Abstract

Taken into account that the natural hazard risk is a contingent liability and, therefore, a sovereign risk for national governments, it is important to assess properly the potential losses to design a suitable risk reduction, retention and transfer strategy. In this article, a disaster risk assessment methodology is proposed based on two approaches: on the one hand, the empiric estimation of losses, using information available from local disaster databases, allowing estimating losses due to small-scale events and, on the other hand, probabilistic evaluations to estimate losses for greater or even catastrophic events, for which information usually is not available due to the lack of historical data. A “hybrid” loss exceedance curve is thus determined, which combines the results of these two approaches and represents the disaster risk in a proper and complete way. This curve merges two components: the corresponding to small and moderate losses, calculated using an inductive and retrospective analysis, and the corresponding to extreme losses, calculated using a deductive and prospective analysis. Applications of this risk assessment technique are given in this article for eleven countries.

Similar content being viewed by others

Avoid common mistakes on your manuscript.

1 Introduction

Disasters are social and environmental processes triggered by the occurrence of hazard events on contexts with certain level of vulnerability, which have a dramatic impact upon the normal operation of the affected community and requesting for immediate response. The level of a disaster depends not only on the intensity of the natural event but also on the vulnerability of the exposed elements. Vulnerability is particularly important in the case of small-scale disasters when the intensity of the hazard events is moderate or even low; conversely, in the case of big disasters, vulnerability is quickly saturated due to the intensity of hazards, and therefore, its relative importance is smaller. The social, economic and physical fragilities are factors that contribute to the lack of capacity of the communities to resist, recover and adapt (Cardona 2004; Carreño et al. 2006; Barbat et al. 2011). The fragility and the lack of resilience can be intervened with ex ante approaches in order to reduce disaster risk, and this is the reason why vulnerability and hazard must be first identified (Carreño et al. 2007).

Intensive risk refers to the possibility of occurring extreme, low-frequency hazard events, usually geographically concentrated. It is associated with high-intensity hazard events that are able to affect simultaneously an important number of exposed elements, overwhelming the response capacity of the local and even of the national emergency response agencies. Extensive risk refers to high-frequency events, usually affecting only a few communities each time; in this case, the local and national emergency response mechanisms could be effective when used. Nevertheless, the accumulated losses due to extensive, recurrent risk could lead to the exhaustion of the available resources and, thus, to the lack of capacity to absorb future losses and to recover from future events (ERN-AL 2011; UNISDR 2009, 2011a, 2013).

The existing global risk databases and the global or national risk indices usually depict a pattern of the intensive risk, leaving aside the extensive risk due to its low visibility at the global or national scales. The patterns of extensive risk, visible only at local scale, are constantly ignored. Moreover, extensive risk has not been often used in driving disaster risk reduction policies, which are primarily focused on the reduction in catastrophic or major losses. Nevertheless, small disasters that are configuring the extensive risk are often the result of climate variability and of the increase in social, economic and environmental vulnerability. Thus, these small disasters turn into a significant social problem because they destroy properties and livelihoods of the weak sectors of society and deepen their incapability to adapt, perpetuating vulnerability and poverty. Even if extensive risk is commonly ignored, when it is identified, it has relevant social and environmental implications for the governments. In view of this, governments have to be aware of the cumulative effect of small disasters upon society. The economic effect of intensive risk is observable immediately, within an uncertainty level, for each catastrophic disaster; extensive risk has, in average, a low cost per event, but when accumulated over a reasonable time window, it has an important impact. Furthermore, over time, extensive risk can become intensive, and the frequent and small disasters can produce major disasters due to the continuous reduction in the capacity of the exposed elements (Marulanda 2013).

The objective of this article is to describe a new comprehensive methodology for risk assessment in which the accumulated effect of minor and frequent past events is combined with that of the potential effect of extreme events whose catastrophic impact can have consequences affecting the fiscal and sovereign sustainability of a country. Thus, the proposed approach considers both the extensive risk that must be retained using reserve funds and reduced with effective vulnerability intervention strategies, and the intensive risk that mainly must be the object of strategies for financial protection and risk transfer (Marulanda et al. 2010; Cardona et al. 2008a). The proposed simplified evaluation of the consequences of small-scale disasters, rather than estimating the real or the total value of losses, provides estimates of the minimum cost or minimum impact on the society assets; this minimum cost is the amount that can be expected to be covered by the government due to its fiscal responsibility (if any) with the vulnerable sectors of society and that has been ignored so far. The effect of insurance policies or risk transfer instruments has not been considered herein. It is important to state that, traditionally, in the insurance industry and in the risk modeler community, the risk assessment approaches use the information of previous events for calibrating their probabilistic models. Conversely, the methodology proposed in this article uses the available data on historic events in order to consider the risk due to small disasters; uses a probabilistic analytical model to obtain different risk metrics for potential catastrophic natural hazards—because most catastrophic events have not occurred yet; and, eventually, combines the two results into a new risk description (Velásquez et al. 2011; Cardona et al. 2012a).

2 Disaster risk and risk metrics

The risk definition used herein is based on UNDRO (1980) but slightly modified by Cardona (1985) to acknowledge the conditional relation of hazard and vulnerability with the exposed elements

In this equation, H i is the probability of a hazard of reaching or exceeding an intensity i during the exposure period t of the element e; V e is the probability that the exposed element e suffers damage due to a hazard reaching or exceeding the intensity i; exposure is implicit in the notion of vulnerability because one cannot be “vulnerable” unless one is “exposed”; finally, R ie|t is the risk of the exposed element e to suffer a loss due to the occurrence of an event with an intensity i or larger over the time period t. Risk could be expressed as a relative value, as an insurance premium (if among several factors, the commercial value is considered) or as a fiscal liability (if the social value is used).

