Abstract

Given a differential game, if agents have different time preference rates, cooperative (Pareto optimum) solutions obtained by applying Pontryagin’s maximum principle become time inconsistent. We derive a set of dynamic programming equations in continuous time whose solutions are time-consistent equilibria for problems in which agents differ in their utility functions and also in their time preference rates. The solution assumes cooperation between agents at every time. Since coalitions at different times have different time preferences, equilibrium policies are calculated by looking for Markov (subgame perfect) equilibria in a (noncooperative) sequential game. The results are applied to the study of a cake-eating problem describing the management of a common property exhaustible natural resource. The extension of the results to a simple common property renewable natural resource model in infinite horizon is also discussed.

Similar content being viewed by others

Avoid common mistakes on your manuscript.

1 Introduction

In the analysis of intertemporal decision problems with several agents, when players can communicate and coordinate their strategies in order to optimize their collective payoff, cooperative solutions are introduced. Although the natural framework for most economic problems is to assume that the agents compete among each other, in some models—for instance, those related to the analysis of international trade agreements, topics in environmental economics concerning climate change policies, or the exploitation of common property natural resources (see [13] and [17] for two recent surveys on dynamic games in these topics)—it is natural to look for mechanisms inducing cooperation between economic agents (see, e.g., [3] and references therein for a recent study of coalition formation and stability of coalitions in resource economics).

Although it is customary to assume that all economic agents have the same rate of time preference, there is no reason to believe that consumers, firms, or countries have identical time preferences for utility streams (see, e.g., [12] and references therein). For instance, in a noncooperative setting, for the problem of extraction of exhaustible resources under common access, feedback Nash equilibria have been studied in the case of equal [5] and different [18] discount rates. With respect to the Pareto optimum in the cooperative framework, if there is a unique (constant) discount rate for all agents, it is easily obtained by solving a standard optimal control problem. However, in the case of different discount rates, when looking for time-consistent cooperative solutions, standard dynamic optimization techniques fail. The reason is that time preferences become time inconsistent, as in the case of hyperbolic preferences. In [10], effects of aggregation of heterogeneous time preferences were studied by assuming that there is a representative agent and that agents can commit to their future consumption plan at date t = 0 (this is the so-called precommitment solution according to the literature of nonconstant discounting). Li and and Löfgren [16] characterized long-run steady states for a renewable resource model with two agents under similar assumptions. If we remove the commitment assumption, time-consistent policies can be computed by solving the dynamic programming equation (DPE) first derived in [14]. This paper aims to fill the gap in the search for time-consistent solutions in a cooperative continuous time setting if agents are asymmetric (or heterogeneous), in the sense that their preferences are represented by different utility functions (there is not a representative agent) and they also use different discount rates. It is important to realize that when agents lack commitment power, they act at different times t as sequences of independent coalitions (the t coalitions). The solution we compute assumes cooperation among players at every time t but is a noncooperative equilibrium for the noncooperative sequential game defined by these infinitely many t coalitions.

In recent years, papers departing from standard discounting have received increasing attention. Strotz [25] called attention to the problem of time inconsistency arising when nonconstant discount rates of time preference are introduced. We refer to [9] for a review of the literature up to 2002. Time inconsistency also arises in problems where the decision-maker discounts instantaneous utilities and final gains in a different way. Equilibrium conditions for time-consistent solutions have recently been obtained for both kinds of problems in a continuous time setting (see [14] for the case of nonconstant discounting and [20] for the problem with heterogeneous discounting).

As we have mentioned above, despite the fact that nonstandard discounting models have focused on individual agents, this framework has proved to be useful in the study of multiagent problems if decision-makers cooperate among them (although the different t coalitions act in a noncooperative way). If players share the same joint instantaneous utility function (there is a representative agent) but have different rates of time preference, say r 1 ≠ ⋯ ≠ r N , the cooperative problem can be rewritten as a nonconstant discounting problem and previous results in the literature can be applied in order to obtain a time-consistent (subgame perfect) solution (see Remark 2 in [14]) as follows. Let us consider an N player cooperative differential game where, as usual, the joint coalition maximizes the weighted sum of their respective payoffs, \(J\left(c(\cdot)\right)=\sum_{m=1}^N \lambda_m J^m\), where \(J^m=\int_t^T e^{-r_m (s-t)}U^m\left(x(s),c(s),s\right) ds\) represents the individual payoff of player m, λ m ≥ 0 characterizes the weight of player m in the coalition, and x(s) and c(s) are the vectors of state and control variables. Thus, the joint payoff is \(J\left(c(\cdot)\right)= \sum_{m=1}^{N} \lambda_m \int_t^T e^{-r_m (s-t)}U^m\left(x(s),c(s),s\right)\, ds\). If there is a representative agent, we can write the (joint) utility function as U(x,c,s), and the payoff for the group can be rewritten as

where \(\theta(s-t)=\sum_{m=1}^N \lambda_m e^{-r_m (s-t)}\) is the discount function, which can be also rewritten as \(\theta(s-t)=e^{-\int_t^s \bar{r}(\tau-t)d\tau} =e^{-\int_0^{s-t} \bar{r}(\tau)d\tau}\) where the time preference rate \(\bar{r}(\tau)\) is a nonconstant function of its argument, \(\bar{r}(\tau)=-\frac{\theta'(\tau)}{\theta(\tau)}=\frac{\sum_{m=1}^N \lambda_m r_m e^{-r_m \tau}}{\sum_{m=1}^N \lambda_m e^{-r_m \tau}}\). For N = 2, this nonconstant discounting model has been applied to study a model of catastrophic climate-related damages in [15].

