Abstract

The downturn in the world economy following the global banking crisis has left the Chinese economy relatively unscathed. This paper develops a model of the Chinese economy using a DSGE framework with a banking sector to shed light on this episode. It differs from other applications in the use of indirect inference procedure to test the fitted model. The model finds that the main shocks hitting China in the crisis were international and that domestic banking shocks were unimportant. However, directed bank lending and direct government spending was used to supplement monetary policy to aggressively offset shocks to demand. The model finds that government expenditure feedback reduces the frequency of a business cycle crisis but that any feedback effect on investment creates excess capacity and instability in output.

Similar content being viewed by others

Avoid common mistakes on your manuscript.

1 Introduction

There is much work on how China has developed and achieved rapid growth in the past three decades—most recently Coase and Wang (2012). There is also much commentary on the day-to-day behaviour of the Chinese economy, and some efforts to model this behaviour, such as Qin et al. (2007), Sun et al. (2009), and the Xiamen University China Quarterly Macroeconomic Model (CQMM). While a number of studies of the Chinese economy exist using the DSGE frameworkFootnote 1, there has been no effort to model the Chinese economy’s business cycle behaviour as a Dynamic Stochastic General Equilibrium (DSGE) model, in the manner applied in this paper. Yet, even though China is at an earlier stage of development than these, a DSGE model does not appear to make assumptions that prevent its application to countries at earlier stages, provided these economies have normal market structures. Since such market structures have evolved rapidly since the end of the 1970s, there seems to be every reason to expect that a DSGE model could explain the business cycle behaviour of China in the past three decades. The banking sector has also developed rapidly and since the early 1990s has both been central to the operation of the economy and has been reformed to allow entry by non-state banks so that a degree of normal bank competition has prevailed.

In this paper we examine whether China’s economy since the 1990s can be explained by a model with banking that has been successfully applied to the US (Le et al. 2012a) and with some but rather less success to a ‘world’ economy consisting of the US, the eurozone and the rest of the world (Le et al. 2013). The model, developed from that of Smets and Wouters (SW) following Christiano et al. (2005) with a banking sector due to Bernanke et al. (1999, BGG), is only suitable for a large continental economy since it assumes a closed economy. It might be thought that since China has a large export sector (26 % of GDP) and a similarly large import sector, it cannot be modelled as a closed economy. However, China’s export and import sector has developed rapidly as a result of decisions to invest in new infrastructure in cities and transportation; once these decisions were taken, the resulting output of goods was sold on world markets at the prices needed to absorb it. Nevertheless as there is a degree of price and wage rigidity in China, there will be effects of world demand in the short run. Because the industrial structure is largely dominated by multi-national companies, imports too are closely related to the export volumes. Thus we would argue that net imports can reasonably be modelled as exogenous processes in China; this is how they enter in the Smets-Wouters model, as an exogenous error process in the goods market-clearing equation whereby output equals demand for goods.

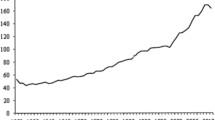

Our purpose in this paper is empirical. We apply a powerful testing procedure to this theoretical set-up, and check whether China’s business cycle behaviour can be regarded as explained by this theory. In particular, we look at the crisis period and see whether its evolution can be plausibly explained within this set-up. As Fig. 1 shows, China too experienced a severe loss of output in the crisis. Since then it has neither recouped this loss nor reached its previous trend growth rate—much like most western countries.

We are treading to some extent in the footsteps of earlier work without banking and for a longer time period by Dai (2012) which managed to fit a model of this type on stationary data to the joint behaviour of output, inflation and interest rates. DSGE models have increasingly been used to examine the Chinese economy but studies that incorporate a banking sector have been rare. In this paper we apply the same procedure on our full model with banking to the raw Chinese data since 1991. To anticipate our results, we find, as Dai (2012), that we can find a version of this model, with rather less nominal rigidity than the US, to fit Chinese behaviour for these three variables. The model tells us that the main shocks hitting China in the crisis were international and that Chinese banking shocks, together with the effect of the crisis on GDP, were not important. However the state banking system together with direct government spending was used to supplement monetary policy in aggressively offsetting the crisis on GDP. It seems that while Chinese capitalism is as vulnerable as any to crises, such is the importance of growth to the Chinese leadership’s strategy that the state retains powerful instruments to control the effects of crises on growth. Nevertheless, their use carries a risk of destabilising the economy.

In our empirical procedures we use the indirect inference procedure to test the model on some initial parameter values, mainly based on US data, and then allow the parameters to be moved flexibly to the values that maximise the criterion of replicating the data behaviour—indirect estimation. This allows us to test the model itself rather than a particular set of parameter values that could be at fault. The basic reason for using indirect inference over the now-popular Bayesian ML is that it tests the overall ability of the model to replicate key aspects of data behaviour—there is no guarantee that Bayesian estimates will pass this test.

In the rest of this paper, we begin by setting out the model in outline. The third section we review the application of DSGE models to the Chinese economy. In the fourth section, we describe the state of the banking sector in China. In the fifth section we explain our testing procedure, based on the method of Indirect Inference whereby the model’s simulated behaviour is compared statistically with the behaviour found in the data; we also explain the method of indirect estimation. In the sixth section, we set out the empirical results for the model, starting with the Bayesian estimates and ending with the indirect estimates. In the penultimate section we review the resulting model’s properties. Our final section concludes, with some reflections on the implications for China’s macroeconomic policies.

2 The SW-BGG Model

One of the main issues that emerged from the first type of calibrated DSGE model, the real business cycle (RBC) model, was its failure to capture the stylised features of the labour market observed in actual data. Employment was found to be not nearly volatile enough in the RBC model compared with observed data, and the correlation between real wages and output was found to be much too high (see, for example, King et al. 1988). The clear implication is that in the RBC model real wages are too flexible. The Smets-Wouters model (2003 for the euro-area, 2007 for the US) marks a major development in macroeconometric modelling based on DSGE models; it is based essentially on the work of Christiano et al. (2005). Its main aim is to construct and estimate a DSGE model in which prices and wages, and hence real wages, are sticky due to nominal and real frictions arising from Calvo pricing in both the goods and labour markets, and to examine the consequent effects of monetary policy which is set through a Taylor rule—without a banking sector, the addition of which in the BGG manner we will discuss shortly. It is therefore a New Keynesian model. SW combine both calibration and Bayesian estimation methods.

Unusually, the SW model contains a full range of structural shocks. In the EA version—Smets and Wouters (2003)—on which the US version is based, there are ten structural shocks. These are reduced to seven in the US version: for total factor productivity, the risk premium, investment-specific technology, the wage mark-up, the price mark-up, exogenous spending and monetary policy. These shocks are generally assumed to have an autoregressive structure. The model finds that aggregate demand has hump-shaped responses to nominal and real shocks. A second difference from the EA version is that in the US version the Dixit-Stiglitz aggregator in the goods and labour markets is replaced by the aggregator developed by Kimball (1995) where the demand elasticity of differentiated goods and labour depends on their relative price. A third difference is that, in order to use the original data without having to detrend them, the US model features a deterministic growth rate driven by labour-augmenting technological progress.

Smets and Wouters made various tests of their model. Subsequently Del Negro et al. (2007, DSSW) further examined it by considering the extent to which its restrictions help to explain the data. Estimating the SW model using Bayesian methods, they approximate it by a VAR in vector error-correction form and compare this with an unrestricted VAR fitted to actual data that ignores cross-equation restrictions. They introduce a hyperparameter λ to measure the relative weights of the two VARs. \( \overset{\frown }{\lambda } \) is chosen to maximise the marginal likelihood of the combined models. DSSW find that this estimate of λ is a reasonable distance away from λ = 0, its value when the restrictions are ignored, but is also far away from λ = ∞, its value when the SW restrictions are correct.

