Abstract

Environmental degradation is a severe problem for all nations, especially for developing ones like Pakistan. For analysis purpose, this study employed two proxies of environmental degradation, i.e., carbon emission and ecological footprint as the explained variables during 1980–2017. In contrast, real GDP per capita, electricity consumption, financial development, urbanization, life expectancy rate, and fertility rate are used as independent variables. For the empirical analysis, Johnson co-integration, Markov switching equilibrium correction model (MS-ECM), and other second-generation econometric models have been used. Granger causality is also used to quantify the causal association among concern variables. MS-ECM results showed that there is U-shaped behaviour that holds for the case of ecological footprint and real GDP; on the other hand, inverted U-shaped behaviour has been seen between CO2 and real GDP. Study found negative association between electricity consumption and environmental degradation to save the environment. Study suggests that electricity production sector should be shifted from non-renewable to renewable energy (solar and wind) sources for sustainable future.

Similar content being viewed by others

Avoid common mistakes on your manuscript.

1 Introduction

Global warming exerts significant extortions to the attainment of sustainable development goals (SDGs) and requires a comprehensive rejoinder. The United Nations laid down a seventeen point agenda for the fulfilment of these goals by 2030; among these access to the reasonable and decent energy and combating overtime climate variation are two (Assembly, 2015). The populations are facing rising temperature worldwide due to greenhouse gasses effect, and one of the key reason behind these gasses accumulation is electricity production, as over one-third of human-induced gasses emissions are from the burning of non-renewable energy sources to produce electricity (Holbrook and Johnson, 2014). Different studies have quantified diverse scopes of the environmental damages by employing different proxies such as carbon emission (CO2) and ecological footprints (EFP). However, the CO2 denotes a specific segment of the total outcome coming from large-scale human activities by energy usage (Al-Mulali et al., 2015).

The developed economies have observed a decrease in several contaminants per unit of production because of technological advancement and increasingly strict green protocols (Stern, 2014). Another explanation for the deterioration is the transition of the mixture of waste from sulphur dioxide to solid, which results in high aggregate waste that could not have minimized per capita pollution (Bello et al., 2018). This indicates that a particular environmental degradation (ED), which involves carbon dioxide, should be followed by an aggregate measure. The EFP also acts as a quantitative indicator of ED to assess the effect of human demand on the natural capital. It is the synthesis of anthropogenic environmental pressures, and this indicator was firstly used by Rees (1992).

The EFP is an impending instrument that can be utilized to assess human undertakings within planetary limits. This measure includes knowledge about environmental issues that include restrictions on the use of energy, global natural resource allocation, and sustainability of resource uses worldwide. The ED is resulting from the fundamental economic output-consumption process because nations are using their resources to improve output and become more competitive. Growth in terms of development and competitiveness is at the risk of ED. The theory of the Kuznets has been approved from his seminal research on economic development and income inequality that argued that there exists an inverted U-shaped association between ED and gross domestic product (GDP) (Grossman, 1995). It means at starting phase of economic development, environment quality go down, and at a later stage of development, the environmental quality enhances, i.e. per capita income touches a turning point. Thus, it suggests that ED first increases and later on, it drops with an upsurge in the development level.

Likewise, out of total production, residential sector requires about 33 per cent electricity consumption globally (Boonyasana, 2013). The rising emphasis on the environmental concerns of electricity intake and production has led to a discussion on how to develop new technologies, strategies and business solutions those encourage more effective and sustainable production, distribution and consumption of energy (Farhangi, 2009). Similarly, demand-side management should also be focused. Efficiency of the energy consumption can be encouraged by decreasing consumption during the critical peak hours, or by adjusting consumption pattern by moving consumption from peak hours to peak-off that is referred to as load shift and such program are known as demand response (Strbac, 2008).

This article also uses financial development (FD) as a determinant of ED and influences ED in two ways. With FD, energy can be consumed more efficiently through advanced technologies, and environment security regulation those can be decreed with enlarged funds and less cost (Tamazian et al., 2009). Through this, the adverse impact of ED brought about by FD can be abridged. Nevertheless, compact cost, augmented investment and energy consumption triggered by FD can lead to more GDP (Dasgupta et al., 2001). Such growth may adversely affect the efficiency of the economic climate. A growing population of urban areas along with increased use of energy (electricity use) and natural resources contribute to more ED. Worldwide, more than two-thirds of the global energy consumption constitutes 70% of the environmental harm that is caused by ED (IRENA, 2016).

Taking into account the existing information about the environment–development relationship, current study would help understanding the EKC-hypothesis in Pakistan from the EFP and CO2 viewpoints. The research adds in the body of knowledge in the following ways. Firstly, as compared to existing literature, our model explores the effect of socio-economic factors, i.e. economic development, electricity consumption, FD, urbanization, life expectancy, and fertility rate on ED variables within the same context for Pakistan. Counting socio-economic factors enable us to interact with likely omitted variable bias prevailing in the relevant framework. Secondly, in addition to the CO2 proxy that has been extensively considered previously, we also use per capita EFP to cover the diverse features of ED like cropland footprint, carbon footprint, grazing land footprint, build-up footprint, fishing ground. Through this, EKC association and its pollution dependency is clarified. Thirdly, our econometric technique controls the numerous factors that can cause the spurious inferences if ignored. Therefore, current study has employed a series of statistic and econometric methods to obtain the robust outcomes. Initially, we have employed the unit root tests with and without structural breaks i.e. augmented Dickey–Fuller (ADF) and Zivot Andrews. Furthermore, this study has employed Johnson co-integration and confirmed the long-term co-integration for both models via Bayer and Hank co-integration test. For the regression analysis, we have used the fully modified ordinary least square (FMOLS) and Markov Switching regression test. Moreover, this study has employed the stability test with impulse response function (IRF). In the last, Pairwise Granger causality test has been applied to validate the causal association among variables.

Furthermore, the inspiration of this article is that the existing literature often assumes the traditional quantification of ED (CO2) and unfortunately offers few comprehensions for Pakistan regarding EKC-hypothesis by using latest ED proxy, i.e. EFP. As the rising trend of environmental damages, Pakistan deserves detailed examination, which inspires to focus on Pakistan economy. Further, the focus on the Pakistan economy is relevant because selected economy has set a number of targets to attain the sustainable economic development while preserving environment through endorsing green economy.

The rest of this manuscript is systematized as follows: Sect. 2 discusses the empirical literature explaining the EKC theory with per capita income, electricity consumption, FD, urbanization, life expectancy, and fertility rate. Section 3 elucidates the data, model specifications, and empirical methodology. Section 4 presents and discourses the empirical outcomes of time series unit root tests, Bayer and Hanck co-integration, FMOLS, MS-ECM and the causality findings in last, and Sect. 5 concludes the paper and suggests policy options.

2 Literature review

The effects of economic development, energy consumption, FD and other macro indicators on different proxies of ED have been investigated in various case studies of the past. This section is separated into two parts to differentiate the impacts of concerning indicators on carbon emissions and EFP.

2.1 Long-run association between macro-economic indicators and CO2 (EKC-hypothesis)

Dogan and Seker (2016) suggested that in topmost renewable energy consuming nations, renewable energy intake, FD, and trade openness play a substantial role in decreasing the emission and encourage the EKC-hypothesis. For a time series of UAE economy, Charfeddine and Khediri (2016) recommended that there exists EKC-hypothesis. Further, they found the inverted U-shaped relation between FD and CO2. Ali et al. (2016) suggested that for a time series of Nigeria economy, urbanization leads a non-significant influence on the CO2. In the long run, GDP and energy consumption positively contribute to the level of environmental damages, while trade openness has an adverse effect on carbon emission. Similarly, number of case studies also supported the existence of EKC phenomenon [Refers: Al-Mulali et al. (2016); Apergis (2016); Kang et al. (2016)].