In this paper, we tackle the more general problem that consists in maximizing

subject to

Hence, we focus on the case when agents exhibit different instantaneous payoff functions and different (but constant) rates of time preference. This problem cannot be transformed into a problem with nonconstant discounting.

There are two sources of time inconsistency in problem (1–2). First, there is the time-consistency problem related to the changing time preferences of the different t coalitions, as we have discussed in the previous paragraphs. In addition, if players are not committed themselves to cooperate at every instant of time t, a problem of dynamic inconsistency or time inconsistency (both words are synonymous and are used indistinctly in the literature of cooperative differential games) can arise, independently of the form of the discount function: it is possible that players initially agree on a cooperative solution that generates incentives for them, but it is profitable for some of them to deviate from the cooperative behavior at later periods. Haurie [11] proved that the extension of the Nash bargaining solution to differential games is typically not dynamically consistent. We refer to [27] for a recent review on the topic. For the case of transferable utilities, if the agents can redistribute the joint payoffs of players in any period, Petrosyan proposed in a series of papers a payoff distribution procedure in order to solve this problem of dynamic inconsistency (see, e.g., [26] or [22] and references therein). We do not consider this issue of dynamic consistency (related to the stability of the whole coalition) in this work. Throughout the paper, we assume that the agents commit themselves to cooperate at every instant of time t. On the contrary, recall that we do not assume that the different t coalitions (with different time preferences) have precommitment power. Equilibria are computed by finding subgame perfect equilibria in a noncooperative sequential game where players are the different t coalitions (representing, for instance, different generations). Hence, our solution to the problem is time consistent provided that all the agents at a given time t cooperate. This is not a real restriction in some problems, in which it is always profitable for the agents to cooperate. In other cases, if utilities are transferable, payoff (imputation) distribution procedures can be introduced in order to guarantee the stability of the whole coalition, extending in a rather easy way this method to our problem with asymmetric players, as in the case of differential games with nonconstant discounting (see [21]). If utilities are not transferable, weights λ m of agents in whole coalition should be nonconstant, in general, but a result of a bargaining procedure at every time t, as in the case of equal discount rates. For instance, in a multiperiod (discrete time) setting with two heterogeneous agents, Sorger [24] proposed the so-called recursive Nash bargaining solution, which is a dynamically consistent equilibrium. According to this solution, nonconstant weights λ m (x) of the different players in the whole coalition are computed for each period according to a Nash bargaining scheme.

Our main contributions are the following: First, for a finite horizon two-person cooperative differential game, we introduce a computationally tractable approach based in transforming the problem into a one-agent problem with heterogeneous discounting (see [20]). As a result, we must solve two coupled DPEs. A second approach enables us to study problems with an arbitrary number of players. In the derivation of the DPE, we adopt the procedure given in [14] for the nonconstant discounting problem. And third, we apply the approach in [21] for the analysis of the problem in an infinite horizon setting. We illustrate the effects of using different discount rates by solving an exhaustible resource extraction model with common access (see, e.g., [7]), and a basic common property renewable natural resource model (see, e.g., [4]). We prove that, for these problems, if all the agents have the same σ in their utility functions \(U^i(c_i)=\frac{c_i^{1-\sigma_i}-1}{1-\sigma_i}\), the extraction rates of all agents in the time-consistent solution coincide. A similar result has recently been obtained in a discrete time setting in a fisheries model in the limit σ = 1 for a logarithmic utility function (see [2]).

The paper is organized as follows: In Section 2, we study the two-player case in finite horizon. The extension to the N player case is considered in Section 3. Section 4 analyzes the infinite time horizon setting. Finally, Section 5 presents a summary of the main results of the paper.

2 Heterogeneous Discounting and Time-Consistent Solutions in a Cooperative Setting: the Case of Two Asymmetric Players

Heterogeneous discounting problems were studied in [20] in order to study problems where the agent discounts in a different way the utilities enjoyed along the planning horizon (typically due to consumption) and the final function (which has normally a different nature), i.e., the decision-maker faces the problem of maximizing

subject to

We refer to [20] for an economic motivation of problems (3–4), as well as a discussion on the time inconsistency of these time preferences. In that paper, it was proved that if the value function W(x,t) is continuously differentiable function in (x,t), a time-consistent solution can be obtained by solving the DPE

with W(x,T) = F(x,T) and

If, for each pair (x,t), there exists c * = φ(x,t), with the corresponding state trajectory, such that c * maximizes the right-hand side term of Eq. 5, then c * = φ(x,t) is called a Markov equilibrium rule for the problem with heterogeneous discounting. The same DPE can be obtained by following a derivation in the spirit of [14] for nonconstant discounting models, by first obtaining the DPE for a discretized version of problem (3–4), and passing next to the continuous time limit.Footnote 1

Next, note that \(\bar{U}(x,s)=U(x(s),\phi(x(s),s),s)\), where x(s) is the solution to \(\dot{x}(s)=f(x,\phi(x,s),s)\) with x(t) = x.Footnote 2 Hence,

and, by differentiating K in Eq. 6 with respect to t, we obtain the “auxiliary DPE”

Hence, let W(x,t) and K(x,t) be two continuously differentiable functions in (x,t) such that W(x,t), K(x,t), and the strategy c * = φ(x,t) satisfy the set of two DPEs (5) and (7) with boundary conditions W(x,T) = F(x,T) and K(x,T) = 0. Then, W(x,t) is the value function for problem (3–4), and the strategy c * = φ(x,t) maximizing the right-hand side term of Eq. 5 is a Markov equilibrium rule.

