Abstract

This paper presents an analytical overview of recent contributions to the literature on the policy implications of capital flows in emerging and developing countries, focusing specifically on capital inflows as well as on the links between inflows and subsequent capital-flow reversals. The objective is to clarify the policy challenges that such inflows pose and to evaluate the policy alternatives available to the recipient countries to cope with those challenges. A large menu of possible policy responses to large capital inflows is considered, and experience with the use of such policies is reviewed. A policy “decision tree”—i.e., an algorithm for determining how to deploy policies in response to an exogenous inflow episode—is developed, and strategies to achieve resilience to both inflows and outflows in a world where exogenous events may frequently drive capital flows in both directions are discussed.

Similar content being viewed by others

Avoid common mistakes on your manuscript.

1 Introduction

The last 20 years have witnessed a dramatic increase in the integration of developing economies with international financial markets. This has resulted in large flows of capital across the borders of many of these countries, especially of the “emerging market economies” (EMEs, highly financially-integrated middle-income countries) among them. While developing economies tend to be capital-scarce, and access to foreign capital should therefore normally be expected to be beneficial to them, in fact both large capital inflows as well as sudden outflows have proved to present significant policy challenges. These challenges have spawned a large literature dealing with the policy implications of capital flows in emerging and developing countries. Among other things, this literature has addressed the causes of inflow and outflow episodes, the nature of the policy challenges they pose, and the appropriate policy responses on the part of the recipient countries.

This paper presents an analytical overview of recent contributions to this literature, focusing specifically on capital inflows as well as on the links between inflows and subsequent capital-flow reversals. It does not address issues related to sudden capital outflows that are not specifically linked to previous inflow episodes. Such issues are considered in the currency crisis literature, which is simply too vast to subsume into a survey of issues related to capital flows. Instead the focus here is on the challenges posed by capital inflows, including the possibility that inflows may come to a sudden stop or even be associated with sudden and large capital-flow reversals that may (but need not necessarily) be associated with currency crises. The specific focus is on clarifying the policy challenges that such inflows pose and on evaluating the policy alternatives available to the recipient countries to cope with those challenges.

The paper is organized as follows: the first section presents a short overview of capital-flow experience of emerging and developing countries over the past three decades. Of specific interest are the volatility of net private inflows, their magnitude, their composition, and their disposition. Section 2 considers why these flows have behaved as they have—i.e., what forces drive capital flows to these economies. I identify potential drivers theoretically and then examine what the rather extensive evidence on this issue has to say, with a specific focus on recent work. The third section turns to policy challenges. These include specific challenges posed by inflows as well as how to avoid capital-flow reversals (vulnerability). Section 4 considers a menu of possible policy responses to large capital inflows, the pros and cons of each one individually, and reviews some experience with the use of such policies. Section 5 turns to policy strategies in response to large inflows—i.e., policy combinations. Policy combinations matter, because individual policies tend to interact with each other and may be substitutes or complements, so the specific set of policies deployed may turn out to be important. The last two sections attempt to draw prescriptive policy lessons from the preceding analysis. Section 6 focuses on developing a policy “decision tree”—i.e., an algorithm for determining how to deploy policies in response to an exogenous inflow episode. The paper concludes by taking up a broader question: how to achieve resilience to both inflows and outflows in a world where exogenous events may frequently drive capital flows in both directions. The focus there is on an idealized set of conditions that would put an emerging or developing country in an advantageous position to deal with both inflows and outflows.

2 The Evolution of Capital Flows to Emerging and Developing Countries

2.1 Volatility

Figure 1 describes the behavior of net private capital flows for emerging and developing countries in the aggregate.Footnote 1 Precisely because these countries are capital-poor, their experience has been dominated by inflows, rather than outflows. Only in two of the last 32 years (1983–1984, immediately after the outbreak of the Latin American debt crisis) did these countries experience net outflows as a group. Capital-flow volatility for these countries has therefore referred not to distinct episodes of inflows and outflows, but rather to variability in the size of inflows.

As is evident from Fig. 1, net private capital inflows to emerging and developing countries have tended to be episodic over the past three decades: inflows increased sharply after the 1973–1974 oil crisis, mainly in the form of syndicated bank lending to sovereigns financed by the recycling of petrodollars, and peaked in 1981. They collapsed during the debt crisis of the 1980s, but revived strongly after the adoption of the Brady Plan late in the decade. The Asian and Russian crises of 1997–1998 once again brought inflows to a halt, but they revived after 2002, reaching a dramatic peak in 2007. The international crisis associated with the Great Recession caused a new collapse in 2008, but inflows revived once again after March of 2009, when the post-Lehman credit freeze began to ease. They began to recede again in the second half of 2011.

2.2 Magnitude

Net private capital inflows have been large relative to the GDP of the recipient countries, even taking all emerging and developing countries as a group. During the inflow episodes of the early 1990s and 2003–2007, they averaged just short of 3 % of GDP (Fig. 2), but they surged to about 3.5 % of GDP in 1995 and about 4.5 % of GDP in 2007.

2.3 Composition

As shown in Fig. 3, the composition of private capital flows has changed in important ways over time. The inflow episode of the early 1990s featured a combination of FDI, portfolio flows, and bank lending. During the 1989–1996 inflow episode FDI flows were roughly comparable in size to bank lending, with portfolio flows only slightly smaller. However, the share of FDI flows increased steadily over time during the decade of the 1990s. The Mexican and Asian crises primarily affected portfolio flows and bank lending, as FDI flows continued a steady climb. By the end of the 1990s FDI flows had stabilized at between 2 and 3 % of GDP for emerging and developing countries as a group, and the episodic nature of total inflows was driven entirely by fluctuations in portfolio flows and bank lending, which have been much more volatile than FDI. FDI became dominant during the 2003–2008 episode, as portfolio capital inflows have been offset by outflows to a much greater extent than during the episode of the 1990s, consistent with the two-way capital flows that one would expect to characterize a much increased degree of financial integration among the recipient countries.

The upshot of this change in inflow composition, as noted by Prasad (2011), is that the external balance sheet of emerging and developing countries has evolved over time. The foreign liabilities of emerging and developing economies are now largely dominated by equity in the form of both FDI and portfolio equity, rather than by debt, while external financial assets among such countries largely consist of official foreign exchange reserves.

2.4 Disposition

The counterpart of net capital inflows may be a current account deficit or reserve accumulation. The inflow episodes of the early 1990s and the 2000s have been different in this regard, with the early episode primarily offset by current account deficits and small amounts of reserve accumulation, and the later one by reserve accumulation, which was magnified by current account surpluses. As shown in Fig. 4, prior to the year 2000, net capital inflows (private and official) to emerging and developing economies exceeded reserve accumulation, with the difference accounted for by current account deficits. Beginning in 2000, however, this pattern was reversed: reserve accumulation far exceeded net capital inflows, with the difference made up by large current account surpluses.

3 Factors Driving Capital Flows

What has driven these large and volatile flows? A large literature has emerged over the past two decades that addresses this question. Although this literature has not reached a clear consensus, there are signs that one may be beginning to emerge more recently. To understand why it has proven difficult to pin down the factors driving these flows, it is important to emphasize that the volume of capital flows into or out of a country is an endogenous macroeconomic variable. Consequently, inflows and outflows could in principle be driven by a broad array of factors. It is useful to classify these into three types:

-

“Push” factors.

