Abstract

This paper examines factors that influence whether or not employees choose to enroll in a group long-term care insurance plan. A conceptual family decision-making framework is used to group factors to study the enrollment decision of 509 state employees who were offered a long-term care insurance plan in 2000. Logistic regression results revealed that employee age, perceived risk, perceived affordability, decision-making style (communication with others and use of information), goals of control and choice, goal of financial peace of mind, household income, and potential caregiver availability explained 68.7% of the decision to enroll. Results support the key role of perception, specifically the perceived risk of needing long-term care and the affordability of the insurance plan, in the decision outcome.

Similar content being viewed by others

Explore related subjects

Discover the latest articles, news and stories from top researchers in related subjects.Avoid common mistakes on your manuscript.

Introduction

Group long-term care insurance (LTCI) is receiving increasing attention as the emphasis on personal responsibility for financing long-term care increases. An increasing number of private and public employers offer LTCI as a worker benefit and more employees are facing decisions about LTCI enrollment as a long-term care risk management strategy. However, relatively little is known about how employees actually make LTCI decisions. Employee benefit decisions have often been examined solely as an interaction between the individual employee and employer. Little attention has been paid to the context in which such decisions are made, including the family system of the employee. This study applies a family decision-making conceptual framework to understand the decision context, as well as the perception and decision processes that contribute to LTCI enrollment as a decision outcome. This study focuses on examining the specific factors that have the largest impact on differences between enrollees and non-enrollees of employer-sponsored group LTCI.

When employees are offered employer-sponsored LTCI, the percent of employees who enroll is typically 2–20% (Health Insurance Association America [HIAA], 2001). On an average, fewer than 8% of workers offered this benefit added it to their employee benefit package. More often, the enrollment rates were less than 5–7% (HIAA, 2001). Current theoretical frameworks and empirical knowledge regarding LTCI decision-making processes and outcomes are limited. Relatively few published studies have specifically examined factors influencing the purchase of group LTCI (HIAA, 2001; Stucki, 2001b; Stum, Zuiker, Pelletier, & Hope, 2001). The majority of studies have focused on examining the purchase of LTCI as an individual policy versus group plan (HIAA, 1995, 2000; McCall, Mangle, Bauer, & Knickman, 1998; Mellor, 2000; Stucki, 2000, 2001a; Swamy, 2004). A theoretical basis for understanding the range of factors affecting whether or not employees enroll in group LTCI is absent from much of the literature. Stum et al. (2001) used a three-tiered systems framework to examine group LTCI decision-making processes and outcomes. Swamy (2004) applied a consumer purchasing model (Engel-Blackwell-Miniard) to explore the role of knowledge and attitudes on group and individual LTCI decisions. These two studies are also the only ones that have used multivariate analysis to examine factors influencing enrollment decisions (Stum et al., 2001; Swamy, 2004).

Due to these gaps in the literature, it is difficult to understand what group LTCI decision-making factors can and/or should be influenced and by whom. This study addresses these gaps and offers policymakers and practitioners a conceptually solid foundation to identify factors that impact decisions related to the purchase/use of employer-sponsored LTCI.

Literature Review and Conceptual Framework

Figure 1 depicts the family decision-making conceptual framework that underlies this study. This framework is based on existing theories in family decision-making (Rettig, 1993), human ecological systems (Bubolz & Sontag, 1993), and decision making in financing long-term care (Stum, 2001). Rettig’s (1993) family decision-making theory reinforces the role of factors within the decision context, including perception and decision processes as interacting influences on decision outcomes.

Decision Context

Decision context variables are those static or unchangeable factors that the respondent brings to the decision-making situation, generally not influenced by perceptions or information. Four contextual factors that individual employees bring to the decision situation are proposed to influence the decision processes and outcomes. These factors are (a) age, (b) gender, (c) self-reported health status, and (d) prior experience with long-term care. Age is expected to influence enrollment patterns with individuals nearing or in retirement more likely to purchase LTCI than younger individuals. While individuals in the group LTCI market have a median age of 49 years (HIAA, 2001; Stum et al., 2001), the mean age of individual LTCI policyholders is 67 years (HIAA, 2000). Age of an individual is an important factor given that LTCI premiums are tied to age at purchase. With females enrolling in group LTCI plans at greater rates than men, gender is also expected to be an influential factor. Stum et al. (2001), Stucki (2001b), and the HIAA (2001) studies reported a 58% to 42% ratio of female to male enrollees. In part due to longer life expectancies and outliving their informal caregivers, women have a greater risk of needing long-term care than men (Bureau of the Census, 2000; Jecker, 2001; Waidmann, 2003). In both individual and group LTCI enrollments, individuals with poorer health were more likely to own/enroll in LTCI than individuals in excellent health (Stucki, 2001a, 2001b; Stum et al., 2001). We expect that both individuals who have prior experience with long-term caregiving and individuals with a high risk of impoverishment (due to long-term care costs) will be more receptive to LTCI as a risk management strategy. Non-enrollees were more likely to lack personal experience with long-term care than the enrollees in both Stucki (2001a) and Stum et al. (2001) studies. Stucki (2001a) found that most group enrollees had provided some type of care for a family member or friend. This reinforced the role prior long-term care experience (providing or paying for) had on enrollment decisions.

