Abstract

We estimate a two-stage Heckman selection model of credit card adoption and use with a unique dataset that combines administrative data from the Equifax credit bureau and self-reported data from a representative survey of consumers. Higher-income consumers carry higher credit card balances, but they tend to repay those balances each month. Credit card revolvers have lower income and are less educated. Revolvers are twice as likely to use debit cards as credit cards for payments, but they carry much higher balances on their credit cards. The high cost of paying off credit card debt likely exacerbates existing inequalities in disposable income. Unlike the mortgage market, we find no evidence for lenders’ cutoff between subprime and prime consumers in the credit card market.

Similar content being viewed by others

Avoid common mistakes on your manuscript.

1 Introduction

We estimate a two-stage Heckman selection model of adoption and use of credit cards, previously applied in studies of consumer payment behavior using only self-reported survey data (e.g., Schuh and Stavins 2010, 2013). In contrast, we apply the model using a merged dataset that combines survey data from the Survey of Consumer Payment Choice (SCPC) and the Equifax credit bureau data. The merged dataset gives a unique combination of unbiased, external information on consumers’ risk scores and credit card behavior from Equifax, and detailed information about demographics, income, and consumer preferences from the SCPC, a nationally representative consumer survey. We therefore avoid potential biases in self-reported survey data, due to poor recall and/or stigma associated with reporting unpaid debt.

Older, more-educated, higher-income consumers, and homeowners were found to have a higher probability of adopting a credit card. Higher-income consumers also carry significantly higher credit card balances, conditional on credit card adoption, but they tend to repay those balances each month (they are so-called convenience users). Credit card revolvers—those who carry unpaid balances—differ from convenience users: They are more likely to have lower income and be less educated. They also exhibit a pattern of payment behavior that is different from that of consumers who pay their credit card balances on time: Revolvers are twice as likely to use a debit card as a credit card for payments, but they carry much higher balances on their credit cards, even after controlling for demographic and income attributes. Almost half of all consumers—44%—carried unpaid credit card debt in 2015 and 2016, and the average credit card balance on all cards for revolvers was $6597. Because revolvers have lower income on average, those unpaid balances are particularly worrisome and could contribute to even larger discrepancies in disposable income among consumers.

Age affects the probability of having a card, but even conditional on having a credit card, people use credit cards more heavily as they grow older—up to a point—even when controlling for income. The average balance increases with age until its peak for the 45–54 age cohort; then it declines. Adoption and use of credit cards rise with the risk score, while the use of cash declines with the risk score.

Previous studies found that consumer payment behavior is affected by demographic and financial attributes, as well as by consumers’ perceptions of payment instruments (Schuh and Stavins 2010, 2013; Koulayev et al. 2016). However, most of the studies of consumer payment behavior rely exclusively on self-reported survey data. Although survey data can provide information on variables that cannot otherwise be observed by researchers, the self-reported data may be inaccurate due to poor recall or other reasons. In particular, household surveys have been found to systematically underreport credit card debt (Brown et al. 2015; Karlan and Zinman 2008; Zinman 2009). Brown et al. (2015) find that the aggregate credit card debt reported by borrowers in the Survey of Consumer Finances (SCF) is about 40% lower than the aggregate credit card debt reported by lenders to the credit bureau Equifax. Zinman (2009) shows that lenders report approximately three times higher credit card debt than borrowers do. One possible reason why consumers may underreport their credit card debt is social stigma (Gross and Souleles 2002; Lopes 2008; Zinman 2009). On the other hand, while the Equifax data represent unbiased reporting by the lenders, the data lack information about consumers that surveys can provide, such as demographic attributes, income and wealth, and perceptions and attitudes. The merged data avoid both of those shortcomings.

This is the first paper to estimate consumer credit card behavior using the merged credit bureau and survey data. We find that the regression results based on the merged data are qualitatively similar to those based exclusively on survey data. In both cases, demographic and income attributes affect credit card adoption. However, the Equifax data allow us to measure credit card use as the dollar value of balances, instead of just the number of transactions, as the earlier studies do. The results demonstrate that even though survey data may not be as accurate as administrative data, using that information to estimate consumer behavior yields reasonable results and can be employed if administrative data are not available, provided the data can be accurately matched by individual respondents.

The rest of the paper is organized as follows: Section 2 reviews the relevant literature; Section 3 describes the data; Section 4 compares the self-reported survey data and the administrative data from a credit bureau; Section 5 analyzes the relationship between the risk score and payment behavior; Section 6 presents the model of payment adoption and use; Section 7 describes regression results; Section 8 shows how credit card debt affects payment choice; Section 9 tests whether discontinuity exists between subprime and prime consumers in terms of credit card behavior; and Section 10 concludes.

2 Literature review

Earlier studies typically analyze consumer payment behavior by applying only survey data. Using the Survey of Consumer Payment Choice (SCPC), Schuh and Stavins (2010, 2013), Koulayev et al. (2016), and Stavins (2016) find that demographic factors and characteristics of payment instruments significantly affect adoption and use of payment instruments: higher-income, more-educated, and older consumers are more likely to have and use credit cards. Other studies use the Survey of Consumer Finances (SCF) to study consumer payment behavior. Klee (2006) employs multiple years of the SCF to find that families’ use and adoption of payment instruments are significantly correlated with demographic characteristics. Zinman (2009) estimates aggregate credit card use and revolving debt with both the SCF data and data from Nilson Reports. Mester (2012) uses SCF data from 1995 to 2010 to focus on the employment of electronic forms of payments. Sánchez (2014) and Min and Kim (2003) use the SCF data and find that income is positively correlated with credit card balances or credit card debt, although it is negatively correlated with the probability of carrying a credit card balance. Ching and Hayashi (2010) and Rysman (2007) use private sector survey data to study consumer payment behavior related to payment cards.

A few other studies analyze household finance and payment behavior using administrative data from the Equifax credit bureau: Fulford and Schuh (2017) examine changes in consumer credit over the business cycle and life cycle; Demyanyk and Koepke (2012) examine consumers’ deleveraging behavior after the 2007–2009 financial crisis; Brevoort (2011) studies the relationship between credit card limits and race; and Muñoz and Butcher (2013) examine the effect of the Community Reinvestment Act on consumer credit outcomes.

