Abstract

The purpose of this study is to investigate the rise in credit card ownership rates among high school seniors in the United States. It uses the Jump$tart Coalition’s cross-sectional surveys from 1997 to 2008 to analyze the determinants of credit card ownership among high school seniors. These results show that students with credit cards are less financially literate than students without credit cards; and students with credit cards in their own names are almost twice as likely to work during the school year for money. These findings help make a case for improved financial education and training, and institutional changes that limit the pervasive issuance of credit cards to high school students.

Similar content being viewed by others

Avoid common mistakes on your manuscript.

Introduction

On May 22, 2009 President Obama signed into law the Credit Card Accountability Responsibility and Disclosure Act of 2009 (Credit CARD Act of 2009), which will be enacted in February 2010. Earlier versions of this Act made it clear that (1) adolescents under 18 years old could not be issued credit cards; and (2) adolescents older than 18 but younger than 21 could not get credit in an amount greater than (a) 20% of the annual gross income of a student, or (b) $500 (this goes for all credit card accounts in total). However, these sections were either removed from the final version or made so vague that they are now ineffective. For example, instead of making it illegal for credit card companies to issue credit cards to people under 18 years old, it now states that someone under 21 years old has to have a co-signer (someone 21 or older, such as a parent, who can repay the borrower’s delinquent debts if she is unable to pay) or someone under 21 must submit an application stating that she can repay their debt obligations—no income verification is required. Therefore, a credit card company can send someone under 21 years old a credit card application and ask them if they are able to repay a certain amount of debt; and if they say yes, then they will get a credit card. The Credit CARD Act of 2009 will lessen many egregious lending and billing practices used by credit card companies. This paper argues, however, that the Credit CARD Act does not go far enough to protect adolescents from unrelenting credit card lenders, and stronger regulations are required.

High school is the time many students get their first credit cards. According to Manning (2005), the number of high school students with credit cards has increased three-fold since 2000. Moreover, teenagers between ages 16 and 18 represent the fastest growing users of credit cards (Williams 2004). Few studies, however, analyze the causes and problems associated with high school seniors having their own credit cards. Research by Williams (2004), Manning (2005) and the General Accountability Office GAO (2001) have all identified this topic as an issue of concern; but none of them had the data to study the issue in detail. This paper uses data on high school seniors collected by the Jump$tart Coalition from 1997 to 2008 to study the causes and consequences of increased credit card ownership rates of high school seniors. Previous studies analyze the efficacy and impact of financial literacy education (e.g., Collins 2007; Hanes-Bordas et al. 2008; Joo and Grable 2004; Mandell 2006, 2008; Varcoe et al. 2001); but none address if credit card borrowing is significantly correlated with financial literacy. This paper extends the financial literacy literature by investigating whether, and to what degree, high school seniors’ financial literacy scores (as measured by the Jump$tart financial literacy test) are associated with specific credit card borrowing behaviors.

The following research begins with a presentation of the recent history of the credit card industry and why high school students have become desirable customers for credit card companies. Then, using the Jump$tart Coalition data, descriptive statistics are presented that let us see, among other things, changes in students credit card ownership rates over time. The data is further analyzed using logit regressions that show differences in characteristics between various groups of students with credit cards and those without cards. These results are then used to present public policy solutions that can help (a) high school seniors (and adolescents, in general) get the necessary financial knowledge and experience needed to make good decisions with their credit cards, and (b) ensure credit card companies are less able to exploit adolescents’ lack of personal finance knowledge and experience.

Literature Review

Development of the Credit Card Industry

To understand why credit card companies are seeking out high school students as borrowers, it is necessary to examine the recent history of the industry. The expansion in credit card lending began with the Marquette Decision, a ruling by the United States Supreme Court in 1978 that let banks charge the rate of interest in the states where the banks are located rather than the states where their customers live (Marquette National Bank of Minneapolis v. First of Omaha Services Corporation 1978). This ruling enabled banks to move their credit card operations to states with limited usury laws. Before the Marquette Decision credit cards were only issued to people with excellent credit records, steady incomes and collateral. After the Marquette Decision banks could extend credit to riskier borrowers and set higher interest rates and fees (Lander 2008; Manning 2000; Sullivan et al. 2000). As a result, credit cards became incredibly profitable. According to Ausubel (1997), the return on assets on credit cards equals roughly four times the return on assets on all other banking activities, which encouraged banks to issue many more credit cards (Baek and Hong 2004; Watkins 2000). In 2008 Americans received over 4 billion credit card solicitations, which is an increase of 246% since 1990 (Plunkett and Mierzwinski 2009). This unrestrained lending through credit cards is now reaching high school students, and the Credit CARD Act of 2009 will not stop this trend (GAO 2001).