For risk calculations, the following equation includes all the terms of Eq. (1) and considers all the uncertainties involved:

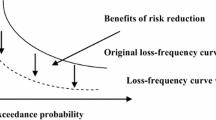

In this equation, v(p) is the exceedance rate of loss, p; F A(Event i ) is the annual frequency of occurrence of the Event i ; and \(\Pr (P > p |Event_{i} )\) is the probability of the loss to be greater than or equal to p, conditioned by the occurrence of the Event i . The graphical representation of v(p) given by Eq. (2) in function of p is the loss exceedance curve, LEC, which provides the most complete description of risk. It displays the relation between a given loss (usually economical) and the annual frequency of occurrence of that loss or of a larger one. Figure 1 shows an LEC, and it can be seen that it correlates an expected loss with an estimated frequency. As the frequency is the inverse of the return period, the loss can also be represented as a function of the return period (the right vertical axis).

Other important risk metrics that can be obtained are the annual average loss (AAL) and the probable maximum loss (PML). The AAL is the loss expectation, that is, the weighted average of all plausible loss values; in other words, it is the value expected to be saved every year in order to cope with all the future losses. The AAL can be obtained from the LEC as the integral of v(p):

The PML is the maximum foreseeable loss for the exposed portfolio, and it is usually defined for a specific return period; the PML is also a value obtained from the LEC.

3 Retrospective risk assessment

The retrospective risk assessment consists in the empirical estimation of the economic losses due to events contained in a historical disaster database, in which the losses caused by minor but frequent events are recorded. For the economic estimation of disasters, there are few available methodologies; one of the most notable has been developed by ECLAC (2003). This methodology permits estimating the economic impact of individual events; the effects upon social sectors, infrastructure and economic sectors are considered along with the impact upon the environment, employment and income.

A methodology, like the ECLAC’s, is mainly used for the valuation of catastrophic disasters. It requires an important amount of resources, accurate input data, specialized staff and high computational effort. Therefore, it would not be feasible, from a practical point of view, to apply this methodology to the valuation of the minor but frequent disasters contained in a database, due to the high number of records, the details of the contained information and the time required to perform each evaluation. This fact makes necessary to establish, for this purpose, a simplified methodology.

The proposed methodology herein used is based on the ECLAC’s approach, but is far simpler. Its objective is to provide an indicative cost for each disaster in the database to evaluate the accumulated impact of the recurrent hazard events on the study area. This is supplementary to the analytical probabilistic risk assessment used for low-frequency and high-loss events. The economic valuation of each small-scale disaster is not based on the full replacement value of the affected asset; the loss value is neither the commercial nor the real value of the asset, but the value for the government to provide an equivalent asset. For example, a destroyed house of any cost will be replaced by an individual social housing solution; it would be the response of the government, and it will have a defined price.

3.1 The disaster database

There are only a few disaster databases at global level, and among those, only two are public and constantly updated: EM-DAT (CRED) and DesInventar (UNISDR 2011b, OSSO); these databases are organized in a different way and have different objectives. The main difference between them is the resolution level (country or subnational), the threshold of what is stored and the number of variables stored for each disaster.

The DesInventar disaster database (www.Desinventar.net; www.Desinventar.org) has been chosen in order to perform the retrospective risk assessment in the proposed methodology due to its high resolution at local level and the numerous reliable records of past events. These records are reasonably described by means of variables such as type of event, date of occurrence, geographical location, as well as other credible variables that can be used in the analysis, such as the number of damaged houses, the number of destroyed houses, affected crops area, affected cattle and others. The information available in the DesInventar database is not the complete history of the events of a specific country, but is a large part of it. It is important to note that the compilation of the information included in DesInventar is subjected to uncertainties due to processing errors or wrong estimations; for these reasons, the database requires previously an exhaustive review using statistical methodologies, such as the detection of outliers (Marulanda et al. 2008).

In fact, the DesInventar records have to be submitted first of all to a process of filtering, merging and economic valuation, in order to develop a database that includes, in addition to the available information, an estimate of the economic cost of each event, considering only the direct effects. The information included in the DesInventar database is used to estimate the economic cost associated with each event.

Taking into account the small intensity and the regional dispersion of most of the events contained in the DesInventar database records, we conclude that they have affected the more vulnerable sectors of the society, which require the aid of the government for shelter, health care and reconstruction after each event.

In this study, we decided to use the DesInventar database because it has certain relevant advantages: The number of countries covered is constantly increasing; it is periodically updated to cover larger time periods and to reduce erroneous data; and it contains a large set of fields that are useful in this study. The analysis of the DesInventar database requires the following steps:

-

Removing non-natural hazards from the database. Due to the fact that we consider in the LEC only natural hazards, the records corresponding to other hazards, such as biological and technological, have to be removed.

-

General statistical analysis. The selected database is analyzed for an adequate distribution of the number of records and of the consequences by year and for the distribution of the records over the studied area rather than their concentration at the main cities. This statistical analysis allows the revision and verification of the reliability of the database.

-

Selection of the period of analysis. The DesInventar database tries to collect the largest number of previous disastrous events including, in some cases, historical data (from early 1900 or before). That is, the period covered by the database contains irregularities that have to be removed by a statistical process.

