Abstract

Using data from 9,674 individuals in three waves of the Health and Retirement Study, we used three latent-class transition models to predict the probabilities of monetary transfers that study participants made to adult children and received from their adult children over a 6-year period of time, from 1998 to 2002. Generally, we found a high degree of stability in over time transition patterns. Whereas time invariant predictor variables (i.e., age, race, and gender) were related to the probabilities of transfers in Wave 1 of the study, these variables were not predictive of over time changes. Only changes in marital status were consistently related to intergenerational exchanges of monetary resources over time.

Similar content being viewed by others

Avoid common mistakes on your manuscript.

The purpose of this study was to examine, over time, probabilities of intergenerational monetary exchanges between older persons and their adult children. Intergenerational monetary transfers are important because they may be related to the financial well-being of adult children (Dunn and Phillips 1997; Hayhoe and Stevenson 2007; McGarry and Schoeni 1997; Nichols and Junk 1997), be factors in older adults’ decisions to continue working or to retire (Pagani and Marenzi 2008; Soldo and Hill 1995; Szinovacz et al. 2001), have implications for the effectiveness of public policy (Cox and Jakubson 1995; Schaeber and Stum 2007), and may be related to the likelihood that older adults will receive monetary or caregiving assistance from their children when they experience age-related declines in their economic well-being or health (Cox and Rank 1992; Stum 2001). Intergenerational exchanges are attracting increasing attention from researchers because of demographic changes that are expected to take place over the next two decades. Specifically, the Administration on Aging (2003) has suggested that the proportion of the population comprised of persons 65 years old or older is projected to grow from about 12% in 2000, to slightly more than 20% by the year 2030, causing some policymakers to become concerned about a growing old-age dependency ratio.

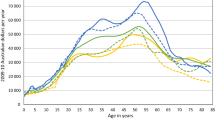

This study examined how monetary resources may flow up or down generations, as well as how those flows may interact with each other. Second, we took a longitudinal approach to intergenerational transfers so that we could examine dynamics over time and how intergenerational exchanges were related to lifecourse transitions in geographic location, marital status, and socioeconomic status. We also included race and gender as time invariant predictors of intergenerational exchanges based on previous studies that have emphasized the importance of these variables (see Fig. 1).

Literature Review

Bidirectional Monetary Exchanges

The exchange perspective has, for good reason, dominated discussions about intergenerational exchanges. Generally, this perspective assumes that adult children provide assistance to their aging parents in return for the assistance that they received from their parents in the past (Brakman 1995; Dowd 1975). The empirical evidence has been consistent in supporting the exchange perspective, in general. For example, Silverstein et al. (2002) found that emotional investments, as well as financial assistance, from parents to children in 1971 were significantly related to the assistance that parents received from their children in 1985 and 1997. Although evidence for the reciprocity perspective seems clear, some researchers have suggested that parents and children do not exchange resources in the same mediums of exchange (Koh and MacDonald 2006).

In regard to mediums of exchange, research has suggested that adult children are more likely to receive monetary resources from parents than to give to parents, but adult children are more likely to provide than to receive caregiving assistance. For example, Henretta et al. (1997) found that the effect of earlier parental monetary transfers to children on the selection of specific children to provide assistance was nearly as strong as the effect of sex of adult children on providing caregiving assistance. This finding was replicated by Koh and MacDonald (2006) who found positive relationships between earlier parent to child monetary transfers and subsequent transfers of caregiving, time, and co-residence. No relationship was found between early parent to child monetary transfers and later child to parent monetary transfers.

Rurality

It may be that intergenerational exchanges vary across rural contexts. As compared to their less rural counterparts, older rural persons may have more adult children but not necessarily more adult children who are available and willing to provide them with needed assistance (Coward et al. 1989, 1993). In fact, as Coward et al. (1993) noted, older non-farm rural persons were less likely than persons living in any other context to have at least one adult child living nearby. Older persons living on farms were an exception because they were likely to have at least one son living nearby who was expecting to inherit the farm. It was suggested that adult children living in close proximity to their parents’ farms were making investments in the farm and expecting to inherit the farms.

Koh and MacDonald (2006) speculated that the lack of a bidirectional flow of monetary resources may have reflected altruistic motives for providing monetary assistance. That is, monetary resources may have been more likely to flow to family members with the greatest need. Because the average net wealth of older persons is greater than that of their adult children (Holtz-Eakin and Smeeding 1994), it is not surprising that parent to child financial transfers are more prevalent than child to parent financial transfers. This also emphasizes the importance of examining transfers across rural contexts. It may be that older persons in rural communities have more variation in their economic well-being and need over time than their non-rural counterparts because of increased barriers to accessing resources and higher health care costs resulting from unfavorable economies of scale (Nelson and Salmon 1993). Clearly, more research is needed as there have been no studies using nationally representative data sets that examine bidirectional intergenerational flows of resources across rural contexts.