Several factors explain the recent rise in credit card ownership rates among high school students. First, credit card companies know that high school students, like college students, are a source of high current (and future) consumption and that they show a willingness to take on debt (Manning 2005). Credit card companies want students using credit cards early to build both brand loyalty and possibly a debtor–creditor relationship in which they become financially beholden to credit card companies (Hayhoe et al. 1999; Williams 2004). Second, credit cards have become the most popular method of payment in the economy (Manning 2005). According to Teen Research Unlimited, in 2007 teenagers spent over $176 billion, and roughly 25% of their purchases were made using credit cards (R. Callender, personal communication, March 13, 2008). Reasons for credit cards’ popularity include the following: (a) they are widely accepted by many businesses, (b) they are relatively secure compared to carrying cash, (c) they let people defer payment on their debt for roughly 30–60 days without incurring interest charges or fees, (d) people generally consider them a cool way to spend money—especially adolescents (Williams 2004), and (e) they let people buy what they want now without having the money to pay for it—though if they do not pay off their debt when it is due they will incur interest charges (and possibly fees). This last reason is a principal one that explains why credit cards appeal to students. Students do not usually have much money; therefore, having the ability to buy what they want now is tempting, especially because they are only required to make small minimum payments to remain in good standing with their credit card companies. Only making minimum payments, however, ensures that it will take a long time to pay off their debt (usually many years) and the amount they pay back will far exceed the amount they initially borrowed because of high interest rates and fees (Williams 2004). High school students are often unaware of these long-term financial consequences because they lack the personal finance knowledge and experience needed to successfully manage and understand their credit cards (Allen et al. 2007; Manning 2005).

Personal Finance Education

It is generally agreed that people need solid personal finance skills today so they can effectively manage their money (Carswell 2009; Collins 2007; Hanes-Bordas et al. 2008; Joo and Grable 2004; Varcoe et al. 2001). Formal personal finance classes, increasingly offered in high school, are generally considered the best way to improve people’s personal finance knowledge. However, Lewis Mandell’s (2006, 2008) research indicates that—controlling for various factors (teacher quality, student interest, etc.)—high school students who have had at least a one semester course in personal finance performed worse on the Jump$tart financial literacy survey compared to other students. Other researchers (Peng et al. 2007) note similar findings, but add that students who took a personal finance course in college considerably improved their financial knowledge. Peng et al. (2007) state that the differences they found in financial knowledge between high school and college students are possibly the result of how personal finance is taught at both levels. For example, in high school personal finance courses are usually short (where personal finance topics may only comprise a few weeks worth of class), and rarely give students hands-on experience (Varcoe et al. 2001). However, college personal finance courses are usually longer (the topic is often covered throughout a full semester), and students get more applied practice using their newly developed personal finance skills (Peng et al. 2007).

Even if college personal finance courses are a good way to increase financial literacy, about 58% of high school graduates attend college (either 2 or 4 year colleges), and of those only 25% take a personal finance course (Davis and Bauman 2008; Peng et al. 2007). Many students, therefore, get a formal education without obtaining adequate personal finance knowledge. So, it is best to offer personal finance classes early (e.g., high school) in order to reach the largest number of people. However, when to offer personal finance courses to students is easier to determine than figuring out what personal finance course formats are most successful. Borden et al. (2008) studied the effectiveness of finance education seminars (or workshops) in increasing the financial knowledge of college students. The results from their pilot study found that shorter more focused finance education seminars increased college students’ financial knowledge and responsibility. They also suggest that a seminar (or workshop) format is more likely to reach a larger group of students—because few students are willing to take a one semester personal finance course unless it is required. Perhaps Borden et al.’s short, focused finance education seminar format could also be an effective (and more efficient) way to increase high school students’ financial literacy. In addition, Varcoe et al. (2001) found that for high school students it is important to create “teachable moments”; where teachers use examples that are directly relevant to students’ lives. For example, teach students about the costs associated with buying and operating a car, paying for college or the high cost of carrying revolving credit card debt.

