Abstract

Researchers have debated for years whether money can lead to happiness. Indeed, the findings to date are contradictory in regard to the impact of individuals’ motives for making money on their psychological well-being. This study aimed to reconcile these findings and show that certain motives for making money can be beneficial to individuals’ psychological health, while others can be detrimental, not only by reducing well-being, but also by increasing ill-being. Based on self-determination theory, basic psychological needs (autonomy, competence, and relatedness) were hypothesized to be the psychological mechanism explaining these differential effects. More precisely, need satisfaction and need frustration were hypothesized to mediate the relationship between employees’ money motives and psychological health (well-being and ill-being). Our findings suggest that self-integrated motives for making money lead to greater well-being and lesser ill-being by positively predicting need satisfaction and negatively predicting need frustration. On the other hand, non-integrated motives for making money appear to result in lesser well-being and greater ill-being by being negatively associated with need satisfaction and positively associated with need frustration. Together, these findings suggest that money motives can have differential effects on employees’ psychological health depending on whether these underlying reasons are need-satisfying or need-frustrating life goals.

Similar content being viewed by others

Avoid common mistakes on your manuscript.

Introduction

For more than 20 years, researchers have debated whether money can lead to happiness (e.g., Ashkanasy 2011; Blanchflower and Oswald, 2011; Diener et al. 2013; Kasser and Ryan 1993; Srivastava et al. 2001; Sacks et al. 2012), yet the question remains largely unanswered. While some evidence suggests that financial aspirations have detrimental consequences for individuals’ health (e.g., lower self-actualization, global adjustment, vitality, and physical health; Carver and Baird 1998; Kasser and Ryan 1993, 1996), other findings indicate that certain motives for making money are positively related to individuals’ subjective well-being and mental health (Garđarsdóttir et al. 2009; Srivastava et al. 2001). A potential explanation for these seemingly contradictory findings may lie in researchers’ different conceptualizations of the relevant key concepts. Hence, the goal of our research was to improve our understanding of individuals’ motives for making money. Moreover, the present study aimed to clarify our understanding of why certain motives for making money may lead to enhanced well-being and others to increased ill-being, by investigating the psychological mechanisms underlying these relationships. Self-determination theory (SDT; Deci and Ryan 2000) was used as an explanatory model, as it provides valuable insight into why and how motives for making money can impact psychological health by highlighting the role of the basic psychological needs within these relationships.

In order to achieve these objectives, two studies were conducted with two working samples. In Study 1, our starting point was Srivastava et al.’s (2001) conceptualization of individuals’ motives for making money, as represented by their Motives for Making Money Scale (MMMS). We tested the structure of this scale and investigated the factorial configuration offering the best representation of individuals’ motives for making money. In Study 2, using this new factorial structure, we tested the relationship between individuals’ money motives and psychological health, conceptualized using indicators of both well-being and ill-being. In addition, we examined how individuals’ basic psychological needs underlie this relationship. More specifically, the mediating role of need satisfaction and frustration in the relationship between individuals’ money motives and psychological health was tested.

In the following section, we present the theoretical and empirical arguments that contributed to our specific hypotheses. More precisely, we first review the current literature on the relationship between money motives and psychological health, before examining in greater detail the findings pertaining to Srivastava et al.’s (2001) MMMS and highlighting important theoretical limitations of this scale.

Motives for making money and well-being

It is commonly proposed that although money can bring individuals some form of contentment, it will not buy them long-lasting happiness regardless of how much they earn (e.g., Ashkanasy 2011; Diener et al. 2013; Kasser 2002; Sacks et al. 2012). Indeed, although research has shown that, at a societal level, wealthier individuals tend to be happier than less wealthy individuals (Blanchflower and Oswald 2011; Diener et al. 2013; Sacks et al. 2012), at an individual level of analysis, personal income does not seem to adequately predict people’s own well-being (Ashkanasy 2011). Most importantly, research has shown that the relationship between personal income and subjective well-being is rather weak, especially for middle- and upper-class individuals in wealthy countries (Diener and Biswas-Diener 2002). In fact, for these individuals, earning a high income has little impact on well-being (Diener and Biswas-Diener 2002). For example, the General Social Survey, administered to close to 48,000 Americans since 1972, indicates that on a four-point scale, average subjective well-being ratings only rise 0.22 points between Americans earning below $25,000 and Americans earning above $75,000 (Blanchflower and Oswald 2011). In addition, the results show that subjective well-being in wealthy countries has remained fairly stable over recent decades despite steady increases in personal income (Blanchflower and Oswald 2011).

Furthermore, other studies have shown that individuals who value financial success above other life goals (e.g., affiliation, self-acceptance, community) experience less well-being than those who do not (Kasser and Ryan 1993, 1996). For example, in three studies, Kasser and Ryan (1993) showed that placing high importance on financial aspirations was associated with lower self-actualization and vitality among undergraduate students, and with lower global functioning and social activity as well as increased behavioral problems among teenagers. Placing high importance on extrinsic goals such as financial aspirations was also related to greater physical symptoms in adults and greater depression in undergraduate students (Kasser and Ryan 1996). Based on their findings, Kasser and Ryan (1996) concluded that the American Dream of being rich and famous was chimerical and even detrimental to young citizens, a conclusion that launched a debate that has now lasted for over two decades.

Although the findings presented above have appealed to many researchers (e.g., Sirgy 1998), others have argued that money can provide some form of contentment and that desiring it does not necessarily cause individuals any harm (e.g., Carver and Baird 1998). For instance, as a reply to Kasser and Ryan’s (1993, 1996) studies, Carver and Baird (1998) asked the question, “Is it what you want or why you want it that matters?” In their study among undergraduate students, the authors found that individuals who endorsed greater financial aspirations experienced less self-actualization, whereas individuals who endorsed greater communal aspirations experienced greater self-actualization. However, their results also showed that financial aspirations were positively related to self-actualization when individuals desired financial success for intrinsic reasons such as personal fun and satisfaction (e.g., “because it would be satisfying to have a job that pays well”). Inversely, financial aspirations were negatively related to self-actualization when individuals desired financial success for extrinsic reasons such as social pressure (e.g., “because people will respect me if I’m financially successful”). In light of these findings, it appeared that financial aspirations could potentially be less detrimental for individuals’ psychological health than Kasser and Ryan had proposed (1993, 1996), depending on the motives underlying these aspirations.

Motives for Making Money Scale (MMMS)

Srivastava et al. (2001) went a step further in their interpretation of Carver and Baird’s (1998) findings, and, along with a few other researchers (e.g., Lea and Webley 2014), suggested that money was simply a means to an end, since most people aspire to attain financial success in order to fulfill other life goals. From this perspective, money is a tool enabling individuals to satisfy their needs and desires. In other words, money can be viewed as an intermediary that simplifies exchanges between individuals and their environment in order to achieve valued outcomes (Lea and Webbley 2014). In line with this, Srivastava et al. (2001) argued that Carver and Baird’s (1998) study was limitative, as it only focused on a restricted number of reasons for aspiring to financial success. Indeed, according to Srivastava et al. (2001), considering only (1) extrinsic financial aspirations: social pressure (e.g., “because it’s something you’re supposed to do”), family considerations (e.g., “because it will make my family proud of me”), and admiration or respect from others (e.g., “because people will respect me if I’m financially successful”), as well as (2) intrinsic financial aspirations: fun (e.g., “because it would be fun to have a job that pays well”), promotion of self-determination (e.g., “because it’s important to me to have the freedom to do what I choose”), and personal satisfaction (e.g., “because it would be satisfying to have a job that pays well”), offered a very limited representation of individuals’ motives for making money.

