Abstract

This paper investigates the effect of spousal insurance coverage on married women’s labor supply. This effect was hypothesized to be negative, since married women have an incentive to seek employment in jobs that will provide insurance when their husbands do not provide coverage. Panel data from the 1996–2004 Medical Expenditure Panel Surveys was used to control for the potential correlation between unobserved characteristics and spousal insurance. The findings suggest that spousal coverage does have a negative effect on married women’s labor supply, and that most of the reduction in labor supply seems to derive from shifts out of the labor force rather than between part-time and full-time work.

Similar content being viewed by others

Explore related subjects

Discover the latest articles, news and stories from top researchers in related subjects.Avoid common mistakes on your manuscript.

Introduction

Employment-based health insurance remains the primary source of insurance for working-age adults and their families in the United States. Group plans offered through employment cover 92% of non-elderly individuals in the private insurance market (Kaiser Commission on Medicaid and the Uninsured 2005). These plans are the most affordable means of private health coverage, with firms covering an average of 73–84% of total premiums, leaving the remainder to be paid by workers (Claxton et al. 2006). Private insurance that is provided outside the employer-sponsored market is substantially more expensive and more difficult to obtain, making it less desirable. The U.S. system creates a link between the demand for employer-based health insurance and individuals’ labor supply decisions, highlighting an important dimension to discussions on health care reform. The economics literature has examined several aspects of the insurance–labor relationship in the U.S., including job mobility, the effects of continuation-of-coverage laws, and retirement decisions (Currie and Madrian 1999).

Much of labor supply economic research recognizes that work and consumption decisions are often made at the family level. The majority of research that examines the relationship between family labor supply decisions and health insurance focuses on the retirement decisions of older workers, where significant incentive effects derive from whether employer-provided health insurance stops or continues after retirement (e.g. Blau and Gilleskie 2006; Gruber and Madrian 1995; Kim and DeVaney 2005). Fewer studies have examined other aspects of family labor supply behavior related to health insurance. One relatively neglected area of research is on the labor supply decisions of married women, especially those of prime working age. Other things equal, married women may have an incentive to seek jobs that will provide insurance benefits when their husbands do not provide family coverage. Since firms offer these benefits in larger part to full-time employees, married women who have a higher propensity towards part-time employment or nonparticipation in the labor force may pursue full-time employment, thereby, working longer hours than they would otherwise work. While similar incentive effects may pertain to older workers or prime-age working men, married women are of particular interest due to their often-observed large labor supply elasticities (Blau and Kahn 2007). If married women have similar responsiveness to insurance as they exhibit to their own and spouses’ wages, then incentive effects may be strongest for this group.

A small number of published studies have examined the relationship between married women’s labor supply decisions and spousal insurance coverage, and all have found a negative association. Olson (1998) used semiparametric methods to evaluate the effect of spousal coverage on married women’s labor supply and found that spousal coverage is associated with a 7.1–8.5% reduction in the probability of wives working full-time, and a 1.78–4.23 reduction in hours worked per week. Buchmueller and Valletta (1999) employed Tobit, probit, and multinomial logit specifications and found a 15–36% reduction in hours worked and an 11–12% reduction in the probability of working full-time. Wellington and Cobb-Clark (2000), using probit and Ordinary Least Squares (OLS) procedures, found a 19.5% reduction in the probability of labor force participation and a 7.1–14.8% reduction in annual hours worked.

These studies consistently indicate that spousal insurance coverage has a negative effect on the labor force participation of married women. They are also subject to two important limitations that need to be addressed in extending this line of research. The first limitation concerns the sources of data. All three studies used data from the 1993 Current Population Survey (CPS), reflecting the experiences of the U.S. population in the early 1990s. However, since the late 1990s, insurance premiums have outpaced both overall inflation and workers’ earnings, reflecting an increase in the real price of health insurance to workers (Gabel et al. 2003). The implications of this are ambiguous. For example, a price effect would make employer-subsidized insurance more attractive relative to non-subsidized insurance, strengthening the incentive for wives to work in the absence of spousal coverage. Alternatively, an income effect suggests that given spousal coverage, wives may increase their work effort since higher premiums account for a larger proportion of disposable family income. In addition to increasing insurance prices, recent work has shown that married women’s labor supply cross-elasticities with spousal wages exhibited modest declines through the 1990s (Blau and Kahn 2007). This would also suggest weakened incentive effects of spousal coverage on labor supply if trends in wage elasticities have parallels in employer-provided benefits such as health insurance.

