Abstract

This paper investigates the change in women’s earnings following marital dissolution from a longitudinal approach. Using unique data that matches the Survey of Income and Program Participation (SIPP) with Social Security longitudinal earnings records, we examine marital dissolution events occurring between 1985 and 2003. Results show significant increases in women’s labor market involvement and earnings following marital dissolutions over the past two decades. We find greater labor force involvement prior to the dissolution event among more recent divorcees; however, among those already in the labor force, the pattern of change in earnings associated with divorce has changed little over the examined period. Human capital and family characteristics were associated with the change in earnings after marital dissolution.

Similar content being viewed by others

Avoid common mistakes on your manuscript.

Background

Change in family status and its impact on women is an important research and policy area. Among the most influential changes in family status is divorce. While divorce rates in the United States have gradually decreased from their peak in the late 1970s and early 1980s, a sizeable share of the population continues to experience divorce (Stevenson and Wolfers 2007). If current trends continue, approximately one-half of first marriages will end in divorce or separation (Raley and Bumpass 2003; Schoen and Standish 2001). Recent declines in remarriage may imply an increase in the share of the population who remain divorced (Isen and Stevenson 2010; Tamborini and Whitman 2007).

Understanding the economic consequences of divorce for women has been a substantive interest for an extensive multidisciplinary literature over the past 30 years (Amato 2000; Dew 2009; Duncan and Hoffman 1985; Hanson et al. 1998; Johnson and Skinner 1986; Smock 1993; Smock et al. 1999). While past research has been characterized by a diverse range of methodological approaches, data sources, and outcome measures, the majority of evidence has revealed a greater decline in economic well-being after divorce among women than men, in large part due to the loss of the husband’s labor income (Hoffman and Duncan 1988; Holden and Smock 1991; McKeever and Wolfinger 2001; Smock 1994). Explanations of the disproportionate financial costs borne by women after a divorce have tended to highlight lower labor force participation and human capital investments, as well as greater childrearing responsibilities (Bradbury and Katz 2002; Morgan et al. 1992; Smock 1993).

This study examines the change in women’s earnings in the years immediately following the dissolution of a marriage ending in divorce. We analyzed this change from a longitudinal approach using a unique, restricted-use dataset that matches Wave 2 of the 1996 and 2004 Survey of Income and Program Participation (SIPP) panels with Social Security Administration (SSA) longitudinal earnings records. The SIPP data provide rich retrospective marital history information, from which we selected a large sample of women who separated and divorced between 1985 and 2003. The linked administrative data provide the annual earnings of these women before and after the reported marital dissolution.

Developing a better understanding of women’s earnings following marital dissolutions over almost a twenty-year period is of considerable interest on several fronts. Representing the largest component of divorced women’s resources, earnings play a pivotal role in post-dissolution financial well-being. The economic status of divorced women is of concern given their relatively high poverty rates. For example, in 2008, almost 22% of divorced or separated women aged 16 or older lived below the poverty line, a markedly greater proportion than men and married families (U.S. Census Bureau 2009).

Women’s earnings after a divorce can also have implications for their long-run financial well-being. A major source of retirement income for single elderly U.S. women is Social Security, which is determined, in large part, by a person’s lifetime earnings (Haider et al. 2003; Holden and Fontes 2009; Spratlin and Holden 2000). Recent evidence has indicated a decline in the proportion of U.S. divorced women with a 10-year marriage (Tamborini et al. 2009); the length of time a marriage must last for a person to be eligible for Social Security divorced spouse or survivor benefits. As a result, divorced women’s own lifetime earnings will be of increasing consequence for the level of their Social Security benefits. Finally, since the bulk of existing literature on this subject appeared in the 1980s and 1990s, up-to-date estimates on the pattern of earnings change among women after marital dissolution are needed.

Our empirical investigation addressed three primary research questions. First, to what extent do women’s earnings change after marital dissolution? Insofar as women experience a reduction in financial well-being when their marriage dissolves, they face financial incentives to increase their labor income, either by entering the labor market, working longer hours, or finding higher paid employment. For some women, increasing earnings after a divorce reflects a central strategy to avoid poverty (Bane and Ellwood 1986); for others, it offsets reductions in family income (Gadalla 2009; Weitzman 1985).

Yet, what actually happens to women’s earnings after a marital dissolution has remained curiously understudied. One strand of research has examined women’s labor supply around marital dissolution, but primarily in terms of the determinants of divorce (Burstein 2007; Weagley et al. 2007), rather than the consequences of it. A limited amount of empirical work has focused on the association between the change in female labor supply (hours worked) and marital dissolution, often showing a positive relationship (Gray 1998; Johnson and Skinner 1988; Johnson and Skinner 1986).

