Abstract

To model the uncertainty in the secondary possibility distributions, this paper develops a new method for handling interval-valued fuzzy variables with variable lower and upper possibility distributions. For a parametric interval-valued fuzzy variable, we define its lower selection variable, upper selection variable and lambda selection variable. The three selection variables are characterized by variable possibility distributions, and their numerical characteristics like expected values and n-th moments are important indices in practical optimization and decision-making problems. Under this consideration, we establish some useful analytical expressions of the expected values and n-th moments for the lambda selections of parametric interval-valued trapezoidal, normal and Erlang fuzzy variables. Furthermore, we focus on the arithmetic about the sums of common parametric interval-valued fuzzy variables. Finally, we apply the proposed optimization indices to a quantitative finance problem, where the second moment is used to measure the risk of a portfolio.

Similar content being viewed by others

Explore related subjects

Discover the latest articles, news and stories from top researchers in related subjects.Avoid common mistakes on your manuscript.

1 Introduction

The concept of type-2 (T2) fuzzy set was proposed by Zadeh (1975) to generalize type-1 fuzzy set, and the advantage of T2 fuzzy theory is its ability to model the uncertainty in the secondary possibility distributions. In order to study T2 fuzzy theory, Mendel and John (2002) established some basic terms for T2 fuzzy set so that it could be easily understood or used in practical fuzzy logic systems. Liu and Liu (2010) studied T2 fuzziness by fuzzy possibility theory. To reduce the uncertainty in the secondary possibility distributions, Bai and Liu (2014) developed a value-at-risk reduction method for type-2 fuzzy variables via possibility measure. In the recent literature, the research on interval T2 fuzzy set becomes the focus of T2 fuzzy theory. Since the computation associated with interval T2 fuzzy set is more manageable, interval T2 fuzzy sets become the most widely used T2 fuzzy sets, and have been used successfully to many application areas. Wang et al. (2004) presented an interval T2 fuzzy neural network to handle uncertainty with dynamical optimal learning. Mendel et al. (2006) derived formulas for the union, intersection and complement about interval T2 fuzzy sets, and used them in the interval T2 fuzzy logic system. Chen and Lee (2011) presented a fuzzy interpolative reasoning method, which can deal with the sparse fuzzy rule-based systems in a more flexible and intelligent manner. For protecting computer networks, Viscontia and Tahayori (2011) proposed a performance-based artificial immune system that mimicked the workings of an adaptive immune system on the basis of interval T2 fuzzy set paradigm. Khosravi et al. (2012) proposed the application of interval T2 fuzzy logic systems for the problem of short term load forecasting, and proved that the proposed models can approximate future load demands with an acceptable accuracy. Mendez et al. (2012) presented an interval T2 fuzzy logic system with intelligent controllers, and proved the feasibility of the developed system for finishing mill thread speed set-up and control. Chen (2013) developed an interactive method for handling multiple criteria group decision-making problems, in which the criterion values were expressed as interval T2 trapezoidal fuzzy numbers, and the applicability of the method was illustrated with a medical decision-making problem of patient-centered medicine concerning basilar artery occlusion. Pagola et al. (2013) proposed a new fuzzy thresholding algorithm, in which an expert can select multiple membership functions to construct an interval T2 fuzzy set such that the length of the interval represents the uncertainty of the expert. All the applications mentioned above have demonstrated that interval T2 fuzzy sets are good at modeling the uncertainty embedded in secondary possibility distributions. In Bustince et al. (2014), the authors pointed out that interval type-2 fuzzy sets are generalization of interval-valued fuzzy sets. In this sense, some researchers are actually discussing interval-valued fuzzy sets in their works but using the concept of the interval T2 fuzzy set. In the present paper, we will distinguish the two basic concepts.

In many application problems, because the footprint of uncertainty of an interval-valued fuzzy set is a bounded region, some researchers often use fixed lower and upper region boundaries as the representatives of an interval-valued fuzzy set. For example, using the upper and lower membership functions, Wu and Mendel (2007) introduced the centroid, cardinality, fuzziness (entropy), variance and skewness of an interval T2 fuzzy set as measures of uncertainty. Gong (2013) proposed the lower and upper possibility mean value of an interval T2 fuzzy set, and established an optimization model to determine the attributes’ weights for multi-attribute group decision making problem. In the present paper, we propose a novel method for handling the interval T2 fuzziness, and represent an interval-valued fuzzy variable by variable lower and upper boundaries. To characterize a parametric interval-valued fuzzy variable, we introduce its lower selection variable, upper selection variable and lambda selection variable. For practical optimization and decision-making problems, it could be more flexible and effective to take the lambda selection as the representative of a parametric interval-valued fuzzy variable.

Numerical characteristics are usually important indices to describe uncertainty. Among them, the expected value, variance, skewness and kurtosis are frequently used for modeling the return and risk in financial and management problems. In addition, it is more important to take into account the higher moments than the lower ones. In the present paper, the lambda selection variable is characterized by parametric possibility distributions, its numerical characteristics like the expected values and n-th moments are important optimization indices in practical decision-making problems. We establish some useful analytical expressions of the expected values and n-th moments for the lambda selections of the common parametric interval-valued fuzzy variables. We employ L–S integral (Carter and Brunt 2000) to define the n-th moment, where the L–S measure is generated by the credibility distribution of a general fuzzy variable (Liu and Liu 2014).

The rest of this paper is organized as follows. Section 2 reviews some basic concepts in fuzzy theory, and defines the parametric interval-valued fuzzy variable. Section 3 defines the lower selection variable, upper selection variable for parametric interval-valued fuzzy variables. In Sect. 4, we establish the analytical expressions of the expected value and n-th moment for the lambda selections of the common parametric interval-valued fuzzy variables and their sums. In Sect. 5, we apply the proposed method to the portfolio selection problem, and develop a new mean-moment optimization model. Section 6 gives our conclusions.

