Abstract

Today’s college students have grown up with legalized gambling and access to a variety of gambling venues. Compared to the general adult population, rates of disordered gambling among college students are nearly double. Previous research suggests that the desire to win money is a strong motivator to gamble (Neighbors et al. in J Gambl Stud 18:361–370, 2002a); however, there is a dearth of literature on attitudes towards money in relation to gambling behavior. The current study evaluated the association between the four subscales of the Money Attitude Scale (Yamauchi and Templer in J Pers Assess 46:522–528, 1982) and four gambling outcomes (frequency, quantity, consequences and problem severity) in a sample of college students (ages 18–25; N = 2534) using hurdle negative binomial regression model analyses. Results suggest that college students who hold high Power–Prestige or Anxiety attitudes toward money were more likely to gamble and experience greater consequences related to their gambling. Distrust attitudes were negatively associated with gambling behaviors. Retention-Time attitudes were not significantly associated with gambling behaviors and may not be directly relevant to college students, given their often limited fiscal circumstances. These findings suggest that money attitudes may be potential targets for prevention programs in this population.

Similar content being viewed by others

Avoid common mistakes on your manuscript.

Introduction

Gambling is defined as risking something of value, most often money, on an event with an uncertain outcome. In the United States, most individuals who gamble do so without significant negative consequences associated with their gambling (Welte et al. 2015). However, it is estimated that approximately 10% of college students meet DSM criteria for gambling disorder (American Psychiatric Association and DSM-5 Task Force 2013), which is approximately five times higher than the prevalence in the general adult population (Nowak and Aloe 2014). This rate represents a twofold increase of the estimate 15 years before (5.1%; Shaffer et al. 1999) and presents a substantial public health concern, as approximately 20 million individuals were enrolled in American colleges and universities in the fall of 2017 (Hussar and Bailey 2017). This rapid increase in gambling problems among college students might be expected, as today’s college students have grown up with gambling being an acceptable recreational activity (Petry et al. 2017). For example, the number of fantasy sports players has skyrocketed during the last two decades, from an estimated 500,000 in 1988 to 59.3 million in 2017 (Fantasy Sports Trade Association 2017). Emerging research suggests college student gamblers, especially college student athletes, participate in fantasy sports wagering (Marchica and Derevensky 2016).

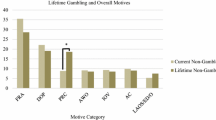

Recent estimates suggest over 80% of first-year college students believe that being very well off financially is a very important or an essential objective of attending college (Eagan et al. 2017). The desire to gain money is also a primary motivator for gambling among college students (Neighbors et al. 2002a). Although some events (e.g., sporting events, animal races, card games) are associated with information that can aid the gambler in making an educated wager (e.g., player and team statistics, knowledge of cards that have already been dealt from the deck), most events are based on chance with overall odds that favor the house (e.g., slot machines, craps, lottery), usually resulting in net losses to the individual. Significant losses are not diagnostic of gambling disorder, but almost always accompany it, as financial consequences tend to drive the personal, social, and psychological consequences that comprise the DSM-5 diagnostic criteria (American Psychiatric Association and DSM-5 Task Force 2013; Nowak and Aloe 2014). Despite the inextricable connection between money and gambling, there is a dearth of empirical studies examining the role individuals’ attitudes about money play in their gambling behavior.

An attitude is “a relatively enduring organization of beliefs, feelings, and behavioral tendencies towards socially significant objects, groups, events or symbols” (Hogg and Vaughan 2005, p. 150). As this definition implies, attitudes influence behavior. Thus, understanding more about individuals’ attitudes toward money may help elucidate why individuals may choose to spend their money on gambling. Although the exact number of factors vary across scales, extant measures of money attitudes (e.g., the Money Attitudes Scale [MAS], Yamauchi and Templer 1982; the Money Ethic Scale, Tang 1992) capture common themes around (a) power/prestige, wherein money is viewed as an indicator of success, (b) anxiety, wherein money is viewed as the source of or protector from emotional distress, (c) distrust, wherein money is viewed as a potential source of personal exploitation, and (d) retention/time, wherein management of money is viewed as a responsibility. Specific predictions about gambling behavior can be drawn from these four attitudes.

