Abstract

To identify predictors of coverage continuity for United States children and assess how they have changed in the first 12 years since implementation of the Children’s Health Insurance Program in 1997. Using data from the nationally-representative Medical Expenditure Panel Survey, we used logistic regression to identify predictors of discontinuity in 1998 and 2009 and compared differences between the 2 years. Having parents without continuous coverage was the greatest predictor of a child’s coverage gap in both 1998 and 2009. Compared to children with at least one parent continuously covered, children whose parents did not have continuous coverage had a significantly higher relative risk (RR) of a coverage gap [RR 17.96, 95 % confidence interval (CI) 14.48–22.29 in 1998; RR 12.88, 95 % CI 10.41–15.93 in 2009]. In adjusted models, parental continuous coverage was the only significant predictor of discontinuous coverage for children (with one exception in 2009). The magnitude of the pattern was higher for privately-insured children [adjusted relative risk (aRR) 29.17, 95 % CI 20.99–40.53 in 1998; aRR 25.54, 95 % CI 19.41–33.61 in 2009] than publicly-insured children (aRR 5.72, 95 % CI 4.06–8.06 in 1998; aRR 4.53, 95 % CI 3.40–6.04 in 2009). Parental coverage continuity has a major influence on children’s coverage continuity; this association remained even after public health insurance expansions for children. The Affordable Care Act will increase coverage for many adults; however, ‘churning’ on and off programs due to income fluctuations could result in coverage discontinuities for parents. If parental coverage instability persists, these discontinuities may continue to have a negative impact on children’s coverage stability as well.

Similar content being viewed by others

Avoid common mistakes on your manuscript.

Introduction

The health insurance landscape in the United States (US) has changed significantly over the past two decades due to political and economic factors. Employer-sponsored and other private coverage options have become less accessible for children and adults [1–3], and public insurance eligibility cutoffs prevent many adults from gaining coverage [4]. Public coverage options; however, have expanded for children with the creation of the Children’s Health Insurance Program (CHIP) in 1997 [5]. CHIP has led to substantial increases in coverage; seven million children gained health insurance in its first 10 years and coverage rates significantly improved for children in families earning <400 % of the federal poverty level (FPL) [6–8].

Though CHIP has improved health insurance rates, many children continue to experience gaps in coverage [9–11]. This is problematic because insurance discontinuities are associated with higher rates of unmet medical and prescription drug needs and a lack of recommended preventive health services similar to the uninsured [12–14]: all leading to poorer health [15]. In comparison, having continuous health insurance leads to better access to health care and improved health outcomes [16–18].

Child age and ethnicity, and family income have been shown to be predictors of discontinuous health insurance coverage for children [19, 20]. Few studies have included parental health insurance continuity as a potential predictor of discontinuous coverage; many of which were conducted in one state only [12, 21–24]. Further, little is known about whether there have been changes in the predictors associated with discontinuous coverage for children in the first 12 years after implementation of CHIP. Thus, this study examines the strength of association between known and potential predictors of children’s health insurance continuity in both 1998 and 2009.

Methods

Data Source and Study Population

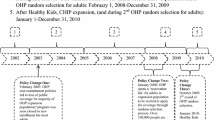

This analysis used data from the Medical Expenditure Panel Survey (MEPS)—Household Component (HC), which collects information from a subsample of households from the National Health Interview Survey, utilizes a stratified, clustered random sample with weights that produce estimates for the civilian, non-institutionalized US population [25, 26]. MEPS selects a new panel of respondents each year, and data are collected from each panel five times over a 2-year period. Each annual public use file contains data from two overlapping panels of the MEPS. Each year of MEPS data constitutes a nationally-representative sample. MEPS survey design and methodology are reported elsewhere [27–29]. We used MEPS-HC annual public use files from 1998 to 2009 [30].

An individual child was the unit of analysis. We selected children aged 0–17 years, with responses to one full year of the survey (n = 6,912 in 1998; n = 10,081 in 2009). To account for parental characteristics associated with children’s insurance coverage, we linked each child with at least one biological, adopted, and/or stepparent residing in the same household (MEPS does not include variables for linking foster parents or non-parent guardians in this manner) [26] and excluded children for whom no identifiable parent records could be linked. Because we were interested in comparing discontinuous versus continuous coverage, we excluded children who were uninsured. This resulted in a final study population of 5,879 children in 1998 and 9,125 children in 2009, weighted to represent approximately 64 million fully- or partially-insured US children in 1998 and 68.7 million in 2009.