Perception Processes: Feeling

Perception is considered a filtering process that influences how families view the problem, their resources, and potential solutions (Rettig, 1993). We propose that LTCI enrollment decisions will be influenced by how a person perceives the risk of needing long-term care (or the problem), the availability of financial capital and caregiver availability (as resources to help solve the problem), and the role of private and public financing solutions.

Not surprisingly, studies have found that individuals who perceive a greater risk of needing long-term care are also more likely to purchase coverage (HIAA, 2001). In the HIAA (2001) study, 25% of non-buyers claimed the reason for not enrolling was due to a low perceived risk of needing care. Perceived financial resources have consistently been found as reasons for not enrolling in LTCI coverage. In a study of group LTCI, 52% cited “too costly” and “lack of affordability” as primary reasons for not enrolling in LTCI (HIAA, 2000; Swamy, 2004). For the younger group market, competing financial responsibilities were a reason to not enroll (Stucki, 2001b). It was also anticipated that an individual’s perception of available caregivers as a type of resource would influence enrollment decisions. McCall et al. (1998) found lack of caregivers to be a factor in the decision to purchase LTCI. We also expect that enrollment will be influenced by an individual’s perceived solutions to financing long-term care. Previous studies indicated the majority of individuals believe that long-term care is an individual responsibility and that the government should not shoulder the financial costs (HIAA, 1995, 2000, 2001; Stucki, 2001a, 2001b; Stum et al., 2001). We expect individuals who believe in personal responsibility for financing long-term care will be more likely to enroll in LTCI.

Decision Processes: Thinking

Decision-making is a cognitive (vs. emotional) process that encompasses seeking relevant information, assessing the alternatives, and planning for the future (Rettig, 1993). We expect that a person’s “decision-making style,” the knowledge and confidence in that knowledge to solve the problem, the financial goals, and the actual resources available to implement the decision will influence the LTCI enrollment decision.

Decision-making style refers to the manner in which a person approaches the decision, whether he or she discusses it with many people and uses many informational materials or approaches the decision autonomously in a more isolated manner (Paolucci, Hall, & Axinn, 1977). Studies have found that employees who enrolled in a group plan discussed the benefit with spouses, coworkers, employers, or individuals connected to the work setting more than those who did not enroll (HIAA, 2001; Stum et al., 2001). HIAA (2001) reported that two-thirds of enrollees discussed the decision mainly with their spouse. This supports Henkens’ (1999) findings that spousal support was the key influence in family decisions related to household finances. The decision phase is also expected to be influenced by a person’s knowledge and confidence about that knowledge to make an informed decision. Stum et al. (2001) found enrollees of group LTCI policies had greater knowledge of the risk, costs, and alternatives to long-term care; they were also more self-confident when compared to non-enrollees. It is expected that group enrollees in LTCI will have multiple goals competing for limited resources. Stum (2000), in a qualitative study, identified six competing goal patterns that families considered when coping with long-term care: (a) maintaining financial independence or self-sufficiency for self and spouse, (b) maintaining control and choice over the services needed, (c) maintaining privacy around financial matters, (d) using government resources when entitled, (e) leaving an inheritance, and (f) financial peace of mind. Additional studies have identified independence, asset protection, protecting one’s standard of living or lifestyle in retirement, and avoiding dependence on others as reasons for purchasing LTCI (HIAA, 2000; Stucki, 2001b).

Actual financial capital and caregiving resources are expected to be influencing factors in the decision phase. In a study of who buys LTCI in the workplace, enrolled employees had higher incomes and more assets than non-enrollees (HIAA, 2001). The vast majority of group LTCI enrollees have been positioned in the middle to higher income ranges (over $24,000) (HIAA, 2001; Stucki, 2001b; Stum et al., 2001). If the buyer’s assets were in mid-range ($100,000 to $200,000) they were found to be a factor in the individual LTCI enrollment decision (McCall et al., 1998; Mellor, 2000; Sloan & Norton, 1997). In addition to financial resources, the family structure or availability of caregivers as a source of informal long-term care is expected to influence the purchase of LTCI. However, Mellor (2000) found no significant effects of the availability of informal caregivers when examining insurance ownership and intentions to purchase.

