Abstract

Most nations are predominately preoccupied with the need to increase economic growth amidst pressure for increased energy consumption. However, higher energy consumption from fossil fuel has its environmental implication(s) especially in a high industrial economy like China. In this context, the current study explores the interaction between pollutant emission, foreign direct investment, energy consumption, tourism arrival, and economic growth for quarterly frequency data from 1995Q1 to 2016Q4 for econometrics analysis. Pesaran’s autoregressive distributed lag–bound test traces long-run relationship between all outlined variables over the investigated period. Empirical results show positive relationship between pollutant emissions with all other variables with the exception of economic growth. This further exposes the environmental degradation in China with the curtailing strength from the GDP. The Granger causality analysis detects that CO2 emissions and energy consumption show a two-way causality observed. Also, one-way causality existing between growth and foreign direct investment is seen running to pollutant emission. Furthermore, one-way causality is observed among foreign direct investment, energy consumption, pollutant emission, and tourism arrivals with economic growth, and this established their impact on the economic growth which will be a guide to the policy implication on how to ameliorate environmental degradation from the effect of consumption of fossil energy sources and foreign direct investment–induced pollutant emission.

Similar content being viewed by others

Explore related subjects

Discover the latest articles, news and stories from top researchers in related subjects.Avoid common mistakes on your manuscript.

Introduction

The manufacturing sector and activities of foreign direct investment (FDI) are considered a key determinant of economic growth in China (Yabuki 2018). In addition, industrial activities in China have been identified as the mainstream contributor to the Chinese economy output. FDI is among the contributing factors in the expansion of industrial sector in China through the mobilization of foreign resources via offshore or transferring of manufacturing activities from foreign countries—especially developed countries to China. Hence, Khan and Kim (1999) argued in favor of fostering manufacturing benefits needing the backings of foreign resources, which is considered a very essential element for the advancement of the manufacturing sector. The expansion in industrial sector via manufacturing activities leads to high-energy consumption demand, and this is among the main causes of pollutant emissions (Shahbaz et al. 2015a, b, c). However, this revelation has its implication on the economic growth trajectory and environment at large. Further, FDI inflow to China could impact carbon dioxide (CO2) emission through scale, technique, and structure effects (Bakhsh et al. 2017).

Energy utilization has been increased with the shifting of the global economic activities into offshore production of goods and commerce. China in particular has attained a laudable economic advancement over the earlier three decades of reform and liberalization. China’s growth has moved from below 6% to more than 60% approximately (Zhang 2018). This rocket speed–like in economic advancement without full attention from the government side as regards the environmental effect has placed the country in a position to face some severe environmental degradation. Apart from its impact to global climatic changes, China is also one of the global leaders in other forms of emissions that constitute pollution, considering its huge populace coupled with its determination to grow into the next global commercial-recognized nation. Recent statistics from the World Health Organization (WHO) show that pollution emissions in China far surpass global ecological criteria (Atapattu and Schapper 2019). This position is further reiterated in a recent study (Liu and Bae 2018): the air in some Chinese regions encompasses much larger gas emissions with ability to be stored in human lungs and causes series of well-being issues. This is aggravated by China’s coal use, a major source of global CO2 emissions which should double anytime in the year 2020, while the country’s overall CO2 emissions would double around 2030 (Davidson et al. 2016). Thus, this is a clear indication that Chinese energy consumption is among the global environmental threats, hence calls for a check.

Several developed and emerging economies are asserting desired efforts to limit and, if possible, to overcome the difficulties of enlarged environmental pollution: as outlined by Sy et al. (2016), ecological complications are delicate zones of great concern not only for the municipal but also in terms of monetary policies. Reducing the demagogic harms of the CO2 emission to the universal climatic variation has been among the global fight (Tamazian and Rao 2010). China is the world’s largest emitter of carbon dioxide after the USA, and the country is under massive pressure in international climate change negotiations (Clémençon 2016).

On the premise highlighted, the inconclusive debate in the literature is worthy of re-investigation on the linkage between the carbon-income function while considering the pivotal role of FDI and energy consumption in the Chinese context (Omri and Kahouli 2014; Shahbaz et al. 2015a, b, c). The present study seeks to complement and add to the existing literature by reinvestigating the relationship among the FDI, tourism arrival, and energy consumption and their effects on pollutant emission. Is there truly any meaningful relationship between FDI and carbon emission via energy consumption?

The rest of the study is organized as follows: the “Literature review” section presents the review of related literature on the nexus among the selected variables. “Data and methodology” provides the data, theoretical backgrounds, and methodology. “Empirical results and discussion” shows the empirical results, interpretations, discussion, and diagnostic tests. Finally, “Conclusions and policy implications” gives conclusions and policy implications.

Literature review

The section focuses on review of previous studies.