The second limitation concerns assumptions about the exogeneity of spousal insurance coverage. It is possible, and perhaps likely, that unobserved characteristics are correlated with both spousal insurance coverage and married women’s labor supply decisions. These characteristics, including leisure and risk preferences, can bias estimates on the effect of spousal coverage. Previous studies have addressed this problem in different ways. Olson (1998) and Wellington and Cobb-Clark (2000) used empirical methods that assumed the exogeneity of spousal insurance coverage, though both studies acknowledged the potential for bias in their estimates. Olson (1998) reported a lower-bound to his semiparametric estimates, implicitly assuming a downward bias on the negative effect of spousal coverage on wives’ labor supply. Wellington and Cobb-Clark (2000) attempted to sign their bias by examining the covariance of error terms between husbands’ and wives’ labor supply equations. They contend that the positive covariance between spousal hours reflects an upward bias, suggesting that their estimates are understated. Only Buchmueller and Valletta (1999) directly incorporated the endogeneity of spousal coverage into their empirical analysis by deriving difference-in-difference estimates from a multinomial logit specification that exploits variation in insurance status across categories of work effort (part-time, full-time, and no work). Though not directly comparable to their probit and Tobit estimates, the difference-in-difference estimates suggest a downward bias on the negative effect of spousal coverage on wives’ labor supply.

This paper revisits the hypothesis that spousal coverage has a negative effect on the labor supply of married women. In doing so, it addresses the data and methodological limitations of previous work. First, this analysis used contemporary data from the Medical Expenditure Panel Survey (MEPS), an alternate data source of detailed insurance and employment information for the US population. The surveys cover the period 1996–2004, providing an updated examination of the relationship between insurance and labor markets. MEPS offers an advantage over CPS data because of its longitudinal design, following individuals over a two-year period.

The longitudinal component of MEPS facilitates the second contribution of this paper, that is the use of first-differencing panel data estimation procedures that control for unobserved characteristics. Specifically, unobserved characteristics were eliminated from the estimated labor supply equations by differencing over two time periods. This is a useful tool in addressing the endogeneity of spousal insurance coverage and represents an alternate approach to the empirical procedure employed by Buchmueller and Valletta (1999) to deal with unobserved effects. One advantage to a first-differencing approach relative to a multinomial approach like Buchmueller and Valletta (1999) is that changes in work hours can be evaluated on a continuous rather than a categorical basis. This reduces any sensitivity of estimates to predefined hours categories and makes statements about aggregate changes in participation and work hours easier. Another advantage is that by eliminating the unobserved characteristics directly, there is no need to make identifying restrictions on the estimated effect from spousal insurance on wives’ labor supply to derive difference-in-difference estimates.Footnote 1

The major policy implication of this research is the impact of universal health coverage on labor supply. Though the policy debate on universal health coverage in the U.S. has not continued with the same political fervor as in the early 1990s, the recent call for universal coverage by the Institute of Medicine (2004) and continuing discussions on other potential extensions to public health insurance such as Medicare buy-in proposals (Johnson et al. 2002) make the relationship of interest in this paper relevant to contemporary U.S. health policy. A negative association between spousal insurance coverage and married women’s work effort suggests that an exogenous source of coverage will result in a decline of women’s labor supply. Such labor supply reductions can have macro-level effects in terms of reductions in aggregate work hours and a demographic transition in the U.S. labor force. These effects can potentially be largest for married women relative to other groups if their sensitivity to insurance coverage parallels their larger wage elasticities. There are also micro-level implications as female labor force participation is often studied in relation to outcomes such as child development and family health.

Research on these policy implications is mixed. The only published study to directly examine the effects of national insurance on wives’ labor supply uses recent changes in Taiwan. Chou and Staiger (2001) found that the implementation of Taiwan’s National Health Insurance program in 1995 was associated with a 4% decline in married women’s labor force participation. No such comparison can be made with the U.S., though some insight might be gained by examining recent extensions to public insurance programs. To date, little research has attempted this in relation to married women’s labor supply. In one study, Tomohara and Lee (2007) showed that, on average, the implementation of State Children’s Health Insurance Programs (SCHIP) in 1997 did not reduce wives’ labor supply. However, they did find reductions in the work effort of non-White, less-educated wives and wives with young children. Given that SCHIP plans target children and not adults, it is possible that universal coverage would have a greater effect on married women’s labor supply given their own insurance status and that of their husbands.

This paper proceeds as follows. The next section discusses the data and methods used to examine the effect of spousal insurance coverage on married women’s labor supply. The results of the empirical analysis are then presented, followed by a discussion and concluding remarks.