Consequently, Srivastava et al. (2001) suggested that considering a broader range of motives would allow researchers to better understand the complex relationship between motives for making money and well-being. Hence, with a team of seven researchers, they reviewed existing money scales and generated a list of seventeen motives, for which they developed three items per motive. They then submitted the 51-item survey to 240 business students (mean age = 24; mean work experience = 3 years). Through exploratory factor analysis (EFA; Costello and Osborne 2005; Floyd and Widaman 1995), thirty items were retained and regrouped in ten meaningful factors representing individuals’ main money motives: security (e.g., “to maintain a reasonable bank balance for emergencies”), family support (e.g., “to take care of the college education of my children”), market worth (e.g., “to get just compensation for my work”), pride (e.g., “to know that I can deal with life challenges”), leisure (e.g., “to spend time and money on my hobbies”), freedom (e.g., “to direct my own life with no interference from any other”), impulse (e.g., “to spend money on impulse”), charity (e.g., “to donate money to those who need it”), social comparison (e.g., “to have a house and cars that are better than those of my neighbors”), and overcoming self-doubt (e.g., “to prove that I am not as dumb as some people assumed”).

In a second sample of 266 business students (mean age = 23 years old; mean work experience = 3 years), Srivastava et al. (2001) replicated the scale’s ten first-order factor structure using confirmatory factor analysis (CFA). Second-order exploratory factor analyses were consequently conducted and revealed a three second-order factor structure. More specifically, security, family support, market worth, and pride were identified as positive motives reflecting one’s life achievement and competency in meeting basic life necessities, whereas social comparison and overcoming self-doubt were grouped as negative motives reflecting one’s desire to feel confident and superior, and to have power over others. As for leisure, freedom, impulse, and charity, they were considered freedom of action motives, illustrating one’s ability to spend money as desired.

Replication of the original factor structure of the MMMS

Few studies have measured individuals’ money motives using the complete version of the MMMS as proposed by Srivastava et al. (2001). Indeed, although some research has been conducted on these motives (e.g., Garđarsdóttir et al. 2009; Lim and Sng 2006; Robak et al. 2007), many studies have focused on a few dimensions of the scale (e.g., only the negative motives; Giacomantonio et al. 2013; Lim and Sng 2006) or even a limited set of items (e.g., Garđarsdóttir et al. 2009). For example, Garđarsdóttir et al. (2009) used only four of the original twelve items to measure positive motives, four of the original six items to measure negative motives, and they did not assess freedom of action motives.

Moreover, the few studies that have used the complete MMMS have not been able to replicate the originally proposed factorial structure (e.g., Burke 2004; Robak et al. 2007). For example, through EFA, Burke (2004) found a two second-order factor structure underlying the items of the MMMS, as opposed to the three second-order factor structure proposed by Srivastava et al. (2001). More specifically, Burke (2004) obtained a second-order factor structure with positive motives (i.e., security, family support, market worth, and pride) as in the MMMS validation study. However, as opposed to Srivastava et al. (2001), the negative motives in Burke’s structure included not only social comparison and overcoming self-doubt, but also impulse, leisure, and freedom. As a result, the original second-order factor freedom of action motives was not replicated, as it only included the first-order factor charity.

Given the limited number of studies that have fully investigated the MMMS and the divergent results they have produced, it seemed important to revisit the factorial structure of this scale.

Study 1: Goal

Study 1 therefore aimed to investigate the factorial structure of the MMMS, with the objective of replicating the ten first-factor factorial structure initially obtained by Srivastava et al. (2001). Indeed, Study 1 investigated whether a different second-order factorial structure could more adequately represent individuals’ money motives. Based on SDT, we propose that the ten motives identified by Srivastava et al. (2001) have inherent common denominators at their roots that can be used to conceptualize and categorize them to better explain their positive and negative effects on individuals’ psychological health.

Specifically, the original positive motives family support and security may be better conceived as basic money motives for making money as they reflect a general desire to make money to attain basic life necessities and financial security. Pursuing money to be able to afford basic living requirements such as decent housing and emergencies (security) and to support one’s family by offering education and financial security to one’s children (family support) may convey the sense of responsibility that most individuals experience as they grow older and start earning an income. As such, family support and security may be better conceptualized separately from the other motives and grouped as financial stability motives reflecting a general desire to ensure one’s stable financial situation (Tables 1, 2).

In addition to these financial stability motives for making money, individuals may hold two distinct types of money motives. Much as Sheldon and Elliot (1999) suggested that goals can be integrated or non-integrated with the self, depending on whether they are in line with individuals’ personal values and psychological growth, we suggest that the remaining eight first-order factors could be better grouped into two distinct categories representing either self-integrated or non-integrated motives for making money.

In line with SDT, self-integrated motives for making money could be conceptualized as those that promote personal growth in psychologically healthy environments (Deci and Ryan 2000). In this light, it appears that the original freedom of action motives leisure, freedom, and charity along with the original positive motives market worth and pride could be categorized as self-integrated motives, given that all five directly encourage individuals’ personal growth in psychologically healthy environments. More precisely, the money motives to earn fair compensation for one’s work, thinking and effort (market worth), to donate money and spend volunteering time for causes that one values (charity), to spend time and enjoy one’s leisure and hobbies (leisure), to know that one can deal with life challenges (pride), and to direct one’s life without enduring external interference or having to justify what one does (freedom) all appear to be aimed at sustaining individuals’ optimal social, emotional, and physical development in various contexts. Whether through involvement in charity, leisure, or work activities, individuals who endorse these motives for making money seem to strive toward positive self-growth in a healthy and appropriate way. Accordingly, self-integrated motives could thus include the money motives pride, charity, market worth, freedom, and leisure.

In contrast, non-integrated motives for making money could be conceptualized as those that promote neither personal growth nor psychologically healthy environments. In this light, the original negative motives social comparison and overcoming self-doubt, along with the original freedom of action motive impulse, could be more appropriately categorized as non-integrated motives as they actively impede both personal growth and development of psychologically healthy environments. As such, they appear to be compensatory motives to the extent that individuals pursuing money for these motives could potentially do so to compensate for deficiencies within themselves or in their social environments. For instance, some researchers have suggested that individuals with social deficiencies may be tempted to seek money as an alternative path to becoming socially accepted, valued, and liked (e.g., Banerjee and Dittmar 2008; Mead and Stuppy 2014, Mead et al. 2011). From this perspective, making money to attract attention, show off, and have more material possessions than friends, family, and neighbors (overcoming self-doubt) does not appear to foster healthy social environments or psychological states, nor does making money to prove that one is not incompetent as others have claimed (social comparison). Finally, wanting to make money to be able to spend just for the thrill of it (impulse) seems to be an unhealthy and risky personal investment. Together, these motives for making money seem to stem from a desire to compensate for the absence of more psychologically meaningful and sustainable elements in one’s social context (e.g., feeling socially accepted, valued, supported, competent, in control). In other words, individuals with non-integrated money motives such as seeking money to overcome self-doubt and to make social comparisons may be perpetuating an unfulfilling cycle in which they seek money to compensate for social deficiencies instead of seeking to invest in activities that are more likely to fulfill their needs for relatedness, competence and autonomy. In other words, individuals with non-integrated money motives may be seeking money to invest in activities that are costly for their psychological health. Given these considerations, non-integrated motives could include the money motives impulse, social comparison, and overcoming self-doubt.

Hence, in Study 1, we aimed to test this newly proposed three second-order factor structure and compare it to the original three second-order factor structure of the MMMS. Study 1 addressed another important limitation of past research concerning financial aspirations by examining money motives in a sample of full-time working adults as opposed to students, the population studied in most previous investigations (e.g., Burke 2004; Robak et al. 2007; Studies 1a and 1b in Gađarsdóttir et al. 2009; Study 1 in Giacomantonio et al. 2013; Studies 1 and 2 in Srivastava et al. 2001). As such, this study was intended to provide new insight into the money motives debate and to improve the ecological validity of the scale, given that, by definition, the work context represents the life domain in which most individuals earn money (Milkovich and Newman, 2007).

Study 1: Method

Participants and measures

Data for Study 1 was collected with the help of a consultation firm that agreed to send an email to employees of its client organizations. Employees were invited to complete the study and/or share it within their organizations. Participation was voluntary and anonymous, and took place at the location of their choosing (e.g., office, home) provided that it had internet access. Participants were not required to provide any identifiable data other than socio-demographic information such as gender, age, organizational tenure, and salary, which are customary in industrial and organizational psychology studies (e.g., Hogg and Terry 2000; Tsui and O’reilly 1989). As such, not requiring the name of participants’ employers prevented us from matching their data to any specific organization and ensured their anonymity. In total, 538 employees took part in the study. The majority were women (57.3 %) between 35 and 54 years of age (66.2 %) working in the private sector (for profit; 59.7 %). Moreover, 53.1 % had an annual salary (including bonuses) of $90,000 or less, and the majority (87.5 %) worked full-time. Informed consent was obtained from all participants included in the study. The study included the 30-item Motives for Making Money Scale (Srivastava et al. 2001), which evaluates the ten money motives with three items each. Participants were asked to rate on a scale from 1 (totally unimportant) to 10 (extremely important) the importance of each motive for making money.