In summary, it is expected that significant differences in group long-term care insurance enrollees and non-enrollees will be explained by a combination of factors within the decision making framework: decision context, perception, and decision processes. Based on the literature related to decision context, this study hypothesizes that employees most likely to enroll in LTCI will be those who are older, female, have poorer health, and have had prior experiences with long-term care. In the perception process, it is hypothesized that employees most likely to enroll in LTCI will be those who perceive (a) themselves to be at higher risk for long-term care, (b) the plan to be affordable, (c) fewer potential caregivers, and (d) that individuals should be responsible for long-term care. In the decision process, it is hypothesized that employees who gather more information and discuss the plan with more people will enroll. It s also expected that those who have greater knowledge in long-term care and confidence in that knowledge will enroll. In addition, it is hypothesized that enrollees will rank specific financial goals as more important, have higher income and assets, and fewer potential family caregivers. This study will explore the impact of each of these factors on the enrollment decision.

Method

A stratified random sample of 1,600 individuals (800 enrollees and 800 non-enrollees) was selected from slightly over 61,000 public employees. All employees were eligible to purchase long-term care coverage as a part of a benefits package offered in Fall 2000. A 53% overall response rate resulted in 830 completed questionnaires (504 enrollees and 326 non-enrollees). Non-enrollees may be less apt to respond to a survey regarding an optional benefit offering they did not purchase. For hierarchical logistic regression analysis, only cases with complete data on all variables in the proposed model were included in the study sample; this resulted in a final sample size of 509 (317 enrollees and 192 non-enrollees). The resulting sample size provided a 95% confidence level with a maximum error range of ±5%. The missing data points were spread across 21 of the 22 parameters with ranges from 1.8% to 15.8% of missing values for any one parameter and with the majority around 2–3%.

The population examined was of particular interest given that an 18% enrollment rate greatly exceeded the industry norm and sponsors’ expectations. The long-term care coverage was optional, portable, and paid 100% with employee contributions. The results are generalizable to the entire eligible employee population. Other existing studies have not been able to generalize to all eligible employees given that their sample selection was from only those who requested LTCI information.

Data Collection

This study used data collected from a previous study that investigated LTCI decision-making from the employee perspective (Stum et al., 2001). Data were collected using a 12-page, mail survey that had two versions, one for enrollees and one for non-enrollees. The two questionnaires were identical in content, but each was worded appropriately for its specific audience. The first mailing included a cover letter inviting participation in the survey, a survey instrument, and a self-addressed, stamped, return envelope. A second and third mailing consisting of a reminder postcard was sent to everyone in the sample; a final reminder was also sent to non-enrollees who had not responded.

Measures

The dependent variable of interest was whether or not an employee chose to enroll in long-term care coverage for themselves or for eligible family members. Enrollees and non-enrollees were identified in the sample selection based on the enrollment records of the underwriting company. Factors within three sets of independent variables were measured using existing survey questions; the variables were grouped by the decision-making framework: decision context, perception processes, and decision processes.

Decision context variables

Age was measured by date of birth (calculated into age in years) and used as a continuous variable. Gender was dichotomous, and dummy coded with male (0) as the reference group. Self-perceived health status was measured by responding to the question, “Compared to other people your age, would you say your health is excellent (1), good (2), fair (3), or poor (4)?” Although this is a subjective response, it is relatively a static measure of health and a good indicator of health and longevity (Ware, 2004). Prior experience with long-term care was measured by a summed score, giving one point if respondents indicated they or anyone close to them had experience with needing, providing, or paying for long-term care, as well as purchasing or using long-term care insurance. The summed score indicated the total types of experience with long-term care and ranged from 0 (no experience) to 4 (all types of experience).

Perception variables.

Respondent attitudes were measured by indicating agreement/disagreement to the statement, “you are willing to take the chance that you won’t need long-term care” using a 4-point scale (strongly agree = 1 to strongly disagree = 4). It is presumed that a respondent with a low perceived risk (strongly agree) may also be a risk taker and a high perceived risk (strongly disagree) may be a non-risk taker. Perceived risk takes into account other life experiences beyond present health such as family history of disease and parental longevity. Perceptions of resources were measured using questions regarding affordability and caregiver availability. Affordability was measured by using a 4-point scale to (1 = strongly agree/very affordable to 4 = strongly disagree/not at all affordable) rate the statement, “The plan was affordable.” Caregiver availability was a composite score calculated by summing the number of people the respondent identified who would be, “Willing and able to provide help over a long period of time.” Four caregiver types were provided: children, other family members, friends, and neighbors (0 = no caregiver types identified and 4 = four caregiver types identified).

