Abstract

This research delves into the potential for promoting environmental sustainability in China through an in-depth analysis of the interplay between green investment, financial inclusion, digitalization, and their impact on sustainable development. The study adopts a novel three-stage methodology that encompasses quantile-on-quantile regression, Granger causality in quantiles, wavelet analysis, and robustness tests to ensure the reliability of the findings. The results uncover a robust and positive relationship between green investment, financial inclusion, digitalization, and environmental sustainability in China. These findings underline the significance of directing investments towards green resources, fostering technological innovation, and strengthening the financial sector to facilitate the country's transition towards sustainable development. Importantly, the study emphasizes the critical role played by green investment, financial inclusion, and digitalization in enhancing the environmental sustainability of China's current economic growth trajectory. By providing valuable insights, this research becomes a valuable resource for developing countries striving to achieve their sustainable development goals through the strategic utilization of technology innovation, green investment, and financial inclusion.

Similar content being viewed by others

Avoid common mistakes on your manuscript.

1 Introduction

In the past few years, there has been a notable increase in recognition from academics, industry professionals, and policymakers regarding the significance of sustainable development. This surge in awareness stems from mounting concerns over the adverse effects of human activities on the environment, including climate change, deforestation, biodiversity loss, and natural resource depletion. These impacts not only endanger the existence of various species and ecosystems but also undermine the economic and social pillars that support human well-being. Therefore, it is imperative to uphold a robust economy and prioritize the responsible utilization of energy as fundamental elements in attaining sustainable economic growth in the era of digital advancements (Hosan et al., 2022). Governments around the world are implementing regulations on financial instruments to promote environmental sustainability. These regulations aim to encourage investment in environmentally responsible initiatives and reduce harm to the planet (Tolliver et al., 2020). Economic growth and development should be carried out in a way that preserves the safety, health, and welfare of future generations, instead, it should be in harmony with environmental sustainability (Azam & Research, 2019). Promoting sustainable economic growth has emerged as a top priority for economies worldwide. It is recognized as crucial for ensuring long-term success and stability by striking a balance between economic expansion and social and environmental responsibility (Zhao et al., 2023). Sustainability is becoming increasingly important as the world faces growing environmental and social challenges, and economies recognize the need to adopt practices that support a better future (Hung, 2023). Economic growth is frequently accompanied by substantial energy consumption, which in turn results in heightened emissions of harmful waste gases and wastewater. This poses significant environmental risks. Recognizing this, it is imperative for governments to prioritize sustainable and environmentally friendly green growth. While energy plays a crucial role in driving a nation's economic performance, it also contributes significantly to the pressing issue of global warming. Therefore, it is essential to pursue economic growth strategies that minimize environmental impacts and foster a sustainable future (Shahzad et al., 2020).

The investment in renewable energy is insufficient to support sustainable development (Hung, 2023). It is crucial to implement macroeconomic policies that promote environmental sustainability to reduce the correlation between \({CO}_{2}\) emissions and economic development (Luukkanen et al., 2019). Investing in green initiatives is critical for encouraging economic development, conservation, and environmental preservation. Green investments can further these goals (Musah et al., 2022). China has shifted towards developing renewable energy sources due to the dwindling supply of fossil fuels and the need to conserve energy and lower greenhouse gas emissions (Guilhot, 2022). As reported by Bakhsh et al., (2021) advancements in technology enhance the utilization of existing resources, leading to a more environmentally sustainable future. Investing in technological progress can provide China with an eco-friendly means of fostering economic stability without sacrificing environmental standards. As a result, R&D is a key factor in the advancement of new and improved technologies and is critical to the growth of industries and economies (Bakhsh et al., 2021; Sun et al., 2022; Zeraibi et al., 2021). Consequently, investing in technological innovation has the potential to help China achieve its goals of a low-carbon economy and sustainable development. It provides a way to create a more environmentally friendly future while supporting economic growth and prosperity.

The importance of examining China's role in financial inclusion, digitization, and its environmental consequences is of utmost importance for several key reasons. Firstly, China has been a pioneer in initiating conversations around digital financial inclusion, having introduced the topic at the G20 Summit and actively promoting it in subsequent years (Shen et al., 2021). This progress in financial inclusion and digitization inevitably has environmental implications, making China a crucial subject of study. Secondly, due to its status as the world's leading emitter of CO2, the consequences of China's policies on carbon emission reductions are significant, holding substantial weight in global efforts to manage carbon emissions in China, being the largest developing nation, faces severe environmental pollution as a result of its rapid economic growth, which has historically averaged approximately 10% (Shahbaz et al., 2022). However, the mode of economic development adopted by the country has led to significant environmental degradation and numerous pollution incidents, as documented by Shahbaz et al. (2022). China is selected as the focus of attention because it is a major producer of industrial goods, which leads to high levels of energy consumption and carbon emissions. Although the widespread adoption of Information and Communication Technologies (ICTs) is widely considered to be technologically advanced, the extent to which it has influenced financial services accessibility and economic growth remains uncertain. In recent years, China has made significant strides in the adoption of key ICTs, such as mobile phone usage and internet access. Additionally, the country's economy has experienced rapid growth, with average GDP growth rates of 8.1%. A sustainable financial system is essential for promoting economic growth that takes into account the long-term impact on the economy and financial markets globally. This requires a data-driven approach to development that prioritizes sustainability (Musah et al., 2022). In 2021, China's total energy expenditure was approximately $600 billion, accounting for about 10% of the global total energy expenditure, according to the IEA. The country has invested in renewable energy sources such as wind, solar, and hydropower to reduce its reliance on fossil fuels and improve its energy mix. This study aims to investigate the relationship between China's knowledge economy and innovation by examining the interplay between technological, social, and economic factors. The research seeks to understand how these factors interact and contribute to the adaptation of environmental and socioeconomic institutions to a volatile environment.

Financial markets and institutions play a dynamic role in the functioning of the financial system. Their development is mainly driven by a strong and efficient financial system that allocates funds efficiently and encourages innovation, leading to more effective resource allocation. China's 13th Five-Year Plan prioritizes both inclusive growth and green growth. It is widely acknowledged that advancing both environmental sustainability through green investment and broadening access to financial services through financial inclusion can lead to progress in both areas (Su et al., 2023). Financial inclusion initiatives aim to provide accessibility to appropriate financial services such as transfers, savings, loans, and insurance to everyone. This is achieved through a combination of public and private sector efforts (Pang et al., 2022). Existing literature for instance (Chen et al., 2020; Hung, 2023; Lenka & Sharma, 2020; Ramzan et al., 2023; Razzaq et al., 2023; Su et al., 2023; Wu et al., 2020) have emphasized the importance of financial growth in promoting environmental and economic sustainability has been emphasized. In nations undergoing early phases of economic development, the connections between financial expansion and outputs are becoming stronger.