For the two-player case, N = 2, we can connect our cooperative problem with a heterogeneous discounting problem. In order to do this, we rewrite the functional objective for one of players in the Mayer form, in such a way that problem (1–2) for the t coalition becomes equivalent to the problem of maximizing

subject to

(for t = 0, x(0) = x 0, and y(0) = 0, as usual). With the addition of a new state variable y, we transform the cooperative problem with asymmetric players into a Bolza problem for just one agent with integral and terminal value terms, but with different time preference rates.

We can apply these results in the analysis of a simple model of a common-property nonrenewable resource with two agents, N = 2, with equal weights λ 1 = λ 2, in a finite time horizon T. Let x(t) and c m (t), m = 1,2, denote the stock of the resource and player m’s rate extraction at time t, respectively, while the evolution of the system follows

Each player m has an increasing and concave utility function \(U^m(c_m)\). Let us assume that the utility functions are logarithmic, \(U^m(c_m)=\ln(c_m)\), and are discounted at constant time preference rates r m > 0, with r 1 ≠ r 2. If the agents at time t = 0 decide to cooperate throughout all the planning horizon [0,T], the objective for the coalition is to maximize

subject to Eq. 8. If we solve problem (9) subject to Eq. 8 by means of Pontryagin’s maximum principle, we obtain

where the superscript 0 in \(c_m^0\) accounts for the moment at which the decision has been taken. This is the so-called (in the hyperbolic discounting literature) precommitment solution, which is optimal from the viewpoint of the 0 coalition, c P(s) = c 0(s), and can be associated with the existence of some binding agreement between players at the beginning of the game, in the sense that both agents will follow the decision rule taken at time t = 0, despite having incentives to deviate in the future from the previously calculated decision rule. However, if such an agreement does not exist, players in the coalition can recalculate the cooperative solution at some instant t ∈ (0,T]. The maximum of

subject to

is given by

Note that this solution differs from that calculated in Eq. 10. For instance, \(c_1^t(t)=c_2^t(t)\), whereas \(c^0_1(t)\neq c_2^0(t)\) for every t > 0. Thus, the joint solution becomes time inconsistent as long as the coalition has the possibility of reoptimizing at any instant after t = 0.

In general, if players in the coalition can continuously recalculate the “cooperative” solution, they will follow what we call the (time inconsistent) naive decision rule \(c_m^N(t)\). Note that a coalition taking a decision at time t will choose the decision rule (13). However, at time t ′ > t, the coalition will recompute the decision rule. Hence, \(c_m^t(s)\) in Eq. 13 is followed only at the time s = t at which the agents of the t coalition have calculated the extraction rate, so that the actual extraction rate becomes

Note that the precommitment and naive solutions do not coincide unless r 1 = r 2. In fact, \(c_1^P(t)\neq c_2^P(t)\), for every t ∈ (0,T], whereas \(c_1^N(t)=c_2^N(t)\) for every t ∈ [0,T]. If the agents can split the resource at time t = 0 in an irreversible way so that \(x_0=x^1_0+x^2_0\), where \(x^m_0=\int_0^T c_m(s)\, ds\), i = 1,2, then the precommitment solution becomes time consistent.

In order to determine a time-consistent equilibrium, we first reformulate problem (11–12) by rewriting the payoff of player 2 in the Mayer form. The objective functional becomes

subject to

with x(T) = 0. Although the DPE for the problem with heterogeneous discounting was derived in [20] for the case of free terminal states x(T) and y(T), it is easy to check that it is preserved if a terminal condition on x(T) is imposed. We look for the solution to the DPE (5), i.e.,

where \(K(x,y,t)=(r_1-r_2) \int_t^{T} e^{-r_1(s-t)} \ln(c_1^*,s) ds\). As we prove in the Appendix, for this particular problem, the solution obtained for the naive coalition is a time-consistent policy. This feature, also arising in nonconstant discounting models (see Pollak [23] and [19]), is a consequence of using logarithmic utility functions, and it no longer holds when more general utility functions are considered, as we show in the following section for a general N-player cooperative differential game.

3 An Exhaustible Resource Model Under Common Access: the Case of N-Asymmetric Players

In this section, we extend the two-player case analyzed above. Let us consider the case of N players who decide to form a coalition seeking for a time-consistent solution maximizing

subject to

3.1 A Dynamic Programming Equation

First, we derive a dynamic programming equation describing time-consistent equilibria for problem (17–18), by following a formal procedure. In we discretize (17) and (18), the corresponding problem in discrete time is

subject to

In the Appendix, the following dynamic programming algorithm for the discrete time problem (19–20) is derived:

with x (j + 1) = x j + f(x j , c j ,jε)ε, j = 0,...,n − 1, and \(V_n^* = 0\).

Next, we define the value function for problem (17–18) as the solution to the DPE obtained by taking the formal continuous time limit when ε→0 of the DPE (21) obtained from the discrete approximation to the problem, assuming that the limit exists and that the solution is of class C 1 in all their arguments. Proceeding in this way, it can be easily proved (see the Appendix) that if W m(x,t), m = 1,...,N, is a set of continuously differentiable functions in (x,t) satisfying the DPE

with W m(x,T) = 0, for every m = 1,...,N, and

where c *(t) = φ(x(t),t) is the maximizer of the right-hand term in Eq. 22; then \(W(x,t)=\sum_{m=1}^N W^m(x,t)\) is the value function of the whole coalition, the decision rule c * = φ(x,t) is the (time consistent) Markov perfect equilibrium, and W m(x,t), for m = 1,...,N, is the value function of player m in the cooperative problem (17–18).