Studies analyzing the relationship between FDI and energy consumption

Several studies on the relationship between FDI and energy consumption have been documented in the energy economics literature. Paramati et al. (2017) investigated the relationship between financing clean energy projects through domestic and foreign capital. They found a significant positive association between FDI and energy consumption over the investigated period. This is also affirmed by Sbia et al. (2014), where a significant positive association between FDI and economic growth with regard to energy savings capacity in the UAE is shown. Narayan and Doytch (2017) revealed a positive association among energy consumption and FDI. Furthermore, Lee and Brahmasrene (2013) using a 3-stage model found a positive relationship among the FDI, CO2, and energy consumption for selected European member countries. In addition to the already-mentioned studies, several other papers affirmed the positive relationship between FDI and energy. Omri and Kahouli (2014) found a positive connection between FDI and energy consumption, while Zaman et al. (2012) found a positive correlation between FDI and energy. Khatun and Ahamad (2015) in their causal work in Bangladesh found FDI to have a positive relationship with energy use. Also, Kuo et al. (2012) explored the connection among FDI, energy consumption, and economic growth between 1978 and 2010 showing a feedback transmission between the energy consumption and FDI. On the contrary, Elliot and Maier (2013) demonstrated in a panel study for China a significant negative association between FDI and energy consumption by using dynamic panel data estimators.

Studies analyzing the relationship among FDI and CO2

The studies of the linkage between FDI and the ecological greenhouse gasses proxy as CO2 have occupied much space and still on going in the energy-environment literature. Shahbaz et al. (2015a, b, c) studied a panel of 110 industrialized and emerging economies and show a positive association between the FDI and the environmental degradation, indicating that FDI surges CO2 emissions. Pazienza (2015) researched on OECD countries, seeing the link between FDI and the environment with focus on how FDI inflows to the “agriculture and fishing” segment increase CO2 emission level; the results suggest a negative relationship between FDI and CO2. Blanco et al. (2013) showed that FDI arrivals in pollution-prone firms could be connected to upsurge in ecological dilapidation via CO2 emissions per capita and GDP. Omri et al. (2014) revealed that FDI inflows raise the CO2 emissions by about 0.19%. In addition, Ajide and Adeniyi (2010) established the positive link between FDI in terms of oil exploration and CO2 emissions for Nigeria. On the other hand, Talukdar and Meisner (2001) noticed a negative significant relationship between FDI from the industrialized nations and CO2 emissions.

Studies analyzing the relationship between CO2 and energy consumption

Magazzino and Cerulli (2019) analyzed the determinants of CO2 emissions in the MENA countries through a Responsiveness Scores approach. Balsalobre-Lorente et al. (2018) investigated the carbon-income nexus on how economic growth, renewable electricity, and natural resources contribute to CO2 emissions effect on selected EU countries. The study found a positive linkage between energy consumption and carbon emissions. Bekun et al. (2019) for EU-16 found a one-way transmission from energy use to carbon emissions. Magazzino (2017) explored the relationship among economic growth, CO2 emissions, and energy use in the APEC countries with a panel VAR approach. Nasir et al. (2011) applied Johansen cointegration approach and found quadratic relation between carbon emission and GDP, hence confirming the EKC hypothesis for Pakistan. Zhang and Cheng (2009) on Chinese pollution showed evidence of economic activities contributing towards carbon emissions and GDP growth. Ahmed and Long (2012) did a work on Pakistan and came up with a proof that some amount of carbon emissions is caused by economic development which is anchored on energy utilization in Pakistan. Magazzino (2015) analyzed the link among economic growth, CO2 emissions, and energy use in Israel. Sheinbaum-Pardo et al. (2012) analyzing Mexican manufacturing industries found the relationship between energy intensity and the CO2 to be negative in all the small sectors. Lean and Smith (2009) investigated the nexus association amid the CO2 emissions and energy consumption through a cross-sectional estimation for five ASEAN countries, finding a statistical significant positive relationship between energy consumption and emissions. Menyah and Wolde-Rufael (2010) established a positive outcome of CO2 emission on energy use. Also, Niu et al. (2011) found positive association between energy consumption and CO2 emission in 8 ASEAN countries. Arouri et al. (2012) in a panel work on the 12 emerging countries found positive substantial effects of energy use on CO2 emissions.

Studies analyzing the relationship between CO2 and GDP

Magazzino (2016) presents results on the relationship between CO2 emissions, energy consumption, and economic growth in Italy. Halicioglu (2009) applied bound testing cointegration approach for the study of Turkey and found a bi-directional Granger causality between carbon emission and income in Turkey. Han and Lee (2013) established an inverse link between economic growth and CO2 emissions for G-20 nations. On the other hand, examining the direct impact of GDP on CO2 emission, he found a positive relationship between GDP and CO2 emissions. Twerefou et al. (2016) investigated the nexus between GDP and pollutant emission in Ghana and found a negative linkage with CO2 emissions inferring the improve value of the ecology. Sharma et al. (2011) established a positive effect of financial growth on CO2 emissions. Also, Omotor (2016) established a positive relationship among GDP and the atmosphere in his study on ECOWAS nations. Boopen and Vinesh (2011) established a negative association between GDP and CO2. However, Acharya et al. (2009) stated that FDI has a positive impact on the CO2 emissions via production increase, suggesting that a positive relationship exists between GDP and CO2 emission.

Studies analyzing the relationship between tourism and environment

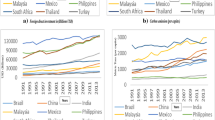

Bojanic and Warnick (2019) examined the impact of the level of tourism on greenhouse gas (GHG) emissions on a global level using WDI panel data from 1995 to 2016 (Fig. 3 in the Appendix). The findings indicate that the level of tourism does have an impact on GHG emissions. Danish and Wang (2018) investigated the dynamic relationship between tourism, economic growth, and CO2 emissions from 1995 to 2014 in the context of BRICS economies. Empirical findings suggest that tourism sector significantly encourages economic growth; however, tourism degrades the quality of the environment. Butler (2000) reviewed key elements of the relationship between tourism and the environment, with particular reference to the environmental impacts of tourism from a geographical perspective, highlighting that disproportionate attention has been given to research on recreation and its relationship with the environment compared with tourism and that this needs to be corrected in the future.