Because recall-based surveys rely exclusively on the memory of the respondents, survey data are likely to include inaccuracies in self-reported answers that lead to measurement errors. Issues may arise due to respondents’ poor recall or rounding errors, or because the stigma associated with certain financial information makes respondents reluctant to report it. The statistics literature shows that survey responses are highly sensitive to the questionnaire design (Sudman et al. 1996; Tourangeau et al. 1991), and that survey-based statistics are very sensitive to the recall period used in the survey questionnaire (Deaton and Grosh 2000; Hurd and Rohwedder 2009). Also, respondents might not know about other household members’ financial information for jointly held accounts, or when bills are paid on behalf of the household by another person.

Administrative data from a credit bureau might provide more accurate information because the data are reported by the lenders, who are more likely to keep accurate and comprehensive records, and they are likely to be objective. However, administrative data may also be subject to errors due to varying definitions of some financial or payment measures. Cole et al. (n.d.) analyze the correlation between self-reported survey data in the SCPC and the Equifax credit bureau data for some credit card–related variables and find that even though the two data sources are highly correlated, discrepancies are often correlated with age, income, or education. In particular, older and higher-income consumers were more prone to discrepancies between their self-reported data and the relevant statistics from the credit bureau data, because they had more credit accounts, on average. Brown et al. (2015) conduct a comparison of the CCP and SCF debt information and find a substantial gap in the reporting of credit card debt between the two data sources.

A related but separate literature analyzes the relationship between the supply of credit and credit score. Keys et al. (2010) and Calem et al. (2017) show that mortgage lenders apply different rules for borrowers with a credit score below 620 and those with a credit score above 620, an arbitrary “rule of thumb” cutoff used to define risky, or subprime, borrowers. Nichols et al. (2005) found that the type of sorting commonly used by mortgage lenders does not apply in the credit card market, where lending is continuous based on creditworthiness. Thus mortgage lenders treat borrowers below a certain level of credit score differently, but credit card lenders do not make such a strict distinction. However, Han et al. (2015) show that after the financial crisis lenders sharply reduced credit card offered to subprime borrowers.

This paper contributes to the literature by combining credit bureau administrative data and self-reported data from the SCPC survey to estimate consumer credit card behavior, focusing on the relationship between consumer attributes and credit card borrowing. The combined Equifax-SCPC data provide a more comprehensive view of consumer payment behavior, including credit card holding and use, as well as demographic and income information. We estimate the effect of demographics and income on credit card behavior, and test whether there is a discontinuity separating subprime and prime borrowers.

3 Data description

Our data come from two sources. The first is a nationally representative survey of consumer payment behavior, the Survey of Consumer Payment Choice. The SCPC is an annual survey of US consumers on their adoption and use of several common payment instruments, including cash, checks, debit cards, credit cards, prepaid cards, online banking bill payments (OBBP), and bank account number payments (BANP). The SCPC also includes data on consumer bank account holding and on consumer assessments of payment characteristics, and a rich set of consumer and household demographic characteristics. The Federal Reserve Bank of Boston conducted the SCPC annually from 2008 through 2017. See Greene et al. (2017) and Angrisani et al. (2017) for more details about the SCPC.Footnote 1

Our administrative data come from Equifax, a consumer credit reporting agency. An agreement between the Federal Reserve Bank of Boston and Equifax allowed us to obtain full credit report information on the SCPC respondents who agreed to be anonymously matched with the Equifax data. Unlike with an actual credit pull by potential lenders, only those respondents who gave consent had their credit pulled. Moreover, the process was completed anonymously, without using names or addresses, and there is no record on the individual’s credit report of any action taking place due to this matching process. Moreover, the credit report is from the exact month when those respondents took the SCPC in each of three consecutive years: 2014, 2015, and 2016. The consent rate increased substantially from 2015 to 2016, after we changed the way we asked for consent (we removed the term “credit pull”) and offered monetary incentives to the respondents. The consent rate for 2016 was 70%.

In 2016, we were able to match the Equifax data for 2379 SCPC respondents. In 2015, there are 733 matched respondents, and in 2014, 553 respondents. The total matched observations for the 2014–2016 period is 3815, but we dropped 536 of those observations because the respondents indicated that they were credit card adopters in the SCPC but they had missing credit card balance information in the Equifax data. Because the 2014 merged sample is small, and to avoid a possible selection bias, we included only the 2015 and 2016 data in the analysis. In some cases, the number of observations based on the Equifax data differs from the corresponding number based on the SCPC data. This is because some of the variables for a subset of individuals may be missing in either dataset.

Table 1 shows the number of respondents in the matched SCPC-Equifax sample for 2015 and 2016. The table also shows a breakdown by the major demographic and income cohorts. The numbers in this table are based on unweighted data. To make the matched sample resemble the demographic composition of the US Census, we constructed weights and applied them to the summary results shown in subsequent sections of the paper. The weights are based on age, gender, and income. For details on how the weights were constructed and applied, see Angrisani et al. (2017).

4 Comparison of survey data and credit bureau data

Cole et al. (n.d.) compared data from the Survey of Consumer Payment Choice (SCPC) with data from the credit bureau, Equifax, using the Equifax Consumer Credit Panel (CCP). The SCPC combines information about payment behavior along with components of a consumer’s balance sheet, including credit card debt, while the CCP contains full credit file information. That paper is one of few studies to compare survey data to administrative data at the individual level. It compared several variables related to the use of credit cards: number of cards, credit scores, credit limits, and credit card balances. Data on those variables are collected in both datasets, although the definition of a particular variable may not be identical. For example, the SCPC defines credit card debt as unpaid credit card balances carried over from the previous month, while Equifax data shows account balances at a given time, including current credit card charges.

Measures of comparable concepts in the two data sources were found to be highly correlated. However, none of the variables matched perfectly. The lowest match rate was for credit score, which matched 50% of the time, while other variables matched at higher rates, but always below 100%. Respondents who checked their records and those who spent more time on the survey had higher rates of matched variables than those respondents who relied exclusively on their memory and took less time. Discrepancies also varied by socio-demographic characteristics of the respondents: Income is positively correlated with having a discrepancy in the number of cards and credit card limits. Older participants are more likely to have discrepancies for number of cards, limits, and balances. These findings suggest that individuals may be more likely to forget credit cards if they have a large number of them.

There are several reasons for the discrepancies between the self-reported survey data and the administrative data. Self-reported survey data are subject to memory lapses and/or potential behavioral biases due to stigma, especially related to credit card debt. The SCPC questions related to credit cards may require respondents to sum up information across multiple accounts. Given that the average SCPC respondent has between two and three credit cards, it is possible that respondents make errors when summing limits, balances, or number of cards across accounts. When summing is required, respondents may round the numbers rather than giving the exact amount. Respondents with multiple credit accounts may forget about some of their credit cards, especially if some their cards are not used on a regular basis.