Remark 1

Note that, throughout the equilibrium rule c * = φ(x,t), for every player m, W m(x,t) in Eq. 23 is a solution to the partial differential equation

for m = 1,...,N, with W m(x,T) = 0. Hence, we can compute the value function by first determining the decision rule solving the right-hand term in Eq. 22 as a function of \(\nabla_x W^m(x,t)\), m = 1,...,N, and then substituting the decision rule into the system of N partial differential equations (24).

3.2 An Exhaustible Resource Model Under Common Access and Partial Cooperation

Now we can extend the results for the nonrenewable resource model in Section 2 to the general case of N asymmetric players. If λ 1 = ⋯ = λ N = 1, we must solve

subject to

For m = 1,...,N, the precommitment and naive solutions for problem (25–26) are given by

respectively, where \(\gamma_m=\frac{r_m}{\sigma_m}\). In the naive case, the extraction rates of all agents coincide.

In order to look for a time-consistent equilibrium, we apply the results in Section 3.1 to problem (25–26).Footnote 3 From Eq. 22, we have to solve

The maximizer of the right-side term in (28) is \(c_m^S(t)=\left(\sum_{j=1}^N \frac{\partial W^j(x,t)}{\partial x}\right)^{-\frac{1}{\sigma_m}}\), for m = 1,...,N. Therefore, the extraction rates of agents m and m ′ coincide (\(c^S_m=c^S_{m^\prime}\)) if, and only if, \(\sigma_m=\sigma_{m^\prime}\). Thus, if there are two players m and m ′ such that \(\sigma_m\neq\sigma_{m^\prime}\) (hence, \(c^S_m\neq c^S_{m^\prime}\)), the naive solution is always time inconsistent.

In order to compute the actual decision rule, we can solve the family of N coupled partial differential equations (24), which in our particular case becomes

for m = 1,...,N. If σ 1 = ⋯ = σ N = σ, the above system simplifies to \(r_m W^m(x,t)-\frac{\partial W^m(x,t)}{\partial t} =\) \(\frac{1}{1-\sigma}\big[\!\big(\!\sum_{j=1}^N \!\frac{\partial W^j(x,t)}{\partial x}\!\big)^{1-\frac{1}{\sigma}}\!-\!1\!\big] - N \frac{\partial W^m(x,t)}{\partial x} \big(\sum_{i=1}^N \frac{\partial W^i(x,t)}{\partial x}\big)^{-\frac{1}{\sigma}}\), m = 1,...,N. We guess \(W^m(x,t)=A^m(t)\frac{x^{1-\sigma}-1}{1-\sigma} +B^m(t)\), m = 1,...,N, with A m(t) > 0 for every t ∈ [0,T). By substituting in the above DPE, we find that the functions A m(t) are the solution to the system of ordinary differential equations

For instance, if we reproduce the calculations for the case of logarithmic utility functions, which corresponds to the limit σ = 1, it is easy to check that the above system simplifies to \(\dot{A}^m-r_m A^m+1=0\), for m = 1,...,N. Note that \(A^m(t)=\frac{1}{r_m}[1-e^{-r_m(T-t)}]\), which is the naive solution, satisfies this set of differential equations. Hence, the naive solution also becomes time consistent in the case of N asymmetric players, extending in this way the result obtained in Section 2. Summarizing, we have proved the following property: in problem (25–26), in the time-consistent solution, the extraction rates of two agents coincide if, and only if, they have the same marginal elasticity σ. In particular, if σ 1 = ⋯ = σ N = 1, then the naive solution (27) is time consistent.

If σ ≠ 1, note that \(c^S_m(t)=\left(\sum_{j=1}^N A^j(t)\right)^{-\frac{1}{\sigma}}\) and the solution to the state equation is \(x(t)=x_0 e^{-\int_0^t\frac{N}{\left(\sum_{j=1}^N A^j(s)\right)^{1/\sigma}} ds}\). In order to achieve the terminal condition x(T) = 0, from the positivity of A m(t) for t < T, we obtain that \(\lim_{t\to T}\sum_{j=1}^N A^j(t)=0\); therefore, A m(T) = 0, for every m = 1,...,N. It can be shown that the naive solution is time inconsistent, in general, for σ ≠ 1, as we illustrate numerically in Section 3.3.

Remark 2

If \(U^m(c_m)=U(c_m)\), i.e., all the agents have the same utility function (in the isoelastic case, σ 1 = ⋯ = σ N = σ), along the equilibrium rule all players extract the resource at the same rate and problem (25–26) become equivalent to the problem of a representative agent using the discount function \(\sum_{m=1}^N e^{-r_m(s-t)}\). This result is not preserved for the precommitment solution. The time inconsistency of the naive solution if σ ≠ 1 for the corresponding cake-eating problem with nonconstant discounting was already proved in [19]. On the contrary, if there two agents m and m ′ with different marginal utilities (\(\sigma_m\neq\sigma_{m^\prime}\)), the problem cannot be simplified to a nonconstant discounting problem.