Those who are high in power–prestige attitudes should be attracted to gambling, given portrayals of gambling as glamorous and exciting in the popular media (Derevensky et al. 2009). By comparison, individuals high in retention-time attitudes should see gambling behavior as a poor return on investment, and thus be less likely to engage in gambling. Those individuals with high distrust attitudes may see gambling as too risky, and therefore avoid it. Finally, individuals high in anxiety attitudes may have a more mixed relationship with gambling. Some individuals gamble to cope with anxiety generally (Blaszczynski and Nower 2002) and may gamble to alleviate money anxiety specifically. Conversely, individuals who focus more on losses may be made more anxious by gambling.

Nower and Blaszczynski (2010) conducted the only known study examining the relationship between the four subscales of the MAS and gambling behavior among adults. Based on their findings, these investigators suggested gambling may be best understood as a behavior motivated by money-related attitudes and beliefs. Just as substance use expectancies and beliefs play an important role in the development and maintenance of problematic substance use (Pabst et al. 2014), money-related beliefs and attitudes may be important factors in the development and maintenance of gambling-related problems.

Building on the work of Blaszczynski and Nower (2010), the purpose of the current study is to investigate the relationship between money attitudes, gambling behaviors and disordered gambling severity among college students. As outlined above, it is hypothesized that individuals higher in power–prestige attitudes will gamble more frequently, spend more money gambling, and have higher gambling disorder severity compared to individuals holding lower power–prestige attitudes toward money. In contrast, those individuals higher in attitudes of distrust and time-retention regarding money will gamble less frequently, spend less money on gambling, and have lower gambling severity scores. As those who hold higher anxiety attitudes could plausibly exhibit more or less gambling than those lower in these attitudes, a non-directional hypothesis of greater association between gambling outcomes (either significantly more or significantly less) among those higher in these attitudes than those who are lower in these attitudes was made.

Methods

Participants

Participants were recruited from an undergraduate psychology research subject pool at a large northwestern university in the United States over the span of five academic quarters. All participants provided informed consent for their participation. Students who completed the survey received extra credit in their psychology course. The University’s Human Subjects Institutional Review Board reviewed and approved all protocols.

A total of 5933 students were invited to participate in the study and 4266 (72%) replied. Because the survey was offered over the span of five quarters, some students were invited to complete the survey more than once due to enrollment in more than one psychology course over time; 236 individuals were identified as completing the survey more than once, and only data from their initial survey response was included in the final analyses. Thus, the sample of participants who completed the survey included 4014 individuals. From these participants, data were included in the present study if the participant indicated they had gambled at least once in their lifetime, and reported their age to be between 18 and 25 years old. This yielded a final sample of 2534 undergraduate psychology students (59.8% female; Mage = 19.1 years, SD = 1.24). The sample was representative of the campus in terms of ethnicity, with most participants self-identifying as White (53.6%) or Asian/Asian American (29.8). See Table 1 for additional demographic details of the sample.

Procedure

Participants were sent an email with a description of the study and an invitation to participate. The e-mail contained a hyperlink to a website with an information statement containing all elements of informed consent, including the voluntary nature of participation, risks and benefits for participation, and alternatives to participating in the study. Participants who indicated their consent moved forward to the online survey. If participants did not respond to the initial email, a maximum of six email reminders were sent over the span of 6 weeks (one email every week) inviting them to participate. Participants could decline participation and opt out of the emails at any point.

Measures

Participants completed a brief demographics questionnaire that included their age, birth sex, sexual orientation, ethnic and racial background, and year in school. Before participants were asked any questions about gambling, they were provided with a definition of gambling, which stated, “By gambling we mean placing a bet/wager of money on the outcome of an event; this event has an element of chance and you stand to win more money. Typically, people gamble on activities such as the lottery, scratch tickets, bingo, sporting events, card games, casino games, etc.” A table of means and standard deviations for variable of interest are reported in Table 2.

