Abstract

With the rapid development of global ocean transportation, storage space in container terminals is becoming a scarce resource. Hence, the terminal yard only performs as a temporary storage facility for inbound cargos. A storage charge is levied for inbound cargos that stay longer than a free storage time (called free-time-limit). After the free-time-limit, customers may move cargos from the terminal yard to a remote container yard where the storage price is lower than that in the terminal. This paper proposes inbound container storage pricing game models between the container terminal and a remote container yard. Two cases are considered: (1) the inbound container’s dwell time is random and follows a probability distribution function; (2) the inbound container’s dwell time is sensitive to the storage prices. The primary objective of this paper is to analyze the storage pricing behavior and competition outcomes of the container terminal and the remote container yard. A number of insights and analysis are provided.

Similar content being viewed by others

Avoid common mistakes on your manuscript.

1 Introduction

With the rapid development of globalization, the ocean transportation business is booming. Motivated by the growth of market demand, container size and vessel volume are increasing. Consequently, the storage space in container terminals is becoming scarce, especially in the major merchandize ports of East Asia and Europe. Researchers have been trying to improve the operations efficiency in container terminal yards by optimization (operations research) methods, such as yard crane scheduling and storage/stacking logistics. Besides operational level approaches, strategic level decisions, such as port capacity development, terminal layout design and handling/storage price schemes may also help to relieve the congestion situation in the container terminal. In this paper, we adopt the non-cooperative game theory to study the inbound container storage price schemes between the container terminal and a remote container yard.

From the supply chain system dynamics perspective, the high capacity utilization level in terminals causes long leadtimes and large variability, which makes shippers send their cargos earlier (Fransoo and Lee 2010). However, customers may not pick up inbound cargos earlier than needed and will just store them on the quay. Increased storage of inbound cargos on the quay further reduces the terminals’ operations efficiency and causes a vicious cycle of capacity problems.

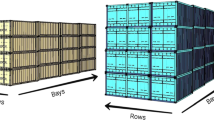

Hence, the container terminal yard (hereafter CTY) only provides a temporary storage space for inbound cargos and it is not set up for long-term storage. Long-term storage creates high congestion, and thus low productivity in yard operations. For all inbound cargos passing through the container terminal and temporarily stored in the yard, a terminal handling charge is levied. And to discourage customers from storing containers in the terminal for too long, the terminal will charge an extra storage fee if inbound containers stay longer than a free-time-limit. In practice, the storage fee charged by the terminal is usually proportional to the length of dwell time beyond the free-time-limit. For example, in the Hong Kong seaport, after the free-time-limit, a terminal operator will start to charge the storage fee: about HK$100 to HK$500 per container per day, depending on the relationship between the terminal and shipping lines.

The limited storage space in the terminal yard and customers’ extra storage payment after the free-time-limit make possible the emergence of an alternative inbound container storage place, called remote container yard (hereafter RCY). RCYs have less severe capacity constraints and charge a lower storage price than the CTY. But customers need to pay additional handling and transportation costs to move a container from CTY to RCY. So RCYs are only attractive for relatively long term storage. The idea of the transport route combination of CTY and RCY in the port transport system was first discussed by Imakita (1978).

The container terminal and the RCY are operated by different companies. If the dwell time of inbound containers is shorter than the free-time-limit, containers will be stored in the CTY after arrival, and then be transported directly to customers when needed. Otherwise, containers may be transported to an outside RCY after the free-time-limit. When needed, containers will then be delivered to customers from the RCY.

Motivated by the competitive relationship of the CTY and RCY, we study an inbound container storage price competition problem in this paper. We adopt the non-cooperative game theory to analyze the existence and uniqueness properties of the price equilibrium. The sequence of decision events is defined as follows: (1) The CTY and the RCY simultaneously and independently decide and announce their storage prices per unit time per container for the inbound container; (2) Based on the announced storage price schemes in the CTY and the RCY, and the cost of moving a container from the CTY to the RCY, the customer determines whether to move his container from the CTY to the RCY so as to minimize storage payment and the potential container movement cost.

Two cases are considered: price-independent container dwell time and price-dependent container dwell time. In the first case, the dwell time of the inbound container is random and follows a probability distribution function. This is applicable to the transit container whose dwell time is relative to the customer’s production or sales plan. The second case is proposed for the situation when the customer tends to treat the CTY and RCY as long term storage places. In this case, it is assumed that the customer has a random tolerance payment for every container. The tolerance payment characterizes the maximal storage payment per container the customer willing to disburse. The customer stores a container in the CTY (or RCY) till the tolerance payment is reached. Given the storage prices, the container storage time increases with the tolerance payment. Consequently, with a given tolerance payment, the container dwell time decreases with the per unit time storage price.

We summarize our contributions as follows.

-

1.

We adopt the idea of non-cooperative game theory and for the first time study the inbound container storage price competition problem. Three different models are considered: uniformly distributed dwell time model, linearly reduced distributed dwell time model and price-dependent dwell time model.

-

2.

We study the pricing schemes of the CTY and the RCY, aiming to maximize their storage profits. In all the three models, we analyze the existence and uniqueness of the price equilibriums.

-

3.

We propose a convex operation cost for the CTY, taking the limited capacity of the CTY into account. This applies to the situation when the capacity development of the container terminal lags behind the demand, and long container dwelling in the terminal increases the congestion level.

-

4.

We provide operational insights with respect to the change of parameters, and strategic analysis for the rationality of RCY’s existence.

The rest of the paper is organized as follows. Section 2 reviews the related literature. Section 3 discusses the general storage pricing game model when dwell time is stochastic. In Sect. 4, we analyze the competition outcomes when the dwell time follows the uniform distribution. Section 5 discusses the pricing game model with linearly reduced dwell time distribution. Section 6 provides equilibrium analysis when the dwell time depends on the storage prices. In Sect. 7, we demonstrate the numerical analysis result. Further discussion and conclusions are provided in Sect. 8. For clarity of description, all proofs are deferred to the "Appendix".

2 Literature review

There is plenty of research for container terminal operations efficiency improvement from different perspectives. A comprehensive literature review can be found in Steenken et al. (2004), Stahlbock and Voss (2008), Günther and Kim (2006). Recently, Fransoo and Lee (2010) point out that there are still some interesting and challenging container supply chain research questions remaining to be answered, in areas such as pricing and risk management, capacity management, competition research, and coordination analysis. In the following, we discuss a few results that are related to our work.