“Push” factors are those that lower the supply price of funds from creditor countries. This refers primarily to changes in financial conditions in those countries or in the international financial environment more generally that create incentives for agents in those economies to invest abroad. “Push” factors may involve financial innovations in advanced countries (such as the emergence of new financial institutions more willing or able to invest abroad than existing ones), changes in prudential policies in advanced economies that allow advanced-country financial institutions more scope to invest in emerging and developing economies, domestic advanced-country distortions such as deposit guarantees that induce moral-hazard lending by advanced-country financial institutions, including to emerging and developing economies (Levy Yeyati 1999), or distortions operating at the international level, in the form of direct or indirect (through the IFIs) G-7 guarantees for funds invested in emerging economies. But the most important “push” factors cited in the literature are probably macroeconomic ones—the stance of monetary policy in advanced economies and the degree of uncertainty in the international economic environment. Expansionary policies that drive down rates of return on advanced-country financial assets give rise to flows driven by the search for higher returns elsewhere. More uncertainty in the international financial environment, on the other hand, tends to drive a “flight to safety,” encouraging financial investment at home or in countries that are perceived to be safe havens for financial investors.Footnote 2

-

“Pull” factors.

“Pull” factors are those that increase the demand price of external funds in emerging and developing economies. These may also include a broad range of factors, including benign ones such as improvements in country creditworthiness (whether caused by changes in the domestic policy environment or by exogenous factors, such as improvements in the terms of trade or natural resource discoveries) and increased commercial openness, or less benign ones such as domestic distortions that result in overborrowing (McKinnon and Pill 1999). They also include short-run macroeconomic policies in developing countries that create interest rate differentials in favor of such countries, such as restrictive monetary or expansionary fiscal policies.

-

Easing of natural or policy barriers to capital flows.

A variety of factors may create “wedges” between the demand and supply prices of external funds (transactions costs that create differences between the cost of funds to the borrowers and the returns received by the lenders). Such wedges act as barriers to the free flow of capital across international borders. These barriers may be natural ones that arise in the very process of financial intermediation, primarily in the form of costs arising from asymmetric information and contract enforcement costs, or policy-imposed ones, in the form of legislated (quantity- or price-based) restrictions on international borrowing and lending. Natural barriers may be affected by technological and institutional developments. For example, improvements in communications and information-processing technologies have undoubtedly reduced the effects of asymmetric information, while improvements in the domestic institutional environment in the form of more clearly defined property rights, a more efficient legal system, better legal frameworks for corporate governance and the enforcement of creditor rights, and improved accounting and disclosure standards, together with domestic financial development more generally, have undoubtedly played a role in reducing natural barriers to capital flows in recent years. At the same time, many countries have eased or entirely removed formal capital account restrictions. The upshot is that the easing of natural and policy barriers to capital flows has enhanced international financial integration among the affected countries, providing more scope for both “push” and “pull” factors to induce larger volumes of capital flows.

While this has rarely been recognized in the literature, the factors listed above are likely to interact in nonlinear ways to determine the magnitude and allocation of capital flows.Footnote 3 Suppose, for example, that a country starts from a rationed regime in which a high supply price of capital, a low demand price, and significant natural and policy barriers to capital flows prevent the movement of capital into the country. Suppose that from this initial situation, significant domestic institutional and policy reforms increase the marginal product of physical capital in the country. The result would be to increase its demand price for external funds. However, this may result in small (if any) changes in actual flows as long as the supply price of external funds and any wedges between the supply and demand prices are unchanged. But because the domestic reforms move the supply and demand prices of external funds closer to each other, a reduction in international interest rates would then have the potential to trigger large flows. In that case, most of the observed variation in flows may be associated with variations in international financial conditions, yet it would be inappropriate to say that domestic factors played no role in permitting flows to arise.

Such interactions are capable of explaining both the time series variation in flows as well as their cross-section variation (i.e., their concentration in large reforming economies):

-

Starting from a rationed regime, it is possible for domestic factors to have been the key ingredient that made capital inflows possible (through an increased demand price), while most of the actual changes in capital flows would have been attributable to reductions in the supply price.

-

Geographic dispersion in the destination of private capital does not necessarily imply that changes in flows are due to changes in “pull” factors, but only that there is substantial cross-country variation in such factors.

So what does the empirical literature tell us about the roles of these factors? The “push-pull” literature of the 1990s focused on lower world interest rates as a “push” factor, and on improved prospects for domestic productivity as a “pull” factor. Overall, the systematic evidence from this period suggests that much of the variation in capital flows in the early 1990s was driven by “push” factors—specifically, industrial-country interest rates (IMF 2011). This seems counterintuitive, however, since we know that major structural reform and stabilization efforts were undertaken in the period 1985–1990 by countries that later received large capital inflows and had previously been shut out of international capital markets. Did these reforms play no role in attracting external capital? The analysis above suggests an alternative interpretation: the empirical dominance of “push” factors in this literature may have been a pure artefact of the sequencing of reforms and interest rate decreases. Reforms increased the demand price of capital in the reforming countries, but actual flows did not materialize in these countries until expansionary monetary policies in creditor countries lowered the supply price of external funds. In countries where the demand price for external funds stayed low, however, no inflows materialized. The 1990s “push-pull” literature thus established that external interest rate changes were important in driving capital inflows during the inflow episode of the early 1990s, but did not establish that domestic creditworthiness and other factors were unimportant. The most reasonable interpretation of this early evidence is that intuition is right, and both factors were important.

Several recent studies have updated this literature to examine the factors driving the more recent capital-inflow episodes. Below I provide a brief description of some recent studies and then summarize what we have learned from the more recent literature:

Alfaro et al. (2005) focused strictly on the role of alternative “pull” factors. They found that deep-seated domestic institutional and structural factors matter in driving international capital flows. They examined the factors driving real per capita equity capital inflows (FDI + portfolio equity) for 47 countries during 1970–2000. Their results were based on a cross-section regression of such flows on a variety of characteristics of the receiving economy, including measures of institutional quality, the country’s initial level of human capital, its “distantness,” its inflation volatility, its use of capital controls, its sovereign risk indicators, its corporate tax rate, and the share of credit coming from deposit money banks as a measure of its degree of financial development. They found that institutional quality, the country’s human capital endowment, and its distantness all were important in explaining equity flows, but the other variables were not. They also found that legal origin had an independent effect, with British legal origin having positive and French legal origin negative effects.

Fostel and Kaminsky (2007) derived similar results using a different dependent variable and allowing a role for “push” factors. Specifically, they looked at primary gross issuance data for 20 Latin American countries in bond, equity, and syndicated loan markets from 1980 to 2005. Unlike the Alfaro, Kalemli-Ozcan and Volosovych study, therefore, the sample used by Fostel and Kaminsky included observations from the inflow episode of the 2000s. Fostel and Kaminsky used fixed-effect quarterly panel estimates of gross issuance/GDP as a function of a variety of variables that captured both “push” and “pull” factors. These included the world interest rate, the degree of investor risk aversion (measured by the high-yield spread), world liquidity (measured by world issuance relative to world GDP), the incidence of crises, and a variety of issuing country variables, including output growth, terms of trade, domestic political risk, inflation, openness, real exchange rate variability, and whether the country had previously defaulted.