Lifecourse Transitions

Based on a lifecourse perspective, it is reasonable to hypothesize that over time transitions in older persons’ marital status and financial well-being, are related to changes in the exchange of resources between older persons and their adult children. It is also reasonable to hypothesize that the implications of those lifecourse transitions for intergenerational transfers vary across the rural continuum. There is considerable empirical support for these hypotheses.

Marital status and transitions in marital status may be the most important predictors of assistance to older persons by their adult children (Hans et al. 2009; Ulker 2009). A hierarchical-compensatory model (Cantor 1979) and the convoy model of support (Antonucci and Akiyama 1995) suggests that spouses are preferred over adult children as sources of needed assistance. It is not surprising, therefore, that older persons receive most of the assistance they need from spouses, especially if the older person needing assistance is a husband who is receiving assistance from his wife (Allen et al. 1999). Importantly, as older persons make the transition to widowhood, adult children become the preferred source of needed assistance. As a result, these models emphasize the importance of both marital status and transitions in marital status to explain assistance that older persons receive from their adult children.

Clearly, Social Security has played an important role in reducing rates of poverty among older persons (Social Security Administration 2002). Nevertheless, older persons are likely to experience declines in their disposable incomes, especially after retirement and after being faced with expanding healthcare needs (Harrington-Meyer and Bellas 1995; Lai 2008; U.S. Bureau of the Census 2000). For many, the decline in income that often occurs in late life may not be offset by the wealth of older persons. Although older persons are likely to stay active and make significant contributions after retirement (Dosman et al. 2006), it is not surprising that intergenerational exchanges are related to the financial well-being and the retirement and work status of older parents. Evidence indicates that older persons are much less likely to transfer resources to adult children after retirement than before retirement (Hogan et al. 1993; Rossi and Rossi 1990). In fact, it may be that providing assistance to their adult children may delay retirement (Szinovacz et al. 2001).

Race and Ethnicity

Race and ethnicity comprise another important context within which intergenerational exchanges take place. Angel and Angel (1997) reviewed the relatively large set of literature on social group differences in intergenerational exchanges. They found that, although Black and Hispanic persons have larger extended family networks, there are likely to be lower levels of financial intergenerational exchanges than in White families. In contrast, minority older persons are more likely than older persons who are not minorities to share a residence with their adult children. It may be that the relatively low rates of monetary exchanges between minority persons, as compared to non-minorities, reflect differences in socio-economic status and that minorities close the gap on socio-economic differences by providing direct caregiving and co-residence to other family members.

Sex

One of the strongest findings in research regarding intergenerational exchanges is that women provide more caregiving assistance to older family members than men (Stone et al. 1987), and women may experience negative financial consequences as a result of co-residence with an aging parent (Kolodinsky and Shirey 2000). Along these lines, Dwyer and Coward (1991) found gender differences in both family caregiving provided and received; females were more likely to provide assistance and mothers were more likely to receive it. Although both of these studies imply that women are more inclined than men to assist their older family members, neither takes into account other types of assistance beyond caregiving. In the Netherlands, Ikkink et al. (1999) found sons and daughters were equally predisposed to help their parents when assistance included financial advice. It may be that sex differences in assistance are limited to caregiving and play a lesser role in financial assistance.

Theoretical Model and Research Questions

This study used data from the Health and Retirement Study (HRS) to examine a conceptual model about intergenerational exchanges over a period of 6 years. This model assumed that transfers to and from adult children are two parallel and interactive processes, that current probabilities of giving or receiving transfers to and from children depend on prior transfers, and that these processes are a function of asset of socio-demographic variables. With this model, we examined three research questions. First, what are the over time latent patterns of: (a) monetary transfers to adult children, (b) receipts from adult children, and (c) interactive patterns of intergenerational exchanges? Second, what were the probabilities of giving and receiving transfers at the beginning of the study, and how do these probabilities change over time? Finally, how were the probabilities of participating in intergenerational transfers related to both time invariant and time variant predictor variables? Time invariant predictors included participants’ age, sex, race, ethnicity, and educational achievement. Time varying predictors included rurality of residence, marital status, and household income.