In contrast, administrative data, such as the data from a credit bureau, help avoid such errors and biases. Because administrative data are less prone to errors and biases, the data should be used when available. However, the credit bureau data lack a lot of important information, including individual demographic and income data, and data on other payment instrument adoption and use. Having a rich set of variables provided by the SCPC survey allows researchers to get a clear picture of income vulnerabilities for the credit constrained. Because evidence shows that all the variables that exist in both datasets are highly correlated, the survey data is superior for the purposes of estimating payment behavior. Without the survey data, we could not estimate payment instrument adoption or use as a function of demographic and income attributes. However, if the objective is to obtain measures of credit limits or credit scores in aggregate or average values per person, the credit bureau data should be used instead.

5 Payment behavior and risk score

Consumer payment behavior can be affected by both supply-side and demand-side factors (Stavins 2017). The Equifax risk score measures the risk of default—the higher the score, the less likely the consumer is to default. Lenders use measures of default risk to decide whether to approve a loan and to determine the terms of the loan, including credit card limits. The risk score is a good predictor of whether a consumer is likely to repay his loans, including credit card debt, on schedule. Therefore, the Equifax risk score is correlated with the supply of credit. In this section, we analyze the relationship between payment behavior and risk score, exploiting a rare opportunity to isolate the effect of supply-side variables on consumer payment behavior.

An Equifax risk score ranges from 280 to 850. FICO uses a numerical range of 300 to 850, where higher scores also indicate lower credit risk.Footnote 2 Although the scores for the two measures may differ (the exact formulas that the credit bureaus use to calculate scores are proprietary), they quantify the same concept and are therefore correlated.

Credit card issuers typically raise the credit limit over time for cardholders with good repayment track records. Dey and Mumy (2009) show that cardholders with better credit scores have higher credit limits and lower interest rates on their credit card accounts because they are perceived as less risky. Figure 1 shows the mean and median credit limits by risk score cohort, based on the Equifax data. The credit limits are summed over all of the respondents’ credit cards. As expected, the credit limit increases with the risk score. Despite the monotonic increase in credit limits, the mean and median credit card balances on all cards combined rise with the risk score initially, but then they decline. As Fig. 2 shows, the mean and median balances increase with the risk score until the 700–749 range; they decline for consumers with a risk score between 750 and 799, and they drop even more substantially for those with a risk score over 800, where the mean balance drops to its lowest level. The mean balance rises from $2322 for those with the lowest risk score to $8191 for those with a risk score of 700 to 749, but then it declines to $5201 for those with a risk score of 750 to 799 and down to $2230 for those with a risk score over 800 (all for the pooled 2015–2016 sample).

Credit card utilization measures how much of his credit limit a consumer uses. Figure 3 depicts the average credit card utilization rate—the fraction of the total credit limit used by each consumer—by risk score range. As the figure demonstrates, consumers with the highest risk score have the lowest credit utilization rates. Figure 3a and b separate the utilization rates for revolvers and non-revolvers, respectively. The pattern for revolvers is similar to that for the whole sample, reflecting that more than half of credit card holders are revolvers, but convenience users with risk scores above 650 tend to utilize a very small fraction of their credit limits. Revolvers are more likely to be constrained by their credit card limits, and their higher use of debit cards (compared with convenience users) could be due to those supply-side restrictions rather than different preferences. Below we test whether there is a discontinuity between consumers with risk score below 650 (subprime) and above 650 (prime).

a Average credit card utilization rate by Equifax risk score. b Average credit card utilization rate by Equifax risk score, revolvers. c Average credit card utilization rate by Equifax risk score, non-revolvers. Source: 2015 and 2016 merged dataset of SCPC and Equifax, Federal Reserve Bank of Boston and Equifax

5.1 Risk score and credit limit by demographics and income

Column 1 in Table 2 uses the pooled 2015–2016 data to show the mean Equifax risk scores by demographic and income cohorts in the sample. The overall mean risk score is 707, but the mean scores vary by demographic and income attributes. The significance tests at the bottom of each demographic breakdown indicate that the means differ significantly by each category: age, education, income, gender, race, ethnicity, and homeownership status. The mean risk scores increase monotonically with income, education, and age. White respondents have a higher average risk score than do black respondents, and the average risk score for men is significantly higher than that for women.

Columns 2 and 3 in Table 2 display the mean credit limit for each cohort, from the Equifax data (provided by the lenders) and from the SCPC survey (self-reported by the consumers), respectively. The overall average credit limit is $25,720 in the Equifax data and $15,490 in the SCPC data. The discrepancy could be due to poor recall by consumers. Consumers may not remember the limits on all their credit cards, especially if they tend to use only one or a small subset. In contrast, the Equifax data from the lenders measure the total credit limit summed over all the open credit card accounts, even if the cards are not used or have been discarded.

For each data source, the credit limit is summed over all the respondents’ cards. There are large and statistically significant differences in the average total credit limits across the demographic and income groups. The average credit limit rises with age, income, and education. The pattern is similar to the one observed with the average risk score. As consumers grow older, and as their incomes rise, they have more cards and higher overall credit limits on average (Fulford and Schuh 2017; Agarwal et al. 2006).

5.2 Credit card adoption and number of cards

Based on the Equifax data, 74% of consumers have at least one credit card, and the average number of cards per person is 2.26 (Table 3). The rate of credit card adoption and the average number of cards are slightly higher in the SCPC. The sample size for Equifax is smaller, because some of the matched SCPC respondents have missing data in the Equifax.

The rate of credit card adoption is not uniformly distributed across demographic and income subsamples. The significance tests at the bottom of each demographic breakdown indicate that the rate of adoption and the number of cards differ significantly across all the cohorts: age, education, income, gender, race, ethnicity, and homeownership status. Both measures increase with age, education, and income. White respondents are more likely to have a credit card than are black respondents, and men are more likely than women to have a credit card.

The youngest, lowest-education, and lowest-income consumers have rates of credit card adoption that are substantially lower than those of their counterparts (Fig. 4a, b, c). The rate of credit card adoption for the youngest consumers—those under age 25—is only 48%, compared with 87% for those 65 and over. Only 33% of consumers who don’t have a high school education have a credit card, compared with 92% of those with a graduate degree. Forty-two percent of respondents with an annual household income below $25,000 have a credit card, compared with 91% of those with income greater than $100,000. The results are similar to the findings in Connolly and Stavins (2015) and Stavins (2016), both of which use only self-reported survey data. The results reported here are based on data from Equifax provided by lenders and are therefore more likely to be accurate.