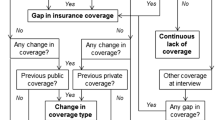

Variables

MEPS-HC asks about monthly insurance coverage status and type at each data collection round; these responses are then logically edited and constructed by MEPS-HC staff into monthly variables. We utilized each child’s monthly coverage information to construct a variable that represented the child’s insurance continuity during a given calendar year: (1) continuous coverage and (2) discontinuous coverage [30]. For continuous coverage, the child had to have at least 1 day of coverage reported in every month of the calendar year. Children with coverage reported in 1–11 months of the calendar year, but not in all 12 months, were classified as having discontinuous coverage. Children with no health insurance reported in any of the 12 months were considered uninsured and were excluded from the analysis. Parental insurance coverage continuity was defined similarly: for continuous coverage, at least one parent had to have at least 1 day of health insurance coverage in every month of the calendar year. Parent(s) with coverage reported in 1–11 months of the calendar year, but not all 12 months were classified as having discontinuous coverage. If both parents or the sole parent in the household reported no coverage in all 12 months, parental coverage was designated as no coverage.

We also utilized each child’s monthly coverage information to construct a variable that represented the child’s insurance coverage type during a given calendar year: (1) only private insurance, (2) only public insurance and (3) both private and public insurance. Children who were reported to have at least 1 day of public insurance (e.g. Medicaid, CHIP) in each calendar month were considered to have had public insurance for that month; those reported to have least 1 day of private insurance (e.g. employer/union group insurance) in each calendar month were considered to have had private insurance for that month. For both private and public insurance, the child could have both private and public types of coverage reported for any or all months of the calendar year. Note that because of small sample sizes (n < 30) of for some categories of the interaction term between child’s insurance type and parental insurance status in our final models, we re-categorized the insurance type variable as (1) any private insurance—those with only private insurance during the year or a combination of public and private, and (2) only public insurance.

We examined the following characteristics previously shown to influence coverage or coverage continuity: child’s age, race/ethnicity, family income, region of residence, health status (as perceived by the reporting parent), family composition (one parent in the household vs. two parents in the household), child’s insurance type, and parent’s insurance continuity (continuous, discontinuous, or no coverage) [13, 19–24, 31].

Analysis

We conducted chi-square tests to assess significant differences in sample characteristics, comparing 1998–2009. We used univariate logistic regression to identify factors significantly associated with whether or not a child had discontinuous coverage (vs. continuous) in 1998 and in 2009. We conducted chi-square tests to assess significant changes in these percentages, comparing 1998–2009. We used multivariate logistic regression to explore characteristics associated with children’s discontinuous (vs. continuous) coverage in 1998 and in 2009. All covariates (except family composition) from univariate analyses were entered into the multivariate models because each was significantly associated with the primary outcome in 1998 and/or in 2009. Family composition was not retained in final models due to its high collinearity with parental insurance continuity. Further, we found evidence of significant effect modification by child’s insurance type on the association between parent’s and child’s insurance continuity, which led us to include an interaction term between child’s insurance type and parent’s insurance continuity in the final models.

We assessed measures of association from logistic regression modeling as relative risks (RR) because odds ratios tend to overestimate the risk for commonly occurring outcomes [32]. Sampling stratification variables and weights accounted for the complex sample design of the survey; all analyses were conducted using SUDAAN software, version 11.0 (Research Triangle Institute, Research Triangle Park, NC). A P value of <0.05 was considered statistically significant for all analyses. This study was deemed exempt by the Oregon Health & Science University Institutional Review Board as MEPS data are publicly available.

Results

When assessing the demographic characteristics of our study sample, we found statistically significant differences in three of the variables: race/ethnicity, child insurance type, and parent(s) insurance in 1998 versus 2009. The distribution of other characteristics did not change during this time period (Table 1).

