Abstract

The paper examines the impact of import of technology on productivity of the organised manufacturing sector of India using firm level panel data for the period of 1995–2010. The estimation of an augmented Cobb-Douglas production function using the Levinsohn and Petrin econometric technique suggests that both embodied as well as disembodied forms of technology import have a positive and significant effect on aggregate manufacturing productivity. However, the sectoral estimation results based on technology intensive classification of firms reveal that the embodied technology purchases have a relatively more significant and positive impact across sectors, whereas the disembodied technology imports have positive effect on the productivity of medium technology intensive sectors.

Similar content being viewed by others

Avoid common mistakes on your manuscript.

1 Introduction

It is well known that international trade results in static production and consumption gains via reallocation of resources according to a country’s comparative advantage. However, trade can also bring dynamic effects by way of exposure to new technology and realization of economies of scale, which in turn may contribute to technical change or productivity growth. It has been widely emphasised that technical change plays an important role in economic growth. As argued by Hall and Jones (1999) and Keller (2009), the level of technology is a key contributor to productivity and, hence, the differences in the levels of technology can explain the large variation of incomes across countries.Footnote 1 In the seminal studies by Abramovitz (1956) and Solow (1957), technical change turns out to be the single most determining factor of economic growth in the advanced countries. However, in their studies, technical changes are exogenously determined and, therefore, are devoid of any causal analysis. In contrast, the recent trade theories and endogenous growth models have highlighted the importance of technological development, especially the role of imports as an important vehicle of knowledge transmission in enhancing the productivity and efficiency of the industrial sector leading to sustained growth in the long run (see Grossman and Helpman 1991; Feenstra et al. 1992; and Lee 1995).

Innovation is not a costless phenomenon, as assumed in the context of exogenous technical progress theories, but is an outcome of an economic activity which requires the use of productive inputs, in particular the investment of risk-bearing capital. However, countries differ in their ability to generate new knowledge or technology. In the less developed countries, the supply of necessary inputs for innovative activity may be scarce. These economies are at a disadvantaged position due to the lack of: (i) capital, particularly risk bearing type; (ii) skilled labour; (iii) the size of the market, and (iv) the low levels of per capita income. In these circumstances, the vehicle of technical change for these countries can be direct foreign investments (DFI) by firms of advanced countries and also licensing or the adaptation of superior technology of the advanced countries.

The continuous process of innovating new products and new processes in the developed countries can also increase the rate of obsolescence of their technologies. As the market for these products dries up, the incentive to sell them to the less developed countries increases. The underdeveloped economies can directly import second-hand machinery at an arm’s length prices and can adapt them to their factor market conditions. The import of these ‘new’ capital goods embodying better technologies facilitates technology transfer. Since the capital goods are the major inputs in the production process, firms that incorporate them in production can produce better quality and cost effective products which, in turn, increases productivity (Halpern et al. 2005). The inflow of imports provides domestic producers new ideas and that the restriction of imports reduces the rate at which these producers accumulate and use knowledge capital. Accordingly, trade in capital goods provides an alternative ‘route’ to innovate for the underdeveloped economies. Since only handful of countries devote R&D to make specialised equipments, trade in capital goods transmit technological advances and improve productivity in the host country (Eaton and Kortum 2001). Similarly, Lall (2000a) has noted that for developing countries, technology import is the most vital initial input in technology learning.

The objective of this paper is to assess the contribution of technology import on productivity of the organised manufacturing sector in India. Since the onset of systematic economic liberalisation in the 1990s, the manufacturing sector has witnessed considerable technology purchases from abroad. This has widened the choices of industries to adopt better technology in the production process, which can result in improved productivity performance. In this context, using an econometric methodology, we investigate the impact of technology import on productivity of the manufacturing sector using firm level data for the period of 1995–2010.

The reminder of the paper is organised into four sections. In Section 2 we discuss the empirical literature on import of technology and productivity, especially in the context of India. This is followed by a detailed description of methodology, data sources and descriptive analysis in Section 3. The econometric results for technology import and productivity is discussed in Section 4. Finally, Section 5 summarises and concludes the entire discussion.

2 Literature Review

2.1 Import of Technology and Productivity Growth: Empirics

A number of empirical studies have examined the impact of trade and productivity growth. For developed countries, there is overwhelming evidence to support that trade has a positive impact on productivity growth. For example, using aggregate cross-country data for the 21 OECD countries for the period 1971–90, Coe and Helpman (1995) found that imports which embody foreign R&D has a significant impact on productivity growth of the home country. They suggested that this impact is stronger, the more an economy is open to international trade. Keller (2002) found that foreign R&D contributed about 20 % to the total productivity effect for OECD countries during 1970–91. Ben-David and Loewy (1998) show that trade liberalisation can facilitate the diffusion of knowledge and move the steady-state income of lower income economies to a higher level. Similarly, studies that examined the performance of East Asian countries, generally found a positive role of trade in productivity growth. For instance, Lawrence and Weinstein (1999) for Japan and Kim et al. (2009) for Korea reported positive impact of imports on productivity growth.

However, the evidences are less conclusive for developing countries. Muendler (2004) finds that the effects of intermediate imports on labour productivity are smaller in Brazilian manufacturing plants. Similarly, Choudhri and Hakura (2000) argued that the growth effect of productivity by trade openness depends upon the country characteristics. The study explored the trade productivity relationship among 33 developing countries for the period of 1970–1993. Thangavelu and Rajaguru (2004), using a vector correction model, found that import enhances economic growth for nine rapidly developing Asian countries including India.

2.1.1 Import of Technology and Productivity of Indian Manufacturing Firms

The issue of trade and manufacturing productivity growth has been an active area of empirical research in India. Studies that covered the initial wave of liberalisation during the 1980s and the 1990s did not find any significant impact of trade on manufacturing productivity growth—for instance, see Das (1998), Balakrishnan et al. (2000) and Goldar and Kumari (2003), among others. In contrast, several recent studies, such as Milner et al. (2007), for the period 1984–1998, and Sen (2009), for the period 1973–1998, found that trade liberalisation via reduction in protective instruments has a significant impact on manufacturing industrial productivity. Similarly, Basant and Fikkert (1996), Hasan (2002), Parameswaran (2009) Goldberg et al. (2010), and Topalova and Khandelwal (2011), using firm level data, have found that foreign technology purchase has a positive impact on manufacturing productivity. The first two studies cover the pre-1991 period and the rest of them cover the post liberalisation period, up to 2001.