To measure perceptions of solutions for financing long-term care, nine items (three per category) pertaining to individual, family, and government responsibility were ranked on a 4-point numerical scale (strongly agree to strongly disagree). Scores were reverse coded and composite scores created by summing responses from the three items in each category (3 = low responsibility to 12 = high responsibility). For the “individual responsibility” category, respondents were asked to indicate (a) if individuals should use their own income and assets, (b) if they should rely on these assets for long-term care, and (c) if long-term care insurance should be purchased to protect against the costs. For the “family responsibility” area, respondents indicated (a) if family members should provide unpaid care, (b) if they should pay for long-term care when the family member is unable, and/or (c) if the family should pay rather than rely on the government to do so. For the “government responsibility” category, respondents were asked to indicate if they believed the government should (a) pay for long-term care, (b) provide new programs to cover costs, and/or (c) provide safety nets for those unable to pay.

Decision variables

Measures of discussion with others and information use were summed to create a composite decision-making style scale. Discussion with others was measured by respondents indicating if they had discussed their long-term care coverage decisions with people within the family (spouse/partner, adult children, parents), people outside the family (human resources, insurance agent, financial planner, co-workers/friends), or with no one at all. Respondents were asked to indicate if they had used any of the ten possible information sources in their decision-making process. A high decision-making style score reflected discussion with the maximum number of people and the use of other resources (17); a low score indicated little to no discussion with others or use of information sources (0).

A previously developed long-term care knowledge test was adapted to measure knowledge regarding long-term care risk, costs, and alternatives (Stum et al., 2001). Agree/disagree answers to a total of 13 items were scored with the right answer given one point and the wrong or missing answer given no points (.61alpha reliability). A composite score was computed ranging from 0 (indicating none correct) to 13 (indicating all correct). The concept of confidence was measured with respondents ranking their degree of confidence on a 4-point scale (1 = extremely confident to 4 = not confident at all) regarding six specific actions involved in long-term care financing decisions (.86 alpha reliability). Scores were reverse coded with a score of 6 indicating “no confidence in making a financial decision” to a score of 24 indicating “extremely confident.”

Financial goals were measured by ranking the importance (4-point scale ranging from “very important” to “not at all important”) of six items referring to six common later life financial goals: financial independence, leaving an inheritance, control and choice, privacy in finances, not relying on government, and financial peace of mind. Scores were reverse coded with 4 indicating an important goal and 1 indicating no importance.

Rather than asking specific amounts and in order to improve response rates, categorical variables were utilized for both household income and assets (value of home was excluded). Income and asset ranges were selected based on a review of income and asset data for households in the state. The income categories included: (a) Less than $30,000, (b) $30,000 to 70,000, (c) $70,000 to 150,000, and (d) More than $150,000. These were categorical variables with (a) Less than $30,000 as the reference group. Asset categories included: (a) Less than $60,000, (b) $60,000 to $140,000, (c) $140,000 to $300,000, and (d) More than $300,000 with (a) Less than $60,000 as the reference group. Actual caregiver availability was measured by “the number of immediate family members who would be most likely to provide informal care if long-term care is needed.” A summed score of the number of living children and a spouse/partner (0 or 1) reported through marital status was created. Responses ranged from 0 indicating “no family members” to the actual number of family members available.

Analysis Procedures

Zero order correlation results were first examined between all independent variables, as well as between the independent and dependent variables using Pearson’s correlation coefficients for continuous variables and Spearman’s rho for categorical variables. Zero-order correlation coefficients among the independent variables were low to moderate, ranging from r = .00–.48; this indicated that multicolinearity was not a problem (data not shown). The items with the highest correlation were Goals: not relying on government and Goals: financial peace of mind (r = .48). As would be expected, income and assets were also moderately correlated (r = .47). Bivariate relationships between the independent and dependent variables were examined using independent sample t-tests for continuous variables and chi-squares for categorical variables. The relative impact of factors in the conceptual model was tested using logistic regression with variable subset entry guided by the proposed decision-making framework: decision context variables, perception variables, and decision variables (Munro, 1997). A comparison of the B coefficients (Log odds), SE B (standard errors), and the β coefficients (odds ratios) tested for significance with a Wald chi-square statistic, was used to identify those factors within the conceptual model that were the strongest contributors to the decision outcome.

Results

Descriptive Overview

Table 1 provides a descriptive profile of the total sample and bivariate differences in all independent variables by LTCI enrollment decision. The typical employee in this sample was female (56%), married (76%), white (96%), and had “good” or “excellent” perceived health status (85%). Employees ranged from 26 to 75 years old with a mean age of 49 years. A majority had living children (72%) with 60% reporting 1–2 children. Almost three-fourths of the sample lived in an urban area (74%) and a majority had some college or higher levels of education (84%). Household incomes of the sample ranged primarily from $30–70,000 (48%) and $70–150,000 (44%). Slightly over a third had household assets (excluding the home) of less than $60,000 (36%) and another 20% had assets of $60,000 to $140,000. Close to 94% of the sample was White/Caucasian; the remainder of the sample was Asian (2.6%), Black/African American (2.1%) and American Indian (0.5%) and reflected the population demographics of the state in which the data was collected (Bureau of the Census, 2000).