Developmental Psychology

Research in developmental psychology indicates that the brains of adolescents (which generally include teenagers and those in their early twenties) are not developed enough to make mature decisions without proper education and training. Baird et al. (1999) used functional magnetic resonance imaging (fMRI) to study the brains of adolescents. They found that adolescents’ decision making processing occurs mostly in the amygdale section of their brains, which is responsible for instinctual emotional reactions. This is one reason why adolescents are more apt than adults to make illogical decisions (see also Davies and Lea 1995; Lewis 2002). In adults, decision making is typically more rational and less emotional because it happens largely in the frontal cortex of the brain. The frontal cortex, however, is not fully developed until one’s late teens or early twenties (regardless of gender) (Halpern-Felsher and Cauffman 2001; Linn 2004). Consequently, many adolescents with credit cards are unlikely to foresee the problems their debt can cause because they are satisfying their immediate wants. Credit card companies encourage this behavior with low minimum payments, high spending limits and loose lending practices (Williams 2004).

Developmental psychologists have found that it is possible to minimize adolescents’ irrational decision making by increasing their experience levels and self-regulation (Baird et al. 1999; Galotti 2001). The more experience adolescents have performing an action (e.g., driving a car, balancing a checkbook, etc.) the more likely they are to make rational decisions when engaging in those activities (Galotti 2001). Personal finance training often results in a heightened level of self-regulation—students think about decisions more carefully and weigh the long-term consequences of their decisions (Galotti 2001). This supports the findings of Varcoe et al. (2001) who suggest that tailoring financial education so the material taught is relevant to students is important for increasing students’ interest in—and consequently retention of—the lessons learned.

Credit Card Lending Policy Changes

High school students with credit cards are a new phenomenon (Manning 2005). Previously students were required to have their parents co-sign their credit card loans, but most credit card companies abandoned this policy in the 1990s (Nocera 1995). Credit card companies discovered that students are not debt averse. Also, around this time, the market for credit cards among adults started to become saturated; so credit card companies started seeking younger customers (Williams 2004). Since the 1990s, they have heavily solicited college students on campuses across the United States. In 2002 the average undergraduate student had $3,262 in revolving credit card debt when they graduated (Nellie Mae 2005). As a result, at least 24 states have enacted legislation to prohibit credit card solicitations on college campuses (GAO 2001). These policies have forced many credit card companies to promote their cards to high school students before they enter college.

The Consumer Protection Act of 1968 (precursor to the Truth in Lending Act) does not prohibit credit card companies from issuing credit cards to minors. However, minors are not liable for any debt they incur. Nonetheless, this does not preclude pre-discharged debt from damaging a minor’s credit history before it is removed; and credit card companies recognize that most parents will pay off their children’s debt to avoid harming their credit history (or risk a legal entanglement) (Williams 2004). Credit histories are important today because they are used for a variety of purposes. For example, companies use credit histories as criteria for hiring and promotion; and more than 90% of insurance companies use credit histories to set customers’ rates (Federal Reserve System Board of Governors 1968; Kellison et al. 2003).

The literature summarized above has two important themes: (a) regulation, and (b) education. First, credit card companies profit from people’s indebtedness; therefore, many of the previous regulations established to limit the over-issuance of credit to risky borrowers have been eliminated—resulting in, among other things, more credit cards loaned to younger people. Second, high school seniors need good personal finance education and training so they can make better financial decisions (Mandell 2008). But not all financial education is equal; Borden et al. (2008) found that short, focused seminars worked best with college students; so possibly this type of format could work well with high school students. Varcoe et al. (2001) suggest that for financial education in high school to be effective it must be adapted so it is relevant to students’ interests. Regardless the teaching method employed, better financial education is necessary because many high school seniors face complex financial decisions (credit cards, school loans, etc.) (GAO 2001; Varcoe et al. 2001; Williams 2004).

The following analysis builds on the existent literature by investigating empirically the increase in the number of high school students getting credit cards, and identifying the primary characteristics of high school seniors who have credit cards. These results will help guide our policy suggestions, which are designed to ensure high school seniors are given credit cards only when they are prepared to manage them.