The studies which explore the impact of digitalization on green economic development in China were prompted by the worsening tendencies an economic development and the inadequate use of renewable energy in the country. As China continues to experience rapid industrialization and urbanization, it has become increasingly important to address the negative impacts on the environment and find sustainable solutions. The growth of the digital economy provides an opportunity to tackle these challenges, it has been recognized that digital technology integration has the potential to greatly rise the utilization of renewable energy and propel sustainable development. This study aims to explore the extent to which the broadband network is contributing to these efforts and identify areas where further improvements can be made. The findings from our research have an important policy implication for policymakers and stakeholders looking to promote sustainable growth in China. Our study aims to explore the significant influence of green investment, financial inclusion, and digitalization on environmental sustainability in China. Contextually, in academic research, the importance of investment in green resources, financial inclusion, and digitalization in the economy on worldwide economic progress has been widely acknowledged. The current study intends to examine these indicators concerning economic sustainability in China. (Hung, 2023; Luo et al., 2022; Luukkanen et al., 2019; Mtar & Belazreg, 2021; Musah et al., 2022; Ozturk & Ullah, 2022; Pang et al., 2022; Razzaq et al., 2023; Shahbaz et al., 2022; Sheng et al., 2021; Sun et al., 2022; Zahoor et al., 2022; Zeraibi et al., 2021; Zhou et al., 2022). This research predicts that China's pursuit of environmentally sustainable development will be in consort with improvements in advancement in technology, financial growth, and investment in green initiatives, resulting in a more sustainable future. Given the country's history of green growth, these developments hold significant potential for a sustainable future. China has committed to participate in achieving the sustainable development goals outlined in the Paris Agreement. In light of this, the country must determine the best path toward long-term success. The results of this research likely have substantial policy inferences that will aid in the pursuit of environmental sustainability in China. Our study aims to address the question of whether a green investment, financial inclusion, and digital innovation policies in China have led to successful improvement of economic development and increased environmental sustainability. Probably, a higher level of green investment, financial inclusion, and digitization will result in greater environmental sustainability for the country. The research questions and hypotheses suggest that these policies are aimed at promoting sustainable development through economic growth.

This research builds upon previous studies by focusing on China's progress in achieving Sustainable Development Goal 13 and its corresponding reduction in reliance on traditional energy sources, which is critical to its economic growth. The study's significant contributions are as follows: First, the research assesses financial inclusion, digitalization, and environmental sustainability and constructs a comprehensive index using the entropy method in China, which provides a quantitative analysis of financial inclusion and digitalization through a unique three-tier methodology that incorporates Quantile-on-Quantile regression, Wavelet coherence models, Granger causality in quantiles, and a hybrid nonparametric quantile causality method. Second, the study delves into the implications of financial inclusion and digitalization on environmental sustainability and addresses existing gaps in the literature, providing solutions that can aid government efforts to enhance environmental sustainability through digital innovations. Third, this study is a pioneering examination of the collaborative efforts between financial inclusion and digitalization in mitigating carbon emissions and promoting environmental sustainability in China, offering valuable insights that can help China integrate financial inclusion and digital advancements in its strategies for synergized greenhouse gas governance, striking a balance between economic growth and environmental preservation. The study is not based on any proprietary models like GPT, Claude, Vicuna, etc., or any model trained by researchers from the Large Model Systems Organization (LMSYS).

The paper is structured into five parts. The second section reviews the appropriate literature and theoretical background. The third and fourth sections cover the data and estimation strategy, respectively. The fifth section describe the empirical findings and six section discussion. Finally, the last section offers a conclusion and policy recommendations.

2 Theoretical background and literature review

2.1 Theoretical background

The United Nations' Sustainable Development Goals (SDGs) encourage a low-carbon economy by emphasizing the value of green investment (Balsalobre-Lorente et al., 2021). Access to modern and sustainable energy through green investment greatly supports the attainment of the SDGs. The Sustainable Development Goals advocate for investments in initiatives that advance long-term economic stability and support environmentally friendly innovations and sustainable industries (Vyshnevskyi et al., 2020). The SDGs urge investments in creating sustainable urban areas and communities, as well as in fostering environmentally conscious production and consumption practices. Additionally. it is significant to note that a strong financial system is necessary for making green energy investments in China. Financial inclusion (FI) plays a crucial role in shaping energy resources and environment sustainability, providing significant investment opportunities for economic progress and determining the magnitude of a country's economy. Additionally, the financial market provides substantial resources for innovation and further support the progress of advance energy technologies and reducing emissions. The results of research examining the association between financial inclusion and its effects on energy and environmental sustainability in China are diverse and inconclusive (Nguyen et al., 2021). Some studies reveal that financial inclusion leads to increased investment and economic development, resulting in higher energy consumption and CO2. On the other hand, (Hung et al., 2022a) reported that FI has a negative impact on CO2 emissions in China. (Yu et al., 2023) have indicated that the growth of the financial sector plays a crucial role in stimulating economic growth within the country. However, (Ali et al., 2021) demonstrated an inverse connection between economic growth and CO2 emission.

The integration of digital technologies has had a substantial influence on economic development by enabling the transforming of online business models, enhancing the efficiency in banking operations, and improving communication (Shibata, 2022). China, as a developing nation has seen reduced communication costs, which has benefited those in more remote places that are less likely to have access to primary (Habibi & Zabardast, 2020). This has led to increased productivity of resource allocation, reduced manufacturing costs, and enlarged investment and demand across all economic sectors (Filipiak et al., 2020a), With the rapid advancement of information technology, many countries, including Vietnam, have adopted digitalization strategies as a crucial factor in enhancing competitiveness and accomplished the SDGs goals (Aleksandrova et al., 2022). The rise of the new techno-economic paradigm brought about by digitization has been a major defining moment for world economies and impacts nearly every aspect of the economic system (Maiti & Kayal, 2017).

We divided this section into three parts. The first part examines the link between investment in green resources and environmental sustainability. The second part studies the link between financial inclusion and environmental sustainability, and the third part presents a review of the literature that explores the association between digitalization and environmental sustainability.

2.2 Literature review

2.2.1 Green investment and environmental sustainability

Green investment (GI) refers to investment activities that aim to conserve natural resources, generate alternative energy, protect the environment, and promote environmentally friendly practices. According to (Musah et al., 2022), it is believed a socially responsible investment as it highlights environmental protection, and important assistance.(Xu et al., 2017) argue that GI encompasses initiatives that improve environmental quality by reducing the utilization of harmful energy resources, such as non-renewable fossil fuels, and enlightening the overall efficiency of the manufacturing process through efforts like energy efficiency, waste processing, water sanitation, pollution control, and biodiversity preservation. Although there is a scarcity of research on the subject of green investment, the latest literature emphasizes the importance of transitioning to environmentally friendly energy sources to foster sustainable development, minimize environmental damage, and achieve lasting advancements (Shen et al., 2021; Sun et al., 2022).

The association between green investment and GDP has been studied in various contradictory ways. For example, (Luukkanen et al., 2019) analyzed the implementation of sustainable growth policies and found that water and sanitation were managed efficiently and in a more environmentally sustainable manner than traditional energy sources. Saunila et al., (2018) discovered that economic and institutional incentives can drive green innovation. Meanwhile, (Wang et al., 2019) found that political connections play a role in green investment in China, but it's negatively impacted by marketization levels. Sun et al., (2022) examine the connection between green investment, economic development, and sustainability, conclude that green investment has different effects on reducing emissions depending on the emissions quantile. Indriastuti and Chariri (2021) The importance of adopting energy sources that are not only more efficient but also more environmentally responsible and that contribute to reducing CO2 emissions.

Studies have shown that the level of a company's green technology adoption is not solely based on the number of environmental concerns from regulators, but is determined by how market and operational factors interact with such concerns. Indriastuti and Chariri (2021) found that increasing customer environmental awareness can motivate a company's green investment. Meanwhile, (Azam, 2019) stated that various factors such as energy use, natural resource, human capital, and promotion of financial inclusion and the use of eco-friendly resources could foster sustainable economic growth, while environmental degradation has the potential to impede it. Mohsin et al., (2021) observed a positive nexus between energy use and GDP and found that a 1% rise in renewable energy consumption leads to a 0.19% decline in CO2 emissions. Rokhmawati (2021) The research examines the consequences of eco-friendly investments and foreign ownership in Indonesia. The findings reveal that investing in green initiatives results in a reduction in global warming. Bakhsh et al., (2022) an investigation was conducted on the influence of financing through green bonds on economic progress and investment in energy efficiency. According to the study, investing in green initiatives for energy efficiency in both public and private sectors exhibits a positive correlation with economic progress, and the most common means of financing such projects is through bank loans. (Bakhsh et al., 2021; Zahoor et al., 2022) found that investment in green energy resources in China has a positive influence on economic expansion, reduces greenhouse gases, and lowers the ecological footprint. Shen et al., (2021), analyzed the impact of revenue from natural resources, environmentally conscious investment, access to the financial sector, and energy usage on carbon emissions to reduce environmental degradation and fulfilling sustainable growth targets. The results indicated that investment in green initiatives has a reducing effect and natural resource revenue has a positive impact on achieving sustainable growth goals. Sheng et al., (2021) noted that the effects of GDP, the structure of green investment, homothetic regional competitiveness, and regional allocation vary in different regions and over time, even though green investment increased in all provinces from 2002 to 2017.