Study 1: Results

Preliminary analyses

A MANOVA was performed to test whether the ten motives differed according to background variables (i.e., gender, age, job status, type of organization and annual salary). No significant differences were found.

In order to investigate the factorial structure of the MMMS, Confirmatory Factor Analysis (CFA) using Mplus (Muthén and Muthén 2012) was conducted. Four goodness-of-fit indices were used: the Comparative Fit Index (CFI), Tucker–Lewis Index (TLI), Root Mean Square Error of Approximation (RMSEA), and Standardized Root Mean Square Residual (SRMR). Generally, values higher than .90 for the CFI and the TLI indicate an acceptable fit (Hoyle 1995; Schumacher and Lomax 1996a, b), and values lower than .08 for the RMSEA as well as the SRMR suggest an adequate fit (Browne and Cudeck 1993; Hu and Bentler 1999). A first measurement model (M1) was tested in which all items loaded on their respective factor (ten-factor structure). This model provided a good fit to the data (see Table 3).

Testing of the proposed second-order structure

Second-order Confirmatory Factor Analysis (CFA) was performed subsequently in order to investigate a second-order factor structure underlying the ten motives. In line with SDT, a second-order factor solution (M2) was tested containing three second-order factors: (1) “financial stability motives” comprised of two first-order factors (security and family), (2) “self-integrated motives” comprised of five first-order factors (charity, market worth, freedom, pride, and leisure) and (2) “non-integrated motives” comprised of three first-order factors (impulse, overcoming self-doubt, and social comparison). This model provided a good fit to the data (see Table 3). However, inspection of the model modification indices suggested that the inclusion of one covariance between an item pertaining to pride (i.e., “to know that I can deal with life’s challenges”) and the first-order factor security would significantly improve model fit. Given the conceptual overlap between the two, it was decided to modify to factorial model to include this covariance (Byrne 2012). A third measurement model (M3), consisting of M2 with the inclusion of the covariance, fit the data well and provided a significantly better fit than M1 (see Table 3). It also provided a significantly better fit to the data than the three second-order factor solution (M4) proposed by Srivastava et al. (2001; see Table 3).

Study 1: Discussion

The results of Study 1 support the relevance of investigating employees’ motives for making money through the theoretical lens of self-determination theory. More specifically, motives for making money appear to be better conceptualized as either financial stability motives, or self-integrated and non-integrated motives, depending on whether they are aimed at ensuring the stability of one’s financial situation, or at encouraging or impeding personal growth in psychologically healthy environments.

Study 2

On the basis of the findings obtained in Study 1, Study 2 focused on self-integrated and non-integrated money motives and aimed to examine their differential predictive effect, above and beyond that of financial stability motives, on individuals’ psychological health, conceptualized as well-being and ill-being. More importantly, Study 2 investigated the underlying mechanisms explaining why certain motives for making money are beneficial to well-being, while others are detrimental and could potentially lead to ill-being. Whereas researchers (e.g., Sheldon et al. 2004) have suggested that differences in interpersonal relationships, self-worth contingencies, social comparison, and energy levels may explain the differential effect of money motives on psychological health, we suggest that it is due to differences in psychological need satisfaction and frustration. Our interpretation is aligned with Sheldon and Elliot’s (1999) proposition that individuals can choose to pursue goals that have the potential to maximize their psychological need satisfaction. Such potential can either be optimal, when the chosen goal is in line with one’s personal values and psychological growth, as in the case of self-integrated money motives, or sub-optimal, when the chosen goal does not promote long-term personal growth, as in the case of non-integrated money motives (Sheldon and Elliot 1999; Brown et al. 2009; Grouzet et al. 2005; Kasser 2011; Kasser and Ahuvia 2002; Kasser et al. 2007, 2014). We thus hypothesize that psychological need satisfaction and frustration mediate the relationship between self-integrated and non-integrated money motives and psychological health. In the next sections, we present in greater detail the notions of psychological need satisfaction and frustration as well as their relationship to individuals’ psychological health. We also present the theoretical and empirical foundation supporting their hypothesized relationships with the two types of money motives.

Self-determination theory

According to SDT, all humans possess three basic psychological needs that are more or less likely to be satisfied depending on individuals’ contexts: the needs for competence, autonomy, and relatedness (Deci and Ryan 2000; Sheldon et al. 2011). In regard to the need for competence, individuals must believe they can modify their environment, overcome challenges it presents using their skills, and achieve their desired outcomes within it (Deci and Ryan 2000; Hofer and Busch 2011). As for the need for autonomy, individuals must have a sense of volition in engaging in their activities and be able to act in concordance with their true self and values (Chirkov et al. 2011; Deci and Ryan 2000). Finally, the human need for relatedness is expressed as the desire to feel connected to others in a personally meaningful way (Deci and Ryan 2000; Lavigne et al. 2011).

Need satisfaction and well-being

SDT further proposes that satisfaction of these three psychological needs ensures mental health and optimal human functioning. Past research, including in the work context, has indeed supported this claim (e.g., Gillet et al. 2012a; Van de Broeck et al. 2010; Gagné et al. 2015; Trépanier et al. 2015). For example, Van de Broeck et al. (2010) found that need satisfaction was associated with greater vigor at work. Other research found need satisfaction to be positively associated with job satisfaction, and hedonic as well as eudaimonic well-being (Gillet et al. 2012a, b).

Need satisfaction and self-integrated money motives

In line with our new conceptualization of the money motives, we argue that only self-integrated money motives can have a positive impact on individuals’ psychological health by satisfying their psychological needs. More specifically, based on the conceptualization of money motives found in Study 1, self-integrated motives (pride, charity, market worth, freedom, and leisure) are likely to contribute to individuals’ life goals aimed at fulfilling their psychological needs for competence, autonomy, and relatedness. For example, having the financial goal of making enough money to direct one’s life independently, without external help or interference, and without having to justify every action taken may help satisfy one’s psychological needs for autonomy and competence. Similarly, wanting a fair compensation for one’s work and skills in the current job market could be a way for individuals to feel competent. As such, earning a high salary as an acknowledgement that one has acquired the necessary skills and reached a high level of expertise in a specific job domain may contribute positively to one’s psychological need for competence. Wanting money to be able to help others and to engage in leisure activities may also contribute positively to individuals’ psychological need for relatedness, as it enables them to feel connected to significant others. Hence, self-integrated money motives are likely to lead to greater need satisfaction.

Hypothesis 1a

Self-integrated money motives are positively associated with need satisfaction.

Hypothesis 2a

Need satisfaction is positively associated with well-being.

Need frustration and ill-being

Nonetheless, while extensive research has found need satisfaction to be a strong predictor of well-being, recent work suggests that it may not the best predictor of ill-being (e.g., depressive symptoms). This claim is further supported by empirical findings suggesting that well-being and ill-being are not opposite ends of a continuum and should rather be conceptualized as two distinct yet related dimensions of mental health (Ryff et al. 2006). In line with this new dual conceptualization of psychological health, researchers have begun investigating whether need frustration (i.e., the perception that one’s psychological needs are actively being thwarted), provides a better explanation of individuals’ sub-optimal functioning (Bartholomew et al. 2011a, b; Vansteenkiste and Ryan 2013; Gunnell et al. 2014). In other words, by encompassing instances where individuals experience actual feelings of rejection (as opposed to not feeling related), incompetence (as opposed to not feeling competent), and oppression (as opposed to not feeling volitional), need frustration may better predict individuals’ ill-being (Bartholomew et al. 2011a, b). To this day, findings from many studies, including in the work context, concur with this argument (e.g., Bartholomew et al. 2014; Gunnell et al. 2013). Indeed, recent studies conducted by Bartholomew et al. (2011a, b) showed that need satisfaction and need frustration have distinct outcomes. More specifically, they showed that need satisfaction was more strongly related to well-being (i.e., vitality and positive affect), while need frustration better predicted ill-being (i.e., depression, negative affect, burnout, disordered eating, and physical symptoms). In their second set of studies, Bartholomew et al. (2011a, b) replicated their findings regarding need satisfaction and vitality, and further expanded their findings for need frustration, revealing its strong link with emotional and physical exhaustion.

