Abstract

Even as the number of children with health insurance has increased, coverage transitions—movement into and out of coverage and between public and private insurance—have become more common. Using data from 1996 to 2005, we examine whether insurance instability has implications for access to primary care. Because unobserved factors related to parental behavior and child health may affect both the stability of coverage and utilization, we estimate the relationship between insurance and the probability that a child has at least one physician visit per year using a model that includes child fixed effects to account for unobserved heterogeneity. Although we find that unobserved heterogeneity is an important factor influencing cross-sectional correlations, conditioning on child fixed effects we find a statistically and economically significant relationship between insurance coverage stability and access to care. Children who have part-year public or private insurance are more likely to have at least one doctor’s visit than children who are uninsured for a full year, but less likely than children with full-year coverage. We find comparable effects for public and private insurance. Although cross-sectional analyses suggest that transitions directly between public and private insurance are associated with lower rates of utilization, the evidence of such an effect is much weaker when we condition on child fixed effects.

Similar content being viewed by others

Explore related subjects

Discover the latest articles, news and stories from top researchers in related subjects.Avoid common mistakes on your manuscript.

Over the past quarter century, health insurance coverage among children has changed substantially. Whereas approximately three of every four children had private coverage in 1987, now less than 60 % of children have insurance through a private plan, according to data from the Current Population Survey. Over the same period, enrollment in public coverage has grown dramatically. Once limited almost exclusively to poor children receiving cash welfare, public insurance income eligibility limits for Medicaid or the State Children’s Health Insurance Program (SCHIP) now extend to at least 200 % of the Federal poverty level in most states.Footnote 1 SCHIP, like earlier expansions of the Medicaid program, has reduced the number of children without insurance.

However, the policy developments of the past two decades have left a more complex and fragmented market for health insurance. Recent research has shown that changes in insurance status and movements between public and private coverage have become increasingly common, especially for children in lower income families (see, for example, Ham et al. 2009, Hill and Shaefer 2011 and Short et al. 2012). “Churning” among different types of insurance coverage may become even more common after 2014, when the main coverage provisions of the Affordable Care Act go into effect (Sommers and Rosenbaum 2011; Buettgens et al. 2012).

In addition to contributing to higher administrative costs, transitions between private coverage, public coverage, and no insurance may have negative consequences for access to care. In this paper we use data from the Survey of Income and Program Participation (SIPP) to analyze the relationship between health insurance coverage and medical care utilization among children. Because the SIPP records a child’s insurance coverage every month over a three to four year period, we are able to go beyond measures of health insurance coverage that are based on a point in time, testing for differences in utilization between children with full- and partial-year public and private coverage. Using these measures we investigate whether transitions between public and private insurance, including those that do not entail a spell without insurance, are associated with reduced access.

The longitudinal nature of the SIPP data also allows us to control for individual heterogeneity in our models of medical care utilization using child fixed effects. The inclusion of child fixed effects will eliminate the bias associated with selection into health insurance coverage as long as the unobserved factors that influence selection are constant over time. For example, this will be the case if children with greater medical needs are more likely to be continuously insured, but that selection is based on long-standing health conditions. Similarly, parental preferences, attitudes and capabilities are likely to influence both whether a child maintains continuous insurance coverage and whether she has an annual well child visit. Since chronic health conditions and parental factors are not likely to change substantially from one year to the next, their effects will also be differenced away in a fixed effect model. On the other hand, if changes in health status precipitate changes in insurance coverage and changes in utilization, endogeneity bias remains a concern.

To test for the importance of such bias, we estimate models of health insurance coverage with and without child fixed effects. We confirm that while in the cross section health status is significantly correlated with coverage, after controlling for child fixed effects this correlation becomes insignificant, suggesting that acute child health shocks are not an important determinant of insurance coverage. These results support our use of a fixed effects framework to investigate insurance instability and utilization. In that analysis, we find that children with part-year coverage are significantly less likely to have an annual visit than children with full-year coverage, though they are more likely to have a visit than children who were uninsured all year. The effect of full-year coverage (of any type) relative to being uninsured is 60 % higher than the effect of part-year coverage relative to being uninsured. When we model coverage using a monthly measure, each additional month increases the probability of having at least one visit by roughly one percentage point. We also find some evidence that transitions between public and private insurance are associated with a slight reduction in access, even when the transition does not entail a spell without insurance, though the evidence for this finding is weak when we control for child fixed effects.

