solid results in both cases, elasticity estimates with national data (0.85–1.14) are more stable than those ones with provincial data (0.57–0.96). These results can be explained by the strong relationship between light demand in coastal roads and such local activities as tourism, as well as the high proportion of long-distance trips—less related to local effects—in interior roads.

Again, this visual display of analysis is complemented with a panel data regression to test whether statistically significant differences on demand elasticities can be identified depending on the location of the toll road. As shown in (9), structural differences between coastal and interior roads are captured through the δCOAST dummy variable (equals 1 if the toll road is located near the coast; 0 otherwise).

Socioeconomic data at the provincial level: t = 1990,…, 2010; i = 1,…, 14

The model is calibrated for the whole time period (1990–2010), considering socioeconomic data at the level of the provinces. Results are included in Table 6.

Figures from Table 6 do not provide conclusive results regarding structural differences between coastal and interior roads. Elasticities with regard to socioeconomic variables seem to be higher for coastal roads in all the cases. Nevertheless, differences among the different kinds of roads (Socioec. × δCOAST) are noticeable and statistically significant only when considering GDP per capita in the model. This may be caused by the fact that the economy in Spanish regions near the coast is highly dependent on tourism activities, which have an important impact on light vehicle volume. Toll elasticities are generally smaller (less negative) in coastal roads, but statistically significant estimates for Toll × δ COAST are only observed when considering GDP per capita in the model. In this respect, traffic volume in coastal roads may be less sensitive to tolls since a high percentage of trips are occasional, generally linked to leisure activities. Again, results for fuel costs present great volatility depending on the model we choose. By contrast, differences between coastal and interior roads are not statistically significant in any of the models presented in Table 6. This analysis clearly shows that estimates can vary considerably depending on the socioeconomic variable considered in the model, so a great deal of attention needs to be paid when selecting the explanatory parameters.

Summary of results

Finally, Table 7 summarizes the main elasticity estimates calculated by means of this panel data approach. As the analysis over time has demonstrated, a range of values seems a more complete and fairer way to present results for demand elasticities, rather than the traditional approach of simply showing a single value for each variable. This procedure gives essential information for traffic forecasts, since it can be generally assumed that the shorter the range of elasticities for a certain variable, the greater its ability to explain road traffic evolution.

Regarding socioeconomic variables, we found that GDP does not exhibit a stable behavior over time, as elasticity values generally vary in parallel with the cycles in economic growth. However, such variables as Employment and GDP per capita have a shorter range of values, both at the provincial and national level, so they are more consistent explanatory variables of light vehicle demand. Significant variability in the values for fuel costs and for tolls respond to the numerous runnings and versions of the model calibrated, since these variables generally show a fairly constant trend for each single model.

Robustness of results

With regard to the robustness of the estimates, we have opted for showing one case in detail, displayed in Table 4, and briefly summarize the results for the other versions of the model. Detailed results for the 80 runnings included in Figs. 1, 2, 3 and 4, are very similar to those of the example discussed and all of them fully meet the requirements pointed out in “Dynamic panel data methodology specification” section.

Next, robustness of results regarding m1 and m2 tests is noted. According to González et al. (2011), two main conditions must be fulfilled in order to test that no serial correlation is observed in the estimated residuals εit. First, there should be evidence of negative first-order serial correlation of differenced residuals (Δεit), so that the value of the statistic m1 must be negative, with a p value preferably below 0.05. Second, there should not be evidence of second-order correlation of differenced residuals, so that the p value associated to the statistic m2 should be greater than 0.05. Regarding the example detailed in Table 4, results for m1 and m2 tests are consistent with absence of serial correlation in the residuals. As can be noted, the value of the statistic m1 is negative (−1.82) with a p value of 0.034 (<0.05), while the p value for the m2 test is 0.289 (greater than 0.05). Robustness of estimates for the rest of the models presented in Figs. 1, 2, 3 and 4 is very similar to the example from Table 4. The value of statistic m1 moves from −2.258 to −1.152, with an associated p value ranging between 0.011 and 0.043. Furthermore, the p value for the m2 test runs from 0.103 to 0.317. Then, the requirements needed for the Arellano and Bond tests of serial correlation are fully met for all the alternatives shown.

With regard to the Sargan test, the validity of instruments used in the demand equation is checked when the null hypothesis is not rejected. Specifically, González et al. (2011) pointed out the convenience of having an associated p value greater than 0.10. For the case detailed in Table 4, we can observe that the p value in the Sargan test for GMM-DIFF (0.729) is far above the reference value. Although GMM-SYS also presents a p value greater than 0.10, values near 1.0 are clear symptoms of the low power of the test in that case, since the null hypothesis may exhibit almost zero rejection frequency of the validity of instruments null hypothesis (Baum et al. 2007). These results for the Sargan test support the choice of a GMM-DIFF approach for the analysis rather than a GMM-SYS one. Robustness estimates for the rest of the models are very similar to this case, as the associated p value for the Sargan test lies from 0.373 to 0.783, again greater than the reference value (0.10) and also not close to 1.0.