-

Selection of the parameters for merging the records corresponding to the same event. In the specific case of DesInventar database, the consequences of a unique event can be stored over several records, each one corresponding to a different locality.

-

Classification of the records by hazard categories. The database includes several event types, allowing a better understanding of the local risk. But, this fact makes it inadequate for regional or national analyses. The following event categories are considered in the DesInventar database analysis: seismic hazard (earthquakes and tsunamis), landslide hazard, volcanic hazard and hydrometeorological hazard (rainfall, flood, hail storm and others). The final selection of categories is based on local characteristics.

-

General statistical analysis of the records by categories. Statistics of the records are performed in order to classify by hazard categories the injured and dead people, the damaged or destroyed houses and several other aspects contained in the database. This analysis allows a better understanding of the severity and spatial distribution of the events occurred in the studied region.

-

Definition of the parameters necessary for the loss assessment by event. These parameters account for the affected assets over several sectors and have to be consistent with the variables existing in the database. For example, for evaluating the effects upon the house sector, the variables of the database corresponding to the number of damaged and destroyed houses can be used.

3.2 Economic valuation

As explained previously, the cost estimation for each recorded event is based on the replacement of the affected assets by a social equivalent element; this procedure is in agreement with the idea that the most affected are the most vulnerable sectors of society and that the local government has a social responsibility for these sectors. The estimated cost is that of the minimum loss suffered by the community due to the occurrence of the disaster. It is not necessary to compare the results obtained with the proposed approach with those obtained using more robust methodologies, because the scope, purpose and amount of data of the two approaches are different. We try to estimate the minimum loss values of what previous disasters could have cost in order to identify and measure the amount of resources required to withstand future emergencies if the current tendencies continue.

The largest number of records in the DesInventar database corresponds to the sectors of the most vulnerable population, and the responsibility of the government upon those sectors, additional to their own public assets, will be denominated as fiscal responsibility. It is due to the lack of proper building codes, the lack of enforcement on housing solutions, the lack of land-use policies, the lack of prevention works or because it is required by laws (UNDP 2004). The damages over the private sector will not be considered as fiscal responsibility, due to the possibility of this sector to assess risk and buy insurance, to access to financial markets and to their own resources.

Therefore, the proposed approach is oriented toward the public sector as a tool to generate concern regarding the losses to the public social infrastructure and to the low-income population sectors that it supports. Those losses due to their small scales and high occurrence rate usually are not covered by the insurance market; therefore, the corresponding authorities and the local government need to be aware of this liability. When we couple retrospective risk with the catastrophic one, we obtain a comprehensive view of natural disaster risk which allows its measurement. And, once risk is measured, it is possible to determinate the best policies for its reduction and management.

The following assumptions were made regarding the economic valuation technique (UNISDR 2011a, b, 2013):

-

Only quantifiable variables will be used.

-

The base cost for houses will be expressed in terms of $USD/m2, and the area of the houses will be based on available information of social housing area for the studied country.

-

Only direct cost for the selected variables will be considered, that is, the property content and the indirect cost will be ignored.

The retrospective risk analysis and the empirical development of a loss exceedance curve considering minor, but frequent, events is carried out in the following steps:

-

Calculation of losses by event. The previously selected parameters are used in this step. Each record has to be processed for estimating the economic value of the consequences.

-

Statistical analysis of losses by hazard categories. The economic distribution of the losses over the studied area for all and each one of the different hazards and over the database time window is obtained in this step.

-

Development of the LEC for each category of natural hazard. A loss exceedance curve is obtained for each natural hazard category considered in the analysis.

-

Development of the multihazard LEC. A loss exceedance curve for all the events presented in the database is obtained and will be used for the construction of the hybrid LEC.

3.3 Results of empirical risk assessment

Following the proposed methodology, several useful results can be obtained (ERN-AL 2011; CIMNE et al. 2013b). Thus, Fig. 2 shows the different hazard categories analyzed and their economic impact for different return periods. It also allows observing how the hydrometeorological hazards have the most important annual impact and how the seismic hazard produces the most important losses in the long term. It has to be noted that due to the nature of this analysis, the results are limited to the time window covered by the disaster database.

Another useful result for the awareness of the institutions is how the economic losses due to small but frequent events affect the communities over the years. As an example, Fig. 3 shows this effect for regular periods of 4 years which, for instance, can correspond to the government periods of a country; it shows how much of the budget is expected to be used by that government for risk response and recovering. In this case, using the purchase parity power (PPP) correction, it can be observed the increase in economic loss and the increase in frequency.

The last period in Fig. 3 represents only the losses due to the El Niño-Southern Oscillation (ENSO) event in Colombia in a period of eight months, between October 2010 and May 2011 (ECLAC 2012). This phenomenon was the cause of hundreds of local and small-scale events (landslides, flash floods and inundations) affecting most municipalities of the country, and it illustrates how several small and local disasters (extensive risk) occurred in a relatively short period and are perceived by the national government as a single national disaster (intensive risk) due to the correlation of losses. The same events over a longer period (various decades) have produced chronic and invisible disasters because each one of the events has been not considered relevant by the national government.