Need frustration and non-integrated money motives

On the basis of our new conceptualization of the money motives, we argue that non-integrated money motives lead to ill-being because they increase need frustration. Indeed, non-integrated motives (impulse, social comparison, and overcoming self-doubt) seem to contribute to life goals that may be counter to individuals’ healthy psychological growth. Individuals with non-integrated motives for making money invest their energy in sub-optimal social and emotional environments that are likely to increase their need frustration. Through compensatory strategies, these individuals choose to pursue money for activities and experiences that bring short-lived pleasant feelings, and that encourage feelings of isolation, incompetence, competition, pressure, and overall need frustration for the long haul (Van den Broeck et al. 2008a, b). For example, making money to attract attention, show off, and accumulate more material possessions than others (social comparison) might provide temporary relief, but will not sustain long-term psychological, emotional, and social development. This also seems to be the case for the money motives to spend money just for the thrill of it (impulse), and to prove to others that one isn’t incompetent, dumb, or failing (overcoming self-doubt). By investing in these types of activities and experiences, individuals with non-integrated money motives risk actively impeding their psychological needs. As such, we argue that non-integrated money motives, as a whole, are likely to lead to greater need frustration.

Hypothesis 1b

Non-integrated money motives are positively associated with need frustration.

Hypothesis 2b

Need frustration is positively associated with ill-being.

Money motives, psychological needs and psychological health

Similar to our conceptualization of self-integrated and non-integrated money motives, some researchers have investigated the differential effect of material and experiential purchases on individuals’ well-being (e.g., Carter 2014; Dunn et al. 2011; Howell and Hill 2009; Kahneman et al. 2006). More precisely, studies show that psychological need satisfaction mediates the relationship between experiential purchases, which could be conceived as self-integrated money motives as they include spending money on events such as leisure and charity, and individuals’ subsequent well-being (e.g., Howell and Hill 2009; Howell et al. 2013; Nicolao et al. 2009). As such, individuals experience greater psychological need satisfaction when spending on experiential purchases, and subsequently report greater vitality and happiness (Howell and Hill 2009; Nicolao et al. 2009). Howell et al. (2013) further demonstrated in a multi-sample study that psychological need satisfaction mediates the relationship between individuals’ affluence and their psychological health, as measured by life satisfaction.

In accordance with these findings, we use the concept of psychological need frustration and hypothesize that need satisfaction and need frustration play distinct mediating roles in the relationships between money motives and psychological health. More specifically, we propose the following meditational hypotheses while controlling for the effect of financial stability motives:

Hypothesis 3a

Need satisfaction mediates the relationship between self-integrated money motives and well-being.

Hypothesis 3b

Need frustration mediates the relationship between non-integrated money motives and ill-being.

Study 2: Method

Participants

Data for Study 2 was collected through the listserv of the professional order of Certified Human Resources Professionals (CHRP) in the province of Québec, Canada. French-speaking members of this professional order received an email inviting them to complete an online study concerning their financial aspirations as well as their psychological health. Participation in this study was voluntary and anonymous and took place at the location of their choice (e.g., office, home) provided that it had internet access. Similar to Study 1, participants were not required to provide any identifiable data other than socio-demographic information such as gender, age, organizational tenure, and salary, and were not required to indicate the name of their employer, which ensured their anonymity. In total, 748 employees took part in the study. Informed consent was obtained from all participants included in this study. The majority were women (71.9 %), had a mean age of 41.02 (SD = 10.81), worked in the private sector (for profit; 58.4 %), and were full-time workers (85.6 %). Moreover, 56.1 % of the participants had an annual salary (including bonuses) of $75,000 or less. As such, the final sample obtained was fairly representative of the professional order’s membership, of whom 61 % are women, 89 % are aged between 26 and 55 years old, and 60 % work in the private sector.

Measures

In this study, all measures were administered in French. Following the guidelines of the International Test Commission (Hambleton 1993), scales that were not available in French were translated using the back-translation procedure with independent bilingual judges (Vallerand 1989). Hancock’s coefficient (i.e., coefficient H) was calculated using standardized factor loadings to determine the reliability of measures (Hancock and Mueller 2001). This coefficient estimates the stability of the latent construct across multiple observed variables. Values equal to or greater than .70 are deemed satisfactory (Hancock and Mueller 2001).

Motives for making money

As in Study 1, Srivastava et al.’s (2001) MMMS was used to assess employees’ motives for making money. Based on the results of Study 1, a second-order factor structure regrouping the ten first-order factors into three second-order factors was used in the SEM analyses: (1) “financial stability” (security and family; H = .74) “self-integrated motives” (pride, charity, market worth, freedom, and leisure; H = .87) and (2) “non-integrated motives” (impulse, overcoming self-doubt, and social comparison; H = .84).

Need satisfaction

The Balanced Measure of Psychological Needs Scale (Sheldon and Hilpert 2012) was used to assess the satisfaction of the needs for autonomy (e.g., “I am free to do things my own way”; 3 items; H = .66), competence (e.g., “I take on and master hard challenges”; 3 items; H = .79), and relatedness (e.g., “I feel close and connected with other people who are important to me”; 3 items; H = .71). Participants were asked to indicate the extent to which they agreed with the proposed statements. Items were rated on a five-point scale ranging from 1 (totally disagree) to 5 (totally agree). In accordance with previous research, mean scores of the three subscales were used as indicators of the latent construct of need satisfaction (Gillet et al. 2012a, b).

Need frustration

The adapted French version (Gillet et al. 2012b) of the Psychological Need Thwarting Scale (Bartholomew et al. 2011a, b) was used to assess the frustration of the needs for autonomy (e.g., “I feel prevented from making choices with regard to the way I do things”; 4 items; H = .82), competence (e.g., “There are situations where I am made to feel inadequate”; 4 items; H = .87), and relatedness (e.g., “I feel other people dislike me”; 4 items; α = .82). Participants were asked to indicate the extent to which they agreed with the proposed statements. Items were rated on a seven-point scale ranging from 1 (totally disagree) to 7 (totally agree). In accordance with previous research, mean scores of the three subscales were used as indicators of the latent construct of need frustration (Bartholomew et al. 2011a, b).

Well-being

Employee well-being was conceptualized with two indicators: positive affect and life satisfaction. Positive affect was assessed using Thompson’s (2007) Short-Form version of the Positive and Negative Affect Schedule (PANAS). On a five-point scale ranging from 1 (not at all) to 5 (extremely), participants were asked to indicate the extent to which they felt different feelings and emotions during the past weeks (e.g., “inspired”; 5 items; H = .76). Life satisfaction was assessed using Diener, Emmons, Larson, and Griffin’s (1985) five-item Satisfaction with Life Scale (e.g., “I am satisfied with my life”; H = .89). Participants were asked to indicate their agreement with the proposed statements on a seven-point scale ranging from 1 (strongly disagree) to 7 (strongly agree). In the present study, the mean scores of the positive affect subscale and of the life satisfaction scale were used as indicators of the latent factor of well-being.

Ill-being

Employee ill-being was conceptualized with two indicators: negative affect and depressive symptoms. Negative affect was assessed using Thompson’s (2007) Short-Form version of the Positive and Negative Affect Schedule (PANAS). On a five-point scale ranging from 1 (not at all) to 5 (extremely), participants were asked to indicate the extent to which they felt different feelings and emotions during the past weeks (e.g., “hostile”; 5 items; H = .77). Depressive symptoms were assessed using an adapted version of the short-form of the Center for Epidemiologic Studies–Depression scale (CES-D; Cole et al. 2004). On a four-point scale ranging from 0 (rarely) to 3 (most of the time), participants were asked to indicate how often they experienced the proposed statements (e.g., “I felt that everything I did was an effort”; 8 items; H = .77). In the present study, the mean scores of the negative affect subscale and the depressive symptom scale were used as indicators of the latent factor of ill-being.