2 Interval-valued fuzzy set and interval-valued fuzzy variable

The concept of T2 fuzzy set was given by Zadeh (1975). To understand and use T2 fuzzy set easily, Mendel and John (2002) gave the following representation for a T2 fuzzy set:

Definition 1

A T2 fuzzy set A is characterized by a T2 membership function \(\mu _{A}(x,u)\), for \(x \in X\) and \(u\in J_x\subseteq [0,1]\), i.e. \( A=\{((x,u),\mu _A(x,u))\mid \forall x\in X,\forall u\in J_x\subseteq [0,1]\}\), where \(0\le \mu _A(x,u)\le 1\).

Karnik et al. (2000) introduced the notion of an interval T2 fuzzy set. The interval T2 fuzzy set is a special T2 fuzzy set, and Mendel et al. (2006) described its definition as follows.

Definition 2

A T2 fuzzy set A is characterized by a T2 membership function \(\mu _{A}(x,u)\). If for \(\forall x\in X,\forall u\in J_x\subseteq [0,1]\), \(\mu _{A}(x,u)=1\), then A is an interval T2 fuzzy set.

The notion of an interval-valued fuzzy set was introduced by Zadeh (1975) and Sambuc (1975), it is a particular case of interval T2 fuzzy sets. In Bustince et al. (2014), the author used the following definition of an interval-valued fuzzy set. Let us denote by \(L([0,1])=\{[\underline{x}, \overline{x}]\mid (\underline{x}, \overline{x})\in [0,1]^2 \;\text{ and }\; \underline{x}\le \overline{x} \}\) the set of all closed subintervals of [0, 1].

Definition 3

An interval-valued fuzzy set A on the universe X is a mapping \( A: X \rightarrow L([0,1])\) such that the membership degree of x is given by \(A(x)=[\underline{\mu }_A(x), \overline{\mu }_A(x)] \in L([0,1])\), where \(\underline{\mu }_A: X\rightarrow [0,1]\) and \( \overline{\mu }_A: X\rightarrow [0,1]\) define the lower and upper bounds of the membership interval A(x), respectively.

We next recall some basic concepts in fuzzy possibility theory (Liu and Liu 2010). Let \(\mathcal {P}(\Gamma )\) be the power set on the universe \(\Gamma \), and \({{\tilde{\mathrm{P}}}\mathrm{os}}: \mathcal {P}(\Gamma )\mapsto \mathcal {R}([0, 1])\) a fuzzy possibility measure. The triplet \((\Gamma , \mathcal {P}(\Gamma ), {{\tilde{\mathrm{P}}}\mathrm{os}})\) is referred to as a fuzzy possibility space. A map \(\xi =(\xi _1,\xi _2,\ldots ,\xi _n):\Gamma \mapsto \mathfrak {R}^n\) is called a T2 fuzzy vector. As \(n=1\), the map \(\xi :\Gamma \mapsto \mathfrak {R}\) is usually called a T2 fuzzy variable. The secondary possibility distribution function \({{\tilde{\mu }}}_{\xi }(x)\) of the T2 fuzzy vector \(\xi \) is defined as

and the T2 possibility distribution function \(\mu _{\xi }(x,u)\) of \(\xi \) is defined as

where \(J_x\subset [0,1]\) is the support of \({{\tilde{\mu }}}_{\xi }(x)\).

An interval T2 fuzzy variable is a special case of T2 fuzzy variables, and it is defined as follows:

Definition 4

Assume that \(\xi \) is a T2 fuzzy variable with a T2 possibility distribution function \(\mu _{\xi }(x,u)\). If for any \(x\in \mathfrak {R}, u \in J_x\subseteq [0,1]\), \(\mu _{\xi }(x,u)=1\), then \(\xi \) is called an interval T2 fuzzy variable.

If the secondary possibility distribution function \({{\tilde{\mu }}}_{\xi }(x)\) is a subinterval of [0, 1], then we have the following definition about a parametric interval-valued fuzzy variable.

Definition 5

Assume that \(\xi \) is a T2 fuzzy variable with the secondary possibility distribution function \({{\tilde{\mu }}}_{\xi }(x)\). If for any \(x\in \mathfrak {R}\), \({{\tilde{\mu }}}_{\xi }(x)\) is a subinterval \([\mu _{\xi ^{L}}(x; \theta _l), \mu _{\xi ^{U}}(x; \theta _r)]\) of [0, 1] with parameters \(\theta _l, \theta _r \in [0,1]\), then \(\xi \) is called a parametric interval-valued fuzzy variable.

Before ending this section, we give some explanations about the difference between a parametric interval-valued fuzzy variable and an interval-valued fuzzy set.

-

(i)

The interval-valued fuzzy set is a concept in set theory. The interval \([\underline{\mu }_A(x), \overline{\mu }_A(x)]\) represents the membership degree that x belongs to the set A. The parametric interval-valued fuzzy variable is a concept in possibility theory. The interval \([\mu _{\xi ^{L}}(x; \theta _l), \mu _{\xi ^{U}}(x; \theta _r)]\) represents the possibility degree of an interval-valued fuzzy variable \(\xi \) takes on the value x.

-

(ii)

It is evident that the interval \([\mu _{\xi ^{L}}(x; \theta _l), \mu _{\xi ^{U}}(x; \theta _r)]\) with variable boundaries is different from the interval \([\underline{\mu }_A(x), \overline{\mu }_A(x)]\) with fixed boundaries. In practical modeling process, the values of parameters \(\theta _l\) and \(\theta _r\) can be determined by decision makers or generated randomly in some prescribed subintervals of [0, 1].

