Abstract

Many important decisions are made under stress and they often involve risky alternatives. There has been ample evidence that stress influences decision making, but still very little is known about whether individual attitudes to risk change with exposure to acute stress. To directly evaluate the causal effect of psychosocial stress on risk attitudes, we adopt an experimental approach in which we randomly expose participants to a stressor in the form of a standard laboratory stress-induction procedure: the Trier Social Stress Test for Groups. Risk preferences are elicited using a multiple price list format that has been previously shown to predict risk-oriented behavior out of the laboratory. Using three different measures (salivary cortisol levels, heart rate and multidimensional mood questionnaire scores), we show that stress was successfully induced on the treatment group. Our main result is that for men, the exposure to a stressor (intention-to-treat effect, ITT) and the exogenously induced psychosocial stress (the average treatment effect on the treated, ATT) significantly increase risk aversion when controlling for their personal characteristics. The estimated treatment difference in certainty equivalents is equivalent to 69 % (ITT) and 89 % (ATT) of the gender-difference in the control group. The effect on women goes in the same direction, but is weaker and insignificant.

Similar content being viewed by others

Avoid common mistakes on your manuscript.

1 Introduction

In recent decades, stress has become an integral part of society. Daily decision making in many professions involves risky choices under severe pressure or even stress, such as trading stocks, diagnosing patients in emergency rooms, or controlling air-traffic. Stress is an instinctive psychological, physiological and behavioral reaction to perceived threats and as such it cannot be controlled by human will (Goldstein and McEwen 2002). Most people have to face stressful situations with risky choices throughout their lives, for instance university exams, job-interviews, asking for promotions, or starting their own businesses. The choices made in these situations are crucial determinants of economic outcomes and therefore we consider it important to understand whether they might be affected by stress.

In the context of developing countries, poverty remains one of the most pressing global issues, with 836 million people still living on less than $1.25 a day (United Nations 2015). Recently it has been argued that poverty causes stress and a negative emotional state which can play an important role in the perpetuation of poverty by increasing risk-aversion and lowering patience (Haushofer and Fehr 2014). Risk preferences are relevant for the housing, investment, schooling, and occupational decisions of the poor. Higher risk-aversion could lead to choices that make it hard to escape poverty, thus creating a feedback loop. Poverty is indeed found to be correlated with higher risk-aversion (Yesuf and Bluffstone 2009; Guiso and Paiella 2008) and the first part of the proposed relationship—poverty causes stress—has been well established (Haushofer and Fehr 2014; Haushofer and Shapiro 2013; Chemin et al. 2013). Still, much less is known about the causal relationship between stress and risk preferences, a question that we examine in this paper.

Moreover, risk preferences are incorporated in major economic theories in fields ranging from finance, labor economics, the economics of innovation to development economics. These theories typically assume the stability of risk preferences, which in turn allows for an elegant solution to the proposed models. However, increasingly more evidence shows that this assumption may not always hold: risk preferences may temporarily fluctuate (Guiso et al. 2013; Cohn et al. 2015), can be affected by the direct administration of cortisol (Kandasamy et al. 2014), and emotions (Nguyen and Noussair 2014). We contribute to this literature by studying the stability of risk preferences with respect to stress.

Behavioral changes under stress have been studied extensively in the psychological literature, mainly looking at the effects of stress on memory and performance, but also on various other aspects of decision making (see review in Starcke and Brand 2012). However, due to the methodological limitations of previously published studies, only little is known about the effect of stress on risk preferences. Our study differs from the previous literature by (i) using an efficient stressor and a risk task that is (ii) easy to understand and (iii) involves neither feedback processing nor learning which itself may be affected by stress (Petzold et al. 2010).

In this paper, we identify the causal effect of psychosocial stress on risk preferences using a laboratory experiment with 151 subjects, who are randomly assigned to a stress treatment or a control group. Our stress-inducing procedure, the Trier Social Stress Test (Kirschbaum et al. 1993) in the group modification (TSST-G, von Dawans et al. 2011), is well-established in the literature and has been shown to be one of the most efficient laboratory stressors in terms of physiological as well as psychological reactions (Dickerson and Kemeny 2004). We use three different measures to validate the efficiency of the TSST-G procedure: two physiological (salivary cortisol concentration and heart-rate) and one psychological (multi-dimensional mood questionnaire scores, MDMQ, Steyer et al. 1997). To elicit risk-preferences we use the task of Dohmen et al. (2010), which is easily comprehensible to subjects, is incentive compatible and has been shown to predict risk-taking behavior outside of the laboratory in 30 countries (Vieider et al. 2014).

In addition, we measure the “Big-Five” personality traits (Costa and McCrae 1992; Goldberg et al. 2006) that are one of the most enduring and popular models of personality and include them in our analysis. We do so because recent laboratory experiments have shown that personality plays an important role in the explanation of individual risk-attitudes, potentially through the mediation of emotions that may be connected to stress; and because personality may reflect generally stable patterns in behavior, motivation and cognition (Capra et al. 2013; Deck et al. 2010, 2012).

We were successful in inducing stress using the TSST-G procedure. All three measures of stress responded in the expected direction: compared to the reaction of the control group, the cortisol levels and heart-rates of the treatment group increased and their reported mood shifted towards the bad and nervous poles. On an individual level, when we focus on the increase of salivary cortisol as an indicator of stress, we show that the compliance rate i.e. the correct physiological response to either the TSST-G stress or control procedure is 78 %.

Our main result is that acute psychosocial stress increases risk aversion in men, when controlling for personal characteristics. Risk preferences are measured using elicited certainty equivalents. Since not all subjects exposed to the stress-inducing procedure were actually stressed and vice-versa, we need to face the problem of imperfect compliance. Therefore in the analysis we distinguish between the intention-to-treat effects (ITT—effect of random exposure to the stressor on risk preferences) and the average treatment effect on treated (ATT, effect of being stressed on risk preferences). The ATT effect is estimated using a two-stage instrumental variable regression, with random exposure to the stressor used as an instrument for the physiological state of stress. For men, the ITT and ATT effects of stress on elicited certainty equivalent are significant at 10 and 5 % level, respectively, when controlling for age and “Big-5” personality traits, showing that stress increases risk-aversion. The corresponding effect size is equivalent to 69 % (ITT) and 89 % (ATT) of the estimated gender difference in the control group. The effect on women goes in the same direction, but is insignificant.

2 Methodology

2.1 Measurement of risk preferences

Risk preferences were elicited using a simple task similar to the one in Dohmen et al. (2010), where participants repeatedly chose between a lottery and different safe payments. Subjects had to fill in a table of 10 rows, where in each row the lottery stayed the same paying either 4000 ECU or 0 ECU with 50 % probability each, but the safe payment gradually increased from 0 ECU by increments of 300 ECU up to 2700 ECU. Detailed instructions and a screenshot of the decision-making task can be found in the Online Appendix. Subjects knew that one row would be randomly determined for payment and that they would be paid according to their choices in that row. We allowed for inconsistent behavior; subjects filled in all 10 rows and were not in any way guided to a single switching point. The risk task was programmed in and conducted with the software Z-TREE (Fischbacher 2007).

If the individual’s behavior is consistent, then the row where the subject switches preferences indicates the individual certainty equivalent, i.e. the safe amount which makes the individual indifferent to choosing or not choosing the lottery. For the descriptive statistics, the individual certainty equivalent is determined as the central point of the switching interval. For interval regressions, the certainty equivalent is specified as lying in the interval between the two safe amounts where the switch occurred.Footnote 1 As the expected value of the lottery is 2000 ECU, risk neutral subjects should start by preferring the lottery up to the safe amount equal to 1800 ECU (row 7) and then switch to preferring the safe amounts. Risk-averse subjects may switch to preferring safe amounts earlier, with the switching row depending on their degree of risk-aversion (the more risk-averse they are, the earlier they switch). Only risk-loving subjects should choose lottery for the safe amounts greater than or equal to 2100 ECU.

2.2 Trier social stress test for groups

Stress was induced by a standard validated stress procedure the Trier Social Stress Test for Groups (von Dawans et al. 2011) which is a modified version of an individual TSST originally developed in Kirschbaum et al. (1993). The TSST-G provides a combination of a social-evaluative threat and uncontrollable elements, which are the key attributes of an efficient psychosocial stressor (Dickerson and Kemeny 2004). Specifically, the TSST-G treatment (i.e. stress-inducing) protocol consists of two parts—a public speaking task and a mental arithmetic task that are performed in front of an evaluation committee. The control group faces cognitively similar tasks but with no stressful aspects present.