Several characteristics were associated with having a higher likelihood of discontinuous coverage (vs. continuous) in unadjusted models for both 1998 and 2009 (Table 2). Low- and middle-income children had a higher prevalence of discontinuous coverage, as compared to high-income children. Greater proportions of Hispanic children had discontinuous coverage, as compared to white, non-Hispanic children, and children with only public insurance had a higher prevalence of discontinuous coverage than children with any private coverage. In univariate analyses, having parents without continuous coverage was the greatest predictor of a child’s coverage gap versus having a parent with continuous coverage in 1998 (RR 17.96, 95 % confidence interval (CI) 14.48–22.29) and also in 2009 (RR 12.88, 95 % CI 10.41–15.93). Having parents with no coverage also predicted a gap in children’s coverage as compared to continuous coverage in 1998 (RR 10.94, 95 % CI 8.28–14.45) and in 2009 (RR 5.65, 95 % CI 4.40–7.24).

In multivariate analyses, having parent(s) with discontinuous or no coverage was the greatest predictor of a child having a health insurance coverage gap. There was significant effect modification by child’s insurance type on the association between parents and children’s insurance continuity. The magnitude of association was much greater among privately-insured children than publicly-insured children. Among privately-insured children, those whose parent(s) had discontinuous coverage were significantly more likely to have a coverage gap in 1998 [adjusted relative risk (aRR) 29.17, 95 % CI 20.99–40.53] and 2009 (aRR 25.54, 95 % CI 19.41–33.61) as compared to those whose parents were continuously covered. Among publicly-insured children, parental coverage discontinuity was also significantly associated with child having discontinuous coverage in 1998 (aRR 5.72, 95 % CI 4.06–8.06) and 2009 (aRR 4.53, 95 % CI 3.40–6.04). We are unable to report reliable estimates on the association between no parental coverage and child’s coverage gaps among privately-insured children due to small sample sizes (n < 30). However, among the publicly-insured children, significant associations between no parental coverage and child’s coverage gaps were seen in 1998 (aRR 4.61, 95 % CI 3.15–6.75) and 2009 (aRR 2.75, 95 % CI 2.03–3.72), though not to the same magnitude as the association with parental discontinuity. No other variables were significantly associated with child’s discontinuous coverage in multivariate models, with one exception: in 2009, children ages 5–9 were less likely to have a coverage gap than the oldest children aged 14–17 (aRR 0.80, 95 % CI 0.65–0.97) (Table 3).

Discussion

CHIP has improved coverage for children, yet many still experience gaps [9–11]. Previous research found child age (older) and Hispanic ethnicity were the strongest predictors of a child not maintaining continuous coverage [13, 19]. One study found among publicly-insured children, having a parent with public coverage lowers the child’s risk of disenrollment, compared to children whose parents were not publicly insured [22]. We found parental continuous coverage was the only significant predictor of discontinuous coverage for children in both 1998 and 2009 (with one exception in 2009). Thus, our study contributes new information to this important body of knowledge by highlighting the strong association between coverage continuity for parents and children, which remained significant after CHIP policies expanded children’s coverage opportunities and decoupled children’s coverage eligibility from parental employment. The magnitude of this association was much greater among children with private coverage as compared to children with public coverage. The strong correlation between parent and child insurance continuity for privately-insured children is understandable given that employer-sponsored private health insurance plans are usually obtained by a parent who then adds his/her children to the plan. However, public coverage for children does not come from a parent’s plan; children can acquire individual coverage from Medicaid or CHIP. Thus, it was much more surprising to see that the association between coverage for children and parents remained highly significant among publicly-insured children in 2009, 12 years after CHIP expanded individual coverage to millions of US children [7].

Policy Implications

From 1998 to 2009, opportunities for children to gain and maintain coverage were expanded and children’s eligibility requirements were relaxed; however, we found the association between coverage continuity for parents and children remained nearly as strong in 2009 as it was in 1998. Our findings suggest that if parents experience discontinuity, it will likely impact their children’s health insurance continuity even if the child remains eligible for coverage.

The Patient Protection and Affordable Care Act (known as the ACA) of 2010 has provisions to expand public coverage options for adults, which may lead to improved coverage continuity for many parents [33, 34]. The Supreme Court did not uphold the requirement to enforce state participation in Medicaid expansions, so it is unclear whether coverage options will be affordable to low- and middle-income families in states choosing not to expand their Medicaid programs [35–37]. The ACA also established a mechanism to allow people making up to 400 % FPL to receive subsidies for purchasing health insurance through state exchanges. Income fluctuations experienced by many low- and middle-income families, however, may cause parents to ‘churn’ on and off Medicaid and other subsidized health insurance plans [33, 38]. These fluctuations in eligibility could result in unstable coverage for parents [38, 39]. Based on the findings of our study children whose parents experience coverage instability will likely continue to be vulnerable to coverage discontinuities. Additionally, CHIP provisions are scheduled to expire in 2015, and little is known about what impact the lack of its reauthorization will have on children’s coverage [40].