Data and methodology

The current study uses annual time series data. To this end, the selected variables are tourism (in amount of arrivals), gross domestic product (constant 2010 in US$), CO2 emissions from solid fuel consumption (kt), foreign direct investment (FDI) net inflows, energy use (in kg of oil equivalent per capita)Footnote 1, and urban population. All the variables are sourced from the World Bank Development Database (2018) and have been transformed into logarithmic form.

Theoretical framework

The present paper is built on a hypothetical framework to conceptualize the association among the carbon dioxide, energy consumption, and offshore intensity activities. The current study adopts the Ehrlich and Holdren (1972) IPAT framework. The IPAT model established that the per capita CO2 hinges on know-how technology and GDP per income. The basic conceptual structure is stated as follows:

where y1t= l1t/P1t and y1t is the per capita pollution emissions impact. A1t stands for prosperity which is expressed by GDP per capita; T1t stands for technology.

Technology is hard to estimate in a concise manner. Nevertheless, other investigations such as Javorcik and Spatareanu (2008) and Keller (2004) stated that when investment flourishes, it provides both ground for capital formation for firms and technological improvement via spillover effect. Likewise, Hübler and Keller (2010) studied the prevailing works and noticed that more active machineries of outside producers can as well lead to an energy-subsidizing technique impact via expertise handover. Hence, technology can be measured with FDI. To our knowledge, few studies (Shahbaz et al. 2014; Pazienza 2015; Omri et al. 2014; Talukdar and Meisner 2001; Ajide and Adeniyi 2010) have researched the effect of FDI or have considered it as an important influence of ecological value.

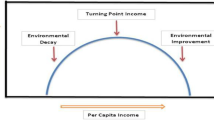

A shift from the traditional environmental Kuznets curve (EKC) theory where the association between GDP and environmental degradation is determined with either U- or N-shaped pattern proves that it can be studied empirically employing altered measures of environmental qualities. A good example is the study of Mazzanti and Montini (2010) who applied the basic EKC to analyze indigenous emissions and international emissions (Mazzanti et al. 2010). Furthermore, Galli (1998), Hübler and Keller (2010), and Sadorsky (2011) utilized the EKC in analyzing energy consumption effect on income per capita. Altering the basic EKC theory where income remains the only independent variable, Selden and Song (1994) expose that all the relationships of GDP per capital are not tangible. Initial works applying the EKC method did not acknowledge the problem that the order I(1) of square of a joined method is non-stationary (Cheng et al. 2014). Hence, it is out of place for the framework to employ GDP per capita in its squared form when it is a joined process. Like in the manner of Wagner (2008) who opined that at most one of GDP per capita and its doubled term can be a combined procedure (i.e., when income per capita is a joined process), this study considered only one income per capita in its methodology. The model is specified as follows:

where y1t is measured by carbon dioxide emission, GDP denotes per capita GDP of Chinese economy, TA represents tourism arrival, FDI represents foreign direct investment, which captured and reflects a technology impact and accounts for offshore industrial and commercial practices that induce high energy use which is capable of prompting high emissions of CO2, EU denotes energy use, and POP stands for population.

Stationarity tests

The phenomenon of the interruptions and shocks in the social-political and financial activities in most countries has brought about the assumption that most yearly single-country data are non-stationary. For this, the time series analysis calls for the estimation of the stationarity of the variables chosen in the study to eliminate error in estimations and spurious results from any estimate. In consideration of the model in our work, the stationarity and unit root of the variables have been tested and a mixed order of integration is confirmed. Among these tests are the augmented Dickey and Fuller (ADF 1979), the Leybourne (1995), the Dickey and Fuller generalized least squares (DF-GLS), the Elliott et al. (ERS 1996), the Phillips and Perron (PP 1988), the Kapetanios et al. (KSSUR 2003), the Kapetanios and Shin (KSUR 2008), the Ng-Perron (NP, 2001), and the Kwiatkowski et al. (KPSS 1992) tests.

ARDL-bound testing approach

In a guest for a well-fitted model specification and for the avoidance of the likelihood of arriving at misleading or spurious estimations, the current study considered autoregressive distributed lag (ARDL) approach more suitable for the analyses with emphasis on the output of the unit root test from different techniques for robust check. Adopting Pesaran et al. (2001), we considered ARDL a suitable technique for this analysis with the presence of mixture of order of integration from the unit root test.

The econometric arrangement of ARDL can be inscribed as follows:

where CO2 represents the log of carbon dioxide emission, GDP is the log of GDP, TA is the log of tourism arrival, FDI is the log of foreign direct investment, EU is the log of energy use, POP is the log of population, and ∈t is the error term. This model is further expressed and specified into more advanced ARDL models, which are ARDL long-path and short-path techniques. The two models captured the associations that exist among the CO2, GDP, tourism arrivals, FDI, energy use, and population in two separate equations, thus

where the parameters in Eq. (4) denote long-run coefficients, while in Eq. (5), a1, aj, ak, al, am, and an are the short-run coefficients. Δ and ECMt − 1 signify the first differences of variables and the promptness of correction over the long-run, respectively. More expansion of the ARDL exploration was done by testing the long path associations among the chosen variables by means of bound testing approach. We ascertained the long-run cointegration by relating the lower I(0) and upper I(1) boundaries with F and T statistics. If the F or T statistics is more than the lower and upper limits, it displays the existence of long path association, and vice versa.