Study 2: Results

Statistical analyses

The adequacy of the proposed model was assessed by structural equation modeling using Mplus (Mùthens and Mùthens 2012). All models were tested with standardized coefficients obtained by maximum likelihood estimation. The goodness-of-fit of the model was evaluated using the same indices (CFI, TLI, RMSEA, and SRMR) as in Study 1.

Preliminary analyses

A measurement model (M5), in which indicators of the variables included in the structural model (money motives, psychological need satisfaction and frustration, psychological ill-being and well-being) loaded on their respective latent factor, was tested. This model provided a satisfactory fit to the data (see Table 3) and all indicators had significant loadings on their corresponding latent factor. Given that all data were self-reported, we then ran a single-factor model (M6) to test for common method bias (CMB). This model provided a poor fit to the data (see Table 3), suggesting that CMB was unlikely to distort the interpretation of relationships among the studied variables. Next, to confirm that need satisfaction and need frustration were distinct constructs, two second-order models were tested and compared. M7 included two second-order factors: (1) need satisfaction and (2) need frustration, with three first-order factors each: autonomy, competence, and relatedness. M8 included three second-order factors: (1) need for autonomy, (2) need for competence, and (3) need for relatedness. Each second-order factor was represented by two first-order factors regrouping the corresponding need satisfaction and frustration items. As can be seen in Table 3, M7 provides a significantly better data fit than M8.

Next, a MANOVA was performed to test whether the variables in the model differed according to background variables (i.e., gender, age, job status, type of organization, and annual salary). Since no significant differences were found, demographic characteristics were excluded from further analysis.

Testing of the proposed model

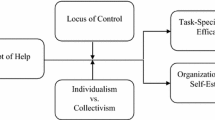

SEM analysis was conducted in order to test the suggested model, which proposed indirect links from self-integrated motives to employee psychological well-being through need satisfaction, and from non-integrated motives to employee ill-being through need frustration (full mediation). Prior to testing the proposed model, the correlation table was inspected. Results show that financial stability motives were not significantly related to need satisfaction and need frustration. As such, a first model (M9) consisting of the proposed model with the exclusion of the two links between financial stability motives and need satisfaction/frustration was tested. The model provided a relatively satisfactory fit to the data (see Table 3). M9 was then compared to a subsequent one (M10), which consisted of M9 with the addition of four cross-links (i.e., self-integrated motives to need frustration, non-integrated motives to need satisfaction, need frustration to well-being, and need satisfaction to ill-being). This model provided a satisfactory fit to the data and a significantly better fit that M9 (see Table 3). Next, M10 was compared to a partial mediation model (M11). M11 consisted of M10 with the addition of six direct paths from the three types of money motives to employee well-being and ill-being. Although this model provided a satisfactory fit to the data, model comparison revealed that M11 did not provide a significantly better fit to the data than M10 (see Table 3). It was therefore concluded that M10 was the best fitting model. As can be seen in Fig. 1, all hypothesized links were significant. More specifically, self-integrated motives positively predicted need satisfaction but were unrelated to need frustration, whereas non-integrated motives negatively predicted need satisfaction and positively predicted need frustration. Moreover, need satisfaction positively predicted well-being and negatively predicted ill-being. The opposite pattern was observed for need frustration: it negatively predicted employee well-being and positively predicted employee ill-being.

In order to formally test the mediating role of need satisfaction and need frustration in the relationship between money motives and psychological health, 95 % CIs were computed from 1000 bootstrap samples (MacKinnon et al. 2004; Preacher and Hayes 2008). In general, mediation (i.e., indirect) effects are said to be significant when confidence intervals exclude zero. Results indicated several significant indirect effects. More specifically, results showed indirect effects of self-integrated motives [Estimate = .237 (CI = .074–.375), p = .004] and non-integrated motives [Estimate = −.322 (CI −.492 to −.179), p < .001] on employee well-being through need satisfaction. The indirect effect of non-integrated motives on employee well-being through need frustration was significant [Estimate = −.066 (CI −.126 to −.016), p = .031]. Moreover, results showed significant indirect effects of non-integrated motives on employee ill-being through need frustration [Estimate = .285 (CI .210–.348), p < .001] and through need satisfaction (Estimate = .071 (CI 20–.113), p = .006], as well as indirect effects of self integrated motives on employee ill-being through need satisfaction [Estimate = −.052 (CI −.094 to −.017), p = .014].

Study 2: Discussion

In terms of our predictions, Hypotheses 1a and 1b regarding the relationship between self-integrated and non-integrated money motives and psychological needs were supported: self-integrated motives were positively associated with need satisfaction, whereas non-integrated motives were positively associated with need frustration. Non-integrated motives were also negatively associated with need satisfaction. As expected, financial stability motives were unrelated to either need satisfaction or need frustration.

As for Hypotheses 2a and 2b regarding the relationship between psychological needs and psychological health, both were supported: need satisfaction was positively associated with well-being, while need frustration was positively associated with ill-being. Need satisfaction was also found to be negatively associated to ill-being and need frustration was found to be negatively associated to well-being.

In terms of the mediating role of psychological needs in the relationship between money motives and psychological health, results supported both Hypotheses 3a and 3b. Not only did results indicate the mediating role of need satisfaction between self-integrated motives and well-being, they also supported the mediating role of need satisfaction between self-integrated motives and ill-being, between non-integrated motives and ill-being, and between non-integrated motives and well-being. Results further supported the mediating role of need frustration in the relationships between non-integrated motives and ill-being, and between non-integrated motives and well-being.

General discussion

Our study is arguably the first to thoroughly validate a scale to measure individuals’ money motives—the Motives for Making Money Scale—and to provide a potential explanation as to why self-integrated and non-integrated money motives respectively lead to well-being and ill-being. In Study 1, the factor structure of Srivastava et al.’s (2001) MMMS was analyzed and the findings were in line with previous research showing that the original factor structure could not be replicated (e.g., Robak et al. 2007). As expected, the second-order factor structure identified differed from Srivastava et al.’s (2001) initial structure and revealed three second-order factors composed of financial stability motives as well as self-integrated and non-integrated money motives. In Study 2, a structural model, in which self-integrated money motives positively relate to well-being through greater need satisfaction, whereas non-integrated money motives positively relate to ill-being through greater need frustration, was tested. Results supported this model.

Our study provides a preliminary answer regarding the conditions under which pursuing money could be beneficial or detrimental to individuals’ psychological health. While much research has shown that money generally leads to negative cognitive and affective consequences (e.g., Aknin et al. 2009; Garđarsdóttir et al. 2009; Kahneman et al. 2006; Kiatpongsan and Norton 2014; Srivastava et al. 2001; Vohs et al. 2006, 2008), our study is one of the few to have identified a potential mechanism by which money can lead to either positive or negative consequences. As such, our findings strengthen the argument that money has no beneficial or detrimental value in and of itself, as it is merely a medium through which one interacts with the outside world (Lea and Webbley 2014; Srivastava et al. 2001). Our results show that it is actually the goals for which individuals choose to pursue money that determine whether it will have a positive or negative impact on their psychological health. This aligns with Lea and Webbley’s proposition (2014) that money enables us to satisfy our biologically rooted needs and desires. More precisely, money appears to be a means that enables us to satisfy—or not—our basic psychological needs.

From this perspective, our findings partly corroborate those of Carver and Baird (1998) by showing that why people want money is indeed what really matters. However, we provide a more nuanced understanding by showing that the reason individuals want money affects their psychological need satisfaction and need frustration, which then determines whether it has a positive or negative impact on their psychological health. As such, the present findings suggest that pursuing money to promote one’s psychological growth in a healthy environment through leisure, freedom, charity, pride, and market worth can lead individuals to experience greater feelings of competence, autonomy, and relatedness. On the other hand, pursuing money to compensate for feelings of inadequacy and superiority through impulse, overcoming self-doubt, and social comparison not only prevents individuals from experiencing feelings of autonomy, competence, and relatedness, but also actively frustrates these needs.