Background and previous literature

A key objective of expanding public health insurance coverage for children is to increase access to health care. A large literature documents a positive relationship between insurance coverage and various measures of utilization for children.Footnote 2 Commonly in these studies insurance status is categorized based on coverage at the time of the survey and utilization is measured over some period preceding the survey, typically a year. A key limitation of this approach is that it fails to account for changes in coverage over the course of the year. To the extent that insurance status is not static, researchers correlating current status with past year utilization may be missing an important part of the relationship between insurance coverage and utilization. Moreover, studies using point-in-time measures of insurance coverage cannot speak to the question of whether discontinuities in insurance coverage and transitions between public and private coverage have consequences for health care utilization.

Despite this strong evidence of a positive relationship between insurance coverage and health care utilization, it is not obvious that coverage transitions, even those that entail a spell of uninsurance, should necessarily result in reduced utilization of care. As we show in the next section, most spells of uninsurance are short. To the extent that parents can anticipate transitions in insurance coverage, they will want to adjust the timing of their children’s utilization, to the extent possible. As a result, differences between children with full-year and part-year coverage may be small. Of course, not all transitions in insurance coverage will be fully anticipated and it will not be possible to time precisely all physician visits. Therefore, how medical care utilization by children with partial year coverage compares to utilization by children with full year coverage is an empirical question.

Three recent studies suggest that even short spells without insurance can result in reduced utilization of care. Olson et al. (2005) find that children who were uninsured for part of the year are more likely to delay seeking care for financial reasons and to report unmet medical needs and less likely to have an office visit compared to children with full-year coverage. For most outcomes, however, there was no significant difference between being uninsured for all or part of the year.Footnote 3 Similarly, Aiken et al. (2004) find that children with partial year coverage are less likely than continuously insured children to have at least one physician visit over the year, though these results are imprecisely estimated. Leininger (2009) examines how physician visits vary with the months of insurance coverage during the course of a year and finds that children with partial-year coverage have fewer visits than those who are insured for a full year.

Each of these studies has limitations related to the data and methods used. Olson et al. use data from the 2000 and 2001 National Health Interview Survey (NHIS). While the main insurance variables in the NHIS are point-in-time measures, additional questions ask about the child’s recent coverage history. These questions cannot capture direct transitions between public and private insurance, nor can they be used to calculate the number of months a child had each type of coverage. Aiken et al. use questions available in the 1999 National Survey of America’s Families (NSAF) that do identify transitions between public and private insurance. However, because of their retrospective nature, estimates based on these data are still subject to recall error. This may explain why in these studies the estimated differences between children with full- and partial-year coverage are not statistically significant.

An additional limitation of both of these studies is that they treat insurance coverage as exogenous. If factors that affect the stability of coverage also affect utilization, the estimated effects from these studies will be biased. We would expect children with chronic health conditions to be more likely to maintain continuous coverage because insurance is more valuable to them. This indirect effect of health status is likely to be strongest in the case of Medicaid because providers may assist patients with program enrollment. Unobserved parental characteristics are likely to be important as well. It is reasonable to expect that parents who take greater efforts to ensure that their children maintain continuous insurance coverage are also more likely to make sure their children receive annual medical check-ups. In this case, the effect of discontinuous coverage on access to care will be overstated. The paper by Leininger (2009) improves upon both of these limitations. With longitudinal data from the Medical Expenditure Panel Survey (MEPS), she is able to measure the number of months a child is insured over a year and she is also able to control for unobserved heterogeneity by using a fixed effect model.

Our analysis extends this literature in several ways. To begin with, it is important to test whether results found in one data set can be replicated in another. Although the SIPP contains information on fewer health outcomes than the MEPS, it has other advantages. One is that SIPP panels are slightly longer than the MEPS, giving us two to four years of utilization data on children, compared to only two years in Leininger’s analysis. Given that identification of our fixed effects estimates comes from children experiencing changes in insurance coverage, longer panels make it possible to use more detailed measures of insurance coverage. Specifically, whereas Leininger uses a single measure of insurance that combines public and private coverage, we are able to distinguish between the two types of coverage.