It should be noted that none of these exercises in evaluating the SW model were a test of specification in the classical sense. Le et al. (2011) proposed such a test, a Wald test based on indirect inference which compares the model’s VAR representation with the VAR coming from the data, and showed that over the full post-war sample the original SW New Keynesian (NK) model was rejected. In addition, they examined an alternative version in which prices and wages were fully flexible but there was a simple one-period information delay for labour suppliers. This ‘New Classical (NC)’ version was also rejected. They also proposed a hybrid model that merged the NK and NC models by assuming that wage and price setters find themselves supplying labour and intermediate output partly in a competitive market with price/wage flexibility, and partly in a market with imperfect competition. They assumed that the size of each sector depended on the facts of competition and did not vary in the sample but they allowed the degree of imperfect competition to differ between labour and product markets. The basic idea was that economies consist of product sectors where rigidity prevails and others where prices are flexible, reflecting the degree of competition in these sectors. Similarly with labour markets; some are much more competitive than others. An economy may be more or less dominated by competition and therefore more or less flexible in its wage/price-setting. The price and wage setting equations in the hybrid model are assumed to be a weighted average of the corresponding NK and NC equations. It turned out that this combined model got much closer to the data for the full sample, when the rigidity was quite limited.

Essentially, the NK model generated too little nominal variation while the NC model delivered too much. However the hybrid model was able to reproduce the variances of the data; and it is this key feature that enables it to match the data overall more closely. This feature was also found to be critical in matching Chinese behaviour by Dai (2012). It is this version that we use here, adding to it the BGG model of banking to which we now turn.

The BGG financial sector produces certain changes in this model but much remains unchanged. The household and government sectors are unchanged. They are able to issue bonds and make deposits with the banks, at the risk-free rate.

The BGG divides the production side into three distinct participants: as previously, retailers and intermediate goods producers (now called entrepreneurs) and in addition, capital producers. Retailers and capital producers function in the same way as before, respectively bundling intermediate goods into consumption goods, and converting consumption goods into capital goods.

The difference in BGG lies in the nature of entrepreneurs. They still produce intermediate goods, and they have the usual marginal productivity conditions on their production side, but now they do not rent capital from households (who do not buy capital but only buy bonds or deposits) but must buy capital goods from capital producers and in order to buy this capital they have to borrow from a bank which converts household savings into lending. They pledge their net worth against loans from the bank, which thus intermediates household savings deposited with it at the risk-free rate of return. The net worth of entrepreneurs is kept below the demand for capital by a fixed death rate of these firms (1 − θ); the stock of firms is kept constant by an equal birth rate of new firms. Entrepreneurial net worth therefore is given by the past net worth of surviving firms plus their total return on capital minus the expected return (which is paid out in borrowing costs to the bank) on the externally financed part of their capital stock—equivalent to

where \( \frac{K}{N} \) is the steady state ratio of capital expenditures to entrepreneurial net worth (n t ), θ is the survival rate of entrepreneurs, cy t is the ex-post aggregate return to capital and enw t is the shock to net worth. Those who die will consume their net worth, so that entrepreneurial consumption (c e t ) is equal to (1 − θ) times net worth. In logs this implies that this consumption varies in proportion to net worth so that:

In order to borrow, entrepreneurs have to sign a debt contract prior to the realisation of idiosyncratic shocks on the return to capital: they choose their total capital and the associated borrowing before the shock realisation. The optimal debt contract takes a state-contingent form to ensure that the expected gross return on the bank’s lending is equal to the bank opportunity cost of lending. When the idiosyncratic shock hits, there is a critical threshold for it such that for shock values above the threshold, the entrepreneur repays the loan and keeps the surplus, while for values below it, he would default, with the bank keeping whatever is available. From the first order conditions of the optimal contract, the external finance premium is equated with the expected marginal product of capital which under constant returns to scale is exogenous to the individual firm (and given by the exogenous technology parameter); hence the capital stock of each entrepreneur is proportional to his net worth, with this proportion increasing as the expected marginal product rises, driving up the external finance premium. Thus the external finance premium increases with the amount of the firm’s capital investment that is financed by borrowing:

where the coefficient χ > 0 measures the elasticity of the premium with respect to leverage, qq t is the price of capital (k t ). Entrepreneurs leverage up to the point where the expected return on capital equals the cost of borrowing from financial intermediaries. The external finance premium also depends on an exogenous premium shock, epr t . This can be thought of as a shock to the supply of credit: that is, a change in the efficiency of the financial intermediation process, or a shock to the financial sector that alters the premium beyond what is dictated by the current economic and policy conditions.

Entrepreneurs buy capital at price qq t in period t and uses it in (t + 1) production. At (t + 1) entrepreneurs receive the marginal product of capital rk t + 1 and the ex-post aggregate return to capital is cy t + 1. The capital arbitrage equation (Tobin’s Q equation) becomes:

The resulting investment by entrepreneurs is therefore reacting to a Q-ratio that includes the effect of the risk-premium. There are as before investment adjustment costs. Thus, the investment Euler equation and capital accumulation equations are unchanged from Le et al. (2011). The output market-clearing condition becomes:

3 DSGE Models of the Chinese Economy

DSGE models of the Chinese economy have become increasingly popular in recent years as a means of evaluating trends and welfare implications of specific policies in the Chinese economy. Zhang (2009) calibrate a DSGE model for China to examine welfare implications of a money supply rule versus an interest rate rule. Mehrotra et al. (2013) use a partially estimated (GMM) and calibrated DSGE model based on Christiano et al. (2005) to evaluate a rebalancing of the Chinese economy from investment-led to consumption-led growth. The labour market is assumed to be frictionless but rigidities arise from staggered price setting by firms, habit formation in consumption and capital adjustment costs. Technology shocks have a damped effect on output in a re-balanced economy. Wan and Xu (2010) use Bayesian methods to estimate an open economy DSGE model based on Fernandez-Villaverde and Rubio-Ramirez (2004). They find the standard result that technology shocks are the main driver of the business cycle and that they dominate monetary shocks. Counter-cyclical credit policy is examined by Peng (2012), in a New-Keynesian DSGE model based on Iacoviello (2005). Firms are credit constrained and the Peoples Bank of China controls credit growth through its hold on the banking system. While as expected, technology shocks dominate the variance of output, credit shocks are also a strong driver. Counter-cyclical credit policy is effective in reducing output volatility. In contrast, Sun and Sen (2012), develop a Bayesian estimated modified Smets-Wouters DSGE model to examine the business cycle and find that technology shocks play a subsidiary role. The dominant drivers of output are investment and preference shocks.

A number of studies using the new-Keynesian DSGE framework have been published by Chinese scholars (in Chinese). Xu and Chen (2009) incorporate a bank lending channel into a DSGE model with price stickiness. They find that technology shocks explain the majority of the variations of output, investment and long-term consumption, and the fluctuations of short-term consumption, loan and real money balance are mainly attributed to credit shocks. Xi and He (2010) evaluate the welfare losses of China’s monetary policy with a new Keynesian DSGE model and find that the welfare losses is negatively correlated with the nominal interest rate-inflation sensitivity and positively correlated with the nominal interest rate-output sensitivity. They recommend using interest rate policy to stabilize the price level but not to adjust economic growth rate. They also find that the welfare losses caused by fluctuations in money supply are larger than caused by fluctuations in interest rate; hence the appropriate intermediate target of monetary policy should be interest rate instead of money supply. Yuan et al. (2011) investigate the existence of the financial accelerator within a small open economy. The likelihood ratio test supports the existence of a financial accelerator in Chinese economy. While the financial accelerator amplifies the impacts of shocks to the marginal efficiency of investment and monetary policy, its amplification effect on the technology and preference shocks is subsidiary. Similar results are reported in Liu and Yuan (2012). Overall, the Chinese publications are in line with the results of those in the international arena.

Among all existing DSGE modelling of Chinese economy, to our knowledge, only two have incorporated a banking sector: Chen et al. (2012) and Xu and Chen (2009). We examine the application of these models in the next section.