Our present findings are directly related to those of Niemiec et al. (2009) study, which showed that changes in need satisfaction mediate the negative relationship between attaining extrinsic aspirations such as financial success, fame, and image, and changes in psychological health. Together with these results, our study seems to suggest that pursuing and obtaining money for reasons that are not aligned with one’s psychological needs can be detrimental to one’s psychological health. However, our results go a step further by showing that on the other hand, pursuing money for reasons that are aligned with one’s psychological needs can be beneficial to one’s psychological health. Building upon Moller and Deci’s (2014) conclusion, achieving financial aspirations may not constitute an empty victory in terms of psychological health and well-being if the reasons underlying one’s financial aspirations are self-integrated money motives which fulfill one’s psychological needs.

Limits

One of major limits of the present article is the cross-sectional, self-reported nature of the two studies, which increases the risk for common method bias. However, results from a single-factor measurement model suggest that the current results were not overly affected by such bias (Podsakoff et al. 2003). Furthermore, many researchers have argued that self-reports are appropriate to measure subjective appraisals and private events that are not easily observable and translatable into behavior such as the constructs under study (e.g., Chan 2009; Conway and Lance 2010; Podsakoff et al. 2012). As such, self-reports constitute an appropriate method to measure the variables included in the study (money motives, need satisfaction, need frustration, well-being and ill-being), as they all represent subjective evaluations of cognitive, emotional and physical states and experiences.

Nonetheless, future research should look at other indicators of well-being, including objective measures such as duration of affect and other-reported measures such as ratings by significant others. Similarly, future research is also encouraged to use longitudinal designs to investigate the temporal relationship between individuals’ money motives, psychological needs and psychological health.

Moreover, future studies should aim to replicate the new factor structure of the MMMS found in the present study using other working samples. Indeed, sample restrictions may have influenced our results since all the participants in the present research had a professional background in human resources or in industrial relations. For example, although results in our studies did not reveal differences between employees from the for-profit and the non-profit sectors, other studies have found significant differences in terms of salaries, motivation, and work orientation (e.g., De Cooman et al. 2009; Goulet and Frank 2002; Mirvis and Hackett 1983). It thus appears that individuals’ money motives may differ according to their work field.

Conclusion

The present study provides new insight into the factorial structure of the Motives for Making Money Scale (MMMS; Srivastava et al. 2001) and illustrates why money (e.g., Furnham and Argyle 1998; Tang and Chiu 2003) can promote or hinder individuals’ psychological health. Our results showed that self-integrated money motives increase need satisfaction, while non-integrated money motives increase need frustration, which in turn distinctly affect individuals’ psychological health: need satisfaction fosters well-being whereas need frustration promotes ill-being. Future research is encouraged to find ways to foster more self-integrated and less non-integrated money motives.

References

Aknin, L. B., Norton, M. I., & Dunn, E. W. (2009). From wealth to well-being? Money matters, but less than people think. The Journal of Positive Psychology, 4(6), 523–527. doi:10.1080/17439760903271421.

Ashkanasy, N. M. (2011). International happiness: A multilevel perspective. The Academy of Management Perspectives, 25(1), 23–29.

Banerjee, R., & Dittmar, H. (2008). Individual differences in children’s materialism: The role of peer relations. Personality and Social Psychology Bulletin, 34, 17–31. doi:10.1177/0146167207309196.

Bartholomew, K. J., Ntoumanis, N., Cuevas, R., & Lonsdale, C. (2014). Job pressure and ill-health in physical education teachers: The mediating role of psychological need thwarting. Teaching and Teacher Education, 37, 101–107. doi:10.1016/j.tate.2013.10.006.

Bartholomew, K. J., Ntoumanis, N., Ryan, R. M., Bosch, J. A., & Thøgersen-Ntoumani, C. (2011a). Self-determination theory and diminished functioning: The role of interpersonal control and psychological need thwarting. Personality and Social Psychology Bulletin, 37, 1459–1473. doi:10.1177/0146167211413125.

Bartholomew, K. J., Ntoumanis, N., Ryan, R. M., & Thøgersen-Ntoumani, C. (2011b). Psychological need thwarting in the sport context: Assessing the darker side of athletic experience. Journal of Sport & Exercise Psychology, 33, 75–102. doi:10.1037/t00804-000.

Biljeveld, E., & Aarts, H. (2014). The psychological science of money. New York, NY: Springer.

Blanchflower, D. G., & Oswald, A. J. (2011). International happiness: A new view on the measure of performance. The Academy of Management Perspectives, 25(1), 6–22.

Brown, K. W., Kasser, T., Ryan, R. M., Alex Linley, P., & Orzech, K. (2009). When what one has is enough: Mindfulness, financial desire discrepancy, and subjective well-being. Journal of Research in Personality, 43(5), 727–736. doi:10.1016/j.jrp.2009.07.002.

Browne, M. W., & Cudeck, R. (1993). Alternative ways of assessing model fit. In K. A. Bollen & J. S. Long (Eds.), Testing structural equation models (pp. 136–162). Newbury Park, CA: Sage.

Burke, R. J. (2004). Workaholism, self-esteem, and motives for money. Psychological Reports, 94, 457–463. doi:10.2466/PR0.94.2.457-463.

Byrne, B. M. (2012). Structural equation modeling with Mplus: Basic concepts, applications, and programming. New York: Routledge Academic.

Carter, T. J. (2014). The psychological science of spending money. In E. Bijleveld & H. Aarts (Eds.), The psychological science of money (pp. 213–242). New York: Springer.

Carver, C. S., & Baird, E. (1998). The American dream revisited: Is it what you want or why you want it that matters? Psychological Science, 9, 289–292. doi:10.1111/1467-9280.00057.

Chan, D. (2009). So why ask me? Are self-report data really that bad? In C. E. Lance & R. J. Vandenberg (Eds.), Statistical and methodological myths and urban legends: Doctrine, verity and fable in the organizational and social sciences (pp. 309–336). New York, NY: Routledge.

Chirkov, V. I., Sheldon, K. M., & Ryan, R. M. (2011). The struggle for happiness and autonomy in cultural and personal contexts: An overview. Human Autonomy in Cross-cultural Context,. doi:10.1007/978-90-481-9667-8_1.

Cole, J. C., Rabin, A. S., Smith, T. L., & Kaufman, A. S. (2004). Development and validation of a Rasch-derived CES-D short form. Psychological Assessment, 16, 360–372. doi:10.1037/1040-3590.16.4.360.

Conway, J. M., & Lance, C. E. (2010). What reviewers should expect from authors regarding common method bias in organizational research. Journal of Business and Psychology, 25(3), 325–334. doi:10.1007/s10869-010-9181-6.

Costello, A. B. & Osborne, J. W. (2005). Best practices in exploratory factor analysis: Four recommendations for getting the most from your analysis. Practical Assessment Research & Evaluation, 10(7). http://pareonline.net/getvn.asp?v=10&n=7.

De Cooman, R., De Gieter, S., Pepermans, R., & Jegers, M. (2009). A cross-sector comparison of motivation-related concepts in for-profit and not-for-profit service organizations. Nonprofit and Voluntary Sector Quarterly. doi:10.1016/j.jvb.2008.10.010.

Deci, E. L., & Ryan, R. M. (2000). The “what” and “why” of goal pursuits: Human needs and the self-determination of behavior. Psychological Inquiry, 11, 227–268. doi:10.1207/S15327965PLI1104_01.

Diener, E., & Biswas-Diener, R. (2002). Will money increase subjective well-being? Social Indicators Research, 57(2), 119–169. doi:10.1023/A:1014411319119.

Diener, E., Emmons, R. A., Larsen, R. J., & Griffin, S. (1985). The satisfaction with life scale. Journal of Personality Assessment, 49, 71–75. doi:10.1207/s15327752jpa4901_13.

Diener, E., Tay, L., & Oishi, S. (2013). Rising income and the subjective well-being of nations. Journal of Personality and Social Psychology, 104(2), 267. doi:10.1037/a0030487.