In our case, during the public speaking task each participant was asked to perform her best at a fictive job interview for 2 min. In the second part during the mental arithmetic task participants were asked to serially subtract 17 from a high number (e.g. 4878) for 2 min. Participants were called one by one in random order, were separated by cardboard barriers and wore headphones so that they would not see or hear the other participants. The two committee members wore white laboratory coats and had two video cameras at their sides that recorded the performance of the participants. The committee was trained not to give any feedback on the subjects’ performance, neither verbally or physically.

The full TSST-G control protocol was applied to the control group, which mirrors the activities of the treatment protocol but omits the stressful aspects of the situation. Participants also went through a public speaking task where they were asked to read a text out loud and then were given a simple mental arithmetic task, i.e. to count by multiples of a small number, e.g. 5–10–15 and so on. There was a committee present in the room, but they were not evaluating the performance of participants, did not wear white lab coats and were asked to act naturally. There were no cameras in the room and the participants did not have the headphones on.

To conform to the standards of experimental economics, we modified the TSST-G original protocol so that it did not contain any deception or false information. These modifications concerned mainly the information given to the participants in the treatment condition; they were not told that the panel members were trained in behavioral analysis, and we did not tell them that the video recordings would later be analyzed.Footnote 2

2.3 Measurement of stress response

To measure individual stress response, we combine two physiological measures, salivary cortisol concentration and heart rate, and one psychological measure of stress reaction.

First, cortisol is the final hormone of the major endocrine stress axis of the human body (hypothalamic-pituitary-adrenal axis, Dedovic et al. 2009) and Foley and Kirschbaum (2010) show that it is highly predictive of psychosocial stress, while being the most commonly used measure of stress in general. Cortisol concentration peaks in the interval approximately 20–40 min after the onset of the stressor (Dickerson and Kemeny 2004). Saliva sample 1 was collected right before the TSST-G procedure, sample 2 was collected right after the stress procedure, and sample 3 was gathered before the risk-preferences protocol, approximately 15 min after the cessation of the stressor. We decided to use three samples in order to be able to show that (i) the groups did not differ in the cortisol levels before the TSST-G protocol, (ii) the TSST-G administration was successful and (iii) the reaction lasted as in the comparable experiments.Footnote 3

Second, as shown in Kirschbaum et al. (1993), heart rate increases are correlated with endured psychosocial stress and can be used as a proxy for the immediate reaction of the sympathetic nervous system. The heart-rate of participants was measured with standard heart-rate monitors.Footnote 4 The individual difference between the average heart-rate during the TSST-G procedure and the average baseline level can be used as one measure of the induced stress.

Third, Multidimensional Mood Questionnaire (MDMQ, Steyer et al. 1997) was used to assess the effects of the TSST-G procedure on the mood of the participants.Footnote 5 Mood is measured in three dimensions: good-bad, awake-tired, and calm-nervous. The MDMQ questionnaire has two parts. In our case, participants filled in one part of the MDMQ right before the TSST-G procedure and the other part right after the TSST-G procedure, where the order of the two parts was randomized across sessions. Based on previous literature, we expected that the stress response would be associated with scores closer to the “bad” and “nervous” poles of the respective dimension (Allen et al. 2014).

2.4 Measurement of personality traits

Apart from basic observable characteristics, such as gender or age, personality traits can also explain individual differences in risk attitudes (Borghans et al. 2008; Heckman 2011). Becker et al. (2012) find that economic preferences and personality traits are not substitute, but rather complementary concepts for explaining economic choices. To capture the personality profile of participants, we used a battery of 50 questions from the International Personality Item Pool to construct the “Big Five” factors that are openness to experience, conscientiousness, extraversion, agreeableness and neuroticism (Goldberg et al. 2006). The “Big Five” factors are the most commonly used measure of personality traits, where each factor represents a summary of a large number of specific personality characteristics (Costa and McCrae 1992).

2.5 Experimental procedure

The experiment was run at the Laboratory of Experimental Economics in Prague in two batches: the first six sessions were run in May/June 2012 and the additional five in November 2014. All the procedures were identical so we pooled the results. Each session included treatment and control group with 7 subjects in each.Footnote 6 All of the sessions were conducted between 4:30 PM and 7:00 PM to control for the impact of the circadian variability in cortisol levels. Each session lasted on average a little less than two and a half hours. The average payment was 500 CZK (about EUR 20), including the fixed show-up fee of 150 CZK (about EUR 6). Throughout the experiment, all payoffs were denominated in experimental currency units (ECU), with the conversion rate was set to 32 ECU = 1 CZK. The whole experiment was run in English, which is the standard working language in this laboratory. No communication among the participants was allowed. The study was approved by the Internal Review Board of the Laboratory of Experimental Economics.

Subjects were recruited via the on-line recruitment-system ORSEE (Greiner 2004). In addition to standard invitation, subjects were informed in the recruitment e-mail that through-out the experiment, the physiological responses of their bodies would be measured using standard procedures. For this reason, they were instructed to abstain from heavy food, nicotine intake and strenuous exercise at least 2 h prior to the experiment. No further specification regarding the content of the experiment was given, in order to avoid self-selection.

Before the start of the experiment, the participants filled in a screening questionnaire in order to find out if there were any circumstances that would interfere with the cortisol measurement. Before entering the laboratory, subjects were randomly assigned into either the control or treatment group. We made sure that women taking oral contraceptives were evenly distributed across the two groups.

The timeline of the experiment is summarized in Fig. 1. The instructions explaining the general procedure of the experiment were read aloud first and subjects were then asked to sign an informed consent form. In the consent form and through-out the experiment, the TSST-G protocol was referred to as a “challenge task”. It was emphasized in the consent form that subjects could leave at any point of the experiment, still receiving their show-up fee.

The heart-rate monitors were attached and subjects were asked to fill-out a questionnaire to measure their personality traits. They were then given instructions on a task studying Bayesian updating and completed two trial and five real rounds of this task (results from this task are not reported in this paper).Footnote 7 Next, the first saliva samples were collected and participants filled in the first part of the MDMQ questionnaire.

Afterwards, instructions to either the TSST-G stress-inducing treatment or TSST-G stress-free control procedure were distributed, describing the tasks that would follow. Subjects in the treatment group were informed that they would be evaluated in public and recorded on video. Subjects read the instructions quietly and had 5 min for preparation. Then the groups were taken to two separate rooms where they completed the TSST-G treatment or control procedure, which lasted about 30 min. When finished, the participants arrived back in the laboratory, gave the second sample of their saliva, filled in the second part of the MDMQ questionnaire and continued in the task aimed at Bayesian updating for the following 15 min. Afterwards, the third saliva sample was collected and the risk-preferences task was run, which did not last more than 5 min. Then the payments for the whole experiment were revealed, subjects were asked to fill-out a questionnaire regarding their personal characteristics, returned the heart-rate monitors and were paid. After the participants from the control group had left, a thorough debriefing about the TSST-G treatment procedure was conducted.

2.6 Sample

In total 70 female (mean age 22.2, SD = 2.0 years) and 81 male subjects (mean age 22.8, SD = 3.1 years) took part in the experiment. Participants were mostly students of economics or related disciplines (73.5 %). The participants had not participated in a TSST-G-related study before. With one exception the participants were all normal body-weight and 26 women indicated taking oral contraceptives.Footnote 8 From the end-questionnaire, we confirm that all subjects were unfamiliar with the stress-inducing procedure and they mostly did not know other participants. We repeat that they were required to sign an informed consent form, which emphasized an option to leave at any point of the experiment.Footnote 9 Out of the 151 participants, none decided to leave, but five were dropped from the analysis due to inconsistent answers in the risk-preferences task (see below), so we were left with 71 observations in the treatment group (39 men and 32 women) and 75 observations in the control group (41 men and 34 women).

Descriptive statistics of the sample with respect to our main control variables are presented in the Online Appendix Table 4. Our treatment and control groups are balanced regarding gender and age. The sample of men is balanced for all observed characteristics except for the “Big-5” personality trait Neuroticism, while for women we saw an imbalance in Extraversion. To make sure potential imbalances in personality traits do not influence our results regarding the effect of the exposure to the stressor on risk preferences, we control for the “Big-5” personality traits in the following analysis.