4 The Chinese Banking Sector

The evolution of the Chinese banking system illustrates the broader evolution of its capitalism with Chinese characteristics. Traditionally banking like the rest of the economy has been dominated by the state: state-owned banks provide credit to state-owned firms, under orders from the government. But more recently the non-state owned banks have grown in parallel with the private production sector. Because the state banks are closely supported by the government on favourable terms, credit from them finds its way also to the private sector via a round-about route, to the shadow banking system through the sale of wealth management products. Thus emerges the peculiarly Chinese feature of two parallel systems, separate but connected in certain ways.

In 2010, the Chinese banking system consisted of 3,769 banking institutions, including 2 policy banks, 5 state-owned commercial banks (SOCB), 12 joint-stock commercial banks, 147 city commercial banks, and the rest made up of foreign banks, urban and rural credit cooperatives and other financial institutions.

Like many economies that have undeveloped financial and capital markets, the banking sector in China plays a pivotal role in financial intermediation. Table 1 below shows that the ratio of total bank assets to GDP has increased from 125 %, in 1997, to 243 % in 2011. The market is absolutely dominated by the five state owned banks, although their share of the market has been decreasing steadily through competition from the other nationwide banks (Joint-stock banks and some City Commercial Banks).

Up until 1995, control of the banking system remained firmly under the government and its agencies. Under state control, the banks in China served the socialist plan of directing credits to specific projects dictated by political preference rather than commercial imperative. Under state planning, the PBOC set loan quotas for each sector and disbursed these through the branch network in each province. As China evolved towards a capitalist system, the banks lagged behind the rest of the economy in improving its efficiency, management and performanceFootnote 2. Even with the development of a commercial banking system, the state kept a strong hold on the banking system by maintaining direct control of the SOCBsFootnote 3. Table 1 shows that in 1997 the SOCB share of total bank assets was 88 %. Even by 2011, concentration of the top 5 remains high with the SOCBs share close to 50 % with 16 % being supplied by the national joint stock banks (JSCB). Despite the growth and development of the non-state owned banking sector, state influence remains significant through a complicated process of ownership and governance. Many of the national joint stock commercial banks (JSCB) are owned by state-owned industries, which in turn are owned by the state. City commercial banks which have geographical limits to their banking activities are owned by provincial governments. All banks have a governance structure that includes the oversight of the Communist Party and senior officials of the SOCBs are appointed by the government, many who are career officials in the politburo.

One reason for the lag in the full commercialization of the banking sector is that the SOCBs are seen not just as profit maximizing organizations but also organs of the state in promoting social and economic harmony. Profit maximization in the SOCBs is subject to political, social and employment constraints. Another important reason was the high level of inherited non-performing loans (NPLs). Table 1 shows that the NPL ratio of the SOCBs was estimated as 53 % in 1997. As a preparation for recapitalization and eventual listing, 1.3 trillion RMB was divested to the Asset Management Companies (AMCs) in 1999, financed by the Ministry of Finance and the PBOC at par. In 2004 a further 750 billion RMB was divested at discount. The process of recapitalization began with the use of the governments holding of dollar assets to inject equity into the SOCBs. This also explains the reticence of the PBOC to allow a faster depreciation of the dollar for fear of tipping the risk-weighted CAR of the banks below the Basle norms prior to listing of the non-governmental share.

In 2011, NPL ratios have fallen to tolerable levels, although it can be argued that one reason for this was the rapid expansion of bank assets during the period of the global economic crisis. Profitability and net interest margins have reached comparable levels with banks in developed economies on the eve of the global banking crisis. However, the government and the PBOC retains control of the banking system through its levers on quantity and price with the objective of hitting a multiplicity of intermediate targets. Initially, the objective of price stability and economic growth was to be achieved by targets for M1 and M2. By 2007, the PBOC had stopped publishing targets for the money supply. Another but informal target is the growth of bank credit which is controlled the use of its administrative ‘window guidance’ policy. Up until 2004, the rate of interest on loans and deposits were strictly controlled. With, strong controls on the lending rates and high levels of NPLs, ROA and NIM were well below what would be expected as appropriate risk pricing by banks in emerging market economies. The recent policy of lifting the ceiling on loan rates has created some potential for risk pricing but there is little evidence that banks are independently pricing risk into their loans and taking advantage of this freedomFootnote 4. The spread between the benchmark loan and deposit rate has remained fixed throughout the deregulatory period. However, the average loan-deposit ratio of the SOCBs are around 65 % and the current CAR in excess of 10 % provides ample slack for the banks to make credit advances as and when the government decides through its ‘window guidance’ policy. The PBOC also use the regulated deposit and loan rate benchmarks as monetary policy tools. While the plan is to move towards market determined interest rates over time, the reality is that the deposit rate ceiling set by the PBOC is binding.

Another target the PBOC has is the stability of the exchange rate. The RMB was pegged to the dollar up until 2005, but is currently allowed to fluctuate between upper and lower bounds of a reference basket of currencies. However, the dollar remains the dominant focus of exchange rate policy. The levers for exchange rate policy are capital controls, and sterilization of foreign currency inflowsFootnote 5. Lending to the non-commercial sector is controlled by the frequent adjustment of the required reserves ratio (RRR). In order to counteract the possibility that bank lending escape into the household sector with its implications for house price and stock price inflation, the PBOC has raised RRR from an average of 10 % to levels of above 20 % in recent times.

The Chinese banking system, particularly the SOCBs, support the state-owned enterprises (SOEs) through directed bank credits. The SOEs account for over 50 % of the industrial sector, which represents a drop from 70 % in 1999 but the number of enterprises have also declined from a share of 40 % in 1999 to less than 10 % in 2008, indicating a sharp increase in individual size and concentration. The average asset size of an SOE is around RMB 923 million, compared with the average asset base of a non-SOE at RMB 60 millionFootnote 6. Nearly 70 % of the funding of the SOEs is from bank loans and nearly 70 % of the loan portfolio of the SOCBS is to the SOEs. About half of GDP is accounted for by the SMEs and their participation in international trade and outward investment is also very significant, representing 69 % of the total import and export values and about 80 % of outward investmentFootnote 7. While it is estimated that 75 % of industrial profits are generated by the non-SOE sector, only 3.5 % of the SOCBs lending is to the SMEsFootnote 8. With no alternative for funding, China’s SMEsFootnote 9 turn to the shadow banking system which according to PBOC estimates has grown to RMB 30 trillion (54 % of the total assets of the SOCBs). Funding for the shadow banks have come from hedge funds, private equity funds, money market funds, as well equity wealth management products sold by the banks as off-balance sheet instruments.

The consolidation of undercapitalised and failing city commercial banks and urban credit cooperatives in the 2009–10 periods provides an insight into CBRC resolution strategy. There is no formal deposit insurance in China as yetFootnote 10 and the depositors of the small failing city commercial and cooperatives have been compensated by the government. It is therefore inconceivable that any of the SOCBs which together account for RMB 54.8 trillion of assets and 1.6 million employees are allowed to fail and unlikely that any of the national JSCBs which together have RMB 18.4 trillion and 16 % of the market by assets be allowed to fail.

The multiple targets and instruments available to the PBOC mean that the methods of monetary control require careful interpretation. The seemingly impossible objective of the PBOC is to control both price and quantity in the money markets. This is possible because of the undeveloped state of the money markets in China which makes interest rate policy less effective, allowing room for quantity adjustment.

Chen et al. (2012) group monetary policy instruments of the PBOC into two categories. The first is market based instruments such as open market operations and lending at the equivalent of the discount window as well as frequent changes to RRR. The rest are levers that have been part and parcel of the planning regime. These levers include the directed credit policy through the ‘window guidance’ policy, controls on interest rates, and capital controls. They develop a calibrated new-Keynesian DSGE model in the spirit of Gerali et al. (2010) with Chinese features to allow for market determined deposit and loan rates within the corridor set by the administered rates, but are fixed when they hit the corridor boundaries. The model is used to evaluate the efficacy of the policy instruments, which depends on the source of the shocksFootnote 11.