Dunn, E. W., Gilbert, D. T., & Wilson, T. D. (2011). If money doesn’t make you happy, then you probably aren’t spending it right. Journal of Consumer Psychology, 21(2), 115–125. doi:10.1016/j.jcps.2011.02.002.

Floyd, F. J., & Widaman, K. F. (1995). Factor analysis in the development and refinement of clinical assessment instruments. Psychological Assessment, 7, 286–299.

Furnham, A., & Argyle, M. (1998). The psychology of money. London: Psychology Press.

Gagné, M., Forest, J., Vansteenkiste, M., Crevier-Braud, L., Van den Broeck, A., Aspeli, A. K., et al. (2015). The Multidimensional Work Motivation Scale: Validation evidence in seven languages and nine countries. European Journal of Work and Organizational Psychology, 24(2), 178–196. doi:10.1080/1359432x.2013.877892.

Garđarsdóttir, R. B., Dittmar, H., & Aspinall, C. (2009). It’s not the money, it’s the quest for a happier self: The role of happiness and success motives in the link between financial goals and subjective well-being. Journal of Social and Clinical Psychology, 28, 1100–1127. doi:10.1521/jscp.2009.28.9.1100.

Giacomantonio, M., Mannetti, L., & Pierro, A. (2013). Locomoting toward well-being or getting entangled in a material world: Regulatory modes and affective well-being. Journal of Economic Psychology, 38, 80–89. doi:10.1016/j.joep.2012.07.003.

Gillet, N., Fouquereau, E., Forest, J., Brunault, P., & Colombat, P. (2012a). The impact of organizational factors on psychological needs and their relations with well-being. Journal of Business and Psychology, 27, 437–450. doi:10.1007/s10869-011-9253-2.

Gillet, N., Fouquereau, E., Lequeurre, J., Bigot, L., & Mokounkolo, R. (2012b). Validation d’une Échelle de Frustration des Besoins Psychologiques au Travail (EFBPT). Psychologie du Travail et des Organisations, 18, 328–344.

Goulet, L. R., & Frank, M. L. (2002). Organizational commitment across three sectors: Public, non-profit, and for-profit. Public Personnel Management, 31(2), 201–210. doi:10.1177/009102600203100206.

Grouzet, F. M., Kasser, T., Ahuvia, A., Dols, J. M., Kim, Y., Lau, S., et al. (2005). The structure of goal contents across 15 cultures. Journal of Personality and Social Psychology, 89(5), 800–816. doi:10.1037/0022-3514.89.5.800.

Gunnell, K. E., Crocker, P. R. E., Mack, D. E., Wilson, P. M., & Zumbo, B. D. (2014). Goal contents, motivation, psychological need satisfaction, well-being and physical activity: A test of self-determination theory over 6 months. Psychology of Sport and Exercise, 15(1), 19–29. doi:10.1016/j.psychsport.2013.08.005.

Gunnell, K. E., Crocker, P. R. E., Wilson, P. M., Mack, D. E., & Zumbo, B. D. (2013). Psychological need satisfaction and thwarting: A test of basic psychological needs theory in physical activity contexts. Psychology of Sport and Exercise, 14, 599–607. doi:10.1016/j.psychsport.2013.03.007.

Hambleton, R. K. (1993). Translating achievement tests for use in cross-national studies. European Journal of Psychological Assessment, 9, 57–68.

Hancock, G. R., & Mueller, R. O. (2001). Rethinking construct reliability within latent systems. In R. Cudeck, S. du Toit, & D. Sörbom (Eds.), Structural equation modeling: Present and future—A festschrift in honor of Karl Jöreskog (pp. 195–216). Lincolnwood, IL: Scientific Software International.

Hofer, J., & Busch, H. (2011). Satisfying one’s needs for competence and relatedness consequent domain-specific well-being depends on strength of implicit motives. Personality and Social Psychology Bulletin, 37(9), 1147–1158. doi:10.1177/0146167211408329.

Hogg, M. A., & Terry, D. I. (2000). Social identity and self-categorization processes in organizational contexts. Academy of Management Review, 25(1), 121–140.

Howell, R. T., & Hill, G. (2009). The mediators of experiential purchases: Determining the impact of psychological needs satisfaction and social comparison. The Journal of Positive Psychology, 4(6), 511–522. doi:10.1080/17439760903270993.

Howell, R. T., Kurai, M., & Tam, L. (2013). Money buys financial security and psychological need satisfaction: Testing need theory in affluence. Social Indicators Research, 110(1), 17–29. doi:10.1007/s11205-010-9774-5.

Hoyle, R. H. (1995). Structural equation modeling: Concepts, issues, and applications. Thousand Oaks, CA: Sage Publications.

Hu, L.-T., & Bentler, P. M. (1999). Cutoff criteria for fit indexes in covariance structure analysis: Conventional criteria versus new alternatives. Structural Equation Modeling, 6(1), 1–55. doi:10.1080/10705519909540118.

Kahneman, D., Krueger, A. B., Schkade, D., Schwarz, N., & Stone, A. A. (2006). Would you be happier if you were richer? A focusing illusion. Science, 312(5782), 1908–1910. doi:10.1126/science.1129688.

Kasser, T. (2002). Sketches for a self-determination theory of values. In E. L. Deci & R. M. Ryan (Eds.), Handbook of self-determination research (pp. 123–140). Rochester, NY: University Of Rochester Press.

Kasser, T. (2011). Cultural values and the well-being of future generations: A cross-national study. Journal of Cross-Cultural Psychology, 42(2), 206–215. doi:10.1177/0022022110396865.

Kasser, T., & Ahuvia, A. (2002). Materialistic values and well-being in business students. European Journal of Social Psychology, 32(1), 137–146. doi:10.1002/Ejsp.85.

Kasser, T., Kanner, A. D., Cohn, S., & Ryan, R. M. (2007). Psychology and American corporate capitalism: Further reflections and future directions. Psychological Inquiry, 18(1), 60–71. doi:10.1080/10478400701459103.

Kasser, T., Rosenblum, K. L., Sameroff, A. J., Deci, E. L., Niemiec, C. P., Ryan, R. M., et al. (2014). Changes in materialism, changes in psychological well-being: Evidence from three longitudinal studies and an intervention experiment. Motivation and Emotion, 38(1), 1–22. doi:10.1007/s11031-013-9371-4.

Kasser, T., & Ryan, R. M. (1993). A dark side of the American dream: Correlates of financial success as a central life aspiration. Journal of Personality and Social Psychology, 65, 410–422. doi:10.1037//0022-3514.65.2.410.

Kasser, T., & Ryan, R. M. (1996). Further examining the American dream: Differential correlates of intrinsic and extrinsic goals. Personality and Social Psychology Bulletin, 22, 280–287. doi:10.1177/0146167296223006.

Kiatpongsan, S., & Norton, M. I. (2014). How much (more) should CEOs make? A universal desire for more equal pay. Perspectives on Psychological Science, 9(6), 587–593. doi:10.1177/1745691614549773.

Lavigne, G. L., Vallerand, R. J., & Crevier-Braud, L. (2011). The fundamental need to belong: On the distinction between growth and deficit-reduction orientations. Personality and Social Psychology Bulletin, 37(9), 1185–1201. doi:10.1177/0146167211405995.

Lea, S. E. G., & Webley, P. (2014). Money: Metaphors and motives. In E. Bijleveld & H. Aarts (Eds.), The psychological science of money (pp. 21–35). New York, NY: Springer.

Lim, V. K., & Sng, Q. S. (2006). Does parental job insecurity matter? Money anxiety, money motives, and work motivation. Journal of Applied Psychology, 91(5), 1078–1087. doi:10.1037/0021-9010.91.5.1078.

MacKinnon, D. P., Lockwood, C. M., & Williams, J. (2004). Confidence limits for the indirect effect: Distribution of the product and resampling methods. Multivariate Behavioral Research, 39(1), 99–128. doi:10.1207/s15327906mbr3901_4.

Mead, N. L., Baumeister, R. F., Stillman, T. F., Rawn, C. D., & Vohs, K. D. (2011). Social exclusion causes people to spend and consume in the service of affiliation. Journal of Consumer Research, 37, 902–919.