Thus, it is evident that several empirical studies have examined the extent of productivity growth of India’s manufacturing sector during the trade liberalisation period. However, not many have tried to disentangle the external effect of trade, especially the role of embodied and disembodied technology imports on productivity. Most of the earlier studies suffer from comprehensive coverage of firms and periodisation. For instance, Basant and Fikkert (1996) used 787 firms for the period 1974–81, whereas Hasan (2002) has taken only 286 public listed firms for the period of 1976–87. Some of the recent empirical work, notably by Parameswaran (2009) and Goldberg et al. (2010), have tried to cover large number of firms during the post liberalisation period. For instance, the former covered 2100 firms while the latter 2927 firms. However, these studies have not gone beyond 2001. Moreover, most of the previous studies on the technology import and productivity have not looked at the inter-sectoral variation based on firm level technological intensity. We know that the adaptation of import of technology requires considerable technological learning and capability building since firms operate with imperfect knowledge of technological alternatives.Footnote 2 Therefore, we expect considerable heterogeneity among firms in the process of import of technology and productivity improvement. The existing empirical studies have often overlooked this aspect. The present study tries to fill this gap by considering a wide range of industrial firms of India across different technology intensive sectors during the period of intensive trade liberalisation.

3 Methodology and Data Source

3.1 Methodology of the Study

A common practice in the empirical literature is to first estimate the elasticity of output with respect to inputs using the standard production function and measure productivity (TFP) as residual. Subsequently, in the second stage, the estimated TFP measures are regressed against a range of productivity determinants. This two-stage procedure, however, leads to biased estimates if productivity determinant factors are correlated with the production factor variables used to derive TFP. Since these factors were omitted from the first stage of output determinant model used to derive TFP, the two-stage procedure often produces inefficient and potentially biased estimatesFootnote 3 (Harris 2005). Using the Monte Carlo simulation, Wang and Schmidt (2002) has shown that serious and substantial bias exists at all stages of estimation due to omitted variable problem. In these circumstances, a more appropriate method is to include the determinants of output (and, thus, productivity) directly into the production function estimates (See Harris 2005).

Therefore, in the present study, our preferred approach is to incorporate the technology import variables (both embodied and disembodied technology purchases) directly into the production function estimates.Footnote 4 For robustness, the base results are evaluated across different datasets and a two-stage productivity determinant model. In the following sub-section 3.1.1, we provide the detailed outline of our preferred direct approach of production function estimation. This is followed by a description of the alternative two-step productivity determinant model in sub-section 3.1.2.

3.1.1 Production Function Estimation

Under the production function approach, we assume that the firm produces output (Q) using traditional inputs, such as capital (K) and labour (L) subject to the state of technology (T). Any technological advancement shifts the production function enabling given quantities of K and L to produce more output. Here, we assume that the Indian manufacturing firms can improve technology by importing superior technology from abroad.

We assume a Cobb-Douglas production functionFootnote 5 including the import of technology variables (embodied and disembodied technology) along the traditional inputs. For the i th firm in t th year, the functional relationship is given by Eq. (1):

where Q it refers to output of the firm i in period t, A it is the efficiency level of the firm i in period t, K it , L it , M it , ET it , DET it are inputs of capital, labour and material, embodied technology and disembodied technology respectively. Taking the natural log of Eq. (1) results in a production function (2) which is linear in logs of output and input variables;

where q denotes log of gross output of the firm, k is log of capital stock, l is log of labour input, m is log of raw material consumed, eT is the log of embodied technology, deT is the log of disembodied technology and ε is the error term.

Here, ln(A it ) = b 0 + ε it ; where b0 measures mean efficiency level across firms and over time and εit is the time-producer-specific deviation from that mean (Van 2012). We can decompose ε it into two parts: ε it = ω it + γ it where ω i is the firm specific differences in productivity caused by factors such as technological knowledge not captured by the explanatory variables, accumulated experiences of firms, managerial ability and unmeasured input qualities and so on not captured by explanatory variables and γ it is a pure random variable. The major difference between ω it and γ it is that the former is a state variable which is observable to the firm but not to the econometrician and, hence, influences firms input demand choices.Footnote 6 Incorporating these two error components, we can rewrite Eq. (2) as follows,

The econometric estimation of the Eq. (3) poses two important concerns with respect to the endogeneity of input choice resulting in simultaneity bias and the selection bias.Footnote 7 The simultaneity bias exists because generally the input decision by the firm is determined by the characteristics of the firm or its efficiency performance (See Marschak and Andrews 1944). This means that the firms’ choices of inputs are subject to its perception of its own productivity performance. If this were the case, then the OLS estimates would be biased and inconsistent as the productivity may be correlated with the level of inputs. The issue of selection bias occurs when the input choice of the firm at a particular period depends upon market survival.

An innovative way to correct for the simultaneity bias is the semi-parametric method developed by Olley and Pakes (1996) and later modified by Levinsohn and Petrin (2003).Footnote 8 One of the key assumptions in the procedure to control for the endogeneity bias is that capital is pre-determined, i.e., its level is chosen before production takes place. Hence, the orthogonality of k to the innovation in ω i can be used to identify b k k i . To solve the endogeneity problem with respect to freely variable labour, we use a proxy (in our case material inputs), which is assumed to be monotonic in ω it. This help us to invert out the unobserved productivity shock based on the observable characteristics (i.e., material input) of the firm. The incorporation of the proxy variable allows eliminating the variation in input related to productivity term. In this study, we follow the Levinsohn and Petrin (2003), or the LP methodology of production function estimation, and the details are outlined as follows.

The LP method uses firm’s raw material consumption to control for the variation in inputs correlated with the unobserved productivity. We assume that firms material demand function is monotonically increasing in its unobserved productivity, conditional on k it , a state variable. This allow us to specify the raw material demand function as m it = m i (ω it k it ). Assuming monotonicity, we invert the raw material demand function as ω it = ω t (m it k it ). This function shows that the unobservable productivity component depends upon observable inputs and hence, control for ω it in estimation. Rewriting Eq. (3) by proxying the productivity term, we obtain

where θ t (m it k it ) = b o + b k k it + b m m it + ω t (m it k it ).