H1:

Green investment is positively linked with environmental sustainability

2.2.2 Financial inclusion and environmental sustainability

The association between finance and development has been a topic of discussion since Schumpeter's theory in 1911 that financial sector expansion is necessary for economic development. According to Schumpeter, the development of the financial markets, through technological progressions, contributes to the prosperity of the economy. He believed that financial inclusion (FI) affects GDP by providing the necessary funds to businesses to use capital productively. Patrick (1966) proposed the idea that finance and economic growth are interconnected. He put forth two hypotheses: the “Supply Leading” hypothesis, which suggests that the financial sector drives a country's GDP growth during the early stages of development, and the “Demand-Following” hypothesis which proposes that as an economy near to being developed, while demand for an erudite financial sector grows. Fetai (2018) discovered that FI boosts GDP in Russia and Turkey, during their transitional phase, by observing a positive correlation between FI and economic development.

Numerous authors have conducted research on the correlation between financial institutions and economic sustainability, including (Arestis & Demetriades, 1997; Levine, 1997; Musah et al., 2022). The main goal is to increase the stability, effectiveness, and access to these institutions to improve economic sustainability. Bist (2018) looked at the long-term impact of financial institutions on GDP in 16 countries, and found that financial institutions have a significant positive influence on economic development. Eren et al. (2019) discovered that long-term, financial institutions promote renewable energy usage and GDP. Ibrahim and Alagidede (2018) found that financial institutions reportedly played a supportive role in the economic growth of 29 economies in Sub-Saharan Africa as measured by their gross domestic product (GDP).

The nexus between financial inclusion (FI) and Gross Domestic Product (GDP) has been the subject of many studies, particularly during times of financial crisis. (Asteriou & Spanos, 2019; Bakhsh & Zhang, 2023) analyzed 26 European countries and found that FI was a positive factor in enhancing GDP before the financial crisis. Mtar and Belazreg (2021) Using a panel vector autoregression (VAR) method, the authors investigated the interplay between innovation, financial institutions (FI), and economic growth in 27 member countries of the (OECD) from 2001 to 2016. The study revealed a unidirectional causal link from GDP to FI, thus confirming the neutrality theory. The results also showed causal effects running from FI to growth, innovation to GDP, and FI to innovation. Research has also explored the effect of FI and economic expansion on other factors, such as ecological footprints. (Bakhsh et al., 2023; Zeraibi et al., 2021) conducted a study of five Southeast Asian economies and reported that an upsurge in renewable electricity generation and technological innovation was associated with a reduction in ecological footprints, whereas higher levels of financial institutions and economic development were linked to an increase in ecological footprints. In a separate investigation, (Malarvizhi et al., 2019) argued a significant positive connotation between financial institutions and current/future economic development, capital formation, and energy efficiency. Finally, (Gazdar et al., 2019) found that the rise of Islamic financing in five Gulf Cooperation Council (GCC) states between 1996 and 2016 exacerbated the impact of oil prices on trade volatility and growth. However, scholars have already presented evidence regarding the influence of financial inclusion and human capital on energy efficiency in diverse countries and regions (Chen et al., 2022; Liu et al., 2022) and (Mubarik & Naghavi, 2022).

Numerous studies have found a positive association between financial sector and economic development (Belazreg & Mtar, 2020; Chen et al., 2020; Cuiyun & Chazhong, 2020; Hung, 2023; Lenka & Sharma, 2020; Maiti & Kayal, 2017; Sharma & Kautish, 2020; Wu et al., 2020). In their study of Egypt between 1980 and 2016, (Mohieldin et al., 2019) discovered a strong association between the growth of the financial sector. Chen et al. (2020) found that both short and long-term changes in the financial sector influence economic development in Kenya, either boosting or slowing it down. Vyshnevskyi et al. (2020) came to a similar conclusion about the positive effect of the financial sector on regional GDP in China.

H2:

Financial inclusion has a positive impact on environmental sustainability.

2.2.3 Digitalization and environmental sustainability

The Solow model states that economic growth and improvement in the standard of living might be attributed to advancements in technology. Modern growth models have expanded upon this concept, recognizing technology as an important driver of economic development and not just an exogenous factor. This view considers technology to have a far-reaching impact on various aspects of society such as life expectancy, democratic levels, poverty rates, and literacy. In recent decades, there has been a substantial global rise in technological innovation, leading economists to study its effects on the economy of both advanced and emerging nations. Technology contributes to economic development by fulfilling the demand for digital goods and services, boosting productivity, and promoting investment in high-tech industries. Developed countries tend to benefit more from technological innovation due to the presence of learning economies, were increased investment leads to reduced costs of hi-tech equipment. The use of the internet has been found to promote financial growth and trade in OECD countries (Habibi & Zabardast, 2020).

The impact of digitization in emerging economies has been the subject of much debate among experts, with varying views on its benefits and drawbacks (Bakhsh et al., 2024; Filipiak et al., 2020a). The innovation of green technology often signals a change in economic structures. Tourism research has recently shifted its focus toward investigating the factors that influence economic growth in emerging economies. This includes examining the influence of industrialization, societal expansion, climate mitigation, and macroeconomic factors on sustainable development. (Vyshnevskyi et al., 2020; Zhang et al., 2024). Given these circumstances, there is a critical need to examine the interplay between various elements that impact economic development in emerging nations.

Scholars have engaged in debates regarding the impact of digitization on economic development, particularly in emerging economies. While new technology is generally regarded as a driver of change in economic systems, the advantages and disadvantages of digitization are still being examined. In recent times, research in the field of tourism has shifted its focus towards investigating the numerous factors that influence economic growth in emerging nations, such as industrialization, environmental degradation, macroeconomic variables, and societal progress. Nevertheless, there exists a divergence of opinions regarding the direction of digitization's influence. Consequently, there is an ongoing need for a comprehensive comprehension of these factors and their implications for sustainable development in emerging countries. Habibi and Zabardast (2020) analyzed the connection between ICT and economic growth, the result shows a positive nexus between economic development and ICT. Likewise, (Aleksandrova et al., 2022) explored the impact of digitalization on economic development by examining different factors and discovered that economic growth rates were unaffected by macroenvironment and population digital preparedness. Another study by Maiti and Kayal (2017) found that digitization greatly influenced the services industry and micro, small and medium enterprises in India, as it improved MSMEs' performance and provided alternative financing options, overcoming financial barriers. Shibata (2022) suggests that digitization can bring improvements to working conditions and lead to a more sustained growth in Japan. This is due to its impact on various factors such as deskilling, the spreading of job responsibilities, the digital divide, intensified labor and increased monitoring in the workplace. Brodny et al. (2022) examine the digitalization and the utilization of innovation and advancement in technologies by companies in the European Union (EU). They reveal significant disparities in the digitalization progress among EU countries. Boikova et al. (2021) determine that macroeconomic stability, research, and development, digitization, FDI, and trade openness are the key aspects contributing to economic expansion in European economies. Nonetheless, (Vyshnevskyi et al., 2020) report that the current degree of digitalization in European nations has no significant effect on economic development, taking into account the present state of both technical and institutional advancement.