Little literature has been found in container supply chain competition issues. The main reason lies in the fact that the structure of the container supply chain is quite complex. It involves many different entities and various contractual relationships. Yang (1999) analyzes the three-player (port administrators, carriers, and shippers) game theory model in the container transportation market and discusses port management policy in an equilibrium shipping market. Anderson et al. (2008) develop a game-theoretic best response framework to analyze the current investment and competition between the ports of Busan and Shanghai. Lim et al. (2008) study the auction mechanism between the shipper and carrier in the ocean transportation procurement process. In their model, shipments made in nonpeak periods will be commensurate with shipments in peak periods when shipping demand fluctuates in peak and nonpeak seasons. Zhou and Lee (2009) study the empty container repositioning problem by using the two-carrier symmetric Bertrand competition game model. Luo et al. (2010) use a two stage duopoly game model to investigate the port competition between Hong Kong and Shenzhen in two steps: the pricing subgame and the capacity expansion subgame.

Some literature is available on storage and stacking logistics in the container terminal yard, while only a few papers focus on the storage price research. Fransoo and Lee (2010) mention that, if the storage price for inbound cargos is too low, the terminal yard may become a remote warehouse for the customers. Castilho and Daganzo (1991) study the pricing schemes for temporary storage facilities at ports with and without remote warehouses. Two pricing policies are considered, nondiscriminatory and discriminatory pricing strategies. Holguin-Veras and Jara-Diaz (1999) develop models to determine the optimal yard allocation and the corresponding storage price for different container classes in a priority container port system. They analyze three different pricing rules: welfare maximization, welfare maximization under a financial constraint, and profit maximization. Kim and Kim (2007) discuss the optimal price schedule for inbound container storage in a container yard, assuming that there is an alternative storage site outside the container yard. However, they take the storage price in the outside storage site as given and ignore the price competition between the terminal and the outside storage site. We extend their paper and consider the competition relation of the inbound cargo storage price between the port terminal and a private remote yard. The problem in our paper belongs to the game-theoretic duopoly model of the Bertrand type. The reader may refer to the extensive Bertrand duopoly research in the literature, which provides a broad foundation for the price competition analysis in our paper.

3 General framework

In this section, we propose a general mathematical formulation for the storage pricing game. The framework of the mathematical models in this paper is based on the following assumptions.

Assumption 1

The inbound cargo flow is stable and independent of storage prices. This assumption is reasonable in that the inbound cargo flow in a port is mainly affected by the customers’ physical locations, the local market size and the productivities of the container terminal. This assumption is widely used in the literature (Castilho and Daganzo 1991; Holguin-Veras and Jara-Diaz 1999).

Assumption 2

The capacity development of the CTY lags behind the demand, and the operation cost in the limit-capacity CTY is mainly determined by the rehandle operations. Hence, long container dwelling causes high stacks in the yard, thus more rehandle operations. Considering the rehandle number estimation in Kim (1997) and Kim and Kim (1999) which is a quadratic function, we assume the container operation cost in the CTY is also a quadratic function of the container dwell time Footnote 1. So the unit time container operation cost grows with the container dwelling. Note that the quadratic type of terminal operation cost function is also used in Luo et al. (2010).

Assumption 3

Compared to the CTY, the RCY has unrestricted capacity. Thus, the container operation cost in the RCY is a linear function of the dwell time. This assumption is possible in practice due to the fact that the RCY usually has more land resources.

Assumption 4

We consider homogeneous customer behavior. Namely, we only consider one type of inbound containers and they have identical dwell time characteristics. The homogeneous container dwell time could be obtained from the statistic average among all inbound container dwell times from a long term perspective.

We have the following notations in the problem definition and formulation.

-

F: the free-time-limit in the CTY.

-

c 0: the transportation cost per container of moving containers from the CTY to the RCY.

-

T: a random variable which stands for the container dwell time. The container dwell time is defined as the time interval between the container unloaded time and the time when the customer calls for the container. Every container’s dwell time is independently and identically distributed (i.i.d.).

-

c 1: the operation cost coefficient of the CTY. According to Assumption 2, c 1 T 2 is the container operation cost in the CTY when the container dwelling is T.

-

c 2: the operation cost coefficient of the RCY. According to Assumption 3, c 2 T is the container operation cost in the RCY when the container dwelling is T. Since we assume that the CTY is capacity limited and the RCY has unlimited capacity, it is reasonable that c 2 < c 1.

-

f(T): probability density function of container dwell time. f(T) is assumed to be a non-increasing function. In practice, the container dwell time distribution could be found from the history data. For example, in the container terminal literature, Watanabe (2001) proposed uniform and exponential distributions for the inbound container dwell time.

Decision variables:

-

s 1: the container storage price per unit time per container in the CTY. We assume s 1 ≥ c 1, which indicates that, when the container dwelling after the free-time-limit (denoted by t) is not longer than one time unit, the storage charge of a container in the CTY, s 1 t, is higher than c 1 t 2.

-

s 2: the container storage price per unit time per container in the RCY. We assume s 2 ≥ c 2, which ensures the per unit time per container storage price of the RCY is higher than his marginal operation cost.

Firstly, the CTY and RCY will simultaneously determine their storage prices, s 1 and s 2. After they finish the price decisions and announce the storage prices, the customer will decide whether and when to move their containers from the CTY to the RCY with the objective of minimizing storage payment and the potential container movement cost. Figure 1 shows the customer payment function. The container will be stored in the CTY if its dwell time is shorter than F + t s , where t s = c 0/(s 1 − s 2) is the indifference time . If its dwell time is longer than F + t s , the container will be first transported to the RCY at time F and then delivered to the customer later.

Mathematically, in order to maximize the CTY’s profit, the optimal value of F is zero Footnote 2. However, in practice, F is set as positive, and the operation cost in the time interval [0,F] is covered by the terminal handling charge. In our models, we treat F as a given positive parameter and only focus on the storage profit after F. Actually, terminals usually set the value of F according to their relationship with shipping lines. For example, in the Hong Kong International Terminal (HIT), F is about 7 days. In Busan terminal, Korea, F is around 4 days (Kim and Kim 2007).

The objective of the CTY (RCY) is to decide the appropriate price for inbound container storage service so that the profit of storing a container is maximized. That is, to maximize CTY’s storage profit π1(s 1,s 2) and RCY’s storage profit π2(s 1, s 2), respectively,

Here \(\bar{T}\) is the up-bound of the container dwell time. The RCY will compete with the CTY such that \(F+t_s \leq \bar{T}. \) The first and second terms of (1) are the revenue and operation cost of the CTY after F, respectively. In (1), we only consider CTY’s storage profit after the free-time-limit (F) because the terminal handling charge covers the operation cost before F. We aim to determine the duopoly pricing game’s Nash equilibrium (hereafter NE), and also guarantee the non-negative profits of the two players at the NE. So what we intend to find is the intersection of the two players’ best response functions (hereafter BRF), (s *1 , s *2 ), under which π1(s *1 ,s *2 ) ≥ 0 and π2(s *1 ,s *2 ) ≥ 0.