Empirical results and discussion

Table 1 presents both the measure of central tendency and dispersion of the variables under consideration. The basic measure of location shows the economic growth (GDP) has the highest average while pollutant emission (CO2) displays the lowest means over the sample period. All examined series reveals high dispersion from their mean as reported by the standard deviation (SD). GDP, FDI, TA, and POP show negative skewness, while pollutant emission and energy consumption reveal a positive skewness. Moreover, the interquartile range shows high deviation of all series between the first quantile and third quantile.

Subsequently, the need to investigate the stationarity properties of the variables is crucial. This is in order to avoid the pitfall of spurious analysis. Table 2 renders a battery of unit root and stationarity tests of the series. All the series are I(1): in fact, the levels of our selected variables are non-stationary, while the first differences are stationary. This supports the need for the ARDL test that is reported in Table 3.

From Table 3, we found cointegration equation for the current study with CO2 as a dependent variable to have maintained 2.3% promptness of correction to the long-run stability pathway via the effect of TA, GDP, FDI, EU, and POP on a quarterly instance. The outcome affirms the positive significant relationship among CO2 and all the variables with the exception of GDP which depicts negatively significant relationship in both the short run and the long run. This means that the underlying variables (FDI, tourism arrivals, POP (− 1), and EU) impact favorably and significantly to the amount of CO2 emissions in China. The outcome displays the long-run elasticity of CO2 in respect to tourism arrival, POP (− 1), EU, and FDI is positive and significant. Hence, a 1% increase in tourism arrival induces the rise in CO2 emissions at 0.4%, and a 1% in GDP will lead to − 0.118 CO2 emission in the long run. This means that economic growth of China moderates carbon emissions which can be a pointer in framing a lasting policy to tackle the pollutant emission in China. This finding supports the findings of negative relationship between economic growth and pollution for developing countries in the work of Sarkodie and Strezov (2019) and Emir and Bekun (2019) in their work in Romania. A 1% increase in energy use will amount to 0.3% of CO2 emissions. This suggests that the energy consumption induces the CO2 emissions of China as expected; no doubt the high offshore economic activities in China go with high energy intensity which will definitely lead to environmental impact; this is in affirmative with the discoveries of Bekun et al. (2019) in their study on 16 EU countries, Alola et al. (2019) in their work on large economies of Europe, and Akadiri et al. (2019). Also, 1% upsurge of FDI will cause 0.3% rise in CO2 emissions in China. This finding is in consonance with the findings of Saboori et al. (2012) for Malaysia and Fei et al. (2011) for China. This finding also supports the works of Sarkodie and Strezov (2019) that validated pollution haven hypothesis for China and Alola et al. (2019) in their work on large economies of Europe. Again, the population portrays a broken trending pattern of relationship with the pollution in China. At first, it was a negatively significant relationship with pollution but changes to positive relationship in lag 1. One percent upsurge of POP will cause − 3.8% in CO2 emissions in China, but in lag 1, the pattern changed to 4.6% rise in CO2. This should not come or be seen as a surprising pattern; it flows with Chinese population control. Furthermore, Chinese pollutant emissions have little or no correlation with the population. This is backed by the observation of Wang et al. (2010) on Chinese energy consumption, pollution, and population. Hence, the negatively significant relationship exhibited between the CO2 and GDP is a clear indication that economic growth via outsourced industrial and manufacturing activities enhances efficient management of carbon emission in China. In addition, a positive significant association found amid the CO2 and energy use is expected following the speed of coal engagement in energy generating via the industrial activities in China. China is seen competing favorably with other developed countries following its speed of attracting outsourced industrial and manufacturing activities (in terms FDI) from other countries. This amounts to heavy energy consumption in China to keep up with the steady increase of economic activities in the country. No doubt, this trend of accelerated good economic performance and growth of China can be ascribed to the accommodation of the outsourced economic activities from other nations like the UK and the USA to China. This is a pointer to the correlation or nexus causality that exists among energy consumption, GDP, and CO2 emission. This result exposes the implication of different policies in the economic activities and performance of China’s economy towards the inducement of the CO2 emissions in the country. It portrays the different policies responsible to the inducement of CO2 emissions in China; hence, policy implication should be channeled towards the sustainable management of the policies to reduce the rate of environmental pollution. This is in support with Cui (2016) who suggested from his discoveries that China still encourages economic advancement through a loose policy towards checkmating the excesses of foreign investors at the price of great energy utilization and significantly ecological pollution.

Causality tests

The orthodox linear estimation does not show a direct and perfect transmission and feedback (i.e., causation among the selected variables) notwithstanding the cointegration engaged by the authors with the ARDL-bound style establishing the existence of causality. This is inadequate in defining the path of the causality or feedback and transmission. This is what led to the authors’ choice of advancing their estimation for causation and the direction of the selected variables with Granger causality.