Finally, the LEC for minor but frequent events is determined, and it can be used for the assessment of the risk at regional level. The calculated cost can be considered as an approximation of the real loss; actually, due to the different constrains of the model, it is a minimum value; nevertheless, considering the lack of reliable data, it is a good estimation. The LEC can be obtained for each individual hazard category and also for all the categories analyzed, resulting in the multihazard LEC shown in Fig. 4. The economic losses shown in this figure correspond to what a government or the society had to assume for a prompt community recovery, including replacing, repairing or compensating the suffered losses. In any case, the proposed procedure of assessment allows establishing the amount of resources that the government must spend every year to meet its fiscal responsibility, under the assumption that the affected private parties have been the most disadvantaged sectors of the society. In general terms, these losses are those which would not be covered by catastrophic risk insurance, if any is contracted by the government, because they correspond approximately to what the deductible would be. Those would be the losses that the governments should try to reduce by developing prevention–mitigation policies.

4 Prospective risk assessment

Considering that highly destructive events might occur in the future, risk assessment must follow a prospective approach, focusing on probabilistic models that allow calculating adequate information for the possible future catastrophe scenarios with the lowest possible uncertainty. Over the past decades, risk estimation models have been based on historical data (consequences of past events and insurance claims); these models were characterized by the lack of sufficient information regarding major, catastrophic events. For this reason, different academic models were developed which considered the hazard intensity and frequency, the increasing portfolio of assets and its vulnerability into a probabilistic estimation of hazard and risk (Barbat et al. 2010; CIMNE et al. 2013a).

In general, it should be recognized that the reliable historical information is limited, in most cases, to the last decades and that many catastrophic events are still expected to occur. In other words, the existing disaster databases (e.g., EM-DAT, DesInventar) lack the sufficient records of low-frequency and high-consequence events, because the window covered by those databases is very narrow; therefore, the consequences of future extreme events cannot be anticipated based only on the statistical or historic available information.

The probabilistic assessment of catastrophe risk requires specialized computational tools, and for this reason, we decided to use in this research the CAPRA platform (ERN-AL 2010). This platform has been developed within an initiative sponsored by the World Bank Group, the Inter-American Development Bank and UN-ISDR, and it allows the probabilistic evaluation of the natural hazards, the exposure and the disaster risk at different scales (ERN-AL 2010; Cardona et al. 2010a, b; Marulanda et al. 2014).

4.1 The CAPRA platform

The CAPRA platform (ERN-AL 2010) is a compendium of tools developed for the assessment of probabilistic hazard risk oriented toward disaster risk reduction (DRR) policies. These tools consider the different components of disaster risk along with their uncertainties, the characteristics of the natural phenomena, the definition and location of the exposed assets and the vulnerability of the building and infrastructure classes (Cardona et al. 2012b; Marulanda et al. 2014).

The occurrence of the natural hazards is assumed to follow a Poisson process; accordingly, all the possible events are independent from each other. When calculating the risk with CAPRA, a special file, called AME, is used to represent the hazard. This file is exhaustive, i.e., it includes all the possible events (past, present and future) corresponding to the considered natural phenomena, and exclusive, i.e., each event only has to be included once. Each hazard scenario is defined as a raster map, where each location is defined by its mean value and standard deviation. CAPRA has models for earthquake and hurricane, among other natural hazards.

For the exposure, the CAPRA platform uses a geospatial database which has the format of an ESRI Shape file. The different exposed assets are represented using geographic located entities (points, lines or polygons), and their main characteristics (e.g., building type, number of stories, economic value and others) are linked. The CAPRA platform includes the necessary procedures to gather the information regarding the exposed elements based on the scale of analysis; when the cadastral information of the city is not available, this information has to be generated from remote sensing or it has to be generated using proxy models.

CAPRA evaluates the expected behavior of the different assets by means of vulnerability functions that correlate a certain characteristic of the intensity of the natural phenomena (e.g., gust speed, spectral acceleration of an earthquake, depth of flood) with the mean damage ratio (MDR). The vulnerability functions are not defined for each individual element but for a set of elements with similar characteristics; that is, a vulnerability curve has to be defined for each building or infrastructure class included in the portfolio of the exposed assets.

As shown in Fig. 5, a vulnerability function has to account for the dispersion and uncertainty of the expected damage. This dispersion has its origin in several factors such as the construction process, the quality of the materials, the weather during the construction phase and the maintenance of the structure, and also due to the uncertainties inherent to the estimations made during the design phase.

4.2 Characterization of exposure

Exposure refers to elements such as buildings, structures and infrastructure (physical exposure) or population (human exposure) present in the hazard-prone areas, which are susceptible of being affected by the occurrence of a hazardous event; only the physical exposure is considered in this paper. To define the exposure, it is necessary to identify each one of the different susceptible elements along with their main characteristics, including but not limiting to geographical location, vulnerability to the studied hazard and their economical replacement value. The exposure values of the assets at risk are normally estimated using secondary information sources, such as databases and maps, or can be estimated using simplified procedures based on general social and macroeconomic information, such as population density, construction statistics and other parameters.

In order to develop a model of fiscal responsibility, physical assets such as structures and main infrastructure are of special importance. Several assumptions have to be made when aggregation is made from a local to a national scale. In general, the exposure model includes information about the following exposed components or elements:

-

Buildings and houses;

-

Industrial facilities;

-

Roads and bridges;

-

Electricity systems;

-

Communications systems;

-

Distribution systems;

-

Relevant infrastructure (such as airports, ports and others).

The level of detail of the exposure model has to be changed according to the available information, going from the individual buildings or blocks to the larger scale of the neighborhoods, cities, regions or countries. This variability in the disaggregation of the exposed elements is reflected in the level of resolution of the results and, thus, in their expected use; nevertheless, the overall results will have some similarities, independently of the resolution used.