Money Attitudes

The 29-item Money Attitudes Scale (MAS; Yamauchi and Templer 1982) was used in this study. The MAS contains four subscales: (1) Power–Prestige; (2) Retention-Time; (3) Distrust; and (4) Anxiety. Response options for all items appeared as a Likert-type scale ranging from 1 (Never) to 7 (Always), with higher score indicating stronger attitudes. Yamauchi and Templer (1982) reported the MAS has good reliability (α = 0.77) and good test–retest reliability (0.88). The reliabilities for the original subscales were Power–Prestige (α = 0.80); Retention-Time (α = 0.78); Distrust (α = 0.73); and Anxiety (α = 0.69). The current study also demonstrated strong reliabilities and higher than the original publication for both the measure overall (α = 0.88) and for each of the four subscales: Power–Prestige (α = 0.87); Retention-Time (α = 0.81); Distrust (α = 0.81); and Anxiety (α = 0.72).

Frequency and Quantity of Gambling

Gambling outcomes were assessed using items from the Gambling Quantity and Perceived Norms Scale (GQPN; Neighbors et al. 2002b). Gambling frequency was assessed via a single item: Approximately how often do you gamble? The range of responses were from 0 (Never) to 9 (Daily). Gambling quantity was also assessed using a single item: In the past 6 months, approximately how much money have you spent (lost) gambling? The scale ranged from 0 ($0) to 10 (More than $2000).

Gambling-Related Consequences

Consequences were assessed using the 23-item Gambling Problem Index (GPI; Neighbors et al. 2002a, b). For each item, participants were asked to use a 1–5 Likert-type scale to indicate how many times during the past 6 months they experienced problems related to gambling. Higher GPI scores indicate greater frequency of gambling-related problems.

Severity of Gambling Problems

Gambling severity was measured with a modified version of the 20-item South Oaks Gambling Screen (SOGS; Lesieur and Blume 1987; Lostutter et al. 2014). The SOGS assesses behaviors consistent with diagnostic criteria for gambling disorder, such as gambling more than intended, missing school or work due to gambling, and returning to gambling to regain losses of money. The timeframe for experiencing gambling consequences was modified from lifetime (original measure) to past 6-months (current study). The SOGS scoring criteria has demonstrated sensitivity for detecting gambling severity ranging from at-risk through disordered gambling (Shaffer et al. 1999; Goodie et al. 2013). The original scoring was retained and previous studies have reported modifying the assessment timeframe does not alter the measure’s ability to accurately assess gambling severity (Stinchfield 2002).

Data Analysis Plan

The focus of the study was to examine the relationship between the four MAS subscales—Power–Prestige, Retention-Time, Distrust, and Anxiety—and four specific gambling outcomes (i.e., gambling frequency, gambling quantity, gambling problems, and gambling severity). Given that the gambling outcomes were positively skewed and overdispersed with a large number of zeros, we used a count regression model. Based on the Vuong test, we chose the hurdle negative binomial model as it had the best fit (Hilbe 2011). The hurdle model fits all zeros in a logistic regression portion of the model; non-zero responses are included in a truncated count regression model (truncated due to not including zero values). This approach allowed us to simultaneously examine effects of gambling attitudes on the rate of any gambling outcomes (i.e., zero vs. non-zero values on each outcome) as well as on the intensity of gambling involvement among those reporting at least one experience of the outcome (i.e., among those with non-zero values on the outcome) (Atkins et al. 2013). One model was tested for each of the four gambling outcomes. As substantial research suggests that gambling behavior and gambling-related problems are more prevalent among men in this age-range (e.g., Nowak 2017), we controlled for sex in each model1. The analyses were conducted using SPSS version 19 (IBM Corp. (2010) and R 3.1.0 (R Core Team 2013).