5.3 Credit card use by demographics, income, risk score

While credit card adoption increases monotonically with age, this is not the case with credit card use among cardholders. Figure 5a, b, c show the average credit card balances by age, education, and income, respectively. As Fig. 5a indicates, cardholders’ balances rise with age initially but then decline after the peak for the 45–54 cohort. The pattern is similar among the revolvers, who the SCPC identifies as consumers who report carrying unpaid balances on their credit card: The average balance increases with age until its peak for the 45–54 age cohort; then it declines. The inverse-U-shaped pattern of credit card use is consistent with the results presented by Fulford and Schuh (2017), who find that credit card debt rises gradually with age before declining somewhat. The average credit card balance on all cards for revolvers is $6597.

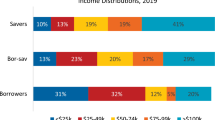

The first two columns in Table 4 show the percentage of revolvers by demographic and income attributes, based on survey data from the SCPC and the SCF, respectively. Approximately 44% of all consumers carried unpaid credit card debt in 2015 and 2016, based on the pooled 2015–2016 SCPC, and 43% reported doing so in the 2016 SCF.

The Equifax data report credit card balances for each consumer, but the balances include both current charges and unpaid balances carried over from the previous month. Therefore, we cannot use the Equifax data to identify credit card revolvers. However, once we identified a consumer as a credit card revolver based on the SCPC survey, we obtained his credit card balances from the Equifax data.

The right panel in Table 4 reports mean credit card balances for revolvers based on three data sources: the Equifax data, the SCPC (2015 and 2016), and the SCF (2016 only). The Equifax balances are higher than the SCPC balances for two reasons: (1) the measurement includes current charges in addition to unpaid balances carried over from the previous month; and (2) respondents are likely to underreport credit card debt due to the stigma associated with it. The average unpaid balance in the SCF is higher than the amount reported in the SCPC, possibly because of differences between the two questionnaires: The SCF asks more detailed questions about each credit card account, therefore facilitating better recall, while the SCPC asks about the aggregate amount owed on all credit cards. Despite the difference in amounts, the two surveys yield similar fractions of revolvers, suggesting that the SCPC identifies the revolvers correctly, which in turn allows us to compare the payment behaviors of revolvers and non-revolvers.

Although the amount of credit card debt varies with income, even high-income consumers carry debt: In 2015 and 2016, 43% of those with annual household income over $100,000 revolved on their credit cards (SCPC). The youngest, least-educated, and lowest-income consumers are less likely to revolve, but that is because they are less likely to have a credit card (Table 3; below we estimate the effects of various consumer attributes on the probability of revolving, conditional on having a credit card). The percentage of revolvers increases with income until the $50,000–$75,000 annual household income cohort, then declines for each consecutive cohort above $75,000, yielding an inverse-U-shaped distribution of debt. In contrast, credit card adoption and the number of cards held rise monotonically with income (Table 3). These findings indicate that lower-income consumers are more likely to use credit cards as a source of credit, while higher-income consumers are more likely to use credit cards as a means of payment and repay the balance each month.

5.4 Use of other payment instruments by risk score cohorts

We expect that consumers with higher risk scores (that is, lower credit risk) are more likely to be approved for a variety of payment methods, including but not limited to, credit cards. However, the adoption and use of payment instruments are influenced by both supply and demand for those instruments. Demand for payment methods also varies across consumers and may not be correlated with their credit risk. Therefore, the adoption or use may increase with risk score for some payment methods, but it may decline for others.

Table 5 shows the rates of adoption and shares of payment use for a variety of payment instruments by the Equifax risk score. In contrast to Table 4, which shows credit card balances, Table 5 shows the shares of the number of transactions for credit cards and for other payment instruments. The rates of adoption and use of credit cards rise with the risk score, as expected, but that is not the case for cash or debit cards. While cash is universally adopted, the use of cash, as measured by the share of transactions, declines with the risk score: Consumers with a risk score below 600 conduct 36% of their transactions in cash, compared with only 22% for those with a risk score above 800. The share of debit card transactions rises with the risk score initially, but then it declines for each consecutive cohort with a risk score above 650. The majority of the mean rates of adoption and use vary significantly across the demographic subgroups. Note that those mean rates of adoption and use do not control for any income or demographic attributes, which are correlated with the Equifax risk score. Below, we show the results of an econometric regression that isolates the effect of risk score from those of demographic attributes and income.

6 Model of adoption and use of credit cards

To isolate the effects of demographic and income attributes on payment behavior, we estimate a two-stage model of adoption and use of credit cards, where use is measured as the dollar amount of credit card balances. The model is based on the Heckman (1976) selection model that controls for potential selection bias in payment use. In stage 1, consumers adopt a portfolio of payment instruments, including credit cards. In stage 2, they choose how extensively to use each instrument, conditional on adoption. Consumers must first decide whether to adopt a payment instrument (the extensive margin) before they can use it (intensive margin). The standard theoretical models involving money, money-in-utility (MIU), or cash-in-advance (CIA) models, abstract from a discrete practical decision that typically is included in the empirical literature on payment choice. Schuh and Stavins (2010, 2013) use a similar model based on only the self-reported survey data. Those earlier studies lack data on the dollar value of credit card balances, and instead define credit card use as the share of the number of transactions conducted with credit cards. Here, we apply the model using the external credit bureau data with a measure of actual credit card balances, thereby reducing the probability of bias in the reporting of credit card use due to poor recall or fear of being stigmatized.

Adoption of a payment method is a function of various characteristics of the payment method, as well as demographic and financial attributes of the consumer. Respondents assessed the characteristics of a payment method on an absolute scale of 1 to 5, where 1 is the least desirable (for example, slowest or most expensive) and 5 is the most desirable (fastest or cheapest). We use these numerical assessments to construct average relative characteristics, as described below. Some specifications include the Equifax risk score. We follow the standard used in the literature and treat the risk score as exogenous with respect to financial behavior. For example, Agarwal et al. (2006), Bhardwaj and Sengupta (2011), Brown et al. (2013), Emekter et al. (2015), and Meier and Sprenger (2010) treat risk score as exogenous. Credit card adoption and risk score may be affected by some of the same factors (people with better loan repayment habits are likely to have higher risk scores and are also more likely to have a credit card). However, risk score is calculated based on many different variables, and lenders use it as input in deciding whether to approve an application for various types of loans. Therefore, it is unlikely that treating it as exogenous affects the results of credit card use regressions.