Results from the bivariate analysis for the decision context variables indicated that enrollees and non-enrollees differed significantly by age and prior experience. The older employee with more types of prior experience was more likely to enroll. In perception processes, significant differences between enrollees and non-enrollees were found for perceived risk, perceived affordability, and individual or government responsibility as perceived solutions. LTCI enrollees were less likely to be willing to take the chance of needing long-term care and they perceived the LTCI plan as affordable. Enrollees rated individual responsibility for long-term care financing higher than non-enrollees. In contrast, non-enrollees were more likely to rate government responsibility higher than enrollees.

In the decision processes, bivariate results indicated significant differences between enrollees and non-enrollees in decision-making style, knowledge, confidence, actual resources, and three of the six financial goals. Enrollees reported more active and involved decision-making styles by utilizing more input from people and informational materials. Enrollees were also significantly more knowledgeable and more confident regarding long-term care risks, cost, and alternatives. When compared to non-enrollees, enrollees were significantly more likely to rank the goals of control and choice, not relying on the government, and financial peace of mind as important. Income was significantly different between the two groups; more enrollees were represented in the higher income brackets and more non-enrollees were represented in the lower income brackets. Actual caregiver availability measured by people in the family other than the employee also differed significantly. Enrollees were more likely to be single/widowed/divorced and without children than non-enrollees. Non-enrollees tended to report larger family sizes than enrollees.

Relative Influence of Decision-making Factors

Results of the logistic regression were examined to understand which decision-making factors within the decision context, perception, and decision dimensions of the conceptual framework contributed the most explanation to the differences between enrollees and non-enrollees (Table 2). To examine the relative influence of the factors, each set of decision context, perception, and decision variables were entered hierarchically following the theoretical assumptions guiding the framework.

Eight factors were found to be significant in influencing enrollment patterns when controlling for other factors: age, perceived risk, perceived affordability, decision-making style, the goal of control and choice, the goal of peace of mind, income, and actual caregiver availability. Together these factors explained 68.7% of the variation in enrollment patterns (Nagelkerke pseudo r-square with p < .001).

This study hypothesized that four decision context variables would contribute to explaining differences between enrollees/non-enrollees. Only one decision context variable, age of the employee, significantly related to enrollment decisions (odds ratio = 1.089). The odds of enrolling were 1.089 times greater for every year increase in employee age. The gender, health status, and prior experience were not significant when controlling for other factors.

This study hypothesized that six perception variables would explain the enrollment decision. Empirical support was found for two of the six factors expected to influence enrollment patterns, perceived risk (odds ratio = 4.075) and perceived affordability (odds ratio = .151). This indicates that the odds of enrolling were four times greater for each unit increment (Munro, 1997) in perceived risk. When the plan is perceived as unaffordable, the odds of purchasing LTCI were 15.1% less with each increment measure. Perceived caregiver availability and perceived solutions or who should be responsible for long-term care financing were not significant factors in the enrollment decision.

This study hypothesized that 18 decision variables would explain enrollment decisions. A strong contribution to understanding enrollment pattern differences was decision-making style (odds ratio = 1.532); the odds of enrolling were 1.5 times greater when the employee communicated with others and used information sources. Another contributor to understanding differences was actual caregiver availability (odds ratio = .653); the odds of enrolling were 65.3% lower for every additional family member. Two financial goals were found influential: peace of mind (odds ratio = 1.993) and control/choice (odds ratio = .495). While an employee was 1.9 times as likely to enroll if their goal was financial peace of mind, they were less likely to enroll if control and choice were important to them. The odds of enrolling were 49.5% lower for each increment measure if control and choice were important to the respondent.

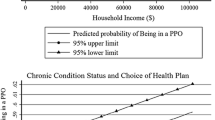

The odds of enrolling in a LTCI plan were significant at all income levels but more likely with any income level over $30,000 which was the referent group. The strongest odds of enrollment were in the $70,000 to $150,000 level (odds ratio = 29.280) and second strongest level over $150,000 (odds ratio = 26.492). In contrast, the odds of enrolling were not significant for all asset levels, although the higher asset levels, the less likelihood of enrollment.

Discussion and Implications

This study offers new theoretically grounded insight for individuals interested in the potential role of group LTCI as a risk management solution for financing long-term care. Study findings identify which factors, organized within a family decision-making framework, are likely to make the difference between enrolling and not enrolling in group LTCI. We encourage readers to keep in mind that the findings in this study are not generalizable to employees of all types, or to all individuals who may be making decisions about individual versus group long-term care insurance. The findings do present an informative picture of public employees in a midwest region of the United States facing decisions about long-term care financing; this population is a likely target for personal responsibility educational and marketing campaigns.