Methods

Data and Participants

Data for this study were drawn from three waves (i.e., 1998, 2000, and 2002) of the Health and Retirement Study (HRS). Data for this study were first collected in 1992 from persons born between the years 1931 and 1941. Since 1992, data have been collected biannually and additional cohorts have been added to the study. In fact, we examined data from the 1998-2002 waves because data from the so-called War Babies (born between 1942 and 1947, inclusively) and Children of the Depression (born between 1924 and 1930, inclusively) cohorts first became available in 1998. Participants in four cohorts were included. These were the Aging and Health Dynamics (born prior to 1923), Children of the Depression (1923–1930), Health and Retirement (1931–1941), and War Babies (1942–1947). In the end, the sample for this study was nationally representative of Americans born prior to 1948.

Data in the HRS may be analyzed using a household or an individual unit of analysis. Households in the HRS sometimes contribute two individual responses. Because we were interested in individual level predictor variables, we examined these data using an individual level of analysis. For households that contributed two cases to the study, a single case was randomly selected to preserve the assumption on non-independent responses. Also, because we were interested only in transfers between older persons and adult children, only participants who had adult children not co-residing with them were included. After the baseline data were observed in 1998, it was found that attrition rates were about 6.8% in 2000 and 6.2% in 2002. Preliminary analyses found that participants who dropped out of the study over time were significantly different from those who persisted in that those who persisted in the study were younger, more likely to be female, and more highly educated than participants who were excluded because of missing data in later waves. In the end, our analyses were based on data collected from 9,674 individual participants.

As can be seen in Table 1, participants ranged in age from 51 years old to 103 years old, with a mean of about 67 years (SD = 9.9). About 57% of participants were female, and most (76%) were White. Black participants comprised about 15% of the sample, and about 8% were Hispanic. Most participants (52%) had a high school degree, and 20% had a college degree. However, 27% did not have a high school degree.

In the first wave of data collection, about 58% of participants were married. This proportion decreased in each successive wave to 55% in 2000 and to 52% in 2002. The decrease in the married participants was mirrored by an increase in the proportion of widowed participants beginning with 26% in 1998 and increasing to 29% and 32% in 2000 and 2002, respectively. The proportion of separated, divorced, or single participants (16%) remained stable across all three waves.

Measures

Predicted Variables

Because we were primarily interested in examining variations between participants who exchanged or did not exchange resources with adult children, a binary variable was used to indicate whether an exchange took place. Interviewers asked participants whether they had given or received a transfer of $500 or more in the two prior years. As indicators of transfers to children states, participants who had given transfers to adult children in the two years prior to data collection were coded as 1 and 0, if otherwise. Similarly, as indicators of membership in receiving transfer states, participants who had received assistance from adult children were coded 1 and 0 if otherwise. About 35% of participants were in the transfer to children state in 1998 and 2000, and about 31% were in the same state in 2002. Only about 5% of participants received monetary assistance from children in 1998 and 2000, and only slightly more, (6%) received assistance in 2002 (see Table 1).

Time Invariant Predictor Variables

Participants’ age at the beginning of the study was included in the models. Although participants aged over the course of the longitudinal study, age is perfectly correlated with time and it was, therefore, appropriate to include age as a time invariant variable. Sex was recoded so that female participants were coded 1 and male participants were coded 0. Indicators of race and ethnicity available in HRS were collapsed into a three categories (White, Black, and Hispanic) and each category was described with a binary indicator (1 = yes; 0 = otherwise). Non-Black and non-Hispanic minorities were excluded from the sample because there were insufficient numbers of them to make reliable estimates. Similarly, educational achievement was collapsed into three binary variables (less than high school, high school graduate, and college graduate) and each variable was described with a binary indicator.

Time Varying Predictor Variables

The indicator for rurality was based on the Beale Rural-Urban Continuum Code (Butler and Beale 1994). This is a ten-point scale that ranges from zero to nine, and higher numbers correspond with increasing rurality. Although this scale was not available in the public release version of the HRS, the reduced version of this scale was available. Specifically, this reduced scale collapsed the ten category scale into three categories: urban, exurban, and rural urban corresponds to code 0 on the Beale Rural-Urban Continuum. Exurban corresponds to codes 1 and 2 and, Rural corresponds to codes 3–9 on the Beale Rural-Urban Continuum. Log transformations of annual income were included as time varying predictor variables. These transformations were made to partially correct for the non-normal distribution of the raw data. Finally, marital status was described by recoding original HRS data into three binary variables (married; separated, divorced, or single; and widowed).