3 Results

3.1 Stress response

First, we show that our external manipulation was successful: stress was induced in the participants in the TSST-G treatment procedure but not in the participants in the control procedure.

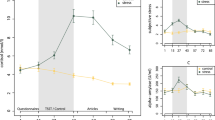

The dynamics of our primary measure of stress, the cortisol reaction, are presented in Fig. 2. As a response to the TSST-G procedure, salivary cortisol levels significantly increased for the treatment group, but remained stable over time for the control group. The average maximum cortisol response, calculated as the maximum difference between the baseline sample (sample 1) and samples taken after the stress-inducing procedure (sample 2 or 3), was an increase of 10.47 nmol/l in the treatment group (\(SD=11.38\)) and a decrease of \(-\)0.31 nmol/l in the control group (\(SD=2.96\)). In other words, the treatment and the control group do not differ in cortisol levels before the stress procedure (sample 1: \(p=0.570, d=-0.13\)), but the cortisol level is significantly higher for the treatment group both immediately after the TSST-G procedure (sample 2: \(p<0.001, d=-1.10\)) and 15–20 min after its end, right before the risk-preferences task (sample 3: \(p<0.001, d=-1.09\)). The differences are tested using a two-sample Wilcoxon rank-sum test and the reported effect sizes are Cohen’s d, unless stated otherwise. The stress manipulation was successful for both genders, as reported in Fig. 7 in the Online Appendix. In line with results from comparable studies, the cortisol response to the stress treatment was stronger among males (Kudielka et al. 2009).

Similarly, the average heart-rate of subjects during the TSST-G stress procedure is significantly higher than the heart-rate of subjects during the control procedure (\(p=0.058, d=-0.42\)), but not afterwards (\(p=0.231, d=-0.16\)). When we look at the average heart rate response associated with the TSST-G procedure (average heart rate during the procedure—average heart rate prior to the procedure), the average heart rate increases for both treatment and the control group, but significantly more so for the treatment group (\(p=0.023, d=-0.46\)). Heart-rate dynamics is plotted in Fig. 8 in the Online Appendix.

To measure the psychological response to stress, we test the effect of the TSST-G stress-induction/control procedure on the mood of the participants, using a good-bad dimension, awake-tired dimension and calm-nervous dimension from the Multidimensional Mood Questionnaire. As summarized in Online Appendix Fig. 9, the treatment and control group score similarly in all three dimensions before the TSST-G procedure, but subjects who underwent the TSST-G stress-induction procedure feel worse (\(p<0.001, d=0.71\)) and more nervous (\(p<0.001, d=0.63\)) compared to subjects who underwent the TSST-G control procedure. The treatment group also feels more awake, but the difference is not significant (\(p=0.177, d=-0.17\)). These results are robust across gender, see Fig. 10 in the Online Appendix.

The results of our stress manipulation confirm that stress reaction is complex and cortisol can be used only as a proxy for the stress response. The maximum cortisol response is correlated not only with the heart rate response (\(\rho =0.344, p<0.001\), Spearman’s rank correlations), but also with the psychological measures in the good-bad dimension (\(\rho =-0.296, p<0.001\)) and in the calm-nervous dimension (\(\rho =-0.208, p=0.013\)).

Induced Stress Reaction: Mean levels of free salivary cortisol. Exposed to stressor is an indicator variable equal to 1 if subjects were exposed to the TSST-G stress-induction procedure, Control subjects were exposed to the TSST-G control procedure. Sample 1 was collected before the TSST-G stress-induction/control procedure, sample 2 after the TSST-G procedure and sample 3 before the risk task. Error bars indicate mean \(\pm \) SEM

3.1.1 Compliance

We have shown that the manipulation of the stress condition was successful on the aggregate level. To analyze compliance on an individual level, we focus on the cortisol response.

We define that a participant is stressed if their maximum cortisol response is greater than 2.5 nmol/l as is standard in the literature and may be even overly conservative (Miller et al. 2013). Following this classification, 52 out of 75 subjects in the treatment group are stressed and 60 out of 71 subjects in the control group are not stressed, so the compliance rate is 78 %.Footnote 10 We have a lower compliance rate among women in the treatment group, which is consistent with women showing weaker cortisol response to TSST in general (Allen et al. 2014).

Of course, stress reaction is generally highly complex and cortisol reactivity individual, so this approach is necessarily a simplification. However, we still consider using the cortisol response as a proxy for being stressed a useful simplification as it enables us to distinguish the effect of random exposure to the stress treatment from the physiological effect of stress on risk preferences (see below).

3.2 Risk preferences

Starting with the descriptive statistics of the elicited risk attitudes, we see that inconsistent behavior, i.e. multiple switches between preferring lottery and safe payment in the risk task occurred in five cases (four in the control group, one in the treatment group). These subjects were dropped from the analysis, as their certainty equivalent could not be inferred.Footnote 11 For the remaining 146 observations (75 in the treatment group and 71 in the control group), the modal certainty equivalent is 1950 ECU, the median is 1650 ECU and 83 % of subjects are weakly risk-averse, i.e. their certainty equivalent is below 2000 for a lottery paying either 4000 ECU or 0 ECU with 50 % probability each.

To talk about the effect of stress on risk preferences, we need to distinguish the effect of random exposure to the stressor (the TSST-G stress-induction procedure) on risk preferences from the effect of stress (a physiological state of the body) on risk preferences. The problem of imperfect compliance does not usually arise in economic experiments performed in the laboratory, but it is a relevant issue when estimating the effects of laboratory-induced stress.

We start the analysis by presenting the differences in risk attitudes between the TSST-G treatment and control group, to estimate the effect of random exposure to the psychosocial stressor on risk preferences (ITT). Next, we show correlation between induced physiological stress and risk attitudes, using cortisol response as a proxy for the endured stress. To estimate the causal effect of physiological stress on risk preferences (the average treatment effect on the treated, ATT), we apply a two-stage instrumental variable regression with random exposure to the stressor as an instrument for the induced physiological stress.

3.2.1 Effect of exposure to stressor—ITT

Risk preferences of the TSST-G stress and control groups are summarized in Fig. 3, which presents the elicited certainty equivalent for a lottery paying either 4000 ECU or 0 ECU with 50 % probability each. The differences between the treatment and control groups will first be tested using a two-sample Wilcoxon rank-sum test, the reported effect sizes are Cohen’s d.

Figure 3 shows that the group exposed to psychosocial stressor is more risk-averse than the control group, but the difference is not statistically significant for our sample size (\(N=146, p=0.192, d=0.2\)). As can be seen in Fig. 3, the effect goes in the same direction for men and women, but is not significant for either group (Males: \(N=80,p=0.299, d=0.23\); Females: \(N=66, p=0.447, d=0.18\)). Note that women in our sample are in general more risk-averse than men (\(p=0.001, d=0.51\)), which is a standard result in the literature, and this is true both for the treatment group (\(p=0.013, d=0.54\)) and for the control group (\(p=0.037, d=0.50\)).

Risk preferences by Stress Treatment. Risk preferences are presented using an elicited certainty equivalent for a lottery paying 4000 ECU or 0 ECU with 50 % probability each. Exposed to stressor is an indicator variable equal to 1 if subjects were exposed to the TSST-G stress-induction procedure, Control subjects were exposed to the TSST-G control procedure. Error bars indicate mean \(\pm \) SEM

Even though exposure to the stressor does not have significant effects on risk preferences using a simple mean comparison, we need to control for other observable characteristics that have been shown to affect risk preferences. Therefore, we conduct a more detailed analysis by regressing the elicited certainty equivalent on the treatment status Exposed to stressor and additional controls: gender, age, and personality traits measured prior to the stress procedure (“Big Five”—openness to experience, conscientiousness, extraversion, agreeableness and neuroticism), which have been found to be important determinants of risk preferences in the literature (Dohmen et al. 2010; Dohmen and Falk 2011; Borghans et al. 2008). We also allow for different responses to treatment across gender by including an interaction term \({\textit{Exposed\,to\,stressor}} \times {\textit{female}}\). Effects are estimated using an interval regression, to account for the fact that certainty equivalents were elicited in intervals.

