Abstract

Indian manufacturers have invested significantly in technological upgradation since the opening up of Indian economy to foreign trade and technology in the mid-1980s. In this paper, we examine the impact of technology on employment and skill demand within Indian manufacturing sector. Estimating a dynamic labour demand equation, we find that despite reducing the required labour per unit of output, technology has not reduced the aggregate employment in Indian manufacturing sector. However, qualitative effect of technology on labour demand has been very significant. Our results show that adoption of new technology has increased the demand for high-skilled workers at the cost of intermediary skills, leading to the polarization of manufacturing jobs. It suggests that perhaps technology has reduced the routine-task content of manufacturing jobs in India.

Similar content being viewed by others

Avoid common mistakes on your manuscript.

1 Introduction

Technological progress has been the single most important driver of economic growth in the modern history of mankind. Over the years, technological innovations have brought colossal benefits. They have increased labour productivity and raised standards of living across the globe. However, all major technological innovations, starting from the great industrial revolution, have also coincided with a fear of technological unemployment and a significant churning in labour markets. The current wave of information- and communication-based technological progress is no exception. The advancement of digital technology and consequent increase in automation has once again instilled the fear of mass unemployment. It has been argued that if digital innovations continue at the current pace, machines, in the near future, will be able to substitute labour in most economic activities, leading to a workless world (Rifkin 1995). However, these predictions have come from public activists and not from accredited researchers. Economists have tried to dispel these concerns. Citing the standard compensation theory,Footnote 1 researchers have argued that there are many compensation mechanisms which, in the long run, can counterbalance the initial negative impact of labour-saving technological changes (Vivarelli 2012). For example, technology may reduce the demand for labour in traditional industries; however, it simultaneously increases the demand for labour in new industries that emerge from technological innovations. Similarly, technological progress reduces the unit cost of production, and if demand for goods is price elastic, the overall demand goes up, leading to an increase in demand for labour (Smolny 1998). Yet another mechanism works through an increase in income. Since technological progress increases labour productivity, it can translate into an increase in income of labour and hence higher consumption. Finally, the compensation mechanism can work through a decrease in real wages. In a competitive market with perfect substitutability between labour and capital, technological unemployment implies reduction in wages which induces firms to use more labour.

The compensation theory is not free from limitations as all compensation mechanisms mentioned above are based on one or another assumption that may or may not pass the test of reality. For example, job creation through a reduction in unit cost is possible only in perfectly competitive markets where the reduction in unit cost is passed on to consumers. In the case of oligopoly markets, this mechanism may not work at all as producers may decide to increase their profits rather than passing on the benefits to consumers. Job creation via an increase in income is possible only if the benefits of increase in productivity are shared with labour, which may or may not be the case in today’s globalized world where labour unions have become extremely weak. Similarly, the idea of job creation through reduction in wages not only collides with the Keynesian idea of effective demand, but also depends on the level of labour market flexibility (for detail see Vivarelli 2012). Nonetheless, despite all these limitations, the theory of compensation mechanism has withstood the test of time as world has not witnessed any increase in structural unemployment despite many waves of technological revolution in the past.

The technology-induced-unemployment or end-of-work hypothesis may be farfetched. However, there is a consensus that technological change always affects labour by changing the job mix and skill demand. The adoption of new technology makes a few traditional skills and jobs redundant while creating the demand for a new set of skills, leading to a labour market disequilibrium which could result in higher wage disparities. It is now widely documented that the ICT revolution has also coincided with an increase in wage disparity across the globe. It has been observed that despite huge increases in the relative supply of college graduates, return to skill has kept increasing over the last 25 years or so. This phenomenon has induced some researchers to argue that the recent wave of technological change has been biased towards high-skilled and educated workers. The advocates of skill-biased technological change (SBTC) cite two facts to prove their point; first, the increase in demand for skilled workers has been driven by within rather than between industries. Second, there has been a very strong within-sector correlation between various indicators of technological change and increase in demand for skilled workers.

The hypothesis of SBTC is not only conceptually attractive but it has also proved empirically quite successful (Autor and Dron 2013). However, of late, the SBTC framework has received a lot of criticism for equating education with skill and also for its inability to explain the mechanism by which technology affects the demand for different categories of labour or skill groups. Moreover, strong evidence of labour market polarization in many countries has also raised concerns about the validity of SBTC. Some researchers have recently tried to address these limitations by proposing a hypothesis of task-biased technological change (Goos et al. 2009, Autor and Dron 2013). Instead of dividing labour into skilled and unskilled categories, these models try to understand the skill requirement of different jobs through a task-based framework. These models categorize the tasks performed by labour into two broad groups, routine tasks and non-routine tasks, both of which are imperfect substitutes of each other. The routine tasks are those which can be codified and therefore can be easily performed by machines. By contrast, non-routine tasks require human interaction and hence cannot be mechanized easily. The non-routine tasks are further divided into two subgroups; non-routine abstract tasks and non-routine manual tasks. These models illustrate that recent improvements in ICT and a consequent decline in the price of ICT capital have reduced the labour input demand for routine tasks. By contrast, it has increased the labour input demand for non-routine tasks in general and non-routine abstract tasks in particular, which are complementary to computerization. Since non-routine-task-intensive occupations are concentrated at the top and bottom of the wage pyramid, it has led to polarization of the labour market. In short, these models suggest that recent spurts in technology have increased the demand for high-skilled workers at the cost of intermediate-skilled workers.