The theoretical view of Granger causality is captured with the Gregory and Hansen (1996) approach. This model is a two-sage approximation procedure, in which the first step is to evaluate the following regression expression:

where W1t and W2t are of I(1) and W2t is a variable or a set of variables. ΔUt(λ) = 1 for t > Tλ; otherwise, ΔUt(λ) = 0; λ = TB/T signifies the place where the structural break lies; T remains the sample size; TB is the date when the structural break occurred. The second step is to test if ET in Eq. (4) is of I(0) or I(1) via ADF technique. If ET is found to be consistent with I(1), it will be assumed that cointegration exists between W1t and W2t. Once the numerical property of ET is confirmed, one can implement the bivariate VAR approach to exam the Granger causality. Again, if the cointegration is found between W1t and W2t, an error correction term is required in analysis of Granger causality which is revealed as:

where δ1 and δ2 account for the speed of adjustment. As shown by Engle and Granger (1987), the existence of the cointegration implies a causality among the set of variables as shown by [δ1] + [δ2] > 0. Failing to reject the null hypothesis (H0): a21 = a22 = . . …a2k = 0 and δ1 = 0 implies that CO2 does not Granger cause GDP or other variables, while failing to reject (H0): β11 = β12 = . . …β1k = 0 and δ2 = 0 shows that GDP and other variables Granger cause CO2. Hence, to test whether CO2 Granger causes GDP and other variables, we examined the null hypothesis (H0): a21 = a22 = . . …a2k = 0 and δ1 = 0. Conversely, to test if GDP or other variables Granger cause CO2, we examined (H0): β11 = β12 = . . …β1k = 0 and δ2 = 0. We noticed that adding the error correction terms does not change the lead-lag relationship.

For the uniformity in the outcomes that transmissions and feedbacks occur among the selected variables, we use the pairwise Granger causality test, which also assists as a healthy confirmation of the discoveries from the error correction test.

Table 4 presents the results of causality tests. The results give support to the outcomes of the different models from the ARDL-bound method. The outcome exposed a one-way causal relationship passing from GDP to TA; a unidirectional causality is observed running from FDI to GDP, from GDP to EU, from GDP to CO2, from TA to CO2, and from EU to CO2. This is confirmed from the ARDL-bound estimation that China’s GDP advancement is centered on energy and FDI-enhanced growth, hence the feedback from FDI to both energy and growth, and GDP influencing CO2 favorably. Consequently, there is a feedback causality or nexus between energy and environmental pollution. This is a clear-cut validation of a trade-off of environmental quality dilapidations with emphasis on the heavy energy consumption and intensity resulting from outsourced or foreign economic (FDI) events in China emanating from the manufacturing and commercial sectors. The outcomes are in support with other related studies in this area such as Udemba et al. (2019) for Indonesia, Balsalobre-Lorente et al. (2018) for 5 EU countries, Bekun et al. (2019) for 16 EU countries, and Alola et al. (2019) for some European states.

Diagnostic tests

A diagnostic test was done to check the stability of the analyses and to confirm if the estimations are breached in any form, and be certain that our study is void of any form of erroneous approximation or error in estimation, which will finally lead to a false result. We tested for the stability and the reliability of the estimated ARDL models, with both cumulative sum and squared tests. Following Brown et al. (1975), we adopted (a) cumulative sum (CUSUM) tests and (b) cumulative sum of square test on residuals of the model. The test evidently revealed that the firmness of the coefficients over the explored time was confirmed. Okunola (2016) is of the view that if the design of the blue line drives outer the area of 5% critical line, enclosed with red line, it shows that the coefficients are unstable. Thus, the outcomes obtained in Figs. 1 and 2 specify that at the 5% significant level for the functional model in this study, parameters and variance are stable in both CUSUM and CUSM square tests (see Figs. 1 and 2 for graphical schematic).

Conclusions and policy implications

The present study investigates the interacting force between carbon emissions and FDI intensive activities as it concerns China with its environmental impact. Attention is paid to the nexus among CO2 emissions, FDI, EU, and tourism arrivals, which displayed the interwoven connections that exist among the selected variables, and this is designed towards exposing how these variables affect the environmental quality of China. The ARDL-bound estimate affirms that long path association exists between CO2 emissions and other outlined variables. In fact, empirical results show that CO2 emissions have a positive association with the chosen variables (energy consumption, FDI, and population) except GDP, and this contributes to intense CO2 emissions, which we consider as the subcontracted CO2 emission in China via FDI. This validates pollution haven hypothesis in China, consistent with the findings of Cole and Elliott (2003) and Shahbaz et al. (2015a, b, c). Furthermore, we found from causality tests feedback causal association among energy consumption and CO2. Moreover, we found that FDI, energy use, CO2, and tourism arrivals have one-way link with GDP. These findings are in line with Shahbaz et al. (2013) and Aceleanu et al. (2017).

In addition, the outcomes in our research confirm the consequence of high-energy consumption that is encouraged from both subcontracted industrial events (FDI) and tourism arrivals. This backs the outcomes from Saboori et al. (2012) for Malaysia and Fei et al. (2011) for China. This finding also support the conclusion of Cui (2016), who reaffirmed that China still encourages GDP advancement at the price of great energy intensity and deeply ecological pollution.