In order to further study the properties of the equilibrium prices and to find out how the change of parameters affects the competition outcomes, we will specify the container dwell time distribution in the following two sections. In container terminals, the delivery date of inbound containers to the customer may vary under different local factors. In the next two sections, we follow the analysis of Watanabe (2001) and use two patterns of inbound container dwell time distribution, uniform distribution and linearly reduced distribution (Fig. 2).

4 Price-independent container dwell time: uniform distribution

In this section, we study the model (called M1) in which the container dwell time follows uniform distribution on [0, b], b > F. Since customers just store the inbound containers in the CTY before time F, the CTY and the RCY will compete with each other only if container dwell time is longer than F.

Based on (1) and (2), we have the objective functions of the CTY and the RCY when container dwell time follows uniform distribution:

Here s 1 ≥ c 1, s 2 ≥ c 2, and we use the superscript “U” to denote the uniform distribution. In this section, we aim to find the price NE (s U*1 , s U*2 ) and prove that the CTY and the RCY make non-negative profits at the NE, namely, π U1 (s U*1 , s U*2 ) ≥ 0 and π U2 (s U*1 , s U*2 ) ≥ 0. The following two propositions prove the quasi-concavities of π U1 (s 1,s 2) and π U2 (s 1,s 2).

Proposition 1

In M1, the profit function of the CTY is quasi-concave.

Proposition 2

In M1, the profit function of the RCY is quasi-concave.

Let the BRFs of the two players in M1 be s U*1 (s 2) and s U*2 (s 1), respectively. Propositions 1 and 2 make sure that there is at least one BRF curve intersection in the storage game with uniformly distributed container dwell time. From the proofs of Propositions 1 and 2, we can get the first order conditions of the price NE:

By solving (5) and (6), the price NE (s U*1 , s U*2 ) could be obtained. Before the following analysis of the non-negative profits of the two players at the NE, we shall explicitly specify an assumption which ensures that at the NE, F + t U* s ≤ b. Here t U* s = c 0/(s U*1 − s U*2 ).

Here \(\alpha=b^{\prime}(c_1-c_2)/c_0\) and \(b^{\prime}=b-F. \) Let \(Q= \root{3} \of {{{\alpha - \sqrt{\alpha^2 + \frac{1}{27}}}}} + \root{3} \of {{{\alpha+ \sqrt{\alpha^2 + \frac{1}{27}}}}}, \) then we will have ∂Q/∂b > 0 and ∂Q / ∂c 0 < 0. ASS 4.1 assumes that Q ≥ 1, hence it indicates that: given the operation cost coefficients of the CTY and RCY, the transportation cost (c 0) is not too large and the maximum dwell time (b) is not too short.

Proposition 3

In M1, the CTY makes a non-negative profit at the NE. And if ASS 4.1 holds, the RCY makes a non-negative profit at the NE.

We now examine the uniqueness property of the price NE.

Proposition 4

In M1, the storage pricing game has a unique price NE.

We use an example to demonstrate the best response functions of the two players in M1. In the example, we set the parameter values as: F = 4, b = 20, c 0 = 50, c 1 = 20 and c 2 = 10. As shown in Fig. 3, the best response mapping is a contraction. So every storage-price node will converge to the unique price NE, P U*(s *1 = 230, s *2 = 214).

5 Price-independent container dwell time: linearly reduced distribution

In this section, we discuss the model (called M2) in which the container dwell time follows a linearly reduced distribution. Let the probability density function of container dwell time T be f(T) = l(a − T), a > 0, l = 2/a 2 and 0 ≤ T ≤ a, so the CTY and the RCY compete with each other only if the inbound containers’ dwell time is in range [F, a]. We can write out the objective functions of the CTY and the RCY:

Here s 1 ≥ c 1, s 2 ≥ c 2, and we use the superscript “L" to denote the linearly reduced distribution. We aim to find the price NE, (s L*1 , s L*2 ) and prove that the CTY and the RCY make non-negative profits at the NE, namely, π L1 (s L*1 , s L*2 ) ≥ 0 and π L2 (s L*1 , s L*2 ) ≥ 0. Below, we provide two propositions to show the quasi-concavities of the two profit functions.

Proposition 5

In M2, the profit function of the CTY is quasi-concave.

Before the analysis about the quasi-concavity of the RCY’s profit function, we shall explicitly specify following assumption which ensures that given s 1, F + t L* s (s 1) ≤ a in π L2 (s 1,s 2). Here t L* s (s 1) = c 0/(s 1 − s L*2 (s 1)).

Here \(\beta=(162a^{\prime}(c_1-c_2)/c_0+34)/250\) and \(a^{\prime}=a-F. \)

Let \(Q'= \root{3} \of {{{\beta - \sqrt{\beta^2 + 0.44^3}}}} + \root{3} \of {{{\beta + \sqrt{\beta^2 + 0.44^3}}}}, \) then we have ∂Q′/∂a > 0 and ∂Q′/∂c 0 < 0. ASS 5.1 assumes that Q′ ≥ 1, therefore it indicates that: given the operation cost coefficients of the CTY and RCY, the transportation cost (c 0) is not too large and the maximum dwell time (a) is not too short.

Proposition 6

In M2, if ASS 5.1 holds, the profit function of the RCY is quasi-concave.

We denote the best response functions of the CTY and RCY in M2 as s L*1 (s 2) and s L*2 (s 1), respectively. By Propositions 5 and 6, with ASS 5.1, there exists at least one BRF curve intersection in M2. We now further verify whether the intersection is unique.

By the proofs of Propositions 5 and 6, the price NE could be obtained by solving the following two equations (\(a^{\prime}=a-F\)):

Based on Eq. (9), s L*1 (s 2) could be derived by solving the following cubic equation for s 1:

Here, \(L(s_2)=-3a^{\prime}s_2-4c_0-12a^{\prime}c_1F, \,M(s_2)=-3a^{\prime}s_2^2+(2c_0+24a^{\prime}c_1F)s_2-6a^{\prime}c_0c_1+12c_0c_1F,\) and \(N(s_2)=3a^{\prime}s_2^3+(2c_0-12a^{\prime}c_1F)s_2^2+ (6a^{\prime}c_0c_1-12c_0c_1F)s_2+6c_0^2c_1. \) We find that the discriminant of (11), denoted by \(\Updelta, \) is greater than zero. Namely, there are three distinct BRF curves for s L*1 (s 2). Similarly, from (10) we find that s L*2 (s 1) is unique. Hence, there may be finite multiple BRF curve intersections in M2. Nevertheless, Proposition 7 shows that, under ASS 5.1, there is a unique price NE. In addition, Proposition 8 indicates that the CTY and RCY make non-negative profits at the NE under ASS 5.1.