In the first stage of the estimation, we estimate conditional moments E(q it |k it , m it ), E(l it |k it , m it ), E(eT it |k it , m it ), E(deT it |k it , m it ) by regressing respective variables on k it and m it using third order polynomial regression with full set of interactions. Subtracting the expectation of Eq. (4) conditional on k it and m it from (4) we get the following equation.

Following Levinsohn and Petrin (2003), we use a no intercept OLS on Eq. (5) to obtain the estimates of the parameters of b l , b eT , b deT .

In the second stage, we use two moment conditions to identify the parameters b k and b m . E[(ψ it + γ it )k it ] = E[ψ it k it ] = 0 and E[(ψ it + γ it )m it − 1] = E[ψ it m it − 1] = 0.

The first condition states that capital does not respond to innovation in productivity ψ it , while the second moment condition implies that last period choice of material input is not related to the current period innovation in productivity. The residual in the moment condition is given by the following relationship

Where the residuals are explicitly expressed as a function of the two parameters b* = (b * k , b * m ). Estimate of E(ω it |ω it − 1) is obtained using the assumption that ω it follows a first order markov process. We use a fourth order polynomial regression to get an estimate of E(ω it |ω it − 1) by regressing \( \widehat{\omega_{it}} \) in \( \widehat{\omega_{it-1}} \) obtained from Eqs. (7) and (8) using the estimates obtained from the first stage regression and b* values obtained from the OLS estimation of Eq. (2).

The \( \widehat{\phi} \) in Eq. (8) is estimated by regressing output net of inputs, whose coefficients have been obtained in the first stage, on capital and material, using a third order polynomial regression with full set of interactions. We estimate \( \widehat{\phi} \) for three sub periods of the sample, 1995–2000, 2001–2005 and 2006–2010. To test the unbiasedness of the estimated coefficient on the choice of variables of the firm, we use the following additional moment conditions

In the estimation of capital and materials coefficients, we include these five over identifying restrictions under the null hypothesis that the coefficient estimates are unbiased. This provides us with seven population moment conditions given by the vector of expectations E[(ψ it + γ it )Z it ] = 0

Where the vector Z it = {k it , m it − 1, l it − 1, k it − 1, m it − 2, eT it − 1, deT it − 1}. The estimates of b k and b m are obtained by minimising the following GMM criterion function

where i indexes firms, h indexes 7 instruments and Ti is the last period for which firm i is observed. As the estimation involves several steps, we bootstrapFootnote 9 the estimates to draw inference. In bootstrapping, we (re)sample the empirical distribution of the sample and generate bootstrapped samples. The value of the statistic is estimated from each bootstrapped sample and generates the empirical distribution function (EDF) of the parameter of interest. This EDF provides a bootstrap approximation of the sampling distribution of the statistic (Parameswaran 2009). We use block-bootstrapping methodFootnote 10 that treats time series observations on each firm as an independent and identical draw from the population of firms (see Horowitz 2001).

3.1.2 Productivity Determinant Model

In this alternative method, we first estimate the Cobb-Douglas production function of the following form using Levinsohn and Petrin (2003) methodology:

This allows us to calculate productivity of manufacturing firms by taking the difference between actual and predicted output (see Eq. 11).

We then regress firm productivity on import of technology (TI) and a set of additional control variables (X). Specifically, we estimate the following equation,

where lnTFP is the productivity (total factor productivity) of firm i in period t, TI is the technology import variable (ET and DET), X is a set of control variables such as export growth rate and capital intensity of the firm. ζ i and τ t are coefficients of industry and year dummies. We use traditional panel estimation technique to estimate the productivity determinant model.

3.2 Data Sources and Construction of Variables

The study use data on Indian manufacturing firms from PROWESS, which is a database of the financial performance of Indian companies, maintained by the Center for Monitoring Indian Economy (CMIE). The data is collected according to the National Industrial Classification (NIC) 2008Footnote 11 system. We first extracted manufacturing firms (which is reported at 5-digit NIC 2008 level) and find out that there are 9328 listed manufacturing firms. Although PROWESS reports data from 1989 onwards, we limited our analysis for the period 1995–2010 due the availability of a large number of observations for most of the firms.

Based on the sectoral contribution in total manufacturing output and the level of import of technology, we restricted our analysis to the firms belonging to 20 two digit NIC 2008 classification system.Footnote 12 As the original data set contains a large number of missing or negative values, we cleaned the data before the empirical analysis. As a first step, we took sales variable for all the reported firms and removed firms that reported zero or missing values during the entire period. This was repeated using other key variables such as labour and fixed capital. As a result, 1851 manufacturing firms were removed from the analysis. For the remaining 7090 firms, we selected those firms that reported sales data for 5 years or more during 1995–2010. Further, we removed firms that reported zero values for capital, labour and material in any of the reference years. This left us with 5551 firms, which is our main dataset for the empirical analysis.Footnote 13

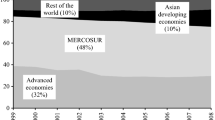

We further classified the selected manufacturing firms according to technological intensity, namely High Technology (HT), Medium High Technology (MHT), Medium Low Technology (MLT) and Low Technology (LT) intensive sectorsFootnote 14 based on the OECD (2011) classification scheme. The distribution of firms according to technology intensive classification is given in Table 4 in the appendix. We expect this classification captures the inter-sectoral differences in technological opportunity and heterogeneity among sample firms. In Table 1, the number of industries (2-digit) and firms according to technology intensive categories is given. It is evident that more than 60 % of the manufacturing firms belong to low to medium technology intensive sectors, while only about 10 % are in the high technology intensive group. The empirical analysis is carried out separately for aggregate manufacturing as well as for each of the four technology intensive categories of firms.

3.2.1 Variable Construction

Output (Q)

We have taken sales of goods by firms plus changes in stocks to represent the output variable.Footnote 15 The value of output in 2004–05 prices is obtained by deflating the nominal value by the Wholesale Price Index (WPI) of product groups at the disaggregate industry level. If the appropriate deflator is not available, the deflator corresponding to the nearest product group is selected. The WPI is collected from the office of Economic Advisor, Government of India.