Conclusions and further research

This paper has developed a panel data methodology to analyze light vehicle traffic evolution in toll roads. The analysis has provided some interesting conclusions.

First, this paper establishes a feasible and original alternative, which consists of gradually varying the time period in the model specification, to analyze the stability of short-run elasticities over time. This approach has some advantages not present in the traditional procedure. First, it enables us to identify which parameters have a more constant and solid relationship with the dependent variable and, therefore, which are more suitable to be chosen as explanatory variables for long term estimates. Second, it makes the analysis more complete, objective, and rigorous.

The second conclusion is that, despite being an important element, GDP does not seem to be the most suitable socioeconomic explanatory variable for light vehicle demand. The significant variability of elasticity results, especially when changes in the economic environment occur, weakens its value in explaining traffic behavior and in making traffic forecasts. However, such socioeconomic variables as Employment and GDP per capita provide more consistent estimates, and clearly improve the performance of GDP. Employment as a variable considers only that part of the population who is employed, and better approximates income level and mobility. Moreover, GDP per capita constitutes a better proxy of a person´s income.

The third conclusion points out that some differences can be observed in traffic behavior in toll roads depending on where, within the country, they are located (coast, interior). Roads near the coast seem to be more influenced by local activities such as tourism and better correspond to socioeconomic data of provinces, while the traffic in interior roads tends to fit better with global economic variables. Moreover, even though toll roads near the coast seem to be more sensitive to changes in socioeconomic data and less responsive to toll rates than interior roads, the results are not conclusive in this matter.

The last conclusion concerns the traffic decreases experienced on Spanish toll roads since the arrival of the recession. According to the results, it cannot be concluded that the reduction in demand is an anomaly, given the fairly constant trends shown by travel demand elasticities, mainly with regard to socioeconomic data. Furthermore, the paper has shown that users´ responsiveness towards generalized costs of transport (toll, fuel) have not statistically varied in recent years despite the deterioration observed in the Spanish economy.

From the results of this paper, several aspects can be pointed out as subjects for further research. First, the analysis can be extended to heavy vehicle demand on toll roads, as the literature in this area is very scarce, and no specific research for heavy vehicles has been conducted in Spain. Furthermore, it would be interesting to compare these results with estimates from free high capacity motorways in Spain, in order to check whether each type of roads exhibits different behavior. Finally, a trans-national analysis could be developed in order to compare the influence that the key explanatory variables studied for light vehicles—GDP, Employment and GDP per capita—can have on toll road demand in different countries.

References

Álvarez, Ó., Cantos, P., García, L.: The value of time and transport policies in a parallel road network. Transp. Policy 14, 366–376 (2007)

Arellano, M., Bond, S.: Some tests of specification for panel data: Monte Carlo evidence and an application to employment equations. Rev. Econ. Stud. 58, 277–297 (1991)

Arellano, M., Bover, O.: Another look at the instrumental variable estimation of error-components models. J. Econom. 68, 29–52 (1995)

Baum, C.F., Schaffer, M.E., Stillman, S.: Enhanced routines for instrumental variables/generalized method of moments estimation and testing. Stata J. 7(4), 465–506 (2007)

Blundell, R., Bond, S.: Initial conditions and moment restrictions in dynamic panel data models. J. Econom. 87, 115–143 (1998)

Blundell R, Bond S, Windmeijer F (2000) Estimation in dynamic panel data models: Improving on the performance of the standard GMM estimators. WP 00/12. The Institute for Fiscal Studies

Böckerman, P., Hämäläinen, U., Uusitalo, R.: Labour market effects of the polytechnic education reform: The Finnis experience. Econ. Educ. Rev. 28, 672–681 (2009)

Boilard F (2010) Gasoline Demand in Canada: Parameter Stability Analysis. EnerInfo, Vol. 15, No. 3, Fall, Centre for Data and Analysis in Transportation (CDAT). Université Laval

Bond S (2002) Dynamic panel data models: A guide to micro data methods and practice. Working Paper CWP09/02. The Institute for Fiscal Studies. Department of Economics, UCL

Bond S, Hoeffler A, Temple J (2001) GMM estimation of empirical growth models. CEPR Discussion Papers 3048. Centre for Economic Policy Research. November, 2001