4.3 Hazard assessment

The identification and evaluation of the hazard in terms of intensity and annual recurrence constitutes a step prior to risk assessment. The historical knowledge regarding the occurrence of major events with substantial or extreme consequences and their characteristics provides an initial idea of the destructive potential of the phenomena. This allows the study of the hazard in the region and makes possible to establish the approximate return periods for the most significant events.

The hazards that can generate catastrophic consequences are often those with a high possibility of producing simultaneous damage or loss correlation over extended areas, such as hurricanes and earthquakes and sometimes floods. Other types of natural hazards, such as volcanoes, landslides or flash floods, very often affect only smaller areas and, usually, produce relatively smaller losses.

4.4 Characterization of vulnerability

The physical vulnerability of an exposed element is characterized by functions that relate a parameter used to describe the hazard intensity to a parameter characterizing the loss or damage suffered by that element; they allow estimating the consequences produced in each element if an event occurs. Moreover, vulnerability is defined in a probabilistic way, for each value of the hazard intensity, by the mean damage ratio (MDR) and by its standard deviation (SD). Nevertheless, vulnerability functions are not evaluated for individual elements but for each class or typology of exposed elements (buildings or infrastructure) and are then stored in a vulnerability functions library. When risk has to be evaluated in a certain area, the corresponding vulnerability function of this library is assigned to each element of the exposure database. Due to the fact that the vulnerability functions correspond to the expected statistical behavior of a typological group, the results are valid only for the group of assets as a whole and not for each individual exposed element (FEMA 2006; Barbat et al. 2008).

As an example, Figs. 6 and 7 show vulnerability functions for different building types and infrastructure elements. Due to the number of the represented elements, only the MDR has been plotted.

4.5 Results of the analysis

The results of the analysis can be obtained for different portfolios or sectors, summarizing the annual average losses (AAL) and the probable maximum loss (PML) for the evaluated area. The PML values depend on the degree of dispersion of the evaluated assets. It should be kept in mind that the values obtained for different return periods correspond to the PML of the entire area and that, when evaluated for a part of this area, they could significantly change because of the level of risk concentration.

For the performed analysis, the fiscal portfolio was considered which is composed by:

-

Poor people livelihoods and assets: low-income population inventory;

-

Public health: public assets used for medical and healthcare services;

-

Public education: public assets used for educational and cultural services;

-

Government: public assets and buildings used for administrative services.

For fiscal responsibility, the AAL and the PML are obtained at country level. These risk metrics correspond to the losses that the country would have to face due to the potential damage in public and low-income population assets which, under the assumptions of this paper, would have to be covered by the government in the case of a major disaster (Cardona et al. 2008b). The fiscal LEC for an analyzed area shown in Fig. 8 is obtained analytically and only covers extreme events such as strong earthquakes, hurricanes or other phenomena that can cause catastrophic consequences due to the simultaneousness of the effects on the exposed assets of the portfolio. It is obtained for a given area following the previously described methodology which can be summarized as follows:

-

Construction of a hazard model. This model has to define all the possible scenarios in which the hazard can occur, taking into account their inherent uncertainties. The considered set of scenarios has to be exhaustive (i.e., it has to include all the possible manifestations); each scenario has to be exclusive (i.e., it is included only once in the set); the scenarios are described by means of the frequency and the intensity. This approach is compatible with that of the CAPRA initiative.

-

Preparation of a georeferenced database of exposed elements. A georeferenced database of the exposed elements is required, which allows relating each asset to the hazard intensity. If a cadastral database is available, it can be used; otherwise, such a database has to be built using demographic and economic statistics. This approximate exposure model has to take into account the concentration of population around productive regions and, at the same time, the corresponding housing and infrastructure. The resulting losses will be obtained in the units used for expressing the exposed value (e.g., if economic values are defined, the losses will be expressed in economic terms).

-

Assignation of vulnerability functions to each building and infrastructure type of the exposed elements. These functions are extracted from the existing literature (HAZUS, Risk-UE) or defined by using computational models (FEMA 2006; Lagomarsino and Giovinazzi 2006; Lantada et al. 2009a, b; Vargas et al. 2013a, b, c). These functions relate the asset, a severity hazard level and the expected damage in the exposed element.

-

Loss estimation. It is performed by combining the hazard information with the exposure and the vulnerability by using the CAPRA platform which allows evaluating the exposed assets against each one of the hazard scenarios. Subsequently, the results are probabilistically integrated (Eq. 2) in order to obtain the loss exceedance curve and other necessary metrics.

It should be noted in Fig. 8 that there is a gap in the information provided by the prospective LEC for small events with a high frequency, that is, of more than ten occurrences per year. Furthermore, the prospective LEC could underevaluate the events with an occurrence frequency over 1 per year. The missing information in the LEC is due to the fact that the prospective methodology considers only catastrophic hazards and dismisses the small and frequent hazards. Moreover, these small hazards require a large amount of data and a detailed analysis, beyond the normal capabilities of the existing risk evaluation models, including CAPRA. For instance, the flooding hazard could be evaluated for a specific basin but not for all the basins of a large region; this is also true for landslides and other hazardous events that, many times, are considered as “minor.” That is why we propose in this article to cover the mentioned gap of the prospective LEC of Fig. 8 with the results of a retrospective analysis. Even if the proposed analysis has limitations and restrictions, it can provide the solution we are searching for those small and frequent events.