-

(iii)

For an interval-valued fuzzy set \([\underline{\mu }_A(x), \overline{\mu }_A(x)]\), the lower membership \(\underline{\mu }_A(x)\) and the upper membership \(\overline{\mu }_A(x)\) are often chosen as its representatives. We will use the \(\lambda \) selection variable \(\xi ^{\lambda }\) as the representative of a parametric interval-valued fuzzy variable. Therefore, our method not only considers the lower possibility distribution and upper possibility distribution corresponding to \(\lambda =0\) and \(\lambda =1\), respectively, but also deals with the intermediate states corresponding to \(\lambda \) in the open interval (0, 1).

3 The selections of parametric interval-valued fuzzy variables

In this section, we define the selection variables of parametric interval-valued fuzzy variables, and give several common interval-valued fuzzy variables.

Definition 6

If \(\xi \) is a parametric interval-valued fuzzy variable with the secondary possibility distribution \({{\tilde{\mu }}}_{\xi }(x)=[\mu _{\xi ^{L}}(x; \theta _l), \mu _{\xi ^{U}}(x; \theta _r)]\), then the fuzzy variable described by the lower parametric possibility distribution \(\mu _{\xi ^{L}}(x; \theta _l)\) is called the lower selection \(\xi ^{L}\) of \(\xi \). The fuzzy variable characterized by the upper parametric possibility distribution \(\mu _{\xi ^{U}}(x; \theta _r)\) is called the upper selection \(\xi ^{U}\) of \(\xi \).

Definition 7

Assume that \(\xi \) is a parametric interval-valued fuzzy variable with the secondary possibility distribution \({{\tilde{\mu }}}_{\xi }(x)=[\mu _{\xi ^{L}}(x; \theta _l), \mu _{\xi ^{U}}(x; \theta _r)]\). For any \(\lambda \in [0,1]\), a fuzzy variable \(\xi ^{\lambda }\) is called a \(\lambda \) selection of \(\xi \) provided that \(\xi ^{\lambda }\) is characterized by the following parametric possibility distribution

In the following examples, we give five common parametric interval-valued fuzzy variables, which will be used in the rest of the paper.

Example 1

Let \(r_1 < r_2 \le r_3<r_4\) be real numbers. Then a map \(\xi \) is called a parametric interval-valued trapezoidal fuzzy variable if its secondary possibility distribution \({{\tilde{\mu }}}_{\xi }(x)\) is the following subinterval

of [0, 1] for \(x\in [r_1, r_2]\), the interval [1, 1] for \(x\in [r_2, r_3]\), and the following subinterval

of [0, 1] for \(x\in [r_3, r_4]\), where \(\theta _l,\theta _r\in [0,1]\) are two parameters characterizing the degree of uncertainty that \(\xi \) takes on the value x. We denote the parametric interval-valued trapezoidal fuzzy variable \(\xi \) with the above distribution by \([r_{1}, r_{2}, r_{3}, r_{4}; \theta _l, \theta _r]\). If \(\theta _l=\theta _r=0\), then the corresponding secondary possibility distribution is called the principle possibility distribution of \(\xi \), and the fuzzy variable characterized by the principle possibility distribution is denoted by \(\xi ^p\). Particularly, if \(r_2=r_3\), then \(\xi \) is called a parametric interval-valued triangular fuzzy variable and usually denoted by \([r_{1}, r_{2}, r_{3}; \theta _l, \theta _r]\) with \(r_1<r_2<r_3\).

Example 2

A map \(\eta \) is called a parametric interval-valued normal fuzzy variable if its secondary possibility distribution \({{\tilde{\mu }}}_{\eta }(x)\) is the following subinterval

of [0, 1] for any \(x\in \mathfrak {R}\), where \(\mu \in \mathfrak {R}\) and \(\sigma >0\). We denote the parametric interval-valued normal fuzzy variable \(\eta \) with the above distribution by \(n(\mu , \sigma ^2; \theta _l, \theta _r)\). If \(\theta _l=\theta _r=0\), then the corresponding secondary possibility distribution is called the principle possibility distribution of \(\eta \), and the fuzzy variable characterized by the principle possibility distribution is denoted by \(\eta ^p\).

Example 3

A map \(\zeta \) is called a parametric interval-valued Erlang fuzzy variable if its secondary possibility distribution \({{\tilde{\mu }}}_{\zeta }(x)\) is the following subinterval

of [0, 1] for any \(x\ge 0\), where \(\rho >0\) and \(\kappa \in N^+\). The parametric interval-valued Erlang fuzzy variable \(\zeta \) with the above distribution is denoted by \(\mathrm{Er}(\rho , \kappa ; \theta _l, \theta _r)\). If \(\theta _l=\theta _r=0\), then the corresponding secondary possibility distribution is called the principle possibility distribution of \(\zeta \), and the fuzzy variable characterized by the principle possibility distribution is denoted by \(\zeta ^p\). Particularly, if \(\kappa =1\), then \(\zeta \) is called a parametric interval-valued exponential fuzzy variable and usually denoted by \(\exp (\rho ; \theta _l, \theta _r)\).

4 Numerical characteristics of lambda selection variables

In this section, we establish some useful analytical expressions about the numerical characteristics of \(\lambda \) selections of the common parametric interval-valued fuzzy variables.

4.1 Expected values of lambda selection variables

In the following, we derive the analytical expressions about the expected values of \(\lambda \) selection variables.

