Abstract

This purpose of the research is to determine the financial expansion index effect on renewable electricity production for Brazil, Russia, India, China, and South Africa (BRICS countries) from 1995 to 2015. Principal component analysis is applied to generate a bank-based and stock market-based index of financial expansion. The article uses three recently developed estimators, namely Mean Group, Augmented Mean Group, and Common Correlated Effects Mean Group Estimators. The empirical results showed that there is no evidence of inverse U-shaped impacts of financial expansion index on renewable electricity production. The results demonstrate that the financial expansion index has a positive influence on renewable electricity production in total, including and excluding the hydroelectricity for the panel of BRICS countries; a larger effect was observed when non-hydropower renewable electricity was considered. The Dumitrescu–Hurlin (DH) causality test outcomes represent that there are one-way causalities running from the financial expansion index to hydroelectricity and the financial expansion index to the production of sustainable electricity in total. Therefore, the production of renewable electricity in total and hydroelectricity are driven by financial expansion. However, there is a one-way causation moving from the production of renewable electricity from non-hydropower to financial expansion, which shows that the latter is driven by an increase in renewable non-hydroelectricity. Policy implications are provided at the end of this study.

Similar content being viewed by others

Avoid common mistakes on your manuscript.

1 Introduction

There is a vast amount of literature that has examined the association between financial expansion and energy demand (Sadorsky 2010; Coban and Topcu 2013); however, the effect of financial expansion on renewable electricity production (hydropower, wind energy, solar power, biomass power, geothermal power, marine power, etc.) is an area that has not received sufficient consideration in the literature.

Financial expansion plays an important role as it can raise the effectiveness of the financial system of a region and the demand for renewable electricity. It allows for the promotion of activities such as raising the banking transactions or raising stock market expansion. If it is found that financial expansion affects the production of renewable electricity, then it becomes important for energy policy planning and strategies for carbon emissions.

Financial expansion is also important for the economy due to various reasons: It reduces the financial exposure and the credit cost; it contributes to greater clarity among lenders and borrowers, higher capital; and the possibility to access energy-efficient technologies and cutting-edge products, which might increase the energy demand through increased consumption. Individual investors and businesses can also benefit from improved financial expansion because it provides less costly access to capital.

Being a component of financial expansion, the stock market is an important economic indicator and it can be employed as a signal of the expansion of the economy as well as the economic confidence of both individual investors and businesses. This confidence might lead to expanded demand for renewable electricity products. The stock market expansion brings benefits for businesses because it provides entry to another origin of funding, namely equity, and it can be employed to expand the business. The stock market expansion also raises the risk of diversity for both individual investors and businesses; it is an essential factor for achieving prosperity throughout the whole economy.

On the other hand, financing of renewable energy has emerged very rapidly. Sustainable power installations in 2012 outstripped non-renewables, and it represented approximately 60% of the new global power-producing capacity in 2016 (IRENA 2017a). Similarly, renewable power technologies in 2015 brought more funds than non-sustainable ones (Buchner et al. 2017).

The BRICS region has a powerful effect on regional and global affairs. All BRICS members are representatives of the G20 and they have a total populace of over 3 billion, which accounts for 40% of the world’s populace. Moreover, according to the International Monetary Fund (IMF), these countries’ nominal GDP is US$18.6 trillion, which represents about 23.2% of the gross world product.

As demonstrated in Fig. 1 and Table 1, the conventional electricity production in the BRICS countries, which is mainly generated from large coal-fired and nuclear-powered generating facilities, is very high. For example, in total, the BRICS countries generated 37.44% of the total world electricity production (BP World energy statistical review 2018). The highest amount of electricity was generated by China with 24% and the lowest by South Africa with 1% in 2015.

However, when the total renewable energy capacity in the BRICS region is analyzed, as illustrated in Fig. 2 and Table 2, it is found that the BRICS countries contribute 39.22% of the total world capacity of renewable energy. Once again, China is the highest capacity country for renewable energy with almost 26% and South Africa has the lowest with 0.19%.

Renewable electricity is an important source of energy since it decreases the inefficient consumption of fuel. Renewable electricity can reduce the intensity of carbon emissions by almost 90%. In this respect, it is significant to underline that one of the major goals of the Paris Agreement (IRENA 2017b) was to set the limit for the increase in average temperatures to “less than 2 °C” and an optimal goal of 1.5 °C. It was reported by the IRENA (2017) that to meet the objectives of the Paris Agreement, it would be necessary to raise energy efficiency and the electrification pathway for all sectors along with increase in the percentage of renewables in the total energy production. Therefore, the proportion of sustainable energy in the power sector should raise to 86% by 2050.

This research aims to test the relation between financial expansion and sustainable electricity production for the BRICS region for the span of 1995–2015. The BRICS case is an important and attractive setting to investigate as they represent different degrees of production of renewable electricity and financial expansion. Furthermore, the Renewable Energy Attractiveness Index (2019) showed that China and India occupy 1st and 3rd positions, respectively.

This article’s contribution to the existing literature can be listed as the following:

-

1.

The majority of papers have focused on the combination of financial expansion and the consumption of energy, whereas this research tries to increase awareness of the financial expansion impact on the production of renewable electricity. It is essential to increase the usage of renewable electricity to deal with environmental issues.

-

2.

This study included GDP and the square of GDP to test whether there is an inverted U-shaped relation between renewable electricity production in total, excluding and including hydroelectricity.

-

3.

This study combines seven indicators of bank performance and stock market performance to create a financial expansion index to study the financial industry's effect on the production of renewable electricity.

-

4.

Moreover, previous studies have considered renewable electricity including hydroelectricity, which might lead to misleading results. We have examined the effect of financial expansion on renewable electricity production in total, both including and excluding hydroelectricity.

-

5.