5 The hybrid loss exceedance curve (HLEC)

In the previous sections, two LECs were obtained using different approaches. The first one is the retrospective LEC, shown in Fig. 4, which considers small but frequent losses; the second one is the prospective LEC, shown in Fig. 8, which corresponds to large losses, with very low annual frequencies (Velásquez et al. 2011; Cardona et al. 2012a).

Now we represent both LECs in the same graphic as it can be seen in Fig. 9, obtaining the whole picture of the risk in the studied area.

Using the two LECs of Fig. 9, we build a new hybrid loss exceedance curve (HLEC) as the envelope of both curves and by overlapping the common part making use of interpolation. This new curve is shown in Fig. 10. In other words, the proposed technique for risk analysis is based on combining the LEC corresponding to the extensive risk with the LEC obtained for hazards that have the potentiality of producing catastrophe risk, that is, for intensive risk.

The insurance policies are a way in which policyholders deal with the uncertainties of risk. However, in order to save the insurance industry from the risk that the insured party does not comply with its responsibility of reducing a risk that is already covered (i.e., moral risk), an attachment point, or deductible, has to be defined for every insurance policy. This is the value to be met by the policyholder and from which the insurance company starts its responsibility. This means that losses below the attachment point have to be completely covered by the policyholders. In the natural hazards insurance, only the analytical, prospective, loss exceedance curves have been used so far by the insurance companies that are not covering losses below this deductible point. Nevertheless, dealing repeatedly with small events can lead a country to an administrative decline. Therefore, countries have to assume the consequences caused by small-scale events, which are clearly visible in the HLEC, from their own budget.

6 Applications of the proposed HLEC

We present in this section examples of the HLEC calculated for eleven countries. These case studies were performed using the available information for the retrospective analysis and the necessary data for the prospective risk models. The selected countries were included in the “Global assessment report for disaster risk reduction” (GAR) of UN-ISDR (2011a, b, 2013), and the corresponding HLEC is shown in Figs. 11, 12, 13, 14, 15, 16, 17, 18, 19, 20 and 21. The prospective analysis for all the countries was made for seismic and hurricane wind hazards by using the CAPRA platform. The required information for the risk model was gathered with the help of several institutions; among the collected information were the population census, the building census, the construction prices, utilities sector coverage and prices, macroeconomic indicators, etc.

Table 1 illustrates the differences in the values of the annual average loss (AAL) obtained by using the retrospective analysis, the prospective analysis of the fiscal responsibility of the national governments and the proposed HLEC.

These AALs (pure premiums) are the amount that the governments would have to save annually in order to cover all the future disasters. In the case of using the insurance industry, the value to be paid (commercial premium) to the insurance companies has to include the AAL, but also other costs such as opportunity cost, interest rate, reinsurance, administrative fees and profit, among others (Cardona et al. 2008b). These additional costs are internal to each company and based on the uncertainty and correlation of the insured portfolio, and we are not considering any of these herein. For each country policy, the insurance companies leave as deductible the losses caused by the so-called small-scale disasters. For this reason, governments must have an explicit strategy of disaster risk reduction and management, through effective mitigation and prevention policies; otherwise, the losses due to minor events would continue to have a very high economic and social impact upon the countries.

It is worth noting a special behavior in the cases of El Salvador and Mexico, where the expected loss calculated with the hybrid curve is lower than the obtained with the retrospective analysis. This aspect can be explained by the fact that the corresponding disaster database includes certain events that should have been considered as catastrophic but that, due to the nature of the analysis, have an assigned occurrence frequency higher than that corresponding to the probabilistic models. The loss exceedance curves shown in Figs. 11, 12, 13, 14, 15, 16, 17, 18, 19, 20, and 21 were trimmed (i.e., we have not plotted the complete set of points) to allow a better visualization of the retrospective and prospective assessments curves, and of the connecting segment. As shown in Fig. 22, which contains the full set of points for El Salvador (which should be compared with the trimmed curve of Fig. 15), the empiric curve exceeds the curve obtained with the probabilistic model. That is, there are at least one or two historic events that can be considered as catastrophic, that is, which have a larger return period; but, due to the nature of the analysis, we assigned them a lower return period (e.g., less than one in 40 years).

7 Conclusions

In this article, a new risk analysis methodology has been proposed based on a hybrid loss exceedance curve, which represents risk in a proper and complete way. This loss exceedance curve has two components. The first one corresponds to frequent, minor events, usually producing small and moderate, but repetitive and extensive losses and is calculated by using an inductive and retrospective analysis; the second one considers the potential occurrence of extreme events that produce intensive and huge losses and is calculated by using a deductive and prospective analysis for which, in this article, we used the CAPRA platform. The extensive risk has to be mitigated with efficient intervention strategies, such as land-use planning or protection works, while for the intensive risk, construction regulations and strategies of financial protection and risk transfer are required.

The study performed at country level shows that it is indispensable to measure risk retrospectively, with an empirical focus and, at the same time, prospectively, with a probabilistic focus. The lack of procedures to evaluate losses due to minor and repetitive events has prevented until now that governments be aware of the enormous losses due to such events and that they retain. The proposed approach and the case studies performed in this article permit not only to illustrate but also to promote the interest of decision makers toward an effective risk management, based on the complete and multihazard risk assessment facilitated by the hybrid loss exceedance curve. The proposed hybrid curve allows capturing aspects which the prospective LEC is not able to consider, avoiding the underestimation of the consequences of small-scale and recurrent events. And, obviously, it is important to have the possibility of estimating expected losses that a country may face perhaps every year and of planning the economical mechanism needed to recover more promptly. One possible improvement to the proposed methodology may consist in filtering the extreme events by using outliers (Marulanda et al. 2010).