Later on, the association between per capita income with other macro-economic indicators and environment has been broadly studied. For the case of Turkey, Ozatac et al. (2017) considered the Autoregressive Distributive Lag (ARDL) bound test to quantify the incidence of EKC over the period of 1963–2013. The outcomes exposed that the EKC phenomenon is valid for Turkey. Solarin et al. (2017) calculated the impact of hydroelectricity consumption, growth, and EFP for the case of China and India. Empirical confirmation illustrates the EKC-hypothesis for selected economies. They also found the negative impact of hydroelectricity consumption on emissions. Zhang et al. (2017) used the ARDL method to quantify the link between economic development and emission for Pakistan. The long-run outcomes supported the evidence of U-shaped EKC-hypothesis for Pakistan. Furthermore, they found non-renewable energy consumption, trade openness and FD as the leading accelerators of CO2 discharge. Likewise, a bulk of past literature claimed the presence of EKC phenomenon such as for G-7 nations by Shahbaz et al. (2017); a study related to China by Dong et al. (2017); and a study of USA by Apergis et al. (2017).

Using the dynamic time series model based on FMOLS and CCR techniques, Pata (2018) examined the determinants of CO2 in Turkey from 1974 to 2016. The outcomes demonstrate that urbanization and FD have a significant influence on CO2. In addition, long-run outcomes support the presence of U-shaped EKC-hypothesis. Amri (2018) employed the ARDL model for the Tunisia economy over the period of 1975–2014. Their findings revealed the presence of EKC-hypothesis. Various case studies used economic development and CO2 and validated the EKC during the same year (Balado-Naves et al., 2018; Dong et al., 2018; Sinha & Shahbaz, 2018). For the panel data set of selected OECD region, Zafar et al. (2019) employed the Cup-FM and Cup-BC estimations. The results revealed that energy use enhances the level of carbon emission. Further, they found the evidence of EKC for the selected economies. Similarly, a case study about USA by Işık et al. (2019) also supported this phenomenon. Another case study pertaining to BRI countries also endorsed the presence of EKC (Khan et al., 2019). Likewise in the continuous year, some other studies also found the same phenomena such as Zhang et al. (2019), Usman et al. (2019) and Chen et al. (2019).

Cetin and Bakirtas (2020) quantified the influence of GDP, FD, and energy consumption on emission in emerging economies using an econometric panel technique. The results proved the FD as the main contributor to CO2 emissions. They saw the EKC phenomenon in the case of emerging economies. In the same year, several other studies supported this hypothesis [refer to: Murshed et al. (2020); Kim et al. (2020); Shah et al. (2020); Ng et al. (2020)]. Later on, Genç et al. (2021) investigated the association of income per capita with carbon emissions in Turkey during 1980–2015. They used ARDL model and found the inverted U-shaped EKC. Jiang et al. (2021) investigated the association of real per capita GDP with CO2 in China during 1985–2018. The outcomes of ARDL technique proved inverted U-shaped EKC for China. Jun et al. (2021) demonstrated the linkage of income with CO2 emissions in South Asian economies from 1985 to 2018. Study used FMOLS technique and found the inverted U-shaped EKC phenomenon for selected economies.

2.2 Long-run association between macro-economic indicators and EFP (EKC-hypothesis)

Researchers have conducted extensive research to find the link between different types of energy use and EFP by using cross country and panel analyses. Charfeddine et al. (2017) explained the dynamic relation between economic development and EFP with other socio-political factors in the selected MENA economies and found the occurrence of EKC phenomenon for the whole region as well as for oil-exporting economies. Similarly, another case study of Qatar also supported the evidence of U-shaped association of economic development with an EFP (Charfeddine, 2017). Mrabet and Alsamara (2017) explained the linear affiliation between economic development, and EFP for the case of Qatar. Concluding remarks explained the U-shaped EKC-hypothesis for the EFP. Later on, a study about income groups used the Cup-FM and Cup-BC panel technique to quantify the long-run association between EFP and economic development. The concluding remarks found U-shaped long-run association between selected indicators. Another study related to Malaysia emerging economy by Bello et al. (2018) supported the U-shaped relation between economic development and EFP. This outcome is validated by other studies for the numerous nations and regions, containing EU economies by Destek et al. (2018), ten tourist destinations by Katircioglu et al. (2018), EU nations by Destek et al. (2018), and a study of China by Hao et al. (2018).

Afterward, Destek and Sarkodie (2019) examined the linkage between economic development, EFP, FD and renewable energy use to validate the EKC-hypothesis and concluding remarks proved the concerned phenomena. Results found the bidirectional causality between growth and EFP. Alola et al. (2019) analysed the long-run connection among GDP, fertility rate, energy use, and EFP in EU nations over the time of 1997–2014. The study validated the incidence of EKC phenomenon in concerned economies. They used pooled mean group ARDL regression and found that renewable energy consumption has an adverse sway on the environmental damages (EFP). Likewise, other relevant literature also supported the same (Fakher, 2019; Sabir & Gorus, 2019).

In the recent year, a case study associated with BRICS economies by Ulucak and Khan (2020) quantified the association between urbanization, energy use, growth and EFP. The long-run findings validated the incidence of EKC-hypothesis for selected economies. Further, they observed that the natural resources, renewable energy consumption, and urbanization are eco-friendly indicators. Sharif et al. (2020) examined the association of renewable, non-renewable energy use, growth with EFP for Turkey during 1965–2017. Concluding remarks explained the existence of EKC-phenomena and found renewable energy as an environment-friendly indicator. Moreover, bidirectional causality was also quantified among energy use, GDP, and EFP. Similarly, other studies also supported this direction of economic growth and EFP such as case study of Turkey by Bulut (2020), Central-and East Asian by Ansari et al. (2020) and ASEAN region by Nathaniel and Khan (2020). Pata and Aydin (2020) studied the influence of economic development on emissions, while results did not express the occurrence of EKC-hypothesis. Similarly, another case study related to Pakistan by Abbas et al. (2020) investigated linkage between GDP, FDI, industrialization and total population, while the outcomes ignored the concept of EKC-hypothesis. Later on the case study related to Turkey tried to check out the connection of real income with EFP during 1970–2016, and outcomes of ARDL method supported the existence of EKC (Bulut, 2021). Similarly, Lee and Chen (2021) demonstrated the association of GDP per capita with EFP across 123 economies over the period of 1992–2016. Findings under the quantile regression validated the EKC-hypothesis. Caglar et al. (2021) claimed the presence of EKC for the USA by using the non-linear ARDL technique. They validated the presence of inverted u-shaped EKC.

3 Data and methodology

This paper studies the long-run and short-run association between the economic development, electricity consumption, FD, urbanization, fertility rate and life expectancy rate with ED (EFP and carbon emissions) for the case of Pakistan. The data for electricity consumption, real economic output and other concerned variables except EFP are retrieved from World Development Indicators, while data on EFP have been taken from Knoema data bank. The annual data employed for the econometric investigation span from 1980 to 2017. The data description, units of measurements and sources are given in Table 1. The variables comprise EFP and CO2 emissions as a proxy of environment quality, income per capita estimated in US current dollar to the ratio of the GDP and total population, electricity consumption is calculated in kWh/capita, FD is measured in % of GDP, and urbanization is estimated as the % of the total population. Likewise, life expectancy is measured as total births per woman. The fertility rate is a portion of the birth, total in years. This article is dissimilar from the preceding studies in terms of choice or variables and data selection. The stimulus of data choice is based on the SDGs, i.e. 3, 7, 8, 11 and 13. Goal 3 outlines the pivotal role of access to suitable health facilities for sustainable growth and the environment. Goal 7 represents access to energy use to access sustainable growth. The involvement of goal 8 is informed by access to financial services. Goal 11 is focused on the well sustainable cities with well-organized urbanization. Last on, 13 SDG is related to environmental quality and also discusses the attainment of a sustainable environment. Conceptual framework of the study is presented in Fig. 1.