Adoption of credit cards by consumer i is modeled as:

where

Ait is a measure of current credit card holding in period t (some consumers indicated that they had a credit card in the past, but do not have one currently); \( {\overline{RCHAR}}_{it} \) is a vector of average characteristics of credit cards relative to the characteristics of all the other payment instruments for consumer i in period t (created as described below); Xit is a vector of control variables for consumer i in period t (demographic and financial variables age, gender, race, education, marital status, income, and financial responsibility within the household); Rit is the Equifax risk score for consumer i in period t; Zit is a set of variables included in the adoption stage but omitted from the use stage (see discussion below).

We model the use of credit cards (conditional on the adoption of credit cards) by consumer i in year t as follows:

where Uit is the dollar amount of credit card balances for consumer i in period t; \( \overline{RCHA{R}_{it}} \) and Xit are defined as in Eq. (1); and MRit−1 is the inverse Mills Ratio from the first-stage Heckman probit model to control for potential selection bias.

Characteristics are rated on a 1 through 5 scale. We are interested in consumers’ rating of credit cards relative to all the other payment instruments j. For each characteristic k, we create a measure of relative characteristics as explanatory variables as follows:

where k indexes the characteristics acceptance, cost, convenience, security, setup, and record keeping; i indexes the consumer; and j denotes all the other payment instruments. For example, for k = cost, we measure how a consumer assesses the cost of credit cards relative to each of the other payment instruments. In principle, all the relative characteristics could influence a consumer’s choice of any payment instrument. We include ratings relative to all other methods of payments, because each person’s ratings are somewhat subjective. Some people may give high ratings to all payment instruments, while other people may give low ratings. Relative ratings eliminate those tendencies and create a more objective variable. However, to facilitate the interpretation of the marginal effects of the characteristics on use, we construct the average relative characteristic for each payment characteristic,

where J = all the payment instruments. For example, \( \overline{RCHAR} \) for cost in the credit card use equation is the average of the log ratios of credit card cost to the cost of each of the other payment instruments, and it measures how a consumer evaluates the cost of credit cards relative to the cost of all the other payment methods. \( \overline{RCHAR} \) measures perceptions, and as such it could be endogenous with respect to payment behavior. However, earlier studies find that including these characteristics in payment behavior regressions does not qualitatively change the estimated effects of other attributes, and it improves the goodness of fit (Schuh and Stavins 2010, 2013). We expect the coefficients on all the average relative characteristics to be positive, because a higher numerical value of CHAR indicates a more positive assessment by a consumer, and we assume that consumers value all the characteristics. Respondents assess the characteristics for all payment instruments, not only for those payment instruments they own or use. The ratings of adopters and nonadopters of a given payment instrument depend on the information each has about that payment instrument. Nonadopters may have the same information as adopters, even though their experience is different. However, experience may give the adopters more information.

6.1 Heckman identification requirement

For the Heckman model to be identified, some variables included in the first stage (adoption) must be omitted from the second (use) stage. Setup and acceptance are payment method characteristics that affect adoption but are unlikely to affect use: setup is the difficulty of first obtaining a payment instrument, and acceptance is a measure of how many merchants accept a payment instrument, something consumers are likely to take into account when deciding whether or not to acquire the payment instrument. Similarly, past incidence of bankruptcy is likely to affect whether issuers agree to give certain payment methods to a consumer, but it is less likely to affect use. That is especially likely to be true for credit cards, as credit card issuers have access to information on past bankruptcy filings when considering credit card applications. For robustness, we applied various measures of past bankruptcy filings: a dummy variable for whether a consumer declared bankruptcy in the previous 12 months, the previous 7 years, or a combination of the two (either past 12 months or past 7 years), but altering the bankruptcy measures did not change any of the other estimated coefficients or their statistical significance.

To test whether those variables satisfy the identification requirement, we calculated correlation coefficients between each of the three variables and the dependent variables from stage 1 and stage 2 of the Heckman regression, Ait and Uit. The correlation coefficients are as follows:

Adoption (stage 1) | Use (stage 2) | |

Acceptance | 0.122 | 0.037 |

Setup | 0.347 | 0.020 |

Bankruptcy | −0.129 | −0.028 |

We also estimated Uit on the full set of exogenous variables including acceptance, setup, and bankruptcy, and none of those coefficients were statistically significant, supporting our claim that those three variables can be excluded from the second stage of the Heckman model (the results are available on request). Moreover, excluding those three variables did not affect the remaining regression coefficients.

7 Regression results

We estimate the two-stage Heckman model of adoption and use of credit cards shown above using the Equifax-SCPC merged data for 2015 and 2016. Because the panel data present some estimation issues with the sample selection model (see Stavins 2016), and because it is not a balanced sample, we estimate the two years separately. The measures of credit card adoption (whether or not a consumer has a credit card) and credit card use (the dollar amount of his credit card balances) are based on the Equifax data. The corresponding demographic and income data for each consumer are based on the self-reported SCPC survey results.

7.1 Stage 1: Adoption

In the first stage, we estimate the adoption of credit cards on a vector of demographic and financial variables and on the assessed characteristics of credit cards, as specified in Eq. (1). The results of stage 1 for both years are in Table 6. The numbers represent marginal effects derived from the estimated coefficients. The first two columns show the results of the base model, while Models 2 and 3 add the Equifax risk score. In the base model, age, education, income, and homeownership are statistically significant in both years: Older, more-educated, higher-income consumers, and homeowners have a higher probability of having a credit card. A respondent with an annual household income below $25,000 had a significantly lower probability of having a credit card than someone with a household income of more than $100,000 a year: 18% lower in 2015 and 31% lower in 2016. In 2016, gender and race are also highly significant: Men had a 4.6% higher probability of having a card than women, and black consumers had a 12% lower probability than white consumers, all controlling for income, age, and education.