Second, has the change in women’s earnings associated with marital dissolution changed over time? Several studies have examined whether the financial costs of marital disruption for women have changed over recent decades, with mixed conclusions (McKeever and Wolfinger 2001; Smock 1993). However, no research to date has focused on whether the pattern of change in women’s earnings associated with divorce has shifted over recent decades. Changes in women’s education, work, and family lives over the examined period (1985-2003) lead us to speculate that women’s earnings adjustments following a marital dissolution have lessened for more recent divorces. For example, between 1980, 1990, and 2005, the share of women aged 25 and over with a college degree rose from 12.8% to 18.4% to 26.5% (U.S. Census Bureau 2008a, Table 222). Female labor force participation also has risen, particularly for married women with children, rising from 45% in 1975, to 66% in 1990, and to 71% in 2000 (Blau and Kahn 2007; U.S. Census Bureau 2008a, Table 579). Marriage patterns have changed. The duration of marriages ending in divorce have declined among recent cohorts (Tamborini et al. 2009), and trends show increasing prevalence of delayed or forgone marriage (Goldstein and Kenney 2001; Tamborini 2007), which may imply a change in the selectivity of marriage.

Third, how do individual and family characteristics relate to the change in women’s earnings after marital dissolution? Studies on this point have been limited partly because cross-sectional data do not contain information on women’s characteristics at the time of marital dissolution. While panel data may provide this information, they often do not offer a large enough sample of divorced women to conduct meaningful analysis across a large range of variables (e.g., Gadalla 2009). Even so, given the strong links between women’s educational attainment and labor market prospects (Blau and Kahn 2007), it follows that women with higher educational attainment may find it less difficult to increase their earnings (or maintain relatively high earnings) subsequent to a marital dissolution. In terms of family, evidence has suggested that divorced women who quickly remarry may fare better economically than those who do not (Dewilde and Uunk 2008; Duncan and Hoffman 1985; Zissimopoulos 2009), and as a result, may face reduced financial incentives to increase their own earnings (Gerner et al. 1990).

The presence and age of children also may be salient. Some evidence has suggested that mothers of young children experience significant declines in financial well-being after divorce (Hanson et al. 1998). Even when child support is provided from the non-custodial parent, it seldom replaces the ex-spouse’s earnings. In addition, because children increase a household’s economic needs (Holden and Smock 1991), divorced mothers likely face strong financial incentives to increase their labor income. At the same time, children reduce women’s labor supply during marriage (Bianchi 2000; Gangl and Ziefle 2009), thus, the earnings prospects of mothers may be diminished following a marital dissolution. Because children often live with their mothers after a divorce (Kreider 2008, Table 9), childrearing may continue to put downward pressure on women’s labor market activity after the marriage dissolves. For example, some women may work fewer hours due to the scarcity of childcare (Morgan et al. 1992).

Method

Data

Data were drawn from Wave 2 of the 1996 and 2004 SIPP panels matched to SSA’s longitudinal earnings records. The SIPP is a nationally representative household panel survey of the civilian non-institutionalized U.S. population administered by the Census Bureau. Interviews (also referred to as waves) were conducted every 4 months for 28–36 months with a sample size ranging from approximately 14,000–46,500 households, depending on the panel. The survey can be used as a longitudinal or cross-sectional data source.

Wave 2 of the SIPP panels contain the marital history topical module, which provided complete retrospective marital histories for every person in the household aged 15 years or older, including the year a respondent married, separated, or divorced for up to three marriages. Unlike the 1996 panel, the 2004 Public-Use marital history file suppressed marital transition dates; as a result, we used a Restricted-Use version containing such information. The Wave 2 interview also contains the fertility and educational history modules, which were utilized to identify the presence and age of children and the education level of women at the time of their marital dissolution.

With the assistance of the U.S. Census Bureau, SSA’s longitudinal earnings records (1984–2005) were matched to the aforementioned SIPP panels (see McNabb et al. 2009 for detail about the matching process). The current study used SSA’s Detailed Earnings Records (DER) file, which holds employer-reported tax earnings data for the U.S. population sent to the Internal Revenue Service (IRS). Annual earnings used in this study reflected all wages, salaries, bonuses, and any self-employment income, as reported on the W-2 form and the 1040 U.S. Individual Income Tax Return, including the Schedule SE for self-employment. Olsen and Hudson (2009) provide detailed information on SSA’s earnings files.

There were several advantages in using the SIPP-SSA data over SIPP panel data alone. Most importantly, the matched administrative earnings made it possible to compare the annual earnings of the same individual in the SIPP before and after the reported year of marital dissolution. This allowed us to examine a larger number of marital dissolutions, and for a longer time span, than using a SIPP panel prospectively. The SIPP panel alone, for example, would have limited analysis to only those marital dissolutions that took place during the 32–48 months of the panel, resulting in a much smaller sample of divorced women, with less variation in age, cohort, and period. The SIPP-SSA data were also subject to considerably less sample attrition than a SIPP panel. Between Wave 1 and Wave 2 interviews, attrition in the SIPP was relatively low: 8.4% for the 1996 SIPP and 7.5% for 2004 SIPP. However, considerable attrition occurred after the early waves, reaching 35–40% toward the final wave depending on the panel. Finally, because the matched administrative earnings reflect respondents’ own tax records, they contained less measurement error than self-reported earnings (Pedace and Bates 2000).

One drawback was that not all SIPP respondents were matched to their administrative earnings. Some provided inaccurate matching information and others opted out of the matching program. Somewhat analogous to survey nonresponse, there was the potential for a match selectivity problem. However, the match rates for our final sample were high; 86.4% for the 1996 SIPP and 83.3% for the 2004 SIPP. Moreover, sensitivity analysis showed strong similarities between the matched-SIPP and SIPP samples in terms of age, birth cohort, current marital status, educational level, and race/ethnicity. Most differences did not exceed 1 percentage point. Czajka et al. (2008) analyzed the potential match bias in several SIPP-SSA matched samples and concluded that the bias is minimal. Another limitation discussed further in the next section was that the matched data did not contain information on women’s labor hours or non-labor income, such as child support or welfare payments.