It is clear that the Chinese banking system, state, non-state and shadow, is complex and that its operations are intervened in by the government in many ways. Here we necessarily abstract from these complexities partly because there is little relevant data and partly because their interactions are hard to model. Instead we model it as if it behaves like an ordinary banking system, facing idiosyncratic risk and costs of bankruptcy, the result of which is a credit premium that rises with investment needs. Essentially one can think of this as what the marginal investor in the private sector faces as the outcome of the banking system in China.

5 The Method of Indirect Inference

We evaluate the model’s capacity in fitting the data using the method of Indirect Inference originally proposed in Minford et al. (2009) and subsequently with a number of refinements by Le et al. (2011) who evaluate the method using Monte Carlo experiments. The approach employs an auxiliary model that is completely independent of the theoretical one to produce a description of the data against which the performance of the theory is evaluated indirectly. Such a description can be summarised either by the estimated parameters of the auxiliary model or by functions of these; we will call these the descriptors of the data. While these are treated as the ‘reality’, the theoretical model being evaluated is simulated to find its implied values for them.

Indirect inference has been widely used in the estimation of structural models (e.g., Smith 1993; Gregory and Smith 1991, 1993; Gourieroux et al. 1993; Gourieroux and Monfort 1995 and Canova 2005). Here we make a further use of indirect inference, to evaluate an already estimated or calibrated structural model. The common element is the use of an auxiliary time series model. In estimation the parameters of the structural model are chosen such that when this model is simulated it generates estimates of the auxiliary model similar to those obtained from the actual data. The optimal choices of parameters for the structural model are those that minimise the distance between a given function of the two sets of estimated coefficients of the auxiliary model. Common choices of this function are the actual coefficients, the scores or the impulse response functions. In model evaluation the parameters of the structural model are taken as given. The aim is to compare the performance of the auxiliary model estimated on simulated data derived from the given estimates of a structural model—which is taken as a true model of the economy, the null hypothesis—with the performance of the auxiliary model when estimated from the actual data. If the structural model is correct then its predictions about the impulse responses, moments and time series properties of the data should statistically match those based on the actual data. The comparison is based on the distributions of the two sets of parameter estimates of the auxiliary model, or of functions of these estimates.

The testing procedure thus involves first constructing the errors implied by the previously estimated/calibrated structural model and the data. These are called the structural errors and are backed out directly from the equations and the dataFootnote 12. These errors are then bootstrapped and used to generate for each bootstrap new data based on the structural model. An auxiliary time series model is then fitted to each set of data and the sampling distribution of the coefficients of the auxiliary time series model is obtained from these estimates of the auxiliary model. A Wald statistic is computed to determine whether functions of the parameters of the time series model estimated on the actual data lie in some confidence interval implied by this sampling distribution.

Following Meenagh et al. (2012) we use as the auxiliary model a VECM which we reexpress as a VAR(1) for the three macro variables (interest rate, output gap and inflation) with a time trend and with the productivity residual entered as an exogenous non-stationary process (these two elements having the effect of achieving cointegration)Footnote 13. Thus our auxiliary model in practice is given by:

where \( {\overline{x}}_{t-1} \) is the stochastic trend in productivity, g t are the deterministic trends, and v t are the VECM innovations. We treat as the descriptors of the data the VAR coefficients (on the endogenous variables only, I − K) and the VAR error variances (var[v]). The Wald statistic is computed from theseFootnote 14. Thus effectively we are testing whether the observed dynamics and volatility of the chosen variables are explained by the simulated joint distribution of these at a given confidence level. The Wald statistic is given by:

where Φ is the vector of VAR estimates of the chosen descriptors yielded in each simulation, with \( \overline{\varPhi} \) and ∑ (ΦΦ) representing the corresponding sample means and variance-covariance matrix of these calculated across simulations, respectively.

The joint distribution of the Φ is obtained by bootstrapping the innovations implied by the data and the theoretical model; it is therefore an estimate of the small sample distributionFootnote 15. Such a distribution is generally more accurate for small samples than the asymptotic distribution; it is also shown to be consistent by Le et al. (2011) given that the Wald statistic is ‘asymptotically pivotal’; they also showed it had quite good accuracy in small sample Monte Carlo experimentsFootnote 16.

This testing procedure is applied to a set of (structural) parameters put forward as the true ones (y t = G(L)y t − 1 + H(L)x t + f + M(L)e t + N(L)ε t ., the null hypothesis); they can be derived from calibration, estimation, or both. However derived, the test then asks: could these coefficients within this model structure be the true (numerical) model generating the data? Of course only one true model with one set of coefficients is possible. Nevertheless we may have chosen coefficients that are not exactly right numerically, so that the same model with other coefficient values could be correct. Only when we have examined the model with all coefficient values that are feasible within the model theory will we have properly tested it. For this reason we later extend our procedure by a further search algorithm, in which we seek other coefficient sets that could do better in the test.

Thus we calculate the minimum-value full Wald statistic for each period using a powerful algorithm based on Simulated Annealing (SA) in which search takes place over a wide range around the initial values, with optimising search accompanied by random jumps around the spaceFootnote 17. In effect this is Indirect Inference estimation of the model; however here this estimation is being done to find whether the model can be rejected in itself and not for the sake of finding the most satisfactory estimates of the model parameters. Nevertheless of course the method does this latter task as a by-product so that we can use the resulting unrejected model as representing the best available estimated version. The merit of this extended procedure is that we are comparing the best possible versions of each model type when finally doing our comparison of model compatibility with the data.

Before we proceed to carry out our tests and estimation, we should explain why we do not use the much more familiar ‘direct inference’ estimation and testing procedures here. In direct inference one fits a structural model directly to the data, either by classical ‘frequentist’ FIML or by the now popular Bayesian ML. The likelihood that is maximised in FIML is derived from the size of the reduced form errors. In Bayesian ML it is derived from this plus the priors—effectively the resulting ML parameters are a weighted average of the FIML values and the priors, where the weights depend on the prior distributions and the extent to which the FIML values differ from the priors. The FIML values are essentially those that give the best current forecasting performance for the model (i.e. minimising the size of the reduced form errors). One can develop overall tests of the model specification under direct inference by creating, in the FIML case, a Likelihood Ratio against some benchmark model, a natural one being an unrestricted VAR; in the Bayesian case Del Negro and Schorfheide have proposed the DSGE-VAR weight as a measure of model closeness to the data (this is the weight on the prior model’s implied VAR, as combined with the unrestricted VAR, that maximises the likelihood). This can also be treated as a specification test of the overall model, even though usually Bayesians are reluctant to talk about ‘testing’ the model as whole.

Such tests are compared with the indirect inference tests using Monte Carlo experiments with an SW model, in Le et al. (2012b). They find that the tests compare quite different features of model performance. The direct ones check (in-sample) forecasting ability, while the indirect one checks the model’s causal structure. For policy purposes we are most interested in using DSGE models for simulation of the effects of policy changes and hence in their causal structure. Typically forecasting is done by other means.

Both tests can still be used to test a model’s specification and hence its causal structure, even if the direct method checks it via forecasting performance. But Le et al. also find that, viewed as test of model specification, the power of direct inference tests in small samples is much lower than that of indirect inference. In other words they discriminate rather weakly against false models. This is presumably because forecasting is only weakly related to good specification; bad models with a lot of ad hoc lags and added exogenous variables forecast better than models based on good theory, which are restricted to having only structural shock processes as their exogenous variables. Furthermore false models will generate false structural shock processes which may well partly compensate for the specification error in the model’s forecasting performance. Meanwhile the indirect inference test’s power against false models allows one to discover rather accurately what features of the data behaviour a model can replicate and what not; this in turn can be helpful in thinking about respecification.