Borjesson, M., Eliasson, J., Hugosson, M., Brundell-Freij, K.: The Stockholm congestion charges—5 years on. Effects, acceptability and lessons learnt. Transp. Policy 20, 1–12 (2012)

Burris, M., Huang, C.: The Short-Run Impact of Gas Prices on Toll Road Use. DOT Grant No. DTRT06-G-044. University Transportation Center for Mobility, Texas Transportation Institute, Texas (2011)

Cain, A., Burris, M., Pendyala, R.M. The Impact of variable pricing on the temporal distribution of travel demand. Transp. Res. Rec. 1747, 36–43 (2001)

Cantos P, Álvarez Ó (2009) El valor del tiempo con congestión: el caso de la Radial-3. Revista de Economía Aplicada 51 (vol. XVII), 55–80

Cervero, R.: Traffic impacts of variable pricing on the San Francisco–Oakland bay bridge. Transp. Res. Rec. 2278, 145–152 (2012)

Currie, G., Phung, J.: Understanding links between transit ridership and gasoline prices: Evidence from the United States and Australia. Transp. Res. Rec. 2063, 133–142 (2008)

De Jong, G., Gunn, H.: Recent evidence on car cost and time elasticities of travel demand in Europe. J. Transp. Econ. Policy 35(2), 137–160 (2001)

De León, M., Fullerton, T., Kelley, B.: Tolls, exchange rates, and borderplex international bridge traffic. Int. J. Transp. Econ. 36, 223–259 (2009)

Garín-Muñoz, T.: Inbound international tourism to Canary Islands: A dynamic panel data model. Tour. Manag. 27, 281–291 (2006)

Gifford, J.L., Talkington, S.W.: Demand elasticity under time-varying prices: Case study of day-of-week varying tolls on Golden Gate Bridge. Transp. Res. Rec. 1558, 55–59 (1996)

González, R.M., Marrero, G.A.: Induced road traffic in Spanish regions: A dynamic panel data model. Transp. Res. Part A 46, 435–445 (2011)

Goodwin, P., Dargay, J., Hanly, M.: Elasticities of road traffic and fuel consumption with respect to price and income: A Review. Transp. Rev. 24(3), 275–292 (2004)

Graham, D., Glaister, S.: Road traffic demand elasticity estimates: A review. Transp. Rev. 24(3), 261–274 (2004)

Graham, D.J., Crotte, A., Anderson, R.A.: A dynamic panel analysis of urban metro demand. Transp. Res. Part E 45, 787–794 (2009)

Hanly, M., Dargay, J., Goodwin, P.: Review of Income and Price Elasticities in the Demand for Road Traffic. Centre for Transport Studies, University of London, London (2002)

Harvey, G.: Transportation pricing behavior. In: Curbing Gridlock: Peak-Period Fees to Relieve Traffic Congestion 2. Transportation Research Board, Special Report 242, pp. 89–114. National Academy Press (1994)

Hirschman, I., McKnight, C., Pucher, J., Paaswell, R.E., Berechman, J.: Bridge and tunnel elasticities in New York. Transportation 22, 97–113 (1995)

Holguín-Veras, J., Wang, Q., Xu, N., Ozbay, K.: The impacts of time of day pricing on car user behavior: Findings from the Port Authority of New York and New Jersey´s initiative. Transportation 32, 427–443 (2011)

Hsiao, C.: Analysis of Panel Data. Cambridge University Press, Cambridge (1986)

Hymel, K.M., Small, K., Van Dender, K.: Induced demand and rebound effects in road transport. Transp. Res. Part B 44, 1220–1241 (2010)

Instituto para la Diversificación y Ahorro de Energía, Idae (2011) Guía de Vehículos Turismo de venta en España con indicación de consumos y emisiones de CO2. Ministerio de Industria, Turismo y Comercio

Jones, P., Hervik, A.: Restraining car traffic in european cities: An emerging role for road pricing. Transp. Res. A 26, 133–145 (1992)

Judson, R.A., Owen, A.L.: Estimating dynamic panel data models: a guide for macroeconomists. Econ. Lett. 65, 9–15 (1999)

Kiviet, J.F.: On bias, inconsistency, and efficiency of various estimators in dynamic panel data models. J. Econom. 68, 53–78 (1995)

Lake M, Ferreira L (2002) Modelling tolls: values of time and elasticities of demand: a summary of evidence. Physical Infrastructure Centre Research Report 02-01, School of Civil Engineering, Queensland University of Technology, Brisbane

Litman, T.: Understanding Transport Demands and Elasticities. How prices and Other Factors Affect Travel Behavior. Victoria Transport Policy Institute, Victoria (2013)

Loo, B.P.Y.: Tunnel traffic and toll elasticities in Hong Kong: Some recent evidence for international comparisons. Environ. Plan. A 35, 249–276 (2003)