Somewhat surprisingly in light of the early 1990s literature, all variables but the US real interest rate and the terms of trade were significant and correctly signed in explaining issuance. To explicitly examine the role of domestic versus external factors, Fostel and Kaminsky classified growth, inflation, openness, political risk, real exchange rate volatility, the terms of trade and their default indicator, interacted with world issuance, as domestic factors, while they considered emerging market crises, the high yield spread, the term premium, the US real interest rate, and world issuance as external factors. They calculated fitted values for the domestic components for each country, as well as the common external factor. They found that except for Colombia, all countries showed strong improvement in domestic factors during the early 1990s, but only Chile showed continuous improvement into the late 1990s. The influence of external factors in driving capital flows became more important after the mid-1990s. They found that except for Argentina, booms and busts starting in 1999 were driven mostly by external factors. They thus concluded, contrary to the early “push-pull” literature, that good domestic behavior was more important in driving capital flows during the early 1990s, while global factors dominated later on, especially after 2002.

More recent studies are able to include surges up through 2007 in their samples. Reinhart and Reinhart (2008) used yet a third dependent variable, the current account balance, as their measure of capital flows in a study that examined the factors driving capital-inflow “bonanzas” (defined as a current account deficit below a common threshold of the 20th percentile ratio of the current account balance to GDP in each country). Using annual data for 1980–2007 for 181 countries and 1960–2007 for a subsample of 66 countries, as well as a third subsample of 18 countries with housing price data, they found that “bonanzas” tended to last between 2 and 4 years for most countries. Reminiscent of the 1990s “push-pull” literature, they also found that global factors (commodity prices, interest rates, and growth in the world’s largest economies) had systematic effects on capital flow cycles. Low world interest rates caused bonanzas not just through portfolio channels, but also through commodity price channels. Interestingly from the perspective of the discussion later in this paper about the effectiveness of capital controls, they noted that bonanzas became more frequent as restrictions on capital flows were relaxed.

Forbes and Warnock (2011) added a new twist to this literature by arguing that disentangling the factors that drive capital flows requires distinguishing between the roles of domestic and foreign agents as well as between inflows and outflows. To do so, they defined four types of phenomena: “surges,” “stops,” “flight” and “retrenchment.” The first two reflect the behavior of foreign agents in bringing capital into or taking it out of an emerging or developing economy, while the last two refer to the corresponding role of domestic agents. They investigated the roles of both global factors as well as domestic ones in affecting these episodes, and treated contagion as a separate type of factor. They considered global factors to consist of global measures of risk, liquidity, interest rates, and growth. The domestic factors they considered were financial development, financial integration, the fiscal position, and growth. Finally, they considered contagion through trade links, financial links, and through the simple sharing of geographic location. Looking at 58 countries during 1985–2009, they found that global factors, contagion effects, and domestic factors were all important in explaining all four types of episodes. Surges and flight were more likely to happen during periods of global calm (they reasoned that when volatility indicators are low, all agents are more likely to invest abroad), while stops and retrenchment were more likely during periods of high global volatility. They found that global risk was the most significant variable in explaining all types of episodes. Higher levels of global risk were associated with stops and retrenchment, and lower levels with surges and flight. Neither world interest rates nor global liquidity (including QEs) were helpful in explaining any of the four types of episodes. Global and domestic growth were important in explaining surges and stops, but not the other types of episodes. Financial integration (the absence of capital controls) did not affect the likelihood of surges and stops (but may have had an effect on flight).

In a follow-up paper, Forbes and Warnock (2012) investigated whether the factors driving the various types of capital flow episodes differed between equity-led episodes (those dominated by FDI and portfolio equity flows) and debt-led ones (dominated by portfolio bond flows and bank lending). They found that 80 % of inflow episodes and 70 % of outflow episodes were dominated by debt, and the conclusions of their previous paper were driven by debt-led episodes, with equity-led episodes being more idiosyncratic and not systematically related to any of the determinants they investigated.

Fratzscher (2011) conducted an investigation of portfolio flows from a representative sample of mutual and hedge funds (consisting of 14000 equity funds and 7000 bond funds) into 50 countries during the recent global financial crisis. Consistent with the findings of Forbes and Warnock, he concluded that both global “push” factors as well as country-specific “pull” factors were important in determining the behavior of these flows. In particular, he found that although global events in the form of changes in measured risk were important in driving capital out of EMEs during the crisis after August 2007 and back in during the recovery after March 2009, there was substantial cross-country heterogeneity among EMEs, and specifically that countries with higher institutional quality and stronger macro fundamentals were better able to insulate themselves from adverse shocks during the crisis. Overall, he found that global factors were about as important as domestic ones in explaining capital flows to the countries in his sample over 2005–2010, but that global factors were more important during the crisis (from August 2007 to March 2009), and domestic factors more important in explaining post-crisis capital flows. In other words, the global crisis drove capital out of all EMEs, but which ones received post-crisis inflows was largely determined by domestic factors. Interestingly, like Forbes and Warnock he found no effect of the degree of financial integration in determining the sensitivity of capital flows to common global shocks.

Finally, a comprehensive study by Ghosh et al. (2012a, b) examined surges of net capital inflows (defined using a threshold methodology) in a sample of 56 EMEs over the period 1980–2009. They identified 149 surge episodes, lasting 2 years on average. They found that:

-

Surge episodes can be large. The average ratio of net capital inflows to GDP in 232 annual observations falling within such episodes was 10.6 % of GDP.

-

Some two-thirds of their surge episodes were liability-driven (i.e., arising from an increase in domestic residents’ foreign liabilities, rather than a reduction in their foreign assets). In the Forbes-Warnock terminology these were “surges” rather than “retrenchment.”

-

As noted by others as well, surges seemed to be synchronized internationally, indicating that common factors have been at play and suggesting a role for global “push” factors.

-

However, even in episodes of widespread surges, not all EMEs were affected (the proportion experiencing a surge in any given year never exceeded half of the sample), suggesting that idiosyncratic (domestic) factors have also been important.

-

There was considerable time series and cross-section variation in the size of flows, conditional on the occurrence of a surge, again suggesting the importance of country-specific factors.

-

During surge periods U.S. real interest rates and global uncertainty were lower, while commodity prices were higher. Consistent with the results of Fratzscher, countries with better institutional quality were more likely to experience surge episodes. When experiencing surges, countries tended to have larger financing needs, to be growing faster, and to have more open current and capital accounts.

-

The magnitudes of surges were negatively affected by U.S. real interest rates and international uncertainty, but positively affected by a country’s financial openness and exchange rate regime (countries with more fixed regimes experienced larger surges) as well as the country’s financing needs.

The recent studies, therefore, reach a fairly uniform conclusion: both global “push” factors and domestic “pull” ones matter in driving the pattern of capital flows. The time series variation in capital flows (the temporal volatility described in the previous section) seems to be strongly driven by global factors, although the relative roles of risk and rates of return in advanced-country financial markets remain to be sorted out. At the same time, however, the cross-section variation (i.e., which countries are affected by the global factors as well as how large the effects are) is strongly influenced by domestic “pull” factors of the type that one might expect, although contagion also plays a role. What has not been settled by this literature is the effect of capital account restrictions in insulating countries from capital flow events, either inflows or outflows.