By following work of Dogan and Turkekul (2016), Mrabet and Alsamara (2017), Charfeddine and Mrabet (2017), and Kahouli (2018), the model that we are going to use is (Eq. 1).

Selected parameters are transformed into their logarithm arrangements to achieve reliable empirical confirmation. It is widely recognized that log-linear equation moderate’s sharpness in the overall data and allows better results than control variance as compared to simple specification (Shahbaz et al., 2012). The log-linear description of the empirical equation is modelled and can be written as (Eq. 2),

where lnEDt, lnGDPt, ln GDPt2, lnELECt, lnFDt, lnURBt, lnLEXPt, and lnFRt are the natural log of the ED, which could be either the EFP or the carbon emission, natural log of RGDP, its square, natural log of electricity consumption, natural log of FD, natural log of urbanization, natural log of life expectancy and the natural log of fertility rate. µt is an error term, which has normally distributed with zero mean and constant variance. And, βi (i = 1, 2,….,5) shows the long-run elasticities of EDt, GDPt,, GDPt2, ELECt, FDt, URBt, LEXPt, and FRt, respectively. The EKC theory that describes U-shape or inverted U-shape of the curve is usable in the quadratic function, and several other potential forms can be forecasted following the sign of the examined coefficient β1 and β2. The coefficient of urbanization < 0 implies that the well-established urbanization lowers ED; otherwise, urbanization degrades the environment quality. This study assumes the positive or negative impact of FD on ED. The effect of FD on ED is prejudiced by the loans shifted the clean or dirty project to the concerned economies.

3.1 Unit root tests

This paper uses the ADF test by Dickey and Fuller (1979) and the Zivot–Andrews test with one structural break (Zivot & Andrews, 2002). The ADF test is used to check the integration level of the datasets. The potential misunderstanding of procedural violations in a collection of facts of not stationary origin is one of the key deficiencies of this technique. Alternatively, if the sequence under analysis has a structural split, it cannot support the null hypothesis of unit origin. The Zivot–Andrews root test making one structural break is used to manage this issue.

3.2 Bayer and Hanck co-integration test

There are number of co-integration techniques documented in the econometric literature for testing co-integration link among the variables. The long-run association prevails between a number of series if there is some sort of linear stationary arrangement among them as suggested by the past literature, i.e. Johansen (1991), Gregory and Hansen (1996) and Carrion‐i‐Silvestre and Sansó (2006). In addition, all concerned co-integration tests reduced diverse conclusions of co-integration and non-cointegration null hypothesis. Similarly, more robust results can be obtained by findings the individual test statistics (Banerjee et al., 1998; Bayer & Hanck, 2013; Boswijk, 1995). This study has used Bayer and Hanck co-integration approach and its general mathematical form is given below (Eqs. 3 and 4),

Likewise, Prob.EG, Prob.JOH, Prob.BO, and ProbBDM is denoted with individual probabilities of each test.

3.3 FMOLS

This quantification technique is distinct in its ability to produce optimal co-integration regression estimates among series integrated of order one (Pedroni, 2000). The method also addresses the issue of endogeneity and auto-correlation without compromising the robustness of the variables. Also, it allows the serial correlation and existence of the endogeneity problem (Eq. 5).

It also permits co-integration of Yi and Xi with the slope of βi, where βi may or may not be homogenous across i, so the equation can be written as Eq. 6,

Similarly, t = 1, 2, ….., T and i = 1, ……., N. The simultaneous covariance is showed as Ω01, while the weighted sum of auto-covariance is Γi. Thus, FMOLS equation can be written as Eq. 7

3.4 MS-ECM approach

To validate the hypothesis of EKC, this study used the FMOLS and the MS-ECM techniques. This methodology has many benefits to co-integration estimation technique. Universal form of this model can be transcribed as (Eq. 8),

where

where β measure the rapidity of the adjustment on the way to the long-run equilibrium, Xt is independent variables, and Yt is the explained variable. And Δ is the first difference operator. The MS-ECM has numerous benefits equated to the other error correction models. This methodology does not provide previous details on the number of regimes, the number of breaks and the date of breaks, all of which are endogenously quantified and defined.

3.5 Error correction-based granger causality analysis

As the both econometric techniques applied by study i.e. FMOLS and MS-ECM are unable to track the causality association among the variables so we move towards Granger causality. If no evidence is provided for co-integration of the variables, the vector autoregression test in the first differences is defined for the Granger causality test. However, if we find signs of co-integration, we must add a one-period lag error correction term for the granger causal test mode (ECT-1). If the results prove the long-run relationship among the specified indicators of environmental quality, the next step is to quantify the vector error correction model (VECM) as given in Eqs. 10–15 by succeeding Engle and Granger (1987).

Here, τ measure the speed of amendment to find equilibrium in the event of shock (S) to the system, and ECT-1 is lagged error correction tool accomplished from the long-run Granger causality.

4 Results and discussion

Before moving towards the long-run analysis, descriptive statistics and pairwise correlation matrix are estimated to check out the behaviour of variables through mean, median and expected signs. These help in shaping the pathway of investigation for accurate findings. Table 2 discourses the descriptive statistics of variables and validates the normal distribution of all selected variables. Moreover, given Table 2 offers the descriptive statistics in terms of mean, median, maximum, minimum, standard deviation and Jarque–Bera statistics. According to the calculated values, life expectancy has the highest value and urbanization has the lowest value in explanatory variables. Similarly, the value or Kutosis and J-B tests confirm that all variables are normally distributed. This study focuses on ED with two different proxies (CO2 and EFP) and outcomes show that there is not a significant difference between the mean and median of the selected variable.

Table 3 shows the pairwise correlation coefficient—the correlation among concerned variables. According to the given results, FD, urbanization and fertility rate have negative correlation with both proxies of ED at a 1% level of significance. Likewise, ELEC, per capita income and life expectancy rate have positive correlation with emissions and EFP (1% statistical significance).

This study continues to observe the stationarity attributes of the variables of interest by applying the set of unit root stationarity tests. This is an essential step to decide the accuracy of the outcomes to find the required policy insights. The findings of both unit root tests are presented in Table 4. The ADF findings are integrated of order I. Furthermore, ZA structural break unit root test outcomes are also reported in the same table. These recognized break dates match with noteworthy economic and political occasions for Pakistan’s economy.

The maximum lag length choice criteria are provided in Table 5. On the behalf of lag length criteria, we can take splurging model. From Table 5, it is clear that the most suitable criteria for selection are Akaike information criteria (AIC) which can accommodate sample size and appropriate for the nature and structure of the study (Lütkepohl, 2006).

The next step of analysis is about long-run equilibrium association that includes a set of co-integration techniques, i.e. Johnson co-integration, Bayer and Hanck with FMOLS and MS-ECM co-integration tests. All concerned co-integration tests are in agreement of a co-integration relationship between EFP, emissions, income per capita, its square, ELEC, FD, urbanization, life expectancy rate and fertility rate over the investigated period. Bayer and Hank co-integration test outcomes are presented in Table 6, authorizing the occurrence of an equilibrium relationship among both series (Model 1 and 2) at one per cent level of significance, thereby inferring a long-run link between the selected variables.

Table 7 shows the Johnson co-integration results about the co-integration and no co-integration on the base of trace statistics values. So, according to a given table, at seven co-integration value, calculated trace value is more significant as compared to the critical value at five per cent statistical significance, i.e. at none* (320.9974 > 125.615). Likewise, ‘At most 1*’ to ‘At most 6*’ trace statistics is greater than the critical value, which provides evidence about the presence of co-integration.

Further, in Table 7; maximum Eigenvalue is larger than the table value at five per cent level that shows the existence of co-integration among the variables. Each level max-Eigen value is more than the table value, which is confirmation of co-integration. The same theme can be seen in Table 7 for the case of carbon emission.