Mead, N. L., & Stuppy, A. (2014). Money can promote or hinder interpersonal harmony. In E. Bijleveld & H. Aarts (Eds.), The psychological science of money (pp. 243–262).

Milkovich, G., & Newman, J. (2007). Compensation (9th ed.). New York, NY: Irwin/McGraw-Hill.

Mirvis, P. H., & Hackett, E. J. (1983). Work and workforce characteristics in the nonprofit sector. Monthly Labor Review, 106, 3–12.

Moller, A. C., & Deci, E. L. (2014). The psychology of getting paid: An integrated perspective. In E. Bijleveld & H. Aarts (Eds.), The psychological science of money (pp. 189–211). New York: Springer.

Muthén, L. K., & Muthén, B. O. (2012). Mplus user’s guide (6th ed.). Los Angeles, CA: Muthén & Muthén.

Nicolao, L., Irwin, J., & Goodman, J. (2009). Happiness for sale: Do experiential purchases make consumers happier than material purchases? Journal of Consumer Research, 36, 188–198. doi:10.1086/597049.

Niemiec, C. P., Ryan, R. M., & Deci, E. L. (2009). The path taken: Consequences of attaining intrinsic and extrinsic aspirations in post-college life. Journal of Research in Personality, 43(3), 291–306. doi:10.1016/j.jrp.2008.09.001.

Podsakoff, P. M., MacKenzie, S. B., Lee, J.-Y., & Podsakoff, N. P. (2003). Common method biases in behavioral research: A critical review of the literature and recommended remedies. Journal of Applied Psychology, 88, 879–903.

Podsakoff, P. M., MacKenzie, S. B., & Podsakoff, N. P. (2012). Sources of method bias in social science research and recommendations on how to control it. Annual Review of Psychology, 63, 539–569. doi:10.1146/annurev-psych-120710-100452.

Preacher, K. J., & Hayes, A. F. (2008). Asymptotic and resampling strategies for assessing and comparing indirect effects in multiple mediator models. Behavior Research Methods, 40(3), 879–891. doi:10.3758/BRM.40.3.879.

Robak, R. W., Chiffriller, S. H., & Zappone, M. C. (2007). College student’s motivations for making money and subjective well-being. Psychological Reports, 100, 147–156. doi:10.2466/pr0.100.1.147-156.

Ryff, C. D., Love, G. D., Urry, H. L., Muller, D., Rosenkranz, M. A., Friedman, E. M., & Singer, B. (2006). Psychological well-being and ill-being: Do they have distinct or mirrored biological correlates? Psychotherapy and Psychosomatics, 75, 85–95. doi:10.1159/000090892.

Sacks, D. W., Stevenson, B., & Wolfers, J. (2012). The new stylized facts about income and subjective well-being. Emotion, 12(6), 1181. doi:10.1037/a0029873.

Schumacher, R. E., & Lomax, R. G. (1996a). A beginner’s guide to SEM. New Jersey: Mahwah.

Schumacher, R. E., & Lomax, R. G. (1996b). A beginner’s guide to structural equation modeling. New Jersey: Lawrence Erlbaum Associates, Publishers.

Sheldon, K. M., Cheng, C., & Hilpert, J. (2011). Understanding well-being and optimal functioning: Applying the Multilevel Personality in Context (MPIC) model. Psychological Inquiry, 22(1), 1–16. doi:10.1080/1047840x.2011.532477.

Sheldon, K. M., & Elliot, A. J. (1999). Goal striving, need satisfaction, and longitudinal well-being: The self-concordance model. Journal of Personality and Social Psychology, 76(3), 482–497. doi:10.1037/0022-3514.76.3.482.

Sheldon, K. M., & Hilpert, J. C. (2012). The Balanced Measure of Psychological Needs (BMPN) scale: An alternative domain general measure of need satisfaction. Motivation and Emotion, 36, 439–451. doi:10.1007/s11031-012-9279-4.

Sheldon, K. M., Ryan, R. M., Deci, E. L., & Kasser, T. (2004). The independent effects of goal contents and motives on well-being: It’s both what you pursue and why you pursue it. Personality and Social Psychology Bulletin, 30, 475–486. doi:10.1177/0146167203261883.

Sirgy, M. J. (1998). Materialism and quality of life. Social Indicators Research, 43(3), 227–260. doi:10.1023/A:1006820429653.

Srivastava, A., Locke, E. A., & Bartol, K. M. (2001). Money and subjective well-being: It’s not the money, it’s the motives. Journal of Personality and Social Psychology, 80, 959–971. doi:10.1037//0022-3514.80.6.959.

Tang, T. L.-P., & Chiu, R. K. (2003). Income, money ethic, pay satisfaction, commitment and unethical behavior: Is the love of money the root of evil for Hong Kong employees? Journal of Business Ethics, 46, 13–30. doi:10.1023/A:1024731611490.

Thompson, E. R. (2007). Development and validation of an internationally reliable short-form of the Positive and Negative Affect Schedule (PANAS). Journal of Cross-Cultural Psychology, 38(2), 227–242. doi:10.1177/0022022106297301.

Trépanier, S.-G., Forest, J., Fernet, C., & Austin, S. (2015). On the psychological and motivational processes linking job characteristics to employee functioning: Insights from self-determination theory. Work and Stress. doi:10.1080/02678373.2015.1074957.

Tsui, A. S., & O’reilly, C. A. (1989). Beyond simple demographic effects: The importance of relational demography in superior-subordinate dyads. Academy of Management Journal, 32(2), 402–423.

Vallerand, R. J. (1989). Vers une méthodologie de validation trans-culturelle de questionnaires psychologiques: Implications pour la recherche en langue française. Canadian Psychology/Psychologie Canadienne, 30(4), 662–680.

Van de Broeck, A., Vansteenkiste, M., De Witte, H., Soenens, B., & Lens, W. (2010). Capturing autonomy, competence, and relatedness at work: Construction and initial validation of the Work-related Basic Need Satisfaction scale. Journal of Occupational and Organizational Psychology, 83(4), 981–1002. doi:10.1348/096317909X481382.

Van den Broeck, A., Vansteenkiste, M., & De Witte, H. (2008a). Self-determination theory: A theoretical and empirical overview in occupational health psychology. In J. Houdmont & S. Leka (Eds.), Occupational health psychology (Vol. 3, pp. 63–88). European perspectives on research, education, and practice. Nottingham: University Press.

Van den Broeck, A., Vansteenkiste, M., De Witte, H., & Lens, W. (2008b). Explaining the relationships between job characteristics, burnout, and engagement: The role of basic psychological need satisfaction. Work & Stress, 22(3), 277–294. doi:10.1080/02678370802393672.

Vansteenkiste, M., & Ryan, R. M. (2013). On psychological growth and vulnerability: Basic psychological need satisfaction and need frustration as a unifying principle. Journal of Psychotherapy Integration, 23, 263–280. doi:10.1037/a0032359.

Vohs, K. D., Mead, N. L., & Goode, M. R. (2006). The psychological consequences of money. Science, 314, 1154–1156. doi:10.1126/science.1132491.

Vohs, K. D., Mead, N. L., & Goode, M. R. (2008). Merely activating the concept of money changes personal and interpersonal behavior. Current Directions in Psychological Science, 17, 208–212. doi:10.1111/j.1467-8721.2008.00576.x.

Acknowledgments

The research was facilitated by a grant from the “Fondation de l’Ordre des conseillers en ressources humaines agréés” to the fourth author.

Author information

Authors and Affiliations

Corresponding author

Ethics declarations

Ethical approval

All procedures performed in the current studies involving human participants were in accordance with the ethical standards of the institutional and/or national research committee and with the 1964 Helsinki declaration and its later amendments or comparable ethical standards.

Rights and permissions

About this article

Cite this article

Thibault Landry, A., Kindlein, J., Trépanier, SG. et al. Why individuals want money is what matters: Using self-determination theory to explain the differential relationship between motives for making money and employee psychological health. Motiv Emot 40, 226–242 (2016). https://doi.org/10.1007/s11031-015-9532-8

Published:

Issue Date:

DOI: https://doi.org/10.1007/s11031-015-9532-8