Education affects credit card adoption through the college level, but the probability of having a credit card is not statistically significantly different between college graduates and those with post-graduate education. Homeowners are 12% (in 2015) or 7.7% (in 2016) more likely to have a credit card than those who do not own a home. Having declared bankruptcy during the previous 12 months lowered the probability of having a credit card by 47% in 2016. The 2016 sample is substantially larger than the 2015 sample, and more of the 2016 coefficients are statistically significant. Consumers who rated credit cards higher in terms of various characteristics—cost, convenience, ease of setup, record keeping, security—are more likely to have a credit card, controlling for income and demographics. Bearing all or almost all of the financial responsibility for the household increases the probability of having a card, while having shopping responsibility does not affect the probability of having a credit card.

For robustness, we estimate two specifications including the Equifax risk score. Model 2 includes the risk score as a continuous variable, while Model 3 includes a set of dummy variables for the risk score ranges, with 650–699 as the omitted category. Not surprisingly, higher risk score was associated with a higher probability of having a credit card in both years. In both specifications, some of the demographic variables become statistically insignificant. This is because the risk score incorporates some of the information that is correlated with demographics or income. However, none of the coefficients change signs. Including the risk score improves the goodness of fit, as measured by pseudo R-squared.

7.2 Stage 2: Use

In the second stage, we estimate the use of credit cards, measured as the dollar value of the consumers’ credit card balances, as specified in Eq. (2). The OLS results are presented in Table 7. The first two columns show the results of the base model, while the subsequent columns show the results of the model with the Equifax risk score added. Model 2 includes the risk score as well as the risk score squared, to account for the U-shaped relationship between risk score and credit card balances (see Fig. 2). Stage 1 did not include risk score squared due to the nonlinear specification. Income has a significant effect on credit card balances, both economically and statistically: Higher-income consumers have significantly higher credit card balances, conditional on credit card adoption. Recall that balances include current charges as well as any balances carried over from the previous month. The effect of income is even greater when we control for the risk score, and including credit score ranges leads to higher effect of income than including risk score as a continuous variable (Models 2 and 3). All of the coefficients on the income categories are negative, indicating that consumers with annual household income of $100,000 or more (the omitted category) carry the highest credit card balances, after we control for all the other demographic attributes.

As Fig. 5a shows, credit card use is non-monotonic with respect to age. Credit card balances increase with age but at a declining rate, as indicated by the positive coefficient on age and negative coefficient on age squared. Both the age and age squared coefficients are statistically significant in every specification. Thus, age affects the probability of having a card, but even conditional on having a credit card, people use credit cards more heavily as they grow older—up to a point—even when we control for income.

Model 2 shows that credit card balances rise with the risk score at a declining rate (the quadratic term is negative and significant). Model 3 shows that as the risk score rises above 600, consumers’ credit card balances increase, but those with risk scores above 750 carry lower credit card balances, when we control for income and age. Figure 3 demonstrates the inverse correlation between the risk score and credit card utilization, and the findings are consistent with those of Castronova and Hagstrom (2004) and Musto and Souleles (2006), who find that credit limits increase proportionally more than the amount borrowed as credit scores rise. In other words, credit utilization drops when credit scores rise above certain levels.

The low value of R-squared suggests that only a small part of credit card use can be explained by demographics. When the risk score is included in the regression, the adjusted R-squared increases, indicating that the risk score is a much better predictor of credit behavior than are just demographic and financial attributes.

In the base model, the coefficient on the inverse Mills ratio in stage 2 of the Heckman base model is not statistically significant, so there is no evidence that sample selection exists in the model. However, the coefficients are significant in Model 2 for both years, supporting the use of the Heckman selection model and indicating that the OLS results may be biased. The results of OLS estimation (available on request) are qualitatively very similar to the Heckman results presented here: Credit card use increases significantly with income and with age, but none of the other consumer attributes affect credit card use. The predicted values of credit card balances at the mean are very close, whether the use is estimated using the Heckman model or OLS (bottom of Table 7).

8 Credit card debt and consumer payment choice

Credit cards are a unique method of payment, because they can be used as a source of credit in addition to serving as a means of payment. Identifying consumers who revolve (borrow) on their credit cards allows us to analyze their other payment habits and preferences: Do they behave differently from those who repay their credit card balances each month? Above, we showed that revolvers differ from convenience users in their credit card utilization rates (Fig. 3a, b). In this section, we analyze the relationship between payment preferences and credit card debt. Table 8 shows the rates of adoption and shares of use of various payment methods for all consumers, as well as broken down by credit card revolvers and non-revolvers. One thing to note is that credit card revolvers are more likely to have a debit card compared with consumers who pay their credit card balances on time (payment method adoption, top panel): In the sample, 90% of revolvers and 79% of non-revolvers hold a debit card. Comparing the shares of use by payment instrument (bottom panel), we find that revolvers have much higher shares of debit card transactions and much lower shares of credit card transactions, relative to convenience users who pay their credit card bills on time. On average, revolvers use debit cards almost twice as frequently as credit cards (37% versus 19%), while convenience users do the reverse: They use credit cards twice as often as debit cards (37% versus 18%). Credit card revolvers might avoid using their credit cards in order to curtail their debt, or so that at least they do not increase their debt.

The numbers in Table 8 are weighted means for each subsample and do not control for any demographic or income attributes. To analyze the relationship between demographics and credit card revolving, we start by addressing a question: Who revolves on credit cards? Using pooled 2015–2016 data, we estimate the following probit regression among credit card holders:

where

The control variables are defined as above. The results (Table 9) show that revolvers differ from convenience users along the demographic and financial attributes. Compared with convenience users, revolvers are more likely to have lower income and be less educated. Thus, the unconditional differences across income and education shown in Table 4 hold even when the probability of revolving is conditional on having a credit card. However, the probability of revolving increases slightly with age. Being black or unemployed does not increase the probability of revolving, conditional on having a credit card.

We show that revolvers use their credit card less frequently than convenience users do, but we also find that income and demographic attributes affect who revolves. Next, we estimate the effect of credit card revolving on the dollar amount of credit card balances while controlling for the demographic attributes. Table 10 shows the results of an OLS model using pooled 2015–2016 data.Footnote 3 Even though revolvers use their credit cards less frequently, their credit card balances are significantly higher than those of convenience users. Note that the balances are from the Equifax data and therefore are likely to be unbiased, but they include current charges as well as any unpaid balances carried over from the previous month. Even after we control for credit risk (Models 2 and 3), being a revolver indicates higher balances, although the effect is smaller in magnitude. The model-predicted values (bottom of Table 10) are qualitatively similar across the three specifications, although including the risk score increases the model fit, as measured by the R-squared.