Methods

Jump$tart Coalition Data

This study uses data from a series of surveys administered by the Jump$tart Coalition for Personal Financial Literacy. Jump$tart is a non-profit organization based in Washington DC that studies and promotes personal finance education (especially for students in grades K-12). They conducted six nationwide surveys from 1997 to 2008 to analyze the financial literacy of high school seniors attending public schools. This data is used in the following research because (a) it is of high quality (cf. Lucey 2005), and (b) it contains several important variables not available anywhere else; of particular importance are those variables that allow us to measure the increase in the number of high school students with credit cards over the past several years.

Besides ordering and cosmetic changes, questions in all the Jump$tart surveys were nearly identical; thus making them comparable (Mandell 2006). Because Jump$tart wanted a nationally representative sample, it was impossible to consider giving exams to randomly selected high school seniors individually. Instead they took the list of all public high schools in the US provided by the US Department of Education and randomly selected a portion of schools from each state as potential study participants. Then each school’s principal was asked to select a senior level class—English or Social Studies (not economics)—meeting closest to 10 a.m. to take the survey. According to Mandell (2006, p. 14), “the sample was stratified by state to insure geographic representation.”

The survey instrument in 2008 had 49 questions. The first 31 questions constitute the “test” part of the survey, and the remaining questions are mostly demographic. All test questions are multiple-choice and cover four main areas: (1) income; (2) money management; (3) saving and investing; and (4) spending and credit. They were constructed so high school seniors could understand them. Lucey (2005) analyzed the reliability and validity of Jump$tart’s survey and generally found their research techniques and methodology robust.

Jump$tart administered their first survey in 1997 to 1,532 high school seniors in 65 public high schools across the country. Their survey in 2000 included 723 high school seniors (32 schools); 2002 survey 4,024 (179 schools); 2004 survey 4,074 (215 schools); 2006 survey 5,775 (305 schools); and 2008 survey 6,856 (388 schools). Sample weights were available for all surveys except 1997 and 2000.

Binary Logit Regressions

Five Jump$tart datasets (2000, 2002, 2004, 2006, and 2008) were stacked to create one complete dataset. The 1997 dataset was removed because it did not have a question about whether students worked during the school year for money—a likely determinant of credit card ownership (Manning 2005). Three models were specified. All of which contain identical independent variables, but different dependent variables. The first dependent variable is coded 1 if the student has a credit card in her own name; 0 otherwise (OWNCC). The second dependent variable is coded 1 if a student has a credit card given to her by her parent(s); 0 otherwise (PARCC). The third dependent variable is coded 1 if a student has both a credit card in her own name and one given to her by her parent(s); 0 otherwise (BOTHCC). Because all three dependent variables are binary it was sensible to use a binary logit regression method to test the models. Logit regression is useful because it (a) allows for easy estimation, and (b) provides easy to interpret log-odds ratios (Allison 1999). The binary logit regressions let us identify the differences in characteristics between three groups of students with credit cards (OWNCC, PARCC, and BOTHCC) compared to students without credit cards.

Independent variables of importance include: (a) whether or not a student received a passing financial literacy score (≥60%, as defined by Mandell 2004, 2006) (dummy variable coded as 1 if a student passed; 0 otherwise), which we use as a proxy for being financially literate,Footnote 1 , Footnote 2 (b) whether they work during the school year (dummy variable coded as 1 if a student works during the school year; 0 otherwise), and (c) education expectations (dummy variable coded as 1 if a student plans to attend college (including community college); 0 otherwise). The remaining variables control for sex, race (white is used as the base variable in a vector of race dummy variables), parents’ education level—highest level of education achieved by either parent (high school graduate is the base variable), and survey date (2000 is the base variable).

Results

Descriptive Statistics

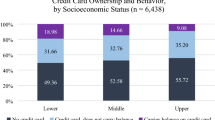

In Table 1 we see that the number of students with credit cards in their own names increased from 7.7% in 1997 to 14.9% in 2008 (a 94% rise), which is a statistically significant increase. The number of students who use credit cards given to them by their parents, however, decreased from 17.9 to 14.2% (a 21% drop), which is a statistically significant decrease. Additionally, the percentage of students with both credit cards in their own names and cards from their parents rose 40% between 1997 and 2008, which if we use the previous two results as a guide, is probably being caused by more students with credit cards from their parents getting credit cards in their own name—thus, students moved from the PARCC category into the BOTHCC category. Some possible explanations for these findings include: (1) fewer parents believed their children were responsible enough to have credit cards, so fewer parents gave their children cards; and/or (2) the supply of credit cards available to high school students increased, so more high school seniors were able to get cards in their own name, which possibly reduced their demand for cards given to them by their parents. Either way, it is clear that the number of high school seniors with their own credit cards increased significantly during the period studied.