Labour Input (L)

We define labour input in value terms, i.e., compensation to employees at 2004–05 prices that includes all cash payments in kind made by a company to its employees.Footnote 16 The nominal values of compensation to employees reported by PROWESS were deflated by the consumer price index for industrial workers (at 2004–05 prices). The use of wages and salaries is advantageous as it proxies worker skill composition, quality and payments made to contract workers (Keshari 2013).Footnote 17 One of the drawbacks of this measure is that there can be a potential bias in the estimate if the workers share the productivity benefits (See Sivadasan 2006).

Capital Stock (K)

The capital input is taken as gross fixed capital assets (GFA) expressed in 2004–05 prices. We use the perpetual inventory method to estimate capital stock at constant price for each year. For this, we follow the methodology devised by Srivastava (1996) and later adopted by many studies on Indian manufacturing firms including Balakrishnan et al. (2000) and Parameswaran (2009), among others. This method revalues the capital given at historical cost to a base year. The real capital stocks were obtained by deflating the revalued GFA by capital good price series (at 2004–05 prices) constructed using gross capital formation series obtained from the National Accounts Statistics, CSO.

Material Input (M)

The raw material expenses include the value of raw materials, power and fuel consumption. The nominal value of the raw material cost was deflated using raw material price indices, base 2004–05 = 100. The raw material price indices were constructed using weights obtained from the Input–output transaction table, published by the CSO and appropriate price indices from the WPI.

Technology Import (TI)

We measure the technology imports by two indicators. One is the purchase of machinery and equipment (capital goods) embodying superior technology and the second is the royalties, licensing, and technical fees paid by domestic firms for using the technology of foreign firms.Footnote 18 The former activity captures technology embodied in capital goods and the latter proxies the disembodied form of technological flows from abroad. The construction of technology import stock variables is based on the method suggested by Basant and Fikkert (1996) and Hasan (2002).Footnote 19

(i) Stock of embodied technology import (ET)

To determine how much new technology is embodied in machinery & equipment purchased from abroad, we assume, for simplicity, that the recently purchased machinery embodies newer and a more productive vintage of technology (See Bregman et al. 1991 for a similar assumption). The stock of recent investment in imported capital goods (ET) is obtained according to Eq. (13)

where ET is the stock of recent investment in imported capital goods, I M is the real investment in capital goods import obtained by deflating the expenditure on capital goods imports by the unit value index of imported capital goods (base 2004–05 = 100). We discounted the past using a depreciation rate of 6 % and T = 4 was chosen as in Hasan (2002).

(ii) Stock of disembodied technology import (DET) :

The stock of disembodied technology import was estimated using the methodology followed by Basant and Fikkert (1996).Footnote 20 The stock of disembodied technology import is constructed using the perpetual inventory method on the firm’s annual real expenditure on technological paymentFootnote 21 obtained through technology transfer agreement with foreign firms. We assume that the import of disembodied technology affects productivity with a 1-year lag and depreciates at the rate of 15 % per annum. The stock of DET is derived from Eq. (14)

where RDET is the real expenditure on disembodied technology import derived by deflating the nominal value of expenses on disembodied technology purchase by R&D deflator for US manufacturing industry.Footnote 22

3.3 Descriptive Statistics

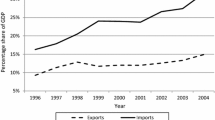

The detailed account of the growth performance and summary statistics of some of the key variables are given in Tables 5 and 6 in the Appendix. At 2-digit industrial classification, the high growth performing sectors are manufacture of wearing apparel (NIC 14), computers and electrical products (NIC 26), Coke & petroleum products (NIC 19) and transport equipment (NIC 30). In terms of output share, the largest component of manufacturing output originates from MLT followed by MHT and LT. As expected, HT products contribute very little to India’s overall manufacturing output.

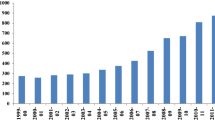

The data on embodied technology import revealed that out of 5619 firms, 3200 firms (i.e., 57 % of the total firms selected for the analysis) have imported capital goods at least once in a year during the reference period. Among them only 35 % (1976 firms) have bought capital goods for the entire period. In terms of technology category, the largest importer of capital goods were MLT (47 %) followed by MHT (29 %), LT (15 %) and HT (9 %). For most of technology categories, the growth rates have picked up during the latter half of 2000s. Some of the high growth performers belong to MLT and LT sectors such as manufacture of tobacco products (NIC 12), wearing apparel (NIC 14), printing & recorded media (NIC 18), rubber and plastic products (NIC 22), non-metallic minerals (NIC 23) and basic metals (NIC 24).

Looking at the disembodied technology purchases, it is evident that only a few firms are engaged in this mode of activity. For example, only 22 % of firms (1216 firms) purchased disembodied technology at least once in the reference period. Furthermore, only 71 firms purchased it for the entire period. This reveals that the preferred mode of technology transfer for Indian firms is embodied technology in terms of purchase of machinery & equipment from abroad. The largest purchase of disembodied technology is carried out by MHT (49 %) followed by MLT (41 %), HT (6 %) and LT (4 %). The sub-period analysis reveals that the share of MHT has increased over the years, whereas MLT and LT witnessed a downfall in disembodied technology imports. MHT witnessed double-digit growth rate (12 % per annum) during the entire as well as the major sub-period.

The summary statistics of the analysis variables is given in Table 6 in the appendix. We can note that the mean embodied technology purchase is Rs. 17 to 89 lakhs and the average disembodied payment is Rs. 10 to 36 lakhs at the aggregate level. Further, the level of dispersion is larger for embodied technology than disembodied technology purchase for total manufacturing. The technology classification suggests that the MLT firms are the largest buyers of technology imports followed by MHT, HT and LT. The average expenditure on embodied technology is between Rs. 52 to 89 lakh and Rs.15 to 30 lakhs for disembodied technology by MLT firms. On the extreme end, LT firms spend Rs. 17 to 33 lakhs on an average on embodied technology and an average of Rs. 10 to 15 lakhs on disembodied technology imports. Here, also, we can see that standard deviation is larger for embodied technology than disembodied technology, suggesting high dispersion in the former variable.