Data and Methods

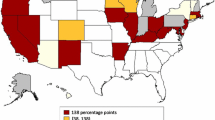

The data are from the Agency for Healthcare Research Quality’s Medical Expenditure Panel Surveys (MEPS). MEPS is an annual survey whose main purpose is to examine insurance trends and healthcare utilization among the non-institutionalized population in the United States. Individuals are followed for two years with interviews conducted in each of five rounds over the two-year period. Information on demographics, health insurance, and labor outcomes is collected in each round. In any given year, two panels of individuals are surveyed to form an annual, nationally representative sample: one panel whose two-year period is ending in the current year and another panel whose two-year period is beginning in the current year. Longitudinal linkage over panels provides representative samples over two-year periods. The surveys began in 1996 and have been conducted every year since.

The data used in this analysis are from the 1996–2004 years of MEPS that capture eight panels of individuals. The analysis sample includes women of prime working age between 25 and 54 who were married in both the first and last interviews in their respective two-year survey periods. Women who were self-employed or whose husbands were self-employed, women who were covered by public insurance or whose husbands were covered by public insurance, and women whose husbands were not working are excluded from the analysis sample. These exclusions focus the sample on women choosing between non-employment and wage-earning employment that may provide health insurance, in consideration of their husband’s employer-based coverage and without consideration to intra-family retirement decisions. The sample most closely resembles that used by Buchmueller and Valletta (1999).

The total number of women in the panel sample is 8,806. Though MEPS interviews individuals in several rounds throughout the two-year period, only the first and last interviews are used in this analysis so that individuals are observed for two time periods (T = 2). This is an attempt to maximize variation in insurance coverage over the survey period. A pooled sample is also derived with 17,612 observations (8,806 women over two periods), yielding a representative sample over the period 1996–2004. The average time between interviews was 20.0 months. Approximately 10% of women experienced a change in employer-based spousal insurance coverage between the two interviews, with 6% gaining coverage and 4% losing coverage.

Table 1 presents a description of labor force participation for the pooled analysis sample. Almost 75% (74.3%) of the sample is employed, with 25.0% of those employed working under 35 h. Among those not working, the most common reasons were staying home to care for children/family after previous employment (51.6% of the non-working sample) and having never worked (38.1%). Less prevalent reasons included temporary unemployment/job-seeking (3.5%), retirement (1.4%), disability (5.6%), and other temporary reasons such as school or maternity leave (6.9%). These numbers indicate that much of non-employment in the analysis sample was due to long-term absence, with most of this attributed to household production.

The goal of this research was to estimate the effect of spousal insurance coverage on married women’s labor supply. Both the decision to participate in the labor force and the number of weekly hours worked were examined. The empirical strategy was to exploit the longitudinal nature of the MEPS data and control for unobserved effects that may be correlated with the explanatory variables, including spousal insurance. To motivate the analysis, consider a simple linear specification for labor supply given as:

where Y it is a measure of labor supplied by individual i = 1, 2,…, N in time t = 1, 2,…, T, X it is a vector of observed characteristics that are thought to affect labor supply, I it is an indicator of spousal insurance coverage, c i are unobserved time-constant characteristics (fixed effects) that affect labor supply, and ε it is a random error term. Unobserved characteristics at the individual-level can include preferences related to leisure, risk, and time discounting. To the extent that these characteristics of married women correlated with spousal characteristics (e.g. assortative mating), the fixed effects reflect in part unobserved couple heterogeneity.

An important issue in estimating the effects from X it and I it is whether the unobserved effects c i can be treated as uncorrelated with the explanatory variables. If they cannot, then parameter estimates from an estimation strategy that does not account for correlation will be biased. Given this paper’s focus on I it , there is reason to suspect such endogeneity problems. For example, suppose women with preferences for high-hour, professional jobs marry men with similar preferences. Since men in high-hour jobs are more likely to be offered employer-based insurance, spousal coverage will be positively correlated with the couple’s shared work preferences for longer hours, and the parameter estimate on I it will be biased upwards. This suggests that any negative effect of spousal coverage on wives’ labor supply will be understated. Conversely, suppose that unobserved leisure preferences cause women to reduce labor supply in response to their husbands’ longer hours. In this case, spousal coverage will be negatively correlated with wives’ preferences for more leisure, and the parameter estimate on I it will be biased downwards. This suggests that any negative effect of spousal coverage on wives’ labor supply will be overstated. Similar examples can be offered for other aspects of unobserved preferences.