The Indian manufacturing sector is not isolated from the current wave of technological change. Since the opening up of the Indian economy to foreign trade and technology in the mid-1980s, Indian manufacturers have invested substantially in technology upgradation. However, little effort has been made to study the impact of technology on demand for labour within the manufacturing sector. Against this backdrop, this paper examines the impact of technology on employment and skills demand in the Indian manufacturing sector. The analysis in this paper has been restricted to the organized manufacturing sector because of two reasons. One, the available data on unorganized manufacturing sector are not sufficient for this kind of study. Second, and more importantly, the use of advance technology is not expected to be very high among the unorganized manufacturing sector. Estimating the alternative specifications of the dynamic labour demand equation, the paper argues that technology has not reduced the aggregate demand for labour in Indian manufacturing once we allow the output to vary. However, our results suggest that the adoption of new technology has significantly changed the demand for skill in Indian manufacturing. The adoption of new technology has increased the demand for high-skilled workers at the cost of intermediate skills leading to a polarization of job opportunities within the manufacturing sector.

The rest of the paper is structured as follows: Sect. 2 provides an overview of technological upgradation in the Indian manufacturing sector. Section 3 summarizes the growth and changes in composition of manufacturing employment over the last three decades, while Sect. 4 describes the empirical methodology and data sources. The results are discussed in Sect. 5. Section 6 concludes with a recapitulation of the main findings and some policy implications.

2 Technological Progress in Indian Manufacturing

Measuring technological change is a very difficult task as we do not have any direct measure of technological change faced by an individual at the work place. Therefore, researchers have used many proxies to quantify the technological change. Expenditure on research and development activities (R&D), patent citations, imports of capital goods, royalties and licence fees, accumulation of ICT capital and change in total factor productivity (TFP) are some of the most widely used indicators of technological change. Notably, all these indicators capture different dimensions of technology. For example, R&D expenditure captures in-house innovations, while capital imports and royalty payments capture the embodied and disembodied transfer of technology from one country to another country, respectively. Investment in ICT capital directly captures the use of digital technology in any firm, industry or country.

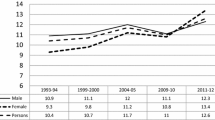

In this paper, we have used five indicators of technological change and all these indicators suggest that the last 25 years have seen significant technological upgradation in the Indian manufacturing sector. The R&D intensity of the Indian manufacturing sector has increased more than three times since 1990–1991. However, it is still very low as compared to global standards. The low R&D intensity of the Indian manufacturing sector is not very surprising. It is widely documented that firms in developing countries rely more on imports of technology than in-house innovations. A surge in capital imports and expenses on royalty and technical know-how fee by Indian firms, in the post-reform period, corroborates this fact. The Indian government allowed capital imports in the mid-1980s, and since then the imports of capital goods have increased from around US$5 billion in 1987–1988, to around US$100 billion in 2012–2013 (RBI 2014). Consequently, the share of imported capital in net capital formation of the Indian manufacturing sectors went up substantially (Table 1). The foreign exchange expenditure on royalty and technical know-how fee, which captures the disembodied technological transfer, has also spiked over the last two and a half decades (Table 1). There has also been an increase in ICT capital (Fig. 1). The stock of ICT capital, which was less Rs. 300 billion in 1999–2000, increased to around Rs. 900 billion in 2011–2012.Footnote 2 In line with this, the TFP in the Indian organized manufacturing sector has increased substantially, too.Footnote 3 Over the last three decades, the TFP in Indian manufacturing sector has increased by more than 33% (see “Appendix”).

3 Jobs in Indian Manufacturing: Some Stylized Facts

There was a slump in employment growth in the Indian organized manufacturing sector soon after it opened up to international trade and technology in the early 1980s. Despite an impressive growth in manufacturing output, manufacturing jobs remained virtually stagnant during the 1980s. Employment growth recovered in the first half of the 1990s, at an annual rate of 3.73%. However, this upturn was short-lived and employment growth plunged into the negative in 1996–1997. The downturn becomes more pronounced in the following years: from 1997–1998 to 2003–2004, jobs in the organized manufacturing sector declined at an annual rate of 1.73%. Consequently, jobs gained in the first half of the 1990s were almost neutralized. In a nutshell, the Indian organized manufacturing sector witnessed a long spell of jobless growth during the period 1980–1981 to 2003–2004. During this period, manufacturing value added grew at an annual rate of around 7.5%, while the corresponding employment growth was just 0.76% and the resultant employment elasticity was only 0.10 (Kannan and Raveendran 2009). Nonetheless, the era of jobless growth came to an end in 2003–2004, and since then the organized manufacturing sector has been generating jobs at an impressive rate of around 7% per annum. During the last 8 years, the Indian organized manufacturing sectors has created more than 5 million jobs and employment elasticity during these years has been very high (Vashisht 2016).