3.3 Numerical Illustrations

Next, we illustrate numerically the above results. We consider as a baseline case the problem for three players, N = 3, exhibiting as time preference rates r 1 = 0.03, r 2 = 0.06, and r 3 = 0.09, respectively, i.e., agent 1 being the most patient and agent 3 the most impatient. Agents face the “optimal” exploitation of a common property exhaustible resource with an initial stock of x 0 = 100 during a time interval that extends from t 0 = 0 to T = 50 periods. Utilities from consumption are assumed to be of the isoelastic type with equal intertemporal elasticity of substitution (1/σ) for all three players in the coalition.

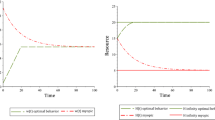

Figures 1 and 2 show the individual extraction rate for every agent in the coalition under the assumption of cooperation for the naive (dot dashed line) and the sophisticated solutions (dashed line), with σ = 0.6 (Fig. 1) and σ = 2 (Fig. 2). In both graphs, the solid line shows the extraction rate for logarithmic utilities.

Unless σ = 1 (logarithmic utilities), the time-consistent and naive solutions do not coincide, as expected. For σ = 0.6, the time-consistent agents’ extraction rate is higher at initial periods compared with naive agents, this behavior being reversed for σ = 2. It is noteworthy to observe that the equilibrium appears to be more sensitive to the value of σ than to the behavior (naive or time consistent) of the t coalitions. In addition, higher values of σ lead agents to smooth their extraction rate path along the time horizon. Finally, in Fig. 3, we compare the precommitment solutions (\(c^0_m(s),s\in [0,50],m=1,2,3\)) with the time-consistent solution assuming now that utilities are of the logarithmic type.

We observe that in the precommitment solution, each player’s extraction rate in the coalition is different, (patient) player 1 being the agent in the coalition with higher aggregate extraction (and hence exploitation) of the resource (patient agents have a higher weight in the joint functional payoff than impatient agents). In the time-consistent solution, extraction rates are equal for all the three players in the coalition, as indicated by the solid line.

4 An Extension: Infinite Planning Horizon

In most economic models and, in particular, in the economic modeling of natural resources, it is customary to work in an infinite horizon setting. For instance, an important issue in the management of natural resources (such as forests, aquifers, or fish species) is the existence of positive steady-state levels. In this section, we briefly extend the previous results for the nonrenewable resource model to a simple model of management of a common-property renewable resource. If preferences of agent m, for m = 1,...,N, are characterized by the utility function \(U^m(c_m)=\frac{c_m^{1-\sigma_m}-1}{1-\sigma_m}\) and the discount rate of time preference r m , then, at time t, we must solve

subject to

where c m (t) is the harvest rate of agent m, for m = 1,...,N, and g(x) is the natural growth function of the resource stock x. In the case of a representative agent applying a unique utility function, this problem was already studied in [1] for the neoclassical growth model.

In general, consider the problem of looking for the decision rule “maximizing”

subject to Eq. 18, where τ can be finite or infinite. If τ = ∞, a natural candidate for a DPE is given by Eqs. 22 and 23) with T = ∞. However, in our derivation, we assumed that T is finite. In the Appendix, we provide a mathematical justification of this DPE by using the approach in [21], which is based on the one by [8]. For simplicity, we take λ 1 = ⋯ = λ N = 1. If the value function (42) is finite and of class C 1, then the solution c = φ(x,t) to the right-hand term of the DPE

with

is an equilibrium rule.

Remark 3

The previous result can easily be generalized to the general problem where agents’ time preferences are represented by arbitrary discount functions d m (s,t), m = 1,...,N. In this case, W m(x,t) in Eq. 33 becomes \(W^m(x,t)=\int_t^\tau d(s,t) U(x(s),\phi(x(s),s),s)\, ds\) and the DPE in Eq. 32 transforms into

For instance, if d m (s,t) = θ m (s − t), we obtain the problem of N-hyperbolic heterogeneous agents using different nonconstant discount rates of time preference.

Now, we analyze problem (30–31). Since both the utility functions and the state equation are autonomous, it seems natural to restrict our attention to time-independent value functions W m(x), for m = 1,...,N. From Eq. 32, we have to solve

hence

Therefore, \(c_m^*=c_{m^\prime}^*\) if, and only if, \(\sigma_m=\sigma_{m^\prime}\). In this model, in general, along the equilibrium rule, \(U'(c_m^*)=U'(c_{m^\prime}^*) = \sum_{j=1}^N W^j_x\), for all m ≠ m ′. In addition, we have the set of DPEs

for all m = 1,...,N, where φ m (x) is given by Eq. 35.

Next, let us restrict our attention to the case of linear decision rules. Since \((c_i^*)^{-\sigma_i} = (c_j^*)^{-\sigma_j}\), for all i,j = 1,...,N, if \(c_m^*=\phi_m(x)=\alpha_m x\), then \((\alpha_i x)^{-\sigma_i} = (\alpha_j x)^{-\sigma_j}\). Therefore, no linear decision rules exist unless σ i = σ j , for all i,j. For σ i = σ j = σ, then α i = α j and the DPE (34) becomes \(\sum_{m=1}^N r_m W^m = \frac{N}{1-\sigma} \left(\alpha^{1-\sigma}x^{1-\sigma}-1\right) + \alpha^{-\sigma} x^{-\sigma}\left( g(x)- N\alpha x\right)\). This equation has a solution if g(x) = ax. In this case, we obtain

together with \(\sum_{m=1}^N W^m_x (x)=\alpha^{-\sigma} x^{-\sigma}\) and Eq. 36. If we try \(W^m(x)=A^m\frac{x^{1-\sigma}-1}{1-\sigma}+B^m\), by simplifying we obtain that A m, B m, and α are obtained by solving the equation system

In the case of logarithmic utilities (corresponding to the limit σ = 1), by trying W m(x) = A mln x + B m, we can reproduce the calculations to obtain \(A^m = \frac{1}{r_m}\) and \(\alpha = \frac{1}{\sum_{m=1}^N \frac{1}{r_m}}\). If r 1 = ⋯ = r N = r, then \(\alpha=\frac{r-(1-\sigma)a}{N\sigma}\).