Theorem 1

Let \(\xi \) be the parametric interval-valued trapezoidal fuzzy variable \([r_1,r_2,r_3,r_4;\theta _l,\theta _r]\), and \(\xi ^{\lambda }\) its \(\lambda \) selection variable. Then the expected value of \(\lambda \) selection variable \(\xi ^{\lambda }\) is

Proof

According to the definition of credibility measure (Liu and Liu 2002), we can calculate that the \(\lambda \) selection variable \(\xi ^{\lambda }\) has the following credibility distribution function

According to the definition of the expected value (Liu and Liu 2002), we have the following computational result

which completes the proof of theorem.\(\square \)

Theorem 2

Let \(\eta \) be the parametric interval-valued normal fuzzy variable \(n(\mu , \sigma ^2; \theta _l, \theta _r)\), and \(\eta ^{\lambda }\) its \(\lambda \) selection variable. Then the expected value of \(\lambda \) selection variable \(\eta ^{\lambda }\) is \(\mathrm{E}[\eta ^{\lambda }]=\mu \).

Proof

By Example 2, we know that the \(\lambda \) selection variable \(\eta ^{\lambda }\) has the following parametric credibility distribution function

It follows from the above credibility distribution function that

which completes the proof of theorem.\(\square \)

Theorem 3

Let \(\zeta \) be the parametric interval-valued Erlang fuzzy variable \(\mathrm{Er}(\rho , \kappa ; \theta _l, \theta _r)\), and \(\zeta ^{\lambda }\) its \(\lambda \) selection variable. Then the expected value of \(\lambda \) selection variable \(\zeta ^{\lambda }\) is

where \(\rho >0\), \(\kappa \in N^+\), \( x_1, x_2 \in R^+,\) and \(x_1\), \( x_2\) are the solutions of the equation \(\left( \frac{x}{\kappa \rho }\right) ^{\kappa }\exp \left( \kappa -\frac{x}{\rho }\right) =\frac{1}{2}.\)

Proof

By Example 3, we obtain the following credibility distribution function of \(\zeta ^\lambda \),

where \( x_1, x_2 \in R^+,\) and \(x_1\), \( x_2\) are the solutions of the equation \((\frac{x}{\rho })^{\kappa }\exp \left( \kappa -\frac{x}{\rho }\right) =\frac{1}{2}.\)

Since the \(\lambda \) selection variable \(\zeta ^{\lambda }\) is nonnegative, we have the following computational result

which completes the proof of theorem.\(\square \)

4.2 Higher moments of lambda selection variables

Let \(\xi ^\lambda \) be the \(\lambda \) selection variable of a parametric interval-valued fuzzy variable, and \(\mu _{\xi ^{\lambda }}(x; \theta )\) its parametric possibility distribution with \(\theta =(\theta _l, \theta _r)\). The n-th moment of \(\xi ^{\lambda }\) is defined as the following L–S integral,

where \(\mathrm{Cr}\{\xi ^{\lambda }\le x\}\) is the credibility distribution of \(\xi ^{\lambda }\) and computed by

and the credibility distribution can generate a measure using the method discussed in Liu and Liu (2014).

In the following, we derive the analytical expressions of the n-th moments for \(\lambda \) selection variables.

Theorem 4

Let \(\xi \) be the parametric interval-valued trapezoidal fuzzy variable \([r_1,r_2,r_3,r_4;\theta _l,\theta _r]\), and \(\xi ^{\lambda }\) its \(\lambda \) selection variable. Then the n-th moment of \(\lambda \) selection variable \(\xi ^{\lambda }\) is

Proof

By calculation, the credibility distribution function of \(\lambda \) selection variable \(\xi ^{\lambda }\) is the following nondecreasing function

If we denote the expected value of \(\xi ^{\lambda }\) as m, then the n-th moment of \(\lambda \) selection variable \(\xi ^{\lambda }\) is computed by

which equals the desired result. The proof of theorem is complete.\(\square \)

Theorem 5

Let \(\eta \) be the parametric interval-valued normal fuzzy variable \(n(\mu , \sigma ^2; \theta _l, \theta _r)\), and \(\eta ^{\lambda }\) its \(\lambda \) selection variable. Then the n-th moment of \(\lambda \) selection variable \(\eta ^{\lambda }\) is

Proof

From the expression of \(\mu _{\eta ^{\lambda }}(x; \theta )\) with \(\theta =(\theta _l, \theta _r)\), the credibility distribution function of \(\eta ^\lambda \) is the following nondecreasing function

If we denote the expected value of \(\eta ^{\lambda }\) as m, then the n-th moment of \(\eta ^\lambda \) is computed by

from which we have \(\mathrm{M}_n[\eta ^\lambda ]=0\) provided that n is an odd number, and

provided that n is an even number. The proof of theorem is complete.\(\square \)

Theorem 6

Let \(\zeta \) be the parametric interval-valued Erlang fuzzy variable \(\mathrm{Er}(\rho , \kappa ; \theta _l, \theta _r)\), and \(\zeta ^{\lambda }\) its \(\lambda \) selection variable. Then the n-th moment of \(\lambda \) selection variable \(\zeta ^{\lambda }\) is

where \(\rho >0\), \(\kappa \in N^+\), \( x_1, x_2 \in R^+,\) \(x_1\), \( x_2\) are the solutions of the equation \(\left( \frac{x}{\kappa \rho }\right) ^{\kappa }\exp \left( \kappa -\frac{x}{\rho }\right) =\frac{1}{2}\), and \(m=\mathrm{E}[\zeta ^{\lambda }]\) is given by Eq. (4).