The results for the whole sample are reported in columns 1–3 of Table 1. Controlling for age and personality traits in column 3, we find that the exposure to stressor increases risk aversion (\(p=0.089\)) and we cannot reject the hypothesis that the effect is the same for both genders, as the interaction term \({\textit{Exposed\,to\,stressor}} \times {\textit{female}}\) is insignificant (\(p=0.582\)). Still, running the regressions separately for men and women in columns 4 and 5, respectively, we show that the effect is driven by men (\(p=0.052\)); the effect on women is weaker and insignificant when estimated for this subsample separately (\(p=0.415\)).

To illustrate the size of the treatment effect estimated in columns 4 and 5, in Panel A of Online Appendix Table 6 we generate predicted certainty equivalents for an average man and an average woman in our sample, meaning that we fix their age and personality profile on the gender-specific average. Men in the control group have a predicted certainty equivalent equal to 1939 ECU (for a lottery paying 4000 ECU or 0 ECU with a 50 % probability each), while men exposed to the stressor have 1696 ECU. The prediction for women in the control and treatment groups yields values of 1587 ECU and 1469 ECU, respectively. Thus, the effect size among men is about twice the size of that found among women, and the estimated treatment effect for men is equivalent to 69 % of the gender difference in the control group.

Apart from the significant treatment effect, we also observe a significant effect of age, but only for men. Online Appendix Fig. 11 presents predicted certainty equivalents from specifications in columns 4–5 of Table 1, stratifying by gender, treatment and age, keeping personality traits on gender-specific averages. Generally speaking, older men in our sample are less risk-averse, but at a decreasing rate. For women, we observe no significant relationship between age and certainty equivalent.

In Online Appendix Table 7 we run a sensitivity analysis to check which of the additional controls in Table 1 influence the results in the gender-specific regressions. For women, adding additional controls does not change the estimated treatment effect much. For men, it is controlling for the personality trait neuroticism alone which makes the difference (compare columns 4 and 3). Neuroticism is the trait that is not balanced across men in our treatment and control group and as it significantly affects risk-preferences in our sample, we find it appropriate to control for personality traits in our baseline analysis.

Ordered probit regression is used as a robustness check, marginal fixed effects are reported in the Online Appendix Table 8 for men, and in Online Appendix Table 9 for women. The results confirm that men exposed to the stressor are more likely to have the lower values of the certainty equivalent (1350 and 1650, for a lottery paying 4000 ECU or 0 ECU with a 50 % probability each) and less likely to have certainty equivalents of 1950 and 2250. The effects on women are again weak and insignificant.

3.2.2 Induced stress and risk preferences—correlation and ATT

Before we identify the causal effect of physiological stress on risk preferences, we present differences in risk preferences across participants who are under stress and who are not, independent of treatment. A participant is considered to be under stress if her cortisol increase exceeds 2.5 nmol/l.

As can be seen in Fig. 4, there is a strong difference in risk preferences between men who are under stress and men who are not (\(N=78,\,p=0.031,\,d=0.60\)). For women, the difference is much smaller and insignificant (\(N=66,\,p=0.953, \,d=-0.04\)).

Risk preferences by induced stress. Risk preferences are presented using an elicited certainty equivalent for a lottery paying 4000 ECU or 0 ECU with 50 % probability each. Under stress is an indicator variable equal to 1 if the maximum cortisol response of the subject, calculated as the maximum difference between the baseline sample (sample 1) and samples taken after the stress-inducing procedure (sample 2 or 3), was above 2.5 nmol/l. Error bars indicate mean \(\pm \) SEM

Next, we run a more detailed analysis, which controls for additional observables. The results of an interval regression with the indicator variable Under Stress are presented in the first three columns of Table 2 for the whole sample, and then separately for men and women. The results confirm that on average, there is no significant correlation between the cortisol response and the certainty equivalent (column 1 in Table 2). However, there are significant gender differences as captured by the coefficient \({\textit{Under\,stress}} \times {\textit{Female}}\) in columns 2 and 3.

Men under stress are more risk averse than men who are not under stress, with the effect being significant at the 1 % level (column 4 in Table 2, \(p=0.005\)). The size of the effect is economically important. The estimated certainty equivalent for a lottery paying either 4000 ECU or 0 ECU with 50 % probability each is around 350 ECU lower for men under stress, meaning that men under stress switch to preferring the safe amount about 1.2 rows prior to men not under stress on the scale of 10 rows. On the other hand, the link between physiological stress and the risk preferences of women is weak and insignificant and actually goes in the other direction (column 5 in Table 2, \(p=0.657\)). As a consequence, while there is a significant gender difference in risk preferences among participants not under stress (coefficient of the variable Female in column 3 of Table 2), the gender difference disappears for the participants who are under stress (as measured by the term \({\textit{Female+under\,stress}} \times {\textit{female}}\) in column 3, \(p=0.801\)).Footnote 12

Yet, the observed strong correlation between stress and risk preferences in men could be driven both by the effect of stress on risk preferences and by the different underlying risk preferences of compliers and non-compliers. Subjects that get stressed in the TSST-G control procedure are most likely different from subjects who do not get stressed during the TSST-G stress procedure. Therefore, to identify the causal effect of physiological stress on risk preferences, we next look at which part of the effect is due to the random assignment to treatment.

Therefore, we analyze the data using an instrumental variable (IV) interval regressionFootnote 13 using stress treatment (variable Exposed to stressor) as an IV for the indicator of physiological stress (Under stress). The first stages are fitted using an OLS model and the second stage is fitted using an interval regression. Here we are assuming that stress treatment affects risk preferences only through cortisol increase, which is merely a simplification of the complex stress reaction. Apart from that, we are aware that IV is an asymptotic estimator, so applying it in small samples generally leads to biased estimates. However, this should not be a problem in our case as the instruments are very strong.

The results of the IV interval regression are presented in Table 3 for the whole sample and then again separately for men and women. The first stages show that the assignment to treatment is strongly correlated with the stress (cortisol) response and therefore confirm that the assignment to treatment is a strong instrument. The second-stage results reveal that for men, the strong correlation between physiological stress and risk preferences was not driven by selection. The estimated causal effect of stress on risk preferences in column 4 is still strong and significant (\(p=0.042\)), showing that physiological stress makes men more risk averse, when controlling for age and personality traits.Footnote 14 For women, where there was no significant correlation between physiological stress and risk preferences, the causal effect of physiological stress on risk-preferences (column 5) again points towards increased risk-aversion, but this effect is weaker and insignificant, \(p=0.426\)). Still, we cannot reject the hypothesis that the effect is the same across both genders, as the estimated coefficient \({\textit{Under\,stress}}\times {\textit{female}}\) in column 3 is not significantly different from zero (\(p=0.663\)).

The size of the ATT effect is illustrated in Panel B of Online Appendix Table 6. We use estimation results from regressions reported in columns 4 and 5 of Table 3 and generate predicted certainty equivalents for an average (in terms of age and personality traits) man and an average woman in our sample. Men who are under exogenously induced stress have a predicted certainty equivalent of 1638 ECU (for a lottery paying 4000 ECU or 0 ECU with a 50 % probability each), while those who are not have 2053 ECU. The prediction for women in the same respective groups yields values of 1356 ECU and 1585 ECU, respectively. Therefore, the effect size among men is almost twice the effect size among women and the estimated treatment effect for men is equivalent to 89 % of the gender difference in the control group.

To sum up, the estimated effect of physiological stress on risk preferences (ATT) confirms the results obtained by estimating the effect of random exposure to the stressor (ITT) on risk preferences, both showing that stress leads to increased risk aversion for men, when controlling for other personal characteristics. The effect on women goes in the same direction, but is weaker and insignificant when estimated for this subsample separately.

4 Discussion

4.1 Physiological or psychological effects of stress

We cannot clearly distinguish whether the change in risk preferences we observe is caused by the physiological or the psychological reaction to the stressor. This is because the cortisol response is strongly correlated with the heart-rate response and also with the mood response, as shown above, and possibly with other aspects of stress that we do not measure.

When we focus on cortisol response only, we find a strong correlation between cortisol response and risk-aversion among men. We can also look at the link between risk-preferences and other measures of stress. The correlation between the heart-rate response and risk-aversion is weaker, but still statistically significant at the 10 % level for men, when controlling for other observable characteristics (see Table 12 in the Online Appendix). Similarly, if we focus just on the change in mood, we find a significant correlation between a mood change in the good-bad direction and the elicited certainty equivalent (see Table 13 in the Online Appendix). This shows that the response to the stressor is complex and may operate through physiological as well as psychological channels.