4 Policy Challenges Associated with Capital Flows

Since economists have adduced a large number of reasons why capital-account openness may be beneficial for emerging and developing economies, the next question is why inflow and outflow episodes should be considered as representing policy challenges. The arguments for the beneficial effects of capital account openness take several forms: opening up the capital account may accelerate convergence in capital-poor countries by allowing such countries to invest more than they save; an open capital account may increase the productivity of domestic investment by allowing projects with high risk,—but high expected returns—to be undertaken, since their country-specific risks can be diversified away; an open capital account allows domestic residents to diversify risk more generally, a consideration that may be particularly important in small, non-diversified developing countries; an open capital account may also act to discipline domestic macroeconomic policymakers by increasing sovereign risk premia when fiscal policies appear unsustainable; it may also enhance competition and therefore efficiency in the domestic financial sector; finally, an open capital account may improve the policy environment more broadly, in the form of policies that create broader access to the formal financial system, improve public and corporate governance, and promote financial market development.

Despite such arguments, however, capital flows have indeed been perceived as presenting policy challenges, whether they take the form of inflows or outflows. While the challenges presented by sudden large capital outflows may be easy to understand, those presented by large capital inflows are more subtle. Are such inflows a good thing or a bad thing, then? More precisely, under what conditions are capital inflow surges a problem?

This question has no general answer. Since the capital account is endogenous, the welfare implications of inflows—if any—are created by the shock that gives rise to the capital inflow. This distinction matters because in principle, as argued in the last section, a variety of shocks could be associated with the emergence of capital inflows, and the welfare implications of such flows should in general be expected to be different depending on the source of the shock that triggers them as well as the characteristics of the economy receiving them. Since the welfare economics are ambiguous, it is by no means clear that policy challenges should be expected to be associated with shocks of just any type that happen to generate capital inflows.

To illustrate this point, consider an RBC model as a benchmark. In such an economy, which is populated by well-informed optimizing agents who operate in a competitive and undistorted environment, the general equilibrium is Pareto efficient. While such an economy may be subjected to a broad variety of shocks that trigger capital inflows, and while such shocks may have large effects on the economic welfare of the agents that populate the economy, these outcomes could not meaningfully be improved by policy. In such an environment, therefore, shocks that are associated with capital inflows do not pose a policy challenge. Examples of shocks that would trigger capital inflows while improving welfare in such an environment include an anticipated future increase in productivity and a permanent or transitory reduction in the world real interest rate facing a net debtor economy. An example of a shock that would trigger capital inflows while reducing welfare is an adverse terms-of-trade shock that is expected to be transitory. In addition, capital inflows would not pose a policy challenge if they arise as the result of a move from a distorted to an undistorted RBC-type environment. Examples include the removal of capital controls in an otherwise undistorted capital-poor economy or the removal of a gap between private and social rates of return as the consequence of the resolution of a debt overhang problem.

For capital inflows to pose a policy challenge, then, a distortion must be present in the domestic economy that can be addressed by policy. The nature of the policy challenge will in general depend not just on the shock that triggers the inflow, but also on the nature of the distortion(s) that creates the welfare problem. The policy challenge has been perceived as emerging in four distinct forms: Footnote 4

-

Avoiding immiserizing external borrowing (making sure that funds are allocated correctly within the capital-importing economy).

-

Avoiding macroeconomic overheating (destabilization associated with large inflows).

-

Avoiding real exchange rate appreciation.

-

Avoiding vulnerability to sudden outflows (destabilization associated with large outflows) and financial crises.

The first three of these are associated with capital inflows, while the last is associated with outflows that are made more likely by a previous surge in inflows.

4.1 Immiserizing External Borrowing

Immiserizing external borrowing can arise because decisions in capital-importing countries about the amount of resources borrowed, and their allocation among competing domestic uses, are undertaken in decentralized fashion, rather than by a benevolent social planner. This means that in the presence of distortions, resources may be misallocated, yielding a social return that is lower than the cost of external funds. This creates a challenge for a variety of primarily microeconomic policies. Capital inflows may pose a policy challenge of this type under three different sets of circumstances:

-

When they arise in association with an exogenous shock in the context of a distorted domestic environment.

From the perspective of the possible misallocation of external resources within the domestic economy, the most serious domestic distortion is probably what we can refer to heuristically as a “malfunctioning” domestic financial system. In extreme cases, a “malfunctioning” domestic financial sector could exist either in the context of financial repression and directed credit, or in the form of an inappropriately liberalized financial system—i.e., a financial system allowed to function under laissez faire rules, with inadequate regulation and supervision. A malfunctioning domestic financial system could reduce aggregate income by misallocating foreign funds such that the marginal social return on such funds falls short of their cost—for example, through cronyism in the presence of financial repression, or through moral hazard lending in the context of an inappropriately liberalized financial system. When the domestic financial system is distorted, inflows driven by a “push” factor such as, for example, lower advanced-country interest rates or reduced international risk, could well be welfare-reducing.

While distortions in the domestic financial system may be the most important ones, there are other possible domestic distortions that could also be welfare-reducing, even in the presence of a well-functioning domestic financial system. These may be static (distorted relative prices) or dynamic (e.g., if domestic residents tend to confuse transitory with permanent shocks, for example, a transitory reduction in world interest rates may induce them to undertake long-term investments that may have a negative net present value when evaluated at the appropriate long-term real interest rate).

-

When they represent an aspect of the macroeconomic response to the creation of a new distortion in a previously undistorted environment.

The most familiar example of such a distortion would be the extension of domestic government guarantees for external borrowing, or for specific activities that are financed through external borrowing. Another example is that of Calvo-type “incredible reforms,” such as an exchange rate-based stabilization or a trade liberalization that is expected to be reversed.

-

When they represent an aspect of the macroeconomic response to the removal of a distortion that had been performing a second-best welfare-enhancing role.

Consider, for example, the 1980s “reform sequencing” literature. This literature suggested that capital-account liberalization should come relatively late in the reform process, after macroeconomic stability had been achieved, trade distortions had been reduced, and the financial sector had been appropriately reformed. The basis for this argument was precisely that until such reforms were in place, the additional resources available to the domestic economy from capital inflows were likely to be misallocated, so capital account restrictions were performing a second-best welfare-enhancing role by avoiding such misallocation. The removal of capital controls in this context could well be immiserizing by aggravating the resource-misallocation effects of existing distortions in the unreformed economy. Similarly, as noted by Dooley (1996), inflows may respond to improved sovereign creditworthiness that makes inappropriate guarantees credible. In this case, low creditworthiness played a role equivalent to a capital-account restriction, preventing distorting guarantees from becoming credible. The removal of this barrier creates resource misallocations that could be welfare-reducing.