The findings suggest that affecting employee decision outcomes will involve paying attention to eight factors in the framework that account for 68.7% of the decision to enroll. Specifically, employees more likely to enroll in LTCI are older, perceive themselves to be at a higher risk for needing long-term care, perceive the plan to be affordable, use many sources of information, value financial peace of mind over long-term care options, have a higher income, and have a smaller family size. The regression findings indicate that 32% of the differences in enrollment decisions were not identified. Factors not examined could include additional context, perception and decision factors, as well as factors outside of the family (e.g. in policy or legal).

Decision Context

When controlling for other variables, age of the employee was the only significant decision context factor influencing LTCI enrollment decisions. The influence of age was consistent with that found in other studies; the older the individual, the more likely they are to enroll (HIAA, 1995, 2000, 2001). This finding and those of Stucki (2001b) reinforce that an older age increases the probability of enrollment; however, some younger aged individuals also enroll. These findings support the fact that LTCI enrollment is not limited to those individuals close to retirement age.

Study results of the non-significant factors in the enrollment decision illuminate contradictions from other studies. Prior experience as a decision context factor was not significant when other factors were controlled. Prior experience has been found related to enrollment in bi-variate studies (Stucki, 2001a, 2001b) and as a major influence in multivariate analysis (Stum et al., 2001). In these studies, prior experience with long-term care was measured as a dichotomous variable (experience or no experience). In this study, prior experience was measured by the types of caregiving experience the employee had previously, whether it be needing, providing, and/or paying for long-term care, or purchasing LTCI. This did not take into account the duration or intensity of that caregiving experience. Further study is needed between the enrollment decision and the relationship of prior experience and what that experience entails. Gender and health status were also not significant factors in the enrollment decision. While not found significant as hypothesized, these factors are conceptually important to explore due to the contradiction with the Stum et al. (2001) and Stucki (2001b) studies where women and employees with poorer health were more likely to enroll.

Perception Process

Two significant factors influencing LTCI enrollment decisions were perception factors. Perceived risk was the key factor explaining differences between enrollees and non-enrollees. Not surprisingly, the odds of enrolling in LTCI increased dramatically when employees were willing to take the chance that they would not need long-term care in the future. Holden, McBride, and Perozek (1997) found that individuals move away from perceived risk or “uncertainty” of the chance of needing long-term care based on probabilities of entry such as health status, prior experience, family size, and education. The measure of perceived risk used in this study reflects an individual’s perceived risk of needing long-term care, as well as whether they are risk averse (unwilling to take a chance financially). The results are consistent with Atchley and Dorman (1994) who found that risk aversion influenced the decision to purchase LTCI. The results are also supportive of findings in which individuals who perceive they are at higher risk for needing long-term care are more likely to purchase LTCI (HIAA, 1995, 2000, 2001; Mellor, 2000; Stucki, 2001a). This result is consistent with decision-making theory, that individuals, who perceive there is a problem (in this case financing long-term care), are most likely to take action.

Perceived affordability of LTCI significantly influenced the enrollment outcome. If a person perceived the plan to be unaffordable, they were less likely to enroll. This result supports existing findings that affordability is a major barrier to purchasing LTCI (HIAA, 2000, 2001; Swamy, 2004). The importance of affordability is consistent with decision-making theory which suggests that even if an individual perceives a problem, they won’t take action if resources are perceived as insufficient.

Few studies have examined perceived versus actual caregiver availability. In this study, perceived caregiver availability was not found to be significant. This reinforces that employees do not enroll in LTCI based on perceived expectations of family caregiving support.

Perceptions of who should be responsible for financing long-term care (individual, family, government) were not found as significant factors between enrollees and non-enrollees. In this sample, a majority of enrollees and non-enrollees agreed that financing long-term care is primarily the responsibility of the individual. Findings suggest that perceiving individual responsibility, does not sufficiently impact enrollment decisions unless a person perceives they are at risk and that LTCI is an affordable financing solution. A majority of enrollees and non-enrollees indicated that family members should not be responsible for providing or financing long-term care. This is consistent with studies that find elders do not want to be dependent on their families, even if they have available caregivers (Stucki, 2000; Stum, 2001). This is a contradiction to study findings that indicate families do, in reality, provide the care. The desire to remain independent and not depend on family members conflicts with the reality that when long-term care is needed, family members provide a majority of the informal caregiving (Kemper, 1992).