Proposition 7

In M2, if ASS 5.1 holds, there exists a unique price NE.

Proposition 8

In M2, if ASS 5.1 holds, the CTY and the RCY make non-negative profits at the NE, namely, π L1 (s L*1 , s L*2 ) ≥ 0 and π L2 (s L*1 , s L*2 ) ≥ 0.

We use an example to demonstrate the best response functions of the two players in M2. The parameter values are set as: F = 2, a = 12, c 0 = 50, c 1 = 15 and c 2 = 5. As shown in Fig. 4, in the feasible region (s 1 ≥ c 1, s 2 ≥ c 2), there exist a unique NE, P L* (s L*1 = 106, s L*2 = 84).

6 Price-dependent container dwell time

In previous sections, we discuss the case where the container dwell time is independent of the storage prices. This is applicable to the transit container whose dwell time is relative to the customer’s production or sales plan. However, customers may hoard cargos, such as grain, coal and nonferrous metal in the CTY or the RCY, and tend to treat them as relative long term storage places. In this case, we believe that the container dwell time is not unrestricted, namely, it is sensitive to the storage prices. That is, the larger the per container per unit time storage prices, the shorter the container dwell time.

Therefore, in this section, we consider a new model (M3) which has a price-dependent container dwell time. In order to model the relationship between the storage prices and the container dwell time, we assume that the CTY and RCY believe the customer has a tolerance payment for each container’s storage beyond the free-time-limit (F), denoted by p (p ≥ 0). We assume that p is random and follows a uniform distribution on [0, P], P > c 0. The tolerance payment characterizes the maximal storage payment per container the customer willing to disburse. To enjoy long term storage for the container, the customer will store it in the CTY or the RCY till the tolerance payment is reached. p = 0 means that a container will not stay in the CTY longer than the free-time-limit and it can be moved away any time before F.

As shown in Fig. 5, if 0 < p ≤ s 1 t s , the customer will continue storing the container in the CTY for p/s 1 time units after the free-time-limit. On the other hand, if p > s 1 t s , the customer will transfer the container to the RCY after the free-time-limit and store it there for (p − c 0)/s 2 units time. We call s 1 t s indifference payment. Recall that in M1, the container dwell time is uniformly distributed, and the customer chooses the best storage place so as to minimize his payment. While in M3 where the payment tolerance is uniformly distributed, the customer decides the storage place to store the container as long time as possible.

According to Fig. 5, the RCY will compete with the CTY such that s 1 t s ≤ P. We can write out the objective functions of the CTY and the RCY:

Here s 1 ≥ c 1, s 2 ≥ c 2, and we use the superscript “D" to denote the price-dependent dwell time. We aim to find the price NE, (s D*1 , s D*2 ) and prove that the CTY and the RCY make non-negative profits at the NE. We now discuss the quasi-concavities of π D1 (s 1,s 2) and π D2 (s 1,s 2).

Proposition 9

In M3, given s 2 > c 1 F, the profit function of the CTY is quasi-concave.

Before discussing the quasi-concavity of π D2 (s 1,s 2) and the non-negative benefits of the two players at the NE, we introduce the following assumption which ensures that given s 1 we have s 1 t D* s (s 1) ≤ P in π D2 (s 1,s 2). Here t D* s (s 1) = c 0/(s 1 − s D*2 (s 1)).

Specifically, ASS 6.1 states that: given the operation cost coefficients of the CTY and RCY, the transportation cost (c 0) should not be too large and the maximum tolerance payment (P) should not be too small.

Proposition 10

In M3, the profit function of the RCY is quasi-concave under assumption ASS 6.1.

The BRFs of the CTY and RCY in the storage game with price-dependent container dwell time are denoted as s D*1 (s 2) and s D*2 (s 1), respectively. Based on Propositions 9 and 10, there exists at least one BRF curve intersection, and the RCY’s storage price is above c 1 F at the intersection. From the proofs of Propositions 9 and 10, we can get the first order conditions of the NE:

Here, C(s 1) = − P′ − 2c 20 s 1, D(s 1) = (3P′ + 4c 20 c 2)s 1, G(s 1) = − (3P′ + 3c 20 c 2)s 21 , H(s 1) = (P′ + c 20 c 2)s 31 and P′ = c 2 P 2 − 2c 0 c 2 P. By solving (14) and (15), the price NE could be derived. We now prove that at the NE, the two players make non-negative profits.

Proposition 11

In M3, the CTY makes a non-negative profit at the NE. And if ASS 6.1 holds, the RCY makes a non-negative profit at the NE.

The following proposition shows the uniqueness property of the BRF curve intersection.

Proposition 12

In M3, if ASS 6.1 holds, there exists a unique price NE.

We use an example to demonstrate the best response functions of the two players in M3. The parameter values are set as: F = 4, P = 500, c 0 = 50, c 1 = 20 and c 2 = 10. As shown in Fig. 6, there is a unique price NE, P D*(s D*1 = 241, s D*2 = 132).

7 Numerical analysis

In this section, we use numerical experiments to analyze the competition outcomes with the change of different parameters. We analyze how the change of parameters affects the competition outcomes in models M1-M3. All parameter values in the numerical analysis are randomly selected and it is guaranteed that b > F, a > F, P > c 0 and the three assumptions (ASS 4.1, ASS 5.1 and ASS 6.1) are satisfied. In each instance set of the three models, we adjust one parameter value, keeping all other parameters unchanged. The common parameter values are set as follows: M1: c 0 = 50, c 1 = 20, c 2 = 10, b = 12, F = 2; M2: c 0 = 50, c 1 = 20, c 2 = 5, a = 16, F = 2; M3: c 0 = 50, c 1 = 20, c 2 = 10, P = 500, F = 2. The numerical results are provided in Fig. 7–12.

The important insights can be concluded as follows:

-

(1)

According to Fig. 7, the indifference times (t U* s and t L* s ) increase with the transportation cost in M1 and M2; and the indifference payment (s D*1 t D* s ) increases with the transportation cost in M3. Recall that, the container whose planning dwell time (tolerance payment) is shorter (less) than the indifference time (indifference payment) will stay in the CTY after time F. Hence Fig. 7 reveals that there will be more containers stored in the CTY when the transportation cost is large. So the profit of the CTY increases with the transportation cost (refer to Fig. 8).