Proof

By the expression of \(\mu _{\zeta ^{\lambda }}(x; \theta )\) with \(\theta =(\theta _l, \theta _r)\), the credibility distribution of \(\zeta ^{\lambda }\) is the following nondecreasing function

where \(x_1\), \( x_2\) are the solutions of the equation \(\left( \frac{x}{\kappa \rho }\right) ^{\kappa }\exp \left( \kappa -\frac{x}{\rho }\right) =\frac{1}{2}\).

If we denote \(\mathrm{E}[\zeta ^{\lambda }]=m\), then the n-th moment of \(\zeta ^{\lambda }\) is computed by

which equals the desired result. The proof of theorem is complete.\(\square \)

4.3 Sums of parametric interval-valued fuzzy variables

In this subsection, we focus our attention on the sums or linear combinations of the common parametric interval-valued fuzzy variables so that their numerical characteristics can be calculated by the results obtained in Sects. 4.1 and 4.2.

Theorem 7

Suppose that \(\xi _j=[r_{1j},r_{2j},r_{3j},r_{4j};\theta _{lj},\theta _{rj}]\) are parametric interval-valued trapezoidal fuzzy variables, and \(a_j\) real numbers for \(j=1,2,\ldots ,m\). If the principle possibility distributions of \(\xi _j\)’s are mutually independent, then \(\xi =\sum _{j=1}^{m}a_j\xi _j\) is the parametric interval-valued trapezoidal fuzzy variable \([r_1, r_2, r_3, r_4;\theta _l,\theta _r]\), where the parameters \(\theta _l=\max _{1\le j\le m}\theta _{lj}\), \(\theta _r=\min _{1\le j\le m}\theta _{rj}\), and

with \(a_j^+=\max \{a_j,0\}\), and \(a_j^-=\max \{-a_j,0\}\).

Proof

By the definition of \(\xi _j\), its principle possibility distribution corresponds to the trapezoidal fuzzy variable \(\xi _j^p=(r_{1j},r_{2j},r_{3j},r_{4j})\). Since fuzzy variables \(\xi _j^p\)’s are mutually independent in the sense of (Liu and Gao 2007), their linear combination \(\sum _{j=1}^{m}a_j\xi _j^p\) also follows trapezoidal possibility distribution \((r_{1},r_{2},r_{3},r_{4})\), where \(r_1,r_2,r_3\) and \(r_4\) are determined by Eq. (6). Note that \((r_{1},r_{2},r_{3},r_{4})\) is the principle possibility distribution of the parametric interval-valued fuzzy variable \(\xi =\sum _{j=1}^{m}a_j\xi _j\). We next derive the secondary possibility distribution of \(\xi \). For any \(x\in [r_1,r_2]\), there exist real numbers \(x_j\)’s such that \(x=\sum _{j=1}^{m}a_jx_j\), and

where \(\theta _j=(\theta _{lj}, \theta _{rj})\). By the secondary possibility distribution \(\xi _j\), we have the following result

where \(\theta _{l}=\max _{1\le j\le m}\theta _{lj}\) and \(\theta _{r}=\min _{1\le j\le m}\theta _{rj}\). The proof of theorem is complete.\(\square \)

Theorem 8

Suppose that \(\eta _j=n(\mu _j, \sigma _j^2; \theta _{lj}, \theta _{rj})\) are parametric interval-valued normal fuzzy variables, and \(a_j\) real numbers for \(j=1,2,\ldots ,m\). If the principle possibility distributions of \(\eta _j\)’s are mutually independent, then \(\eta =\sum _{j=1}^m a_j\eta _j\) is the parametric interval-valued normal fuzzy variable \(n(\mu ,\sigma ^2;\theta _{l},\theta _{r})\) with the parameters \(\mu =\sum _{j=1}^m a_i\mu _j\), \(\sigma =\sum _{j=1}^m a_j\sigma _j\), \(\theta _l=\max _{1\le j\le m}\theta _{lj}\) and \(\theta _r=\min _{1\le j\le m}\theta _{rj}\).

Proof

By the definition of \(\eta _j\), its principle possibility distribution corresponds to the normal fuzzy variable \(\eta _j^p=n(\mu _j, \sigma _j^2)\). Since fuzzy variables \(n(\mu _j, \sigma _j^2)\)’s are mutually independent, their sum \(\sum _{j=1}^{m}a_j\eta _j^p\) also follows normal distribution \(n(\mu _, \sigma ^2)\), where the parameters are determined by \(\mu =\sum _{j=1}^{m}a_j\mu _j, \sigma =\sum _{j=1}^{m}a_j\sigma _j\). Note that the normal distribution \(n(\mu _, \sigma ^2)\) is the principle possibility distribution of the parametric interval-valued fuzzy variable \(\eta =\sum _{j=1}^{m}a_j\eta _j\). In the following, we continue to derive the secondary possibility distribution of \(\eta \). For any \(x\in \mathfrak {R}\), there exist real numbers \(x_j\)’s such that \(x=\sum _{j=1}^{m}a_j x_j\), and

where \(\theta _j=(\theta _{lj}, \theta _{rj})\). By the the secondary possibility distribution of \(\eta _j\), we have the following result

where \(\theta _{l}=\max _{1\le j\le m}\theta _{lj}\) and \(\theta _{r}=\min _{1\le j\le m}\theta _{rj}\). The proof of theorem is complete.\(\square \)

Theorem 9

Suppose that \(\zeta _j=\mathrm{Er}(\rho _j, \kappa ; \theta _{lj}, \theta _{rj})\) are nonnegative parametric interval-valued Erlang fuzzy variables, and \(a_j\) nonnegative real numbers for \(j=1,2,\ldots ,m\). If the principle possibility distributions of \(\zeta _j\)’s are mutually independent, then \(\tilde{\zeta }=\sum _{j=1}^m a_j\tilde{\zeta }_j\) is the parametric interval-valued Erlang fuzzy variable \(\mathrm{Er}(\rho , \kappa ;\theta _{l},\theta _{r})\) with the parameters \(\rho =\sum _{j=1}^m a_j\rho _j\), \(\theta _l=\max _{1\le j\le m}\theta _{lj}\) and \(\theta _r=\min _{1\le j\le m}\theta _{rj}\).