Decision Process

Five of the significant factors influencing LTCI enrollment decisions were decision or thinking factors. Employees who had active and involved decision-making styles were more likely to enroll than employees with more isolated styles. This study defined decision-making style as communication with others and use of informational materials. These findings are similar to Stum et al. (2001) who found that buyers were 15.14 times as likely to buy group LTCI if they discussed the plan with others and 16.01 times more likely to buy if they used informational sources. Stum et al. cited these as two of the three strongest contributors to understanding differences in enrollment (the other being perceived risk).

Knowledge of long-term care and confidence in that knowledge were not found significant in this study. Given existing decision-making theory and evidence from other studies, knowledge and confidence should continue to be examined as influential factors in the deciding process.

Two of the six financial goals (control and choice over long-term care and financial peace of mind) were significant in the decision to enroll in LTCI. In contrast, the major financial goals explored in most studies have included preserving financial independence, avoiding dependence, asset protection, and guaranteeing affordability (HIAA, 1995, 2000, 2001; Stucki, 2001a). Earlier studies focused predominantly on the goal of asset protection as the strongest motivator for purchasing individual LTCI (HIAA, 1995, 2000; McCall et al., 1998). While the other proposed financial goals were not found significant in this study, it may reflect the reality that a majority of employees ranked all of the financial goals as important. This suggests that financial goals are influential and important to include conceptually in the decision-making model and should continue to be explored in other samples. The financial goals that were not found to significantly distinguish enrollees and non-enrollees (financial independence, leaving an inheritance, privacy in financial situation, and not relying on government) seem to be connected to the broader policy debate of who should finance long-term care.

Two types of resources contributed to understanding differences in enrollees and non-enrollees: household income and actual caregiver availability. As household income increased, the likelihood of enrolling in LTCI increased accordingly. This supports the findings from other studies that those with moderate to high incomes are more likely to view LTCI as a financing option than individuals with low incomes (HIAA, 2001). When actual caregiver availability was measured by family size, employees became less likely to enroll with the addition of each family member. Holden et al. (1997) found that employees with fewer children considered themselves to be at higher risk of nursing home use. Other bi-variate studies of LTCI have examined marital status (as a single indicator of caregiver availability) and found married individuals as more likely to enroll than non-married individuals (Atchley & Dorman, 1994; McCall et al., 1998). These studies did not use a combined measure of potential caregivers (spouse and offspring), to examine the influence of family size on the enrollment decision. Marital status as a factor indicates not only potential caregivers, but also the concern of spouses to protect each other financially from the threat of financing long-term care. Future studies should continue to develop sound conceptual and operational measures of actual caregiver availability as part of the LTCI decision process. Actual assets were not a significant influence on the enrollment decision. This homogeneous sample may contrast with other study samples that used more asset rich groups. Interestingly, in this study, one-third of the study sample reported less than $60,000 in total household assets (excluding home value) and over half (58%) reported less than $140,000.

Research Implications

Additional research is needed to examine if the same factors would impact the LTCI enrollment decision for culturally diverse or private employees. Future research should include refining conceptual definitions and operational measures; it should also examine interaction of the components in the decision-making framework. Due to the strength of perceptions and the fact that they are guided by underlying attitudes, values, and beliefs, future studies may benefit from the use of a qualitative approach to explore the influence that experiences have on perception processes. While this study used individual responses, family science research also needs to consider perceptions from multiple family members and to examine the influence of family member interactions that influence the decision outcome.

Practice Implications

Policymakers and practitioners are encouraged to recognize which of the influential factors can be controlled or influenced, by whom, and if the impact will be in best interest of employees and their families. Age of the employee, actual caregiver availability, and household income as resources are not factors that are likely to be influenced by either education or policy. The critical factor of perceived risk has the potential to be influenced by educators, employers, and the LTCI industry. Incentives could be provided for private and public collaborative strategies to help employees and their family members understand who is at risk of needing long-term care, their level of risk aversion, and the potential consequences of doing nothing. LTCI underwriting companies and employers could negotiate and develop LTCI plans that address the affordability of LTCI for employees, as well as provide education regarding affordability. Efforts could focus on providing accessibility to multiple types of user-friendly information and opportunities that provide the time and tools for employees to discuss the decision with others, especially spouses/partners. Information and decision-making tools could focus on helping employees and their family members determine their most important financial goals and understand if LTCI can help them achieve these goals.

This study contributes new conceptual and empirical insight into the family decision-making process for LTCI enrollment. Understanding the complexity of factors influencing decisions about financing long-term care will continue to be essential if policies and practices are to actually motivate individuals to make informed decisions in the future.

References

Atchley, R. C., & Dorman, M. S. (1994). Gaining marketing insights from the Ohio long-term care survey. Journal of the American Society of CLU and ChFC, 48(5), 66–71.

Bubolz, M., & Sontag, M. (1993). Human ecology theory. In P. G. Boss, W. J. Doherty, R. LaRossa, W. R. Schumm, & S. K. Steinmetz (Eds.), Sourcebook of family theories and methods: A contextual approach (pp. 419–448). New York: Plenum Press.