These examples show that failure to account for correlation between unobserved characteristics and spousal insurance coverage will potentially result in biased parameter estimates on I it . The strategy of this research was to use first-differencing techniques to eliminate unobserved effects from the estimating equations, an approach similar to that used in the literature on the incidence of overtime work (Kalwij and Gregory 2005). The analysis was performed in two parts. First, non-differenced models were estimated on the decision to work and hours worked. Correlation between c i and I it was ignored in these models, providing a comparative analysis to previous studies and to the first-differenced models presented in this paper. A non-differenced linear probability model examined the decision to work:

where W it is a binary indicator of labor force participation for individual i in time t, X it includes both time-variant and time-invariant characteristics that include age, race, Census region of residence, urban/MSA residence, years of education, family size, the presence of young children in the household, family non-wage income, husband’s working hours, husband’s wage income, and husband’s years of education, I it is an indicator variable of whether the wife is covered by an employer- or union-based insurance plan in which the husband is the policyholder, and η it = c i + μ it where μ it is the random component to the error term. To avoid selection issues, wives’ wage income was omitted from X it since wage offers are not observed when W it = 0. Age and education are assumed to affect potential market wages. The LPM was estimated on the entire pooled sample. Regressions for working hours take the form:

where Y it is weekly hours worked by individual i = 1, 2,…, N in time t = 1, 2,…, T, υ it = c i + ω it where ω it is the random component to the error term, and X it and I it are defined as before. The corner solution outcome of hours worked suggests that a pooled Tobit estimation procedure is appropriate for the model given by (3) and (4).

The second part of the analysis estimates the first-differenced form of models given in (2), (3), and (4). By taking first-differences of all variables, the time-constant c i are eliminated from the estimated equations, controlling for any correlation between the c i and other explanatory variables including I it .Footnote 2 All time-invariant characteristics in X it are also eliminated, including race, region of residence, urban status, and years of education.Footnote 3 The first-differenced LPM takes the form:

Equation 5 was estimated on the panel sample of 8,806 women. As in the non-differenced model, the coefficient γ is the marginal effect that gives the change in the probability of working due to a change in spousal coverage.

For hours worked, a first-differenced Tobit model was estimated as presented by Kalwij (2004)Footnote 4 who suggested estimating a first-differenced equation that includes correction terms for data censoring:

where Λ t and Λ t−1 are correction terms and ξ it is an error term with expectation equal to zero. The motivation for this procedure is to difference out fixed effects while controlling for the censoring of work hours.

Equation 6 is estimated with a two-step procedure. First, estimates of Λ t and Λ t−1 are derived from a bivariate probit regression on indicator variables for whether the individual works in each time period. This step uses a conditional mean independence assumption to model unobserved effects as a function of the explanatory variables and a random individual-specific error term (Wooldridge 1995). For T = 2, two correction terms are included in the model. In the second step, OLS was used to consistently estimate the parameters of (6) on the sample of women working in both time periods (N = 5,680). An F-test on the joint significance of Λ t and Λ t−1 can be used to indicate whether censor-correction needs to be in the model. An appendix to this paper outlines the two-step procedure in more detail. This approach yields a fully specified model that can be used to derive marginal effects. OLS estimation of (6) is attractive because it can be easily adjusted for the complex survey design of the MEPS data, producing corrected standard errors of the estimated parameters.

Table 2 lists all variables defined above and their sample means. As the table shows, about 65% of women covered by their husband’s insurance were employed at an average of 22.9 h/week, while among women without spousal coverage 84% were employed at an average of 33.5 h/week. Alternatively, 54% of employed women had insurance coverage through their husbands compared to 77% of non-working women. These descriptive statistics suggest a negative relationship between wives’ labor supply and spousal insurance coverage. However, as noted above, confounding factors may be driving this relationship. To examine this further, the results of the multivariate analyses are presented in the next section.

Results

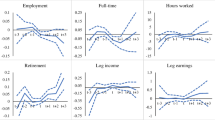

Pooled Models

Table 3 presents the results of the pooled LPM and Tobit models that maintain an exogeneity assumption of spousal insurance coverage. Controlling for a number of time-variant and time-invariant characteristics, spousal insurance coverage was estimated in all models to have a negative effect on wives’ labor supply. First, given husband’s insurance coverage (I it = 1) and mean values for X it , the reduction in the probability of working in the linear probability model was 18.7%. This effect is slightly less than the 19.5% estimate of Wellington and Cobb-Clark (2000), but higher than other studies. Inspection of the fitted values from the LPM shows that about 5% of the predicted probabilities lie outside the unit interval. A probit analysis (not shown) on the same data estimates a 20.1% reduction in the probability of working, suggesting that the LPM is a close approximation of the response probability.