4 Estimation and Results

The production function estimates of Indian manufacturing firms (at the aggregate as well as the four technology intensive category level of firms) using OLS and Levinsohn and Petrin (LP) algorithm are given in Table 2. The coefficients of all the traditional factors of production such as labour, capital and materials have the expected positive sign and are highly significant (at 1 % level). The estimation results based on OLS reveal that the size of capital coefficient is significantly lower than the coefficient for labour and material inputs across manufacturing. As discussed in the methodology section, this can be attributed to the simultaneity between productivity shock and the input choices of the firm resulting in an upward bias in the labour and material coefficients and a downward bias in the capital coefficient.Footnote 23

Once we address this with the help of semi-parametric methods, we can expect a lower coefficient magnitude for material and labour, and an increase in the capital coefficient relative to OLS. Indeed, this is exactly what we observe in all LP estimates. For instance, in the case of aggregate manufacturing, the estimate of capital coefficient is 0.10 for OLS and 0.32 under LP.Footnote 24 Similarly, the size of capital coefficient is found to be lower in OLS for all technology categories (see column 4 to 11 in Table 2). It has increased considerably in all LP estimation results. Taking together all categories of manufacturing, the range of capital coefficient based on OLS estimates is 0.04 to 0.16, while the LP estimate ranges from 0.18 to 0.32. This suggests that the LP estimates have adequately addressed the problem of simultaneity inherent in the production function estimates.

4.1 Impact of Technology Import on Manufacturing Output

The econometric results of the production function estimates for aggregate manufacturing sector suggest that both embodied and disembodied form of technology imports have the expected positive impact of a significant magnitude. The magnitudes of the coefficients are similar across manufacturing, but the level of significance differs. The LP coefficient estimate for embodied technology is 0.01 and significant at 5 % level, while the elasticity of output with respect to disembodied technology is 0.02, which is significant at 10 % level. Although, the size of the coefficient seems to be small,Footnote 25 it is notable that the import of technology in the form of capital goods has a significant positive impact on manufacturing output.

The sectoral results show that for the HT group, which consists of highly advanced and fast changing technology firms in the pharmaceuticals, computers and aircraft industries, the estimated coefficient of technology import variables has the expected positive sign but are not statistically significant. The results suggest that the role of import of technology on high technology intensive firms’ output is limited. This is not surprising as we have already seen that compared to other categories this sector has received only marginal import of embodied and disembodied technology (9 and 6 %, respectively). Further, the technology content embodied in these segments may be too sophisticated or tacit, which hinders effective learning in the production process. Since HT segment involves rapidly changing technology which involves specialised technical skills and close interaction with rest of the firms, the nature of absorptive capacity is crucial for appropriating benefits from foreign technology.

In contrast, we find that both embodied and disembodied forms of technology imports have had a positive and significant impact on the output of MHT intensive firms. The estimated elasticity of output with respect to embodied technology and disembodied technology is 0.01 and 0.02, respectively, and both are statistically significant at 5 % level. The MHT sectors such as machinery, transport equipments and chemical sectors involve complex technology and, often, the production processes are skill and scale intensive. The access to superior technology from abroad, which often requires a lengthy learning process, has greatly enhanced the domestic productive capacity. Since MHT is the largest purchaser of disembodied technology (share of 49 %) and second largest importer of capital goods (share of 29 %), the positive and highly significant contribution on output confirms the theoretical predictions. Thus, our empirical estimation reveals that access to foreign technology is an important source of productivity gains for MHT manufacturing firms.

For MLT product firms, we find positive but no significant coefficient estimates for embodied technology imports. Although the OLS estimate suggests a positive and significant coefficient (at 10 % level), this is not found in the case of LP estimates. This is surprising since we have seen that the MLT segment such as petroleum, rubber, mineral and metal producing firms are the largest purchaser of embodied technology in the liberalisation period. The technology in these segments may not be complex or skill intensive but may involve adaptability issue to the local production conditions. One possible reason behind the insignificant result can be the mismatch between the nature of technology and the domestic absorptive capability. In the case of disembodied technology, we find a negative and insignificant coefficient estimate, which again reflects the marginal effect of technology import on domestic output and productivity.

Finally, in LT firms, the LP estimates reveals that the output elasticity of embodied technology import is positive (0.02) and significant at 10 % level. The LT firms such as food & beverages, textiles and paper producing segments have stable and well diffused technology and the access to foreign machinery and equipments have greatly facilitated the productivity improvements. On the other hand, the coefficient estimate of disembodied technology purchase is found to be negative and insignificant. Although OLS reports both positive and highly significant coefficient estimates, the same cannot be concluded from our more reliable LP estimates. As disembodied technology purchase is only 4 % during the reference period, the result is not surprising. On the other hand, most of them have opted for import of machineries (around 15 %) and this has had a significantly positive impact on output.

4.2 Robustness Checks

This section reports the additional robustness checks to assess the reliability of our main findings. We conducted similar LP estimates of production function with import of technology variables on different datasets. We constructed an unbalanced panel (dataset B) based on sales data for at least 10 years or more and a balanced panel (dataset C) of all those firms that reported sales during 1995–2010. The estimation results are given in Table 7 in the appendix. For the aggregate manufacturing, both datasets confirm a positive and significant contribution of embodied technology imports on output. The disembodied technology import is found to be positive and significant only in dataset B, although it is positive but not significant in the balanced panel. In the case of sectoral classification, the results reconfirm the significant contribution of technology imports (both embodied and disembodied) on output of medium technology firms. In the case of MLT and LT, the positive and significant impact of capital goods import is found in both datasets. However, except the balanced dataset C for MLT, the coefficient of disembodied technology is found to be either negative or not significant in both MLT and LT using balanced and unbalanced panel datasets. In the high technology category, both embodied and disembodied technology imports are found to be positive but not statistically significant. These findings are largely in agreement with our benchmark estimation of unbalanced panel dataset A.Footnote 26

As noted in the methodology section, a popular method in the literature is to examine the productivity determinant factor in a two-stage regression model. Therefore, as a sensitivity check, we employ a two-step procedure for assessing the impact of import of technology on productivity of the Indian manufacturing sector. This is carried out by estimating productivity (TFP) determinant model specified in section 3.1.2. The estimated model is Eq. (12). We regressed TFP on embodied technology, disembodied technology and other control variables, such as export growth and capital-labour ratio.Footnote 27 The estimation result is given in Table 3.