The composition of the manufacturing employment has changed significantly over the last three decades: there was an increase in the share of managerial and supervisory staff in total manufacturing employment (Fig. 2). Starting from 1980 to 1981, and up until 1999–2000, there was a slow but steady increase in the share of managers and supervisors in total employment. During this period, the share of managerial and supervisory staff in total employment increased by around 3% points (Fig. 2). However, the trend reversed in 2000–2001 and since then the share of white-collar workers in total employment has declined. The increase in share of white-collar workers in the total workforce was followed by an increase in skill premium.Footnote 4 An analysis of wage rates suggests that the real wages of both blue-collar (manual workers) and white-collar workers grew together during the 1980s. However, after 1990–1991, the real wage of white-collar workers and manual workers witnessed a completely opposite trend. The average real wage of blue-collar workers remained almost stagnant during 1990–1991 to 2011–2012. During these 22 years, the real wage rate of blue-collar workers increased at an annual rate of just 0.2%. By contrast, the real wage rate of managerial and supervisory staff grew at an annual rate of around 4%. Consequently, the skill premium in the Indian manufacturing sectors increased sharply (Fig. 3). In line with this, the share of managerial and supervisory staff in the total wage bill also went up from around 34% in 1990–1991, to around 50% in 2011–2012.

Berman and Somonathan (2005) and Ramaswami (2008) attributed the increase in skill premium to SBTP. However, these studies have two major limitations. First, none of these studies have used any measure of technology or investment in technology. Instead, these studies have relied on capital skill complementarity to draw conclusion about skill-biased technological Progress. Moreover, their estimates show that increase in the capital–output ratio explains only a small fraction of the observed increase in the share of white-collar workers in the total wage bill. Second, these studies assume that the workers employed in the manufacturing sector are either skilled or unskilled. However, dividing workforce into only skilled and unskilled categories is problematic as firms employ workers with different levels of skills, including workers with very high skills, intermediate skills and also workers who are unskilled. In fact, recent theoretical advances have shown that the ongoing wave of technological change has increased the demand for high-skilled workers at the cost of those with intermediate skills, without having any direct impact on the demand for unskilled workers. The empirical studies have also supported this hypothesis (Michaels et al. 2014).

3.1 Signs of Job Polarization and Decline of Intermediate Skills

In order to better understand technology-induced changes in skill demand, we analyse the structure of manufacturing employment by occupation by using the NSSO data of two rounds. We restricted our analysis to a one-digit level of occupation classification. Moreover, we club together some occupations falling under the same skill category. The results of our exercise are shown in Table 2. It is evident from the table that the occupation structure of manufacturing employment has changed significantly over the last two decades. The share of high-skilled occupations such as managers, professionals and associates in total manufacturing employment has increased by more than 3% points. However, their share in the total wage bill has increased by 11.8% points. This clearly shows that the demand for high-skilled workers has indeed increased over the last two decades and increase in demand has also been higher than the increase in supply, which has resulted in a substantial increase in the wages share of high-skilled professionals. Interestingly, the share of high-skilled professionals in total employment has not increased at the cost of unskilled workers as the share of elementary occupations in total employment has also increased by 3.4% points. Rather, the share of both skilled- and unskilled-intensive occupations has increased at the cost of middle-level skill-intensive occupations such as machine operators, clerks and craft-related workers. The share of machine operators, clerks and craft-related occupations, which are generally concentrated at the middle of the skill distribution, has come down from 76.5% in 1993–1994 to 70.2% in 2011–2012. Their wage share, too, has come down from 70% in 1993–1994 to 59.4% in 2011–2012. Given the fact that machine operators, clerk and craft occupations are routine-task intensive, a drastic decline in the share of these occupations in total employment suggests that the routine-task content of manufacturing jobs in India has declined, which underlines an increase in automation.

4 Methodology and Data Sources

4.1 Labour Demand Equation

We use the labour demand equation to quantify the impact of technology on aggregate employment in the Indian manufacturing sector. Under certain conditions, a labour demand equation can be derived from the CES production function either for a given level of output or for a given level of capital. The labour demand equation derived for a given level of output can be specified asFootnote 5:

where L is labour, W/P is real wage rate, Q is output, A is technology and \(\sigma\) is the elasticity of substitution between capital and labour. Replacing unobserved technology (A) with proxies for technology, Eq. (1) is used to quantify the impact of technology on employment. However, Eq. (1) has one serious limitation. Since it has been derived for a given level of output, it overlooks the output expansion effect of technology on employment.Footnote 6 Keeping this in mind, scholars have preferred a capital-constrained labour demand equation to quantify the impact of technology on employment (Reenen 1997). A capital-constrained labour demand equation can be expressed as:

where K is capital and R is the user cost of capital. For estimation purposes, a capital-constrained labour demand equation simply implies replacing output with capital, and inclusion of a time dummy in Eq. (1).Footnote 7 In this paper, we experiment with both specifications of the labour demand equation.