The pooled Tobit results also suggest a strong negative relationship between spousal coverage and married women’s labor supply. For the full sample (working and non-working), the coefficient on I it suggests that having spousal insurance coverage reduced weekly hours worked by 11.2 h, or 44%. Conditional on positive working hours, having spousal insurance coverage reduced weekly hours worked by 8.8 h, or 30%.Footnote 5 Given that employed women worked an average of 37.3 h in the sample, a change of 8.8 h conditional on employment suggests movement between full-time and part-time work that is associated with spousal insurance coverage. These estimates are generally higher than estimates from previous studies, and are closest to the high-end estimate of a 36% reduction in hours found in Buchmueller and Valletta (1999).

With respect to other variables included in X it , these typically show the expected sign and significance of female labor supply models, including negative effects from family size, the presence of young children, husband’s hours, and husband’s wage income. Of particular interest is that the magnitude of effect from spousal insurance coverage was the strongest of the explanatory variables. The next strongest effect is from the presence of young children, which was associated with a 14.9% reduced probability of working and 9.2 fewer weekly hours. The strength of spousal insurance coverage as a predictor of married women’s labor supply highlights the potential for strong policy implications resulting from this relationship.

First-Differenced Models

The findings of the pooled models rest on the assumption of the exogeneity of husband’s insurance status. As previously discussed, there is reason to believe that unobserved characteristics may be correlated with spousal coverage, making the assumption of exogeneity inappropriate. Results from the first-differenced LPM and Tobit procedures that address this issue are shown in Table 4. First, the LPM coefficient on spousal coverage indicates a 7.9% reduction in probability of working among married women in response to such coverage. This is a substantial reduction of the effect implied by the LPM that did not account for unobserved effects and is most consistent with the 7.1–8.5% range of Olson (1998), and somewhat less than the difference-in-difference estimate of 11% by Buchmueller and Valletta (1999). Effects from other control variables are typically consistent with the non-differenced LPM results, though the magnitudes in the first-differenced model are weaker. A key difference occurs with the effect of husband’s hours, which becomes positive and not statistically significant. This is similar to Buchmueller and Valletta (1999) who also found weak substitutability between spousal work hours.

Results from the first-differenced Tobit model proposed by Kalwij (2004) are also shown in Table 4. The estimated coefficients are interpreted as the marginal effect of a particular explanatory variable on hours worked, conditional on positive working hours and accounting for unobserved effects. There was a large reduction in the effect of spousal insurance coverage on married women’s labor supply when unobserved effects are differenced from the model. Conditional on positive hours worked, spousal insurance was associated with only 1.01 fewer weekly work hours, an effect significant at the 5% level. For a 50-week working year, this translates to a reduction of 50.5 annual hours. Given that this effect is conditional on positive working hours in both time periods, it suggests that movement between part-time and full-time work in response to spousal coverage is limited when controlling for unobserved effects. This is in contrast to the pooled Tobit model that ignores such effects.

An important empirical consideration is whether censoring needs to be taken into account when modeling the first-differenced hours equation. To answer this, a test on the joint significance of the censor-correction terms Λ t and Λ t−1 was performed and reported with the results in Table 4. The F-statistic on the joint significance of these terms was not significant (p = 0.359), suggesting that censoring is not of empirical importance when first-differencing on hours worked. To evaluate an alternate specification, a first-differenced equation on hours worked was estimated without the correction terms. This is simply a first-differenced OLS regression on hours worked for the sample of women working in both time periods and is equivalent to fixed-effects estimation on this sample. The results are shown in Table 5. The effect from spousal coverage is quite similar to that in the first-differenced Tobit model and remains much weaker than the effect given by the non-differenced Tobit model. Leaving out the correction terms, spousal coverage is associated with an approximate 1.10-h reduction per week in working time for married women, an effect that remains significant. Whether correcting for censoring or not, the effects from these first-differenced models are a departure from previous studies that find more substantial shifts in work hours in response to spousal insurance coverage. They are most consistent with the lower bound estimate of a 1.78 reduction in work hours given by Olson (1998).

Discussion

To sum, non-differenced models that assume exogeneity of unobserved heterogeneity indicate that spousal insurance coverage was associated with an 18.7% reduction in the probability of married women participating in the labor force and a reduction of 8.8 weekly work hours (30%) conditioned on participation. When unobserved characteristics are differenced out, spousal insurance coverage is associated with a 7.9% reduction in the probability of married women participating in the labor force. Conditioning on positive work hours, spousal coverage is associated with only a modest reduction in weekly work hours. This paper has shown that failing to account for the endogeneity of spousal insurance coverage suggests an overstatement of its negative effect on married women’s labor supply. The first-difference methods verify the bias that was previously evidenced in Buchmueller and Valletta (1999) and acknowledged in Olson (1998). The contention by Wellington and Cobb-Clark (2000) that endogenous spousal insurance is associated with an understatement of its effect is not supported by the results of this paper.