Proof

By the definition of \(\zeta _j\), its principle possibility distribution corresponds to the Erlang fuzzy variable \(\zeta _j^p=\mathrm{Er}(\rho _j, \kappa )\). By the supposition of theorem, fuzzy variables \(\zeta _j^p\)’s are mutually independent. Thus, for any nonnegative real numbers \(a_j\), the sum \(\sum _{j=1}^{m}a_j\zeta _j^p\) also follows Erlang distribution \(\mathrm{Er}(\rho , \kappa )\), where the parameter \(\rho =\sum _{j=1}^{m}a_j\rho _j\). Note that the Erlang distribution \(\mathrm{Er}(\rho , \kappa )\) is the principle possibility of the parametric interval-valued fuzzy variable \(\zeta =\sum _{j=1}^{m}a_j\zeta _j\). We next derive the secondary possibility distribution of \(\zeta \). For any \(x\ge 0\), there exist real numbers \(x_j\)’s such that \(x=\sum _{j=1}^{m}a_jx_j\), and

where \(\theta _j=(\theta _{lj}, \theta _{rj})\). By the secondary possibility distribution of \(\zeta _j\), we have the following result

where \(\theta _{l}=\max _{1\le j\le m}\theta _{lj}\) and \(\theta _{r}=\min _{1\le j\le m}\theta _{rj}\). The proof of theorem is complete.\(\square \)

5 Application of the proposed optimization indices

In this section, we apply the proposed optimization indices to a quantitative finance problem.

5.1 A new portfolio optimization model

Every investor, from the individual to the professional fund manager, must decide on an appropriate mix of assets to include his investment portfolio. Given a set of potential securities indexed from 1 to m, let \(\xi _j\) denote the return in the next time period on security \(j,j=1,\ldots ,m\). In general, due to the impacts of the economic environment and political factors, the return \(\xi _j\) is uncertain and often modeled as a fuzzy variable with a fixed possibility distribution. In many situations, however, the exact possibility distribution of \(\xi _j\) is unavailable due to the lack of historical data. In the present paper, the return \(\xi _j\) is described by a parametric interval-valued fuzzy variable with variable lower and upper possibility distributions.

A portfolio is a set of nonnegative numbers \(x_j,j=1,\ldots ,m\), that sum to one. The return one would obtain using a portfolio is represented as \(\sum _{j=1}^{m}x_j\xi _j\), and its \(\lambda \) selection variable is denoted as \((\sum _{j=1}^{m}x_j\xi _j)^{\lambda }\). The reward associated such a portfolio is defined as the expected return \(\mathrm{E}[(\sum _{j=1}^{m}x_j\xi _j)^{\lambda }]\). Since investments with high reward typically also carry a high level of risk, it is necessary to give an appropriate way to define risk. We will define the risk associated with a portfolio of investments to be the second moment \(\mathrm{M}_2[(\sum _{j=1}^{m}x_j\xi _j)^{\lambda }]\).

In the following, we assume that the return \(\xi _j\) is the parametric interval-valued triangular fuzzy variable \([r_{1j},r_{2j},r_{3j}; \theta _{lj}, \theta _{rj}]\). Given a portfolio \(x=( x_{1}, \ldots , x_{m})^{T}\), it follows from Theorem 7 that the sum \(\sum _{j=1}^{m}x_j\xi _j\) is also a parametric interval-valued triangular fuzzy variable. Thus, the expected value is computed by

and the second moment is \(\mathrm{M}_2[(\sum _{j=1}^{m}x_j\xi _j)^{\lambda }]=\frac{1}{2}r^TQr\), where \(r=(\sum _{j=1}^{m}x_j r_{1j},\sum _{j=1}^{m}x_j r_{2j},\sum _{j=1}^{m}x_j r_{3j})^T\), and the matrix Q is

with the parameters \(\theta _{l}=\max _{1\le j\le m}\theta _{lj}\) and \(\theta _{r}=\min _{1\le j\le m}\theta _{rj}\).

It is easy to check that the matrix Q is positive semidefinite, so the second moment \(\mathrm{M}_2[(\sum _{j=1}^{m}x_j\xi _j)^{\lambda }]\) is a parametric quadratic convex function with respect to \(r\in R^3\).

If we denote

\(r=Rx\) and \(P=R^TQR\), then the second moment can be represented as \(\frac{1}{2}x^TPx\).

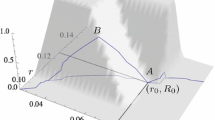

In our portfolio selection problem, if an investor is looking for a portfolio with minimum risk in the sense of moment, under prescribing a minimum acceptable level \(\phi \) of the expected return, then he may build the portfolio selection problem as a mean-moment model. Based on the above analysis, the mean-moment model can be turned into the following equivalent parametric quadratic convex programming problem

where \(\phi \) is the minimum expected return level that the investor can accept.