The policy inference of China should consider carbon emissions as environmental threats and deviate from high carbon economy to low carbon economy without much disruption of GDP advancement, also moving away from heavy coal-demanding energy consumption to a cleaner renewable energy that has the ability to promote cleaner system and environment. Moreover, more determination must be made in deviating from coal-enhanced energy source to more controllable energy sources (e.g., wind or solar power) in reducing high CO2 production. A policy to lessen the degree of the tropical deforestation and encourage the manufacturing of automobiles with fuel economy is needed, and even adopting the solar energy using motors needs to be among the strategies in place. Thus, China should regulate FDI and tourism events with environment-friendly policies, which will reduce the CO2 emissions in the country and sustain the good performance of the economy. In addition, considering the association that occurs between energy use and economic activities, it is a clear evidence that CO2 emissions will surely follow in the cycle which will be the last result of the entire process and this is detrimental to the quality of environment. This calls for the attention of the Chinese authorities over the financial and industrial events in the state while building the strategy framework.

Conclusively, China should represent a major player in promoting economic growth with full energy consumption, supporting energy saving and atmosphere protection.

References

Aceleanu MI, Șerban AC, Pociovălișteanu DM, Dimian GC (2017) Renewable energy: a way for a sustainable development in Romania. Energy Sources B Econ Plan Policy 12(11):958–963

Acharya B, Dutta A, Basu P (2009) Chemical-looping gasification of biomass for hydrogen-enriched gas production with in-process carbon dioxide capture. Energy Fuel 23(10):5077–5083

Ajide KB, Adeniyi O (2010) FDI and the environment in developing economies: evidence from Nigeria. Environ Res J 4(4):291–297

Akadiri SS, Alkawfi MM, Uğural S, Akadiri AC (2019) Towards achieving environmental sustainability target in Italy. The role of energy, real income and globalization. Sci Total Environ 1–13

Alola AA, Yalçiner K, Alola UV, Saint Akadiri S (2019) The role of renewable energy, immigration and real income in environmental sustainability target. Evidence from Europe largest states. Sci Total Environ 674:307–315

Ahmed K, Long W (2012) Environmental Kuznets curve and Pakistan: an empirical analysis. Procedia Econ and Financ 1:4–13

Arouri MEH, Youssef AB, M’henni H, Rault C (2012) Energy consumption, economic growth and CO2 emissions in Middle East and North African countries. Energy Policy 45:342–349

Atapattu S, Schapper A (2019) Human rights and the environment: key issues. Routledge

Bakhsh K, Rose S, Ali MF, Ahmad N, Shahbaz M (2017) Economic growth, CO2 emissions, renewable waste and FDI relation in Pakistan: new evidences from 3SLS. J Environ Manag 196:627–632

Balsalobre-Lorente D, Shahbaz M, Roubaud D, Farhani S (2018) How economic growth, renewable electricity and natural resources contribute to CO2 emissions? Energy Policy 113:356–367

Bekun FV, Alola AA, Sarkodie SA (2019) Toward a sustainable environment: nexus between CO2 emissions, resource rent, renewable and nonrenewable energy in 16-EU countries. Sci Total Environ 657:1023–1029

Blanco I, Anifantis AS, Pascuzzi S, Mugnozza GS (2013) Hydrogen and renewable energy sources integrated system for greenhouse heating. J Agric Eng 44:2

Bojanic DC, Warnick RB (2019) The relationship between a country’s level of tourism and environmental performance. J Travel Res. https://doi.org/10.1177/0047287519827394

Boopen S, Vinesh S (2011) On the relationship between CO2 emissions and economic growth: the Mauritian experience. University of Mauritius, Mauritius Environment Outlook Report

Brown RL, Durbin J, Evans JM (1975) Techniques for testing the constancy of regression relations over time. J R Stat Soc Ser B 37:149–163

Butler RW (2000) Tourism and the environment: a geographical perspective. Tour Geogr 2(3):337–358

Cheng SC, Wu TP, Lee KC, Chang T (2014) Flexible Fourier unit root test of unemployment for PIIGS countries. Econ Model 36:142–148

Clémençon R (2016) The two sides of the Paris climate agreement: dismal failure or historic breakthrough? J Environ Dev 25:1

Cole MA, Elliott RJ (2003) Determining the trade–environment composition effect: the role of capital, labor and environmental regulations. J Environ Econ Manag 46(3):363–383

Cui H (2016) China’s economic growth and energy consumption. Int J Energy Econ Policy 6(2):349–355

Danish, Wang Z (2018) Dynamic relationship between tourism, economic growth, and environmental quality. J Sustain Tour 26(11):1928–1943

Davidson MR, Zhang D, Xiong W, Zhang X, Karplus VJ (2016) Modelling the potential for wind energy integration on China’s coal-heavy electricity grid. Nat Energy 1:7

Dickey DA, Fuller WA (1979) Distribution of the estimators for autoregressive time series with a unit root. J Am Stat Assoc 74:427–431

Ehrlich PR, Holdren JP (1972) Critique. Bull At Sci 28(5):16–27

Elliot AJ, Maier MA (2013) The red-attractiveness effect, applying the Ioannidis and Trikalinos (2007b) test, and the broader scientific context: a reply to Francis (2013). J Exp Psychol Gen 142(1):297–300

Elliott G, Rothenberg TJ, Stock JH (1996) Efficient tests for an autoregressive unit root. Econometrica 64:813–836

Emir F, Bekun FV (2019) Energy intensity, carbon emissions, renewable energy, and economic growth nexus: new insights from Romania. Energy Environ 30(3):427–443

Engle RF, Granger CW (1987) Co-integration and error correction: representation, estimation, and testing. Econometrica:251–276

Fei L, Dong S, Xue L, Liang Q, Yang W (2011) Energy consumption-economic growth relationship and carbon dioxide emissions in China. Energy Policy 39(2):568–574