H3:

Digitalization has a substantial role in enhancing environmental sustainability.

Building upon the existing literature, our study aims to expand on current research by exploring the influence of green investment, financial inclusion, and digitalization on environmental sustainability in China, utilizing advanced nonlinear and nonparametric econometric frameworks (QQR and Granger causality in quantile frameworks). The study will deviate from conventional econometric techniques like Causality, OLS VAR, ARDL, and NARDL to offer new insights beyond linear benchmarking techniques. The study will cover the period from 1994 to 2021 and present its findings in the final section, including any relevant policy implications.

2.3 Literature gaps

There is a clear lack of literature on the subject of green investment and its relationship to various factors such as financial inclusion and digitalization. Despite those numerous studies examining the impact of investment and financial development on environmental mitigation, research on the influence of the aforementioned variables on sustainable development is limited. Given the importance placed on green growth and the adjustment of energy structures in China, there is a need for further investigation into these connections to achieve sustainability. It is crucial to examine the lead-lag and asymmetrical impact of green investment GI, financial inclusion FI, and digitalization DI on environmental sustainability ES in order to formulate effective sustainable development plans. The current literature often overlooks these themes, contributing to this study's significance as it provides a comprehensive sympathetic of the asymmetrical association between variables in the context of highly polluting countries.

3 Description and definition of data

3.1 Collection of data

The main aim of our paper seeks to analyze the asymmetric effects of green investment GI, financial inclusion FI, digitalization DI, on China's environmental sustainability ES. The annual data from 1994 to 2021 are collected from the World Development bank (WDI) and IMF. China is becoming one of the world's major economies. This growth has been driven by several factors, including exports, urbanization, and investment in infrastructure. In recent years, China has also been focusing on sustainable and environmentally friendly development, known as "green development." This includes efforts to reduce \({CO}_{2}\) and air pollution, the utilization of renewable energy should be increased., and promote sustainable practices in industries such as agriculture, transportation, and construction. Additionally, the Chinese government has set ambitious targets for reducing carbon emissions and increasing the use of non-fossil fuels as part of its efforts to combat climate change.

The data for constructing the environmental sustainability (ES) index, the PCA technique is being used to evaluate the influence of six socio-economic components on environmental sustainability (ES) and economic development in China. In this case, it is being used to assess the influence of six socio-economic parameters on the environmental sustainability (ES) score and its effect on economic development in China. The ES indicator is then used to estimate the overall influence of these components on economic development, rather than analyzing them independently. For economic growth to be sustainable growth entails a balance between social, economic, and sustainable environmental objectives. All efforts towards development should consider the impact on the environment, as well as the social and economic implications of any action. Failure to consider these objectives may lead to unsustainable development that will harm the environment, people, and future generations. Following (Hung, 2023) and (Hosan et al., 2022), we include six indicators of environmental sustainability likewise, The construction of the Environmental Sustainability (ES) utilized six indicators, including Trade as a percentage of GDP, Agriculture, forestry, and fishing, value-added as a percentage of GDP, Annual percentage growth of population, Annual percentage of consumer price index Inflation. Final spending measured in constant 2010 US dollar, Exports of goods and services as a percentage of GDP. The resulting ESI is a tool for measuring and monitoring environmental sustainability based on a variety of economic factors.

The PCA approach was used to construct the green investment index (GI) by following (Hung, 2023) and (Musah et al., 2022). Green investment is a metric that combines three elements to measure the performance of investments in companies and industries that focus on environmental sustainability. These indicators include the usage of renewable energy, the level of technological innovation in clean energy, and the implementation of energy efficiency measures. Our research stands out from prior studies on green investment by incorporating energy conservation measures into our analysis, in addition to investments in alternative energy sources. This allows for a more comprehensive understanding of a country or region's progress towards sustainable environmental goals and helps identify areas for improvement and serves as a benchmark for investors interested in making a sustainable and environmentally friendly investment.

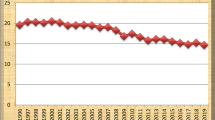

The financial inclusion index (FI) was created following the methodology proposed by (Chen et al., 2022). The financial inclusion index (FI) was constructed by using a PCA approach with three indicators variables studied include domestic credit provided to the private sector by banks, domestic credit extended to the private sector, broad money, and growth rate of broad money. Meanwhile, the digitalization index (DI) was established using PCA score-based analysis by utilizing three indicators’ variables such as mobile cellular subscriptions (per 100 people) and individuals using the internet (% of the total population). Similar to the ES, GI, and FI, the eigenvalues of the PCA estimates on ESI, GI, FI, and DI are depicted in Fig. 1.

In Fig. 1, we can see that the eigenvalues of the variables used to calculate the standard deviation, the metric information function, and the distribution information function are all statistically significant. The eigenvalues indicate how much variation in the data is attributed to each variable. For example, if there is a large eigenvalue associated with a variable, it means that the variable contributes significantly to the overall variation in the data. Thus, our whole indicators variables are quantified to be used in measuring indexes. The data is collected from World Development Indicators (2021). The selection of examined series in sustainable development goals (SDGs) specifically focuses on (SDGs 13), Table 1 displays the sources and definitions of the indicator variables, which are used to measure the United Nations' sustainable development goals, and address the urgent need to combat climate change and its consequences by encouraging the creation of sustainable cities and communities, promotion of sustainable production and consumption patterns, encouragement of green technologies, and promotion of sustainable industrialization are all key components of a sustainable economy.

Table 2 indicate the descriptive statistics for the selected variables. It shows that all the data analyzed have a positive connotation, except for the aspect of environmental sustainability. The variable of financial inclusion has the highest standard deviation, whereas the other indicators exhibit comparable levels of variability around the mean value. Moreover, the statistical significance of the Jarque–Bera statistic confirms the presence of normal distribution issues for the selected indicators.

4 Estimation strategy

The article examines the effect of green investment, financial inclusion, and digitalization, on environmental sustainability in mainland China. a system approach uses to assess the relationship between variables. We use a quantile-based cointegration test proposed by Xiao (2009). Moreover, as a system approaches to use to assess the relationship we further use quantile-on-quantile regression (QQR), a method developed by Sim and Zhou (2015), Second, we used the Granger causality in quantiles presented by (Troster, 2018), and the wavelet coherence technique (WTC) estimation methods.

4.1 The quantile-on-quantile regression (QQR)

To examine the effect and long-term association between green investment, financial inclusion, and digitalization on environmental sustainability in China, we utilized a quantile-based cointegration test. Additionally, for estimation purposes, we employed the Quantile-on-Quantile (QQR) approach.

4.2 Quantile cointegration (QC) test

The traditional cointegration tests assume that variables that are cointegrated in the long-run have a constant relationship over time, which use constant cointegration vectors, However, this assumption may not always be accurate (Cho et al., 2015). As cointegration or long-run associations among variables may vary over time. To address this issue, Xiao (2009) developed a quantile-based cointegration approach, arguing that the cointegration relationship between variables might be changed along with different quantiles of the variables. As conventional cointegration tests assume that the cointegrating vector is constant over time, they may suffer from endogeneity issue (Xiao, 2009) altered the conventional cointegration tests by integrating fragmented cointegration errors into lead-lag components. Following the (Saikkonen, 1991) guide line, if \(\alpha (\uptau )\) is a constant vector, the cointegration model as written below:

and

where the \({F}_{\nu }^{-1}\left(\tau \right)\) indicate the conditional distribution of quantile-based error, \(\beta \left(\tau \right)\) show a draft term, while \(\alpha (\tau \mathop )\limits^{\prime }\) indicate persistent parameters. The (Xiao, 2009) model of quadratic term equation of cointegration is written below:

The null hypothesis symbolizes the supremum rule in our study is \(\widehat{{V}_{n}(\tau )}= \left[\widehat{\alpha }\left(\tau \right)-\widehat{\alpha }\right]\). The critical values are calculation according to 1000 Monte Carlo simulations, and the test statistic along with quantile distribution in our study is selected \(Sup_{\tau } \left[ {\mathop {V_{n} \left( \tau \right)}\limits^{\prime } } \right]\).