Analytic Sample and Research Strategy

Our analysis was designed to identify the change in women’s earnings after a marital dissolution event and how this change may vary over time. We restricted the sample to women in the matched SIPP-SSA dataset who separated and divorced from their first or only marriage between 1985 and 2003. We did not consider divorce from remarriages, because they were likely to have different characteristics than first marriages. Women who separated or divorced prior to 1985 were excluded given limitations in SSA’s DER earnings data prior to 1983.

While marital event dates are generally captured well in retrospective histories (Lillard and Waite 1989), there is potential for recall bias, especially the further back respondents are asked to remember events. To address this issue and better account for compositional changes in the population, such as immigration, deaths, and the formation of new households, we drew two independent samples reflecting two divorce periods. The first period sample (P1) used the 1996 SIPP panel to provide data on divorces occurring between 1985 and 1995. The second period (P2) used the 2004 SIPP panel to provide data on divorces occurring between 1996 and 2003. To guard against the confounding effect of schooling and retirement, we restricted the samples to women who separated and divorced between the ages of 25 and 50. The unweighted sample sizes were 1,545 for the 1985–1995 period (1996 SIPP) and 1,023 for the 1996–2003 period (2004 SIPP). These represent among the largest samples utilized to date among studies examining marital dissolution and women’s economic change using a longitudinal perspective.

To assess earnings change longitudinally, we used an observation window of 4 years (see Fig. 1). We identified the marital dissolution as the reported year of separation (T) from a marriage ending in divorce. Using the year of separation (from a marriage ending in divorce) instead of divorce as the transition flag has been a common approach in the literature because a marriage ends, for practical purposes, when the couple separates, even though it legally terminates with the divorce (Sweet and Bumpass 1987). Once time T had been determined, we compared a woman’s annual earnings in the calendar year before the event (T − 1) to her annual earnings two calendar years after the event (T + 2). We selected the second calendar year (T + 2) rather than the first (T + 1), because by T + 2 most of the women in our sample (92%) had not only separated from their marriage, but had also divorced. Sensitivity analysis examining time T + 1 showed qualitatively similar results. All earnings were adjusted to 2006 dollars using the CPI-W index.

Our analysis utilized both descriptive and multivariate regression techniques. Because our regressions did not intend to evaluate causal relationships, they should be viewed as falling within a descriptive regression framework (Ginther and Pollak 2004). While a more thorough causal specification of the effect of divorce on women’s earnings is needed, the current analysis helps advance the understanding of the conditions that differentiate the pattern of change in women’s earnings after a marital dissolution.

To better identify period differences, the descriptive regressions pooled the two period samples. To control for the possibility that an independent variable has a different effect by period, we introduced interaction terms between the divorce period, which also reflected the survey year, and all of the independent variables. Interaction coefficients at the 0.10 significance level were kept in the final models, and those at the 0.05 significance level were reported directly in the Tables. The reported standard errors were adjusted for SIPP’s complex survey design using STATA’s survey (SVY) command (Kreuter and Valliant 2007). Sensitivity analysis estimating separate-sample regressions (available upon request) showed qualitatively similar results.

Four outcome variables were examined. The first outcome, which required multinomial logistic regression, captured four mutually exclusive categories of labor market status change:

-

(1)

Earner: Respondent has positive earnings at T − 1 and T + 2;

-

(2)

Non-Earner: Respondent has zero earnings at T − 1 and T + 2;

-

(3)

Labor market entry: Respondent has zero earnings at T − 1, but has positive earnings at T + 2;

-

(4)

Labor market exit: Respondent has positive earnings at T − 1, but zero earnings at T + 2.

The second outcome was the proportional earnings change, defined as a woman’s log annual real earnings at T + 2 minus her log annual real earnings at T − 1. A positive log change indicated the proportional increase in earnings after the event, whereas a negative value indicated the proportional reduction. A value of zero indicated no change. We estimated an OLS model on this outcome and included only women with non-trivial earnings (at least $1,000) before and after marital dissolution so as not to conflate earnings with labor force participation. We selected $1,000 as the cut off, rather than $1, as a strategy to exclude very low earnings at T − 1 as evidence of labor force involvement. Around 3% of women in each period sample had pre-dissolution earnings above $0 but below $1,000.

The third outcome indicated whether a woman’s earnings were at least 30% higher after the dissolution using binary logistic regression (1 = yes, 0 = otherwise). We selected 30% as the threshold to identify earnings gains that went beyond wage growth and incremental increases associated with work experience.

The fourth outcome was the log annual earnings at time T + 2 of women who moved from trivial earnings (less than $1,000) at T − 1 to non-trivial earnings at T + 2. For this subset, post-dissolution earnings essentially reflected the earnings change associated with marital dissolution. An OLS model was used.