The more recent data used in this analysis yields estimates that are comparable in magnitude to lower bound estimates offered by Olson (1998) and somewhat less in magnitude than the estimates of Buchmueller and Valletta (1999), the only two studies that offered an adjustment to their estimates for the potential endogeneity of spousal insurance. That the results obtained in the present study are at or below the lower-bound estimates of studies that used data from the early 1990s can reflect different trends as discussed in the Introduction. First, it can reflect a negative income effect that derives from rising insurance prices over the decade, putting pressure on wives with spousal coverage to seek work as higher premiums account for a larger proportion of disposable family income. This would act to negate price effects from rising insurance premiums that would increase wives’ probability of working in the absence of spousal coverage. Second, it is consistent with married women becoming less responsive to spousal variables over this period, including the provision of insurance. This may reflect a parallel to recent findings of falling wage elasticities among this group, which as Blau and Kahn (2007) suggest may be associated with fewer married women being at the margin of labor force participation. Sorting out these effects is beyond the scope of this study and is an important avenue for future research.

The main qualitative difference between this and previous studies is the finding that spousal insurance coverage is associated with a reduction in married women’s labor supply mainly from shifts out of the labor force, rather than from shifts between full-time and part-time work. This is especially distinct from the difference-in-difference estimates of Buchmueller and Valletta (1999). However, translating the results from their categorical model to a statement on continuous hours is difficult. Indeed, while their results suggest shifting into part-time work, their relative probabilities on part-time work are weaker than non-participation. This suggests that most of the hours-shifting in their analysis may be between full-time work and no work.

The overall findings suggest that universal health insurance coverage that is exogenous to employment choice will reduce married women’s labor supply, though the reductions will be sourced in women leaving the labor force rather than shifting to jobs with lower time commitments. This has macro-level implications in terms of the demographic makeup of the U.S. labor force and micro-level implications for trends in family structure and labor supply decisions. Though this paper does not address the consequences of such transitions, the relationship between female labor force participation and outcomes such as child development and family health is of ongoing interest in literature and policy discussions.

There are limitations to the present study. First, this study only examines the response of married women’s labor supply. This is an important population given its historically large labor supply elasticities relative to other groups, however policies concerning extensions to public health coverage must be evaluated in terms of their effect on the whole population. For example, Gruber and Hanratty (1995) found that the provision of universal coverage in Canada actually resulted in an increase in overall employment, possibly owing to a healthier labor force or increased job mobility. This is contrary to what the results on married women suggest. Additionally, as an increasing share of married households in the U.S. have women as the dominant earner, future work may need to consider how the distribution of risk preferences within these households influences family labor decisions as they relate to health insurance (Jianakoplos and Bernasek 2008).

Another limitation is that the data of MEPS only allow longitudinal analysis for two years. This may not be long enough to capture the full dynamic transitions that occur with insurance status and employment responses. The benefit of using datasets such as the CPS and MEPS is that samples are provided on the entire working-age population. The tradeoff is that individuals are only examined for a cross-section of time or are followed for relatively brief periods. Examination of datasets that follow specific populations over longer periods of time may yield additional insight on the findings of this study and others.

Finally, this study does not address how different characteristics of married women affect their response to spousal coverage, nor does it examine how different types of health coverage may affect labor supply decisions. For example, Buchmueller and Valletta (1999) found that the response to spousal coverage is stronger for women with children in the household. Other studies suggest that the health of children may be a factor in the relationship between family labor supply decisions and health insurance coverage (Baydar et al. 2007; Sharpe and Baker 2007), that insurance coverage may be related to labor decisions influenced by informal caregiving for older adults (Wilson et al. 2007), and that family labor supply decisions may influence potential substitutes for insurance such as self-care behaviors (Doumas et al. 2008). Also, different types of employer-offered insurance may play a role in family labor supply decisions. For example, an aging population may place greater importance on long-term care insurance, and such coverage is beginning to receive more attention in the literature (e.g. Schaber and Stum 2007). Extensions of research that address these study limitations should be beneficial in understanding a broader range of effects from changes to U.S. health policy.

Conclusion

The system of employer-based health coverage in the U.S. creates a link between labor supply decisions and the demand for health insurance. An important implication of this relationship is how insurance coverage affects family labor supply decisions. This paper has provided new estimates on one component of this relationship: the effect of spousal insurance coverage on married women’s labor supply. The findings suggest that most of the response to spousal coverage is found in shifts out of the labor force, rather than between full-time and part-time work. As policy discussions on extensions to public health coverage continue in the U.S., research such as that presented in this paper is imperative to encourage informed debate and policy design.