Note that what each of these circumstances has in common is that inflows occur in association with a shock to an economic environment characterized by the presence of a distortion, either an exogenously-created new one or a preexisting one. Calvo (2011) has recently argued that the arrival of capital inflows, caused say, by an exogenous “push” factor, may itself create a domestic distortion, in the form of an asset-price bubble (so that the new distortion is endogenous to the arrival of capital inflows). The mechanism works through the enhancement of the liquidity of the domestic asset acquired by the foreign investor. As the demand for such assets increases, their “salability” does so as well, making them more liquid. But this enhanced liquidity itself increases the value of such assets, and this value increases as their market expands. The added value from liquidity would cause the price of such assets to increase, and the joint effects of added liquidity and expected future price increases would justify an asset price in excess of what would otherwise by justified by other fundamentals—i.e., it would trigger a rational asset-price bubble. The difference between liquidity and the other fundamentals, however, is that the added value from liquidity is contingent: it exists only as long as the market for the asset is large. Should an exogenous event curtail inflows and therefore reduce the rate of increase of the liquidity of the asset, expected future price increases would dissipate and the bubble would collapse, as the prevailing market price could no longer be justified by a combination of high liquidity value and expected future price increases. The distortion in this case arises from an externality: demand for the asset from some agents increases its “salability,” and therefore its perceived liquidity, in the perception of other agents.

What is the mapping between “push and pull” and “welfare-enhancing or welfare-reducing” as defined above? It may be tempting to take the view that flows attracted to the recipient country by domestic “pull” factors do not present a policy problem, because they reflect an enhancement in creditworthiness—caused, e.g., by the rectification of previous policy mistakes—while flows “pushed” out of the source countries are an external shock which can easily be reversed and thus call for a policy response. This would be incorrect, however. As indicated by the discussion above, the distinction between “pull” and “push” factors does not necessarily have normative content. Because both broad categories of factors can incorporate a wide variety of domestic and foreign phenomena, the welfare implications associated with “push” and “pull” factors depend on the specific “pull” or “push” phenomena that are at work, rather than on whether the origin of the shock is domestic or external.

4.2 Macroeconomic Overheating

The presence of nominal rigidities allows fluctuations in aggregate demand to generate fluctuations in the level of output that can have negative welfare implications.Footnote 5 In this context, shocks that give rise to capital inflows or outflows have welfare repercussions because they destabilize aggregate demand. In the early years of the capital inflow episode of the early 1990s, for example, when several EMEs were attempting to stabilize from high inflation, the stabilization issue was of paramount policy concern. In particular, whatever the nature of the shock that ultimately triggered the arrival of capital inflows, policymakers were concerned that such inflows would be associated with macroeconomic instability by causing an excessive expansion of aggregate demand (“overheating”).Footnote 6 The policy challenge in this case arises from the possibility of using domestic policies to stabilize aggregate demand and thus avoid such fluctuations. In Section 5, I consider the nature of the policy response to the problem of overheating.

For the purpose of analyzing those potential policy responses, it is useful to consider the mechanism through which capital inflows may result in macroeconomic overheating. Recall that capital inflows are endogenous variables, so we have to begin by specifying the shock that triggers them. Consider, then, a capital-inflow shock caused by a “push” factor such as a reduction in advanced-country interest rates or reduced global perceptions of risk.

The first point to make is that the effect of such a shock on aggregate demand depends on the exchange rate regime that is in place. Consider a simple Dornbusch-type model and hold the domestic money supply constant. In that context, a “push” shock that is associated with a capital inflow would result in an appreciation of the nominal (and real) exchange rate. Given the real appreciation, the domestic money and goods market can only be cleared simultaneously if the domestic interest rate falls and real output contracts on impact. The contractionary effect of the real appreciation must more than offset the expansionary effect of the lower domestic interest rate in the goods market, because if that were not the case the money market could not clear (given the money supply, a lower domestic interest rate and higher level of output would result in an excess demand for money).Footnote 7 Under fixed rates, however, the effect would be the opposite. It would result in macroeconomic overheating—i.e., an excessive expansion of aggregate demand, resulting in an increase in domestic inflation and an appreciation of the real exchange rate. The mechanism through which inflows could have this effect is as follows:

With a predetermined exchange rate, large capital inflows are likely to generate an overall balance of payments surplus. To avoid an appreciation of the nominal exchange rate, the central bank would have to intervene in the foreign exchange market to buy the excess supply of foreign currency at the prevailing exchange rate. Ceteris paribus, this would result in an expansion of the monetary base. Base expansion would lead to growth in broader monetary aggregates, which would fuel an expansion of aggregate demand. This, in turn, would put upward pressure on the domestic price level. With the nominal exchange rate fixed, rising domestic prices would imply a gradual appreciation of the real exchange rate. In short:

The standard mechanism just described would play out even with a well-functioning financial system. But a malfunctioning domestic financial system could further destabilize aggregate income by providing a mechanism for amplifying the effects of the macroeconomic expansion, for example through excessive aggregate credit creation or by misallocating credit to sectors (such as the stock market and real estate) that may be prone to asset-price bubbles, with attendant wealth effects that would magnify the macroeconomic boom.Footnote 8 Moreover, a weak financial sector can also magnify the boom through the actual or perceived constraints that it may impose on policies. For example, the central bank may be reluctant to combat the boom with tighter policies if it fears that the financial sector’s solvency could be impaired by the puncturing of an asset-price bubble.

4.3 Real Exchange Rate Appreciation

As indicated above, there is a tradeoff between macroeconomic overheating and real exchange rate appreciation, at least in the short run. While a sustained capital inflow would eventually result in an appreciation of the real exchange rate whether the exchange rate floats or is officially determined, the appreciation would materialize much more quickly under floating rates, since the nominal exchange rate is a “jump” variable in that case, while the price level tends to be predetermined (sticky). Reinhart and Reinhart (2008) indeed found that capital-inflow “bonanzas” tended to be associated with cumulative real exchange rate appreciation during the episode, and depreciation after.

The question is why real exchange rate appreciation should be a policy concern. There are at least three possible reasons:

-

First, the policy concern may arise purely out of political-economy considerations. Politically-powerful exporting and import-competing firms will find their profits squeezed by real exchange rate appreciation, and they are likely to exert pressure on policymakers to avoid this outcome. While this may be a legitimate concern for real-world policymakers, however, it is not a justifiable concern for a benevolent social planner.

-

What may be a more justifiable concern for a benevolent social planner is the likelihood that capital inflows and outflows would magnify volatility in the real exchange rate. The real exchange rate is a key macroeconomic relative price that guides the composition of domestic production and absorption between traded and nontraded goods. Volatility in this central relative price tends to obscure its sustainable equilibrium value and thus undermines the efficiency of resource allocation by creating a signal-extraction problem for domestic agents.

-

Finally, to the extent that inflow episodes prove persistent and the perceived sustainable value of the real exchange rate appreciates, the profitability of the domestic traded goods sector may be impaired, and resources will flow out of that sector. If the traded goods sector includes activities (such as manufacturing for export) that create a stream of positive production externalities, those activities should be subsidized. However, a sustained real exchange rate appreciation will have exactly the opposite effect on the profitability of such activities, moving resource allocation in precisely the wrong direction. In this case capital inflows could have harmful effects on the economy’s long-run growth rate.

For many emerging and developing economies, the last of these factors is likely to be the most important one, since many such countries have adopted export-oriented development strategies relying on a persistently depreciated real exchange rate to guide resources into the production of traded goods.