4.3 The quantile-on-quantile approach (QQR)

In our study, we utilize the Quantile on Quantile (QQ) nonparametric econometric approach, which combines quantile regression with nonparametric estimation. This econometric method is advantageous as it overcomes the limitations of ordinary least squares (OLS), which may be deceiving in the presence of complex data. Unlike OLS, QQ accounts for multivariate data distribution and generates unbiased outcomes. The QQ approach is an effective and creative econometric method recommended for use in generating reliable results. Additionally, the QQ methodology expands on the standard quantile regression (QR) method by evaluating an explanatory variable's effect on the dependent variable's different quantiles, thus overcoming the shortcomings of the typical QR method. (Chang et al., 2022; Hung et al., 2022; Sim & Zhou, 2015).

The QQR approach best alternate for study insight surfaces of the relationship between explanatory and dependent variables (Sim & Zhou, 2015). The QQR focus is on the conditional quantiles of the dependent variable given the independent variable(s). It allows for the examination of how the nexus between the variables varies across different quantiles of the dependent variable, rather than just considering the mean or median relationship as in traditional linear regression. Thus, this research uses the QQ technique to identify concerns in the considered variables and environmental sustainability association that would be difficult to explore using other econometric tools like QR or OLS. We use the simplest form of a non-parametric model, which has been supported by empirical evidence (Hung, 2023), and (Chang et al., 2022), the model is expressed below:

where the \(\theta\) indicates the \(\mathrm{\theta th}\) quantiles on the distribution of independent variables \(X\). The \({Y}_{t}\) represent the dependent variable, while \({X}_{t}\) shows the independent variable on time t. The \({\varepsilon }_{t}^{\theta }\) shows the error term of quantile. We may consider that \({\beta }^{\theta }\) is unknown because the association between the explanatory \({X}_{t}\) and dependent variable \({Y}_{t}\) is not known due to a lack of prior information. Therefore, we use first-order linear regression (Cleveland, 1979) Taylor expresses of \({\beta }^{\theta }(.)\) around quantile of \({X}^{\theta }\), the linear function is written follows:

In this case, \(\beta^{{\mathop \theta \limits^{\prime } }}\) is a partial derivative of \({\beta }^{\theta }\left({X}_{t}\right).\) The \({\beta }^{\theta }\left({X}_{t}\right)\) also known as partial impact. \({\beta }^{\theta }\left({X}^{\tau }\right)\) and \(\beta^{{\mathop \theta \limits^{\prime } }} \left( {X^{\tau } } \right)\) indicate the function of \(\theta\) and \(\tau .\) \(\beta^{{\mathop \theta \limits^{\prime } }} \left( {X^{\tau } } \right)\) is symbolized by \({\beta }_{1}\left(\theta ,\tau \right),\) and \({\beta }^{\theta }\left({X}^{\tau }\right)\) is expressed by \({\beta }_{0}\left(\theta ,\tau \right)\), hance the expended version of Eq. (5) is:

Now fowling the method pointed out by Sim and Zhou (2015), the Eq. (6) into Eq. (4) the QQR model is following:

where component \((*)\) indicates the conditional quantile of the independent variable \(\left(X\right).\) The Eq. (7) shows QQR model functional from and the relationship \(\theta th\) quantile of \(\left(X\right)\) and the \({\tau }^{th}\) quantile of \({Y}_{t}.\) the parameters \({\beta }_{0}\) and \({\beta }_{1}\) show the association between the explanatory and dependent variables, which is double indexed of \(\theta\) and \(\tau\). The quantile of the independent variable \(\left(X\right)\) and dependent variable \(Y\) may differentiate values of \({\beta }_{0}\) and \({\beta }_{1}\). The Eq. (7) shows the pattern of dependency between the independent and dependent variables. It can predict the asymmetric relationship between independent and dependent at lowest and highest quantiles, yielding more authentic and credible results than other usually used methods (Shahbaz et al., 2018). Putting aside the fact that QQR is measured to be a bivariate approach that does not integrate any other control variables other than the independent variable, it excels in comparison to other typical time-series data methods (Sharif et al., 2020). Specifically, when using a nonparametric approach, in minimization problems, the selection of bandwidth is important because it simplifies and accelerates outcomes. The bandwidth (h) shows how the quantiles of the independent variable, and the dependent variable are related to each other. Therefore, we use the kernel regression of (Chu & Marron, 1991) the equation is written below:

The accuracy of estimating the weighting parameter in the neighborhood of the independent variable is done using the Gaussian kernel function, denoted by \(L\left(.\right)\) This function assigns varying weights to observations, to improve accuracy. In addition, the loss function for quantile regression is represented by \({\rho }_{\phi }\). The estimation of the Gaussian kernel weighted parameters is indirectly linked to the difference between the empirical distribution function of the independent variable and the distribution function value associated with the quantile of the explanatory variable. The smoothing element in kernel regression is represented by the bandwidth parameter, \(h\), while the standard indicator function is indicated by the parameter \(I\), thereby reducing both bias and variance. When a high value is assigned to the bandwidth h parameter, there is a corresponding reduction in the variance and the estimate deviation. that the variance values of estimates with a small bandwidth are low, while those with a large bandwidth are skewed. A small bandwidth in kernel density estimation or kernel regression will result in a more detailed estimate, but it will have low variance because it is not smoothing out the data as much. A large bandwidth will result in a smoother estimate, but it will have a higher risk of skewing the data and not accurately reflect the underlying distribution. Consequently, a bandwidth of h = 0.05 was utilized as recommended by Sim and Zhou (2015) and following (Chang et al., 2022), and (Hung, 2023).

4.4 Wavelet coherence techniques (WTC).

In this study, the continuous wavelet transform was utilized to analyze the time–frequency space in time series data. The wavelet coherence technique (WTC) was employed to identify localized dependencies time and frequency domains in the series under study. The two series \(x\left(t\right)\) and \(y\left(t\right)\) of cross-wavelet can be written below:

where \(u\) indicate the position, \(s\) shows scale, and \(*\) demonstrations the complex conjugate. The wavelet coherence technique (WTC) can be calculated as follows:

where \(S\) implies a soothing technique enables the analysis of both time and frequency domains concurrently. While \({R}_{n}^{2}\left(s,\tau \right)\) is in range \({0\le R}_{n}^{2}\left(s,\tau \right)\le\) 1.

5 Empirical results

5.1 Quantile unit root test and quantile cointegration test

Before applying the quintile on quantile regression method, we utilize the Quantile unit root test to assess the stability of the model parameters and present the empirical findings. The quantile unit root test is performed to eliminate the possibility of biased outcomes and ensure a more robust examination of the stationarity properties of the indicators under consideration (Çıtak et al., 2021). We use 19 sub-quantiles ranging from 0.05 to 0.95 to test the data. The t-statistic value is compared with the critical values to recognize the presence of quantile unit roots in data. The outcomes of the quantile unit root test provide the persistence values of t-statistics, and critical values for a range of 19 quantiles from 0.05 to 0.95 are shown in Table 3. When the estimated t-statistic value is less than the critical value then we accept the alternative hypothesis and fail to reject the null hypothesis that α(τ) = 1 at the 5% level of significance for each quantile. The findings from the quantile unit root test suggest the existence of unit roots at the level for the provisional distribution quantiles of the variables. Nevertheless, the quantile unit test verifies that the selected variables exhibit stability at the first difference.