-

(2)

As shown in Fig. 9, the storage prices in the CTY and the RCY increase with the transportation cost. Therefore Fig. 9 reveals that the customer suffers not only high container transportation cost but also high storage cost when the transportation cost is high.

-

(3)

As demonstrated in Fig. 10, the indifference times (t U* s and t L* s ) and the indifference payment (s D*1 t D* s ) decrease with the CTY’s operation cost coefficient, respectively. Large operation cost coefficient of the CTY indicates his low capacity level. Since a container will be moved to the RCY at time F if its planning dwell time (tolerance payment) is longer (larger) than the indifference time (indifference payment); Fig. 10 exposes that the more restricted the CTY’s capacity, the more containers will be transferred to the RCY. Hence, the existence of the RCY helps to relieve the congestion in the CTY.

-

(4)

In Fig. 11, the profit of the RCY increases with the CTY’s operation cost coefficient. As a result, the more restricted of the CTY’s capacity (higher operation cost coefficient in the terminal), the more profit the RCY makes.

-

(5)

Refer to Fig. 12, the indifference time and indifference payment decrease with F. A container will keep staying in the CTY after time F if its planning dwell time (tolerance payment) is shorter (less) than the indifference time (indifference payment). Namely, Fig. 12 exposes that in the competition situation, a short F may lead to more containers stored in the CTY after the free-time-limit, which increases the congestion level. Therefore, the CTY should balance the total profit and the capacity utilization situation in the terminal yard to choose a proper free-time-limit value.

8 Discussion and conclusion

In this paper, we analyze the storage price competition between the CTY and the RCY. This competition relationship exists in practice but is not emphasized in the literature. The RCY performs as a long term storage alternative when customers do not have enough warehouse space to store the cargo. For example, at the beginning of 2009, when the steel price was dropping, customers stored steel in Hangzhou terminal of China for a long time for the purpose of hoarding and speculationFootnote 3. Under this situation, if there is a remote yard located near the terminal, customers will transfer their cargo there. Hence, the existence of the remote yard not only benefits the terminal by relieving in-port crowding, but also helps to reduce customers’ storage payments.

To sum up, in this paper we study the inbound container storage pricing game between the CTY and the RCY. Our primary objective is to develop the basic theory concerning the pricing behavior and competition outcomes in such a market. We build mathematical models for two cases: the price-independent container dwell time and price-dependent container dwell time. We analyze the existence and uniqueness of the competition outcomes and reveal a number of insights.

It is shown that the CTY makes more profit when the transportation cost of cargo moving is large. The customer suffers not only high container transportation cost but also high storage cost when the transportation cost is high. The more restricted of the CTY’s capacity, the more profit the RCY makes.

We have made some assumptions to make our models tractable. We study homogeneous customer behavior; namely, we assume the container dwell time distribution and container tolerance payment distribution are the same for all containers. Furthermore, a simple two-player game model with one port yard and one remote yard is studied. Although these assumptions limit the applicable range of the conclusions, our results provide a conceptual base for the inbound container storage competition which exists in reality but has not been studied in the literature. The results and ideas of this paper may provide some managerial suggestion for decision makers in government, port authorities and remote yards.

An interesting extension is to study heterogeneous customer behavior, namely, there are multiple types of containers and their dwell time characteristics are not identical. One may also study a new topic on the optimal value of the free-time-limit, taking the three-player relationship (RCY, CTY and the shipping lines) into consideration. Furthermore, instead of only one remote yard, multiple remote yards could be considered. The inbound cargo storage competition model may also be applied to the storage market where there are a central public warehouse and remote warehouses.

Notes

In Kim (1997) and Kim and Kim (1999), they proposed an evaluated expression for the total rehandles needed to retrieve all containers in a container bay. Their estimation is a quadratic function with respect to the average height of the container stack. And the average height of the container stack is proportional to container dwell time (with stable container flow). So we can estimate that the operation cost is also a quadratic function of the container dwell time.

Let the terminal handling charge be h per container. Then the total profit of the CTY is, \(h+\int_F^{F+t_s}s_1(t-F)f(t)dt-\int_0^{F+t_s}c_1t^2f(t)dt. \) Differentiating the profit with respect to F, we get \(s_1t_s \cdot f(F+t_s)-\int_F^{F+t_s}s_1f(t)dt - c_1(F+t_s)^2\cdot f(F+t_s). \) Since f(T) is a non-increasing function, \(s_1t_s \cdot f(F+t_s)-\int_F^{F+t_s}s_1f(t)dt \leq 0. \) Hence, the profit decreases with F, and to maximize the profit, the CTY should set F = 0.

Chinese Website: http://www.dfjinshu.com/thmlnews/2009/03/10/20093102536.html.

Quasiconcavity and quasiconvexity–by Martin J. Osborne, University of Toronto Department of Economics.

References

Anderson CM, Park Y-A, Chang Y-T, Yang C-H, Lee T-W, Luo M (2008) A game-theoretic analysis of competition among container port hubs: the case of Busan and Shanghai. Maritime Policy Manag 35(1):5–26

Bertsekas DP (1999) Nonlinear programming. Athena Scientific, Nashua

Cachon G, Netessine S (2004) Game theory in supply chain analysis. In: Simchi-Levi D, Wu SD, Shen M (eds) Supply chain analysis in the eBusiness era. Kluwer, Dordrecht

Castilho BD, Daganzo CF (1991) Optimal pricing policies for temporary storage at ports. Transp Res Rec 1313:66–74

Fransoo JC, Lee CY (2010) Ocean container transport: an underestimated and critical link in global supply chain performance. Prod Oper Manag (to appear)

Gillemin V, Pollak A (1974) Differential topology. Prentice Hall, NJ

Günther HO, Kim KH (2006) Container terminals and terminal operations. OR Spectrum 28(4):437–445

Holguin-Veras J, Jara-Diaz S (1999) Optimal pricing for priority service and space allocation in container ports. Transp Res Part B 33(2):81–106

Imakita J (1978) A techno-economic analysis of the port transport system. Praeger, New York

Jansson JO, Shneerson D (1982) Port economics. MIT, Cambridge

Kim KH (1997) Evaluation of the number of rehandles in container yards. Comput Ind Eng 32(4):701–711

Kim KH, Kim HB (1999) Segregating space allocation models for container inventories in port container terminals. Int J Prod Econ 59(1-3):415–423