A key independent variable in each regression model was a dummy variable that signified whether the marital dissolution occurred in the 1985–1995 or the 1996–2003 period. The coefficient on this variable captured if the average change was significantly different in the two periods, controlling for the variables in the model. Sensitivity analysis using different year groupings (e.g., 5-year intervals, single-year dummies) showed similar results to those presented below. Note that individual years in each period were sufficiently represented in the data. However, the probability of selecting women who had both separated and divorced toward the end of each period cut-off, namely the last year, was understated. The magnitude of this censoring was minimal given the type of analysis undertaken.

The independent variables also included a range of human capital, family, and demographic measures likely associated with the change in women’s earnings following a marital dissolution. Specifically, we measured women’s pre-dissolution earnings at T − 1, age and educational attainment at T, the occurrence of a quick remarriage (by T + 1), the presence and age of children at T, the length of the marriage before T, and race/ethnicity. Aside from controlling for compositional differences between each period, such variables were of substantial interest in their own right as potential sources of variation in women’s earnings adjustments to marital dissolution. The appendix provides more detailed information on these variables. Finally, because children may have a strong impact on labor market attachment before and after a dissolution event, preliminary models introduced interaction terms between the presence and age of children at T and other variables in the model. Significant interactions (at the 0.05 level) were kept in the final models.

Several factors that we would have ideally measured were not included in the regressions due to data limitations. Our longitudinal data, for example, did not include alimony and child support. Sufficiently large alimony or child support payments after a marital dissolution may put downward pressure on women’s work incentives, while small payments may increase such incentives. The absence of these measures, nonetheless, is unlikely to substantially influence our results for several reasons. First, very few U.S. divorced women actually receive alimony. According to data from Wave 2 of the 2004 SIPP panel, only 2% of currently divorced women aged 25–50 reported alimony income. The pattern was similar in 1996. Second, in terms of child support, payments rarely compensate for declines in family income and household economies of scale (Duncan and Hoffman 1985). Child support targets child-associated expenses rather than women’s standard of living. Moreover, the typical payment, when paid, has been shown to be very small. In 2005, for example, the median estimated annual child support due and received among custodial parents was $2,400 (Grall 2007; see also U.S. Census Bureau 2008b).

Our models did not control for the ex-spouse’s earnings prior to divorce. Theoretically, an ex-spouse’s earnings are likely to be associated with the family’s overall economic status before the dissolution event. Nevertheless, our models measured women’s education level at the time of dissolution which, because of assortative mating patterns (Pencavel 1998; Schwartz and Mare 2005), proxies, to some degree, the ex-spouse’s socioeconomic status. Post-dissolution living arrangements may also be important. While our measure of remarriage controlled for a key post-dissolution living arrangement, the data precluded us from measuring whether women cohabit or live with relatives after their divorce.

Results

Descriptive Findings

Table 1 displays the summary statistics for the two samples by dissolution period. The characteristics of the two samples were generally similar. Approximately 7% of women in each period had remarried within 1 calendar year of their marital dissolution. The share with children prior to marital dissolution constituted roughly two-thirds of both samples. About 9% gave birth within 2 calendar years of the dissolution event. There were, however, some noteworthy compositional differences between the samples, which likely mirror broader population changes. Most notably, women from the more recent divorces (P2) were better educated than from earlier divorces (P1), with about a 5-percentage point higher share of college graduates and a 4% lower share of high school dropouts. More recently divorced women (P2) were also slightly more likely to have positive earnings 1 year prior to their marital dissolution.

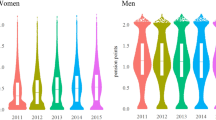

Figure 2 depicts the change in labor market involvement after the dissolution event, measured by the percentage with non-zero (positive) and substantial ($24,000) earnings relative to time T. Overall, the data showed clear increases in women’s labor market involvement after marital dissolution. In the year following the event, the share with positive earnings was approximately 4–6 percentage points higher than 1 year prior. The share with substantial earnings was 7 percentage points higher. With respect to period, women in the more recent divorce period (1996–2003) had a higher share with positive earnings prior to the dissolution event relative to the earlier period (1985–1995). More recently divorced women also had a greater substantial earnings rate before and after the event. The slope of the change around time T, however, appeared fairly similar across the periods.

Figure 3 focuses attention on the change in earnings around the dissolution event. To hone in on earnings, rather than labor force participation, this analysis included only women with non-trivial annual earnings (at least $1,000) in time T − 1 and T + 2. This represented 74% of the P1 sample and 78% of the P2 sample. Two findings stood out. First, the earnings levels of a clear majority of divorced women increased following a marital dissolution. Approximately one-half of women in our samples experienced a post-dissolution real earnings gain of at least 10% and approximately 20% experienced gains of more than 90%. That said, almost 30% of women had lower earnings in time T + 2 than in T − 1. Second, the results showed remarkably similar cumulative distributions across both periods, suggesting stability in the broad pattern of change in women’s earnings after marital dissolutions occurring over an almost 20-year period.

Table 2 disaggregates the labor market and earnings outcomes by period and selected characteristics. Panel (a) reports the positive earnings rates at time T − 1 and T + 2 for the full samples. We observed greater labor market involvement at time T + 2 across most subgroups. The pattern, however, appeared slightly less dramatic for more recent dissolutions. For example, divorced women with college degrees in the P2 sample had a higher share with positive earnings at time T − 1 than their counterparts in the P1 sample, and therefore a lower net change after the event. Also important, there was substantial diversity in outcomes across the different subgroups. For example, labor market involvement at time T + 2 relative to T − 1 dropped among women who gave birth within two calendar years of their marital dissolution. By contrast, the labor market involvement for high school drop-outs jumped between 8 and 12 percentage points at T + 2, in large part due to their low positive earnings rates at time T − 1.