Notes

Buchmueller and Valletta (1999, p. 54) specify that the component of the effect from spousal insurance that runs through unobserved heterogeneity is independent of whether women’s jobs provide insurance. This is not a strong assumption, but may be problematic if women’s jobs that offer insurance are associated not only with her working hours, but also with provisions such as flexible work schedules and paid time-off that are likely to be associated with leisure preferences. This would suggest that the effect of unobserved heterogeneity may vary depending on the insurance status of wives’ jobs.

For T = 2, as is the case here, first-differencing yields identical estimates and inference as fixed effects estimation. First-differencing was preferred in this analysis since it is easier to implement with population weighting and the complex survey design of MEPS. It also makes dealing with unobserved characteristics in the hours-worked model straightforward, as discussed in note 4.

Though geographic mobility implies that region and urban status are time-variant, the variation in these variables between time periods is negligible.

This approach is chosen because of difficulty in dealing with the c i in a Tobit model. In a standard linear regression model, the typical response to correlation between c i and the explanatory variables in a panel setting is a fixed-effects model. The fixed-effects estimator in a Tobit model, however, suffers from an incidental parameters problem. In short, treating the c i as parameters to be estimated results in inconsistent estimation of the remaining model parameters (in this case, β and γ) with \( N \to \infty \) and T fixed. See Greene (2004) for an analysis of fixed-effects and the incidental parameters problem in the Tobit model.

These effects are calculated from the formulas for marginal effects and elasticities in a Tobit model. See Wooldridge (2002), pages 522–523 for details.

References

Baydar, N., Joesch, J. M., Kieckhefer, G., Kim, H., & Greek, A. (2007). Employment behaviors of mothers who have a child with asthma. Journal of Family and Economic Issues, 28, 337–355.

Blau, F. D., & Gilleskie, D. B. (2006). Health insurance and retirement of married couples. Journal of Applied Econometrics, 21, 935–953.

Blau, F. D., & Kahn, L. M. (2007). Changes in the labor supply behavior of married women: 1980–2000. Journal of Labor Economics, 25, 393–438.

Buchmueller, T. C., & Valletta, R. G. (1999). The effect of health insurance on married female labor supply. The Journal of Human Resources, 34, 42–70.

Chou, Y. J., & Staiger, D. (2001). Health insurance and female labor supply in Taiwan. Journal of Health Economics, 20, 187–211.

Claxton, G., Gabel, J., Gil, I., Pickreign, J., Whitmore, H., Finder, B., et al. (2006). Health benefits in 2006: Premium increases moderate, enrollment in consumer-directed health plans remains modest. Health Affairs, 25, w476–w485.

Currie, J., & Madrian, B. (1999). Health, health insurance and the labor market. In D. Card & O. Ashenfelter (Eds.), Handbook of labor economics (Vol. 3c, pp. 3309–3407). Amsterdam: North Holland.

Doumas, D. M., Margolin, G., & John, R. S. (2008). Spillover patterns in single-earner couples: Work, self-care, and the marital relationship. Journal of Family and Economic Issues, 29, 55–73.

Gabel, J., Claxton, G., Holve, E., Pickreign, J., Whitmore, H., Dhont, K., et al. (2003). Health benefits in 2003: Premiums reach new thirteen-year high as employers adopt new forms of cost sharing. Health Affairs, 22, 117–126.

Greene, W. (2004). Fixed effects and bias due to the incidental parameters problem in the Tobit model. Econometric Reviews, 23, 125–147.

Gruber, J., & Hanratty, M. (1995). The labor-market effects of introducing national health insurance: Evidence from Canada. Journal of Business and Economic Statistics, 13, 163–173.

Gruber, J., & Madrian, B. C. (1995). Health insurance availability and the retirement decision. American Economic Review, 85, 938–948.

Institute of Medicine. (2004). Insuring America’s health: Principles and recommendations. Washington, DC: National Academy Press.

Jianakoplos, N. A., & Bernasek, A. (2008). Family financial risk taking when the wife earns more. Journal of Family and Economic Issues, 29, 289–306.