There are several reasons why it is important to distinguish between public and private insurance. First, different factors affect selection into the two types of coverage. Clearly, income will have opposing effects on public and private coverage. In addition, we find evidence of adverse selection into public insurance but positive or “advantageous” selection into private insurance. Second, there are longstanding concerns that because of low reimbursement rates, Medicaid does not provide the same degree of access to care that private insurance does. To the extent that this is true, measures of insurance that combine public and private coverage will overstate the impact of the former and understate the impact of the latter. Finally, with combined measures of insurance coverage it is not possible to test whether transitions between private and public insurance lead to disruptions in access. This question is particularly important in light of recent policy developments. Once the coverage expansions of the Affordable Care Act are fully in effect, low income families will be less likely to experience spells without insurance but will be more likely to make transitions between public and private coverage (Sommers and Rosenbaum 2011; Buettgens, Nichols and Dorn 2012).

Data

We use the full 1996 and 2001 SIPP panels and the first 2 years of the 2004 panel to construct an extract that spans the years 1996 to 2005.Footnote 4 As our focus is on children, we use only observations for individuals younger than 16. We drop observations that have fewer than 12 reported months, since in those cases we are unable to determine the child’s insurance status for the missing months.Footnote 5 We also drop observations for which the physician visit variable is imputed. Our analysis is thus based on an extract that consists of 68,156 observations on 24,443 children from the 1996 panel, 42,176 observations on 18,661 children from the 2001 panel and 38,959 observations on 23,334 children from the 2004 panel.Footnote 6

Every four months (a “wave”), SIPP respondents are asked questions on family status, employment, program participation, and insurance coverage. In addition to these “core” questions, additional questions covering a variety of topics (known as “topical module” questions) are asked on a rotating basis. We are primarily interested in the health insurance questions, which are part of the core, and the health care utilization and health status questions, which are topical module questions asked annually.Footnote 7

The health insurance questions in the core data ask about coverage in each of the four months since the last interview. We construct variables that describe each individual’s insurance coverage experience over the year corresponding to the reference period for the utilization questions of the topical module. For all of these measures, we distinguish between three coverage categories: uninsured, public insurance and private insurance.Footnote 8 One of these measures is insurance status at the time of the interview when the topical module on medical care utilization was administered, a point-in-time measure of coverage comparable to the variables available in cross-sectional data sets such as the NHIS. Using data from prior waves, we also construct variables that take into account full-year and partial-year insurance coverage and transitions between private plans and public programs.

Table 1 summarizes the distribution of insurance coverage for the full sample and by income categories. It is important to note that because we have information on broad coverage categories, we do not observe changes from one private plan to another or movements between different types of public coverage. Transitions from one private plan to another may occur if the child’s parent changed jobs during the analysis period or if the 12-month period straddled two calendar years and the parent switched among plans offered by his or her employer. Plan changes within the public category could occur if a change in family income caused a child to move from Medicaid to a stand-alone SCHIP program, or vice versa. Even with this limitation, the data in the table reveal that health insurance coverage for children is very fluid. Over one-fifth of all children experienced a transition—into or out of coverage or between public and private coverage—during the preceding 12-month period. Transitions are most common among lower income children, with 60 % of children in the lowest income group and 27 percent of those with family incomes between 100 and 300 % of poverty experiencing a coverage change. In contrast, coverage was more stable in the upper part of the income distribution, although not perfectly so: above 300 % of the federal poverty level (FPL), 90 % of children had the same coverage status for the full year.

Table 1 also reports the mean number of months in each insurance category over the 12-month period.Footnote 9 The data in Table 1 show that the probability a child is uninsured at some point in the year decreases with income. Conditional on having a spell, however, children in both of the two bottom income groups are equally likely to be uninsured for a full year.

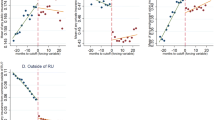

In Figs. 1, 2, and 3, we plot the distribution of coverage spells, using the same income categories as in Table 1. The first thing to note about the figures is that they illustrate the well-known issue of “seam bias” in the SIPP. The disproportionate mass at values of 4, 8 and 12 reflects the tendency of respondents to report the same values of a variable like health insurance for all months within a survey wave and to report that transitions occurred at the “seam” between interview periods. This type of respondent behavior will lead to an under-counting of spells that begin and end within a single survey wave. This may explain why our estimate of the number of children experiencing insurance transitions is greater that estimates from prior studies that use a 12-month recall period (Aiken et al. 2004; Olson et al. 2005).

Abstracting from the issue of response bias, the data in Fig. 1 indicate that for most children, periods without insurance are relatively short. Over half of all spells without insurance are between 1 and 4 months. Figures 2 and 3 show a positive relationship between income and coverage stability. Eighty-six percent of children in the highest income category who have private health insurance at some point in the year had that coverage for the entire year. In contrast, when lower income children obtain private insurance it tends to be for shorter periods. Public insurance coverage is somewhat less stable. Roughly half of the lowest income group who have public insurance at any time during the year maintain that coverage for 12 consecutive months.