The findings of previous studies were inconclusive regarding the direction of the association between financial expansion and renewable electricity production. This research uses the Dumitrescu–Hurlin causality to find the causation direction among the series, not only for renewable electricity in total but also including and excluding hydroelectricity.

-

6.

We also concentrated on the production of renewable electricity and financial index by using a sample of BRICS countries, as well as by examining the relationship using second-generation tests, particularly Augmented Mean Group estimator (AMG) (Eberhardt and Teal 2010, 2011) Common Correlated Effects Mean Group (CCEMG) (Pesaran 2006; Kapetanios et al. 2011), and the Dumitrescu–Hurlin causality test.

The initial tests are important because macroeconomic series income and financial expansion might have endogeneity issues (Shahbaz et al. 2013), while they were also justified by recent diagnostic tests. The justification for using AMG and CCEMG is that they have several advantages over the other traditional tests; they do not consider cross-sectional dependence and problems of heterogeneity. The CCEMG method considers the existence of an unobserved common factor, and it includes dependent and independent series cross-sectional averages. Both approaches are robust to non-stationarity, structural breaks, serial correlation, and deal with cross-sectional correlation.

The remaining part of the research is structured as follows: Section 2 is a detailed literature review on financial expansion and the demand for conventional and sustainable energy; Sect. 3 covers the data, model, and the methodology that is employed throughout the research. The results are considered in Sect. 4, and Sect. 5 is the conclusion.

2 Literature review

Numerous studies exist on the relation between financial expansion and energy utilization. All these studies have demonstrated the nature of the financial expansion variables’ influence on the need for energy. Most of them also have shown that in both developing and developed countries, financial expansion positively affects energy demand.

In terms of developing regions in the Middle East and Africa, Al-Mulali and Sab (2012) considered the effect of the use of power and CO2 emissions on GDP and financial advancement in 30 Sub-Saharan African Countries. Both cointegration and causality panel tests were used for the period from 1980 to 2008. The findings indicated that the consumption of energy increased both GDP and financial expansion, but it damaged the environment. They stated that it is crucial to raise the efficiency of energy and power infrastructure outsourcing to obtain the desired financial expansion.

Aslan et al. (2014) investigated seven Middle Eastern regions for the period from 1980–2011 by employing FMOLS and causality tests. Their findings were that bank expansion positively impacted the use of energy and a bidirectional feedback association was found. The authors stated that since bank expansion affects energy use, especially in the long-term, policymakers should advance the efficiency of energy in these countries by including the bank expansion factor.

Sadorsky (2010) used the GMM technique to estimate the relationships among financial expansion and energy utilization by employing data from 22 emerging regions for the period from 1990 to 2006. He found the existence of a positive and significant association among stock market expansion and the consumption of energy. He stated that emerging markets that remain to advance their stock markets will have a higher demand for energy, which is related to increases in income. Therefore, he indicated that emerging economies’ energy demand projects should include stock market expansion variables in order not to underestimate their energy demands.

Islam et al. (2013) tested the consumption of energy, financial improvement, and population in Malaysia for the period of 1971–2009 by using the vector error correction model (VECM) and ARDL test. The researchers stated that energy utilization is influenced by economic expansion and financial expansion; financial expansion increases the consumption of energy. It was stated that loans will trigger a rise in energy demand.

Samour et al. (2019) tested the influence of the banking sector expansion on the emissions of Turkey during the 1980–2014 period by applying ARDL, FMOLS, and CCR techniques. Their findings stated that bank expansion could lead to an increase in the utilization of energy; therefore, it raises emission.

Xu et al. (2018) assessed the effect of financial expansion on energy utilization for the N-11 countries. They used dynamic seemingly unrelated regression (DSUR) and DH causality tests for the time of 1990–2014. Their findings suggested that financial expansion stimulates the utilization of energy. They also inferred that the authorities to establish projects that are energy efficient should assure the introduction of borrowings with low-interest rates.

Ziaei (2015) also investigated the impact of credit and stock market shocks on the use of energy and CO2. The panel vector autoregression (PVAR) approach was used to test the association for the group of European, East Asian, and Oceania economies for the period of 1989 to 2011. It was found that the effect of energy utilization and CO2 shocks on private sector credit was not very significant for all the regions, but the effect of the use of power shock on stock returns in European regions was higher in comparison with East Asian and Oceania regions.

Sadorsky (2011) also investigated the relationship among financial expansion and energy utilization for nine frontier markets for the period of 1996–2006 by using the GMM model. The author found the existence of a positive and statistically significant association between bank expansion and the use of energy. Furthermore, it was also found that Central and Eastern European countries that forecast the need for energy without including financial expansion variables might underestimate the real energy demand.

The demand for energy for financial expansion is also evidenced in the comparatively richer and more developed countries. For instance, Furuoka (2015) investigated the association among financial advancement and energy utilization in Asia from 1980 to 2012 by employing the DH test of causality. The causality test showed one-way causation from energy utilization to financial advancement. These findings implied that an increase in the usage of power could become a leading force for financial progress in Asia. They stated that a stable supply of energy is a crucial factor for attracting investors to the sector of finance and enhancing the supply of energy is essential for financial expansion in Asia.

Similarly, Coban and Topcu (2013) tested the association among financial improvement and energy utilization in the European Union (EU) for the period 1990–2011 by employing the GMM approach. They demonstrated the effect of financial expansion on the consumption of energy among the founding members of the EU. Their findings indicated that improvements in the banking and stock market sectors increased the use of energy.

Balsalobre-Lorente et al. (2019) investigated the association among carbon emissions, the use of energy, the openness of trade, and mobile use during the 1990 to 2014 period by employing DOLS (dynamic ordinary least squares) and FMOLS (fully modified ordinary least squares) techniques. It was found that the consumption of the electricity made an unfriendly influence on emissions, and it was recommended to raise foreign investment in high tech.