The relative importance of the physiological and psychological aspect of stress can be subject-specific and can also differ by the type of stressor. In this paper we concentrate on psycho-social stressors as we believe they are the most widespread types of stressors in developed countries: it is social status, not physical survival that is being threatened in subjectively uncontrollable situations (Dickerson and Kemeny 2004). Stressors generally differ from each other by the effects they cause in the body: a physical stressor (stemming from e.g. blood loss and sleep deprivation) may eventually produce a different response than a psychological stressor (e.g. interpersonal conflict or death in the family Baum and Grunberg 1997; Clow 2001). Another way of inducing stress could be increasing the stakes involved. The “choking under pressure” literature (Dohmen 2008; Ariely et al. 2009) shows the negative effects of high stakes on performance, which may operate through stress. However, our paper is different from this literature as it concentrates on the effects of stress on preferences and not performance.

Our results are related to the emerging literature on the effects of mood on risk preferences, since TSST has been found to generally increase negative emotions (Allen et al. 2014). Our results that exposure to the stressor increases risk aversion are in line with the findings of Michl et al. (2011), who found that for no stakes, a sad mood induced risk-aversion (but no effect was present for high stakes). Similarly, Nguyen and Noussair (2014) used face-reading software to show that positive emotions correlate with more risk-taking.

Further, we can relate our findings to the existing literature on the effects of cortisol on decision making. On the sample of 17 professional traders, Coates and Herbert (2008) found an increase in their salivary cortisol levels when anticipating higher volatility and thus higher uncertainty in their trading market. The authors hypothesized that there is a direct positive association between stress, cortisol and risk-aversion, but could not prove it. Following up on that, Kandasamy et al. (2014) induced in a sample of students increases in cortisol comparable to the findings from traders by direct administration of hydrocortisone. They found no effect when they measured risk-preferences shortly after the first dose, but after long term administration (8 days) they found increased risk-aversion in the treatment group.

However, we argue that the effects of stress are more complex than effects of cortisol only, since the stress reaction includes a complicated interplay of physiological and psychological changes (allostasis).Footnote 15 This can be demonstrated by the opposing results of the following two studies on the link between time-preferences, stress and cortisol: Cornelisse et al. (2013) directly administered hydrocortisone and found that subjects 15 min after application revealed increased preferences for a small, more immediate reward compared to the placebo group. Contrary to that, Haushofer et al. (2013) employed the TSST protocol to obtain no effect of stress on time-discounting that they measured at three distinct time-points after the manipulation.

Therefore we acknowledge the results of Kandasamy et al. (2014), which moreover support our findings of increased risk-aversion, but claim that our study is not directly comparable as we study the effects of psychosocial stress and not of cortisol only. We believe that direct hydrocortisone administration may not provide enough insight into the complex effects of stress that people experience in everyday life and that we aim to measure in this paper. Our ATT effect estimation which assumed that the TSST-G treatment affected risk-preferences only through cortisol is necessarily a simplification as we show that other channels are possibly in operation.

To summarize, studying the effects of psychosocial stress is different from studying the effects of direct hydrocortisone administration or mood induction alone, since the stress reaction includes a complex interplay of physiological as well as psychological aspects. In this paper, we estimate the effect of a random exposure to the stressor which captures the effects of all of the above. The results show that exposure to the stressor (the ITT effect) increases risk aversion for men, when controlling for other characteristics, and it should be taken as the principle finding of this paper.

4.2 Gender-specific response to stressor

Our results show that stress leads to increased risk-aversion among men, when controlling for age and personality characteristics. Even though we cannot reject the hypothesis that the effect of stress is the same for both genders, the effect among women is weaker and insignificant when analyzing this subsample separately. There can be several reasons why the response among women is less strong.

As reviewed in Kajantie and Phillips (2006) and confirmed by our data, female physiological reaction to stress is typically of a smaller magnitude than the reaction of men of the same age, including the secretion of cortisol. In our sample, only 50 % of women after the stress procedure show a cortisol increase above 2.5 nmol/l. This can be partially attributed to a weaker cortisol response among women who take hormonal contraceptives (Kudielka et al. 2009, see Table 14 in the Online Appendix). Therefore, if the main channel causing the effect we observe is the increase in cortisol, women should be less affected than men, which is what we find in our results.

We acknowledge the fact that our findings concerning women are limited because we did not ask about the phase of the menstrual cycle, since the cortisol reaction may depend on it (Kajantie and Phillips 2006). However, there is emerging evidence that risk-preferences are stable throughout the cycle (Schipper 2012) so we believe that the overall results are not affected.

Second, as women are typically found to be more risk-averse than men (Charness and Gneezy 2012), which holds in our sample, it is possible that there is a floor effect in the sense that the downward reactivity of risk preferences is lower compared to men.

Moreover, recent studies suggest behavioral response to stress may be gender-specific. The “fight-or-flight” behavioral response is considered to be a rather male reaction to acute stress, while the typical female reaction may be characterized as “tend-and-befriend” (Taylor et al. 2000). In brief, the “tend-and-befriend” reaction means that females under stress show tendencies to maximize the chance of survival for themselves and their offspring by seeking help in social networks or groups. An evolutionary perspective can help to explain both the facts that women are more risk-averse under normal conditions and that stress should increase risk-aversion especially in men. In human history, the division of gender roles has typically been such that men had to expose themselves to riskier conditions than women, for example while hunting. In this sense, males generally needed to be more risk-seeking than women, but this tendency had to be regulated when facing an immediate threat.

This leads us to a general note: most of the laboratory research on behavioral decisions under stress has been carried out only on men, mainly because their cortisol response is affected by fewer other factors, such as the use of hormonal contraceptives or the phase of the menstrual cycle (Kirschbaum et al. 1999). But since gender differences in preferences and decision-making can be large (Croson and Gneezy 2009), studying the effects of stress on men only gives half of the story. More emphasis in the future should be put on understanding gender-specific responses to stressors.

4.3 Link to other studies on stress and risk preferences

Several studies have already been published on the topic of stress and risk-preferences, but overall they do not provide conclusive results. Some studies point to increased risk-taking under stress (Starcke et al. 2008), others find men take more risks under stress, while women take fewer (van den Bos et al. 2009; Lighthall et al. 2009), or conclude on no change in risk preferences under stress (von Dawans et al. 2012). Pabst et al. (2013a) found a time trend in risk-taking behavior with respect to the time elapsed from the onset of the stressor. Porcelli and Delgado (2009) obtain increased risk-aversion for gain domains, but increased risk-seeking for loss domains. Buckert et al. (2014) found that cortisol increase correlates with risk-taking in the gain domain, but not in loss domain.Footnote 16 However, the problem with these studies is that they either do not show a causal relationship, are unable to effectively induce stress in the majority of subjects, or use tasks for elicitation of risk-preferences that include feedback-processing which itself can be affected by stress and thus confound the results (Starcke et al. 2008; Petzold et al. 2010).Footnote 17

The closest study to ours is by von Dawans et al. (2012), who included a risk-game as a control task in their framework for studying social preferences under successfully induced psychosocial stress in men. The risk game consisted of a repeated choice between high-risk and low-risk lotteries and was executed in the middle and right after the end of the TSST-G protocol. Contrary to our results, no difference was found between the treatment and control groups in terms of risk-preferences. This may have been caused by several factors: First, our task was administered relatively later after exposure to the stressor. As suggested in Pabst et al. (2013a), hormones adrenaline and noradrenaline which are released immediately after the onset of the stressor and disappear from the body within several minutes after the cessation of the stressor may have opposing effects to cortisol, which is released later than adrenaline and its presence lasts longer (Starcke and Brand 2012). Second, the task of von Dawans et al. (2012) combined positive and negative payoffs and it is possible that the effect of stress on risk preferences is heterogeneous over the gain and the loss domains (Porcelli and Delgado 2009; Buckert et al. 2014; Pabst et al. 2013b). As risk preferences in von Dawans et al. (2012) were measured just by the number of risky choices made (the task does not allow for the direct computation of a risk-aversion parameter), it is possible that the effects in the gain domain and loss domain canceled each other out. Third, the elicited risk preferences may depend on the framing of the risk-task. In our risk-elicitation protocol subjects made their choices between a risky lottery and a safe payment, whereas in von Dawans et al. (2012) subjects faced two different lotteries. Lastly, the recruited subjects in von Dawans et al. (2012) anticipated the stress procedure since it was literally stated in the advertisement, which may have led to self-selection for the experiment, possibly directly linked to risk attitudes. Although we cannot distinguish between these factors in our data, related literature suggests the timing explanation seems to be the most promising and thus should be explored by future studies.