The average score on the Jump$tart financial literacy survey fell from a high of 57.3% in 1997 to a low of 48.3% in 2008—a statistically significant decrease of 16%. Also, the percentage of students who received a passing score (≥60%) on the survey decreased from 47.2% in 1997 to 31% in 2008. These results show that a majority of high school seniors are financially illiterate; and that this is a persistent problem and perhaps getting worse (Mandell 2004, 2006).

Most high school seniors sampled worked during the school year in 2008 (62.5%). Researchers have found that high school students who work during the school year have lower grades, fewer college scholarship offers, and are less academically prepared for college compared to students who do not work during the school year (McNeal 1997; Markel and Frone 1998). Most students work because they need (or want) money, which may create greater demand for credit cards. And credit card debt itself may necessitate the need to get a job, work more hours or get a second job (Manning 2005). This may be why we see that in all surveys (except 2002) a lower percentage of students with credit cards plan to attend college versus the overall sample.

Characteristics of Students with Credit Cards

Table 2 below presents the odds ratios for the three binary logit regressions specified above. The first variable in the table shows that students with credit cards in their own name were 24% less likely to have received a passing score on the Jump$tart survey compared to students without credit cards; and students with credit cards given to them by their parents were even less likely (by 28%) to have passed compared to students without credit cards. This finding suggests that parents are either (a) not good judges of their children’s financial literacy, and/or (b) they give credit cards to their children based on criteria other than financial literacy (e.g., safety, education or convenience). However, this behavior may be fueling the rise in the number of high school seniors getting credit cards in their own names because those students who are not given cards by their parents may be enticed to apply for their own cards (and possibly keep them secret from their parents). This may explain the inverse trend we observe between these two variables.

Male students are 15% more likely (1.15 times) than female students to have credit cards in their own names, but male students are roughly 23% less likely than female students to have credit cards given to them by their parents. This finding suggests a difference between adolescent males and females regarding risk taking behavior and maturity. While developmental psychology research (e.g., Baird et al. 1999; Lewis 2002) has generally found no systematic gender differences in decision making among adolescents, perhaps parents perceive a difference; thus, parents are more likely to give credit cards to daughters than sons because they believe adolescent females as more mature than adolescent males (regardless of whether this is actually the case or not) (e.g., Gatherum 1993, pp. 78–79). Also, parents may be more likely to give their daughters credit cards because of safety reasons without taking into consideration their financial literacy; whereas with their sons, safety may be less of a concern than financial literacy.

Students with credit cards in their own name are 1.83 times (83%) more likely to work during the school year versus students without credit cards; whereas students with credit cards given to them by their parents are roughly 23% less likely to work during the school year compared to students without credit cards. Students who work during the school year are probably more financially independent from their parents compared to students who do not work during the school year. Therefore, working students probably have more opportunities to get their own credit cards. For example, working students may get more credit card offers through the mail. Also, working students possibly have more motivation to get their own cards because they are responsible for more of their own expenses (gasoline, car insurance, clothes, etc.) compared to students who do not work.

Looking at the race variables we find that students with credit cards in their own name were more likely to be either black, Hispanic or classified as “race other.” None of the race variables were significant for students with credit cards given to them by their parents. However, students with both credit cards in their own names and ones given to them by their parents were more likely to be black (by 46%) or classified as “race other” (by 69%).

The survey date variables show that in each survey period after 2000 the number of students with credit cards in their own name increased. Both 2006 and 2008 show a statistically significant increase in credit card ownership rates since 2000. The number of students with credit cards given to them by their parents did not change significantly since 2000. But the number of students who have both credit cards in their own names and cards from their parents increased a statistically significant amount from 2000 to 2008 (again, this is probably the result of more students getting cards in their own name).

Discussion

As shown above, the number of high school seniors with their own credit cards almost doubled from 1997 to 2008. Of particular concern is the finding that high school seniors with credit cards are more likely to receive a failing score on the Jump$tart financial literacy survey compared to students without credit cards. By giving credit cards to students who have inadequate personal finance knowledge and low (or no) income credit card companies are knowingly taking advantage of them. These underwriting practices allow for the exploitation of financially vulnerable students (GAO 2001; Manning 2005; Williams 2004). It is reasonable, therefore, to reevaluate the Consumer Protection Act of 1968 and prohibit companies from issuing cards to minors. Too many young, unemployed and financially naïve high school seniors are issued credit cards with little (or no) consideration given to whether they can manage this responsibility (Manning 2005; Williams 2004). Currently people must be at least 18 years old before they can get a card in their own name. It may be reasonable, however, to consider raising the age limit to 21 based on the developmental psychology research cited above. At minimum we should bring back the requirement that students need their parents to co-sign for any credit card loan (with minimal exceptions).