The SIPP topical module on Medical Expenditures and Health Care Utilization includes a question on how many physician visits each child had during the prior year. Although the question on physician visits asks for the number of visits, most of our analysis focuses on a binary measure that equals one if the child had at least one visit during the year and zero otherwise. Since it is recommended that all children have an annual check-up, regardless of their health status, this binary measure is likely to be a better measure of access than the number of visits, which will be more strongly related to a child’s health status (Currie and Gruber 1996; Sommers 2006).

Given the 12-month recall period for visits we cannot match the timing of the visits to the timing of the child’s insurance coverage. Therefore, we cannot test for intertemporal effects of insurance that would arise if parents were able to anticipate losing or gaining coverage and schedule visits to coincide with the timing of that coverage. The best we can do is to estimate how utilization over the 12-month period depends on whether the child was covered for all or part of the year.Footnote 10

Table 2 presents means for this outcome cross-tabulated by alternative insurance measures and the three family income categories. These descriptive results point to the importance of distinguishing between full and part-year coverage. The data in the top panel show that in the full sample, children who were insured at the time of the survey were 24 percentage points more likely to have at least one visit than children who were uninsured (71 vs. 47 percent). These figures understate the importance of insurance because of the way that point-in-time measures pool children with full-year and part-year coverage. The data in the next panel show that the gap between children with full-year insurance and those who were uninsured for 12 months is roughly 10 percentage points larger (33 percentage points). Utilization rates for children with part-year coverage fall between those for children who were insured for the full year and those who were uninsured all year. The data presented in the bottom panel of the table indicate that the probability of having at least one visit increases monotonically with the length of coverage.

As noted above, one difference between our analysis and that of Leininger is that we distinguish between public and private coverage. For the full sample, it appears that private coverage is associated with greater utilization, though this is not the case when we cut the data by broad income categories. In the lowest income category (\(<\)100 % of FPL), where public insurance is much more common, the utilization rate is higher for public coverage than for private. In contrast, in the top income category (\(>\)300 % of FPL) where private coverage is much more common, the difference goes the other way. In the middle category, we see no significant difference between children with full-year public vs. full-year private coverage.

As noted in the introduction, one concern related to the fragmented nature of the U.S. health care system is that transitions between public and private coverage may disrupt access to care even if the transition does not entail a spell without any insurance. The results in Table 2 are consistent with this hypothesis. In the lowest income group (where mixed coverage is most common) children who are insured for a full year with mixed coverage are 5 percentage points less likely to have an annual visit than those with full-year public coverage and 3 percentage points less likely than those with full-year private insurance. The gap is larger in the highest income category, though only 1.3 % of children in this income category have mixed coverage in a given year. Of course, unadjusted results like this should be interpreted with caution, as this pattern may reflect underlying differences between children with continuous or discontinuous coverage rather than a causal effect of transitions.

Regression analysis

Our main regression specification is

where the dependent variable is an indicator that equals one for children with at least one physician visit over the past 12 months, \({ Insurance}_{it}\) represents insurance coverage, which we measure in a variety of ways, \(X_{it}\) is a vector of observable covariates (which may vary over time), and \(\mu _{i}\) is a child fixed effect.

In Table 3 we report results from regressions of the binary utilization variable on point-in-time measures of insurance coverage. In panel A, the insurance variable is an indicator for coverage from any source; panel B includes separate indicators for public and private insurance. Each column corresponds to a different version of these models. For the sake of comparison and to illustrate the effect of controlling for child fixed effects, the first three columns report results from cross-sectional models that control for observable child and family characteristics, but do not include child fixed effects. In column 1, we report marginal effects from a logit model estimated using the full sample. One disadvantage of the logit specification is that it is not straightforward to include individual-level fixed effects. Therefore, we also estimate the relationship between insurance and utilization using a linear probability model (LPM, column 2). In the fixed effects specification (column 4) only children for whom we have multiple observations contribute to the identification. To make sure that any difference between this model and the cross-sectional models is due to the fixed effects and not differences in samples, we re-estimate the cross-sectional linear probability model on a sample of children with more than one observation (column 3).