Analytical Approach

We examined our hypotheses using Latent Transition Analyses (LTA) models with covariates (Bartholomew 1987; Goodman 1974; Muthén et al. 1992; Vermunt et al. 1999). For longitudinal and categorical data, LTA examines the probability of a participant transiting to a current category of membership given that participant’s category of membership in a prior stage. Thereby, LTA estimates the probabilities of changes in membership over time. In the case of this study, LTA estimated the latent transition patterns of membership over time in the categories of transfer and no transfer. Three LTA models were constructed. The first predicted over time transfers from parents to children. The second predicted over time transfers that parents received from children. The third examined dynamic interactions between transfers to and transfers from adult children.

LTA is particularly useful for examining the data in three ways. First, LTA identifies latent transition patterns. The fits of the estimated patterns were estimated using chi-square Pearson tests that compared the estimated patterns to the observed transition patterns. Insignificant chi-square values indicated insignificant differences between the estimated and observed latent transition pattern, thus indicating better model fit.

Second, LTA is useful for examining the probability of research participants to be in particular states at the first data collection point and, given membership in a state, predicting the probability that research participants remained in, or changed states over time. In the context of our study, states were defined by whether or not participants had given monetary transfers, as well as whether participants had received monetary transfers. Participants could be in the transfer state that was coded as 1. Or, participants could be in the no transfer transfer state that was coded 0. Participants could also be in the received state that was coded as 1, or in the not received state that was coded 0.

In addition, the LTA model estimated how individuals’ state memberships may be a function of both time invariant and time variant predictor variables. Maximum likelihood estimation methods with robust standard errors (Muthén and Muthén 2006) were used to estimate models that described over time probability in state memberships, as well as how predictor variables were related to those state memberships (Muthén and Muthén 2003).

Results

Latent Transition Patterns

Table 2 presents the estimated latent transfer patterns compared to observed transfer patterns over the three waves of data collection. The low chi-square values on major patterns of monetary transfers suggest that there are insignificant differences between the observed and the estimated patterns, thus, it is a good model fit in general. Based on the observed data, some basic characteristics of these patterns can be generated as indicated below.

The first model described over time transfers from parents to adult children. As can be seen in the table, there are three general patterns: stable patterns, occasional patterns, and frequent patterns. Two patterns are characterized by stability (i.e., 000 and 111). The first stable pattern is that parents did not give any assistance to adult children—about 44% of participants. The second stable pattern is that parents gave money to their adult children in each wave of the study—about 14% of participants. The second pattern is that parents gave monetary assistance to adult children occasionally. That is, they gave assistance to adult children at a single time point in the study (i.e., 100, 010, or 001). This pattern is consistent with about 23% of participants. About 18% of participants gave financial assistance to children frequently. That is, they gave assistance to adult children in two out of the three time points (i.e., 011, 101, 110).

In regard to transfers that parents received from adult children, stability characterized about 90% of cases. Specifically, 89% of participants did not receive any monetary gift during the six years of this study. Less than 1% indicated that they had always received financial assistance from adult children. About 7% had occasionally received assistance from adult children, and the remaining 3% had frequently received assistance. In other words, most participants did not receive monetary resources from adult children. At the same time, about 11% of participants did receive resources, a small, but substantive proportion.

There were as many as 62 individual patterns of transfers in the interactive model. Only the most frequent 11 patterns are described and it is estimated that nearly 93% of participants are described by one of these 11 patterns. As can be seen in Table 2, 38% of participants reported that there were no financial transfers in either direction during the years of this study. Although only 38% of the participants fit this pattern, this was by far the most common pattern of over time transfers. It is also important to note that of the 11 most common patterns of transfers, there was no pattern that indicated that monetary resources flowed in both directions over time.

Latent Transition Probabilities

Transfers to Children

Over time probabilities of state membership were estimated and these estimates are described in Fig. 2. As can be seen, stability characterizes over time transitions. The probability of remaining in the transfer state was .82 between 1998 and 2000 and was .76 between 2000 and 2002. In comparison, the probability of remaining in the no transfer state was higher. Specifically, the probability of remaining in no transfer state was .88 between 1998 and 2000. The probability of remaining in the no transfer state was .93 between 2000 and 2002. There was a slight preference for remaining in the no transfer state as compared to the transfer state. Specifically, the probability of remaining in the no transfer state was 1.1 to 1.2 times higher over the course of the study. (Figs. 3 and 4).

Transfers from Children

Over time probabilities of state membership in regard to receiving monetary transfers from children were also stable. For example, the probability of remaining in the receiving state was .70 and .75 for the time periods of 1998 to 2000 and 2000 to 2002, respectively. The probability for remaining in the not receiving state was .97 and .95 for the same respective time periods. Note that the probability of remaining in the not receiving state was 1.4 to 1.3 times higher than for remaining in the receiving state, indicating a preference for not receiving assistance from adult children.