Before empirical estimation, Eqs. (1) and (2) need further attention on two more counts. First, the labour demand equations specified above are static. Since there is a cost associated with labour adjustment, it is important to include a lagged employment variable while estimating the labour demand equation. The inclusion of lag is also necessary to capture labour market rigidities as well as the heterogeneity effect (Nickell 1986). Second, technology itself is a dynamic concept and can have a long and persistent effect on employment. Therefore, one also needs to include lags of the proxies for technology. After allowing for persistence in employment and technology and replacing unobserved technology A with proxies for technology (X), the final dynamic labour demand equation can be expressed as:

where \(\tau\) is the industry fixed effect, \(\epsilon\) is random disturbance term, i stand for the ith industry and t stands for time.

Owing to the presence of lag of dependent variable as an explanatory variable, fixed effect or time difference cannot be used to estimate Eq. (3). A major concern is that the lagged dependent variable on the right-hand side might be serially correlated and hence correlated with the error term, which makes the least square dummy variable (LSDV) estimator biased and inconsistent (Baltagi 2005). Two alternative approaches have been used to deal with this problem. One set of studies has used various versions of bias-corrected LSDV estimators, while another set of studies has relied on the generalized method of moments (GMM) and its variants to address the issue in estimating dynamic panel data. However, GMM estimators were developed for situations with large N and small T (number of cross sections and number of time periods, respectively). Alvarez and Arellano (2003) have shown that there is no real advantage of GMM when T and N are of a similar dimension and that the within-group estimator is clearly better when T > N. Further, Bun and Kiviet (2005) note that in small sample models with dynamic feedbacks, method of moments and least squares estimates are biased, as the former is more biased with a higher number of moment conditions employed. The N in our data is the modest and should be treated as fixed. Various Monte Carlo simulations have shown that with a dynamic panel such as ours, the bias-corrected LSDV estimator outperforms the GMM estimators (Judson and Owen 1999). Hence, we obtained the bias-corrected LSDV estimates, using the method in Bruno (2004).

4.2 Wage Share Equation

Following the standard approach, we use the wage share equation to quantify the impact of technology on the demand for skill (qualitative impact). A standard wage share equation for different skill groups of workers can be expressed asFootnote 8:

where wsj is the wage bill of skill group j, W is the total wage bill, psj is the wage rate of skill group j, pus is the wage rate of unskilled workers, K is capital stock, Q is output, i stands for the ith industry and t stands for time. Equation (4) can be augmented with a technology-related variable to quantify the impact of technology on skill demand. It is also common in the literature to replace the relative wage term with a time dummy. After replacing relative wage with a time dummy, adding a proxy for technological change (X) and adding a fixed effect and random disturbance term, the final wage share equation is:

Equation (5) can be estimated either using fixed effect or time difference as both these methods effectively control the unobserved heterogeneity, a feature of panel data. In this paper, we used the second approach. Following Michaels et al. (2014), we estimate Eq. (5) in long difference (20 years). The long difference is chosen because it not only helps to get rid of unobserved heterogeneity but also smoothens out the measurement error and also allows labour markets to adjust to a given shock (Michaels et al. 2014).

4.3 Data Sources

There is no single database for the Indian economy which provides data on all variables needed for the estimation of Eqs. (3) and (5). Therefore, data for this study have been compiled from three different sources. All technology-related variables have been compiled from the Prowess database. Prowess provides firm-level data with a coverage of more than 10,000 firms. It allows identifying the sectors in which a firm is operating at the four-digit level of the National Industrial Classification (NIC). We extracted all technology-related variables from Prowess and aggregated the firms for each sector at the 3-digit level of NIC. The data for sector-wise employment, wage, net fixed capital stockFootnote 9 and output have been taken from the Annual Survey of Industry (ASI) which provides the most reliable and comprehensive disaggregated data on the manufacturing sector in India. However, there have been frequent changes in the National Industrial Classification (NIC)Footnote 10 which makes the older series and new series of ASI data incomparable. Therefore, for any meaningful time series analysis of the manufacturing sector, it is essential to work out a concordance between different National Industrial Classifications. The Economic and Political Weekly Research Foundation (EPWRF) has created a consistent electronic database by using the summary results from ASI from 1973 to 2003–2004. We draw data up to 2003–2004 from EPWRF CD Volume II. For the remaining years, we have taken the data from ASI summary results, after working out a concordance using the concordance table provided by the Central Statistical Organization (CSO). The sector-wise change in the share of different skill groups in the total wage bill has been compiled from the National Sample Survey Data. We used NSS’s 50th and 68th Round data to calculate the sector-wise change in the share of high-skilled, intermediate-skilled and unskilledFootnote 11 workers in the total wage bill, after making the data of these two rounds comparable in terms of occupation as well as industry classification.