Results displayed in panel (b) depict the change in real earnings among our sample excluding trivial earners. Overall, the average real earnings of women in the second calendar year after their marital dissolution were a striking 20% higher than in the year prior to the event. The magnitude of this relative gain was consistent across the two samples, which suggests that the average earnings change following marital dissolution among women has not changed significantly over the period. That said, earnings were generally higher in the P2 sample (1996–2003) due, in part, to higher levels of education among these women.

The data in panel (b) also revealed systematic differences by characteristics, with some types of women experiencing much sharper increases than others. For example, women with low earnings at time T − 1 experienced the highest post-dissolution (T + 2) earnings gains, while women who quickly remarried or gave birth at around T had some of the lowest average gains. Women with college degrees at time T experienced relatively sharp average earnings gains after the dissolution event.

Multivariate Regression Estimates

Labor Market Status Change

We estimated a series of descriptive multivariate regressions. As discussed previously, the regressions pooled the two period samples used in the previous analysis. The aim of these models was not to evaluate causal relationships, but rather to begin to disentangle the relationship between individual and family characteristics and the change associated with women’s post-dissolution earnings, holding other variables constant.

Table 3 presents the results for the multinomial logistic regression estimating the four labor market change categories. In terms of period, the results showed that women of more recent dissolutions (P2) had reduced odds of ‘labor market entry’ following their marital dissolution than women of earlier dissolutions (P1). This is consistent with our descriptive results; namely, that a greater share of women in the P2 sample had positive earnings prior to dissolution, and as a result, were less likely to experience a labor market entry after such an event. The period coefficient is not significant for the other change statuses.

With respect to characteristics, educational attainment at T had a statistically significant association with labor market change. Specifically, women with no high school diploma, relative to college graduates, were more likely to have zero pre- and post-dissolution earnings, to enter the labor market, or to exit the labor market. Conversely, college graduates were more likely to have positive earnings both before and after time T. Family composition also mattered. Women with a young child at time T − 1 were more likely to enter the labor market after their marital dissolution. In contrast, women bearing a child within two calendar years of time T were more likely to have zero pre- and post-dissolution earnings and to exit the labor market relative to the reference group. This finding appears to reflect, by and large, the often immediate negative association between childbirth and mothers’ labor supply (Gangl and Ziefle 2009).

Several significant interactions merit brief discussion. Women who quickly remarried were more likely to exit the labor market, but only in the more recent period. In contrast, women with children prior to T were less likely to exit the labor market in the more recent divorce period (P2) than in the earlier period (P1). This result is consistent with evidence of increased labor force participation of mothers in recent years (Cohany and Sok 2007). Meanwhile, being a mother with a young child and without high school diploma reduced the significant positive association between these variables alone and labor market entry.

Earnings Level Change

Table 4 contains the results of several models focused on the change in earnings levels. The first and second models (Section A of Table 4) were restricted to women with non-trivial earnings before and after the dissolution. The first model was an OLS regression estimating the log difference between a woman’s post- and pre-dissolution earnings. The second model was a logistic regression estimating the log odds that a woman’s real earnings at time T + 2 were 30% higher than at time T − 1. A central finding from both models was that the pattern of change, all else equal, did not vary across the two divorce period samples (the period coefficients were insignificant). Sensitivity analyses using different period groupings (e.g., five-year intervals, single year dummies) yielded similar results.

Significant differences emerged by family and individual characteristics. Among the most pronounced were women’s pre-dissolution earnings. Women in the lowest pre-dissolution earnings quartile (below $12,000) had the greatest positive change in log earnings (OLS regression). Consistent with this result, the logistic regression revealed a significant positive association between being in the lowest pre-dissolution earnings quartile and experiencing a 30% earnings gain at time T + 2, controlling for other variables. It is likely that this coefficient picked up the movement from part-time employment before the marital dissolution (thus lower annual earnings) to full-time employment after the event.

Educational attainment at time T was also a powerful measure for understanding the trajectory of women’s earnings following a marital dissolution. Relative to college graduates, non-college graduates were associated with a lower proportional change in earnings. This downward association persisted in the logistic regression as women without a college degree, particularly high school drop-outs, were less likely to have a 30% earnings gain after a marital dissolution, relative to college graduates.

Family context also showed important moderating effects on the earnings change after the dissolution. Consistent with expectations, women bearing a child around the time of dissolution (T, T + 1, or T + 2) experienced reduced proportional changes in their post-dissolution earnings. They also were significantly less likely to have a 30% post-dissolution gain in earnings. Such findings capture the negative effect of childbirth on women’s earnings, even when it coincides with a marital dissolution. Also interesting, the interaction terms revealed that having a young child prior to the dissolution combined with quick remarriage (within one calendar year of time T) reduced the log change in earnings.