The analysis is based on unbalanced datasetFootnote 28 using fixed effect estimation based on Hausman specification test. The fixed effect estimates are a useful tool in the presence of firm heterogeneity, which seems plausible given the knowledge that firms operate in a diverse range of economic activities, even in a particular technology intensive classification. The findings are broadly in line with the production function estimates. Here, we found that embodied technology is positive and highly significant in all the estimated models, which includes manufacturing as well as the four technology intensive groups. However, the coefficient of disembodied technology is found be positive and significant only for the aggregate manufacturing and MHT sectors. This further substantiates our earlier findings that technology imports, especially the purchase of capital goods, has a significant impact on the productivity of Indian manufacturing firms.

Therefore, based on the econometric results, we can summarise the major findings of the study as follows:

-

a)

The traditional factors of production, namely capital, labour and material have a significant positive effect on Indian manufacturing output. The result holds for different segments of technology intensive product groups as well.

-

b)

Imports of embodied technology and disembodied technology have statistically significant positive effects on the output of firms in organised manufacturing in India.

-

c)

The technology import variables (embodied and disembodied) have no significant impact on high technology (HT) intensive manufacturing firms of India.

-

d)

There is statistically significant evidence to confirm that embodied as well as disembodied technology import contribute positively to the productivity of medium-high technology (MHT) category firms in India.

-

e)

Embodied technology import has a significant positive impact on productivity and output of medium-low technology firms (MLT) in India. The disembodied technology is found to have an impact on the productivity of medium-low technology (MLT) firms based on balanced panel database.

-

f)

The import of machinery and equipment embodying superior technology has a significant positive effect on the productivity performance of low technology (LT) intensive firms. The disembodied technology has no significant effects.

-

g)

The coefficient estimates of elasticity for technology import variables is generally low across different specifications and datasets. The estimate for embodied technology is found to be larger than that for disembodied technology.

4.3 Comparison With Related Studies

One major study for pre-liberalisation period by Hasan (2002) reported significant positive impact of embodied and disembodied technology purchases for the manufacturing sector. On the other hand, the elasticity estimates were reported to be even lower than those observed in this study. A similar work by Parameswaran (2009) reported significant positive effects of disembodied technology import stock and stock of recent investment in imported capital goods on productivity of Indian manufacturing sector firms. The study found that the disembodied technology was a significant contributor to productivity for only the low technology firms, which is just the opposite of what we have found. The impact of embodied technology was positive and significant in only high technology firms, whereas we have found an across the board effect of embodied technology on productivity. The elasticity estimates for disembodied technology were in the range of 0.001 to 0.004 across different datasets, which are smaller than what we have found. On the other hand, coefficient estimates for embodied technology were much larger (0.32 to 0.42) across different manufacturing groups. The divergence in results at the sectoral level can be attributed to differences in periodisation, coverage of firms or firm classification schemes selected for the analysis.

5 Summary and Conclusion

The import of technology is often considered as one of the main channels of trade-induced dynamic benefits to the recipient country. The use of imported technology inputs are expected to increase productivity and efficiency of production. Indian industries have a long history of importing advanced technology from abroad. This issue has been significant in the recent past because of the increasing liberalisation and openness of the economy. In this context, the present study has examined the effect of import of technology on the productivity performance of organised manufacturing sector using firm level data from PROWESS database for the period of 1995–2010. We examined the role of import of technology with the help of an augmented Cobb-Douglas production function, which explicitly considered technology import as an explanatory variable. The production function estimates were obtained by using Levinsohn and Petrin (2003) semi-parametric technique that attempts to correct for the simultaneity bias. We used balanced and unbalanced panels of firms in the organised manufacturing sector. Keeping firm heterogeneity in mind, we classified the sample-manufacturing firms into four technology-intensive groups for the analysis.

The descriptive analysis shows that the manufacturing output has consistently grown during the post liberalisation period. Some of the major growing sectors were electrical equipment, machinery, transport equipments, computer electrical, rubber & petroleum products, wearing apparel and mineral products. The latter half of 2000s witnessed an increase in purchase of embodied and disembodied technology for firms in the sample. The level of technology imports also differed across technology intensive groups. The largest buyers of embodied technology were MHT and MLT firms. The medium technology intensive firms happened to be the largest buyer of disembodied technology.

The empirical results confirm the general contention that technology import has a significant positive productivity impact on manufacturing firms. We have found that both embodied technology and disembodied technology are significant determinants of manufacturing productivity. The elasticity coefficient estimates for the two technology import variables are, by and large, positive and statistically significant for different data sets, estimation methods and technology categories. However, the estimates of elasticity coefficients are rather low. The coefficient estimate for disembodied technology appears to be smaller than that for embodied technology. The sectoral analysis reveals that embodied technology has a much larger impact than disembodied technology. The elasticity coefficient estimate for embodied technology is significant for MHT, MLT and LT product groups. In contrast, elasticity coefficient estimates for disembodied technology are positive and significant for MHT and MLT product groups only. The result is robust across different datasets and estimation techniques. This suggests that technology import has been beneficial for improving productivity for medium to low technology intensive firms such as chemicals, electrical & non-electrical machinery, metals and mineral products.

Our empirical findings confirm the theoretical proposition that technology import has a significant and positive role in improving productivity of industrial sectors, especially for an emerging economy like India. We add to the existing body of literature by showing that the impact is not homogeneous across different industrial segments but differs considerably across technology intensive groups. Although the elasticity estimates are low, the scope for learning and improving through foreign technology purchases is quite large. Some of the insignificant results for disembodied technology may be due to measurement problem as most of the technologies are tacit and often difficult to measure precisely. Moreover, the nature of technology may be too complex for high technology and scientific firms, which is why we find a limited role of technology import on productivity in these sectors. A more detailed industry specific analysis may further highlight the intricacies of technology import and its adaptability in the production process.