Johnson, R. W., Moon, M., & Davidoff, A. J. (2002). A Medicare buy-in for the near elderly: Design issues and potential effects on coverage. Retrieved from Henry J. Kaiser Family Foundation: http://www.kff.org/uninsured/6009-index.cfm

Kaiser Commission on Medicaid and the Uninsured. (2005). Health coverage in America, 2004 data update. Retrieved January 29, 2008, from the Henry J. Kaiser Family Foundation Web site: http://www.kff.org/uninsured/7415.cfm

Kalwij, A. S. (2004). A two-step first difference estimator for a panel data Tobit model under conditional mean independence assumptions (Discussion Paper 2004-67). Retrieved January 29, 2008, from Tilburg University Center Web Site: http://arno.uvt.nl/show.cgi?fid=12116

Kalwij, A. S., & Gregory, M. (2005). A panel data analysis of the effects of wages, standard hours and unionization on paid overtime work in Britain. Journal of the Royal Statistical Society, Series A, 168, 207–231.

Kim, H., & DeVaney, S. A. (2005). The selection of partial or full retirement by older workers. Journal of Family and Economic Issues, 26, 371–394.

Olson, C. A. (1998). A comparison of parametric and semiparametric estimates of the effect of spousal health insurance coverage on weekly hours worked by wives. Journal of Applied Econometrics, 13, 543–565.

Rochina-Barrachina, M. E. (1999). A new estimator for panel data sample selection models. Annales d’Economie et de Statistique, 55/56, 153–181.

Schaber, P. L., & Stum, M. S. (2007). Factors impacting group long-term care insurance enrollment decisions. Journal of Family and Economic Issues, 28, 189–205.

Sharpe, D. L., & Baker, D. L. (2007). Financial issues associated with having a child with autism. Journal of Family and Economic Issues, 28, 247–264.

Tomohara, A., & Lee, H. J. (2007). Did State Children’s Health Insurance Program affect married women’s labor supply? Journal of Family and Economic Issues, 28, 668–683.

Wellington, A. J., & Cobb-Clark, D. A. (2000). The supply-side effects of universal health coverage: what can we learn from individuals with spousal coverage? In S. Polachek (Ed.), Worker well-being: Research on labor economics (Vol. 19, pp. 315–344). Amsterdam: Elsevier.

Wilson, M. R., Harold Van Houtven, C., Stearns, S. C., & Clipp, E. C. (2007). Depression and missed work among informal caregivers of older individuals with dementia. Journal of Family and Economic Issues, 28, 684–698.

Wooldridge, J. M. (1995). Selection corrections for panel data models under conditional mean independence assumptions. Journal of Econometrics, 68, 115–132.

Wooldridge, J. M. (2002). Econometric analysis of cross section and panel data. Cambridge, MA: The MIT Press.

Author information

Authors and Affiliations

Corresponding author

Appendix

Appendix

This appendix presents the two-step procedure for estimating the censor-correction terms and parameters for Eq. 5 in the paper. For the original derivation of the model, see Kalwij (2004) or Kalwij and Gregory (2005).

Step 1: For two time periods, estimate a bivariate probit model of the form:

where W it is an indicator variable for positive work hours for individual i in time t, c i are unobserved couple-specific effects, and ε it is an error term. To model the correlation between c i and the explanatory variables, a conditional mean independence assumption is used (Rochina-Barrachina 1999; Wooldridge 1995):

where μ i is a random individual-specific error term. The function h(·) is commonly treated as the average over time, so that \( h(X_i ) = \bar X_i .\) Substituting into (1a) and (2a), the model yields:

Step 2: The bivariate model given by (4a) and (5a) is estimated to yield the predicted values \( \hat M_{i1} = X_{i1} \hat \beta + \bar X_i \hat \gamma \) and \( \hat M_{i2} = X_{i2} \hat \beta + \bar X_i \hat \gamma .\) These are used to derive the correction terms given by:

where \( \hat \rho \) is the estimated correlation between the error terms in (4a) and (5a), \( \phi ( \cdot ) \) is the standard normal density function, \( \Upphi ( \cdot ) \) is the standard normal distribution function, and \( \Upphi _2 ( \cdot ) \) is the bivariate standard normal distribution function. Given \( \Uplambda _1 (\hat M_{i1} ,\hat M_{i2} ,\hat \rho ) \) and \( \Uplambda _2 (\hat M_{i1} ,\hat M_{i2} ,\hat \rho ), \) Eq. 5 in the paper is estimated by least squares on a subset of individuals with positive working hours in both time periods:

Rights and permissions

About this article

Cite this article

Murasko, J.E. Married Women’s Labor Supply and Spousal Health Insurance Coverage in the United States: Results from Panel Data. J Fam Econ Iss 29, 391–406 (2008). https://doi.org/10.1007/s10834-008-9119-6

Published:

Issue Date:

DOI: https://doi.org/10.1007/s10834-008-9119-6