Results

Logistic Model

Table 3 presents the results of the four, hurdle negative binomial models. Scores on the power–prestige subscale were associated with reporting non-zero (i.e., some degree of) gambling frequency, Β = 0.24, SE = 0.06, z = 4.25, p < 0.001, quantity, Β = 0.22, SE = 0.05, z = 3.92, p < 0.001, consequences, Β = 0.19, SE = 0.07, z = 2.72, p < 0.01, and problem severity, Β = 0.25, SE = 0.07, z = 3.55, p < 0.001. Scores on the anxiety subscale were similarly associated with reporting nonzero gambling frequency, Β = 0.24, SE = 0.06, z = 3.76, p < 0.001, quantity, Β = 0.32, SE = 0.06, z = 4.94, p < 0.001, consequences, Β = 0.51, SE = 0.09, z = 5.76, p < 0.001, and problem severity, Β = 0.46, SE = 0.09, z = 5.31, p < 0.001. Scores on the distrust subscale were associated with zero gambling quantity, Β = − 0.17, SE = 0.06, z = − 3.00, p < 0.01, but not associated with zero/non-zero values on other outcomes, whereas scores on the retention-time subscale were associated with zero gambling quantity, Β = − 0.10, SE = 0.04, z = − 2.28, p < 0.05, consequences, Β = − 0.12, SE = 0.06, z = − 2.05, p < 0.05, and problem severity, Β = − 0.18, SE = 0.06, z = − 2.94, p < 0.01, but not frequency.

Count Model

Among those with non-zero gambling outcomes, scores on the power–prestige subscale were positively associated with gambling quantity, Β = 0.19, SE = 0.06, z = 3.20, p < 0.01, gambling consequences, Β = 0.36, SE = 0.10, z = 3.55, p < 0.001, and gambling problem severity, Β = 0.23, SE = 0.10, z = 2.23, p < 0.05. Scores on the anxiety subscale were only positively associated with gambling quantity, Β = 0.18, SE = 0.08, z = 2.34, p < 0.01, and consequences, Β = 0.44, SE = 0.13, z = 2.86, p < 0.001.

Scores on the distrust subscale were negatively associated with gambling quantity, Β = − 0.21, SE = 0.07, z = − 3.26, p < 0.001, whereas scores on the retention-time subscale were not significantly related to any gambling outcome in the count model.

Discussion

The current study evaluated the association between attitudes about money and gambling frequency, quantity, consequences, and problem severity, in a sample of college students who gambled at least once in their lifetime. We hypothesized that attitudes reflecting money as a means to obtain power and prestige would be associated with greater gambling frequency, quantity, consequences, and problem severity. We further expected attitudes reflecting distrust of money and attitudes related to retaining money would be associated with less gambling behavior and consequences. As attitudes that reflect anxiety related to money could lead to either less or more gambling, we made a non-directional hypothesis.

Results largely supported our hypotheses within the logistic and count models. In particular, those who viewed money as a tool for obtaining or maintaining power and prestige reported significantly more non-zero values on gambling frequency, quantity, consequences, and problem severity in the logistic model and higher rates of gambling quantity, consequences, and problem severity in the count model. These findings suggest power–prestige attitudes toward money may be a risk factor for gambling involvement and gambling disorder among college students. Similarly, those who held higher anxiety attitudes were more likely to report non-zero values on gambling frequency, quantity, consequences, and problem severity in the logistic model and reported gambling more frequently and experiencing more consequences in the count model. These findings suggest individuals higher on anxiety attitudes toward money may view gambling as a means of increasing their financial security, and may persist in gambling as a result. Popular media portrays gambling as means to gain money, power and status. This portrayal may perpetuate gambling-related cognitive distortions and encourage individuals to continue gambling despite the negative consequences in the hopes of achieving success.

As hypothesized, students who viewed money from a distrustful perspective were more likely to report zero gambling quantity in the logistic portion of the model and spent less money gambling in the count model. These results are similar to those found by Roberts and Jones (2001) on compulsive spending wherein individuals higher in attitudes of distrust or caution about spending money were less like to be compulsive buyers. This suggests that a distrustful perspective toward money may serve as a protective or limiting factor for gambling.