Similarly, for second model, trace value, as well as Maximum Eigenvalue, showed the number of co-integrated equations. Results given in Table 7 depict that there are seven co-integrated equations for the EFP as an explained variable.

4.1 The long-run impact of socio-economic and demographic variables on environment quality (CO2)

Table 8 reports the FMOLS and MS-ECM regression findings for the first and second models. The first panel of Table 8 describes the results for both regression techniques when carbon emissions (CO2) are used as an explained variable. For an understanding of EKC, the quadratic term of per capita income (LGDP) is introduced for the emissions. For FMOLS and MS-ECM, the coefficient of LGDP (β1 > 0) and LGDP2 (β2 < 0) advocated that 1% rise in this factor leads to an upsurge of 0.163% in emission, while the per capita income’s square causes to decrease equivalent to 0.565% in an explained variable. Results approved the inverse U-shaped EKC-hypothesis for Pakistan’s economy. The EKC-hypothesis posits that income per capita increases the ED during the industrialization. Precisely, industrialization requires a widespread consumption of energy sources, which in response causes ED. As any country grows economically, a post-industrialization phase takes place during which a country experiences a decline in its emissions due to economic structure and strict laws and protocols of environmental protection (Cheng et al., 2019).

Developing economies often consume inexpensive energy and natural resources excessively for their industrialization and economic growth. They develop huge infrastructures to encourage economic growth which involves a wide consumption of energy sources and ultimately causes ED. Pakistan is leading example that has reported sufficient economic growth during current years. Such economic growth would not have been realized if Pakistan has engrossed on pollution during the first phase of its development. The Pakistan’s economic model is energy extensive that is intensely focused on industrialization and investment, and same is being followed by several other developing nations. These nations place their economic growth and energy security goals over their environment protection (Omoju 2014). Moreover, our findings are concurrent with the available literature, like a study about 31 provinces of China (Li et al., 2016), a study related to the USA also supports the incidence of inverted u-shaped EKC (Aslan et al., 2018), and same results are suggested by Shahbaz et al. (2019) and a case study by Fethi and Senyucel (2020) for 50 top tourist economies.

Under the highlighted specifications, it can be observed that the link between ELEC and emissions is negative. This shows that a 1% rise in LELEC would decrease ED by 0.075% under the FMOLS specification, while the result of MS-ECM has no significant influence on the emissions due to insignificant p-value (0.752). Based on the conclusions of this study, it is clear that Pakistan would have significant challenges in pursuing an energy conservation programme in the face of rapidly increasing energy demand. To fulfil the expanding energy demand, electricity is largely generated from fossil fuel sources; hence, Pakistan urgently needs to discover alternate forms of power generation, as well as other viable actions to prevent ED. Pakistan has the ability to cut emissions through a range of approaches, particularly by improving the efficiency of energy generation. These results are concurrent with the study of Bello et al. (2018) for emerging economies and contrast with the results of Middle Eastern countries by Al-Mulali and Che Sab (2018), and same is found by Rahman (2020).

Regarding the other determinant of emission, the coefficient of FD is positive and statistically significant. The possible explanation is that the share of the loan to the private sector for environmentally dirty projects increases the pollution, and by extension, it depletes the environment quality. In other words, FMOLS and MS-ECM explain that a 1% rise in this variable (LFD) will enhance the environment pollution by 0.403% and 0.094%, respectively. These outcomes are coherent with a case study of Nigeria by Ali et al. (2019) and a study related to income groups by Ehigiamusoe and Lean (2019). The possible logic behind the positive trend of environment damages due to FD can be explained. A country with the less developed financial system cannot provide the opportunities to the industries for the adoption and utilization of advance state-of-the-art technology which produce fewer emissions. Similarly, the development of the financial sector does not enhance the enforcement of regulations that are environment friendly in Pakistan. The policy implication in this regards is that Pakistan should strive to develop the financial sector to mitigate emissions.

Likewise, urbanization as a percentage of the total population is being used another factor which can be responsible for disturbing environment situation. Thus, 1% proliferation in this variable would rise environment pollution by 0.824% and 0.183% under the both econometric specifications. These results authenticate the previous case studies (Sarwar et al., 2019; Shah et al. 2020). As suggested by Shah et al. (2020), constant rise in Pakistan’s urbanization would upsurge energy demand and emissions due to fossil fuel burning. Further, they explained, the transportation system, building construction and demand for electricity machines have augmented the CO2 emission over time. It means electricity demand is rising day by day due to an upsurge of urbanized sector.

The positive association between the life expectancy rate and carbon emission under the both specifications has been seen here. Investigated outcomes depict that life expectancy has noteworthy effect on the emissions as the value of its coefficient is highly significant and an increase in the level of environment pollution by 0.089% and 0.421% due to 1% increase in life expectancy rate in Pakistan. These results are against the study about 15 MENA economies by Charfeddine and Mrabet (2017). The result of the quantified coefficient of life expectancy at birth has an inverse effect on environment pollution. These results are consistent with our expectations for Pakistan, so as life expectancy rate at birth increases, there will be more ED in terms of emissions. The possible explanation may be that people in that Pakistan are engaged more in agriculture sector activities relative to industrial activities, which is more injurious. This outcome is align with a study of 154 countries by Wang and Li (2021) pointed out that the increase in life expectancy plays an important role in boosting carbon emissions.

Lastly, an increase in the level of fertility rate causes an expansion and contraction in the level of environmental pollution for the case of Pakistan, i.e. 1% increase in fertility rate can cause an increase and a decline by 0.127% and 0.565% under FMOLS and MS-ECM specification. This rising trend is based on the income availability. The increase in household income may rise in fertility rate. An increase in domestic population by increasing the fertility rate and boosting the income that cause improving the child’s care support. However, boosting the household income and household size are likely to increase in household consumption in turn leading to increase in greenhouse gas emissions.

4.2 The long-run impact of socio-economic and demographic factors on environment quality (EFP)

The second panel of Table 8 reports FMOLS and MS-ECM regressions findings. This panel refer to the effect of socio-economic and demographic variables on the EFP for the case of Pakistan. The result obtained from Table 8 showed that GDP and its square have a negative and positive effect on the EFP under the FMOLS and MS-ECM specifications, respectively. The coefficient of GDP (β1 < 0), the GDP2 (β2 > 0) advocated that 1% increase in this factor would lead to decline in environmental damages by 0.162% and 0.124%, while GDP2 can rise ED by 0.072%. However, there is U-shaped EKC-hypothesis that exists under the specification of FMOLS, while MS-ECM has not supported this phenomenon due to the insignificant impact of GDP2 on the dependent variable. These verdicts are consistent with the various available case studies (Dogan & Turkekul, 2016; Aung et al., 2017; Shah et al. 2020). Thus Pakistan is recently at the period of industrial growth as its energy demand is proliferating. Though the outline of traditional energy consumption appears to keep no modification in the uninterrupted span, and it may still need a long time for Pakistan to range the day when the quantity of EFP would decrease. Moreover, the inverted U-shaped EKC is not valid for Pakistan economy as it is in the early stage of industrialization and overall development. Therefore, at its threshold level (β2 > 0) the environmental damages deteriorates as domestic economic growth tends to further increase. With the rise in income, carbon emissions can decline, but this type of association only happens when technologies are existing that advance energy efficiency, energy saving and green energies, which are inaccessible for because of high cost.