The proposed methodology makes a different use of the historical data of disasters compared with other existing approaches. Instead of using the empiric data of events and losses for calibrating or validating catastrophic models, it proposes an approach that allows evaluating the cost of previous disasters, their effect upon the society, and measures the country fiscal responsibility, providing risk metrics such as the AAL and the LEC. The existing models usually do not consider the estimations of the consequences of the small events whose accumulated impact over time is of special relevance mainly for governments and risk takers. The AAL and the LEC cannot be obtained for the small disasters due to the complexity of the models and the detailed information required at local scale, such as topography or mechanical characteristics of the soil which have greatly influence on the results. Even more, the exposure also requires detailed data available only in big cities but not in rural areas. Combining the retrospective approach with a prospective one (which accounts for the future catastrophic events that are still to occur), a general picture of the disaster risk can be achieved allowing governments to design better risk reduction policies.

The proposed methodology has been used as background paper (ERN-AL 2011; CIMNE et al. 2013b) for the GAR report (UNISDR 2011a, 2013), and it brought a new interest of the UNISDR, the WB Group and the Inter-American Development Bank in using it in their disaster risk management policies.

References

Barbat AH, Pujades LG, Lantada N, Moreno R (2008) Seismic damage evaluation in urban areas using the capacity spectrum method: application to Barcelona. Soil Dyn Earthq Eng 28(10–11):851–865

Barbat AH, Carreño ML, Pujades LG, Lantada N, Cardona OD, Marulanda MC (2010) Seismic vulnerability and risk evaluation methods for urban areas. A review with application to a pilot area. Struct Infrastruct Eng 6(1):17–38

Barbat AH, Carreño ML, Cardona OD, Marulanda MC (2011) Evaluación holística del riesgo sísmico en zonas urbanas. Revista internacional de métodos numéricos para cálculo y diseño en ingeniería, 27(1):3–27

Cardona OD (1985) Hazard, vulnerability analysis and risk assessment. Institute of Earthquake Engineering and Engineering Seismology IZIIS, Skopje

Cardona OD (2004) The need for rethinking the concepts of vulnerability and risk from a holistic perspective: a necessary review and criticism for effective risk management. In: Bankoff GF, Hilhorst D (eds) Mapping vulnerability: disasters, development and people. Earthscan, London, pp 37–51

Cardona OD, Ordaz MG, Yamin LE, Marulanda MC, Barbat AH (2008a) Earthquake loss assessment for integrated disaster risk management. J Earthq Eng 12:48–59

Cardona OD, Ordaz MG, Marulanda MC, Barbat AH (2008b) Estimation of probabilistic seismic losses and the public economic resilience—an approach for a macroeconomic impact evaluation. J Earthq Eng 12:60–70

Cardona OD, Ordaz MG, Marulanda MC, Carreño ML, Barbat AH (2010a) Disaster risk from a macroeconomic perspective: a metric for fiscal vulnerability evaluation. Disasters 34(4):1064–1083

Cardona OD, Ordaz MG, Reinoso E, Yamin LE, Barbat AH (2010b) Comprehensive approach for probabilistic risk assessment (CAPRA): international initiative for disaster risk management effectiveness. Presented at the 14th European conference on earthquake engineering, Ohrid, Macedonia

Cardona OD, Marulanda MC, Velásquez CA, Barbat AH (2012a) Earthquake loss assessment for evaluation of the sovereign risk and financial sustainability of countries: economic impacts, fiscal responsibilities and contingent liabilities. Presented at the 15th World conference on earthquake engineering, Lisbon, Portugal

Cardona OD, Ordaz MG, Reinoso E, Yamin LE, Barbat AH (2012b) Comprehensive approach for probabilistic risk assessment (CAPRA): International initiative for disaster risk management effectiveness. Presented at the 15th World conference on earthquake engineering, Lisbon, Portugal

Carreño ML, Cardona OD, Barbat AH (2006) Urban seismic risk evaluation: a holistic approach. Nat Hazards 40(1):137–172

Carreño ML, Cardona OD, Barbat AH (2007) A disaster risk management performance index. Nat Hazards 41(1):1–20

CIMNE, EAI, INGENIAR, ITEC (2013a) Probabilistic modeling of natural risks at the global level: global risk model. Background paper prepared for the 2013 global assessment report on disaster risk reduction, UNISDR, Geneva, Switzerland. http://www.preventionweb.net/gar

CIMNE, EAI, INGENIAR, ITEC (2013b) Probabilistic modelling of natural risks at the global level: the hybrid loss exceedance curve. Background paper prepared for the 2013 global assessment report on disaster risk reduction, UNISDR, Geneva, Switzerland. http://www.preventionweb.net/gar

ECLAC (2003) Manual para la estimación de los efectos socio-económicos de los desastres naturales (report LC/MEX/G.5). CEPAL, Banco Mundial, México DF

ECLAC (2012) Valoración de daños y pérdidas: Ola invernal en Colombia 2010–2011. ECLAC, IDB, Bogotá

EM-DAT (n.d.) The OFDA/CRED international disaster database—www.emdat.net. Université catholique de Louvain, Brussels, Belgium. http://emdat.be/. Last visit the 2nd of February 2012