In estimation both FIML and Indirect estimators are consistent and asymptotically normal. But as we have seen the latter’s power is greater in small samples so that it should also give more reliable results from estimation in small samples. For these reasons we use the indirect inference procedure here both to estimate the model on our available small samples and to test its specification.

6 What Does the Model with Financial Factors Say About the Origins of the Banking Crisis?

6.1 Estimation and Model Fit

The model that integrates the banking sector is estimated using the method of Indirect Inference as set out in Le et al. (2011) for the 1991–2011 period. The estimated model is tested against the data using the main macroeconomic variables, output, inflation and the interest rate. We use a test of whether the model can match the time series properties of the data jointly. The model is found to fit the data well according to the Wald statistic with a p-value of 0.1084. The estimated parameters can be found in Table 2. Impulse response functions to key variables when the model is applied to non-stationary data are shown in Fig. 2. Note that the second set of IRFs in Fig. 2 are due to a non-stationary productivity shock. Figure 3 shows that the model generates 95 % confidence intervals for the implied VAR responses that easily encompasses the data-based VAR responses to a monetary shock—see Appendix 2 for the VAR responses to other shocks.

Table 2 compares the estimates for China with those for the US by Le et al. (2012a) for an identical model. The comparison reveals that in China the competitive structure of labour and product markets is similar to that in the US; about two thirds of the labour market is imperfectly competitive but nine tenths of the product market is competitive. In the imperfectly competitive labour market wages are less rigid in China and there is less wage indexation. Chinese labour supply is about twice as responsive to real wages as in the US. In China there is about a third less habit persistence in consumption. Capital adjustment costs are about twice as great and it is four times as costly to vary capacity utilisation. In money and banking the response of the credit spread to Q is twice as large; and the Taylor Rule is roughly twice as responsive both to inflation and output gaps, and has similar persistence. If one had to place China along the New Keynesian-New Classical spectrum it would therefore be closer to the New Classical end, with less nominal rigidity. This should mean that in response to a similar-sized shock prices are more volatile than in the US. This is what we find in for example the IRF to a monetary contraction; inflation falls about three times as much as it does for an equivalent shock in the US.

6.2 Error Properties on Unfiltered Data

Having established that the model that integrates the banking sector fits the data, we now go on to apply it to the recent crisis episode in the China. To do this we extract the model shocks from the unfiltered data (Fig. 4) and fit to each an AR time-series process over the period. Table 3 shows the status of each shock and also the AR parameters that emerge from the estimation process. We find that productivity unambiguously has a unit root and we specify it in first differences. The other shocks we treat as either stationary or trend-stationary, because theoretically the model implies that they should be; for example ‘government spending’ (which includes net exports) is bounded by taxable capacity/the balance of payments, and the credit spread by collateral and limits on Q. We then allow the error data to determine the AR parameters, with the results reported in this Table. Even though the AR coefficients do not closely approach the unit root, many of them show high persistence. Though the ADF and KPSS tests are consistent in several cases with unit roots, the fact that the model as a whole fits the data behaviour with the AR coefficients used here is evidence in their favour; had unit roots given a better fit, we would observe AR coefficients negligibly different from unity. (In the US model we find two roots of this sort, which are placed at 0.999.)

Plainly the crisis had international ramifications but we cannot identify the causality of these in a China-only model. The shocks that show up in the model are partly coming from these international effects. Thus commodity price shocks enter through the ‘price mark-up’ here are themselves responding to the crisis. Also the exogenous demand shock, which consists of government spending and net exports, contains the international downturn in world trade.

A further, similar limitation of our account is our inability to analyse connections between the shocks to the model. No doubt the banking shocks we identify had simultaneous and lagged effects on the non-banking shocks; but also vice versa, the non-banking on the banking. The sample episode is too short to establish which way such effects might go or even if they exist, tempting as it might be to run some regressions to detect them. The model assumes that each shock is separate from the others and only related to its own past. The model then disentangles how each shock works through the economy to affect final outcomes. Anyone that wished to take matters further would have to model the interactions of the shocks themselves through a wider model, such as one of political economy.

6.3 The Errors Driving the Episode

We begin by showing the behaviour of the main model errors (i.e. the total cumulated innovations) during the crisis episode, which we treat as 2006Q1 to 2011Q4.

We can see from Fig. 5 that there was turbulence over the crisis in many of these shocks. We can single out ones where this was greatest. Exogenous demand shows the collapse of world trade at the end of 2008. There are parallel falls in consumption and investment. The price mark-up fluctuated with world commodity price movements. The Taylor Rule error appears to be associated with these and with world trade movements; there was no zero bound problem in China such as we find in the US as both interest rates and inflation remained fairly high during the episode.

Productivity fell after the crisis hitFootnote 18; and the labour supply error (a measure of ‘wage push’ from workers) rose and then fell as workers responded to the crisis by cutting wages unusually.

Finally there is a strong banking shock coming via a net worth, which fell sharply after the crisis.

Overall, we can see that there was a wide set of shocks hitting the Chinese economy during the crisis period, the major ones coming from abroad but in turn triggering domestic counterpart shocks. The Chinese authorities’ response was, as we know, to give orders to banks to lend for investment projects, mainly infrastructure. We can see this response in the investment error, which turns sharply positive from the end of 2009. We can also see a strong reaction to the crisis in government spending which with net exports constitutes the exogenous demand shock; this is revealed by the available annual data shown in Fig. 6 (there is quarterly data only for the two combined).

6.4 A Stochastic Variance Decomposition of the Episode

We next look at the variance decomposition of such episodes. Again, we are using unfiltered data when performing this analysis which treats the episode stochastically—that is, we take the shocks in the episode and replay them by redrawing them randomly and repeatedly with replacement to see what a typical crisis episode would be like. Our variance decomposition is therefore for such a typical episode.

What we see from Table 4 is that only 30 % of the output variance is due to financial shocks (here the net worth shock); and the rest is due to the usual non-banking shocks. For investment the share of financial shocks is very high (88 %); but this gets dampened in its effect on GDP partly because interest rates react to them and partly because it is a small part of GDP. Accordingly we see that interest rates are also highly affected (30 %) by the financial shocks. As for inflation only 2 % comes from this financial side.

It is worth reflecting that net worth here is itself falling in response to the collapse of international demand. It is then triggering a further tightening of financial conditions which affect the economy twice as powerfully as in the US economy. Thus we can think of this ‘banking shock’ as the financial effect in China of the global crisis; the direct demand effect is already captured by the exogenous demand shock.

Thus there is a distinct role for financial shocks in such Chinese episodes. However, the bulk of the variation comes from the other shocks: exogenous demand, labour supply, productivity, monetary policy and the price mark-up.

6.5 Accounting for This Particular Banking Crisis Episode

We can also decompose what actually happened in the precise episode that occurred according to the model as a result of these shocks. We do this in the charts that follow for the main macro variables (Figs 7, 8, 9).

If we focus first on output (Fig. 7), we see that the economy overall contracts about 9 % due to the crisis between the peak in 2008 and the trough in 2009. There are two main elements in this: exogenous demand and Taylor Rule tightening. It may seem surprising that tightening money reinforced the crisis downturn, but to understand this one must turn to the inflation chart (Fig. 8, in % per quarter) which shows the inflation upsurge just prior to the Lehman collapse; the upward swing in inflation by mid-2008 from 2006 was 8 % per annum. This would have fuelled alarm in the central bank over and above the normal counter-inflation response in the Taylor Rule.

Thus when we turn to interest rates (Fig. 9), we see that they do decline after Lehman but not as fast as one might expect. They remain surprisingly flat until the middle of 2009 when finally they plunge, assisted by the collapse of the price mark-up with falling commodity prices (Fig. 10).