Interactive Model of Transfers

Next, a model that examined over-time dynamics of transfers both to and from children were examined. Although probabilities of state transitions varied across time, those variations were relatively small, and two consistent patterns emerged. First, state membership was stable over time. Second, there was little evidence for an interactive model of over time state transitions. For example, the model suggested that participants in the receiving state in 1998 were less likely to be members of the transfer state in 2000 than the no transfer state. Specifically, the probability of transition from the receiving state in 1998 to the transfer state in 2000 was .30, compared to the probability of transition from the not receiving state to the transfer state in 2000 which was .45. In other words, the probability of the transition from the not receiving state in 1998 to the transfer state in 2000 was 1.5 times higher than the probability of the transition from the receiving state in 1998 to the transfer state in 2000.

When transitions between states in 2000 and states in 2002 were considered, a similar pattern emerged. The probability that membership in the not receiving state in 2000 would transition to the transfer state in 2002 (i.e., .40) was about 1.7 times higher than the probability of the transition from the receiving state in 2000 to the transfer state in 2002 (.24).

Predicting State Membership: Time-Invariant and Time Variant Predictors

As noted previously, we examined state membership over three waves of data. More specifically, both time invariant and time variant predictor variables were regressed on state membership in each of the three waves of data. Also, in the second and third waves of data, prior state memberships were used as predictors of later state memberships.

Transfer to Children Model

This model predicted the probability of membership in the transfer state over the three waves of data collection. As can be seen in Table 3, nearly each variable was related to the probability of transferring monetary resources to adult children in 1998. Female participants were less likely than male participants to make monetary transfers to children. Hispanic participants were less likely than White participants to transfer monetary resources to adult children, but there was no difference in transfer probabilities between Black and White participants. Measures of socio-economic status (e.g., household income in 1998 and educational achievement) were all positively related to the probability of monetary transfers to adult children. Both widowed and unmarried participants in 1998 were more likely than those who were married to transfer resources to adult children. Also, suburban and rural participants were less likely to transfer monetary resources in 1998 than were urban participants.

State membership in 1998 was strongly related to state membership in 2000. Specifically, those who had transferred monetary resources to children in 1998 were over 25 times more likely to transfer resources again in 2000. Household income was also positively related to the probability of transferring resources, as was being widowed or unmarried, in comparison to being married. Note that no time-invariant variables were directly predictive of state membership in 2000, but most were indirectly predictive in that they were related to state membership in 1998.

Participants, who had transferred resources in the previous wave, were nearly 30 times more likely to transfer resources in 2002 compared to those who had not transferred monetary resources in the previous wave. Household income in 2002 was positively related to the probability of transferring resources. Participants without high school degrees were less likely than those with a high school degree to transfer resources to adult children in 2002. This relationship was over and above the effect of previous transfers and household income. Age was negatively related to the probability of transferring resources to adult children, and widowed participants were more likely than those who were married to transfer resources to adult children.

Received from Children Model

This model predicted the probability of membership in the receiving state. Receiving resources from adult children in 1998 was negatively related to participants’ annual income. Female participants were 1.6 times more likely than males to receive monetary assistance from adult children. Black participants were more than twice as likely and Hispanic participants were nearly twice as likely to receive monetary assistance from their adult children, as compared to White participants. Receiving monetary assistance from adult children was not related to educational achievement. Widowed participants were 1.6 times more likely and unmarried participants were 1.4 times more likely to receive assistance from adult children than were married participants. There were no differences in the probability of receiving assistance based on geographic location.

Again, state membership in 1998 was a strong predictor of state membership in 2000. Specifically, compared to those who had not received monetary assistance, participants who had received assistance in 1998 were nearly 40 times more likely to also receive assistance in 2000. Household income in 2000 continued to be negatively related to the probability of receiving assistance. Black participants were more likely than White participants to receive assistance from their adult children in 2000, and married participants were less likely than either widowed or unmarried participants to have received assistance in 2000.

Those who received monetary assistance in 2000 were more than 48 times as likely to also have received assistance in 2002. Again, age was negatively related to receiving assistance in 2002. Women were more likely than men to receive monetary assistance. Hispanic participants were more than twice as likely to receive assistance as compared to White participants, and those with college degrees were less likely to receive assistance than those with only high school degrees.