Revolvers carry balances that are several thousand dollars higher than those of convenience users (on average), when we control for income and demographics, and thus they can be subject to high interest rate charges. Interest rate charges for revolvers accrue on the total balances, including any current charges, not only the balances carried over from a previous month. According to FRED, the average interest rate on credit card plans for accounts that assess interest was 13.66% in 2015 and 13.56% in 2016.Footnote 4 Based on the SCPC data on unpaid balances, the annual interest cost for a revolver in 2016 is $5262*13.56% = $713.55. Cardholders should be encouraged to pay off their credit card debt as much as possible to avoid the interest charges. Relevant information on the cost of carrying credit card debt, such as that which the Schumer box provides,Footnote 5 can be helpful to cardholders.

9 Discontinuity between subprime and prime consumers

We test whether there is a discontinuity between subprime and prime consumers in terms of their credit card behavior. Previous literature found that the mortgage market differentiates between the two subgroups, as potential lenders treat consumers in the two subgroups differently (Keys et al. 2010), but that there is no evidence for a discontinuity in the credit card market (Nichols et al. 2005). Our data show some evidence for a break at credit score equal to 650 between revolvers and convenience users (Fig. 3a, b), so we test whether there is evidence that consumers below and above that threshold operate in different credit card markets due to differences in the supply of credit, either in a form of limitations or different prices. In other words, we test whether there is a discontinuity at credit score equal to 650 separating subprime and prime borrowers.

We estimate the model of adoption and use separately for consumers with credit score below 650 and above 650. The prime coefficients are qualitatively very similar to the full sample results, both in terms of their signs and statistical significance. Most of the signs in the subprime regressions are the same as in the full sample regression. Because of the smaller sample size, few coefficients are statistically significant in the subprime regressions (regression results are available on request). The prime subsample (credit score above 650) is approximately three times as large as the subprime subsample (credit score below 650).

We also tested for the discontinuity by applying the regression discontinuity (RD) approach, as outlined in Imbens and Lemieux (2008). RD analysis is an approach that can be used to estimate the impact of a program where candidates are selected for treatment based on whether their value for a numeric rating exceeds a designated threshold. Here, the dependent variable is credit card balances, and the running variable is Equifax risk score. We did not find any convincing evidence suggesting that a treatment effect exists at the threshold of 650.Footnote 6 For robustness, we tested if there is a discontinuity at credit score equal to 620 or 670, and those results confirmed our finding for the 650 threshold. Therefore we found no evidence for significantly different behavior between subprime and prime consumers.

10 Conclusions

We estimate a two-stage Heckman selection model of credit card adoption and use with a unique dataset that combines self-reported information from a consumer survey with information on risk score and credit card holding and balances from the Equifax credit bureau. Even though the Equifax data do not always match the self-reported survey data, the estimation results are qualitatively similar to those based exclusively on self-reported survey data. In particular, most of the demographic and income attributes significantly affect credit card adoption, and income and age also affect credit card use, as measured by the dollar value of credit card balances.

The relationship between the Equifax risk score, a measure of the risk of default, and credit card use is not monotonic: As their risk score rises, consumers increase their credit card balances initially, but above the score of 750, credit card balances decline with the risk score. Credit card revolvers differ from consumers who pay their balances each month: They are more likely to have lower income and be less educated. They also are much more likely to use a debit card instead of a credit card, but revolvers carry much higher balances on their cards, even after we control for demographic and income attributes. Consumers who carry debt might be liquidity constrained and not have cheaper borrowing alternatives. For example, payday loans are likely to be even more expensive than credit card loans, while home equity loans are not available to non-homeowners. Thus, supply-side constraints may cause credit card revolving. The high cost of paying off credit card debt could exacerbate existing inequalities in disposable income among consumers.

We find no evidence that subprime and prime consumers behave differently when it comes to credit card debt: there is no significant break between the two groups. Although we cannot separately identify supply-driven credit constraints, we find no support for a strict cutoff in the credit card market, unlike what has been found in the mortgage market.

Notes

The SCPC questionnaire and data are available at https://www.frbatlanta.org/banking-and-payments/consumer-payments/survey-of-consumer-payment-choice.

The two-stage Heckman model cannot be estimated here, because the entire sample consists of credit card holders. Thus, credit card adoption = 1 for everyone in the sample, and so stage 1 of Heckman (adoption) cannot be identified.

Federal Reserve Economic Data, see https://fred.stlouisfed.org/series/TERMCBCCINTNS

RD analysis includes several steps. In step 1, we plot the relationship between the outcome variable and the rating variable to investigate what functional form to use. The data fit a 2nd degree polynomial with no discontinuity at 650. In step 2, we select a bandwidth based on minimizing MSE and test the validity of RD. The bandwidth is 60, or consumers with risk score between 590 and 710. RD is tested by examining if consumers can cross the 650 threshold and if the density of the variable is continuous. The test showed no statistical evidence of systematic manipulation of the score variable. In step 3, we estimate the treatment effect using observations within the chosen bandwidth [590, 710] using the specification: Credit _ Balance = α + β0Ti + β1Ri + β2RiTi + β3DEMi + εi where Ti is the treatment effect indicator, and Ri is the rating variable included to correct for selection bias (Heckman and Robb 1985). The coefficient on the treatment effect indicator Ti is not significant.

References

Agarwal S, Ambrose BW, Liu C (2006) Credit lines and credit utilization. J Money Credit Bank 38(1):1–22

Angrisani, Marco, Kevin Foster, and Marcin Hitczenko (2017) The 2015 survey of consumer payment choice: technical appendix. Federal Reserve Bank of Boston Research Data Reports No 17–4

Bhardwaj, Geetesh, and Rajdeep Sengupta (2011) Credit scoring and loan default. Federal Reserve Bank of St. Louis Working Paper No. 2011-040A

Brevoort KP (2011) Credit card redlining revisited. Rev Econ Stat 93(2):714–724

Brown, Meta, Sarah Stein, and Basit Zafar (2013) The impact of housing markets on consumer debt: credit report evidence from 1999 to 2012. Federal Reserve Bank of New York Staff Reports No 617

Brown M, Haughwout A, Lee D, van der Klaauw W (2015) Do we know what we owe? Consumer debt as reported by borrowers and lenders. Econ Policy Rev 21(1):19–44

Calem PS, Jagtiani J, Lang WW (2017) Foreclosure delay and consumer credit performance. J Financ Serv Res 52(3):225–251

Castronova E, Hagstrom P (2004) The demand for credit cards: evidence from the survey of consumer finances. Econ Inq 42(2):304–318

Ching A, Hayashi F (2010) Payment card rewards programs and consumer payment choice. J Bank Financ 34(8):1773–1787

Cole, Allison, Scott Schuh, and Joanna Stavins (Forthcoming) Matching consumer survey data with credit Bureau Data. Federal Reserve Bank of Boston Research Department Working Papers.