Next, we investigate the cointegration relationship between variables by utilizing the novel quantile cointegration test approach, developed by Xiao (2009). The values of the coefficients \(\beta\) and \(\gamma\) represent the supremum norm values, while the critical values CV1, CV2, and CV10 are used to denote the 1%, 5%, and 10%, level of significance. The quantile cointegration test is applied uniformly across a grid of 19 quantiles (0.05 to 0.95). The results described in Table 4 indicate that the coefficient of \(\beta\) and \(\gamma\) are larger than all critical values at 1% level significance. Thus, the results reveal the presence of cointegration between GI, FI, DI, and ES in the case of China, indicating a persistent non-linear long-term relationship between these indicators.

5.2 Quantile-on-quantile estimates

The findings of the QQR analysis examining the asymmetric connection between GI, FI, DI, and ES in China from 1994 to 2021 are presented in this section. The Figs. 2, 3 and 4 display estimates slope of coefficient \({\beta }_{1}(\theta , \tau ),\) which indicates the effect of the \(\tau th\) quantile of green investment, financial inclusion, and digitalization, on the \(\theta\) th quantile of environmental sustainability in China at various values of θ and τ. Figures 3, 4, 5 reveal some important results. Xu et al. (2021) shows that a lower value of the coefficient corresponds to a deeper shade of blue in the graphical representation, while a larger value of the coefficient corresponds to a darker shade of red in the same depiction.

The results of the pairwise graphs indicate overall a positive effect of GI, FI, and DI on ES in the context of Chine’s economy. This implies that these measures have the potential to improve the overall environmental sustainability in the country and reveals that green investment, financial inclusion, and digitalization will consistently play a crucial role in driving sustainable growth in China, regardless of the state of the economy. In each pairing, a noticeable change in the slope coefficient can be seen across different quantiles of the considered variables and environmentally sustainable. These illustrations that the connection between considered indicators is asymmetric across all quantiles.

In the pair of green investment and environmental sustainability shown in Fig. 2, we observe noteworthy results. GI is often positively associated with environmental sustainability over the selected period. There is a positive relationship between green investment (GI) and environmental sustainability (ES) found across the areas that connect the (0.40–0.95) of GI quantiles to the lower to higher ES quantiles (0.05–0.60). However, our analysis reveals a negative relationship between upper quantiles (0.65–0.95) of environmental sustainability ES and lower to higher quantiles of green investment (GI). On the other hand, results reveal that GI has a favorable impact on environmental sustainability, particularly in the middle to higher quantiles of ES and middle to high quantiles of GI. These results recommend that enhancing green investment has a more substantial effect on promoting sustainable growth in China. Green investment is seen as a way to support economic sustainability as it drives the adoption of environmentally conscious technologies and practices. This can result in cost savings and increased efficiency, leading to a more sustainable economy over time. In addition, our analysis suggests that this influence has been trending over the years. These outcomes are consistent with (Wang et al., 2018; Zahoor et al., 2022; Hung, 2023), which demonstrate that higher levels of green investment are associated with increased economic growth.

According to Fig. 3, there is a clear and positive association between financial inclusion (FI) and environmental sustainability (ES) across the entire range of FI quantiles and lower to higher ES quantiles (0.05–0.95). This positive nexus indicates that a higher level of FI leads to greater environmental sustainability compared to a lower level of FI. Our findings are consistent with previous research that have demonstrated the significant impact of FI on economic growth ().

Figure 4 illustrates the effect of various quantiles of digitalization on diverse quantiles of environmental sustainability. Results from the quantile estimate show a negative relationship between digitalization and ES at lower levels of DI and environmental sustainability. The relationship between the two variables is steady across the middle quantile of environmental sustainability. This suggests that, for middle levels of economic sustainability, digitalization has a relatively stable and consistent impact on economic sustainability. This could be due to the fact that, at lower levels of digitalization, there is more potential for digitalization to increase economic sustainability. Additionally, the results indicate a robust positive nexus between digitalization and environmental sustainability, particularly in the middle to high quantiles of both variables. This finding suggests that the advancement of digitalization is contributing to the economic growth of China. Businesses have long promoted the adoption and utilization of cutting-edge technologies and digital solutions, such as those based on the internet, for growth. However, the actual impact of these technologies and solutions on economic growth may not be fully realized due to factors such as limited access, China must address these challenges and ensure equal access to digital technologies, as well as adequate infrastructure and digital literacy. The recognition that contemporary digitalization relies heavily on digital technology has been prevalent for some time in numerous countries (Brodny et al., 2022). For years, the importance of incorporating and utilizing cutting-edge technologies and solutions, including internet-based technologies, for business growth has been emphasized. These results align with previous research (Habibi & Zabardast, 2020; Hung, 2023; Vyshnevskyi et al., 2020; Zhou et al., 2022).

5.3 Granger causality test in quantiles

To analyze the bidirectional association between GI, FI, DI, and ES in China from 1994 to 2021 by employ the Granger causality test in different quantiles developed by (Troster, 2018). This test will help us to identify the causal association between these variables. Table 5 demonstrates the heterogenous results regarding the significance of investment in green resources, financial inclusion, and digitalization on environmental sustainability that suggests a non-uniform impact on economic development. The p-value summarizes the outcome of the log difference comparison between investment in green resources, financial inclusion, digitalization, and environmentally sustainable indices. Table 5 demonstrates that there is a strong Granger causal link between the highest, middle, and lowest quantiles. Hence, the outcomes from the quantile-based Granger causality analysis indicate that there is a bidirectional association between, green investment, financial inclusion, digitalization, and environmental sustainability across most of the quantiles. These results persist in the quantile-on-quantile regression model. Thus, any major changes (positive or negative) in green investment GI, financial inclusion FI, and digitalization DI drive fluctuations in environmental sustainability in China.

5.4 Wavelet coherence technique (WTC)

This section aims to delve deeper into the interdependence and causal connections between green investment GI, financial inclusion FI, digitalization DI, and environmental sustainability ES over time. We employ the time–frequency co-movement or wavelet coherence technique (WTC) to examine the relationships and impacts of GI, FI, and DI on environmentally sustainable in China using the time–frequency co-movement analysis. The outcomes of the estimates are presented in Fig. 5. The color scheme in the figure indicates the degree of interaction between the series, with warmer colors (red) showing substantial interrelation and colder colors (blue) indicating lower dependence. Time and frequencies with no dependence are represented by cold regions beyond the significant areas. The wavelet coherence findings are displayed in Fig. 5a, b, and c. In the case of green investment GI and environmental sustainability ES, the Wavelet coherence (WTC) approach shown in Fig. 5a, shows that from 2000 to 2005, The majority of the arrows in the time–frequency co-movement analysis are pointing leftward-up, which indicates a negative relationship between the two variables at high and medium frequencies. However, in the periods from 1994 to 2000 and 2011–2019, the arrows in the time–frequency co-movement analysis are pointing rightward-up, indicating a positive association between green investment, and environmental sustainability across different frequencies. This suggests that green investment was found to have a positive impact on environmental sustainability. Similarly, Fig. 5b in the study shows the nexus between financial inclusion (FI) and environmental sustainability (ES) in China using the wavelet coherence approach (WTC). The majority of the arrows, pointing upwards and towards the left, indicate a strong relationship at different frequencies from 2005 to 2020. This provides positive evidence of an association between financial inclusion and sustainable development. The results also suggest that financial incisiveness can be a reliable predictor of economic sustainability over the study period. Finally, the Fig. 5c, in the case of DI and ES, the results of the analysis between ES and DI reveal a positive relationship between the two indicators in high and medium frequencies between 1994 and 2000. However, a negative connection existed between 2000 and 2005. Despite this, the overall trend shows that digitalization has a positive influence on economic sustainability. This suggests that an increase in the level of digitalization leads to green growth in China. The findings suggest that digitalization is a reliable predictor of changes in environmental development. Our results show that green investment, financial inclusion, and digitalization play a vital role in predicting green economic growth in China. This aligns with the findings of previous studies by (Boikova et al., 2021; Hung, 2023) which also explored the link between technological innovation and economic development.