All three cross-sectional models yield results that are essentially identical. The probability of having an annual physician visit is 17 to 18 percentage points higher for children who are insured at the time of the survey than for children who are uninsured at that point in time. When we condition on child fixed effects, the estimated effect of insurance is less pronounced, though still statistically significant. The point estimate in column 4 of Panel A implies that having insurance increases the probability of a visit by roughly 10 percentage points. The results in Panel B suggest that private and public insurance have comparable effects on utilization. The differences between the coefficients for the two types of coverage are not statistically significant.

Table 4, which has a similar layout to Table 3, presents results from models that distinguish between part-year and full-year coverage. In panel A we use three insurance categories: insured full-year, insured part-year and uninsured all year (the omitted category.) Relative to being uninsured all year, part-year coverage increases the probability of a visit by 8 percentage points and full-year coverage increases the probability by 13 percentage points. Comparing Tables 3 and 4, we see that the coefficients on the full year coverage variables are substantially larger than the estimates for the corresponding point-in-time variable.

In panel B we distinguish between public and private coverage using seven mutually exclusive categories (including the omitted category of uninsured all year). In the cross-sectional LPM models, full-year public and full-year private coverage raise the probability of at least one visit (relative to being uninsured all year) by 26 and 24 percentage points, respectively. When we condition on child fixed effects, the coefficient on full-year public is slightly larger than that on full-year private (14.6 vs. 11.9 percentage points), a statistically significant difference (\(p\) value \(=\) 0.006). However, looking at children with part-year coverage, the difference between public and private insurance is not statistically significant (\(p\) value \(=0.19\)).

With the Panel B model, we can test the hypothesis that transitions between sources of coverage can have negative consequences for utilization even if those transitions do not entail a spell without insurance by comparing the coefficient on the indicator variable for full-year, mixed coverage with the coefficients for the other two full-year categories. In the cross-sectional LPM model, the difference is 4.1 percentage points when we compare mixed coverage to full-year public insurance and 2.8 percentage points when the comparison is to full-year private. Both differences are statistically significant (\(p\) values \(<\)0.0001). However, it appears that part of these gaps is driven by unmeasured differences between children who do and do not make transitions between public and private insurance. Once we condition on child fixed effects, the difference between mixed coverage and public coverage becomes slightly smaller (2.6 percentage points) and still significant (\(p\) value 0.004). However, there is no difference between mixed coverage and full-year private coverage (\(p\) value \(=0.9\)).

An alternative way to account for the difference between full-year and part-year coverage is to enter the number of months of coverage over the prior year. In Panel A of Table 5, we report such a model, which is similar to Leininger’s (2009) specification. The fixed effect model reported in column 4 indicates that an additional month of coverage increases the probability of a visit by a little more than 1 percentage point. This is similar to the 0.7 percentage point effect that Leininger finds using two years of MEPS data, though slightly larger. We also estimated models with separate variables for months of public insurance and months of private insurance (not reported). Similar to the results in Tables 3 and 4, the coefficients on the public and private coverage variables are not significantly different from each other.

One potential problem with the specification in Panel A is the reporting error documented in Figs. 1, 2, and 3. Therefore, in addition to models in which months of coverage enters linearly, in Panel B we also report models that use three categorical variables corresponding to 4-month coverage intervals. The idea is that differences in insurance coverage across SIPP waves should be measured more accurately than differences from one month to the next. The results from this specification suggest a dose-response relationship between insurance coverage and the probability of a visit.

Robustness checks

To examine the robustness of our results, we conducted several additional analyses, varying the sample as well as the specification. We ran our models on two alternate samples to see if attrition bias was likely to pose problems for our analyses. In one case, we limited the sample only to children who were in the sample the entire period; in the other we included only observations from the first two years of any panel. The results from both of these sets of models were nearly identical to the models presented in Tables 3, 4, and 5. Because the health care needs of children vary with age, we repeated our analyses splitting our sample by age according to the following categories: less than 5 years old, 5–9, 10–12, and 13–15. For each age group, the pattern of results is similar to what we find for the full sample.

We chose to analyze the probability of having at least one visit in a year because all children are recommended to have an annual well child visit. Therefore, this outcome can be interpreted as a measure of access that will be less influenced by child health than the total number of visits. Nonetheless, we also ran a full set of regressions using the total number of visits in a year as the dependent variable. The results for this dependent variable are largely similar to those for the binary utilization measure. There is evidence that unobserved heterogeneity biases the cross-sectional estimates of the effect of insurance away from zero, but even when we condition on child fixed effects we find that children with full-year coverage have significantly higher utilization than those with part-year coverage, who in turn have more visits than children who were uninsured all year. One difference between this dependent variable and the binary outcome is that even in the cross-sectional models we find no evidence that children who transition between public and private insurance have lower levels of utilization than children with full-year coverage from a single source.