For that reason, it is worth examining the competitiveness argument a bit more critically. The question of what the effect of capital inflows may be on the profitability of the export sector is actually not well posed, because both capital inflows and export competitiveness are endogenous macroeconomic variables. Therefore the association between them will in general depend on the behavior of the factors that cause them to change. There are two issues: the source of the shock that triggers the capital inflow, and whether that shock is temporary or permanent (its expected duration).

Concerning the source of the shock, consider the case in which inflows are triggered by an improvement in domestic traded goods productivity. Even though the equilibrium real exchange rate will also appreciate in this case as the traded goods sector bids resources away from nontraded goods, thereby increasing the relative price of the latter, capital inflows are associated with an increase in traded goods competitiveness.

As to the duration of the shock, the usual presumption of reduced export competitiveness is based on the view that inflows are exogenous and long-lasting, like the Dutch disease phenomenon associated with an increased flow of revenue from exporting a natural resource. By analogy with Dutch Disease, then, we have the conclusion that the equilibrium real exchange rate must appreciate and, with unchanged productivity in the traded goods sector, its competitiveness must decline.

But this framework may be misleading in the case of capital inflows. If inflows are triggered by a transitory reduction in world interest rates, for example, then as indicated above, they will be associated with transitory fluctuations in the real exchange rate, of a magnitude that is likely to depend on the domestic exchange rate regime. In this case the effect on competitiveness depends on the effect of real exchange rate volatility on the traded goods sector. But even if inflows are triggered by a permanent reduction in world interest rates (say in the form of a lower country risk premium) those inflows and the associated real exchange rate appreciation must both nevertheless be transitory, lasting until international portfolios adjust. Indeed, in the long run the equilibrium response would be a real depreciation, to generate the trade surpluses required to service the increased stock of debt associated with the transitory inflows. If it is the longer-run trajectory of the real exchange rate that guides the allocation of irreversible investment between traded and nontraded goods, it is not clear how that allocation would be affected in either of these cases.

The bottom line is that while the volatility issue and the signal extraction problem that it creates may be important, it is less clear that inflows pose a policy challenge by undermining the long-run competitiveness of the export sector. The simple analysis with Dutch disease is unwarranted in the case of capital inflows.

4.4 Vulnerability

It is a stylized fact that many of the most important emerging-market currency crises in the 30 years that have elapsed since the 1981 Chilean crisis have been preceded by large capital-inflow episodes. This was certainly true not only in the 1982 Latin American debt crisis, but also in the 1994 Mexican crisis, the 1997 Asian crisis, the 1998 Russian crisis, and a variety of other less prominent ones. But the association between inflow episodes and subsequent crises is more general. Reinhart and Reinhart (2008) found, for example, that capital-inflow “bonanzas” are associated with a higher probability of financial crises in developing countries (the conditional probability of debt, banking, currency and high-inflation crises is higher in countries that have experienced such episodes than the unconditional probability), though the same is not true not for advanced countries.Footnote 9 They found that bonanza episodes end more often than not with a sudden stop, and the path of the current account tends to be V-shaped during such episodes, with a sharp increase in the current account deficit followed by a reversal at the end of the episode. Cardarelli et al. (2010) similarly found that of the 87 completed capital inflow episodes that they identified from 1987 to 2006, 34 ended with a sudden stop and 13 with a currency crisis. Caballero (2012) found that capital-inflow surge episodes were associated with subsequent banking crises, whether the surges were accompanied by lending booms or not. It is therefore not unreasonable to fear that inflows may be associated with enhanced vulnerability to subsequent costly capital outflows and crises.

Capital-flow reversals are likely to happen when creditors (foreign or domestic) come to believe that the value of their investment in the domestic economy is in danger of becoming impaired. In turn, this is likely when:

-

The exchange rate is perceived to be overvalued.

-

The domestic financial system is perceived to be fragile.

-

Fiscal solvency comes into question.

-

The public sector is highly illiquid.

The first three make outflows more likely, while the last makes a crisis more likely if there are outflows, and makes self-fulfilling crises more probable. The question is, why should such conditions be associated with a capital-inflow surge?

There are several channels through which such an association could emerge:

-

As already indicated, inflow episodes are likely to be associated with an appreciated real exchange rate and a current account deficit, both of which can be sustained only as long as the inflow episode lasts. If the episode is driven by a reversible external event (such as a reduction in advanced-country interest rates), then a reversal of that event could end the inflow episode, leaving an overvalued real exchange rate that the authorities may be reluctant to correct through a nominal devaluation (this was the case in Mexico in 1994, in Thailand in 1997, and in Russia in 1998, for example). The anticipation of a future real exchange rate depreciation would increase the domestic real interest rate, which together with the appreciated actual real exchange rate would contract aggregate demand and set the stage for a speculative attack.

-

To the extent that the malfunctioning domestic financial sector misallocates the external resources associated with the inflow, its solvency may be impaired by even a small negative shock to the economy, in which case such a shock could trigger “twin crises” in the domestic economy, consisting of a combination of banking and currency crises. This is particularly likely if the misallocation takes the form of excessive financing for bubble-prone sectors.

-

The inflow could create financing, either directly or indirectly through a boom-induced expansion in tax revenues, for an increase in government spending that may prove difficult to reverse when the inflow recedes, thereby raising doubts—which could potentially be self-fulfilling—about public sector solvency and culminate in a sovereign debt crisis. Reinhart and Reinhart (2008) indeed found that fiscal policy was procyclical during inflow episodes in developing countries. They reasoned that favorable output movements improved fiscal indicators and encouraged excessive credit-financed fiscal expansion. As a result, bonanzas systematically preceded sovereign default episodes.

The degree of vulnerability to any of these types of crises is not independent of the composition of capital inflows, for several reasons. First, there is a general perception that the composition of external liabilities affects the probability of capital-flow reversals because some types of flows are more prone to reversals than others. There is wide agreement on the “pecking order” of volatility among types of flows. From more to least volatile, this would be: foreign-currency debt, indexed domestic-currency debt, nonindexed domestic currency debt, portfolio equity, and FDI (Ostry et al. 2010). As shown in Section 1, FDI flows have indeed proven to be very stable in recent years, whereas portfolio flows and bank lending have tended to be relatively much more volatile.Footnote 10 Second, equity flows—whether FDI or portfolio—have risk-sharing and self-correcting characteristics that are not shared with debt flows, whether in the form of bonds or bank lending. When external liabilities take the form of equity, outflow episodes that depress equity prices place some of the cost on foreign shareholders, and rapid corrections in equity prices may discourage outflows by maintaining expected rates of return at competitive levels. Third, the currency composition of external liabilities also matters, since a large stock of external liabilities denominated in foreign exchange can impair the solvency of domestic agents in the event of an exchange rate depreciation if such agents do not possess a corresponding amount of foreign currency-denominated assets—i.e., if currency mismatches are important. From the perspective of vulnerability, therefore, the composition of a country’s stock of external liabilities makes a difference.

It also makes a difference how inflows are used by the recipient country. To the extent that inflows finance current account deficits driven by consumption booms or relatively illiquid investments, rather than reserve accumulation, the end of an inflow episode would require a current account adjustment. Such an adjustment may require a large real exchange rate depreciation. The expectation that such a depreciation may be in the offing, in turn, would make an outflow episode more likely, especially if large real exchange rate depreciations are expected to prove disruptive to domestic economic activity, making defaults by domestic agents on both their domestic and external financial obligations more likely.