Regarding the determinants of EFP, as one would expect, the coefficient of ELEC is negative and statistically significant, which shows electricity use has a decreasing effect on the environmental damages under the concerned specification (FMOLS and MS-ECM). These findings are coherent with a study of Nigeria by Belaid and Youssef (2017) and a case study of 5 EU nations by Balsalobre-Lorente et al. (2018). It shows that a one per cent increase in this variable would decline ED by 0.282% and 0.203% under specified specifications. Study urges Pakistani policy makers to devise policies for finding and utilizing the green energy sources. So sustained quick economic growth necessitates higher and more efficient consumption of electricity. Besides, the results recommend that Pakistan economy should adopt the multi-pronged strategy of enhancing investment in energy infrastructure and putting in place energy conservation to advance delivery efficiency. Additionally, the current situation of regional initiatives to ensure the energy security is inefficient and ex-governments of Pakistan have not taken necessary steps to bolster energy inputs and improve energy efficiency. For example, Pakistan has not slackened its electricity markets to permit full competition in the retail electricity markets and taken steps to progress energy efficiency.

In addition, FD variable (0.336 and 0.241) showed that there is a positive linkage between FD and EFP over time. Alternatively, a 1% rise in this factor will lead to a rise in EFP by 0.336% and 0.241%, respectively. The FD stimulated the markets to include a low-interest rate loan that argues for investment activity across a strong financial system. The resulting growth in the procurement of large-scale energy incentives raises conventional energy needs and environmental impact. Cumulative environmental deterioration is increasing due to the insufficient availability of financial resources to eco-sustainable projects and expansion of the heavy energy use scheme and these results are concurrent with the available relevant literature (Charfeddine, 2017; Saud et al., 2020).

However, urbanization is positively linked with EFP. These results are occupied with the prior proxy of environment quality, i.e. carbon emission. There can be a rise in the level environment damages by 0.775% and 0.593%, respectively, due to 1% upsurge in the level of urbanization in Pakistan. The scale of the urban population makes the equilibrium of urban accumulation more difficult and also contributes to increased urban property costs, pollution and disruption to the environment (Shen et al. 2017). In order to achieve sustainable urbanization market, further strengthening of environmental investment and governance is essential (Mutisya and Yarime 2014). Further, it is also now needed of time to encourage the transformation and optimization of chemical industries, upgradation of the industrial structure, with joint prevention and controlling the environment pollution. As proposed, the degree of environmental destruction will be decreased in the growth of urban areas and the creation of a sustainable civilisation that will guarantee a green future.

In the last, life expectancy rate at birth and fertility rate are positively associated with ED. This suggested that a 1% rise in life expectancy rate and fertility rate would cause to enhance EFP by 0.039% and 0.023% for LEXP, and, 0.106% and 0.057% for FR, under both specifications, respectively. The findings of the quantified coefficient about life expectancy and fertility rate show that rise in level of population has a harmful impact on ecology. These outcomes are in line with our expectations for selected region. The logic is that as life expectancy and fertility rate increase, there will be more ED. We can explain this connection by fact that people in Pakistan economy are engaged more in agriculture activities relative to industrial activities. The policies proposed by policymakers for these two indicators are well defined and need more investment especially in health and resident cognizance to improve the fertility rate and life expectancy and secure the environment quality. Such outcomes are in contrast with Charfeddine and Mrabet (2017). A comparison of selected variables in context of existing research findings is presented in Appendix Table 12.

4.3 Model stability test

Table 9 displays the outcomes of short-run diagnostic tests. Findings depict that all these analyses appear effective for short-term models, which mean that they are free from serial correlations between variables and autoregressive conditional homoscedasticity.

4.4 Result robustness and stability test

We tested the consistency of residuals from short-term effects prior to assessing the causality among the concern variables. We also examined the robustness of the results by considering emissions and EFP as explained variables in both models.

4.5 CUSUM and RS-CUSUM test

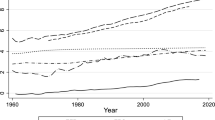

CUSUM and RS-CUSUM are tested after selection of the required definition of each contingent residual stability. Results are defined in Fig. 2 for mean stabilization and variance (CUSUM and RS-CUSUM).

This diagram depicts that cumulative sum of a square and square residual do not deviate from the critical bounds at the conventional five per cent significant level. Thus selected specification are plausible for telling the evolution of both proxies of ED. On behalf of the stability of selected models, this scenario can move forward to causality quantification among variables.

4.6 VECM Granger causality test

The VECM Granger is applied to detect the causality interaction between the variables being considered as well as to break down the course of the interaction in the short and long term, as shown in Table 10. The track of the selected variables’ causality is important to establish right policies related to energy, environment and economic systems to make an informed decision. On behalf of this analysis, we observed short- and long-run associations between the selected indicators with both proxies of ED.

The results expose the bidirectional causality feedback existing between carbon emissions and life expectancy rate. The direction of causality shows that the emission causes life expectancy rate and any progress in life expectancy rate causes Granger to environment pollution. The findings validate the feedback hypothesis, i.e. the life expectancy rate for the selected region is in strong correlation with emissions. In addition, any increase in the LEXP will affect the level of environmental pollution in Pakistan and vice versa positively. Likewise, the results also support bidirectional causality between life expectancy rate and EFP, when EFP is considered as a dependent variable in the scenario of the EFP model. This means that any fluctuation in life expectancy rate reflects the environmental damages immediately, while EFP stimulates the life expectancy rate in the long run. No one study has been conducted in the past literature, which estimates this exciting association between the concerning indicator of environment. Further, findings of Granger causality recommend a two-way causal linkage between ELEC and life expectancy rate, i.e. policies related to these indicators are working jointly. Thus all procedures related to LEXP and ELEC should be efficient for the attainment of long-run support.

In the same way, two-way causality relationship exists between ELEC and urbanization. The results expose that any change in ELEC causes a shift in urbanization development. In addition, the feedback relation from urbanization to ELEC shows that variation in urbanization sector can also have a considerable effect on ELEC. In other words, ELEC and URB are interconnected, and an upsurge in the ELEC will enhance the level of urbanization, while fluctuation in the progress of urbanization will positively affect the level of ELEC demand. Similarly, the results indicate that ELEC can significantly cause variation in fertility rate in Pakistan, while the feedback relationship from FR to ELEC demonstrations that any variation in FR will positively distress the level of electricity usage. Moreover, the results show that FD can cause Granger link to life expectancy rate, and feedback hypothesis have also been observed from LEXP to FD. In the last, bidirectional casual relationship has been found from life expectancy to fertility rate, and per capita income to fertility rate.

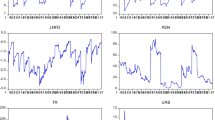

Above and beyond in the first model, unidirectional causality is detected running from trade openness and urbanization to human development index, from carbon emissions to fertility rate, while in the second model from EFP to FD (Table 11). Similarly, one-way causality has been found among the explanatory variables in the light of both models, whereas, the one-way causality is running from FD to fertility rate, GDP–ELEC and FD, from urbanization to lifer expectancy rate and from fertility rate to urbanization. Further, the graphical representation of these causal links is presented in Appendix Fig. 3. Also, the results of the impulse response function (IRF) are presented in Appendix Figs. 4 and 5 by assuming the responses of both environment proxies to shock applied to the selected explanatory variables.

5 Conclusions and limitations

The primary emphasis of this paper is on the determinants of ED with two well-known proxies, i.e. CO2 emissions and EFP in Pakistan for the time of 1980–2017 with annual data. This research article uses FMOLS and MS-ECM for finding long-run links among the selected variables. To summarize the findings, an inverted U-shaped EKC is confirmed for the CO2 with per capita income for the case of Pakistan economy. Also, FD, urbanization, life expectancy rate and fertility rate enhance the emission under the FMOLS, while life expectancy rate and fertility rate reduces the CO2 emissions under the MS-ECM. Likewise, electricity has a negative association with emissions. Moreover, in the case of the second model when the EFP is taken as dependent variable, we found U-shaped EKC between per capita income and EFP. Likewise, all selected indicators augment the level of ED under both econometric techniques, while ELEC reduces the level of environmental damages under the MS-ECM.