These additional models rely on the same identifying assumption as the main results presented in Tables 3, 4, and 5: to the extent that there is unobserved heterogeneity that is correlated with both health insurance coverage and the demand for medical care is time invariant, it can be captured by a child fixed effect. If this assumption does not hold—i.e., if changes in unobserved characteristics influence both coverage and utilization—the problem of endogeneity bias will not be completely eliminated by the inclusion of individual fixed effects. An alternative strategy for estimating the causal effect of insurance is the use of instrumental variables. Changes in income eligibility limits caused by states implementing the SCHIP program provide one possible instrument. Simulated eligibility measures that capture differences across states in the timing and extent of eligibility expansions have been used to predict changes in public and private insurance coverage (LoSasso and Buchmueller 2004; Gruber and Simon 2008) and similar instruments have been used in analyses of medical care utilization (Currie and Gruber 1996).

The limitation of the IV approach for our purposes is that our preferred models have multiple endogenous explanatory variables and we lack additional instruments. Thus, the models are under-identified. In principle, the model in which insurance is measured by the number of months with any coverage is just identified, however here we face the problem of weak instruments. It has been documented that increases in SCHIP eligibility had opposite signed effects on public and private coverage. Because of this crowd-out, simulated eligibility measures are strong predictors of either public insurance or private insurance, but are weakly correlated with coverage from any source.

One IV model that we are able to estimate is one where the number of months covered by public coverage is the only insurance variable on the right hand side. The estimated coefficient on this variable can be interpreted as a local average treatment effect—i.e., the effect of an additional month of public coverage on those children who gained coverage as a result of the CHIP expansion. When we run this model the estimated coefficient on the months public variable is 0.019 (\(t \hbox {statistic}=4.92\)). This is essentially identical to the coefficient on months of public coverage in our cross-sectional models and slightly larger than the estimate from our fixed effect specification (0.012). Although we cannot draw definitive conclusions from this comparison, it does suggest that our fixed effects estimates are not subject to a positive bias from omitted variables.

Exploring unobserved heterogeneity

As an additional check on our fixed effect specification we test whether changes in individual characteristics predict changes in insurance coverage. Of particular interest is whether changes in health status affect changes in coverage. We do this by regressing measures of insurance coverage on observable child characteristics with and without fixed effects. The observable characteristics, which are the same as those we use in the utilization regressions, include four indicator variables corresponding to whether the child’s health is described as excellent, very good, good or fair; poor health is the omitted category. In simple OLS models, the coefficients on the health variables capture the combined effect of long lasting chronic conditions and acute health shocks. In models with child fixed effects, chronic conditions will be captured by the fixed effects and the coefficients on the health variables will represent the effect of changes in health status on changes in insurance coverage.

The results are reported in Table 6. The OLS models imply that health insurance coverage is, in fact, correlated with health status, though, interestingly, the sign of the correlation is different for public and private insurance. For public insurance, we see evidence of adverse selection. Children who are in excellent health spend 1.37 fewer months per year on public coverage than children who are in poor health (the omitted category). The coefficients on the other health variables indicate a monotonic relationship between health status and public coverage enrollment, with children in poorer health spending more time on the program. In contrast, children in excellent health spend almost an extra month per year with private insurance compared to children in poor health, evidence of “advantageous” selection. The gap between children in very good health and those in poor health is a statistically significant 0.5 months per year.

For both types of coverage, the correlation between health status and months of coverage is substantially diminished in magnitude and significance when we include child fixed effects. In the case of public coverage, the point estimates for excellent, very good and good health are still negative, though the \(t\) statistics are all approximately less than one. The health coefficients in the private insurance regression, which were already small in the OLS model, are precisely estimated zeros in the model with fixed effects.

The estimated relationships between insurance coverage and the other explanatory variables are also sensitive to the inclusion of fixed effects, though in most cases the coefficients remain statistically significant, implying that changes in these variables lead to changes in insurance coverage. The fixed effects models indicate that increases in family income and parental employment are positively related to private insurance and negatively related to public coverage. This pattern is as expected, given the fact that eligibility for public insurance is explicitly based on income and the vast majority of private coverage is employment-based. In both the OLS and fixed effect models, being in a two-parent family has a strong positive correlation with private insurance coverage and a negative correlation with public coverage.