Finally, retention-time attitudes toward money were related to greater reporting of zero values for all four gambling outcomes in the logistic model, but were unrelated to gambling outcomes in the count models. These findings suggest retention attitudes toward money may be a protective factor for engaging in any gambling, perhaps due to the recognition that gambling poses a risk to financial security. However, among those students who do choose to gamble, retention attitudes do not appear to be protective against problematic levels of gambling involvement. Some research has suggested the retention-time subscale of the MAS is less relevant for younger populations such as college students (Roberts and Jones 2001), due to its focus on financial planning for the future. Given that many students take out loans or otherwise go into debt to pay for college, financial planning for retirement and saving money for the future may not be a topic that receives much focus until after graduation. Alternatively, it may be that students with higher retention-time attitudes toward money who nonetheless choose to gamble believe their financial planning and budgeting abilities will allow them to succeed at gambling as a means of increasing their financial resources.

Although the current research adds to the sparse literature on the relation between money attitudes and gambling outcomes among college students, there are several limitations that must be considered. First, the current research is based on cross-sectional data; thus, we are unable to determine the extent to which money attitudes predict future gambling behavior, nor whether observed relationships, such as the relationship between gambling and anxious attitudes toward money, precede or follow the development of greater gambling consequences, many of which stem from financial losses.

In addition to the cross-sectional design, the current research is limited due to recruiting only students enrolled in undergraduate psychology classes at a single university, and from that sample only those individuals who reported gambling at least once in their lifetime on the screening measure. Although these factors may limit generalizability, the resultant sample was demographically very similar to the population of students as a whole on the campus, likely in part because psychology is one of the largest undergraduate majors and the vast majority of students across all majors enroll in at least one introductory psychology course to fulfill general education requirements. Further research is needed to evaluate the extent to which findings generalize to college students at other campuses and to non-student young adult populations.

An additional limitation is that all data were collected via self-report, which could be subject to bias. In the current study, data were collected confidentially; students were assured that their answers would not be linked to their identities, and only aggregate data would be shared outside the research team. Further, the current study utilized measures with established reliability and validity and included clear definitions of gambling and behavioral outcomes of gambling. Under these circumstances, self-report of gambling behavior and consequences among adolescent and young adult populations has generally been found to be valid (Kim and Hodgins 2017; Hodgins and Makarchuck 2003).

The desire to gain money has been shown to be a primary motivator for college-student gambling (Neighbors et al. 2002a), and one factor that influences the continuation of gambling among adolescents (Gupta and Derevensky 1998). The current findings suggest attitudes toward money may be a viable target for prevention of gambling disorders in college and other young adult populations, with a particular focus on reducing power–prestige and anxiety attitudes and increasing retention-time attitudes. Increasing education about financial management and encouraging thoughtful spending may serve as protective factors against gambling involvement and debt (Chen et al. 2012). However, more research is needed to evaluate how attitudes toward money develop, as well as their role in mediating or moderating the relation between gambling behavior and disordered gambling over time. Future studies examining the relation between attitudes toward money and other theoretical mechanisms underlying problem gambling (i.e. impulsivity, motivations, culture, cognitive distortions) are also important, and could lead to increased understanding of the persistence of disordered gambling behavior thereby improving prevention and treatment.

References

American Psychiatric Association, & DSM-5 Task Force. (2013). Diagnostic and statistical manual of mental disorders: DSM-5. Retrieved from http://dsm.psychiatryonline.org/book.aspx?bookid=556. Accessed 10 Dec 2017.

Atkins, D. C., Baldwin, S. A., Zheng, C., Gallop, R. J., & Neighbors, C. (2013). A tutorial on count regression and zero-altered count models for longitudinal substance use data. Psychology of Addictive Behaviors, 27, 166–177.

Blaszczynski, A., & Nower, L. (2002). A pathways model of problem and pathological gambling. Addiction, 97, 487–499. https://doi.org/10.1046/j.1360-0443.2002.00015.x.