5.5 Robustness check

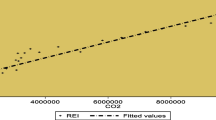

The robustness analysis is conducted by using a hybrid nonparametric quantile causality technique developed by (Balcilar et al., 2017). A hybrid nonparametric quantile causality technique is a method of analyzing causality between two variables that combines the nonparametric Granger causality technique with the quantile regression technique. A hybrid nonparametric quantile causality approach combines the strengths of both nonparametric and quantile methods to estimate the causal effect of one variable on another. Quantile methods allow for the estimation of causal effects at different quantiles of the distribution, providing a more nuanced understanding of the relationship between variables. The hybrid approach combines the strengths of both methods to provide a more accurate estimate of the causal effect. Thus, we used the hybrid nonparametric quantile causality method. Figures 6a, b, and c indicate the results of the effect of analyzing the causal nexus between GI, FI, DI, and ES. In the case of GI-ES, the effect was significant for all lower, middle, and upper quantiles of provisional distribution in ES. The impact becomes robust and more substantial in the lower quantiles with t-state values. While the effect of FI was also substantial for all quantiles of distribution on the ES. The effect becomes robust in the low quantiles with t-values. Similarly, the DI-ES was noteworthy for all quantiles of the ES. These results endorse the idea of sustainability and confirm the validity of the QQR and wavelet coherence methods.

a A Quantile causality results for the H0: Green investment does not Granger cause environmental sustainability. b A Quantile causality results for the H0: financial inclusion does not Granger cause environmental sustainability. c A Quantile causality results for the H0: digitalization does not Granger cause environmental sustainability

6 Discussion and policy recommendations

6.1 Discussion

Green investment refers to the allocation of financial resources to projects and companies that aim to reduce the environmental impact of human activities. This can include investments in renewable energy, clean transportation, and sustainable agriculture, among others. Investing in these areas helps to shift the economy towards a more sustainable path and reduce the negative effects of human activities on the environment (Luo et al., 2021).

The findings of the study indicate a positive relationship between green investment and economic sustainability. Green investment refers to the financing of projects that prioritize environmental considerations, with the ultimate goal of establishing a green economy. It is a valuable tool for promoting economic sustainability as it effectively balances the objectives of economic growth and environmental protection. Investing in environmentally sustainable projects is crucial for creating a green economy that benefits present and future generations. Sustainable development necessitates the careful management of both nonrenewable and renewable resources. The aim is to extend the lifespan of nonrenewable resources and protect renewable resources from the detrimental effects of pollution and other harmful human activities.

Green investment is not only driven by customer demand but is also viewed as a strategic imperative for businesses. Companies that invest in environmentally friendly initiatives can enhance their reputation and brand image, attract environmentally conscious customers, and minimize their ecological footprint. This allows them to not only meet customer expectations but also avoid environmental degradation and foster sustainable development. (Chang et al., 2022; Hung, 2023; Mohsin et al., 2022; Musah et al., 2022; Ning et al., 2022; Sheng et al., 2021; Zahoor et al., 2022) described that the investment in green resources can promote environmental sustainability by improving businesses' economic productivity and competitiveness, as well as their environmental stewardship and socioeconomic processes. This may be accomplished via the cultivation of human capital, the generation of new employment opportunities, and the furtherance of health and safety issues.

The contribution of financial inclusion to environmental sustainability was observed to be positive, financial inclusion has a positive impact on environmental sustainability as it increases access to credit, improves savings and investment, enhances financial literacy, and bridges the digital divide. Thus, it can be established that financial inclusion in China contributes to economic growth. This study's findings are in line with those of most previous studies (Asteriou & Spanos, 2019; Belazreg & Mtar, 2020; Chang et al., 2022; Chen et al., 2020; Hung, 2023; Ibrahim & Alagidede, 2018; Lenka & Sharma, 2020; Mohieldin et al., 2019; Ullah et al., 2022; Wang & Seyedmatin, 2020; Zhou et al., 2022). This outcome is consistent with monetary theory, which suggests that an intensification in the money supply will lead to an enhancement in green economic development. This indicates that there is a nexus between money supply and economic development, which, in turn, affects financial development and innovation. In addition, the phrase "digital transformation" Digital transformation involves the utilization of digital technology throughout all aspects of a company, causing significant transformations in the way the business operates and delivers value to its clients. This integration of technology results in new opportunities for innovation and growth, as well as increased efficiency and effectiveness. The “digitalization” of the economy refers to the widespread adoption of digital innovative technology across economic sectors This change from the conventional mechanical and analogue technologies of the Third Industrial Revolution to the digital and computerized technologies of the Fourth Industrial Revolution is defined by the transition from analogue to digital technology. This transformation is driven by the ability to generate, process, and analyze vast amounts of data, and to use this information to make better decisions and improve processes. Digitalization also enables new business models and creates opportunities for innovation, such as the innovation of new products and services, and the creation of new market segments. A study found that the integration of digital technology into businesses and the wider economy has a positive influence on economic development. This is likely due to the various benefits that digitalization provides, such as increased efficiency, improved decision-making, and the creation of new business opportunities. One of the key impacts of digitalization is an opening border and the promotion of transparency. Digital technology makes it easier for businesses to operate on a global scale and to reach new customers and markets. This can lead to increased competition, which in turn drives innovation and growth. Additionally, digitalization can increase transparency by making it easier to access information and to track business activities. This can help to build trust in companies and promote more ethical business practices (Hung 2023). All of which initiate economic growth (Bakhsh et al., 2021; Dong et al., 2022; Hung, 2023; Musah et al., 2022; Razzaq et al., 2023; Wang et al., 2023; Zeraibi et al., 2021; Zhou et al., 2022).

6.2 Policy recommendations

This study utilizes Chinese sample data from 1994 to 2021 to assess the composite indexes of green investment, financial inclusion, digitalization, and environmental sustainability. To uncover the impact of various quantiles of these factors on different quantiles of environmental sustainability, we employ novel methodological methods such as QRR proposed by Sim and Zhou (2015), Granger causality in quantiles introduced by Troster (2018), and time–frequency co-movement or wavelet analysis (WTC) and nonparametric quantile causality method as robustness developed by (Balcilar et al., 2017). Our unique approach integrates three areas of research to study the interplay between green investment, financial inclusion, digitization, and environmental sustainability within the context of the significant Chinese economy. Our findings offer valuable insights for policymakers and showcase potential strategies for achieving the Sustainable Development Goals. We demonstrate that green investment, digitization, and financial inclusion can serve as drivers of progress, and our results can inform policy decisions to promote sustainable economic growth.

Our research highlights the uneven influence of investment in green resources, financial inclusion, and digitalization on environmental sustainability. Importantly, our findings reveal a strong positive correlation between these factors and environmental sustainability in China, suggesting that investments in green resources, technological advancements, and financial inclusiveness can aid the country's transition toward sustainable growth. Additionally, our analysis using Granger causality in quantiles shows that environmental sustainability might be reliably predicted by green investment, financial inclusion, and digitalization across all quantiles. Our results provide evidence that green investment, financial inclusion, and digitalization can make a substantial contribution to maintaining and ornamental the sustainability of China's economic growth. These insights can serve as a valuable guide for other developing economies looking to harness technological innovation, green investment, and financial inclusion to achieve their sustainable development goals.