Overall, these results tell a generally reassuring story about the robustness of the fixed effects utilization models. Importantly, they suggest that while health status is significantly related to insurance coverage, this relationship is driven mainly by chronic conditions, which would be captured by the inclusion of child fixed effects, rather than acute health shocks, which would not be.Footnote 11 However, the results also suggest that changes in insurance coverage from one year to the next are affected by changes in family economic circumstances that affect eligibility for public insurance and access to private insurance. While we cannot rule out the possibility that there are other economic shocks that we do not measure that affect both insurance coverage and access to medical care, we view this potential threat to identification as less severe than if we had found that changes in health insurance status were driven largely by changes in health status.

Concluding comments

The Medicaid expansions of the late 1980s and early 1990s and the establishment of the State Children’s Health Insurance Program in the latter part of the 1990s have significantly increased the insurance coverage of children in the U.S. However, because of fundamental features of the U.S. health care system, for many children insurance coverage remains unstable. We find that over the period from 1996 to 2005 transitions in insurance coverage are quite common: in a given year roughly one in five children—and roughly one third of all poor children—experienced a transition in coverage, either between being insured and uninsured or between public and private coverage.

In addition to decreasing the number of Americans who are uninsured, the coverage expansions of the Affordable Care Act will likely increase the frequency of transitions among different types of insurance. An important policy question is whether discontinuities and transitions in coverage translate to lower access to health care services. Results from fixed effect regressions indicate greater utilization among children with full-year coverage than children with part-year coverage, by approximately five percentage points or one percentage point for every additional month insured. In models where we further distinguish between public and private insurance, we again find that coverage transitions that entail a period of time without insurance are significantly negatively correlated with the probability of having at least one physician visit over the course of a year. Perhaps surprisingly, we also find a statistically significant 2.7 percentage point difference in utilization between full year public and full year private coverage for the population of children experiencing some insurance change over the course of the panel. However, we note no significant public/private difference when looking at children with part year coverage.

Lastly, the SIPP data also allow us to test whether transitions between public and private insurance per se affect utilization by comparing results for children with full year coverage split between public and private, to children with full year coverage entirely provided by a public or private source. In models without child fixed effects, we find that children with mixed coverage have significantly lower utilization than children who have full-year coverage of either type. When we include the fixed effects we find that children with mixed coverage have slightly lower utilization than children with full-year public insurance, but we find no significant difference with full-year private coverage.

Our findings are relevant for current Medicaid and SCHIP eligibility and enrollment policies, and the dramatic changes that will take place with the full implementation of the Affordable Care Act in 2014. In order to limit the substitution of public insurance for private coverage, many states require that children be uninsured for a minimum period of time before enrolling in SCHIP. While these requirements may reduce transitions out of private insurance, they may also increase spells of uninsurance for some children. At the same time, states enacted administrative reforms that simplify procedures for re-certifying eligibility and that allow children to remain in public programs for longer periods of time. To the extent these policies reduce periods without coverage, our results would suggest that these policies may have real effects on children’s medical care utilization.

While the establishment of subsidized exchange qualified health plans will offer low income families a new market to obtain low-cost private insurance, it will also create new challenges for families and for state and federal policy makers. Low-income families have highly volatile incomes, making them candidates to fluctuate between subsidized coverage programs (Shore-Sheppard 2013). Enacting procedures to ensure continuous coverage when someone’s eligibility shifts between programs may be necessary to ensure children do not experience spells without coverage due to changes in family circumstances such as increases in income or family size, spells which may have negative consequences for children’s use of medical care.

Notes

Following the enactment of the Children’s Health Insurance Program Reauthorization Act of 2009 in February 2009, the official acronym for the State Children’s Health Insurance Program was changed to “CHIP.” In this paper, however, we continue to use the previous acronym.

See Buchmueller et al. (2005) for a review.

An earlier study using data from the 1980s also finds significant differences between children who were insured for a full year and those who were uninsured for a full year, but no significant differences between children with partial year coverage and those who were uninsured all year (Short and Lefkowitz 1992).

The 1996 panel starts in December 1995 and ends in February 2000; the 2001 panel covers the period October 2000 to December 2003; and the first six waves of the 2004 panel covers October 2003 to December 2005.

An exception to this criterion is infants: for children under a year old, we use all months since the child was born.

If we use calendar year weights, the analysis sample is reduced by over 12,000 person-years due to missing weights for those observations. We have run all of our models both using the weights and not using the weights, and the results do not substantively differ. We report the unweighted models in the paper, but weighted results are available upon request.