5 Results and Discussion

5.1 Technology and Employment

As a first step to quantifying the impact of technology on employment, we run a simple fixed effect regression of employment on various proxies of technology; results are reported in Table 3. These descriptive regressions show a positive association between employment and all proxies of technology. Specifically, three proxies of technological progress, that is, imported capital, ICT capital and foreign exchange expenditure on royalty and technical know-how have a very strong and positive impact on employment. The coefficients of other two proxies, TFP and R&D expenditure, were also positive, but statistically insignificant. These results suggest that technological upgradation has not hampered jobs in the Indian manufacturing sector. However, the results shown in Table 3 leave out many control variables from the labour demand equation that could alter the association between technology and employment. Keeping this in mind, Tables 4 and 5 build on a more complex and theoretically satisfactory labour demand equation specified in Sect. 4.1. Table 4 shows the results of an output-constrained dynamic labour demand equation augmented with alternative proxies of technology. It is evident from the table that our labour demand is well specified as the coefficients of main variables are statistically significant with the expected signs. A positive and statistically significant coefficient of lag employment confirms strong persistence in the Indian labour market. Similarly, a negative and statistically significant coefficient of real wage rate indicates the theoretical preposition which states that with other things remaining same, any increase in real wage rate causes a decline in employment. The coefficient of output is positive and significant at the 1% level, which underlines the positive scale effect of increase in output on employment. Turning to technology, the result in column 1 of Table 4 shows that TFP has a very strong and negative association with employment. Our results suggest that a 10% increase in TFP reduces employment by around 3.2% in the short run. However, the implied long-run impactFootnote 12 is much more severe. The implied long-run coefficient of TFP is − 0.832 which means that a 10% increase in TFP reduces employment by 8.3%.

Technology itself is a dynamic concept and can have a long and persistent effect on employment. In order to capture this aspect, in column 2, we included three lags of TFPFootnote 13 in our labour demand equation. Results show that the contemporaneous impact of TFP on employment is negative and it becomes more pronounced at first lag before tapering off at lag 2 and lag 3. The implied long-run impact of an increase in TFP on employment is very high. The estimated long-run coefficient of TFP is − 0.846, which implies that a 10% increase in TFP reduces the labour demand by almost 8.5%. The use of TFP as a measure of technological progress has some serious limitations. First, TFP as a measure is prone to short-term fluctuations owing to the changes in capacity utilization. Second, TFP can increase without any progress in technology if there is an increase in efficiency. The chances of an efficiency-driven increase in TFP are particularly stronger during the period of structural reforms. Finally, at least theoretically, it is also possible to have a sustained growth in technology without having any change in TFP (Lipsey and Carlaw 2004). Given these limitations, one cannot solely rely on TFP while exploring the impact of technology on employment.

Keeping this in mind, we replaced TFP with three more appropriate proxies of technology in columns 3 and 4 of Table 4. The results in column 3 show that the immediate impact of technology on labour demand is not significant as the coefficient of all three proxies of technology, the ICT capital, R&D expenditure and Royalty payment, turned out to be insignificant. However, once we take into account the persistence in labour market and calculate the implied long-run coefficient, we found a significant negative impact of ICT capital and royalty payment on labour demand. The implied long-run coefficient of ICT capital and royalty payments turned out to be − 0.088 and − 0.011, respectively. By contrast, we did not find any significant long-run impact of R&D on labour demand. Given the low R&D intensity of Indian manufacturing firms coupled with the fact that most of the R&D in Indian manufacturing is directed towards product innovation rather than process innovation, the positive but insignificant long-run coefficient of R&D intensity is not surprising.

In column 4, we controlled for lag effect of each indicator of technology. The results for ICT capital are almost unchanged as the short-run impact turned out to be insignificant while the long-run impact turned out to be negative and significant. By contrast, the results in column 4 show that the short-run impact of royalty payment on employment fluctuate substantially across lags. The contemporaneous impact of royalty payment on labour demand is insignificant, while the first and third lag show a negative and significant impact. The impact of the second lag of royalty turned out to be positive and significant; however, the cumulative long-run impact of royalty payment on labour demand continues to be negative and significant. As for R&D expenditure, the short-run as well as the long-run coefficients continue to be insignificant, even after inclusion of three lags.

In column 5, we replace ICT capital with share of imported capital in total capital stock. The result, once again, confirms the negative impact of technology on labour demand if output is kept constant as short-run as well as long-run coefficient of imported capital turned out to be negative and significant. In column 6, we control for lag effect of imported capital. Results show that the contemporaneous impact of imported capital on labour demand is negative. The coefficient of first lag turned out to be positive and significant. The coefficients of second and third lag turned out to be negative, but insignificant. However, the cumulative long-run impact of imported capital continues to be negative, even after controlling for lag effect. Notably, the magnitude of long-run coefficients of ICT capital, royalty payment and imported capital is much smaller when compared to the long-run coefficient of TFP. It suggests that perhaps a large part of negative impact of TFP on employment can be attributed to increase in efficiency rather than technological progress.