Galli R (1998) The relationship between energy intensity and income levels: forecasting long term energy demand in Asian emerging countries. Energy J:85–105

Gregory AW, Hansen BE (1996) Residual-based tests for cointegration in models with regime shifts. J Econ 70(1):99–126

Halicioglu F (2009) An econometric study of CO2 emissions, energy consumption, income and foreign trade in Turkey. Energy Policy 37(3):1156–1164

Han C, Lee H (2013) Dependence of economic growth on CO2 emissions. J Econ Dev 38(1):47

Hübler M, Keller A (2010) Energy savings via FDI? Empirical evidence from developing countries. Environ Dev Econ 15(1):59–80

Javorcik BS, Spatareanu M (2008) To share or not to share: does local participation matter for spillovers from foreign direct investment? J Dev Econ 85(1–2):194–217

Kapetanios G, Shin Y (2008) GLS detrending-based unit root tests in nonlinear STAR and SETAR models. Econ Lett 100:377–380

Kapetanios G, Shin Y, Snell A (2003) Testing for a unit root in the nonlinear STAR framework. J Econ 112:359–379

Keller W (2004) International technology diffusion. J Econ Lit 42(3):752–782

Khan AH, Kim YH (1999) Foreign direct investment in Pakistan: policy issues and operational implications. Asian Development Bank–Economics and Development Resource Center, 66, July

Khatun F, Ahamad M (2015) Foreign direct investment in the energy and power sector in Bangladesh: implications for economic growth. Renew Sust Energ Rev 52:1369–1377

Kuo KC, Chang CY, Chen MH, Chen WY (2012) In search of causal relationship between FDI, GDP, and energy consumption – evidence from China. Adv Mater Res 524:3388–3391

Kwiatkowski D, Phillips PCB, Schmidt P, Shin Y (1992) Testing the null hypothesis of stationarity against the alternative of a unit root: how sure are we that economic time series have a unit root? J Econ 54:159–178

Lean HH, Smith R (2009) CO2 emissions, energy consumption and output in ASEAN. Business and Economics, Development Research Unit Discussion Paper DEVDP, 09–13

Lee JW, Brahmasrene T (2013) Investigating the influence of tourism on economic growth and carbon emissions: evidence from panel analysis of the European Union. Tour Manag 38:69–76

Leybourne SJ (1995) Testing for unit roots using forward and reverse Dickey-Fuller regressions. Oxf Bull Econ Stat 57:559–571

Liu X, Bae J (2018) Urbanization and industrialization impact of CO2 emissions in China. J Clean Prod 172:178–186

Magazzino C (2015) Economic growth, CO2 emissions, and energy use in Israel. Int J Sust Dev World 22(1):89–97

Magazzino C (2016) The relationship between CO2 emissions, energy consumption and economic growth in Italy. Int J Sust Energy 35(9):844–857

Magazzino C (2017) The relationship among economic growth, CO2 emissions, and energy use in the APEC countries: a panel VAR approach. Environ Syst Decis 37(3):353–366

Magazzino C, Cerulli G (2019) The determinants of CO2 emissions in MENA countries: a responsiveness scores approach. Int J Sust Dev World Ecol 26(6):522–534

Mazzanti M, Montini A (2010) Embedding the drivers of emission efficiency at regional level – analyses of NAMEA data. Ecol Econ 69(12):2457–2467

Mazzanti M, Musolesi A, Zoboli R (2010) A panel data heterogeneous Bayesian estimation of environmental Kuznets curves for CO2 emissions. Appl Econ 42(18):2275–2287

Menyah K, Wolde-Rufael Y (2010) Energy consumption, pollutant emissions and economic growth in South Africa. Energy Econ 32(6):1374–1382

Narayan S, Doytch N (2017) An investigation of renewable and non-renewable energy consumption and economic growth nexus using industrial and residential energy consumption. Energy Econ 68:160–176

Nasir AA, Ameh EA, Abdur-Rahman LO, Adeniran JO, Abraham MK (2011) Posterior urethral valve. World J Pediatr 7(3):205

Niu YF, Jin GL, Chai RS, Wang H, Zhang YS (2011) Responses of root hair development to elevated CO2. Plant Signal Behav 6(9):1414–1417

Okunola AM (2016) Nigeria: positioning rural economy for implementation of sustainable development goals. Turk J Agric Food Sci Technol 4(9):752–757

Omotor DG (2016) Group formation and growth enhancing variables: evidence from selected WAMZ countries. In: Seck D (ed) Accelerated economic growth in West Africa. Springer, Cham, pp 53–73

Omri A, Kahouli B (2014) Causal relationships between energy consumption, foreign direct investment and economic growth: fresh evidence from dynamic simultaneous-equations models. Energy Policy 67:913–922

Omri A, Nguyen DK, Rault C (2014) Causal interactions between CO2 emissions, FDI, and economic growth: evidence from dynamic simultaneous-equation models. Econ Model 42:382–389

Paramati SR, Apergis N, Ummalla M (2017) Financing clean energy projects through domestic and foreign capital: the role of political cooperation among the EU, the G20 and OECD countries. Energy Econ 61:62–71

Pazienza P (2015) The relationship between CO2 and foreign direct investment in the agriculture and fishing sector of OECD countries: evidence and policy considerations. Intellectual Econ 9(1):55–66