Bureau of the Census (2000). Americans with disabilities: 1997. Washington, D.C. Retrieved February, 13, 2003, from http://www.census.gov/hhes/www/disable/sipp/disab97/ds97t3.html

Health Insurance Association of America (1995). Who buys long-term care insurance? 1994–95 profiles and innovations in a dynamic market. Managed Care and Insurance Operations Report. Washington, D.C.: Lifeplans.

Health Insurance Association of America (2000, October). Who buys long-term care insurance in 2000? A decade of study of buyers and non-buyers. Washington, D.C.: Lifeplans.

Health Insurance Association of America (2001, October). Who buys long-term care insurance in the workplace? A study of employer LTCI plans. Washington, D.C.: Lifeplans.

Henkens, K. (1999). Retirement intentions and spousal support: A multi-factor approach. Journals of Gerontology Series B: Psychological & Social Sciences, 54(2), S63–73.

Holden, K., McBride, T., & Perozek, M. (1997). Expectations of nursing home use in the Health and Retirement study: The role of gender, health, and family characteristics. Journals of Gerontology Series B: Psychological & Social Sciences, 52(5), S240–251.

Jecker, N. S. (2001). Family caregiving: A problem of justice. In D. N. Weisstub, D. D. Thomasma, S. Gauthier, & G. F. Tomossy (Eds.), Aging: Caring for our elders (pp. 19–28). Boston: Kluwer Academic.

Kemper, P. (1992). The use of formal and informal home care by the disabled elderly. Health Services Research, 27(4), 421–451.

McCall, N., Mangle, E., Bauer, E., & Knickman, J. (1998). Factors important in the purchase of partnership long-term care insurance. Health Service Research, 33(2), 187–203.

Mellor, J. M. (2000). Private long-term care insurance and the asset protection motive. Gerontologist, 40(5), 596–604.

Munro, B. H. (1997). Statistical methods for health care research (3rd ed.). Philadelphia, PA: Lippincott-Raven.

Paolucci, B., Hall, O., & Axinn, N. (1977). Family decision making: An ecosystem approach. New York: John Wiley.

Rettig, K. (1993). Problem-solving and decision-making as central processes of family life: An ecological framework for family relations and family resource management. Marriage and Family Review, 18(3/4), 187–222.

Sloan, F. A., & Norton, E. C. (1997). Adverse selection, bequests, crowding out, and private demand for insurance: Evidence from the long-term care insurance market. Journal of Risk and Uncertainty, 15, 201–219.

Stucki, B. R. (2000). Expanding retirement strategies with long-term care insurance. Washington, D.C.: American Council of Life Insurers (ACLI).

Stucki, B. (2001a). Long-term care insurance at work: The retirement link and employee perspectives. Washington, D.C.: American Council of Life Insurers.

Stucki, B. (2001b). Making the retirement connection: The growing importance of long-term care insurance in retirement planning. Washington, D. C.: American Council of Life Insurers.

Stum, M. (2000). Later life financial security: Examining the meaning attributed to goals when coping with long-term care. Financial Counseling and Planning, 11(1), 25–37.

Stum, M. (2001). Financing long-term care: Examining decision outcomes and systemic influences from the perspective of family members. Journal of Family and Economic Issues, 22(1), 25–53.

Stum, M. S., Zuiker, V. S., Pelletier, E., & Hope, L. (2001, December). To buy or not to buy: Examining long-term care insurance decision making from the employee perspective (Research Report). St. Paul, MN: University of Minnesota, Department of Family Social Science.

Swamy, N. (2004). The importance of employer-sponsorship in the long-term care insurance market. Journal of Aging and Social Policy, 16(2), 67–84.

Waidmann, T. A. (2003, July). Estimates of the risk of long-term care: Assisted living and nursing home facilities. Urban Institute Report Office of Disability, Aging, and Long-Term Care Policy. Retrieved March 9, 2004 from http://www.aspe.hhs.gov/daltcp/reports/riskest.pdf.

Ware J. E. (2004). SF- 36 Health survey update. In M. Maruish (Ed.), Use of psychological testing for treatment planning and outcomes assessment (vol. 3, pp.693–718). Mahwah, NJ: Lawrence Erlbaum.

Author information

Authors and Affiliations

Corresponding author

Rights and permissions

About this article

Cite this article

Schaber, P.L., Stum, M.S. Factors Impacting Group Long-Term Care Insurance Enrollment Decisions. J Fam Econ Iss 28, 189–205 (2007). https://doi.org/10.1007/s10834-007-9062-y

Published:

Issue Date:

DOI: https://doi.org/10.1007/s10834-007-9062-y