With these policy changes, there is a need to closely monitor children’s health insurance continuity. Because insurance coverage gaps of only a few months are associated with unmet health care needs [13, 18], it is important to understand factors associated with a child being at risk for a coverage gap. If we focus only on increasing coverage status rates, we may miss persistent discontinuities in coverage, especially among vulnerable subgroups. Further, if not carefully investigated, a new coverage “gain” may actually just be the same child who had a coverage gap and then re-enrolled in coverage.

As it is essential to get a complete picture of how policies are affecting children’s health insurance coverage, it will be important to closely monitor factors that continue to predict discontinuities in coverage in order to develop better mitigating strategies to keep children continuously insured [41]. In addition to monitoring children’s health insurance, there are ways for states and health care providers to intervene to improve coverage. For example, states should continue to conduct outreach to eligible children and adults, and state policies to streamline enrollment and re-enrollment (i.e. express lane eligibility and enrollment) could make it easier to enroll and stay enrolled in coverage. Another possibility is for health care providers to devise systems to help their patients obtain and maintain coverage, as is being done within the OCHIN practice-based research network in Oregon through electronic health record tools [42, 43].

Limitations

Our analyses were limited by use of existing data: the MEPS-HC data is of an observational nature—causal associations cannot be inferred; and, as with all studies that rely on self-report, response bias remains a possibility. However, the MEPS-HC survey assesses monthly insurance status and asks several questions about insurance status and type of coverage at various time-points, and survey staff ensure that the final dataset has consistency across variables [26]. Finally, publicly-available MEPS data are not able to account for state-level differences in policies, nor does this study account for specific economic trends.

Conclusions

Despite gains in US children’s health insurance coverage from 1998 to 2009, many children continue to experience coverage discontinuity. Children whose parents had discontinuous or no health insurance coverage were significantly more likely to experience coverage gaps as compared to children whose parents maintained continuous coverage. The Affordable Care Act will increase coverage for many adults; however, ‘churning’ on and off programs due to income fluctuations could result in coverage discontinuities for parents. If parental coverage instability persists, these parental discontinuities may continue to have a negative impact on children’s coverage stability as well.

References

Vistnes, J. P., Zawacki, A., Simon, K., & Taylor, A. (2012). Declines in employer-sponsored insurance coverage between 2000 and 2008: Examining the components of coverage by firm size. Health Services Research, 47(3 Pt 1), 919–938.

Kaiser family foundation and health research and educational trust. (2008). Employer Health Benefits: 2008 annual survey. Kaiser family foundation and health research and educational trust [cited 2009 February 22]. http://ehbs.kff.org/pdf/7790.pdf.

Gould, E. (2010). Employer-sponsored health insurance erosion continues in 2008 and is expected to worsen. International Journal of Health Services, 40(4), 743–776. (Epub 2010/11/10).

Mann, C. (2009). Family coverage: Covering parents along with their children. Washington, DC: Center for Children and Families, Georgetown University Health Policy Institute.

Medicaid.gov. (2012). Children’s Health Insurance Program. Baltimore, MD: Centers for Medicare & Medicaid Services [cited 2013 June 19]. http://www.medicaid.gov/Medicaid-CHIP-Program-Information/By-Topics/Childrens-Health-Insurance-Program-CHIP/Childrens-Health-Insurance-Program-CHIP.html.

Choi, M., Sommers, B. D., & McWilliams, J. M. (2011). Children’s health insurance and access to care during and after the CHIP expansion period. Journal of Health Care for the Poor and Underserved, 22(2), 576–589.

Ryan, J. (2009). The children’s health insurance program (CHIP): The fundamentals. Washington, DC: The George Washington University.

Henry, J. (2009). Kaiser family foundation. Children’s coverage and SCHIP reauthorization [cited 2013 June 19]. http://www.kaiseredu.org/Issue-Modules/Childrens-Coverage-and-SCHIP-Reauthorization/Background-Brief.aspx.

Kaiser Commission on Medicaid and the Uninsured. (2007, January). Health coverage for low-income children [cited 2009 February 20]. http://www.kff.org/uninsured/upload/2144-05.pdf.