Given the undisputed fact that technological progress always results in higher labour productivity, the labour-saving impact of technology summarized above is not surprising at all. There is consensus among scholars that direct impact of technology on employment is always negative. However, scholars have identified many indirect channels though which technology contributes to job creation and most of these indirect channels work through expansion in total output.Footnote 14 The results given in Table 4 overlook the output expansion effect of technological progress as it estimates the impact of technology for a given level of output. In order to mitigate this problem, in Table 5, we switch to a capital-constrained dynamic labour demand equation that allows output to vary. The results in Table 5 show significant complementarity between capital and labour demand. According to our estimates, a 10% increase in real capital stock increases labour demand by around 2.5%. The coefficients of the other two control variables, real wage and lag employment, are similar to the one reported in Table 4. However, the long-run impact of technology and employment turned out to be completely different. Unlike the output-constrained labour demand equation, the estimated long-run coefficients of all the proxies of technological progress are positive. The results in column 1 of Table 5 show that a 10% increase in TFP leads to 3.17% increase in employment in the long run. Similarly, the long-run coefficient of all the other four proxies of technology turned out to be positive and significant when we do not control for their lag effect. Once we control for lag effect, the long-run impact of royalty payment and R&D becomes insignificant. However, none of the proxy of technology shows any negative impact on employment once we allow output to vary. These results suggest that one or another compensation mechanism is working in the Indian manufacturing sector, thus vindicating the time-tested standard compensation theory.

5.2 Technology and Skill Demand

We estimated the wage share equation specified in Sect. 4.2 to quantify the impact of technology on skill demand, and results are reported in Table 6. The dependent variable is the change in wage share of high-skilled workers in Panel A, the change in wage share of middle skill workers in Panel B and the change in wage share of unskilled workers in Panel C. As mentioned earlier, all equations have been estimated in long difference.Footnote 15

We started our analysis by simply estimating the intercept. Results reported in column 1 of Panel A indicate that there has been a significant increase in share of skilled workers in the total wage bill. In columns 2 and 3, we include explanatory variables. The results show that inclusion of technology and other variables reduces the magnitude of the intercept and renders it insignificant. Notably, the coefficients of all proxies of technology, except the imported capital, are positive and significant which underlines the role of technology in skill upgradation. However, the coefficient of capital–output ratio turned out to be negative and insignificant suggesting that there is no capital skill complementarity. An insignificant capital–output ratio is not unexpected. Michaels et al. (2014) have shown that if a direct measure of technology is included in the regression, the capital–output ratio is expected to be insignificant. The coefficient of output in our results also turned out to be insignificant which shows that there has not been any significant difference in the rate of skill upgradation between fast-growing and slow-growing sectors of Indian manufacturing.

In Panel B of Table 6, we repeat the wage share specification for intermediate-skilled workers. Results show that there has been a negative growth in the share of intermediate-skilled workers as the coefficient of intercept is negative and significant at 1%. However, once we include explanatory variables into the equation, the intercept becomes insignificant. Result in columns 2 and 3 shows that the association between technology and wage share of intermediate-skilled workers is negative. Specifically, change in ICT capital, change in R&D sale ratio and change in royalty payment have a significant negative impact on the share of intermediate-skilled workers in the total wage bill. The coefficients of the imported capital also turned out to be negative, but insignificant.

In Panel C of Table 6, we estimate the impact of technology on the share of unskilled workers. Though the coefficient of each variable can be calculated from the results reported in Panels A and B, we estimated these results to check the significance of coefficients. Our results suggest that none of the proxies of technology has any significant association with the share of unskilled workers in total wage bill. These results suggest that technology seems to have increased the demand for high-skilled professionals at the cost of intermediate-skilled workers and not at the cost of unskilled workers. They also imply that technology has perhaps reduced the routine-task content of manufacturing jobs in India.

6 Conclusion and Policy Implications

Technological progress has been the most important driver of economic growth in the modern history of mankind. Yet technological innovations have always caused anxiety among labour. The current wave of information- and communication-based technological progress is no exception in this regard. It is now widely documented that the ongoing technological revolution is bringing about fundamental changes in labour demand. The Indian manufacturing sector is not isolated from the current wave of technological change. Since the opening up of the Indian economy to foreign trade and technology in the mid-1980s, Indian manufacturing firms have invested significantly in technological upgradation. It is in this context that this paper has examined the quantitative and qualitative effect of technology on labour demand within Indian manufacturing. Estimating an output-constrained labour demand equation, we find that technology has, indeed, reduced the labour demand for a given level of output. However, once we switch to a capital-constrained model that allows output to vary, we find a small but positive effect of technology on employment. These results suggest that despite reducing the employment intensity, technology has not reduced the aggregate number of jobs in Indian manufacturing because the output expansion effect of technology has been quite strong. Our results suggest that the qualitative impact of technology on labour demand in Indian manufacturing is very much in line with the experience in developed countries. The adoption of new technology seems to have increased the demand for high-skilled workers at the cost of intermediary skills, leading to the polarization of manufacturing jobs. It suggests that technology has, perhaps, reduced the routine-task content of manufacturing jobs. Interestingly, despite job polarization, we did not find any sign of wage polarization within the manufacturing sector. This suggests that technology has benefited only a very small section of very high-skilled labour employed in the manufacturing sector.