Adedoyin et al. (2020) tested the association between the expansion of the economy, emissions, coal rents, and regulatory quality for the BRICS region for the period 1990 to 2014. It was found that regulations on coal rents as the costs of the damage of the carbon costs make a significant and positive influence on emissions. It was suggested to reduce the emissions’ level was crucial to include stringent environment energy regulations and the necessity to BRICS to shift to sustainable energy sources.

The other strand of researchers found mixed results and a negative association between consumption of energy and financial expansion. Yue et al. (2019) examined data for 21 transitional regions for the span of 2006–2015 by employing Panel Smooth Transition Regression (PSTR) and Fixed Effect models. They also proposed that the ratio of financial systems deposits to GDP positively influenced the consumption of energy in all the studied countries, while stock market expansion only decreased the use of energy in China and Poland. This article demonstrated that an advanced stock market will decline the consumption of energy. Stock market expansion lowers costs of borrowing and costs of financing, and there is more capital to use for energy-saving technologies. Thus, the authors stated that transitional economies should pay more attention to stock market expansion to lower the use of energy.

Ahmad et al. (2019) studied the impact mechanisms between the consumption of energy, financial expansion, expansion of the economy, and climate for Chinese provinces from 1997 to 2016 by using the augmented growth model. Their findings indicated that financial expansion based on the banking sector increases energy utilization, and financial expansion based on the stock market decreases the utilization of energy and improves the quality of the environment.

In terms of comparative studies between developing and developed countries, Chang (2015) studied the financial advancement impact on energy utilization where private loans, host credit, traded stocks’ value, and turnover of the stock market represented financial advancement for 53 countries for the time of 1999–2008, by employing a panel threshold model. He found different results such as that in non-high-income countries, the energy utilization increased with private and domestic credits. The value of traded stocks and turnover of the stock market slightly declined the use of energy in high-income economies.

Assi et al. (2020) explored the interconnection between financial expansion, economic freedom, and the consumption of gasoline for twenty-eight states during 1996–2017. The ARDL and Dumitrescu–Hurlin panel causality techniques were used. The outcomes presented that financial advancement reduced the consumption of gasoline; thus, these states advised to reinforce financial advancement to achieve green innovations.

Topcu and Payne (2017) evaluated the impact of financial advancement on the use of energy for 32 high-income countries for 1990–2014. Their research incorporated the equity market, the banking division, and the bond sector to define financial expansion, and heterogeneity panel estimation techniques were applied. The results showed that there were no statistically significant relationships among the overall financial expansion and energy utilization. The authors found that an expansion in the stock index led to a slight decrease in energy utilization.

Similarly, Ouyang and Li (2018) tested the relation among financial advancement, energy utilization, and expansion of the economy in China by employing the GMM panel VAR method for the period 1996Q1–2015Q4. They stated that financial advancement could significantly lessen the use of energy for all regions of China.

Another strand of research tested the relation between renewable energy and financial expansion. Most of the researchers found that financial expansion positively affects renewable energy. In terms of the BRICS countries, Eren et al. (2019) studied the financial expansion effect and the expansion of the economy on the use of sustainable energy in India for the period 1971–2015 by employing the Maki (2012) and dynamic ordinary least squares (DOLS) techniques. Their findings stated that the expansion of the economy and financial expansion had an affirmative and significant effect on the use of sustainable energy. The Granger causality approach suggested that renewable energy utilization and expansion of the economy are driven by financial improvement. They suggested that financial markets should be the main driver for the use of renewable energy.

Anton and Nucu (2020) studied the financial expansion effect on the use of renewable energy for European Union members from 1990 to 2015 by using fixed-effect models. They found that the bond market, banking sector, and capital market positively affected the renewable energy share. However, they found that the improvement of the capital market had no significant effect on renewable energy.

Wu and Broadstock (2015) studied 22 emerging countries from 1990 to 2010 and found that financial expansion and the quality of institutions had an affirmative effect on the utilization of sustainable energy. Best (2017) employed 137 countries’ data for the time of 1998–2013 and found that financial capital bank credits and domestic securities from domestic private debt had an affirmative impact on the utilization of sustainable energy.

Kutan et al. (2017) tested the equity market expansion impact on the consumption of renewable energy for the BRICS region for the span of 1990–2012 by using fully modified ordinary least squares. They stated that stock market expansion is an essential driver of sustainable energy.

Brunnschweiler (2010) studied the financial sector expansion effect on sustainable energy resources for the panel of 119 non-OECD regions for the span of 1980–2006 by using the GMM technique. They stated that banking had an affirmative effect on the produced RE, and the effect was larger when non-hydro power RE was considered.

Liddle and Sadorsky (2017) used a dataset of 93 countries and applied AMG and CCEMG estimators to test the association between the consumption of non-fossil electricity and CO2 emissions. They found that electricity generated from non-fossil fuels decreases CO2 emissions, and this effect is higher for the non-OECD region than for the OECD region.

Burakov and Freidun (2017) tested the causality among financial expansion, expansion of the economy, and sustainable energy for the span of 1990–2014 and used the vector error correction (VEC) model. They found that there was no causal relation between financial expansion and sustainable energy for Russia.

The expenditure for renewable electricity is greater in comparison with the traditional sources of energy, and greater use of financial instruments (borrowing and equity) is detrimental for the expansion of this sector. The expectation is that there is a positive relation among financial expansion index and the production of renewable electricity. Therefore, we test the following hypothesis:

Hypothesis

There is a positive association among the financial expansion index and sustainable electricity production.

3 Data and analysis

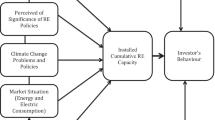

The structure for the methodology used for this research is presented in Fig. 3:

4 Methodology and data

In this study, we used the GDP per capita, square of GDP per capita, financial expansion index, and production of renewable electricity variables kWh per capita for the BRICS countries.