The insignificance of age at dissolution and children prior to dissolution was also noteworthy. In large part, these characteristics were not significant because the equations included women’s pre-dissolution earnings, a correlate of these variables. A similar model estimated without pre-dissolution earnings (results not shown) revealed significant coefficients for these variables. For example, without controlling for pre-dissolution earnings, age at dissolution had a negative association with the log change in earnings and the odds of a 30% increase. By contrast, the presence of a child in the pre-dissolution period had a positive association with the outcomes, which partly reflected the low pre-dissolution earnings levels of many of these mothers prior to their marital dissolution.

Section B of Table 4 contains results of the OLS regression estimating log earnings at time T + 2 for women who moved from trivial (or zero) to non-trivial earnings after the dissolution event. Results revealed no significant period differences, but did provide further evidence of the importance of women’s family and individual characteristics. For example, post-dissolution earnings were lower for women without a college degree at time T. The birth of a child around the time of the marital dissolution was associated with lower post-dissolution earnings.

Conclusions

Recent research examining how marital dissolution may precipitate change in women’s earnings is surprisingly limited. To begin addressing this gap, this study used national survey data matched to longitudinal earnings records to examine how, and under what conditions, women’s earnings change in the years immediately following the dissolution of a marriage ending in divorce. Overall, our results confirm a strong positive association between marital dissolution and women’s labor market involvement and earnings. Estimates indicated that the share of divorced women with positive earnings increased 4–6 percentage points after the marital dissolution. Among women already in the labor market, average real earnings rose significantly following their marital dissolution, by approximately 20%.

In addressing the question of whether the pattern of change varied over the examined period, our results are mixed. On the one hand, the overall pattern appears qualitatively similar. The descriptive findings, for example, show a similar pattern of change across the two periods. In addition, the regression estimates reveal a lack of statistical significance for the period dummy variable. On the other hand, we observe lower labor market involvement prior to marital dissolution among women of earlier divorces (P1). Consequently, women in the earlier divorce period were more likely to experience labor market entry after their dissolution than women in the more recent divorce period. Important compositional differences were also evident. Most notably, more recently divorced women (P2) were better educated, more likely to already be in the labor force, and had higher earnings than divorced women of the earlier period (P1). While such changes do not appear to have altered the general pattern of earnings change associated with marital dissolution, they suggest greater labor market prospects for more recently divorced women.

Our findings also confirm the importance of family and individual characteristics. In both periods, post-dissolution gains were greatest among women with low pre-dissolution earnings. This estimate most likely picked up, in part, the switch from part-time work prior to the dissolution to full-time work after it. The results also support the view that higher educational attainment can act as a buffer for the financial costs associated with divorce. Simply put, women with a college degree, all else equal, earned more after marital dissolution than their counterparts without a college degree. There was also considerable variation by family structure. The presence of a young child prior to a marital dissolution in combination with a quick remarriage reduced the pattern of increase in earnings. Not surprisingly, bearing a child at or shortly after the dissolution event had a downward effect on post-dissolution labor market involvement and earnings. Taken together, such results suggest the salience of human capital and family structure characteristics rather than pre-dissolution earnings alone in explaining women’s earnings after a divorce.

Several limitations of this study should be recognized. First, we have analyzed only one dimension of economic change associated with marital dissolution. Other important dimensions not explored here due to data constraints include change in labor hours and family income. Second, analysis of the factors shaping women’s earnings following a divorce would ideally include non-labor and transfer income, such as child support and alimony. We suspect that accounting for such income sources would not change the general patterns observed in our study, but it would be interesting to tease out their effects. Third, in-depth interviews with recently divorced women could help advance the knowledge of the underlying relationships raised in this article.

The implications of family status change for women are considerable. Women’s earnings after a marital dissolution not only have implications for their present economic well-being but also for their retirement income security (Haider et al. 2003; Holden and Kuo 1996; McDonald and Robb 2004; Ulker 2009). Marital status change, and more specifically, change in earnings associated with a marital dissolution, influence women’s future Social Security retirement benefits, as well as their private savings and wealth (Couch et al. 2011; Holden and Fontes 2009; Zissimopoulos 2009). Divorced women continue to have relatively high poverty rates in old age, in large part due to low lifetime Social Security earnings (Tamborini 2007; Weaver 1997). Given trends toward declining eligibility for Social Security divorced spouse and survivor benefits due to an increase in marriages of less than 10 years, the earnings of today’s working-age divorced women may be of heightened importance to their future retirement security.

A promising avenue of additional research would examine the relationship between marital dissolution and women’s earnings beyond the immediate years following the event. Analysis of divorced women’s lifetime earnings, for example, may shed light on the sources of variation in the economic well-being of different marital status groups in old age. An important open question is whether some women develop human capital after a divorce, which facilitates substantive labor income gains at a later point in life. Assessing the extent to which the financial costs associated with divorce, or other marital shocks such as widowhood, have changed among recent cohorts may be informative. The current study also highlights the need to develop a more systematic causal model of women’s earnings response to divorce using longitudinal data. Finally, it would be interesting to investigate questions related to changes in men’s earnings at the time of divorce.

References

Amato, P. R. (2000). The consequences of divorce for adults and children. Journal of Marriage and the Family, 62, 1269–1287.

Bane, M. J., & Ellwood, D. T. (1986). Slipping into and out of poverty: The dynamics of spells. Journal of Human Resources, 21, 1–23.