In the last step of empirical analysis, a pairwise causality test discloses the nature of the association among study variables. Consequently, there occurs two-way causality from carbon emission to life expectancy rate (model 1) and from EFP to LEXP (model 2). Besides, remaining explanatory variables showed Granger links with each other as described in the following. ELEC and life expectancy rate have causal link with each other. Likewise, the feedback hypothesis is found between ELEC to urbanization and fertility rate. Similarly, bidirectional causality has also been seen running between FD and life expectancy rate, LEXP and fertility rate, urbanization and ELEC, and per capita income and FR. However, unidirectional causality is running from emission to fertility rate (model 1) and EFP to FD (Model 2). Finally, FD Granger causes fertility rate, GDP Granger causes ELEC and FD, urbanization granger causes life expectancy and fertility rate causes urbanization.

The results of the scientific analysis yield certain valuable conclusions which can have significant policy consequences. High urbanization rate in any economy needs to speed up growth to achieve the optimum income level. The inclusion of electricity consumption at a higher rate may be harmful for the environment situation, so Pakistan economy’s production and consumption side should diverge to clean energy for gaining sustainable environment. More budget should be dedicated to renewable energy initiatives with growing energy demands. Furthermore, income alone cannot regulate environmental damage without posing constraints on environmental policies to make natural resources more sustainable.

On the other hand, the policymakers in the rest of the selected region are suggested to adopt new clean and green projects to minimize the usage of electricity consumption from fossil fuels. Similarly, there is a need to manage the financial sector, which creates loans only for those projects which are eco-friendly with the environment. In addition, there is a need to control urbanization pattern in a similar way to the current implication in order to launch a sustainable future. As indicated by the investigated findings, life expectancy rate and fertility rate show the ambiguous results with positive as well as the negative effect on the environmental damages proxies. We need more investment on both indicators since these are directly related to environmental pollution.

In the last, this study has some shortcoming as well. The study employs the data for the Pakistan to estimate the exciting association with environmental quality, so similar pattern can be run in different regions. Secondly, pragmatic strategy follows the FMOLS and MS-ECM estimators with some constrained assumption, but alternative time series methods may produce additional output. Thirdly, this study explores elements of two different proxies of ED, but alternative environment indicators such as GHG emissions, SO2, NOX may react to study variables differently. Consequently, new studies should be carried out with the follow-up of various data across regions with a broader duration and more comprehensive measurement to analyse the findings obtained and to spread how ED responds to alternative determinants.

Abbreviations

- ED:

-

Environmental degradation

- CO2 :

-

Carbon emissions

- EFP:

-

Ecological footprint

- GDP:

-

Per capita economic growth

- ELEC:

-

Electricity consumption

- FD:

-

Financial development

- URB:

-

Urbanization

- LEXP:

-

Life expectancy rate

- FR:

-

Fertility rate

- ADF:

-

Augmented Dickey–Fuller

- FMOLS:

-

Fully modified ordinary least square

- MS-ECM:

-

Markov switching equilibrium correction model

- AIC:

-

Akaike information criteria

- EKC:

-

Environment Kuznets curve

References

Abbas, S., et al. (2020). Impact assessment of socioeconomic factors on dimensions of environmental degradation in Pakistan. SN Applied Sciences, 2(3), 1–16.

Ahmed, Z., et al. (2021). Linking economic globalization, economic growth, financial development, and ecological footprint: Evidence from symmetric and asymmetric ARDL. Ecological Indicators, 121, 107060.

Ali, H. S., et al. (2016). Dynamic impact of urbanization, economic growth, energy consumption, and trade openness on CO2 emissions in Nigeria. Environmental Science and Pollution Research, 23(12), 12435–12443.

Ali, H. S., et al. (2019). Financial development and carbon dioxide emissions in Nigeria: Evidence from the ARDL bounds approach. GeoJournal, 84(3), 641–655.

Al-Mulali, U., & Che Sab, C. N. B. (2018). Electricity consumption, CO2 emission, and economic growth in the Middle East. Energy Sources, Part B: Economics, Planning, and Policy, 13(5), 257–263.

Al-Mulali, U., et al. (2015). Investigating the environmental Kuznets curve (EKC) hypothesis by utilizing the ecological footprint as an indicator of environmental degradation. Ecological Indicators, 48, 315–323.

Al-Mulali, U., et al. (2016). Investigating the presence of the environmental Kuznets curve (EKC) hypothesis in Kenya: An autoregressive distributed lag (ARDL) approach. Natural Hazards, 80(3), 1729–1747.

Alola, A. A., et al. (2019). Dynamic impact of trade policy, economic growth, fertility rate, renewable and non-renewable energy consumption on ecological footprint in Europe. Science of the Total Environment, 685, 702–709.

Amri, F. (2018). Carbon dioxide emissions, total factor productivity, ICT, trade, financial development, and energy consumption: Testing environmental Kuznets curve hypothesis for Tunisia. Environmental Science and Pollution Research, 25(33), 33691–33701.

Ansari, M. A., et al. (2020). Environmental Kuznets curve revisited: An analysis using ecological and material footprint. Ecological Indicators, 115, 106416.

Apergis, N. (2016). Environmental Kuznets curves: New evidence on both panel and country-level CO2 emissions. Energy Economics, 54, 263–271.

Apergis, N., et al. (2017). Are there environmental Kuznets curves for US state-level CO2 emissions? Renewable and Sustainable Energy Reviews, 69, 551–558.

Aslan, A., et al. (2018). Bootstrap rolling window estimation approach to analysis of the environment Kuznets curve hypothesis: Evidence from the USA. Environmental Science and Pollution Research, 25(3), 2402–2408.

Assembly, U. G. (2015). The 2030 agenda for sustainable development. Middlesbrough, UK: Resolution.

Association, W. N. (2014). “Climate change-the science.”

Aung, T. S., et al. (2017). Economic growth and environmental pollution in Myanmar: An analysis of environmental Kuznets curve. Environmental Science and Pollution Research, 24(25), 20487–20501.

Balado-Naves, R., et al. (2018). Do countries influence neighbouring pollution? A spatial analysis of the EKC for CO2 emissions. Energy Policy, 123, 266–279.

Balsalobre-Lorente, D., et al. (2018). How economic growth, renewable electricity and natural resources contribute to CO2 emissions? Energy Policy, 113, 356–367.

Banerjee, A., et al. (1998). Error-correction mechanism tests for cointegration in a single-equation framework. Journal of Time Series Analysis, 19(3), 267–283.

Bayer, C., & Hanck, C. (2013). Combining non-cointegration tests. Journal of Time Series Analysis, 34(1), 83–95.

Belaid, F., & Youssef, M. (2017). Environmental degradation, renewable and non-renewable electricity consumption, and economic growth: Assessing the evidence from Algeria. Energy Policy, 102, 277–287.

Bello, M. O., et al. (2018). The impact of electricity consumption on CO2 emission, carbon footprint, water footprint and ecological footprint: The role of hydropower in an emerging economy. Journal of Environmental Management, 219, 218–230.

Boonyasana, K. (2013). World electricity co-operation. University of Leicester.

Boswijk, H. P. (1995). Efficient inference on cointegration parameters in structural error correction models. Journal of Econometrics, 69(1), 133–158.

Bulut, U. (2021). Environmental sustainability in Turkey: An environmental Kuznets curve estimation for ecological footprint. International Journal of Sustainable Development and World Ecology, 28(3), 227–237.

Bulut, U. (2020). “Environmental sustainability in Turkey: An environmental Kuznets curve estimation for ecological footprint.” International Journal of Sustainable Development and World Ecology, 1–11.