Finally, vulnerability depends not just on the composition of inflows and their disposition, but also on the domestic macroeconomic environment in which the inflow episode takes place. Two factors that are of particular importance are the economy’s degree of both financial and real openness and the interest elasticity of its demand for money. Of these, the role of financial openness is easiest to see. The easier it is to move assets in or out of the economy, the larger the outflow episode that is likely to be associated with any given-sized incentive to move assets abroad. To the extent than an outflow episode requires a current account adjustment, on the other hand, the more closed the economy on the real side the larger the real exchange rate depreciation required to effect that adjustment, and therefore the more disruptive an outflow episode is likely to be. Finally, the more elastic the demand for money with respect to the rate of return on alternative assets, the larger an outflow episode is likely to be, because domestic residents will find it easier in this case to move to foreign assets by economizing on cash balances.

The upshot is that large capital inflows indeed have the potential to increase vulnerability to a variety of financial crisis events, whether currency, banking, or sovereign debt crises. To the extent that such crises have large costs in terms of domestic macroeconomic stability, they represent a legitimate cause for policy concern.

5 The Policy Response

Given these diverse policy challenges, it is not surprising that emerging and developing countries, confronted in recent years with new surges of capital inflows, have become concerned with formulating an appropriate policy response. But what do we know and not know about the effectiveness of alternative policies (and potential interactions among them) in order to deal with the challenges posed by capital inflows? This section presents an analytical survey of recent policy analyses.

The policy challenges described in the last section are intertwined. Some policy objectives are complementary. Most obviously, policies that succeed in avoiding inflow episodes or restricting their magnitudes would ameliorate all four potential problems that such inflows may create. But beyond this, there are other direct complementarities among these objectives. For example, policies designed to avoid immiserizing external borrowing may also be helpful in avoiding vulnerability by safeguarding the health of the domestic financial system. On the other hand, the policy response may also require making tradeoffs among competing objectives. The clearest of these may be that between avoiding real exchange rate appreciation and avoiding macroeconomic overheating.

5.1 Microeconomic and Financial-Sector Policies

In the presence of distortions that may result in immiserizing external borrowing, the first-best policy prescription is obviously to remove the relevant domestic distortions and allow the free inflow of capital. However, if the distortions that are in place cannot be removed, it may (but also may not) be preferable to restrict financial integration until the distortions are removed. This is the message from the 1980s “sequencing” literature, as mentioned above.Footnote 11 The reason it may not necessarily be preferable to do so is that if even the suboptimal return available in a distorted environment exceeds the marginal cost of external funds, the country may still be better off by borrowing abroad than by not doing so.

The most widely-discussed source of domestic microeconomic distortions and the most likely source of immiserizing external borrowing is the domestic financial system. The policy challenge in this case is the “structural” one of addressing the distortions responsible for the malfunctioning of the system. When the problem is moral hazard lending, the situation calls for appropriate prudential measures. Such measures include, for example, capital adequacy requirements, maximum loan-to-value ratios, sectoral limits on loan concentration, limits on foreign-currency lending to unhedged domestic borrowers, and asset classification and provisioning rules. These are standard prudential measures to prevent moral-hazard lending by the domestic financial system in the presence of asymmetric information and contract enforcement costs. Their absence or imperfect enforcement may create the distortions in the financial system that give rise to immiserizing external borrowing by encouraging excessively risky lending.

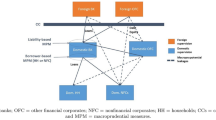

But such distortions may also have macroeconomic implications. Micro-prudential policies can interact with the macroeconomic policy challenge in at least two ways. First, capital inflow episodes may be caused by distortions in the domestic financial system that attract foreign capital. For example, government guarantees of bank liabilities without adequate regulatory and supervisory restrictions on bank lending may induce banks to raise interest rates on their liabilities to attract external capital for the purpose of moral hazard lending. In this case, the adoption of appropriate micro-prudential policies may ease the macro-level policy challenge by reducing the inflow pressure. Second, an inappropriate financial system regulatory environment may induce banks to undertake an excessive expansion of credit with the external funds that they receive from capital inflows attracted to the country for other reasons—e.g., due to reduced risk or lower interest rates abroad or because an improved domestic macro policy environment improves the country’s creditworthiness. In this case, the credit boom and likely associated asset-price bubbles may magnify both overheating and vulnerability challenges. Again, appropriate prudential policies, by mitigating credit booms, would help mitigate macroeconomic policy challenges. In this sense, Ostry and others (2011) note that capital inflow surges are often associated with credit booms and greater reliance on foreign exchange credit, but countries that make more extensive use of non-foreign exchange related prudential measures have a lower incidence of domestic credit booms. Prudential policies toward the financial system that are adopted primarily to deal with the macroeconomic challenges posed by capital inflows—either by reducing the scale of such inflows or by avoiding the magnification of their macroeconomic effects by the financial system—have recently come to be referred to as macroprudential policies.Footnote 12

The relationship between prudential and macroeconomic policies could also operate in the other direction—i.e., appropriate macro policies could help reduce the risks that large capital inflows pose to the financial system. An obvious example is that restrictions on capital inflows can prevent a distorted financial system from misallocating foreign funds, and in that manner serve as a partial substitute for prudential measures. Less obviously, purely macroeconomic distortions—such as an undervalued real exchange rate—may attract capital inflows to the domestic financial system at the same time that they cause a rapid expansion in the domestic economy. Because credit risks are more difficult to evaluate under boom conditions, the financial system’s balance sheet may expand at the same time that its asset quality deteriorates. In this case, macroeconomic measures to avoid overheating would also contribute to a less vulnerable domestic financial system.

5.2 Macroeconomic Policy Intervention: A Menu

The causal chain described in the last section linking capital inflows to overheating can be broken at various points by policy intervention. One useful way to organize the menu of policies available to the authorities to resist the emergence of overheating is thus according to where the intervention occurs along the chain of transmission described above. Accordingly, policy interventions can be classified as follows:

-

i.

Policies designed to restrict the net inflow of capital, either by restricting gross capital inflows or promoting gross capital outflows.

Such policies include the imposition of administrative or price-based restrictions on capital inflows as well as the elimination of a variety of restrictions on capital outflows. They may also include the widening of exchange rate bands with the intention of increasing uncertainty.

-

ii.

Policies that seek to restrict the net foreign exchange inflow (reserve accumulation) by encouraging a current account offset to a capital account surplus.

Trade liberalization and nominal exchange rate appreciation would have this effect. As indicated above, in the limit (fully floating exchange rates), the latter could avoid any foreign exchange accumulation whatsoever.

-

iii.

Policies that accept the reserve accumulation associated with a balance of payments surplus, but attempt to ameliorate its effects on the monetary base.

These amount to sterilized intervention, as well as attempts to limit recourse to the central bank’s discount window.

-

iv.

Policies that accept an increase in the base, but attempt to restrain its effects on broader monetary aggregates.

Increases in reserve requirements and quantitative credit restrictions are examples of such policies.

-

v.