Next, we summarize the main results of this simple model:

-

1.

In problem (30–31), along the equilibrium rule, the extraction rates of two agents are equal if, and only if, they have the same marginal elasticity. From a mathematical viewpoint, this result is straightforward. However, it is noteworthy to observe how, in the time-consistent solution with partial cooperation, agents with different discount rates harvest the resource at equal rates. This solution is different from that obtained in a noncooperative setting, or from that obtained by applying the Pontryagin’s maximum principle (the so-called precommitment solution).

-

2.

Since \(c_i^{\sigma_i}=c_j^{\sigma_j}\), for every i,j = 1,...,N, extraction/harvesting rates are higher for agents with a higher intertemporal elasticity of substitution (lower value of the parameter σ) when c i ,c j > 1. This property is reversed when c i ,c j < 1. Note that this property is independent on the use of different discount rates (although discount rates affect to the value of extraction/harvesting rates).

-

3.

If there are two players with different marginal elasticities, no linear decision rules exist. This property is independent on the use of different discount rates. As a consequence, in the case of different marginal elasticities, it becomes very difficult to derive analytic solutions.

-

4.

If the natural growth function is linear and all the agents have the same marginal elasticity σ, then the decision rules c m = αx and the value functions \(W^m(x)=A^m\frac{x^{1-\sigma}-1}{1-\sigma}+B^m\), m = 1,...,N solve problem (30–31), where the coefficients α, A m, and B m are the solutions to Eq. 37.

-

5.

It is easy to show that the previous qualitative properties (coincidence of extraction/harvesting rates, existence of linear decision rules) are preserved if time preferences of agent m, m = 1,...,N, are given by d m (s,t) (see Remark 3).

We can particularize some of these results for the case of an exhaustible resource (function g(x) = 0). In the case of equal marginal elasticities, in the Markov–perfect Nash equilibrium, linear decision rules of the form c i = γ i x exist where if 1 − σ i ∈ [0,1/2), then \(\gamma_i>\gamma_j\Longleftrightarrow r_i>r_j\). Hence, patience is weakness. In the case of partial cooperation, it is easy to prove (as we have illustrated numerically) that, in the precommitment solution, the agent with the lower discount rate extracts at the higher rate, as expected (patience is better). On the contrary, in the naive and time-consistent solutions, all agents extract at the same rate.

If marginal elasticities are different, in the Markov–Nash equilibrium with c i = γ i x, if 1 − σ ∈ [0,1/2), then \({\gamma_i>\gamma_j\Longleftrightarrow \frac{r_i}{r_j}>\frac{2\sigma_i-1}{2\sigma_j-1}}\). Therefore, the solutions do not cross in the sense that different agents extract the resource always at different rates. On the contrary, it can be shown that, if the initial stock x 0 is sufficiently high so that c i (0) > 1 for some i, the (cooperative) time-consistent solutions cross. This property is also preserved for the (time inconsistent) naive solution. Next, we illustrate this result with a numerical example (we take x 0 = 50 and N = 2).

-

Cooperation: precommitment solution

r i

σ i

Higher initial extraction rate

Higher final extraction rate

Agent 1

0.04

1/3

✓

✓

Agent 2

0.08

2/3

Agent 1

0.04

2/3

✓

Agent 2

0.08

1/3

✓

Agent 1

0.04

1/3

✓

Agent 2

0.06

2/3

✓

Note that, in this case, solutions do not cross in the first example, and they do in the other two examples. In the first example, final extraction rate is higher for the agent with a lower σ. On the contrary, in the two examples where solutions cross, final extraction rate is higher for the agent with a higher σ.

-

Cooperation: naive and time-consistent solutions

r i

σ i

Higher initial extraction rate

Higher final extraction rate

Agent 1

0.04

1/3

✓

Agent 2

0.08

2/3

✓

Agent 1

0.04

2/3

✓

Agent 2

0.08

1/3

✓

Agent 1

0.04

1/3

✓

Agent 2

0.06

2/3

✓

In this case, solutions cross in the three examples. Final extraction rates are higher always for the agent with a higher value of the parameter σ.

5 Concluding Remarks

In this paper, we address the problem of searching time-consistent solutions for cooperative differential games with asymmetric players (in the sense that they exhibit different instantaneous payoff functions and different discount rates of time preference). We focus our attention in the implications of introducing heterogeneous agents in the exploitation of a common property resource. We analyze the time-consistency problem related to the changing preferences of the different t coalitions. In order to avoid the possible time-consistency problem associated to the stability of the grand coalition, we assume that agents commit themselves to cooperate at every instant of time t (although we do not assume that the different t coalitions cooperate among them). First, we restrict our attention to problems in a finite horizon setting. For this case, we introduce two alternative approaches in order to find time-consistent equilibria. In the first approach, we transform a two-player cooperative differential game into a one-agent problem with heterogeneous discounting. The second approach allows us to study problems with an arbitrary number of players. We apply these two approaches to the study of the effects of using different discount rates in the derivation of time-consistent extraction rates in a simple exhaustible resource extraction model with common access (see, e.g., [5] and [7]). We prove that, within the class of isoelastic utility functions, if the agents decide to cooperate, if all the agents have the same σ in their utility function, then the extraction rate of all players in the time-consistent solution coincide (although they are using different discount rates of time preferences). A similar result has been recently obtained in a discrete time setting in a fisheries model for a logarithmic utility function (see [2]). Next, we extend our results to an infinite horizon setting, and a simple common access renewable natural resource model with asymmetric players is discussed. We show that, if there are two players with different marginal elasticities, no time-consistent linear decision rules exist if the agents decide to cooperate. We illustrate with several examples that, in this case, if agents decide to form the grand coalition, along this solution it can happen (depending on the initial stock of the resource) that one agent (that with a higher intertemporal elasticity of substitution) extracts the resource at a higher rate at the beginning, and at a lower rate when time passes.