We show three lines on the chart: the total predicted, the predicted total without financial shocks, and the total predicted without either financial shocks or any financial transmission. The last two hardly differ, showing that financial transmission of non-financial shocks is modest in this episode: the effect of the non-financial shocks is occurring through the usual non-financial channels. The financial effect is coming from the financial shocks themselves; as one can see they are negligible in effect for inflation but are visibly present in output and interest rates. Though they do contribute the systematic variation of the latter two over the whole episode, as we saw in the last section, they do not contribute importantly to the swings in the heart of the crisis period, 2008–9.

The overall interpretation coming from this analysis is of a crisis in China triggered by a large exogenous demand shock, mainly external, and by large shocks to inflation from world commodity prices; these in turn probably triggered the sharp monetary policy shocks which also contributed. Financial shocks seem to have played a modest part in the swings at the heart of the crisis period, though they did contribute to general variation over the whole period. Notice that this is not a crisis ‘created by the (Chinese) financial system’Footnote 19.

6.6 What is and Causes a (Financial) Crisis in China?

If we take a longer perspective than just this crisis, we can ask: what is the nature of a crisis in China and what causes it, according to our analysis of this sample? Let us define a ‘crisis’ as a severe interruption in output growth, a large part of which is permanent; and a financial crisis as a crisis in which there is also a financial collapse of some sort. What does this model have to say in general about the causes of these? We examine this question by inspecting the bootstrap experience (potential scenarios over the period) from the model and its normal shocks; for this we use the shocks from the period 1991 to 2007 so that we do not reuse the shocks from this crisis period itself. Again, this analysis is done on unfiltered data. Plainly we know that these shocks generate crisis; and we want to discover whether this experience is unique. We also look at the full period including the crisis, 1991–2011; as it turns out the two periods are not that different, because China’s crisis was not particularly severe.

We find the following regularities:

-

a)

Crisis is a normal part of Chinese capitalism: this economy will generate crises regularly from ‘standard’ shock sequences. In Figs. 11 and 12 we illustrate this from some of the bootstrap simulations/scenarios produced from the shocks of the 1991–2007 period (i.e. sans crisis). In around half of them there were quite serious interruptions of activity, which satisfy the definition of crisis. If we define a crisis as an interruption of GDP growth such that output falls and does not recover to its past peak for at least 3 years (which for a China accustomed to regular 7 % plus growth is a severe interruption), then we find that a crisis on average will occur about every 35 years.

Plainly these figures are affected by the nature of the sample shocks; here we have used the experience of the last two decades, which apart from the crisis itself was the period of the Great Moderation in the world economy. As we know that the variance of shocks in this period was markedly lower than in earlier post-war history, extending our sample backwards in time would no doubt change our estimates in detail.

-

b)

When there is crisis, about a quarter of the time there is also financial crisis; we measure this here by the appearance of an abnormal premium rise accompanying a crisis fall in output. This is shown for the same scenarios by showing the corresponding external premium behaviour.

-

c)

An extreme financial shock is not required to produce a financial crisis. This is evident from the charts above since the financial shocks from 1991 to 2007 were none of them extreme and yet we clearly got several financial crises. Figure 13 shows the net worth shock during this sample period, the only financial shock that contributed to the crisis; as can be seen the swings in it are smaller compared with the severity of the swing over the crisis (to the right of the vertical line).

-

d)

A financial shock is not sufficient to produce a crisis, even though it produces a rise in the premium. To check this point we redid these scenarios with just the two financial shocks including the crisis period values (Fig. 14); thus this shock series includes both normal and extreme financial shocks. If financial crisis can be the result of extreme financial shocks, we should obtain a few at least. However what we see is that even though our financial shock series is effectively non-stationary it does not cause a crisis; we obtained none by our measure above.

7 How China Tames the Capitalist Tiger—One State Two Systems

For China, a crisis of the dimensions we have just considered is too dangerous to contemplate. The Communist Party’s strategy for containing popular discontent among the many who have not yet achieved middle class status and income growth is to maintain fast growth in GDP so that the promise of such achievement can be kept credibly alive. A failure on the scale of a crisis would threaten possible revolution. It follows that some means has to be found to respond to crisis quickly so as to prevent its getting to such a scale—much as was done during the current crisis.

The means the Chinese state has found are in the existence of two systems, the publicly owned alongside the private sector. The state still owns half the banking system and it still controls half of the economy. The state-owned banks (SOCBs) and firms (SOEs) act as twin channels through the government can rapidly respond to events where necessary. Thus in this crisis, the SOCBs were ordered to lend to SOEs for infrastructure investment: the response is visible in the investment residual which picks up sharply from the start of 2010 onwards. Additionally government directly spent on infrastructure and consumption, this time funded directly by the Central Bank. This response too is visible in the behaviour of the exogenous demand residual from 2009 onwards.

Our simulations above treat these residuals as independent processes apart from any simultaneous correlation (which is picked up because we bootstrap by vector); thus once the innovations have occurred future residual values are determined solely by their own past. Yet plainly if there is some feedback policy they will respond to the past of GDP as well. So to investigate the Chinese economy’s crisis behaviour in reality, we add some feedback parameters to both investment and to exogenous demand qua government spending and reran the simulations of the 1991–2011 period to check on the frequency of crises when feedback was added. The feedback we added was to government spending with a coefficient of −0.67 to the difference of the GDP growth rate from its balanced growth path; we also experimented with feedback parameters for investment.

If we redo the full period simulations with the government spending feedback we find a strong reduction (by about 75 %) in crisis frequency to once about every 150 years—compared with about 35 without feedback. However, if we add any sort of systematic feedback on investment the economy is eventually badly destabilised: as output falls the government adds capacity, so creating excess capacity but reducing private consumption and investment via crowding out. If the feedback is strong crises become much more frequent—e.g. with a feedback of 1.1 the stabilising effect of government feedback is neutralised, giving crises about every 35 years still, and with a feedback of 3 it is overwhelmed and crises occur with both feedbacks every 10 years.Footnote 20 Hence we are rediscovering here the advice of Friedman (1968) to stick to simple rules because of the risk of destabilising the economy with feedback rules. It is clear the Chinese government sought to stabilise the crisis period with strong feedback interventions on both government spending and investment (Fig. 15); also this intervention clearly worked in this episode, when we can assume it was unanticipated. However what the simulations are telling us is that, once anticipated and repeated, investment feedback could cause serious instability.

8 Conclusions

We have investigated the behaviour of the Chinese economy over the period of the recent crisis. We have treated China as a closed economy in which net exports are exogenous, in common with government spending. We justified this by appealing to the government’s growth strategy which was to build infrastructure and factories for the export market and then to sell this output aggressively into the world market at whatever price the market required. For this purpose we used the well-known Smets-Wouters model, derived from Christiano et al. (2005), but here in the form as modified by Le et al. (2011) to allow for more heterogeneity in price/wage behaviour, and we have integrated into it the banking/financial accelerator model of Bernanke et al. (1999) in order to assess the role of banking transmission and banking shocks.

We began by estimating the model to get it as close as possible to the data on the indirect inference test we are using. We then used the model with its re-estimated parameters to carry out an accounting exercise in the shocks causing the crisis episode. All this was done on unfiltered data, allowing for non-stationary shocks. We did a variance decomposition to establish what a typical crisis generated by these shocks if redrawn randomly would be caused by. We then looked at the decomposition for this particular episode. Finally we ran a variety of simulations bootstrapped from different sets of the shocks in our sample (over the last three decades, on the grounds that this is of most relevance today) to shed light on the causes of crisis and banking crisis.

Our conclusion is perhaps not very surprising: the crisis in China was not a crisis in the conventional sense, in that it is a growth slowdown rather than a precipitous drop in output as in the rest of the world, it is mainly the result of external shocks from world trade and commodity prices, which in turn triggered responses from the Chinese authorities in the form of monetary policy shocks and shocks to investment (via targeted loans from state banks). Banking shocks as identified by the model played quite a small role in the main crisis period of 2008–9 though they added to fluctuations over the whole period to date. Thus the crisis in China was not a crisis of Chinese banking, as is well known.