5.2 Computational results under interval-valued fuzzy returns

Solving model (7) requires knowledge of the possibility distributions of the returns \(\xi _j\) for \(j=1,2\ldots ,m\). However, these possibility distributions are not known theoretically but instead should be estimated by the experts in the related fields. Assume that the exact possibility distributions of security returns are unavailable and represented by the interval-valued triangular fuzzy variables with variable lower and upper possibility distributions. Table 1 provides the variable possibility distributions about the estimated returns of sixteen candidate securities.

In our numerical experiments, we first assume the decision makers prefer to set the values of \(\lambda \) as 0, 0.5 and 1, and the values of parameters \(\theta _{lj}\) and \(\theta _{rj}\), \((j=1,2,\ldots ,16)\) as

and

Thus \(\theta _{l}=\max _{1\le j\le 16}\theta _{lj}=0.9997\), and \(\theta _{r}=\min _{1\le j\le 16}\theta _{rj}=0.0005\).

We employ Lingo software to solve model (7). To further identify the influence of parameter \(\phi \), several numerical experiments are conducted with various values of \(\phi \). The computational results are reported in Tables 2, 3 and 4, respectively, from which we observe that model (7) can provide a diversified investment to securities under different values of model parameters \(\theta \), \(\lambda \) and \(\phi \).

In the modeling process, if decision makers cannot identify the values of model parameters \(\theta \) and \(\lambda \), they may generate randomly the values of model parameters from some subintervals in the interval [0, 1]. To demonstrate the influence of model parameters in this case, we perform some new numerical experiments, in which the parameter \(\lambda \) is generated randomly from the interval [0, 1], the parameters \(\theta _{lj}\) are generated randomly from the interval [0.2, 0.4], while the parameters \(\theta _{rj}\) are generated randomly from the interval [0.6, 0.8]. Table 5 reports the computational results, from which we observe that model (7) can also provide a diversified investment to securities with the values of model parameters are generated randomly.

5.3 Computational results under fuzzy returns

For the sake of comparison, we take the fixed possibility distributions as the principle possibility distributions of the interval-valued fuzzy variables, which are obtained by setting \(\theta _{lj}=\theta _{rj}=0\) in parametric possibility distributions collected in Table 1.

We solve our problem by Lingo software. To identify the influence of the expected return level \(\phi \), we set the values of \(\phi \) as 1.198, 1.268, 1.310, 1.346, 1.407, 1.482, 1.570 and 1.579. Table 6 summarizes the computational results about the optimal allocations.

5.4 Discussions

From the computational results in Sects. 5.2 and 5.3, we obtain the following observations.

-

(i)

When the exact (fixed) possibility distributions of returns are available, we can build our portfolio selection problem as a fuzzy optimization model. In this situation, the computational results reported in Table 6 may help the investor to decide his optimal investments. For example, if the investor sets his expected return level as 1.310, then the investor should allocate his asset to securities 1, 3, 6. If he desires to increase the expected return level as 1.570, then the investor should select the securities 13, 15, and 16 as his optimal portfolio. However, if the investor cannot obtain the exact possibility distributions of returns, then we advise he not to adopt the obtained solutions to make his investments.

-

(ii)

In the case that the exact (fixed) possibility distributions of returns are unavailable in the modeling process, we presented a new robust fuzzy optimization method to model the portfolio selection problem, where the returns are characterized by variable possibility distributions. There are two types of parameters embedded in variable possibility distributions. The parameter \(\theta \) determines the lower bound and upper bound of the variable possibility distribution and it characterizes the degree of uncertainty of the returns take on their values, while the parameter \(\lambda \) determines the location of the variable possibility distribution between the lower and upper bounds. Given the values \(\theta _{l}=0.9997\) and \(\theta _{r}=0.0005\), Tables 2, 3 and 4 summarize the influence of location parameter \(\lambda \) as it takes the values 0, 0.5 and 1, respectively. From the computational results, we observe that the optimal allocation proportions in our portfolio selection problem depend on the values of \(\lambda \). For example, when the expected return level \(\phi \) is 1.346, the invested securities corresponding to \(\lambda =0\) are 3 and 6; while the invested securities corresponding to \(\lambda = 0.5\) and 1 become 3, 6 and 12. In some cases, even though the invested securities are same, the investment proportions to them are different. As a consequence, the computational results demonstrate the advantages of variable possibility distributions over fixed possibility distributions.

-

(iii)

In our variable possibility distributions, the variable lower and upper possibility distributions are determined by the parameters \(\theta _{lj}\) and \(\theta _{rj}\), respectively. After the values of \(\theta _{lj}\) and \(\theta _{rj}\) are known, the location of the variable possibility distribution is determined by the value of parameter \(\lambda \). If decision makers cannot identify the values of model parameters \(\theta _{lj}\), \(\theta _{rj}\) and \(\lambda \), they may assume the model parameters follow uniform distributions in some prescribed subintervals of [0, 1], and generate their values randomly from the intervals. Thus, the variable boundaries in our possibility distributions share some random characteristics. The computational results reported in Table 5 support our arguments. From the above analysis, we may conclude that our parametric optimization method is flexible for decision makers to make their informed investment portfolio.

6 Conclusions

In this paper, we studied T2 fuzzy theory from a new viewpoint by using variable upper and lower possibility distributions. The major new results are summarized as follows.

First, we defined the concept of parametric interval-valued fuzzy variable, where the variable lower and upper possibility distributions are characterized by parameters. For a parametric interval-valued fuzzy variable, we introduced its lower selection, upper selection and \(\lambda \) selection variables.

Second, the proposed selection variables are characterized by parametric possibility distributions, their numerical characteristics are important optimization indices in practical decision-making problems. We established some useful analytical expressions of the expected values and n-th moments for the \(\lambda \) selections of the parametric interval-valued trapezoidal, normal and Erlang fuzzy variables.