Notes

We refer to the preliminary version of this paper, de-Paz et al. [6], for the details.

Along the paper, we will omit the subindex in x t if it is not strictly necessary.

As in the standard case, the same DPE is obtained if x(T) is fixed.

References

Barro, R.J. (1999). Ramsey meets Laibson in the neoclassical growth model. Quarterly Journal of Economics, 114, 1125–1152.

Breton, M., & Keoula, M.Y. (2010). A great fish war model with asymmetric players. GERAD Working paper 2010–73.

Breton, M., & Keoula, M.Y. (2012). Farsightedness in a coalitional great fish war. Environmental and Resource Economics, 51(2), 297–315.

Clark, C.W. (1990). Mathematical bioeconomics: the optimal management of renewable resources. Wiley, New York.

Clemhout, S., & Wan, H.Y. (1985). Dynamic common property resources and environmental problems. Journal of Optimization Theory and Applications, 46(4), 471–481.

de-Paz, A., Marín-Solano, J., Navas, J. (2011). Time consistent Pareto solutions in common access resource games with asymmetric players. Documents de treball (Facultat d’Economia i Empresa. Espai de Recerca en Economia), E11/253.

Dockner, E. J., Jorgensen, S., Long, N.V, Sorger, G. (2000). Differential games in economics and management science. Cambridge University Press, Cambridge.

Ekeland, I., & Pirvu, T. (2008). Investment and consumption without commitment. Mathematics and Financial Economics, 2(1), 57–86.

Frederick, S., Loewenstein, G., O’Donoghue, T. (2002). Time discounting and time preference: a critical review. Journal of Economic Literature 40, 351–401.

Gollier, C., & Zeckhauser, R. (2005). Aggregation of heterogeneous time preferences. The Journal of Political Economy, 113(4), 878–896.

Haurie, A. (1976). A note on nonzero-sum differential games with bargaining solution. Journal of Optimization Theory and Applications, 18(1), 31–39.

Jouini, E., Marin, J.M., Napp, C. (2010). Discounting and divergence of opinion. Journal of Economic Theory, 145, 830–859.

Jorgensen, S., Martín-Herran, G., Zaccour, G. (2010). Dynamic games in the economics and management of pollution. Environmental Modeling and Assessment, 15, 433–467.

Karp, L. (2007). Non-constant discounting in continuous time. Journal of Economic Theory, 132, 557–568.

Karp, L., & Tsur, Y. (2011). Time perspective and climate change policy. Journal of Environmental Economics and Management, 62(1), 1–14.

Li, C.Z., & Löfgren, K.G. (2000). Renewable resources and economic sustainability: a dynamic analysis with heterogeneous time preferences. Journal of Enviromental Economics and Management 40, 236–250.

Long, N.V. (2011). Dynamic games in the economics of natural resources: a survey. Dynamic Games and Applications, 1(1), 115–148.

Long, N.V., Shimomura, K., Takahashi, H. (1999). Comparing open-loop with Markov equilibria in a class of differential games. The Japanese Economic Review, 50(4), 457–469.

Marín-Solano, J., & Navas, J. (2009). Non-constant discounting in finite horizon: the free terminal time case. Journal of Economic Dynamics and Control, 33(3), 666–675.

Marín-Solano, J., & Patxot, C. (2012). Heterogeneous discounting in economic problems. Optimal Control Applications and Methods, 33(1), 32–50.

Marín-Solano, J., & Shevkoplyas, E.V. (2011). Non-constant discounting and differential games with random horizon. Automatica, 47(12), 2626–2638.

Petrosyan, L.A. and Zaccour, G. (2003). Time-consistent Shapley value allocation of pollution cost reduction. Journal of Economic Dynamics and Control, 27, 381–398.

Pollak, R.A. (1968). Consistent planning. Review of Economic Studies 35, 201–208.

Sorger, G. (2006). Recursive bargaining over a productive asset. Journal of Economic Dynamics and Control, 30, 2637–2659.

Strotz, R.H. (1956). Myopia and inconsistency in dynamic utility maximization. Review of Economic Studies 23, 165–180.

Yeung, D.W.K., & Petrosyan, L.A. (2006). Cooperative stochastic differential games. Springer, New York.

Zaccour, G. (2008). Time consistency in cooperative differential games: a tutorial. INFOR, 46(1), 81–92.

Acknowledgements

The authors acknowledge the referee and the associate editor for their valuable comments. This work has been partially supported by MEC (Spain) Grant ECO2010-18015. J. Navas also acknowledges financial support from the Consejería de Educación de la Junta de Castilla y León (Spain) under project VA056A09.