The model also tells us that crises are regular occurrences in capitalist economies, such as China now is moving towards, and that they frequently will have as their by-product financial crisis in the sense that the premium rises sharply. These crises/financial crises will occur in spite of there being no extreme financial shocks such as occurred in the recent episode; so serious financial shocks are not required for crises to happen. Furthermore, extreme financial shocks on their own of the type identified in this sample do not cause crises; all they do is cause temporary recessions. Thus both crises and financial crises result from non-financial shocks; financial shocks if extreme enough will add an extra layer of recession. Again, we must stress the caveat that the financial shocks identified in this sample all occurred in a political environment where the Chinese government acted aggressively with counter-cyclical loans for infrastructure; absent this, the scale of these shocks would have been no doubt very different.

A further caveat should be entered—on the quality of the data and also on the possibility of structural change in the banking parameters as China’s banking system was aggressively liberalised during the 1990sFootnote 21. In defence of our current findings we would point out that the banking system is not the main source of shocks nor does banking transmission much affect other shocks; so structural change in it may not affect matters much. As for poor data quality it must reduce the power of our tests; but the tests have strong power and so this may not be an acute problem. However both issues are clearly important and deserving of further work.

What does the work so far say about the future for the Chinese banking sector and what lessons are there for its regulation? In the first instance the use of directed credit to the state firms in times of crisis has served the Chinese economy well in the short-term, helping it to avoid the worst of the global downturn. However, this policy if it became systematic would create instability as we show; and the longer term implications of focussing lending on state firms and starving the high growth private sector could return to haunt the banks with bad debts in the future. Lending to the large state firms is always a safe bet for the banks and the history of the government in aiding the divestment of non-performing loans to the asset management companies and recapitalisation from the dollar reserves means that a no-bail-out threat is not credible. The suggested reduction in the risk weighting for certain private sector loans by the Chinese Banking Regulatory Commission (CBRC) may help plug some of the funding gap for private sector firms but the reality is that the state-owned banks are politically and historically tied to state firms. It is rational for the banks to assume that any non-performing loans that arise from these state firms will eventually be absorbed by the taxpayer.

Besides the small amount of direct lending, the only other link the mainstream banks have with the private sector is through the off-balance sheet business of selling wealth management products that provide funds for the private firms through the shadow banking system. While it can be argued that private firms are able to finance investment through the unregulated shadow banking system, the concentration of the country’s main regular banking system on the low productive state sector represents a colossal misallocation of resources. Private firms can also get finance from foreign banks but as a group they constitute less than 2 % of the banking market and pose little threat to the Chinese banks. If the regular banks cannot change their lending strategy to include private firms, the next best policy is to license the shadow banks so that they can operate within the legal framework and without fear of arbitrary political sanction.

The recent attempt to clamp down on the wealth management products of the regular banks that provide off balance sheet funds to the shadow banks will be seen in time as a retrograde step that will cause damage: to the banks in the regular sector (Chinese bank shares slumped on March 27 2013 following the move by the CBRC to tighten controls on wealth management products), to the shadow banks and ultimately to the growth sector of the Chinese economy. Bringing the shadow banks from out of the shadows would create transparency and provide much needed competition to the regular banks. Unlike the highly leveraged products of the US shadow banks, the vast majority of the Chinese shadow banks supply traditional credit products. Nevertheless, political reality and recognition that ‘turkeys do not vote for Christmas’, leads us to expect that the shadow banks in China may remain in the shadow for the foreseeable future, and that the next shock to demand will be dealt with in the same way by the government as the previous one, but that the anticipation of this reaction will result in greater instability.

Notes

The big 4 banks that constituted the SOCBs in 1997 were, Industrial and Commercial Bank of China, Bank of China, China Construction Bank and Agricultural Bank of China. By 2006 a fifth bank, Bank of Communication was added to the group.

Chen et al. (2011) report that 60 % of bank loans remain at the regulated benchmark rate or below it.

Chang et al. (2013) use a DSGE model to analyse optimal sterilisation policies in China which includes capital controls, an exchange rate target and stabilisation of the exchange rate.

The Second National Economic Census, 2008 and Industrial Enterprises Survey Dataset, China Statistical Bureau

See Shen et al. (2009)

ICBC 2011 Annual Report.

The term SME is used generically to mean the private sector. While there are some SMEs that are state-owned and some large enterprises (Huawei, Alibaba, Tencent, Baidu etc.) that are private, the private sector is dominated by SMEs and MSEs (Medium Sized Enterprises) and most large enterprises are part of the state sector. Many large scale joint-ventures are also with SOEs or their subsidiaries and therefore cannot strictly be called private.

Although recent press reports indicate that the creation of a deposit insurance scheme could be instituted in the next phase of financial market reform. http://www.nytimes.com/2012/12/14/business/global/china-is-said-to-consider-plan-to-deal-with-failed-banks.html

For example they find that credit quotas are effective in reducing inflation in the case of demand side shocks but reduces output in the case of supply side shocks.

Some equations may involve calculation of expectations. The method we use here is the robust instrumental variables estimation suggested by McCallum (1976) and Wickens (1982): we set the lagged endogenous data as instruments and calculate the fitted values from a VAR(1)—this also being the auxiliary model chosen in what follows.

After log-linearisation a DSGE model can usually be written in the form

$$ A(L){y}_t=B{E}_t{y}_{t+1}+C(L){x}_t+D(L){e}_t $$(A1)where y t are p endogenous variables and x t are q exogenous variables which we assume are driven by

$$ \varDelta {x}_t=a(L)\varDelta {x}_{t-1}+d+c(L){\varepsilon}_t. $$(A2)The exogenous variables may contain both observable and unobservable variables such as a technology shock. The disturbances e t and ε t are both iid variables with zero means. It follows that both y t and x t are non-stationary. L denotes the lag operator z t − s = L s z t and A(L), B(L) etc. are polynomial functions with roots outside the unit circle.

The general solution of y t is

$$ {y}_t=G(L){y}_{t-1}+H(L){x}_t+f+M(L){e}_t+N(L){\varepsilon}_t. $$(A3)where the polynomial functions have roots outside the unit circle. As y t and x t are non-stationary, the solution has the p cointegration relations

$$ \begin{array}{c}\hfill {y}_t={\left[I-G(1)\right]}^{-1}\left[H(1){x}_t+f\right]\hfill \\ {}\hfill =\prod {x}_t+g.\hfill \end{array} $$(A4)Hence the long-run solution to x t , namely, \( {\overline{x}}_t={\overline{x}}_t^D+{\overline{x}}_t^S \) has a deterministic trend \( {\overline{x}}_t^D={\left[1-a(1)\right]}^{-1} dt \) and a stochastic trend \( {\overline{x}}_t^S={\left[1-a(1)\right]}^{-1}c(1){\zeta}_t \).

The solution for y t can therefore be re-written as the VECM

$$ \begin{array}{c}\hfill \varDelta {y}_t=-\left[I-G(1)\right]\left({y}_{t-1}-\prod {x}_{t-1}\right)+P(L)\varDelta {y}_{t-1}+Q(L)\varDelta {x}_t+f+M(L){e}_t+N(L){\varepsilon}_t\hfill \\ {}\hfill =-\left[I-G(1)\right]\left({y}_{t-1}-\prod {x}_{t-1}\right)+P(L)\varDelta {y}_{t-1}+Q(L)\varDelta {x}_t+f+{\omega}_t\hfill \\ {}\hfill {\omega}_t=M(L){e}_t+N(L){e}_t\hfill \end{array} $$(A5)Hence, in general, the disturbance ω t is a mixed moving average process. This suggests that the VECM can be approximated by the VARX

$$ \varDelta {y}_t=K\left({y}_{t-1}-\prod {x}_{t-1}\right)+R(L)\varDelta {y}_{t-1}+S(L)\varDelta {x}_t+g+{\zeta}_t $$(A6)where ζ t is an iid zero-mean process.