Interactive Predictive Model

As can be seen in Table 3, there was little evidence to support an interactive model of over time transfers between older persons and their adult children. In fact, the previous unilateral transfer models were largely replicated in the interactive model with few differences that did not lead to substantive reinterpretation of the results. Although this finding was at odds with expected findings in regard to reciprocity concerns, it should be noted that the study examined transfers over 6 years only, and it is likely that transfers may have been reciprocated before or after the time period covered by this study. In fact, this study suggests that contextual concerns measured by both the time invariant and time variant predictor variables were more useful in regard to understanding over time transfers and receipts of monetary resources.

Discussion

Generally, this research found that monetary intergenerational transfers were stable over time. That is, giving or receiving assistance in earlier years was highly predictive of giving or receiving assistance in later years. However, receiving assistance in early years was not predictive of giving assistance in later years, nor was giving assistance related to receiving assistance. In other words, while the exchange perspective has received considerable empirical support from past studies (Stum 2000), this study suggests that principles of reciprocity are likely worked out over longer time periods than 6 years as was covered by this study, consistent with findings or previous studies (Henretta et al. 1997). Also, as Koh and MacDonald (2006) have suggested, it is likely that reciprocity is worked out in varying mediums of exchange (MacDonald and Koh 2003; Caputo 2002).

In regard to our first research question, we found that longitudinal patterns of whether or not participants transferred money to and received money from adult children were relatively stable, although it is possible that the amounts varied greatly. That is, participants in a given state at the first wave of the study were more likely to remain in that state in subsequent waves of data collection. Note that stability characterized about 58% of transfers to adult children and nearly 90% of monetary assistance received from adult children. These findings are consistent with previous research (Soldo and Hill 1995; Stark 1995). Also, as can be seen in the interactive model, transfers to children were seldom reciprocated over the time period covered by the study. Taken together, these findings are more consistent with altruistic models of transfers than reciprocal models.

In regard to our second research question, we found that state membership in the first wave of the study was predictive of state membership in subsequent waves. For the few participants who made changes in state membership in the second wave of the study, they were likely to change back to the original state in wave 3 of the study. An examination of the interactive model suggested that participants in the transfer state were about 32 times more likely to be in the not received state in each wave of the study, and also at odds with the exchange model of intergenerational exchange.

For our third research question, we generally found that, with only a few exceptions, the predictor variables were significantly related to transfers or receipts in predicted directions. However, marital status and household income variables were the only time-variant variables that were significantly related to over time changes in transfer or receipt states. Specifically, it was found that single older persons were both more likely to give and less likely to receive monetary resources from adult children, but the transition to widowhood increased the likelihood of both receiving and giving assistance to adult children. Our findings are largely consistent with Ha et al. (2006) who found that the transition to widowhood was one of the most important predictors of intergenerational assistance. Specifically, their findings suggested that widowhood increases intergenerational dependency on adult children, evident in increased exchange intensity. These findings are also consistent with hierarchical-compensatory and convoy models of support (Antonucci and Akiyama, 1995; Cantor 1979; Cao 2006; Connidis 2001).

One of the limitations of our analyses was that we limited transfers to an examination of monetary resources. For example, Koh and MacDonald (2006) also found that monetary transfers to adult children were not reciprocated as monetary transfers to older family members. However, their study also examined caregiving transfers adult children make to aging parents and found that monetary transfers are predictive of caregiving in later life, suggesting that transfers may have been motivated by reciprocity concerns. Henretta et al. (1997) also found that monetary resources may be reciprocated by caregiving assistance. Second, it should be noted that the study examined transfers over a period of 6 years only. The finding that exchanges were not reciprocated may be because the period of time was not sufficiently long enough to examine reciprocal transfers that occurred before or after the study. Finally, transfers were operationalized as binary variables, and the over time patterns of the amounts of transfers may have yielded results different from those observed in the binary outcomes.

As concerns for the growing old-age dependency ratio have increased, discussions about how families may provide caregiving services to older family members have also increased. As a result, a greater understanding of the availability and willingness of family members to provide assistance to older family members is likely to grow in importance as public resources become increasingly scarce.

References

Administration on Aging. (2003). A profile of older Americans: 2003. Washington, DC: U.S. Department of Health and Human Services.

Allen, S. M., Goldscheider, F., & Ciambrone, D. A. (1999). Gender roles, marital intimacy, and nomination of spouse as primary caregiver. The Gerontologist, 39, 150–158.

Angel, R., & Angel, J. L. (1997). Who will care for us?: Aging and long-term care in multicultural America. New York: New York University Press.

Antonucci, T. C., & Akiyama, H. (1995). Convoys of social relations: Family and friendships within a life span context. In R. Blieszner & V. H. Bedford (Eds.), Handbook of aging and the family (pp. 335–371). Westport, CT: Greenwood.