Kim KH, Kim KY (2007) Optimal pricing schedule for storage of inbound containers. Transp Res Part B 41(8):892–905

Lim A, Rodrigues B, Xu Z (2008) Transportation procurement with seasonally varying shipper demand and volume guarantees. Oper Res 56(3):758–771

Luo M, Liu L, Gao F (2010) A two-stage game theory model for market power transition and evolution. Working paper

Stahlbock R, Voss S (2008) Operations research at container terminals: a literature update. OR Spectr 30(1):1–52

Steenken D, Voss S, Stahlbock R (2004) Container terminal operation and operations research—a classification and literature review. OR Spectr 26(1):3–49

Watanabe I (2001) Container terminal planning—a theoretical approach. World Cargo News (WCN) Publishing, Great Britain, 58–61

Yang Z (1999) Analysis of container port policy by the reaction of an equilibrium shipping market. Maritime Policy Manag 26(4):369–381

Zhou W, Lee C-Y (2009) Pricing and competition in a transportation market with empty equipment reposition. Transp Res Part B 43(6):677–691

Author information

Authors and Affiliations

Corresponding author

Appendix

Appendix

Proof of Proposition 1

From the expression of π U1 (s 1, s 2), we can get the first order condition:

namely,

There are several methods to prove the quasi-concavity of a functionFootnote 4. One method is that, to prove the quasi-concavity of π U1 (s 1, s 2), we only need to prove that given s 2, we have ∂2 π U1 (s 1,s 2)/∂s 21 ≤ 0 when (16) is satisfied.

thus, it is equivalent to prove that given s 2, we have 4c 1 t s ≥ s 1 + 2s 2 − 6c 1 F when (16) is satisfied. In addition, from (16) we have s 2 = 2c 1 t s + 4c 1 F − s 1. Hence we only need to prove that given s 2, s 1 ≥ 2c 1 F. Substituting t s = c 0/(s 1 − s 2) into (16), we can solve, \(s_1^{U*}(s_2)=2c_1F+\sqrt{(s_2-2c_1F)^2+2c_0c_1}\geq 2c_1F, \) which finishes the proof. \(\square\)

Proof of Proposition 2

From the expression of π U2 (s 1, s 2), we can get the first order condition:

We now prove that given s 1, we have ∂2 π U2 (s 1,s 2) / ∂s 22 ≤ 0 when the first order condition is satisfied.

hence, it is equivalent to prove that given s 1, − 2s 1 − s 2 + 3c 2 ≤ 0 when the first order condition is satisfied. Given s 1, from the first order condition we solve,

Given s 1, since s U*2 (s 1) < s 1, we must have s U*2 (s 1) ≥ c 2, otherwise the first order condition is violated. By s 1 > s U*2 (s 1) ≥ c 2, − 2s 1 − s U*2 (s 1) + 3c 2 ≤ 0 is obvious. Therefore π U2 (s 1,s 2) is quasi-concave. \(\square\)

Proof of Proposition 3

We first prove π U1 (s U*1 ,s U*2 ) ≥ 0. From the expression of π U1 (s 1,s 2),

We now prove that s U*1 − c 1 t U* s − 2c 1 F ≥ 0 and s U*1 ≥ s U*2 . Because if these two inequalities are true, we have π U1 (s U*1 ,s U*2 ) ≥ 0. In the proof of Proposition 1, we already get that \(s_1^{U*}=2c_1F+\sqrt{(s_2^{U*}-2c_1F)^2+2c_0c_1} \geq s_2^{U*}. \) Therefore we now prove s U*1 − c 1 t U* s − 2c 1 F ≥ 0. Substitute (s U*1 , s U*2 ) into the first order condition of π U1 (s 1,s 2),

we find that s U*1 − c 1 t U* s − 2c 1 F ≥ 0 must be true at the NE, otherwise the above first order condition is violated.

We now prove that π U2 (s U*1 ,s U*2 ) ≥ 0 under assumption ASS 4.1. From the expression of π U2 (s 1, s 2),

if we can prove t U* s > 0, F + t U* s ≤ b and s U*2 ≥ c 2, then π U2 (s U*1 ,s U*2 ) ≥ 0. Since in the proof of Proposition 1 we already get s U*1 > s U*2 , namely t U* s > 0, we now only prove F + t U* s ≤ b and s U*2 ≥ c 2. In the first order condition of π U2 (s 1,s 2)

if F + t U* s ≤ b then s U*2 ≥ c 2 must be true, otherwise the first order condition is violated. So we only need to prove \(t_s^{U*} \leq b^{\prime}\) (here \(b^{\prime}=b-F\)), that is \(s_1^{U*}-s_2^{U*}\geq c_0/b^{\prime}. \) From Eq. (6), we can solve the BRF of the RCY,

Therefore \(s_1^{U*}-s_2^{U*} \geq c_0/b^{\prime}\) means

Because s 1 ≥ c 1 and the left part of the above inequality is an increasing function of s 1, so we only need the following assumption to guarantee \(s_1^{U*}-s_2^{U*}\geq c_0/b^{\prime}\)

Simplifying the above assumption, we get assumption ASS 4.1. \(\square\)

Proof of Proposition 4

By the Index Theory approach (Cachon and Netessine 2003), to show the uniqueness of the BRF curve intersection, we only need to prove that,

We firstly prove −1 < ∂s U*1 (s 2) / ∂s 2 < 1. From (16), we can get the best response function of the CTY, \(s_1^{U*}(s_2)=2c_1F+\sqrt{(s_2-2c_1F)^2+2c_0c_1}. \) So the slope of it is,

It is obvious that −1 < ∂s U*1 (s 2) / ∂s 2 < 1. Also from the Implicit Function Theorem (Bertsekas 1999), we have

According to the proof of Proposition 2, we have s U*1 > s U*2 and s U*2 ≥ c 2 at the NE, so 0 < ∂s U*2 (s 1) / ∂s 1 < 1 at the NE. Together with −1 < ∂s U*1 (s 2) / ∂s 2 < 1, we finish the proof.\(\square\)

Proof of Proposition 5

The first order condition of CTY’s best response function is:

Namely,

Here \(a^{\prime}=a-F. \) To prove the quasi-concavity of π L1 (s 1, s 2), we only need to prove that given s 2, we have ∂2 π L1 (s 1,s 2)/∂s 21 ≤ 0 when (17) is satisfied. Substitute t s = c 0/(s 1 − s 2) into (17), we have

Given s 2, the discriminate of the above cubic equation is greater than zero, so it has three distinct roots. Given s 2, define,

By setting s 1 = s 2, we have g(s 2) = − 6c 20 c 1 < 0. So from the shape of function g(s 1), we find that at least one root of the cubic equation is larger than s 2 and we only focus on those that are larger than s 2, therefore s L*1 (s 2) ≥ s 2. From (17) we get,

Hence, s 1 − c 1 t s − 2c 1 F > 0. With s 1 ≥ s 2 and s 1 − c 1 t s − 2c 1 F > 0, we must have \(a^{\prime}>t_s, \) otherwise the first order condition is violated.