Teenagers typically work unskilled minimum wage jobs. This makes them susceptible to unanticipated income fluctuations that can quickly lead to debt problems (Johnson and Lino 2000). If a high school senior finds herself in credit card debt she may have to work more hours or take on a second job to pay off her debt, which could affect her current and maybe future education. McNeal (1997) and Markel and Frone (1998) found that high school students who work the most during the school year have lower grades and a higher likelihood of dropping out compared to students who do not work. While 62.5% of high school seniors worked during the school year in 2008, over 75% of students with credit cards in their own name worked during the school year (see Table 1). Results in Table 2 confirm this finding, and also show that students with credit cards in their own names are almost twice as likely to work during the school year compared to students without credit cards.

Credit cards are not necessarily harmful if students are mature and are taught how to use them properly. Credit cards can be used to teach students financial discipline as well as help them establish good credit histories.Footnote 3 They are an effective way to keep track of spending and they provide a more secure method of payment than cash. But as the research cited above shows, without solid personal finance skills students have a much higher risk of making poor financial decisions. For example, the fastest growing sector of bankruptcy filers is young adults below age 25 (Sullivan et al. 2000). And the recently enacted Bankruptcy Abuse Prevention and Consumer Protection Act of 2005 makes it more difficult for people to discharge credit card debt (Evans and Lown 2008; Moorman and Garasky 2008; White 2007). Many researchers have found a causal link between revolving credit card debt and bankruptcy (Leach 2005; Sullivan et al. 1999, 2000; White 2007). So if high school students find themselves with high credit card debts and no way to discharge the debt quickly they will have to pay the loan back slowly over time at high interest rates. In addition, how students manage their credit cards affects their credit histories. This is an important issue now that more companies are using credit histories to make employment decisions and to price certain types of insurance and loans.

Limitations

It is important to mention some limitations of the present study. First, while the Jump$tart surveys allow us to analyze the financial literacy and credit card ownership rates of high school seniors, none of the surveys include a question(s) about how high school seniors spend their money. For example, it would be interesting to see how high school seniors spend money using their credit cards, and whether they are spending more money with credit cards in their own name versus credit cards given to them by their parents. Second, the Jump$tart surveys only include high school seniors. While high school seniors are probably the most common target group for credit card companies because of their age, parents can give credit cards to their children at any age; so it might be useful to see if students who get credit cards at a younger age are more (or less) financially literate when they get older, and whether this affects the likelihood of them getting their own credit cards later.

Conclusions

This study shows that an increasing number of high school seniors are getting credit cards in their own names. These students are almost twice as likely to work during the school year as students without credit cards; and barely 31% of them received a passing score on the latest Jump$tart financial literacy survey. This inverse trend of rising credit card ownership rates among students with falling financial literacy scores is disheartening. However, two prescriptions, if well employed, will help reverse this trend. First, the research above generally supports the findings of developmental psychologists (e.g., Baird et al. 1999; Davies and Lea 1995; Galotti 2001; Halpern-Felsher and Cauffman 2001; Lewis 2002) and others (e.g., Linn 2004; Varcoe et al. 2001; Williams 2004) who believe that combating adolescents’ instinct-driven decision making requires education and hands-on training. If implemented properly, therefore, financial education can improve adolescents’ financial decision making. Raising financial literacy will help students in many ways; of which, managing their credit cards more responsibly is one.

Second, education alone is probably not enough; thus, institutional changes are also required that go beyond those of the Credit CARD Act of 2009. It is unreasonable to allow credit card companies to continue engaging in lenient lending practices aimed toward credulous high school students. As a result, stricter regulations, such as those presented in earlier drafts of the Credit CARD Act of 2009, should be enacted that prohibit credit card companies from extending credit to minors—and maybe for those up to age 21. At minimum we should (1) reinstitute the requirement, with few exceptions, that students need their parents to co-sign all credit card loans; and (2) set a reasonable limit on how much credit people under 21 years of age can get.