Notes

Comin and Hobijn (2011) argue that countries that performed well in the post-World War II period did so because they were able to adopt new technology quickly.

See Lall (2000b) for an extensive discussion of technological learning and capability among various manufacturing firms in developing countries.

As discussed in Harris (2005), the bias can be disregarded only when the factors determining output and productivity have zero correlation. However, since both these are firm specific, the correlation between them is likely to be high.

Although the Cobb-Douglas functional form is considered too restrictive, it is the most widely used specification in firm level studies on productivity (Hall and Mairesse 1995, O’Mahony and Vecchi 2009). Some of the alternative but more complicated specifications such as Translog do not yield substantially different results (Griliches 1998). See Parameswaran (2009) and Fernandes (2007) for similar estimation procedure.

State variables are fixed factors, which are affected by the distribution of ω it conditional on information set available at t-1 period and past values of ω it . In the case of free variable factors, the input choices by the firm depend upon the current values of ω it (Olley and Pakes 1996).

For a comprehensive survey, see Van (2012) and references therein.

For detailed outline on Semiparametric methods, see Yatchew (2003).

This process uses sampling with replacement and with equal probability from the sets of firm observations in the original sample (Horowitz 2001).

The NIC 2008 is based on International Standard Industrial Classification (ISIC) rev4.

Based on the selection criteria, we excluded three 2-digit sectors from the analysis sample. These are NIC 11 (manufacture of beverages), NIC 31 (Manufacture of furniture) and NIC 32 (other manufacturing). We dropped 387 firms under these product groups.

This is our benchmark sample which we denote as unbalanced panel dataset A. Additionally, for robustness analysis, we also selected firms that reported sales data for at least 10 years during the entire period of reference (unbalanced panel dataset B) and all those firms that reported sales figures during the entire period (balanced panel dataset C). The dataset B consists of 3206 firms and the dataset C has 1442 firms.

The latest OECD classification scheme categorises industries according to ISIC rev3.1, whereas our classification is based on ISIC rev4 (which is equivalent to NIC 2008). Therefore, we established correspondence between ISIC rev3.1 and ISIC rev4 at the aggregate level. See Table 4 in the appendix for the details.

Several studies have employed similar procedures for constructing output variable at the firm level (See for instance, Srivastava (1996).

In PROWESS, the payments made to labour contractors are included in the wage bill of the firm but the workers employed through the contractors are not included in the payroll of the firm. This makes the number of workers as reported therein an inappropriate measure of labour input (Keshari 2013).

In PROWESS, the foreign technology purchases are reported separately under firms’ total forex spending. This is available in its total foreign exchange transactions section.

Parameswaran (2009) have also employed similar procedure.

The annual expenditure on disembodied technology import consist of payment to foreigners for technical assistance and consulting, lump sum and royalty payment for the purchase of technology through licensing agreement between Indian and foreign firms. This information is recorded as expenses on royalties, technical expertise fees in PROWESS.

This is true irrespective of the dataset used for the study (see Table 7 in the appendix).

Additionally, we also checked our results with an alternative classification of technology intensity. We use Lall (2000b) methodology and re-classified firms into Resource Based (RB), Low Technology (LT), Medium Technology (MT) and High Technology (HT). We find that embodied technology is positive and significant for RB, MT and HT sectors while disembodied technology is positive and significant for only MT sector. The results are largely similar to what we have found in our benchmark estimates.

Several studies have noted the importance of export orientation and productivity of firms (See Wagner 2007 for literature review). The export intensity (exi) is calculated by taking the share of exports of individual firm in their total sales. Another important determinant of productivity is capital intensity and is measured as the log of capital-labour ratio (ci).

We have also estimated the model using alternative datasets including unbalanced dataset B and balanced panel dataset of C. The results are broadly similar.

References

Abramovitz M (1956) Resources and output trends in the U.S. since 1870. Am Econ Rev 46(2):5–23

Ackerberg D, Benkard CL, Berry S, Pakes A (2007) Econometric tools for analyzing market outcomes. In: Heckman JJ, Leamer EE (eds) Handbook of econometrics. North-Holland, Amsterdam

Balakrishnan P, Pushpangadan K, Suresh Babu M (2000) Trade liberalisation and productivity growth in manufacturing, evidence from firm-level panel data. Econ Polit Wkly 35(41):3679–3682

Basant R, Fikkert B (1996) The effects of R&D, foreign technology purchase, and domestic and international spillovers on productivity in Indian firms. Rev Econ Stat 78(2):187–199

Ben-David D, Loewy MB (1998) Free trade, growth, and convergence. J Econ Growth 3(2):43–170

Bregman A, Fuss M, Regev H (1991) High-tech and productivity, evidence from Israeli industrial firms. Eur Econ Rev 35(6):1199–1221

Choudhri EU, Hakura DS (2000) International trade and productivity growth, exploring the sectoral effects for developing countries. IMF Staff Pap 47(1):30–53

Coe DT, Helpman E (1995) International R&D spillovers. Eur Econ Rev 39(5):859–887

Comin DA, Hobijn B (2011) Technology diffusion and postwar growth. In NBER Macroeconomics Annual 2010. University of Chicago Press

Das DK (1998) Trade liberalisation and productivity growth, a disaggregated analysis of indian manufacturing sectors. IEG Working Paper E/200/1998, Institute of Economic Growth, New Delhi, India

Dougherty S, Herd R, Chalaux T (2009) What is holding back productivity growth in India? Recent micro evidence. OECD J Econ Stud OECD Publ 2009(1):1–22

Eaton J, Kortum S (2001) Trade in capital goods. Eur Econ Rev 45:1195–1235

Feenstra R, Markusen JR, Zeile W (1992) Accounting for growth with new inputs, theory and evidence. Am Econ Rev 82(2):415–421

Fernandes AM (2007) Trade policy, trade volumes and plant-level productivity in Columbian manufacturing industries. J Int Econ 71(1):52–71

Goldar B, Kumari A (2003) Import liberalisation and productivity growth in Indian manufacturing industries in the 1990s. Dev Econ 41(4):436–460

Goldberg PK, Kumar KA, Nina P, Petia T (2010) Imported intermediate inputs and domestic product growth: evidence from India. Q J Econ 125:1727–1767