From \(a^{\prime}>t_s\) and s 1 ≥ s 2, we find \(-lc_1c_0^3(a^{\prime}-t_s)/(s_1-s_2)^5<0. \) Therefore, to prove ∂2 π L1 (s 1, s 2) /∂s 21 ≤ 0, it is sufficient to prove,

Hence, it is equivalent to prove \(-2a^{\prime}(s_1-s_2)^2+2c_0(s_1-s_2)+(s_1-c_1t_s -2c_1F)(3a^{\prime}s_1-3a^{\prime}s_2-4c_0)\leq 0. \) From (17) we get the expression of (s 1 − s 2)2, and submit it into \(-2a^{\prime}(s_1-s_2)^2+2c_0(s_1-s_2)+(s_1-c_1t_s-2c_1F) (3a^{\prime}s_1-3a^{\prime}s_2-4c_0)\leq 0, \) we have \(2c_0(s_1-s_2)-3a^{\prime}(s_1-c_1t_s-2c_1F)(s_1-s_2) \leq 0. \) Namely, we just need to prove \(2c_0/3a^{\prime}+ \lambda \leq s_1, \) which is obvious according to (18). \(\square\)

Proof of Proposition 6

The first order condition of RCY’s best response function is:

namely,

Here \(a^{\prime}=a-F. \) To prove the quasi-concavity of π L2 (s 1, s 2), we only need to prove that given s 1, we have \(\frac{\partial^2 \pi_2^{L}(s_1,s_2)}{\partial s_2^2} \leq 0\) when (19) is satisfied.

We now prove that given s 1, if ASS 5.1 holds then \(s_1-s_2^{L*}(s_1) \geq 4c_0/(3a^{\prime})\) and s L*2 (s 1) ≥ c 2, because if these inequalities are satisfied, we will have ∂2 π L2 (s 1,s 2)/∂s 22 ≤ 0. In addition, if \(s_1-s_2^{L*}(s_1) \geq 4c_0/(3a^{\prime}), \) then s L*2 (s 1) ≥ c 2 must be true, otherwise the first order condition of RCY’s best response is violated. So we just focus on proving if ASS 5.1 holds then \(s_1-s_2^{L*}(s_1) \geq 4c_0/(3a^{\prime}). \) By solving (19), we get the best response function of the RCY:

here \(A(s_1)=(162c_0^2a^{\prime}s_1-162c_0^2a^{\prime}c_2+34c_0^3)/(54a^{\prime3}), \,B=11c_0^2/(9a^{\prime2}). \) Therefore to prove \(s_1-s_2^{L*}(s_1) \geq 4c_0/3a^{\prime}\) is equivalent to prove

Because s 1 ≥ c 1 and the left part of the above inequality is an increasing function of s 1, so we only need the following assumption to guarantee the above inequality.

Simplify the above assumption we get assumption ASS 5.1. \(\square\)

Proof of Proposition 7

By the Index Theory approach (Cachon and Netessine 2003), to show the uniqueness of the BRF curve intersection, we only need to prove that,

We firstly prove ∂s L*1 (s 2) / ∂s 2 < 1 at the NE. From the Implicit Function Theorem (Bertsekas 1999),we have

According to the proof of Proposition 5, we know that ∂2π L1 (s 1,s 2)/∂s 21 ≤ 0 at the NE, namely the denominator of the above expression is greater than zero. Hence to show ∂s L*1 (s 2) / ∂s 2 < 1 at the NE, it is equivalent to show \(\frac{lc_0^2(a^{\prime}-t_s)}{(s_1-s_2)^3} < \frac{2lc_0^2(a^{\prime}-t_s)}{(s_1-s_2)^3}\) at the NE. By the proof of Proposition 6, we know if ASS 5.1 holds, then \(s_1^{L*}-s_2^{L*} \geq 4c_0/(3a^{\prime}), \) with which \(\frac{lc_0^2(a^{\prime}-t_s)}{(s_1-s_2)^3} < \frac{2lc_0^2(a^{\prime}-t_s)}{(s_1-s_2)^3}\) is true at the NE.

We now prove 0 < ∂s L*2 (s 1) / ∂s 1 < 1 at the NE. Also from the Implicit Function Theorem (Bertsekas 1999), we have

Since in the proof of Proposition 6 we get that \(s_1^{L*}-s_2^{L*} \geq 4c_0/(3a^{\prime})\) and s L*2 ≥ c 2. Hence 0 < ∂s L*2 (s 1) / ∂s 1 < 1 at the NE. By ∂s L*1 (s 2) / ∂s 2 < 1 and 0 < ∂s L*2 (s 1) / ∂s 1 < 1 at the NE, we finish the proof. \(\square\)

Proof of Proposition 8

We first prove π L1 (s L*1 ,s L*2 ) ≥ 0 under assumption ASS 5.1. From the expression of π L1 (s 1, s 2), we have

We now prove s L*1 − c 1 t L* s − 2c 1 F ≥ 0 and s L*1 ≥ s L*2 . Because if these two inequalities are true, we have π L1 (s L*1 ,s L*2 ) ≥ 0. By the proof of Proposition 6, we know at the NE, \(s_1^{L*}- s_2^{L*} \geq 4c_0/3a^{\prime}\) under assumption ASS 5.1, so s L*1 ≥ s L*2 . Substitute (s L*1 , s L*2 ) into the first order condition of π L1 (s 1,s 2)

we find that s L*1 − c 1 t L* s − 2c 1 F ≥ 0 must be true at the NE, otherwise the above first order condition is violated.