Caglar, A. E., et al. (2021). The ecological footprint facing asymmetric natural resources challenges: Evidence from the USA. Environmental Science and Pollution Research. https://doi.org/10.1007/s11356-021-16406-9

Carrion-i-Silvestre, J. L., & Sansó, A. (2006). Testing the null of cointegration with structural breaks. Oxford Bulletin of Economics and Statistics, 68(5), 623–646.

Cetin, M. A., & Bakirtas, I. (2020). The long-run environmental impacts of economic growth, financial development, and energy consumption: Evidence from emerging markets. Energy and Environment, 31(4), 634–655.

Charfeddine, L. (2017). The impact of energy consumption and economic development on ecological footprint and CO2 emissions: Evidence from a markov switching equilibrium correction model. Energy Economics, 65, 355–374.

Charfeddine, L., & Khediri, K. B. (2016). Financial development and environmental quality in UAE: Cointegration with structural breaks. Renewable and Sustainable Energy Reviews, 55, 1322–1335.

Charfeddine, L., & Mrabet, Z. (2017). The impact of economic development and social-political factors on ecological footprint: A panel data analysis for 15 MENA countries. Renewable and Sustainable Energy Reviews, 76, 138–154.

Charfeddine, L., et al. (2017). The impact of economic development and social-political factors on ecological footprint: A panel data analysis for 15 MENA countries. Renewable and Sustainable Energy Reviews, 76, 138–154.

Chen, Y., et al. (2019). CO2 emissions, economic growth, renewable and non-renewable energy production and foreign trade in China. Renewable Energy, 131, 208–216.

Cheng, C., et al. (2019). Heterogeneous impacts of renewable energy and environmental patents on CO2 emission-Evidence from the BRIICS. Science of the Total Environment, 668, 1328–1338.

Dasgupta, S., et al. (2001). Pollution and capital markets in developing countries. Journal of Environmental Economics and Management, 42(3), 310–335.

Destek, M. A., & Sarkodie, S. A. (2019). Investigation of environmental Kuznets curve for ecological footprint: The role of energy and financial development. Science of the Total Environment, 650, 2483–2489.

Destek, M. A., et al. (2018). Analyzing the environmental Kuznets curve for the EU countries: The role of ecological footprint. Environmental Science and Pollution Research, 25(29), 29387–29396.

Dickey, D. A., & Fuller, W. A. (1979). Distribution of the estimators for autoregressive time series with a unit root. Journal of the American Statistical Association, 74(366a), 427–431.

Dogan, E., & Seker, F. (2016). The influence of real output, renewable and non-renewable energy, trade and financial development on carbon emissions in the top renewable energy countries. Renewable and Sustainable Energy Reviews, 60, 1074–1085.

Dogan, E., & Turkekul, B. (2016). CO2 emissions, real output, energy consumption, trade, urbanization and financial development: Testing the EKC hypothesis for the USA. Environmental Science and Pollution Research, 23(2), 1203–1213.

Dong, K., et al. (2017). Impact of natural gas consumption on CO2 emissions: Panel data evidence from China’s provinces. Journal of Cleaner Production, 162, 400–410.

Dong, K., et al. (2018). Does natural gas consumption mitigate CO2 emissions: Testing the environmental Kuznets curve hypothesis for 14 Asia-Pacific countries. Renewable and Sustainable Energy Reviews, 94, 419–429.

Ehigiamusoe, K. U., & Lean, H. H. (2019). Effects of energy consumption, economic growth, and financial development on carbon emissions: Evidence from heterogeneous income groups. Environmental Science and Pollution Research, 26(22), 22611–22624.

Engle, R. F., & Granger, C. W. (1987). Co-integration and error correction: representation, estimation, and testing. Econometrica: Journal of the Econometric Society, 55(2), 251–276.

Fakher, H.-A. (2019). Investigating the determinant factors of environmental quality (based on ecological carbon footprint index). Environmental Science and Pollution Research, 26(10), 10276–10291.

Farhangi, H. (2009). The path of the smart grid. IEEE Power and Energy Magazine, 8(1), 18–28.

Fethi, S., & Senyucel, E. (2020). The role of tourism development on CO2 emission reduction in an extended version of the environmental Kuznets curve: Evidence from top 50 tourist destination countries. Environment, Development and Sustainability, 23(2), 1499–1524.

Genç, M. C., et al. (2021). The impact of output volatility on CO2 emissions in Turkey: testing EKC hypothesis with Fourier stationarity test. Environmental Science and Pollution Research. https://doi.org/10.1007/s11356-021-15448-3

Gregory, A. W., & Hansen, B. E. (1996). Residual-based tests for cointegration in models with regime shifts. Journal of Econometrics, 70(1), 99–126.

Grossman, G., & Krueger, A. (1995). Economic growth and the environment. Quarterly Journal of Economics, 110(2), 353–377.

Hao, Y., et al. (2018). Re-examine environmental Kuznets curve in China: Spatial estimations using environmental quality index. Sustainable Cities and Society, 42, 498–511.

Holbrook, N. J., & Johnson, J. E. (2014). Climate change impacts and adaptation of commercial marine fisheries in Australia: A review of the science. Climatic Change, 124(4), 703–715.

Hussain, H. I., et al. (2021). The role of globalization, economic growth and natural resources on the ecological footprint in Thailand: Evidence from nonlinear causal estimations. Processes, 9(7), 1103.

Irena, I. (2016). Renewable energy in cities. Abu Dhabi, UAE: International Renewable Agency.

Işık, C., et al. (2019). Testing the EKC hypothesis for ten US states: An application of heterogeneous panel estimation method. Environmental Science and Pollution Research, 26(11), 10846–10853.

Jiang, Q., et al. (2021). Measuring the simultaneous effects of electricity consumption and production on carbon dioxide emissions (CO2e) in China: New evidence from an EKC-based assessment. Energy, 229, 120616.

Johansen, S. (1991). Estimation and hypothesis testing of cointegration vectors in Gaussian vector autoregressive models. Econometrica: Journal of the Econometric Society. https://doi.org/10.2307/2938278

Jun, W., et al. (2021). Does globalization matter for environmental degradation? Nexus among energy consumption, economic growth, and carbon dioxide emission. Energy Policy, 153, 112230.

Kahouli, B. (2018). The causality link between energy electricity consumption, CO2 emissions, R&D stocks and economic growth in Mediterranean countries (MCs). Energy, 145, 388–399.

Kang, Y.-Q., et al. (2016). Environmental Kuznets curve for CO2 emissions in China: A spatial panel data approach. Ecological Indicators, 63, 231–239.

Katircioglu, S., et al. (2018). Testing the role of tourism development in ecological footprint quality: Evidence from top 10 tourist destinations. Environmental Science and Pollution Research, 25(33), 33611–33619.

Khan, A., et al. (2019). Does energy consumption, financial development, and investment contribute to ecological footprints in BRI regions? Environmental Science and Pollution Research, 26(36), 36952–36966.

Kim, G., et al. (2020). Does biomass energy consumption reduce total energy CO2 emissions in the US? Journal of Policy Modeling., 42(5), 953–967.

Lee, C.-C., & Chen, M.-P. (2021). Ecological footprint, tourism development, and country risk: international evidence. Journal of Cleaner Production, 279, 123671.

Li, F., et al. (2016). Is there an inverted U-shaped curve? Empirical analysis of the environmental Kuznets curve in agrochemicals. Frontiers of Environmental Science and Engineering, 10(2), 276–287.

Lütkepohl, H. (2006). Structural vector autoregressive analysis for cointegrated variables. Allgemeines Statistisches Archiv, 90(1), 75–88.

McGee, J. A., & York, R. (2018). Asymmetric relationship of urbanization and CO2 emissions in less developed countries. PLoS One, 13(12), e0208388.

Mrabet, Z., & Alsamara, M. (2017). Testing the kuznets curve hypothesis for qatar: A comparison between carbon dioxide and ecological footprint. Renewable and Sustainable Energy Reviews, 70, 1366–1375.