We made three different measures of renewable electricity production. The first dependent variable is LREO, which includes all biofuels, solar power, hydropower geothermal, biomass, tides, wind energy, and is measured in kWh per capita; the second one is LHY, which only considers hydroelectric power generation, and is also in kWh per capita; and the third one is LNHY, which takes into account electricity produced from geothermal, solar, tides, wind, biomass, and biofuels, excluding hydroelectricity, is also in kWh per capita. The series included yearly observed data from 1995 to 2015. The beginning and end of the data were selected based on availability. All the series are in logarithm form, so the coefficients show elasticities.

The empirical approach of this research followed the specifications by Adom (2016) and Shahbaz et al. (2013) with some modifications. Renewable electricity production (LREO) in this paper is shown as a linear function of the growth of the economy (LNY), the square of the growth of the economy (LYS), and a vector of financial expansion index (LFD). Equation (1) represents the mathematical association, where \(a\) is the intercept, \({\beta }_{1,}{\beta }_{2,}{\beta }_{3}\) are long-term coefficients, which refer to the period, and \(\mu\) is the stochastic term, which is counted as white noise.

where LREO, LFD, LNY, and LYS represent the natural logarithms of renewable electricity output, natural log of financial expansion index, and the natural log of growth of the economy, respectively. Information on the variables and sources can be found in Table 3.

This study will follow Sadorsky (2010) to create a financial index for the financial expansion variables that comprise the banking field and the equity market.

In the form of panel data, we can express the model as follows:

where

i = 1, 2,3, …N and t = 1, 2,3…T.

\({\text{LREO}}_{it}\) stands for the ith country’s total renewable electricity production at time t,\({\text{LHY}}_{it}\) stands for the ith count’s renewable electricity production from hydroelectricity at time t, \({\text{LNHY}}_{it}\) stands for the ith country’s renewable electricity production at time t from geothermal, solar, tides, wind, biomass, and biofuels, excluding hydroelectricity. \({\text{LNY}}_{t}\) is the BRICS countries real GDP per capita, \({\text{LYS}}_{t}\) is the square of real GDP per capita, and \({\text{LFD}}_{t}\) is the financial expansion index for the ith country and the subscripts t and i represent time and individuals (countries). In Eqs. (2), (3), (4), \({d}_{t}\) represents observed common effects, where \({f}_{t}\) represents unobserved common effects. The cross-sectional dependence is estimated by the existence of the unobserved common aspect effect \(({f}_{t })\), and the effect is different across countries.

It is first assumed that the unexpected shocks have an impact on the cross-sectional units, and secondly, all of them are affected differently. This study follows Sadorsky (2010) to create a financial index for the financial expansion variables that comprise the banking field and the equity market, which consists of seven indexes that are shown in Table 4 which were obtained from Beck et al.(2000).

Therefore, to run principle component analysis (PCA), the factorability of the data should be determined to confirm that FD is suitable (Table 4). For this reason, in this paper, we employ the test of Bartlett (1950) and Kaiser–Meyer–Olkin (KMO) (Kaiser 1970) to evaluate the adequacy of sampling, which examines the appropriateness of the sample size to construct PCA.

KMO and Bartlett's test outcomes are presented in Tables 5, 6. These tests are crucial to confirm the adequacy of the sample. The regular range of KMO is between 0 and 1. To be appropriate for principal component analysis, the KMO should not be less than 0.60 (Kaiser 1970). Also, the corresponding p value of Bartlett's test should not be more than 5 percent to recommend the principal components’ suitability. The KMO result from Table 5 is 0.691, which indicates that the variables’ correlation is strong and shows that the PCA is appropriate since the KMO value is above 0.6. The statistical significance of Bartlett's test outcome is 1%, and it reinforces the KMO results and rejects the null hypothesis suggesting that the correlation matrix is the identity matrix. Thus, the components of financial expansion can be employed in this article to create PCA. The results for the financial expansion index are shown in Tables 5, 6.

4.1 Slope homogeneity tests

When using panel data methods, testing for cross-sectional dependence (CSD) is essential, since ignoring this could lead to over elimination of the null hypothesis of the unit root (O’Connell 1998). If it is not considered, the findings could be misleading. The CSD was tested by Breusch and Pagan (1980), and Pesaran (2004) tests.

Additionally, it was investigated whether the cross-sectional units are heterogeneous, then it is tested by the tests of slope homogeneity such as \(\stackrel{\sim }{\Delta }\) and \({\stackrel{\sim }{\Delta }}_{adj}\) introduced by Pesaran and Yamagata (2008). The authors derived the assessment statistics by introducing the test of Swamy (1970).

The assessment statistic named \(\stackrel{\sim }{\Delta }\) is shown below:

where \(\stackrel{\sim }{S}\) is the Swamy model, \(\stackrel{\sim }{\Delta }\) can represent better characteristics with normally distributed errors as follows:

The null hypothesis is homogeneous slopes, which is checked against the heterogeneous slopes hypothesis.

4.2 Panel cointegration tests

Westerlund (2008) improved the error correction model (ECM) panel cointegration test. It checks whether cointegration does not exist if there is error correction for both individual countries and the whole panel.

The error correction (EC) approach of Westerlund (2008) is shown below:

\(\alpha\) in Eq. 7 represents the error correction parameter, while \(d_{t}\) = (1, t) is the deterministic factors.

Based on the above equation, Westerlund developed four tests, where group mean statistics which are two tests and are shown below:

\(CSE\left({\widehat{\alpha }}_{i}\right)\) represents the conventional standard error for \({\widehat{\alpha }}_{i}\), where \(\left({\widehat{\alpha }}_{i}\right)\) represents the semi-parametric kernel estimator of \({\widehat{\alpha }}_{i}(1)\) and the different assumption of the methods is that the whole panel is cointegrated. Two other tests, which are proposed in the paper, are as follows:

The different assumption of these two methods is that there would be one individual unit that is cointegrated.

4.3 MG, AMG and CCEMG estimators

In this study, the MG, AMG, and CCEMG approaches are employed to assess the model indicated in Eq. (1). Pesaran and Smith (1995) popularized the MG technique. After finding the cointegrating association, the MG approach measures heterogeneous coefficients for every cross section and collects their unweighted averages. However, the MG approach only considers heterogeneous parameters and it does not consider CSD. Therefore, the AMG technique was introduced to consider CSD.

The advantage of AMG is that it takes into account the CSD by combining the “common dynamic effect” (ft) and it is a two-step approach used to obtain a common dynamic effect that is unobserved. As an initial step, the considered regression is augmented with dummies; thus, the time dummies’ coefficients are collected. As a second step, the time dummies’ estimated coefficients replace the unobserved common effect and OLS estimates the individual regressions.

Once the equation is estimated by OLS, (ft) can be substituted by the collected \(\hat{\theta }_{t}\) for every period and the estimates of AMG can be collected by OLS for every cross section.

Thus, the mean group measure is then collected.

\(\widetilde{{B_{i} }}\) is the OLS measure of country-specific coefficients in Eq. (15).

Pesaran (2006) introduced the CCEMG approach, and it was subsequently modified by Kapetanios et al. (2011). The parameter heterogeneity, CSD, and structural breaks are allowed by this estimator. The AMG approach introduced by Eberhardt and Teal (2010, 2011) and Eberhardt and Bond (2009) also take CSD and parameter heterogeneity into account. The difference is the unobserved common factor’s approximation.

To use the CCEMG approach, the CS means of the dependent and independent series are augmented in Eq. (1):

Afterward, every CS is measured by OLS. However, it should be noted that in cases where the residuals have heteroskedasticity and autocorrelation, White (1980) and Newey and West (1987) can be applied instead of using OLS. The CCEMG approach is the arithmetic mean of every coefficient for every regression.

\(\hat{B}_{i}\)’s are estimates of OLS for every country’s coefficient in Eq. (19).

4.4 Dumitrescu–Hurlin Granger causality test

Checking for cointegration only tests the long-run association; however, it does not show the direction of causality between the series. Thus, we employed the Dumitrescu–Hurlin (DH) panel Granger causality (Dumitrescu and Hurlin 2012) to determine the causation between the variables. The basis for this test is the Granger non-causality individual Wald statistics. It is different from the normal Granger causality test in the way it evaluates that coefficients would not be the same between cross sections and takes into account the heterogeneity of the model. The test statistics calculation of this method is appropriate for the small data by employing the simulation of Monte Carlo.

5 Empirical results

The CSD results and slope homogeneity (SH) test outcomes are indicated in Table 1. CDBP and CDLM reject the assumption of cross-sectional independence. Therefore, there is CSD in all the series. The assumption of homogeneity is rejected by the Delta test results, and the units’ coefficients are heterogeneous (Table 7).

Table 8 represents the outcomes of the CADF unit root test. All the outcomes imply that the series are not stationary at level. However, the series are stationary at their first differences, thus they are I(1). Table 9 (A, B, C) represents the outcomes of Westerlund ECM. We used this cointegration test because the variables have CSD. Table 9 (A, B, C) outcomes reinforce the presence of an association between the variables, as they imply the existence of a long-term relation among these series. The values for Gt and Pt, Pa statistics imply that the assumption of no cointegration can be rejected (in the case of renewable electricity including hydroelectricity, Gt and Pa statistics’ values indicate cointegration). Thus, there is a long-term relation among the series.

The outcomes for MG, AMG, and CCEMG are given in Table 10. The growth of the economy has a positive effect and the square of the expansion of the economy asserts a negative impact, although they are insignificant in all the models except MG. The difference in MG and AMG and CCEMG results could be the fact that MG does not consider the CSD. Therefore, these results imply that an inverted U-shaped association among renewable energy in all the cases and growth of the economy does not exist for the panel of BRICS countries. Thus, these results mean that growth of the economy does not contribute to the mitigation of renewable energy after reaching the threshold, and at higher levels of development, the existence of technology and the need to provide sustainable energy to people at a cheaper cost will drive the need to develop the renewable electricity sector.

It is striking that in all three models, the financial expansion index has a positive effect, and in most of them, it is significant. However, the impact of financial expansion is greater when we only look at LNHY—non-hydro electricity production. It can be noted from the results that a 1% increment in the financial expansion index increases the production of renewable electricity from non-hydro resources by 0.29–0.73%. The results reinforce the concept that financial expansion encourages the expansion of the renewable electricity production, especially when the non-hydro resources are used, and these findings are similar to Brunnschweiler (2010) and Anton and Nucu (2020). These results indicate that the financial industry supports the investments in renewable electricity production, and it is also inclined to invest in the renewable sector with increased R&D activities that are related to higher enterprise-wide sustainable-energy resources. Thus, well-developed banks can facilitate lower-cost financing, which provides liquidity and enhances technological innovation in renewable electricity production industries. Also, stock markets can promote efficient business investments and control the risk of renewable electricity projects. Firms and companies have an opportunity to raise funds for technological innovation and clean energy use with higher efficiency and lower borrowing costs if they directly borrow from banks. Therefore, this will reduce problems of asymmetric information, because there will be transparency between borrowers and lenders. Thus, indirect finance in the form of credit from the bank and stock issuance, which are the components of the financial expansion index, have positive and significant effects on the production of renewable electricity in all three models. These findings confirm our hypothesis.

The outcomes of the DH causality tests are given in Table 11 (A, B, C). Unidirectional causalities are running from the expansion of the economy to the financial expansion index in all three models. These results confirm the finding of Apergis and Payne (2012) and Shahbaz et al. (2016). Thus, the increase/decrease in the expansion of the economy will increase/decrease direct and indirect financing. Therefore, the expansion of the economy enlarges the need for investments in clean energy within the BRICS region.

There is one-way causation, which runs from the expansion of the economy to renewable energy in total (LNY → LREO) and from the growth of the economy to hydroelectricity (LNY → LHY). Therefore, any increase in the expansion of the economy would increase the progress of sustainable electricity production in total and hydroelectricity. This implies that countries can achieve sustainable energy resources and raise economic activities while simultaneously protecting the environment. These findings are in line with Dogan (2016) for Turkey.

It is striking that there is one-way causation which runs from financial expansion to hydroelectricity (LFD → LHY) and financial expansion to the production of sustainable electricity in total (LFD → LREO). This is identical to the outcomes of Eren et al. (2019) and Amuakwa-Mensah et al. (2018). It means that the production of renewable electricity in total and hydroelectricity are driven by financial expansion, and financial expansion increases energy efficiency. Therefore, any change in financial expansion will lead to changes in the production of renewable electricity in total and hydroelectricity. Thus, sustainable financial expansion is important for increasing renewable electricity production in total and for hydroelectricity. This result shows that there are significant motivations in the financial markets of the BRICS region to make massive investments in sustainable energy. This case can be elucidated by the sense that the lower production costs and transmission to environmentally favorable sources of energy are important, and financial expansion increases the clean energy investment projects.

Moreover, in the case of electricity produced from non-hydro resources, the causality is running from renewable electricity from non-hydro resources to financial development (LNHY → LFD). Indeed, non-hydro sustainable advancement is taking an essential role. Since 2008, the role of non-hydro sustainable energy has greatly increased. Thus, we must test how well econometric systems can be sustained without hydropower. Also, it is important because hydro-power projects might have negative externalities. Thus, the increase in non-hydro electricity leads to higher financial expansion, implying that the financial expansion is driven by non-hydro electricity. Therefore, the expansion in the degree of non-hydro electricity will drive higher access to indirect financing and equity financing. This unidirectional causation moving from renewable electricity production from non-hydro electricity to the financial expansion index is driven by the increase in renewable energy investments in this sector, which triggers effects throughout the economy. Moreover, a large proportion of the growth of the economy is influenced by the high capital need for renewable electricity investment and some of these investments are financed using bank lending and equity financing. Therefore, we expect a spillover effect from economic growth to financial development through renewable non-hydro electricity for the BRICS region.

6 Conclusion

This study aimed to test the relation among the financial expansion index, expansion of the economy, and sustainable electricity production in total, including and excluding the production of hydroelectricity in the BRICS. region. The panel techniques such as MG, AMG, and CCEMG were used for a panel of BRICS countries employing annual observations from 1995 to 2015. The cointegration of Westerlund test outcomes showed that there is a long-term association among financial expansion index, expansion of the economy, and renewable electricity production in total as well as both including and excluding hydroelectricity.

Long-term elasticities for the panel of BRICS countries indicated that financial expansion positively affects renewable electricity production in all three cases. In particular, it has a greater effect when hydroelectricity is excluded. These results imply that the financial industry supports the investments in renewable electricity production in all three cases, and it is also inclined to invest in the renewable sector with the increased R&D actions that are related to higher sustainable-energy resources. Thus, an expansion in the size of the financial institutions and an expansion in the financial services’ provision increases RE production, while the expansion of the banking division and the equity market in this region increases the confidence of investors, decreases the borrowing cost and cost of financing, and increases the investment project funds related to the production of sustainable electricity.

The results implied that inverted U-shaped associations among renewable energy in all the cases and growth of the economy do not exist for the BRICS region. These results imply that growth of the economy does not contribute to the mitigation of renewable electricity production after reaching the threshold, and at higher levels of development, the existence of technology and the need to provide sustainable energy to people at a cheaper cost will drive the need to develop renewable electricity sector. Additionally, any increase in the expansion of the economy would increase the progress of sustainable electricity production in total as well as hydroelectricity. It implies that countries can achieve sustainable energy resources and raise economic activities while simultaneously preserving the environment.

The DH results show that there is one-way causation, which runs from the financial expansion index to hydroelectricity and the financial expansion index to the production of renewable electricity in total. Therefore, the production of sustainable electricity in total and hydroelectricity are driven by financial expansion. Thus, any change in financial expansion will cause changes in the production of renewable electricity. The positive unidirectional causation moving from renewable electricity production from non-hydro electricity to the financial expansion index is driven by the increase in renewable non-hydro electricity, which increases the effects throughout the economy. The rise in non-hydro electricity leads to higher financial expansion, implying that financial expansion is driven by non-hydro electricity. Therefore, the expansion in the degree of non-hydro electricity will drive higher access to indirect financing and equity financing. Financial expansion is triggered by the capital-intensive nature of the non-hydro renewable energy technologies. Moreover, a large proportion of the growth of the economy is impacted by the huge need for capital for investments in sustainable energy, and the financing of these investments is done by using bank lending and equity financing. Thus, there is a spillover effect from the growth of the economy to financial expansion through renewable non-hydro electricity for the BRICS countries.

Based on these findings, a beneficial method for financing sustainable electricity projects can be achieved by both indirect financings through bank credit and direct financing such as via the issuance of stocks. Renewable electricity projects where financial expansion and the major types of renewable electricity are not considered may undervalue the real need for renewables in the BRICS region.

These empirical findings lead us to several policy implications:

-

To increase the production of sustainable electricity, investors can be granted tax credits during installation and production stages.

-

The imposition of carbon-related taxes on non-renewable energy projects, as well as the exemption of fuels like biomass from taxes will give an advantage to non-hydro electricity production.

-

Financial leasing can be increased. This approach allows corporations to avoid the burden of building infrastructure for sustainable energy; rather they will pay leases to financial leasing companies.

-

Commercial banks should be encouraged by the authorities to offer loans to enterprises of small and medium-size, which will subsequently provide a good investment climate.

-

A regional reserve ratio monetary policy is proposed as a measure for advancing the production of sustainable electricity. If countries with the ability to progress using sustainable power can access the loans more smoothly, the shortages of sustainable energy companies can be resolved.

-

Policies related to R&D departments in the area of production of renewable electricity, including and excluding hydroelectricity should be increased.

Thus, policymakers should propose mechanisms that will provide firms easier access to financing for renewable energy projects. As a future study, it is suggested that the prices of conventional fuels should be included to investigate their possible impact on the production of sustainable electricity in total, including and excluding hydroelectricity on a global level or comparing developed and developing regions.

References

Adedoyin, F. F., Gumede, M. I., Bekun, F. V., Etokakpan, M. U., & Balsalobre-lorente, D. (2020). Modelling coal rent, economic growth and CO2 emissions: Does regulatory quality matter in BRICS economies? Science of the Total Environment, 710, 136284.

Adom, P. K. (2016). The transition between energy-efficient and energy inefficient states in Cameroon. Energy Economics, 54, 248–262.

Ahmad, M., Zhao, Z.-U., Irfan, M., & Mukeshimana, M. C. (2019). Empirics on influencing mechanism among energy, finance, trade, environment, and economic growth: a heterogeneous dynamic panel data analysis of China. Environmental Science and Pollution Research, 26, 14148–14170.

Al-mulali, U., & Sab, C. N. (2012). The impact of energy consumption and CO2 emission on the economic and financial development in 19 selected countries. Renewable and Sustainable Energy Reviews, 16(7), 4365–4369.

Amuakwa-Mensah, F., Klege, R. A., Adom, P. K., Amoah, A., & Hagan, E. (2018). Unveiling the energy saving role of banking performance in Sub-Sahara Africa. Energy Economics, 74, 828–842.

Anton, S. G., & Nucu, A. E. A. (2020). The effect of financial development on renewable energy consumption. A panel data approach. Renewable Energy, 147, 330–338.

Apergis, N., & Payne, J. E. (2012). Renewable and non-renewable energy consumption-growth nexus: Evidence from a panel error correction model. Energy Economics, 34(3), 733–738.

Aslan, A., Apergis, N., & Topcu, M. (2014). Banking development and energy consumption: Evidence from a panel of Middle Eastern countries. Energy, 72(3), 427–433.

Assi, A. F., Isiksal, A. Z., & Tursoy, T. (2020). Highlighting the connection between financial development and consumption of energy in countries with the highest economic freedom. Energy Policy. https://doi.org/10.1016/j.enpol.2020.111897.

Balsalobre-Lorente, D., Driha, O. M., Bekun, F. V., & Osundina, O. A. (2019). Do agricultural activities induce carbon emissions? The BRICS experience. Environmental Science and Pollution Research, 26(24), 25218–25234.

Bartlett, M. S. (1950). Tests of significance in factor analysis. British Journal of Mathematical and Statistical Psychology, 3, 77–85.

Beck, T., Demirgüç-Kunt, A., & Levine, R. (2000). A new database on financial development and structure. World Bank Economic Review, 14, 597–605.

BP Statistical Review of World Energy. (2018). https://www.bp.com/content/dam/bp/business-sites/en/global/corporate/pdfs/energy-economics/statistical-review/bp-stats-review-2018-full-report.pdf

Breusch, T. S., & Pagan, A. R. (1980). The Lagrange multiplier test and its applications to model specification in econometrics. The Review of Economic Studies, 47(1), 239–253.

Brunnschweiler, C. (2010). Finance for renewable energy: an empirical analysis of developing and transition economies. Environment and Development Economics, 15(3), 241–274.

Buchner, B. K., Oliver, P., Wang, X., Carswell, C., Meattle, C., & Mazza, F. (2017). Global landscape of climate finance 2017. https://climatepolicyinitiative.org/publication/global-landscape-of-climate-finance-2017/

Burakov, D., & Freidun, M. (2017). Financial development, economic growth and renewable energy consumption in Russia: A vector error correction approach. International Journal of Energy Economics and Policy, 7(6), 39–47.

Chang, S. C. (2015). Effects of financial developments and income on energy consumption. International Review of Economics and Finance, 35, 28–44.

Coban, S., & Topcu, M. (2013). The nexus between financial development and energy consumption in the EU: A dynamic panel data analysis. Energy Economics, 39(3), 81–88.

Dogan, E. (2016). Analyzing the linkage between renewable and non-renewable energy consumption and economic growth by considering structural break in time-series data. Renewable Energy, 99, 1126–1136.

Dumitrescu, E. I., & Hurlin, C. (2012). Testing for Granger noncausality in heterogeneous panels. Economic Modelling, 29(4), 1450–1460.

Eberhardt, M., & Bond, S. (2009). Cross-section dependence in nonstationary panel models: A novel estimator. MPRA Paper 17692, University Library of Munich Retrieved from: https://mpra.ub.uni-muenchen.de/17692/1/MPRA_paper_17692.pdf.

Eberhardt, M., & Teal, F. (2010). Productivity analysis in global manufacturing production. Discussion Paper 515, Department of Economics, University of Oxford. Retrieved from: https://www.economics.ox.ac.uk/research/WP/pdf/paper515.pdf.

Eberhardt, M., & Teal, F. (2011). Econometrics for grumblers: a new look at the literature on cross-country growth empirics. Journal of Economic Surveys, 2, 109–155.

Eren, B. M., Taspinar, N., & Gokmenoglu, K. K. (2019). The impact of financial development and economic growth on renewable energy consumption: Empirical analysis of India. Science Total Environment, 663, 189–197.

Furuoka, F. (2015). Financial development and energy consumption: Evidence from a heterogeneous panel of Asian countries. Renewable and Sustainable Energy Reviews, 52(3), 430–444.

International Renewable Energy Agency-IRENA. (2018). Renewable capacity statistics. https://www.irena.org/publications/2018/Mar/Renewable-Capacity-Statistics-2018.

International Renewable Energy Agency – IRENA (2017a). Renewable energy statistics. https://www.irena.org/publications/2017/Jul/Renewable-Energy-Statistics-2017.

International Renewable Energy Agency – IRENA (2017b). Renewable capacity statistics. https://www.irena.org/publications/2017/Mar/Renewable-Capacity-Statistics-2017.

Islam, F., Shahbaz, M., Ahmed, A. U., & Alam, M. M. (2013). Financial development and energy consumption nexus in Malaysia: A multivariate time series analysis. Economic Modelling, 30, 435–441.

Kaiser, H. F. (1970). A second generation little jiffy. Psychometrika, 35, 401–415.

Kapetanios, G., Pesaran, M. H., & Yamagata, T. (2011). Panels with non-stationary multifactor error structure. Journal of Econometrics, 160, 326–348.

Kutan, A. M., Samargandi, N., & Sohag, K. (2017). Does institutional quality matter for financial development and growth? further Evidence from MENA countries? Australian Economic Papers, 56(3), 228–248.

Liddle, B., & Sadorsky, P. (2017). How much does increasing non-fossil fuels in electricity generation reduce carbon dioxide emissions? Applied Energy, 197, 212–221.

Maki, D. (2012). Tests for cointegration allowing for an unknown number of breaks. Economic Modelling, 29(5), 2011–2015.

Newey, W., & West, K. (1987). Hypothesis testing with efficient method of moments estimation. International Economic Review, 28, 777–787.

O’Connell, P. (1998). The overvaluation of purchasing power parity. Journal of International Economics, 44, 1–19.

Ouyang, Y., & Li, P. (2018). On the nexus of financial development, economic growth, and energy consumption in China: New perspective from a GMM panel VAR approach. Energy Economics, 71(3), 238–252.

Pesaran M. H. (2004). General diagnostic tests for cross section dependence in panels. IZA Discussion Paper No. 1240 and CESifo Working Paper No. 1229.

Pesaran, M. H. (2006). Estimation and Inference in large heterogeneous panels with a multifactor error structure. Econometrica, 74(4), 967–1012.

Pesaran, M. H., & Smith, R. (1995). Estimating long-run relationships from dynamic heterogeneous panels. Journal of Econometrics, 68(1), 79–113.

Pesaran, M. H., & Yamagata, T. (2008). Testing slope homogeneity in large panels. Journal of Econometrics, 14, 50–93.

Sadorsky, P. (2010). The impact of financial development on energy consumption in emerging economies. Energy Policy, 38(5), 2528–2535.

Sadorsky, P. (2011). Financial development and energy consumption in Central and Eastern European frontier economies. Energy policy, 39(2), 999–1006.

Samour, A., Isiksal, A. Z., & Resatoglu, N. G. (2019). Testing the impact of banking sector development on Turkey’s CO2 emissions. Applied Ecology and Environmental Research, 17(3), 6497–6513.

Shahbaz, M., Khan, S., & Tahir, M. I. (2013). The dynamic links between energy consumption, economic growth, financial development and trade in China: Fresh evidence from multivariate framework analysis. Energy Economics, 40, 8–21.

Shahbaz, M., Rasool, G., Ahmed, K., & Mahalik, M. K. (2016). Considering the effect of biomass energy consumption on economic growth: Fresh evidence from BRICS region. Renewable and Sustainable Energy Reviews, 60, 1442–1450.

Swamy, P. A. (1970). Efficient inference in a random coefficient regression model. Econometrica, 38(2), 311–323.

Topcu, M., & Payne, M. (2017). The financial development–energy consumption nexus revisited. Energy Sources: Economics, Planning, And Policy, 12(9), 822–830.

Westerlund, J. (2008). Panel cointegration tests of the Fisher effect. Journal of Applied Econometrics, 23, 193–233.

White, H. (1980). A heteroscedasticity-consistent covariance matrix estimator and a direct test for heteroscedasticity. Econometrica, 48, 817–838.

Wu, L., & Broadstock, D. (2015). Does economic, financial and institutional development matter for renewable energy consumption? Evidence from emerging economies. International Journal of Economic Policy in Emerging Economies, 8(1), 20–39.

Xu, Z., Baloch, M. A., Danish, M. F., Zhang, J., & Mahmood, Z. (2018). Nexus between financial development and CO2 emissions in Saudi Arabia: Analysing the role of globalization. Environmental Science and Pollution Research, 25(28), 28378–28390.

Yue, S., Lu, R., Shen, Y., & Chen, H. (2019). How does financial development affect energy consumption? Evidence from 21 transitional countries. Energy Policy, 130, 253–262.

Ziaei, S. M. (2015). Effects of financial development indicators on energy consumption and CO2 emission of European, East Asian and Oceania countries. Renewable and Sustainable Energy Reviews, 42, 752–759.

Author information

Authors and Affiliations

Corresponding author

Additional information

Publisher's Note

Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

Rights and permissions

About this article

Cite this article

Zhakanova Isiksal, A. The financial sector expansion effect on renewable electricity production: case of the BRICS countries. Environ Dev Sustain 23, 9029–9051 (2021). https://doi.org/10.1007/s10668-020-01010-7

Received:

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s10668-020-01010-7