Blaszczynski, A., & Nower, L. (2010). Instrumental tool or drug: Relationship between attitudes to money and problem gambling. Addiction Research and Theory, 18(6), 681–691. https://doi.org/10.3109/16066351003786752.

Chen, E. Z., Dowling, N. A., & Yap, K. (2012). An examination of gambling behaviour in relation to financial management behaviour, financial attitudes, and money attitudes. International Journal of Mental Health and Addiction, 10(2), 231–242.

Derevensky, J. L., Gupta, R., Messerlian, C., & Mansour, S. (2009). The impact of gambling advertisements on child and adolescent behaviors: A qualitative analysis. Montreal: McGill University.

Eagan, M. K., Stolzenberg, E. B., Zimmerman, H. B., Aragon, M. C., Whang Sayson, H., & Rios-Aguilar, C. (2017). The American freshman: National norms fall 2016. Los Angeles, CA: Higher Education Research Institute, UCLA.

Fantasy Sports Trade Association. (2017). Industry Demographics Report. Download on 11/17/18 from https://fsta.org/research/industry-demographics/.

Goodie, A. S., MacKillop, J., Miller, J. D., Fortune, E. E., Maples, J., Lance, C. E., et al. (2013). Evaluating the South Oaks gambling screen with DSM-IV and DSM-5 criteria: Results from a diverse community sample of gamblers. Assessment, 20(5), 523–531. https://doi.org/10.1177/1073191113500522.

Gupta, R., & Derevensky, J. L. (1998). Adolescent gambling behavior: A prevalence study and examination of the correlates associated with problem gambling. Journal of Gambling Studies, 14(4), 319–345.

Hilbe, J. (2011). Negative binomial regression (2nd ed.). Cambridge: Cambridge University Press.

Hodgins, D. C., & Makarchuck, K. (2003). Trusting problem gamblers: Reliability and validity of self-reported gambling behavior. Psychology of Addictive Behaviors, 17(3), 244–248.

Hogg, M., & Vaughan, G. (2005). Social Psychology (4th ed.). London: Prentice-Hall.

Hussar, W. J., & Bailey, T. M. (2017). Projections of education statistics to 2025 (NCES 2017-019). Washington, DC: U.S. Department of Education, National Center for Education Statistics.

IBM Corp. (2010). IBM SPSS statistics for windows, version 19.0. Armonk: IBM Corp.

Kim, H. S., & Hodgins, D. C. (2017). Reliability and validity of data obtained from alcohol, cannabis, and gambling populations on Amazon’s Mechanical Turk. Psychology of Addictive Behaviors, 31(1), 85–94. https://doi.org/10.1037/adb0000219.

Lesieur, H. R., & Blume, S. B. (1987). The South Oaks gambling screen (SOGS): A new instrument for the identification of pathological gamblers. American Journal of Psychiatry, 144(9), 1184–1188.

Lostutter, T. W., Lewis, M. A., Cronce, J. M., Neighbors, C., & Larimer, M. E. (2014). The use of protective behaviors in relation to gambling among college students. Journal of Gambling Studies, 30(1), 27–46. https://doi.org/10.1007/s10899-012-9343-8.

Marchica, L., & Derevensky, J. (2016). Fantasy sports: A growing concern among college student-athletes. International Journal of Mental Health and Addiction, 14(5), 635–645. https://doi.org/10.1007/s11469-015-9610-x.

Neighbors, C., Lostutter, T. W., Cronce, J. M., & Larimer, M. E. (2002a). Exploring college student gambling motivation. Journal of Gambling Studies, 18, 361–370.

Neighbors, C., Lostutter, T. W., Larimer, M. E., & Takushi, R. Y. (2002b). Measuring gambling outcomes among college students. Journal of Gambling Studies, 18(4), 339–360. https://doi.org/10.1023/A:1021013132430.

Nowak, D. E. (2017). A meta-analytical synthesis and examination of pathological and problem gambling rates and associated moderators among college students, 1987–2016. Journal of Gambling Studies, Published online: October 20, 2017. https://doi.org/10.1007/s10899-017-9726-y.