5 Conclusion

In this paper we contribute to the literature by studying the effect of acute psychosocial stress on individual risk attitudes. We induce stress with an effective laboratory stressor Trier Social Stress Test for Groups (von Dawans et al. 2011). Subjects are divided randomly to experience either the treatment “stress procedure”, or the control “no-stress” procedure. Individual risk-preferences are elicited using the task of Dohmen et al. (2010) which is an easily comprehensible, incentive compatible and externally validated measure of risk attitudes. By using three different measures (salivary cortisol concentration, heart rate and multi-dimensional mood questionnaire scores) we show that subjects exposed to the stressor were indeed stressed, while the subjects in the control group were not, with the compliance rate around 78 %. Our main result both from ITT and ATT analyses is that psychosocial stress increases risk aversion among men when controlling for additional observable characteristics (age and personality traits). The effect on women goes in the same direction, but is weaker and insignificant.

Overall, if risk-aversion indeed increases under stress, it has important consequences for the proper formulation of economic theories, the explanation of the puzzling economic behavior of people who have undergone a negative shock, the formulation of policies addressing poverty and for creating policy recommendations for times of stress and panic.

First, the assumption of the stability of risk preferences should be reconsidered if the economic models incorporating them are to provide more accurate predictions including for periods of stress.

Second, our results are relevant for the previous literature finding that people who have experienced some sort of negative shock are more risk-averse. To name a few, people who went through the Great Depression or financial crisis in 2008 choose more conservative investment strategies (Malmendier and Nagel 2011; Guiso et al. 2013). Other studies document that risk-preferences are altered as a result of natural disasters (Cameron et al. 2015; Cassar et al. 2011; Eckel et al. 2009) or exposure to violence (Callen et al. 2014; Voors et al. 2012), although evidence regarding the direction of the change is mixed. It could be well expected that all of these circumstances are highly stressful and thus stress should be considered as a possible driving mechanism behind the observed changes in preferences. In a similar vein, our results support the hypothesis of Haushofer and Fehr (2014) that extreme poverty may decrease the willingness to accept risk through increased stress, resulting in choices that make it hard to escape poverty. By showing that stress increases risk-aversion, we provide evidence of the latter part of the link.

Furthermore, our findings help to explain observed phenomena from financial markets. During periods of market stress there tends to be a high demand for “safe-haven assets”, such as safe government bonds (Upper 2000) safe currencies (Kaul and Sapp 2006), and gold (Baur and McDermott 2010). We suggest stress can be an important operating channel even in financial markets, with the high probability of losing money acting as a stressor.

Generally, it could be argued that professions involving high levels of stress attract people who are less sensitive to the effects of stress. Trading floors are a good example of such a stressful environment that also includes strict selection and self-selection (Oberlechner and Nimgade 2005). Still, as Coates and Herbert (2008) shows, active traders do respond to market volatility with increased stress, as measured by cortisol levels. Cohn et al. (2015) further document that the risk-preferences of professional traders change when primed with market boom or bust, with higher risk-aversion under the bust scenario. We therefore argue that the relationship uncovered in this paper is relevant even for people who self-select into high-stress environments.

As a policy implication we suggest in accordance with Haushofer and Fehr (2014) that targeting the psychological consequences of poverty is a promising new strategy for the eradication of poverty in developing countries and as such should be tested in the field. Similarly, the economic consequences of stress should be considered when designing programs targeting people who experience negative income shocks such as unemployment or bankruptcy.

Last but not least, for professions that encounter stress regularly, higher risk-aversion may not be desirable, for example with managers who should pursue risky innovations, police during strikes, or doctors trying new medical treatments. This highlights the necessity of guidelines for times of stress and panic. Furthermore, training and simulations should be widely used when possible, since the physiological reaction to a specific stressor diminishes with regular exposure (Kudielka et al. 2009).

We should note that our study concerns only immediate reactions to an acute psychosocial stressor. Even though our results are consistent with much field evidence from situations involving chronic stress, the behavioral effects of acute and chronic stress can in principle be different (as the physiological changes are; Goldstein and McEwen 2002). More research is thus needed to understand how the interplay between acute and chronic stress influences economic outcomes.

Notes

For example, if the participant preferred the lottery up to row 6 (safe amount = 1500 ECU) and switched to preferring the safe amount starting in row 7 (safe amount = 1800 ECU), 1650 ECU is taken as the certainty equivalent. For the interval regression, the certainty equivalent is defined as lying between 1500 and 1800 ECU.

The detailed treatment and control instructions and protocol scripts are provided in the Electronic supplementary material.

Saliva samples were collected using a standard sampling device Salivette. The samples were frozen to \(-\)20 \(^{\circ }\)C after each experimental session and the salivary cortisol concentration was analyzed by the laboratory of the Biopsychology department at TU Dresden and by the Department of the Clinical Biochemistry at the Military Hospital in Prague. Prior to the experiment we conducted a separate pilot session where only the TSST-G procedure was administered and five saliva samples were collected and analyzed. The dynamics of the cortisol elevation in the pilot session followed the trajectory common in the literature (e.g. in von Dawans et al. 2011) including the recovery phase and therefore we assume the same trajectory in our subjects. Moreover, cortisol levels show a short-term pulsatility and therefore only one post-stress sample is insufficient to prove the increase in cortisol levels (Young et al. 2004).

The types used are Polar RS400 and Polar S725X which are composed of a wireless chest transmitter and a wrist monitor. The recording precision was 1 s (Polar RS400) or 5 s (Polar S725X).

An English version of the MDMQ was used. Available at:http://www.metheval.uni-jena.de/mdbf.php.

For session 1 only 11 participants arrived.

See Online Appendix for details about the design of the Bayesian updating task. This task does not confound the results in this paper as subjects learned about their payment from the Bayesian updating task only at the end of the experiment. Even though subjects’ expected earnings may still matter, we do not consider this as issue as the TSST-G treatment group actually earned slightly more money in the Bayesian task compared to the control group, but the difference is not significant.

Above-normal weight (BMI above 25) and the intake of hormonal contraceptives may affect cortisol response to stress (Kudielka et al. 2009). Out of the 26 women indicating intake of oral contraceptives, 13 were assigned to the treatment group.

One subject left in the pilot session prior to the TSST-G procedure, confirming that this option was salient enough.

The maximum cortisol response is not available for two subjects in the control group, where saliva samples could not be analyzed.

We perform two robustness checks of our results, in which we do not drop the multiple switchers from the analysis. In the first robustness check, risk preferences are measured not using the elicited certainty equivalent, but using the number of risky choices made. We then estimate the ITT of stress on risk preferences using ordered probit. As a second robustness check, we treat the inconsistent subjects as indifferent between the safe amounts and the lottery for the entire interval in which multiple switches occur, as suggested by Andersen et al. (2006). This means that the certainty equivalent of these subjects is elicited in a wider interval than the certainty equivalent of subjects who switch just once. The ITT of stress on risk preferences is then estimated using interval regression. The results of both robustness checks are reported in Table 5 in the Online Appendix and show that results presented in the main text are robust to including the multiple switchers.

Similarly as in the case of ITT analysis, in Online Appendix Table 10 we run a sensitivity analysis to check which of the additional controls influence the results in the gender-specific regressions of Table 2. The results point to the same conclusion as in the case of ITT analysis.

This was calculated using the cmp module in Stata (Roodman 2015).

In Online Appendix Table 11, we again run a sensitivity analysis to check which of the additional controls influence the results in the gender-specific regressions of Table 3. As in the case of ITT analysis, the results are very similar if we control for neuroticism only.

To support this argument, consider that under stress, there are many other hormones released: First, the autonomic nervous system activates the adrenal medulla to release adrenaline and nor-adrenaline. Second, the hypothalamus-pituitary-adrenal axis follows with the secretion of vasopressin and corticotropin-releasing hormones in the hypothalamus. These hormones in turn stimulate the secretion of adrenocorticotropic hormone in the pituitary, which then triggers the massive secretion of cortisol in the adrenal glands (Kemeny 2003). We take cortisol as a proxy of the physiological response mainly due to the convenience of its measurement, but we do not claim that it is only cortisol which causes the effects on behavior.