Matas, A., Raymond, J.L., Ruiz, A.: Traffic forecasts under uncertainty and capacity constraints. Transportation 39, 1–17 (2012)

Matas, A., Raymond, J.L.: Demand elasticity on tolled motorways. J. Transp. Stat. 6(2/3), 91–105 (2003)

Mattson, J.: The effects of gasoline prices on bus ridership for different types of transit systems. J. Transp. Res. Forum 47(3), 5–21 (2008)

Ministerio de Fomento (2013) Anuario Estadístico. Dirección General de Programación Económica. Subdirección General de Estudios Económicos y Estadísticas

Ministerio de Fomento (2012) Informe 2011 sobre el sector de autopistas de peaje en España. Delegación del Gobierno en las Sociedades Concesionarias de Autopistas Nacionales de peaje

Ministerio de Obras Públicas y Urbanismo, MOPU (1990) Recomendaciones para la evaluación económica, coste-beneficio, de estudios y proyectos de carreteras. Actualización del valor del tiempo y costes de accidentes y combustibles. Servicio de Planeamiento

Nickell, S.: Biases in dynamic models with fixed effects. Econometrica 49(6), 1417–1426 (1981)

Odeck, J., Kjerkreit, A.: Evidence on users´attitudes towards road user charges—A cross sectional survey of six Norwegian toll schemes. Transp. Policy 17, 349–358 (2010)

Odeck, J., Brathen, S.: Travel demand elasticities and users attitudes: A case study of Norwegian toll projects. Transp. Res. Part A 42, 77–94 (2008)

Olszewski, P., Xie, L.: Modelling the effects of road pricing on traffic in Singapore. Transp. Res. Part A 39, 755–772 (2005)

Rey, B., Myro, R., Galera, A.: Effect of low-cost airlines on tourism in Spain. A dynamic panel data model. J. Air Transp. Manag. 17, 163–167 (2011)

Roodman, D.: A note on the theme of too many instruments. Oxford Bull. Econ. Stat. 71(1), 135–158 (2009)

Su, Q.: Induced motor vehicle travel from improved fuel efficiency and road expansion. Energy Policy 39(11), 7257–7264 (2011)

Wilbur Smith Associates (2008) The impacts of gasoline price on traffic and toll revenue. Prepared for North Texas tollway authority

Acknowledgments

The authors wish to thank the Spanish Ministry of Economy and Competitiveness (MINECO), which has funded the project “EU Support Mechanisms to promote Public Private Partnerships for financing TransEuropean Transport Infrastructure” [TRA 2012-36590].

Author information

Authors and Affiliations

Corresponding author

Appendix: description of explanatory variables included in the model

Appendix: description of explanatory variables included in the model

AADT (light veh./day): annual average daily traffic volume for light vehicles in each toll road, as recorded in the statistics of the Spanish Ministry of Transportation.

AADT (−1)(light veh./day): lag of the annual daily traffic volume for light vehicles in each toll road.

GDP, national (M€): Gross domestic product at the national level, as recorded in the Spanish National Statistics Institute (INE) database. In constant euros.

GDP, provincial (M€): sum of the GDPs from the K provinces crossed by each toll road:

Employment, national (103 people): number of people employed in the country, as recorded in the Spanish National Statistics Institute (INE) database.

Employment, provincial (103 people): sum of people employed in the K provinces crossed by each toll road:

GDP per capita, national (103 euro/person): Gross domestic product per person at the national level, as recorded in the Spanish National Statistics Institute (INE). In constant euros.

GDP per capita, provincial (103 euro/person): average GDP per capita from the K provinces crossed by each toll road:

Toll rate (euro/km): toll rate applied in each toll road, as recorded in the statistics of the Spanish Ministry of Transportation. In constant euros.

Fuel price (euro/liter): gasoline and diesel prices in constant euros, weighed by the proportion of gasoline and diesel light vehicle fleet in each year:

Fuel cost (euro/km): product of Fuel price and Fuel consumption:

Fuel cost = Fuel price (euro/liter) × Fuel consumption (liter/km)

Fuel consumption is assumed as a linear progression from average 1990 levels according to the Spanish Ministry of Transportation to 2011 values by the Spanish Ministry of Industry.

Rights and permissions

About this article

Cite this article

Gomez, J., Vassallo, J.M. & Herraiz, I. Explaining light vehicle demand evolution in interurban toll roads: a dynamic panel data analysis in Spain. Transportation 43, 677–703 (2016). https://doi.org/10.1007/s11116-015-9612-3

Published:

Issue Date:

DOI: https://doi.org/10.1007/s11116-015-9612-3