Nowak, D. E., & Aloe, A. M. (2014). The prevalence of pathological gambling among college students: A meta-analytic synthesis, 2005–2013. Journal of Gambling Studies, 30(4), 819–843. https://doi.org/10.1007/s10899-013-9399-0.

Nower, L., & Blaszczynski, A. (2010). Gambling motivations, money-limiting strategies, and precommitment preferences of problem versus non-problem gamblers. Journal of Gambling Studies, 26(3), 361–372.

Pabst, A., Kraus, L., Piontek, D., Mueller, S., & Demmel, R. (2014). Direct and indirect effects of alcohol expectancies on alcohol-related problems. Psychology of Addictive Behaviors, 28(1), 20–30. https://doi.org/10.1037/a0031984.

Petry, N. M., Ginley, M. K., & Rash, C. J. (2017). A systematic review of treatments for problem gambling. Psychology of Addictive Behaviors, 31(8), 951–961. https://doi.org/10.1037/adb0000290.

R Core Team. (2013). R: A language and environment for statistical computing. R Foundation for Statistical Computing, Vienna, Austria. http://www.R-project.org/. Accessed 5 Dec 2017.

Roberts, J. A., & Jones, E. (2001). Money attitudes, credit card use, and compulsive buying among American college students. Journal of Consumer Affairs, 35(2), 213–240. https://doi.org/10.1111/j.1745-6606.2001.tb00111.x.

Shaffer, H. J., Hall, M. N., & Vanderbilt, J. (1999). Estimating the prevalence of disordered gambling behavior in the United States and Canada: A research synthesis. American Journal of Public Health, 89(9), 1369–1376. https://doi.org/10.2105/AJPH.89.9.1369.

Stinchfield, R. (2002). Reliability, validity, and classification accuracy of the South Oaks gambling screen. Addictive Behaviors, 27, 1–19.

Tang, T. L. P. (1992). The meaning of money revisited. Journal of Organizational Behavior, 13, 197–202.

Welte, J. W., Barnes, G. M., Tidwell, M.-C. O., Hoffman, J. H., & Wieczorek, W. F. (2015). Gambling and problem gambling in the United States: Changes between 1999 and 2013. Journal of Gambling Studies, 31(3), 695–715. https://doi.org/10.1007/s10899-014-9471-4.

Yamauchi, K., & Templer, D. (1982). The development of a money attitude scale. Journal of Personality Assessment, 46, 522–528.

Funding

This research was supported in part by Grants from the National Institute on Drug Abuse F31DA023634 awarded to Ty W. Lostutter, and joint funding received from Evergreen Council on Problem Gambling and Washington State’s Division of Behavioral Health and Recovery. Manuscript preparation was also support by National Institute on Alcohol Abuse and Alcoholism Grant T32AA007455-27 awarded to Mary E. Larimer, National Institute on Drug Abuse Grant F31DA042503 award to Matthew Enkema; National Institute on Alcohol Abuse and Alcoholism Grants F31AA02553 and K01AA016966 awarded to Frank Schwebel and Melissa A. Lewis, respectively. The content is solely the responsibility of the authors and does not necessarily represent the official views of any of the funding agencies.

Author information

Authors and Affiliations

Corresponding author

Ethics declarations

Conflict of interest

The authors do not have any conflict of interest to report.

Ethical Approval

All procedures performed in studies involving human participants were in accordance with the ethical standards of the institutional and/or national research committee and with the 1964 Helsinki declaration and its later amendments or comparable ethical standards.

Rights and permissions

About this article

Cite this article

Lostutter, T.W., Enkema, M., Schwebel, F. et al. Doing It for the Money: The Relationship Between Gambling and Money Attitudes Among College Students. J Gambl Stud 35, 143–153 (2019). https://doi.org/10.1007/s10899-018-9789-4

Published:

Issue Date:

DOI: https://doi.org/10.1007/s10899-018-9789-4