In the 2004 SIPP panel the topical module on health was only administered twice. This is why we use only two years of data from that panel.

The public insurance category consists mainly of Medicaid and SCHIP plus a very small number of children who qualify for Medicare or are covered by the Indian Health Service. The private insurance category includes employer-sponsored group insurance, which accounts for the vast majority of private coverage, and individually purchased non-group insurance. CHAMPUS, the insurance program for dependents of military personnel, is considered as private insurance because it is employment related.

The mean months in each category may sum to less than 12 because the sample includes infants less than one year old.

While another commonly used measure of access to care is whether the individual has a usual source of care, that measure is not available in the SIPP.

An alternative explanation for this pattern is that changes in reported health status are very noisy proxies for changes in objective health. However, when we include the same health status variables in our utilization regression they are significant predictors of use, even conditioning on child fixed effects. This suggests that changes in subjective health status do reflect real health shocks.

References

Aiken, K. D., Freed, G. L., & Davis, M. M. (2004). When Insurance Status is not Static: Insurance Transitions of Low-Income Children and Implications for Health and Health Care. Ambulatory Pediatrics, 4(3), 237–243.

Buchmueller, T. C., Grumbach, K., Kronick, R., & Kahn, J. G. (2005). The Effect of Health Insurance on Medical Care Utilization and Implications for Insurance Expansion: A Review of the Literature. Medical Care Research and Review, 62(1), 3–30.

Buettgens, M., Nichols, A., Dorn, S. (2012). “Churning under the ACA and State Policy Options for Mitigation”, Urban Institute Report.

Currie, J., & Gruber, J. (1996). Health Insurance Eligibility, Utilization of Medical Care, and Child Health. Quarterly Journal of Economics, 111(2), 431–466.

Gruber, J., & Simon, K. (2008). Crowd-out 10 years later: Have recent public insurance expansions crowded out private health insurance? Journal of Health Economics, 27(2), 201–217.

Ham, J. C., Li, X., & Shore-Sheppard, L. (2009). Public Policy and the Dynamics of Children’s Health Insurance, 1986–1999. American Economic Review, 99(2), 522–526.

Hill, H. D., & Shaefer, H. L. (2011). Covered Today, Sick Tomorrow? Trends and Correlates of Children’s Health Insurance Instability. Medical Care Research and Review, 68(5), 523–536.

Leininger, L. J. (2009). Partial-Year Insurance Coverage and the Health Care Utilization of Children. Medical Care Research and Review, 66(1), 49–67.

LoSasso, A., & Buchmueller, T. (2004). The effect of the state children’s health insurance program on health insurance coverage. Journal of Health Economics, 23(5), 1059–1082.

Olson, L. M., Tang, S. S., & Newacheck, P. W. (2005). Children in the United States with Discontinuous Health Insurance. New England Journal of Medicine, 353(4), 382–391.

Shore-Sheppard, L. (2013). “Income Dynamics and the Affordable Care Act”. Working Paper, Williams College Department of Economics.

Short, P. F., Graefe, D. R., Swartz, K., & Uberoi, N. (2012). New Estimates of Gaps and Transitions in Health Insurance. Medical Care Research and Review, 69(6), 721–736.

Short, P. F., & Lefkowitz, D. C. (1992). Encouraging Preventive Services for Low-Income Children: The Effect of Expanding Medicaid. Medical Care, 30(9), 766–780.

Sommers, B. (2006). Protecting low-income children’s access to care: Are physician visits associated with reduced patient dropout from Medicaid and the Children’s Health Insurance Program? Pediatrics, 118(1), e36–e42.

Sommers, B., & Rosenbaum, S. (2011). Issues In Health Reform: How Changes In Eligibility May Move Millions Back And Forth Between Medicaid And Insurance Exchanges. Health Affairs, 30(2), 228–236.

Acknowledgments

This research was supported by grants from the U.S. Census Bureau and the Robert Wood Johnson Foundation. Neither funding source had any involvement in the conduct of the research.

Author information

Authors and Affiliations

Corresponding author

Rights and permissions

About this article

Cite this article

Buchmueller, T., Orzol, S.M. & Shore-Sheppard, L. Stability of children’s insurance coverage and implications for access to care: evidence from the Survey of Income and Program Participation. Int J Health Care Finance Econ 14, 109–126 (2014). https://doi.org/10.1007/s10754-014-9141-1

Received:

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s10754-014-9141-1