Bartholomew, D. J. (1987). Latent variable models and factor analysis. London: Griffin.

Brakman, S. V. (1995). Filial responsibility and decision-making. In L. B. McCullough & N. L. Wilson (Eds.), Long term care decisions: Ethical and conceptual dimensions (pp. 181–196). Baltimore: Johns Hopkins University Press.

Butler, M. A., & Beale, C. L. (1994). Rural-urban continuum codes for metro and monmetro counties, 1993. Washington, DC: U.S. Department of Agriculture, Economic Research Service, Agricultural and Rural Economy Division.

Cantor, M. (1979). Neighbors and friends: An overlooked resource in the informal support system. Research on Aging, 1, 434–463.

Cao, H. (2006). Time and financial transfers within and beyond the family. Journal of Family and Economic Issues, 27, 375–400.

Caputo, R. K. (2002). Adult daughters as parental caregivers: Rational actors versus rational agents. Journal of Family and Economic Issues, 23, 27–50.

Connidis, I. A. (2001). Family ties and aging. Thousand Oaks, CA: Sage.

Coward, R. C., Cutler, S. J., & Schmidt, F. E. (1989). Differences in the household compositions of elders by age, gender, and area of residence. Gerontologist, 29, 814–821.

Coward, R. T., Lee, G. R., & Dwyer, J. W. (1993). The family relations of rural elders. In C. N. Bull (Ed.), Aging in rural America (pp. 216–231). Thousand Oaks, CA: Sage.

Cox, D., & Jakubson, G. (1995). The connection between public transfers and interfamily private transfers. The Review of Economics and Statistics, 74, 305–314.

Cox, D., & Rank, M. (1992). Inter-vivos transfers and intergenerational exchange. The Review of Economics and Statistics, 74, 305–315.

Dosman, D., Fast, J., Chapman, S. A., & Keating, N. (2006). Retirement and productive activity in later life. Journal of Family and Economic Issues, 27, 401–419.

Dowd, J. J. (1975). Aging as exchange: A preface to theory. Journal of Gerontology, 30, 585–594.

Dunn, T. A., & Phillips, J. W. (1997). The timing and division of parental transfers to children. Economics Letters, 54, 135–137.

Dwyer, J. W., & Coward, R. T. (1991). A multivariate comparison of the involvement of adult sons versus daughters in the care of impaired parents. Journal of Gerontology: Social Sciences, 46, S259–S269.

Goodman, L. A. (1974). Exploratory latent structure analysis using both identifiable and unidentifiable models. Biometrika, 61, 215–231.

Ha, J., Carr, D., Utz, R. L., & Nesse, R. (2006). Older adults’ perceptions of intergenerational support after widowhood. Do men and women differ? Journal of Family Issues, 27, 3–30.

Hans, J. D., Ganong, L. H., & Coleman, M. (2009). Financial responsibilities toward older parents and stepparents following divorce and remarriage. Journal of Family and Economic Issues, 30, 55–66.

Harrington-Meyer, M., & Bellas, M. L. (1995). U.S. old-age policy and the family. In R. Blieszner & V. H. Bedford (Eds.), Handbook of aging and the family (pp. 263–283). Westport, CT: Greenwood.

Hayhoe, C. R., & Stevenson, M. L. (2007). Financial attitudes and inter vivos resource transfers from older parents to adult children. Journal of Family and Economic Issues, 28, 123–135.

Henretta, J. C., Hill, M. S., Li, W., Soldo, B. J., & Wolf, D. A. (1997). Selection of children to provide care: The effect of earlier parental transfers. The Journals of Gerontology: Series B, 52B, 110–119.

Hogan, D. P., Eggebeen, D. J., & Clogg, C. C. (1993). The structure of intergenerational exchanges in American families. American Journal of Sociology, 98, 1428–1458.

Holtz-Eakin, D., & Smeeding, T. M. (1994). Income, wealth, and intergenerational economic relations of the aged. In L. G. Martin & S. H. Preston (Eds.), Demography of aging (pp. 102–145). Washington, DC: National Academy Press.

Ikkink, K. K., Tilburg, T., & Knipscheer, K. (1999). Perceived instrumental support exchanges in relationships between elderly parents and their adult children: Normative and structural explanations. Journal of Marriage and the Family, 61, 831–844.

Koh, S., & MacDonald, M. (2006). Financial reciprocity and elder care: Interdependent resource transfers. Journal of Family and Economic Issues, 27, 420–436.