Author information

Authors and Affiliations

Corresponding author

Appendix

Appendix

Solution of the DPE (16) We guess for a value function of the form W(x,y,t) = A(t)ln (x) + B(t)y + C(t). If this choice proves to be consistent, the extraction rates for both agents are given by c 1(t) = 1/W x = x/A(t) and c 2(t) = W y / W x = B(t)x/A(t). In order to solve Eq. 16, we calculate the expression for K(x,t). To do that, we substitute our “guessed” controls in Eq. 15. Hence, \(x(s)=x_t \exp\left(\Lambda_t(s)\right)\), with \(\Lambda_t(s)=-\int_t^s \frac{1+B(\tau)}{A(\tau)} d \tau\). Therefore, \(K(x,y,t)= (r_1-r_2)\int_t^T e^{-r_1(s-t)} \ln \big( \frac{x_t e^{\Lambda_t(s)}}{A(s)} \big) ds = \frac{r_1-r_2}{r_1}\big( 1-e^{-r_1(T-t)}\big) \ln(x_t) + (r_1-r_2)\int_t^T e^{-r_1(s-t)} \ln \big( \frac{e^{\Lambda_t(s)}}{A(s)} \big) ds\). By substituting in Eq. 16 and simplifying, we obtain

Since the above equation must be satisfied for every x and y, then

Using the terminal condition B(T) = 1, we obtain B(t) = 1 and c 1(t) = c 2(t) = x/A(t), for every t ∈ [0,T]. With respect to A(t), note that if \(A(t)=\sum_{i=1}^2 \frac{1-e^{-r_i(T-t)}}{r_i}\), which describes the solution for a naive coalition (see (14)), then (38) is satisfied and, in addition, the solution to the state equation \(\dot{x}(t)=-2 x(t)/A(t)\) verifies the terminal condition lim t→T x(t) = 0. Therefore, the naive solution verifies the DPE (16).

Derivation of the Dynamic Programming Algorithm in Discrete Time (21) In the final period, we define \(V_n^*=0\), as usual. For j = n − 1, the optimal value for (19) will be given by the solution to the problem

with x n = x (n − 1) + f(x (n − 1), u (n − 1),(n − 1)ε)ε. If \(c^*_{(n-1)}(x_{(n-1)},(n-1)\epsilon)\) is the maximizer of the right-hand term of the above equation, let us denote

In general, for j = 1,...,n − 1, the value \(V_j^*(x_j,j\epsilon)\) in (19) can be written as

Since

then we can write \(V_{(j+1)}^*(x_{(j+1)},(j+1)\epsilon) - \sum_{i=0}^{n-j-2}\) \( \sum_{m=1}^N \,\,\lambda_m e^{-r_m i \epsilon} \,\,{\bar U}_{(j+i+1)}^m \,\,(x_{(j+i+1)},\,\,(j\,+\,i\,+\,1)\epsilon)\epsilon \,=\,0\). Adding the former expression to (39), we obtain (21).

Derivation of the DPE in Continuous Time (22) Let W m(x,t) be a continuously differentiable function representing the value function of player m in the t coalition, and let \(W(x,t)=\sum_{m=1}^N W^m(x,t)\) be the value function for the t coalition, with initial condition x(t) = x. Since s = jε, for sufficiently small ε, x(s + ε) − x(s) ≅ f(x(s),c(s),s)ε, W(x(t),t) ≅ V j (x j , jε), and \(W(x(t+\epsilon),t+\epsilon)=W(x(t),t)+\nabla_xW(x(t),t)\cdot\) \( f(x(t),c(t),t)\epsilon+\nabla_t W(x(t),t)\epsilon+o(\epsilon)\). Substituting in (21), we obtain

where

Finally, by dividing (40) and (41) by ε and taking the limit ε→0, we obtain Eq. 22.

Derivation of the DPE (32) Without lack of generality, for simplicity, we take λ 1 = ⋯ = λ N = 1. If c *(s) = φ(s,x(s)) is the equilibrium rule, then the value function is

where \(\dot{x}(s)=f(x(s),\phi(x(s),s),s)\), x(t) = x t . We assume that if τ = ∞, along the equilibrium rule, the value function (42) is finite (i.e., the integral converges). This is guaranteed if we restrict our attention to strategies φ(x,s) of class C 1 such that, when t→ ∞, the state variables converge to a stationary state.

Next, for ε > 0, let us consider the variations

If the t agent can precommit her behavior during the period [t,t + ε], the value function for the perturbed control path c ε is given by

Let us assume that W ε is differentiable in ε in a neighborhood of ε = 0. Then, c *(s) = φ(s,x(s)) is called an equilibrium rule if

The above definition can be interpreted as follows: for sufficiently small ε, the maximum of W ε in the limit when ε = 0 is precisely W(x,t). In order to prove that c *(t) = φ(x,t) solving the right-hand term in Eq. 32 is an equilibrium rule, we have to check Eq. 43. We do it in several steps:

If \(\bar{x}(s)\) denotes the state trajectory corresponding to the decision rule c ε (s), then

Note that

In a similar way,

Therefore,

since c * = φ(x,t) is the maximizer of the right-hand term in Eq. 32.

Rights and permissions

About this article

Cite this article

de-Paz, A., Marín-Solano, J. & Navas, J. Time-Consistent Equilibria in Common Access Resource Games with Asymmetric Players Under Partial Cooperation. Environ Model Assess 18, 171–184 (2013). https://doi.org/10.1007/s10666-012-9339-x

Received:

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s10666-012-9339-x