See Buckert et al. (2014) for a detailed comparison of psychological studies on this topic.

The risk-preferences tasks that have been used in previous studies such as the Balloon Analogue Task (Lejuez et al. 2002), the Game of Dice Task (Starcke et al. 2008) and the Iowa Gambling Task (Bechara et al. 1994) all include feedback processing, which is a potential confound. Other standard measures like Holt and Laury (2002) and Becker et al. (1964) may be too complicated to understand, which may be amplified under stress and thus again confound the results.

References

Allen, A. P., Kennedy, P. J., Cryan, J. F., Dinan, T. G., & Clarke, G. (2014). Biological and psychological markers of stress in humans: Focus on the trier social stress test. Neuroscience and Biobehavioral Reviews, 38, 94–124.

Andersen, S., Harrison, G. W., Lau, M. I., & Rutström, E. E. (2006). Elicitation using multiple price list formats. Experimental Economics, 9(4), 383–405.

Anderson, L. R., & Holt, C. A. (1997). Information cascades in the laboratory. The American Economic Review, 87(5), 847–862.

Ariely, D., Gneezy, U., Loewenstein, G., & Mazar, N. (2009). Large stakes and big mistakes. Review of Economic Studies, 76(2), 451–469.

Baum, A., & Grunberg, N. E. (1997). Measuring stress hormones. In S. Cohen, R. C. Kessler, & L. U. Gordon (Eds.), Measuring stress: A guide for health and social scientists, chapter 8 (pp. 175–192). Oxford, UK: Oxford University Press.

Baur, D. G., & McDermott, T. K. (2010). Is gold a safe haven? International evidence. Journal of Banking & Finance, 34(8), 1886–1898.

Bechara, A., Damasio, A. R., Damasio, H., & Anderson, S. W. (1994). Insensitivity to future consequences following damage to human prefrontal cortex. Cognition, 50, 7–15.

Becker, A., Deckers, T., Dohmen, T., Falk, A., & Kosse, F. (2012). The Relationship Between Economic Preferences and Psychological Personality Measures. Annual Review of Economics, 4(1), 453–478.

Becker, G. M., DeGroot, M., & Marschak, J. (1964). Measuring utility by a single response sequential method. Behavioral science, 9(3), 226–232.

Borghans, L., Duckworth, A., Heckman, J., & ter Weel, B. (2008). The economics and psychology of personality traits. Journal of Human Resources, 43(4), 972–1059.

Buckert, M., Schwieren, C., Kudielka, B. M., & Fiebach, C. J. (2014). Acute stress affects risk taking but not ambiguity aversion. Frontiers in Neuroscience, 8(May), 82.

Callen, M., Isaqzadeh, M., Long, J. D., & Sprenger, C. (2014). Violence and risk preference: Experimental evidence. The American Economic Review, 104(1), 123–148.

Cameron, L., Erkal, N., Gangadharan, L., & Zhang, M. (2015). Cultural integration: Experimental evidence of convergence in immigrants preferences. Journal of Economic Behavior and Organization, 111, 38–58.

Capra, C. M., Jiang, B., Engelmann, J. B., & Berns, G. S. (2013). Can personality type explain heterogeneity in probability distortions? Journal of Neuroscience, Psychology, and Economics, 6(3), 151–166.

Cassar, A., Healy, A., & Von Kessler, C. (2011). Trust, risk, and time preferences after a natural disaster: Experimental evidence from Thailand. New York: Mimeo.

Charness, G., & Gneezy, U. (2012). Strong evidence for gender differences in risk taking. Journal of Economic Behavior & Organization, 83(1), 50–58.

Chemin, M., Laat, J. D., & Haushofer, J. (2013). Negative rainfall shocks increase levels of the stress hormone cortisol among poor farmers in kenya. New York: Mimeo.

Clow, A. (2001). The physiology of stress. In F. Jones & J. Bright (Eds.), Stress, myth, theory, and research (pp. 47–61). Harlow: Pearson Education.

Coates, J. M., & Herbert, J. (2008). Endogenous steroids and financial risk taking on a London trading floor. Proceedings of the National Academy of Sciences of the United States of America, 105(16), 6167–72.

Cohn, A., Engelmann, J., & Fehr, E. (2015). Evidence for countercyclical risk aversion : An experiment with financial professionals. The American Economic Review, 105(2), 860–885.

Cornelisse, S., van Ast, V. A., Haushofer, J., Seinstra, M. S., Kindt, M., & Joëls, M. (2013). Time-dependent effect of hydrocortisone administration on intertemporal choice. New York: Mimeo.

Costa, J. P. T., & McCrae, R. R. (1992). Normal personality assessment in clinical practice: The NEO personality inventory. Psychological Assessment, 4(1), 5–13.

Croson, R., & Gneezy, U. (2009). Gender differences in preferences. Journal of Economic Literature, 47(2), 448–474.

Deck, C., Lee, J., Reyes, J. (2010). Personality and the consistency of risk taking behavior: Experimental evidence. Chapman Univesity Working Paper, (10–17).

Deck, C., Lee, J., Reyes, J., & Rosen, C. (2012). Risk-taking behavior: An experimental analysis of individuals and Dyads. Southern Economic Journal, 79(2), 277–299.

Dedovic, K., Rexroth, M., Wolff, E., Duchesne, A., Scherling, C., Beaudry, T., et al. (2009). Neural correlates of processing stressful information: An event-related fMRI study. Brain research, 1293, 49–60.

Dickerson, S. S., & Kemeny, M. E. (2004). Acute stressors and cortisol responses: A theoretical integration and synthesis of laboratory research. Psychological Bulletin, 130(3), 355–391.

Dohmen, T. (2008). Do professionals choke under pressure? Journal of Economic Behavior and Organization, 65(3–4), 636–653.

Dohmen, T., & Falk, A. (2011). Performance pay and multidimensional sorting: Productivity, preferences, and gender. The American Economic Review, 101(2), 556–590.

Dohmen, T., Falk, A., Huffman, D., & Sunde, U. (2010). Are risk aversion and impatience related to cognitive ability? The American Economic Review, 100(3), 1238–1260.

Eckel, C. C., El-Gamal, M. A., & Wilson, R. K. (2009). Risk loving after the storm: A Bayesian-Network study of Hurricane Katrina evacuees. Journal of Economic Behavior and Organization, 69(2), 110–124.

Fischbacher, U. (2007). Z-TREE: Zurich toolbox for ready-made economic experiments. Experimental Economics, 10(2), 171–178.

Foley, P., & Kirschbaum, C. (2010). Human hypothalamus-pituitary-adrenal axis responses to acute psychosocial stress in laboratory settings. Neuroscience & Biobehavioral Reviews, 35(1), 91–96.

Goldberg, L. R., Johnson, J. A., Eber, H. W., Hogan, R., Ashton, M. C., Cloninger, C. R., & Gough, H. G. (2006). The international personality item pool and the future of public-domain personality measures. Journal of Research in Personality, 40(1), 84–96. doi:10.1016/j.jrp.2005.08.007.

Goldstein, D. S., & McEwen, B. S. (2002). Allostasis, homeostats, and the nature of stress. Stress, 5(1), 55–58.

Greiner, B. (2004). An online recruitment system for economic experiments. In K. Kremer & V. Macho (Eds.), Forschung und wissenschaftliches Rechnen GWDG Bericht. Göttingen: Gesellschaft fur Wissenschaftliche Datenverarbeitung.

Guiso, L., & Paiella, M. (2008). Risk aversion, wealth, and background risk. Journal of the European Economic Association, 6(6), 1109–1150.

Guiso, L., Sapienza, P., Zingales, L. (2013). Time varying risk aversion. NBER Working Paper #19284.

Haushofer, J., Cornelisse, S., Seinstra, M., Fehr, E., Joëls, M., & Kalenscher, T. (2013). No effects of psychosocial stress on intertemporal choice. PLoS One, 8(11), e78597.

Haushofer, J., & Fehr, E. (2014). On the psychology of poverty. Science, 344(6186), 862–867.

Haushofer, J., & Shapiro, J. (2013). Household response to income changes : Evidence from an unconditional cash transfer program in Kenya. Cambridge: Massachusetts Institute of Technology.

Heckman, J. (2011). Integrating personality psychology into economics. National Bureau of Economic Research Working Paper Series, No. 17378.