Olson, L. M., Tang, S. S., & Newacheck, P. W. (2005). Children in the United States with discontinuous health insurance coverage. New England Journal of Medicine, 353(4), 382–391.

Crocetti, M., Ghazarian, S. R., Myles, D., Ogbuoji, O., & Cheng, T. L. (2012). Characteristics of children eligible for public health insurance but uninsured: Data from the 2007 National Survey of Children’s Health. Maternal and Child Health Journal, 16(Suppl 1), S61–S69. (Epub 2012/03/29).

DeVoe, J. E., Tillotson, C. J., & Wallace, L. S. (2009). Children’s receipt of health care services and family health insurance patterns. Annals of Family Medicine, 7(5), 406–413.

DeVoe, J. E., Graham, A., Krois, L., Smith, J., & Fairbrother, G. L. (2008). “Mind the gap” in children’s health insurance coverage: Does the length of a child’s coverage gap matter? Ambulatory Pediatrics, 8(2), 129–134.

Wisk, L. E., & Witt, W. P. (2012). Predictors of delayed or forgone needed health care for families with children. Pediatrics, 130(6), 1027–1037. (Epub 2012/11/07).

Franks, P., Clancy, C. M., Gold, M. R., & Nutting, P. A. (1993). Health insurance and subjective health status: Data from the 1987 National Medical Expenditure survey. American Journal of Public Health, 83(9), 1295–1299.

Yu, S. M., Bellamy, H. A., Kogan, M. D., Dunbar, J. L., & Schwalberg, R. H. (2002). Factors that influence receipt of recommended preventive pediatric health and dental care. Pediatrics, 110(6), e73.

Newacheck, P. W., Stoddard, J. J., Hughes, D. C., & Pearl, M. (1998). Health insurance and access to primary care for children. New England Journal of Medicine, 338(8), 513–519.

Hadley, J. (2003). Sicker and poorer: The consequences of being uninsured. Medical Care Research and Review, 60(2 Suppl), 3S–75S.

Fairbrother, G., Madhavan, G., Goudie, A., Watring, J., Sebastian, R. A., Ranbom, L., et al. (2011). Reporting on continuity of coverage for children in Medicaid and CHIP: What states can learn from monitoring continuity and duration of coverage. Academic Pediatrics, 11(4), 318–325.

DeVoe, J. E., Tillotson, C. J., & Wallace, L. S. (2011). Insurance coverage gaps among US children with insured parents: Are middle income children more likely to have longer gaps? Maternal and Child Health Journal, 15(3), 342–351.

Yamauchi, M., Carlson, M. J., Wright, B. J., Angier, H., & Devoe, J. E. (2012). Does health insurance continuity among low-income adults impact their children’s insurance coverage? Maternal and Child Health Journal, 17(2), 248–255.

Sommers, B. D. (2006). Insuring children or insuring families: Do parental and sibling coverage lead to improved retention of children in Medicaid and CHIP? Journal of Health Economics, 25(6), 1154–1169.

DeVoe, J. E., Tillotson, C., & Wallace, L. S. (2008). Uninsured children and adolescents with insured parents. JAMA The Journal of the American Medical Association, 300(16), 1904–1913. (Epub 2008/10/23).

DeVoe, J. E., Krois, L., Edlund, T., Smith, J., & Carlson, N. E. (2008). Uninsurance among children whose parents are losing Medicaid coverage: Results from a statewide survey of Oregon families. Health Services Research, 43(1 Pt 2), 401–418. (Epub 2008/01/18).

Cohen, J., Monheit, A., Beauregard, K., et al. (1996–1997). The Medical Expenditure Panel Survey: A national health information resource. Inquiry, 33(4), 373–389.

Agency for Healthcare Research and Quality. (2004). Medical Expenditure Panel Survey. Silver Springs, MD: Agency for healthcare research and quality [cited 2013 June 19]. http://www.meps.ahrq.gov/mepsweb/.

Weinick, R. M., Zuvekas, S. H., & Drilea, S. K. (1996). Access to health care: Source and barriers. MEPS research findings no. 3. AHCPR Pub. No. 98-0001. Rockville, MD: Agency for Healthcare Research and Quality.

Cohen, S. (1997). Sample design of the 1996 Medical Expenditure Panel Survey household component. MEPS methodology report no. 2. Pub. No. 97-0027. Rockville, MD: Agency for Healthcare Research and Quality.