As

$$ {\overline{x}}_t={\overline{x}}_{t-1}+{\left[1-a(1)\right]}^{-1}\left[d+{\varepsilon}_t\right] $$the VECM can also be written as

$$ \varDelta {y}_t=K\left[\left({y}_{t-1}-{\overline{y}}_{t-1}\right)-\prod \left({x}_{t-1}-{\overline{x}}_{t-1}\right)\right]+R(L)\varDelta {y}_{t-1}+S(L)\varDelta {x}_t+h+{\zeta}_t. $$(A7)Either equations (A6) or (A7) can act as the auxiliary model. Here we focus on (A7); this distinguishes between the effect of the trend element in x and the temporary deviation from its trend. In our models these two elements have different effects and so should be distinguished in the data to allow the greatest test discrimination.

It is possible to estimate (A7) in one stage by OLS. Meenagh et al. (2012) do Monte Carlo experiments to check this procedure and find it to be extremely accurate.

We do not attempt to match the time trends and the coefficients on non-stationary trend productivity; we assume that the model coefficients yielding these balanced growth paths and effects of trend productivity on the steady state are chosen accurately. However, we are not interested for our exercise here in any effects on the balanced growth path, as this is fixed. As for the effects of productivity shocks on the steady state we assume that any inaccuracy in this will not importantly affect the business cycle analysis we are doing here- any inaccuracy would be important in assessing the effect on the steady state which is not our focus. Thus our assessment of the model is as if we were filtering the data into stationary form by regressing it on the time trends and trend productivity.

The bootstraps in our tests are all drawn as time vectors so contemporaneous correlations between the innovations are preserved.

Specifically, they found on stationary data that the bias due to bootstrapping was just over 2 % at the 95 % confidence level and 0.6 % at the 99 % level. Meenagh et al. (2012) found even greater accuracy in Monte Carlo experiments on nonstationary data.

We use a Simulated Annealing algorithm due to Ingber (1996). This mimics the behaviour of the steel cooling process in which steel is cooled, with a degree of reheating at randomly chosen moments in the cooling process—this ensuring that the defects are minimised globally. Similarly the algorithm searches in the chosen range and as points that improve the objective are found it also accepts points that do not improve the objective. This helps to stop the algorithm being caught in local minima. We find this algorithm improves substantially here on a standard optimisation algorithm. Our method used our standard testing method: we take a set of model parameters (excluding error processes), extract the resulting residuals from the data using the LIML method, find their implied autoregressive coefficients (AR(1) here) and then bootstrap the implied innovations with this full set of parameters to find the implied Wald value. This is then minimised by the SA algorithm.

Jian et al. (2010) use a standard sticky-price DSGE, to identify the effects of oil price shocks on productivity. They confirm that oil price shocks have permanent negative effects on output.

Chinese banks had only a limited exposure to the sub-prime market. The Bank of China, ICBC and China Construction Bank together held RMB11.9bn in sub-price mortgage backed securities and CDOs.

For the discussion of this paragraph we used a different solution method, the Extended Path Algorithm set out in Minford et al. (1984, 1986) (it is of the same type as Fair and Taylor 1983), because the feedback creates difficulties in solving for the steady state that Dynare is not set up to handle. The EPA method generates more stable solutions and reduces the frequency of crises; hence here in the benchmark case of no feedback we define a ‘crisis’ as zero growth or less for only 1 year.

The last point was made forcefully by our discussant, Haizhou Huang, of the China International Capital Corporation, at the 2013 Konstanz Seminar. He recommended starting the sample even later, at the end of the 1990s, in the grounds that only then was there a banking system worthy of the name.

References

Bernanke BS, Gertler M, Gilchrist S (1999) The financial accelerator in a business cycle framework. In: Taylor JB, Woodford M (eds) Handbook of macroeconomics, vol 1, ch. 21. Elsevier, pp 1341–1393

Canova F (2005) Methods for applied macroeconomic research. Princeton University Press, Princeton

Chang C, Liu Z, Spiegel M (2013) Capital controls and optimal monetary policy. Federal Reserve Bank of San Francisco, Working Paper 2010–13

Chen H, Chen Q, Gerlach S (2011) The implementation of monetary policy in China. Hong Kong Institute of Monetary Research, Working Paper

Chen Q, Funke M, Paetz (2012) Market and non-market monetary policy tools in a calibrated DSGE model for Mainland China. Bank of Finland Discussion Paper, 16

Christiano LJ, Eichenbaum M, Evans CL (2005) Nominal rigidities and the dynamic effects of a shock to monetary policy. J Polit Econ 113(1):1–45

Coase R, Wang N (2012) How China became capitalist. Palgrave Macmillan, Basingstoke

Dai L (2012) Does the DSGE model fit the Chinese economy? A Bayesian and indirect inference approach. PhD Thesis, Cardiff University

Del Negro M, Schorfheide F, Smets F, Wouters R (2007) On the fit of new Keynesian models. J Bus Econ Stat 25:123–143

Fair RC, Taylor JB (1983) Solution and maximum likelihood estimation of dynamic nonlinear rational expectations models. Econometrica 51:1169–1186

Fernandez-Villaverde J, Rubio-Ramirez JF (2004) Comparing dynamic equilibrium models to data. J Econ 123:153–187

Friedman M (1968) The role of monetary policy. Am Econ Rev 58(1):1–17

Fu X, Heffernan S (2007) Cost X-efficiency in China’s banking sector. China Econ Rev 18(1):35–53

Gerali A, Neri S, Sessa L, Signoretti FM (2010) Credit and banking in a DSGE model of the euro area. J Money Credit Bank 42:107–141

Gourieroux C, Monfort A (1995) Simulation based econometric methods. CORE Lectures Series, Louvain-la-Neuve

Gourieroux C, Monfort A, Renault E (1993) Indirect inference. J Appl Econ 8:S85–S118

Gregory A, Smith G (1991) Calibration as testing: inference in simulated macro models. J Bus Econ Stat 9:293–303

Gregory A, Smith G (1993) Calibration in macroeconomics. In: Maddala G (ed) Handbook of statistics, vol 11. Elsevier, St. Louis, pp 703–719

Iacoviello M (2005) House prices, borrowing constraints and monetary policy in the business cycle. Am Econ Rev 95:735–764

Ingber L (1996) Adaptive simulated annealing (ASA): lessons learned. Lester Ingber Papers 96as, Lester Ingber

Jian Z-H, Li S, Zheng J-Y (2010) Impact of oil price shocks on China’s economy: a DSGE-based analysis. 17th International Conference on Management Science & Engineering, Melbourne Australia

Kimball MS (1995) The quantitative analytics of the basic neomonetarist model. J Money Credit Bank 27(4):1241–1277

King RG, Plosser CI, Rebelo ST (1988) Production, growth and business cycles: I. The basic neoclassical model. J Monet Econ 21(2–3):195–232

Le VPM, Meenagh D, Minford P, Wickens M (2011) How much nominal rigidity is there in the US economy—testing a New Keynesian model using indirect inference. J Econ Dyn Control 35(12):2078–2104

Le VPM, Meenagh D, Minford P (2012a) What causes banking crises? An empirical investigation. Cardiff Economics Working Paper E2012/14

Le VPM, Meenagh D, Minford P, Wickens M (2012b) Testing DSGE models by indirect inference and other methods: some Monte Carlo experiments. Cardiff Economics Working Paper E2012/15

Le VPM, Meenagh D, Minford P, Ou Z (2013) What causes banking crises? An empirical investigation for the world economy. Cardiff Economics Working Paper

Liu L, Yuan S (2012) The financial accelerator effects on Chinese economy: a DSGE analysis. South China Journal of Economics 8:102–114 [In Chinese]