ERN-AL (2010) CAPRA, Compressive approach for probabilistic risk assessment. World Bank, InterAmerican Development Bank. Retrieve from www.ecapra.org

ERN-AL (2011) Probabilistic modeling of disaster risk at global level: development of a methodology and implementation of case studies. Phase 1A: Colombia, México and Nepal. Background paper prepared for the 2011 global assessment report on disaster risk reduction, UNISDR, Geneva, Switzerland

FEMA (2006) Multi-hazard loss estimation methodology, HAZUS-MH MR2 technical manual, prepared for the Federal Emergency Management Agency, Federal Emergency Management Agency and National Institute of Building Sciences, Washington DC, USA

Lagomarsino S, Giovinazzi S (2006) Macroseismic and mechanical models for the vulnerability and damage assessment of current buildings. Bull Earthq Eng 4(4):415–443

Lantada N, Pujades LG, Barbat AH (2009a) Vulnerability index and capacity spectrum based methods for urban seismic risk evaluation. A comparison. Nat Hazards 51(3):501–524

Lantada N, Irizarry J, Barbat AH, Goula X, Roca A, Susagna T, Pujades LG (2009b) Seismic hazard and risk scenarios for Barcelona, Spain, using the Risk-UE vulnerability index method. Bull Earthq Eng 8(2):201–229

Marulanda M (2013) Modelación probabilista de pérdidas económicas por sismo para la estimación de la vulnerabilidad fiscal del Estado y la gestión financiera del riesgo soberano, Tesis Doctoral, Barcelona, España: Universidad Politécnica de Cataluña, UPC

Marulanda MC, Cardona OD, Barbat AH (2008) La gestión financiera del riesgo desde la perspectiva de los desastres: Evaluación de la exposición fiscal del estado y alternativas de instrumentos financieros de retención y transferencia del riesgo. CIMNE IS-61. Centro Internacional de Métodos Numéricos en Ingeniería, Barcelona, España

Marulanda MC, Cardona OD, Barbat AH (2010) Revealing the socioeconomic impact of small disasters in Colombia using the DesInventar database. Disasters 34(2):552–570

Marulanda MC, Carreño ML, Cardona OD, Ordaz MG, Barbat AH (2014) Probabilistic earthquake risk assessment using CAPRA: application to the city of Barcelona, Spain. Nat Hazards. doi:10.1007/s11069-013-0685-z

OSSO (n.d.) Desinventar.org—DesInventar Project. Corporación OSSO, Cali, Colombia. http://desinventar.org/en/

RISK-UE (2001–2004) An advanced approach to earthquake risk scenarios, with applications to different European cities. http://www.risk-ue.net

UNDP (2004) Reducing disaster risk: a challenge for development. United Nations Development Programme, Bureau for Crisis Prevention and Recovery, Geneva

UNDRO (1980) Natural disasters and vulnerability analysis, report of experts group meeting, UNDRO, Geneva

UNISDR (2009) Global assessment report on disaster risk reduction: risk and poverty in a changing climate. United Nations International Strategy for Disaster Reduction, Geneva

UNISDR (2011a) GAR2011: global assessment report on disaster risk reduction: revealing risk, redefining development. United Nations International Strategy for Disaster Reduction, Geneva

UNISDR (2011b) Desinventar.net database: Nepal disaster inventory. United Nations International Strategy for Disaster Reduction, Geneva

UNISDR (2013) GAR2013: global assessment report on disaster risk reduction: from shared risk to shared value; the business case for disaster risk reduction. United Nations International Strategy for Disaster Reduction, Geneva

Vargas YF, Pujades LG, Barbat AH (2013a) Evaluación probabilista de la capacidad, fragilidad y daño sísmico en edificios de hormigón armado. Revista Internacional de Métodos Numéricos para Cálculo y Diseño en Ingeniería 29(2):63–78

Vargas YF, Pujades LG, Barbat AH, Hurtado JE (2013b) Capacity, fragility and damage in reinforced concrete buildings: a probabilistic approach. Bull Earthq Eng. doi:10.1007/s10518-013-9468-x

Vargas YF, Barbat AH, Pujades LG, Hurtado JE (2013c) “Probabilistic seismic risk evaluation of reinforced concrete buildings”, structures and buildings. In: Proceedings of the institution of civil engineering, 2013. 10.1680/stbu.12.00031

Velásquez CA, Cardona OD, Yamin LE, Mora MG, Barbat AH (2011) Curva de excedencia de pérdidas híbrida para la representación del riesgo. Cuarto Congreso Nacional de Ingeniería Sísmica, Granada

Acknowledgments

This work has been sponsored by UNISDR and has been used as a background paper in the GAR report (UNISDR 2011a, 2013). We want to thank the following local institutions for their help and collaboration: Colombia (INGENIAR, ITEC) and Nepal (NSET). We also thank the Florida International University for their support in the PhD studies of two of the authors. This work has been also partially sponsored by the European Commission (project DESURBS-FP7-2011-261652). The authors are also grateful for the support of the Ministry of Education and Science of Spain, project “Enfoque integral y probabilista para la evaluación del riesgo sísmico en España, CoPASRE” (CGL2011-29063).

Author information

Authors and Affiliations

Corresponding author

Rights and permissions

About this article

Cite this article

Velásquez, C.A., Cardona, O.D., Mora, M.G. et al. Hybrid loss exceedance curve (HLEC) for disaster risk assessment. Nat Hazards 72, 455–479 (2014). https://doi.org/10.1007/s11069-013-1017-z

Received:

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s11069-013-1017-z