Pesaran MH, Shin Y, Smith RJ (2001) Bounds testing approaches to the analysis of level relationships. J Appl Econ 16(3):289–326

Phillips PCB, Perron P (1988) Testing for a unit root in time series regression. Biometrika 75:335–346

Saboori B, Sulaiman J, Mohd S (2012) Economic growth and CO2 emissions in Malaysia: a cointegration analysis of the environmental Kuznets curve. Energy Policy 51:184–191

Sadorsky P (2011) Financial development and energy consumption in Central and Eastern European frontier economies. Energy Policy 39(2):999–1006

Sarkodie SA, Strezov V (2019) Effect of foreign direct investments, economic development and energy consumption on greenhouse gas emissions in developing countries. Sci Total Environ 646:862–871

Sbia R, Shahbaz M, Hamdi H (2014) A contribution of foreign direct investment, clean energy, trade openness, carbon emissions and economic growth to energy demand in UAE. Econ Model 36:191–197

Selden TM, Song D (1994) Environmental quality and development: is there a Kuznets curve for air pollution emissions? J Environ Econ Manag 27(2):147–162

Shahbaz M, Khan S, Tahir MI (2013) The dynamic links between energy consumption, economic growth, financial development and trade in China: fresh evidence from multivariate framework analysis. Energy Econ 40:8–21

Shahbaz M, Rehman Ijaz ur, Taneem A (2014) Revisiting financial development and economic growth nexus: the role of capitalization in bangladesh. Working papers 2014. IPAG Business School, Paris

Shahbaz M, Loganathan N, Zeshan M, Zaman K (2015a) Does renewable energy consumption add in economic growth? An application of auto-regressive distributed lag model in Pakistan. Renew Sust Energ Rev 44:576–585

Shahbaz M, Nasreen S, Abbas F, Anis O (2015b) Does foreign direct investment impede environmental quality in high-, middle-, and low-income countries? Energy Econ 51:275–287

Shahbaz M, Solarin SA, Sbia R, Bibi S (2015c) Does energy intensity contribute to CO2 emissions? A trivariate analysis in selected African countries. Ecol Indic 50:215–224

Shahbaz M, Chaudhary AR, Ozturk I (2017) Does urbanization cause increasing energy demand in Pakistan? Empirical evidence from STIRPAT model. Energy 122:83–93

Sharma RD, Jain S, Singh K (2011) Growth rate of motor vehicles in India-impact of demographic and economic development. J Econ Soc Stud 1(2):137

Sheinbaum-Pardo C, Mora-Pérez S, Robles-Morales G (2012) Decomposition of energy consumption and CO2 emissions in Mexican manufacturing industries: trends between 1990 and 2008. Energy Sust Dev 16(1):57–67

Sy A, Tinker T, Derbali A, Jamel L (2016) Economic growth, financial development, trade openness, and CO2 emissions in European countries. Afr J Account Audit Finance 5(2):155–179

Talukdar D, Meisner CM (2001) Does the private sector help or hurt the environment? Evidence from carbon dioxide pollution in developing countries. World Dev 29(5):827–840

Tamazian A, Rao BB (2010) Do economic, financial and institutional developments matter for environmental degradation? Evidence from transitional economies. Energy Econ 32(1):137–145

Twerefou DK, Adusah-Poku F, Bekoe W (2016) An empirical examination of the Environmental Kuznets Curve hypothesis for carbon dioxide emissions in Ghana: an ARDL approach. Environ Socio-econ Stud 4(4):1–12

Udemba EN, Güngör H, Bekun FV (2019) Environmental implication of offshore economic activities in Indonesia: a dual analyses of cointegration and causality. Environ Sci Pollut Res:1–16

Wagner J (2008) Exports, imports, and productivity at the firm level. An international perspective: introduction by guest editor. Rev World Econ 144(4):591–595

Wang JF, Li XH, Christakos G, Liao YL, Zhang T, Gu X, Zheng XY (2010) Geographical detectors‐based health risk assessment and its application in the neural tube defects study of the Heshun Region, China. Int J Geog Inf Sci 24(1):107–127

Yabuki S (2018) China’s new political economy: revised edition. Routledge

Zaman K, Khan MM, Ahmad M, Rustam R (2012) Determinants of electricity consumption function in Pakistan: old wine in a new bottle. Energy Policy 50:623–634

Zhang WB (2018) Economic growth theory: capital, knowledge, and economic structures. Routledge

Zhang XP, Cheng XM (2009) Energy consumption, carbon emissions, and economic growth in China. Ecol Econ 68(10):2706–2712

Author information

Authors and Affiliations

Corresponding author

Ethics declarations

Conflict of interest

The authors declare that they have no conflict of interest.

Additional information

Responsible editor: Muhammad Shahbaz

Publisher’s note

Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

Highlights

• Investigation of determinant of environmental degradation in China.

• Long- and short-run pollutant emissions decomposition in China.

• Economic growth–pollutant emission directional causality has a feedback.

• Foreign direct investment and energy consumption influence pollutant emission.

• Energy portfolio diversification in China is more urgently necessary than ever.

Rights and permissions

About this article

Cite this article

Udemba, E.N., Magazzino, C. & Bekun, F.V. Modeling the nexus between pollutant emission, energy consumption, foreign direct investment, and economic growth: new insights from China. Environ Sci Pollut Res 27, 17831–17842 (2020). https://doi.org/10.1007/s11356-020-08180-x

Received:

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s11356-020-08180-x