Murshed, M., et al. (2020). Value addition in the services sector and its heterogeneous impacts on CO 2 emissions: revisiting the EKC hypothesis for the OPEC using panel spatial estimation techniques. Environmental Science and Pollution Research, 27(31), 38951–38973.

Mutisya, E., & Yarime, M. (2014). Moving towards urban sustainability in Kenya: A framework for integration of environmental, economic, social and governance dimensions. Sustainability Science, 9(2), 205–215.

Nathaniel, S., & Khan, S. A. R. (2020). The nexus between urbanization, renewable energy, trade, and ecological footprint in ASEAN countries. Journal of Cleaner Production, 272, 122709.

Ng, C.-F., et al. (2020). Environmental Kuznets curve hypothesis: Asymmetry analysis and robust estimation under cross-section dependence. Environmental Science and Pollution Research, 27(15), 18685–18698.

Omoju, O. (2014). Environmental pollution is inevitable in developing countries. Breaking Media.

Omoju, O. E., & Abraham, T. W. (2014). Youth bulge and demographic dividend in Nigeria. African Population Studies, 27(2), 352–360.

Ozatac, N., et al. (2017). Testing the EKC hypothesis by considering trade openness, urbanization, and financial development: The case of Turkey. Environmental Science and Pollution Research, 24(20), 16690–16701.

Pata, U. K. (2018). Renewable energy consumption, urbanization, financial development, income and CO2 emissions in Turkey: Testing EKC hypothesis with structural breaks. Journal of Cleaner Production, 187, 770–779.

Pata, U. K., & Aydin, M. (2020). Testing the EKC hypothesis for the top six hydropower energy-consuming countries: Evidence from Fourier Bootstrap ARDL procedure. Journal of Cleaner Production, 264, 121699.

Pedroni, P. (2000). Fully modified OLS for heterogeneous cointegrated panels. Advances in Econometrics, 15, 93–130.

Rahman, M. M. (2020). Environmental degradation: The role of electricity consumption, economic growth and globalisation. Journal of environmental management, 253, 109742.

Rees, W. E. (1992). Ecological footprints and appropriated carrying capacity: What urban economics leaves out. Environment and Urbanization, 4(2), 121–130.

Sabir, S., & Gorus, M. S. (2019). The impact of globalization on ecological footprint: Empirical evidence from the South Asian countries. Environmental Science and Pollution Research, 26(32), 33387–33398.

Saint Akadiri, S., et al. (2020). The role of electricity consumption, globalization and economic growth in carbon dioxide emissions and its implications for environmental sustainability targets. Science of the Total Environment, 708, 134653.

Sarwar, S., et al. (2019). Economic and non-economic sector reforms in carbon mitigation: Empirical evidence from Chinese provinces. Structural Change and Economic Dynamics, 49, 146–154.

Saud, S., et al. (2020). The role of financial development and globalization in the environment: Accounting ecological footprint indicators for selected one-belt-one-road initiative countries. Journal of Cleaner Production, 250, 119518.

Shah, S. A. R., et al. (2020). Exploring the linkage among energy intensity, carbon emission and urbanization in Pakistan: Fresh evidence from ecological modernization and environment transition theories. Environmental Science and Pollution Research. https://doi.org/10.1007/s11356-020-09227-9

Shah, S. A. R., et al. (2020). Exploring the linkage among energy intensity, carbon emission and urbanization in Pakistan: Fresh evidence from ecological modernization and environment transition theories. Environmental Science and Pollution Research, 27(32), 40907–40929.

Shah, S. A. R., et al. (2020). Nexus of biomass energy, key determinants of economic development and environment: A fresh evidence from Asia. Renewable and Sustainable Energy Reviews, 133, 110244.

Shah, S. A. R., et al. (2021). Associating drivers of economic development with environmental degradation: Fresh evidence from Western Asia and North African region. Ecological Indicators, 126, 107638.

Shahbaz, M., & Sinha, A. (2019). Environmental Kuznets curve for CO2 emissions: a literature survey. Journal of Economic Studies, 46(1), 106–168.

Shahbaz, M., et al. (2012). Environmental Kuznets curve hypothesis in Pakistan: Cointegration and Granger causality. Renewable and Sustainable Energy Reviews, 16(5), 2947–2953.

Shahbaz, M., et al. (2017). The CO2–growth nexus revisited: A nonparametric analysis for the G7 economies over nearly two centuries. Energy Economics, 65, 183–193.

Shahbaz, M., et al. (2019). Testing the globalization-driven carbon emissions hypothesis: International evidence. International Economics, 158, 25–38.

Sharif, A., et al. (2020). Revisiting the role of renewable and non-renewable energy consumption on Turkey’s ecological footprint: Evidence from quantile ARDL approach. Sustainable Cities and Society, 57, 102138.

Shen, J., Wei, Y. D., & Yang, Z. (2017). The impact of environmental regulations on the location of pollution-intensive industries in China. Journal of Cleaner Production, 148, 785–794.

Sinha, A., & Shahbaz, M. (2018). Estimation of environmental Kuznets curve for CO2 emission: Role of renewable energy generation in India. Renewable Energy, 119, 703–711.

Solarin, S. A., et al. (2017). Validating the environmental Kuznets curve hypothesis in India and China: The role of hydroelectricity consumption. Renewable and Sustainable Energy Reviews, 80, 1578–1587.

Stern, D. I. (2014). The environmental Kuznets curve: A primer. SSRN Electronic Journal. https://doi.org/10.2139/ssrn.2737634

Strbac, G. (2008). Demand side management: Benefits and challenges. Energy Policy, 36(12), 4419–4426.

Tamazian, A., et al. (2009). Does higher economic and financial development lead to environmental degradation: Evidence from BRIC countries. Energy Policy, 37(1), 246–253.

Tenaw, D., & Beyene, A. D. (2021). Environmental sustainability and economic development in sub-Saharan Africa: A modified EKC hypothesis. Renewable and Sustainable Energy Reviews, 143, 110897.

Ulucak, R., & Khan, S.U.-D. (2020). Determinants of the ecological footprint: Role of renewable energy, natural resources, and urbanization. Sustainable Cities and Society, 54, 101996.

Usman, O., et al. (2019). Revisiting the environmental Kuznets curve (EKC) hypothesis in India: The effects of energy consumption and democracy. Environmental Science and Pollution Research, 26(13), 13390–13400.

Wang, Q., & Li, L. (2021). The effects of population aging, life expectancy, unemployment rate, population density, per capita GDP, urbanization on per capita carbon emissions. Sustainable Production and Consumption, 28, 760–774.

Zafar, M. W., et al. (2019). The impact of globalization and financial development on environmental quality: Evidence from selected countries in the organization for economic co-operation and development (OECD). Environmental Science and Pollution Research, 26(13), 13246–13262.

Zhang, B., et al. (2017). Role of renewable energy and non-renewable energy consumption on EKC: Evidence from Pakistan. Journal of Cleaner Production, 156, 855–864.

Zhang, Y., et al. (2019). The environmental Kuznets curve of CO2 emissions in the manufacturing and construction industries: A global empirical analysis. Environmental Impact Assessment Review, 79, 106303.

Zivot, E., & Andrews, D. W. K. (2002). Further evidence on the great crash, the oil-price shock, and the unit-root hypothesis. Journal of Business and Economic Statistics, 20(1), 25–44.

Author information

Authors and Affiliations

Corresponding author

Additional information

Publisher's Note

Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

Rights and permissions

About this article

Cite this article

Shah, S.A.R., Naqvi, S.A.A., Anwar, S. et al. Socio-economic impact assessment of environmental degradation in Pakistan: fresh evidence from the Markov switching equilibrium correction model. Environ Dev Sustain 24, 13786–13816 (2022). https://doi.org/10.1007/s10668-021-02013-8

Received:

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s10668-021-02013-8