Policies that accept a monetary expansion, but attempt to offset expansionary effects on aggregate demand that could result in inflation and/or real exchange rate appreciation.

This refers essentially to fiscal contraction.

5.3 Individual Policies: Pros and Cons

5.3.1 Restrictions on the Magnitude of Gross Inflows and the Promotion of Outflows

The key requirement for capital account restrictions to improve welfare on microeconomic grounds is the presence of a distortion that creates an excessive level of foreign borrowing, either in the aggregate or in specific forms. This creates a first-best case for capital account restrictions (in the sense that imposing such restrictions could move the economy to a Pareto optimum). Such a situation could arise, for example, when the act of foreign borrowing itself creates externalities. If the costs of servicing an international loan contract are shared by domestic agents other than the borrowing agent, then individual acts of foreign borrowing have negative external effects in the domestic economy. Since individual domestic agents do not internalize such effects, they will tend to overborrow. The traditional formulation takes the form of an upward-sloping supply of funds schedule for the domestic economy as a whole (domestic borrowers face a risk premium that is an increasing function of the country’s total stock of external debt, as in Harberger 1980). A more recent application, however, takes the form of the “new theory” of capital controls: when individual domestic borrowers do not internalize the effects of their actions on an economy’s aggregate financial fragility they also tend to overborrow, either in total or in specific forms (Jeanne et al. 2012).

A potential second-best case for such restrictions (in which they improve welfare, without reaching a Pareto optimum) emerges when the negative welfare consequences of a new or preexisting domestic distortion that cannot be removed are magnified by external borrowing. As discussed previously, distortions in the domestic financial system, for example, may cause resources borrowed from abroad to be allocated in socially unproductive ways within the domestic economy. The first-best solution is to address those distortions directly, but if the distortions causing the problem cannot be removed, a second-best option may be to limit foreign borrowing.Footnote 13

Cottarelli et al. (2010) maintain that there is a contrast between the 1990s and 2000s capital-inflow episodes in the use of this policy instrument. They argue that inflow restrictions tended to be tightened during the episode of the 1990s, but not during the most recent episode. Indeed, they suggest that such restrictions appear to have been eased during the most recent episode. Nonetheless, that does not mean that inflow restrictions have not been used during recent inflow episodes. Brazil introduced a 2 % tax on inflows other than FDI in October 2009, and increased it to 6 % on portfolio bond flows a year later. In November 2009 Taiwan implemented a ban on capital inflows for time deposits, while Korea introduced a variety of inflow restrictions in June of 2010. Indonesia enacted a 1-month minimum holding period for SBIs (a local-currency security issued by the central bank), and Thailand removed an exemption for foreigners on a 15 % withholding tax on income earned from domestic bonds.

An important concern is whether such restrictions—whether imposed on microeconomic or macroeconomic grounds—can be made effective. In other words, is financial integration a choice in an operational sense? If so, is it a once-and-for-all choice? In particular, can capital account restrictions be fine-tuned in response to external pressures (as countries such as Brazil, Chile, Colombia and others tried to do in the 1990s, and as several EMEs have done more recently)? There is a longstanding and large literature addressing these issues, but unfortunately, it has proven to be inconclusive.

Testing the efficacy of controls is complicated by the fact that it is likely to depend on a wide range of factors, including whether controls are imposed on inflows or outflows, whether controls have been imposed previously, whether their coverage is comprehensive or partial, and a host of other considerations. Some have argued, for example, that as trade expands and financial markets develop, and financial institutions increase their cross-border activities, capital controls are likely to become less effective. The upshot is that the effectiveness of controls is likely to differ both across countries as well as over time, making it difficult to draw general conclusions.Footnote 14

What, then, do we know about whether macro-level (non-prudential) capital account restrictions work? The literature on this subject is vast, but unfortunately not tremendously informative. The conventional wisdom has several parts:

-

a.

Restrictions are more effective in the context of countries, like China or India, that have never opened up their capital accounts. Controls that are put on and taken off repeatedly are likely to be ineffective, because once agents learn how to avoid them, their re-imposition may be of little consequence: once the genie is out of the bottle, it is hard to put it back in (see Klein 2012, who provides empirical evidence that this is indeed the case). But some countries, such as Malaysia, seem to be able to make restrictions work.

-

b.

Restrictions on inflows are more likely to be effective than those on outflows—possibly because when they arise, return differentials motivating outflows tend to be much larger than those motivating inflows (see Edison and Reinhart 2001).

-

c.

Countries that trade more extensively with the rest of the world, that have larger stocks of FDI, or that have more highly developed domestic financial systems, find it more difficult to impose restrictions on capital flows. More trade creates more opportunity for evasion through over- or under-invoicing. More FDI creates more evasion opportunities through transfer pricing, and more sophisticated financial systems provide a broader variety of instruments through which to channel capital flows, making it more difficult to restrict them (see Jeanne et al. 2012).

-

d.

Controls are more likely to be effective the more comprehensive they are, because less comprehensive controls allow restrictions to be evaded by simply re-labeling flows.

-

e.

Capital account restrictions of any kind tend to be more effective in the short run than in the long run, because economic agents learn how to avoid them over time. The short run may be as short as 6 months.

-

f.

Finally, capital-account restrictions may be more effective in altering the composition of flows (especially toward the longer end of the maturity spectrum) than their total magnitude (every survey of the effectiveness of capital account restrictions that I know of reaches this conclusion).

Unfortunately, the empirical support for these views is less than overwhelming. There are a large number of country studies—especially on emerging economies such as Brazil, Chile, and Colombia that imposed inflow restrictions during the 1990s—that employ questionable methodologies and often reach conflicting conclusions.Footnote 15

There are few multi-country studies that would allow us to derive more general results. One such study is Montiel and Reinhart (1999). Montiel and Reinhart estimated a set of fixed-effects panel regressions explaining the volume and composition of various types of capital inflows for a set of 15 EMEs during the 1990s as a function of the severity of capital account restrictions while controlling for a variety of other variables, including domestic financial development, the intensity of sterilization and various International interest rates. They found that U.S. interest rates significantly influenced the overall volume of flows and that foreign interest rates had the most significant effect on portfolio flows. An intensification in the degree of monetary sterilization was associated with an increase in the volume of aggregate capital flows as well as with a substantial change in the composition of inflows away from FDI and toward short-term flows. The coefficients on their capital control variable (coded subjectively based on the perceived intensity of such restrictions) were consistently of the right sign, with negative effects on all but FDI flows (which have typically been exempt from such restrictions). However, all the relevant coefficients were measured with a relatively low level of precision. On the other hand, controls were associated with a significantly lower share of short-term flows and portfolio flows—the two components of the capital account targeted by the measures in the sample countries—and a higher share of FDI. They concluded that explicit capital inflow restrictions and “prudential measures” (usually limiting banks’ foreign exchange transactions or foreign exchange exposure) appeared to be more effective in altering the composition of capital inflows rather than reducing their overall magnitude.

More recently, Ostry and others (2010) found that countries with capital controls have a less crisis-prone external liability structure (less debt relative to equity), countries with capital controls and foreign exchange–related prudential regulations have a lower reliance on foreign exchange lending, and countries with capital controls and foreign exchange-based regulations have greater growth resilience during a sudden-stop episode.Footnote 16