Cohen, J. W., Cohen, S. B., & Banthin, J. S. (2009). The medical expenditure panel survey: A national information resource to support healthcare cost research and inform policy and practice. Medical Care, 47(7 Suppl 1), S44–S50.

Agency for Healthcare Research and Quality. (2008). MEPS HC-036: 1996–2006 pooled estimation file [cited 2012 February 20]. http://meps.ahrq.gov/mepsweb/data_stats/download_data_files.jsp.

Hill, H. D., & Shaefer, H. L. (2011). Covered today, sick tomorrow? Trends and correlates of children’s health insurance instability. Medical Care Research and Review, 68(5), 523–536.

McNutt, L., Wu, C., Xue, X., & Hafner, J. (2003). Estimating the relative risk in cohort studies and clinical trials of common outcomes. American Journal of Epidemiology, 157, 940–943.

111th Congress. (2010). Compilation of Patient Protection And Affordable Care Act [cited 2011 December 16]. http://docs.house.gov/energycommerce/ppacacon.pdf.

Medicaid.gov. (2012). Children's Health Insurance Program. Baltimore, MD: Centers for Medicare & Medicaid Services [cited 2012 March 6]. http://www.medicaid.gov/Medicaid-CHIP-Program-Information/By-Topics/Childrens-Health-Insurance-Program-CHIP/Childrens-Health-Insurance-Program-CHIP.html.

Henry, J. (2012, August). Kaiser family foundation. Implementing the ACA’s medicaid-related health reform provisions after the Supreme Court’s decision. Report no.: 8348.

Kenney, G., Dubay, L., Zuckerman, S., & Huntress, M. (2012, June 29). Making the medicaid expansion an ACA option: How many low-income Americans could remain uninsured.

McDonough, J. E. (2012). The road ahead for the Affordable Care Act. New England Journal of Medicine, 367(3), 199–201.

Sommers, B. D., & Rosenbaum, S. (2011). Issues in health reform: How changes in eligibility may move millions back and forth between Medicaid and insurance exchanges. Health Affairs, 30(2), 228–236.

Klein, K., Glied, S., & Ferry, D. (2005). Entrances and exits: Health insurance churning, 1998–2000. Issue brief (Commonwealth Fund).

Racine, A. D., Long, T. F., Helm, M. E., Hudak, M., Shenkin, B. N., Snider, I. G., et al. (2014). Children’s health insurance program (CHIP): Accomplishments, challenges, and policy recommendations. Pediatrics, 133(3), e784–e793.

Fiscella, K. (2011). Health care reform and equity: Promise, pitfalls, and prescriptions. Annals of Family Medicine, 9(1), 78–84.

Devoe, J. E. (2013). Being uninsured is bad for your health: Can medical homes play a role in treating the uninsurance ailment? The Annals of Family Medicine, 11(5), 473–476. (Epub 2013/09/11).

DeVoe, J., Angier, H., Likumahuwa, S., Hall, J., Nelson, C., Dickerson, K., et al. (2014). Use of qualitative methods and user-centered design to develop customized health information technology tools within federally qualified health centers to keep children insured. Journal of Ambulatory Care Management, 37(2), 148–154.

U.S. Department of Health and Human Services. (1998). Annual update of the HHS poverty guidelines. Federal Register, 63(36), 9235–9238.

U.S. Department of Health and Human Services. (2009). Annual update of the HHS poverty guidelines. Federal Register, 74(14), 4199–4201.

Acknowledgments

This study was financially supported by the Agency for Healthcare Research and Quality (AHRQ) (1 R01 HS018569), the Patient-Centered Outcomes Research Institute (PCORI), and the Oregon Health & Science University Department of Family Medicine. The authors are grateful for editing and publication assistance from Ms. LeNeva Spires, Publications Manager, Department of Family Medicine, Oregon Health & Science University, Portland, Oregon, USA.

Author information

Authors and Affiliations

Corresponding author

Rights and permissions

About this article

Cite this article

DeVoe, J.E., Tillotson, C.J., Angier, H. et al. Predictors of Children’s Health Insurance Coverage Discontinuity in 1998 Versus 2009: Parental Coverage Continuity Plays a Major Role. Matern Child Health J 19, 889–896 (2015). https://doi.org/10.1007/s10995-014-1590-0

Published:

Issue Date:

DOI: https://doi.org/10.1007/s10995-014-1590-0