We now prove that π L2 (s L*1 ,s L*2 ) ≥ 0 under assumption ASS 5.1. From the expression of π L2 (s 1, s 2), if we can prove s L*1 ≥ s L*2 , F + t L* s ≤ a and s L*2 ≥ c 2, then π L2 (s L*1 ,s L*2 ) ≥ 0. We already have s L*1 ≥ s L*2 , hence we just focus on the proof of F + t L* s ≤ a and s L*2 ≥ c 2. In the first order condition of π L2 (s 1,s 2)

if F + t L* s ≤ a then s L*2 ≥ c 2 must be true. So we only need to prove \(t_s^{L*} \leq a^{\prime}, \) here \(a^{\prime}=a-F, \) that is \(s_1^{L*}-s_2^{L*} \geq c_0/a^{\prime}, \) which is satisfied under assumption ASS 5.1. Therefore we have π L2 (s L*1 ,s L*2 ) ≥ 0 if ASS 5.1 holds. \(\square\)

Proof of Proposition 9

We can write out the first order condition of CTY’s best response function:

Simplifying the first order condition, we get

To prove the quasi-concavity of π D1 (s 1,s 2) we only need to prove that given s 2, we have ∂2 π D1 (s 1,s 2) / ∂s 21 ≤ 0 when (21) is satisfied.

From (21) we know

Substitute the above equation into the expression of ∂2 π D1 (s 1, s 2)/∂s 21 , we find that to prove ∂2 π D1 (s 1,s 2)/∂s 21 ≤ 0 is equivalent to prove,

which can be verified if we can show that, s D*1 (s 2) > s 2 when s 2 > c 1 F. Thus we now try to prove, given s 2 > c 1 F, s D*1 (s 2) > s 2. From (22), we solve,

Given s 2 > c 1 F, to ensure s D*1 (s 2) > s 2 we need 3c 0 c 1 s 2 > 0, which is obvious.\(\square\)

Proof of Proposition 10

We can write out the first order derivative and second order condition of π D2 (s 1,s 2):

To prove the quasi-concavity of π D2 (s 1, s 2), we only need to prove that given s 1, the above inequality is satisfied at (s 1 ,s D*2 (s 1)). We now prove that s D*2 (s 1) < s 1, s 1 t D* s (s 1) ≤ P and s D*2 (s 1) ≥ c 2. Because if these relations are true, the above inequality is satisfied. From (23), if s D*2 (s 1) < s 1 and s 1 t D* s (s 1) ≤ P, then s D*2 (s 1) ≥ c 2 must be true. So we only need to prove s D*2 (s 1) < s 1 and s 1 t D* s (s 1) ≤ P now. Given s 1, by letting (23) equal to zero, we have

Here, C(s 1) = − P′ − 2c 20 s 1, D(s 1) = (3P′ + 4c 20 c 2)s 1, G(s 1) = − (3P′ + 3c 20 c 2)s 21 , H(s 1) = (P′ + c 20 c 2)s 31 and P′ = c 2 P 2 − 2c 0 c 2 P. The discriminate of this cubic equation is less than zero, so it has only one real root. And given s 1, define,

Let s 2 = s 1, we have d(s 1) = 2c 20 c 2 − 2c 20 s 1 < 0. So according to the shape of function d(s 2), we know that s D*2 (s 1) < s 1.

Now we prove s 1 t D* s (s 1) ≤ P, namely, (1 − c 0/P)s 1 − s D*2 (s 1) ≥ 0. According to the shape of d(s 2), it is sufficient to prove d((1 − c 0/P)s 1) ≤ 0, that is,

By P > c 0, it is sufficient to prove Pc 2 − Ps 1 + s 1 c 0 ≤ 0. Because s 1 > c 1, with the assumption Pc 2 − Pc 1 + c 1 c 0 ≤ 0, the above inequality is satisfied. Hence, by assuming Pc 2 − Pc 1 + c 1 c 0 ≤ 0, we have \(s_1t_s^{D*}(s_1)\leq P.\,\square\)

Proof of Proposition 11

By the proof of Proposition 10. we know that if ASS 6.1 is satisfied, then s D*2 < s D*1 and s D*1 t D* s ≤ P at the NE. Substitute (s D*1 , s D*2 ) into the first order condition of RCY’s best response,

we find that at NE, we must have s D*2 ≥ c 2, otherwise the first order condition is violated. Therefore if ASS 6.1 holds, then in the expression of π D2 (s D*1 , s D*2 ), we have s D*2 ≥ c 2, s D*2 < s D*1 and s D*1 t D* s ≤ P, and these three inequalities ensure that π D2 (s D*1 ,s D*2 ) ≥ 0.

Similarly, since s D*2 < s D*1 , according to the first order condition of the CTY’s best response, (21), we find that at NE, we must have s D*1 − c 1 t D* s − 2c 1 F ≥ 0, otherwise the first order condition is violated. By the expression of π D1 (s 1,s 2),

With s D*2 < s D*1 and s D*1 − c 1 t D* s − 2c 1 F ≥ 0, we get \(\pi_1^D(s_1^{D*},s_2^{D*}) \geq 0.\,\square\)

Proof of Proposition 12

By the Index Theory approach (Cachon and Netessine 2003), to show the uniqueness of the NE, we only need to prove,

We first prove ∂s D*1 (s 2)/∂s 2 < 1 at the NE. Note that, by the Implicit Function Theorem (Bertsekas 1999), \(\frac{\partial s_1^{D*}(s_2)}{\partial s_2} = -\frac{\frac{\partial^2 \pi_1^D(s_1,s_2)}{\partial s_1 \partial s_2}}{\frac{\partial^2 \pi_1^D(s_1,s_2)}{\partial s_1^2}}\).

According to (21), the above equation can be simplified to

Hence, we need to prove

As shown in Proposition 11, s D*1 > s D*2 and s D*1 − c 1 t D* s − 2c 1 F ≥ 0. Therefore the above inequality is satisfied at the NE.

We then prove 0 < ∂s D*2 (s 1) / ∂s 1 < 1 at the NE. Because we have:

also from the Implicit Function Theorem:

substitute the expressions of ∂2 π D2 (s 1,s 2) / ∂s 22 and ∂2 π D2 (s 1,s 2)/ ∂s 2 ∂s 1 into the above equation and then simplify it, we find that to prove 0 < ∂s D*2 (s 1) / ∂s 1 < 1, we only need,

According to the proof of Proposition 11, if ASS 6.1 holds, s D*2 < s D*1 , s D*2 ≥ c 2 and s D*1 t D* s ≤ P at the NE. And these three relations ensure the above inequality. Therefore 0 < ∂s D*2 (s 1) / ∂s 1 < 1 at the NE. By ∂s D*1 (s 2)/∂s 2 < 1 and 0 < ∂s D*2 (s 1) / ∂s 1 < 1 at the NE, we finish the prove. \(\square\)

Rights and permissions

About this article

Cite this article

Lee, CY., Yu, M. Inbound container storage price competition between the container terminal and a remote container yard. Flex Serv Manuf J 24, 320–348 (2012). https://doi.org/10.1007/s10696-011-9103-6

Published:

Issue Date:

DOI: https://doi.org/10.1007/s10696-011-9103-6