Third, we focused on the arithmetic of the parametric interval-valued trapezoidal fuzzy variables, normal fuzzy variables and Erlang fuzzy variables. Based on the obtained results, we can derive the analytical expressions about the numerical characteristics of \(\lambda \) selections for the sums of the common parametric interval-valued fuzzy variables.

Finally, we applied the proposed optimization indices to a portfolio selection problem, where the second moment is used to measure the risk of a portfolio. In the case that the exact (fixed) possibility distributions of returns are unavailable in the modeling process, the proposed parametric optimization method is flexible for decision makers to make their informed investment portfolio. The computational results supported our arguments and demonstrated the advantages of variable possibility distributions over fixed possibility distributions.

References

Bai, X., & Liu, Y. (2014). Semideviations of reduced fuzzy variables: A possibility approach. Fuzzy Optimization and Decision Making, 13, 173–196.

Bustince, H., Fernandez, J., Hagras, H., Herrera, F., Pagola, M., & Barrenechea, E. (2014). Interval type-2 fuzzy sets are generalization of interval-valued fuzzy sets: Towards a wider view on their relationship. IEEE Transactions on Fuzzy Systems. doi:10.1109/TFUZZ.2014.2362149.

Carter, M., & van Brunt, B. (2000). The Lebesgue–Stieltjes integral. Berlin: Spinger.

Chen, T. Y. (2013). An interactive method for multiple criteria group decision analysis based on interval type-2 fuzzy sets and its application to medical decision making. Fuzzy Optimization and Decision Making, 12, 323–356.

Chen, S. M., & Lee, L. W. (2011). Fuzzy interpolative reasoning for sparse fuzzy rule-based systems based on interval type-2 fuzzy sets. Expert Systems with Applications, 38, 9947–9957.

Gong, Y. (2013). Fuzzy multi-attribute group decision making method based on interval type-2 fuzzy sets and applications to global supplier selection. International Journal of Fuzzy Systems, 15, 392–400.

Karnik, N. N., Mendel, J. M., & Liang, Q. (2000). Type-2 fuzzy logic systems. IEEE Transactions on Fuzzy Systems, 7, 643–658.

Khosravi, A., Nahavandi, S., Creighton, D., & Srinivasan, D. (2012). Interval type-2 fuzzy logic systems for load forecasting: A comparative study. IEEE Transactions on Power Systems, 27, 1274–1282.

Liu, B., & Liu, Y. (2002). Expected value of fuzzy variable and fuzzy expected value models. IEEE Transactions on Fuzzy Systems, 10, 445–450.

Liu, Y., & Gao, J. (2007). The independence of fuzzy variables with applications to fuzzy random optimization. International Journal of Uncertainty, Fuzziness & Knowledge-Based Systems, 15, 1–20.

Liu, Y. K., & Liu, Y. (2014). Measure generated by joint credibility distribution function. Journal of Uncertain Systems, 8, 239–240.

Liu, Z., & Liu, Y. (2010). Type-2 fuzzy variables and their arithmetic. Soft Computing, 14, 729–747.

Mendez, G. M., Colas, R., Leduc, L., Lopez-Juarez, I., & Longoria, R. (2012). Finishing mill thread speed set-up and control by interval type 1 non-singleton type 2 fuzzy logic systems. Ironmaking & Steelmaking, 39, 342–354.

Mendel, J. M., & John, R. I. (2002). Type-2 fuzzy sets made simple. IEEE Transactions on Fuzzy Systems, 10, 117–127.

Mendel, J. M., John, R. I., & Liu, F. (2006). Interval type-2 fuzzy logic systems made simple. IEEE Transactions on Fuzzy Systems, 14, 808–821.

Pagola, M., Lopez-Molina, C., Fernandez, J., Barrenechea, E., & Bustince, H. (2013). Interval type-2 fuzzy sets constructed from several membership functions: Application to the fuzzy thresholding algorithm. IEEE Transactions on Fuzzy Systems, 21, 230–244.

Sambuc, R. (1975). Function \(\Phi \)-Flous, Application de l’Aide a Diagnostique en Pathologie Thyroidienne. Doctoral dissertation, These Univ. de Marseille, Marseille.

Viscontia, A., & Tahayori, H. (2011). Artificial immune system based on interval type-2 fuzzy set paradigm. Applied Soft Computing, 11, 4055–4063.

Wang, C. H., Cheng, C. S., & Lee, T. T. (2004). Dynamical optimal training for interval type-2 fuzzy neural network (T2FNN). IEEE Transactions on Systems, Man, and Cybernetics, Part B: Cybernetics, 34, 1462–1477.

Wu, D., & Mendel, J. M. (2007). Uncertainty measures for interval type-2 fuzzy sets. Information Sciences, 177, 5378–5393.

Zadeh, L. A. (1975). The concept of a linguistic variable and its application to approximate reasoning-I. Information Sciences, 8, 199–249.

Acknowledgments

The authors wish to thank Editors and anonymous reviewers, whose valuable comments led to an improved version of the paper. This work was supported partially by the Youth Science Foundation of Hebei University (No. 2010Q28), the Natural Science Foundation of Hebei Province (No. A2014201166), and the National Natural Science Foundation of China (No. 61374184).

Author information

Authors and Affiliations

Corresponding author

Rights and permissions

About this article

Cite this article

Liu, Y., Liu, YK. The lambda selections of parametric interval-valued fuzzy variables and their numerical characteristics. Fuzzy Optim Decis Making 15, 255–279 (2016). https://doi.org/10.1007/s10700-015-9227-3

Published:

Issue Date:

DOI: https://doi.org/10.1007/s10700-015-9227-3