Notes

Increasing the minimum financial literacy survey passing score to 70% produced nearly identical results.

However, students do not need credit cards to establish their credit histories. Paying rent, car payments, and being on their parents’ credit card accounts are just a few ways students can establish good credit (given that all these bills are regularly paid on time).

References

Allen, M. W., Edwards, R., Hayhoe, C. R., & Leach, L. (2007). Imagined interactions, family money management patterns and coalitions, and attitudes toward money and credit. Journal of Family and Economic Issues, 28(1), 3–22.

Allison, P. D. (1999). Logistic regression using SAS: Theory and application. Cary, NC: SAS Institute, Inc.

Ausubel, L. M. (1997). Credit card defaults, credit card profits, and bankruptcy. The American Bankruptcy Law Journal, 71(spring), 249–270.

Baek, E., & Hong, G.-S. (2004). Effects of family life-cycle stages on consumer debts. Journal of Family and Economic Issues, 25(3), 359–385.

Baird, A., Gruber, S., Fein, D., Maas, L., Steingard, R., Renshaw, P., et al. (1999). Functional magnetic resonance imaging of facial affect recognition in children and adolescents. Journal of the American Academy of Child and Adolescent Psychiatry, 28(2), 195–199.

Borden, L. M., Lee, S.-A., Serido, J., & Collins, D. (2008). Changing college students’ financial knowledge, attitudes, and behavior through seminar participation. Journal of Family and Economic Issues, 29(1), 23–40.

Carswell, A. T. (2009). Does housing counseling change consumer financial behaviors? Evidence from Philadelphia. Journal of Family and Economic Issues, 30(4), 339–356.

Collins, J. M. (2007). Exploring the design of financial counseling for mortgage borrowers in default. Journal of Family and Economic Issues, 28(2), 207–226.

Credit Card Accountability Responsibility and Disclosure Act of 2009, H.R. 627, 111th Cong., 1st Sess. (2009).

Davies, E., & Lea, S. (1995). Student attitudes to student debt. Journal of Economic Psychology, 16(4), 663–679.

Davis, J., & Bauman, K. (2008). School enrollment in the United States: 2006. Retrieved January 8, 2009, from http://www.census.gov/prod/2008pubs/p20-559.pdf.

Evans, E. A., & Lown, J. (2008). Predictors of Chapter 13 completion rates: The role of socioeconomic variables and consumer debt type. Journal of Family and Economic Issues, 29(2), 202–218.

Federal Reserve System Board of Governors. (1968). Consumer credit protection act. Retrieved February 19, 2007, from http://www.fdic.gov/regulations/laws/rules/6500-200.html.

Galotti, K. M. (2001). Helps and hindrances for adolescents making important real-life decisions. Journal of Applied Developmental Psychology, 22, 275–287.

Gatherum, A. J. (1993). Children’s financial management competence: A gender specific socialization process. Unpublished doctoral dissertation, Oregon State University.

General Accountability Office. (2001). Consumer finance: College students and credit cards. Retrieved March 2, 2007, from http://www.gao.gov/new.items/d01773.pdf.

Halpern-Felsher, B., & Cauffman, E. (2001). Costs and benefits of a decision: Decision-making competence in adolescents and adults. Journal of Applied Developmental Pyschology, 22, 257–273.

Hanes-Bordas, R., Kiss, D., & Yilmazer, T. (2008). Effectiveness of financial education on financial management behavior and account usage: Evidence from the ‘Second Chance’ program. Journal of Family and Economic Issues, 29(3), 362–390.

Hayhoe, C. R., Leach, L., & Turner, P. R. (1999). Discriminating the number of credit cards held by college students using credit and money attitudes. Journal of Economic Psychology, 20(6), 643–656.

Johnson, D. S., & Lino, M. (2000). Teenagers: Employment and contributions to family spending. Monthly Labor Review, 123, 15–25.

Joo, S., & Grable, J. E. (2004). An exploratory framework of the determinants of financial satisfaction. Journal of Family and Economic Issues, 25(1), 25–50.

Kellison, B., Brockett, P., Shin, S., & Li, S. (2003). A statistical analysis of the relationship between credit history and insurance losses. Bureau of Business Research, Retrieved February 1, 2007, from http://bbr.icc.utexas.edu/index.php?pid=100&pub=239.