So what are the policy implications we can draw from this study? Perhaps, we can draw two broad policy implications. The first relates to the technology-induced increase in demand for high-skilled professionals. Our analysis shows that technology upgradations increased the demand for high-skilled professionals, which has increased wage disparities. Since the demand for skilled workers is expected to increase further, the problem of wage inequality cannot be effectively tackled without increasing the supply of skilled workers. Government, over the last few years, has made some efforts in this direction. It has not only increased the number of government institutions for professional and higher education but has also allowed private investment in technical and higher education. However, these efforts have not produced the desired results so far because the quality of education at most private institutes has remained poor. Employers generally complain that even people with formal degrees are not employable. In the face of this problem, serious efforts are needed to improve the quality of education at all levels. Moreover, given the fact that technology is rapidly reducing the jobs opportunities in certain middle-skilled occupations, an overhaul of vocational and technical education is much needed to ensure a demand–supply balance. However, a more detailed study into the technology-induced changes in occupation structure, at a much disaggregated level, is required for this.

The second implication relates to the intervention in labour and capital markets and their impact on choice of technology. Countries use more advanced capital-intensive production technologies at a higher level of economic development when labour costs become very high. However, interventions in labour and capital markets can incentivize firms to use technology which may not be compatible with the factor endowment of the country. Our analysis in this paper shows a phenomenal decline in the share of middle-skilled routine-task intensive manufacturing jobs that underlines the substantial increase in automation. Hasan et al. (2013) have shown that the Indian manufacturing sector uses more capital-intensive technology as compared to other countries at similar levels of development with similar factor endowments. It has been repeatedly argued that policy-induced labour market rigidities have forced Indian manufacturing firms to opt for more capital-intensive technology. There is no doubt that some of the existing labour laws such as the Industrial Disputes Act (IDA) are highly restrictive and therefore distort the choice of technology. However, the choice of more capital-intensive technology and automation cannot be entirely attributed to distortions in the labour market: in fact, distortions in capital markets are equally responsible. It is widely documented that successive policy measures adopted by both the provincial and federal governments in India have reduced the cost of capital. Incentives such as a cash subsidy on level of investment, interest subsidies and various forms of tax exemptions on the use of capital have made the cost of capital cheaper, which has motivated firms to opt for more capital-intensive digital technology (Chandrasekhar 2008; Debroy 2015). Therefore, a rationalization of distortion in capital and labour markets is needed to ensure an efficient choice of technology which will, in turn, prevent premature automation in the Indian manufacturing sector.

Notes

Various market compensation mechanisms that counterbalance the initial labour-saving impact of technology put together are known as Compensation Theory (for details see Vivarelli 2012).

It should be noted that ICT capital shown in Fig. 1 only includes investment in computer hardware and software. Computer-linked production machines (computer numerical control machines) are not included in ICT capital. Therefore, the ICT capital data reported in ASI in its current form seriously underestimates the extent of digitization in the Indian manufacturing sector.

We have estimated TFP for all manufacturing sectors at 3 digit level of NIC using five input Translog index of total factor productivity. The net capital stock has been estimated using the conventional perpetual inventory method. For details of estimation methodology please see Virmani and Hashim (2011).

Following standard literature the skill premium is defined as ratio of the average wage rate of managers and supervisors to average wage rate of manual workers.

Various compensation mechanisms explained in Sect. 1 show that despite reducing the employment for a given level of output, technology creates more jobs by increasing the volume of production.

In a competitive economy, the user cost of capital is expected to be same across sectors. Therefore one can replace R with time dummies which effectively controls for inter-temporal changes in user cost of capital.

For detail derivation of wage share equation, please see Michaels et al. (2014).

Using the standard perpetual inventory method, we estimated the net fixed capital stock for each industry from ASI data.

The NIC is a standardized categorization of the economic activities according to which the economic data is tabulated.

For details of occupations clubbed in different skill groups please see note below Table 2.

The long term impact of TFP on employment has been computed as the sum of the estimated coefficients of the contemporaneous and lagged TFP (∑β) over: 1 − λ (long-run multiplier). For details of the estimation of long run coefficients as well as their standard error see Bhalotra (1998). Same formula has been used to calculate the long run impact of other proxies of technology on employment.

We also experimented with longer time lag. However, the final analysis has been restricted to three lags as the longer lag turnout to be insignificant for all proxies of technology.

For details, please see Sect. 1.

We also estimated the wage share equation by using the ASI data and found a significant positive impact of technology on the share of managers and supervisors in total wage bill. However, unlike other Indian studies, we did not find any significant capital skill complementarity. The results are not reported in this paper. However, results are available on request.

References

Alvarez, J., and M. Arellano. 2003. The Time-Series and Cross-section Asymmetry of Dynamic Panel Data Estimators. Econometrica 71 (4): 1121–1159.

Autor, D.H., and D. Dron. 2013. The Growth of Low-Skill Service Jobs and the Polarization of the US Labor Market. American Economic Review 103 (5): 1553–1597.

Baltagi, B.H. 2005. Econometric Analysis of Panel Data. Sussex: Wiley.