Connolly, Sean, and Joanna Stavins (2015) Payment instrument adoption and use in the United States, 2009–2013, by consumers’ demographic characteristics. Federal Reserve Bank of Boston Research Data Reports No. 15–6

Deaton A, Grosh M (2000) Consumption. In: Grosh M, Glewwe P (eds) Chapter 17Designing household survey questionnaires for developing countries: lessons from ten years of LSMS experience. World Bank, Washington, DC

Demyanyk, Yuliya, and Matthew Koepke (2012) “Americans cut their debt.” Federal Reserve Bank of Cleveland Economic Commentary August 2012

Dey, Shubhasis, and Gene Elwood Mumy (2009) Determinants of borrowing limits on credit cards. Available at SSRN: https://ssrn.com/abstract=889719 or https://doi.org/10.2139/ssrn.889719

Emekter R, Yanbin T, Jirasakuldech B, Min L (2015) Evaluating credit risk and loan performance in online peer-to-peer (P2P) lending. Appl Econ 47(1):54–70

Fulford, Scott, and Scott Schuh (2017) Credit card utilization and consumption over the life cycle and business cycle. Federal Reserve Bank of Boston Research Department Working Papers No. 17–14

Greene, Claire, Scott Schuh, and Joanna Stavins (2017) The 2015 survey of consumer payment choice: summary results. Federal Reserve Bank of Boston Research Data Reports No. 17–3

Gross DB, Souleles NS (2002) An empirical analysis of personal bankruptcy and delinquency. Rev Financ Stud 15(1):319–347

Han, Song, Benjamin J. Keys, and Geng Li (2015) Information, contract design, and unsecured credit supply: evidence from credit card mailings, Finance and Economics Discussion Series 2015–103, Board of Governors of the Federal Reserve System

Heckman JJ (1976) The common structure of statistical models of truncation, sample selection and limited dependent variables and a simple estimator for such models. The Annals of Economic and Social Measurement 5(4):475–492

Heckman J and Robb R Jr. (1985) Alternative methods for evaluating the impact of interventions. J Econometrics 30(1-2):239–267

Hurd MD, Rohwedder S (2009) Methodological innovations in collecting spending data: the HRS consumption and activities mail survey. Fisc Stud 30:435–459

Imbens G, Lemieux T (2008) Regression discontinuity designs: a guide to practice. J Econ 142:615–635

Karlan D, Zinman J (2008) Lying about borrowing. J Eur Econ Assoc 6(2–3):510–521

Keys BJ, Mukherjee T, Seru A, Vig V (2010) Did securitization Lead to lax screening? Evidence from subprime loans. Q J Econ 125(1):307–362

Klee, Elizabeth (2006) Families’ use of payment instruments during a decade of change in the U.S. payment system. Board of Governors of the Federal Reserve System Finance and Economics Discussion Series 2006–01

Koulayev S, Rysman M, Schuh S, Stavins J (2016) Explaining adoption and use of payment instruments by U.S. consumers. RAND J Econ 47(2):293–325

Lopes P (2008) Credit card debt and default over the life cycle. J Money Credit Bank 40(4):769–790

Meier S, Sprenger C (2010) Present-biased preferences and credit card borrowing. Am Econ J Appl Econ 2(1):193–210

Mester LJ (2012) Changes in the use of electronic means of payment: 1995–2010. Federal Reserve Bank of Philadelphia Business Review Q3:25–36

Min I, Kim J-H (2003) Modeling credit card borrowing: a comparison of type I and type II Tobit approaches. South Econ J 70(1):128–143

Muñoz, Ana Patricia, and Kristin F. Butcher (2013) Using credit reporting agency data to assess the link between the community reinvestment act and consumer credit outcomes. Federal Reserve Bank of Boston Community Development Discussion Papers No. 2013–2

Musto DK, Souleles NS (2006) A portfolio view of consumer credit. J Monet Econ 53(1):59–84

Nichols J, Pennington-Cross A, Yezer A (2005) Borrower self-selection, underwriting costs, and subprime mortgage credit supply. J Real Estate Financ Econ 30(2):197–219

Rysman M (2007) An empirical analysis of payment card usage. J Ind Econ 55(1):1–36

Sánchez, Juan M. (2014) Paying down credit card debt: a breakdown by income and age. Federal Reserve Bank of St. Louis Regional Economist April

Schuh S, Stavins J (2010) Why are (some) consumers (finally) writing fewer checks? The role of payment characteristics. J Bank Financ 34(8):1745–1758

Schuh S, Stavins J (2013) How consumers pay: adoption and use of payments. Accounting and Finance Research 2(2)

Stavins, Joanna (2016) The effect of demographics on payment behavior: panel data with sample selection. Federal Reserve Bank of Boston Research Department Working Papers No. 16–5

Stavins, Joanna (2017) How do consumers make their payment choices? Federal Reserve Bank of Boston Research Data Reports No. 17–1

Sudman S, Bradburn NM, Schwarz N (1996) Thinking about answers: the application of cognitive processes to survey methodology. Jossey-Bass, San Francisco

Tourangeau R, Rasinski KA, Bradburn N (1991) Measuring happiness in surveys: a test of the subtraction hypothesis. Public Opin Q 55(2):255–266

Zinman J (2009) Where is the missing credit card debt? Clues and implications. Rev Income Wealth 55(2):249–265

Acknowledgements

The author thanks José Fillat, Joe Peek, and an anonymous referee for helpful comments, and Allison Cole and Liang Zhang for excellent research assistance. The views expressed here are those of the author and do not necessarily represent the views of the Federal Reserve Bank of Boston, the Board of Governors, or the Federal Reserve System.

Author information

Authors and Affiliations

Corresponding author

Additional information

Publisher’s Note

Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

Rights and permissions

About this article

Cite this article

Stavins, J. Credit Card Debt and Consumer Payment Choice: What Can We Learn from Credit Bureau Data?. J Financ Serv Res 58, 59–90 (2020). https://doi.org/10.1007/s10693-019-00330-8

Received:

Revised:

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s10693-019-00330-8