Griliches Z (1998) R&D and productivity: the econometric evidence. University of Chicago Press, Chicago

Grossman GM, Helpman E (1991) Innovation and growth in the global economy. MIT Press, Cambridge

Guan W (2003) From the help desk: bootstrapped standard errors. Stata J 3(1):71–80

Hall RE, Jones CI (1999) Why do some countries produce so much more output per worker than others? Q J Econ 114(1):83–116

Hall BH, Mairesse J (1995) Exploring the relationship between R&D and productivity in french manufacturing firms. J Econ 65(1):263–293

Halpern L, Koren M, Szeidl A (2005) Imports and productivity. CEPR Discussion Paper No. 5139, London

Harris R (2005) Economics of the workplace: special issue editorial. Scott J Polit Econ 52:323–343

Hasan R (2002) The impact of imported and domestic technologies on the productivity of firms: panel data evidence from Indian manufacturing firms. J Dev Econ 69:23–49

Horowitz JL (2001) The bootstrap. In: Heckman JJ, Leamer EE (eds) Handbook of econometrics Vol. 5. Elsevier, Amsterdam, pp 3159–3228

Kambhampati US (2003) Trade reforms and the efficiency of firms in India. Oxf Dev Stud 31(2):219–233

Kathuria V (2001) Foreign firms, technology transfer and knowledge spillovers to Indian manufacturing firms: a stochastic frontier analysis. Appl Econ 33(5):625–642

Keller W (2002) Trade and the transmission of technology. J Econ Growth 7:5–24

Keller W (2009) International trade, foreign direct investment, and technology spillovers. NBER Working Paper 15442, National Bureau of Economic Research, Inc

Keshari PK (2013) Efficiency spillovers from FDI in the Indian machinery industry: a firm-level study using panel data models. MPRA Paper 47070, University Library of Munich, Germany

Kim S, Saravanakumar M (2012) Economic reform and total factor productivity growth in Indian manufacturing industries. Rev Dev Econ 16(1):152–166

Kim S, Lim H, Donghyun P (2009) Imports, exports and total factor productivity in Korea. Appl Econ 41(14):1819–1834

Lall S (2000a) Technological change and industrialization in the Asian newly industrializing economies, achievements and challenges. In: Kim L, Nelson RR (eds) Technology, learning and innovation, experiences of newly industrializing economies. Cambridge University Press, Cambridge, pp 13–68

Lall S (2000b) The technological structure and performance of developing country manufactured exports, 1985–98. Oxf Dev Stud 28(3):337–369

Lawrence RZ, Weinstein DE (1999) Trade and growth, import-led or export-led? Evidence from Japan and Korea, NBER Working Papers No. 7264, National Bureau of Economic Research, Cambridge

Lee J-W (1995) Capital goods imports and long-run growth. J Dev Econ 48(1):91–110

Levinsohn J, Petrin A (2003) Estimating production functions using inputs to control for unobservables. Rev Econ Stud 70(2):317–342

Mackinnon JG (2006) Bootstrap methods in econometrics. Econ Rec Econ Soc Australia 82(s1):S2–S18, 09

Marschak J, Andrews WH Jr (1944) Random simultaneous equations and the theory of production. Econometrica 12(3/4):143–205

Milner C, Vencappa D, Wright P (2007) Trade policy and productivity growth in Indian manufacturing. World Econ 30(2):249–266

Muendler M-A (2004) Trade, technology and productivity, a study of Brazilian manufacturers 1986–98. CESIFO Working Paper No.1148

O’Mahony M, Vecchi M (2009) R&D, knowledge spillovers and company productivity performance. Res Policy 38(1):35–44

OECD (2011) OECD science, technology and industry scoreboard, 2011, ISIC rev 3 Technology Intensity Definition. OECD, online document, www.oecd.org/dataoecd/43/41/48350231.pdf

Olley GS, Pakes A (1996) The dynamics of productivity in the telecommunications equipment industry. Econometrica 64(6):1263–1297

Parameswaran M (2009) International trade, R&D spillovers and productivity, evidence from Indian manufacturing industry. J Dev Stud 45(8):1249–1266

Sen K (2009) Trade policy, inequality and performance in Indian manufacturing. Routledge, London

Sivadasan J (2006) Productivity consequences of product market liberalisation, micro- evidence from Indian manufacturing sector reforms. Working Paper No 1062, Ross School of Business Working Paper Series

Solow MR (1957) Technical change and the aggregate production function. Rev Econ Stat 39(3):212–320

Srivastava V (1996) Liberalisation, productivity and competition, a panel study of Indian manufacturing. Oxford University Press, New Delhi

Thangavelu SM, Rajaguru G (2004) Is there an export or import-Led productivity growth in rapidly developing Asian countries? A multivariate VAR analysis. Appl Econ 36(10):1083–1093

Topalova P, Khandelwal A (2011) Trade liberalization and firm productivity, the case of India. Rev Econ Stat 93(3):995–1009

Van IB (2012) Total factor productivity estimation, a practical review. J Econ Surv 26(1):98–128

Wagner J (2007) Exports and productivity: a survey of the evidence from firm-level data. World Econ Wiley Blackwell 30(1):60–82

Wang H-J, Schmidt P (2002) One-step and two-step estimation of the effects of exogenous variables on technical efficiency levels. J Prod Anal 18(2):129–144

Yatchew A (2003) Semiparametric regression for the applied econometrician. Cambridge University Press, Cambridge

Acknowledgments

I am thankful to Prof. Alokesh Barua, Prof. K.L Krishna and Prof. Prema Chandra Athukorala for the extensive comments and suggestions to the earlier version of the paper. I thank Prof. Parameswaran for his valuable help and suggestions. I like to thank two anonymous referees of this journal for providing constructive comments and suggestions leading to substantial improvement of the paper. However, I am solely responsible for any errors and omissions that may remain.

Author information

Authors and Affiliations

Corresponding author

Appendix

Appendix

Rights and permissions

About this article

Cite this article

Rijesh, R. Technology Import and Manufacturing Productivity in India: Firm Level Analysis. J Ind Compet Trade 15, 411–434 (2015). https://doi.org/10.1007/s10842-015-0193-9

Received:

Revised:

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s10842-015-0193-9