Bianchi, S. (2000). Maternal employment and time with children: Dramatic change or surprising continuity? Demography, 37, 401–414.

Blau, F. D., & Kahn, L. M. (2007). Changes in the labor supply behavior of married women 1980–2000. Journal of Labor Economics, 25, 393–437.

Bradbury, K., & Katz, J. (2002). Women’s labor market involvement and family income mobility when marriages end. New England Economic Review, Q4, 41–74.

Burstein, N. R. (2007). Economic influences on marriage and divorce. Journal of Policy Analysis and Management, 26, 387–429.

Cohany, S. R., & Sok, E. (2007). Trends in labor force participation of married mothers of infants. Monthly Labor Review, 130, 9–16.

Couch, K. A., Tamborini, C. R., Reznik, G. L., & Phillips, J. W. R. (2011). Impact of divorce on women’s earnings and retirement over the life course. Paper presented at the Federal Reserve Bank of San Francisco’s Conference on Unexpected Lifecycle Events and Economic Well-Being. San Francisco, CA, May 2011.

Czajka, J. L., Mabli, J., & Cody, S. (2008). Sample loss and survey bias in estimates of Social Security beneficiaries: A tale of two surveys (Final Report, contract no. 0600-01-60121). Washington, DC: Mathematica Policy Research, Inc.

Dew, J. (2009). The gendered meanings of assets for divorce. Journal of Family and Economic Issues, 30, 20–31.

Dewilde, C., & Uunk, W. (2008). Remarriage as a way to overcome the financial consequences of divorce. European Sociological Review, 24, 393–407.

Duncan, G. J., & Hoffman, S. D. (1985). Economic consequences of marital instability. In M. David & T. Smeeding (Eds.), Horizontal equity, uncertainty, and well-being (pp. 427–467). Chicago: University of Chicago Press.

Gadalla, T. M. (2009). Impact of marital dissolution on men’s and women’s incomes: A longitudinal study. Journal of Divorce and Remarriage, 50, 55–65.

Gangl, M., & Ziefle, A. (2009). Motherhood, labor force behavior, and women’s careers: An empirical assessment of the wage penalty for motherhood in Britain, Germany, and the United States. Demography, 46, 341–369.

Gerner, J. L., Montalto, C. P., & Bryant, W. K. (1990). Work patterns and marital status change. Journal of Family and Economic Issues, 11, 7–21.

Ginther, D. K., & Pollak, R. A. (2004). Family structures and children’s educational outcomes: Blended families, stylized facts, and descriptive regressions. Demography, 41, 671–696.

Goldstein, J., & Kenney, C. (2001). Marriage delayed or marriage forgone? New cohort forecasts of first marriage for U.S. women. American Sociological Review, 66, 506–519.

Grall, T. S. (2007). Custodial mothers and fathers and their child support: 2005 (Current Population Reports, P60–234). Washington, DC: U.S. Census Bureau.

Gray, J. S. (1998). Divorce-law changes, household bargaining, and married women’s labor supply. American Economic Review, 88, 628–642.

Haider, S. J., Jacknowitz, A., & Schoeni, R. F. (2003). The economic status of elderly divorced women (Research paper no. WP 2003–046). Ann Arbor, MI: Michigan Retirement Research Center.

Hanson, T. L., McLanahan, S. S., & Thomson, E. (1998). Windows on divorce: Before and after. Social Science Research, 27, 329–349.

Hoffman, S., & Duncan, G. (1988). What are the economic consequences of divorce? Demography, 25, 641–645.

Holden, K. C., & Fontes, A. (2009). Economic security in retirement: How changes in employment and marriage have altered retirement-related economic risks for women. Journal of Women, Politics & Policy, 30, 173–197.

Holden, K. C., & Kuo, H. D. (1996). Complex marital histories and economic well-being: The continuing legacy of divorce and widowhood as the HRS cohort approaches retirement. The Gerontologist, 36, 383–390.

Holden, K. C., & Smock, P. J. (1991). The economic costs of marital dissolution: Why do women bear a disproportionate cost? Annual Review of Sociology, 17, 51–78.

Isen, A., & Stevenson, B. (2010). Women’s education and family behavior: Trends in marriage, divorce and fertility (Working Paper no. 15725). Cambridge, MA: National Bureau of Economic Research.

Johnson, W. R., & Skinner, J. (1986). Labor supply and marital separation. American Economic Review, 76, 455–469.

Johnson, W. R., & Skinner, J. (1988). Accounting for changes in the labor supply of recently divorced women. Journal of Human Resources, 23, 417–436.

Kreider, R. M. (2008). Living arrangements of children: 2004 (Current Population Reports, P70–114). Washington, DC: U.S. Census Bureau.

Kreuter, F., & Valliant, R. (2007). A survey on survey statistics: What is done and can be done in Stata. Stata Journal, 7, 1–21.

Lillard, L. A., & Waite, L. J. (1989). Panel versus retrospective data on marital histories: lessons from the PSID. In Individuals and families in transition: understanding change through longitudinal data) (pp. 243–253). Washington, DC: U.S. Census Bureau.

McDonald, L. A., & Robb, L. (2004). The economic legacy of divorce and separation for women in old age. Canadian Journal on Aging Supplement, 23, S83–S97.