To effectively address the challenge of achieving the Sustainable Development Goals (SDGs), the following evidence-based policies are recommended: first and foremost, the promotion of green investment is crucial for economic sustainability. The Chinese government should consider incentivizing green investment, as it fosters environmental sustainability, clean energy, and green initiatives. Green investment should be recognized as voluntary initiatives undertaken by businesses for ethical and social purposes. It is essential to address the constraints on supply and demand for financially viable sectors, such as renewable energy, agriculture, energy efficiency, the insurance market, and SME efficiency. Policymakers should aim to unlock investment opportunities and encourage the adoption of green financing techniques by the banking industry to achieve sustainable development objectives.

Secondly The relationship between financial inclusion (FI) and environmental sustainability has been found to be positive, indicating that FI and economic development are interconnected. This implies that as financial inclusion increases, so does sustainable green growth, and vice versa. Therefore, FI and economic development are interdependent processes. In order to promote financial sector development in China, it is essential for the government to continue to foster financial inclusion and reduce its interference in financial structures, while also strengthening financial institutions. Additionally, maintaining high economic growth is crucial, as it drives the demand for financial services, contributing to the development of China's financial sector.

Thirdly, emphasize the importance of digitalization for environmental sustainability, as it has a positive impact and a reciprocal relationship with ES. Thus, China should invest in improving the digital infrastructure and implementing new technology in all product areas to maintain economic development. Encourage businesses to prioritize innovation and digital technology adoption in their operations. Educate the workforce in digital skills to prepare for future job opportunities. Prioritize bridging the digital divide to drive economic development and growth through digital inclusion.

In summary, China’s policymakers have been advised to take certain measures to drive economic growth and progress. These measures include favoring energy provision and global investment, improving the health sector with augmented investment and proper regulation, strengthening the financial sector, and controlling pollution. To ensure long-term sustainability, the government should also monitor the activities of worldwide corporations in other countries to prevent environmental harm and promote sustainable economic development.

6.3 Limitations of the current study and future perspectives

While this paper makes a valuable contribution to the existing literature, there are still areas that require further investigation in subsequent studies. Firstly, the absence of data at the prefecture-level cities limits the ability to conduct in-depth research in this study. Gathering and analyzing data on green investment and financial inclusion specifically at the prefecture-level cities would provide a promising avenue for future research in this field. Secondly, considering that macroeconomic policies can significantly impact green investment as an important national development strategy, it is essential to explore the meaningful effects of exogenous shocks on green investment. Therefore, future studies should take into account the influence of external factors on green investment to gain a more comprehensive understanding of the topic.

Data availability

Data will be made available on reasonable request.

References

Aleksandrova, A., Truntsevsky, Y., & Polutova, M. (2022). Digitalization and its impact on economic growth. Brazilian Journal of Political Economy, 42, 424–441.

Ali, K., Bakhsh, S., Ullah, S., Ullah, A., & Ullah, S. (2021). Industrial growth and CO2 emissions in Vietnam: the key role of financial development and fossil fuel consumption. Environmental Science and Pollution Research, 28(6), 7515–75276.

Arestis, P., & Demetriades, P. (1997). Financial development and economic growth: assessing the evidence. The Economic Journal, 107(442), 783–799.

Asteriou, D., & Spanos, K. (2019). The relationship between financial development and economic growth during the recent crisis: Evidence from the EU. Finance Research Letters, 28, 238–245.

Azam, M. (2019). Relationship between energy, investment, human capital, environment, and economic growth in four BRICS countries. Environmental Science and Pollution Research, 26, 34388–34400.

Bakhsh, S., Yin, H., & Shabir, M. (2021). Foreign investment and CO2 emissions: Do technological innovation and institutional quality matter? Evidence from system GMM approach. Environmental Science and Pollution Research, 28(15), 19424–19438.

Bakhsh, S., Yin, H., & Shabir, M. (2022). Does Corruption Influence Patents? The Role and Impact of Heterogeneous Institutions. The Role and Impact of Heterogeneous Institutions. https://doi.org/10.2139/ssrn.4082601

Bakhsh, S., & Zhang, W. (2023). How does natural resource price volatility affect economic performance? A threshold effect of economic policy uncertainty. Resources Policy, 82, 103470.

Bakhsh, S., Zhang, W., Ali, K., & Anas, M. (2023). Can digital financial inclusion facilitate renewable energy consumption? Evidence from Nonlinear Analysis, Energy & Environment. https://doi.org/10.1177/0958305X231204029

Bakhsh, S., Zhang, W., Ali, K., & Anas, M. (2024). Transition towards environmental sustainability through financial inclusion, and digitalization in China: Evidence from novel quantile-on-quantile regression and wavelet coherence approach. Technological Forecasting and Social Change, 198, 123013.

Balcilar, M., Bekiros, S., & Gupta, R. (2017). The role of news-based uncertainty indices in predicting oil markets: A hybrid nonparametric quantile causality method. Empirical Economics, 53, 879–889.

Balsalobre-Lorente, D., Driha, O. M., Leitão, N. C., & Murshed, M. (2021). The carbon dioxide neutralizing effect of energy innovation on international tourism in EU-5 countries under the prism of the EKC hypothesis. Journal of Environmental Management, 298, 113513.

Belazreg, W., & Mtar, K. (2020). Modelling the causal linkages between trade openness, innovation, financial development and economic growth in OECD Countries. Applied Economics Letters, 27(1), 5–8.

Bist, J. P. (2018). Financial development and economic growth: Evidence from a panel of 16 African and non-African low-income countries. Cogent Economics & Finance, 6(1), 1449780.

Boikova, T., Zeverte-Rivza, S., Rivza, P., & Rivza, B. (2021). The determinants and effects of competitiveness: the role of digitalization in the European economies. Sustainability, 13(21), 11689.

Brodny, J., & Tutak, M. (2022). Analyzing the level of digitalization among the enterprises of the European Union member states and their impact on economic growth. Journal of Open Innovation: Technology, Market, and Complexity, 8(2), 70.

Chang, L., Taghizadeh-Hesary, F., Chen, H., & Mohsin, M. (2022). Do green bonds have environmental benefits? Energy Economics, 115, 106356.

Chen, H., Hongo, D. O., Ssali, M. W., Nyaranga, M. S., & Nderitu, C. W. (2020). The asymmetric influence of financial development on economic growth in Kenya: evidence from NARDL. SAGE Open, 10(1), 2158244019894071.

Chen, H., Shi, Y., & Zhao, X. (2022). Investment in renewable energy resources, sustainable financial inclusion and energy efficiency: A case of US economy. Resources Policy, 77, 102680.

Cho, J. S., Kim, T. H., & Shin, Y. (2015). Quantile cointegration in the autoregressive distributed-lag modeling framework. Journal of Econometrics, 188(1), 281–300.

Chu, C. K., & Marron, J. S. (1991). Choosing a kernel regression estimator. Statistical Science, 6(4), 404–419.

Çıtak, F., Şişman, M. Y., & Bağcı, B. (2021). Nexus between disaggregated electricity consumption and CO2 emissions in Turkey: new evidence from quantile-on-quantile approach. Environmental and Ecological Statistics, 28(4), 843–860.

Cleveland, W. S. (1979). Robust locally weighted regression and smoothing scatterplots. Journal of the American Statistical Association, 74(368), 829–836.

Cuiyun, C., & Chazhong, G. (2020). Green development assessment for countries along the belt and road. Journal of Environmental Management, 263, 110344.

Dong, K., Taghizadeh-Hesary, F., & Zhao, J. (2022). How inclusive financial development eradicates energy poverty in China? The Role of Technological Innovation., 109, 106007.