Lander, D. A. (2008). Regulating consumer lending. In J. J. Xiao (Ed.), Handbook of consumer finance research (pp. 387–410). New York: Springer.

Leach, B. W. (2005). The unfinished business of bankruptcy reform: A proposal to improve the treatment of support creditors. Yale Law Journal, 115(1), 247–255.

Lewis, M. (2002). Child and adolescent psychology; a comprehensive textbook (3rd ed.). New York, NY: Lippincott, Williams & Wilkins.

Linn, S. (2004). Consuming kids: The hostile takeover of childhood. New York, NY: New Press.

Lucey, T. A. (2005). Assessing the reliability and validity of the Jump$tart survey of financial literacy. Journal of Family and Economic Issues, 26(2), 283–294.

Mandell, L. (2004). Financial literacy: Are we improving? Results of the 2004 national Jump$tart Coalition survey. Washington, DC: Jump$tart Coalition for Personal Financial Literacy.

Mandell, L. (2006). Financial literacy: Improving education: Results of the 2006 national Jump$tart Coalition survey. Washington, DC: Jump$tart Coalition for Personal Financial Literacy.

Mandell, L. (2008). Financial literacy of high school students. In J. J. Xiao (Ed.), Handbook of consumer finance research (pp. 163–184). New York: Springer.

Manning, R. D. (2000). Credit card nation: The consequences of America’s addition to credit. New York: Basic Books.

Manning, R. D. (2005). Living with debt: A life stage analysis of changing attitudes and behaviors. Charlotte, NC: LendingTree.com.

Markel, K. S., & Frone, M. R. (1998). Job characteristics, work-school conflict, and school outcomes among adolescents: Testing a structural model. Journal of Applied Psychology, 83(2), 277–287.

Marquette Nat. Bank v. First of Omaha Svc. Corp. (1978). 439 U.S. 299.

McNeal, R. B. (1997). Are students being pulled out of high school? The effect of adolescent employment on dropping out. Sociology of Education, 70, 206–220.

Nellie Mae. (2005). Undergraduate students and credit cards in 2004. Retrieved February 15, 2007, from http://www.nelliemae.com/library/research_12.html.

Plunkett T., & Mierzwinski, E. (2009). Testimony of twelve consumer and community groups on HR 627 and HR 1456 before the subcommittee on financial institutions and consumer credit by Travis Plunkett of the Consumer Federation of America and Edmund Mierzwinski of U.S. PIRG. Retrieved May 30, 2009, from http://www.defendyourdollars.org/pdf/CFA-testimony-HR627-HR-1456.pdf.

Moorman, D. C., & Garasky, S. (2008). Consumer debt repayment behavior as a precursor to bankruptcy. Journal of Family and Economic Issues, 29(2), 219–233.

Nocera, J. (1995). A piece of the action: How the middle class joined the money class. New York, NY: Touchstone.

Peng, T.-C. M., Bartholomae, S., Fox, J., & Cravener, G. (2007). The impact of personal finance education delivered in high school and college courses. Journal of Family and Economic Issues, 28(2), 265–284.

Sullivan, T. A., Warren, E., & Westbrook, J. L. (1999). As we forgive our debtors: Bankruptcy and consumer credit in America. New York: Oxford University Press.

Sullivan, T. A., Warren, E., & Westbrook, J. L. (2000). The fragile middle class: Americans in debt. New Haven, CT: Yale University Press.

Varcoe, K. P., Peterson, S., Garrett, C., Martin, A., Rene, P., & Costello, C. (2001). What teens want to know about financial management. Journal of Family and Consumer Sciences, 93(2), 30–34.

Watkins, J. P. (2000). Corporate power and the evolution of consumer credit. Journal of Economic Issues, 34(4), 909–932.

White, M. J. (2007). Bankruptcy reform and credit cards. Journal of Economic Perspectives, 21(4), 175–199.

Williams, B. (2004). Debt for sale: A social history of the credit trap. Philadelphia, PA: University of Pennsylvania Press.

Author information

Authors and Affiliations

Corresponding author

Rights and permissions

About this article

Cite this article

Scott, R.H. Credit Card Ownership Among American High School Seniors: 1997–2008. J Fam Econ Iss 31, 151–160 (2010). https://doi.org/10.1007/s10834-010-9182-7

Published:

Issue Date:

DOI: https://doi.org/10.1007/s10834-010-9182-7