Berman, E., and R. Somanathan. 2005. Is Skill-Biased Technological Change Here Yet? Evidence from Indian Manufacturing in the 1990s. World Bank policy research working paper 3761, World Bank, Washington, DC.

Bhalotra, S.R. 1998. The Puzzle of Jobless Growth in Indian Manufacturing. Oxford Bulletin of Economics and Statistics 60 (1): 5–32.

Bruno, G. 2004. Approximating the Bias of the LSDV Estimator for Dynamic Unbalanced Panel Data Models. Economics Letters 87 (3): 361–366.

Bun, J., and J. Kiviet. 2005. The Effects of Dynamic Feedbacks on LS and MM Estimator Accuracy in Panel Data Models. Journal of Econometrics 132 (2): 409–444.

Chanderasekhar C. P. 2008. Revisiting the Policy Environment for Engendering Employment Intensive Growth. Background Paper Prepared for the International Labour Office, New Delhi.

Debroy, B. 2015. The Anti Labour Mind Set. The Financial Express, 23 April 2015.

Greenaway, D., and R.C. Hine. 1999. An Empirical Assessment of the Impact of Trade on Employment in the United Kingdom. European Journal of Political Economy 15 (4): 485–500.

Goos, M., A. Manning, and A. Salomons. 2009. Job Polarization in Europe. American Economic Review Papers and Proceedings 99 (2): 58–63.

Hasan, R., M. Devashish, and A. Sundram. 2013. The Determinants of Capital Intensity in Indian Manufacturing. Indian Growth and Development Review 6 (2): 212–241.

Judson, R.A., and A.L. Owen. 1999. Estimating Dynamic Panel Models: A Guide for Macroeconomists. Economic Letters 95 (1): 9–15.

Kannan, K.P., and G. Raveendran. 2009. Growth Sans Employment: A Quarter Century of Jobless Growth in India’s Organized Manufacturing. Economic and Political Weekly XLIV (10): 80–91.

Lipsey, R.G., and K.I. Carlaw. 2004. Total Factor Productivity and the Measurement of Technological Change. The Canadian Journal of Economics 37 (4): 1118–1150.

Michaels, G., A. Natraj, and J.V. Reenen. 2014. Has ICT Polarized Skill Demand? Evidence from Eleven Countries over 25 years. Review of Economics and Statistics 99 (1): 60–77.

Nickell, S. 1986. Dynamic models of labour demand. In Handbook of Labor Economics, vol. 1, ed. O. Ashenfelter and R. Layard. Amsterdam: North-Holland.

Ramaswami, K. V. 2008. Wage Inequality in Indian Manufacturing: Is it Trade, Technology or Labour Regulation? IGIDR working paper 2008-021, Indira Gandhi Institute of Development Research, Mumbai.

Reenen, V. 1997. Employment and Technology Innovations: Evidences from UK Manufacturing Firms. Journal of Labour Economics 15 (2): 255–284.

RBI. 2014. Handbook of Statistics on Indian Economy. Mumbai: RBI.

Rifkin, J. 1995. The End of Work—The Decline of the Global Labour Force and the Dawn of the Post-Market Era. New York: Tarcher/Putnam.

Smolny, W. 1998. Innovations, Prices and Employment: A Theoretical Model and an Empirical Application for West German Manufacturing Firms. Journal of Industrial Economics 46: 359–381.

Vashisht, P. 2016. Creating Manufacturing Jobs in India: Has Openness to Trade Really Helped? Journal of Asian Economics 42: 53–64.

Virmani, A., and D. A. Hashim. 2011. J-Curve of Productivity and Growth: Indian Manufacturing Post-Liberalization. IMF working paper 11/163 https://www.imf.org/external/pubs/ft/wp/2011/wp11163.pdf.

Vivarelli, M. 2012. Innovation Employment and Skills in Advanced and Developing Countries: A Survey of Literature. IZA discussion paper 6291, Institute for the Studies of Labour (IZA).

Acknowledgements

This paper is part of the World Bank sponsored “Jobs for Development” research project at ICRIER. Financial support from the World Bank is gratefully acknowledged. This paper was published as ICRIER Working Paper No. 334. The earlier version of this paper was also presented at “Creating Jobs in South Asian” conference at ICRIER on December 4, 2015, “Urbanization, Structural Change and Employment” conference at Hong Kong University of Science and Technology on December 13, 2015 and “Econworld” conference held in Paris on July 25–27, 2017. Author is thankful to the participants of these conferences for their valuable comments and suggestions. Author is also thankful to Prof. Kunal Sen, Manchester University and Dr. Badri Narayanan G., Perdue University for their valuable comments.

Author information

Authors and Affiliations

Corresponding author

Appendix

Rights and permissions

About this article

Cite this article

Vashisht, P. Destruction or Polarization: Estimating the Impact of Technology on Jobs in Indian Manufacturing. Ind. J. Labour Econ. 61, 227–250 (2018). https://doi.org/10.1007/s41027-018-0127-2

Published:

Issue Date:

DOI: https://doi.org/10.1007/s41027-018-0127-2