McKeever, M., & Wolfinger, N. H. (2001). Reexamining the economic costs of marital disruption for women. Social Science Quarterly, 82, 202–217.

McNabb, J., Timmons, D., Song, J., & Puckett, C. (2009). Uses of administrative data at the Social Security Administration. Social Security Bulletin, 69, 75–84.

Morgan, L. A., Kitson, G. C., & Kitson, J. T. (1992). The economic fallout from divorce: Issues for the 1990s. Journal of Family and Economic Issues, 13, 435–443.

Olsen, A., & Hudson, R. (2009). Social Security Administration’s master earnings file: Background information. Social Security Bulletin, 69, 29–45.

Pedace, R., & Bates, N. (2000). Using administrative data to assess earnings reporting error in the Survey of Income and Program Participation. Journal of Economic and Social Measurement, 26, 173–192.

Pencavel, J. (1998). Assortative mating by schooling and the work behavior of wives and husbands. American Economic Review, 88, 326–329.

Raley, R. K., & Bumpass, L. (2003). The topography of the divorce plateau: Levels and trends in union stability in the United States after 1980. Demographic Research, 8, 245–260.

Schoen, R., & Standish, N. (2001). The retrenchment of marriage: Results from marital status life tables for the United States, 1995. Population and Development Review, 27, 555–563.

Schwartz, C. R., & Mare, R. D. (2005). Trends in educational assortative mating from 1940 to 2003. Demography, 42, 621–646.

Smock, P. J. (1993). The economic costs of marital disruption for young women over the past two decades. Demography, 30, 353–371.

Smock, P. J. (1994). Gender and the short-run economic consequences of marital disruption. Social Forces, 73, 243–262.

Smock, P. J., Manning, W., & Gupta, S. (1999). The effect of marriage and divorce on women’s economic well-being. American Sociological Review, 64, 794–812.

Spratlin, J., & Holden, K. C. (2000). Women and economic security in retirement: Implications for Social Security reform. Journal of Family and Economic Issues, 21, 37–63.

Stevenson, B., & Wolfers, J. (2007). Marriage and divorce: Changes and their driving forces. Journal of Economic Perspectives, 21, 27–52.

Sweet, J., & Bumpass, L. (1987). American families and households. New York: The Russell Sage Foundation.

Tamborini, C. R. (2007). The never-married in old age: Projections and concerns for the near future. Social Security Bulletin, 67, 25–40.

Tamborini, C. R., Iams, H. M., & Whitman, K. (2009). Marital history, race, and Social Security spouse and widow benefit eligibility in the United States. Research on Aging, 31, 577–605.

Tamborini, C. R., & Whitman, K. (2007). Women, marriage, and Social Security benefits: Revisited. Social Security Bulletin, 67, 1–20.

U.S. Census Bureau. (2008a). Statistical abstract of the United States: 2009 (128th ed.). Washington, DC: US Government Printing Office.

U.S. Census Bureau. (2008b). Support providers: 2005. Retrieved June 2009, from http://www.census.gov/hhes/www/childsupport/providers2005.html.

U.S. Census Bureau. (2009). “Age of householder, number of children in family, marital status, work experience for people 16 years and over: 2008” Current Population Survey, 2009 Annual Social and Economic Supplement. Retrieved September 2009, from http://www.census.gov/hhes/www/cpstables/032009/pov/new31_100_006_01.htm.

Ulker, A. (2009). Wealth holdings and portfolio allocation of the elderly: The role of marital history. Journal of Family and Economic Issues, 30, 90–108.

Weagley, R. O., Chan, M. L., & Yan, J. (2007). Married couples’ time allocation decisions and marital stability. Journal of Family and Economic Issues, 28, 507–525.

Weaver, D. A. (1997). The economic well-being of Social Security beneficiaries, with an emphasis on divorced beneficiaries. Social Security Bulletin, 60, 3–17.

Weitzman, L. J. (1985). The divorce revolution: The un-expected social and economic consequences for women and children in America. New York: The Free Press.

Zissimopoulos, J. M. (2009). Gain and loss: Marriage and wealth changes over time (Research paper no. WP 2009–213). Ann Arbor, MI: Michigan Retirement Research Center.

Acknowledgments

The views expressed in this paper are those of the authors and do not represent the views of the U.S. Social Security Administration or any agency of the federal government. The administrative data used in this paper are restricted; all users must be approved by the Social Security Administration and the Census Bureau. The data are accessible only at a secured site and subject to Disclosure review. The authors thank David Weaver, John Phillips, Susan Grad, Lionel Deang, Kimberly Burham, Patricia Martin, and Hilary Waldron for valuable comments. An early version of this article was presented at the 2009 Fall Conference of the Association for Public Policy Analysis and Management, Washington, DC.

Author information

Authors and Affiliations

Corresponding author

Appendix

Rights and permissions

About this article

Cite this article

Tamborini, C.R., Iams, H.M. & Reznik, G.L. Women’s Earnings Before and After Marital Dissolution: Evidence from Longitudinal Earnings Records Matched to Survey Data. J Fam Econ Iss 33, 69–82 (2012). https://doi.org/10.1007/s10834-011-9264-1

Published:

Issue Date:

DOI: https://doi.org/10.1007/s10834-011-9264-1