Kolodinsky, J., & Shirey, L. (2000). The impact of living with an elder parent on adult daughter’s labor supply and hours of work. Journal of Family and Economic Issues, 21, 177–202.

Lai, C. W. (2008). How retired households and households approaching retirement handle their equity investments in the United States. Journal of Family and Economic Issues, 29, 601–622.

MacDonald, M., & Koh, S. (2003). Consistent motives for inter-family transfers: Simple altruism. Journal of Family and Economic Issues, 24, 73–97.

McGarry, K., & Schoeni, R. F. (1997). Transfer behavior within the family: Results from the asset and health dynamics Study. The Journals of Gerontology, 52B, 82–92.

Muthén, L. K., Collins, L. M., & Wugalter, S. E. (1992). Latent class models for stage-sequential dynamic latent variables. Multivariate Behavioral Research, 27, 131–157.

Muthén, L. K., & Muthén, B. O. (2003). Modeling with categorical latent variables using Mplus. Mplus short courses. Los Angeles: Muthén & Muthén.

Muthén, L. K., & Muthén, B. O. (2006). Mplus user’s guide. Los Angeles: Muthén & Muthén.

Nelson, G. M., & Salmon, M. A. P. (1993). The rural factor in developing state and local systems of home and community care. In C. N. Bull (Ed.), Aging in rural America (pp. 189–203). Thousand Oaks, CA: Sage.

Nichols, L., & Junk, V. (1997). The sandwich generation: Dependency, proximity, and task assistance needs of parents. Journal of Family and Economic Issues, 18, 299–326.

Pagani, L., & Marenzi, A. (2008). The labor market participation of sandwich generation Italian women. Journal of Family and Economic Issues, 29, 427–444.

Rossi, A. S., & Rossi, P. H. (1990). Of human bonding: Parent-child relations across the life course. New York: DeGruyter.

Schaeber, P. L., & Stum, M. S. (2007). Factors impacting group long-term care insurance enrollment decisions. Journal of Family and Economic Issues, 28, 189–205.

Silverstein, M., Conroy, S. J., Wang, H., Giarrusso, R., & Bengtson, V. L. (2002). Reciprocity in parent-child relations over the adult life course. Journal of Gerontology: Social Sciences, 57B, S3–S13.

Social Security Administration. (2002). Income of the population aged 55 and older: 2000. Publication No. 13-11871. Washington, DC: U.S. Government Printing Office.

Soldo, B. J., & Hill, M. S. (1995). Family structure and transfer measures in the health and retirement study: Background and overview. The Journal of Human Resources, 30, S108–S137.

Stark, O. (1995). Altruism and beyond. An economic analysis of transfers and exchanges within families and groups. Cambridge, NY: Cambridge University Press.

Stone, R., Cafferata, G. L., & Sangl, J. (1987). Caregivers of the frail elderly: A national profile. The Gerontologist, 27, 616–626.

Stum, M. S. (2000). Families and inheritance decisions: Examining non-titled property transfers. Journal of Family and Economic Issues, 21, 177–202.

Stum, M. S. (2001). Financing long-term care: Examining decision outcomes and systemic influences from the perspective of family members. Journal of Family and Economic Issues, 22, 25–53.

Szinovacz, M. E., DeViney, S., & Davey, A. (2001). Influences of family obligations and relationships on retirement: Variations by gender, race, and marital status. The Journal of Gerontology, 56B, S20–S27.

Ulker, A. (2009). Wealth holdings and portfolio allocation of the elderly: The role of marital history. Journal of Family and Economic Issues, 30, 90–108.

U.S. Bureau of the Census. (2000). Money income in the United States, 1999. Current Population Reports (pp. 60–209). Washington DC: U.S. Government Printing Office.

Vermunt, J. K., Langeheine, R., & Böckenholt, U. (1999). Discrete-time discrete-state latent Markov models with time-constant and time-varying covariates. Journal of Educational and Behavioral Statistics, 24, 178–205.

Acknowledgment

This research was supported by the National Research Initiative of the Cooperative State Research, Education and Extension Service, USDA Grant #2005-35401-16027.

Author information

Authors and Affiliations

Corresponding author

Additional information

Dr. Xuewen Sheng completed this research at the University of Arkansas as a Post-Doctoral Research Associate.

Rights and permissions

About this article

Cite this article

Sheng, X., Killian, T.S. Over Time Dynamics of Monetary Intergenerational Exchanges. J Fam Econ Iss 30, 268–281 (2009). https://doi.org/10.1007/s10834-009-9159-6

Published:

Issue Date:

DOI: https://doi.org/10.1007/s10834-009-9159-6