Holt, C. A., & Laury, S. K. (2002). Risk aversion and incentive effects. The American Economic Review, 92(5), 1644–1655.

Kajantie, E., & Phillips, D. I. W. (2006). The effects of sex and hormonal status on the physiological response to acute psychosocial stress. Psychoneuroendocrinology, 31(2), 151–178.

Kandasamy, N., Hardy, B., Page, L., Schaffner, M., Graggaber, J., Powlson, A. S., et al. (2014). Cortisol shifts financial risk preferences. Proceedings of the National Academy of Sciences of the United States of America, 111(9), 3608–13.

Kaul, A., & Sapp, S. (2006). Y2K fears and safe haven trading of the U.S. dollar. Journal of International Money and Finance, 25(5), 760–779.

Kemeny, M. E. (2003). The psychobiology of stress. Current Directions in Psychological Science, 12(4), 124–129.

Kirschbaum, C., Kudielka, B. M., Gaab, J., Schommer, N. C., & Hellhammer, D. H. (1999). Impact of gender, menstrual cycle phase, and oral contraceptives on the activity of the hypothalamus-pituitary-adrenal axis. Psychosomatic Medicine, 61(2), 154–62.

Kirschbaum, C., Pirke, K. M., & Hellhammer, D. H. (1993). The “Trier Social Stress Test”—A tool for investigating psychobiological stress responses in a laboratory setting. Neuropsychobiology, 28(1–2), 76–81.

Kudielka, B. M., Hellhammer, D. H., & Wüst, S. (2009). Why do we respond so differently? Reviewing determinants of human salivary cortisol responses to challenge. Psychoneuroendocrinology, 34(1), 2–18.

Lejuez, C. W., Read, J. P., Kahler, C. W., Richards, J. B., Ramsey, S. E., Stuart, G. L., et al. (2002). Evaluation of a behavioral measure of risk taking: The Balloon Analogue Risk Task (BART). Journal of Experimental Psychology: Applied, 8(2), 75–84.

Lighthall, N. R., Mather, M., & Gorlick, M. A. (2009). Acute stress increases sex differences in risk seeking in the balloon analogue risk task. PLoS One, 4(7), e6002.

Malmendier, U., & Nagel, S. (2011). Depression babies: Do macroeconomic experiences affect risk taking? The Quarterly Journal of Economics, 126(1), 373–416.

Michl, T., Koellinger, P., Picot, A. O. (2011). In the mood for risk? An experiment on moods and risk preferences. Ludwig-Maximilians University Working Paper Series.

Miller, R., Plessow, F., Kirschbaum, C., & Stalder, T. (2013). Classification criteria for distinguishing cortisol responders from nonresponders to psychosocial stress: evaluation of salivary cortisol pulse detection in panel designs. Psychosomatic Medicine, 75(10), 832–840.

Nguyen, Y., & Noussair, C. (2014). Risk aversion and emotions. Pacific Economic Review, 19(3), 296–312.

Oberlechner, T., & Nimgade, A. (2005). Work stress and performance among financial traders. Stress and Health, 21(5), 285–293.

Pabst, S., Brand, M., & Wolf, O. T. (2013a). Stress and decision making: A few minutes make all the difference. Behavioural Brain Research, 250, 39–45.

Pabst, S., Brand, M., & Wolf, O. T. (2013b). Stress effects on framed decisions: there are differences for gains and losses. Frontiers in Behavioral Neuroscience, 7, 142.

Petzold, A., Plessow, F., Goschke, T., & Kirschbaum, C. (2010). Stress reduces use of negative feedback in a feedback-based learning task. Behavioral Neuroscience, 124(2), 248–255.

Porcelli, A. J., & Delgado, M. R. (2009). Acute stress modulates risk taking in financial decision making. Psychological Science, 20(3), 278–283.

Roodman, D. (2015). CMP: Stata module to implement conditional (recursive) mixed process estimator. Statistical software components. https://ideas.repec.org/c/boc/bocode/s456882.html

Schipper, B. (2012). Sex hormones and choice under risk, No. 12, 7. Working Papers, Department of Economics, University of California. http://www.econstor.eu/handle/10419/58361

Starcke, K., & Brand, M. (2012). Decision making under stress: A selective review. Neuroscience and biobehavioral reviews, 36(4), 1228–1248.

Starcke, K., Wolf, O. T., Markowitsch, H. J., & Brand, M. (2008). Anticipatory stress influences decision making under explicit risk conditions. Behavioral Neuroscience, 122(6), 1352–1360.

Steyer, R., Schwenkmezger, P., Notz, P., & Eid, M. (1997). MDBF-Mehrdimensionaler Befindlichkeitsfragebogen. Göttingen: Hogrefe.

Taylor, S. E., Klein, L. C., Lewis, B. P., Gruenewald, T. L., Gurung, R. A. R., & Updegraff, J. A. (2000). Biobehavioral responses to stress in females: Tend-and-befriend, not fight-or-flight. Psychological Review, 107(3), 411.

United Nations. (2015). The millennium development goals report. Technical Report, United Nations, New York

Upper, C. (2000). How Safe Was the“Safe Haven” ? Financial Market Liquidity during the 1998 Turbulences. Discussion paper, Economic Research Group of the Deutsche Bundesbank, 1(February).

van den Bos, R., Harteveld, M., & Stoop, H. (2009). Stress and decision-making in humans: Performance is related to cortisol reactivity, albeit differently in men and women. Psychoneuroendocrinology, 34(10), 1449–1458.

Vieider, F. M., Lefebvre, M., Bouchouicha, R., Chmura, T., Hakimov, R., Krawczyk, M., et al. (2014). Common components of risk and uncertainty attitudes across contexts and domains: Evidence from 30 countries. Journal of the European Economic Association, 13, 1–32.

von Dawans, B., Fischbacher, U., Kirschbaum, C., Fehr, E., & Heinrichs, M. (2012). The social dimension of stress reactivity: Acute stress increases prosocial behavior in humans. Psychological Science, 23(6), 651–660.

von Dawans, B., Kirschbaum, C., & Heinrichs, M. (2011). The trier social stress test for groups (TSST-G): A new research tool for controlled simultaneous social stress exposure in a group format. Psychoneuroendocrinology, 36(4), 514–522.

Voors, M. J., Nillesen, E. E. M., Verwimp, P., Bulte, E. H., Lensink, R., & Soest, D. P. V. (2012). Violent conflict and behavior: A field experiment in Burundi. The American Economic Review, 102(2), 941–964.

Yesuf, M., & Bluffstone, R. A. (2009). Poverty, risk aversion, and path dependence in low-income countries: Experimental evidence from Ethiopia. American Journal of Agricultural Economics, 91(4), 1022–1037.

Young, E. A., Abelson, J., & Lightman, S. L. (2004). Cortisol pulsatility and its role in stress regulation and health. Frontiers in Neuroendocrinology, 25, 69–76.

Acknowledgments

We want to express special gratitude to Michal Bauer for his help and encouragement. Next we express our thanks to Mathias Wibral, Frances Chen, Bertil Tungodden, Peter Martinsson, the editor and referees of this journal and the audience at 2013 Florence Workshop on Behavioral and Experimental Economics for their valuable comments; Bernadette von Dawans and Clemens Kirchbaum for providing all materials and helpful advice for the execution of the TSST-G procedure. The possibility to use the Laboratory of Experimental Economics in Prague and the possibility to use the heart-rate monitors of Faculty of Physical Education and Sport, Charles University are also gratefully acknowledged. We also thank Miroslav Zajicek, Klara Kaliskova, Lukas Recka, Tomas Miklanek, Jan Palguta, Michala Tycova, Ian Levely, Dagmar Strakova, Vaclav Korbel, Jane Simpson and Zuzana Cahlikova for their help with data collection. All errors remaining in this text are the responsibility of the authors. The research was supported by GA UK grant No. 4046/11. Jana Cahlíková also acknowledges support from the grant SVV-2012-265 801 and Lubomír Cingl acknowledges support by the grant SVV-2012-265 504.

Author information

Authors and Affiliations

Corresponding author

Electronic supplementary material

Below is the link to the electronic supplementary material.

Rights and permissions

About this article

Cite this article

Cahlíková, J., Cingl, L. Risk preferences under acute stress. Exp Econ 20, 209–236 (2017). https://doi.org/10.1007/s10683-016-9482-3

Received: