Abstract

The importance of using renewable energy (RE) sources has increased significantly in recent times, especially considering the growing concerns about climate change problems and rising fossil fuel prices, which pose a significant threat to the national economies. Therefore, empirical studies that can be used both domestically and internationally in harmony can be created in line with rising investments in RE. However, there has no more analysis of RE investments from the viewpoint of investors in the literature up to this point, and it is crucial to highlight the best investor practices when deploying RE. This research provides theoretical and empirical support for the factors influencing RE investments; used in this analysis are newly constructed panel data on 34 OECD countries and the 5 BRICS countries that range from 2000 to 2020. Specifically, the generalized moment method (GMM), robustness check, fixed and random effects models, panel unit testing, and other panel regression techniques were employed in the study to analyze the determinants of RE investment. The main findings of this paper suggest that economic growth, RE policy, and R&D expenditures all have a statistically significant and positive relationship with RE capacity. Furthermore, RE investment is inversely relative to energy use, electricity use, and carbon (CO2) emissions. As a result, rigorous governmental or state regulation (policy, R&D) is essential for RE investment.

Similar content being viewed by others

Explore related subjects

Discover the latest articles, news and stories from top researchers in related subjects.Avoid common mistakes on your manuscript.

Introduction

Investments in RE sources are gaining popularity as a viable way for governments to achieve energy independence while also stimulating economic growth. Masini and Menichetti (2012) look into the decision-making process that goes into investing in RE sources. They investigated behavioral factors influencing RE investment decisions and the relationship between RE investments and portfolio performance using a conceptual model and an empirical study. They should choose additional policies to stimulate the investment of renewable resources, since policy instruments, particularly those relevant to investment decisions, have a significant impact on investment decisions. The findings also show that some investors have very distinct investment strategies. One sort of investor likes short-term incentives and is more driven to invest based on short-term policy incentives that have a higher possibility for instant profit. Other investors take a longer-term approach. They prefer policy incentives that yield a lower return on investment over a longer period, as long as the policy ensures the long-term support (Masini and Menichetti, 2012; Bushee, 1998; Hirshleifer, 1993).

In order for the RE investment policy to be successful, it must satisfy its main stakeholders (Bryson, 2004). It identified potential investors as relevant stakeholders who make a crucial difference in the public policy efficacy of RE investment targets, using the logic of stakeholder identification given by Mitchell et al. (1997) and adapting it to the context of RE. However, concerning the relationship between investor behavior and RE investment, there is a lack of a comprehensive theoretical and empirical framework. Based on the literature, this research creates an investor perspective framework, which is then put to the test through an empirical investigation. To put it another way, the current study draws on existing knowledge of RE investment, develops a new conceptual framework to guide policy, and tests the generated conceptual model using quantitative methodologies. The goal of this paper is to provide major insights into the establishment of successful RE policies, focusing specifically on RE investment in OECD and BRICS countries, in order to shed light on the relationship between investor behavior and RE outcomes. The following is the research question addressed in this paper: which factors influence the renewable energy investors' decision?

sThe paper makes manifold contributions to the literature. First, by offering a better knowledge of investor behavior toward RE resources, the study helps RE investors by proposing a conceptual model for designing effective policy instruments that should overcome impediments in their way. Second, the current research makes a methodological addition by identifying the characteristics that are beneficial in RE investments using empirical analysis in a wide range of countries. Third, this is the first attempt in the literature to include the OECD and BRICS countries in the empirical study, with data that is current and collected over a long period, as well as RE deployment from the investor’s perspective. As a result, the publication contributes to the legitimacy of the research. Therefore, the paper contributes to the validity of the findings being extended to a broader and more comprehensive setting. In this paper, we endeavor to provide a greater understanding of the linkage between economic growths, policies, R&D, CO2 emissions, energy, and electricity consumption with RE capacity. It thus made the variables that affect RE investments apparent.

The following is how the rest of the paper is organized: The second part is a review of the literature. The current paper’s method and data are described in the third part. This entails presenting the conceptual foundation and doing quantitative research. The empirical findings and debate are presented in the next part, followed by concluding remarks as policy recommendations.

Literature review

An emerging body of literature has looked into how policies should be crafted to efficiently mobilize investments in the RE sector (Menichetti, 2010). Despite this enormous effort, knowledge of RE investment and the variables linked with RE policy is still inadequate. While various studies have presented policy efficacy measures (Masini and Menichetti, 2012; Musango and Brent, 2011; Wüstenhagen and Menichetti, 2012), they only provide a restricted view of investors’ opinions. As noted in the political economics literature, a key flaw in current research is the lack of attention on investors’ perspectives (Lipp, 2007; Masini and Menichetti, 2012; Musango and Brent, 2011; Wüstenhagen and Menichetti, 2012).

Most of the research focuses on investor behavior as a barrier to RE investments (Niesten et al. 2018; Salm et al. 2016; Nasirov et al. 2015; Leete et al. 2013; Masini and Menichetti 2012; Masini and Menichetti, 2010; Wüstenhagen et al. 2007). Nasirov et al. (2015) explore the barriers to the adoption of RE sources from the investor’s perspective. Grid connection constraints and a lack of grid capacity, long permit processing times, certainty of land and/or water leases, and limited access to finance are among the most significant barriers to RE projects, according to the research. Leete et al. (2013) intend to uncover common hurdles and incentives to investing in RE through a series of in-depth interviews with people in the field. Because of their inability to predict costs and the time required to develop RE technologies, investors/stakeholders do not have the option to re-invest in RE, according to the findings. Masini and Menichetti (2012) look at the decision-making process that goes into investing in RE solutions.

The lack of government/state-based subsidies is another impediment to RE projects (Tura et al. 2019; Jones, 2015; Lilliestam and Patt, 2015; Kostka et al. 2013; Shill et al. 2012). De Jongh et al. (2014) point out that South Africa has a lack of clear regulations and government support. According to several studies, the most significant RE is cost. Malik et al. (2019) for GCC countries, Hu et al. (2018), Fashina et al. (2018) for Uganda, Yuosoff and Kardooni (2012) for Malaysia, and Mostert (2009) for Nicaragua are just a few examples. Furthermore, Painuly (2001) investigates RE energy companies face several challenges, including a lack of pre-financing, credit facilities, and technical competence.

RE investors are often treated in one of two ways in the literature. One way is as a homogeneous group of utility-type actors investing with profit maximization in mind (Bergek et al. 2013; Gross et al. 2010; Koo et al. 2011), and investors in RE often base their judgments on comparisons of various electricity producing methods. Other research defines RE investors as a varied set of participants that includes small- and medium-sized private investors, independent power producers, and cooperatives (Agterbosch et al., 2004; Loock, 2012). Because of the hazards associated with fossil fuels, such as price volatility, import availability, and the cost of domestic economic exposure, investing in RE sources may be more appealing than investing in fossil fuels. RE sources are essentially homegrown energy supplies that are not dependent on the availability and pricing of imported energy based on global markets. Uncertainties in RE policies, prices, and regulations, on the other hand, can raise degrees of investment risk and uncertainty, making renewable investments less appealing than uncertain fossil-based sources (Finon and Perez, 2007; Popp et al. 2011).

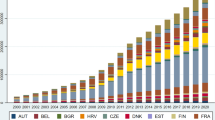

OECD countries rank first in terms of CO2 emissions compared to other regions. In 2018, OECD countries emitted an average of 8.7 tons of CO2 emissions per capita, while the rest of the world released 4.3 tons of CO2 emissions (OECD, 2020). Therefore, increasing the proportion of RE investments is required to create a low-carbon society (Polzin et al. 2015). A greater investment in the RE industry has been seen across the OECD countries. Germany, the USA, Japan, and theUK, for example, were the top investors in 2013. OECD countries have several priorities for attaining global CO2 emissions target, including reducing energy imports, expanding RE technologies, and lowering CO2 emissions. Belgium, Denmark, and Germany have projected a 100% RE share by 2050 to reach these targets (Sisodia et al. 2015; Klaus et al. 2010).

BRICS countries have abundant RE sources; however, they largely employ carbon-intensive energy sources (Zeng et al. 2017). China, for example, has abundant wind resources (Meisen and Hawkins, 2009), whereas India and South Africa have ideal conditions for solar energy development (Nautiyal, 2012; Mulaudzi and Bull, 2016). There are several water resources in Brazil that are ideal for the construction of hydroelectric power facilities (Meisen and Hubert, 2010). Russia exports and uses a lot of fossil fuels every year, but it also possesses a lot of RE sources with a lot of promise (Kirsanova et al. 2018; Cherepovitsyn and Tcvetkov, 2017; Pristupa and Mol, 2015). However, information on the impact of investor behavior on RE implementation is limited. To our knowledge, no research has been done on the development of a conceptual model for the structural and behavioral factors that influence RE investor decisions, as well as the empirical testing of this model for OECD and BRICS nations. Besides these aforementioned studies, the paper has provided further detail for the literature review in the Appendix section, Table 8.

Data and method

To begin, a conceptual model was proposed within the context of the relevant literature in order to construct a conceptual framework, and the paper formed hypotheses based on the models’ goals. Then, for the 34 OECD and 5 BRICS countries, a country-level panel data analysis of RE investments was done for the period 2000–2020.

Conceptual framework analysis from investors’ perspectives

Academic and political debates have centered on what should be done to deploy renewable investments (RE projects) (Polzin et al. 2015; Bergek et al. 2013; Wüstenhagen and Menichetti, 2012). High upfront costs, risks and long-term viability of technology, long payback periods, high regulatory and infrastructure dependency, and uncertainty about public acceptance are all factors influencing investor investments in RE deployment (Rodrguez et al. 2014; Haley and Schuler, 2011; Muller et al. 2011). These characteristics are important drivers in real estate investments, and they have a direct impact on RE investors’ risk and return.

The ultimate goal of a sustainable RE strategy is to lower the capital costs of RE technology by government subsidies, creating fair competition for both fossil fuel-based and RE technologies (Polzin et al. 2015). As a result, policymakers should base their decisions on the issues that affect RE investors. According to Bergek et al. (2013), policymakers make judgments about risk regulation and administrative processes based on the insights of RE project developers (Friebe et al. 2014). Similarly, Chassot et al. (2014) place a premium on the perceived risk posed by policies, which is one of the most significant factors influencing RE investment decisions.

The essential parts of RE investor decision-making are traced in a conceptual analysis based on prior work on renewable investment, which develops the theoretical framework of renewable investment. The conceptual model (Zahra, 1993) is more sophisticated for assessing strategic options for RE investment, and it serves as a framework for comprehending this research and a starting point for identifying relevant study topics (Ata, 2015). Arguments such as property rights protection and the capacity to import materials are expected to play a role here. It also includes a diagram of the suggested conceptual framework for the linkages between RE market investment and variables. There is a dependent variable, installed cumulative RE capacity, and the paper has suggested an econometric model to solve the major research question. The present paper depicts the conceptual model for this investigation in Fig. 1.

A variety of factors affects installed cumulative RE capacity, including technological efficacy, RE regulations, climate policies/problems, market conditions, and country economic conditions, all of which influence investor behavior.

The paper refers to the availability of financial expenditures on renewable technologies for sustainable RE project encouragement as R&D capacity risk. The budget for R&D must be raised in order for RE investments to increase (Kul et al. 2020; Chu and Majumdar, 2012). Renewable and climate policy are one of the most significant factors in expanding RE investments. As a result, politicians must establish clear and suitable long-term RE policies to assist investors in incorporating climate change concerns and allocating money to low-carbon technology (He et al. 2019; Masini and Menichetti, 2012; Reuter et al. 2012). In the energy industry, rising power and energy consumption have prompted many countries, particularly those that import energy, to look for alternate energy sources (Kahia et al. 2017). Finally, rising economic growth leads to more investment in RE sources. According to Chen et al. (2021), in nations where people’s democratic rights are better safeguarded, there is a positive relationship between economic growth and RE capability, whereas in less democratic countries, there is a negative relationship.

The paper empirically investigated the three primary hypothesis proposals to be as follows, based on the literature review described above.

-

H1: The perceived importance of implemented policies has a big impact on investor behavior and RE investments.

-

H2: The higher the proportion of RE investments in total investments, the higher the level of R&D and technological efficiency.

-

H3: Environmental and economic issues influence RE investments.

Data and variable selection

First and foremost, OECD countries were chosen for the study because they include both developed and developing countries, albeit developing countries unquestionably make up a smaller percentage of the group. In order to avoid any inconsistencies in the definition of variables and units of measurement, its statistics are pooled under this umbrella organization. Finally, there are some commonalities and homogeneities among the policies of all OECD nations (Inglesi-Lotz, 2016). BRICS countries were also included in the study. Because BRICS countries, which are in the first place in fossil fuel use and CO2 emission, also have great potential in RE (Zeng et al. 2017).

Twenty years of data, spanning the years 2000 to 2020, were analyzed. Given the fact that, excluding hydroelectricity, roughly 2.7 trillion dollars were invested globally in RE sources between 2010 and 2019, this is over three times and possibly even more than four times the same amount invested in 2000–2009 (Ajadi, et al. 2020). Accessing pre–2000 RE investment statistics for all 34 OECD and 5 BRICS nations is exceedingly challenging.

Annual data from the World Bank, the International RE Agency (IRENA), and the International Energy Agency (IEA) are analyzed using quantitative methodologies (IEA). Installed cumulative RE capacity is used as a dependent variable in this paper, and it is quantified in megawatts (MW). Table 1 summarizes all variables, which are expressed in natural logs.

GDP per capita is calculated using a constant 2017 international US dollar as an indicator of economic development. The economic variable of GDP per capita is commonly used in the literature to examine its impact on RE deployment (Dogan et al. 2021; Nyiwul 2017; Lucas et al. 2016; Wu and Broadstock, 2015). The impact of economic development on the deployment of RE has been studied in many ways. Marques and Fuinhas (2011), for example, discover that GPD has a detrimental impact on RE deployment. Bamati and Raoofi (2020) argue, on the other hand, that GDP plays a role in RE deployment.

Energy consumption is the percentage of total energy use in the industry. According to Rahman et al. (2019), there is a strong and positive relation between RE usage and energy consumption. Qi et al. (2014) discover that economic growth resulted in high energy demand, which has made it easier to accept renewable electricity.

Electricity consumption is measured in megawatt hours (MWh) per capita. Bednarczyk et al. (2021) emphasize that non-household electricity consumption has a negative influence on RE resources in gross final energy consumption. The increase in non-household electricity usage impacts on the decline in RE.

Renewable policies, as well as solar and wind energy feed-in tariff data, are employed. In this policy, the feed-in tariff is calculated in US dollars. Many studies have found that policies have a positive impact on RE development and deployment (Bourcet 2020; Liu et al. 2019; Kilinc-Ata, 2016; Shrimali and Kniefel, 2011; Adelaja et al. 2010). Adedoyin et al. (2020) also stress the importance of policy in the development of renewable technology.

Clean energy R&D is expected to assist RE deployment as a fraction of overall government R&D for RE energy sources. According to Adedoyin et al. (2020), there is a bidirectional relationship between R&D and RE; hence, investment R&D should focus more on long-term success in sustainable energy sources. Wang et al. (2020) show that R&D and policy considerations both contribute to the promotion of RE.

As an environmental variable, CO2 emissions are measured in tons per capita. CO2 emissions, according to Nyiwul (2017), have resulted in an increase in RE development. According to Hao and Shao (2021), nations with lower carbon-intensive economies use higher proportions of RE in their total energy consumption. Similarly, Sharif et al. (2021) demonstrate that reducing CO2 emissions encourages the usage of RE sources. Zafar et al. (2019) highlight that renewable RE helps to improve environmental quality.

Model

A quantitative method was used to test the hypotheses from the conceptual framework. Hypotheses were tested using empirical models to answer the research issue. From 2000 to 2020, the method would use panel data analysis to compile a country-level panel dataset for OECD and BRICS countries. The RE capacity is modeled using explanatory variables as a function:

where i = 1, …, and t = 2000, …, 2020. Equation 1 shows relates RE capacity (\({REC}_{i,t}),\) GDP per capita (\({GDP}_{i,t})\), energy consumption (\({EC}_{i,t})\), electric power consumption (\({EPC}_{i,t})\), RE policies (\({REP}_{i,t})\), research and development (\({R\&D}_{i,t})\), and carbon emission (\({CO2}_{i,t})\). Equation 1 depicts the relationship between RE capacity and the explanatory variables as a linear relationship. The RE capacity model’s panel data fixed effects regression could be represented as Eq. (2):

The installed cumulative RE capacity is represented by \({Y}_{i,t}\), the coefficient of explanatory factors is β, the country fixed effect index is \({u}_{i},\) and the random error term is \({\omega }_{it}\) applied to each country at each year. Because Shrimali and Kneifel (2011) propose that a country’s fixed effects are critical for controlling for unobserved heterogeneity to affect RE investment, the study uses a fixed effects model. The dynamic features of the variables are avoided by transforming all data into a natural logarithmic form. The equation’s logarithmic form is shown below:

Besides the fixed effect model, the random effect method is used to check whether some differences between the variables affect the renewable capacity because this method includes variables that do not change over time (Olanrewaju et al. 2019). Menegaki (2011) also highlights random effects models with homogeneity assumptions. The random effect model is expressed using the following equation:

i denotes the subscript of an entity (i = 1,…10), t shows time (t = 2000,…0.2020), \(\alpha\) is an unknown intercept and \(\beta\) is a coefficient of explanatory variables, \({\varepsilon }_{i,t}\) is the error term, and \({\mu }_{i,t}\) is the random heterogeneity specific to the observation. The Hausman test is then used to determine whether the unique errors are linked to regression. The findings of the Hausman test are used to determine which model is more appropriate (Hausman, 1978). The Hausman test is written like this:

\({\beta }_{RE}\) denotes coefficient estimates from random effect, while \({\beta }_{FE}\) is coefficient estimates from fixed effects.\(\sum FE\) shows the co-variance matrix of a fixed effect, and \(\sum RE\) is the co-variance matrix of a random effect. The H0 hypothesis is accepted, and the random model is selected if the Hausman test result is significant (p > 0.05). The H1 hypothesis, indicating that the fixed model is adequate, is accepted if the Hausman test results are statistically insignificant (p 0.05) (Hausman and Taylor, 1981).

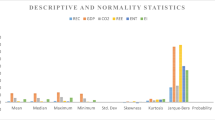

Finally, the dynamic GMM (generalized moments method) model developed by Arrellano and Bond (1991) is used. The GMM model was selected for a number of reasons. First, the GMM model, which is frequently used for panel data, consistently produces accurate findings in the presence of “unobserved heterogeneity, simultaneity and dynamic endogeneity” (Ullah et al. 2018). Second, GMM estimators, which do not require many assumptions, start from the moment relations that exist in the model (Ahn et al. 2001). Finally, the difference GMM estimator is designed for small time dimension and large cross sections (Siddiqui and Ahmed, 2013). There are descriptive data for all factors on each measure of installed cumulative RE capacity, as well as a correlation matrix, in the Appendix section. The correlation coefficient indicates that the explanatory variables are highly multicollinearity.

Results and discussion

All variables were verified for stationary using the Levin, Lin, and Chu (LLC) (Levin et al. 2002), Im, Pesaran, Shin (IPS) (Im et al. 2003), ADF-Fisher Chi square (ADF) (Dickey and Fuller, 1979), and PP-Fisher Chi square (PP) (Phillips and Perron, 1988) techniques. At both the I(0) and I(1) levels, Table 2 displays the unit root results for all the data.

As seen in Table 2, all variables are stationary at the first level, and to avoid spurious regression, a first-order unit root test was used in the study. As a result, for the investigated countries, all exogenous variables have become stationary, and a regression analysis is conceivable. Table 3 summarizes the results of numerous estimations of the fixed-effect and random-effect models (Eqs. 2 and 4).

The findings of the fixed effects panel data regression are shown in Table 3, which identify a few variables as significant drivers of RE investment. The R square value of 0.813 suggests a satisfactory fit for the fixed effects model, according to the panel regression findings for the fixed effects model. As a result, all exogenous variables combined could account for about 81% of the variation in REC. Even though all coefficients are nonzero, an F-statistic probability of 0.000 suggests that the overall panel regressions are significant (F < 0.05). A positive link between REC and energy usage and R&D was discovered using panel data fixed effects regression. In other words, a 1% increase in energy consumption and R&D spending results in a 0.007% rise in REC growth. This finding is supported by recent research by Khezri et al. (2021) and Wu et al. (2020). The findings suggest that R&D spending has a favorable impact on RE sources, such as solar, wind, bio-energy, and geothermal.

On the other hand, GDP, electricity power consumption, RE policies, and CO2 emissions are inversely correlated to REC. The negative relationship between CO2 emissions and REC was an astonishing outcome. However, recent studies by Ponce and Khan (2021) find that RE and energy efficiency is negatively related to CO2 emissions, and Gyamfi et al. (2021c) found a negative relationship between RE and CO2 emissions for Mediterranean area countries. Similarly, Zaidi et al. (2018) show that REC has an insignificant effect on CO2 emissions in Pakistan, and Gyamfi et al. (2021b) shows that there is no significant relationship between RE and CO2 emissions for E7 countries. Recent studies by Gyamfi et al. (2021a), on the other hand, found that a 1% increase in RE consumption in E7 countries improved the environmental quality by 0.588%.

Another conclusion drawn from the study is that there is no statistically significant link between REC and income (economic growth) or renewable policy. The findings obtained from the analysis are also supported by the literature. According to Hughes (2010), FITs fail in the UK because they prevent local promotion of RE capacity. Likewise, Delmas et al. (2007) established that the quota (RPS) policy system had no effect on RE production.

These findings mean that the current RE policies are insufficient to promote investment in RE. Furthermore, the world’s three largest economies (the USA, China, and India) declared net-zero carbon goals, and the UK hosted the UN Climate Change Conference (UNCCC) of the Parties (COP-26) in October–November 2021, which resulted in new important agreements for UNFCCC implementation. However, it has been accepted that the steps planned will not prevent irreversible climate change. Governments should work harder in partnership with businesses, science, and civil society. Although, this result shows that countries should devote more resources (policy and R&D) to RE investments in order to attain net-zero ambitions (UNCC, 2022).

The R-square value was 0.69, and the Prob. (F-statistic) was 0.129, according to the random effects model result in Table 3. While there is a positive correlation between REC with energy consumption and R&D; there is a negative relationship between GDP, electric energy consumption, RE policies, and CO2 emissions with REC. These findings provide insights for reconsidering RE and CO2 emissions policy formulations for adopting cleaner and greener technologies (Gyamfi et al. 2020a).

In the regression model that looked at REC in OECD and BRICS nations between 2000 and 2020, the Hausman test was used for exogenous variables. Table 4 shows the results of the Hausman test.

As seen in Table 4, H0 is rejected because the random effects correlated Hausman test result is p > 0.05, the fixed effect model is more appropriate to estimate the net effect of exogenous variables on REC, and the alternative H1 hypothesis is accepted. Here, the fixed effect model’s R2 score indicates it is suitable for the GMM model. Table 5 shows the findings of the GMM model.

According to the panel regression results for the GMM model, all variables are statistically significant (p < 0.05), indicating that it is appropriate. The findings are consistent with the fixed effects model’s results: there are positive correlations between RE capacity, GDP per capita, RE policies, and R&D. RE policies and R&D spending cause REC to expand by 0.06%, 0.02%, and 0.02%, respectively, with a 1% growth in GDP per capita. Recent research has discovered similar results (Gershon and Emekalam, 2021; Tudor and Sova, 2021). According to Sadorsky (2009), for G7 countries, a 1% increase in GDP per capita boosts RE consumption by 3.5%. Recent research has discovered similar results (Gershon and Emekalam, 2021; Tudor and Sova, 2021). According to Sadorsky (2009), for G7 countries, a 1% increase in GDP per capita boosts RE consumption by 3.5%. Similarly, Baye et al. (2021) find that a 1% rise in real GDP per capita results in a 0.32% increase in REC in African countries. Omri and Nguyen (2014) find that economic development is the key driver for REC growth using a two-stage GMM panel estimate regression technique for 64 nations. In high-income, middle-income, and low-income nations, a 1% rise in GDP per capita improves the REC by 0.199%, 0.169%, and 0.149%, respectively.

Conversely, there are negative correlations between REC, energy use, electricity consumption, and CO2 emissions. REC drops by 0.03%, 0.02%, and 0.23%, respectively, when energy consumption, electricity consumption, and CO2 emissions consumption all rise by 1%. These findings are in line with some previous research. For example, Baye et al. (2021) show that CO2 emissions have a negative impact on REC per capita in sub-Saharan African countries, and they attribute this to energy inefficiency and a lack of environmental awareness.

Conclusion and policy implications

The impact of many variables on RE investment is demonstrated in this paper. This research aims to develop a conceptual framework for quantitatively assessing RE investment from the perspective of investors, and then a quantitative test provides useful insight into the investor’s role in promoting the growth of RE technology. This study provides a systematic and quantitative method for comparing the implications of variables in OECD and BRICS countries, allowing for easy comparisons.

The paper discovered a statistically significant association between RE and energy consumption, electric power consumption, R&D, and CO2 emissions according to the fixed effect model results. However, although energy consumption and R&D and REC have a statistically positive link, electricity consumption, RE policies, and CO2 emissions have a statistically negative relationship. For the OECD and BRICS countries, the GMM approach revealed a statistically significant link between all explanatory variables and RE capacity. It was concluded that while RE policies, R&D, and economic growth promote RE investments, CO2 emissions, energy and electricity consumption negatively affect RE investments. Because of rising energy and electricity consumption, OECD and BRICS countries choose fossil-based energy sources from RE sources.

Considering the findings, it is vital to design a national policy on economic growth, research and development, and RE policies that are effective in RE investments. It illustrates that in order to grow RE investments, both the OECD and the BRICS countries must focus more on their policies. Increasing the share of R&D spending in the RE sector, in particular, will stimulate current technology while simultaneously reducing CO2 emissions. In addition, the OECD and the BRICS countries should collaborate to develop energy-efficient and efficient projects, as well as to support environmental and sustainable activities. As a result, it has the potential to attract green investments from both the public and private sectors. Governments should devote greater resources to increasing public understanding of eco-friendly topics. According to the findings, the OECD and BRICS countries should establish policies to encourage more RE investment in order to meet their net zero carbon commitments, and that increased country cohesion is advocated. Sustainable development, which is founded on the principles of ensuring energy security, will enable green development at the national level, safeguarding the environment from the detrimental effects of fossil fuels, and combating climate change. The study’s findings indicate that harmonization of national and an international energy standard is crucial.

Another significant policy recommendation from the study is that consumers should be able to access RE because of technological constraints. Although the Russian Federation of the BRICS countries has significant RE potential, the volume of commercial RE consumption other than hydro, such as wind and solar, is insufficient to attract the necessary investment. As a result, authorities must foster the right investment climate to encourage the commercialization of RE. Furthermore, RE strategies should emphasize education to increase RE consumption. The training exercises should emphasize RE’s potential contribution to sustainable development and a clean environment, among other energy sources. Gyamfi et al. (2020b) emphasized that policymakers in China, Turkey, Russia, India, Indonesia, Brazil, and Mexico must invest heavily in expanding both clean energy generation (RE) and hydroelectric power, which produces less CO2 emissions in the long run.

The paper only covers OECD and BRICS countries. Another point to consider is that the study is based on a few variables that have been classified. Correspondingly, this paper does not address the financing challenges in RE investments and RE projects. The paper does not discuss in depth the relationship between the financing of RE and its investment. Finally, other factors that are effective in RE investment are not included in the analysis, and the analysis is limited to the countries of the two regions. These issues can/will be addressed in future research as well. Besides these, Ahmad et al. (2021) and Isik et al. (2020) emphasized that the behaviors of individuals are reshaped during pandemic times such as COVID-19, and therefore, more empirical studies on the change in the behavior of RE investors may be needed in this time period.

Data availability

The datasets used and/or analyzed during the current study are available from the corresponding author on reasonable request.

References

Adedoyin FF, Bekun FV, Alola AA (2020) Growth impact of transition from non-renewable to renewable energy in the EU: the role of research and development expenditure. Renewable Energy 159:1139–1145

Adelaja A, Hailu YG, McKeown CH, Tekle AT (2010) Effects of renewable energy policies on wind industry development in the US. J Natur Resour Policy Res 2(3):245–262

Agterbosch S, Vermeulen W, Glasbergen P (2004) Implementation of wind energy in the Netherlands: the importance of the social–institutional setting. Energy Policy 32(18):2049–2066

Ahmad M, Akhtar N, Jabeen G, Irfan M, Khalid Anser M, Wu H, Işık C (2021) Intention-based critical factors affecting willingness to adopt novel coronavirus prevention in Pakistan: implications for future pandemics. Int J Environ Res Public Health 18(11):6167

Ahn SC, Lee YH, Schmidt P (2001) GMM estimation of linear panel data models with time-varying individual effects. Journal of Econometrics 101(2):219–255

Ajadi, T., Cuming, V., Boyle, R., Strahan, D., Kimmel, M., Logan, M., & McCrone, A., (2020). Global trends in renewable energy investment 2020. https://www.fs-unep-centre.org/wp-content/uploads/2020/06/GTR_2020.pdf, Accessed Date: 01.07.2022.

Arellano M, Bond S (1991) Some tests of specification for panel data: Monte Carlo evidence and an application to employment equations. Rev Econ Stud 58(2):277–297

Ata NK (2015) The impact of government policies in the renewable energy investment developing a conceptual framework and qualitative analysis Global Adv. Res. J. Manage Bu Stud 42(2):67–81

Bamati N, Raoofi A (2020) Development level and the impact of technological factor on renewable energy production. Renewable Energy 151:946–955

Baye RS, Olper A, Ahenkan A, Musah-Surugu IJ, Anuga SW, Darkwah S (2021) Renewable energy consumption in Africa: evidence from a bias corrected dynamic panel. Sci Total Environ 766:142583

Bednarczyk JL, Brzozowska-Rup K, Luściński S (2021) Determinants of the energy development based on renewable energy sources in Poland. Energies 14(20):6762–6773

Belaïd F, Elsayed AH, Omri A (2021) Key drivers of renewable energy deployment in the MENA Region: empirical evidence using panel quantile regression. Struct Chang Econ Dyn 57:225–238

Bergek A, Mignon I, Sundberg G (2013) Who invests in renewable electricity production? Empirical Evidence and Suggestions for Further Research,. Energy Policy 56:568–581

Bourcet C (2020) Empirical determinants of renewable energy deployment: a systematic literature review. Energy Economics 85:104563

Bryson JM (2004) What to do when stakeholders matter: stakeholder identification and analysis techniques. Public Manag Rev 6(1):21–53

Bushee, B. J., (1998). The influence of institutional investors on myopic R&D investment behavior. Accounting Review, 305–333.

Chang T, Gupta R, Inglesi-Lotz R, Simo-Kengne B, Smithers D, Trembling A (2015) Renewable energy and growth: evidence from heterogeneous panel of G7 countries using Granger causality. Renew Sustain Energy Rev 52:1405–1412

Chang Y, Fang Z, Li Y (2016) Renewable energy policies in promoting financing and investment among the East Asia Summit countries: quantitative assessment and policy implications. Energy Policy 95:427–436

Chassot S, Hampl N, Wüstenhagen R (2014) When energy policy meets free-market capitalists: the moderating influence of worldviews on risk perception and renewable energy investment decisions. Energy Res Soc Sci 3:143–151

Chen C, Pinar M, Stengos T (2021) Determinants of renewable energy consumption: Importance of democratic institutions. Renewable Energy 179:75–83

Cherepovitsyn, A., & Tcvetkov, P., (2017). Overview of the prospects for developing a renewable energy in Russia. In 2017 International Conference on Green Energy and Applications (ICGEA) (pp. 113–117). IEEE.

Chu S, Majumdar A (2012) Opportunities and challenges for a sustainable energy future. Nature 488(7411):294–303

De Jongh D, Ghoorah D, Makina A (2014) South African renewable energy investment barriers: an investor perspective. Journal of Energy in Southern Africa 25(2):15–27

Delmas M, Russo MV, Montes-Sancho MJ (2007) Deregulation and environmental differentiation in the electric utility industry. Strateg Manag J 28(2):189–209

Dickey DA, Fuller WA (1979) Distribution of the estimators for autoregressive time series with a unit root. J Am Stat Assoc 74(366a):427–431

Dogan E, Inglesi-Lotz R, Altinoz B (2021) Examining the determinants of renewable energy deployment: does the choice of indicator matter? Int J Energy Res 45(6):8780–8793

Dogru T, Bulut U, Kocak E, Isik C, Suess C, Sirakaya-Turk E (2020) The nexus between tourism, economic growth, renewable energy consumption, and carbon dioxide emissions: contemporary evidence from OECD countries. Environ Sci Pollut Res 27(32):40930–40948

Egli F (2020) Renewable energy investment risk: an investigation of changes over time and the underlying drivers. Energy Policy 140:111428

Fashina A, Mundu M, Akiyode O, Abdullah L, Sanni D, Ounyesiga L (2018) The drivers and barriers of renewable energy applications and development in Uganda: a review. Clean Technologies 1(1):9–39

Finon D, Perez Y (2007) The social efficiency of instruments of promotion of renewable energies: a transaction-cost perspective. Ecol Econ 62(1):77–92

Friebe CA, von Flotow P, Täube FA (2014) Exploring technology diffusion in emerging markets–the role of public policy for wind energy. Energy Policy 70:217–226

Gershon, O., & Emekalam, P., (2021). Determinants of renewable energy consumption in Nigeria: a Toda Yamamoto approach. In IOP Conference Series: Earth and Environmental Science, 665 (1): 012005, IOP Publishing.

Gross R, Blyth W, Heptonstall P (2010) Risks, revenues and investment in electricity generation: why policy needs to look beyond costs. Energy Economics 32(4):796–804

Gyamfi BA, Bein MA, Ozturk I, Bekun FV (2020a) The moderating role of employment in an environmental Kuznets curve framework revisited in G7 countries. Indonesian J Sustain Account Manag 4(2):241–248

Gyamfi BA, Bein MA, Bekun FV (2020b) Investigating the nexus between hydroelectricity energy, renewable energy, nonrenewable energy consumption on output: evidence from E7 countries. Environ Sci Pollut Res 27(20):25327–25339

Gyamfi BA, Adedoyin FF, Bein MA, Bekun FV, Agozie DQ (2021a) The anthropogenic consequences of energy consumption in E7 economies: juxtaposing roles of renewable, coal, nuclear, oil and gas energy: evidence from panel quantile method. J Clean Prod 295:126373

Gyamfi BA, Adedoyin FF, Bein MA, Bekun FV (2021b) Environmental implications of N-shaped environmental Kuznets curve for E7 countries. Environ Sci Pollut Res 28(25):33072–33082

Gyamfi BA, Adebayo TS, Bekun FV, Agyekum EB, Kumar NM, Alhelou HH, Al-Hinai A (2021c) Beyond environmental Kuznets curve and policy implications to promote sustainable development in Mediterranean. Energy Rep 7:6119–6129

Haley UC, Schuler DA (2011) Government policy and firm strategy in the solar photovoltaic industry. Calif Manage Rev 54(1):17–38

Hao F, Shao W (2021) What really drives the deployment of renewable energy? A global assessment of 118 countries. Energy Res Soc Sci 72:101880

Hashmi SM, Bhowmik R, Inglesi-Lotz R, Syed QR (2022) Investigating the Environmental Kuznets Curve hypothesis amidst geopolitical risk: global evidence using bootstrap ARDL approach. Environ Sci Pollut Res 29(16):24049–24062

Hausman, J. A., & Taylor, W. E., (1981). Panel data and unobservable individual effects. Econometrica: Journal of the Econometric society, 1377–1398

Hausman, J. A., (1978). Specification tests in econometrics. Econometrica: Journal of the econometric society, 1251–1271

He L, Zhang L, Zhong Z, Wang D, Wang F (2019) Green credit, renewable energy investment and green economy development: empirical analysis based on 150 listed companies of China. J Clean Prod 208:363–372

Hirshleifer, D., (1993). Managerial reputation and corporate investment decisions. Financial Management, 145–160

Hu J, Harmsen R, Crijns-Graus W, Worrell E (2018) Barriers to investment in utility-scale variable renewable electricity (VRE) generation projects. Renewable Energy 121:730–744

Hughes, S., (2010). Feed-in tariffs are disappointing for local renewable energy. The Guardian, 2.

Im KS, Pesaran MH, Shin Y (2003) Testing for unit roots in heterogeneous panels. Journal of Econometrics 115(1):53–74

Inglesi-Lotz R (2016) The impact of renewable energy consumption to economic growth: a panel data application. Energy Economics 53:58–63

Inglesi-Lotz R, Dogan E (2018) The role of renewable versus non-renewable energy to the level of CO2 emissions a panel analysis of sub-Saharan Africa’s Βig 10 electricity generators. Renewable Energy 123:36–43

Isik C, Dogru T, Turk ES (2018) A nexus of linear and non-linear relationships between tourism demand, renewable energy consumption, and economic growth: theory and evidence. Int J Tour Res 20(1):38–49

Isik C, Ongan S, Özdemir D (2019) The economic growth/development and environmental degradation: evidence from the US state-level EKC hypothesis. Environ Sci Pollut Res 26(30):30772–30781

Isik C, Sirakaya-Turk E, Ongan S (2020) Testing the efficacy of the economic policy uncertainty index on tourism demand in USMCA: theory and evidence. Tour Econ 26(8):1344–1357

Isik C, Ahmad M, Ongan S, Ozdemir D, Irfan M, Alvarado R (2021a) Convergence analysis of the ecological footprint: theory and empirical evidence from the USMCA countries. Environ Sci Pollut Res 28(25):32648–32659

Isik C, Ongan S, Ozdemir D, Ahmad M, Irfan M, Alvarado R, Ongan A (2021b) The increases and decreases of the environment Kuznets Curve (EKC) for 8 OECD countries. Environ Sci Pollut Res 28(22):28535–28543

Isik C, Ongan S, Bulut U, Karakaya S, Irfan M, Alvarado R, ... & Rehman A (2022) Reinvestigating the environmental Kuznets curve (EKC) hypothesis by a composite model constructed on the Armey curve hypothesis with government spending for the US States. Environ Sci Pollut Res 29(11) 16472-16483

Isık C, Ongan S, Özdemir D (2019) Testing the EKC hypothesis for ten US states: an application of heterogeneous panel estimation method. Environ Sci Pollut Res 26(11):10846–10853

Javeed SA, Latief R, Jiang T, San Ong T, Tang Y (2021) How environmental regulations and corporate social responsibility affect the firm innovation with the moderating role of Chief executive officer (CEO) power and ownership concentration? J Clean Prod 308:127212

Jones AW (2015) Perceived barriers and policy solutions in clean energy infrastructure investment. J Clean Prod 104:297–304

Kahia M, Aïssa MSB, Lanouar C (2017) Renewable and non-renewable energy use-economic growth nexus: the case of MENA net oil importing countries. Renew Sustain Energy Rev 71:127–140

Kangas HL, Lintunen J, Pohjola J, Hetemäki L, Uusivuori J (2011) Investments into forest biorefineries under different price and policy structures. Energy Economics 33(6):1165–1176

Khezri M, Heshmati A, Khodaei M (2021) The role of R&D in the effectiveness of renewable energy determinants: a spatial econometric analysis. Energy Economics 99:105287

Kilinc-Ata N (2016) The evaluation of renewable energy policies across EU countries and US states: an econometric approach. Energy Sustain Dev 31:83–90

Kirsanova NY, Lenkovets OM, Nikulina AY (2018) Renewable energy sources (RES) as a factor determining the social and economic development of the arctic zone of the Russian Federation. International Multidisciplinary Scientific GeoConference: SGEM 18(53):679–686

Klaus, T., Vollmer, C., Werner, K., Lehmann, H., Müschen, K., Albert, R., & Knoche, G., (2010), Energy target 2050: 100% renewable electricity supply, Federal Environment Agency of Germany, Dessau-Roßlau.

Koo J, Park K, Shin D, Yoon EY (2011) Economic evaluation of renewable energy systems under varying scenarios and its implications to Korea’s renewable energy plan. Appl Energy 88(6):2254–2260

Kostka G, Moslener U, Andreas J (2013) Barriers to increasing energy efficiency: evidence from small-and medium-sized enterprises in China. J Clean Prod 57:59–68

Kul C, Zhang L, Solangi YA (2020) Assessing the renewable energy investment risk factors for sustainable development in Turkey. J Clean Prod 276:124164

Leete S, Xu J, Wheeler D (2013) Investment barriers and incentives for marine renewable energy in the UK: An analysis of investor preferences. Energy Policy 60:866–875

Levin A, Lin CF, Chu CSJ (2002) Unit root tests in panel data: asymptotic and finite-sample properties. Journal of Econometrics 108(1):1–24

Lilliestam J, Patt A (2015) Barriers, risks and policies for renewables in the Gulf States. Energies 8(8):8263–8285

Lipp J (2007) Lessons for effective renewable electricity policy from Denmark Germany and the United Kingdom,. Energy Policy 35(11):5481–5495

Liu W, Zhang X, Feng S (2019) Does renewable energy policy work? Evidence from a panel data analysis. Renewable Energy 135:635–642

Loock M (2012) Going beyond best technology and lowest price: on renewable energy investors’ preference for service-driven business models. Energy Policy 40:21–27

Lu X, White H (2014) Robustness checks and robustness tests in applied economics. Journal of Econometrics 178:194–206

Lucas JNV, Francés GE, González ESM (2016) Energy security and renewable energy deployment in the EU: liaisons dangerousness or virtuous circle? Renew Sustain Energy Rev 62:1032–1046

Malik K, Rahman SM, Khondaker AN, Abubakar IR, Aina YA, Hasan MA (2019) Renewable energy utilization to promote sustainability in GCC countries: policies, drivers, and barriers. Environ Sci Pollut Res 26(20):20798–20814

Marques AC, Fuinhas JA (2011) Do energy efficiency measures promote the use of renewable sources? Environ Sci Policy 14(4):471–481

Marra A, Colantonio E (2021) The path to renewable energy consumption in the European Union through drivers and barriers: a panel vector autoregressive approach. Socioecon Plann Sci 76:100958

Masini, A., & Menichetti, E., (2010). Investment decisions in the renewable energy field: an analysis of main determinants. In PICMET 2010 Technology Management for Global Economic Growth (pp. 1–11). IEEE.

Masini A, Menichetti E (2012) The impact of behavioral factors in the renewable energy investment decision-making process: conceptual framework and empirical findings. Energy Policy 40:28–38

Meisen, P., & Hawkins, S., (2009). Renewable energy potential of China: making the transition from coal-fired generation. Global Energy Network Institute (GENI), San Diego, California.

Meisen, P., & Hubert, J., (2010). Renewable energy potential of Brazil. Global Energy Network Institute: San Diego, CA, USA.

Melnyk LH, Sommer H, Kubatko OV, Rabe M, Fedyna SM (2020) The economic and social drivers of renewable energy development in OECD countries. Probl Perspect Manag 18(4):37–48

Menegaki AN (2011) Growth and renewable energy in Europe: a random effect model with evidence for neutrality hypothesis. Energy Economics 33(2):257–263

Menichetti E (2010) Renewable energy policy risk and investor behavior and analysis of investment decisions and investment performance. Dissertation of the University of St. Gallen. https://www.ehelvetica.nb.admin.ch/api/download/urn%3Anbn%3Ach%3Abel-195236%3Adis3836.pdf/dis3836.pdf. Accessed 29 July 2022

Mitchell RK, Agle BR, Wood DJ (1997) Toward a theory of stakeholder identification and salience: defining the principle of who and what really counts. Acad Manag Rev 22(4):853–886

Mngumi F, Shaorong S, Shair F, Waqas M (2022) Does green finance mitigate the effects of climate variability: role of renewable energy investment and infrastructure. Environ Sci Pollut Res. https://doi.org/10.1007/s11356-022-19839-y

Mostert, W., (2009). Easing investment barriers: Nicaragua’s renewable energy potential. ESMAP: knowledge exchange series, 12.

Moutinho V, Madaleno M, Inglesi-Lotz R, Dogan E (2018) Factors affecting CO2 emissions in top countries on renewable energies: a LMDI decomposition application. Renew Sustain Energy Rev 90:605–622

Mulaudzi SK, Bull S (2016) An assessment of the potential of solar photovoltaic (PV) application in South Africa. In: 2016 7th International Renewable Energy Congress (IREC). IEEE, pp 1–6

Müller, S., Brown, A., & Ölz, S., (2011). Renewable energy: policy considerations for deploying renewables. International Energy Agency (IEA): Paris, France.

Musango JK, Brent AC (2011) A conceptual framework for energy technology sustainability assessment. Energy Sustain Dev 15(1):84–91

Nakumuryango A, Inglesi-Lotz R (2016) South Africa’s performance on renewable energy and its relative position against the OECD countries and the rest of Africa. Renew Sustain Energy Rev 56:999–1007

Nasirov S, Silva C, Agostini CA (2015) Investors’ perspectives on barriers to the deployment of renewable energy sources in Chile. Energies 8(5):3794–3814

Nautiyal H (2012) Progress in renewable energy under clean development mechanism in India. Renew Sustain Energy Rev 16(5):2913–2919

Niesten E, Jolink A, Chappin M (2018) Investments in the Dutch onshore wind energy industry: a review of investor profiles and the impact of renewable energy subsidies. Renew Sustain Energy Rev 81:2519–2525

Nyiwul L (2017) Economic performance, environmental concerns, and renewable energy consumption: drivers of renewable energy development in Sub-Sahara Africa. Clean Technol Environ Policy 19(2):437–450

OECD, (2020), Climate change, Available Online at https://www.oecd.org/environment/environment-at-a-glance/Climate-Change-Archive-June-2020.pdf, (25.01.2022).

Olanrewaju BT, Olubusoye OE, Adenikinju A, Akintande OJ (2019) A panel data analysis of renewable energy consumption in Africa. Renewable Energy 140:668–679

Omri A, Nguyen DK (2014) On the determinants of renewable energy consumption: International evidence. Energy 72:554–560

Ongan S, Işık C, Bulut U et al (2022) Retesting the EKC hypothesis through transmission of the ARMEY curve model: an alternative composite model approach with theory and policy implications for NAFTA countries. Environ Sci Pollut Res 29:46587–46599. https://doi.org/10.1007/s11356-022-19106-0

Oosthuizen AM, Inglesi-Lotz R, Thopil GA (2022) The relationship between renewable energy and retail electricity prices: panel evidence from OECD countries. Energy 238:121790

Painuly JP (2001) Barriers to renewable energy penetration; a framework for analysis. Renewable Energy 24(1):73–89

Phillips PC, Perron P (1988) Testing for a unit root in time series regression. Biometrika 75(2):335–346

Polzin F, Migendt M, Täube FA, von Flotow P (2015) Public policy influence on renewable energy investments—a panel data study across OECD countries. Energy Policy 80:98–111

Ponce P, Khan SAR (2021) A causal link between renewable energy, energy efficiency, property rights, and CO2 emissions in developed countries: a road map for environmental sustainability. Environ Sci Pollut Res 28(28):37804–37817

Popp D, Hascic I, Medhi N (2011) Technology and the diffusion of renewable energy. Energy Economics 33(4):648–662

Pristupa AO, Mol AP (2015) Renewable energy in Russia: the take off in solid bioenergy? Renew Sustain Energy Rev 50:315–324

Prokhorov A, Schmidt P (2009) Likelihood-based estimation in a panel setting: robustness, redundancy and validity of copulas. Journal of Econometrics 153(1):93–104

Qi T, Zhang X, Karplus VJ (2014) The energy and CO2 emissions impact of renewable energy development in China. Energy Policy 68:60–69

Rehman A, Rauf A, Ahmad M, Chandio AA, Deyuan Z (2019) The effect of carbon dioxide emission and the consumption of electrical energy, fossil fuel energy, and renewable energy, on economic performance: evidence from Pakistan. Environ Sci Pollut Res 26(21):21760–21773

Rehman A, Ma H, Ahmad M, Ozturk I, Işık C (2021a) An asymmetrical analysis to explore the dynamic impacts of CO2 emission to renewable energy, expenditures, foreign direct investment, and trade in Pakistan. Environ Sci Pollut Res 28(38):53520–53532

Rehman A, Ma H, Ahmad M, Ozturk I, Işık C (2021b) Estimating the connection of information technology, foreign direct investment, trade, renewable energy and economic progress in Pakistan: evidence from ARDL approach and cointegrating regression analysis. Environ Sci Pollut Res 28(36):50623–50635

Reuter WH, Szolgayová J, Fuss S, Obersteiner M (2012) Renewable energy investment: Policy and market impacts. Appl Energy 97:249–254

Rodríguez, M. C., Haščič, I., Johnstone, N., Silva, J., & Ferey, A., (2014). Inducing private finance for renewable energy projects: evidence from micro-data. iOECD iiENSAE-ParisTech.

Salim RA, Rafiq S (2012) Why do some emerging economies proactively accelerate the adoption of renewable energy? Energy Economics 34(4):1051–1057

Salm S, Hille SL, Wüstenhagen R (2016) What are retail investors’ risk-return preferences towards renewable energy projects? A choice experiment in Germany. Energy Policy 97:310–320

Shahzad U, Radulescu M, Rahim S, Isik C, Yousaf Z, Ionescu SA (2021) Do environment-related policy instruments and technologies facilitate renewable energy generation? Exploring the contextual evidence from developed economies. Energies 14(3):690–705

Sharif A, Bhattacharya M, Afshan S, Shahbaz M (2021) Disaggregated renewable energy sources in mitigating CO2 emissions: new evidence from the USA using quantile regressions. Environmental Science and Pollution Research 28(41):57582–57601

Shill J, Mavoa H, Crammond B, Loff B, Peeters A, Lawrence M, ... & Swinburn BA (2012) Regulation to create environments conducive to physical activity: understanding the barriers and facilitators at the Australian state government level. PLoS ONE 7(9): e42831

Shrimali G, Kneifel J (2011) Are government policies effective in promoting deployment of renewable electricity resources? Energy Policy 39(9):4726–4741

Siddiqui DA, Ahmed QM (2013) The effect of institutions on economic growth: a global analysis based on GMM dynamic panel estimation. Struct Chang Econ Dyn 24:18–33

Sisodia GS, Soares I (2015) Panel data analysis for renewable energy investment determinants in Europe. Appl Econ Lett 22(5):397–401

Sisodia GS, Soares I, Banerji S, Van den Poel D (2015) The status of energy price modelling and its relevance to marketing in emerging economies”. Energy Procedia 79:500–505

Sisodia GS, Soares I, Ferreira P (2016) The effect of sample size on European Union’s renewable energy investment drivers. Appl Econ 48(53):5129–5137

Tudor C, Sova R (2021) On the impact of gdp per capita, carbon intensity and innovation for renewable energy consumption: worldwide evidence. Energies 14(19):6254–6266

Tura N, Hanski J, Ahola T, Ståhle M, Piiparinen S, Valkokari P (2019) Unlocking circular business: a framework of barriers and drivers. J Clean Prod 212:90–98

Ullah S, Akhtar P, Zaefarian G (2018) Dealing with endogeneity bias: the generalized method of moments (GMM) for panel data. Ind Mark Manage 71:69–78

UNCC, (2022), COP26 Outcomes: Transparency and Reporting, https://unfccc.int/process-and-meetings/the-paris-agreement/the-glasgow-climate-pact/cop26-outcomes-transparency-and-reporting, Accessed Date: 20.03.2022.

Wang Q, Li S, Pisarenko Z (2020) Heterogeneous effects of energy efficiency, oil price, environmental pressure, R&D investment, and policy on renewable energy–evidence from the G20 countries. Energy 209:118322

Weideman J, Inglesi-Lotz R, Van Heerden J (2017) Structural breaks in renewable energy in South Africa: a Bai & Perron break test application. Renew Sustain Energy Rev 78:945–954

Wu L, Broadstock DC (2015) Does economic, financial and institutional development matter for renewable energy consumption? Evidence from emerging economies. International Journal of Economic Policy in Emerging Economies 8(1):20–39

Wu T, Yang S, Tan J (2020) Impacts of government R&D subsidies on venture capital and renewable energy investment–an empirical study in China. Resour Policy 68:101715

Wüstenhagen R, Menichetti E (2012) Strategic choices for renewable energy investment: conceptual framework and opportunities for further research. Energy Policy 40:1–10

Wüstenhagen R, Wolsink M, Bürer MJ (2007) Social acceptance of renewable energy innovation: an introduction to the concept. Energy Policy 35(5):2683–2691

Yuosoff S, Kardooni R (2012) Barriers and challenges for developing RE policy in Malaysia. In International Conference on Future Environment and Energy (IPCBEE) 28:6–10

Zafar MW, Shahbaz M, Hou F, Sinha A (2019) From nonrenewable to renewable energy and its impact on economic growth: the role of research & development expenditures in Asia-Pacific Economic Cooperation countries. J Clean Prod 212:1166–1178

Zahra SA (1993) A conceptual model of entrepreneurship as firm behavior: a critique and extension. Entrep Theory Pract 17(4):5–21

Zaidi SAH, Hou F, Mirza FM (2018) The role of renewable and non-renewable energy consumption in CO2 emissions: a disaggregate analysis of Pakistan. Environ Sci Pollut Res 25(31):31616–31629

Zeng S, Liu Y, Liu C, Nan X (2017) A review of renewable energy investment in the BRICS countries: history, models, problems and solutions. Renew Sustain Energy Rev 74:860–872

Author information

Authors and Affiliations

Contributions

Nurcan Kilinc-Ata performed material preparation, data collection, and analysis. Ilya A. Dolmatov reviewed and supervised the paper. All the authors have read and agreed to the published version of the manuscript.

Corresponding author

Ethics declarations

Ethics approval and consent to participate.

Not applicable.

Consent for publication.

Not applicable.

Competing interests

Not applicable.s

Additional information

Responsible Editor: Roula Inglesi-Lotz.

Publisher's Note

Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

Rights and permissions

Springer Nature or its licensor holds exclusive rights to this article under a publishing agreement with the author(s) or other rightsholder(s); author self-archiving of the accepted manuscript version of this article is solely governed by the terms of such publishing agreement and applicable law.

About this article

Cite this article

Kilinc-Ata, N., Dolmatov, I.A. Which factors influence the decisions of renewable energy investors? Empirical evidence from OECD and BRICS countries. Environ Sci Pollut Res 30, 1720–1736 (2023). https://doi.org/10.1007/s11356-022-22274-8

Received:

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s11356-022-22274-8